Estimating the Impact of ESG on Financial Forecast Predictability Using Machine Learning Models

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Framework

2.2. Empirical Evidence on ESG and Financial Predictability

3. Methodology

3.1. Data Collection

3.2. Data Quality and Preprocessing

3.2.1. Data Quality Methodology

- Basic quality metrics. For each series, we calculated the percentage of missing values, the total number of observations, and the data range. Series with more than 15% missing values were flagged for exclusion, in line with established practices in financial time series analysis, where excessive missingness can severely distort results.

- Advanced quality checks. In addition to the basic metrics, several further assessments were performed:

- o

- Outlier detection using z-score analysis with a threshold of three standard deviations;

- o

- Constant value detection to flag series lacking temporal variation;

- o

- Coefficient of variation (CV) calculations to evaluate relative variability;

- o

- Temporal gap analysis to identify discontinuities exceeding seven days in datasets expected to be continuous.

- Composite quality scoring. A composite score ranging from 0 to 100 was then constructed for each series. Deductions were applied based on percentage of missing data (1:1 penalty ratio), outlier prevalence (up to 20 points), constant series identification (50-point penalty), and temporal gaps (5 points per gap, capped at 15 points).

3.2.2. Data Preprocessing and Filtering

3.2.3. Train–Test Split

3.2.4. Min–Max Scaling

3.3. Modelling

- ARIMA: a combination of Auto Regressive and Moving Average models, with the addition of Integration capabilities.

- Elastic Net: linear regression with Lasso (L1) and Ridge (L2) regularization.

- K Neighbours Regressor: finds the K nearest data points to a given input and averages their target values.

- SVR: Support Vector Regressor, transforms input features into high-dimensional spaces to locate the ideal hyperplane that accurately represents the data.

- Random Forest: an ensemble of decision trees organized in parallel.

- XGBoost (eXtreme Gradient Boosting): an ensemble of decision trees organized sequentially.

4. Results

4.1. Overall Results

4.2. MAPE Comparison with Other Studies

4.3. Overfitting Analysis

- Nigeria. The closing price series and exogenous data were of poor quality, with frequent gaps. The aggressive imputation strategy used to reduce data loss introduced distortions that contributed to overfitting. A more conservative approach to imputation would likely have been more effective.

- South Korea. Although some models appeared overfit, two main factors influenced the outcome: (i) validation data quality exceeded that of the test set, artificially inflating validation performance, and (ii) very small error values overall, where even minor differences triggered the ratio-based threshold.

- Tunisia and India. In both cases, a sharp increase in stock prices during late 2024 was not captured by the exogenous variables available from LSEG, resulting in forecast errors flagged as overfitting.

