Abstract

Healthcare leaders are faced with many financial challenges in the contemporary environment, leading to financial distress and notable instances of bankruptcies in recent years. What is not well understood are the specific conditions that may lead to organizational economic failure. Though there are various models that predict financial distress, existing regression methods may be inadequate, especially when the finance variables follow a nonnormal frequency pattern. Furthermore, the regression approach encounters difficulties due to multicollinearity. Therefore, an alternate stochastic approach for predicting the probability of hospital bankruptcy is needed. The new method we propose involves several key steps to better assess financial health in hospitals. First, we compute and interpret the relationship between the hospital’s revenues and expenses for bivariate lognormal data. Next, we estimate the risk of bankruptcy due to the mismatch between revenues and expenses. We also determine the likelihood of a hospital’s expenses exceeding the state’s median expenses level. Lastly, we evaluate the hospital’s financial memory level to understand its level of financial stability. We believe that our novel approach to anticipating hospital bankruptcy may be useful for both hospital leaders and policymakers in making informed decisions and proactively managing risks to ensure the sustainability and stability of their institutions.

1. Introduction

Discussion of bankruptcy involves income, profit, losses, and the occurrences of unusual expenses, as pointed out by Ivanova et al. (2024). When the revenues are less than the expenses in any enterprise, the “financial stress” begins. If the financial stress persists, the undesirable “bankruptcy” emerges as a remedy. In other words, enterprises dealing with a sustained mismatch between expenses and revenues enter financial distress, which may regress into bankruptcy. When the revenues of a hospital are less than its expenses, the hospital is not profitable. Examples are financial distress leading eventually to bankruptcy are abundant across the business landscape, including in the airline, tourism, and healthcare industries (Koptseva et al. 2022; Shi and Li 2021).

The ability to predict the probability of a forthcoming bankruptcy is a crucial step in mitigating the likelihood of bankruptcy occurrence. To acquire such insight, experience in the field and/or guidance from a proper analysis of the pertinent data are vital. Existing efforts, such as Altman’s Z-score model, have been utilized to predict financial distress in various industries (Altman 2018, 1968). Other scholars have attempted to use artificial intelligence to predict the likelihood of hospital bankruptcy (Muñoz-Izquierdo et al. 2019). Despite these efforts, bankruptcy models remain limited and often insufficient because of the requirement that the financial data are normally distributed, highlighting the need for more effective predictive approaches.

The memory of the banking system or the organizational memory plays a role in safeguarding it from becoming bankrupt. Kyoud et al. (2023) provided insights into the inherent systemic memory level of the banking system before bankruptcy. Gomes et al. (2023) provided suggestions for the owners of restaurants in Portugal to increase leadership skills to manage the crisis to avoid bankruptcy during the COVID-19 pandemic. An analogous situation exists in the banking sector, as pointed out by Kyoud et al., and in the economy of Eastern European countries, as pointed out by Gomes et al. The system consists of measurable and non-observable observations, which are recognized as parameters. What has been happening in the system is portrayed by its memory. Memory is describable by the observables and the parameters together. The observables are smoothed over. The system’s memory is quantified by the parameters, as carried out in the derivation of expression (8) later in the article. Wieczorek-Kosmala (2021) advocated the importance of recognizing the existence of risk and its management to avert bankruptcy in all sectors including hospitals based on the system’s memory. Prusak (2018) examined the crucial role of the risk due to the economy in predicting bankruptcy in East European countries. There has been a tendency in almost all U.S. states for a hospital to outspend more than the average expenses of the state, and this is so in thinly populated states such as Hawaii, Montana, Wyoming, and North Dakota. In almost all U.S. states, the memory of excessive spending over the state’s average expenses is higher than the baseline memory 1.0 except in the states of Hawaii, Wyoming, Virginia, North Carolina, Mississippi, and Arkansas. When such a hospital’s memory is greater than 1.0, there might be conscious efforts to prevent bankruptcy from occurring. In our stochastic approach, the concept of memory personifies conscious or unconscious efforts by the hospital administrators’ reaction to the continuing pattern in which the hospital’s revenues have been lesser than the expenses. The higher level of such memory level is indicative of a lower chance for bankruptcy to occur.

Bankruptcy is especially troublesome when it is encountered in hospitals or clinics, as their contribution to community health is well understood (Dubas-Jakóbczyk et al. 2024). The loss of jobs and impact on the local economy associated with bankruptcies are worrisome too, but the associated decrease in access to care for patients and families can be disastrous. Dobkin et al. (2018) identified low hospital admissions rates, poor health insurance coverage in the local community, and unpaid medical bills as the primary causal factors explaining financial stress in the hospital industry. Exogenous shocks such as COVID-19 that significantly impacted the healthcare industry have raised financial concerns to a higher level (Wieczorek-Kosmala 2021). The increased financial distress in the hospital industry is reflected in the sharp increase in bankruptcy filings by U.S. hospitals, which has increased by an astonishing 84% from 2021 to 2022 (Rastogi 2024). A large national study by Beauvais et al. (2023) determined that contemporary structural and operational factors were the root causes of bankruptcies in 27 U.S. short-term acute care hospitals.

The objective of providing an early warning of impending bankruptcy has been universally accepted as a high priority for many years. Altman (2018) narrated the history behind creating the Z-score method, after 50 years, and mentioned that this method is still popularly used to assess the possibility of bankruptcy in the financial sectors. Altman’s method was built on artificially balanced data (i.e., the same number of bankruptcy and non-bankruptcy cases). Normal distribution of the data is a requirement to perform the discriminant analysis, as noted by Ohlson (Ohlson 1980; Lawrence et al. 2015). As an improvement, Ohlson’s method predicts bankruptcy using ratio- and indicator-lagged variables (Keele and Kelly 2006). Zmijewski’s method predicts bankruptcy considering the proportion of non-bankrupt firms to be included in the training sample (Barandela et al. 2004). Despite their importance and popularity, these financial distress models may not be suitable when the financial data are not normally distributed (Almuqrin 2024). The primary purpose of this study was to use a nationally representative sample of U.S. hospitals to develop a method that is applicable when the finance variables such as the revenues and expenses follow a stochastic bivariate lognormal frequency pattern.

The remainder of the paper is organized as follows: Section 2 presents a review of relevant literature; Section 3 describes the data and analysis materials and methods; Section 4 discusses the results; Section 5 includes discussion, limitations, and future research directions; and Section 6 concludes and provides practical implications derived from this study.

2. Literature Review

A literature review on hospital bankruptcy is a necessity before proceeding to revise the bivariate lognormal frequency structure to tackle bankruptcy issues. Prior studies have suggested that internal and external factors are associated with the bankruptcy filings of U.S. hospitals. For instance, Landry and Landry III (2009) studied 42 United States (U.S.) acute care urban hospitals that filed for bankruptcy between 2000 and 2006. Their findings highlighted regional differences in hospital bankruptcy filings. In the Northeast and Southeast regions, multihospital system membership and ownership status were not significant factors. However, in the West Coast, Midwest, and Southwest regions, independent hospitals were more likely to file for bankruptcy compared to those affiliated with a multi-hospital system. Additionally, in the Midwest, hospitals that filed for bankruptcy were more likely to be for-profit (investor-owned) compared to those that did not file for bankruptcy. In addition, they suggested that the major themes associated with the hospital bankruptcy filing were poor financial management, payer mix, reimbursement from insurance, poor management, fraud allegations, financial strategy, competition, physician politics, workforce issues, declining patient volume, cost of malpractice insurance, quality issues, demographic changes, and external politics. In the same vein, Carroll et al. (2021) examined the factors associated with U.S. hospital bankruptcy between 2007 and 2019 using data from 38 hospitals that filed for bankruptcy protection. Beauvais et al. (2023), in their study of U.S. hospitals (n = 3125), developed three predictive models: the first one was based on logistic regression, and the second was a linear support vector machine (SVM) model with hinge function and a perceptron neural network. The three models indicated that up to 18 variables have a significant impact on predicting hospital bankruptcy. These variables, which include net patient revenues, accounts receivable, current ratio, total assets, debt-to-equity ratio, net operating profit margin, and uncompensated care by net patient revenues, are all associated with the decreased classification of the bankrupt status. Similarly, Joint Commission accreditation, government ownership status, and patient perceptions of care recommendation were all also associated with the decreased classification of bankruptcy.

