Abstract

This paper’s purpose is to compare nonprofits with pass-throughs in terms of valuation, leverage, and growth. To achieve this purpose, we use the Capital Structure Model. This model determines maximum firm valuation through incorporating real data (tax rates, credit spreads, and historical growth rates). Since this is the first study to offer our particular set results on valuation, leverage and growth, our findings are value-additive in terms of the comparative research on nonprofits and pass-throughs. The new and scientific value of our findings are further established by robust tests that modify values for key variables. Major findings include the following. Nonprofits have over a fifty percent valuation advantage over pass-throughs and achieve a four times greater increase in dollar value when going from nongrowth to growth. The latter accomplishments are attained with a smaller before-tax plowback ratio and less retained earnings. Such achievements occur because nonprofits are not taxed on earnings retained for growth. While nonprofits have somewhat greater optimal leverage ratios than pass-throughs, they gain a bit less in dollars added from debt unless growth rates increase as projected when tax rates are lowered. Nonprofits gain less percentage-wise from debt because their unlevered firm value is greater than pass-throughs.

JEL Classification:

G32; G35; L31; L333

1. Introduction

Prior Capital Structure Model (CSM) research examines C corp (CC) and pass-through (PT) ownership forms (Hull and Price 2015; Hull 2020b; Hull and Hull 2020). This paper extends this research by being the first CSM study to investigate nonprofits (NPs). While NPs are not profit-driven, they share characteristics similar to the for-profit (FP) ownership forms of PT and CC. For example, both NPs and FPs are primarily composed of small-sized entities. In addition, since NPs depend on FPs for funding, one can argue that both NPs and FPs have their welfare influenced by the same market forces. Furthermore, NPs and FPs can be competitors within the same industry. A case in point in the healthcare industry where NPs and FPs supply the same services and compete for the same customers. Both NPs and FPs are alike in producing financial statements that report assets, liabilities, revenues, and expenses. For NPs, revenues come mainly from services, contributions, grants, and investments in riskless and risky assets. According to the comparative evidence given by Anheier (2014), services (through the fees collected) is the largest component of NP revenue. For PTs, revenues come from services, sales, and investments in riskless and risky assets. Finally, both NPs and FPs have payroll taxes but only PTs pay business income tax with an exception being that some NPs pay business income tax on small commercial endeavors such as gift shops.

This study’s major purpose is to compare NPs with PTs where the latter is the dominant FP ownership form in terms of the quantity of outstanding companies, number of employees, and amount of revenue produced. According to Hull and Hull (2020), PTs pay about 2.3 more in federal taxes than CCs. Our research goal aims at determining how differences in the taxing of NPs and PTs, when all else is equal, affect their performance as measured by debt choice, valuation, leverage gain, and growth-related outcomes. The differences in the taxation policies governing NPs and PTs can be described as nearly polar opposites in that NPs receive three major tax benefits unavailable to PTs. First, NPs are tax-exempt, which means they can avoid the PT forms of taxes such as federal, state, county, municipal, property, and sales. For this study, we focus on differences in federal taxes between NPs and PTs. Second, unlike PTs, NPs do not have monetary payouts to equity owners in the form of cash distributions and taxable capital gains. Third, since NPs issue tax-exempt debt, its debtholders can circumvent the taxes paid on interest income by PT debt owners. To illustrate the nature of tax-exempt debt ownership, NPs seek financing through municipal bonds that are issued by states and municipalities. These bonds are tax-exempt for the bondholders unless more than 5% of proceeds are used for profitable activities, which is highly unlikely. In conclusion, NPs are in a position to avoid all forms of taxes paid by PTs except payroll taxes.

To achieve our research goal, we use the CSM (Hull 2018; Hull 2019) as our method to determine optimal outcomes for NPs and PTs. The CSM allows us to compute firm value for increasing debt-for-equity choices tied to credit ratings of decreasing quality. From these computations, we can determine the maximum firm value (max VL) and thus identify the optimal debt-to-firm value ratio (ODV) that, in turn, is aligned with an optimal credit rating (OCR). The key to these computations is the assumption of analogous risk classes. As NPs are subsidized by PTs, their revenue streams are influenced by the same economic factors and thus capable of having similar risk classes. The assumption of parallel risk classes for NPs and PTs implies the same costs of borrowing. For our tests, costs of borrowing are based on credit spreads matched to bond ratings and interest coverage ratios (ICRs). The same borrowing costs for NPs and PTs enable the CSM to compute outcomes so that comparisons can be made and conclusions can be drawn that are based on different tax rates.

Four arguments support the notion that the outcomes for NPs and PTs can be based on analogous risk classes. First, as illustrated previously with the healthcare industry, there exists businesses that can choose between being a NP or PT and for which they compete for producing the same goods and services. Second, NPs and PTs are of similar sizes as both consist largely of small organizations while having large entities that dominate in terms of revenue and expenses. Third, NPs and PTs are both affected by market conditions as NPs are dependent on funding that is provided by FP businesses and their employees. Even government funding for NPs is dependent on FPs paying taxes. Fourth, like revenues for PTs, charitable contributions received by NPs also decline during an economic recession such as is triggered by a financial crisis.

For our growth tests that use the historical growth rate of 3.12% and Tax Cuts and Jobs Act (TCJA) tax rates for both NPs and PTs, we offer the below findings that are the composites of tests using data for the two most recent years available at the time of this study, namely, 2018 and 2019. To our knowledge, our findings are new as the comparative research on NPs versus PTs is virtually nonexistent in terms of the outcomes we examine. These findings, that are supported by robust tests (so as to further establish their scientific value), are as follows.

First, we document that ODV is 12.27% higher for NPs compared to PTs indicating that NPs need to use more debt to reach maximum firm value (max VL). Second, while we know that NPs have a significant valuation advantage by not paying taxes, we reveal the extent of this advantage by showing that max VL for NPs is 51.63% higher than PTs. Third, we show that growth helps nongrowth NPs more than nongrowth PTs in increasing max VL. To illustrate, NPs achieve a 13.83% increase when going from their nongrowth max VL to their growth max VL while PTs only attain a 3.42% rise.

Fourth, NPs achieve their increase in value from growth with a before-tax plowback ratio (PBRBT) that is 26.63% smaller than PTs and an unlevered growth rate (gU) that is 7.97% lower than PTs. The latter two results occur because PBRBT and gU are positively related to retained earnings (RE) and PTs can only use RE after business taxes are paid on it while NPs avoid business taxes. Fifth, while NPs increase their value more than PTs when going from their nongrowth max VL to their growth max VL, a different picture emerges when going from their unlevered firm value (EU) with growth to their max VL with growth. For example, in terms of the maximum gain to leverage (max GL), NPs gain 2.25% less in absolute dollars by issuing debt compared to PTs. This can be explained by not having an interest tax shield, which is a key valuation component of mainline capital structure theory. While this finding is supported, on average, by robust tests, these tests indicate a great variability in outcomes. In particular, greater growth rates cause NPs to gain more and not less.

Sixth, in terms of the maximum percent change in unlevered equity value (max %∆EU) from a debt-for-equity transaction, we find that NPs increase 4.57% from their unlevered equity value with growth while PTs increase 7.29% from their unlevered equity value with growth. This finding is supported by robust tests including those with greater growth. Seventh, with regard to the net benefit from leverage (NB), we find that EU for NPs rises 15.93% for every dollar of debt while EU for PTs increases 27.96%. Thus, while this indicates that NPs are less efficient in their use of each dollar of debt, it also reflects the fact that NPs not only have greater ODVs but also have higher firm valuations and so must issue more debt to attain the same optimal credit rating (OCR). For both NPs and PTs, OCR is Moody’s rating of A3.

The remainder of this paper is as follows: In Section 2, we discuss the two ownership categories of NP and PT; examine the nature of equity and debt for NPs and PTs; assign tax rates for NPs and PTs tests; and discuss capital structure models. Section 3 presents our methodology, explains how we identify the optimal debt-for-equity choice, reviews the CSM approach to growth, and provides the procedure to get leverage choices and the costs of borrowing based on credit spreads assigned to credit ratings. Section 4 introduces variables and computations and offers illustrations of NP and PT outcomes using our low (L) tax rates under TCJA with a historical growth rate of 3.12%. From these tests, we present figures that graphically display results. Section 5 provides robust results that incorporate high (H) tax rates, pre-TCJA tax rates, and increased growth under TCJA. These results include comparing outcomes for NPs and PTs for different credit spreads that can be found from 2014‒2019 with our focus on the two most recent years of 2018 and 2019. Section 6 summarizes our main findings. Due to the large number of abbreviations, Appendix A provides information on the acronyms used in the paper.

2. Background and Literature Review

This section begins by providing background information on the following: ownership categories of nonprofits (NPs) and pass-throughs (PTs); sources of equity and debt financing for NPs and PTs; tax rates applicable to NPs and PTs. We then provide a literature review of capital structure models.

2.1. Key Features of Nonprofits (NPs) and Pass-Throughs (PTs)

Exhibit 1 summarizes key features for the ownership categories of NPs and PTs. The Major Goal row of the Nonprofit column states that NPs have a major goal of maximizing service distributions. In contrast, the Pass-Through column for this row says that PTs seek to maximize monetary distributions. While these goals appear to be different, they have a common interwoven theme of value in the sense that services have a monetary value. The Equity Distributions row captures the same theme. NP equity distributions refer to services rendered, while PT equity distributions refer to cash payouts and capital gains.

