Efficiency Analysis of Islamic Banks in the Middle East and North Africa Region: A Bootstrap DEA Approach

Abstract

:1. Introduction

2. Literature Review

3. Methodology

- (1)

- Calculate the DEA efficiency scores for each Decision-Making Unit noted DMUj, j = 1, …, n, that uses m different inputs xij (i = 1, ..., m), to produce s different outputs yrj (r = 1, ..., s) by solving the following linear programming model:where is the technical efficiency score. means that the evaluated DMU is technically inefficient. indicates a full technically efficient DMU. is the convexity constraint. This model is the DEA model under the Variable Returns to Scale (VRS) assumption. It was developed by Banker et al. [29] in order to estimate the standard overall technical efficiency2 and to decompose it into pure technical efficiency and scale efficiency.

- (2)

- Generate a random sample of size n by drawing with replacement from . The “smoothed bootstrap” is employed here by using the kernel density estimation and the Silverman’s [31] reflection method, in order to avoid the “naive bootstrap” giving a poor estimate of the DGP (see Simar and Wilson [11] for a detailed explanation).

- (3)

- Compute a pseudo data set , where in order to construct the reference bootstrap technology.

- (4)

- Compute the bootstrap estimate of the efficiency scores for each DMUj, j = 1, …., n, by solving the bootstrap counterpart of the linear programming model previously presented.

- (5)

- Repeat steps 2–4 B number of times, in order to provide a set of bootstrap estimates for j =1, …., n,. Following Simar and Wilson [32], B should be equal to 2000 in order to give a reasonable approximation of confidence intervals.