4.4. Industry Grouping MAE Results

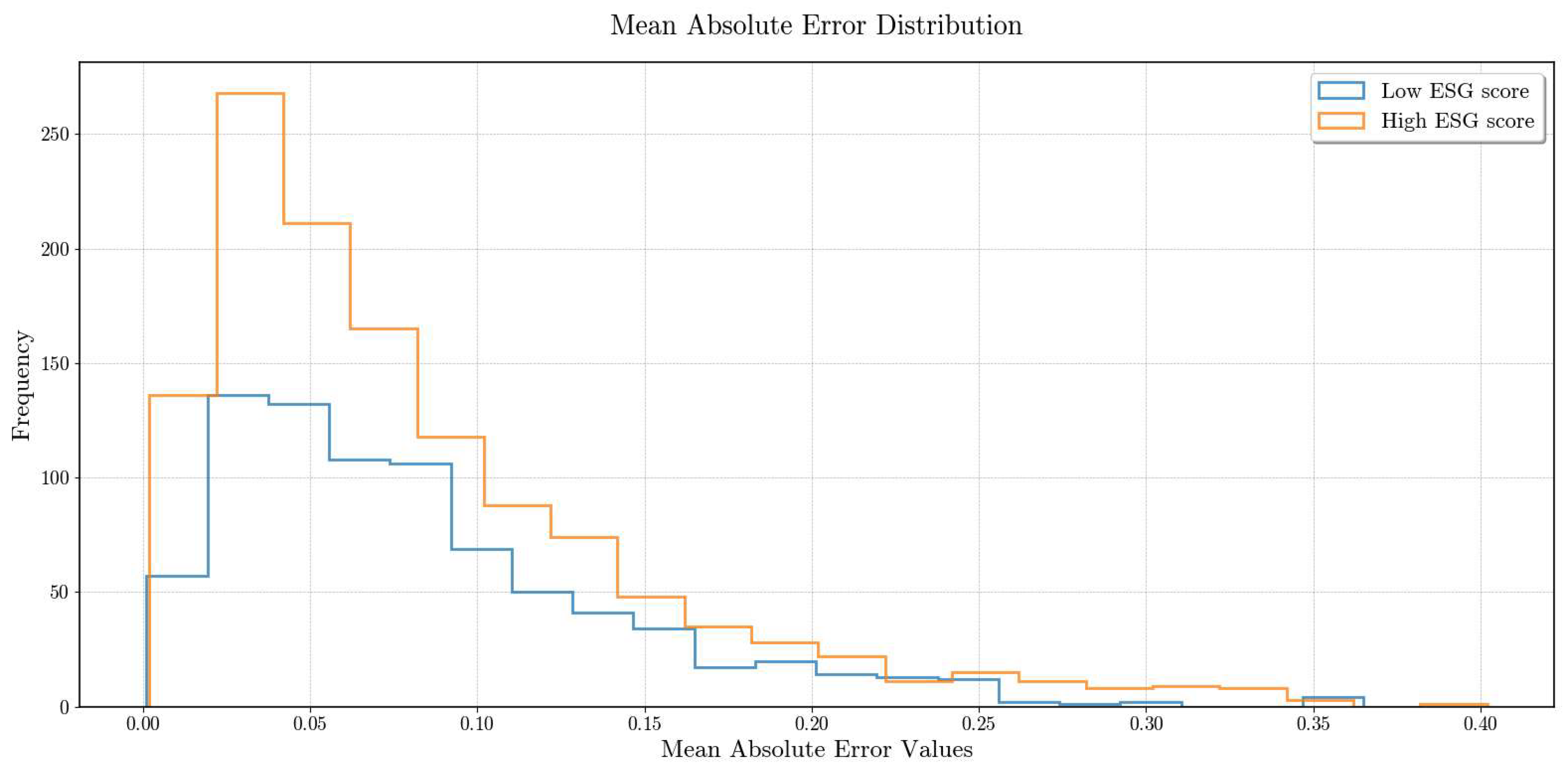

4.5. Error Metrics Histograms

- Most forecasts are reasonably accurate: The majority of time series, both high-ESG and low-ESG, have relatively low forecast errors, so a high concentration of observations in the lower bins (close to zero) is obtained.

- A small number of “hard-to-predict” series stretch the tail: Certain companies have very volatile, noisy, or irregular time series (e.g., sudden price jumps, poor data quality, structural breaks). These produce much larger forecast errors, but they are rare—which creates the long tail toward the right.

- Non-negative metric constraint: MAE, MSE, RMSE are always ≥0, so there is a “hard wall” at zero and no negative side of the distribution. This forces any variability to extend only in the positive direction, inherently creating right-skewness.

- Heterogeneity across companies: Since each company has its own forecast model, differences in sector dynamics, liquidity, and exogenous factor relevance mean that some series are naturally more predictable than others. This heterogeneity broadens the spread and reinforces the skew.

