Corporate Governance Provisions, Family Involvement, and Firm Performance in Publicly Traded Family Firms

Abstract

:1. Introduction

2. Theoretical Overview

2.1. Principal-Principal Problems in Publicly Traded Family Firms

2.2. Corporate Governance Provisions

| Provisions protecting controlling owners through enhancing voting rights | |

| Provisions | Definitions |

| Unequal Voting Rights | To limit voting rights of some shareholders and expand those of others. |

| Cumulative Voting | Allows shareholders to concentrate their votes and helps minority shareholders to elect directors. |

| Supermajority | Voting requirements for approval of mergers. |

| Provisions protecting controlling owners through sustaining controlling status | |

| Provisions | Definitions |

| Blank Check | A preferred stock over which the BOD has broad authority to determine voting, dividend, conversion, and other rights. It is used to prevent takeover by placing this stock with certain friendly investors. |

| Business Combination Law | Requires a waiting period for transactions such as mergers, unless the transaction is approved by the BOD. |

| Poison Pills | Give the holders of the target firm’s stocks the right to purchase stocks in the target at a discount and to sell shares at a premium if ownership changes. This makes the target unattractive. |

| Bylaw | Amendment limitations limit shareholders’ ability to amend the governing documents of the company. |

| Charter | Limitations to change the governing documents of the company. |

| Fair Price | Requires a bidder to pay to all shareholders the highest price paid to any during a period of time before the commencement of an offer. This makes an acquisition more expensive. |

| Anti-greenmail | Prohibits a firm’s controlling owners/managers from paying a raider “greenmail”, which involves the repurchase of blocks of company stock, at a premium above market price, in exchange for an agreement by the raider not to acquire the firm. Eliminating greenmail may discourage potential bidders from considering the target firm for a takeover. Hence, it can be used as an antitakeover device. |

| Provisions protecting noncontrolling owners | |

| Provisions | Definitions |

| Cash-out Laws | Shareholders can sell their stakes to a controlling shareholder at a price based on the highest price of recently acquired shares. It works as fair-price provisions extended to nontakeover situations. |

| Secret Ballot | Confidential voting. Either an independent third party or employees sworn to secrecy count proxy votes and management does not look at proxy cards. |

| Provisions protecting management and directors’ positions | |

| Provisions | Definitions |

| Classified Board | The board is split into different classes, with only one class up for election in a given year. Hence, an outsider who gains control of a corporation may need to wait a few years in order to be able to gain control of the board. |

| Special Meeting Limitations | Bidders must wait until the regularly scheduled annual meeting to replace BOD or dismantle takeover defenses. |

| Written Consent Limitations | Bidders must wait until the regularly scheduled annual meeting to replace BOD or to dismantle takeover defense. |

| Directors’ Duties | Provides BOD with a legal basis for rejecting a takeover that would have been beneficial to shareholders. |

| Provisions protecting management and directors monetarily | |

| Provisions | Definitions |

| Compensation Plans | In case of a change in control, this provision allows participants of incentive bonus plans to cash out options or accelerate the payout of bonuses. |

| Golden Parachutes | Severance agreements that provide cash or noncash compensation to senior executives upon an event such as termination, demotion, or resignation following a change in control. |

| Severance | Agreements assuring executives of their positions or some compensation and are not contingent upon a change in control. |

| Provisions protecting management and directors legally | |

| Provisions | Definitions |

| Contracts | Indemnifies officers and directors from certain legal expenses and judgments resulting from lawsuits. |

| Indemnification | Indemnify officers and directors from certain legal expenses and judgments resulting from lawsuits pertaining to their conduct. |

| Limitations on Director Liability | Limit directors’ personal liability. |

3. Hypotheses

3.1. Family Involvement and Firm Performance

3.2. Moderation Effects of the Provisions Protecting Controlling Owners

3.3. Moderation Effects of the Provisions Protecting Noncontrolling Owners

3.4. Moderation Effects of the Provisions Protecting Management and Directors

4. Methodology

4.1. Data

4.2. Variables

4.2.1. Dependent Variable

4.2.2. Independent Variables

4.2.3. Moderators

4.2.4. Control Variables

4.3. Analyses

| M | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. VOT | 0.29 | 0.50 | 1 | |||||||||||||||||||||||

| 2. STA | 2.06 | 1.04 | 0.05 | 1 | ||||||||||||||||||||||

| 3. NON | 0.21 | 0.41 | −0.06 | 0.01 | 1 | |||||||||||||||||||||

| 4. POS | 1.64 | 1.15 | 0.07 | 0.37 | 0.05 | 1 | ||||||||||||||||||||

| 5. MON | 1.57 | 0.66 | 0.03 | 0.22 | 0.07 | 0.14 | 1 | |||||||||||||||||||

| 6. LEG | 0.96 | 0.97 | 0.09 | 0.05 | 0.02 | −0.17 | 0.03 | 1 | ||||||||||||||||||

| 7. OTH | 0.04 | 0.22 | 0.03 | 0.19 | 0.11 | 0.06 | 0.08 | 0.03 | 1 | |||||||||||||||||

| 8. GEN1 | 0.05 | 0.23 | 0.08 | −0.03 | −0.05 | −0.02 | −0.11 | −0.04 | 0.01 | 1 | ||||||||||||||||

| 9. GEN2 | 0.14 | 0.35 | −0.00 | −0.11 | −0.05 | −0.08 | −0.19 | 0.09 | −0.04 | −0.09 | 1 | |||||||||||||||

| 10. RET | 0.09 | 0.29 | −0.04 | −0.09 | −0.12 | 0.03 | −0.04 | −0.08 | −0.03 | 0.06 | 0.05 | 1 | ||||||||||||||

| 11. SER | 0.27 | 0.45 | −0.01 | −0.02 | −0.03 | 0.10 | −0.05 | −0.06 | −0.03 | 0.01 | −0.03 | −0.21 | 1 | |||||||||||||

| 12. MAN | 0.38 | 0.48 | −0.00 | 0.04 | 0.05 | −0.07 | −0.06 | 0.06 | 0.06 | −0.08 | 0.01 | −0.27 | −0.49 | 1 | ||||||||||||

| 13. IO | 32.29 | 11.21 | −0.02 | 0.08 | −0.07 | 0.05 | 0.17 | −0.03 | 0.03 | −0.05 | −0.07 | 0.11 | −0.07 | 0.03 | 1 | |||||||||||

| 14. FA | 59.19 | 44.63 | 0.09 | 0.09 | 0.08 | 0.04 | 0.06 | 0.13 | 0.02 | −0.15 | 0.09 | −0.09 | 0.03 | 0.05 | −0.27 | 1 | ||||||||||

| 15. FSL | 4.23 | 0.56 | −0.07 | 0.00 | 0.29 | 0.03 | −0.07 | 0.09 | 0.05 | −0.05 | −0.01 | 0.16 | 0.03 | 0.05 | −0.19 | −0.27 | 1 | |||||||||

| 16. OIO | 3.99 | 6.79 | −0.01 | −0.16 | −0.19 | −0.10 | −0.01 | −0.07 | −0.13 | 0.02 | −0.02 | −0.09 | −0.02 | −0.02 | −0.02 | −0.15 | −0.17 | 1 | ||||||||

| 17. FR | 43.84 | 46.59 | −0.03 | −0.04 | −0.11 | −0.02 | −0.03 | −0.17 | −0.02 | 0.03 | −0.10 | 0.02 | −0.02 | 0.06 | −0.05 | 0.15 | −0.26 | 0.19 | 1 | |||||||

| 18. FO | 1.69 | 6.21 | 0.00 | −0.10 | −0.07 | −0.08 | −0.33 | 0.06 | −0.03 | 0.33 | 0.45 | 0.06 | 0.07 | −0.05 | −0.01 | −0.01 | −0.21 | −0.01 | 0.01 | 1 | ||||||

| 19. FOS | 41.42 | 213.33 | −0.00 | −0.10 | −0.05 | −0.85 | −0.29 | 0.05 | −0.03 | 0.29 | 0.29 | 0.03 | 0.09 | −0.05 | −0.05 | −0.20 | −0.02 | 0.00 | −0.08 | 0.93 | 1 | |||||

| 20. FM | 0.39 | 0.96 | −0.00 | −0.16 | −0.04 | −0.12 | −0.23 | 0.07 | −0.06 | 0.36 | 0.69 | 0.12 | −0.04 | −0.04 | 0.00 | −0.12 | 0.01 | 0.00 | −0.14 | −0.06 | 0.44 | 1 | ||||

| 21. FMS | 1.06 | 3.55 | −0.01 | −0.18 | −0.18 | −0.12 | −0.20 | 0.07 | −0.05 | 0.19 | 0.56 | 00.14 | −0.04 | −0.03 | −0.00 | −0.10 | 0.02 | 0.00 | −0.10 | −0.05 | 0.49 | 0.92 | 1 | |||

