Abstract

We empirically advocate for UK regulators to increase the volume limit of 15% outstanding shares on open market repurchases. Our main framework initially tests the determinants of share repurchases based on their size, Small, Medium and Large. The findings reveal that consistent with extant literature, the payout is primarily determined by its capability of distributing excess cash to shareholders and signaling undervaluation. We then check the viability of increasing the volume limit by testing new levels at 2.50% increments, up to 30%. The results indicate that any increase does not broadly change the determinants’ relationship with the payout, rather increased efficiency is realized at every interval, with the 20% and 30% levels being the most favorable.

1. Introduction

The act of repurchasing shares is unique; a firm undergoes the process of listing in the public market, but then buys back these shares. This may seem questionable since the firm will be trading on insider knowledge, which was deemed so by the UK government till 1981 (Rau and Vermaelen 2002); until then, repurchases were virtually impossible. Thereof, regulations allowed open market repurchases but upon adherence to one of the strictest regulatory frameworks (Dhanani and Roberts 2009), which summarily mandates: shareholder approval, limit of 15% shares, time bound to 18 months, limit of price at +/−5% of the average over the preceding five days, blackout when the managerial levels have material information regarding earnings and insider trading restricted during this period, and transactions must be announced the next business day via the Regulatory News Service. For comparison, the US fully legalized repurchases in 1982 (Bryan 2016) and did not replicate most of the UK’s directives, with those applied considered lax (Fried 2014). Today, the US leads the world in repurchases in relative and absolute terms (Goodacre 2023).

An inquiry by PwC (2019), on behalf of the Department for Business, Energy and Industrial Strategy (2018), was undertaken using qualitative and quantitative testing of firms that repurchased shares from 2007 to 2017. Their core conclusion stated that EPS adjustment to trigger higher CEO remuneration and/or artificially inflate stock price is not a determinant for undertaking repurchases. This is a welcome finding as rewarding CEOs is a strong motivational tool, which reduces corporate complacency and has positive effects on stakeholders (Edmans 2016). Overregulating incentive systems to elongate CEO stock ownership to restrict buybacks is disruptive and determinantal (Edmans 2017). Rather, in the US, managerial ownership increments stock returns during repurchases, offsets lack of external governance mechanisms (Lilienfeld-Toal and Ruenzi 2014), and in the event of CEO overconfidence, the market penalizes the stock price (Banerjee et al. 2018). PwC (2019)’s additional findings state that factors driving repurchases are returning cash in the absence of investment opportunities, adjusting mispriced shares, optimizing debt exposure and offsetting dilution due to employee compensation schemes. Finally, repurchases have shown to be negatively influenced by strict regulations in common law countries like the UK (Chen and Liu 2021). Despite this, repurchases are gaining momentum in Britain since the turn of the 21st century (Geiler and Renneboog 2015), with four times the number of firms using them (Renneboog and Trojanowski 2011). Post-COVID, they have reached record levels (Goodacre 2023), along with a steep rise in corporate cash hoarding with five times larger reserves compared to the pre-COVID levels (Willems 2021).

These validate our motivation of regulatory overhaul by increasing the volume cap of 15%. Given that excess cash is one of the key determinants of repurchases, the payout’s rising popularity and the gigantic corporate cash reserves, deregulation of repurchases will facilitate dislodging of cash reserves. This will boost market activity, which is currently depressed; ranging from depleting IPOs (EY 2023) to brokers facing insolvency (Muirhead 2023). The FCA (2023) is undertaking efforts of rapid IPO deregulation, and the simultaneous deregulation of repurchases leading to increased cash with shareholders will create the demand needed for IPO success. Recent decisions (O’Dwyer 2024) by the regulator have received criticism from minority shareholders. They allow for power entrenchment of sovereign funds and venture capitalists through the use of super votes; however, they justify their decision due to support from corporates. Thus, if the regulator is going to such lengths to improve market functioning, then allowing firms to repurchase more shares, which is a decision that requires shareholder consent, is worth undertaking.

We do not advocate full deregulation as other restrictions serve a purpose. The SEC (2023) recently modernized disclosure rules to include more information on an increased frequency. When we compare Japan, a country that replicates all of the UK’s directives except that of requiring shareholder approval, and the US, both markets witness that repurchase completion history is a determinant of future payout success (Leng and Noronha 2013; Ota et al. 2019). Thus, the market is independent of regulatory directives in assessing a repurchasing firm. Furthermore, the US sees governance rather than regulation resulting in better post-repurchase stock performance (Caton et al. 2016). Cline and Williamson (2016)’s cross-country analysis reveals that the market’s trust in corporations has a strong positive impact on shareholder protection and market-level activities.

It is arguable that if firms want to repurchase more than 15% shares, they can opt for off-market methods like the tender offer, Dutch tender offer, or private repurchases. However, it is likely that block shareholders will get prioritized, thus being unfair to retail/minority shareholders. This is one of the reasons why the majority of repurchases in the UK and US are undertaken via the open market method (Rau and Vermaelen 2002; Oswald and Young 2004). This paper’s empirical investigation uses repurchase announcements undertaken by firms listed on the London stock exchange between 1985 and 2014. We first group the payout based on its size, Small, Medium, Large, and then using Tobit regressions compute the determinants of the payouts depending on their size. Following this, we will test predictive scenarios for each of the proposed new volume caps on a 2.50% incremental basis, i.e., 17.50%, 20%, 22.50%, 25%, 27.50%, 30%. These results will be classified using a unique points-based system that we have developed. The findings will then be verified through the undertaking of three independent robustness tests.

The results initially find that the most significant determinants of repurchases across payouts of all sizes are signaling stock undervaluation and adjusting the reporting earnings ratio. Following, we find that deregulation to any level improves the efficacy of the payout, with 20% showing the highest level of benefits and 30% a close second. Thus, our three contributions to extant literature are: (i) Determinants of repurchases fluctuate due to payout size. However, signaling undervaluation and adjusting the earnings ratio have shown rigidity, irrespective of payout size and methodological approach; (ii) Allowing firms the ability to undertake larger repurchases does not demonstrate any material change from the current corporate decision-making mindset, rather improved efficacy is visible; and (iii) The methodological approach of using a points-based system to classify predicative results, which rewards warranted and penalizes unwarranted outcomes, will assist academics in their future works beyond the scope of open market share repurchases.

2. Literature Background

The mechanism through which companies dispense cash to shareholders is either dividend distribution or repurchase undertaking. The two payouts are theoretically substitutable (Dittmar 2000; Jiang et al. 2013), but in practice this is not feasible (Denis and Osobov 2008). Dividends are regular income supplements and, due to this, have a precommitment underlying notion (Renneboog and Trojanowski 2011; John et al. 2015). But repurchases on the other hand are free from such commitments and are expected to be infrequent and undertaken for specific reason(s). Also, the tax treatment of the payout plays a significant role in determining the payout (Korkeamaki et al. 2010; Jacob and Jacob 2013; Andriosopoulos and Lasfer 2015; Ji 2016). Ignoring the fact that a repurchase results in the shareholder forgoing ownership and future dividend instreams, if the dividends received and the capitals gains achieved via repurchases are of the same value but not taxed at the same rate, then the two are not perfectly substitutable.

