1. Introduction

Growing attention to the problem of climate change is moving the traditional economy to a low-carbon economy based on energy sources producing low levels of greenhouse gas emission. According to the United Nations, ‘To preserve a liveable climate, greenhouse-gas emissions must be reduced to net zero by 2050’.

1 Governments and businesses need to take bold, fast, and wide-ranging action to promote a low-carbon world. Such actions also require the participation of individuals. Everyone can act to limit global warming, as stated by the United Nations. Actions in Europe include, for example, EUR 40 billion from the European Regional Development Fund (ERDF) and Cohesion Fund being invested in the low-carbon economy during 2014–2020. The EU Cohesion Policy plays a vital role in supporting the EU’s transition to a low-carbon economy and helps handle the challenges of climate change.

2 In addition, global clean energy investment exceeded USD 300 billion in 2018, according to a report by Bloomberg.

3 Stock markets have also added green indexes, e.g., the Euronext exchange has added a list of green indexes, such as Euronext Climate Europe index (climate index), the Low-Carbon 100 Europe PAB Index (low-carbon index), and the Euronext Eurozone ESG large 80 index.

During the stage of the transition economy—from a traditional economy to a low-carbon economy—high-carbon industries must be reduced while low-carbon industries should be expanded. That is, the demand for crude oil products must decrease, leading to a reduction in oil prices. In such periods, it is crucial that policy interventions asymmetrically support green industries to enhance their profitability and competitiveness. Therefore, analyzing the interactions between energy stock returns, oil prices, and the performance of climate and low-carbon indices during oil price declines is essential. A better understanding of these relationships can help policymakers design effective strategies to foster environmentally sustainable businesses and accelerate progress toward a low-carbon economy.

This research, therefore, investigates the relationship between oil prices, returns on the energy company stock (EQNR) and the energy index, and returns on the climate index and the low-carbon index (green stocks) during the oil price crisis of 2014–2017 by testing the causal and contemporaneous relationships between them.

The main empirical results suggest a bidirectional positive contemporaneous relationship between oil prices and green stock returns, although no significant causal relationship is detected between them. Similarly, energy stocks and green stocks exhibit a bidirectional positive contemporaneous relationship, but no significant bidirectional causality is observed. However, when causality is examined, one-period lag green stock returns positively affect energy stock returns. The findings reveal a strong contemporaneous dependence of both oil prices and energy stocks on green stocks; however, the causal relationships among them are weak or largely absent. The results also suggest that oil prices and energy stocks exert a greater influence in contemporaneous relationships than in causal ones. Moreover, green stocks appear to exhibit a stronger positive association with energy stocks than with oil prices.

The structure of this paper is as follows.

Section 2 presents a review of the relevant literature.

Section 3 describes the dataset, variables, and methodology.

Section 4 reports the empirical results, followed by a discussion of their implications. Finally,

Section 5 provides a summary and concluding remarks.

2. Literature Review

This section briefly reviews the literature related to the relationship between crude oil prices and green stocks.

Some research documents a relationship between oil prices and clean energy stocks, but others suggest that there is no relationship between them. The findings on the relationship between oil prices and clean energy stocks do not establish a consensus, suggesting a negative relationship, a positive relationship, and a dynamic relationship (see

Bondia et al., 2016;

Dinh, 2025;

Dutta et al., 2020b;

Geng et al., 2021;

He et al., 2021;

Henriques & Sadorsky, 2008;

Kumar et al., 2012;

Maghyereh et al., 2019;

Managi & Okimoto, 2013;

Pham, 2019;

Reboredo et al., 2017;

Zhang et al., 2020).

He et al. (

2021) investigate the linkage between clean energy stocks, oil prices, and financial stress. Using the quantile autoregressive distributed lag method, they suggest that changes in oil prices positively impact clean energy stocks in the long run, as well as establishing a positive connection between them in the short run.

Managi and Okimoto (

2013) investigate the relationship between oil, clean energy stocks, and technology stock prices. They find a positive relationship between the prices of oil and clean energy stocks.

Dutta et al. (

2020a) examine the effect of energy-sector volatility on clean energy. Using the regime switching method, they find that there is a negative effect between them, and changes in energy-sector volatility affect the realized volatility of clean energy.

