1. Introduction

Rare earth elements (REEs) play an important role in the twin drivers of energy transition and digital transformation within the global economy. REEs comprise a group of 17 chemically similar metallic elements, including the 15 lanthanides, as well as scandium and yttrium, which possess unique optical, magnetic, and catalytic properties. These characteristics make them indispensable components in a wide range of advanced technologies, from renewable energy systems and electric vehicles to defense applications and high-performance electronics. The criticality of REEs arises from their broad applications across five interdependent strategic sectors: renewable energy, defense, semiconductors, advanced manufacturing, and global supply chain logistics. In the clean energy (CE) sector, REEs contribute to energy efficiency and emissions reduction through their use in permanent magnets for wind turbines and electric motors (

Apergis & Apergis, 2017;

USGS, 2023). Within artificial intelligence, they are essential for optoelectronic components and magnetic memory devices embedded in high-performance computing systems (

Yang et al., 2024). In the defense industry, REEs enable advanced sensors, guidance systems, and radar technologies that underpin modern military capabilities (

Gholz & Hughes, 2021;

Fan et al., 2023). In the semiconductor sector, they function as dopants and substrates that are crucial for the production of advanced chips and microelectronic components (

Diao et al., 2024). Additionally, they are integrated into global electronic supply chains, where they serve as catalytic and processing materials in the manufacturing of IT and telecommunications infrastructure (

Buchholz & Brandenburg, 2018).

This widespread functional importance makes REE markets highly sensitive to geopolitical shocks, trade restrictions, and supply chain disruptions, factors that increasingly propagate systemic risks beyond the commodity sphere. Through channels such as financial performance, technological continuity, and strategic resource allocation, REEs can trigger cross-sectoral contagion, particularly during periods of heightened uncertainty. Recent network-based studies on metals reinforce this notion by identifying REEs as key structural volatility transmitters that are capable of generating spillover effects across industrial and financial ecosystems (

Ding et al., 2023).

Growing empirical evidence supports the integration of REE markets into broader financial and commodity market structures, particularly during geopolitical and financial stress episodes. For instance,

Reboredo and Ugolini (

2020) documented a robust cointegration relationship between REEs, CE markets, and oil futures, indicating that these markets exhibit synchronized responses to common shocks.

Zhou et al. (

2022) showed that REE equity indices are highly responsive to international policy uncertainty, with a pronounced effect in the Chinese market segments.

Salim et al. (

2022) and

Pham and Hsu (

2025) further revealed regime-specific and nonlinear sensitivities of REE prices to exogenous shocks, highlighting patterns of conditional volatility and dynamic asymmetry. This body of evidence underscores that REE dynamics cannot be isolated from broader macro-financial conditions. As global supply chains and strategic sectors become increasingly interconnected, shocks originating in REE markets propagate through multiple transmission channels, influencing commodity prices, equity valuations, and sectoral risk profiles. Such interconnectedness reinforces the need for integrated analytical frameworks capable of capturing both the cross-sectoral and regime-dependent nature of REE-related risks.

This omission reflects a significant theoretical and empirical gap regarding the mechanisms through which REEs operate as conduits for risk transmission across the real economy and financial markets. Such mechanisms are particularly relevant in today’s landscape of compounding global risks, where nonlinear, asymmetric, and regime-dependent relationships increasingly shape market behavior (

Caldara & Iacoviello, 2022;

Diebold & Yilmaz, 2008). To address this complexity, advanced econometric methods, such as time–frequency models and quantile-on-quantile regressions (QQRs), are indispensable for capturing the evolving structure of co-movements and identifying regime-contingent risk dependencies that remain undetected by traditional models.

While a few recent contributions have begun to explore these interconnections, they remain limited in scope and methodological depth.

Chen et al. (

2020), for example, applied DCC-GARCH models to examine the dynamic interactions between REEs and CE markets.

B. Zheng et al. (

2021) employed the Diebold–Yilmaz spillover index at the firm level to measure interconnectedness, while

Henriques and Sadorsky (

2023) used machine learning to forecast REE stock prices, without addressing bidirectional relationships or regime-specific dynamics. As a result, despite mounting vulnerabilities and deepening sectoral interdependencies, current research still lacks an integrated analytical framework capable of jointly capturing the temporal evolution and distributional characteristics of systemic contagion across strategically critical sectors.

This study addresses this gap by investigating how REE markets function as systemic amplifiers of both geopolitical and financial risks. By combining time–frequency analysis with QQR, it develops an integrated framework capable of detecting both persistent co-movements and asymmetric dependencies across different regimes of uncertainty. The results indicate that REE markets exhibit regime-contingent transmission patterns, exerting significant influence on downstream sectors during periods of heightened global risk. The defense, artificial intelligence, and semiconductor sectors emerge as particularly vulnerable under stress conditions, whereas the CE and logistics sectors maintain more stable linkages, primarily under typical market circumstances.

The main contributions of this paper are threefold: (i) it identifies and maps the cross-sectoral channels through which risks originating in REE markets are transmitted; (ii) it highlights the pronounced sectoral heterogeneity in exposure to geopolitical and financial uncertainty; and (iii) it introduces an integrated methodological framework that can be applied to other critical raw materials of strategic importance for global economic security.

The remainder of this article is organized as follows.

Section 2 reviews the literature on REE markets and their interconnections with critical sectors.

Section 3 details the data and describes the methodological framework based on QQR and WTC techniques.

Section 4 presents the empirical findings, while

Section 5 discusses their theoretical and policy implications.

Section 6 concludes the study and proposes future research directions.

2. Literature Review

2.1. Technological and Strategic Role of REE Markets

As foundational components of advanced technologies, REEs play an indispensable role in the development of AI, semiconductors, CE systems, and defense platforms. Beyond their function as physical inputs, the literature increasingly positions REEs as structural enablers embedded within global value chains and innovation systems (

Massari & Ruberti, 2013;

USGS, 2022). Moreover,

Zhu et al. (

2023) demonstrated that REEs and minerals associated with green energy transitions occupy central positions in the price transfer networks of Chinese mining stocks—in contrast to the more peripheral roles of other non-ferrous minerals. This asymmetry underscores their capacity to shape systemic volatility and to transmit shocks across sectoral boundaries.

The strategic relevance of REEs is further underscored by their deep integration into emerging technologies such as AI, cloud infrastructure, and robotics, where dependence on rare and specialized metals is becoming increasingly acute. In the semiconductor industry, REEs contribute both to the precision of fabrication processes and to improving the electromagnetic and thermal performance of microchips (

Nkiawete & Vander Wal, 2025). In the green energy sector, rare earths are essential in enabling high-efficiency energy storage systems, magnet-based electric propulsion, and wind turbine technologies. Accordingly, REEs should be understood not merely as technological inputs but as amplifiers of industrial resilience and strategic leverage within the context of ESG-driven innovation and the broader Industry 5.0 paradigm.