4. Data and Variables

4.1. Data

4.2. Variables

5. Results

5.1. Overall Technical Efficiency Scores

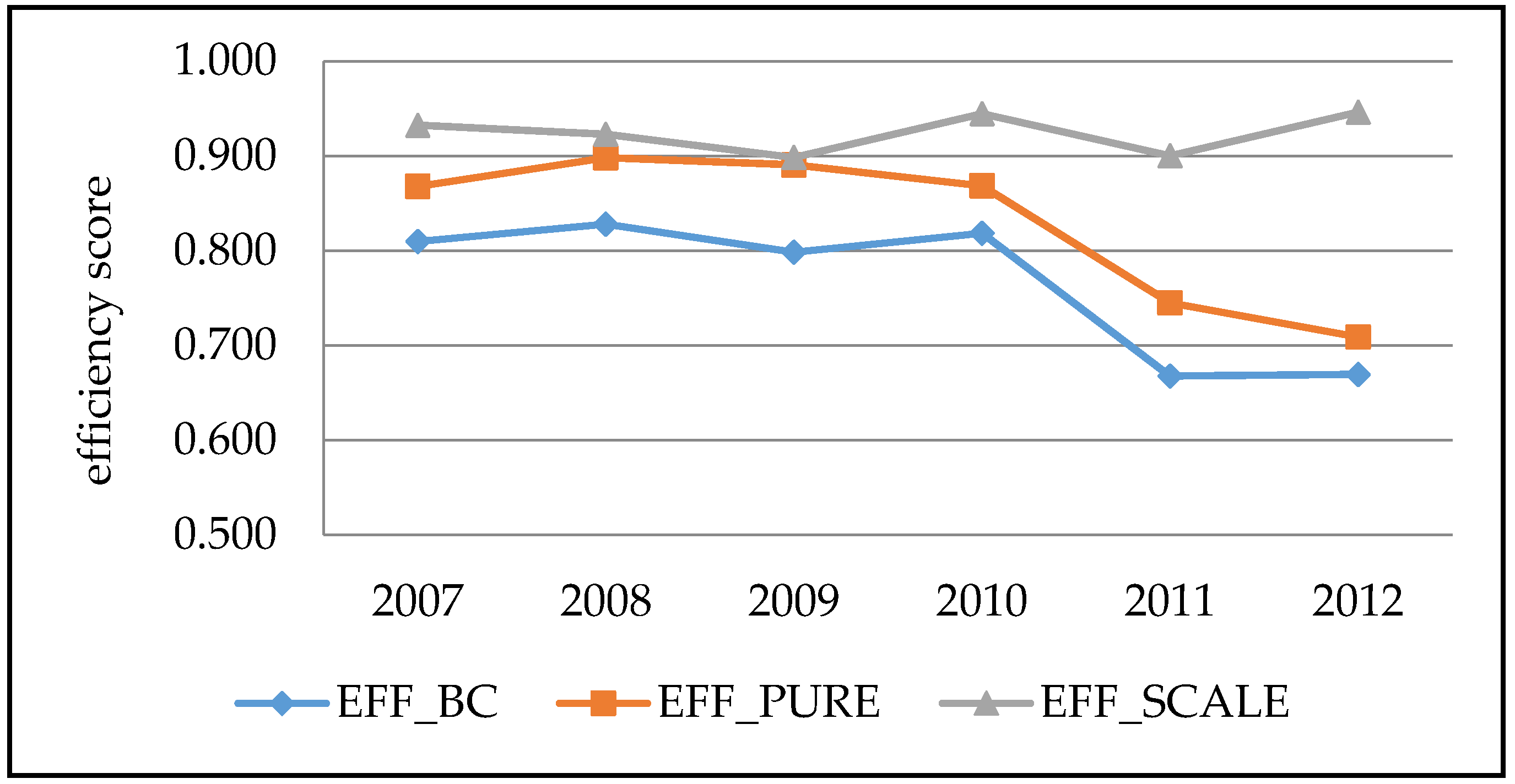

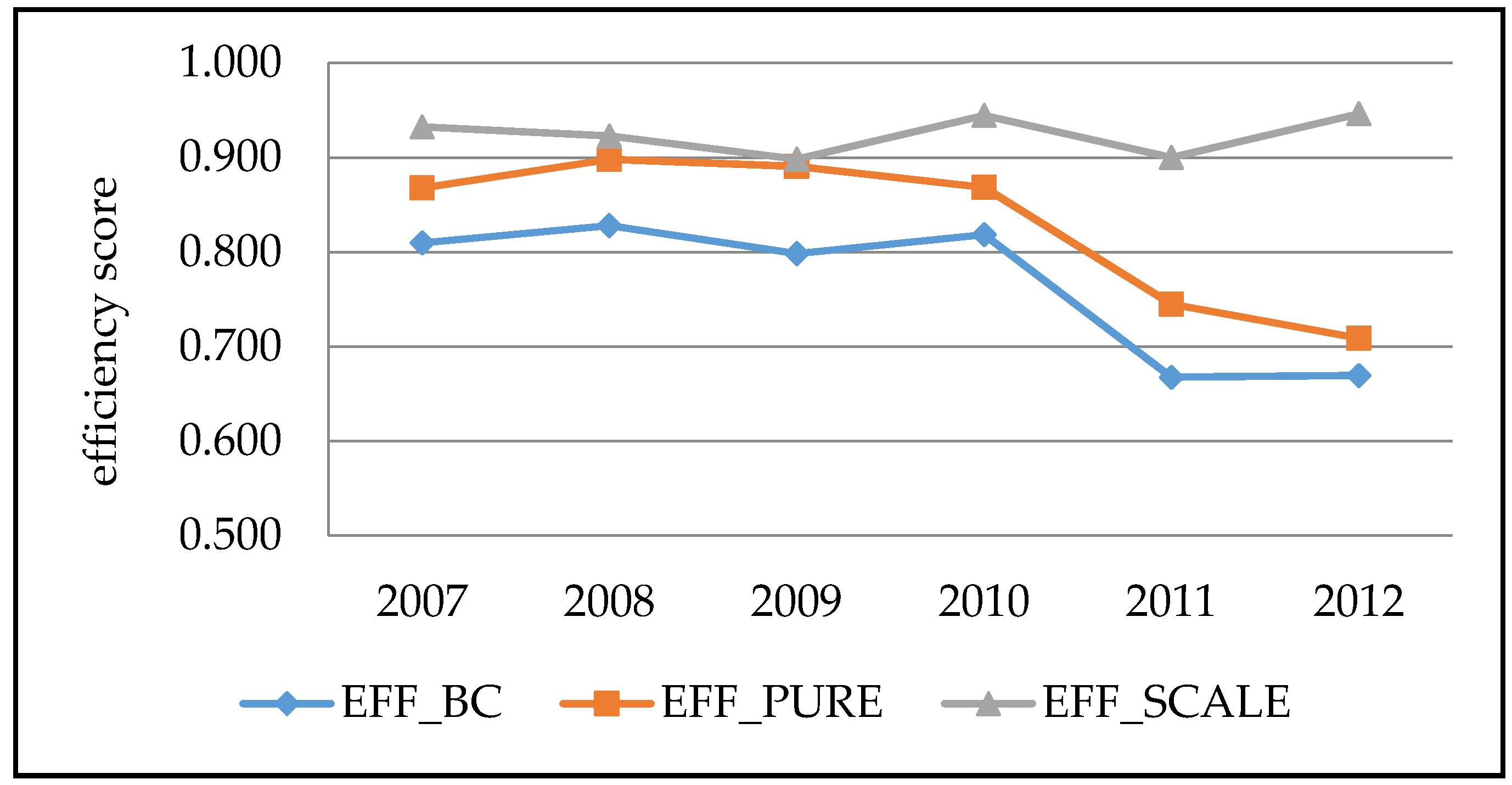

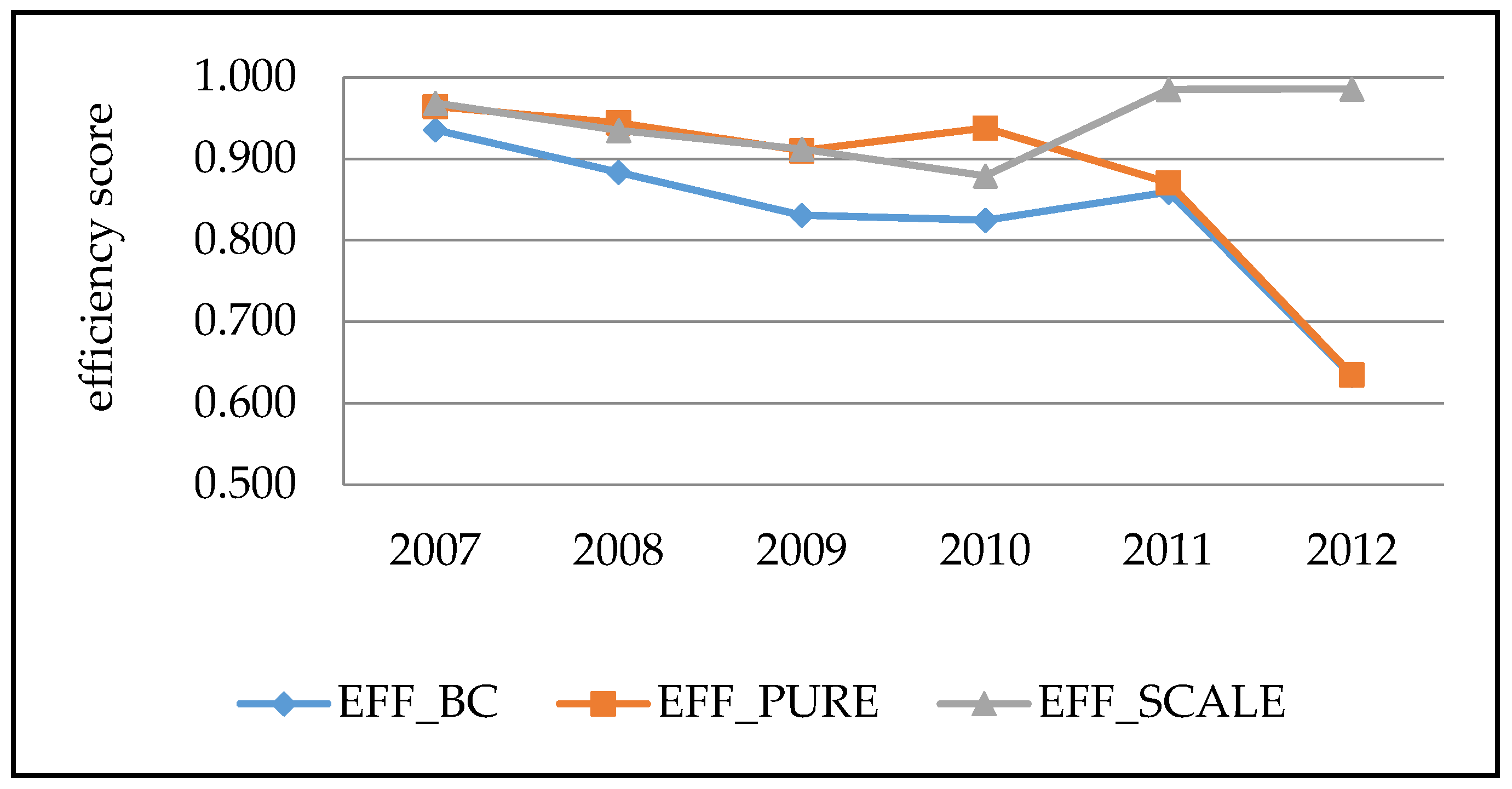

5.2. Decomposition of Overall Technical Efficiency

6. Conclusions

Conflicts of Interest

References

- Ernst & Young. World Islamic Banking Competitiveness Report 2013–2014. London, UK: Ernst & Young, 2014. [Google Scholar]