The distribution of surplus cash has remained a popular motive (Lee et al. 2010; Lee and Suh 2011; Burns et al. 2015; Cesari and Ozkan 2015), with British managers stating this to be their premier repurchase undertaking motive (Dhanani 2016). Thus, the distribution of surplus cash mitigates the age-old agency conflicts of using the money for inappropriate investment outlets (Jensen 1986); however, the execution of the payout in terms of timing too can be a victim of agency conflicts that is mitigatable by insider monitoring (De Cesari et al. 2024). This is important since the timing of the payout ensures if the decision resulted in a superior outcome than the forgone investment opportunities (Bonaime et al. 2016). Additionally, it also allows for shareholders to generate positive abnormal stock price gains following the payout (Ben-Rephael et al. 2014; Dittmar and Field 2015).

Aside from distributing surplus cash, adjusting the earnings ratio is also a popular motive (Dhanani and Roberts 2009; Dhanani 2016). As the payout reduces the outstanding stock volume, the earnings per share increase. This must not happen in a perfect world; the share price would see a proportional rise following a repurchase to offset any artificial increase in the earnings ratio. However, in practice, the share price is driven by the market’s perception of the payout (Andriosopoulos and Lasfer 2015), which could be positive or negative, thus enabling the adjustment of the earnings ratio. This can be curbed through good governance mechanisms (Farrell et al. 2013). Such reasons can be classified as an unethical tactic, but firms also use repurchases to ethically signal the share price undervaluation (Evgeniou and Vermaelen 2017; Andreou et al. 2018; Evgeniou et al. 2018). This sends the signal that if the firm is spending its cash reserves on self-investment, despite not having surplus cash or an adverse earnings ratio, then the stock is worthy of investing, thus increasing market demand that pushes the share price to its fair level. The intention is in tandem with the payout’s longstanding ability to reduce information asymmetry (Ikenberry et al. 1995; Lin et al. 2017). Repurchases are often used for adjusting the capital structure of the company, by using cost-effective debt financing to buy back shares to lower the overall cost of capital (Dittmar 2000; Wang et al. 2024). This is generally seen when companies have achieved a stronger credit position that allows them access to better financing rates, which were unreachable in the past. Finally, when a company is target to a hostile takeover, one of the defense tactics is to repurchase shares and entrench control (Billet and Xue 2007; Lin et al. 2014). However, with stronger disclosure and investor protection regulations, such a situation can be mitigated in the main market.

3. Materials and Methods

We purchased the open market repurchase data from a Thomson Reuters-affiliated vendor, Alacra Inc. (New York, NY, USA). There is evidence for the UK that the initial repurchase announcement is more information-bearing than secondary announcements (Andriosopoulos and Lasfer 2015), which is supported by evidence from the US that frequent repurchase announcements saturate the market’s reaction (Yook 2010). Thus, only initial announcements are collated, which total 419, each representing an average buyback of 10% stock volume. For constructing firm-level independent variables, we used data from the annual accounts, which were sourced from the Companies House. While there are no survivorship and index-of-listing biases, as some of the announcing firms have been merged/acquired or delisted, we were unable to ascertain accounts for 59 announcements. Thus, the tested sample was reduced to 360, with each still representing an average buyback of 10% stock volume. For constructing the taxation variable, data were sourced from the archives of HMRC and government publications.

3.1. Repurchase Sample

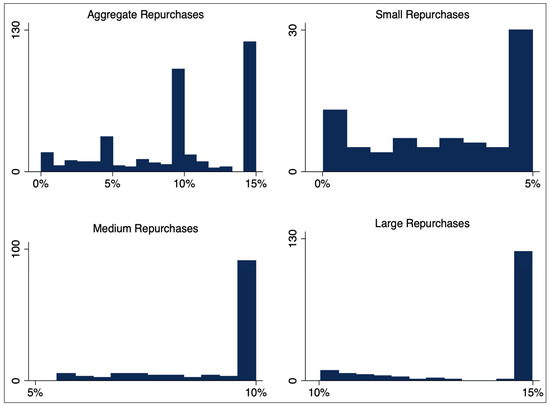

The frequency distribution of repurchase announcements based on the proportion of outstanding shares intended for buyback is presented in Figure 1, and the sample’s summary statistics are presented in Table 1. Given that firms are highly inclined towards opting for repurchases at the 5% interval cut-off, we subcategorize the sample into three subsets. The first is Small Repurchases, which are those that intend to buy back ≤5% of the outstanding stock volume, and there are 82 such repurchases, thus representing 23% of the sample. The second is Medium Repurchases, which are those that intend to buy back 5%<, but ≤10% of the outstanding stock volume, and there are 128 such repurchases, thus representing 36% of the sample. The third is Large Repurchases, which are those that intend to buy back >10% of the outstanding stock volume, and there are 150 such repurchases, thus representing 41% of the sample.

Figure 1.

Frequency Distribution of Repurchases.

Table 1.

Sample Summary.

A univariate assessment reveals that the entire sample and each subset has an equivalent mean–median combination, thus indicating a consistent symmetrical distribution. The average of the total sample remains at 10%, which is equivalent to previous UK studies (Rau and Vermaelen 2002; Padgett and Wang 2007; Lee et al. 2010). As these studies do not cover a timeline as extensive as our paper, it is seen that over short-term and long-term periods, the general managerial attitude remains in favor of announcing a larger-sized payout. This may be considered irrational given that the completion rate of repurchases in the UK remains 31%, which increases to 69% upon removing firms that did not pursue any transaction following an announcement (Andriosopoulos et al. 2013). However, a larger-sized announcement provides a higher degree of execution flexibility, as depending on the market’s reaction to the repurchase transactions, firms can adjust their decision. If abnormally positive, then buy back more without having the need for shareholder reapproval; if abnormally negative, then suspend the payout as regulations do not mandate any completion guidelines.

3.2. Independent Variables

Drawing upon the literature review (Section 2), for our empirical investigation we extract the key factors that influence repurchases, thus resulting in a combination of eight independent variables, seven representing firm-specific traits, while the eighth proxying taxation. They are listed and defined in Table 2.

Table 2.

Descriptions of the Independent Variables.