In a recent article, Phan et al. (2024) asserted Hyman Minsky’s financial instability hypothesis using statistical support of the debt ratios in the post-1980s periods. They also noted a chain reaction that the expansionary monetary actions create an abundance of cheap liquidity, which results in new investments, a prolonged period of consistent profit causes assessment of risk, paving the way to accept riskier investment, which circumvents regulation constraints. This chain is recognized as the instability of capitalism, and it connects to the uncertainty of healthcare profits.

Citterio (2024) promoted a second empirical approach to comprehending bank instability. Ratnasari et al. (2024) compared two prediction models for pharmaceutical companies’ bankruptcy in Indonesia and concluded that Altman Z-score outperformed the Groves method. Santoso et al. (2024) assessed financial distress in 23 companies using modified Altman Z-score, Ohlson O-score, and Zmijewski X-score models and declared that the modified Altman Z-score was the best. Gangwani and Zhu (2024) carried out a systematic review of modeling the data to predict bankruptcy. Xu et al. (2024) emphasized the need to include the parameter uncertainty in forecasting bankruptcy.

Several methods exist to predict bankruptcy (Bellovary et al. 2007). Some of these methods are traditional and ingenious. The earliest method to forecast a hospital’s bankruptcy is called the Z-score method, as coined by Altman (1968). Another classical method is that of Ohlson (1980), which is a probabilistic approach to predicting an emerging bankruptcy situation. Ohlson’s methodology requires the finance variables to follow a normal frequency pattern, and it is built based on a conditional logit regression model. Another noteworthy method by Hillegeist et al. (2004) enables the assessment of the probability for bankruptcy to occur conditionally on data following a normal frequency pattern. The limitations of all these models were that the financial data were normally distributed.

Problem Statement and Purpose of This Research Study

Financial data often follow a nonnormal data distribution. The problem addressed in this study is that existing probabilistic analysis methods are not suitable for analyzing nonnormal financial data. This study proposes a new method for analyzing nonnormal financial data. A second aim is to derive analytic expressions to forecast the revenues and expenses for our U.S. acute care hospital financial bankruptcy data. We thought of a holistic novel approach utilizing a bivariable probability structure on the revenues, the expenses, and their tipping point, causing a disequilibrium. We define the “tipping point” as a place in which the revenues are lesser than the expenses for the first time.

The underlying issue is that when financial data follow a nonnormal (e.g., lognormal) frequency pattern, the Z-score method by Altman (1968) is inappropriate. According to Hillegeist et al. (2004), the Ohlson (1980) probabilistic method, which requires approximate data normality, is a better choice than the Altman method to assess the probability of a bankruptcy occurrence. Unfortunately, the Ohlson method is not suitable for nonnormal financial data indicating a need for a new novel approach to analyzing nonnormal financial data. Financial data are known to be lognormally distributed, according to several published journal articles, and hence there is no novelty or innovation. However, the novelty in this article is the development of methodology for the lognormal financial data analysis. The first aim of this study is to develop and demonstrate a new methodology for predicting the probability of a hospital’s bankruptcy based on revenues and expenses for a bivariate lognormal dataset. The secondary aim of this study is to derive analytic expressions for regression curve to forecast the revenues given the expenses level and vice versa to obtain their correlation value, to interpret risk measures for emerging bankruptcy situations given the level of revenues and expenses, the level of data information in the revenues as well as the expenses, to explain the chance for the hospital to incur excessive expenses to exceed the state’s median of the expenses, and to discuss the hospital’s financial memory level under bivariate lognormal data. We hypothesize that our stochastic approach will provide a novel approach for probability analysis of nonnormal financial data.

In our study, we focus on developing a methodology that is appropriate when the finance variables follow a lognormal frequency pattern. To use Altman’s Z-score, Ohlson et al.’s, or Hillegeist et al.’s method, the finance variable must follow a normal frequency pattern. Because our data on expenses and revenues follow a lognormal frequency pattern, we need a new methodology for the lognormal data, and it is this article’s research aim. To focus on the development of the new methodology, we opted to consider just two finance variables: expenses O and revenues of the individual hospitals in this article without losing its generality of other applications with two finance variables comparable to O and . The finance literature has no article to cite here and hence, we focus on the novelty of our approach. This article aims to identify the tipping point, to help hospital administrators be alert and apply remedial strategies before a bankruptcy occurs. In line with van Dijk et al. (2024), we investigated the random nature of the expenses (O) and revenues (). The employment of appropriate probability frequency structures for O and is crucial in dealing with bankruptcy.

There is a vast history of selecting probability frequency structures for a financial crisis, especially for a bankruptcy situation. We used the lognormal frequency structure as the finance variables follow a bivariate lognormal frequency pattern. See Aitchison and Brown (1957) for the economic and financial applications of the lognormal frequency structure. The literature has no analytic expression(s) or examples to mimic in practice for tackling financial crises such as hospital bankruptcies. The question of whether analytic expressions are fit for bankruptcy is the main theme discussed in this paper.

In the absence of any guidance, financial analysts must derive suitable expressions to deal with bankruptcy. When the data possess a nonlinear relation, linear regression fit is insufficient, and it is considered an inflexibility. One reason is that outliers in the data will distort the fitted regression projections. The sense of the best regression fit is nonexistent or vacuous. Several practitioners overfit in the search for better regression, ignoring the importance of parsimony. Even with a small change in the current predictor, sometimes the fitted regression projects an unreasonable value. Li (2024) concurs, and he mentions that linear regressions do not do a good job of predicting complex nonlinear situations (i.e., not flexible), and outliers in the data can cause larger linear regression prediction errors, hence the need for data scaling; Lien (1986, 2005) tried lognormal for the finance variables with convincing reasons.

A theoretical reason is that a new stochastic methodology could be structured when the data are not normally distributed. In this article, we developed and demonstrated a methodology for data with lognormal distributions. Because the financial data are known to be lognormally distributed, it is appropriate to use our proposed method for evaluating hospital bankruptcy predictors.

3. Materials and Methods

3.1. Data and Sampling

In this study, we obtained data from Definitive Healthcare and from Becker’s Hospital Review 2019 report (bankruptcy status). An exploratory study was carried out earlier on the predictive factors of hospital bankruptcy by Beauvais et al. (2023). Definitive Healthcare compiles data from multiple public access databases such as hospitals, physician group practices, surgery centers, and long-term care organizations. Regarding United States hospitals, data sources include the American Hospital Association Annual Survey (hospital profile), the Medicare Cost Report (financial data), and the Hospital Value-Based Purchasing Program (quality data) (Definitive 2024).

Definitive Healthcare provided revenue and expense data of U.S. short-term acute care hospitals (n = 3126) for the year 2022 (Definitive 2024). The original data set consisted of all 3873 acute care hospitals in the United States. All Federal hospitals, including 172 Veterans Affairs, 26 Indian Health Service, and 31 Military Health System facilities, were excluded from our study because Federal facilities are not required to file Medicare Cost Reports, and thus numerous relevant data elements used in our analysis were not available. We deselected 518 facilities because the data for the revenues or the expenses were not entered, which we recognized as “missing” cases from the database. The final reduced dataset encompassed 3126 hospital observations or roughly 80.7% of the total active short-term acute care facility population in the United States.