Exhibit 1.

Key Features of Nonprofits (NPs) and Pass-Throughs (PTs).

Of importance to this paper is the role of taxes as represented in the last five rows of Exhibit 1. The two rows on personal taxes provide an indicator of the after-tax valuation advantage of NPs over PTs. As seen in the last row, only PTs provide a substantial interest tax shield (ITS). However, NPs offset this ITS disadvantage (as seen in the Sources of Debt Financing row) by being able to issue personal tax-exempt debt (such as local and state government bonds). Thus, NPs will avoid taxable debt (such as bank debt) because it is more expensive. While C corps (CCs) pay both corporate taxes on earnings and personal taxes on distributions and capital gains, a PT only pays personal taxes on earnings albeit their personal tax rate is noticeably higher with a maximum statutory tax rate of 0.37 compared to the maximum personal tax rate of 0.20 paid by most CC owners on qualified dividends and capital gains. With the passage in December 2017 of the Tax Cuts and Jobs Act (TCJA), the maximum CC tax rate of 0.35 fell to a flat rate of 0.21, which is a large decline of 0.14. In contrast, the maximum for PTs only fell from 0.396 to 0.37, which is drop of just 0.026. TCJA caused other changes that affect PTs (and other individual personal income tax filers) in positive and negative ways with these changes often serving to offset one another.

Despite their tax differences, NPs and PTs can be similar in important characteristics. First, some enterprises can choose to be either an NP or a PT implying they can be substitute ownership types. DeSimone (2019) writes that LLCs can be NPs albeit the process is complex. Keatinge (2009) adds that LLCs have statutes that allow them to become NPs. In addition, within industries like the health care industry, NPs coexist with all types of PTs (sole proprietorships, partnerships, S corps, LLCs, and LLPs) with NPs and PTs supplying the same goods and services.

Second, like most PTs (exceptions are large publicly traded PTs), NPs are not publicly traded and so market risk, as represented by the CAPM beta, cannot be directly computed from empirical data. Regardless, NPs and PTs are affected by market conditions as their well-beings are altered when factors affecting market conditions change. For example, large NP donors give through incomes tied to their for-profit businesses and market investments. Furthermore, another major source of income for NPs is their investment portfolios that can be significantly invested in the stock market and so involve assets subject to market risk.

Third, since market risk affects NPs and PTs, they are both susceptible to other risks involving interest rate, exchange rate, geopolitical events, and recessions. In regard to recessionary risk, charitable contributions received by NPs decline when businesses falter during an economic recession such as is caused by a financial crisis (banking panics, stock market crash, currency crises, sovereign defaults), an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale natural or anthropogenic disaster. Thus, NPs and PTs share in classifications of risks that all enterprises face be they operational and financial risk or other lesser mentioned risk types such as competitive, compliance, legal, reputational, quality, credit, resource, and seasonal. Given the similar exposure of NPs and PTs to all forms of risk, our tests assume that NPs and PTs can inhabit similar risk classes and thus can share in the same costs of borrowing.

Fourth, while both NPs and PTs can be quite large, both also consist primarily of smaller enterprises. In fact, the vast majority of for-profits (FPs) are small businesses, whether they are PTs or CCs (although the latter have many larger firms). Brookings (2017) reports that 99% of FPs have less than USD 10 million in revenues with most of these FPs consisting of sole proprietorships that are PT businesses owned by one person. Other types of PTs (partnerships, LLCs, and S corps) can be extremely large. The Tax Policy Center (2018) notes that the 33.7 million PTs in 2016 have USD 957 billion in net income (average of USD 28,398). This is broken down as follows. First, the 25 million sole proprietors (nonfarm) report net income of USD 328 billion (average of USD 13,120). Second, the 8.7 million partnerships and S corporations report USD 629 billion in net income (average of USD 72,299). Like PTs, NPs are predominantly small. According to the National Center for Charitable Statistics, NCCS, (National Center for Charitable Statistics 2018), there are more than 1.5 million NPs registered in the US, including public charities, private foundations, and other organizational classifications. Contributions to different charities reached USD 358.38 billion in 2014 (with an average contribution of USD 238,920). NCCS writes that even after excluding NPs with gross receipts below the USD 50,000 filing threshold, the remaining two-thirds of NPs in 2015 contain 210,670 public charities with less than USD 500,000 in expenses (revenues average about 7.5% greater than expenses). These 210,670 NPs compose less than two percent of total public charity expenses of USD 32.3 billion. NPs with USD 10 million or more in expenses include about 5% of total public charities but account for nearly 88% of public charity expenses of USD 1.6 trillion.

2.2. Equity and Debt Financing for Nonprofits (NPs) and Pass-Throughs (PTs)

NP researchers (Bowman 2002; Miller 2003; Jegers and Verschueren 2006; Calabrese 2011) speak of NP borrowings in the same terms as the two general FP types of financing: equity and debt. Below we discuss these types.

Under the Sources of Equity Financing heading in Exhibit 1, we find that internal equity and external equity are given as the two major sources of equity financing for both NPs and PTs. For our purposes, internal equity refers to cash flows generated by an enterprise and set aside for growth before any applicable taxes are supplied. For NPs, internal equity includes unrestricted cash flows or cash flows earmarked for growth in the form of eligible revenues and investment/endowment income while external equity include cash inflows for growth from contributions, grants, and government sources. The equity financing sources for NPs are subject to debate by researchers as to whether they are internal or external or even if they are equity financing. For example, the external equity financing source of contributions (e.g., donations/gifts) might better be classified as eligible revenues. Bowman (2002) is among those who discuss the nature of contributions. For PTs, internal equity includes retained earnings while external equity consists of new partnerships, new issuances (by large PTs), and venture capital.

Under the Sources of Debt Financing heading for NPs, Exhibit 1 reports that debt can be classified as (i) tax-exempt for which no personal taxes exist, (ii) nonfinancial debt (consisting of mortgages that serves the same purpose as long-term financial debt,) and (iii) short-term debt (mostly trade credit as bank borrowings are avoided). Bowman (2015) cites 2012 data from the NCCS that report that tax-exempt debt composes nearly two-thirds of the long-term debt for NPs. Calabrese and Ely (2016) point out that there has been a twenty-year trend during which NPs have taken on more tax-exempt debt. While NPs can have bank debt, they will go to great lengths to avoid these borrowings since bank debt is not tax-exempt and therefore costlier. Similar to trade credit is a line of credit with a bank that NPs (like PTs) can use to cover the gaps in irregular monthly income. Under the Sources of Debt Financing heading for PTs, Exhibit 1 reports the debt can be classified as bond issues, mezzanine debt, Small Business Administration loans, and short-term debt. These PT debt sources are not tax-exempt.

In terms of comparing financing forms between NPs and FPs, the literature is sparce focusing on the heathcare industry. For this industry, NPs and FPs coexist where FPs can include both PTs and CCs healthcare organizations. For example, Trussell (2012) notes that the NP and FP ownership forms have unique financing mechanisms. However, these differences do not impact the relative amount of debt and equity in their capital structures. The latter is consistent with our findings.

2.3. Assignment of Unlevered and Levered Tax Rates for Nonprofits (NPs) and Pass-Throughs (PTs)

Prior to the lowering of FP tax rates by TCJA, Pomerleau (2015) writes that PTs faced an effective (or average) total tax rate of 0.47 that includes federal taxes and non-federal taxes such as state, county, municipal, property, sales, and payroll. In regard to the latter, NPs disburse payroll taxes like all FPs. Payroll taxes are the largest component of the non-federal taxes paid by PTs. For states without taxes, PTs do not pay state taxes and so resemble NPs in terms of state taxes paid. For our tests, we only consider federal taxes as described in Section 3.1.

When we cover our gain to leverage (GL) equations in our methodology section, we present unlevered and levered federal equity tax rates where the subscript “1” indicated an unlevered tax rate and the subscript “2” indicates a levered tax rate. Thus, for what follows TC1, TE1, and TD1 are unlevered corporate, personal equity, and personal debt tax rates at the federal level, while TC2, TE2, and TD2 are the corresponding levered tax rates that change with leverage as described by Hull (2014). By definition, unlevered refers to no debt. With this in mind, our use of the unlevered debt tax rate of TD1 is only for practically purposes as we need a starting point for the debt tax rate that rises with leverage. For CSM papers, where TD1 is not emphasized as a starting point, TD2 is simply called TD.

Before the reduction by TCJA in the personal levered equity tax rate (TE2), the Tax Policy Center (2016) noted that over two-thirds of PTs are taxed at either the maximum federal tax rate of 0.396 or the 0.28 alternative minimum rate. The average of these two rates generates a TE2 of 0.338. The Small Business Administration (SBA Office of Advocacy 2009), the National Federation of Independent Business (2013), and the Tax Policy Center (2018) indicate that most PTs experience a TE2 below 0.3 indicating a median would fall below 0.3. However, according to the Brookings (2017), almost half of PT income comes from businesses with an TE2 near the TCJA maximum. Considering all sources and the recent fall in TE2 under TCJA an effective TE2 between 0.21 and 0.34 is a reasonable ballpark estimate for TCJA tests. As we begin with an unlevered firm and allow tax rates to change when debt increases as described by Hull (2014), our tests use a personal unlevered equity tax rate (TE1) that is greater than an effective levered TE2 achieved at the optimal debt-to-firm value ratio (ODV).

