Abstract

This paper examined whether financial statement comparability constrains opportunistic earnings management in frontier market countries. Using a large sample of 19 frontier market countries, and an accounting comparability method that maps comparability across several accounting standards, the results show that enhanced financial comparability constrains accruals earnings management (AEM). Contrary to developed markets and novel to this study, a significant relationship between financial comparability and real earnings management (REM) was not found. For greater robustness, AEM and REM were also tested on both International Financial Reporting Standards (IFRS) adopting and non-adopting countries. The results suggest IFRS adoption constrains AEM, yet exhibited no impact on constraining REM. Additionally, the use of BigN auditors failed to conclusively show an ability to moderate EM. When combined, the results suggest that frontier markets engage in less REM than expected. It is also noted that the legal roots (civil vs. common law) play a significant role in constraining earnings management. Common law countries exhibited lower AEM when comparability increased; this significance was not found in countries that were rooted in civil law. Contributions from this study show that findings from developed markets cannot be generalised to frontier markets.

1. Introduction

Comparability in financial reporting enables investors to make sound financial decisions (Chauhan and Kumar 2019). From a regulatory perspective, comparability facilitates the proper interpretation of financial measures and the development of policy responses (Hasan et al. 2020; Nouy 2014). However, little is known regarding the linkages between financial statement comparability on earnings management (EM) in frontier markets—a market too small and generally less accessible to be considered an emerging market. As such, this study aims to explore the impact of financial statement comparability on EM in frontier market countries.

Comparability is defined as a qualitative characteristic that allows users to identify and understand similarities and differences among items (FASB 2010), as well as financial performance across firms (Kim et al. 2016). Greater accounting comparability enhances a firms’ information quality, as rational investing and lending decisions require comparative information (Chen 2016). The enhanced firm information environment that stems from greater comparability leads to better decision making and, thus, the argument for comparability is particularly cogent. Gross and Perotti (2017) note that comparability is positively associated with analyst forecast accuracy and enhances the information environment. Accounting parallels should endure across firms, despite the discretionary flexibility afforded to managers under International Financial Reporting Standards (IFRS) (DeFond et al. 2011). It follows that firms having similar accruals quality, earnings predictability, earnings smoothness, and similar loss reporting will also exhibit greater comparability (De Franco et al. 2011).

Accruals earnings management (AEM) is the selection and interpretation of accounting policies from a set of acceptable policies to achieve earnings objectives1 (Zang 2011), and firms with greater financial statement comparability tend to engage in less of it (Kiya 2017; Sohn 2016). However, firms with greater comparability are also under greater public scrutiny, subject to closer monitoring, and under increased pressure to meet earnings targets. Consequently, such firms are expected to employ more real earnings management (REM) (Braam et al. 2015; Cohen et al. 2008)—defined as actions undertaken that alter the timing or structure of operations from normal business practices. Shen and Chih (2005) note that incentives to manage earnings vary across countries, yet if stakeholders’ preference is universally consistent with prospect theory,2 then a manager has an incentive to manage earnings in order to accomplish the desired outcome.

Healy and Wahlen (1999) noted that future EM contributions would come from identifying factors that limit EM. As such, this study extends Sohn (2016)’s US-based study on the constraint effects of financial statement comparability on EM into frontier markets using a broad cross-country sample. Novel to this study is the application of a model that maps the accounting comparability of a firm based on its economic performance, benchmarked using a counter-country model across a variety of accounting standards. Benchmarking allows for both a longitudinal perspective for a single firm and a cross-sectional perspective of multiple firms.

Following a systematic analysis of financial statements of 2475 firms across 19 countries from 2001–2017, it was found that greater financial statement comparability results in lower AEM scores. This finding was in line with the study’s hypothesis. However, it is argued that decreased AEM results in increased REM activity. For greater robustness, several additional statistical tests were performed on subsections of the data. Robustness test highlight that common law countries were less apt to engage in AEM, and that firms change their EM practices after IFRS adoption. The results underscore the uniqueness of frontier market countries and provide insights into EM methods applied therein. As a result, this study also provides information gains on which investors rely.

The remainder of this paper is organised, as follows: Section 2 reviews the prior literature and develops the study’s hypotheses. Section 3 explains the research design and describes the data. Section 4 presents and discusses the empirical results. Section 5 provides findings from additional sensitivity tests. Section 6 concludes with key observations, finding implications, and suggested directions for future research.

2. Related Research and Hypothesis Development

In this section, the literature on frontier market markets, financial statement comparability, earnings management, and institutional settings is reviewed. These examined areas provide the framework for developing the study’s working hypothesis.

2.1. Frontier Market Countries

The term frontier market is commonly used to describe smaller, economically immature countries with limited capitalisation (Cuervo Valledor et al. 2016). The homogeneity of the frontier market is its classification in having ’some’ openness to foreign ownership, ’partial’ ease of capital flows, and ’modest’ operational efficiency (MSCI 2020). With an aggregate value that is slightly more than USD 100 billion,3 frontier markets account for less than 0.3 per cent of global developed markets, but more than 20 per cent of the global population (Stereńczak et al. 2020). Frontier markets exhibit a low correlation (0.395) with developed markets,4 and also a low correlation among themselves (Gregoriou and Wu 2016). The integration of frontier markets with global markets remains low (Blackburn and Cakici 2017; Zaremba and Maydybura 2019), as cross-listing of companies from developed and emerging markets in frontier markets is atypical. In examining the ownership concentration in a frontier market, Darmadi (2016); Tran and Le (2020) note that frontier equity markets are characterised by high ownership concentration and weak investor protection, unlike the more dispersed ownership form that is commonly found in developed markets. Because diversification into frontier markets can ameliorate portfolio risk (Ali et al. 2020; Thomas et al. 2017), investors and researchers alike can be better informed of company performance and management activity via financial statement comparability.

2.2. Comparability

Financial disclosure is at the forefront of international standard setters’ agenda and it occurs when firms with similar economic outcomes report similar accounting outcomes (Gross and Perotti 2017). The international standardisation of accounting standards,5 has led to higher financial comparability. Lemma et al. (2018) find that firms in less competitive industries appear to engage in higher levels of EM as a consequence of weakly disciplined environments. DeFond et al. (2011) found that increased comparability occurs following IFRS adoption, as it contributed to reduced information acquisition costs and improved forecast accuracy. Gross and Perotti (2017); Young and Zeng (2015) find greater evaluation accuracy to be a benefit from greater comparability.

Findings in several prior studies provide evidence that is consistent with the view that comparability increases transparency. Healy and Palepu (2001) found that, on average, firms with enhanced transparency experience fewer issues with mutual agency, and they were less likely to undertake opportunistic EM. Improved firm transparency and manager forthrightness has also been associated with comparability (Zhang 2018). De Franco et al. (2015) find that analysts are more likely to use the same industry sector benchmarks for comparability as comparability between peer groups increases. Barth et al. (2012) state that the comparability effects are stronger when IFRS adoption is mandatory, and for firms operating in common law countries. Hail et al. (2010) found that increased comparability (due to IFRS harmonisation) resulted in increased market liquidity and reduced capital costs. Greater comparability among firms is also associated with lower bond spreads (Kim et al. 2013), and it is inversely associated with crash risk (Kim et al. 2016). Bond-rating agencies provide fewer divergent ratings for firms when firm financial comparability increases (Kim et al. 2013). Firms with greater comparability were less likely to have overly favourable earnings surprises or issue overvalued equity (Shane et al. 2014). Greater comparability was also found to decrease the size and volatility of related-party transactions (Lee et al. 2016), increase firm acquisition decisions, and reduce post-acquisition goodwill impairments (Chen et al. 2018).

The International Accounting Standards Board (IASB) and Financial Accounting Standards Board (FASB) both list comparability as a desirable property (Framework 2018). Because the comparability concept is neither an absolute nor independent trait (Sohn 2016), a mismatch between financial reports from different countries create difficulties in performing empirical tests for comparability.

Comparability’s value lies in its cost-effectiveness and simplification of cross-firm comparisons (Sohn 2016). Recognising comparability’s value, accounting bodies6 seek greater comparability in financial reports, as noted by the 2002 Norwalk Agreement on developing common standards (Hughes and Larson 2017). The subjective interpretation of accounting standards between managers may be common (Bartov et al. 2002), and it further underscores comparability’s importance. Standards are particularly important in less developed markets, where attenuated analyst coverage results in more laborious firm comparability,

2.3. Earnings Management

Because firms compete globally for capital, those with superior resources enjoy advantages over rivals (Clemons 2019). To secure advantages,7 firms may opportunistically manage earnings to uphold or exceed earnings targets. Howard et al. (2019) note that headline earnings may not be a true representation of performance as earnings may have been managed. Earning management is the process by which a company’s actual financial performance is distorted (Klein 2002). While EM may or may not in itself be opportunistic, firms in less developed markets have been found to manage earnings to a greater degree than those in developed economies (Li et al. 2014, 2011). To manage earnings, a firm can employ multiple EM strategies, ie. AEM and REM.

2.3.1. Accruals Earnings Management

The accrual component of earnings is increasingly viewed as a proxy for firm performance.8 The reversing nature of accruals limits a manager’s ability to make biased estimates during one period and once again in subsequent periods (Abarbanell and Lehavy 2003). Despite inherent limitations, a manager may still engage in opportunistic AEM. Studies on the factors that constrain AEM are prodigious (see Barth (2008); Dechow et al. (2010); DeFond et al. (2011); Francis et al. (2014); Sohn (2016)), yet literature linking comparability’s ability to constrain EM in frontier markets is sparse.