Pham (

2019) investigates the relationship between oil prices and clean energy stocks. The author suggests that the relationship varies largely across clean energy stock sub-sectors.

Geng et al. (

2021) examine changes in oil prices impacting the stock returns of clean energy companies. Their main findings are that ‘oil returns act as a net information receiver in the oil-clean energy nexus system and Crude oil and clean energy return system shows a dynamic high integrated degree’.

Zhang et al. (

2020) investigate the effect of oil price shocks on clean energy stocks. Using wavelet-based quantile-on-quantile and Granger causality-in-quantiles approaches, they show that the impacts of oil price shocks on clean energy stocks vary across quantiles and investment horizons.

Henriques and Sadorsky (

2008) study oil prices and the stock prices of alternative energy companies. Using a vector autoregression (VAR) model, they find that technology stock prices and oil prices each individually Granger-cause the alternative energy companies’ stock prices.

Bondia et al. (

2016) examine the cointegration between stock prices of alternative energy companies and oil prices. They find that the stock prices of alternative energy companies are affected by oil prices in the short run by using threshold cointegration tests.

Maghyereh et al. (

2019) study the co-movement between oil and clean energy stocks. Using a combination of wavelets across various time scales and multivariate GARCH (MGARCH), they find that ‘significant bidirectional return and risk transfer from oil and technology to the clean energy market’.

Kumar et al. (

2012) study stock prices of clean energy firms, and the oil and carbon market using a vector autoregressive (VAR) analysis. Their main results suggest that past movements in oil prices, stock prices of high technology firms and interest rates explain the movements of clean energy stocks, but they do not find a relationship between carbon prices and the firms’ stock prices.

Reboredo et al. (

2017) study the co-movement and causality between oil and renewable energy stock prices using continuous wavelets as well as linear and nonlinear Granger causality methods. Their main findings are nonlinear causality at higher frequencies and linear causality at lower frequencies.

Dinh (

2025) investigates the contemporaneous relationship between oil prices, oil volatility, and two alternative energy sub-sectors: renewable energy equipment and alternative fuels, by applying the OLS method. The author finds a bidirectional relationship between them.

Other studies suggest that there is no relationship between oil prices and clean stocks (see

Dutta et al., 2020b;

Sadorsky, 2012).

Dutta et al. (

2020b) investigate a connection between green investments and oil prices. Using the Markov regime-switching regression method, they find that green assets are more susceptible to oil market volatility than to fluctuations in oil prices.

Sadorsky (

2012) applies multivariate GARCH models to analyze the volatility spillovers between oil prices and the stock prices of clean energy companies and technology companies. The main results suggest that the clean energy companies’ stock prices correlate more highly with technology stock prices than with oil prices.

Gordo et al. (

2024) analyze the relationship between renewable energy and monetary policy using EU data by applying the VAR approach. They confirm that monetary policy has a limited effect on the renewable energy sector.

While previous research has primarily focused on the relationship between oil prices and green stocks in general, relatively little attention has been given to this relationship during periods of oil price crises. This paper addresses that gap by investigating the relationship between oil prices and the returns of climate and low-carbon stocks specifically during such crisis periods. The focus on oil price crises is motivated by the expectation that, in the transition to a low-carbon economy, oil prices will decline. Understanding this dynamic is critical, as falling oil prices may characterize both the transition phase and the long-term outlook.

3. Data Description, Variables and Methodology

3.1. Data Description, Variables

Daily price data is used for energy stocks, including energy company stock (Equinor_ EQNR) and energy index, as well as for the Low-Carbon 100 Europe PAD Index (low-carbon index), the Euronext Climate Europe Index (climate index), and oil prices. These stocks and indices are listed on the Euronext Stock Exchange, while oil prices are Europe Brent Spot prices FOB, obtained from Nasdaq Data.

The energy index contains all eligible stocks from oil, gas, and coal sectors. Equinor (EQNR), an energy company stock included in the index, is chosen because it has the largest market capitalization among energy producers listed on the Euronext Stock Exchange. The company operates in around 30 countries worldwide and has more than 45 years of experience in oil and gas production on the Norwegian Continental Shelf.