4. Research Objectives and Methodology

4.1. Increasing the Volume Limit

In the past, there have been instances where the relationship of share repurchases and regulations are tested (e.g., Chen and Liu 2021). However, to the best of our knowledge, this is the first paper that explicitly tests the potential impact of deregulation, with a specific focus on the regulatory limit on repurchase volume. We do this by first pursuing the computation of repurchase determinants based on payout size, Small, Medium and Large, using literary-backed proxies listed in Table 2. The rationale is that due to ‘one size does not fit all’, corporate decision-making varies based on the size of a repurchase.

- H10 = Determinants of share repurchases are not dependent on payout size.

- H11 = Determinants of share repurchases are dependent on payout size.

Thereof, we check if there is any change in the determinants’ influence if the volume limit were increased at 2.50% incremental levels, up to 30%.

- H20 = Determinants of share repurchases will change if the volume cap is increased.

- H21 = Determinants of share repurchases will not change if the volume cap is increased.In order to empirically test these hypotheses, we undertake a two-stage testing.

4.1.1. Stage I: Computing the Baseline Determinants

In the first stage, we independently ascertain the determinants of Small Repurchases, Medium Repurchases and Large Repurchases using a series of Tobit Regressions (Equations (1)–(3)1). The censoring ability allows us to smoothly test H2.

where are those that intend to buy back ≤5% of the outstanding stock volume, are those that intend to buy back >5%, but ≤10% of the outstanding stock volume, are those that intend to buy back >10% of the outstanding stock volume. i refers to the repurchase announcing firm = 1, 2, 3 … 360, t refers to the year of repurchase announcement = 1985, 1986 … 2014, is the vector of independent variables described in Table 2, and are the error terms.

4.1.2. Stage II: Predicting the Impact of Liberalization

The second stage involves using the results from the first stage as baseline regressions and running six predictive scenarios for each set of repurchases, which will hence test the influence of the determinants if the regulatory limit of 15% is increased to 17.50%, 20%, 22.50%, 25%, 27.50%, or 30%. This will essentially mean increasing the upper limit of each repurchase set’s regression to the predicted deregulated volume cap while holding the lower limit constant. It is arguable that since the upper limit of Large Repurchases is 15%, its sequential incrementing is intuitive, but since the upper limits of Small Repurchases and Medium Repurchases are 5% and 10%, respectively, their sudden incrementing may be contentious. However, we assume that given the pre-existing propensity of firms to opt for larger volume repurchases for implementation flexibilities, the upper limits currently being followed by firms opting for Small Repurchases and Medium Repurchases are possibly due to the current restriction of 15%, and upon deregulation these firms too, will be motivated into engaging larger-sized announcements.

Further, a unique analytical approach is undertaken for the predictive models that compares the value of the coefficients across the range. For instance, two independent variables may currently have a significant influence on Small Repurchases and continue to do so under the deregulated caps. This will reveal that their power of influencing will remain consistent upon the corresponding deregulated cap; however, the value of the coefficients will be key in determining the true impact of the deregulation. Thus, the approach we take computes all possible ratios of the significant independent variables’ coefficients of the baseline regression models for each of the three sets of repurchases, and these coefficients will act as the baseline ratio. Following this, these ratios will be continually computed for the coefficients of the regressions for the deregulated caps.

Once the ratios for the predictive models are computed, they will be compared against the baseline ratios to check the change in influencing trend due to the posited deregulation. Further, we also consider that the directions/strength of the influencing patterns will be diverse in terms of their optimality. Thus, to capture this we will be using a points (pts) system unique to this paper.

The first step will be to assign each deregulated volume cap appropriate pts based on their preference for each ratio; however, given that it is possible to see instances where a deregulated volume cap causes an adverse impact, in that case a reverse awarding (penalizing) will be implemented. If each of the deregulated volume caps provide additional benefits compared to that realized under the current regulatory limit, the (+) 1st preference volume cap will be awarded 6 pts, the (+) 2nd preference volume cap will be awarded 5 pts, the (+) 3rd preference volume cap will be awarded 4 pts, the (+) 4th preference volume cap will be awarded 3 pts, the (+) 5th preference volume cap will be awarded 2 pts and the (+) 6th preference volume cap will be awarded 1 pt. If each of the deregulated volume caps causes an adverse impact compared to that realized under the current regulatory limit, then the (−) 1st preference volume cap will be awarded −1 pt, the (−) 2nd preference volume cap will be awarded −2 pts, the (−) 3rd preference volume cap will be awarded −3 pts, the (−) 4th preference volume cap will be awarded −4 pts, the (−) 5th preference volume cap will be awarded −5 pts and the (−) 6th preference volume cap will be awarded −6 pts. In the case of a particular ratio, there is an assortment of benefitting and adverse deregulated volume caps, then each of them will be awarded the corresponding pts from the combination of the above criterion. Also, if the ratio is within +/−0.10% of the baseline ratio then considering this marginal change it will be considered equivalent to the baseline and will be awarded 0 pts. Once the pts for each deregulated volume cap for each set of the tested repurchase are aggregated, they will be weighted in accordance with the corresponding tested subset’s proportionality in the sample. Small Repurchases constitute 23% of the total sample, Medium Repurchases constitute 36% of the total sample and Large Repurchases constitute 41% of the total sample; the pts aggregated for each of their findings will be hence weighted using the following multiple factors; Small Repurchases = 0.23, Medium Repurchases = 0.36 and Large Repurchases = 0.41. Finally, once the weighing for each set of repurchase is undertaken, they will be tallied to reveal the most optimum deregulated volume cap. A summary of the pts system is provided in Table 3.

Table 3.

Points (Pts) System for Assessing New Volume Limits.

4.2. Robustness Testing

To verify the outcomes of the Tobit Regressions (Equations (1)–(3)), we will undertake three sets of tests that use different methodological approaches. The first test is the Fractional Probit Regression (Equation (4)) on the entire sample, thus providing a macro empirical viewpoint. The second test is the Ordered Probit Regression (Equation (5)). This allows for controlling the subsets of the sample based on size, Small Repurchases, Medium Repurchases and Large Repurchases, thus providing a micro empirical viewpoint. For both tests, we will provide the fixed effects and marginal effects. Finally, we will run a Multiple OLS regression (Equation (6)) for an extended outlook.

where is the proportion of outstanding volume of shares announced for repurchase, which is normalized between 0 and 1, is the proportion of outstanding volume of shares announced for repurchase. i refers to the repurchase announcing firm = 1, 2, 3 … 360, t refers to the year of repurchase announcement = 1985, 1986 … 2014, is the vector of independent variables described in Table 2, is the intercept and is the error terms.