2.3.2. Real Earnings Management

REM provides managers with an alternative method of EM via actual business activities manipulation (Roychowdhury 2006). REM may arise through the manipulation of cash flow, production, or discretionary expenses (Braam et al. 2015; Roychowdhury 2006), and is not without costs. As a risk-increasing factor, REM requires higher bond premiums (Ge and Kim 2014), negatively impacts on the corporate image (Rodriguez-Ariza et al. 2016), adversely affects future firm financial performance (Tabassum et al. 2015), and it is positively associated and more pronounced in countries with greater political stability (Lemma et al. 2019). Because REM masks true financial performance, financial transparency is diminished (Sohn 2016).

2.4. Institutional Factors

Institutional factors have shown the ability to constrain EM in mixed market studies (Ruddock et al. 2006; Salehi et al. 2018). The country-specific institutional factors of external audit quality shapes the reporting environment. Accordingly, this study will also examine this effect in relation to EM.

External Audit Quality

External audit plays an influential role in diminishing information asymmetry among managers and companies’ stakeholders; asymmetry is often rooted in agency problems. An auditor can be considered to be an agent and, thus, expected to take action where financial reports are morally hazardous (Alzoubi 2016). Through the verification of financial statement reliability and fairness, audits enhance financial information quality and mitigates EM (Khanh and Nguyen 2018). Prior research has also shown an association between audit quality and EM (Becker et al. 1998; Ebraheem Saleem 2019; Ghosh and Moon 2005; Ghosh 2007; Gul et al. 2009) and that firms that employ a high-quality auditor, experience lower levels of EM (Francis and Wang 2008; Houqe et al. 2017). Further, studies show that the manipulation of financial results (such as accruals) reduces when the auditor is independent, or the audit company is large (see Becker et al. (1998); Krishnan (2003); Rusmin (2010); Sohn (2016)). Additionally, the clients of BigN audit firms exhibit increased comparability of reported earnings (Francis et al. 2014; Kawada 2014).

Based on the above discussion, the following hypothesis is formalised as H1:

Hypothesis 1 (H1).

Firms audited by a high-quality auditor (BigN) will exhibit lower earnings management activity.

2.5. AEM and REM Trade-Off Decisions

Because EM approaches are not without costs, managers interchange EM methods as a function of its costs (Abernathy et al. 2014; Cohen and Zarowin 2010; Zang 2011). The costlier and greater constraints to an EM strategy, the greater the likelihood a firm will engage in an alternative. REM constraints include increased tax rates, poor financial conditions, and lower industry market share (Joosten 2012). Constraints on AEM include the engagement of a large auditor with longer firm tenure, lower accounting flexibility, and the presence of an audit committee (Ebraheem Saleem 2019).

In order to gain the greatest financial reporting benefit, managers may employ a coordinated approach (complementary AEM and REM). Research shows that managers complement AEM and REM in nations with a relatively low accounting disclosure environment, weaker investment protection regulations, and low litigation costs (Chen et al. 2010; Gramling and Myers 2003; Knapp 1991; Zhou et al. 2017). Firms tend to substitute AEM with REM strategies under more stringent regulatory environments (Ewert and Wagenhofer 2005), or when AEM becomes more costly (Cohen et al. 2008; Cohen and Zarowin 2010; Durnev et al. 2017). Taken together, the above results suggest that managers often consider the cost of different EM methods before engaging in them.

As comparability brings about transparency, AEM is lower in firms with transparent disclosures (Cassell et al. 2015; Hail et al. 2010). Moreover, as comparability reduces information asymmetry between managers and shareholders, it is expected that AEM constraints will result in increased reliance on REM for opportunistic accounting.

By enabling firm comparisons across countries and accounting standards,9 this study predicts that REM will increase as AEM decreases. Accordingly, it is expected that greater cross-border firm comparability will constrain a managers’ ability to manipulate reported accounting performance when using AEM. Greater comparability allows outsiders increased access to performance information on other firms, allowing for better true performance evaluation. However, increased transparency does not necessarily allow for greater visibility of REM activities and, thus, REM is expected to increase.

Prior studies provide an understanding on how comparability improves the utilisation of accounting information (e.g., Bradshaw et al. (2009); Chircop et al. (2020); Lang et al. (2010); Yu and Wahid (2014); Zhang (2018)), yet the linkages between comparability and EM have not been widely examined. This study is motivated by the limited published research on the relationship between financial reporting comparability, EM, and frontier markets.

Based on the above discussions on the current literature, the following hypotheses are formalised as H2 and H3:

Hypothesis 2 (H2).

Increased comparability results in decreased accruals earnings management.

Hypothesis 3 (H3).

Decreased accruals earnings management results in increased real earnings management.

3. Research Design

3.1. Comparability Measures

In financial accounting literature, De Franco et al. (2011)’s comparability research can be seen to be the most influential. De Franco et al. (2011)’s comparability method uses time-series regression of quarterly earnings onto stock returns to capture within industry comparability, yet focuses exclusively on US data without regard to accounting standards. Barth et al. (2012) modified this measure to assess firms using US GAAP and IFRS accounting systems within a cross-sectional industry setting.

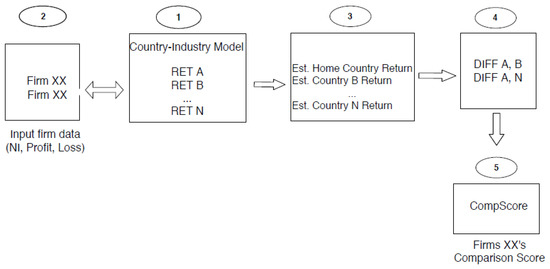

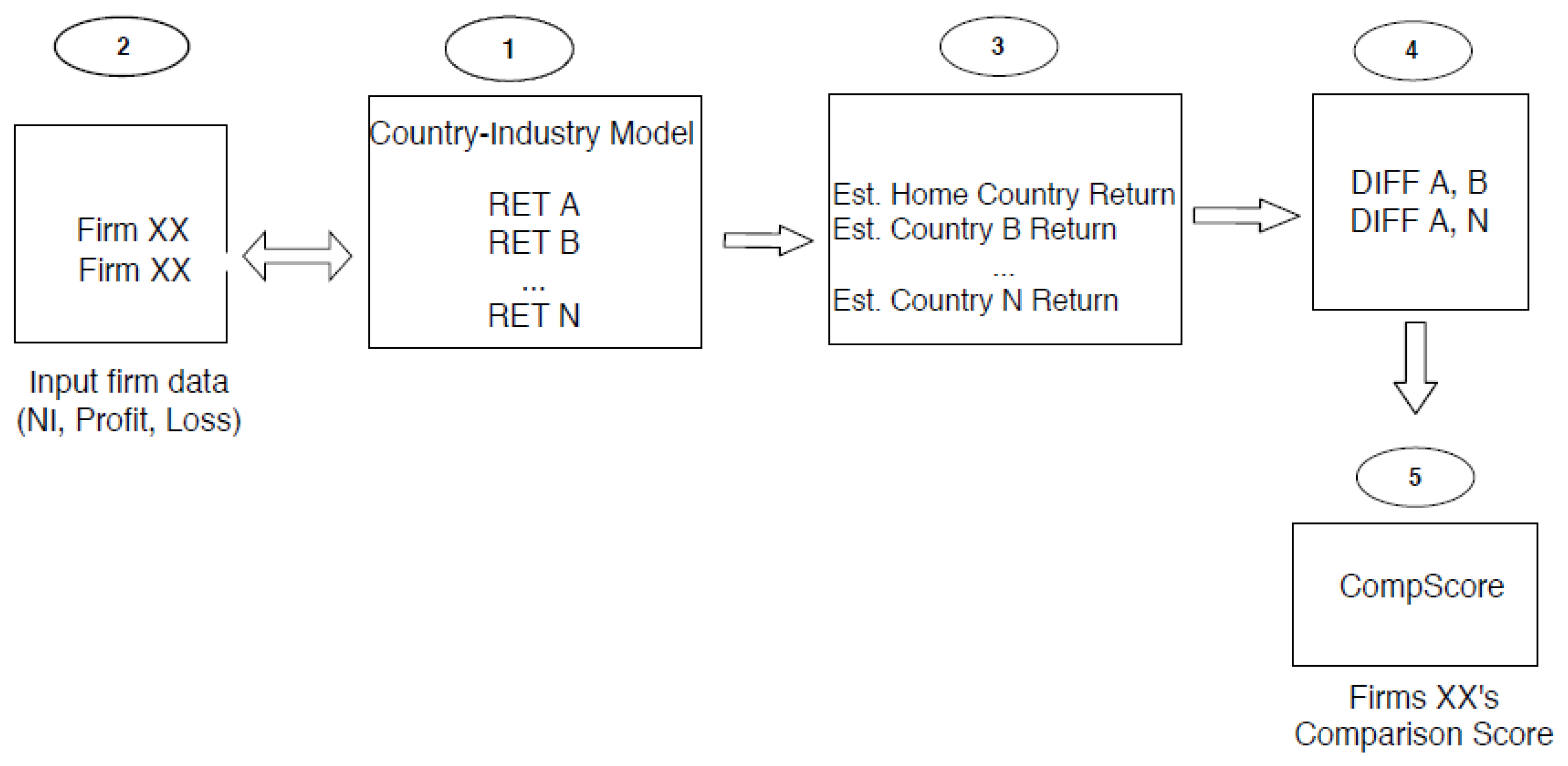

Given the limited availability of quarterly financial data for frontier market companies and the various accounting standards that companies may employ, this study applies Conaway (2017)’s adaption of Barth et al. (2012); De Franco et al. (2011)’s comparability method. This model provides a more comprehensive comparability measure, since firms may produce multiple counter-samples that are based on country-industry specific factors, despite having distinct accounting systems. The five steps to compute the comparability measure follow.