The key tax rate for this study’s purposes is the business tax rate. For NPs, tax rates are only relevant if an NP happens to have a minor for-profit venture on the side. Under this assumption, the CC business tax rate is used albeit small. If small business ventures are not assumed, we use zero tax rates and so the FP ownership type (CC or PT) is irrelevant. For PT tests, the personal tax rate paid by PT owners is the business tax rate. For our low (L) tax rate tests under TCJA, we use an unlevered TE1 of 0.30 for PTs. This usage enables us to achieve an effective levered TE2 that is near 0.255 at ODV where TE2 changes by 0.03 in its predicted direction for each increasing debt-for-equity choice. As described later, each of our fifteen increasing debt-for-equity choices corresponds to a fall in the quality of one of the fifteen credit ratings given by Damodaran (2020).

Besides an L PT business personal tax rate, our tests include a high (H) PT business personal tax rate. This rate is suggested by Hull (2019) where the unlevered TE1 is 0.36 and the effective levered TE2 is around 0.31 at ODV. An H tax rate gives greater weight to averages whereas an L tax rates provides a greater weight to medians. The above L and H tax rates occur under TCJA tax laws. Thus, tests using these tax rates under TCJA can be referred to simply as TCJA tests. When testing pre-TCJA tax rates, we increase our TCJA unlevered and effective levered TE2 values by 0.02 for both the L and H tax rate tests given that TCJA drops rates for its tax brackets by about 0.02 on average. Tax rates for our L tax rate tests under TCJA are used in the first five tables and first five figures, while tax rates for our robust tests (that include L tax rate tests for a pre-TCJA tax environment and H tax rate tests for both pre-TCJA and TCJA tax environments) are used in the last three tables and the last five figures. In addition, these last tables and figures incorporate a greater growth rate (as discussed later).

Interest distributions for a PT debt owner are taxed at the levered personal debt tax rate (TD2). If debt is held longer than three years, any capital gains are taxed at the lower capital gains rate with a typical maximum rate of 0.20 for which we expect a TD2 around 0.16. A marginal TD2 based on the imputed rate from the highest rated municipal and corporate bond yields varies over times and can be near the maximum statutory rate. However, this imputed tax rate is more of a marginal tax rate than an effective tax rate. Considering all factors, a range from 0.16 to 0.26 is feasible for an average TD2. For our TCJA tests where TD2 increases with leverage, we set the unlevered TD1 at 0.18 to get a levered TD2 around 0.21 at ODV. For our pre-TCJA tests, we increase TD1 by 0.01 due to expectations of slightly greater rates on debt income. We use the same TCJA and pre-TCJA values for TD1 and TD2 for both our L and H tax rate tests as the focus is on the business tax rate that directly impacts (i) internal growth that stems from the use of retained earnings (RE) and (ii) the ITS that results in tax savings at the business tax rate level.

Except for occasional ventures that produce negligible taxable income, we view NPs as having zero tax rates at the corporate and/or personal levels. Since NPs can issue debt that is exempt from personal taxes, it is possible for debtholders to achieve a TD2 of zero. Bowman (2015) writes that most NP debt is tax-exempt. He also notes that the trend has been to issue even more tax-exempt debt. Given the possibility of zero tax rates, our L tax rate tests for NP use zero values for the unlevered corporate tax rate (TC1), TE1, and TD1. Since zero tax rates cannot change with leverage, the levered tax rates of TC2, TE2, and TD2 are also zero. For our H tax rate tests for NPs, we assume tax rates are not zero but small. For these tests, we set both TC1 and TE1 at 0.02 where we assume the existence of minor for-profit ventures (such as gift shops). We set TD1 at 0.04 where we assume some debt is issued that is not tax-exempt. Given that TC1 and TE1 are small, they cannot change much and so achieve similar effective levered tax rates for TC2 and TE2. TD1 is slightly larger and so TD2 is slightly higher at 0.045 since TD2 increases with leverage. For pre-TCJA tests, we increase these unlevered tax rates by 0.01 and achieve effective levered tax rates that have a similar increase. In addition, we set both TC1 and TE1 at 0.03 for pre-TCJA tests and so they both fall so that TC2 and TE2 are both about 0.025. Finally, we set TD1 at 0.05 for pre-TCJA tests and it rises so that TD2 is about 0.06.

Exhibit 2 summarizes the tax rates just discussed. The unlevered tax rates are given first in Nonprofit and Pass-Through columns in each row and are followed by the estimated levered tax rates that occur at ODV. Panel A contains the L tax rates and Panel B provides the H tax rates. The top half of each panel gives the pre-TCJA tax rates and the bottom half reports the TCJA tax rates. While we follow tax laws governing C corps (CCs) for NPs, the results would be similar if we used the tax code governing PTs since all of our NP tests have zero or very small tax rates given their tax-exempt nature. Finally, Exhibit 2 reveals that a main change when going from an L tax rate to an H tax rate is for the business tax rate that affects both growth (through RE) and the ITS where the business tax rate is the personal equity tax rate for PTs and the corporate tax rate for NPs.

Exhibit 2.

Tax Rate Sets.

2.4. Capital Structure Models

A capital structure model offers an approach to choose among forms of borrowing (and their proportions) that are needed to finance a firm’s operations and growth. The two major forms of borrowing are equity and debt. Trade-off theory (Baxter 1967; DeAngelo and Masulis 1980; Hackbarth et al. 2007; Berk et al. 2010; Hull 2018) posit that there is an optimal amount of equity and debt that maximizes firm value. Key components of trade-off models should capture the positive influence such as exercised by an ITS and the negative influence such as exerted by bankruptcy costs. Trade-off models are consistent with empirical research (Graham 2000; Korteweg 2010; Van Binsbergen et al. 2010) that finds debt increases unlevered firm value.

Agency models provide a trade-off framework where ODV occurs even without an ITS. Jensen and Meckling (1976) demonstrate how maximum valuation occurs at ODV simply from principal-agent valuation effects. As agents of debt owners, equity owners can undertake projects to enhance their residual ownership positions at the expense of debt owners. Besides the negative agency effects on debt owners involving project choice, agency models also detail positive effects when debt enters the capital structure. For example, consider an all-equity firm with a glut of cash flows that leads to managerial squandering. Jensen (1986) contends that such an enterprise can add value by issuing debt because it lessens the cash flows that are being squandered by caretakers.

For large enterprises with many individual owners, there can be almost perfect separation between owners and managers leading to owner-manager conflicts. For PTs that are sole proprietors, these problems do not exist. For PTs that are partnerships, liability is shared among owners ensuring mutual monitoring and less separation of control between owners and managers. For large NPs, the capital is largely supplied by donors who lack the control found in larger for-profits where owners can withdraw assets or sell stocks. However, since NP donors do not have a monetary enrichment motive, agency problems between donors and management can be lessened. Agency costs for NPs can also be lessened in that large donors are often on the board of directors. This helps ensure proper monitoring of the NP management similar to how residual claimants in larger PTs exercise control due to the constant threat that they can sell their ownership claims if managers prove untrustworthy. Despite these arguments that lessen the agency costs for NPs, lack of a clear-cut profit motive that tends to mitigate many agency costs for PTs is not present for NPs. For example, Manne (1999) argues that NPs have greater agency problems because ownership, goals, and performance are less well-defined compared to for-profits like PTs.

In addition to agency models, pecking order models of financing (Donaldson 1961; Myers 1977; Myers and Majluf 1984) do not depend solely on taxes. For PTs, the preference in financing is internal equity (e.g., RE for growth) followed by debt. External equity is the last resort due to expenses especially asymmetric information costs reflected in the negative signaling that accompanies a new issuance. Pecking order models do not address the high after-tax costs experienced by PTs when using internal equity in the form of RE that can only be used after taxes are paid. By paying zero taxes (or negligible amounts of taxes), NPs avoid the taxation on its sources of equity financing. For NPs, as seen earlier in Exhibit 1, internal equity sources earmarked for growth can include eligible revenues and investment/endowment income.

Researchers (Bowman 2002; Calabrese 2011) have applied pecking order theory to NPs. Bowman (2002) suggests that the real cost of NP debt relates to the fear of default because NPs cannot liquidate all of their assets even if on a downward valuation spiral. This means equity forms of financing such as charitable contributions take precedence over debt. Despite the woes associated with debt, Bowman argues that NPs should still prefer debt to asset conversion where asset conversion refers to selling a portion of the endowment. For Bowman, NPs should wait to use endowment funds until they reach their debt restriction as endowment funds used jointly with tax-exempt debt create arbitrage cash flows.

For Calabrese (2011), NPs prefer internal equity in the form of accumulated unrestricted residual revenues over external borrowing. NPs also prefer to maintain some amount of internal pools of capital for future growth. For NPs, internal equity and external funds are not perfect substitutes. The information asymmetries causing the preference for internal equity in the NP sector are different than those found in the FP sector. This is because of less observable benefits to outsiders and variation in donor oversight, willingness, and ability to finance capital.

In this paper, we use the Capital Structure Model (CSM), which is a trade-off model capable of pinpointing a firm’s ODV. The CSM’s focus on internal equity (e.g., RE) is consistent with pecking order models as well as what is observed in the business world where growth is primarily financed by internal equity. For high (H) tests for NPs, that assume a slight amount of taxation beyond zero, we use the CSM equations given by Hull (2018) for CCs. Low (L) tests for NPs offer results that are invariant to the ownership form as all tax rates are zero. For PT tests, we use the CMS equations given by Hull (2019) for both L and H tax rate tests as well as his suggestions concerning values for inputs, especially for H tax rate tests. Values for inputs are also influenced by the recent CSM research (Hull 2020a, 2020b).

