What Should You Pay to Cap your ARM?—A Note on Capped Adjustable Rate Mortgages

Abstract

:1. Introduction

2. The Market Model

3. Mortgage Products on the Danish Market

3.1. Total Payments on the FRM

3.2. Total Payments on the ARM

3.3. Relations between the FRM and the ARM

4. Results from Affine Term Structure Theory

- Normal, if it is a strictly increasing function of x,

- Inverse, if it is a strictly decreasing function of x,

- Humped, if it has exactly one local maximum and no minimum on

- The yield curve can only be normal, inverse, or humped.

- DefineThe yield curve is normal if , humped if , and inverse if .

5. Implications to the Formalized Mortgage Products

5.1. Transition from ARM to FRM

6. Numerical Example with Vasicek Short Rate

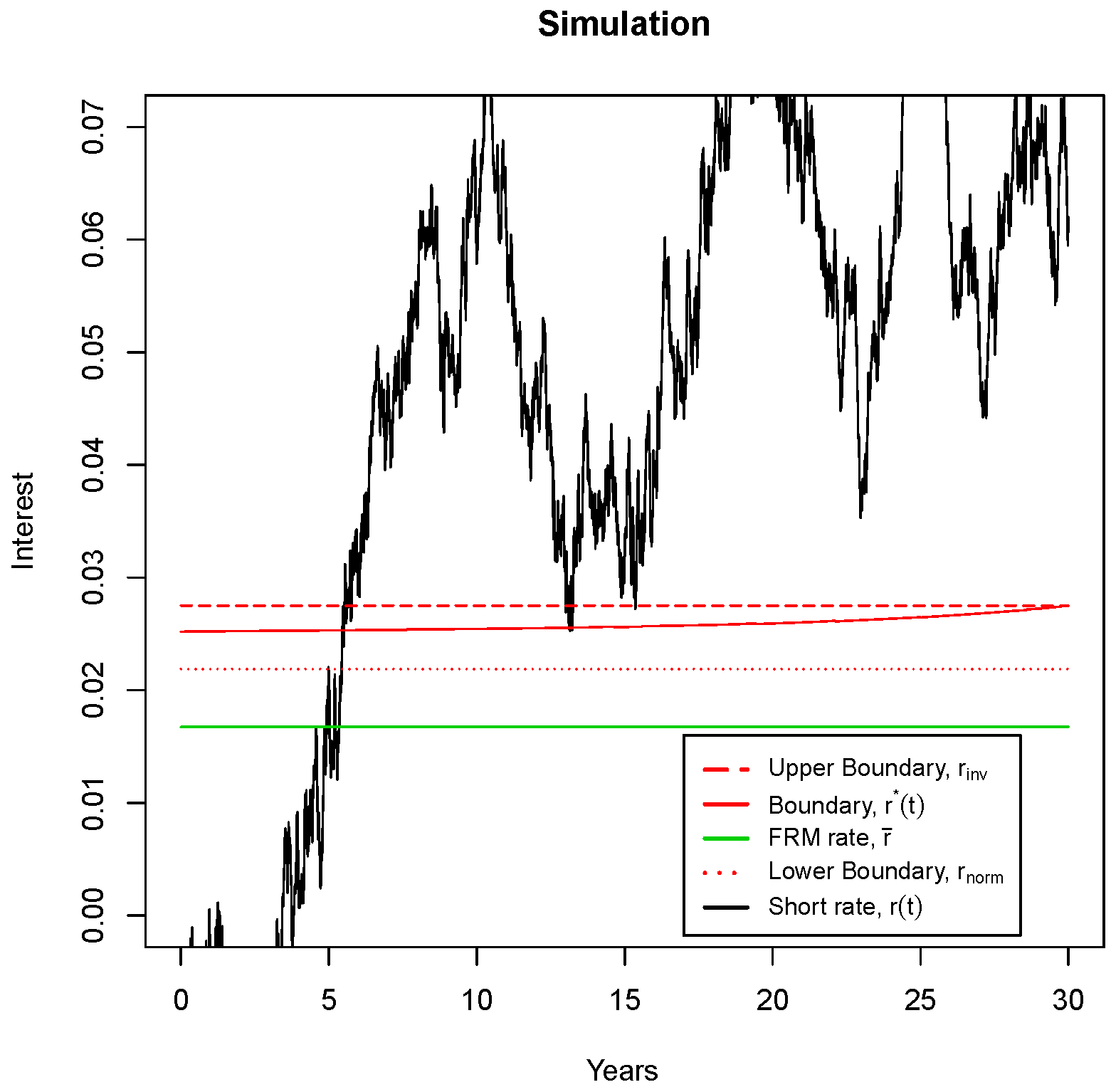

6.1. Simulation

6.2. Sensitivity

7. Conclusion

Acknowledgments

Conflicts of Interest

- 1.Since the infinitesimal generator of the short rate process in Definition 1 isthen it follows directly from Theorem 2.4 in [1] that the specified short rate is a regular affine process, since the parameters are admissible in the sense of Definition 2.3 of [1]. Next, by Proposition 3.4 in [1], the bond prices are given as specified above, since Condition 3.1 is satisfied.

- 2.Since the conditions of Theorem 3.9 in [1] are satisfied by the short rate model specified in Definition 1, we are able to state Theorem 1 as a special case related to the simple short rate model of Definition 1.

References

- M. Keller-Ressel, and T. Steiner. “Yield curve shapes and the asymptotic short rate distribution in affine one-factor models.” Financ. Stoch. 12 (2008): 149–172. [Google Scholar] [CrossRef]

- M.B. Nordfang, and M. Steffensen. “Portfolio Optimization and Mortgage Choice.” J. Risk Financ. Manage. 10 (2017): 1. [Google Scholar] [CrossRef]

- Q. Dai, and K. Singleton. “Term Structure Dynamics in Theory and Reality.” Rev. Financ. Stud. 16 (2003): 631–678. [Google Scholar] [CrossRef]