The energy index and EQNR stock are considered carbon emission stocks because the use of crude oil products, gas, and coal, as well as human activities, such as mining and drilling, generate greenhouse gas emissions, including carbon dioxide and methane.

The Low-Carbon 100 Europe PAD index (low-carbon index) is defined by Euronext as ‘an index which reflects the performance of companies in the Euronext Europe 500 index that have the relative best climate score and the highest Free Float Market Capitalization’. According to the index rule book (

Euronext, 2022), the low-carbon index targets a ‘fixed number of constituents after a stringent exclusion process and with a climate best-in-class approach’. The target number of companies is 100, including green companies and non-green companies. Among them is a green pocket composed of green companies, which should have ‘at least 50% of their turnover related to low-carbon technologies (renewable or energy efficiency)’. The best-in-class approach is a process of selection of non-green companies based on climate score. The lower the climate score, the higher a stock ranks. Companies not classified as green are labeled as non-green. This label serves only for classification purposes and does not indicate the degree of a company’s environmental involvement. The Euronext Climate Europe Index (or climate index) consists of all stocks from the three climate indexes, such as Euronext Climate Europe, Euronext Climate Europe NR, and Euronext Climate Europe GR. Euronext calculates climate scores for the companies ranked from the best to the worst climate scores, and the selection process enables us to obtain at least 200 companies from the 500.