5. Results

5.1. Univariate Analysis

In Table 4, the key univariate summary statistics of the independent variables are presented. Leverage and Firm Size show a similar pattern across the repurchase subsets, as firms that undertake Medium Repurchases have the highest debt exposure and are biggest in size, while firms that undertake Large Repurchases have the lowest debt exposure and are smallest in size. Cashflow and Dividend both have an inverse relationship with the subsets. Firms undertaking Small Repurchases have the highest levels of free cash and dividend distribution, followed by those that opt for Medium Repurchases, while those undertaking Large Repurchases have the least amount of free cash and the lowest levels of dividend distribution. M/B Ratio has an inverse relationship with the subsets, firms undertaking Small Repurchases are least undervalued, followed by Medium Repurchases, and those opting for Large Repurchases are most overvalued. For EPS, only 3.60% of firms have negative earnings in the case of Small Repurchases, with this figure increasing to 7.80% for Medium Repurchases, and a substantial increment to 21.30% in the case of Large Repurchases. Independence reveals that firms undertaking Large Repurchases have the highest proportion of independent directors, followed by Small Repurchases and Medium Repurchases, and Tax Ratio reveals that Large Repurchases are seen during periods when repurchases were most tax efficient compared to dividends.

5.2. Mann–Whitney Rank Sum Testing

In Table 5, the results from the Mann–Whitney Rank Sum are presented that compare firm-level characteristics across those that undertake Small, Medium and Large Size repurchases. We see that as the size of the repurchase increments, the differences across the firms drastically change, with those undertaking Large Repurchases being most different.

Table 5.

Mann–Whitney Rank Sum of Firm-Level Independent Variables.

5.3. Determinants of Repurchase Size—Stage I

In Table 6, we present the baseline regression results from the testing of the determinants of repurchases by undertaking a series of Tobit Regressions (Equations (1)–(3)). Amongst the most popular determinants, we find that the negative influence of M/B Ratio and the positive influence of EPS are consistent across repurchases of all sizes, while the influence of Cashflow is positive for Small and Medium repurchases. The findings are consistent with our expectations and also, on a qualitative level, are consistent with the Dhanani (2016) survey of British managers of companies that undertook repurchases between 2003 and 2007. Their responses indicated that the distribution of surplus cash was the primary motive for the payout’s undertaking, followed by the intention to adjust the reported earnings ratio and the signaling of stock undervaluation.

Table 6.

Determinants of Repurchase Size Selection: Baseline Regressions (Stage I).

Empirical literature, on the other hand, finds some inconsistencies. The influence of undervaluation was determined as insignificant by Geiler and Renneboog (2015), but simultaneously, Sonika et al. (2014) also find that if overvaluation is detected during the payout’s undertaking, then it is withdrawn. We conclude that despite this disparity in findings, there is an underlying strand that is common amongst them all; aversion from overvaluation. As our timeline is the lengthiest, we conclude that over the long term, this trend is persistent. The positive influence of EPS is inconsistent with the findings of PwC (2019)’s investigation, but Sonika et al. (2014) find that positive earnings deter repurchase undertaking. Thus, there is the distinct possibility of companies using repurchases to adjust the reported earnings ratio only when it is negative, while perhaps attempting to refrain from any adjustments when the ratio is low but positive. The positive influence of surplus cash is supported by a host of past studies (Lee et al. 2010; Lee and Suh 2011; Burns et al. 2015; Cesari and Ozkan 2015) and reinforces our motivation that repurchases are a powerful tool for dislodging excess cash from corporate accounts, thus, ensuring enough market liquidity and limiting the use of surplus cash for unwise investment decisions.

The lack of surplus cash’s influence on large repurchases indicates their idiosyncrasy that is determinable using the positive influence of Independence. It is the first instance where independent directors have shown an impact. This illustrates that despite independent directors in the UK stating that they consider their work to be more advisory than monitory (Franks et al. 2001; Ozkan 2007), when the matter in hand is the decision-making of Large Repurchases, they have exerted their influence, which is positive in nature. The key reason for the result is attributable to the independent directors attempting an equilibrium situation of three key stakeholders, the managers, insider owners and minority shareholders. It is understandable that managers are inclined towards repurchases as it offsets the principal–agent conflicts upon realizing surplus cash (Guay and Harford 2000; Brav et al. 2005; Wang et al. 2009), and is a powerful signaling tool compared to dividend distribution for communicating information that is otherwise restricted, such as undervaluation (Dittmar 2000; D’Mello and Shroff 2000; Baker et al. 2003) and asymmetric information bias in favor of the firm (Ikenberry et al. 1995; Lin et al. 2017). On the other hand, insider owners do not prefer that the firm undertakes any form of corporate payouts to avoid precommitment issues (Renneboog and Trojanowski 2011), which is understandable since any perceived guaranteeing of periodic payouts by the wider market may cause a stock price damage upon non-delivery. Thus, given that a Large Repurchase cannot be undertaken frequently, the concerns of insider owners are not very impacting, especially since repurchases are generally considered free from commitments (Fenn and Liang 2001), and minority shareholders will also be content since larger size means maximized probability of their shares being bought.

Finally, Leverage has a positive influence, which directly contradicts this paper’s expectations and current literary evidence that debt exposure has a negative influence on repurchases (Lee and Suh 2011; Burns et al. 2015; Cesari and Ozkan 2015). This is limited to Small Repurchases, which provides an insightful finding. As shareholders are content with pre-existing debt exposures, companies capitalize on this by refinancing the capital structure with more debt as a replacement for outstanding equity. Thus, lowering the overall capital costs and entrenching control to some extent.

The key determinants of repurchases remain persistent across payouts of all sizes; however, there are visible differences in their influence patterns. In light of this, we must accept the alternative hypothesis H11 = Determinants of share repurchases are dependent on payout size.

5.4. Increasing the Volume Cap—Stage II

In Table 7 (Stage II), we list the predictive determinants of repurchases under the six proposed volume caps; 17.50%, 20%, 22.50%, 25%, 27.50% and 30%. Initial analysis indicates that the determinants remain consistent under each predictive new volume cap as that seen with the baseline regressions (Table 6). Thus, we begin by accepting the alternative hypothesis H21 = Determinants of share repurchases will not change if the volume cap is increased. We now construct pairwise ratios of the significant coefficients from the baseline regressions, which will be used as benchmarks for comparing those constructed from the predictive results.

Table 7.

Predictive Determinants of Repurchase Size Selection Under New Volume Caps (Stage II).

In the case of Small Repurchases, the baseline ratio for M/B Ratio/EPS is 6.70%. A higher ratio is desirable as it will indicate a better usage of repurchases to signal stock undervaluation in conjunction with using the payout for adjusting the earnings ratio. The ratio realized for the volume cap of 22.50% is equivalent to the baseline, which makes it the most preferred since it produces an outcome similar to the current circumstances, while under each of the remaining predictive caps, the ratio witnesses a drop. The least drop is seen for the volume caps of 25%, 27.50% and 30%. As the ratio of the coefficients for these three caps are identical, they are all classified as the second preference. The ratio keeps dropping if the volume cap is increased to 20% or 17.50%; these two must be least preferred. The baseline ratio for M/B Ratio/Leverage is 9.70%, and a higher ratio is desirable as it will indicate a better usage of repurchases to signal stock undervaluation in conjunction with the unintuitive positive influence of debt exposure. The ratios realized for the volume caps 22.50%, 25%, 27.50% and 30% are identical, which are also equivalent to the baseline. Deregulating to any of these levels will result in a similar outcome, as seen presently. These are the most preferred recommendation since the ratio drops if the volume cap is lifted to 20%, with a further drop seen at 17.50%, making them least preferred.