Step one uses all available firm data. A relationship estimate is calculated between economic outcomes and earnings within each country-industry-year. Each country-industry-year must include a minimum of 10 firms. Step one is formulated as per Equation (1)

where superscript Cj denotes the pricing multiples relating to the accounting system for country C in industry j; and therefore, each varies across each country-industry-year in the sample. is the change agent. NI is the net income before extraordinary items per share. Firm and year-end are denoted as i and t, respectively. P is the share price and RET is the buy-and-hold stock return beginning nine months before and ending three months after year-end. Loss is an indicator variable that is equal to 1 if NI is negative and zero otherwise, allowing the accounting system models to differ for loss-making firms. All of the variables are measured in nominal US dollars.

Step two estimates a firms’ fitted stock return while using the country model, as expressed by Equation (2)

Step three calculates the fitted stock return under each counter-sample model for each firm10, as expressed by Equation (3)

Step four calculates the absolute value of the difference between the within-sample and counter-sample fitted stock prices for each firm. This is represented by DIFF, as expressed by Equation (4)

Step five calculates the median absolute difference between the within-sample and counter-samples’ fitted stock prices multiplied by the negative natural log. The resultant value represents the firm’s comparability measure with those of the counter-sample. The greater the score, the greater the comparability. Equation (5) expresses this quantity

Note that firms i and k are from different countries, but share the same two-digit SIC industry code. Thus CompScore is estimated using time-series regression and captures accounting comparability between two firms across countries. Figure A1 in Appendix A illustrates the comparison method.

3.2. Accruals Manipulation

With respect to studies that examine discretionary accruals via commonly used proxies (see (Dechow et al. 1995; Jones 1991)), Kothari et al. (2005) states that these methods are mis-specified when samples experience extreme performance. Given the wide-ranging returns of the firms in this study, this study applies Leuz et al. (2003)’s AEM method and calculates a composite measure of AEM to indicate the extent of earnings management via accruals. We first introduce the method of calculating accruals, as per Equation (6)

where CA is total current asset. Cash is cash/cash equivalents; CL is total current liabilities; STD is short term debt; TP is taxes payable; and, Dep is depreciation and amortisation expense.

We then introduce the three measures of AEM, as per Equations (7)–(9)

where AEM1 is the ratio of the standard deviation of earnings before interest and tax to standard deviation of net operating operating cash flows. The smaller the AEM1, the greater the likelihood a manger uses accruals to reduce the operating cash flow variation.

where AEM2 is the Spearman correlation between changes in accruals and changes in net operating cash flow. Operating cash flow is the result of operating earnings less accruals.

where AEM3 is the ratio of the absolute value of accruals to the net absolute value of operating cash flow. A firm-level composite of AEM is calculated by averaging the scaled firm rankings from each of the three individual AEM measures.

3.3. Real Activities Manipulation

The construction of the REM proxy follows prior research (Cohen and Zarowin 2010; Lin et al. 2016; Roychowdhury 2006; Zang 2011), and examines the degree to which firms manipulate real activities through three measures: abnormal cash flow from operations (CFO), abnormal production costs (PROD), and abnormal discretionary expenses (DISX). CFO manipulation arises as a result of accelerated sales while using aggressive price discounts or lenient credit terms. DISX manipulation arises via the reduction of advertising, R&D, and SG&A expenses. PROD manipulation results in a lower cost of goods sold (COGS) via overproduction to spread fixed costs over many units. They are estimated, respectively, by Equations (10)–(12). To determine a composite REM score, firm scores are ranked each year, such that a higher score equates with greater REM. The composite is repeated for each of the three measures, and the average firm scaled rank becomes the composite.

where REV represents sales revenue; DISX is the sum of R&D, advertising, and SG&A activity; and, PROD is the aggregate of the COGS and changes in inventory during the year.

3.4. Regression Specification

This section describes the empirical model that analyses the effects of comparability on EM. This study follows Sohn (2016) while using the mean value of the firm-pair comparability scores as the firm-specific financial statement comparability measure for target firm i’s. This measure captures target firm i’s financial statement comparability relative to its peers with the same 2-digit SIC code, which is more likely to be the broad benchmark sample of comparable firms used by acquisition analysts to compare and contrast a potential target’s accounting information. Equation (13) presents the regression that was constructed to test Hypothesis H1–H3:

where AEMit and REMit are the accruals and real earnings management variables variable of firm i at time t, respectively. This study includes the following control variables routinely included in prior studies (Ashbaugh et al. 2003; Haw et al. 2004). These are firm size (Size), which is proportional to the natural logarithm an equity’s market value, and book to market value (BM). Dechow et al. (1995) noted that importance of controlling for financial performance. Therefore, we also include Return on Assets (ROA), the absolute value of ROA (|ROA|), firm leverage ratio (LEV), operating cycle (OPERCYCLE), standard deviation of sales (SD_Sales), cash flow from operations scaled by total assets (CFOA), the absolute value of scaled CFO (|CFOA|), return (RET), and analyst following (ANALY). Dummy variables employed are: LOSS if the company incurred a loss; and, BIG_N if the firm used a Big 4 (or Big 5 auditor). Dummy variables to control for industry and year effects, denoted as IND and YEAR, respectively, are also included.

4. Results

4.1. Study Sample, Data Sources, Descriptive Statistics, and Descriptive Statistics

Data were collected on all listed firms in 19 frontier countries from Datastream. Subsequently, financial and insurance firms were excluded from the sample due to their unique operating properties and regulations. Also removed were firms whose fiscal year-end is not March, June, September, or December, and those country/industries firms not meeting the minimum comparability requirement. Table 1 displays the firms that remain. Panel A lists the number of included firms by year. Panel B lists firms and observations by country, while Panel C provides industry data and two-digit SIC codes. The final total consists of 2475 firms in the 2001–2017 time frame, with a total of 27,549 observations across 11 industries.

Table 1.

Composition of Sample by Calendar Year By Country, and by Industry.

Table 2 reports the descriptive statistics for key variables in the study. The mean and median value for the comparison score CompScore, respectively, is 0.632 and 0.394, with a standard deviation of 1.116. These values are in line with Conaway (2017), and they suggest that the comparison scores are reasonably distributed. The mean values for AEM for REM are 0.089 and 0.247, respectively, and they are largely consistent with those reported by Sohn (2016) and Cohen et al. (2008). The large standard deviations for AEM and REM (0.110 and 0.341, respectively), are indications of AEM and REM practices that vary widely.

Table 2.

Descriptive Statistics.

The mean annual stock return (RET) for the sample exhibits considerable variation with a mean of −98.89 per cent and a median of 0. This variation persists, despite winsorisation of the data at 1 per cent in the tails, indicating that outliers remain. The quartile descriptive values for RET are more normally distributed at −9.07 and 8.99, respectively.

The mean value for control variables shows similarities and divergence from Sohn (2016)’s US-based. The mean values showing similarities are ROA, LEV, and Analyst, with the following respective scores: 0.045, 0.482, and 1.77, respectively. Variables that show divergence are BigN, Size, and BM with the following respective scores: 0.328, 16.762, and 2.451. BigN and Size are lower, while the mean BM value is higher.

Table 3 presents the results of pairwise correlation between the main variables used in Equation (13). CompScore is significantly positively correlated with AEM (Spearman coefficient of 0.041, Pearson coefficient of 0.015). When CompScore is compared with REM, the coefficient is negative (Pearson −0.0106, Spearman −0.011). The variables Size, LEV, SD_Sales, Loss, RET, and BigN auditors were all found to be significant and negatively correlated with CompScore. Analysts following was also significant, yet it exhibited a positive correlation with firm comparison scores. The significance scores point to the appropriateness of the variables for continued use in the following analysis.

Table 3.

Pairwise Correlation Matrix.

4.2. Discussion of the Results

Prior studies commonly test EM linkages with comparability via pooled ordinary least squares (OLS) estimation. In Table 4, we present the regression results of both AEM and REM variables firms, supplemented by four different methods: Pooled OLS, Fixed effects, Between effects, and Quantile regression.11 The application of the fixed effects models follows that the model addresses some statistical concerns that are not addressed by an OLS estimation, such as controlling for any unobservable firm-specific heterogeneities over time that is likely constant (Gerged et al. 2020; Glass et al. 2016). The random effects model varies from the fixed effects model in that intercepts based on cross-section vary randomly, instead of a fixed manner (Gujarati 2009). Quantile regression method is used to more fully understand the various relationships financial comparability and EM with the additional benefit of mitigating problems, such as non-Gaussian error distribution and sensitivity to outliers (Barnes and Hughes 2002; Chi et al. 2020).

Table 4.

Earnings Management Tested on Financial Comparability.

Consistent with prior OLS research (Ashbaugh et al. 2003; Frankel et al. 2002; Sohn 2016), AEM is negatively correlated with CompScore. This finding holds under all four tested models, which indicates that greater comparability decreases AEM. LOSS and BigN were also negative and significant, suggesting an inverse relationship with AEM engagement. Examination of REM finds a negative relationship with Size, BigN, and Loss, and a positive relationship with absolute ROA and CFOA variables. The results suggest larger firms, and those with greater leverage, are more likely to engage in REM. LEV exhibits a positive relationship with AEM and REM (consistent with Beatty and Weber (2003); Jelinek (2007)), which suggests that firms with high leverage engage in more EM.