3.2. Study Variables

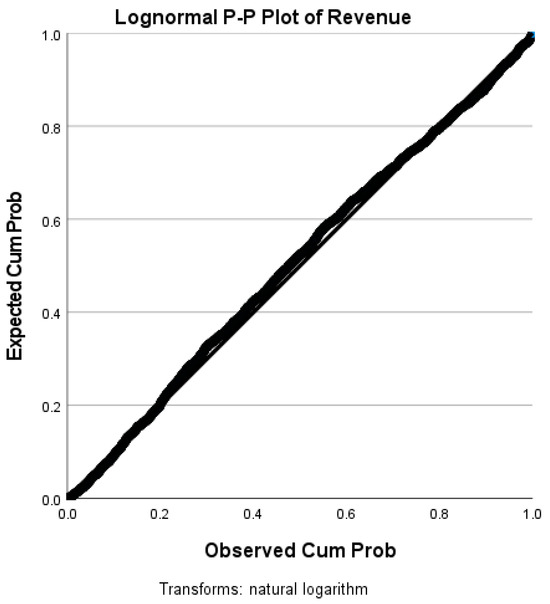

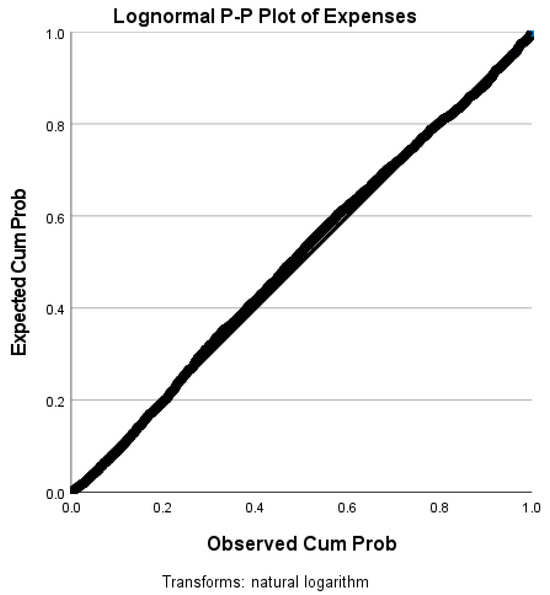

The data variables under study are the hospital’s expenses and revenues from the Definitive Healthcare data for a given period. Table 1 shows the study data descriptive statistics. Our study data meets the requirement for our new method because they are not normally distributed, as is evident from the Kolmogorov–Smirnov test results in Table 2 and Table 3 and from the p-p plots in Figure 1 and Figure 2. Thus, Altman’s Z-score, Ohlson et al.’s O-score, and Hillegeist et al.’s methods are inapplicable. A new method needs to be constructed as the existing relevant literature does not have a method for financial data with a lognormal normal.

Figure 1.

P-P plot of revenues.

Figure 2.

P-P plot of hospital expenses.

3.3. Software

We utilized Microsoft Mathematics 4.0 (n.d.) (https://www.microsoft.com/en-us/) software to develop Figure 1, Figure 2, Figure 3, Figure 4, Figure 5, Figure 6, Figure 7, Figure 8 and Figure 9. Figure 1, Figure 2, Figure 10, Figure 11, Figure 12, Figure 13 and Figure 14 were generated with IBM (International Business Machines) SPSS (Statistical Package for Social Sciences) Statistics Version 28.0.1.0 (IBM SPSS Statistics for Windows 2024) (https://www.ibm.com/products/spss-statistics). The maps and tables were created with Microsoft Excel Version 2407. The PP plots and the Kolmogorov–Smirnov results justify that the financial data follow a lognormal frequency trend. Of course, the Kolmogorov–Smirnov (KS) goodness of fit is powerful as it is based on the distance measure between the theoretical and empirical cumulative distribution curves. The PP plots confirm that both revenues and expenses are lognormally distributed. Moreover, to involve the KS test, we need to select another candidate distribution, and we are uncomfortable selecting without a reason. Then, our research focus deviates from checking the distribution of the data instead of constructing a methodology for the lognormal data. Incidentally, the KS goodness of fit test is a non-parametric technique, and the non-parametric technique is more often an approximate technique less powerful than a parametric technique.

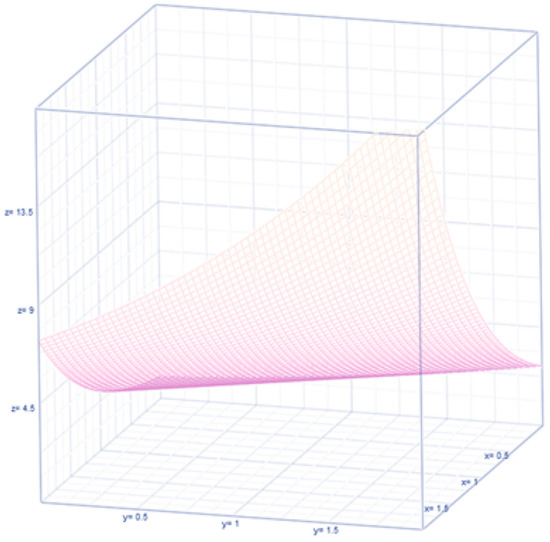

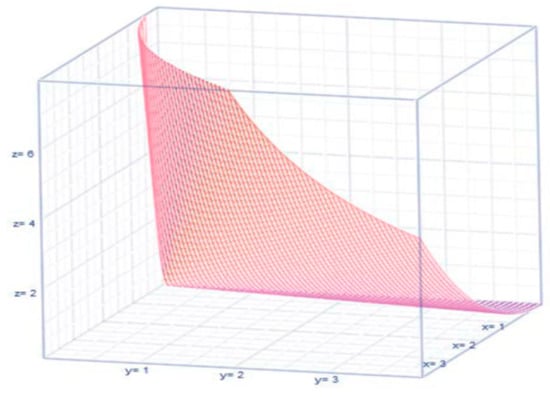

Figure 3.

Exponential regression curve for revenues and expenses with zero correlation.

Figure 4.

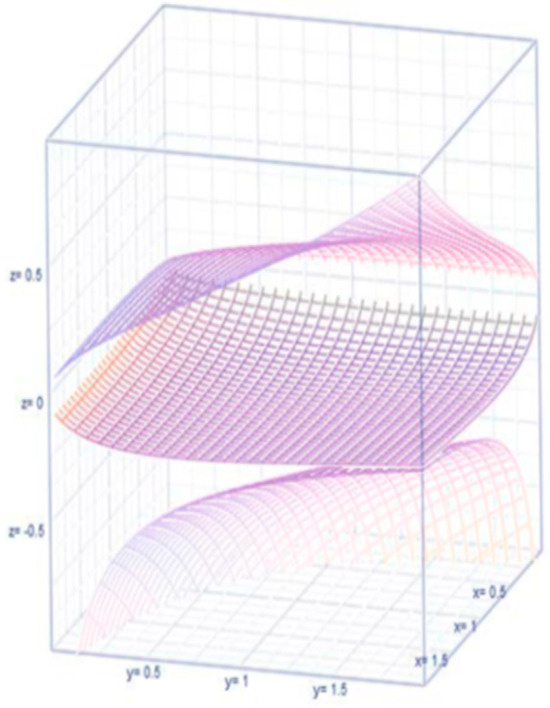

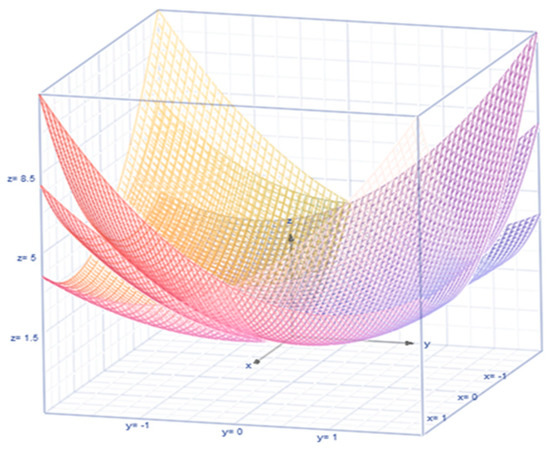

Correlation between and .

Figure 5.

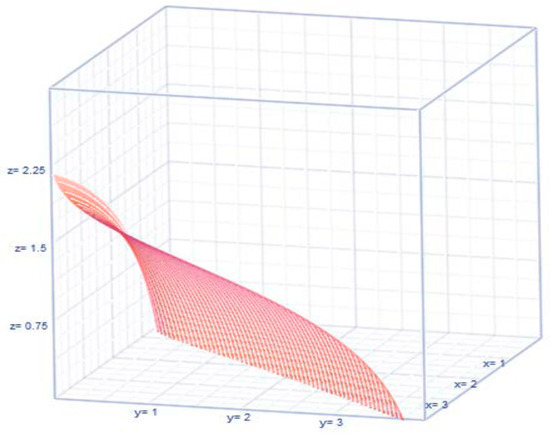

The pattern of the expected value is shown in Figure 5 above.

Figure 6.

Risk in terms of variance of revenues and expenses.

Figure 7.

Information on the patterns of or .

Figure 8.

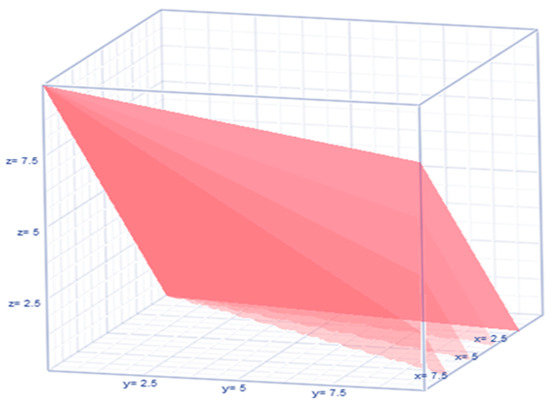

Nonlinear dynamics of .