2.2. Geopolitical and Financial Uncertainty in REE Markets

The sensitivity of REEs to geopolitical shocks, financial volatility, and trade disruptions positions them among the most exposed commodity classes in terms of uncertainty. The theoretical and empirical literature converges on the idea that REEs are particularly sensitive to global uncertainty and systemic shocks (

Baker et al., 2016;

Mancheri et al., 2019). This sensitivity manifests in both the intensity and persistence of price volatility. For example,

Khurshid et al. (

2023) demonstrated that the Russia–Ukraine conflict triggered sustained surges in the prices of critical metals, including REEs, highlighting the role of geopolitical events in propagating volatility across commodity markets.

Proelss et al. (

2020) further identified long memory properties in REE volatility, thereby validating the use of ARFIMA models over standard GARCH frameworks for risk forecasting in strategic materials.

Deng et al. (

2021) showed that endogenous price fluctuations can undermine the feasibility of REE recycling technologies, suggesting that volatility is not merely reactive but structurally embedded in the economics of the energy transition.

More recent studies further reinforce the view that REEs are active transmitters of systemic uncertainty.

Zhang et al. (

2024) used quantile regression models to document regime-dependent responses of REE markets to global shocks, emphasizing asymmetric reactions conditioned by the intensity and type of disruptive events. This asymmetry was echoed by

Nasir et al. (

2024), who employed time–frequency and quantile-based methods to reveal that interdependencies between REEs and correlated asset classes, such as industrial metals and CE stocks, are strongly modulated by both the level of geopolitical uncertainty and its regional origin. In this evolving risk environment, the role of indices such as the GPR and VIX has become increasingly central in modeling REE-related exposures. According to

H. Li et al. (

2025), REE markets act as volatility absorbers under stable regimes but switch to amplifiers of financial contagion during crises, particularly affecting green bonds and CE equities. These dynamics challenge traditional hedging strategies and redefine the strategic role of REEs as channels through which global uncertainty propagates into industrial and financial systems.

2.3. Sectoral Interdependencies in Critical Markets

Volatility originating in REE markets does not remain confined to the raw materials domain but extends into critical industrial sectors through complex transmission channels.

Yahya et al. (

2023) provided robust empirical evidence of directional spillovers from strategic metals to solar energy equities, particularly under geopolitical and health crises, using quantile regression and DCC-GARCH methods. These results underscore the conditional and regime-sensitive nature of REE sector interactions. Building on this insight,

W. Gao et al. (

2024) applied a time-varying parameter VAR model and uncover bidirectional volatility spillovers between REEs and the CE and transportation sectors, with spillover intensity varying markedly in response to geopolitical turbulence.

Other studies highlight the differentiated sensitivity of REE-linked industries to various forms of uncertainty.

Pata and Pata (

2025) revealed that critical minerals essential to China’s green transition, including REEs, respond asymmetrically to changes in energy and climate policy uncertainty, reinforcing the hypothesis of nonlinear exposure paths.

B. Zheng et al. (

2022) demonstrated that the Chinese rare earths market significantly intensifies volatility spillovers toward renewable energy and high-technology sectors. Using a wavelet-based BEKK-GARCH-X model, they found that REEs act as exogenous risk amplifiers, especially in medium-frequency bands (8–16 days), thereby confirming the frequency-dependent nature of risk transmission. However, existing analyses tend to focus on sector-specific or bilateral relationships, often neglecting broader transmission mechanisms across multiple interconnected sectors and time–frequency domains.

Shuai et al. (

2023) addressed this gap by employing ecological niche models to analyze strategic dynamics among key geopolitical actors—China, the U.S., Japan, and the EU—and by highlighting the centrality of REEs within global technology competition and resource diplomacy.

At the microstructural level,

Nkiawete and Vander Wal (

2025) documented significant cross-country variation in REE usage patterns, underscoring the critical importance of neodymium and dysprosium permanent magnets in renewable energy systems and electric vehicles. This differentiated allocation exposes certain economies to more acute value chain disruptions and creates sector-specific channels for volatility propagation. Complementing this view,

Abbas et al. (

2024) linked REEs with both economic complexity and renewable energy integration, thereby reinforcing the idea that these metals function as critical nodes within the broader architecture of industrial transformation and technological innovation. Collectively, these findings position REEs not as isolated inputs but as structurally embedded agents within global volatility networks, capable of transmitting shocks across the CE, transportation, defense, and semiconductor industries.

2.4. Volatility Transmission Across REE and Critical Markets

Although significant progress has been made in understanding the linkages between REEs and key critical sectors, the majority of existing studies remain grounded in conventional econometric techniques such as VAR, GARCH, or linear regression models. These models typically assume linearity, symmetry, and temporal constancy, which substantially limits their ability to capture the true complexity of market interdependencies. By contrast, the behavior of REE-related markets often exhibits pronounced nonlinear dynamics, structural asymmetries, and frequency-dependent fluctuations that are not adequately addressed by static frameworks.

Recent advances in applied finance and energy economics highlight the potential of hybrid methodologies, particularly those combining frequency domain analysis with distribution-sensitive techniques such as QQR. Such integrative approaches have proven effective in modeling risk transmission among foreign exchange rates, cryptocurrencies, and safe haven assets, yet they remain largely absent from REE research. For instance,

Restrepo et al. (

2023) provided valuable insights into spillovers within critical metal sectors but did not explore the spectral or nonlinear aspects of these relationships. Moreover, their focus on transition metals (copper, nickel, cobalt, lithium) leaves an important gap in understanding the dynamics involving rare earths and the sectors they support.

Another limitation concerns the assumed directionality of effects. Much of the literature models shocks as flowing unidirectionally from REEs to downstream industries, overlooking potential feedback loops. However, market turbulence originating in sectors such as CE, defense, or AI could plausibly propagate backward, amplifying volatility in upstream REE markets. Furthermore, few studies explicitly distinguish between industries with direct exposure to REEs (EVs, wind turbines, semiconductors) and those connected indirectly through supply chains (logistics, industrial manufacturing), thereby limiting the precision of systemic risk assessments.

This analytical shortcoming is particularly critical, given that REE allocation patterns reflect not only usage volumes but also their position in the value chain and degree of technological dependence. High-integration applications, such as rare earth magnets in propulsion systems, energy storage, or wind power, imply deeper systemic vulnerabilities compared to more traditional uses in metallurgy or polishing.

In response to these gaps, the present study proposes a novel methodological framework that integrates wavelet-based frequency analysis (WTC and CWT) with regime-sensitive QQR estimation. This combination enables a more comprehensive mapping of volatility transmission, capturing nonlinearities, time–frequency dynamics, and bidirectional interdependencies between REEs and a broad spectrum of industrial and financial sectors. The analysis seeks to uncover underlying contagion mechanisms and identify risk clusters shaped by both exogenous uncertainty and structural dependencies within strategic value chains.

Considering the reviewed literature, the following research hypotheses were formulated:

H1: The interdependencies between REEs and critical sectors are nonlinear, asymmetric, and regime-dependent and intensify during periods of heightened geopolitical and financial uncertainty.

H2: The connectivity between REEs and critical sectors exhibits varying degrees of intensity across frequency bands, reflecting distinct structural sensitivities across sectors.