3. Methodology

In this section, we present our methodology that consists largely of the Capital Structure Model (CSM). We also include a description of how the CSM is used to identify optimal outcomes. We then present the CSM approach to growth. Finally, we provide the method of obtaining the costs of borrowing using credit spreads that are matched to debt-for-equity choices.

3.1. Capital Structure Model (CSM)

Using the definition that the gain to leverage (GL) = VL − VU where VL is levered firm value consisting of levered equity (EL) and debt (D) and VU is unlevered firm value or, equivalently, unlevered equity value (EU), Hull (2014) extends the CSM research on C corps (CCs) by incorporating changes in tax rates and shows that the nongrowth CC equation is

where

GL = (1 − αIrD/rL)D + (1 − α2rU/rL)EU

αI and α2 capture the effects of effective tax rates with α1 = (1 − TE2)(1 − TC2)/(1 − TD2) and α2 = (1 − TE2)(1 − TC2)/(1 − TE1)(1 − TC1) where TE1 and TE2 are the respective unlevered and levered personal equity tax rates, TC1 and TC2 are the respective unlevered and levered corporate equity tax rates, and TD2 is the debt tax rate, which by definition is a levered tax rate;

rD, rL, and rU, are, respectively, the cost of debt, cost of levered equity, and cost of unlevered equity;

D is the amount of debt issued to retire unlevered equity (EU) with D = (1 − TD2)I/rD where I is the interest payment; and,

EU = (1 − TE1)(1 − TC1)C/rU where C is the before-tax payout with C = (1 − PBRBT)(CFBT) where PBRBT is the before-tax plowback ratio with PBRBT = 0 in (1) due to nongrowth and CFBT is the perpetual before-tax cash flow where equals CFBT = C for nongrowth since PBRBT = 0.

For our tests, CFBT refers to cash flows before federal taxes. Since CFBT is analogous to earnings before interest and taxes (EBIT), this means that the non-federal taxes would have already been recorded as expenses when computing EBIT. Thus, any other applicable non-federal tax (state, payroll, county, municipal, property, and sales) would have been expensed before federal taxes are considered.

Hull (2018) extends the CSM research on CCs by correcting the levered equity growth rate (gL) given by Hull (2010) and providing nongrowth and growth constraints. Since the CSM assumes internal growth through earnings retained from operations, the growth constraint is also called the retained earnings (RE) constraint. The CSM growth CC equation with tax rate changes is

where

GL = (1 − αIrD/rLg)D + (1 − α2rUg/rLg)EU

αI, α2, rD, and D are the same as defined when presenting Equation (1);

rLg, and rUg, are, respectively, the growth-adjusted cost of levered equity (which is rL minus the levered equity growth rate, gL), and the growth-adjusted cost of unlevered equity (which is rU minus the unlevered equity growth rate, gU); and,

EU = (1 − TE1)(1 − TC1)C/rUg where C = (1 − PBRBT)(CFBT) with PBRBT = RE/CFBT > 0 due to using RE for growth.

Hull (2019) extends the CSM research on CCs given by Hull (2018) and derives GL for a pass-through (PT) with nongrowth and growth. The Hull (2019) nongrowth PT equation can be expressed in the same manner as the nongrowth CC equation given in (1) but with different definitions for those variables affected by dissimilar tax laws governing CCs and PTs (in particular, TC1 and TC2 are zero for PTs and the corporate business tax rate, TC2, is replaced by the personal business tax rate, TE2). The PT nongrowth equation is

where

GL = (1 − αIrD/rL)D + (1 − α2rU/rL)EU

αI and α2 capture the effects of effective tax rates with α1 = (1 − TE2)/(1 − TD2) as (1 − TC2) falls out from the earlier CC equation for α1 since TC2 = 0 for PTs and α2 = (1 − TE2)/(1 − TE1) as (1 − TC2) and (1 − TC1) both fall out from the earlier CC equation for α2 since TC2 = 0 and TC1 = 0 for PTs;

TE1, TE2, TD2, rD, rL, rU, D, I, and C are the same as just defined when presenting Equation (1); and,

EU = (1 − TE1)C/rU as (1 − TC1) falls out of the earlier CC equation for EU since TC1 = 0 for PTs.

The Hull (2019) growth PT equation can be expressed in the same general manner as the growth CC equation given in (2) but with different definitions for those variables affected by dissimilar tax laws governing CCs and PTs (as described in next paragraph). The PT growth equation is

where

GL = (1 − αIrD/rLg)D + (1 − α2rUg/rLg)EU

αI and α2 are the same as given in (3);

rD and D are the same as prior equations.

rLg and rUg are the same as given in (2) except gL and gU are adapted to PTs (as described below); and,

EU = (1 − TE1)C/rUg where C = (1 − PBRBT)(CFBT) with PBRBT = RE/CFBT > 0 due to using RE for growth.

As seen in Equations (2) and (4), the growth CSM equation for CCs and PTs use two growth rates. First, these growth equations use an unlevered growth rate that is labeled gU. The gU for CCs given in (2) has its origins in Hull (2010) who argues gU = rU(1 − TC1)RE/C where RE represents retained earnings used for growth with RE determined by the plowback-payout decision. Hull (2019) extends the gU used for unlevered CCs and applies it to unlevered PTs. In his extension, TC1 is replaced with TE1 so that gU = rU(1 − TE1)RE/C for PTs. The replacement of TC1 with TE1 reflects the fact that the CC business tax rate of TC1 is at the corporate level, while the PT business tax rate of TE1 is at the personal level. In brief, both TC1 for CCs and TE1 for PTs are business level tax rates because they apply to taxes paid on income generated by business operations and before any federal taxes are paid. As discussed in Section 2.3, the PT business tax rate fell from a maximum of 0.396 to 0.37 in 2018 with the enactment of TCJA and the CC business tax rate fell from a maximum corporate tax rate of 0.35 to a flat rate of 0.21 under TCJA.

Second, these growth equations use a levered equity growth rate that is referred to as gL. The gL for levered CCs mentioned in (2) was first given by Hull (2010) but later corrected by Hull (2018) who offers proof that gL = rL(1 − TC2)RE/[C + G − (1 − TC2)I] for levered CCs where G is the perpetual before-tax cash flow stemming from GL with G = rLgGL/(1 − TE2)(1 − TC2). The GL equation given by the CSM for growth applications requires an iterative procedure (such as offered by Excel) because gL, GL, and G are interdependent. Hull (2019) extends the gL for levered CCs by replacing TC2 with TE2 so that we now have the levered PT version, which is gL = rL(1 − TE2)RE/[C + G − (1 − TE2)I] with G = rLgGL/(1 − TE2) where (1 − TC2) falls out of the earlier CC equation for G since TC2 = 0 for PTs. In conclusion, when going from a CC to a PT, both growth formulae (gU and gL) just replace the unlevered and levered corporate business tax rate on CC income with the corresponding unlevered and levered personal business tax rates on PT income.

While gU depends on the plowback-payout decision through RE, gL depends on both the plowback-payout decision through RE and the debt-equity decision through I. Thus, the growth equations, Equations (2) and (4), tie together growth and leverage through gL. Besides G, another variable instrumental in the derivational process for CSM growth equations is the perpetual levered equity value (EL). As applied to CCs, EL = (1 − TE2)(1 − TC2)(C − I)/rLg. As applied to PTs, EL = (1 − TE2)(C − I)/rLg where (1 − TC2) falls out since TC2 is zero for PTs. For the corresponding CC and PT nongrowth equations for G and EL, we substitute rL for rLg. Under historical and current tax laws, I is considered a tax deductible expense. This leads to an interest tax shield (ITS) for PTs of TE2(I) that is like the ITS for CCs except that it uses TE2 instead of TC2 as the interest deduction comes at the personal business level for PTs instead of the corporate business level. With RE fixed by the company’s plowback-payout decision, the denominator in the gL equation for CCs points out that the expression of C + G > (1 − TC2)I must hold to prevent the earmarked amount of RE from relinquishing some of its growth funds to service debt. In addition, this expression must hold to prevent gL < 0 from occurring. For the gL equation found in (4) for PTs, C + G > (1 − TE2)I must hold to maintain its targeted amount of RE and prevent gL < 0 from happening. Based on the definition of gL for CCs, Hull (2018) posits that the growth (RE) constraint of C + G − (1 − TC2)I ≥ RE must hold. For PTs, Hull (2019) points out that the growth constraint of C + G − (1 − TE2)I ≥ RE must hold. If these growth constraints do not hold, a firm no longer has sufficient RE to achieve growth with internal funds. Since RE is zero for nongrowth, the nongrowth constraint can be expressed as C + G − (1 − TC2)I ≥ 0 for CCs or, equivalently, C + G ≥ (1 − TC2)I. For PTs, we have the nongrowth constraint of C + G ≥ (1 − TE2)I as TE2 replaces TC2.

As shown by Hull (2010), CSM growth equations become nongrowth equations when growth rates are zero. By nongrowth, we mean no growth using internal equity (e.g., RE) as enterprises can always grow in other ways such as by mergers or new external security issues. Practically speaking, nongrowth can imply that a PT has reached a point in its life cycle where it is more valuable to pay out cash flows to investors than endure the double taxes involved with reinvesting after-tax internal funds that create more cash that is again taxed before being paid out to owners. For nonprofits (NPs), nongrowth implies that its revenues have reached a saturation point where they are steady and sufficient to fund current and future needs so that growth is not a viable option.