Contrary to developed market studies, the book-to-market valuation metric (BM) correlated negatively with REM under the OLS, Between Effects, and Quantile estimation methods. The book portion of the BM ratio contains two components: retained earnings and contributed capital. Because contributed capital contains no predictive power, the variation rests in the retained earnings. The inverse relationship between retained earnings and a company’s growth opportunities (Asgari et al. 2015) aligns with Li and Kuo (2017), in that firms with greater growth opportunities are less likely to manipulate earnings. Our findings further support that managers manipulate earnings due to a lack of growth opportunities. ROA, which is a measure of resource efficiency, also diverged from the results found in developed market studies, as both AEM and REM correlated negatively with the performance measure. When combined, both firm performance measures of BM and ROA suggest that management may be transferring future gains to the present for improved reporting results at the expense of future performance.

4.3. The Endogeneity Issue

Managerial discretion may raise concerns of a potential endogeneity bias, as the application of AEM and REM is decided at the managerial level. When loss-making or loss-avoiding firms seek to avoid market consequences, a manager may employ changes in accounting techniques or real business practices. These changes may fundamentally impact the firms’ financial performance.

Two additional tests are conducted in orderto address a possible bias. The first test is a two-stage regression, whereby CompScore is first regressed on the control variables. Subsequently, the predicted comparison score () is regressed on the EM variables. The second test incorporates a lagged variable of the comparison score. The test results provide additional insight into the robustness of the findings that are presented in Table 4.

Table 5 presents the results of the two-stage regression. Stage 1 of this regression includes the following control variables: standard deviation of Return on Assets (SD_ROA), Size, BM, OperCycle, LEV, the capital intensity ratio (CapitalIntensity), and intangible intensity (Intangible). The regression results indicate that firm size, leverage, and capital intensity are significantly negatively correlated with CompScore. Regression coefficients are −0.021, −0.324, and −0.265 for size, leverage, and capital intensity. Stage 2 finds both EM values to be significant and positively correlated with the predicted firm comparison score, with a score of 0.158 and 0.838 for AEM and REM. These results differ from earlier findings and those of developed markets, which suggests that increased firm comparability fails to constrain AEM or REM.

Table 5.

Earnings Management Variables Regressed on Firm Comparison Score.

As stated above, a lag of the comparison score (L.CompScore) is introduced in order to test reverse casualty between comparability and AEM. The thought here is that AEM may be so pervasive that REM is not required. Table 6 presents the results of Equation (13) on the L.CompScore variable. Consistent with earlier results, the comparability score is significant and it continues to be negative with AEM. REM remains insignificant and positive with the comparison score under all but the between effects method. The results again support earlier results in that AEM is inversely related to CompScore, Size, ROA, Loss, and BigN, and positively related to firm LEV, CFOA, and RET.

Table 6.

Lag Comparison Score.

5. Sensitivity Tests

While the robustness checks above suggest that a firms’ financial statement comparability is exogenous to its managers, we also examine other concerns. Specifically, we examine the individual REM measures, the impact of mandatory IFRS adoption in the European Union (EU), and the impact of country’s legal system (civil and common law).

5.1. Individual REM Measures

The aggregated REM measure may distort standard errors by eliminating individual variation and creating misleading impressions with artificial clustering. Because a manager may rely on a combination of the three REM methods, and to increase the power of the test, Panel A in Table 7 illustrates the results of the individual REM measures. However, the explanatory power of these tests is relatively low (adjusted coefficient of determination across industry-years is 0.141, 0.183, and 0.204 for CFO, DISX, and ProdCosts, respectively). The results from the individual REM proxies are also quantitatively similar when tested collectively. Abnormal discretionary expenses show weak significance (0.001) with CompSore. Therefore, the overall linkage between individual REM activity and a firm’s comparability score is inconclusive.

Table 7.

Sensitivity Tests.

5.2. Earnings Management to Avoid Reported Diminished Earnings and Losses

Burgstahler and Dichev (1997) offer evidence for the strong incentive for firms in order to avoid reporting diminished earnings. As the amount of time reported earnings remains positive, the incentive to manipulate financial results increases. The researchers also found an unusually low frequency of small decreases in earnings and small losses. Beatty et al. (2002) suggest the existence of an asymmetric pattern of more small earnings increases than small earnings decreases, is attributable to EM. In examining diminished earnings and small increases, we follow Gunny (2010) and define firms with small profits as those with net income (scaled by lagged total assets), in the interval between 0 and 0.01. Similarly, firms with small earnings increases are defined as those with an annual change in net income (scaled by total assets) greater than 0, but less than 0.01. Panel B in Table 7 reports the results of small profits and small increases. Contrary to the results that are reported in Table 4, CompScore is positively related to AEM and negatively with REM. For the small-profit firm subset, we fail to show a significant relationship between REM and CompScore. Our findings suggest that firms with small profits have a greater tendency to engage in AEM.12,13

5.3. IFRS Adoption in Europe

In 2005, EU firms were obligated to report financial statements in compliance with IFRS (Giner and Rees 2005).14 Cross-country transparency, greater comparability (Barth et al. 2012), and reduced EM pervasiveness were the reported improvements due to the shared global financial reporting language. Cai and Wong (2010) found higher global capital markets integration after IFRS adoption. To evaluate the relative importance of cross-country accounting comparability, and EU IFRS adoption, EM between two periods of time were also examined. Years 2005–2006 (pre-IFRS adoption in the EU) and 2007–2009 (post-IFRS adoption). Table 7, Panel C, depicts both AEM and REM decreasing post-IFRS adoption, indicating that greater comparability after IFRS adoption leads to decreased EM.

5.4. Legal System

La Porta et al. (1997); Leuz et al. (2003) each find a robust negative correlation between ownership concentration and investor protection. A proxy for investor protection is a country’s legal system, often classified as common law or civil law. Hutchison (2002) points out that a robust system of legal enforcement could substitute for weak rules. Hung (2000) states that common law countries are likely to exhibit greater investor protection. Chin et al. (2009); La Porta et al. (1997) demonstrate that countries that are governed by civil law systems provide investors with weaker legal rights relative to those governed by common law. In societies governed by common law, investors benefit from easier lawsuit opportunities (e.g., class actions, contingent fees), which presents auditors with greater exposure to lawsuit risk and causes them to address this threat by adopting a more conservative attitude toward EM (Becker et al. 1998; Kim et al. 2003; Piot and Janin 2007). Research from Enomoto et al. (2015); Leuz et al. (2003) has shown that strong minority investor rights limit insiders’ ability to acquire private control benefits, as effective and well-functioning courts provide recourse for investors that are abused by management. Dayanandan et al. (2016) explain the presence of greater investor protection in common law countries by suggesting that common law countries possess stricter law enforcement and exhibit higher financial disclosure levels.

As strong investor protections in the marketplace should attenuate management opportunism (Bao and Lewellyn 2017; Hölmstrom 1979), we reexamine Equation (3) with a dichotomous variable for common and civil law countries in order to ascertain whether comparability and EM differ between the two legal systems. The results are reported in Panel D of Table 7. Both civil and common law countries show an inverse relationship between AEM and CompScore, with common law countries showing significance at the 0.01 per cent level. This finding is consistent with earlier findings. While not statistically significant, REM exhibits an inverse relationship with CompScore in common law countries. However, an endogenous link between corporate governance and the quality of the reported earnings is inconclusive from the single shareholder protection metric.

5.5. IFRS Adhering Countries

A portion of the countries in our study adopted IFRS, either voluntarily or as a EU membership requirement. We conjecture that the implementation of the standardised accounting systems limits the level of EM. Accordingly, we retest Equation (13) on IFRS and non-IFRS adhering countries separately for 2007–2017. This time frame is post EU IFRS adoption. CompScore was found to be both negative and significant in IFRS adhering countries. As shown in Table 8, the results support earlier findings that link greater comparability with reduced AEM, and that the use of IFRS increased comparability and reduced AEM activity. Conversely, REM was found to be both positive and not significant in IFRS and non-IFRS adhering countries. These findings add robustness to earlier findings, where greater comparability failed to reduce REM activity.

Table 8.

IFRS and Non-IFRS Adhering Countries.

5.6. External Audit Quality

The findings within this study evince a notably different pattern of EM control exhibited by BigN than that found by Francis and Wang (2008); Houqe et al. (2017). Examination shows BigN to constrain EM in regression estimations, save for fixed effects estimation in both the initial examination and when the lagged comparability score was tested. EM constraint was also observed in the post-IFRS adoption time subsection (2007–2009). When examined on individual REM proxies, firms with small profits or small profit increases, or in the pre-IFRS adoption period of 2005–2006, this finding failed to find support. Further, when separately examined on IFRS and non-IFRS adhering counties, the use of BigN audit firms failed to moderate both AEM and REM activity. This latter finding on BigN’s inability to moderate EM concurs with developing market studies from Abid et al. (2018); Kaawaase et al. (2016); Khanh and Nguyen (2018).

6. Conclusions

We examined 19 countries from 2001 to 2017 using a comparability technique that maps accounting comparability based on a firms’ financial statements and its economic performance for cross-country sampling. The results are robust after controlling for firm and country effects and employing several regression estimates. Our results contribute to the EM literature by showing the effects of increased comparability muted AEM activity, yet failed to influence REM activity. The departure of the second finding from the literature on developed markets casts doubts on the pervasive of REM in frontier markets. Given REM’s adverse impact on long-term profitability and competitive advantage (Cohen and Zarowin 2010; Wang and D’Souza 2006), managers in frontier markets may be more attuned to REM’s costs and, consequently, engage in less of it.

The study results also show firms operating in common law environments were less apt to engage in AEM as comparability increases, suggesting that judicial systems influence EM activity. Additionally, the relationship between comparability and REM changes from positive to negative after IFRS adoption in the EU, yet this was not supported when IFRS and non-IFRS adhering countries were tested independently. Inference from this finding leads us to believe that the adoption of IFRS leads firms to altering their application of EM application choices. The trade-off of EM choices aligns with previous research from Cohen et al. (2008); Cohen and Zarowin (2010); Ipino and Parbonetti (2017).