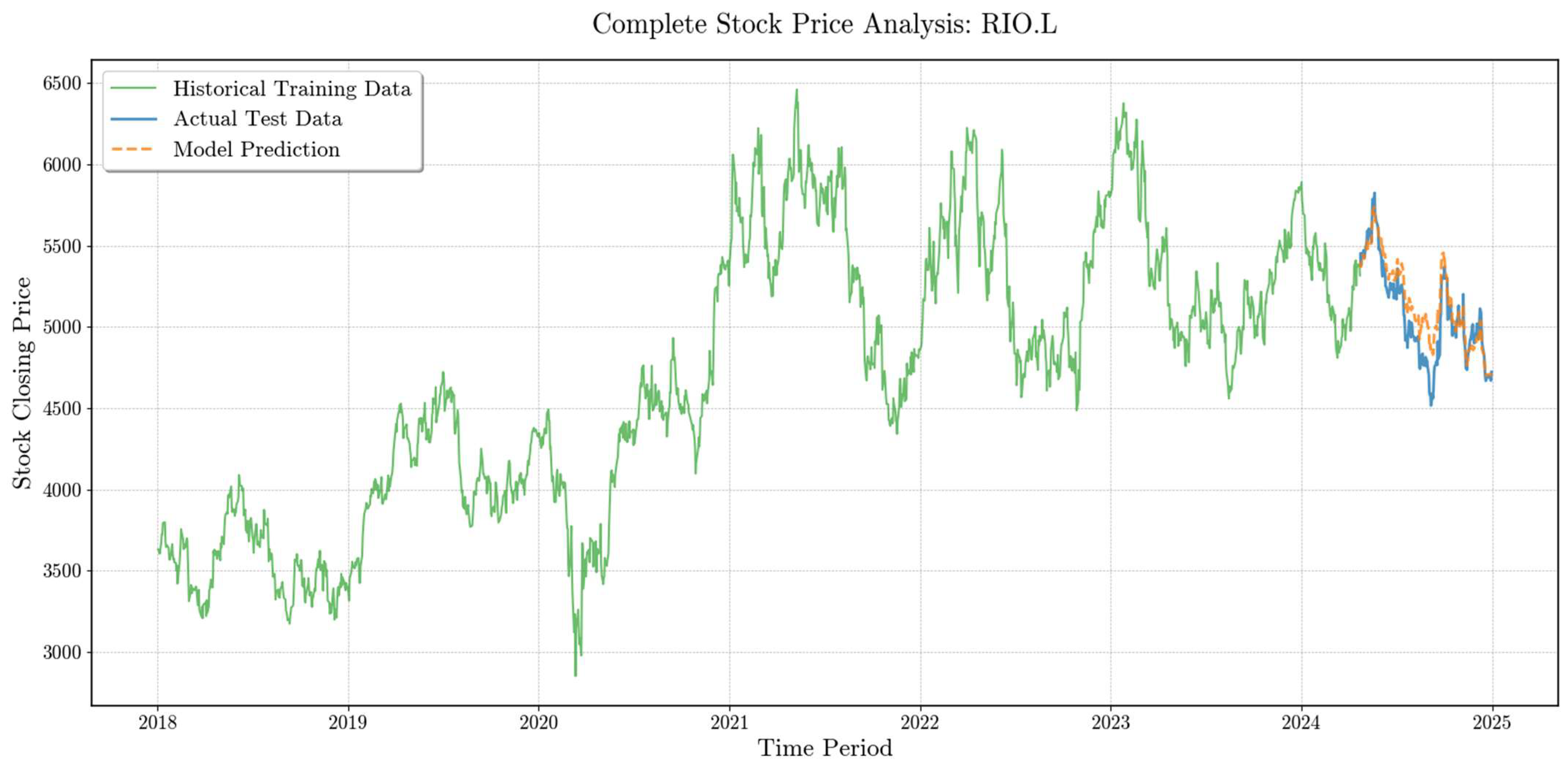

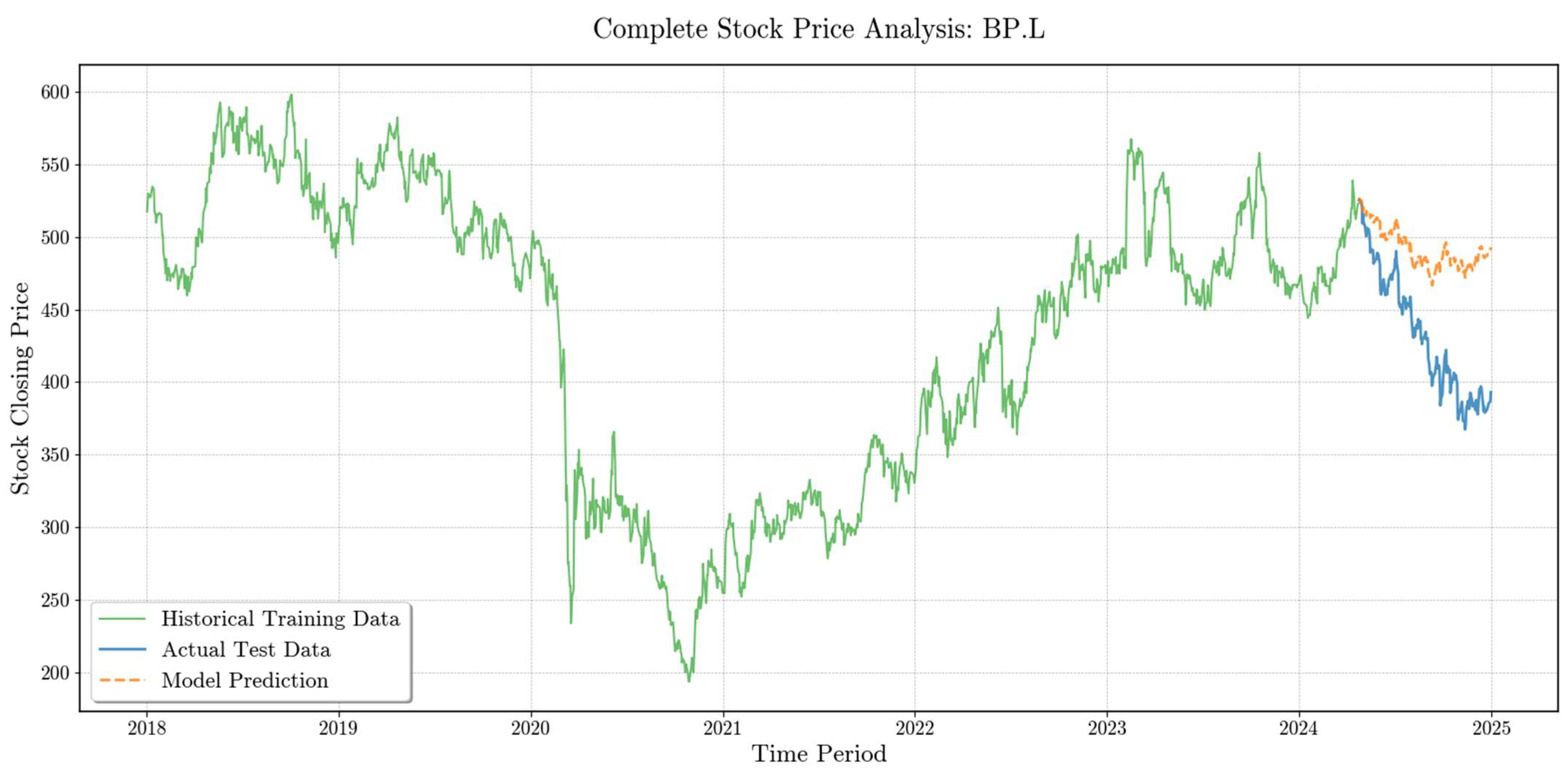

4.6. Time Series Forecast Examples

4.6.1. RIO.L—Rio Tinto Group

4.6.2. BP.L—British Petroleum PLC

4.6.3. GLEN.L—Glencore PLC

5. Discussion

- Included companies from a broad range of countries;

- Used a large sample to achieve statistical significance;

- Grouped firms by industry sector to account for sector-specific effects;

- Excluded companies with sparse closing price histories;

- Applied a consistent modelling approach across firms, verifying assumptions with Levene’s test and applying a Bonferroni correction for industry-wise comparisons.