3. Data and Methodology

3.1. Data and Variables

The empirical study uses a daily high-frequency dataset covering the period from 1 June 2018, to 30 June 2025. The start date coincides with the introduction of the S&P Kensho Artificial Intelligence Enablers & Adopters Index (NDXAI), marking the formal operationalization of advanced AI-focused equity benchmarks. The dataset includes daily price series for REE market indices, sector-specific equity indices representing the performance of critical industries, and widely recognized indicators of both geopolitical and financial uncertainty.

All financial data were retrieved from reputable and widely used sources, including Bloomberg (

Bloomberg.com, n.d.),

Investing.com (

n.d.), and official index providers (S&P Global, MVIS, STOXX, MSCI). The geopolitical risk sub-indices (GPRD-ACT and GPRD-THREAT) were obtained from the

Caldara and Iacoviello (

2022) dataset, while the VIX index was sourced from the Chicago Board Options Exchange (CBOE). All price series were transformed into logarithmic returns to address scale heterogeneity and enhance stationarity. Missing values were imputed through linear interpolation, and all-time series were synchronized to ensure uniform data length. All econometric analyses were conducted using EViews 12 (IHS Markit, 2021) and MATLAB R2023a (MathWorks, 2023).

To address the methodological limitations identified in prior research, this study incorporates a diverse set of sectoral indices. Selection was guided by both direct and indirect relevance to REE supply chains as well as technological integration. For instance, NDXAI and NDXENB capture firms that rely heavily on REEs for AI hardware development, while indices such as SOX, MSCIIT, and TSETECH reflect systemic exposure through advanced electronics and semiconductor production. Similarly, DJSASD, STOXXAD, and FTXIA600 provide coverage of U.S., European, and Chinese defense sectors, respectively. Finally, DJT and SPGIND were included to represent logistics and industrial sectors with indirect but structurally significant links to REE demand.

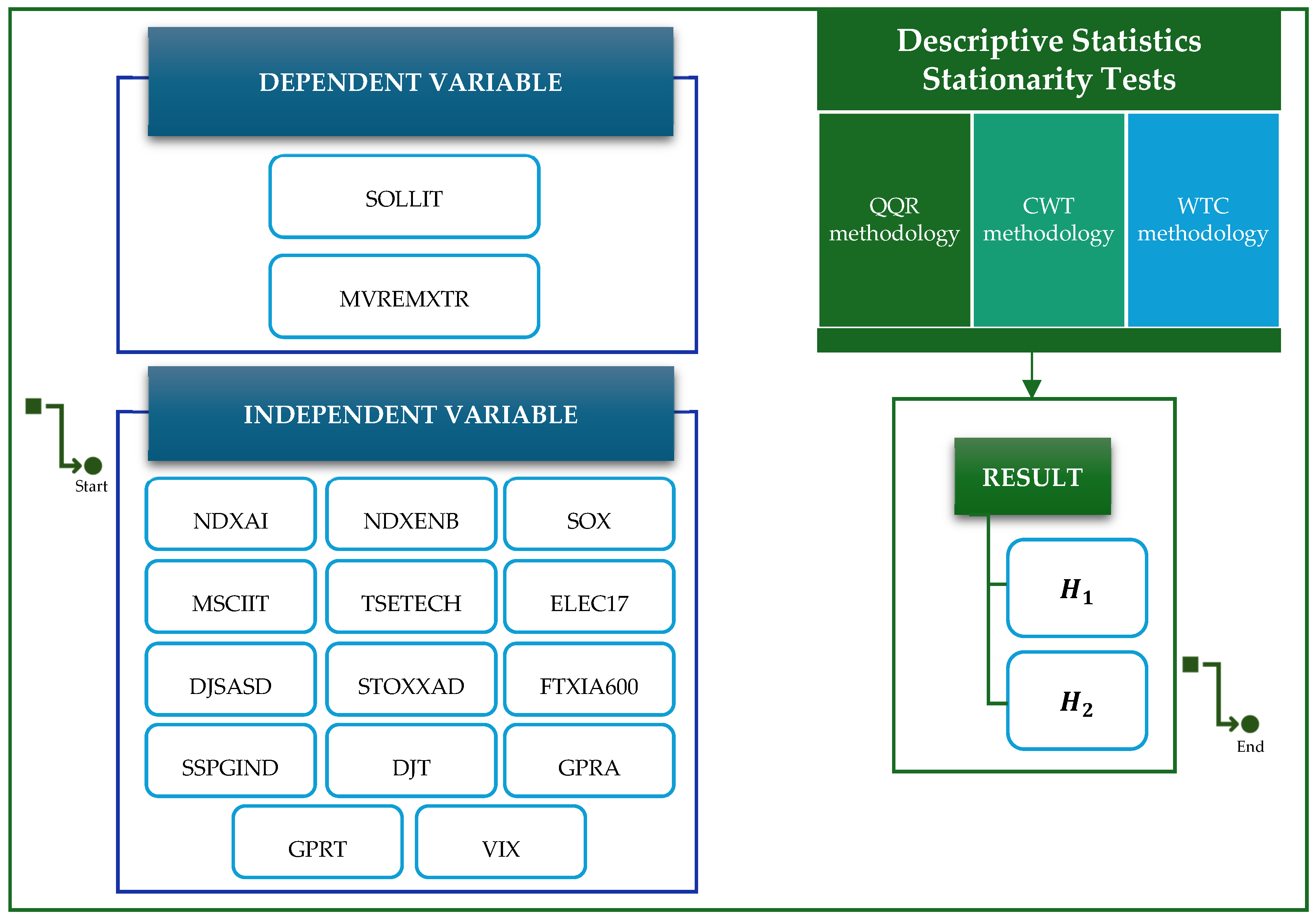

A detailed classification of all variables used in this research is presented in

Table 1, including their roles, sectoral relevance, and index categories.

Figure 1 illustrates the conceptual framework of the analysis, highlighting the variables used, the applied tests, and the methodological approach.

3.2. Methodology

To examine the mechanisms through which REE markets transmit volatility and uncertainty to structurally exposed sectors, this study adopts a dual methodological framework grounded in the theory of risk spillovers and transmission under nonlinear and non-stationary dynamics. Specifically, QQR and wavelet-based methods (WTC and CWT) are combined to capture asymmetric, regime-dependent, and time–frequency co-movements between rare earth indices and sectoral returns.

3.2.1. QQR Methodology

The QQR method is well suited for modeling the heterogeneous transmission of shocks across different segments of the return distribution, enabling researchers to explore how extreme movements in REE markets propagate to various quantile regimes of sectoral performance. This framework aligns with the literature emphasizing asymmetric shock diffusion and tail risk exposure in critical commodity-linked sectors. Following

Erdogan and Leirvik (

2025), who applied QQR to capture nonlinear effects of ERPU on mineral-driven renewable energy production, this study adopts the same approach to explore how geopolitical and financial uncertainty propagates through rare earth markets to critical downstream sectors.

The QQR model proposed by

Sim and Zhou (

2015) extends the classical quantile regression framework of

Koenker and Bassett (

1978) by estimating how the quantiles of REE returns affect the quantiles of sectoral returns. The relationship is specified as follows:

where Y

t denotes the sectoral return (dependent variable), X

t is the return of the REE index (independent variable), τ ∈ (0, 1) represents the quantile of the sectoral return, θ ∈ (0, 1) represents the quantile of the REE return, β(τ, θ) captures the sensitivity of the τ-th quantile of the dependent variable to the θ-th quantile of the independent variable.