| 22. FP1 | 1.80 | 3.82 | −0.06 | −0.07 | 0.02 | −0.09 | −0.13 | 0.03 | −0.04 | −0.01 | 0.09 | 0.01 | −0.03 | 0.11 | −0.10 | −0.05 | −0.03 | −0.06 | 0.06 | 0.05 | −0.03 | −0.03 | 0.06 | 1 | ||

| 23. RD | 0.03 | .0.00 | −0.05 | −0.06 | −0.02 | −0.08 | 0.02 | −0.03 | −0.01 | −0.02 | −0.11 | −0.13 | −0.16 | 0.40 | −0.19 | 0.18 | −0.20 | −0.26 | 0.12 | 0.33 | −0.10 | −0.07 | −.10 | 0.09 | 1 | |

| 24. INT1 | 33.97 | 22.28 | 0.04 | −0.07 | −0.04 | 0.01 | −0.07 | 0.10 | −0.05 | 0.04 | −0.02 | −0.16 | −0.06 | 0.24 | −0.14 | 0.01 | −0.2 | 0.00 | −0.05 | −0.05 | 0.14 | −0.02 | −0.4 | −0.04.0 | 0.28 | 1 |

| H1a-H5c with DV: FP1 (Firm Performance) | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Control Variables (First lagged) | ||||

| GEN1 (Generational majority in management and board) | 0.21 | −0.81 * | 1.26 * | −2.76 *** |

| GEN2 (Generational majority in management and board) | −0.22 | −0.11 | 0.99 | −2.46 *** |

| RETAIL | 0.87 | 1.05 * | 0.95* | 0.96 * |

| SERVICE | 0.52 + | −0.23 | 0.42 | −0.31 |

| MANUFACTURING | 0.73 ** | 0.73 * | 0.70 ** | 0.52 + |

| IO (Institutional Ownership) | 0.01 | 0.01 *** | 0.01 | 0.01 *** |

| FA (Firms Age) | −0.01 | −0.01 * | −0.01 | −0.01 + |

| FSL (Log of Firm Size) | −0.58 *** | 0.04 + | −0.60 *** | 0.01 + |

| OIO (Other Insiders’ Ownership) | 0.04 *** | −0.04 | 0.04 *** | −0.04 |

| RD (Research and Development) | 0.82 | 0.04 | 0.30 | 0.04 |

| FR (Firm Risk) | 0.01 *** | 0.01 + | 0.01 ** | 0.04 + |

| INT1 (Internationalization) | 0.01 | 0.01 *** | 0.01 | 0.04 *** |

| Independent Variables (First lagged) | ||||

| FO (Family Ownership) | 0.91 | −0.03 | 0.02 | |

| FOS (Family Ownership Squared) | −0.01 * | 0.01 | −0.02 ** | |

| FM (Family Management) | 1.1 * | −0.81 | 5.22 *** | |

| FMS (Family Management Squared) | −0.18 + | 0.13 | −0.65 *** | |

| Moderators (First lagged) | ||||

| VOTING (Frequency of the use of provisions protecting owners through voting rights) | −0.11 | 0.29 | ||

| STATUS (Frequency of the use of provisions protecting owners through sustaining control status) | 0.01 | −0.02 | ||

| NONCONTR (Frequency of the use of provisions protecting noncontrolling owners) | 0.11 | −0.51 + | ||

| POSITION (Frequency of the use of provisions protecting managers’ positions) | −0.01 | −0.11 | ||

| MONETARY (Frequency of the use of provisions protecting managers monetarily) | −0.20 * | −0.22 | ||

| LEGAL (Frequency of the use of provisions protecting managers legally) | 0.10 | −0.08 | ||

| Interactions (First lagged) | ||||

| FOVOTING (Family Ownership × Frequency of the use of provisions protecting owners through voting rights) | 0.20 | |||

| FOSVOTING (Family Ownership Squared × Frequency of the use of provisions protecting owners through voting rights) | −0.01 | |||

| FOSTATUS (Family Ownership × Frequency of the use of provisions protecting owners through sustaining control status) | −0.35 *** | |||

| FOSSTATUS (Family Ownership Squared × Frequency of the use of provisions protecting owners through sustaining control status) | 0.01 *** | |||

| FONONCONTR (Family Ownership × Frequency of the use of provisions protecting noncontrolling owners) | −0.19 | |||

| FOSNONCONTR (Family Ownership Squared × Frequency of the use of provisions protecting noncontrolling owners) | −0.04 | |||

| FOPOSITION (Family Ownership × Frequency of the use of provisions protecting managers’ positions) | 0.05 | |||

| FOSPOSITION (Family Ownership Squared × Frequency of the use of provisions protecting managers’ positions) | 0.04 | |||

| Control Variables (First lagged) | ||||

| FOMONETARY (Family Ownership × Frequency of the use of provisions protecting managers monetarily) | 0.55 *** | |||

| FOSMONETARY (Family Ownership Squared × Frequency of the use of provisions protecting managers monetarily) | −0.01 *** | |||

| FOLEGAL (Family Ownership × Frequency of the use of provisions protecting managers legally) | −0.28 *** | |||

| FOSLEGAL (Family Ownership Squared × Frequency of the use of provisions protecting managers legally) | 0.01 *** | |||

| FMVOTING (Family Management × Frequency of the use of provisions protecting owners through voting rights) | −1.96 ** | |||

| FMSVOTING (Family Management Squared × Frequency of the use of provisions protecting owners through voting rights) | 0.59 * | |||

| FMSTATUS (Family Management × Frequency of the use of provisions protecting owners through sustaining control status) | 0.05 | |||

| FMSSTATUS (Family Management Squared × Frequency of the use of provisions protecting owners through sustaining control status) | 0.02 | |||

| FMNONCONTR (Family Management × Frequency of the use of provisions protecting noncontrolling owners) | 4.21 *** | |||

| FMSNONCONTR (Family Management Squared × Frequency of the use of provisions protecting noncontrolling owners) | −0.84 *** | |||

| FMPOSITION (Family Management × Frequency of the use of provisions protecting managers’ positions) | −0.03 | |||

| FMSPOSITION (Family Management Squared × Frequency of the use of provisions protecting managers’ positions) | −0.01 | |||

| FMMONETARY (Family Management × Frequency of the use of provisions protecting managers monetarily) | −3.09 *** | |||

| FMSMONETARY (Family Management Squared × Frequency of the use of provisions protecting managers monetarily) | 0.33 + | |||

| FMLEGAL (Family Management × Frequency of the use of provisions protecting managers legally) | 1.71 *** | |||

| FMSLEGAL (Family Management Squared × Frequency of the use of provisions protecting managers legally) | −0.30 ** | |||

| Log likelihood function | −843.70 | −2902.08 | −829.03 | −2796.64 |

| Hypotheses | Conditions That Will Demonstrate Support for the Hypotheses | Findings (Table 3) |

|---|---|---|

| H1a | Beta coefficient of Family Ownership × Frequency of the use of Provisions Protecting Controlling Owners’ Voting Rights (FO × VOTINGRIGHTS) is negative and significant (p < 0.05) and beta coefficient of Family Ownership2 × Frequency of the use of Provisions Protecting Controlling Owners’ Voting Rights (FO2 × VOTING) is positive and significant (p < 0.05). | Not supported |