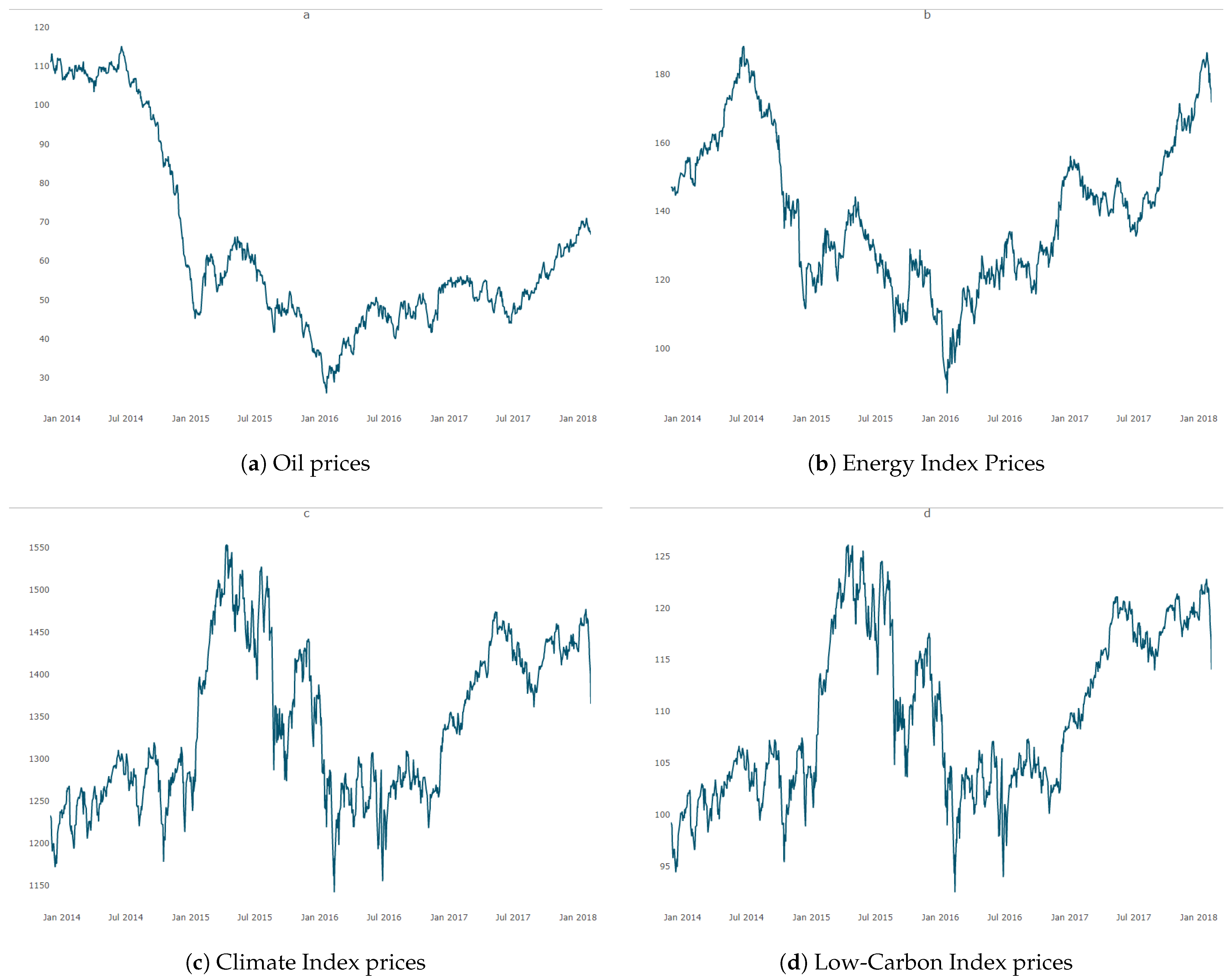

All daily price data for EQNR, the energy index, the low-carbon index, and the climate index from November 2013 to February 2018 are obtained from Euronext. Daily oil prices for the same period are collected from Nasdaq. Data of all prices is presented in

Figure 1.

We choose two energy stocks, EQNR and the energy index, and two green stocks, the low-carbon index and the climate index, because using two different energy stocks and two different green stocks strengthens the analysis of the relationship between oil prices, energy stock returns, and green stock returns.

The research examines the relationship between energy stock returns, oil prices, and returns on the low-carbon index and the climate index during the oil price crisis of 2014–2017. The daily price data are therefore collected from November 2013 to February 2018 covering the entire period of the oil price crisis. The decision to focus on this specific period is motivated by the theoretical expectation that a transition to a low-carbon economy necessitates a significant expansion of low-carbon industries and a corresponding decline in high-carbon sectors (see

Semieniuk et al., 2021). In this scenario, reduced demand for fossil fuels would be expected to exert downward pressure on oil prices. The period from 2014 to 2017 is particularly relevant in this context, as it was marked by a sharp and sustained decline in oil prices. The crisis was unique among oil price crises in recent decades, as the decline occurred rapidly, which was not expected to reverse in the short term and ultimately persisted over an extended period. In contrast to the 2008–2009 downturn, which was closely linked to the global financial crisis, this crisis was not accompanied by other major global shocks. As a result, its economic impact on oil-exporting countries can be more directly attributed to oil market dynamics rather than broader macroeconomic disturbances (

Francesco et al., 2024).

Variables are calculated as below.

Change in oil price:

where

is the change in oil price.

Returns of stocks:

where

is the returns on energy company stock (EQNR).

is the returns on energy index.

is the returns on low-carbon.

is the returns on climate index.

Table 1 presents the summary statistics of all variables.

Energy stock returns (i.e., the return on energy company stock (EQNR) and the return on energy index), green stock returns (i.e., the return on low-carbon index and the return on climate index), and oil prices are tested for stationarity, using the Dickey–Fuller unit root test to avoid issues related to spurious regression. The tests, presented in

Table 2, confirm that all the series are stationary.

3.2. Methodology

This research investigates the relationship between energy stock returns, greens stock returns, and oil prices during the oil price crisis. The research focuses on two types of relationships: causal and contemporaneous.

For the causal relationship, a vector autoregressive (VAR) model is employed, while for the contemporaneous relationship, ordinary least squares (OLS) regression is used. The VAR method is chosen for causal analysis because it has been widely applied in testing the relationship between oil prices and stock markets (see

Bernanke et al., 1997;

Henriques & Sadorsky, 2008;

Kang et al., 2016,

2015;

Kumar et al., 2012;

Roger et al., 1996;

Sadorsky, 1999), and the OLS method for contemporaneous analysis is employed by

Dinh (

2025).

3.2.1. Causal Relationship Models

We use VAR system models to address the causal relationship between oil prices, returns on EQNR, returns on the energy index (Energyindex), returns on the low-carbon index (LowCarbonIndex), and returns on the climate index (ClimateIndex).