AI–ESG Synergies in Financial Markets

6. Conclusions

Practical and Policy Implications

- Dynamic ESG thresholds: Firms should establish minimum ESG investment thresholds (e.g., a score of 60) to reduce volatility in financial forecasts.

- Transparency in ESG scoring: Investors and regulators should examine not only the headline ESG scores but also the underlying data and methodologies to ensure that investment decisions are evidence-based rather than driven by scores alone.

- Decision frameworks for investors: Structured portfolio allocation approaches (e.g., decision-tree models) should integrate ESG considerations alongside traditional financial and sectoral factors.

- Standardized ESG auditing: Regulators and standard-setters should promote harmonized auditing standards for ESG disclosures, leveraging AI to reduce inconsistencies across metrics (Amole & Emedo, 2025).

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

- Software and Computational Environment

- Core Software Platform

- Key Software Libraries and Versions

- NumPy 1.26.4: Fundamental package for numerical computing and array operations.

- Pandas (via dependencies): Essential for time series data manipulation and preprocessing.

- Matplotlib 3.10.0: Primary visualization library for generating statistical plots and time series visualizations.

- Seaborn 0.13.2: Statistical data visualization built on matplotlib for enhanced plotting capabilities.

- sktime 0.35.0: Unified machine learning framework for time series analysis, providing consistent interfaces for forecasting models.

- pmdarima 2.0.4: Auto-ARIMA implementation for automated model selection and parameter tuning.

- XGBoost 2.1.4: Gradient boosting framework used for machine learning-based forecasting approaches.

- yfinance 0.2.54: Python library for accessing Yahoo Finance market data.

- lseg-data 2.0.1: LSEG (formerly Refinitiv) data platform integration for professional financial data access.

- Optuna 4.1.0: Hyperparameter optimization framework for automated model tuning.

- SciPy (via dependencies): Comprehensive scientific computing library for statistical tests and analysis.

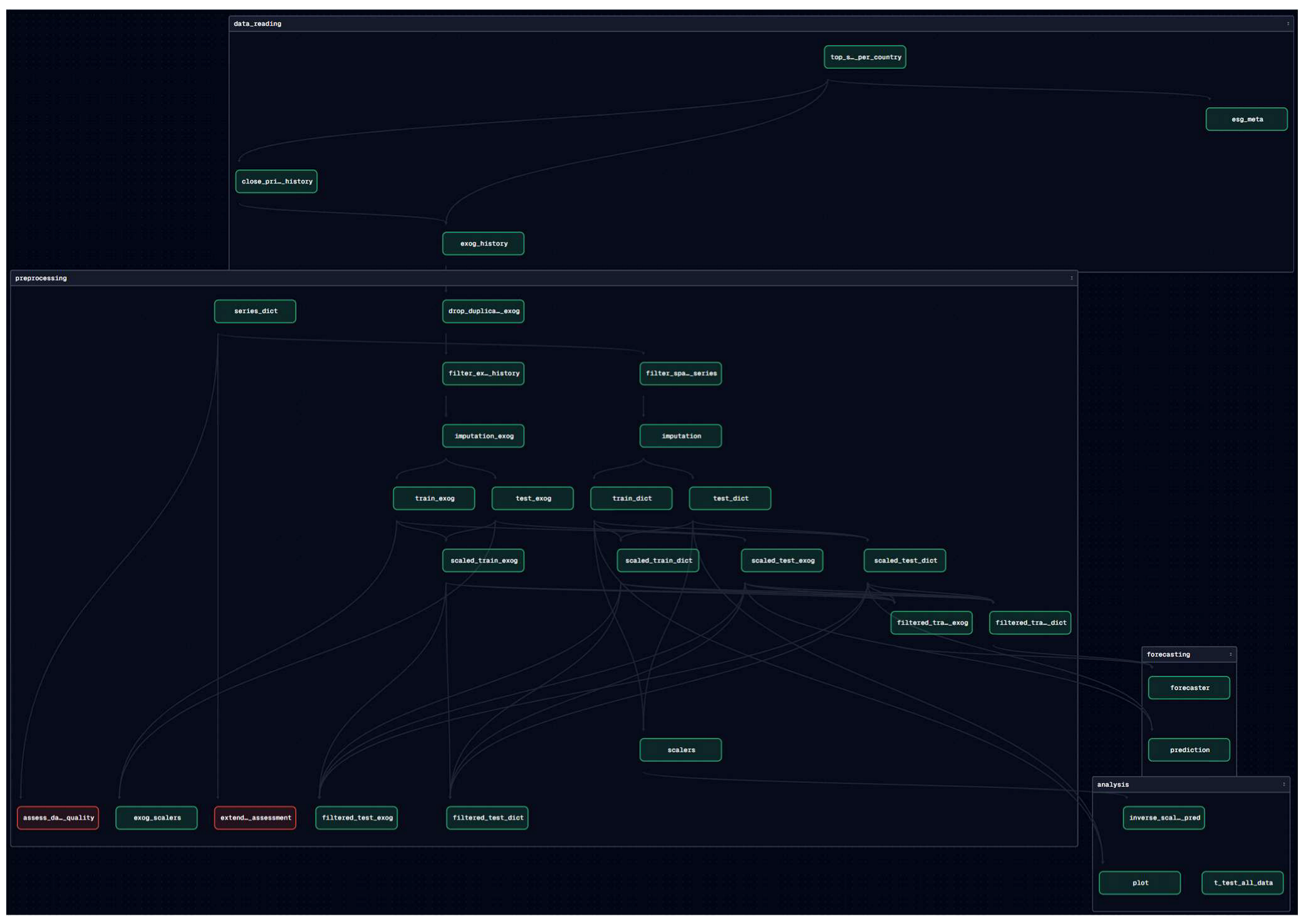

- Dagster 1.10.3: Modern data orchestration platform for building and managing data pipelines.