The baseline ratio for M/B Ratio/Cashflow is 8.10%, and a higher ratio is desirable as it indicates a better usage of the repurchase to signal stock undervaluation in conjunction with using excess cash to finance the payout. However, under each of the new caps, lower ratios are realized. The least reduced ratio is identical for the caps of 22.50%, 25%, 27.50% and 30%, making each of them the least adverse, and the ratio keeps on declining for the cap of 20% and 17.50%, making them the most adverse. The baseline ratio for Leverage/EPS is 68.90%, and gauging if a higher or lower ratio is desirable requires assessing a unique tradeoff since EPS has a positive influence, which is unethical, while Leverage too has a positive influence, which remains inconsistent with the paper’s expectations and literary evidence. However, we argue that the positive influence of Leverage is more determinantal since having higher debt levels can have adverse impacts in the long term, while adjusting the earnings ratio is a short-term tactic that can be offset in the immediate to mid-term by actions such as issuance of shares via employee compensation scheme, or even naturally smoothing out following good operating performances. Thus, having a lower ratio of the coefficients is desirable, which is realized in five of the predicted new caps. The most significant drop in the ratio is seen for the volume cap of 25%, and this ratio is identical to that seen with the volume caps of 27.50% and 30%, thus making either of them the most preferred. Of the remaining three volume caps, the second and third preferential levels are 20% and 17.50%, as they too witness corresponding reductions in the ratio. The volume cap of 22.50%, however, realizes a ratio that is equivalent to the baseline, thus making it the least preferred.

The baseline ratio for Leverage/Cashflow is 83.80%, and a lower ratio is desirable as it will indicate better use of surplus cash in conjunction with the undesired positive influence of debt exposure. A reduction in the ratio is realized under each of the six volume caps, with the most benefit realized at the cap of 17.50%, following that is 20%. The benefits realized with the volume caps of 22.50%, 25%, 27.50% and 30% are identical, thus making either of these the third most preferred. The baseline ratio for Cashflow/EPS is 82.20%, and a higher ratio is desirable as it will indicate better usage of free cash for financing repurchases in conjunction with the payout’s usage for adjusting the earnings ratio. For each of the six volumes caps, the ratio witnesses an increase; however, the highest increment is realized with 17.50%, followed by 20%. An equal level of benefit is realized for the caps 22.50%, 25%, 27.50% and 30%, thus making any of them the third most preferred.

Moving towards Medium Repurchases, the baseline ratio for M/B Ratio/EPS is 6.00%, and a higher ratio is desirable as it will indicate a better usage of repurchases to signal stock undervaluation in conjunction with using the payout for adjusting the earnings ratio. In each of the six predicted models, the ratio of the coefficients witnesses an increase; also, there is no duplicity of the ratio, which indicates that each deregulated cap provides a unique benefit. Thus, the most-to-least benefitting volume caps are 27.50%, 17.50%, 30%, 25%, 20% and 22.50%. The baseline ratio for M/B Ratio/Cashflow is 7.30%, and a higher ratio is desirable as it indicates a better usage of the repurchase to signal stock undervaluation in conjunction with using excess cash to finance the payout. Under each of the volume caps, a higher ratio is realized, while each ratio is unique, thus indicating that each volume cap will realize benefits. Hence, the most-to-least recommended volume caps are 17.50%, 27.50%, 30%, 25%, 20% and 22.50%. The baseline ratio for Cashflow/EPS is 82.00%, and a higher ratio is desirable as it will indicate better usage of free cash for financing repurchases in conjunction with the payout’s usage for adjusting the earnings ratio. The ratio does not fall below the baseline for any of the volume caps; however, it remains equivalent for the volume cap of 17.50%, which makes it the least preferred cap. For the remaining volume caps, non-equivalent higher ratios are realized. Thus, the cap that provides the most benefits is 22.50%, which is followed by 30%, 27.50%, 20% and 25%.

For Large Repurchases, the baseline ratio for M/B Ratio/EPS is 2.40%, and a higher ratio is desirable as it will indicate a better usage of repurchases to signal stock undervaluation in conjunction with using the payout for adjusting the earnings ratio. However, in none of the volume caps a higher ratio is realized; thus, the four least adverse caps are 20%, 17.50%, 22.50% and 25%, followed by the volume caps of 27.50% and 30% as they have similar adverse impacts, thus making either of them the most adverse. The baseline ratio for M/B Ratio/Independence is 2.30%, and a higher ratio is desirable as it will indicate better usage of repurchases for signaling stock undervaluation in conjunction with its increased determination by independent directors. We continue to see that none of the volume caps provide any additional benefits compared to the current regulatory levels, rather the exact opposite is realized. Thus, the three least adverse caps are 20%, 17.50% and 22.50%, followed by the volume caps of 25% and 27.50% as they are equally adverse, and finally the most adverse volume cap is 30%. Finally, the baseline ratio for EPS/Independence is 97.10%, and a lower ratio is desirable as it will reveal constrained usage of repurchases for adjusting the earnings ratio in conjunction with its positive determination by independent directors. However, a continuing pattern of all volume caps being undesirable is realized. The three least adverse volume caps are 30%, 20% and 22.50%, followed by 25% and 27.50% as they both have similar adverse impacts, while the deregulated volume cap of 17.50% is the most adverse.

We now summarize these findings in Table 8, and award/penalize pts based on the metric explained in Table 3.

Table 8.

Pts Awarding/Penalizing and Ranking for Small, Medium and Large Repurchases.

In Table 9, we sum the pts awarded/penalized in Table 8, and initially provide total pts per deregulated volume cap for each repurchase subset. We then weigh these pts using the multiplier explained in Table 3 (Small Repurchases = 0.23; Medium Repurchases = 0.36; Large Repurchases = 0.41). Initially, it is visible that under any of the posited deregulated volume caps, the efficiency of repurchases witnesses an improvement. However, looking at the individual aggregated pts for each tested volume cap, the most benefit is realized if the limit is increased to 20% (2.72 pts), while the benefits of increasing the limit to 30% (2.70 pts) are almost equal. The third most benefitting volume cap is 27.50% (2.60 pts), followed by the fourth most benefitting volume cap of 17.50% (1.65 pts). The fifth most benefitting volume cap is 22.50% (0.80 pts), with the sixth most benefitting volume cap being 25% (0.49 pts).

Table 9.

Pts Aggregation and Weighting Using Results from Table 8.