Figure 9.

Graph of .

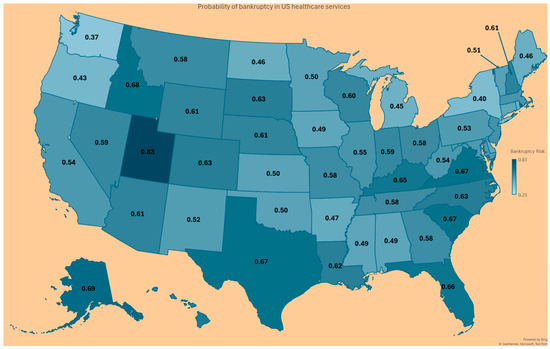

Figure 10.

Probability for a hospital to experience financial bankruptcy in U.S. states.

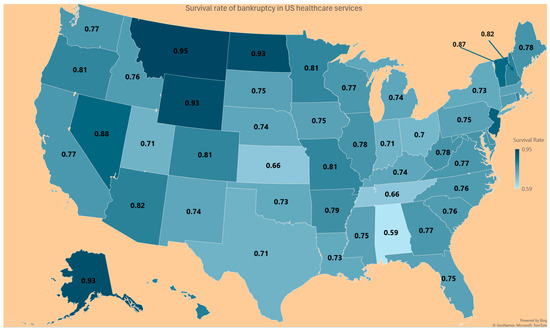

Figure 11.

Survival rate for a hospital in the U.S. states.

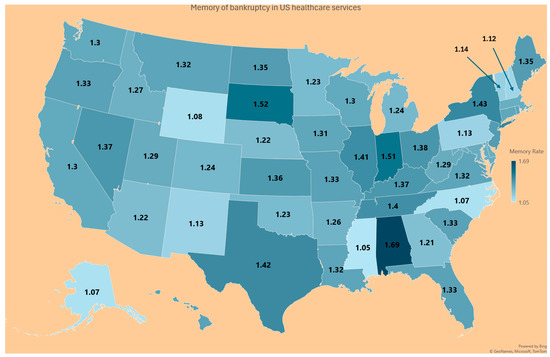

Figure 12.

Memory level of a hospital about its financial matters in U.S. states.

Figure 13.

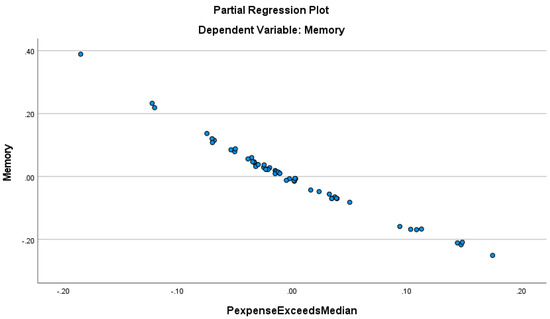

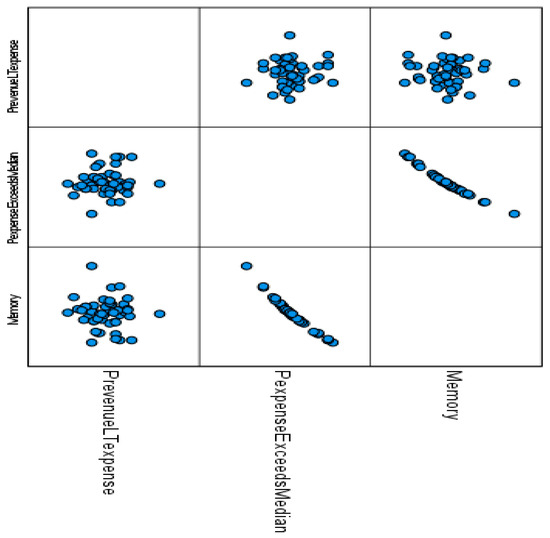

Regressive relationship between the hospitals’ financial memory and the proportion of hospitals with expenses exceeding the median expenses of hospitals in the state.

Figure 14.

Correlograms among the finance proportions.

3.4. Stochastic Method with New Expressions

To be specific to comprehend our stochastic approach, let be a tipping point for bankruptcy to emerge based on the levels of the revenues and expenses of the hospital in a defined duration of time. First, we assumed that both revenues and expenses are intricate random variables whose uncertainty is governed by a bivariate lognormal frequency structure. Second, we confirmed that our bankruptcy data follow a bivariate lognormal (BLN) frequency pattern. Because of the lognormality of the data, the Z-score, simple regression analysis, modified Altman Z-score, Ohlson O-score, or Zmijewski X-score approaches are not appropriate (Zmijewski 1984). The traditional regression approach is not appealing to us to analyze and interpret the data evidence for reasons such as unbalanced sampling and the existence of selection bias stated in Gruszczyński (2019).

In our new and novel stochastic approach, we developed and interpreted the theoretical regression curve to forecast the revenues given the expenses level and vice versa, their correlation measure under bivariate lognormal data, risk measure for bankruptcy due to the revenues and expenses , their level of information, the likelihood for a hospital’s expenses to exceed the state’s median expenses level, and a hospital’s financial memory level. These details are not available in the Altman Z-score or regression approach.

The random finance variables and meet Lien’s reasons for considering a bivariate lognormal frequency structure in (1). The random P-P plots (see Figure 1 and Figure 2) below of the revenues and the expenses confirm that the finance variables and are bivariate lognormal in (1).

The joint bivariate probability frequency function (pff) of and in (1), with denoting their correlation, is called lognormal:

where are linear log transformations. The conditional pff of R for a given O is

The regression curve of R on O is

Notice that when the correlation parameter vanishes (that is, ), the joint pff (1) breaks up into a product of marginal lognormal pffs:

and

Then, the marginal baseline regressions become an exponential curve and (see Figure 3), implying that neither finance variable or is influencing the other as a part of projecting the other.

Otherwise (that is, when the finance variables or are correlated), the (baseline) regressions are uplifted by a factor or as the case is regression to forecast or forecast , respectively. We compare and discuss the uplifting factors later in the article. The earliest reference to (1) is by Thoimopoulos and Longinow (1984). The expression for the correlation under the lognormal chance mechanism for the revenues and expenses variables is expressed as (see Figure 4 for their configuration depending on the value for ).

Let , and , denote, respectively, the marginal median and mode of the revenues and expenses. Also, their expected values under lognormal chance mechanism for the revenues and expenses variables are , (see their configurations in Figure 5), with their covariance as a function of their variances and risk (see Figure 6). The median and mode of the revenues and expenses are indicated by , , , .

Their entropies (which are quantified information) for the expenses and revenues are , and , respectively. See the patterns of or (see Figure 7 for their nonlinear configurations).

The above-shown results are inadequate to capture and interpret the existence of cause or effect of bankruptcy and hence, a different version of the bivariate lognormal pff (1) needs to be modified. There are known disadvantages of using the regression approach in financial distress. In other words, the predictor (alternatively recognized as independent) variables are either incorrectly defined or insufficiently measured. The regression concept encompasses a variety of micro-techniques that are meaningful only when the assumptions are met by the data, according to Greenland (2024). The assumptions, model specifications, or interpretations are not fully understood by the regression builders. Building regressions is an art rather than a methodology to stand up for its merit. One regression fit is better than another. Yet, one regression fit cannot be declared as the best as there is a grey area. Even statisticians are not conclusively answering the right path for data analysis in building regression.

Should a Bayesian or classical (non-Bayesian) regression be used? Both are philosophically opposed to each other, causing a dilemma for those who chose regression analysis. In the Bayesian framework, the non-observable parameter dynamically changes from one time to another, and it requires selecting judiciously prior knowledge. The classical framework is at times tedious, as detailed in Nawajah et al. (2024). Another technical disadvantage exists in interpreting the regression coefficients, especially when the data of the dependent or predictor variables are transformed. The regression approach requires that the data validate the assumptions. One of the assumptions is known to be normality. Many believe that normality is a myth as it seldom exists. However, the popular regression fits are done based on the normality of the dependent variable and the constancy of the predictor variables. When the normality of the dependent variable is unmet with or without the homogeneity assumption, financial analysts are tempted to logarithmically transform the dependent variable. The profit per bed in a hospital is known to be a case in point. Such logarithmic transformation of the predictor) variable intensifies the complexity of the interpretation of the estimated regression coefficient(s). Is the interpretation useful in the defined scale of the variables? How do the finance analysts do it? Should an undoing/reversing of the transformation scale of the regression results occur? More often than otherwise, the reversing of the transformation scale would unravel a reality that the dependent and predictor variable(s) are nonlinearly interrelated before the transformation. The scale-powered transformation or for an appropriate choice is used at times.