- Dagster-webserver 1.10.3: Web interface for monitoring and managing computational workflows.

- Pre-commit 4.1.0: Framework for managing pre-commit hooks to ensure code quality.

- Pylint 3.3.4: Static code analysis tool for maintaining code standards.

- IPykernel 6.29.5: Jupyter notebook kernel for interactive analysis and documentation.

- Data Visualization and Reporting

Appendix B

References

- Addy, W. A., Ajayi-Nifise, A. O., Bello, B. G., Tula, S. T., Odeyemi, O., & Falaiye, T. (2024a). Algorithmic trading and AI: A review of strategies and market impact. World Journal of Advanced Engineering Technology and Sciences, 11(1), 258–267. [Google Scholar] [CrossRef]

- Addy, W. A., Ajayi-Nifise, A. O., Bello, B. G., Tula, S. T., Odeyemi, O., & Falaiye, T. (2024b). Machine learning in financial markets: A critical review of algorithmic trading and risk management. International Journal of Science and Research Archive, 11(1), 1853–1862. [Google Scholar] [CrossRef]

- Agliardi, E., Alexopoulos, T., & Karvelas, K. (2023). The environmental pillar of ESG and financial performance: A portfolio analysis. Energy Economics, 120, 106598. [Google Scholar] [CrossRef]

- Ahmad, S., Mohti, W., Khan, M., Irfan, M., & Bhatti, O. K. (2024). Creating a bridge between ESG and firm’s financial performance in Asian emerging markets: Catalytic role of managerial ability and institutional quality. Journal of Economic and Administrative Sciences, Preprint. [Google Scholar] [CrossRef]

- Alghizzawi, M., Al Shibly, M. S., Ezmigna, A. A. R., Shahwan, Y., & Binsaddig, R. (2024). Corporate social responsibility and customer loyalty from a literary perspective. In Studies in systems, decision and control (pp. 1083–1094). Springer Science and Business Media Deutschland GmbH. [Google Scholar] [CrossRef]

- Al-Refiay, H. A. N., Abdulhussein, A. S., & Al-Shaikh, S. S. K. (2022). The impact of financial accounting in decision making processes in business. International Journal of Professional Business Review, 7(4), 7. [Google Scholar] [CrossRef]

- Amole, O., & Emedo, M. (2025). Integrating environmental, social and governance (ESG) principles into financial planning for sustainable corporate growth. Asian Journal of Advanced Research and Reports, 19(1), 56–64. [Google Scholar] [CrossRef]

- Bamahros, H. M., Alquhaif, A., Qasem, A., Wan-Hussin, W. N., Thomran, M., Al-Duais, S. D., Shukeri, S. N., & Khojally, H. M. (2022). Corporate governance mechanisms and ESG reporting: Evidence from the Saudi stock market. Sustainability, 14(10), 6202. [Google Scholar] [CrossRef]

- Banerjee, S., Aggarwal, D., & Sengupta, P. (2025). Do stock markets care about ESG and sentiments? Impact of ESG and investors’ sentiment on share price prediction using machine learning. Annals of Operations Research. [Google Scholar] [CrossRef]

- Capelli, P., Ielasi, F., & Russo, A. (2021). Forecasting volatility by integrating financial risk with environmental, social, and governance risk. Corporate Social Responsibility and Environmental Management, 28(5), 1483–1495. [Google Scholar] [CrossRef]

- Cheng, L. T. W., Lee, S. K., Li, S. K., & Tsang, C. K. (2023). Understanding resource deployment efficiency for ESG and financial performance: A DEA approach. Research in International Business and Finance, 65, 101941. [Google Scholar] [CrossRef]

- Clementino, E., & Perkins, R. (2021). How do companies respond to environmental, social and governance (ESG) ratings? Evidence from Italy. Journal of Business Ethics, 171(2), 379–397. [Google Scholar] [CrossRef]

- Dai, Z., Zhou, H., Wen, F., & He, S. (2020). Efficient predictability of stock return volatility: The role of stock market implied volatility. The North American Journal of Economics and Finance, 52, 101174. [Google Scholar] [CrossRef]

- D’Amato, V., D’Ecclesia, R., & Levantesi, S. (2021). Fundamental ratios as predictors of ESG scores: A machine learning approach. Decisions in Economics and Finance, 44(2), 1087–1110. [Google Scholar] [CrossRef]

- D’Amato, V., D’Ecclesia, R., & Levantesi, S. (2022). ESG score prediction through random forest algorithm. Computational Management Science, 19(2), 347–373. [Google Scholar] [CrossRef]

- Del Gesso, C., & Lodhi, R. N. (2025). Theories underlying environmental, social and governance (ESG) disclosure: A systematic review of accounting studies. Journal of Accounting Literature, 47(2), 433–461. [Google Scholar] [CrossRef]

- Dincă, M. S., Vezeteu, C. D., & Dincă, D. (2022). The relationship between ESG and firm value. Case study of the automotive industry. Frontiers in Environmental Science, 10, 1059906. [Google Scholar] [CrossRef]