5.5. Robustness Testing

In order for strong verification, we undertake three robustness tests. The first is the Fractional Probit Regression (Equation (4)), and the coefficients and marginal effects from the testing are presented in Table 10. The second is the Ordered Probit Regression (Equation (5)), and the coefficients and marginal effects from the testing are presented in Table 11. The third is the Multiple OLS Regression (Equation (6)), and the coefficients are presented in Table 12. The modelling undertaken for these tests is based on the most-to-least influential determinants realized from the baseline testing. In Model I, we hold M/B Ratio and EPS as base, from Models II through IV Cashflow, Leverage and Independence are individually added, and in Model V all of them are included. This grouping is then held as the new base and in Models VI through XI, the remaining three variables, Firm Size, Dividend and Tax Ratio, are tested in combinations. In Model XII, all of the variables are tested.

Table 10.

Determinants of Repurchase Value I.

Table 11.

Determinants of Repurchase Value II.

Table 12.

Determinants of Repurchase Value III.

The Fractional and Ordered Probit results reveal that M/B Ratio has a negative influence, EPS and Cashflow have positive influences, while Firm Size, Dividend and Tax Ratio are insignificant. These patterns are thus consistent with the baseline results. Independence shows an insignificant influence for the Fraction Probit Regression but a positive influence for Ordered Probit Regression, which is partially consistent with the baseline finding of a positive influence. However, Leverage exhibits insignificance for both robustness tests, which is inconsistent with the baseline finding of positive influence. This discrepancy is attributable to the methodological differences and sample composition. In the baseline testing, Independence and Leverage only influenced one set of repurchases each, Large Repurchases and Small Repurchases, respectively. Given that Large Repurchases dominate the total sample by making up 41% of the sample compared to Small Repurchases’ 23%, the influence of Independence reappears but not that of Leverage when the methodology differentiated the repurchases based on the volume of shares intended for repurchasing. With Multiple OLS Regression results, we only see significance with M/B Ratio (negative) and EPS (positive). Thus, the findings are partially consistent with the baseline results but when combined with the entirety of the robustness tests, reveal an important pattern.

The key determinants of repurchase undertaking are the payout’s usage of signaling undervaluation and adjusting the earnings ratio, as they remain persistent despite sub-grouping the sample based on payout size and changing methodological approaches.

6. Conclusions

If regulators oversee the listing of shares, then it is logical to oversee a corporate action which reverses the listing to some extent; two sides of the same coin. Furthermore, with the complexities in the modern financial system, regulators are expected to protect the interests of shareholders, especially those with minority ownership. However, the positive impact of regulation is nonlinear, as after a certain point it ratchets corporate and financial mobility that has several knock-on negative effects. We do not allege that the current regulatory framework in the UK was intended to enforce overregulation; however, we do insist that it is time for the framework to catch up with current corporate financial conditions and undertake volume-level deregulation.

Our findings support this by initially setting up the determinants of repurchases based on payout size. These indicated that the payout is consistently used for signaling undervaluation and adjusting the earnings ratio, with diversity in additional determinants being dependent on payout size. Thus, the determinants of repurchases vary depending on payout size, but the foundational corporate decision-making is consistent. These were verified by three independent robustness tests. Further, the results indicate that if deregulation were to occur, then at any of the proposed new levels, we see two outcomes: (i) Determinants of repurchases do not change, and (ii) Determinants’ efficacy improves at each level, but the 20% and 30% levels are the most beneficial.

Thus, our findings are useful for regulators to aid in their on-going efforts for increasing the UK’s business friendliness. Corporate managers can use them for lobbying regulators. Academics can use the research objectives and empirical framework for complementary testing of European markets, as the single-country investigation is our limitation.

Author Contributions

Conceptualization, A.S. (Adhiraj Sodhi) and A.S. (Aleksandar Stojanovic); methodology, A.S. (Adhiraj Sodhi) and A.S. (Aleksandar Stojanovic); validation, A.S. (Adhiraj Sodhi) and A.S. (Aleksandar Stojanovic); formal analysis, A.S. (Adhiraj Sodhi) and A.S. (Aleksandar Stojanovic); investigation, A.S. (Adhiraj Sodhi) and A.S. (Aleksandar Stojanovic); data curation, A.S. (Adhiraj Sodhi); writing—original draft and presentation, A.S. (Adhiraj Sodhi); writing—review and editing, A.S. (Adhiraj Sodhi) and A.S. (Aleksandar Stojanovic). All authors have read and agreed to the published version of the manuscript.

Funding

The research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Restrictions apply to the availability of these data. Data were purchased from Alacra Inc. (New York, NY, USA), a vendor of Thomson Reuters, with the transaction limiting the use of data by the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

Pearson’s Correlation Matrix.

Table A1.

Pearson’s Correlation Matrix.

| Leverage | Firm Size | Cashflow | Dividend | M/B Ratio | EPS | Independence | Tax Ratio | |

|---|---|---|---|---|---|---|---|---|

| Leverage | 1.000 | |||||||

| Firm Size | 0.494 | 1.000 | ||||||

| Cashflow | −0.024 | −0.049 | 1.000 | |||||

| Dividend | 0.070 | 0.098 | 0.070 | 1.000 | ||||

| M/B Ratio | 0.005 | 0.102 | 0.092 | 0.014 | 1.000 | |||

| EPS | −0.137 | −0.145 | −0.564 | −0.370 | −0.016 | 1.000 | ||

| Independence | −0.252 | 0.111 | 0.232 | −0.087 | −0.005 | 0.269 | 1.000 | |

| Tax Ratio | 0.021 | 0.139 | −0.155 | −0.009 | 0.001 | 0.094 | 0.220 | 1.000 |

| Highest + ve | 0.494 | |||||||

| Lowest + ve | 0.001 | |||||||

| Highest − ve | −0.564 | |||||||

| Lowest − ve | −0.005 |

Notes

| 1 | We considered the use of Panel Regressions, but since our dataset is an unbalanced panel and encompasses a specific yearly frequency payout, the sample size is not sufficient enough to pursue panel data regressions. |

| 2 | A Pearson’s correlation matrix of the independent variables is provided in the Appendix A. The findings reveal that the correlation coefficients range between −0.564 and 0.494. |

References

- Andreou, Panayiotis C., Ilan Cooper, Ignacio Garcia de Olalla Lopez, and Christodoulos Louca. 2018. Managerial overconfidence and the buyback anomaly. Journal of Empirical Finance 49: 142–56. [Google Scholar] [CrossRef]

- Andriosopoulos, Dimitirs, and Mezaine Lasfer. 2015. The market valuation of share repurchases in Europe. Journal of Banking and Finance 55: 327–39. [Google Scholar] [CrossRef]