- Islamic Financial Services Board. Islamic Financial Services Industry Stability Report 2016. Kuala Lumpur, Malaysia: Islamic Financial Services Board, 2016. [Google Scholar]

- B.S. Chong, and M.H. Liu. “Islamic banking: Interest-free or interest-based? ” Pac. Basin Financ. J. 17 (2009): 125–144. [Google Scholar] [CrossRef]

- M. Hasan, and J. Dridi. “The Effects of the Global Crisis on Islamic and Conventional Banks: A Comparative Study.” IMF Working Paper No. WP/10/201. 2010. Available online: https://www.imf.org/external/pubs/ft/wp/2010/wp10201.pdf (accessed on 5 August 2016).

- M. Cihak, and H. Hesse. “Islamic banks and financial stability: An empirical analysis.” J. Financ. Serv. Res. 38 (2010): 95–113. [Google Scholar] [CrossRef]

- T. Beck, A. Demirgüc-Kunt, and O. Merrouche. “Islamic vs. conventional banking: Business model, efficiency and stability.” J. Bank. Financ. 37 (2013): 433–447. [Google Scholar] [CrossRef]

- M. Farooq, and S. Zaheer. “Are Islamic Banks More Resilient During Financial Panics? ” IMF Working paper No. WP/15/41. 2015. Available online: https://www.imf.org/external/pubs/ft/wp/2015/wp1541.pdf (accessed on 10 September 2016).

- S.A. Srairi, and I. Kouki. “Efficiency and stock market performance of Islamic banks in GCC Countries.” ISRA Int. J. Islam. Financ. 4 (2012): 89–116. [Google Scholar] [CrossRef]

- Z. Ftiti, O. Nafti, and S. Sreiri. “Efficiency of Islamic banks during subprime crisis: Evidence of GCC countries.” J. Appl. Bus. Res. 29 (2013): 285–304. [Google Scholar] [CrossRef]

- R. Rosman, N.A. Wahab, and Z. Zainol. “Efficiency of Islamic banks during the financial crisis: An analysis of Middle Eastern and Asian countries.” Pac. Basin Financ. J. 28 (2014): 76–90. [Google Scholar] [CrossRef]

- L. Simar, and P.W. Wilson. “Sensitivity analysis of efficiency scores: How to bootstrap in nonparametric frontier models.” Manag. Sci. 44 (1998): 49–61. [Google Scholar] [CrossRef]

- I. Faye, T. Triki, and T. Kangoye. “The Islamic finance promises: Evidence from Africa.” Rev. Dev. Financ. 3 (2013): 136–151. [Google Scholar] [CrossRef]

- R. Almarzoqi, S. Ben Naceur, and A. Scopelliti. “How Does Bank Competition Affect Solvency, Liquidity and Credit Risk? Evidence from the MENA Countries.” IMF Working Paper No. 15/210. 2015. Available online: https://www.imf.org/external/pubs/ft/wp/2015/wp15210.pdf (accessed on 11 January 2017).

- K. Brown. “Islamic banking comparative analysis.” Arab Bank Rev. 5 (2003): 43–50. [Google Scholar]

- M.K. Hassan. “The X-efficiency in Islamic banks.” Islam. Econ. Stud. 13 (2006): 49–78. [Google Scholar]

- F. Sufian. “The efficiency of Islamic banking industry: A non-parametric analysis with non-discretionary input variable.” Islam. Econ. Stud. 14 (2007): 53–86. [Google Scholar]

- I.Z. Tahir, and S. Haron. “Cost and profit efficiency of Islamic banks: International evidence using the stochastic frontier approach.” Banks Bank Syst. 5 (2010): 78–83. [Google Scholar]

- M.A. Noor, and N.H. Ahmad. “The determinants of Islamic banks’ efficiency changes: Empirical evidence from the world banking sectors.” Glob. Bus. Rev. 13 (2012): 179–200. [Google Scholar] [CrossRef]

