Abstract

This study examined the relationship between share repurchases and corporate sustainability in South Africa during 2011–2019. According to stakeholder theory, companies may feel a sense of obligation to not only distribute returns to shareholders through share repurchases but also to other stakeholders by investing in environmental, social or governance (ESG)-related projects. Our study, the first of its kind in the context of an emerging economy, reported a positive relationship between share repurchases and corporate sustainability in South Africa (proxied using ESG scores)—specifically social scores. The emphasis on the social, rather than the environmental, dimensions of ESG might result from the emerging economy context, where several societal problems are experienced. The results support stakeholder theory, but increased disclosure pertaining to the social dimension of ESG in years when share repurchases are executed might also provide evidence of ‘social washing’ (when companies employ their integrated report disclosures to paint an overly positive picture of their social responsibility initiatives).

1. Introduction

Corporate sustainability provides an umbrella under which the complex relationships between the economy, environment and society are conceptualised (Bansal and Song 2017). Company executives acknowledge its growing importance, as approximately 90% of executives believe that a sustainability strategy is key to remaining competitive (Unruh et al. 2016). This is a stark change from the conventional shareholder-oriented management approach where shareholder interests were paramount (Friedman 1970). Stakeholder theory proposes that companies’ objectives should be aligned and balanced between the interests of various stakeholders (Freeman 1984). This implies that companies should create value for their shareholders (for example, by executing share repurchases) and for other stakeholders, such as employees, customers and society in general (for example, through social empowerment initiatives) and the environment (by reducing the impact of the company’s operations on natural resources). Environmental, social and governance (ESG) metrics, which have widely been suggested as a corporate sustainability metric, have grown from 3% in 2010 to 30% in 2021 as a key performance indicator for executives (Cohen et al. 2022; Gao and Bansal 2013).

In the context of the United States of America (USA) and using a macro-economic perspective, Lazonick and Jacobson (2019), however, questioned whether corporate sustainability might be impeded by excessive share repurchases. Share repurchases is an investment decision whereby the company distributes excess cash to its shareholders (Vermaelen 2005); share repurchasing has become a preferred method of distributing funds to shareholders globally (Grullon and Michaely 2004). It is often associated with an attempt to signal undervaluation to the market (Ikenberry et al. 1995; Manconi et al. 2019). Many executives are motivated by its shareholder value-creation benefits, as these typically lead to an increase in earnings per share (EPS) and share prices, which could also increase management’s variable remuneration when tied to EPS and share price targets (Brav et al. 2005; Steenkamp et al. 2023).

As share repurchases might benefit only shareholders and executives, while corporate sustainability focuses on long-term value creation for all company stakeholders, these two variables might seem at odds with one another; as such, their interaction should be monitored (Lazonick and Jacobson 2019). Conflicting evidence relating to the relationship between share repurchases and corporate sustainability exists in developed economies. In the USA, a negative association was found between share repurchases, and both social and environmental performance (Vaupel et al. 2022), while European companies displayed a positive association between share repurchases and corporate sustainability performance (Samet and Jarboui 2017; Tran 2021). The fact that prior studies report contradictory results and that no prior research has examined the relationship between share repurchases and corporate sustainability in emerging economies emphasises the research gap in the field.

South Africa presents an important research context in which to study the relationship between share repurchases and corporate sustainability: it has a well-regulated stock exchange and highly evolved corporate governance but is also an emerging economy with high unemployment and low economic growth (Wesson et al. 2018). Moreover, South Africa’s previous political policies of racial segregation has led to current legislation addressing employment equity and black economic empowerment (Johnson et al. 2019). Given the prevalence of societal issues (such as income inequality and poverty) in the country, companies feel more compelled to initiate projects relating to the social dimension of ESG than the environmental dimension (Cheruiyot-Koech and Reddy 2022). The objective of this study was to investigate the relationship between share repurchases and corporate sustainability in the South African context.

The research contributes to the corporate governance literature, as it is the first to provide empirical evidence of the relationship between share repurchases and corporate sustainability in the context of an emerging economy. The study reported a positive relationship between share repurchases and corporate sustainability, particularly the social dimension of ESG, in South Africa. These findings agree with prior European evidence (Samet and Jarboui 2017; Tran 2021) and provide support for the stakeholder theory, according to which companies feel obligated to distribute profits to both shareholders (through share repurchases) and other stakeholders (through ESG projects). The social problems in existence in South Africa seemed to prompt companies to prioritise social, rather than environmental, disclosures in their integrated reports. However, company stakeholders should also be aware that enhanced disclosure on the social component of ESG in years when share repurchases are enacted may be window-dressing (referred to as ‘social washing’ in this context) and may not translate into measurable progress towards corporate sustainability. As such, the findings are of value to South African stakeholders in evaluating the credibility of companies’ sustainability pledges.

The remainder of the paper is structured as follows: First, a literature review discusses prior research on share repurchases and corporate sustainability and their possible interaction. Thereafter, the research methods are explained, the results are reported and conclusions are drawn.