Due to the high correlations observed, 0.961 between the return on EQNR and the return on Energyindex, and 0.987 between the return on LowCarbonIndex and the return on ClimateIndex, as shown in

Table 3, we estimate six separate VAR models. These models treat EQNR and the Energy Index, as well as the Low-Carbon Index and the Climate Index, separately to avoid multicollinearity when examining causal relationships, as detailed below.

We divide the six VAR systems into two parts: (a) the relationship between oil prices, energy stock returns, and the return on low-carbon index, including VAR systems 1, 2, and 3, referred to as the causal relationship models with the return on low-carbon index, and (b) the relationship between oil prices, energy stock returns, and the return on climate index, including VAR systems 4, 5, and 6, referred to as the causal relationship models with the return on climate index.

We use the Akaike Information Criterion (AIC) to choose the optimal number of lags for each VAR system. VAR systems 1, 2, 4 and 5 are suggested to have two lags, and VAR systems 3 and 6 are suggested to have one lag.

The general VAR system for two lags is written as below:

The general VAR system for one lag:

where A and B are vectors of variables.

is the vector of intercepts.

is the coefficient matrix.

is the vector of error terms.

Causal relationship models with the return on low-carbon index:

VAR system 1 with endogenous variables: The return on energy company stock (R_EQNR), oil prices (D_oilprice), and the return on low-carbon index (R_LowCarbonIndex). Two optimal lags are suggested by AIC.

VAR system 2 with endogenous variables: The return on energy index (R_Energyindex), oil prices (D_oilprice), and the return on low-carbon index (R_LowCarbonIndex). Two optimal lags are suggested by AIC.

VAR system 3 with endogenous variables: Oil prices (D_oilprice) and the return on low-carbon index (R_LowCarbonIndex). One optimal lag is suggested by AIC.

Causal relationship models with the returns on climate index:

VAR system 4 with endogenous variables: The return on energy company stock (R_EQNR), oil prices (D_oilprice), and the return on climate index (R_ClimateIndex). Two optimal lags are suggested by AIC.

VAR system 5 with endogenous variables: The return on energy index (R_Energyindex), oil prices (D_oilprice), and the return on climate index (R_ClimateIndex). Two optimal lags are suggested by AIC.

VAR system 6 with endogenous variables: Oil prices (D_oilprice) and the return on climate index (R_ClimateIndex). One optimal lag is suggested by AIC.

3.2.2. Contemporaneous Relationship Models

For the contemporaneous relationship, 12 linear regression models are estimated and divided into two groups: (a) models with the return on low-carbon index, and (b) models with the return on climate index.

Contemporaneous relationship models with the return on low-carbon index:

Six linear regression models examine the contemporaneous relationship between oil prices, energy stock returns, and the return on low-carbon index, as below:

Contemporaneous relationship models with the return on climate index:

Six linear regression models examine the contemporaneous relationship between oil prices, energy stock returns, and return on climate index, as below:

Running the six VAR systems and 12 linear regressions will strengthen the analysis of relationship between the returns on energy company stock (EQNR) and energy index, oil prices and the returns on low-carbon index and climate index in this research.

4. Empirical Results

4.1. Causal Relationship Results

In this section, we investigate the causal relationships between oil prices, energy stocks returns, and green stock returns. We employ six VAR systems, divided into two groups: (a) the relationship between oil prices, energy stock returns, and the return on low-carbon index, and (b) the relationship between oil prices, energy stock returns, and the return on climate index.

The empirical results of the causal relationship are presented in

Table 4 and

Table 5.

Table 4 shows the causal relationship between oil prices, energy stock returns, and the return on low-carbon index, including VAR systems 1, 2, and 3.

Table 5 shows the causal relationship between oil prices, energy stock returns, and the return on climate index, including VAR systems 4, 5, and 6.

The VAR systems are also tested for serial correlation using the Portmanteau test. The results indicate that the VARs do not exhibit any issues with serial correlation.