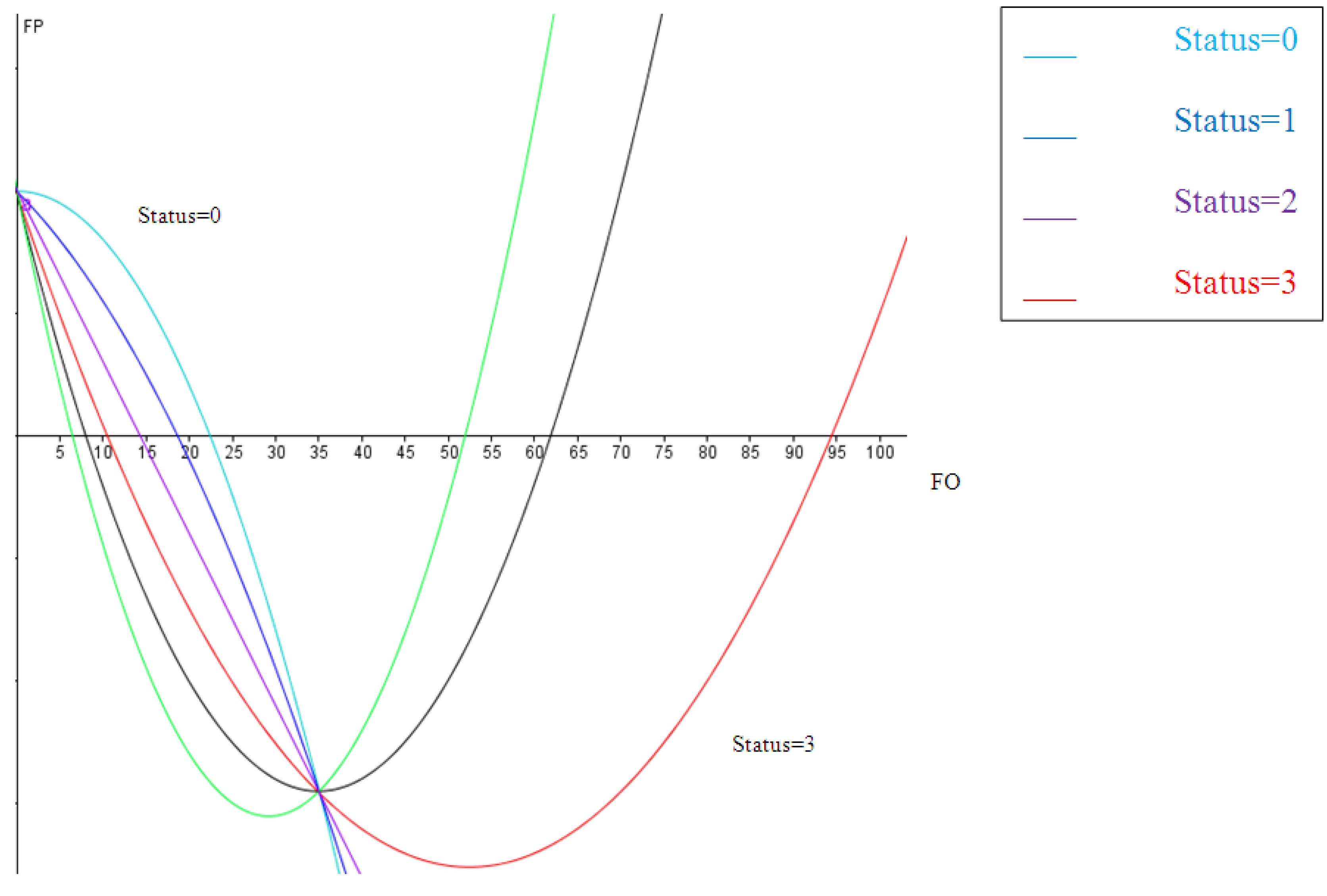

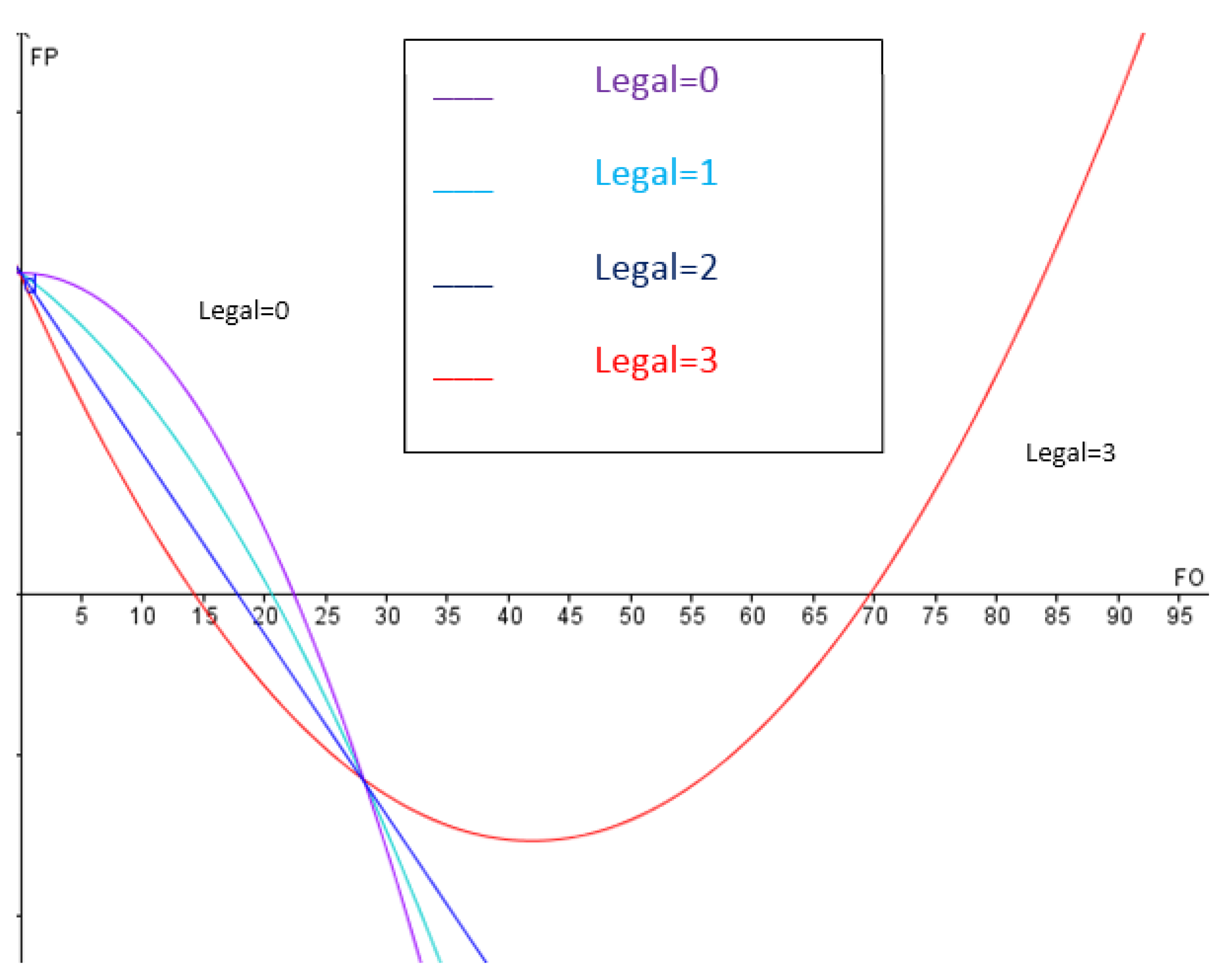

| H1b | Beta coefficient of Family Ownership × Frequency of the use of Provisions Protecting Controlling Owners’ Status (FO × STATUS) is negative and significant (p < 0.05) and beta coefficient of Family Ownership2 × Frequency of the use of Provisions Protecting Controlling Owners’ Status (FO2 × STATUS) is positive and significant (p < 0.05). | Supported (Figure 1) |