CSM nongrowth and growth equations can be easily adapted to NPs. For example, if tax rates are zero and we assume the PT form of ownership for an NP, the multiplicands of (1 − TE1), (1 − TE2) and (1 − TD2) all reduce to 1 when applied to NPs. If we assume a CC ownership form for an NP, the multiplicands of (1 − TC1) and (1 − TC2) also reduce to 1 when applied to NPs. With all multiplicands equal to one because tax rates are zero, both α1 and α2 equal 1 since they are composed solely of multiplicands. When applied to NPs, zero values for tax rates also reduce multiplicands to one for CC and PT formulae that involve growth rates and constraints. For NPs, we now have: gU = rURE/C, gL = rLRE/[C + G − I], G = rLGL; and, the growth and nongrowth constraints are C + G − I ≥ RE and C + G > I, respectively. Finally, zero tax rates reduce ITS to zero. In brief, when tax rates are all zero for NPs, all CMS outputs are invariant to the form of ownership (PT or CC) that is used. This is because all outputs are the same for either ownership from that is used by the CSM.

3.2. Identifying the Optimal P Choice

P refers to the proportion of unlevered equity (EU) retired with debt (D). Identifying the optimal P choice for nongrowth tests is simple as we just find the largest firm value from all tests for feasible P choices where a feasible P choice refers to a leverage choice where the nongrowth constraint is not violated. While identifying optimal nongrowth outputs is straightforward such is not the case for growth and a general procedure is needed. In applying the CSM with growth, Hull (2019) offers the following general two-step procedure when determining the optimal P choice.

First, we run tests using equation (2) for growth CCs or Equation (4) for growth PTs with a long-run sustainable growth rate for all P choices excluding choices where the growth constraint sets in. Since RE = PBRBT(CFBT) and the CSM gL (that represents the long-run sustainable growth rate) is defined in terms of RE, we are able to change PBRBT until our chosen gL is achieved for each feasible P choice. Second, we identify the P choice that generates the max VL among all feasible P choices and this P choice is the optimal choice.

Hull (2019) notes a number of caveats with this procedure and finds that the use of the nongrowth optimal P choice will generally yield the growth optimal P choice when using a long-run historical growth rate. If we assume an average firm, then tests can be reduced to those credit ratings that are most common as is done by Hull (2020a). As shown by Hull (2020b), the nongrowth CSM equations generate credit ratings that are consistent with the ratings most often achieved by firms. Of importance, the nongrowth test generates only one max VL that corresponds to a credit rating that can be called the optimal credit rating (OCR). For our main tests that focus on the years of 2018 and 2019, the nongrowth OCR is Moody’s A3. This OCR is also used for our growth tests as described next.

For our first series of growth tests reported in Section 4, we choose a PBRBT that attains a gL of 3.12% to use with the CSM perpetuity model equations of (2) and (4). A growth rate of 3.12% is suggested by the growth in the annual U.S. real GDP as supplied by the U.S. Bureau of Economic Analysis (2018) the past seventy years. The usage of a GDP growth rate as a proxy for gL assumes that GDP is a result of the growth in businesses including the risk-taking residual equity ownership of businesses. The exact correctness of the 3.12% selection is not essential to our major findings and other realistic gL values consistent with other long-run periods perform similarly. However, we should point out that large deviations from 3.12% can have a significant influence on firm value. For example, growth rates significantly greater than 3.12% can lead to much greater firm value. For some of the results reported in Section 5, we choose a PBRBT that attains a gL of 3.90%. The rate of 3.90% is suggested by the Tax Policy Center (2018) for an TCJA tax environment that reports an estimated boost in growth per year of about 0.8% for both 2018–2020 (average of six sources) and for 2018–2027 (average of five sources). Thus, tests using 3.90% are only applicable for a TCJA tax environment. The use of 3.90% for a TCJA environment is used by Hull and Hull (2020) in their examination of business growth, taxpayer wealth and federal tax revenue. Utilization of 3.90% is also one of two larger growth rates tested by Hull (2020b) in their PT and CC study.

3.3. CSM Approach to Growth

The CSM approach to growth begins with an unlevered firm that has retained earnings (RE) that are set aside for growth purposes. However, RE is taxable at the business level making its usage costly. The growth for an unlevered firm (VU), or equivalently unlevered equity (EU), is captured by gU which increases as PBRBT rises. For example, using the CSM formula of gU = rU(1 − TC1)RE/C from Section 3.1 and noting RE = PBRBT(CFBT), we have gU = rU(1 − TC1)PBRBT(CFBT)/C where we use TC1 if we classify an NP as a CC (TE1 if we classify an NP as a PT). When debt (D) enters the picture, gU becomes gL with gL > gU as can be seen from the definitions given for gU and gL in Section 3.1. The issuance of D to retire EU makes D a de facto partner in growth in terms of increasing the growth rate per equity share. One might even argue that by supplying capital for corporate purposes, D frees up more operational cash flows for growth. Thus, one could argue that the D in conjunction with operating cash flows are now part of the same available cash flows from which a firm could retrieve funds for growth and so debt is a partner in growth.

The traditional view of D, as captured by the DuPont system of ratio analysis, is that it magnifies the return on equity (ROE) by an equity multiplier (EM), which is defined as EM = (equity + D)/equity. This magnification applies in particular to GL models, like the CSM, in that D is issued to retire EU as opposed to a debt offering that seeks funds for purposes different from equity retirement. The latter does not increase EM as much as a debt-for-equity transaction. Like the DuPont model, the CSM shows magnification but in the form of growth where gU is magnified by D and becomes gL. Since this also serves to increase ROE if growth is profitable, the CSM can be viewed as attaining the same outcome as the DuPont model, which is that D increases ROE.

From the CSM viewpoint, NPs have an investment advantage by not paying taxes on RE as this enables NPs to avoid the taxation costs experienced by PTs when using RE for growth. This NP advantage could be neutralized if a PT grew by a debt issuance where the purpose was for growth activities. The only direct costs would be the flotation or issuance costs that are typically much smaller than the business tax rate paid on RE. The valuation advantage of an NP over a PT could be further reduced by a PT’s ITS were it not for the offsetting tax-exempt nature of NP debt that cuts into the relative advantage that PTs have by deducting interest (I). However, I would cause its own problems, as it would be a future threat to reduce the usage of RE for growth since I (like RE) requires the use operational cash flows. If there were problems in refinancing the D, then any principal proceeds used for growth would have to be paid back. Even for external equity financing (which for NPs involves contributions, grants, and government inflows), NPs do not face the costs that exist for large PTs especially those that trade publicly. For example, these costs include the PT flotation expenses as well as any negative signaling that, at least in the short-term, would have a downward effect on PT equity value.

In conclusion, part of the huge NP valuation advantage can be attributed to lower costs when undertaking growth. The role of debt in growth, within the CSM framework, is that of increasing gU to gL. Outside this framework, D can be issued for purposes other than retiring EU and thus could be part of cash flows available to the firm for its chosen usages for equity payouts (dividends), RE, and I.

3.4. P Choices, Costs of Borrowing, and Betas

Table 1 contains the procedure to get the costs of borrowing for each P choice. Table 1 computes P choices using L (e.g., zero) tax rates for NPs. Prior CSM research computes (in a fashion similar to Table 1) P choices using tax rates for CCs (Hull 2020a) and PTs (Hull 2020b). This table’s procedure that uses credit spreads to determine costs of borrowing matched to P choices follows this prior CSM research but uses NP tax rates. Using spreads to get costs of borrowing (as used in the CSM to determine ODV) is consistent with the research (Graham and Harvey 2001; Kisgen 2006) that argues credit ratings influence a firm’s ODV. By using credit spreads, the CSM produces a sequence of increasing borrowing costs that can be used to compute increasing debt-to-firm value ratios (DVs). This sequence is needed to identify which DV corresponds to the maximum firm value as this DV is the ODV.

Table 1.

Costs of Borrowing.

To estimate the costs of borrowing provided in Table 1, we begin by retrieving fifteen credit spreads corresponding to fifteen credit ratings from Damodaran (2020) for 2019. While these are the most recent ratings available at the time of this writing, we also perform additional tests using spreads from prior years that are given by Damodaran (2019). Damodaran (2020) supplies a range of interest coverage ratios (ICRs) for each spread and rating for three groups of firms: large, small, and financial service. For this study, the best fit is the small group given that most NPs and PTs are smaller entities. We follow Hull (2020a) in choosing a feasible point within each range of the small group when identifying an ICR to represent its range.

While ICR is conventionally defined as EBIT/I, Damodaran defines ICR as (1 − T)EBIT/I where T is the effective tax rate on business income. Given Damodaran’s ICRs and noting EBIT is analogous to CFBT, we use the following equation to get the interest (I) paid on debt (D) per USD 1,000,000 in CFBT: I = (1 − T)CFBT/ICR. For NP tests, we compute I using the CSM’s TC2 for T where TC2 is the business tax rate for CCs. For PTs, T is the same as the CSM’s use of TE2. The use of both TC2 and TE2 were described in Section 2.3. Since there are fifteen ICR values, we compute fifteen I values.

