Abstract

This paper compares the “simple-sum” monetary aggregates (M1 and M2) published by the Saudi Arabian Monetary Agency (SAMA) with the new monetary aggregates (D1 and D2)—known as the Divisia monetary indexes. The former aggregates are constructed from a simple accounting identity, whereas the Divisia aggregates are constructed using statistical index number theory and aggregation theory. The findings suggest that both D1 and M1 are identical, given the perfect substitutability of the monetary components within those aggregates. For the broader monetary aggregates where perfect substitutability assumption is not realistic, the two monetary indexes differ substantially. SAMA could benefit by using both monetary indexes simultaneously to better monitor liquidity in the market.

JEL Classifications:

E41; E51; E52; E58

1. Introduction

Simple-sum monetary aggregates (widely denoted by M1, M2, and M3) are commonly used by central banks worldwide. Those monetary indexes are derived from a simple accounting identity. The implicit assumption made when using simple-sum monetary aggregates is that all components are perfect one-for-one substitutes in producing liquidity services. Broad aggregates, which group currency with time deposits, will certainly fail to satisfy this assumption.

Barnett [1,2] proposed monetary indexes that are consistent with monetary aggregation theory and statistical index number theory. He created new monetary measures by linking microeconomic theory with index number theory, calling them “Divisia” monetary indexes. 1 The Divisia monetary index is a money supply measure that weights the monetary components (e.g., currency, demand deposits, and savings and time deposits) according to their usefulness in transactions. The Divisia index accounts for the variability of the share weights among monetary assets within an aggregate, when measuring the monetary service flows of the economy. The index depends upon prices and quantities of monetary assets, where the price of a monetary asset is called its user cost. 2

User cost is the interest return forgone by holding a monetary asset rather than holding a higher return (usually less-liquid) asset. The user cost of money is its opportunity cost and thereby the price of a monetary asset. The seminal work of Barnett [1,2,7] derived the Jorgensonian user cost of monetary assets from a rigorous Fisherine intertemporal consumption expenditure allocation model. His findings have inaugurated the use of index number theory into monetary economics.

A large number of central banks produce Divisia monetary aggregates. While some central banks make these indexes available to the public, many central banks only provide and use them internally. Monetary authorities supplying Divisia monetary aggregates internally or publicly include the Federal Reserve Bank of St. Louis, the European Central Bank, the Bank of England (BoE), the Bank of Japan, and the National Bank of Poland. 3

The International Monetary Fund (IMF) officially supports using the new measure of money. In its “Monetary and Financial Statistics: Compilation Guide”, the IMF comments on the Divisia index:

“A monetary aggregate that is an unweighted sum of components has the advantage of simplicity, but a monetary aggregate with weighted components may be expected to exhibit a stronger link to aggregate spending in an economy. By weighting the monetary components, a Divisia Money formulation takes account of the trade-off between the medium-of-exchange and store-of-value functions of holding of money components.”

Such support from the IMF is understandable, given the fact that Divisia monetary aggregates for a number of countries have been shown to have more robust relationships with major macroeconomic variables than have the traditional simple sum aggregates (see, e.g., Serletis and Gogas [8]).

Building on the work of Alkhareif and Barnett [6,9], this paper provides new monetary measures for Saudi Arabia. Our Divisia monetary indexes can not only provide a wider range of tools, but also can serve as a vehicle for researchers to improve studies on Saudi monetary policy. 4 The effectiveness of monetary policy is partly conditional on the data used by policymakers at central banks to make policy decisions. The higher the quality of the data the policymakers use, the higher the probability that they will be making well-informed policy decisions. The ultimate goal of this work is to provide reliable monetary measures that can be used by the Saudi Arabian Monetary Agency (SAMA) to improve its database, and hence the monetary policy in the kingdom.

The remainder of this paper is organized as follows: Section 2 provides a brief overview of the theoretical background relating to monetary aggregation and statistical index numbers, Section 3 describes the data used in this paper, Section 4 constructs Divisia monetary aggregates for Saudi Arabia, and Section 5 concludes the paper.