Note that the finance variables and are correlated bivariate lognormal variables. Additionally, and are correlated bivariate normal variables with parameters , according to Chattamvelli and Shanmugam (2022). There are two mutually exclusive possibilities in this context. The first possibility is the earliest tipping point, in which the revenues, is over the proportion, times of the expenses . The probability of the event is not of any concern to the hospital and hence it is not pursued in the article. The second (complementary) mutually exclusive possibility is the event , which suggests that the hospital moves into a zone in which bankruptcy might emerge. See the nonlinear dynamics of the inequality in Figure 8.

The likelihood that the revenues, , is less than the proportion, , of the expenses, , could be cast in probability terms as . Using the conditional pff (2) and the marginal pff (4), we rewrite , where is the cumulative normal frequency structure. We now Taylorize at the tipping point , that is, . The derivative of the integral is further simplified to using the formula in (Blumenfeld 2001, p. 198). Going back to the expression for , we seek its closed-form expression as in (6) for the sake of computing the probability. For this purpose, the probabilistic risk of the revenues to be less than the expenses is needed. Realize that such a risk is a function of the tipping point , mean , and variance of the expenses and their correlation parameter , that is,

When the revenues and the expenses are close to each other, the tipping point is , in which case the probability in (6) is . The expression (6) is indicative of the risk of financial stress emerging in the sense that the revenues are lower than the expenses, which is a prelude for bankruptcy i as a possible outcome. Realizing that the chance for the revenues to be lesser than the expenses in (6), only the tipping point , the correlation between the revenues and expenses, and the average and variance of the expenses are involved. Hence, we need to capture the patterns of the expenses . In the literature (see Chattamvelli and Shanmugam 2022), the local dependence of the revenues and expenses with a bivariate normal frequency pattern is echoed by . However, in the alternate situation in which the revenues and expenses of a hospital’s system are governed by a bivariate lognormal frequency pattern, their dependence changes to . Furthermore, the likelihood for the expenses to exceed the state’s median expense level is

where the bankruptcy incidence rate . Notice also that when the survival chance S(t) for the expenses to exceed a tolerance level is slimmer, the bankruptcy incidence rate i(t) is more frequent. In a probabilistic sense, the frequency of the incidence rate of bankruptcy is connected to the hospital’s financial memory. This article now derives an analytic expression to capture and interpret the hospital’s financial memory as in (8). Notice that expression (8) for the hospital’s financial memory is controlled by the mean µO, volatility σO of the hospital’s expenses. The mean excessive frequency pattern of the expenses exceeding the tolerance level is , where the memory of the hospital’s finance system plays a role. The memory of the hospital’s expenses pattern is

In any situation (not necessarily only in the bankruptcy situation), under the bivariate lognormal frequency pattern of the expenses and revenues, the variances are known to be non-ignorable. Issa et al. (2024) defined the financial risk in terms of the variances and covariances of the finance variables. In the bankruptcy context, the variation of the expenses and revenues is built in an elliptical orbit , as shown in Figure 9.

4. Results

The probability–probability (P-P) plots suggested a nonnormality for the revenues and expenses variables of the chosen data. The descriptive statistics in Table 1 indicated that the revenues and expenses are not normally distributed. For normal data, there should be zero skewness, and the kurtosis should be lower than 3.0, which is not the case in our data. Also, the Kolmogorov–Smirnov test results in Table 2 for the revenues and in Table 3 for the expenses reject their normality with a 99.99% confidence level because the p-value was 0.000 for both variables. The expenses variable and the revenues variable in the data were correlated at a level , with a 95% confidence interval . See the value of the Probability Prob ( < ) of the expression (6) in Column 1 of Table 4, and Figure 10 for the probability of U.S. hospitals to become bankrupt. See in Column 2 of Table 1 and Figure 11 for the survival rate S(t) = PR ( > t) for a hospital’s expenses to exceed a given tolerance level t. Because the average and variances of the hospital’s expenses are extremely large numbers, the probability for the excessive expenses to exceed the tolerance level (that is, ) is near zero, and hence their values are not displayed in Table 4. However, the hospital’s memory to hold on to the patterns of finance variables in expression (8) is displayed in the third column of Table 4 as the memory is finite around the baseline value 1.0 across the U.S. states, as seen in Figure 12.

Table 1.

Descriptive statistics indicating the nonnormality of the financial data.

Table 1.

Descriptive statistics indicating the nonnormality of the financial data.

| Valid Cases | n = 3125 (Revenues) | n = 3125 (Expenses) |

|---|---|---|

| Missing cases | 0 | 0 |

| Mode | 808,333.000 | 3.444 × 10+6 |

| Median | 2.032 × 10+8 | 1.953 × 10+8 |

| Mean | 4.132 × 10+8 | 3.879 × 10+8 |

| 95% CI Mean Upper | 4.369 × 10+8 | 4.097 × 10+8 |

| 95% CI Mean Lower | 3.896 × 10+8 | 3.661 × 10+8 |

| IQR | 3.671 × 10+8 | 3.506 × 10+8 |

| Variance | 4.541 × 10+17 | 3.846 × 10+17 |

| 95% CI Variance Upper | 5.581 × 10+17 | 4.749 × 10+17 |

| 95% CI Variance Lower | 3.549 × 10+17 | 3.030 × 10+17 |

| Skewness | 5.154 | 5.027 |

| Std. Error of Skewness | 0.044 | 0.044 |

| Kurtosis | 40.100 | 37.785 |

| Std. Error of Kurtosis | 0.088 | 0.088 |

| Minimum | 808,333.000 | 3.444 × 10+6 |

| Maximum | 8.983 × 10+9 | 7.809 × 10+9 |

The summary of the descriptives in Table 1 confirms that the finance data (that is, revenues and expenses) are not normal. In the normal data, the mean, median, and mode are expected to be close, and this did not happen in our data. The skewness of normal data should be near zero, and it did not happen for the revenues or expenses. The kurtosis value is also expected to be near three in the case of normal data, and this did not occur in our data of revenues or expenses. The lognormal frequency pattern usually exhibits a high-level skewness and a thicker tail (indicative of extremely high kurtosis). Clearly, according to the summary in Table 1, the finance data (both the revenues and the expenses) are not normal but rather lognormal.

Table 2.

One-sample Kolmogorov–Smirnov normal test summary for revenues.

Table 2.

One-sample Kolmogorov–Smirnov normal test summary for revenues.

| Total | n = 3125 | |

|---|---|---|

| Most Extreme Differences | Absolute | 0.270 |

| Positive | 0.229 | |

| Negative | −0.270 | |

| Test Statistic | 0.270 | |

| Asymptotic Sig. (two-sided test) a | 0.000 | |

a Lilliefors corrected.

Table 3.

One-sample Kolmogorov–Smirnov normal test summary for expenses.

Table 3.

One-sample Kolmogorov–Smirnov normal test summary for expenses.

| Total | n = 3125 | |

|---|---|---|

| Most Extreme Differences | Absolute | 0.268 |

| Positive | 0.222 | |

| Negative | −0.268 | |

| Test Statistic | 0.268 | |

| Asymptotic Sig. (two-sided test) a | 0.000 | |

a Lilliefors corrected.

Table 4.

Probability for R < O, survival rate, and memory level in U.S. hospitals by state.

Table 4.