Given the fifteen I values and their corresponding TD2 values and cost of debt (rD) values, we calculate fifteen D values where D = (1 − TD2)I/rD. We then compute fifteen P choices using P = D/EU. Table 1 reports these P choices in the first column along with their corresponding ICRs, Moody’s ratings and credit spreads in the second, third, and fourth columns, respectively. As NPs and PTs have different TD2 values, their P choices differ slightly.

We add each of the fifteen credit spread to a risk-free rate (rF) of 2.5% to get fifteen values for the rD. To illustrate, for the first credit rating of Aaa/AAA where the credit spread (CS) is 0.63%, we have: rD = rF + CS = 2.5% + 0.63% = 3.13%. This value is reported in the first row of the rD column in Table 1. Using an equity risk premium of stocks over bonds (EPB) of 3.45%, we compute costs of levered equity (rL). We have rL = rD + EPB = 3.13% + 3.45% = 6.58%. This value is reported in the first row of the rL column. Finally, we compute debt and equity betas using the CAPM with these values given in the last two columns. These computations reveal two required results. First, the first debt beta (βD) of 0.126 is greater than the risk-free beta of zero. Second, the first levered equity beta (βL) of 0.816 is greater than the unlevered beta (βU) of 0.8 (given later). Of further importance, the βL at the OCR of A3 is 0.9333 and thus near the market beta (βM) of 1. This value for βL is Table 1 is reflective of our tests indicating that our NPs and PTs are representative of a company with an average market risk.

4. Results Using Low (L) Tax Rates under TCJA with Historical Growth

This section provides introductory variables used in the CSM followed by illustrations that contain key outcomes from nonprofit (NP) and pass-through (PT) tests. For these illustrations, we use a historical growth rate of 3.12% and low (L) tax rates under a TCJA tax environment. These tax rates are found in the bottom half of Panel A in Exhibit 2. These illustrations provide data for our first five figures that plot main outcomes against credit rating choices. While this section focuses on result using L tax rates under TCJA with 2019 spreads, the following section will incorporate high (H) tax rates, pre-TCJA tax rates, and spreads for years from 2014 through 2019.

4.1. Variables and Computations

Table 2 presents introductory variables and performs preliminary computations needed to begin the process that uses CSM equations to investigate optimal financing for NPs and PTs. Panel A focuses on the computations for the CSM’s two alpha tax rate variables, α1 and α2, using (i) the L tax rates under TCJA as given in the bottom half of Panel A in Exhibit 2 and (ii) the historical growth rate of 3.12% discussed in Section 3.2. As argued by Hull (2014), α1 and α2 can exercise a key valuation function in the first and second components, respectively, of CSM GL equations. However, for NPs with L tax rates that are all zero, α1 and α2 values do not exercise an influence because α1 =1 and α2 =1 for all P choices where P refers to the proportion of unlevered equity (EU) retired with debt (D). For an alpha variable to change with leverage, at least one tax rate has to be greater than zero. As computed in Panel A, the first P choice for PTs gives (rounding off to two digits) α1 = 0.87 and α2 = 1.01 while the fifth P choice gives α1 = 0.94 and α2 = 1.06. The latter P choice is also the optimal choice and coincides with optimal outcomes including the optimal credit rating (OCR), which is Moody’s rating of A3.

Table 2.

Introductory Variables and Computations.

In Panel B, we offer NP and PT examples when computing the following six variables where each ownership type has USD 1,000,000 in CFBT. These six variables are: retained earnings (RE); cost to use RE (CRE); %CRE per USD 1,000,000 of CFBT; before-tax payout (C); unlevered equity growth rate (gU); and, EU. From the EU values in this panel for the NP and PT, we can see just how much advantage an NP has by not paying taxes. As computed in Panel B, the advantage is USD 6,287,372 as EU is USD 17,546,149 for an NP but only USD 11,258,777 for a PT. From this panel, we can also discover that CRE is USD 0 for NPs. This compares to USD 90,657 for PTs. CRE per USD 1,000,000 of CFBT is 0% for NPs and 9.07% for PTs. This difference casts light on the before-tax plowback ratio (PBRBT) outcomes in Panel B where NPs achieve 3.12% growth with a PBRBT of 0.2598 at its OCR of A3 compared to 0.3519 for PTs at its OCR of A3. We observe that as the cost of using RE increases, the size of PBRBT also increases.

We conclude that, ceteris paribus, lower costs (in the form of lower tax rates) allow the same OCR to be attained with a lower PBRBT and thus less RE is needed to achieve the same growth rate of 3.12%. If less RE is needed with lower tax rates, then growth using RE becomes more affordable when tax rates are lowered. This conclusion is consistent with the empirical research (as summarized by McBride 2012) and tax experts at the Tax Foundation (2018) and Tax Policy Center (2020) who argue that higher tax rates inhibit growth. With higher taxes, more before-tax RE is needed to grow and the CRE per USD 1,000,000 of CFBT becomes too costly. This explains our later results where we find that using a high business tax rate yields a nongrowth firm value greater than its growth value.

4.2. Illustrations of NP and PT Outcomes

Table 3 uses Equation (2) as applied to an NP with zero tax rates and a 3.12% growth rate to generate NP outcomes. Like the prior two tables, Table 3 uses credit spread data for 2019 from Damodaran (2020). In the columns of Panel A in Table 3, we provide outcomes for the unlevered P choice of 0 and the seven feasible levered P choices ranging from 0.0759 to 0.3377. In the last column, n.a. stands for not applicable as the growth (RE) constraint is violated once P reaches 0.3579. Thus, values do not exist for this column. The debt-to-firm value ratio (DV) that is optimal is ODV and it is identified from the maximum gain to leverage (max GL) that coincides with the maximum firm value (max VL) since max VL = EU + max GL. The process to identify max VL was described in Section 3.2. In Panel A, ODV, max VL, max GL and other optimal outcomes are in bold print column. Panel B provides computations for these optimal outcomes.

Table 3.

Nonprofit Illustration.

In Panel A of Table 3, the bold print column reveals that the optimal P is 0.2921, OCR is a Moody’s rating of A3, and a levered growth rate of 3.12%. As noted in Section 3.1, a rate of 3.12% is suggested by data for annual growth in U.S. real GDP for a seventy-year period as supplied by the U.S. Bureau of Economic Analysis (2020). The last row of the bold print column discloses that ODV is 0.2739. The reported debt-to-firm value ratios (DVs) in Table 3 are slightly smaller than P choices because the denominator in DV computations consider the gain to leverage (GL) that is positive. However, with larger DVs and lower quality credit ratings, GL will decline reversing the trend where DV is smaller than P choices. Besides changes in the denominator of DV, the differences between P and DV in Table 3 can also be explained by the low sensitivity of ODVs to situations like the change in tax rates and the value of certain variables (such as βU). For example, there is less deviation between P and ODV for PTs if tax rates are not allowed to change. Furthermore, P and ODVs converge for slightly lower βU values. Finally, as seen in the last column of Table 3, a violation of the growth constraint does not occur until we reach the last column where P is 0.3579. Due to this violation, there are no values in the last column.

Panel A reveals that the first component of GL is positive and increasing until we go past P = 0.1580, while the second component is positive and increasing except for the downward bump that occurs at P = 0.1929. Together these two components (that represent GL) are increasing except at the downward bump at P = 0.1929 until we go past P = 0.2921. At the optimal P of 0.2921, we find that max GL is USD 1.163M (M = million) and max VL is USD 18.709M. After the optimal P choice is reached, we find growth rates greater than 3.12%. While rates greater than 3.12% are not sustainable, on average, for a perpetuity situation if a long-run historical growth rate is only 3.12%, we have already achieved our optimal and so their unsustainability is a moot point.

Panel B of Table 3 continues the NP computations began in Table 1 and Table 2. This panel shows how I, D, G, gL, rUg, rLg, max GL, max VL, EL, max %∆EU, NB, and ODV are calculated for the optimal choice of P = 0.2921. For the latter five variables, we use the following definitions: VL = GL + EU (which only holds when we begin with an unlevered situation and not like the levered situation used by Hull (2012) who derives incremental GL equations that allow for a wealth transfer); EL = VL − D; percent change in EU (%∆EU) = GL/EU in percentage form; net benefit from leverage (NB) = GL/D in percentage form; and, debt-to-firm value ratio (DV) = D/VL. The max %∆EU of 6.63% found in the bold print column agrees with the for-profit (FP) research (Graham 2000; Korteweg 2010; Van Binsbergen et al. 2010) that collectively suggests that leverage increases firm value between 4% and 10% at ODV. Thus, it appears that NPs, like for-profits (FPs), can attain ODVs similar to those found for FPs despite differences over time such as changes in tax rates and tax laws. If we consider the results of our tests using both our H and L tax rates presented in Exhibit 2, the NP values reported in this paper for max %∆EU range from 2.46% to 8.83% with a mean of 5.67% and a median of 5.48%. Finally, as seen in the next to last row of Panel B, NB is reported as 22.69%. Thus, every dollar of debt adds 22.69 cents to EU at the ODV of 0.2739.