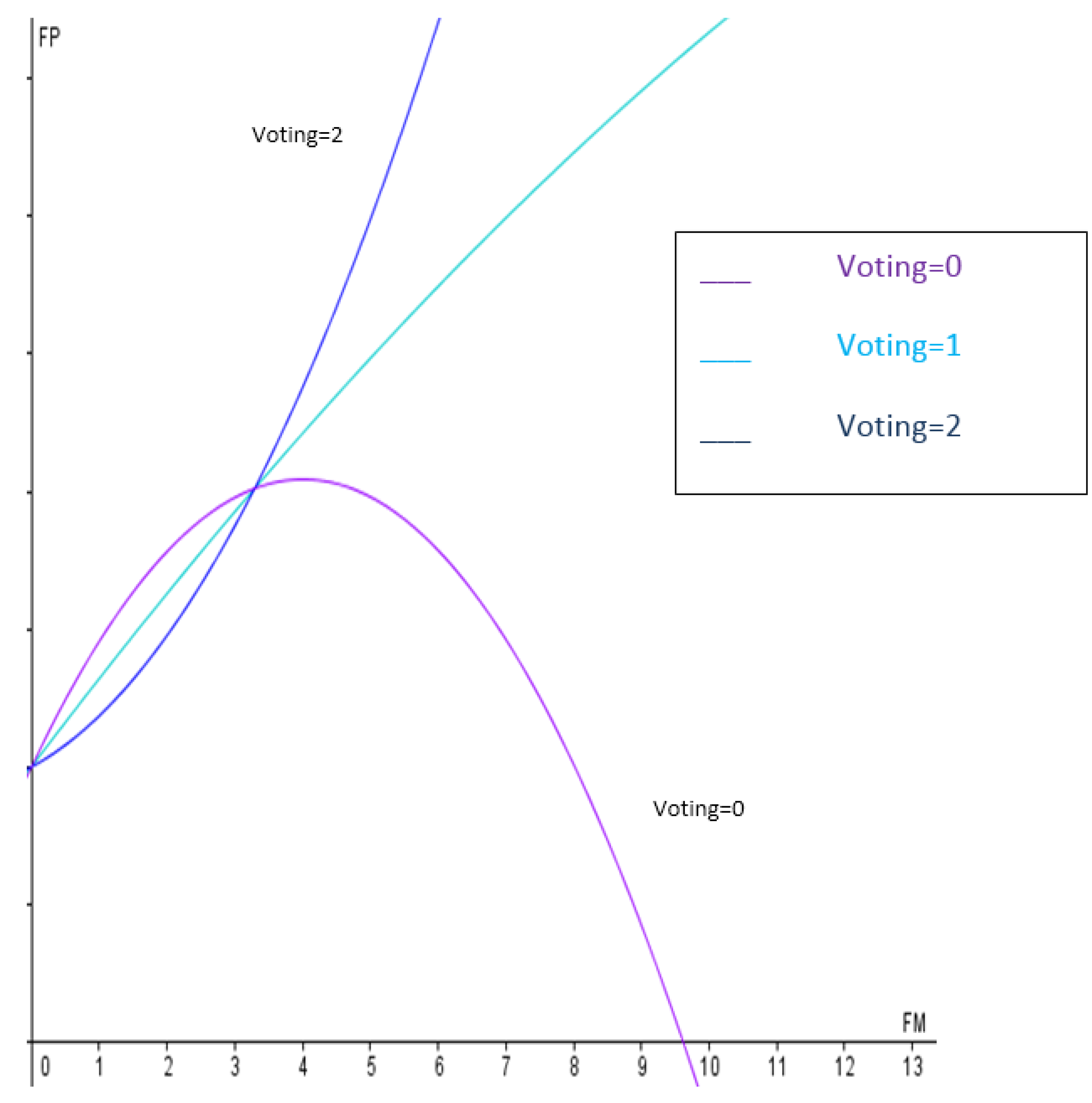

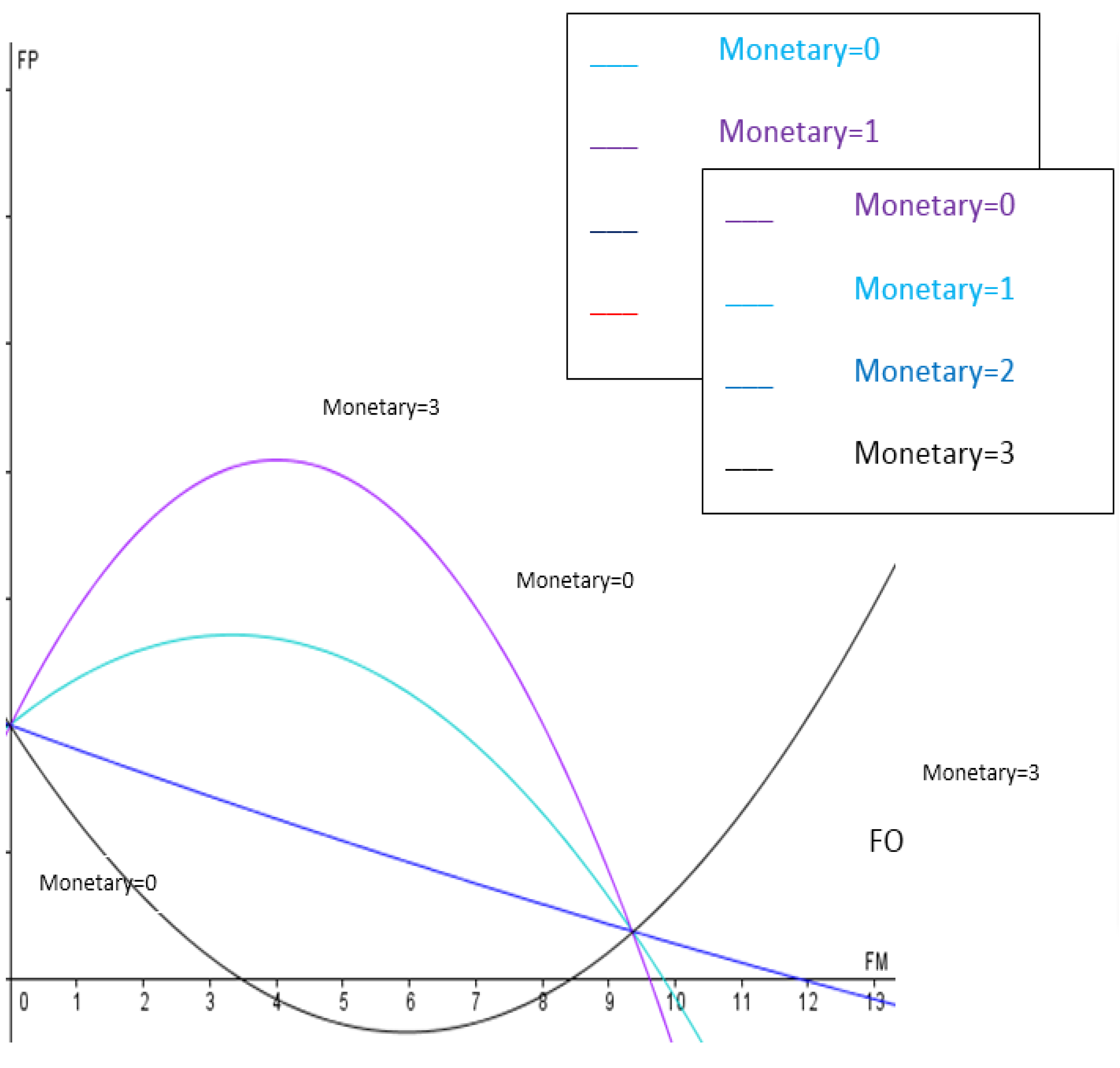

| H2a | Beta coefficient of Family Management × Frequency of the use of Provisions Protecting Controlling Owners’ Voting Rights (FM × VOTING) is negative and significant (p < 0.05) and beta coefficient of Family Management2 × Frequency of the use of Provisions Protecting Controlling Owners’ Voting Rights (FM2 × VOTING) is positive and significant (p < 0.05). | Supported (Figure 2) |

| H2b | Beta coefficient of Family Management × Frequency of the use of Provisions Protecting Controlling Owners’ Status (FM × STATUS) is negative and significant (p < 0.05) and beta coefficient of Family Management2 × Frequency of the use of Provisions Protecting Controlling Owners’ Status (FM2 × STATUS) is positive and significant (p < 0.05). | Not supported |

| H3a | Beta coefficient of Family Ownership × Frequency of the use of Provisions Protecting Noncontrolling Owners (FO × NONCONTROLLING) is positive and significant (p < 0.05) and beta coefficient of Family Ownership2 × Frequency of the use of Provisions Protecting Noncontrolling Owners (FO2 × NONCONTROLLING) is negative and significant (p < 0.05). | Not supported |