Continuing, the inclusive results that were exhibited from BigN audit firms shows that the use of large audit firms fails to constrain EM conclusively, which suggests that a dichotomous variable for a measure of audit quality may be a poor proxy. The use of BigN auditors should, in itself, not be a representation of reporting quality and suggests future studies consider the inclusion of auditor specialisation, independence, and audit option. The results further suggest the necessity of reviewing legal environments where litigation risk is greater, as an auditor’s efforts to moderate EM may consequently be heightened.

In sum, the results herein have several important implications for accounting standards-setting bodies, auditors, and investors. First, the findings provide useful insight into frontier markets firms and their unique operating properties. The conduct divergence from that which is often found in developed markets suggests that values and norms differ, and that findings from other markets may not be universally applicable. From this, future studies may seek to further frontier market EM activity with an examination of classification shifting as a substitute for AEM and REM. Second, capital markets require integrity in financial reporting. Convergence towards a single accounting system (eg. IFRS) or harmonisation of existing systems is an ideal to be supported, as noted by the increased comparability score when IFRS adhering countries are studied in isolation. Third, increased comparability facilitates transnational information transfer, the result of which is stimulated enterprise competitiveness.

Author Contributions

Conceptualization, W.M.; Methodology, W.M.; Software, W.M.; Validation, W.M.; Formal analysis, W.M.; Investigation, W.M.; Resources, W.M.; Data curation, W.M.; Writing—original draft preparation, W.M.; Writing—review and editing, W.M., P.W.S.Y. and M.S.; Visualization, W.M.; Supervision, P.W.S.Y. and M.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

We wish to thank two anonymous reviewers for their suggestions and comments, as well as Professor Apergis (Editor-in-chief of IJFS).

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Comparison statistics by industry.

Table A1.

Comparison statistics by industry.

| Industry Code | Industry | Mean | St | p25 | Median | p75 |

|---|---|---|---|---|---|---|

| 13 | Oil & Gas | 0.675688 | 1.168768 | −0.066618 | 0.482174 | 1.590968 |

| 20 | Food Products | 0.605875 | 1.110439 | −0.19555 | 0.31896 | 1.63655 |

| 24 | Paper and paper products | 0.501877 | 0.942295 | −0.143579 | 0.271035 | 1.148677 |

| 28 | Chemical Products | 0.579586 | 0.975116 | −0.072821 | 0.305981 | 1.352917 |

| 30 | Manufacturing | 0.686949 | 1.040302 | −0.074995 | 0.408874 | 1.63655 |

| 37 | Transportation | 0.535878 | 1.201013 | −0.281128 | 0.403475 | 1.610309 |

| 46 | Scientific instruments | 0.541757 | 1.008466 | −0.101431 | 0.227001 | 1.485157 |

| 48 | Communications | 0.94091 | 1.038662 | 0.103156 | 0.800769 | 1.945861 |

| 50 | Durable goods | 0.423259 | 0.944788 | −0.194386 | 0.211982 | 0.904411 |

| 58 | Eating and drinking establishments | 0.747424 | 1.00025 | −0.032264 | 0.437514 | 1.63655 |

| 80 | Health | 1.003957 | 1.182698 | 0.031 | 1.448939 | 1.94591 |

Figure A1.

Comparison Score Method Illustrated.

Figure A1.

Comparison Score Method Illustrated.

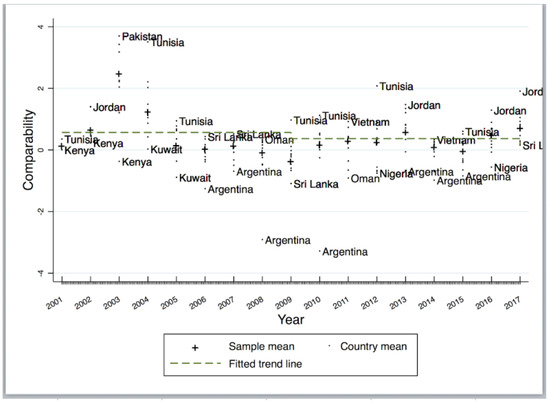

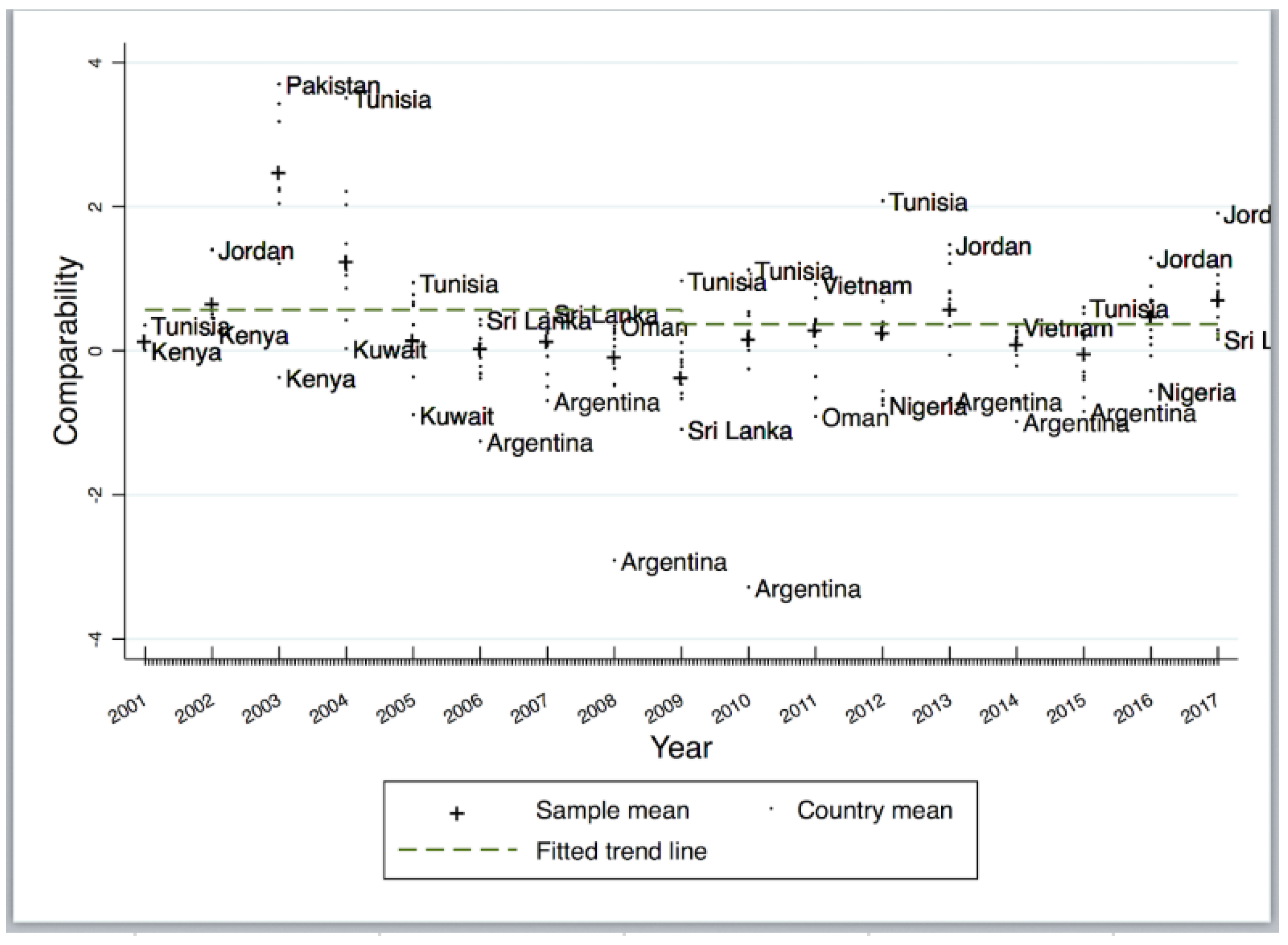

Figure A2.

Comparison Trend.

Figure A2.

Comparison Trend.

Table A2.

Glossary.

Table A2.