- D. Yudistira. “Efficiency in Islamic banking: An empirical analysis of eighteen banks.” Islam. Econ. Stud. 12 (2004): 1–19. [Google Scholar]

- F. Sufian, and M.A.N.M. Noor. “The determinants of Islamic bank’s efficiency changes: Empirical evidence from MENA and Asian banking sectors.” Int. J. Islam. Middle East. Financ. Manag. 2 (2009): 120–138. [Google Scholar] [CrossRef]

- M. Ben Hassine, and R. Limani. “The impact of bank characteristics on the efficiency: Evidence from MENA Islamic banks.” J. Appl. Financ. Bank. 4 (2014): 237–253. [Google Scholar]

- P.A. Aghimien, F. Kamarudin, M. Hamid, and B. Noordin. “Efficiency of Gulf Cooperation Council banks.” Rev. Int. Bus. Strateg. 26 (2016): 118–136. [Google Scholar] [CrossRef]

- A.R. Rahman, and R. Rosman. “Efficiency of Islamic banks: A comparative analysis of MENA and Asian countries.” J. Econ. Coop. Dev. 34 (2013): 63–92. [Google Scholar]

- J.R. Poo. Computer-Aided Introduction to Econometrics. New York, NY, USA: Springer, 2003. [Google Scholar]

- B. Efron. “Bootstrap methods: Another look at the Jackknife.” Ann. Stat. 7 (1979): 1–26. [Google Scholar] [CrossRef]

- B. Efron, and R.J. Tibshirani. An Introduction to the Bootstrap. London, UK: Chapman and Hall, 1993. [Google Scholar]

- J.L. Horowitz. “The bootstrap.” In Handbook of Econometrics. Edited by J. Heckman and E. Leamer. Amsterdam, The Netherlands: Elsevier, 2001, pp. 3159–3228. [Google Scholar]

- E. Tortosa-Ausina, E. Grifell-Tatjé, C. Armero, and D. Conesa. “Sensitivity analysis of efficiency and Malmquist productivity indices: An application to Spanish saving banks.” Eur. J. Oper. Res. 184 (2008): 1062–1084. [Google Scholar] [CrossRef]

- R.D. Banker, A. Charnes, and W.W. Cooper. “Some models for the estimation of technical and scale inefficiencies in data envelopment analysis.” Manag. Sci. 30 (1984): 1078–1092. [Google Scholar] [CrossRef]

- T.J. Coelli, D.S. Prasada Rao, C.J. O’Donnell, and G.E. Battese. An Introduction to Efficiency and Productivity Analysis. New York, NY, USA: Springer, 2005. [Google Scholar]

- B.W. Silverman. Density Estimation for Statistics and Data Analysis. London, UK: Chapman and Hall, 1986. [Google Scholar]

- L. Simar, and P.W. Wilson. “Statistical inference in nonparametric frontier models: The state of the art.” J. Prod. Anal. 13 (2000): 49–78. [Google Scholar] [CrossRef]

- M. Fethi, and F. Pasiouras. “Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey.” Eur. J. Oper. Res. 204 (2010): 189–198. [Google Scholar] [CrossRef]

- D. Sharma, A.K. Sharma, and M.K. Barua. “Efficiency and productivity of banking sector.” Qual. Res. Financ. Mark. 5 (2013): 195–224. [Google Scholar] [CrossRef]

- C.W. Sealey Jr., and J.T. Lindley. “Inputs, outputs and a theory of production and cost at depository financial institutions.” J. Financ. 32 (1977): 1251–1266. [Google Scholar] [CrossRef]

- A.N. Berger, and D.B. Humphrey. “Efficiency of financial institutions: International survey and directions for future research.” Eur. J. Oper. Res. 98 (1997): 175–212. [Google Scholar] [CrossRef]

- A. Mobarek, and A. Kalonov. “Comparative performance analysis between conventional and Islamic banks: Empirical evidence from OIC countries.” Appl. Econ. 46 (2014): 253–270. [Google Scholar] [CrossRef]

- P.W. Wilson. “FEAR: A software package for frontier efficiency analysis with R.” Soc. Econ. Plan. Sci. 42 (2008): 247–254. [Google Scholar] [CrossRef]