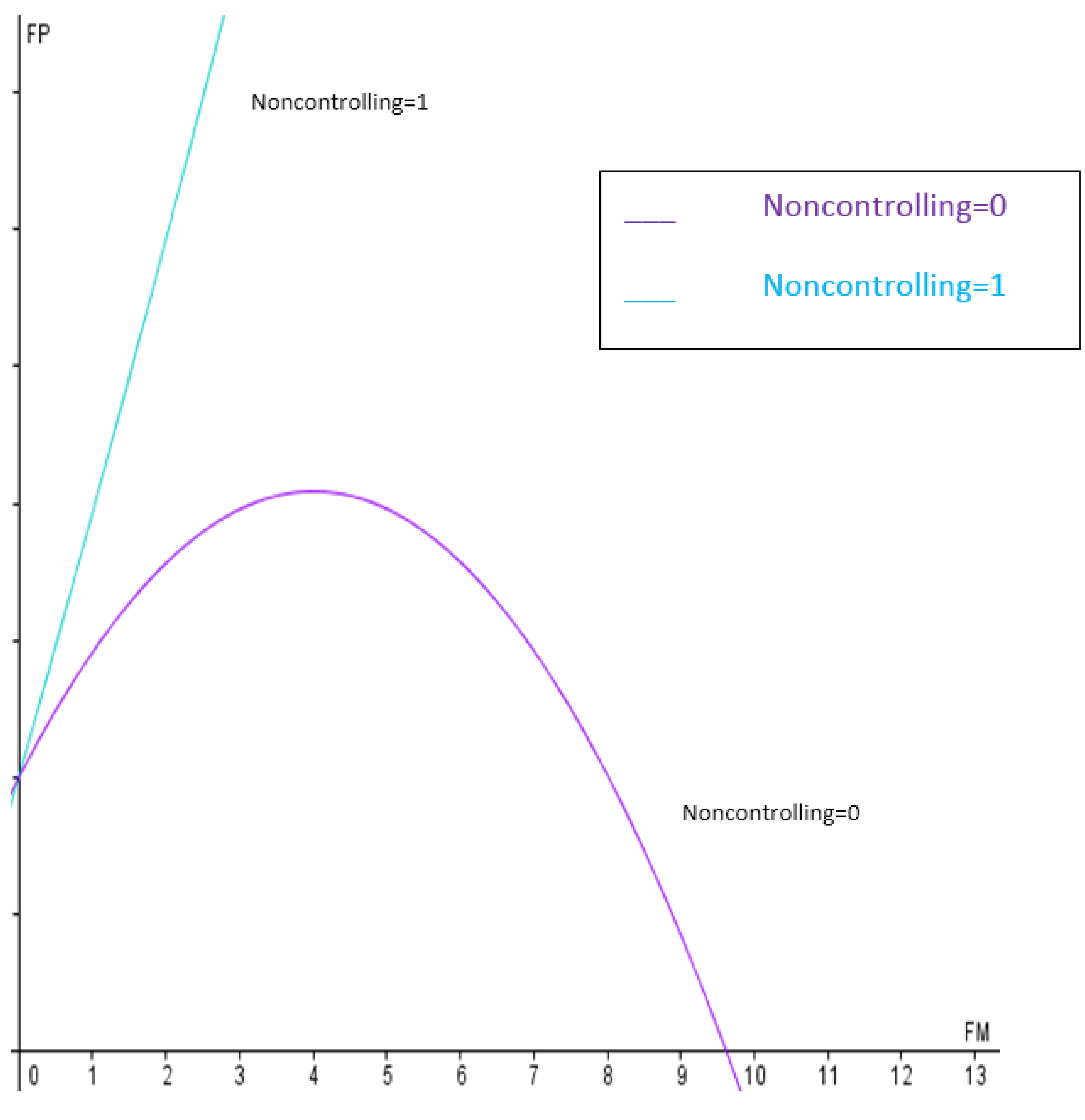

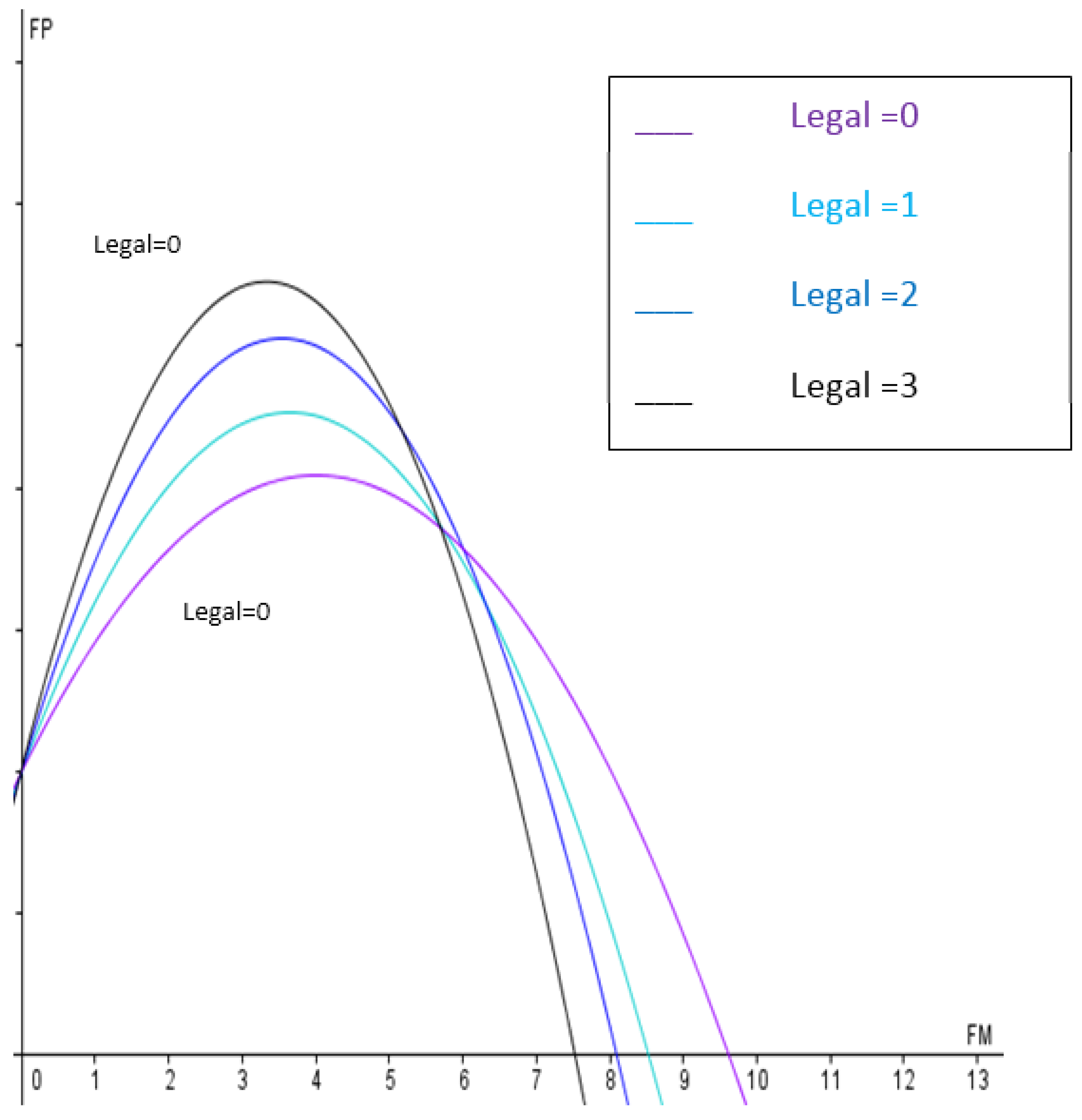

| H3b | Beta coefficient of Family Management × Frequency of the use of Provisions Protecting Noncontrolling Owners (FM × NONCONTROLLING) is positive and significant (p < 0.05) and beta coefficient of Family Management2 × Frequency of the use of Provisions Protecting Noncontrolling Owners (FM2 × NONCONTROLLING) is negative and significant (p < 0.05). | Supported (Figure 3) |

| H4a | Beta coefficient of Family Ownership × Frequency of the use of Provisions Protecting Managers’ and Directors’ Position (FO × POSITION) is negative and significant (p < 0.05) and beta coefficient of Family Ownership2 × Frequency of the use of Provisions Protecting Managers’ and Directors’ Position (FO2 × POSITION) is positive and significant (p < 0.05). | Not supported |