The estimation is performed locally using a Gaussian kernel with a smoothing window, and the results are visualized through QQR 3D surface plots, which highlight asymmetries, extreme regimes, and bidirectional volatility transmission.

3.2.2. WTC Methodology

To capture the common dynamics between REE markets and the analyzed critical sectors, this study integrates two time–frequency domain methods: CWT and WTC. These methods allow for the investigation of nonlinear, nonstationary, and regime-dependent relationships, providing a robust framework for validating the results obtained from the QQR approach. Their use is motivated by recent studies examining the dynamic behavior of critical metals under heightened uncertainty (

Zhou et al., 2022;

Hanif et al., 2023).

From a theoretical standpoint, WTC is a powerful tool for examining systemic transmission under time-varying volatility regimes. In the context of REE-linked sectors, co-movements may be transient or persistent depending on the phase of the economic cycle or the level of geopolitical tension, making wavelet coherence a robust complement to quantile-based methods.

WTC measures the local coherence between two time series as a function of both frequency and time, providing a detailed representation of the common dynamics between REE markets and each analyzed sector. The wavelet coherence between x(t) and y(t) series is defined as follows:

where

and

are the wavelet transforms of the respective series,

is the cross-wavelet transform between the two series, s represents the scale (inversely related to frequency), and τ denotes the time dimension. The operator S(⋅) indicates a local smoothing function applied in both time and scale.

High values of indicate strong coherence between REE markets and the analyzed sector, signaling significant co-movement at the corresponding time scale. The direction of local causality is inferred from the phase difference of the transformation, which is graphically represented by arrows: rightward-pointing arrows indicate that REE markets lead, whereas leftward-pointing arrows suggest that the sector leads.

3.2.3. CWT Methodology

To reinforce the robustness of the results and isolate sector-specific volatility patterns, this study also employs CWT. Unlike WTC, which focuses on co-movements between series, CWT detects the frequency-dependent variation intensity within each series. This is particularly relevant from a risk transmission perspective, as periods of increased wavelet power in REE indices may coincide with heightened sensitivity in specific sectors, reflecting underlying contagion or synchronization mechanisms.

The definition of a time series x(t)’s continuous wavelet transform is as follows:

where ψ is the mother wavelet function (Morlet type), and ψ* is its complex conjugate.

According to

Daubechies (

1988) and

Mallat (

1989), a Morlet wavelet function is expressed as:

where ω

0 = 6 is the standard central (non-dimensional) frequency parameter. The relationship between scale s and Fourier frequency f is approximately inverse; for the Morlet wavelet a common approximation is

, which is often simplified in empirical applications to

for interpretive convenience (

Torrence & Compo, 1998).

For each time series, the wavelet power spectrum can be computed:

which indicates the intensity of variation over time and across different frequencies. Regions with high WPS values indicate amplified volatility or concentrated market movements, thereby providing additional confirmation or potential contradictions to the coherence patterns identified in the WTC analysis.

This combined approach is theoretically grounded in the need to model the nonlinear propagation of compound shocks (geopolitical, financial, and supply-driven) within interconnected systems. It aligns with the recent shift in the literature from mean-based dependency measures toward full-distributional and time–frequency spillover analysis, offering a more comprehensive framework for assessing sectoral vulnerability to REE-driven uncertainty (

Figure 2).

3.3. Descriptive Statistics

Descriptive statistics in

Table 2 provide strong evidence of non-normality, asymmetry, and fat-tailed distributions across both REE indices and sectoral equity returns, thereby justifying the adoption of nonlinear and quantile-based methodologies. Most sectoral indices record positive average returns, especially NDXAI, SOX, and NDXENB, whereas MVREMXTR displays a slightly negative mean, suggesting potential downside exposure. All return series exhibit negative skewness combined with excess kurtosis, indicating a high likelihood of extreme negative events and volatility clustering, particularly pronounced DJSASD, MSCIIT, and ELEC17. Geopolitical risk indices (GPRA, GPRT) and the financial risk proxy (VIX) show substantial positive skewness and extreme kurtosis, underscoring the presence of episodic risk spikes. Jarque–Bera tests confirm significant departures from normality (

p < 0.001), while elevated interquartile ranges, particularly for GPRT, SOX, and MVREMXTR further support the regime-dependent and heavy-tailed nature of the data.

The results in

Table 3 confirm that all series are stationary in levels, as evidenced by the Augmented Dickey–Fuller (ADF) (

Dickey & Fuller, 1979) and Phillips–Perron (PP) (

Phillips & Perron, 1988) tests, which consistently reject the null hypothesis of a unit root at the 1% significance level (

p < 0.001). Complementary evidence from the KPSS test (

Kwiatkowski et al., 1992), whose null hypothesis assumes stationarity, further supports this conclusion: for most variables, the KPSS statistics fall well below the 1% critical value. The only exceptions are GPRA and GPRT, which record marginally higher KPSS values, suggesting possible structural breaks or persistence in geopolitical risk dynamics. Nevertheless, both ADF and PP tests reject non-stationarity for these series, justifying their inclusion in the empirical framework. The convergence of evidence across ADF, PP, and KPSS diagnostics provides a robust statistical foundation for employing the quantile-based and time–frequency methods adopted in this study.

4. Results

4.1. QQR Results for SOLLIT

As reported in

Table A1 (

Appendix A), the quantile-specific coefficients for NDXAI and SOX reveal a regime-switching dependence, with the direction of impact varying according to REE market conditions. The QQR estimates in

Figure A1 (

Appendix B) indicate that the SOLLIT is characterized by strong, asymmetric, and regime-dependent sensitivity to exogenous uncertainty factors, particularly for the GPRA, GPRT, and VIX. This nonlinear pattern underscores the function of RRM markets as amplifiers of strategic risk, with pronounced effects in higher quantiles corresponding to crisis episodes or accelerated market expansion.

From an economic perspective, the impact of the GPRA is particularly pronounced. Realized geopolitical actions, such as export bans or military interventions, directly disrupt rare earth supply chains, provoking sharp price increases and speculative market behavior (

Seiler, 2024). In contrast, the GPRT exerts a more nuanced influence, shaping short-term market expectations without the persistence typically associated with materialized shocks. The QQR coefficients for the VIX and SOLLIT become significant under high-stress regimes, suggesting that rare earths function not as safe havens but rather as tactical hedges, which is consistent with the multiscale evidence reported by

Y. Gao and Liu (

2024). The pronounced effects of realized geopolitical actions, such as the 2022 Russia–Ukraine war shocks, are in line with

Khurshid et al. (

2023), confirming that materialized threats generate more persistent sectoral spillovers than perceived risks.