Probability for R < O, survival rate, and memory level in U.S. hospitals by state.

| State | Probability Prob (R < O) in (6) | Survival Rate (7) | Memory of the Finance System (8) |

|---|---|---|---|

| AK | 0.69 | 0.93 | 1.07 |

| AL | 0.49 | 0.59 | 1.69 |

| AR | 0.60 | 0.82 | 1.22 |

| AZ | 0.47 | 0.79 | 1.26 |

| CA | 0.54 | 0.81 | 1.24 |

| CO | 0.63 | 0.76 | 1.31 |

| CT | 0.49 | 0.76 | 1.32 |

| DC | 0.63 | 0.78 | 1.28 |

| DE | 0.49 | 0.75 | 1.33 |

| FL | 0.66 | 0.77 | 1.3 |

| GA | 0.58 | 0.83 | 1.21 |

| HI | 0.64 | 0.75 | 1.33 |

| IA | 0.49 | 0.76 | 1.31 |

| ID | 0.68 | 0.78 | 1.27 |

| IL | 0.55 | 0.71 | 1.41 |

| IN | 0.59 | 0.66 | 1.51 |

| KS | 0.50 | 0.74 | 1.36 |

| KY | 0.65 | 0.73 | 1.37 |

| LA | 0.62 | 0.75 | 1.32 |

| MA | 0.55 | 0.78 | 1.28 |

| MD | 0.53 | 0.78 | 1.29 |

| ME | 0.46 | 0.74 | 1.35 |

| MI | 0.45 | 0.81 | 1.24 |

| MN | 0.50 | 0.81 | 1.23 |

| MO | 0.58 | 0.75 | 1.33 |

| MS | 0.49 | 0.95 | 1.05 |

| MT | 0.58 | 0.76 | 1.32 |

| NC | 0.63 | 0.93 | 1.07 |

| ND | 0.46 | 0.74 | 1.35 |

| NE | 0.61 | 0.82 | 1.22 |

| NH | 0.61 | 0.89 | 1.12 |

| NJ | 0.56 | 0.74 | 1.35 |

| NM | 0.52 | 0.88 | 1.13 |

| NV | 0.59 | 0.73 | 1.37 |

| NY | 0.40 | 0.7 | 1.43 |

| OH | 0.58 | 0.73 | 1.38 |

| OK | 0.50 | 0.81 | 1.23 |

| OR | 0.42 | 0.75 | 1.33 |

| PA | 0.53 | 0.89 | 1.13 |

| PR | 0.52 | 0.8 | 1.25 |

| RI | 0.44 | 0.76 | 1.32 |

| SC | 0.67 | 0.75 | 1.33 |

| SD | 0.63 | 0.66 | 1.52 |

| TN | 0.58 | 0.71 | 1.4 |

| TX | 0.67 | 0.71 | 1.42 |

| UT | 0.83 | 0.77 | 1.29 |

| VA | 0.67 | 0.76 | 1.32 |

| VT | 0.51 | 0.87 | 1.14 |

| WA | 0.37 | 0.77 | 1.3 |

| WI | 0.60 | 0.77 | 1.3 |

| WV | 0.54 | 0.78 | 1.29 |

| WY | 0.61 | 0.93 | 1.08 |

Figure 13 suggests that the memory level of the hospitals’ financial system is less only when the probability for the expenses to exceed the state’s median expenses is higher. In other words, the hospitals’ financial system is more predictable by the proportion of the hospitals spending more than the state’s median expenses, with an R-squared higher than 0.975. The proportion of the hospitals with revenues less than the expenses is not a significant predictor of the memory of the hospitals’ financial system, as confirmed by the correlograms in Figure 14.

Figure 14 provides the correlation pattern among all three analytic results (namely PR (revenues < expenses), PR (expenses exceed the state’s median expenses), and the hospital’s memory of the finance variables) across the US states which reveals an interesting advantage of our stochastic approach as these are not possible in the Z-score, regression, modified Altman Z-score, Ohlson O-score, or Zmijewski X-score approach.

5. Discussion

This study aimed to provide a new method for analyzing nonnormal financial data. We illustrated our new method by analyzing a U.S. acute care hospital financial data set to estimate the probability of bankruptcy in hospitals. Our study focused on hospitals’ revenues and expenses. The existing methods that are used to predict financial distress require the frequency pattern of the data to be normal (Gaussian). The primary strength of our methodology is that it can be applied to financial data that follow a lognormal distribution. When the finance data follow a normal frequency pattern, the traditional methods in the literature can be applied to extract the implications of the data. When finance data such as the that which we illustrated here follow a lognormal frequency pattern, the traditional methods in the literature are inappropriate and the method we illustrated in this article is appropriate as it yields interpretable valid results. The neat expressions (6)–(8) that we derived and illustrated in this article are novel, innovative, and significant contributions. The revenues could increase occasionally with or without an increase in expenses. In the context of decision-making, we ought to involve the updated revenues and the updated expenses.

Our results indicated that hospital expenses and revenues are significantly positively correlated, implying that more revenues might lead to more expenses, or vice versa, which is as expected. However, to be profitable, hospitals should be more efficient by finding ways to reduce expenses and increase revenues. Financial stress in a hospital is a significant issue when the expenses consistently exceed the revenues, and it is in essence the root cause of bankruptcy.

The hospitals in a state are bound by the state’s financial strength, the state’s law governing the healthcare system, and the ambitions for the people’s welfare and/or the availability of resources. Furthermore, the hospitals within a state would vary with respect to their revenue generation along with their expense pattern due to their operational efficiencies and desire to fulfill the needs of the surrounding communities. As an autonomous entity, every hospital may strategize future policy, what happened in the immediate past with respect to the revenues and expenses, and what needs to be altered in future periods. These are referred to here as the “hospital’s memory.” All the abovementioned factors are of an uncertain type and are not typically measured in the data collection. Hence, these are together termed here as the “memory level” of the past experience by the hospitals with respect to the revenues and expenses. The memory level of the hospital’s uncertainty system is the opposite of what we had anticipated. When the hospital’s expenses exceed the state’s average for hospital expenses, the memory level within the hospital should be higher to safeguard it from being trapped in the possibility of bankruptcy.

An important implication of our study is that we can delineate states that may be more susceptible to their hospitals facing financial distress and bankruptcy (Ramamonjiarivelo et al. 2020; Ramamonjiarivelo 2013). A few examples of such states include Utah, Michigan, Florida, and Texas. Most of the coastal states in the eastern or western U.S. are less likely to be drawn into bankruptcy. Given the implications of hospital bankruptcy on patient access to care, more research is needed to track regional variations in the likelihood of bankruptcy across U.S. states.

For hospital administrators, our methodology provides an avenue that may allow them to anticipate financial distress/bankruptcy. Specifically, they will need to sum up all the revenues and all the expenses and apply them in the expression as we outlined in the Section 3. Then, they obtain the probability for the hospital to become bankrupt according to Equations (6)–(8) in the manuscript. Since our methodology accommodates lognormal data, it confers significant advantages over existing methods.

According to the American Hospital Association’s Cost of Caring report (American Hospital Association 2022), American hospitals incurred an extraordinary volume of patient arrivals, revenue losses, and skyrocketing expenses, causing hospital management to panic and prepare to deal with the possibility of bankruptcy. Nearly one out of three hospitals in the USA were operating on negative margins due to an expensive healthcare workforce, drug costs, and declined patient demand for healthcare services with high inflations. The healthcare workforce constitutes a significant part of hospital expenses, according to a report by the American Hospital Association (2024). Financial uncertainty and inflation were additional causal factors to the stress and instability of the health situation in hospital management. The financial reserves to provide essential healthcare services diminished, and the cost of administrative services has increased. Transportation costs to make necessary supplies available to hospitals have increased. More cuts to Medicare and Medicaid reimbursement have added financial stress to the hospital administration. The increase in healthcare bankruptcies in 2023 was the highest in the last five years (Payerchin 2024).

The prediction of bankruptcy is a challenge to healthcare managers due to economic complications, according to Gholampoor and Asadi (2024). Among several reasons is the evolving nature of the healthcare system, in which the revenues are decreasing while the expenses are increasing. The researched interaction between revenues and expenses is mysterious. Their interplay enables informed risk management strategies to avoid hospital bankruptcy, as discussed in this article using a stochastic approach. Several reasons for the poor management of balancing the revenues and expenses are summarized in Enumah and Chang (2021). In this article, all their reasons are incorporated, in a collective sense, in terms of the revenues and expenses. The traditional Altman Z-score-based approach uses case mix and normal data. We came across lognormal data, which consequently nullified the Altman Z-score method. Our stochastic approach is a remedy to a situation that is not amenable to the Altman Z-score method. Santoso et al. (2024) studied financial distress predictions by utilizing modified Altman Z-Score, Ohlson O-Score, and Zmijewski X-Score methods. They verified the existence of normality for the collected data to make bankruptcy predictions. Our data happened to be lognormal, and hence the data cannot be analyzed in the same manner as Santosa et al. did. Our stochastic approach is a necessity, and it worked, as illustrated in the article.

