2. Materials and Methods

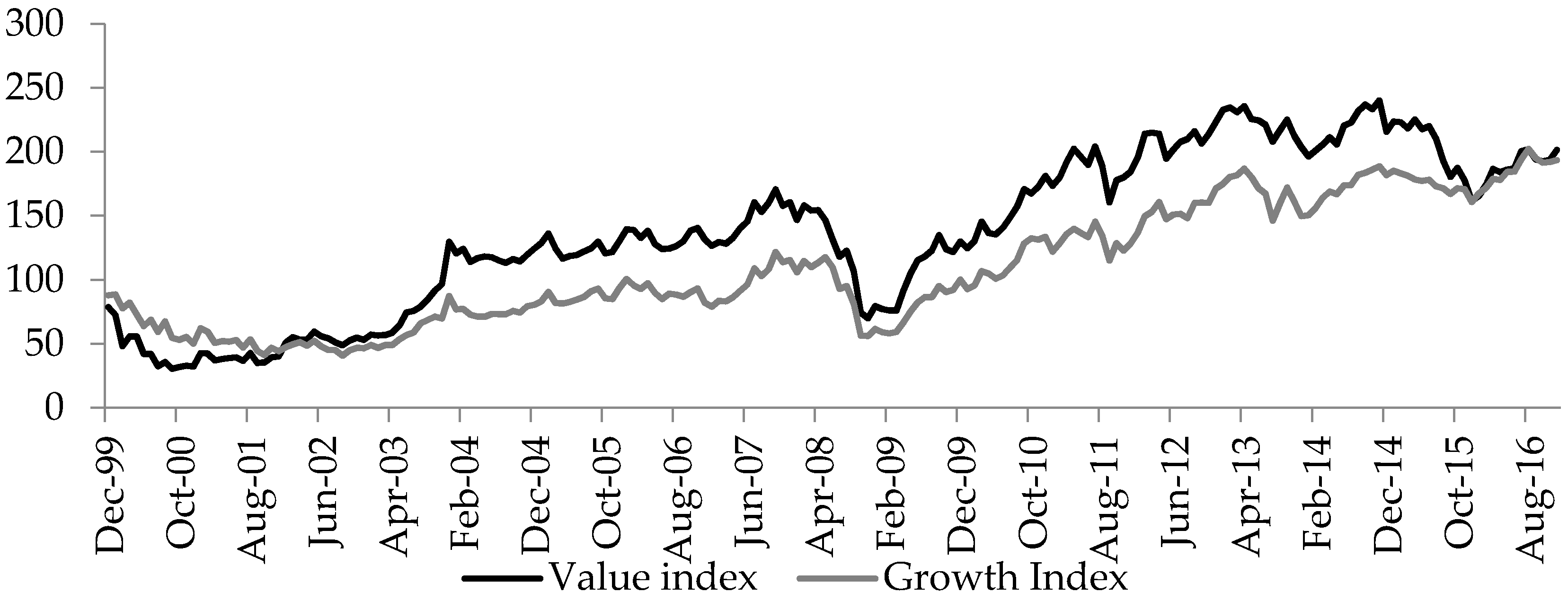

The indexes used for comparing the performance of value versus growth stocks in the Thai market were the MSCI Thailand Value Index and the MSCI Thailand Growth Index. All the data were extracted from the database Bloomberg. The end of month value for both indexes were collected for the period from December 1999 to December 2016. The risk free rates for Thailand for all these years were extracted from Bloomberg and equate to the 10 year local treasury bond yield (longest time series available in the data base). For the previously mentioned period the value index generated returns of approximately 156% while the growth index generated a return of 120%. The MSCI indexes are frequently used as benchmarks by actual institutional investors in this market. It seemed reasonable then to use these indexes, rather than creating an artificial basket of stocks representing value and growth investments. In the indexes used, there is no double counting, in other words, there are no companies included simultaneously in the value and the growth indexes.

The performance of both indexes can be seen in

Figure 1 and the risk adjusted comparison in

Table 1. There were only three years in which the indexes moved in opposite directions. These years were 2001, 2006, and 2011. In all these three years the growth indexes had negative returns while the value indexes had positive returns. Of the 17 years analyzed the value index outperformed the growth index in 10 years. On a risk adjusted basis, the results are similar with the point estimate for the Sharpe ratio being bigger for 9 out of the 17 years analyzed. The point estimate for the correlation between the two indexes for the entire period was rather high, 0.931, but this correlation did change over time (

Table 2). The smallest correlation for these two indexes was in 2005 (0.683) while the highest correlation was in 2007 (0.986).