2. Monetary Aggregation Theory and Statistical Index Numbers

The connection between the fields of aggregation theory and statistical index number theory was absent prior to the seminal work pioneered by Diewert [10]. In particular, Diewert coupled the statistical indexes with certain economic properties in a novel way that allows for measuring the effectiveness of the statistical indexes in tracking a particular functional form for the unknown aggregator function. 5 Reputable statistical indexes are capable of describing the unknown economic aggregator function: henceforth, the statistical indexes supersede using particular functional forms. Barnett [11] stated that a statistical index is called “exact” only if it can track the unknown economic aggregator function.

However, exactness does not guarantee the admissibility of the statistical number indexes, especially when the true functional form for the aggregator function is unknown. A statistical index must be exact for a flexible functional form that is defined as a functional form providing a second-order approximation to any arbitrary unknown aggregator function. Barnett [11] specified that the Divisia index, which is exact for the linearly homogeneous (and flexible) translog, is superlative. Hence, a Divisia index is capable of approximating an arbitrary unknown exact aggregator function up to a third-order remainder term, signifying its ability to do a better job even if the form of the underlying function is unknown. Diewert used the term “statistical index superlative” to refer to any statistical index that is exact for a flexible functional form.

Many official government data are produced from techniques developed in aggregation theory and index-number theory. Our Divisia indexes are based on the same aggregation and statistical index number theory as the Department of Commerce’s real quantity and price indexes, which include gross domestic product (GDP) and personal consumption expenditure (PCE), and their dual price indexes, the GDP and PCE deflators. Our Divisia indexes were produced fully by means of the Statistical Index Numbers. 6 Issues related to utility function specifications, parameter estimations, and other econometric modeling factors were avoided. Hence, our Divisia indexes are fair and unbiased in the sense that they involve no estimations at all, and we let the data speak for themselves.

3. Data Descriptions and Sources

The analysis in this study is based on monthly data starting from January 1999 and ending in October 2013. The period was constrained by the availability of data for several of the series. Monetary data were obtained from SAMA while interest rates on deposits were extracted from Bloomberg database. Variables taken into consideration in the calculation of the Divisia monetary aggregates include: currency in circulation, overnight deposits, demand deposits, savings and time deposits, quasi-money, overnight deposit rates, rate of return on demand deposits, interest rates on savings and time deposits, and interest rates on short-term loans. The domestic short-term loan rate is usually the highest and hence used as the benchmark rate for most periods. The benchmark rates as well as the user costs for all monetary assets were obtained from Alkhareif [12]. All quantities have been seasonally adjusted using the X11 procedure.

4. Constructing New Monetary Aggregates for Saudi Arabia

SAMA classifies currency in circulation and demand deposits as the components of the narrow monetary aggregate, namely M1. The broader monetary aggregate, M2, incorporates monetary assets within M1 as well as less liquid assets such as savings and time deposits. In accordance with SAMA’s definition of money supply, this paper defines the new “Divisia” monetary aggregates for Saudi Arabia as following: the narrowed Divisia monetary aggregate, D1, will contain both currency in circulation and demand deposits. As in M2, the broader Divisia monetary aggregate, D2, will include D1 plus savings and time deposits.