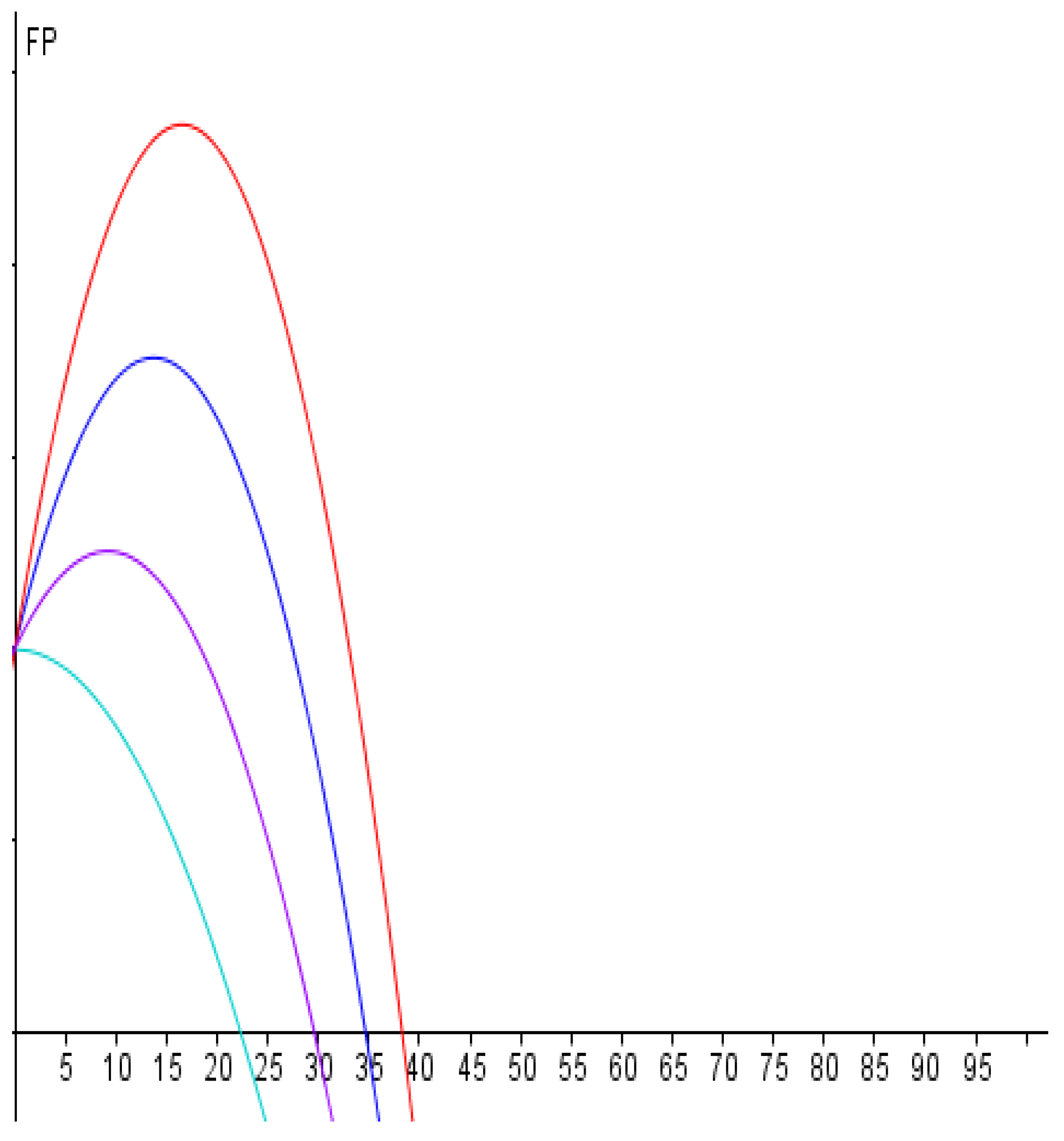

| H4b | Beta coefficient of Family Ownership × Frequency of the use of Provisions Protecting Managers and Directors Monetarily (FO × MONETARY) is negative and significant (p < 0.05) and beta coefficient of Family Ownership2 × Frequency of the use of Provisions Protecting Managers and Directors Monetarily (FO2 × MONETARY) is positive and significant (p < 0.05). | Not supported (Significant, but in the opposite direction) (Figure 4) |

| H4c | Beta coefficient of Family Ownership × Frequency of the use of Provisions Protecting Managers and Directors Legally (FO × LEGAL) is negative and significant (p < 0.05) and beta coefficient of Family Ownership2 × Frequency of the use of Provisions Protecting Managers and Directors Legally (FO2 × LEGAL) is positive and significant (p < 0.05). | Supported (Figure 5) |

| H5a | Beta coefficient of Family Management × Frequency of the use of Provisions Protecting Managers’ and Directors’ Position (FM × POSITION) is negative and significant (p < 0.05) and beta coefficient of Family Management2 × Frequency of the use of Provisions Protecting Managers’ and Directors’ Position (FM2 × POSITION) is positive and significant (p < 0.05). | Not supported |

| H5b | Beta coefficient of Family Management × Frequency of the use of Provisions Protecting Managers and Directors Monetarily (FM × MONETARY) is negative and significant (p < 0.05) and beta coefficient of Family Management2 × Frequency of the use of Provisions Protecting Managers and Directors Monetarily (FM2 × MONETARY) is positive and significant (p < 0.05). | Supported (Figure 6) |

| H5c | Beta coefficient of Family Management × Frequency of the use of Provisions Protecting Managers and Directors Legally (FM × LEGAL) is negative and significant (p < 0.05) and beta coefficient of Family Management2 × Frequency of the use of Provisions Protecting Managers and Directors Legally (FM2 × LEGAL) is positive and significant (p < 0.05). | Not supported (Significant, but in the opposite direction) (Figure 7) |

5. Discussion

6. Conclusions

Author Contributions

Conflicts of Interest

References

- R.V. Aguilera, and R. Crespi-Cladera. “Firm family firms: Current debates of corporate governance in family firms.” J. Family Bus. Strategy 3 (2012): 66–69. [Google Scholar] [CrossRef]

- B. Villalonga, and R. Amit. “How do family ownership, management, and control affect firm value? ” J. Financ. Econ. 80 (2006): 385–417. [Google Scholar] [CrossRef]

- B. Villalonga, and R. Amit. “Benefits and costs of control-enhancing mechanisms in U.S. family firms.” Available online: http://isites.harvard.edu/fs/docs/icb.topic66847.files/Belen_Villalonga.pdf (accessed on 2 March 2015).

- J.J. Chrisman, J.H. Chua, and R. Litz. “Comparing the agency costs of family and nonfamily firms: Conceptual issues and exploratory evidence.” Entrep. Theory Pract. 28 (2004): 335–354. [Google Scholar] [CrossRef]

- F.A.G. Neubauer. Lank the Family Business: Its Governance for Sustainability. New York, NY, USA: Routledge, 1998, Chapter 6; pp. 133–166. [Google Scholar]

- J.F. Siebels, and D. zu Knyphausen-Aufseß. “A review of theory in family business research: The implications for corporate governance.” Int. J. Manag. Rev. 14 (2012): 280–304. [Google Scholar] [CrossRef]

- M. Carney. “Corporate governance and competitive advantage in family-controlled firms.” Entrep. Theory Pract. 29 (2005): 249–266. [Google Scholar] [CrossRef]

- D. Miller, I.L. Breton-Miller, and R.H. Lester. “Family firm governance, strategic conformity, and performance: Institutional vs. strategic perspectives.” Org. Sci. 24 (2013): 189–209. [Google Scholar] [CrossRef]

- A. Ali, T.Y. Chen, and S. Radhakrishnan. “Corporate disclosures by family firms.” J. Account. Econ. 44 (2007): 238–286. [Google Scholar] [CrossRef]

- B. Maury. “Family ownership and firm performance: Empirical evidence from Western European corporations.” J. Corp. Financ. 12 (2006): 321–341. [Google Scholar] [CrossRef]

- P. Gompers, J. Ishii, and A. Metrick. “Corporate governance and equity prices.” Q. J. Econ. 118 (2003): 107–155. [Google Scholar] [CrossRef]

- C.M. Daily, D.R. Dalton, and A.A. Cannella. “Corporate governance: Decades of dialogue and data.” Acad. Manag. Rev. 28 (2003): 371–382. [Google Scholar]

- C.M. Daily, D.R. Dalton, and N. Rajagopalan. “Governance through ownership: Centuries of practice, decades of research.” Acad. Manag. J. 46 (2003): 151–158. [Google Scholar] [CrossRef]

- E. Memili, K. Misra, and J.J. Chrisman. “Family involvement and the use of corporate governance provisions protecting controlling vs. noncontrolling owners.” J. Leadersh. Account. Ethics 9 (2012): 11–27. [Google Scholar]

- R.C. Anderson, and D.M. Reeb. “Founding-family ownership and firm performance: Evidence from the S&P 500.” J. Financ. 58 (2003): 1301–1328. [Google Scholar]

- R.C. Anderson, and D.M. Reeb. Who Monitors the Family? Working Paper; Washington, DC, USA: American University, 2003. [Google Scholar]

- R.C. Anderson, and D.M. Reeb. “Founding-family ownership, corporate diversification and firm leverage.” J. Law Econ. 46 (2003): 653–684. [Google Scholar] [CrossRef]

- D. Miller, I. le Breton-Miller, R.H. Lester, and A.A. Cannella. “Are family firms really superior performers? ” J. Corporate Financ. 13 (2007): 829–858. [Google Scholar] [CrossRef]

- B. Villalonga, and R. Amit. Family Control of Firms and Industries. Boston, MA, USA: Harvard Business School Publishing, 2009. [Google Scholar]

- R. Morck, and L. Steier. The Global History of Corporate Governance: An Introduction. Working Paper 11062; Chicago, IL, USA: University of Chicago Press, 2005. [Google Scholar]

- B. Villalonga. Note on Valuing Control and Liquidity in Family and Closely Held Firms. Boston, MA, USA: Harvard Business School Publishing, 2009. [Google Scholar]

- W.G. Dyer, and D.A. Whetten. “Family firms and social responsibility: Preliminary evidence from the S&P 500.” Entrep. Theory Pract. 30 (2006): 785–802. [Google Scholar]

- J.J. Chrisman, F.W. Kellermanns, K.C. Chan, and K. Liano. “Intellectual foundations of current research in family business: An identification and review of 25 influential articles.” Family Bus. Rev. 23 (2010): 9–26. [Google Scholar] [CrossRef]

- L.R. Gómez-Mejía, K.T. Hynes, M. Núñez-Nickel, and H. Moyano-Fuentes. “Socioemotional wealth and business risk in family-controlled firms: Evidence from Spanish olive oil mills.” Adm. Sci. Q. 52 (2007): 106–137. [Google Scholar]

- J.J. Chrisman, J.H. Chua, A.W. Pearson, and T. Barnett. “Family involvement, family influence, and family-centered non-economic goals in small firms.” Entrep. Theory Pract. 36 (2012): 267–293. [Google Scholar] [CrossRef]

- C.E. Crutchley, M.R.H. Jensen, J.S. Jahera, and J.E. Raymond. “Agency problems and the simultaneity of financial decision making: The role of institutional ownership.” Int. Rev. Financ. Anal. 8 (1999): 177–197. [Google Scholar] [CrossRef]

- R. Morck, A. Shleifer, and R.W. Vishny. “Management ownership and market valuation: An empirical analysis.” J. Financ. Econ. 20 (1988): 293–315. [Google Scholar] [CrossRef]

- E. Memili. “Control Enhancing Corporate Governance Mechanisms: Family vs. Nonfamily Publicly Traded Firms.” Ph.D. Dissertation, Mississippi State University, Mississippi, MS, USA, August 2011. [Google Scholar]