As a first step, the normality of the data was tested using an Anderson–Darling test. For the entire time series (from December 1999 to December 2017) the null assumption that the data follow a normal distribution is rejected as a 5% significance level. Nevertheless, it should be noted that when the test was performed for each individual year in the majority of the cases the Anderson–Darling test was unable to reject the hypothesis that the data follow a normal distribution (

Table 3). As there are conflicting data regarding the issue of normality of distribution on these stocks returns and in accordance to the majority of the existing literature regarding this issue it was not assumed that the index returns follow a normal distribution. Hence, a non-parametric test was used. The non-parametric test used to compare both indexes was the Wilcoxon test. The null hypothesis of equal medians, comparing the MSCI Thailand Value and the MSCI Thailand Growth Index, was rejected in all cases (including when analyzing the entire time series together) with the exception of the 2016 period (

Table 4).

Another option instead of using indexes is to create portfolios of stocks directly according to some of the characteristics of value and growth investing. The approach followed for the creation of these indexes is similar to the one used in (

Lakonishok et al. 1994). These authors used four metrics to classify companies into two categories; value and growth. One of the metrics that they used, and of the most frequently mentioned in the literature is the P/E ratio. First, a list of all the companies listed in the Bangkok Stock Exchange with positive earning as of December 1999 was obtained. Companies with extensive suspension periods were excluded from the index. It should be noted that the liquidity in some of those names was not too high with some of them not having daily trading. Only companies with relatively liquid stocks were included in the analysis. Those companies were grouped into four different groups according to their respective P/E values. For instance, the highest 25% of companies, according to their P/E were included in group one, the following 25% in group two and thereof. Some authors chose to use more subgroups , for instance in 10% intervals, but given the relatively small amount of stocks that satisfied our criteria in the Thai market on that date it seemed preferable to use a classification into four groups. The top and bottom groups, according to their P/E values, were selected to represent growth and value stocks. Each of these groups contained 16 stocks. An equal weight index was then created with all these 16 components. The returns on both indexes can be seen in

Figure 2 and the correlation data in

Table 5. Low P/E stocks are typically associated with value investments while high P/E stocks are typically associated with growth stocks.