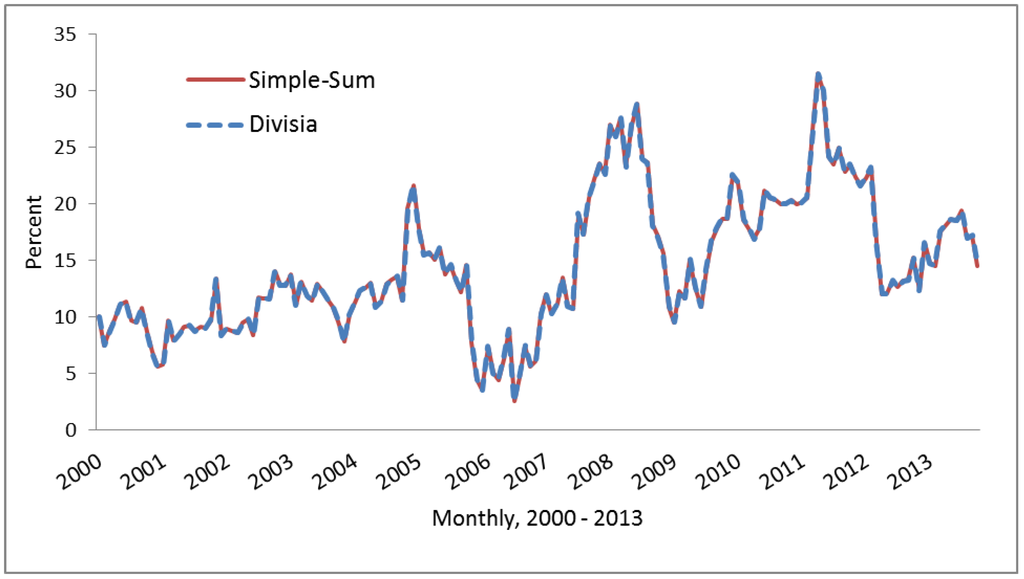

Figure 1 reports the year-over-year growth rates of the narrow Divisia and simple-sum monetary aggregates for Saudi Arabia. The two approaches to aggregation produce identical results, since all assets within the monetary aggregates bear zero-interest rates and therefore have the same user-cost prices. Specifically, currency in circulation and demand deposits are zero-interest assets, and hence the theory implies that consumers are indifferent between those two assets. 7

By construction, broad monetary aggregates contain assets with positive interest rates. Assuming perfect substitutability among assets yielding different interest rates is not permissible. 8 The imperfect substitutability among those assets leads to distinct results between Divisia and simple-sum aggregates—suggesting that policy makers may reach different conclusions based on the different aggregation procedures.

Figure 1.

Year-Over-Year Growth Rates of the Divisia and Simple-Sum Monetary Aggregates, M1 (Annual Percentage Change).

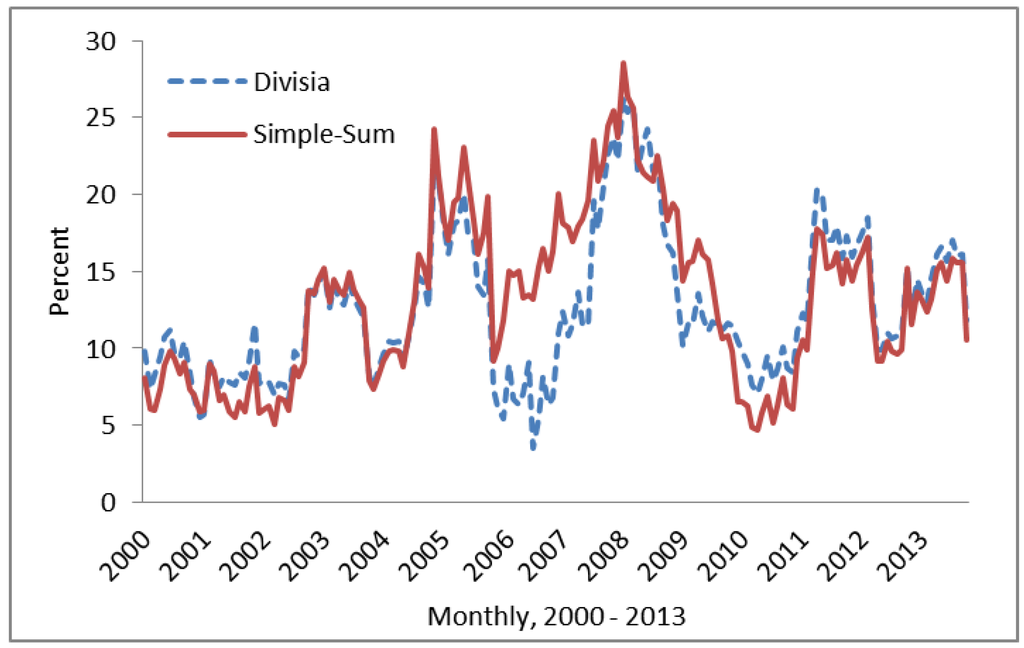

Figure 2 displays the year-over-year growth rates of the broad Divisia and simple-sum monetary aggregates for Saudi Arabia.