Limitations and Future Research

This study has some limitations. First, we analyzed Definitive Healthcare data for the calendar year 2022, with lagged independent and control variables from 2021 to mitigate endogeneity and reverse causality. Future research drawn from a longitudinal dataset could reveal new insights into the probability of hospital bankruptcy.

Second, future research could examine our studied relationship at a more granular level. Such work might consider looking at the likelihood of bankruptcy at the county level. Coupled with the sort of mapping that we endeavored to provide in our paper, such work may provide healthcare policymakers with a clearer understanding of what areas of a state, region, or country may be the most at risk and in need of financial assistance or intervention.

Third, there could be other factors affecting bankruptcy that were not accounted for in our study. Future studies should consider adding more organizational and market variables which may reveal new factors related to predicting hospital bankruptcies. For example, higher labor expense ratios vis-à-vis local competitors or the use of contract labor can significantly reduce a hospital’s profit margin. Beauvais et al. (2023) found numerous other factors reduce the likelihood of bankruptcy, including Joint Commission accreditation, Hospital Consumer Assessment of Health Care Providers and Systems (HCAHPS) survey results, higher liquidity ratios, less competitive markets, increased Medicare payer mix, and a higher case mix index. Several other factors increased the likelihood of bankruptcy in their study, including facility age, higher Medicaid payer mix, and the hospital’s serious complication rate. Additionally, the geographic location of hospitals, local economic conditions, population mobility, and operational efficiency of the hospitals could impact the financial status of hospitals, eventually leading to bankruptcy.

Fourth, this study focused on bivariate lognormal data, and thus the study results may not be generalizable to other data distributions. We recognize the reality that the actual financial data are more complex, undergoing nonlinear relationships with each other. Also, similar results for other bivariate distributed data need to be worked out case by case as a parametric technique in future research. A non-parametric technique without a chosen distributional is less powerful than the distribution-based parametric method such as the one in this article.

The last limitation is validation versus verification. That is, for model validation, we chose to use graphical results based on simple and easy-to-comprehend P-P plots by healthcare financial analysts. We could have used a sophisticated statistical methodology to assess. The cases with incomplete entries, less accuracy, or non-robustness were removed before analyzing the data. We noticed that the data were not from a random sample. While we could have resorted to slicing the data into two divisions with one for building up and another for verification, this was beyond the scope of this introductory study. Nevertheless, this is the first study that predicts bankruptcy using data with lognormal distribution. Researchers are encouraged to test the replicability of our methodology to financial data that may follow other distributions. There may be additional, external, and non-financial factors that affect hospitals’ expenses and revenues. Such reasons might include urban versus rural locations, poor local economy, high competition, declining admission, demographic changes, poor financial management, ownership status, facility age, unhealthy condition of states, inflation, and politics (Carroll et al. 2021; Landry and Landry III 2009; Beauvais et al. 2023). An implication of it is that the information helps to assess whether a hospital is more likely to be financially distressed.

6. Conclusions

Financial distress and bankruptcies are major concerns in the U.S. healthcare system, significantly impacting hospitals and, consequently, patient access to essential medical services. The instability of hospital finances can lead to reduced quality of care, closures of critical facilities, and decreased availability of specialized treatments. Existing models that predict financial distress typically require the data to follow a normal distribution, which limits their applicability given the often-non-normal nature of financial data in the healthcare industry. These limitations hinder the ability of hospital administrators to proactively manage financial risks and ensure the sustainability of their institutions.

The main contributions in this article include the derivation and illustration of the neat expressions (6)–(8) to address the probability for a hospital in a chosen U.S. state to declare bankruptcy when the finance data (consisting of revenues and expenses) happened to follow bivariate lognormal frequency pattern. The existing traditional methods in the literature do require the finance data to follow a normal frequency pattern. Our study introduces a novel approach that accommodates lognormal financial data. This method provides a more accurate prediction of bankruptcy risks by analyzing the relationship between revenues and expenses in a manner that reflects the true distribution of healthcare financial variables. Furthermore, by identifying states with higher susceptibility to hospital financial distress, our approach offers policymakers an opportunity for targeted interventions to mitigate the risk of financial distress/bankruptcy. For hospital administrators, this methodology enhances the ability to foresee and mitigate financial risks. This proactive approach is essential for safeguarding the financial health of hospitals and, by extension, the well-being of the communities they serve.

Author Contributions

R.S., B.B., D.D., R.P. and Z.R. contributed equally to conceptualization, methodology, software, formal analysis, resources, data curation, writing, and visualization. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available in the public domain database https://www.definitivehc.com/, accessed on 15 May 2024.

Acknowledgments

We acknowledge and thank Cristian Lieneck, Director of the School of Health Administration, for his encouragement.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Aitchison, J., and J. Brown. 1957. Lognormal Frequency structure: With Special Reference to Its Uses in Economics. Cambridge: Cambridge University Press. [Google Scholar]

- Almuqrin, Muqrin A. 2024. Bayesian and non-Bayesian inference for the compound Poisson log-normal model with application in finance. Alexandria Engineering Journal 90: 24–43. [Google Scholar] [CrossRef]

- Altman, El I. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, El I. 2018. Applications of distress prediction models: What have we learned after 50 years from the Z-score models? International Journal of Financial Studies 6: 70. [Google Scholar] [CrossRef]

- American Hospital Association. 2022. Massive Growth in Expenses and Rising Inflation Fuel Continued Financial Challenges for America’s Hospitals and Health Systems. Cost of Caring Report. Available online: https://www.aha.org/guidesreports/2023-04-20-2022-costs-caring (accessed on 12 May 2024).

- American Hospital Association. 2024. America’s Hospitals and Health Systems Continue to Face Escalating Operational Costs and Economic Pressures as They Care for Patients and Communities. Available online: https://www.aha.org/system/files/media/file/2024/05/Americas-Hospitals-and-Health-Systems-Continue-to-Face-Escalating-Operational-Costs-and-Economic-Pressures.pdf (accessed on 23 May 2024).

- Barandela, Ricardo, Rosa M. Valdovinos, J. Salvador Sánchez, and Francesc J. Ferri. 2004. The imbalanced training sample problem: Under or over sampling? In Structural, Syntactic, and Statistical Pattern Recognition: Joint IAPR International Workshops, SSPR 2004 and SPR 2004, Lisbon, Portugal, 18–20 August 2004. Proceedings. Berlin/Heidelberg: Springer, pp. 806–14. [Google Scholar]

- Beauvais, Bradley, Zo Ramamonjiarivelo, Jose Betancourt, John Cruz, and Lawrence Fulton. 2023. The Predictive Factors of Hospital Bankruptcy—An Exploratory Study. Healthcare 11: 165. [Google Scholar] [CrossRef] [PubMed]

- Bellovary, Jodi L., Don E. Giacomino, and Michael D. Akers. 2007. A review of bankruptcy prediction studies: 1930 to present. Journal of Financial Education 33: 1–42. [Google Scholar]

- Blumenfeld, Dennis. 2001. Operations Research Calculations Handbook. Boca Raton: CRC Press. [Google Scholar]

- Carroll, Nathan W., Amy Y. Landry, Cathleen O. Erwin, Philip J. Cendoma, and Robert J. Landry, III. 2021. Factors Related to Hospital Bankruptcy: 2007–2019. Journal of Accounting and Finance 21. [Google Scholar]

- Chattamvelli, Rajan, and Ramalingam Shanmugam. 2022. Continuous Distributions in Engineering and the Applied Sciences—Part I. Berlin/Heidelberger: Springer Nature. [Google Scholar]

- Citterio, Alberto. 2024. Bank failure prediction models: Review and outlook. Socio-Economic Planning Sciences 92: 101818. [Google Scholar] [CrossRef]

- Definitive. 2024. Available online: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9858769/ (accessed on 15 May 2024).