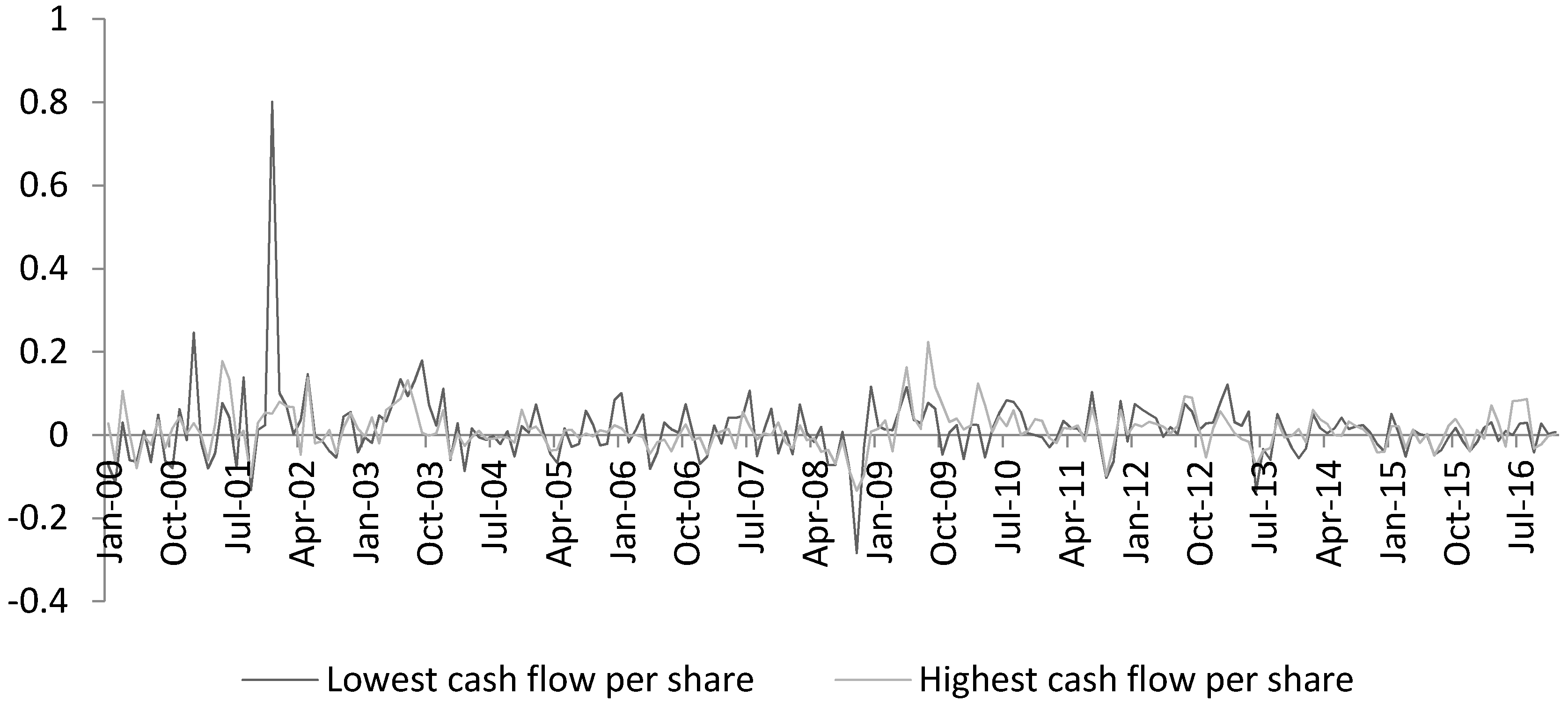

Portfolios were also created using the cash flow per share metric. Similarly to the previous case a list of the companies listed in the Bangkok Stock Exchange at the end of December 1999 was used as a starting point. Then the cash flow per share was extracted from the data base Bloomberg for each of those stocks and arranged into four buckets. Only companies with positive cash flows were included. Due to these limitations, only 50 companies were left on the overall list. The top and bottom buckets contained 12 companies each. The returns of the indexes created using this criteria can be seen in

Figure 3 and the correlation data in

Table 6.