Figure 2.

Year-Over-Year Growth Rates of the Divisia and Simple-Sum Monetary Aggregates, M2 (Annual Percentage Change).

The year-over-year growth rates for the broad Divisia and the M2 aggregate interchangeably shift over time. The most noticeable divergence between the Divisia index and the M2 aggregate started in early 2005. The probable cause of this divergence was due to SAMA hiking short-term interest rates steadily during the year—for example, the repo rate was raised from 2.7 percent at beginning of 2005 to 5.5 percent at mid-2007. The Saudi stock market meltdown in 2006, when the market dropped by 50 percent between February and June of that year, was also accurately captured by the Divisia monetary indexes. Note that the year-over-year growth rates for the Divisia index fell sharply during the first six months of 2006 to around three percent and bounced up to reach its maximum in early 2008 (Figure 2). 9 During the recent financial crisis, the Divisia growth rate fluctuated from above simple-sum M2 in late 2008 to below in early 2009.

Interest rates on savings and time deposits have remained exceptionally low after the recent financial crisis. Growth rates of the two monetary aggregation indexes converge as components within those aggregates become increasingly perfect substitutes to one another. The gap between Divisia and simple-sum broad money supply growth rates is expected to be small as long as the interest rates on savings and time deposits are at their low levels. 10

5. Conclusions

Using modern aggregation and index number theory, based on Theil [15] and Barnett [2,16], this paper constructs the Divisia monetary indexes for Saudi Arabia. These indexes are properly weighted monetary aggregates which provide critical information regarding inside liquidity created by financial intermediaries. The findings suggest a high correlation between the two approaches of aggregation only for the narrow monetary aggregates, as perfect substitutability among components within these aggregates hold. On the other hand, there is a clear distinction between the two approaches of aggregation for the broad monetary aggregates. The gap between growth rates of the two monetary measures widen during the recent global economic downturns, and this gap has been shrinking afterwards.

The Saudi Arabian Monetary Agency could benefit from this research in enhancing its monetary database, whereas economic researchers and financial analysts can use the new money supply indexes to carry out various applications and empirical studies.

Author Contributions

William A. Barnett and Ryadh M. Alkhareif constructed the Divisia monetary indexes for Saudi Arabia.

Conflicts of Interest

The authors declare no conflict of interest.

References

- W.A. Barnett. “The User Cost of Money.” Econ. Lett. 1 (1978): 145–149. [Google Scholar] [CrossRef]

- W.A. Barnett. “Economic Monetary Aggregates: An Application of Index Number and Aggregation Theory.” J. Econom. 14 (1980): 11–48. [Google Scholar] [CrossRef]

- W.A. Barnett. “The New Monetary Aggregates: A Comment.” J. Money Credit Bank. 13 (1981): 485–489. [Google Scholar] [CrossRef]

- W.A. Barnett. Getting It Wrong: How Faulty Monetary Statistics Undermine the Fed, the Financial System, and the Economy. Boston, MA, USA: MIT Press, 2012. [Google Scholar]

- W.A. Barnett, and A. Serletis. Functional Structure Inference. Cambridge, MA, USA: Elsevier, 2007. [Google Scholar]

- R.M. Alkhareif, and W.A. Barnett. “Divisia Monetary Aggregates for the GCC Countries.” In Recent Developments in Alternative Finance: Empirical Assessments and Economic Implications. Edited by W.A. Barnett and F. Jawadi. West Yorkshire, UK: Emerald Press, 2012, pp. 1–37. [Google Scholar]

- W.A. Barnett. “The Microeconomic Theory of Monetary Aggregation.” In New Approaches to Monetary Economics. Cambridge, UK: Cambridge University Press, 1987. [Google Scholar]