- Dincă, M. S., Vezeteu, C. D., & Dincă, D. (2023). Does withdrawal from/remaining in aggressor country affect companies’ ESG ratings? Case study of the Russia-Ukraine war. Frontiers in Environmental Science, 11, 1225084. [Google Scholar] [CrossRef]

- Ding, G., & Qin, L. (2020). Study on the prediction of stock price based on the associated network model of LSTM. International Journal of Machine Learning and Cybernetics, 11(6), 1307–1317. [Google Scholar] [CrossRef]

- Domanović, V. (2021). The relationship between ESG and financial performance indicators in the public sector: Empirical evidence from the Republic of Serbia. Management: Journal of Sustainable Business and Management Solutions in Emerging Economies, 27(1), 69–80. [Google Scholar] [CrossRef]

- Edmans, A. (2023). The end of ESG. Financial Management, 52(1), 3–17. [Google Scholar] [CrossRef]

- Faheem, M. A., Aslam, M., & Kakolu, S. (2021). Enhancing financial forecasting accuracy through AI-driven predictive analytics models. Iconic Research and Engineering Journals, 4(12), 322–328. [Google Scholar]

- Fang, T., Lee, T. H., & Su, Z. (2020). Predicting the long-term stock market volatility: A GARCH-MIDAS model with variable selection. Journal of Empirical Finance, 58, 36–49. [Google Scholar] [CrossRef]

- Guo, T., Jamet, N., Betrix, V., Piquet, L. A., & Hauptmann, E. (2020). ESG2Risk: A deep learning framework from ESG news to stock volatility prediction. arXiv, arXiv:2005.02527. [Google Scholar] [CrossRef]

- Hsu, W. L., Lin, Y. L., Lai, J. P., Liu, Y. H., & Pai, P. F. (2025). Forecasting corporate financial performance using deep learning with environmental, social, and governance data. Electronics, 14(3), 417. [Google Scholar] [CrossRef]

- Huang, D. Z. X. (2022). Environmental, social and governance factors and assessing firm value: Valuation, signaling and stakeholder perspectives. Accounting & Finance, 62(S1), 1983–2010. [Google Scholar] [CrossRef]

- Jia, Y., & Ma, J. (2024). Study on ESG performance and financial distress prediction of listed companies: Based on logistic regression and artificial neural network. International Business & Economics Studies, 6(6), 53. [Google Scholar] [CrossRef]

- Kräussl, R., Oladiran, T., & Stefanova, D. (2024). A review on ESG investing: Investors’ expectations, beliefs and perceptions. Journal of Economic Surveys, 38(2), 476–502. [Google Scholar] [CrossRef]

- Kuzmina, J., Maditinos, D., Norena-Chavez, D., Grima, S., & Kadłubek, M. (2023). ESG integration as a risk management tool within the financial decision-making process. In Digital transformation, strategic resilience, cyber security and risk management (pp. 105–113). Emerald Publishing Limited. [Google Scholar] [CrossRef]

- Lee, H., Kim, J. H., & Jung, H. S. (2024). Deep-learning-based stock market prediction incorporating ESG sentiment and technical indicators. Scientific Reports, 14(1), 10262. [Google Scholar] [CrossRef] [PubMed]

- Li, Y., Liang, C., Ma, F., & Wang, J. (2020). The role of the IDEMV in predicting European stock market volatility during the COVID-19 pandemic. Finance Research Letters, 36, 101749. [Google Scholar] [CrossRef]

- Liang, C., Ma, F., Li, Z., & Li, Y. (2020). Which types of commodity price information are more useful for predicting US stock market volatility? Economic Modelling, 93, 642–650. [Google Scholar] [CrossRef]

- Lim, T. (2024). Environmental, social, and governance (ESG) and artificial intelligence in finance: State-of-the-art and research takeaways. Artificial Intelligence Review, 57(4), 76. [Google Scholar] [CrossRef]

- Long, J., Chen, Z., He, W., Wu, T., & Ren, J. (2020). An integrated framework of deep learning and knowledge graph for prediction of stock price trend: An application in Chinese stock exchange market. Applied Soft Computing, 91, 106205. [Google Scholar] [CrossRef]

- Lu, W., Li, J., Wang, J., & Qin, L. (2021). A CNN-BiLSTM-AM method for stock price prediction. Neural Computing and Applications, 33(10), 4741–4753. [Google Scholar] [CrossRef]

- Luo, K., & Wu, S. (2022). Corporate sustainability and analysts’ earnings forecast accuracy: Evidence from environmental, social and governance ratings. Corporate Social Responsibility and Environmental Management, 29(5), 1465–1481. [Google Scholar] [CrossRef]

- Meng, Z. (2024). The impact of ESG reporting on analyst forecast accuracy: A cross-market review. Science, Technology and Social Development Proceedings Series, 2, 180–186. [Google Scholar] [CrossRef]

- Ming, K. L. Y., Vaicondam, Y., & Mustafa, A. M. A. A. (2024). ESG integration and financial performance: Evidence from Malaysia’s leading companies. International Journal of Energy Economics and Policy, 14(5), 487–494. [Google Scholar] [CrossRef]

- Momparler, A., Carmona, P., & Climent, F. (2024). Catalyzing sustainable investment: Revealing ESG power in predicting fund performance with machine learning. Computational Economics, Preprint. [Google Scholar] [CrossRef]