In

Table 4 and

Table 5, Equations (1) of VAR systems 1, 2, 4, and 5 show that the lag-1 returns of low-carbon index and climate index have a positive relationship with the returns on EQNR and energy index at the significance levels of 5% and 1%, respectively. This indicates that energy stock returns are positively impacted by one lag returns of the green stocks. In addition, lag-1 oil prices positively affect the energy stock returns at the 1% significance level.

Equations (2) of VAR systems 1, 2, 4, and 5 show that the lag-1 and lag-2 returns of green stocks have no significant relationship with oil prices, whereas lag-2 returns of energy stocks do. Specifically, lag-2 returns on EQNR and energy index negatively affect oil prices at the significance levels of 1% and 5%, respectively.

Equations (3) of VAR systems 1, 2, 4, and 5 show there is no significant causal relationship between oil prices, energy stock returns, and green stock returns.

Equations (1) and (2) of VAR systems 3 and 6 show that there is no bidirectional causal relationship between oil prices and green stock returns. This indicates that the lag-1 returns of green returns do not affect oil prices, and the lag-1 oil prices do not impact current green stock returns.

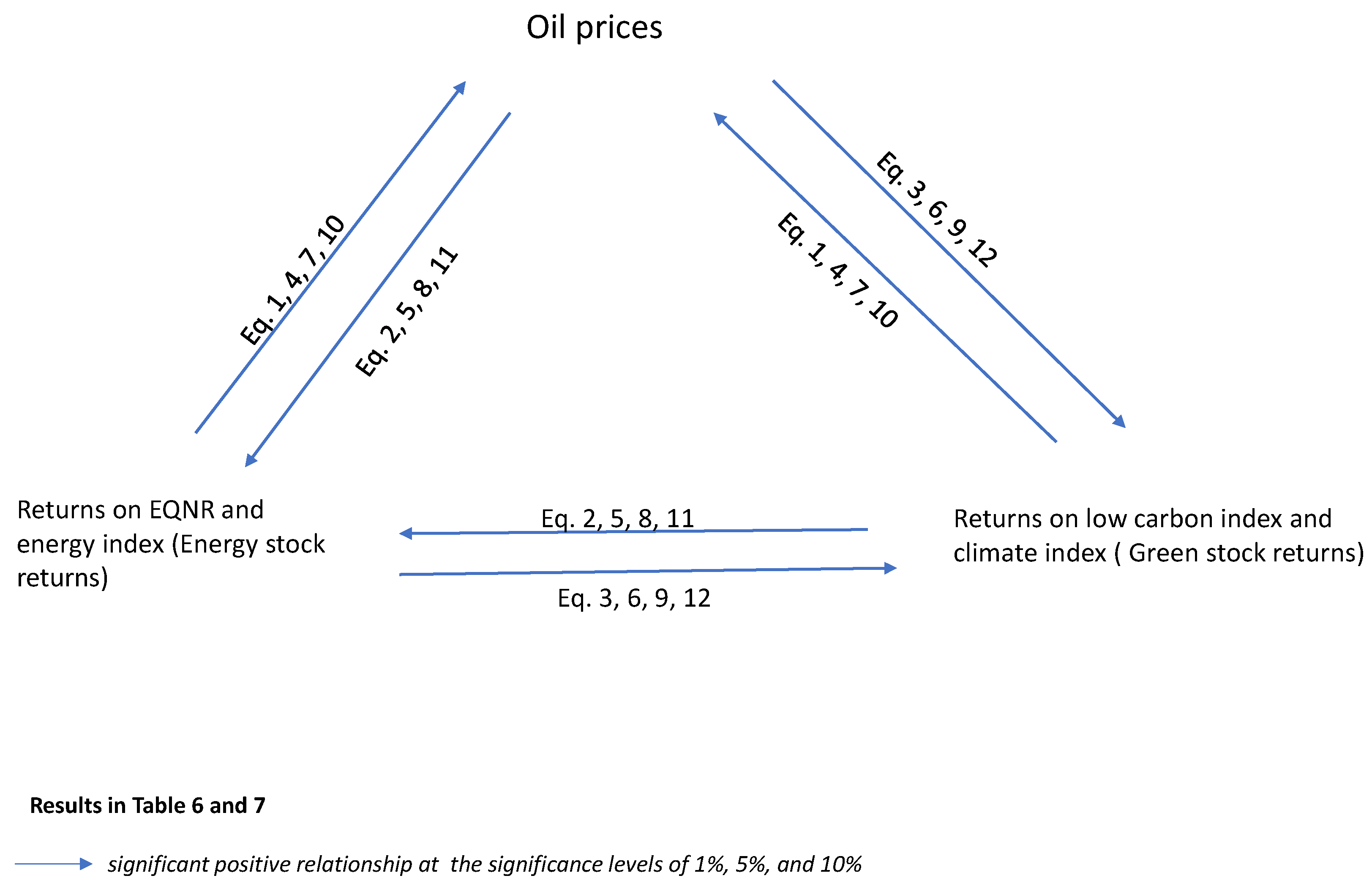

In short, oil prices have no causal relationship with green stock returns, but with energy stock returns. Green stock returns have a causal relationship with energy stock returns but not with oil prices. Energy stock returns have a causal relationship with oil prices but not with green stock returns.

The causal relationship between oil prices, energy stock returns, and green stock returns can be also illustrated in

Figure 2.

4.2. Contemporaneous Relationship Results

In this section, we examine the contemporaneous relationships between energy stock returns, oil prices, and green stock returns, including two parts: (a) the contemporaneous relationships between energy stock returns, oil prices, and the low-carbon index returns, and (b) the contemporaneous relationships between energy stock returns, oil prices, and the climate index returns.

We employ 12 linear regressions, as described in the subsection of contemporaneous relationship models, and use the ordinary least squares (OLS) method to analyze the contemporaneous relationship.

These regressions are also tested for serial autocorrelation using the Durbin–Watson test. The results indicate that none of the regressions exhibit a problem with autocorrelation.

The empirical results of the contemporaneous relationship are presented in

Table 6 and

Table 7.

Table 6 presents the results of the contemporaneous relationship between energy stock returns, oil prices, and the return on low-carbon index.