- Andriosopoulos, Dimitris, Kostas Andriosopoulos, and Hafiz Hoque. 2013. Information disclosure, CEO overconfidence, and share buyback completion rates. Journal of Banking and Finance 37: 5486–99. [Google Scholar] [CrossRef]

- Baker, H. Kent, Gary E. Powell, and E. Theodore Veit. 2003. Why companies use open-market repurchases: A managerial perspective. Quarterly Review of Economics and Finance 43: 483–504. [Google Scholar] [CrossRef]

- Banerjee, Suman, Mark Humphery-Jenner, and Vikram Nanda. 2018. Does CEO bias escalate repurchase activity? Journal of Banking and Finance 93: 105–26. [Google Scholar] [CrossRef]

- Ben-Rephael, Azi, Jacob Oded, and Avi Wohl. 2014. Do firms buy their stock at bargain prices? Evidence from actual stock repurchase disclosures. Review of Finance 18: 1299–340. [Google Scholar] [CrossRef]

- Billet, Matthew T., and Hui Xue. 2007. The takeover deterrent effect of open market share repurchases. Journal of Finance 62: 1827–50. [Google Scholar] [CrossRef]

- Bonaime, Alice A., Kristine W. Hankins, and Bradford D. Jordan. 2016. The cost of financial flexibility: Evidence from share repurchases. Journal of Corporate Finance 38: 345–62. [Google Scholar] [CrossRef]

- Brav, Alon, John R. Graham, Campbell R. Harvey, and Roni Michaely. 2005. Payout policy in the 21st century. Journal of Financial Economics 77: 483–527. [Google Scholar] [CrossRef]

- Bryan, Bob. 2016. US Companies Have Spent $2 Trillion Doing Something that Has Absolutely No Impact on Their Businesses. Available online: https://www.businessinsider.in/us-companies-have-spent-2-trillion-doing-something-that-has-absolutely-no-impact-on-their-business/articleshow/52769948.cms (accessed on 13 September 2023).

- Burns, Natasha, Brian C. McTier, and Kristina Minnick. 2015. Equity-incentive compensation and payout policy in Europe. Journal of Corporate Finance 30: 85–97. [Google Scholar] [CrossRef]

- Caton, Gary L., Jeremy Goh, Yen Teik Lee, and Scott C. Linn. 2016. Governance and post-repurchase performance. Journal of Corporate Finance 39: 155–73. [Google Scholar] [CrossRef]

- Cesari, Amedeo De, and Neslihan Ozkan. 2015. Executive incentives and payout policy: Empirical evidence from Europe. Journal of Banking and Finance 55: 70–91. [Google Scholar] [CrossRef]

- Chen, Ni-Yun, and Chi-Chun Liu. 2021. The effect of repurchase regulations on actual share reacquisitions and cost of debt. North America Journal of Economics and Finance 55: 101298. [Google Scholar] [CrossRef]

- Cline, Brandon N., and Claudia R. Williamson. 2016. Trust and the regulation of corporate self-dealing. Journal of Corporate Finance 41: 572–90. [Google Scholar] [CrossRef]

- De Cesari, Amedeo, Nicoletta Marinelli, and Rohit Sonika. 2024. The timing of stock repurchases: Do well-connected CEOs help or harm? Journal of Banking and Finance. Forthcoming. [Google Scholar] [CrossRef]

- Denis, David J., and Igor Osobov. 2008. Why do firms pay dividends? International evidence on the determinants of dividend policy. Journal of Financial Economics 89: 62–82. [Google Scholar] [CrossRef]

- Department for Business, Energy and Industrial Strategy. 2018. Government to Research Whether Companies Buy Back Their Own Shares to Inflate Executive Pay. Available online: https://www.gov.uk/government/news/government-to-research-whether-companies-buy-back-their-own-shares-to-inflate-executive-pay (accessed on 13 September 2023).

- Dhanani, Alpa. 2016. Corporate share repurchases in the UK: Perception and practices of corporate managers an investors. Journal of Applied Accounting Research 17: 331–55. [Google Scholar] [CrossRef]

- Dhanani, Alpa, and Roydon Roberts. 2009. Corporate Share Repurchases: The Perceptions and Practices of UK Financial Managers and Corporate Investors. Edinburgh: Institute of Chartered Accountants of Scotland. [Google Scholar]

- Dittmar, Amy K. 2000. Why do firms repurchase stock? Journal of Business 73: 331–55. [Google Scholar] [CrossRef]

- Dittmar, Amy K., and Laura Casares Field. 2015. Can managers time the market? Evidence using repurchase price data. Journal of Financial Economics 115: 261–82. [Google Scholar] [CrossRef]

- D’Mello, Ranjan, and Pervin K. Shroff. 2000. Equity undervaluation and decisions related to repurchase tender offers: An empirical investigation. Journal of Finance 60: 2399–421. [Google Scholar] [CrossRef]

- Edmans, Alex. 2016. Performance-based pay for executives still works. Harvard Business Review. Available online: https://hbr.org/2016/02/performance-based-pay-for-executives-still-works (accessed on 13 September 2023).

- Edmans, Alex. 2017. The case for stock buybacks. Harvard Business Review. Available online: https://hbr.org/2017/09/the-case-for-stock-buybacks (accessed on 1 September 2023).

- Evgeniou, Theodoros, and Theo Vermaelen. 2017. Share buybacks and gender diversity. Journal of Corporate Finance 45: 669–86. [Google Scholar] [CrossRef]

- Evgeniou, Theodoros, Enric Junque de Fortuny, Nick Nassuphis, and Theo Vermaelen. 2018. Volatility and the buyback anomaly. Journal of Corporate Finance 49: 32–53. [Google Scholar] [CrossRef]

- EY. 2023. Challenging 2022 in London Stock Markets as Proceeds Fall by 90%. Available online: https://www.ey.com/en_uk/news/2023/01/challenging-2022-for-london-stock-markets-as-proceeds-fall-by-90 (accessed on 13 September 2023).

- Farrell, Kathleen A., Jin Yu, and Yi Zhang. 2013. What are the characteristics of firms that engage in earnings per share management through share repurchases? Corporate Governance: An International Review 21: 344–50. [Google Scholar] [CrossRef]

- FCA. 2023. FCA proposes to simplify rules to help encourage companies to list in the UK. Available online: https://www.fca.org.uk/news/press-releases/fca-proposes-simplify-rules-help-encourage-companies-list-uk (accessed on 13 September 2023).