- Park, S. R., & Jang, J. Y. (2021). The impact of ESG management on investment decision: Institutional investors’ perceptions of country-specific ESG criteria. International Journal of Financial Studies, 9(3), 48. [Google Scholar] [CrossRef]

- Petrović, D., Radosavac, A., & Mashovic, A. (2023). Implications of applying fair value accounting to modern financial reporting. Journal of Process Management and New Technologies, 11(1–2), 22–33. [Google Scholar] [CrossRef]

- Pérez, L., Hunt, V., Samandari, H., Nuttall, R., & Biniek, K. (2022). Does ESG really matter-and why? Available online: http://www.registeredinvestor.com/ACCESS/Library/20220800_McKinsey.pdf (accessed on 18 March 2025).

- Ran, Z., Gul, A., Akbar, A., Haider, S. A., Zeeshan, A., & Akbar, M. (2021). Role of gender-based emotional intelligence in corporate financial decision-making. Psychology Research and Behavior Management, 14, 2231–2244. [Google Scholar] [CrossRef] [PubMed]

- Ravikumar, S., & Saraf, P. (2020, June 5–7). Prediction of stock prices using machine learning (regression, classification) algorithms. 2020 International Conference for Emerging Technology, INCET 2020, Belgaum, India. [Google Scholar] [CrossRef]

- Rossi, P., & Candio, P. (2023). The independent and moderating role of choice of non-financial reporting format on forecast accuracy and ESG disclosure. Journal of Environmental Management, 345, 118891. [Google Scholar] [CrossRef]

- Sattar, M. U., Dattana, V., Hasan, R., Mahmood, S., Khan, H. W., & Hussain, S. (2025). Enhancing supply chain management: A comparative study of machine learning techniques with cost–accuracy and ESG-based evaluation for forecasting and risk mitigation. Sustainability, 17(13), 5772. [Google Scholar] [CrossRef]

- Shah, S. F., Alshurideh, M. T., Al-Dmour, A., & Al-Dmour, R. (2021). Understanding the influences of cognitive biases on financial decision making during normal and COVID-19 pandemic situation in the United Arab Emirates. In The effect of coronavirus disease (COVID-19) on business intelligence (pp. 257–274). Springer International Publishing. [Google Scholar] [CrossRef]

- Song, Y., Li, R., Zhang, Z., & Sahut, J. M. (2024). ESG performance and financial distress prediction of energy enterprises. Finance Research Letters, 65, 105546. [Google Scholar] [CrossRef]

- Soni, P., Tewari, Y., & Krishnan, D. (2022). Machine Learning Approaches in Stock Price Prediction: A Systematic Review. Journal of Physics: Conference Series, 2161(1), 012065. [Google Scholar] [CrossRef]

- Trierweiler Ribeiro, G., Santos, A. A. P., Mariani, V. C., & dos Santos Coelho, L. (2021). Novel hybrid model based on echo state neural network applied to the prediction of stock price return volatility. Expert Systems with Applications, 184, 115490. [Google Scholar] [CrossRef]

- Upadhyay, S. (2024). Impact of environmental, social, and governance (ESG) factors on individual investor performance. International Journal of Scientific Research in Engineering and Management, 8(4), 1–5. [Google Scholar] [CrossRef]

- Vinothkumar, B., Janaki, A. N., & Lawrance, R. (2024). Futuristic trends in artificial intelligence AI and sustainable finance, AI and sustainable finance IIP series. AI and Sustainable Finance. [Google Scholar]

- Xu, J. (2024). AI in ESG for financial institutions: An industrial survey. Available online: https://arxiv.org/pdf/2403.05541 (accessed on 14 July 2025).

- Yu, P., & Yan, X. (2020). Stock price prediction based on deep neural networks. Neural Computing and Applications, 32(6), 1609–1628. [Google Scholar] [CrossRef]

- Zhang, Y., Wang, Y., & Ma, F. (2021). Forecasting US stock market volatility: How to use international volatility information. Journal of Forecasting, 40(5), 733–768. [Google Scholar] [CrossRef]

| Model | MAE | MAPE | MSE | RMSE |

|---|---|---|---|---|

| ARIMA | 0.1024 | 0.1753 | 0.0429 | 0.1301 |

| Elastic Net | 0.4051 | 0.5109 | 0.1744 | 0.4176 |

| K-Nearest Neighbours | 0.1926 | 0.2335 | 0.0485 | 0.2202 |

| Random Forest | 0.1712 | 0.2072 | 0.0387 | 0.1967 |

| SVR | 0.3220 | 0.4026 | 0.1140 | 0.3376 |

| XGBoost | 0.1625 | 0.2027 | 0.0344 | 0.1856 |

| Metric | Low ESG | High ESG | Statistical Test | Value |

|---|---|---|---|---|

| ESG Count | 1533 | 1533 | ESG Threshold | 61.2989 |

| MAE (Mean Absolute Error) | 0.0839 | 0.0841 | Levene’s Test Statistic | 1.6751 |

| Levene’s p-value | 0.1957 | |||

| t-statistic | −0.0666 | |||

| p-value | 0.9469 | |||

| Degree of freedom | 2063 | |||

| MSE (Mean Squared Error) | 0.0146 | 0.0158 | Levene’s Test Statistic | 2.4673 |