Table 4 repeats Table 3 but is for a PT. The optimal P choice of 0.2674 in Table 4 for a PT is less than that of 0.2921 in Table 3 for an NP. Once again, the column in Panel A with the optimal P choice is in bold print and coincides with an OCR of A3. For this panel there is no violation of the growth constraint indicating there is enough RE to achieve the growth designated by the plowback-payout policy for ratings from Aaa to Ba2. NPs could not achieve a rating of Ba2 as the growth constraint was violated. Of importance, ODV has already been reached for both NPs and PTs before RE is exhausted. Therefore, internally generated earnings are satisfactory to achieve the historical average growth rate of 3.12%. The last three P choices in the last three columns of Panel A in Table 4 reveal that values are only attained with growth rates that are higher than the historical average of 3.12%. For example, these columns reveal respective gL values of 3.49%, 3.97%, and 4.49%. Regardless, VL values for these higher growth rates are not greater than max VL that is achieved when gL = 3.12%. This was also true for NPs in Table 3.

Table 4.

Pass-Through Illustration.

Panel A of Table 4 reveals that the first component of GL is positive for the first six P choices for a PT. This is similar to the results in Table 3 for an NP where the first five P choices were also positive. The second component for PTs is increasing. This is similar to NPs where its second components was also increasing except for a downward bump at the P choice corresponding to Moody’s rating of A1. Similar to the generally increasing GL for NPs in Panel A of Table 3, Panel A of Table 4 reveals that GL is strictly increasing for PTs until we go past the OCR of A3. At A3, we see that max GL is USD 1.046M and max VL is USD 12.305M. These values are less than the corresponding values in Table 4 for NPs where max GL is USD 1.163M and max VL is USD 18.709M.

Panel B of Table 4 continues the computations began in Table 1 and Table 2 that are applicable to PTs. Panel B reports that %∆EU is 9.29% for a PT and this is greater than 6.63% for an NP while the ODV of 0.2447 for a PT is less than the ODV of 0.2739 for an NP. The smaller %∆EU for an NP can be at least partially explained by its greater EU value since it has a larger max GL value than a PT. Like %∆EU, the NB of 22.69% for an NP is less than 34.75% reported for a PT. Once again, since the NP value for max GL is larger than that for a PT, the smaller NB can be explained by the larger EU for which it takes more debt to retire greater amounts of EU to achieve the OCR of A3. At ODV, Table 4 shows that that PTs issue only USD 3.011M in debt compared to USD 5.125M in debt for NPs in Table 3. More debt issued for NPs relative to their max GL translates into a smaller NB so that NPs can be said to be relatively less efficient in its use of debt by getting less value per dollar of debt that is issued.

In conclusion, noticeable differences in Table 3 and Table 4 occur for D, max GL, max VL and ODV where NPs have greater relative values and for %∆EU and NB where NPs have smaller relative values. Since NPs do not have an interest tax shield (ITS) when the business tax rate is zero, their greater max GL values indicate other positive leverage-relate effects are operative. These effects are consistent with agency trade-off models discussed in Section 2.4.

4.3. Five Illustrative Figures Using TCJA Tax Rates and Growth of 3.12%

We now offer five illustrative figures that plot values for five outcomes against Moody’s credit ratings where these values are from Table 3 and Table 4. The five outcomes are P, GL, VL, %∆EU, and gL and they are plotted along the vertical axis with ratings along the horizontal axis where ratings are decreasing in quality (from the highest quality of Aaa to the lowest quality of Ba2). These outcomes include both NP values (in solid line trajectories) and PT values (in dashed line trajectories). These two trajectories enable us to contrast NP and PT outcomes. These figures only show the feasible points or those points where the growth constraint is not violated. As first shown in Section 4.2, the growth constraint sets in for NPs at a Moody’s credit rating of Ba2 (speculative rating), which is a notch in quality above that for PTs where the growth constraint occurs at B1 (highly speculative rating). For these five figures, like Table 3 and Table 4, we use the low (L) tax rates under TCJA given in the bottom half of Panel A in Exhibit 2. For the L tax rate tests, all NP tax rates are zero and PT unlevered corporate, personal equity, and personal debt tax rates are: TC1 = 0; TE1 = 0.30; and, TD1 = 0.18. The corresponding PT levered tax rates are: TC2 = 0; TE2 = 0.2576 (projected was 0.255); and, TD2 = 0.2087 (projected was 0.21).

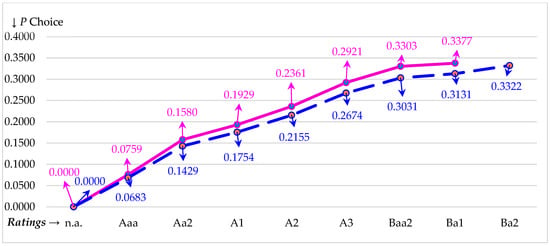

Figure 1 illustrates the extent that P choices increase as credit ratings decrease in quality where P is the proportion of unlevered equity (EU) retired by debt (D) and is computed as D/EU. The NP trajectory (solid line) undergoes greater increases in P values at Moody’s ratings decrease in quality. This trajectory reaches the Moody’s rating of Ba1 before the growth constraint sets in. At this plot point of Ba1, P is 0.3377. The PT trajectory (dashed line) continues to a rating of Ba2 where P is 0.3322. Thus, even though the PT trajectory has more P choices, it still does not reach the height of 0.3377 achieved by NPs. Figure 1 reveals that, for any rating that might be targeted, NPs must issue relatively more debt to achieve the same target. This holds not only for relative dollars in debt but, as can be seen in Table 3 and Table 4, it also holds for absolute dollars in debt.

Figure 1.

P choices are plotted along vertical axis against Moody’s credit ratings along horizontal axis. P is debt divided by unlevered equity value. The nonprofit trajectory is the solid line and the pass-through trajectory is the dashed line. We use credit spreads for 2019, TCJA low (L) tax rates, and 3.12% growth where the growth (RE) constraint sets in after Ba1 for nonprofits (NPs) and after Ba2 for pass-throughs (PTs). The optimal credit rating (OCR) is A3.

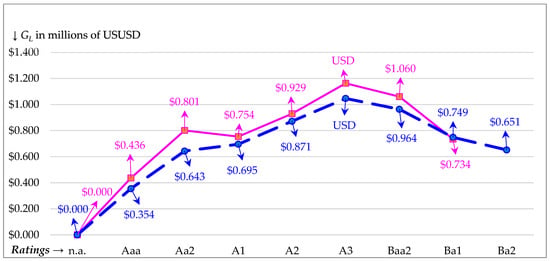

Figure 2 plots the gain to leverage (GL) along the vertical axis against credit ratings along the horizontal axis. As seen in Figure 1, the decrease in quality represents increasing P choices. Thus, Figure 2 also illustrates the concave relation between GL when plotted against increasing leverage choices. Consistent with trade-off theory that posits an optimal debt-to-firm value ratio (ODV) exists, Figure 2 reveals full (two-sided) concave trajectories except for the NP trajectory (solid line) where there is a downward bump for a Moody’s rating of A1 (upper medium grade rating). This bump is where the GL differences in the NP trajectory and PT trajectory (dashed line) peak at USD 0.801M − USD 0.643M = USD 0.158M (which is a 24.49% difference in terms of the higher NP value of USD 0.801M). By the time we get to the last credit rating of Ba1 for which both NPs and PTs have feasible plot points, we find a small difference in GL of USD 0.734M − USD 0.749M = −USD 0.015M between a PT and an NP (which is only a −2.04% difference).

Figure 2.

Gain to leverage (GL) values are plotted along the vertical axis against Moody’s credit ratings along the horizontal axis. The nonprofit trajectory is the solid line and the pass-through trajectory is the dashed line. We use credit spreads for 2019, TCJA low (L) tax rates, and 3.12% growth where the growth (RE) constraint sets in after Ba1 for nonprofits (NPs) and after Ba2 for pass-throughs (PTs). The optimal credit rating (OCR) is A3.

As seen in Figure 2, the NP max GL of USD 1.163M is greater than the PT max GL of USD 1.046M. The greater NP value appears to be inconsistent with the notion that the advantage from an ITS should be greater for PTs compared to NPs. This is because an ITS is virtually non-existent given the tax-exempt status of NPs compared to PTs where interest lowers taxable income. However, debt still adds value for NPs due to other influences such as those posited by agency models. To illustrate, the percentage increase in unlevered value from issuing debt (%∆EU) is 6.63% for NPs in Table 3. This compares to 9.29% for PTs in Table 4. Thus, despite having a greater absolute gain (as seen in the max GL values), NPs gain relatively less from debt and this latter result is consistent with NPs not having an ITS. However, any PT advantage from having an ITS is offset since NP debt owners pay less personal tax on debt compared to PT debt owners. To illustrate the offsetting nature for the tests represented in Figure 2, the difference in business tax of 0.2576 favoring PTs is substantially neutralized by the difference in the personal tax on debt of 0.2087 favoring NPs.

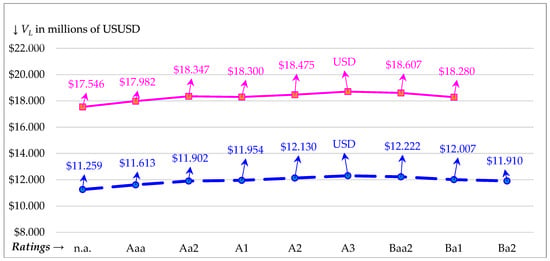

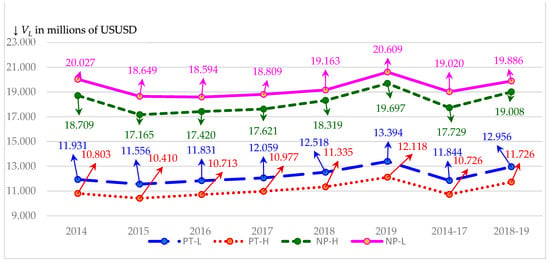

In Figure 3, we duplicate Figure 2 by replacing GL with VL. Since our valuations are after all taxes are considered, this figure visually shows the tremendous VL advantage that an NP (solid line trajectory) has from not paying taxes when everything else is equal (such as same before-tax cash flows, same costs of borrowing, and same growth rate). Thus, Figure 3 serves to depict, from a strictly tax standpoint, the vast differences in VL that occur when everything is the same except tax rates. In fact, Figure 3 reveals that the NP max VL of USD 18.709M is USD 6.404M greater than the PT max VL of USD 12.305M. Only a small portion of this difference of USD 6.404M can be explained by the gain to leverage since the NP max GL of USD 1.163M in Figure 2 is only USD 0.117M greater than the PT max GL of USD 1.046M.