- A. Serletis, and P. Gogas. “Divisia Monetary Aggregates, the Great Ratios, and Classical Money Demand Functions.” J. Money Credit Bank. 46 (2014): 229–241. [Google Scholar] [CrossRef]

- R.M. Alkhareif, and W.A. Barnett. Advances in Monetary Policy Design. Newcastle upon Tyne, UK: Cambridge Scholars Publishing, 2013. [Google Scholar]

- W.E. Diewert. “Exact and Superlative Index Numbers.” J. Econom. 4 (1976): 115–145. [Google Scholar] [CrossRef]

- W.A. Barnett. “The Optimal Level of Monetary Aggregation.” J. Money Credit Bank. 14 (1982): 687–710. [Google Scholar] [CrossRef]

- R.M. Alkhareif. Essays in Divisia Monetary Aggregation: Applications to the Gulf Monetary Union. Ann Arbor, MI, USA: ProQuest Dissertation Publishing, 2013. [Google Scholar]

- B. Klein. “Competitive Interest Payments on Bank Deposits and the Long-Run Demand for Money.” Am. Econ. Rev. 64 (1974): 931–949. [Google Scholar]

- R. Startz. “Implicit Interest on Demand Deposits.” J. Monet. Econ. 5 (1979): 515–534. [Google Scholar] [CrossRef]

- H. Theil. Economics and Information Theory. Amsterdam, The Netherlands: Elsevier, 1967. [Google Scholar]

- W.A. Barnett. “The Joint Allocation of Leisure and Goods Expenditure.” Econometrica 47 (1979): 539–563. [Google Scholar] [CrossRef]

- 1Divisia indexes were proposed and analyzed formally by François Divisia in 1926, and discussed in related 1925 and 1928 works. Barnett linked aggregation theory to monetary economics and accordingly produced the Divisia monetary indexes. See Barnett [3,4] and Barnett and Serletis [5] for more details.

- 2While aggregation and index number theory are highly developed in the fields of consumer demand theory and production theory, they were not applied to monetary theory until Barnett [1,2] derived the correct formula of the price (user cost) of monetary assets and thereby produced a connection between monetary economics and index number theory. Alkhareif and Barnett [6] provide a formal derivation of the user cost formula.

- 3BoE has published Divisia money series since 1993. The Center for Financial Stability (CFS) in New York City provides a directory on the literature pertaining to Divisia monetary aggregations for over 40 countries throughout the world. For more information on Divisia monetary aggregates, visit the CFS website at www.centerforfinancialstability.org/amfm.php.

- 4The complete dataset used in this study is available as an Excel workbook. For more information, contact the authors at: alkhareif@gmail.com.

- 5For a more detailed discussion of aggregation theory and statistical index number theory, see Barnett [11].

- 6Statistical index number theory offers parameter-free approximations to aggregator functions.

- 7Some papers impute an implicit rate of return on demand deposits (see, e.g., Klein [13] and Startz [14]). Nevertheless, given the fact that there is neither public data nor solid evidence on such an imputation, we exclude implied interest rates on demand deposits. In addition, Saudis are relatively insensitive to interest rates paid on their personal banking deposits, as a result of religious and cultural reasons. The ubiquitous prevalence of gold and platinum debit cards, which entitle the holders to special services at the bank branches, suggests that Saudis prefer these services in lieu of receiving interest on their demand deposits. It should be noted that there are no explicit legal prohibitions to the paying of interest.

- 8Perfect substitutability among assets exists, if and only if, all assets within an aggregate offer the same rate of return.

- 9The stock market decline in 2006 was the case of a classical asset bubble caused by a flood of oil money. The boom-bust cycle was exacerbated by retail investors who drove the average P/E ratio to a value higher than 50 at one point. The 2008 spike of the Divisia growth rate was likely driven by the high oil prices that prevailed in early to mid-2008.

- 10See Alkhareif and Barnett [9] for a more complete discussion pertaining to the user-cost subject.

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).