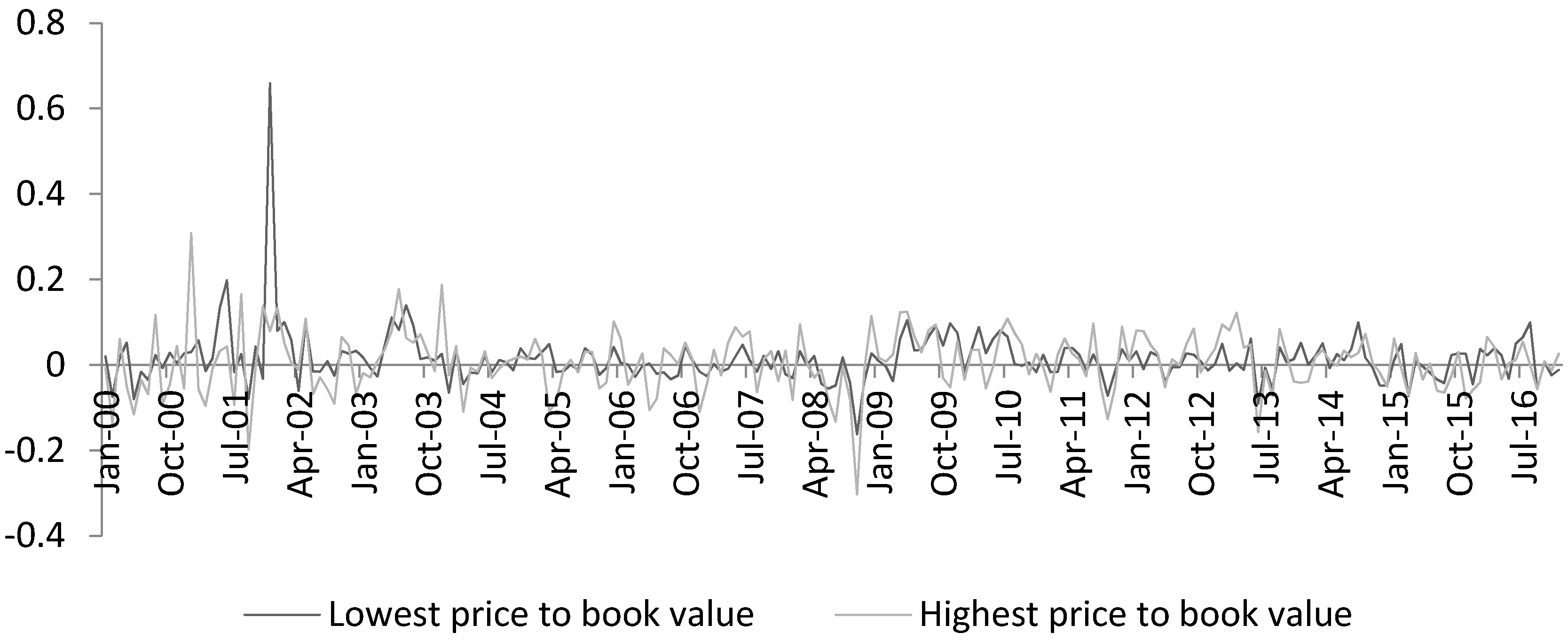

A third approach used to construct portfolios was to use the price to book value metric. Like in the previous cases, the starting point was the list of companies listed in the Bangkok Stock Exchange as of the end of December 1999. Then the price to book value metric was obtained from Bloomberg for each of the companies and arrange accordingly. The top and bottom buckets each contained 14 companies. Low price-to-book value is typically associated with value investment strategies while high price-to-book value is normally associated with growth stocks. The returns of the indexes created using this criteria can be seen in

Figure 4 and the correlation data in

Table 7.

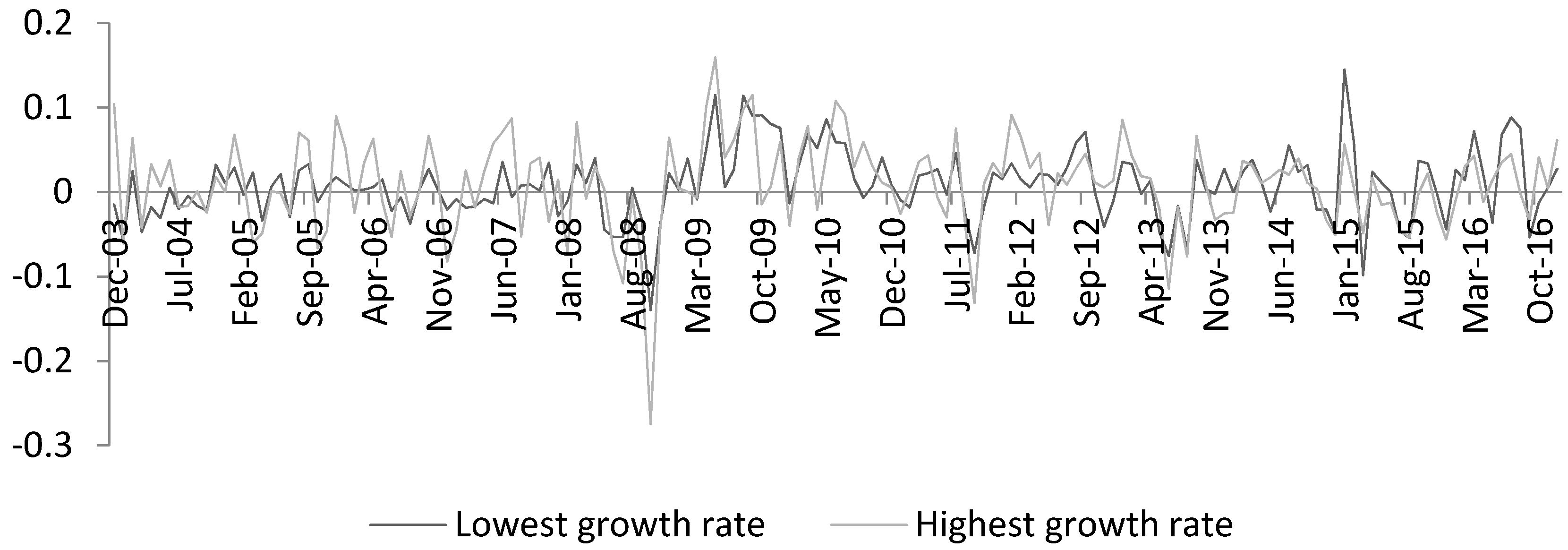

The final metric used for the classification of companies was the average five years sales growth for the companies. Due to data availability, the time series using this metric is shorter compared to the other metrics. This was necessary in order to maintain a reasonable number of stocks in each index. The starting data point, used for the classification of stocks was the end of December 2003, rather than the end of December of 1999 like in the previous cases. Also in this case 14 companies were included in the top and bottom buckets. The returns of the indexes created using this criteria can be seen in