| Levene’s p-value | 0.1164 | |||

| t-statistic | −1.1044 | |||

| p-value | 0.2695 | |||

| Degree of freedom | 2063 | |||

| R-squared | −1.3091 | −1.2713 | Levene’s Test Statistic | 0.0433 |

| Levene’s p-value | 0.8381 | |||

| t-statistic | −0.1556 | |||

| p-value | 0.8764 | |||

| Degree of freedom | 2063 | |||

| RMSE (Root Mean Squared Error) | 0.0988 | 0.0987 | Levene’s Test Statistic | 1.9787 |

| Levene’s p-value | 0.1597 | |||

| t-statistic | 0.0261 | |||

| p-value | 0.9792 | |||

| Degree of freedom | 2063 |

| Paper | MAPE | Forecast Horizon (Days) |

|---|---|---|

| Our paper | 0.17530 | 180 |

| Sattar et al. (2025) | 0.00480 | 365 |

| D’Amato et al. (2021) | 0.03740 | 1 |

| D’Amato et al. (2022) | 0.03735 | 1 |

| Industrial Sector | Num. of Companies | MAE t-Stat | MAE p-Value | MAE Degrees of Freedom |

|---|---|---|---|---|

| Business Services | 140 | 2.0336 | 0.0438 | 143 |

| Real Estate; Mortgage Bankers and Brokers | 112 | −1.1460 | 0.2541 | 117 |

| Investment and Commodity Firms/Dealers/Exchanges | 109 | 0.6992 | 0.4858 | 114 |

| Electronic and Electrical Equipment | 97 | 1.4612 | 0.1471 | 100 |

| Food and Kindred Products | 90 | −1.0473 | 0.2977 | 91 |

| Commercial Banks, Bank Holding Companies | 86 | −0.5880 | 0.5580 | 90 |

| Oil and Gas; Petroleum Refining | 81 | 0.7489 | 0.4560 | 84 |

| Transportation and Shipping (except air) | 76 | 1.4006 | 0.1653 | 78 |

| Drugs | 70 | 0.4732 | 0.6375 | 73 |

| Metal and Metal Products | 68 | 0.9081 | 0.3670 | 69 |

| Measuring, Medical, Photo Equipment; Clocks | 65 | −0.3387 | 0.7360 | 65 |

| Machinery | 64 | −1.7052 | 0.0929 | 65 |

| Telecommunications | 62 | −0.3013 | 0.7641 | 64 |

| Prepackaged Software | 58 | −1.0391 | 0.3029 | 61 |

| Insurance | 58 | 0.4665 | 0.6426 | 57 |

| Transportation Equipment | 48 | −0.7194 | 0.4753 | 49 |

| Wholesale Trade—Durable Goods | 44 | −0.3531 | 0.7256 | 46 |

| Stone, Clay, Glass, and Concrete Products | 41 | −0.4486 | 0.6562 | 40 |

| Wholesale Trade—Non-durable Goods | 35 | 1.1389 | 0.2625 | 35 |

| Miscellaneous Retail Trade | 33 | 0.7709 | 0.4461 | 34 |

| Computer and Office Equipment | 30 | −0.4287 | 0.6714 | 28 |

| Retail Trade—General Merchandise and Apparel | 25 | 0.3927 | 0.6982 | 23 |

| Health Services | 25 | −0.5168 | 0.6102 | 23 |

| Printing, Publishing, and Allied Services | 17 | 0.7233 | 0.4806 | 15 |

| Radio and Television Broadcasting Stations | 18 | 1.7910 | 0.0922 | 16 |

| Communications Equipment | 16 | −0.5177 | 0.6128 | 14 |

| Retail Trade—Eating and Drinking Places | 11 | −1.7864 | 0.1077 | 9 |

| Retail Trade—Home Furnishings | 9 | 0.2860 | 0.7831 | 7 |

| Motion Picture Production and Distribution | 7 | −0.0869 | 0.9342 | 5 |

| Miscellaneous Manufacturing | 7 | −0.4091 | 0.6994 | 5 |

| Leather and Leather Products | 6 | −0.3854 | 0.7196 | 4 |

| Savings and Loans, Mutual Savings Banks | 3 | 0.1535 | 0.9030 | 1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dincă, M.S.; Ciotlăuși, V.; Akomeah, F. Estimating the Impact of ESG on Financial Forecast Predictability Using Machine Learning Models. Int. J. Financial Stud. 2025, 13, 166. https://doi.org/10.3390/ijfs13030166

Dincă MS, Ciotlăuși V, Akomeah F. Estimating the Impact of ESG on Financial Forecast Predictability Using Machine Learning Models. International Journal of Financial Studies. 2025; 13(3):166. https://doi.org/10.3390/ijfs13030166

Chicago/Turabian StyleDincă, Marius Sorin, Vlad Ciotlăuși, and Frank Akomeah. 2025. "Estimating the Impact of ESG on Financial Forecast Predictability Using Machine Learning Models" International Journal of Financial Studies 13, no. 3: 166. https://doi.org/10.3390/ijfs13030166

APA StyleDincă, M. S., Ciotlăuși, V., & Akomeah, F. (2025). Estimating the Impact of ESG on Financial Forecast Predictability Using Machine Learning Models. International Journal of Financial Studies, 13(3), 166. https://doi.org/10.3390/ijfs13030166