Table 7 presents the results of the contemporaneous relationships between energy stock returns, oil prices, and the return on climate index.

Equations (1), (4), (7) and (10) in

Table 6 and

Table 7 suggest energy stock returns and green stock returns have a positive relationship with oil prices.

Equations (2), (5), (8) and (11) suggest that oil prices and green stock returns have a positive relationship with energy stock returns at the significance level of 1%.

Equations (3), (6), (9) and (12) indicate that oil prices and energy stock returns have a positive relationship with green stock returns.

In short, the returns on low-carbon index and climate index have bidirectional positive contemporaneous relationship with the returns on EQNR and energy index and oil prices.

The contemporaneous relationship can be also seen in

Figure 3.

In conclusion, the finding that green stocks exhibit contemporaneous, but not causal, relationships with oil prices and energy stock returns suggests that their observed co-movement is likely driven by short-term market sentiment or common external shocks. In the short term, both sectors may move together in response to macroeconomic shocks, investor sentiment, inflation expectations, or monetary policy changes—factors that simultaneously influence commodity prices and equity valuations across sectors. However, the fundamental drivers of green stocks—such as environmental regulation, technological innovation, and ESG-driven capital flows—are distinct from those influencing traditional energy stocks, which are more directly affected by fossil fuel supply–demand dynamics, geopolitical developments, and commodity price fluctuations. Additionally, structural features of financial markets—such as the increasing integration of ESG considerations into mainstream investment strategies—may induce parallel movements without implying a direct causal link. Therefore, while green and fossil energy stocks may respond similarly to broad macro shocks—such as inflation news or interest rate changes—there is no robust channel by which oil prices causally transmit to green stock fundamentals. The co-movement that does occur might be thus better explained by short-term sentiment, correlation through third-party variables, or temporary portfolio effects, rather than by a meaningful, direct economic link.

5. Implications

The main empirical results suggest that returns on the low-carbon and climate stocks have a bidirectional positive contemporaneous relationship with oil prices and energy stock returns, but not a causal relationship. Only lag-1 returns on the low-carbon and climate stocks positively affect energy stock returns. The findings indicate that there is strong evidence of dependence between oil prices, energy stocks and green stock returns in contemporaneity, but independence in causality.