Glossary.

| Variable | Definition | |

|---|---|---|

| A | Total assets, sum of current and non-current assets. Source: Datastream. | |

| AEM | Accruals earnings management score, calculated using the Leuz et al. (2003) model. | |

| Analy | Analyst following, calculated by taking the natural log of one plus the number of analysts following a stock. Data source: Datastream. | |

| BM | Book to market, calculated by dividing book value of by equity market value. | |

| BigN | Big 4 or 5 auditor, dummy variable, set to 1 if yes. No otherwise. Source: Datastream. | |

| CA | Total current assets, as stated on the balance sheet. Source: Datastream. | |

| CapitalIntensity | Capital intensity, calculated by dividing net PPE by total assets. | |

| Cash | Cash as stated on the balance sheet. Source: Datastream. | |

| CFOA | Cash flow from operations divided by total assets at the start of the year. | |

| |CFOA| | Absolute value of CFOA. | |

| CL | Current liability. Source: Datastream. | |

| COGS | Cost of goods sold as stated on the balance sheet. Source: Datastream. | |

| CompScore | Firm-year level accounting comparability for the combination for firm i and other firms in the same two-digit SIC in a given year calculated as per Conaway (2017). | |

| DEP | Depreciation and amortisation. Source: Datastream. | |

| DISX | Abnormal discretionary expenses, estimated by discretionary expenses divided by lagged assets. Source: Datastream. | |

| EXP | Sales and General Admin expenses. Source: Datastream. | |

| Intangible | Intangible intensity, calculated as the sum of advertising and R&D expenses divided by sales. | |

| INV | Inventory. Source: Datastream. | |

| NI | Net income before extraordinary items. Source: Datastream. | |

| P | Price, annual share price at year end. Source: Datastream. | |

| LEV | Leverage, calculated by dividing total assets by total liabilities. | |

| LOSS | Loss, a dummy variable of 1 if dummy if loss generated (Net Income before extraordinary items < 0) as per Barth et al. (2012). | |

| OperCycle | Operating cycle, measured by natural logarithm of the sum of days receivables (365/(sales/accounts receivable)) and days inventory (365/(ales/ INV)). | |

| PAY | Payable, net accounts payable. Source: Datastream. | |

| PEN | Pension and retirement Expenses. Source: Datastream. | |

| PPE | Property, plant and equipment. Source: Datastream. | |

| REC | Receivables, total receivables. Source: Datastream. | |

| REM | Real earnings management score, calculated using the Roychowdhury (2006) model. | |

| RET | Return, 12 month buy and hold stock return; nine months before and three months after year-end. | |

| ROA | Net income before extraordinary items divided by divided by total assets at the start of the year. | |

| |ROA| | Absolute value of cash flow from operations divided by total assets at the start of the year. | |

| REV | Revenue, net sales. Source: Datastream. | |

| SD_ROA | Standard deviation of ROA for the previous five years at maximum. | |

| SD_Sales | Standard deviation of sales, calculated on the previous 5 years of revenue divided by total assets a the start of the year. | |

| Size | Firm size as calculated using the natural logarithm of the market value of equity. | |

| STD | Short term debt. Source: Datastream. |

References

- Abarbanell, Jeffery, and Reuven Lehavy. 2003. Biased forecasts or biased earnings? The role of reported earnings in explaining apparent bias and over/underreaction in analysts’ earnings forecasts. Journal of Accounting and Economics 36: 105–46. [Google Scholar] [CrossRef]

- Abernathy, John L., Brooke Beyer, and Eric T. Rapley. 2014. Earnings management constraints and classification shifting. Journal of Business Finance & Accounting 41: 600–26. [Google Scholar]

- Abid, Ammar, Muhammad Shaique, and Muhammad Anwar ul Haq. 2018. Do big four auditors always provide higher audit quality? Evidence from Pakistan. International Journal of Financial Studies 6: 58. [Google Scholar] [CrossRef]

- Ali, Sajid, Elie Bouri, Robert Lukas Czudaj, and Syed Jawad Hussain Shahzad. 2020. Revisiting the valuable roles of commodities for international stock markets. Resources Policy 66: 101603. [Google Scholar] [CrossRef]

- Alzoubi, Ebraheem Saleem Salem. 2016. Audit quality and earnings management: Evidence from jordan. Journal of Applied Accounting Research 17: 170–89. [Google Scholar] [CrossRef]

- Asgari, Mohammad Reza, Ali Asghar Shaban Pour, Reza Ataei Zadeh, and Samaneh Pahlavan. 2015. The relationship between firm’s growth opportunities and firm size on changes ratio in retained earnings of listed companies in tehran stock exchange. International Journal of Innovation and Applied Studies 10: 923. [Google Scholar]

- Ashbaugh, Hollis, Ryan LaFond, and Brian W Mayhew. 2003. Do nonaudit services compromise auditor independence? Further evidence. The Accounting Review 78: 611–39. [Google Scholar] [CrossRef]

- Bao, Shuji Rosey, and Krista B. Lewellyn. 2017. Ownership structure and earnings management in emerging markets—An institutionalized agency perspective. International Business Review 26: 828–38. [Google Scholar] [CrossRef]

- Barnes, Michelle L., and Anthony Tony W. Hughes. 2002. A quantile regression analysis of the cross section of stock market returns. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Barth, Mary E. 2008. Global financial reporting: Implications for us academics. The Accounting Review 83: 1159–79. [Google Scholar] [CrossRef]

- Barth, Mary E., Wayne R. Landsman, Mark Lang, and Christopher Williams. 2012. Are ifrs-based and us gaap-based accounting amounts comparable? Journal of Accounting and Economics 54: 68–93. [Google Scholar] [CrossRef]

- Bartov, Eli, Dan Givoly, and Carla Hayn. 2002. The rewards to meeting or beating earnings expectations. Journal of Accounting and Economics 33: 173–204. [Google Scholar] [CrossRef]

- Beatty, Anne, and Joseph Weber. 2003. The effects of debt contracting on voluntary accounting method changes. The Accounting Review 78: 119–42. [Google Scholar] [CrossRef]

- Beatty, Anne L., Bin Ke, and Kathy R. Petroni. 2002. Earnings management to avoid earnings declines across publicly and privately held banks. The Accounting Review 77: 547–70. [Google Scholar] [CrossRef]

- Becker, Connie L., Mark L. DeFond, James Jiambalvo, and K. R. Subramanyam. 1998. The effect of audit quality on earnings management. Contemporary Accounting Research 15: 1–24. [Google Scholar] [CrossRef]

- Blackburn, Douglas W., and Nusret Cakici. 2017. Overreaction and the cross-section of returns: International evidence. Journal of Empirical Finance 42: 1–14. [Google Scholar] [CrossRef]

- Braam, Geert, Monomita Nandy, Utz Weitzel, and Suman Lodh. 2015. Accrual-based and real earnings management and political connections. The International Journal of Accounting 50: 11–141. [Google Scholar] [CrossRef]

- Bradshaw, Mark T., Gregory S. Miller, and George Serafeim. 2009. Accounting Method Heterogeneity and Analysts’ Forecasts. Chicago: University of Chicago. Ann Arbor: University of Michigan. Cambridge: Harvard University. [Google Scholar]

- Burgstahler, David, and Ilia Dichev. 1997. Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics 24: 99–126. [Google Scholar] [CrossRef]

- Cai, Francis, and Hannah Wong. 2010. The effect of ifrs adoption on global market integration. International Business and Economics Research Journal 9: 25–34. [Google Scholar] [CrossRef]

- Cassell, Cory A., Linda A. Myers, and Timothy A. Seidel. 2015. Disclosure transparency about activity in valuation allowance and reserve accounts and accruals-based earnings management. Accounting, Organizations and Society 46: 23–38. [Google Scholar] [CrossRef]

- Chauhan, Yogesh, and Surya B. Kumar. 2019. Does accounting comparability alleviate the informational disadvantage of foreign investors? International Review of Economics & Finance 60: 114–29. [Google Scholar]

- Chen, Anthony. 2016. Does Comparability Restrict Opportunistic Accounting? Tallahassee: Florida State University, vol. 205. [Google Scholar]

- Chen, Ciao-Wei, Daniel W. Collins, Todd D. Kravet, and Richard D. Mergenthaler. 2018. Financial statement comparability and the efficiency of acquisition decisions. Contemporary Accounting Research 35: 164–202. [Google Scholar] [CrossRef]

- Chen, Jeff Zeyun, Lynn L. Rees, and Shiva Sivaramakrishnan. 2010. On the use of accounting vs. real earnings management to meet earnings expectations-a market analysis. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Chi, Ching-Wen, Ken Hung, and Shinhua Liu. 2020. Corporate governance and earnings management in taiwan: A quantile regression approach. Journal of Accounting and Finance 20. [Google Scholar] [CrossRef]

- Chin, Chen-Lung, Yu-Ju Chen, and Tsun-Jui Hsieh. 2009. International diversification, ownership structure, legal origin, and earnings management: Evidence from Taiwan. Journal of Accounting, Auditing & Finance 24: 233–62. [Google Scholar]

- Chircop, Justin, Daniel W. Collins, Lars Helge Hass, and Nhat (Nate) Q. Nguyen. 2020. Accounting comparability and corporate innovative efficiency. The Accounting Review 95: 127–51. [Google Scholar] [CrossRef]

- Clemons, Eric K. 2019. Resources, platforms, and sustainable competitive advantage: How to win and keep on winning. In New Patterns of Power and Profit. Berlin: Springer, pp. 93–104. [Google Scholar]

- Cohen, Daniel A., Aiyesha Dey, and Thomas Z. Lys. 2008. Real and accrual-based earnings management in the pre-and post-sarbanes-oxley periods. The Accounting Review 83: 757–87. [Google Scholar] [CrossRef]

- Cohen, Daniel A., and Paul Zarowin. 2010. Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics 50: 2–19. [Google Scholar] [CrossRef]

- Conaway, Jenelle. 2017. Has Global Financial Reporting Comparability Improved? Ph.D. Thesis, Boston University, Boston, MA, USA. [Google Scholar]

- Cuervo Valledor, Álvaro, Adolfo Pérez Mena, Miguel Vicente López, and Rosalía Calvo Clúa. 2016. Estudio de las Posibilidades de Inversión en los Mercados Frontera. Munich: Ludwig Maximilian University of Munich. [Google Scholar]

- Darmadi, Salim. 2016. Ownership concentration, family control, and auditor choice. Asian Review of Accounting 24: 19–42. [Google Scholar] [CrossRef]

- Dayanandan, Ajit, Han Donker, Mike Ivanof, and Gökhan Karahan. 2016. Ifrs and accounting quality: Legal origin, regional, and disclosure impacts. International Journal of Accounting and Information Management 24: 296–316. [Google Scholar] [CrossRef]

- De Franco, Gus, Ole-Kristian Hope, and Stephannie Larocque. 2015. Analysts’ choice of peer companies. Review of Accounting Studies 20: 82–109. [Google Scholar] [CrossRef]