- Dobkin, Carlos, Amy Finkelstein, Raymond Kluender, and Matthew J. Notowidigdo. 2018. The economic consequences of hospital admissions. American Economic Review 108: 308–52. [Google Scholar] [CrossRef]

- Dubas-Jakóbczyk, Katarzyna, Costase Ndayishimiye, Przemysław Szetela, and Christoph Sowada. 2024. Hospitals’ financial performance across European countries: A scoping review protocol. BMJ Open 14: e077880. [Google Scholar] [CrossRef]

- Enumah, Samuel J., and David C. Chang. 2021. Predictors of financial distress among private US hospitals. Journal of Surgical Research 267: 251–59. [Google Scholar] [CrossRef]

- Gangwani, Divya, and Xingquan Zhu. 2024. Modeling and prediction of business success: A survey. Artificial Intelligence Review 57: 44. [Google Scholar] [CrossRef]

- Gholampoor, Hadi, and Majid Asadi. 2024. Risk Analysis of Bankruptcy in the US Healthcare Industries Based on Financial Ratios: A Machine Learning Analysis. Journal of Theoretical and Applied Electronic Commerce Research 19: 1303–20. [Google Scholar] [CrossRef]

- Gomes, Conceição, Filipa Campos, Cátia Malheiros, and Luís Lima Santos. 2023. Restaurants’ Solvency in Portugal during COVID-19. International Journal of Financial Studies 11: 63. [Google Scholar] [CrossRef]

- Greenland, Sander. 2024. Regression methods for epidemiological analysis. In Handbook of Epidemiology. New York: Springer, pp. 1–76. [Google Scholar]

- Gruszczyński, Marek. 2019. On unbalanced sampling in bankruptcy prediction. International Journal of Financial Studies 7: 28. [Google Scholar] [CrossRef]

- Hillegeist, Stephen A., Elizabeth K. Keating, Donald P. Cram, and Kyle G. Lundstedt. 2004. Assessing the probability of bankruptcy. Review of Accounting Studies 9: 5–34. [Google Scholar] [CrossRef]

- IBM SPSS Statistics for Windows. 2024. Version 28.0. Armonk: IBM Corp. Available online: https://www.ibm.com/products/spss-statistics (accessed on 15 May 2024).

- Issa, Samar, Gulhan Bizel, Sharath K. Jagannathan, and Sri Sarat Chaitanya Gollapalli. 2024. A Comprehensive Approach to Bankruptcy Risk Evaluation in the Financial Industry. Journal of Risk and Financial Management 17: 41. [Google Scholar] [CrossRef]

- Ivanova, Mariya N., Henrik Nilsson, and Milda Tylaite. 2024. Yesterday is history, tomorrow is a mystery: Directors’ and CEOs’ prior bankruptcy experiences and the financial risk of their current firms. Journal of Business Finance & Accounting 51: 595–630. [Google Scholar]

- Keele, Luke, and Nathan J. Kelly. 2006. Dynamic models for dynamic theories: The ins and outs of lagged dependent variables. Political Analysis 14: 186–205. [Google Scholar] [CrossRef]

- Koptseva, Elena P., Liudmila P. Paristova, and Ekaterina G. Sycheva. 2022. Model for determining the probability of airline bankruptcy. Transportation Research Procedia 61: 164–70. [Google Scholar] [CrossRef]

- Kyoud, Ayoub, Cherif El Msiyah, and Jaouad Madkour. 2023. Modelling systemic risk in Morocco’s banking system. International Journal of Financial Studies 11: 70. [Google Scholar] [CrossRef]

- Landry, Amy Yarbrough, and Robert J. Landry III. 2009. Factors associated with hospital bankruptcies: A political and economic framework. Journal of Healthcare Management 54: 252–71. [Google Scholar] [CrossRef]

- Lawrence, Judy Ramage, Surapol Pongsatat, and Howard Lawrence. 2015. The use of Ohlson’s O-score for bankruptcy prediction in Thailand. Journal of Applied Business Research 31: 2069. [Google Scholar] [CrossRef]

- Li, Xiang. 2024. Comparing Linear Regression and Decision Trees for Housing Price Prediction. Paper presented at 2023 International Conference on Data Science, Advanced Algorithm, and Intelligent Computing (DAI 2023), Lucknow, India, July 14–15; Amsterdam: Atlantis Press, pp. 77–84. [Google Scholar]

- Lien, Donald. 1986. Moments of ordered bivariate log-normal frequency structures. Economics Letters 20: 45–47. [Google Scholar] [CrossRef]

- Lien, Donald. 2005. On the minimum and maximum of bivariate lognormal random variables. Extremes 8: 79–83. [Google Scholar] [CrossRef]

- Microsoft Mathematics-4. n.d. Redmond: Microsoft. Available online: https://www.microsoft.com/en-us/ (accessed on 15 May 2024).

- Muñoz-Izquierdo, Nora, María-del-Mar Camacho-Miñano, María-Jesús Segovia-Vargas, and David Pascual-Ezama. 2019. Is the external audit report useful for bankruptcy prediction? Evidence using artificial intelligence. International Journal of Financial Studies 7: 20. [Google Scholar] [CrossRef]

- Nawajah, Inad, Hassan Kanj, Yehia Kotb, Julian Hoxha, Mouhammad Alakkoumi, and Kamel Jebreen. 2024. Bayesian regression analysis using median rank set sampling. European Journal of Pure and Applied Mathematics 17: 180–200. [Google Scholar] [CrossRef]

- Ohlson, James A. 1980. Financial ratios and the probabilistic prediction of bankruptcy. J. Account. Res. 18: 109–31. [Google Scholar] [CrossRef]

- Payerchin, Richard. 2024. Health Care Bankruptcies in 2023 Reach Highest Level in Five Years. Medical Economics. February 9. Available online: https://www.medicaleconomics.com/view/health-care-bankruptcies-in-2023-reach-highest-level-in-five-years (accessed on 22 May 2024).

- Phan, Linh N., Mario G. Beruvides, and Victor G. Tercero-Gómez. 2024. Statistical Analysis of Minsky’s Financial Instability Hypothesis for the 1945–2023 Era. Journal of Risk and Financial Management 17: 32. [Google Scholar] [CrossRef]

- Prusak, Błażej. 2018. Review of research into enterprise bankruptcy prediction in selected central and eastern European countries. International Journal of Financial Studies 6: 60. [Google Scholar] [CrossRef]

- Ramamonjiarivelo, Zo H. 2013. Public hospitals in peril: Factors associated with financial distress. In Academy of Management Proceedings. Briarcliff Manor: Academy of Management, vol. 2013, p. 12764. [Google Scholar]

- Ramamonjiarivelo, Zo, Robert Weech-Maldonado, Larry Hearld, Rohit Pradhan, and Ganisher K. Davlyatov. 2020. The privatization of public hospitals: Its impact on financial performance. Medical Care Research and Review 77: 249–60. [Google Scholar] [CrossRef]

- Rastogi, Sonal. 2024. Rural Health Care in the Age of Hospital Bankruptcies. Emory Bankruptcy Developments Journal 40: 215. [Google Scholar]

- Ratnasari, I., N. Nugraha, and I. Sutardiyanta. 2024. Predicting Bankruptcy of Pharmaceutical Companies Using the Altman Z-Score and Grover Methods. Accounthink: Journal of Accounting and Finance 9. [Google Scholar]

- Santoso, Nurilen Wuri, Ratih Kusumawardhani, and Alfiatul Maulida. 2024. Comparative Analysis of The Altman, Ohlson, and Zmijewski Models to Predict Financial Distress During the COVID-19 Pandemic. MAKSIMUM: Media Akuntansi Universitas Muhammadiyah Semarang 14: 13–21. [Google Scholar] [CrossRef]

- Shi, Yin, and Xiaoni Li. 2021. Determinants of financial distress in the European air transport industry: The moderating effect of being a flag-carrier. PLoS ONE 16: e0259149. [Google Scholar] [CrossRef] [PubMed]

- Thoimopoulos, Nick T., and A. Longinow. 1984. Bivariate Lognormal Probability Frequency structure. Journal of Structural Engineering 110: 3045–49. [Google Scholar] [CrossRef]

- van Dijk, Tessa S., Martijn Felder, Richard T. J. M. Janssen, and Wilma K. van der Scheer. 2024. For better or worse: Governing healthcare organizations in times of financial distress. Sociology of Health & Illness 46: 926–947. [Google Scholar]

- Wieczorek-Kosmala, Monika. 2021. COVID-19 impact on the hospitality industry: Exploratory study of financial-slack-driven risk preparedness. International Journal of Hospitality Management 94: 102799. [Google Scholar] [CrossRef]

- Xu, Yong, Gang Kou, Yi Peng, Kexing Ding, Daji Ergu, and Fahd S. Alotaibi. 2024. Profit-and risk-driven credit scoring under parameter uncertainty: A multi objective approach. Omega 125: 103004. [Google Scholar] [CrossRef]

- Zmijewski, Mark E. 1984. Methodological Issues Related to the Estimation of Financial Distress Prediction Models. Journal of Accounting Research 22: 59–82. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).