At the sectoral level, and in line with extended comparisons to previous studies (

Bouri et al., 2021;

B. Zheng et al., 2022) the SOLLIT emerges as a transmitter of systemic risk to multiple strategic domains. In the defense sector, pronounced co-movements in the upper quantiles underscore the sector’s critical dependence on rare earth inputs for advanced military systems, which is a pattern that intensifies during episodes of geopolitical conflict (

Yuan et al., 2024). The industrial and manufacturing segment exemplified by China’s FTXIA600 index displays a U-shaped dependence, reflecting vulnerabilities to both demand collapses and supply chain disruptions. Semiconductor and artificial intelligence indices exhibit positive responses to rare earth price shocks during phases of technological expansion, pointing to a demand-pull mechanism rooted in the strategic value of these inputs. The logistics market demonstrates contagion effects under compounded uncertainty that are consistent with second-order impacts arising from supply chain rigidities. Technology and electronics indices reveal more moderate co-movements generally concentrated in periods of market exuberance or acute global tensions.

4.2. QQR Results for MVREMXTR

The QQR estimates presented in

Figure A2 (

Appendix C) reveal pronounced nonlinear and asymmetric relationships between the MVREMXTR index and the sectoral benchmarks, indicating that the rare earth equity market operates simultaneously as a transmitter and amplifier of systemic risk, with its influence contingent on prevailing market regimes. Sectors linked to artificial intelligence displayed heterogeneous patterns of sensitivity. The NDXAI index exhibited strong negative dependence in extreme quantiles, particularly during the March 2020 market crash and the late 2021 energy price surge, highlighting its pronounced vulnerability to supply-side disruptions. This aligns with previous evidence that AI-intensive industries incur disproportionate operational risk when critical inputs, such as rare earth magnets, become scarce. In contrast, NDXENB demonstrated mild positive dependence around the median quantiles, suggesting that upstream enabling technologies maintain a comparatively greater degree of resilience to volatility in rare earth markets.

The SOX index exhibited a marked asymmetry, showing positive dependence under low MVREMXTR regimes and shifting to negative dependence during high-index regimes, underscoring the sector’s vulnerability to supply chain disruptions. The MSCIIT index followed a V-shaped pattern, indicating relative stability under normal market conditions but heightened fragility during extreme regimes (

Yen et al., 2023). In contrast, the TSETECH index revealed an upward-sloping dependence, a dynamic likely driven by its competitive advantage in vertically integrated manufacturing systems, which may enhance adaptability to fluctuations in rare earth market conditions.

The ELEC17 index mirrored the asymmetry observed in MSCIIT, maintaining relative stability under normal market conditions but exhibiting heightened sensitivity in extreme regimes. Defense-related sectors demonstrated more divergent patterns: the DJSASD index was adversely affected during high-risk regimes, whereas the STOXXAD index showed a mild positive dependence, potentially indicative of stronger hedging strategies or broader diversification of operational and supply chain risk.

The FTXIA600 index exhibited consistently positive dependence, underscoring its dual role as both a major producer and a primary beneficiary within rare earth pricing cycles. Similarly, the SPGIND and DJT indices registered strong positive dependence during expansionary regimes, consistent with the amplified economic momentum generated by the cyclical dynamics of the REE market.

Exogenous uncertainty factors reinforce these patterns. GPRA exhibited a negative association with MVREMXTR in the distribution tails, indicating that concrete geopolitical shocks exerted sustained downward pressure on rare earth equities. This effect was particularly evident during the 2019 U.S.–China trade tensions, when export control announcements triggered sharp equity sell-offs. The GPRT displayed a weak but positive influence around the median quantiles, suggesting that markets may incorporate moderate geopolitical threats into valuations without provoking systemic corrections. The VIX index demonstrated moderately positive dependence in high-uncertainty regimes, implying that rare earth equity markets provide only limited defensive capacity during episodes of elevated financial stress.

4.3. CWT Results for SOLLIT

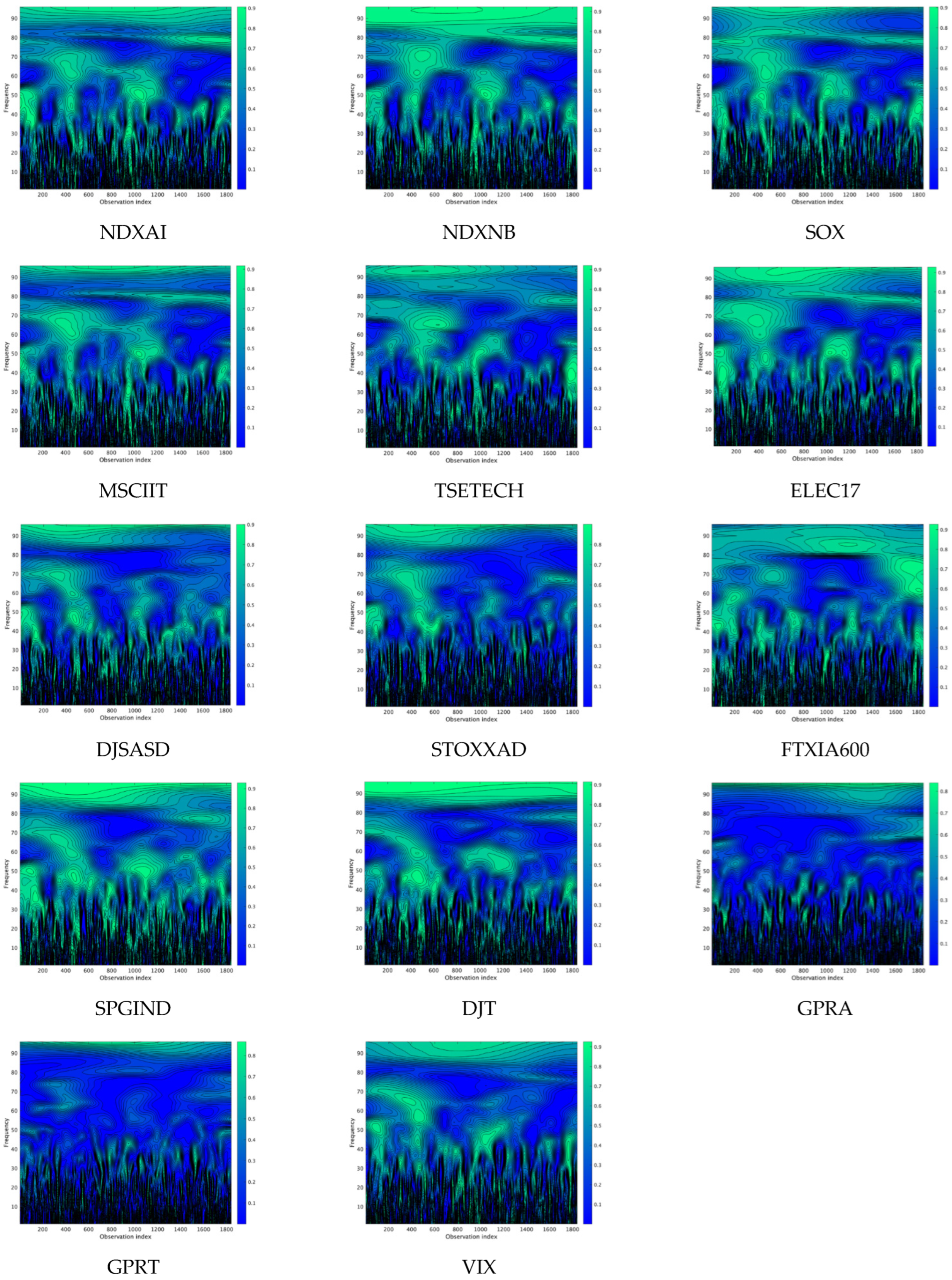

The CWT results presented in

Figure A3 (

Appendix D) complement the QQR findings by providing a spatiotemporal and directional view on the co-movements between the SOLLIT and key sectoral as well as uncertainty-related indices over 2018–2025. The coherence structure was predominantly concentrated in the low-frequency domain, indicating persistent, long-horizon linkages that strengthened during periods of heightened geopolitical and macroeconomic stress.