- Fenn, George W., and Nellie Liang. 2001. Corporate payout policy and managerial stock incentives. Journal of Financial Economics 60: 45–72. [Google Scholar] [CrossRef]

- Franks, Julian, Colin Mayer, and Luc Renneboog. 2001. Who disciplines management in poorly performing companies? Journal of Financial Intermediation 10: 209–48. [Google Scholar] [CrossRef]

- Fried, Jesse M. 2014. Insider trading via the corporation. University of Pennsylvania Law Review 162: 801–39. [Google Scholar] [CrossRef]

- Geiler, Philipp, and Luc Renneboog. 2015. Taxes, earnings payout and payout channel choice. Journal of International Financial Markets Institutions and Money 37: 178–203. [Google Scholar] [CrossRef]

- Goodacre, Harry. 2023. The Increasing Popularity of Share Buybacks Outside the US. Available online: https://www.schroders.com/en-gb/uk/intermediary/insights/the-increasing-popularity-of-share-buybacks-outside-the-us (accessed on 13 September 2023).

- Guay, Wayne, and Jarrad Harford. 2000. The cash-flow permanence and information content of dividend increases versus repurchase. Journal of Financial Economics 57: 385–415. [Google Scholar] [CrossRef]

- Ikenberry, David, Josef Lakonishok, and Theo Vermaelen. 1995. Market underreaction to open market share repurchases. Journal of Financial Economics 39: 181–208. [Google Scholar] [CrossRef]

- Jacob, Marcus, and Martin Jacob. 2013. Taxation, dividends, and share repurchase: Taking evidence global. Journal of Financial and Quantitative Analysis 48: 1241–69. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1986. Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review 76: 323–29. [Google Scholar]

- Jiang, Zhan, Kenneth A. Kim, Erik Lie, and Sean Yang. 2013. Share repurchases, catering and dividend substitution. Journal of Corporate Finance 21: 36–50. [Google Scholar] [CrossRef]

- Ji, Philip Inyeob. 2016. Is corporate payout taxation a long run phenomenon? Evidence from international data. North American Journal of Economics and Finance 36: 84–100. [Google Scholar] [CrossRef]

- John, Kose, Anzhela Knyazeva, and Diana Knyazeva. 2015. Governance and Payout Precommitment. Journal of Corporate Finance 33: 101–17. [Google Scholar] [CrossRef]

- Korkeamaki, Timo, Eva Lilijeblom, and Daniel Pasternack. 2010. Tax reform and payout policy: Do shareholder clienteles or payout policy adjust? Journal of Corporate Finance 16: 572–87. [Google Scholar] [CrossRef]

- Lee, Bong Soo, and Jungwan Suh. 2011. Cash holdings and share repurchases: International evidence. Journal of Corporate Finance 17: 1306–29. [Google Scholar] [CrossRef]

- Lee, Chun I., Demissew Diro Ejara, and Kimberly C. Gleason. 2010. An empirical analysis of European stock repurchases. Journal of Multinational Financial Management 20: 114–25. [Google Scholar] [CrossRef]

- Leng, Fei, and Gregory Noronha. 2013. Information and long-term stock performance following open-market share repurchases. The Financial Review 48: 461–87. [Google Scholar] [CrossRef]

- Lilienfeld-Toal, Ulf Von, and Stefan Ruenzi. 2014. CEO ownership, stock market performance and managerial discretion. Journal of Finance 69: 1013–50. [Google Scholar] [CrossRef]

- Lin, Ji-Chai, Clifford P. Stephens, and YiLin Wu. 2014. Limited attention, share repurchases, and takeover risk. Journal of Banking and Finance 2014: 283–301. [Google Scholar] [CrossRef]

- Lin, Tsui-Jung, Yi-Pei Chen, and Han-Fang Tsai. 2017. The relationship among information asymmetry, dividend policy and ownership structure. Finance Research Letters 20: 1–12. [Google Scholar] [CrossRef]

- Muirhead, Calum. 2023. Three City Brokers Warn that Weak Activity in the Markets has Hit their Business. Available online: https://www.thisismoney.co.uk/money/markets/article-11934167/Brokers-battering-downturn-hits-activity (accessed on 13 September 2023).

- O’Dwyer, Michael. 2024. UK Announced Biggest Overhaul of Listing Regime in Decades. Available online: https://www.ft.com/content/a990dfd6-ef99-40ca-b382-276f9f811d00 (accessed on 21 August 2024).

- Oswald, Dennis, and Steven Young. 2004. What role taxes and regulation? A second look at open market share buyback activity in the UK. Journal of Business, Finance and Accounting 31: 257–92. [Google Scholar] [CrossRef]

- Ota, Koji, Hironori Kawase, and David Lau. 2019. Does reputation matter? Evidence from share repurchases. Journal of Corporate Finance 58: 287–306. [Google Scholar] [CrossRef]

- Ozkan, Neslihan. 2007. Do corporate governance mechanisms influence CEO compensation? An empirical investigation of UK Companies. Journal of Multinational Financial Management 17: 349–64. [Google Scholar] [CrossRef]

- Padgett, Carol, and Zhiqi Wang. 2007. Short-Term Returns of UK Share Buyback Activity. Reading: University of Reading, pp. 1–30. Available online: https://core.ac.uk/download/pdf/6565339.pdf (accessed on 13 July 2024).

- PwC. 2019. Share repurchases, executive pay and Investment. BEIS Research Paper 2019/911. Available online: https://www.pwc.co.uk/economic-services/documents/share-repurchases-executive-pay-investment.pdf (accessed on 14 September 2023).

- Rau, P. Raghavendra, and Theo Vermaelen. 2002. Regulation, taxes and share repurchases in the United Kingdom. Journal of Business 75: 245–82. [Google Scholar] [CrossRef]

- Renneboog, Luc, and Grzegorz Trojanowski. 2011. Patterns in payout policy and payout channel choice. Journal of Banking and Finance 35: 1477–90. [Google Scholar] [CrossRef]

- SEC. 2023. Share Repurchase Disclosure Modernization. Available online: https://www.sec.gov/corpfin/secg-share-repurchase-disclosure-modernization (accessed on 14 September 2023).

- Sonika, Rohit, Nicholas F. Carline, and Mark B. Shackleton. 2014. The option and decision to repurchase stock. Financial Management 43: 833–55. [Google Scholar] [CrossRef]

- Wang, Chuan-San, Norman Strong, Samuel Tung, and Steve Lin. 2009. Share repurchases, the clustering problem, and the free cash flow hypothesis. Financial Management 38: 487–505. [Google Scholar] [CrossRef]

- Wang, Zigan, Qie Ellie Yin, and Luping Yu. 2024. Do share repurchases facilitate movement toward target capital structure? International evidence. Journal of Empirical Finance 77: 101498. [Google Scholar] [CrossRef]

- Willems, Michiel. 2021. Cash Holdings: UK Corporates’ £109bn Warchest Increasingly a Rival to Private Equity in M&A. Available online: https://www.cityam.com/cash-holdings-uk-corporates-109bn-warchest-increasingly-a-rival-to-private-equity-in-ma/ (accessed on 13 September 2023).

- Yook, Ken C. 2010. Long run stock-performance following stock repurchases. Quarterly Review of Economics and Finance 50: 323–31. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).