- E.F. Fama, and M.C. Jensen. “Agency problems and residual claims.” J. Law Econ. 26 (1983): 327–349. [Google Scholar] [CrossRef]

- M.C. Jensen, and W.H. Meckling. “Theory of the firm: Managerial behavior, agency costs, and economic organization.” J. Financ. Econ. 3 (1976): 305–360. [Google Scholar] [CrossRef]

- L.R. Gómez-Mejía, M. Núñez-Nickel, and I. Gutierrez. “The role of family ties in agency contracts.” Acad. Manag. J. 44 (2001): 81–95. [Google Scholar] [CrossRef]

- R. Morck, and B. Yeung. “Agency problems in large family business groups.” Entrep. Theory Pract. 27 (2003): 367–383. [Google Scholar] [CrossRef]

- R.C. Anderson, and D.M. Reeb. “Board composition: Balancing family influence in S&P 500 firms.” Adm. Sci. Q. 49 (2004): 209–237. [Google Scholar]

- C. Andres. “Large shareholders ad firm performance: An empirical examination of founding-family ownership.” J. Corporate Financ. 14 (2008): 431–445. [Google Scholar] [CrossRef]

- S. Johnson, R. la Porta, F. Lopez-de-Silanes, and A. Shleifer. “Tunneling.” Am. Econ. Rev. 90 (2000): 22–29. [Google Scholar] [CrossRef]

- R. La Porta, F. Lopez-De-Silanes, and A. Shleifer. “Corporate ownership around the world.” J. Finance 54 (1999): 471–517. [Google Scholar] [CrossRef]

- R. Dharwadkar, G. George, and P. Brandes. “Privatization in emerging economies: An agency theory perspective.” Acad. Manag. Rev. 25 (2000): 650–669. [Google Scholar]

- M.N. Young, M.W. Peng, D. Ahlstrom, G.D. Bruton, and Y. Jiang. “Corporate governance in emerging economies: A Review of the principal-principal perspective.” J. Manag. Stud. 45 (2008): 198–220. [Google Scholar] [CrossRef]

- A. Shleifer, and R.W. Vishny. “A survey of corporate governance.” J. Financ. 52 (1997): 737–784. [Google Scholar] [CrossRef]

- J.M. Mahoney, and J.T. Mahoney. “An empirical investigation of the effect of corporate charter antitakeover amendments on stockholder wealth.” Strateg. Manag. J. 14 (1993): 17–31. [Google Scholar] [CrossRef]

- J.M. Mahoney, C. Sundaramurthy, and J.T. Mahoney. “The differential impact on stockholder wealth of various antitakeover provisions.” Manag. Decis. Econ. 17 (1996): 531–549. [Google Scholar] [CrossRef]

- J.M. Mahoney, C. Sundaramurthy, and J.T. Mahoney. “The effects of corporate antitakeover provisions on long-term investment: Empirical evidence.” Manag. Decis. Econ. 18 (1997): 349–365. [Google Scholar] [CrossRef]

- K.J.M. Cremers, and V.B. Nair. “Governance mechanisms and equity prices.” J. Finance 60 (2005): 2859–2894. [Google Scholar] [CrossRef]

- M.C. Jensen, and R.S. Ruback. “The market for corporate control: The scientific evidence.” J. Financ. Econ. 11 (1983): 5–50. [Google Scholar] [CrossRef]

- E. Berkovitch, and M.P. Narayanan. “Motives for takeovers: An empirical investigation.” J. Finance. Quant. Anal. 28 (1993): 347–363. [Google Scholar] [CrossRef]

- L.A. Bebchuk. “Why firms adopt antitakeover arrangements.” Univ. Penn. Law Rev. 152 (2003): 713–753. [Google Scholar] [CrossRef]

- M.C. Jensen. “Takeovers: Their causes and consequences.” J. Econ. Perspect. 2 (1988): 21–48. [Google Scholar] [CrossRef]

- L.R. Gómez-Mejía, M. Makri, and M.L. Kintana. “Diversification decisions in family controlled firms.” J. Manag. Stud. 47 (2010): 223–252. [Google Scholar] [CrossRef]

- R. La Porta, F. Lopez-De-Silanes, A. Shleifer, and R. Vishny. “Investor protection and corporate governance.” J. Financ. Econ. 58 (2000): 3–27. [Google Scholar] [CrossRef]

- R.C. Anderson, S.A. Mansi, and D.M. Reeb. “Founding family ownership and the agency cost of debt.” J. Financ. Econ. 68 (2003): 263–285. [Google Scholar] [CrossRef]

- S. Claessens, S. Djankov, J.P.H. Fan, and L.H.P. Lang. “Disentangling the incentive and entrenchment effects of large shareholdings.” J. Financ. 57 (2002): 2741–2771. [Google Scholar] [CrossRef]

- J.P. Walsh, and J.K. Seward. “On the efficiency of internal and external corporate control mechanisms.” Acad. Manag. Rev. 15 (1990): 421–458. [Google Scholar]

- P. Westhead, M. Cowling, and C. Howorth. “The development of family companies: Management and ownership imperatives.” Family Bus. Rev. 14 (2001): 369–385. [Google Scholar] [CrossRef]

- D. Miller, and I. le Breton-Miller. “Family governance and firm performance: Agency, stewardship, and capabilities.” Family Bus. Rev. 19 (2006): 73–88. [Google Scholar] [CrossRef]

- R.J. Gilson, and J.N. Gordon. “Doctrines and markets: Controlling shareholders.” Univ. Penn. Law Rev. 152 (2003): 785–844. [Google Scholar] [CrossRef]

- B. Villalonga, and R. Amit. “How are U.S. family firms controlled? ” Rev. Financ. Stud. 22 (2009): 1–45. [Google Scholar] [CrossRef]

- J.S. Ang, R.A. Cole, and J.W. Lin. “Agency costs and ownership structure.” J. Financ. 55 (2000): 81–106. [Google Scholar] [CrossRef]

- P. Berrone, C. Cruz, L.R. Gomez-Mejia, and M.L. Kintana. “Socioemotional wealth and corporate responses to institutional pressures: Do family-controlled firms pollute less? ” Adm. Sci. Q. 55 (2010): 82–113. [Google Scholar] [CrossRef]

- J.H. Chua, J.J. Chrisman, and P. Sharma. “Defining the family business by behavior.” Entrep. Theory Pract. 23 (1999): 19–39. [Google Scholar]

- J.J. Chrisman, J.H. Chua, and R. Litz. “A unified systems perspective of family firm performance: An extension and integration.” J. Bus. Ventur. 18 (2003): 467–472. [Google Scholar] [CrossRef]

- P. Wright, S.P. Ferris, A. Sarin, and V. Awasthi. “Impact of corporate insider, blockholder, and institutional equity ownership on firm risk taking.” Acad. Manag. J. 39 (1996): 441–463. [Google Scholar] [CrossRef]

- C. Mishra, and D. McConaughy. “Founding Family Control and Capital Structure.” Entrep. Theory Pract. 23 (1999): 53–64. [Google Scholar]

- M. Brecht, P. Bolton, and A. Roell. “Corporate Governance and Control.” Available online: http://ssrn.com/abstract=343461 (accessed on 5 March 2015).

- J.G. Combs. “Commentary: The servant, the parasite, and the enigma: A tale of three ownership structures and their affiliate directors.” Entrep. Theory Pract. 32 (2008): 1027–1034. [Google Scholar] [CrossRef]

- H. Demsetz, and K. Lehn. “The structure of corporate ownership: Causes and consequences.” J. Polit. Econ. 93 (1985): 1155–1177. [Google Scholar] [CrossRef]

- E.S. Herman. Corporate Control, Control Power. Cambridge, UK: Cambridge University Press, 1981. [Google Scholar]

- C.D. Jones, M. Makri, and L.R. Gomez-Mejia. “Affiliate directors and perceived risk bearing in publicly traded, family-controlled firms: The case of diversification.” Entrep. Theory Pract. 32 (2008): 1007–1026. [Google Scholar] [CrossRef]

- F.W. Kellermanns, and K.A. Eddleston. “Feuding families: When conflict does a family good.” Entrep. Theory Pract. 28 (2004): 209–228. [Google Scholar] [CrossRef]

- F.W. Kellermanns, and K.A. Eddleston. “A family perspective on when conflict benefits family firm performance.” J. Bus. Res. 60 (2007): 1048–1057. [Google Scholar] [CrossRef]

- B. Holmstrom, and S.N. Kaplan. “Corporate governance and merger activity in the United States: Making sense of the 1980s and 1990s.” J. Econ. Perspect. 15 (2001): 121–144. [Google Scholar] [CrossRef]

- G.F. Davis. “Agents without principles? The spread of the poison pill through the incorporate network.” Adm. Sci. Q. 36 (1991): 583–613. [Google Scholar] [CrossRef]

- C. Sundaramurthy. “Corporate governance within the context of antitakeover provisions.” Strateg. Manag. J. 17 (1996): 377–394. [Google Scholar] [CrossRef]

- S.L. Gillan, and L.T. Starks. “Corporate governance proposals and shareholder activism: The role of institutional investors.” J. Financ. Econ. 57 (2000): 275–305. [Google Scholar] [CrossRef]

- S.L. Gillan, J.C. Hartzell, and L.T. Starks. “Explaining corporate governance: Boards, bylaws, and charter provisions.” Available online: http://ssrn.com/abstract=442740 (accessed on 2 February 2015).