The findings are vital for policymakers to formulate appropriate strategies for low-carbon and climate-friendly businesses. It is important to understand that energy is a type of commodity, and commodities compete on price. Policymakers might support low-carbon and climate-friendly businesses through, for example, cost policy. Since green stocks are not causally driven by oil markets, policy interventions (e.g., subsidies, tax incentives, carbon pricing) remain the primary levers for shaping green investment flows. This validates the continued use of climate policy tools to accelerate the energy transition, as green markets are not simply responding to market forces in fossil fuel sectors. Policymakers should recognize that the development of clean energy finance may be not self-correcting or market-led, and thus requires dedicated and sustained policy support.

Policymakers might consider some key policies, such as tax credits and cash grants for clean energy developers. That will help to reduce the cost disadvantage for clean energy technologies. A lower cost of capital for clean energy technologies is an important factor to encourage the production of clean energy to reduce greenhouse gas emission. In addition, establishing a price on carbon is an important policy to support clean energy businesses. By doing so, companies must calculate the costs of emissions into their operating and investment decisions, which might be an incentive for capital to move towards innovation and scale-up. In addition, green bonds and targeted capital incentives can serve as effective instruments for supporting the development of green investment. These instruments can help to reduce financing barriers, attract private capital, and foster a supportive policy and market environment for sustainable project. Green bonds are debt instruments where the proceeds are allocated for environmentally beneficial projects—such as renewable energy, green buildings, energy efficiency, or sustainable transport. Targeted capital incentives are financial tools used by governments to encourage investment in green sectors by improving the risk–return profile of sustainable projects, e.g., investment tax credits, low-interest loans, grants for green innovation, or environment-related investment mandates. Green bonds and targeted capital incentives serve as complementary policy instruments in the promotion of green investment. Green bonds facilitate the mobilization of substantial volumes of sustainable finance by attracting long-term, ESG-driven capital, while targeted capital incentives influence the allocation and direction of this capital by enhancing the financial attractiveness and risk profile of specific green sectors or technologies. Collectively, these instruments contribute to improving the economic viability of environmentally beneficial projects, mitigating investment risk, and reinforcing policy credibility through long-term commitment signals.

The findings have also benefits for energy companies in term of moving towards innovation in order to contribute to the achievement of low-carbon economy and reduce their high risk in future.

To achieve a low-carbon economy, policy makers may aim to support and incentivize the demand for green energy products while simultaneously reducing demand for high-carbon products. As a result, it can be expected that demand for crude oil may decline, potentially leading to a decrease in oil prices in the near future.

The positive contemporaneous relationship between green stock returns and oil prices in this research during the oil crisis period of 2014 to 2017 might serve as a prediction for the relationship between them in a future oil price crisis—where oil prices reduce and green stock returns also reduce—if supporting policies do not function well. If it is expected that there would be an increase in green investments, it might require the development of a stock market that would allow green companies to obtain capital easily for investment.

6. Summary and Conclusions

This research investigates the relationship between oil prices, energy stock returns, and green stock returns during the oil price crisis of 2014–2017, by testing causal and contemporaneous relationships between them.

We employ vector autoregressive (VAR) system analysis to test causal relationships and linear regression analysis to test contemporaneous relationships. Six VAR system models and twelve linear regressions are conducted to identify these relationships.

The main empirical results suggest a bidirectional positive contemporaneous relationship between oil prices and green stocks, although no significant causal relationship is detected between them. Similarly, energy stocks and green stocks exhibit a bidirectional positive contemporaneous relationship, but no significant bidirectional causality is observed. However, when examining causality, one-period lag green stock returns positively affect energy stock returns. The findings reveal a strong contemporaneous dependence of both oil prices and energy stocks on green stock returns; however, the causal relationships among them are weak or largely absent. The results also suggest that oil prices and energy stocks exert greater influence in contemporaneous relationships than in causal ones. Moreover, green stocks appear to exhibit a stronger positive association with energy stocks than with oil prices.

The findings are useful for investors in terms of shifting toward green investments and for policymakers in terms of implementing targeted policies to support the development of green industries and achieve a low-carbon economy for sustainable development.