- A. Episcopos. “Further evidence on alternative continuous time models of the short-term interest rate.” J. Int. Financ. Mark. Inst. Money 10 (2000): 199–212. [Google Scholar] [CrossRef]

- M. Dahlquist. “On alternative interest rate processes.” J. Bank. Financ. 20 (1996): 1093–1119. [Google Scholar] [CrossRef]

- O. Vasicek. “An equilibrium characterization of the term structure.” J. Financ. Econ. 5 (1977): 177–188. [Google Scholar] [CrossRef]

- H. Kraft, and C. Munk. “Optimal housing, consumption, and investment decisions over the life cycle.” Manage. Sci. 57 (2011): 1025–1041. [Google Scholar] [CrossRef]

| Parameter | Variable | Value |

|---|---|---|

| Maturity | T | 30 |

| Mean reversion rate | κ | 0.2 |

| Long-term short rate | 0.02 | |

| Short rate volatility | 0.015 | |

| Sharpe ratio of bond | λ | 0.1 |

| Initial short rate | –0.0034 |

| Bond | Model Price | Closing Price |

|---|---|---|

| 4.0%, 15 November 2017 | 103.96 | 104.17 |

| 4.5%, 15 November 2039 | 150.31 | 171.92 |

| 7.0%, 10 November 2024 | 141.03 | 153.77 |

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nordfang, M.-B. What Should You Pay to Cap your ARM?—A Note on Capped Adjustable Rate Mortgages. Int. J. Financial Stud. 2017, 5, 10. https://doi.org/10.3390/ijfs5010010

Nordfang M-B. What Should You Pay to Cap your ARM?—A Note on Capped Adjustable Rate Mortgages. International Journal of Financial Studies. 2017; 5(1):10. https://doi.org/10.3390/ijfs5010010

Chicago/Turabian StyleNordfang, Maj-Britt. 2017. "What Should You Pay to Cap your ARM?—A Note on Capped Adjustable Rate Mortgages" International Journal of Financial Studies 5, no. 1: 10. https://doi.org/10.3390/ijfs5010010

APA StyleNordfang, M.-B. (2017). What Should You Pay to Cap your ARM?—A Note on Capped Adjustable Rate Mortgages. International Journal of Financial Studies, 5(1), 10. https://doi.org/10.3390/ijfs5010010