For the NDXAI and NDXENB, the co-movements with the SOLLIT intensified markedly during 2020–2023, with persistent coherence concentrated in the low-frequency domain. Phase arrows predominantly pointed to the right and downward, indicating a leading role for rare earth price dynamics in driving subsequent sectoral adjustments. Comparable patterns emerged for the SOX and MSCIIT indices, where phase relationships confirmed SOLLIT’s function as a transmitter of upstream cost shocks, particularly during the supply chain disruptions associated with the pandemic and the ensuing recovery period (

Pham & Hsu, 2025).

Regional technology indices (TSETECH, ELEC17) exhibited strong yet less stable coherence with the SOLLIT. For the TSETECH, phase arrows frequently indicated synchronous movements, reflecting parallel dynamics in rare earth pricing and regional technological activity. In contrast, the ELEC17 displayed episodes of inverse co-movement emerging after 2022, potentially associated with Japan’s import dependency and the implementation of diversification strategies.

Defense sector indices displayed diverging dynamics. The DJSASD recorded strong coherence during 2020–2022 in the low-frequencies domain, with phase arrows indicating SOLLIT as the leading variable, underscoring the sector’s sensitivity to raw material volatility under geopolitical escalation (

Hanif et al., 2023). Conversely, the STOXXAD maintained positive long-term coherence but with weaker phase directionality, potentially supported by EU-level coordination mechanisms on critical materials.

The FTXIA600 demonstrated robust and persistent coherence with the SOLLIT, predominantly in-phase, underscoring China’s dual role as both a supplier and industrial processor within the rare earth value chain. The DJT and SPGIND exhibited strengthened coherence after 2021, consistent with the surge in logistics demand and global reindustrialization trends. In both cases, bidirectional phase arrows pointed to a feedback loop between industrial momentum and rare earth market expectations.

Coherence with the exogenous uncertainty indices reveals temporally distinct regimes. The GPRA exhibited high coherence with the SOLLIT during crisis periods such as early 2020 and 2022, with unidirectional arrows pointing from GPRA to SOLLIT, indicating the causal influence of geopolitical shocks on rare earth pricing. The GPRT maintained low-frequency coherence with weaker phase directionality, consistent with anticipatory market adjustments. By contrast, the VIX index showed only moderate and episodic coherence—lacking persistence—reinforcing the interpretation that the MVREMXTR functions not as a conventional safe haven but as a context-dependent transmitter of systemic stress.

4.4. CWT Results for MVREMXTR

The WTC analysis provided in

Figure A4 (

Appendix E) complements the QQR findings by providing a detailed spatiotemporal and directional assessment of the co-movements between the MVREMXTR and key sectoral and uncertainty-related indices over the period 2018–2025. Consistent with previous studies on commodity–sector linkages (

Abbas et al., 2024), coherence patterns were predominantly concentrated in the low-frequency band, reflecting persistent long-term interdependencies that intensified during episodes of heightened geopolitical tensions and macroeconomic stress.

For the NDXAI and NDXENB indices, coherence with the MVREMXTR was markedly reinforced over the 2020–2023 interval, a period characterized by the joint effects of pandemic-related disruptions and intensifying strategic competition in technology and energy markets. The interactions were concentrated in the low-frequency range, with phase arrows predominantly oriented to the right and downward, indicating that rare earth price fluctuations tended to lead sectoral responses. This pattern reinforces the role of MVREMXTR as a leading indicator. Similar dynamics were observed for the SOX and MSCIIT indices, where the phase structure highlights the transmission of upstream cost shocks, particularly during the supply chain disturbances induced by the pandemic and the subsequent recovery phase.

Regional technology indices (TSETECH and ELEC17) also displayed strong, though less stable, coherence patterns. For the TSETECH, phase arrows frequently indicated synchronous co-movements with the MVREMXTR, consistent with the integration of Canadian technology manufacturing into global rare earth supply chains. In the case of the ELEC17, inverse co-movement episodes emerged after 2022, potentially reflecting Japan’s heightened vulnerability to rare earth import constraints and its parallel efforts to diversify sourcing strategies.

The defense sector indices reveal heterogeneous dynamics. The DJSASD recorded pronounced low-frequency coherence during 2020–2022, with phase arrows indicating that rare earth market fluctuations preceded adjustments in defense equities. This pattern underscores the sector’s heightened sensitivity to raw material volatility during periods of geopolitical escalation. Conversely, the STOXXAD maintained stable long-term coherence with comparatively weaker directional signals, potentially reflecting the stabilizing influence of EU-level frameworks on critical materials management and coordinated supply chain policies.

The FTXIA600 exhibited strong and persistent in-phase coherence, underscoring China’s strategic dual role as both a primary supplier and a downstream processor within the rare earth value chain. The DJT and SPGIND indices displayed reinforced coherence from 2021 onward, coinciding with heightened logistical demand and the broader momentum of global reindustrialization. In both cases, the bidirectional phase arrows indicate a feedback mechanism in which industrial expansion and rare earth market expectations mutually reinforce one another.

Coherence patterns with uncertainty indices confirm the presence of temporally segmented regimes. The GPRA showed high coherence with the MVREMXTR during crises, such as early 2020 and throughout 2022, with the arrows indicating that geopolitical shocks exerted a causal influence on rare earth pricing. Conversely, the GPRT displayed low-frequency coherence with weaker directionality, pointing to anticipatory behavior embedded in market expectations. The VIX index, meanwhile, exhibited only intermittent and moderate coherence, which suggests that the MVREMXTR does not behave as a conventional safe haven but rather acts as a responsive conduit for transmitting systemic stress.

4.5. WTC Results for SOLLIT

The WTC analysis presented in

Figure A5 (

Appendix F) indicates that the rare earth market, as captured by the SOLLIT index, maintains deep interconnections with multiple strategic global sectors, particularly during episodes of systemic crises and accelerated technological transitions. The most prominent coherence clusters are concentrated in the low-frequency domain (periods exceeding 32 weeks), reflecting persistent structural linkages underpinned by fundamental industrial dependencies. These linkages become particularly clear during the intervals 2020–2021 (COVID-19 pandemic), 2021–2022 (energy and raw materials crisis), and 2022–2023 (Russia–Ukraine conflict and escalating global trade tensions).

In the technology sector, indices linked to artificial intelligence and the semiconductor industry (NDXAI, SOX, MSCIIT) exhibited persistent and intense coherence with the SOLLIT at low frequencies, particularly in the post-pandemic period. This pattern reflects the structural dependence of these industries on rare earth supply chains, which are indispensable for the production of microchips, processors, and advanced technological components. The SOX index, in particular, demonstrated strong coherence from the second quarter of 2020 onward, underscoring the heightened vulnerability of semiconductor markets to fluctuations in critical raw material prices.