- J. Johnes, M. Izzeldin, and V. Pappas. “A comparison of performance of Islamic and conventional banks 2004 to 2009.” J. Econ. Behav. Organ. 103 (2014): 93–107. [Google Scholar] [CrossRef]

- F. Alqahtani, D.G. Mayes, and K. Brown. “Economic turmoil and Islamic banking: Evidence from the Gulf Cooperation Council.” Pac. Basin Financ. J. 39 (2016): 44–56. [Google Scholar] [CrossRef]

- A.M. Mashal. “The financial crisis of 2008–2009 and the Arab states economies.” Int. J. Bus. Manag. 7 (2012): 96–111. [Google Scholar] [CrossRef]

- H. Zarrouk. “The impact of the international financial crisis on the performance of Islamic Banks in MENA countries.” In The Developing Role of Islamic Banking and Finance: From Local to Global Perspectives (Contemporary Studies in Economic and Financial Analysis. Edited by F.H. Beseiso. Bingley, UK: Emerald Group Publishing, 2014, Volume 95, pp. 45–69. [Google Scholar]

- M. Polemis. “Does monopolistic competition exist in the MENA region? Evidence from the banking Sector.” Bull. Econ. Res. 67 (2015): 74–96. [Google Scholar] [CrossRef]

- N. Apergis, and M. Polemis. “Competition and efficiency in the MENA banking region: A non-structural DEA approach.” Appl. Econ. 48 (2016): 5276–5291. [Google Scholar] [CrossRef]

- F. Kamarudin, A.M. Nassir, M.H. Yahya, R.M. Said, and B.A.A. Nordin. “Islamic banking sectors in Gulf Cooperative Council countries: Analysis on revenue, cost and profit efficiency concepts.” J. Econ. Coop. Dev. 35 (2014): 1–42. [Google Scholar]

- 1The DGP is the joint probability distribution that is supposed to characterize the entire population from which the data set has been drawn (Poo [24]).

- 2Efficiency scores estimated under Constant Returns to Scale (CRS) assumption. This was done by solving the linear programming model in Equation (1) without the convexity constraint ( (see Coelli et al. [30]).

- 3This was done by solving the linear programming model in Equation (1) after substituting the convexity constraint ( with the constraint (see Coelli et al. [30]).

| Outputs | Inputs | |||||

|---|---|---|---|---|---|---|

| Total Loans (Y1) | Investment Portfolio (Y2) | Labor (X1) | Fixed Assets (X2) | Total Deposits (X3) | ||