- S. Sciascia, and P. Mazzola. “Family involvement in ownership and management: Exploring nonlinear effects on performance.” Family Bus. Rev. 21 (2008): 331–345. [Google Scholar] [CrossRef]

- H. Short, and K. Keasay. “Managerial ownership and the performance of firms: Evidence from the UK.” J. Corporate Financ. 5 (1999): 79–101. [Google Scholar] [CrossRef]

- R. Morck, D.A. Strangeland, and B. Yeung. Inherited Wealth, Corporate Control and Economic Growth: The Canadian Disease? Working Paper 6814; Chicago, IL, USA: University of Chicago Press, 1998. [Google Scholar]

- W.G. Dyer. “Examining the “family effect” on firm performance.” Family Bus. Rev. 19 (2006): 253–273. [Google Scholar] [CrossRef]

- M. Burkart, F. Panunzi, and A. Shleifer. “Family firms.” J. Financ. 58 (2003): 2167–2201. [Google Scholar] [CrossRef]

- A. Alchian, and H. Demsetz. “Production, information costs, and economic organization.” Am. Econ. Rev. 62 (1972): 777–795. [Google Scholar]

- J.C. Short, G.T. Payne, K.H. Brigham, G.T. Lumpkin, and J.C. Broberg. “Family firms and entrepreneurial orientation in publicly traded firms: A comparative analysis the S&P 500.” Family Bus. Rev. 22 (2009): 9–24. [Google Scholar]

- K.H. Chung, and S.W. Pruitt. “A simple approximation of Tobin’s q.” Financ. Manag. 23 (1994): 70–74. [Google Scholar] [CrossRef]

- R.B. Carton, and C.W. Hofer. Measuring Organizational Performance: Metrics for Entrepreneurship and Strategic Management Research. Northampton, MA, USA: Edward Elgar Publishing, Inc., 2006. [Google Scholar]

- W.D. Perreault, and L.E. Leigh. “Reliability of nominal data based on qualitative judgments.” J. Mark. Res. 26 (1989): 135–148. [Google Scholar] [CrossRef]

- R.G. Netemeyer, W.O. Bearden, and S. Sharma. Scaling Procedures: Issues and Applications. Thousand Oaks, CA, USA: Sage Publications, 2003. [Google Scholar]

- G. Hansen, and B. Wernerfelt. “Determinants of firm performance: The relative importance of economic and organizational factors.” Strateg. Manag. J. 10 (1989): 399–411. [Google Scholar] [CrossRef]

- R.D. Dewar, and J.E. Dutton. “The adoption of radical and incremental innovations: An empirical analysis.” Manag. Sci. 32 (1986): 1422–1433. [Google Scholar] [CrossRef]

- W.S. Schulze, M.H. Lubatkin, and R.N. Dino. “Exploring the agency consequences of ownership dispersion among inside directors at family firms.” Acad. Manag. J. 46 (2003): 179–194. [Google Scholar] [CrossRef]

- D.M. Decarolis, and D.L. Deeds. “The impact of stocks and flows of organizational knowledge on firm performance: An empirical investigation of the biotechnology industry.” Strateg. Manag. J. 20 (1999): 953–968. [Google Scholar] [CrossRef]

- S.B. Graves, and N.S. Langowitz. “Innovative productivity and retums to scale in the pharmaceutical industry.” Strateg. Manag. J. 14 (1993): 593–605. [Google Scholar] [CrossRef]

- H. Greene. Econometric Analysis, 7th ed. New York, NY, USA: Prentice Hall, 2011, pp. 833–860. [Google Scholar]

- F. Caselli, and W.J. Coleman. “Cross-country technology diffusion: The case of computers.” Am. Econ. Rev. 91 (2001): 328–335. [Google Scholar] [CrossRef]

- W. Enders. Applied Econometric Time Series, 2nd ed. Hoboken, NJ, USA: John Wiley & Sons, 2004, pp. 72–75. [Google Scholar]

- G.S. Maddala. “A perspective on the use of limited-dependent and qualitative variables models in accounting research.” Account. Rev. 66 (1991): 788–807. [Google Scholar]

- S.B. Klein. “Family businesses in Germany: Significance and structure.” Family Bus. Rev. 13 (2000): 157–182. [Google Scholar] [CrossRef]

- F. Silva, and N. Majluf. “Does family ownership shape performance outcomes? ” J. Bus. Res. 61 (2008): 609–614. [Google Scholar] [CrossRef]

- P. Westhead, and C. Howorth. “Ownership and management issues associated with family firm performance and company objectives.” Family Bus. Rev. 19 (2006): 301–317. [Google Scholar] [CrossRef]

- J.J. Chrisman, J.H. Chua, and P. Sharma. “Trends and directions in the development of a strategic management theory of the family firm.” Entrep. Theory Pract. 29 (2005): 555–576. [Google Scholar] [CrossRef]

- K.R. Conner. “A historical comparison of resource-based theory and five schools of thought within industrial organization economics: Do we have a new theory of the firm? ” J. Manag. 17 (1991): 121–154. [Google Scholar] [CrossRef]

- M.W. Peng, and Y. Jiang. “Institutions behind family ownership and control in large firms.” J. Manag. Stud. 47 (2010): 253–273. [Google Scholar] [CrossRef]

- J.C. Coates. “The goals and promise of the Sarbanes-Oxley Act.” J. Econ. Perspect. 21 (2007): 91–116. [Google Scholar] [CrossRef]

- J.H. Chua, J.J. Chrisman, and P. Sharma. “Succession and nonsuccession concerns of family firms and agency relationship with nonfamily managers.” Family Bus. Rev. 16 (2003): 89–108. [Google Scholar] [CrossRef]

- G.G. Dess, and G.T. Lumpkin. “The role of entrepreneurial orientation in stimulating effective corporate entrepreneurship.” Acad. Manag. Exec. 19 (2005): 147–156. [Google Scholar] [CrossRef]

- G.T. Lumpkin, and G.G. Dess. “Clarifying the entrepreneurial orientation construct and linking it to performance.” Acad. Manag. Rev. 21 (1996): 135–172. [Google Scholar]

- G.T. Lumpkin, and G.G. Dess. “Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle.” J. Bus. Ventur. 16 (2001): 429–451. [Google Scholar] [CrossRef]

- G.G. Dess, G.T. Lumpkin, and J.E. McGee. “Linking corporate entrepreneurship to strategy, structure, and process: Suggested research directions.” Entrep. Theory Pract. 23 (1999): 85–102. [Google Scholar]

- G.T. Lumpkin, W.J. Wales, and M.D. Ensley. “Assessing the Context for Corporate Entrepreneurship: The Role of Entrepreneurial Orientation.” In Praeger Perspectives on Entrepreneurship. Edited by T. Habbershon and M. Rice. Mishawaka, IN, USA: Better World Books, 2005, Volume 3, pp. 1–43. [Google Scholar]

- 1According to Morck and Steier [20], a pyramid is a structure prevalent around the world except in the U.S. and U.K. in which a shareholder, usually a family, controls a single company and this company then holds control blocks in other companies and each of these companies holds control blocks in even more companies, which is rare in the U.S.

- 2Has been originally developed as part (i.e., Essay 2) of a dissertation (Memili [28]) by one of the co-authors of this manuscript.

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Memili, E.; Misra, K. Corporate Governance Provisions, Family Involvement, and Firm Performance in Publicly Traded Family Firms. Int. J. Financial Stud. 2015, 3, 194-229. https://doi.org/10.3390/ijfs3030194

Memili E, Misra K. Corporate Governance Provisions, Family Involvement, and Firm Performance in Publicly Traded Family Firms. International Journal of Financial Studies. 2015; 3(3):194-229. https://doi.org/10.3390/ijfs3030194

Chicago/Turabian StyleMemili, Esra, and Kaustav Misra. 2015. "Corporate Governance Provisions, Family Involvement, and Firm Performance in Publicly Traded Family Firms" International Journal of Financial Studies 3, no. 3: 194-229. https://doi.org/10.3390/ijfs3030194

APA StyleMemili, E., & Misra, K. (2015). Corporate Governance Provisions, Family Involvement, and Firm Performance in Publicly Traded Family Firms. International Journal of Financial Studies, 3(3), 194-229. https://doi.org/10.3390/ijfs3030194