The MSCIIT and TSETECH exhibited strong long-term coherence with the SOLLIT, though the patterns varied regionally. In Japan, coherence remained stable over the 2019–2023 period, reflecting a structural alignment between rare earth price movements and the performance of the national technology sector. In contrast, coherence for emerging Asia was more intermittent but intensified during trade tension episodes, pointing to the region’s exposure to China’s export restriction policies.

Defense-related indices such as the DJSASD and STOXXAD showed persistent and pronounced coherence with the SOLLIT starting in 2021, supporting the hypothesis of structural dependence on critical raw materials amid increasing demand for advanced weapons systems, communication technologies, and autonomous platforms. The emergence of coherence clusters during the Russia–Ukraine conflict further highlights the strategic role of rare earths in sustaining and enhancing military production capabilities.

In the industrial and logistics domains (SPGIND, FTXIA600, DJT), the WTC analysis reveals strong and sustained coherence beginning in 2020. The FTXIA600 index, reflecting China’s industrial performance, maintained a stable and robust relationship with the SOLLIT, underscoring both China’s dominant position as a rare earth supplier and the deep integration of these materials in its domestic industrial processes. At the global level, coherence with the DJT transportation index highlights the sensitivity of international logistics systems to disruptions in the supply chains of critical resources.

4.6. WTC Results for MVREMXTR

The WTC analysis for the MVREMXTR index reveals a strong and persistent structure of interdependence with multiple critical sectors (

Figure A6,

Appendix G). These coherence structures are concentrated primarily in the low-frequency domain (above 32 weeks), reflecting long-term structural linkages that transcend short-term cyclical or context-specific fluctuations. The most prominent and extensive coherence clusters occurred during the COVID-19 pandemic (2020–2021) and the subsequent period of intensified geopolitical tensions over strategic resource supply chains (2022–2023), when global markets experienced compounded supply disruptions alongside heightened demand for strategic minerals.

In the technology sector, indices such as the NDXAI, SOX, and MSCIIT exhibited sustained and robust coherence with the MVREMXTR, reflecting a clear synchronization between rare earth market dynamics and the demand for emerging technologies, particularly those dependent on strategic inputs such as artificial intelligence, digital infrastructure, and advanced components. These findings align with prior studies showing that technological sectors experience heightened sensitivity to rare earth price shocks during global supply disruptions (

R. Zheng et al., 2025), reinforcing the notion of rare earths as the invisible infrastructure underpinning technological progress.

At the regional level, the TSETECH and MSCIIT underscore the deep integration of Asian value chains within global critical raw material cycles. Notably, Japan maintained a stable interdependence with the MVREMXTR throughout the sample period, which reflects not only its structural vulnerability to strategic imports but also its ongoing efforts to diversify supply sources and enhance technological autonomy. This observation is consistent with previous evidence on Japan’s policy-driven investment in rare earth recycling and supply chain resilience following the 2010 China export restrictions (

WEF, 2023).

The DJSASD and STOXXAD indices showed visible coherence with the MVREMXTR starting in 2021, aligning with a shift in public policy toward strengthening strategic security capabilities. This suggests that the market increasingly recognizes rare earths as critical inputs for advanced military equipment, anticipating sustained demand over the medium and long term.

In the industrial and logistics domains, indices such as the SPGIND, FTXIA600, and DJT exhibited significant and persistent coherence with the MVREMXTR. The FTXIA600 index, which reflects Chinese industrial performance, reveals particularly strong linkages, underscoring the mutual dependence between domestic industrial activity and the dynamics of the local rare earth market. These connections intensified during China’s COVID-19 lockdowns (2020–2022), consistent with broader evidence on pandemic-induced vulnerabilities in strategic mineral supply chains (

Giese, 2022). Coherence with the DJT global transportation index further highlights the transmission of volatility along the rare earth supply chain into international logistics capacity, especially during episodes of trade tensions or maritime disruptions.

Overall, the results validate the systemic role of the MVREMXTR, similar to the SOLLIT, as a key indicator for global critical markets. The low-frequency coherence patterns not only reflect the structural dependence on rare earths but also illustrate the deep embedding of these resources in the financial architecture of high-tech sectors. These results corroborate earlier research, which emphasized that rare earth market volatility serves as a transmission channel for geopolitical and financial risks to multiple strategic sectors (

Humphries, 2023).

In light of these results, Hypothesis H1 is supported, confirming that the relationship between uncertainty (both financial and geopolitical) and rare earth markets is regime-dependent and asymmetric, with amplified effects under extreme conditions. Likewise, Hypothesis H2 is validated, with varying levels of connectivity observed between REE indices and critical sectors (technology, defense, logistics, and advanced industry), conditional on systemic stress levels and the intensity of exogenous shocks.

5. Discussion

Our results confirm and extend the current body of research on the role of REE markets in propagating systemic risks under conditions of extreme uncertainty. Both the QQR and wavelet-based methods (CWT and WCO) indicate that REE markets, as captured by the SOLLIT and MVREMXTR indices, act as active transmitters of volatility to critical sectors (technology, defense, CE, and logistics) but also as recipients of shocks within specific quantile regimes. Consistent with the findings of

Bouri et al. (

2021), REE markets respond asymmetrically and in a regime-dependent manner to shocks originating from critical industries, thereby validating the bidirectional nature of the relationship. These findings complement the results of

Depraiter and Goutte (

2025), who demonstrated that geopolitical risk amplifies the volatility of CE markets through rare earth dependencies. By extending the analysis to sectoral indices beyond CE, our study broadens the understanding of rare earths as a systemic transmission channel under compounded geopolitical and financial uncertainty. In doing so, it addresses a research gap noted in the prior literature regarding the cross-sectoral propagation of risk, thereby providing empirical evidence that rare earth markets are not merely sector-specific influencers but are integral components of the broader financial contagion network. However, unlike previous approaches, the methods employed in this study allow us to highlight that this asymmetry is jointly conditioned by the quantile distribution of both variables involved. Consequently, during high-volatility regimes, REE markets predominantly act as transmission vectors, amplifying uncertainty across sectors highly dependent on critical inputs.

The CWT results support the hypothesis of unstable regimes and recurrent periods of elevated co-volatility between REE markets and critical sectors, particularly during the COVID-19 pandemic, the global energy crisis, and the Russia–Ukraine conflict. These episodes generate pronounced spectral coherences at low and medium frequencies, indicating that volatility transmissions are not short-lived but instead persist over extended horizons. This finding is consistent with the systemic perspective advanced by

Considine et al. (

2023) and with the empirical evidence of

Song et al. (

2021), which demonstrated that REE markets become increasingly interconnected and sensitive to global shocks during periods of crisis. The persistence of these linkages suggests that effective policy interventions or market adjustments may require longer time frames to mitigate cross-sectoral volatility spillovers. In this context, REE markets operate as “volatility nodes” within global financial networks, a role that elevates them from the status of industrial inputs to that of systemic transmitters of risk. This reinforces the argument that REE markets warrant monitoring not only for supply chain stability but also for their broader implications for global financial resilience.