| 2007 | Mean | 2587.077 | 823.805 | 41.024 | 107.003 | 3086.277 |

| Std | 4438.200 | 2201.676 | 78.924 | 269.096 | 5799.622 | |

| 2008 | Mean | 2850.608 | 1025.127 | 44.617 | 130.665 | 3621.562 |

| Std | 4605.444 | 3163.074 | 84.393 | 331.632 | 6844.633 | |

| 2009 | Mean | 3120.620 | 1034.002 | 45.715 | 136.638 | 3861.140 |

| Std | 4861.921 | 3045.888 | 86.986 | 331.697 | 6790.052 | |

| 2010 | Mean | 3483.911 | 786.852 | 46.614 | 148.633 | 4208.558 |

| Std | 6115.853 | 1633.461 | 84.434 | 391.114 | 7420.107 | |

| 2011 | Mean | 3761.604 | 959.868 | 50.712 | 166.882 | 4362.321 |

| Std | 7005.744 | 1839.884 | 91.087 | 405.044 | 8360.321 | |

| 2012 | Mean | 4140.703 | 987.048 | 54.527 | 156.086 | 4673.127 |

| Std | 7962.652 | 1841.203 | 93.956 | 377.165 | 9500.599 | |

| YEAR | EFF_STD | BIAS | EFF_BC |

|---|---|---|---|

| Panel A: ALL BANKS | |||

| 2007 | 0.886 | 0.076 | 0.810 * |

| 2008 | 0.899 | 0.071 | 0.828 * |

| 2009 | 0.881 | 0.083 | 0.799 * |

| 2010 | 0.889 | 0.071 | 0.819 * |

| 2011 | 0.792 | 0.124 | 0.668 * |

| 2012 | 0.790 | 0.121 | 0.670 * |

| Mean | 0.856 | 0.091 | 0.765 |

| Panel B: GCC BANKS | |||

| 2007 | 0.914 | 0.066 | 0.849 * |

| 2008 | 0.929 | 0.071 | 0.858 * |

| 2009 | 0.926 | 0.066 | 0.859 * |

| 2010 | 0.921 | 0.065 | 0.856 * |

| 2011 | 0.826 | 0.135 | 0.691 * |

| 2012 | 0.912 | 0.065 | 0.847 * |

| Mean | 0.905 | 0.078 | 0.827 |

| Panel C: NON-GCC BANKS | |||

| 2007 | 0.965 | 0.030 | 0.936 * |

| 2008 | 0.937 | 0.053 | 0.884 * |

| 2009 | 0.911 | 0.080 | 0.831 * |

| 2010 | 0.905 | 0.080 | 0.825 * |

| 2011 | 0.923 | 0.063 | 0.859 * |

| 2012 | 0.825 | 0.191 | 0.634 * |

| Mean | 0.911 | 0.083 | 0.828 |

| YEAR | EFF_BC | EFF_PURE | EFF_SCALE |

|---|---|---|---|

| Panel A: ALL BANKS | |||

| 2007 | 0.810 * | 0.868 * | 0.932 * |

| 2008 | 0.828 * | 0.898 * | 0.923 * |

| 2009 | 0.799 * | 0.891 * | 0.898 * |

| 2010 | 0.819* | 0.868 * | 0.945 * |

| 2011 | 0.668 * | 0.745 * | 0.900 * |

| 2012 | 0.670 * | 0.709 * | 0.946 * |

| Mean | 0.765 | 0.830 | 0.924 |

| Panel B: GCC BANKS | |||

| 2007 | 0.849 * | 0.923 * | 0.919 * |

| 2008 | 0.858 * | 0.924 * | 0.930 * |

| 2009 | 0.859 * | 0.924 * | 0.932 * |

| 2010 | 0.856 * | 0.923 * | 0.943 * |

| 2011 | 0.691 * | 0.909 * | 0.858 * |

| 2012 | 0.847 * | 0.809 * | 0.929 * |

| Mean | 0.827 | 0.902 | 0.918 |

| Panel C: NON-GCC BANKS | |||

| 2007 | 0.936 * | 0.964 * | 0.968 * |

| 2008 | 0.884 * | 0.944 * | 0.935 * |

| 2009 | 0.831 * | 0.910 * | 0.912 * |

| 2010 | 0.825 * | 0.938 * | 0.879 * |

| 2011 | 0.859 * | 0.871 * | 0.985 * |

| 2012 | 0.634 * | 0.635 * | 0.986 * |

| Mean | 0.828 | 0.877 | 0.944 |

| YEAR | IRS | CRS | DRS |

|---|---|---|---|

| Panel B: GCC BANKS | |||

| 2007 | 18% | 35% | 47% |

| 2008 | 18% | 59% | 24% |

| 2009 | 18% | 53% | 29% |

| 2010 | 12% | 47% | 41% |

| 2011 | 41% | 29% | 29% |

| 2012 | 24% | 29% | 47% |

| Mean | 22% | 42% | 36% |

| Panel C: NON-GCC BANKS | |||

| 2007 | 44% | 44% | 13% |

| 2008 | 63% | 19% | 19% |

| 2009 | 50% | 25% | 25% |

| 2010 | 63% | 25% | 13% |

| 2011 | 81% | 13% | 6% |

| 2012 | 63% | 25% | 13% |

| Mean | 60% | 25% | 15% |

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bahrini, R. Efficiency Analysis of Islamic Banks in the Middle East and North Africa Region: A Bootstrap DEA Approach. Int. J. Financial Stud. 2017, 5, 7. https://doi.org/10.3390/ijfs5010007

Bahrini R. Efficiency Analysis of Islamic Banks in the Middle East and North Africa Region: A Bootstrap DEA Approach. International Journal of Financial Studies. 2017; 5(1):7. https://doi.org/10.3390/ijfs5010007

Chicago/Turabian StyleBahrini, Raéf. 2017. "Efficiency Analysis of Islamic Banks in the Middle East and North Africa Region: A Bootstrap DEA Approach" International Journal of Financial Studies 5, no. 1: 7. https://doi.org/10.3390/ijfs5010007

APA StyleBahrini, R. (2017). Efficiency Analysis of Islamic Banks in the Middle East and North Africa Region: A Bootstrap DEA Approach. International Journal of Financial Studies, 5(1), 7. https://doi.org/10.3390/ijfs5010007