- De Franco, Gus, Sagar P. Kothari, and Rodrigo S. Verdi. 2011. The benefits of financial statement comparability. Journal of Accounting Research 49: 895–931. [Google Scholar] [CrossRef]

- Dechow, Patricia, Weili Ge, and Catherine Schrand. 2010. Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics 50: 344–401. [Google Scholar] [CrossRef]

- Dechow, Patricia M., Richard G. Sloan, and Amy P. Sweeney. 1995. Detecting earnings management. Accounting Review 70: 193–225. [Google Scholar]

- DeFond, Mark, Xuesong Hu, Mingyi Hung, and Siqi Li. 2011. The impact of mandatory ifrs adoption on foreign mutual fund ownership: The role of comparability. Journal of Accounting and Economics 51: 240–58. [Google Scholar] [CrossRef]

- Durnev, Artem, Tiemei Li, and Michel Magnan. 2017. Beyond tax avoidance: Offshore firms’ institutional environment and financial reporting quality. Journal of Business Finance & Accounting 44: 646–96. [Google Scholar]

- Ebraheem Saleem, Salem A. 2019. Audit committee, internal audit function and earnings management: Evidence from jordan. Meditari Accountancy Research 28: 72–90. [Google Scholar]

- Enomoto, Masahiro, Fumihiko Kimura, and Tomoyasu Yamaguchi. 2015. Accrual-based and real earnings management: An international comparison for investor protection. Journal of Contemporary Accounting & Economics 11: 183–98. [Google Scholar]

- Ewert, Ralf, and Alfred Wagenhofer. 2005. Economic effects of tightening accounting standards to restrict earnings management. The Accounting Review 80: 1101–24. [Google Scholar] [CrossRef]

- FASB. 2010. Conceptual Framework for Financial Reporting: Concepts Statement No. 8. Available online: https://www.fasb.org/resources/ccurl/515/412/Concepts (accessed on 13 September 2020).

- Framework, Conceptual. 2018. Conceptual Framework for Financial Reporting. London: IFRS Foundation. [Google Scholar]

- Francis, Jere R., Matthew L. Pinnuck, and Olena Watanabe. 2014. Auditor style and financial statement comparability. The Accounting Review 89: 605–33. [Google Scholar] [CrossRef]

- Francis, Jere R., and Dechun Wang. 2008. The joint effect of investor protection and big 4 audits on earnings quality around the world. Contemporary Accounting Review 25: 157–91. [Google Scholar] [CrossRef]

- Frankel, Richard M., Marilyn F. Johnson, and Karen K. Nelson. 2002. The relation between auditors’ fees for nonaudit services and earnings management. The Accounting Review 77: 71–105. [Google Scholar] [CrossRef]

- Ge, Wenxia, and Jeong-Bon Kim. 2014. Real earnings management and the cost of new corporate bonds. Journal of Business Research 67: 641–47. [Google Scholar] [CrossRef]

- Gerged, Ali Meftah, Lara Mohammad Al-Haddad, and Meshari O. Al-Hajri. 2020. Is earnings management associated with corporate environmental disclosure? Accounting Research Journal 33: 167–85. [Google Scholar] [CrossRef]

- Ghosh, Aloke, and Doocheol Moon. 2005. Auditor tenure and perceptions of audit quality. The Accounting Review 80: 585–612. [Google Scholar] [CrossRef]

- Ghosh, Saibal. 2007. Loan loss provisions, earnings, capital management and signalling: Evidence from indian banks. Global Economic Review 36: 121–36. [Google Scholar] [CrossRef]

- Giner, Begoña, and Bill Rees. 2005. The introduction of international financial reporting standards in the european union. European Accounting Review 14: 35–52. [Google Scholar]

- Glass, Christy, Alison Cook, and Alicia R. Ingersoll. 2016. Do women leaders promote sustainability? Analyzing the effect of corporate governance composition on environmental performance. Business Strategy and the Environment 25: 495–511. [Google Scholar] [CrossRef]

- Gramling, Audrey A., and Patricia M. Myers. 2003. Internal auditors’ assessment of fraud warning signs: Implications for external auditors. The CPA Journal 73: 20. [Google Scholar]

- Gregoriou, G. N., and M. Wu. 2016. An application of style analysis to middle east and north african (mena) hedge funds. In Handbook of Frontier Markets. Amsterdam: Elsevier, pp. 19–31. [Google Scholar]

- Gross, Christian, and Pietro Perotti. 2017. Output-based measurement of accounting comparability: A survey of empirical proxies. Journal of Accounting Literature 39: 1–22. [Google Scholar] [CrossRef]

- Gujarati, Damodar N. 2009. Basic Econometrics. New York: McGraw-Hill Education. [Google Scholar]

- Gul, Ferdinand A, Simon Yu Kit Fung, and Bikki Jaggi. 2009. Earnings quality: Some evidence on the role of auditor tenure and auditors’ industry expertise. Journal of Accounting and Economics 47: 265–87. [Google Scholar] [CrossRef]

- Gunny, Katherine A. 2010. The relation between earnings management using real activities manipulation and future performance: Evidence from meeting earnings benchmarks. Contemporary Accounting Research 27: 855–88. [Google Scholar] [CrossRef]

- Hail, Luzi, Christian Leuz, and Peter Wysocki. 2010. Global accounting convergence and the potential adoption of ifrs by the us. Part I: Conceptual underpinnings and economic analysis. Accounting Horizons 24: 355–94. [Google Scholar] [CrossRef]

- Hasan, Mostafa Monzur, and Grantley Taylor. 2020. Financial statement comparability and bank risk-taking. Journal of Contemporary Accounting & Economics 16: 100206. [Google Scholar]

- Haw, In-Mu, Bingbing Hu, Lee-Seok Hwang, and Woody Wu. 2004. Ultimate ownership, income management, and legal and extra-legal institutions. Journal of Accounting Review 42: 423–62. [Google Scholar] [CrossRef]

- Healy, Paul M., and Krishna G. Palepu. 2001. Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics 31: 405–40. [Google Scholar] [CrossRef]

- Healy, Paul M., and James M. Wahlen. 1999. A review of the earnings management literature and its implications for standard setting. Accounting Horizons 13: 365–83. [Google Scholar] [CrossRef]

- Hölmstrom, Bengt. 1979. Moral hazard and observability. The Bell Journal of Economics 10: 74–91. [Google Scholar] [CrossRef]

- Houqe, Muhammad Nurul, Kamran Ahmed, and Tony van Zijl. 2017. Audit quality, earnings management, and cost of equity capital: Evidence from india. International Journal of Auditing 21: 177–89. [Google Scholar] [CrossRef]

- Howard, Michael, Maroun Warren, and Robert Garnett. 2019. Misuse of non-mandatory earnings reporting by companies. Meditari Accountancy Research 28: 125–46. [Google Scholar] [CrossRef]

- Hughes, Susan, and Sander G. Xiques Larson Robert. 2017. Difficulties converging us gaap and ifrs through joint projects: The case of business combinations. Advances in Accounting 39: 1–20. [Google Scholar] [CrossRef]

- Hung, Mingyi. 2000. Accounting standards and value relevance of financial statements: An international analysis. Journal of Accounting and Economics 30: 401–20. [Google Scholar] [CrossRef]

- Hutchison, Michael M. 2002. European banking distress and emu: Institutional and macroeconomic risks. Scandinavian Journal of Economics 104: 365–89. [Google Scholar] [CrossRef]

- Ipino, Elisabetta, and Antonio Parbonetti. 2017. Mandatory ifrs adoption: The trade-off between accrual-based and real earnings management. Accounting and Business Research 47: 91–121. [Google Scholar] [CrossRef]

- Jelinek, Kate. 2007. The effect of leverage increases on earnings management. The Journal of Business and Economic Studies 13: 24. [Google Scholar]

- Jones, Jennifer J. 1991. Earnings management during import relief investigations. Journal of Accounting Review 29: 193–228. [Google Scholar] [CrossRef]

- Joosten, Carmen. 2012. Real Earnings Management and Accrual-Based Earnings Management as Substitutes. Tilburg: Tilburg University, vol. 52. [Google Scholar]

- Kaawaase, Twaha K., Mussa Juma Assad, Ernest G. Kitindi, and Stephen Korutaro Nkundabanyanga. 2016. Audit quality differences amongst audit firms in a developing economy. Journal of Accounting in Emerging Economies 6: 1–26. [Google Scholar] [CrossRef]

- Kawada, Brett. 2014. Auditor Offices and the Comparability and Quality of Clients’ Earnings. San Diego: San Diego State University. [Google Scholar]

- Khanh, Hoang Thi Mai, and Vinh Khuong Nguyen. 2018. Audit quality, firm characteristics and real earnings management: The case of listed Vietnamese firms. International Journal of Economics and Financial Issues 8: 243. [Google Scholar]

- Kim, Jeong-Bon, Richard Chung, and Michael Firth. 2003. Auditor conservatism, asymmetric monitoring, and earnings management. Contemporary Accounting Research 20: 323–59. [Google Scholar] [CrossRef]

- Kim, Jeong-Bon, Leye Li, Louise Yi Lu, and Yangxin Yu. 2016. Financial statement comparability and expected crash risk. Journal of Accounting and Economics 61: 294–312. [Google Scholar] [CrossRef]

- Kim, Seil, Pepa Kraft, and Stephen G. Ryan. 2013. Financial statement comparability and credit risk. Review of Accounting Studies 18: 783–823. [Google Scholar] [CrossRef]

- Kiya, Ali, and Safari G. 2017. Financial statement comparability, accruals-based earnings management, real earnings management. an empirical test of tehran stock exchange. Journal of Financial Accounting Knowledge 26: 115–137. [Google Scholar]