Figure 3.

Firm Value (VL) values are plotted along the vertical axis against Moody’s credit ratings along the horizontal axis. The nonprofit trajectory is the solid line and the pass-through trajectory is the dashed line. We use credit spreads for 2019, TCJA low (L) tax rates, and 3.12% growth where the growth (RE) constraint sets in after Ba1 for nonprofits (NPs) and after Ba2 for pass-throughs (PTs). The optimal credit rating (OCR) is A3.

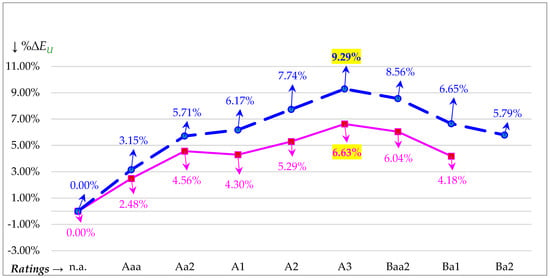

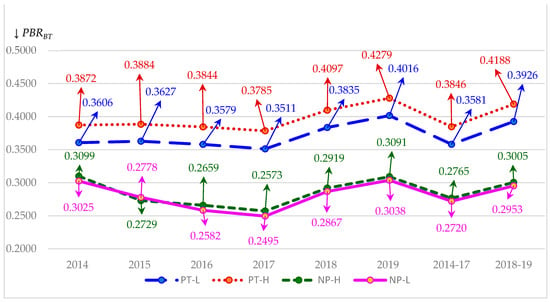

Figure 4 shows the relative gain to leverage in terms of the percentage change in unlevered firm value (%∆EU). This figure illustrates the greater relative gain to leverage for PTs (dashed line trajectory) compared to NPs (solid line trajectory) by showing the superiority of PTs over NPs for all feasible leverage choices as represented by credit ratings. The difference in %∆EU between NPs and PTs of 9.29% − 6.63% = 2.67% peaks at the OCR of A3. The differences in values for %∆EU increase up to A3 and then slowly decline. The decline is short-lived because the growth constraint is violated after Ba1 for NPs and after Ba2 for PTs. In fact, if we plotted the %∆EU differences, we would get a full (two-sided) concave relation. Thus, the peak in the %∆EU differences reveals the OCR for both NPs and PTs. Finally, the two max %∆EU values of 9.29% for PTs and 6.63% for NPs are consistent with the empirical research (Graham 2000; Korteweg 2010; Van Binsbergen et al. 2010) that indicates a range of 4% to 10%, albeit that research is assumedly geared more toward large FPOs dominated by C corps (CCs).

Figure 4.

%ΔEU values are plotted along vertical axis against Moody’s credit ratings along horizontal axis. %ΔEU is GL as a percent of unlevered equity (EU). The nonprofit trajectory is the solid line and the pass-through trajectory is the dashed line. We use credit spreads for 2019, TCJA low (L) tax rates, and 3.12% growth where the growth (RE) constraint sets in after Ba1 for nonprofits (NPs) and after Ba2 for pass-throughs (PTs). The optimal credit rating (OCR) is A3.

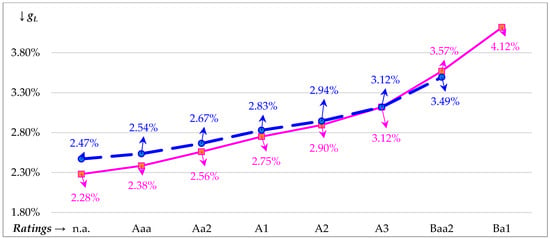

Figure 5 plots the levered equity growth rate (gL) against ratings. This figure reveals that gL values for PTs are greater until the OCR of A3 is reached, at which point gL values for NPs are greater. While an NP achieves a growth rate of 4.12% at its last feasible credit rating (which is Ba1), a PT would only attain a growth rate of 3.49% at its last feasible rating (which is Ba2). Of interest (and as seen in Figure 2, Figure 3 and Figure 4), higher growth rates do not lead to greater values for GL, VL, and %∆EU. However, if we had achieved these higher rates at the OCR of A3, then tests (that we have conducted) indicate that greater valuations can often occur.

Figure 5.

Levered equity growth rate (gL) values are plotted along vertical axis against Moody’s credit ratings along horizontal axis. The nonprofit trajectory is the solid line and the pass-through trajectory is the dashed line. We use credit spreads for 2019, TCJA low (L) tax rates, and 3.12% growth where the growth (RE) constraint sets in after Ba1 for nonprofits (NPs) and after Ba2 for pass-throughs (PTs). The optimal credit rating (OCR) is A3.

As mentioned above, the NP trajectory ends at Ba1 in Figure 1, Figure 2, Figure 3, Figure 4 and Figure 5 because the growth constraint sets in so that P choices with quality credit ratings below Ba1 are not feasible. As first seen in Table 3 and Table 4 and now visually shown in Figure 5, we can find levered equity growth rate (gL) values greater than 3.12% once a firm goes past its ODV. As noted previously, a growth of 3.12% was determined from annual U.S. real GDP growth data given by the U.S. Bureau of Economic Analysis (2018). Thus, based on this data, a growth rate greater than 3.12% is not sustainable at least for an average firm. However, the question of sustainability in Figure 1, Figure 2, Figure 3, Figure 4 and Figure 5 is moot as the enterprise has already achieved its ODV (and its OCR of A3). If we set the before-tax plowback ratio (PBRBT) so that 3.12% is achieved with the lowest choice of debt corresponding to the highest grade credit rating then we can achieve a max GL greater than that achieved at a rating of A3. However, it is unlikely that a typical enterprise could simultaneously attain the highest possible investment-grade credit rating while sustaining a long-run historical growth rate. In fact, a typically credit rating is issued with a medium grade rating, which is the classification for A3. The highest quality grade ratings are rare and, as noted by Morningstar (2019), have become even more rare over time.

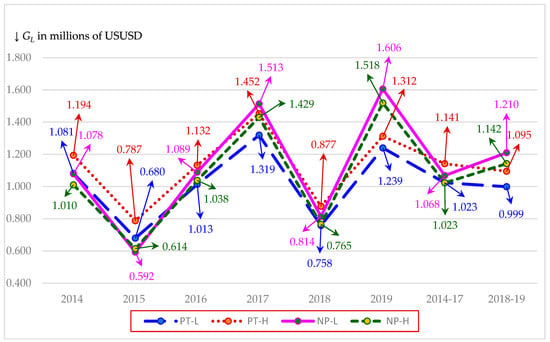

5. Results Incorporating High Tax Rates (H), Pre-TCJA Tax Rates, and Increased Growth

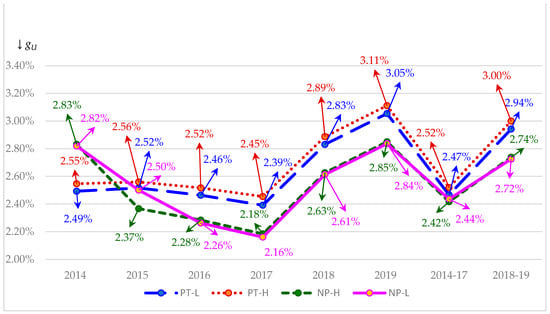

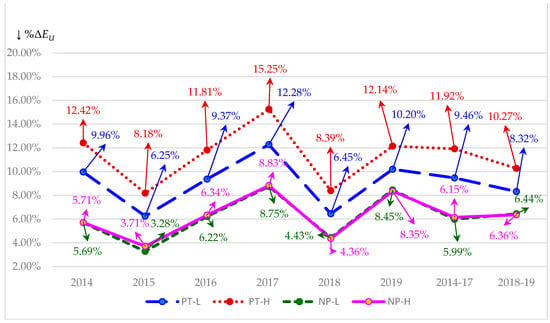

The tests in this section take into account different tax rates that reflect two feasible schools of thought and two different tax laws. As discussed in Section 2.3, the two schools of thought consist of high (H) and low (L) tax rate scenarios while the different tax laws refer to those laws governing the pre-TCJA and TCJA years. The tests in this section also consider the increase in growth projected under TCJA of 3.90% as discussed in Section 3.2. In addition, we perform tests that take into account the six most recent years for which Damodaran (2020) provides credit spreads matched to ratings. These spreads are given in Exhibit 3. The last two columns of this exhibit show credit spread means for the pre-TCJA period of 2014–2017 and the TCJA period of 2018–2019. The bottom two rows of Exhibit 3 provide means and standard deviations for each year and period.

Exhibit 3.

Credit Spreads: 2014 through 2019.