Moreover, the WCO analysis reveals that the SOLLIT index exhibits strong structural coherence with the semiconductor, AI, defense, heavy industry, and logistics sectors. The frequent directionality from REE markets toward these sectors suggests an anticipatory and catalytic function of REEs in the transmission of shocks. This finding confirms and extends the results of

Z.-Z. Li et al. (

2023) on the bidirectional nature of the REE–GPR relationship while adding a detailed sectoral dimension. In particular, the observed lead–lag dynamics imply that REE price movements can serve as early indicators of stress in technology-intensive and defense-related industries, thereby offering predictive insights for market participants and policymakers. The long-term coherence observed between the SOLLIT and indices such as SOX or DJT, for instance, indicates a structural alignment between the prices of critical inputs and the performance of frontier sectors, suggesting that such linkages may reflect deeper technological and supply chain interdependencies that remain robust even during non-crisis periods.

From a different perspective, the MVREMXTR index exhibits heightened sensitivity to geopolitical (GPRA, GPRT) and financial (VIX) risks, particularly under tail-risk regimes. The QQR results reveal amplified reactions during periods of extreme volatility, with both the magnitude and direction of responses varying across quantile regimes. Shock transmission is selective, with stronger spillovers toward sectors heavily dependent on supply chains, such as advanced industry, transport, and logistics. This pattern is consistent with

Ul Haq et al. (

2022), who demonstrated that REE-related risk transmission is heterogeneous and shaped by the regional specificity of industrial dependence. Accordingly, market vulnerability appears not to be uniformly distributed but rather conditioned by structural dependencies and the nature of the triggering shock.

According to

Kamal and Bouri (

2023), REEs can serve as a stabilizing buffer in the relationship between clean energy (CE) and global equities. Our results only partially support this view. Under conditions of low to moderate uncertainty, REEs may absorb part of the shocks; however, in high-volatility regimes (upper quantiles), they transition into net exporters of risk, particularly toward energy-related ETFs and industrial equities. This asymmetry underscores the regime-dependent nature of REE dynamics and aligns with prior evidence that commodity markets can alternate between hedging and amplifying roles depending on market stress levels. Moreover, it suggests that portfolio strategies incorporating REEs as safe haven assets must explicitly account for volatility thresholds beyond which their protective function deteriorates. This dual behavior reinforces the notion that the role of REEs is not static but is conditioned by both the nature of the shock and the broader macro-financial environment.

This regime-dependent dynamic is also confirmed by

Y. Gao and Liu (

2024), who provided a multi-sectoral perspective on rare earth market connectivity. In line with our findings, the authors highlighted that REEs function as net recipients of risks originating from CE, ESG, and base metals, particularly during periods of systemic stress. Their use of a mixed-frequency framework further substantiates our evidence of asymmetric transmission patterns across short- and long-term horizons, reinforcing the notion that REE market behavior cannot be fully captured through single-frequency models. Thus, rare earths are reaffirmed as critical nodes within global volatility networks, a role that not only shapes intersectoral financial linkages but also carries strategic implications for industrial policy design and economic security frameworks.

Moreover, our evidence on high-volatility regimes and tail-risk transmission aligns with the findings of

Jiang et al. (

2025), who demonstrated that the positive correlations between oil and rare earth prices are inherently unstable and regime-dependent, becoming statistically significant only over long horizons and in periods of elevated geopolitical uncertainty. This supports our interpretation that REE markets are less responsive to short-term energy shocks and more sensitive to structural drivers such as technological demand and geopolitical risk, thereby reaffirming their strategic significance and role in transmitting volatility through persistent channels. Accordingly, our results extend previous studies by showing that the role of REE markets is dynamic, regime-dependent, and heterogeneous, shaped by the underlying source of uncertainty (GPR versus VIX), the nature of the index (price-based versus company-based), and the temporal frequency of analysis.

Overall, our findings support the view that REEs are not merely industrial inputs but also operate as systemic catalysts in the transmission and reconfiguration of economic and financial risks. This underscores the importance of integrating critical commodity risk into economic governance models, portfolio management strategies, and industrial policy frameworks. Moreover, differentiating between distinct categories of risk and identifying vulnerability regimes across the quantile distribution can provide a more precise basis for strategies aimed at diversification, strategic stockpiling, and the safeguarding of global supply chains.

6. Conclusions

This study examined how REE markets interact with critical sectors of the real economy under the influence of geopolitical, financial, and cyber risks. Through an integrated methodological approach, combining QQR with frequency domain tools, the analysis highlights the regime-dependent, asymmetric, and nonlinear nature of these relationships. The analysis employed two complementary perspectives on REEs, reflected by the SOLLIT index and MVREMXTR, in relation to thematic markets such as defense, CE, artificial intelligence, semiconductors, and logistics.

The results validate the hypothesis that REEs function simultaneously as transmitters and receivers of shocks, considering the uncertainty regime and the nature of the connected assets. Extreme volatility regimes intensify interdependencies and sectoral co-volatility. In this context, REEs take on a systemic role, capable of amplifying instability during crises but also providing relative absorption in more stable periods. This dynamic supports the inclusion of REEs in extended models of global risk management.

From a methodological perspective, integrating QQR with wavelet analysis enables a dual examination of REE–sector connectivity across both quantile and temporal dimensions, providing greater granularity than linear or static approaches. This combined framework makes it possible to detect quantile-specific vulnerability regimes and recurrent episodes of structural coherence between REEs and the sectors they influence.

At the sectoral level, the defense, AI, and logistics markets exhibit pronounced sensitivity to shocks transmitted via REEs, particularly in low-frequency regimes. In contrast, the CE sector demonstrates more variable behavior and occasionally functions as a shock absorber, suggesting potential for repositioning within global value chains.

The main insights emerging from this study are threefold. First, the analysis highlights the dual role of REEs within the architecture of global systemic risks. Second, it proposes a robust methodological combination capable of capturing both intersectoral coherence and the nonlinear character of these links. Third, it offers actionable insights for public and private decision makers in developing strategies for supply chain security, resource diversification, and strategic stockpiling.

This research has several limitations. First, it does not provide a granular geographical breakdown of REE–sector linkages, which could mask regional heterogeneity. Second, explicit political or trade-related variables were excluded from the modeling framework, potentially overlooking relevant drivers of market connectivity. Third, REEs were analyzed as an aggregated group, without differentiating between individual metals, their distinct market structures, or the effects of region-specific industrial policies. Finally, while the methodology captures dynamic associations, it does not establish definitive causal relationships.

Future investigations could address these limitations by incorporating detailed geographical segmentation and sector-specific trade or policy variables. Disaggregating REEs into individual elements and exploring their heterogeneous responses to shocks would enrich the analysis. Expanding the framework to include complementary commodities, such as transition metals or heavy rare earth elements, may help in identifying broader patterns of systemic risk transmission. Moreover, integrating cyber risk into a composite uncertainty index could strengthen the multi-risk perspective. Finally, examining post-crisis adjustments; the effects of reshoring, subsidies, and regulatory changes; and the combined impact of ecological and digital transitions would provide a deeper understanding of the systemic exposure and resilience mechanisms linked to these critical resources.