- Klein, April. 2002. Audit committee, board of director characteristics, and earnings management. Journal of Accounting and Economics 33: 375–400. [Google Scholar] [CrossRef]

- Knapp, Michael C. 1991. Factors that audit committee members use as surrogates for audit quality. Auditing: A Journal of Practice & Theory 10: 35–52. [Google Scholar]

- Kothari, Sagar P., Andrew J. Leone, and Charles E. Wasley. 2005. Performance matched discretionary accrual measures. Journal of Accounting and Economics 39: 163–97. [Google Scholar] [CrossRef]

- Krishnan, Gopal V. 2003. Does big 6 auditor industry expertise constrain earnings management? Accounting Horizons 17: 1–16. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de Silanes, Andrei Shleifer, and Robert W. Vishny. 1997. Legal determinants of external finance. The Journal of Finance 52: 1131–50. [Google Scholar] [CrossRef]

- Lang, Mark H., Mark G. Maffett, and Edward Owens. 2010. Earnings comovement and accounting comparability: The effects of mandatory ifrs adoption. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Lee, Myung-Gun, Minjung Kang, Ho-Young Lee, and Jong Chool Park. 2016. Related-party transactions and financial statement comparability: Evidence from south korea. Asia-Pacific Journal of Accounting & Economics 23: 224–52. [Google Scholar]

- Lemma, Tesfaye Taddese, Ayalew Lulseged, Mthokozisi Mlilo, and Minga Negash. 2019. Political stability, political rights and earnings management: some international evidence. Accounting Research Journal 33: 57–74. [Google Scholar] [CrossRef]

- Lemma, Tesfaye T., Minga Negash, Mthokozisi Mlilo, and Ayalew Lulseged. 2018. Institutional ownership, product market competition, and earnings management: Some evidence from international data. Journal of Business Research 90: 151–63. [Google Scholar] [CrossRef]

- Leuz, Christian, Dhananjay Nanda, and Peter D. Wysocki. 2003. Earnings management and investor protection: an international comparison. Journal of Financial Economics 69: 505–27. [Google Scholar] [CrossRef]

- Li, Leon, and Chii-Shyan Kuo. 2017. Ceo equity compensation and earnings management: The role of growth opportunities. Finance Research Letters 20: 289–95. [Google Scholar] [CrossRef]

- Li, Shaomin, Seung Ho Park, and Rosey Shuji Bao. 2014. How much can we trust the financial report? Earnings management in emerging economies. International Journal of Emerging Markets 9: 33–53. [Google Scholar] [CrossRef]

- Li, Shaomin, David D. Selover, and Michael Stein. 2011. “Keep silent and make money”: Institutional patterns of earnings management in china. Journal of Asian Economics 22: 369–82. [Google Scholar] [CrossRef]

- Lin, Hsiou-Wei William, Huai-Chun Lo, and Ruei-Shian Wu. 2016. Modeling default prediction with earnings management. Pacific-Basin Finance Journal 40: 306–22. [Google Scholar] [CrossRef]

- Lin, Steve, William N. Riccardi, Changjiang Wang, Patrick E. Hopkins, and Gary Kabureck. 2019. Relative effects of ifrs adoption and ifrs convergence on financial statement comparability. Contemporary Accounting Research 36: 588–628. [Google Scholar] [CrossRef]

- MSCI. 2020. Msci Market Classification Framework. Available online: https://www.msci.com/documents/1296102/1330218/MSCI_Global_Market_Framework_2019.pdf/57f021bc-a41b-f6a6-c482-8d4881b759bf (accessed on 28 April 2020).

- Nouy, Daniele. 2014. Regulatory and Financial Reporting Essential for Effective Banking Supervision and Financial Stability. Available online: https://www.bankingsupervision.europa.eu/press/speeches/date/2014/html/se140603.en.html (accessed on 13 September 2020).

- Piot, Charles, and Rémi Janin. 2007. External auditors, audit committees and earnings management in France. European Accounting Review 16: 429–54. [Google Scholar] [CrossRef]

- Rodriguez-Ariza, Lázaro, Jennifer Martínez-Ferrero, and Manuel Bermejo-Sánchez. 2016. Consequences of earnings management for corporate reputation: Evidence from family firms. Accounting Research Journal 29: 457–74. [Google Scholar] [CrossRef]

- Roychowdhury, Sugata. 2006. Earnings management through real activities manipulation. Journal of Accounting and Economics 42: 335–70. [Google Scholar] [CrossRef]

- Ruddock, Caitlin, Sarah J. Taylor, and Stephen L. Taylor. 2006. Nonaudit services and earnings conservatism: Is auditor independence impaired? Contemporary Accounting Research 23: 701–46. [Google Scholar] [CrossRef]

- Rusmin, Rusmin. 2010. Auditor quality and earnings management: Singaporean evidence. Managerial Auditing Journal 25: 1–24. [Google Scholar] [CrossRef]

- Salehi, Mahdi, Hossein Tarighi, and Samaneh Safdari. 2018. The relation between corporate governance mechanisms, executive compensation and audit fees: Evidence from iran. Management Research Review 41: 939–67. [Google Scholar] [CrossRef]

- Shane, Philip, David Smith, and Suning Zhang. 2014. Financial statement comparability and valuation of seasoned equity offerings. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Shen, Chung-Hua, and Hsiang-Lin Chih. 2005. Investor protection, prospect theory, and earnings management: An international comparison of the banking industry. Journal of Banking & Finance 29: 2675–97. [Google Scholar]

- Sohn, Byungcherl Charlie. 2016. The effect of accounting comparability on the accrual-based and real earnings management. Journal of Accounting and Public Policy 35: 513–39. [Google Scholar] [CrossRef]

- Stereńczak, Szymon, Adam Zaremba, and Zaghum Umar. 2020. Is there an illiquidity premium in frontier markets? Emerging Markets Review 42: 100673. [Google Scholar] [CrossRef]

- Tabassum, Naila, Ahmad Kaleem, and Mian Sajid Nazir. 2015. Real earnings management and future performance. Global Business Review 16: 21–34. [Google Scholar] [CrossRef]

- Thomas, Nisha Mary, Smita Kashiramka, and Surendra S. Yadav. 2017. Dynamic linkages among developed, emerging and frontier capital markets of asia-pacific region. Journal of Advances in Management Research 14: 332–51. [Google Scholar] [CrossRef]

- Tran, Nam Hoai, and Chi Dat Le. 2020. Ownership concentration, corporate risk-taking and performance: Evidence from vietnamese listed firms. Cogent Economics & Finance 8: 219–38. [Google Scholar]

- Tversky, Amos, and Daniel Kahneman. 1992. Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk & Uncertainty 5: 297–323. [Google Scholar]

- Wang, Sean, and Julia D’Souza. 2006. Earnings management: The effect of accounting flexibility on R&D investment choices. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Young, Steven, and Yachang Zeng. 2015. Accounting comparability and the accuracy of peer-based valuation models. The Accounting Review 90: 2571–601. [Google Scholar] [CrossRef]

- Yu, Gwen, and Aida Sijamic Wahid. 2014. Accounting standards and international portfolio holdings. The Accounting Review 89: 1895–930. [Google Scholar] [CrossRef]

- Zang, Amy Y. 2011. Evidence on the trade-off between real activities manipulation and accrual-based earnings management. The Accounting Review 87: 675–703. [Google Scholar] [CrossRef]

- Zaremba, Adam, and Alina Maydybura. 2019. The cross-section of returns in frontier equity markets: Integrated or segmented pricing? Emerging Markets Review 38: 219–38. [Google Scholar] [CrossRef]

- Zhang, Joseph H. 2018. Accounting comparability, audit effort, and audit outcomes. Contemporary Accounting Research 35: 245–76. [Google Scholar] [CrossRef]

- Zhou, Zejiang, Jing Ma, and Yue Geng. 2017. Does tenure location impact governance role of independent directors? Empirical evidence from the earnings management perspective. Journal of Accounting and Economics 5: 275. [Google Scholar]

| 1. | Goodwill impairment or deferred tax assets and liabilities recognition are areas where interpretation may be applied. |

| 2. | Prospect theory suggests that individuals derive value from gains from a reference point, rather than absolute levels (Tversky and Kahneman 1992). |

| 3. | Based on the MSCI Frontier Market Index companies. |

| 4. | Based on weekly data of MSCI Frontier Market and MSCI Developed market index from 2015 to 2020. Source Thomson Datastream. |

| 5. | As evidenced by the EU members requirement to adopt IFRS, and the United States, Japan, and China, the choice to converge with IFRS (Lin et al. 2019). |

| 6. | Financial Accounting and Standards Board (FASB), and the International Accounting Standards Board (IASB). |

| 7. | Advantages may be market share dominance and or profitability above the industry average. |

| 8. | As opposed to earnings composed of cash. |

| 9. | Whether it is local accounting standards, International Financial Reporting Standards (IFRS), or Generally Accepted Accounting Principles GAAP). |

| 10. | A minimum of two countries with sufficient firms in each industry-year is required. |

| 11. | The Hausman test for fixed vs. random-effects models returns a chi-squared value of 51.87, which is significant at the 0.01% level, indicating that the fixed-effects model is appropriate. |

| 12. | Wooldridge test for autocorrelation in panel data finds an F-statistic of 1786.826, which is significant at the 0.01% level for the lag comparable score value. |

| 13. | Breusch–Pagan/Cook–Weisberg test for heteroskedasticity score is 96.46, which is significant at the 0.01% level. |

| 14. | Prior to 2005, EU listed companies followed a variety of country-specific accounting principles. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).