Figure 5 and the correlation data in

Table 8.

Similarly to the previous cases, in which the MSCI indexes were used, the first step was to do a test regarding the normality of the portfolio returns built using the previously mentioned four different metrics. For consistency considerations the Anderson–Darling test was selected as the appropriate test. Similarly to the previous cases, when the entire data series is analyzed the hypothesis that the returns follow a normal distribution can be rejected at a 5% significance level for most of the indexes. However, for the majority of the individual years such assumption cannot be rejected (

Table 9,

Table 10,

Table 11 and

Table 12).

Wilcoxon tests were then performed, as in the previous cases, to compare the indexes built using the P/E, P/B, Cash flow per share and five-year growth rate. Interestingly, the results of these tests (

Table 13,

Table 14,

Table 15 and

Table 16) fail to reject the hypothesis that the returns come from distributions with the same median. This might relate to the fact that perhaps using only one of these criteria to allocate companies into the value or growth categories is not enough and further analysis is needed. The issue of poor liquidity of some of the stocks included in the analysis is also acknowledged. While significant efforts were made to include only liquid securities, given the limited number of stocks that satisfied the previously mentioned criteria, some not highly liquid stocks were included in the portfolios. This, while a factor to take into account, is unlikely to be the sole factor between the discrepancy of the MSCI indexes and the portfolios built from individual stocks satisfying some broad market criteria such as P/E ratios.

3. Results

For the entire period analyzed, from the end of December 1999 to the end of December 2016, value stocks in Thailand, represented by the MSCI Thailand Value Index, gained 156% while growth stocks, represented by the MSCI Thailand Growth Index, gained 120%. When applying a formal statistical test to the monthly returns during that period, such as the Wilcoxon test, and at a 5% significance level the hypothesis that the medians of the returns are equal is rejected, supporting the view that value stocks outperform growth stocks over the long term. However, when the performance of the individual years is compared, the results are more mixed. For 10 of the 17 years analyzed, the point estimate of the returns was higher for value stocks than for growth stocks. The results of the Wilcoxon test suggest that the median returns are statistically different every year with the only exception of 2016. When risk adjusted returns are used, using the Sharpe ratio, it is obtained that the point estimate of the Sharpe ration for value stocks is higher in 9 out of the 17 years analyzed. This would seem to indicate that while over long time frames, such as 17 years, value stocks did outperform growth stocks, over shorter time fames such as one calendar year that was not necessarily the case. In fact, in many occasions, over a one calendar year time frame, growth stocks statistically significantly outperformed value stocks. When using portfolios built according to P/E, P/B, cash flow per share, and five-year growth rates the results fail to reject the hypothesis that the medians of the returns are different. This is a surprising result and it might be related to the fact that classification of companies into the value and growth categories is a process more complex than just picking companies using a single criteria such as P/E. The poor liquidity of some of the stocks might also be a fact impacting comparisons of returns.

4. Discussion

In the Thai market, and for the period of time analyzed, value stocks seem to outperform growth stocks. There are discrepancies between the results using existing indexes, such as the MSCI Thailand Value index, and building portfolios according to some criteria, such as low P/E. This might be related to the fact that classifying companies into the value or growth buckets might require more analysis than just using a single criteria such as low P/E. The results obtained using the indexes, of outperformance of value stocks, is similar to the ones obtained in other markets. It is interesting that this result is obtained when analyzing the entire period (17 years) together but not when analyzing every year individually. When calendar years are analyzed individually, the results are much more mixed with growth stocks outperforming in some of those years. It might be that one year is too short of a time frame in the Thai market for value stock to be able to outperform growth stocks. It is possible that the outperformance of value stocks over growth stocks is related to some risks that the models do not fully reflect and this could be an interesting area of further research.