2. Literature Review

While some studies in the USA have hinted at a negative relationship between share repurchases and corporate sustainability (Vaupel et al. 2022; Lazonick and Jacobson 2019), most prior studies (Samet and Jarboui 2017; Benlemlih 2019; Tran 2021) and theoretical perspectives (such as life-cycle theory, agency theory and stakeholder theory) propose a positive association between the two variables. The conflicting evidence might be explained by contextual differences—the level of share repurchases in the USA is the highest in the world (Manconi et al. 2019; Wesson et al. 2015). This emphasises the importance of evaluating the relationship between share repurchases and corporate sustainability in other contexts, including emerging economies such as South Africa, to further the body of knowledge in this regard. The literature review first discusses share repurchases and corporate sustainability; the distinct South African context pertaining to these variables is also emphasised. Then, the potential relationship between the two variables is examined by considering both theoretical perspectives and empirical evidence, after which a hypothesis is articulated pertaining to the South African context.

2.1. Share Repurchases

The Friedman Doctrine, which characterised corporate strategy for most of recent history, identifies shareholders as the most important stakeholder—which implies shareholder value creation to be the primary responsibility of a company (Friedman 1970). Shareholder value is associated with the financial risk carried by the shareholders which is rewarded by either capital appreciation, dividends or share repurchases (Rappaport 2006). Share repurchases is a method of redistributing wealth to shareholders whereby a company reacquires its own shares from existing shareholders (Vermaelen 2005). This redistribution method has been under increased scrutiny due to perceived inappropriate utilisation of company funds to satisfy management’s interests at the expense of sustainable wealth creation for its stakeholders by cutting back on long-term reinvestments (Bendig et al. 2018). Executive share options have been proposed to address these concerns by aligning the interests of managers with those of shareholders to ensure that the company is managed in a way that satisfies long-term shareholder interests. However, information asymmetries enable managers to influence share price and consequently prioritise short-term interests by enacting repurchases (Benhamouda and Watson 2010).

Company valuation is a positive function of future dividend cash flows; thus, by declaring dividends the company’s share-price declines (Rakotomavo 2012). Conversely, repurchases are positively associated with share price increases, which are accentuated by repurchase announcements (Ikenberry et al. 1995; Manconi et al. 2019), often referred to as a manifestation of signalling theory whereby managers signal an undervaluation of shares to the market (Benhamouda and Watson 2010). Share repurchases are also enacted when companies have excess cash flow available (Wesson et al. 2015). Furthermore, repurchases increase management’s stake in the company, as well as its remuneration, when it is tied to share price and EPS (Lazonick 2014). Evidently, share repurchases have led to company executives acting in their own interest and not necessarily in the long-term interest of shareholders and other stakeholders. Others would rightly point out the average holding period of company shares by shareholders is less than one year, and therefore, catering for the short-term is precisely aligned with the interests of shareholders (Rappaport 2006). However, one could argue that share repurchases have enabled and further exacerbated short-sighted behaviour.

Benhamouda and Watson (2010) emphasise that disclosure rules, governance standards, tax legislation, economic conditions and regulatory environments may influence share-repurchase behaviour in specific countries. As a result, the share-repurchase behaviour of South African listed companies differs from that of listed companies in developed economies (Wesson et al. 2015; Steenkamp and Wesson 2020). The Johannesburg Stock Exchange (JSE) has permitted share repurchases only since 1 July 1999. Despite the relative novelty of share repurchases in South Africa, Steenkamp and Wesson (2020) report that repurchases have become increasingly popular with approximately 60% of JSE-listed companies engaging in repurchases in the 2010–2017 period. South African share repurchases were, contrary to the global experience, at an all-time high during the global financial crisis of 2008/2009 (Wesson et al. 2015). Post-crisis, share-repurchase value decreased and then stabilised at a lower rate, which echoed the post-crisis European experience (as opposed to the American experience where share repurchases continued to show growth) (Steenkamp and Wesson 2020).

Comprehensive repurchase data are not readily accessible in South Africa due to disclosure rules (Steenkamp and Wesson 2020). In most developed economies, companies are required to announce share repurchases in real time or after a specified interval (e.g., a week) (Kim et al. 2005). However, the JSE Listing Requirements compel companies to announce open-market share repurchases only once they have cumulatively repurchased three percent of their issued shares of that class (Wesson et al. 2015). Crotty (2012) found companies to apply the rule on a financial-year basis instead of the applying it according to a cumulative basis. This has resulted in 45% of repurchases not being announced during the 2010–2017 period (Steenkamp and Wesson 2020). As a result of the lack of complete repurchase data on South African companies, announced share-repurchase activity in South Africa has predominantly been studied (Wesson et al. 2014). These studies suggest a positive signalling effect whereby share prices increase subsequent to repurchase announcements. This corresponds with the studies conducted in developed economies by, for example, Ikenberry et al. (1995) and Manconi et al. (2019). Thus, it can be generalised that share-repurchase announcements are associated with share-price increases.

Other environmental differences are noted in the South African context. While open-market share repurchases are the preferred repurchase method globally, repurchases by subsidiaries of their holding companies’ shares was the repurchase method most often utilised by South African companies (Wesson et al. 2015). An explanation for this preference is that it provides greater flexibility, as these shares are not cancelled but rather held in treasury (Steenkamp and Wesson 2020). Despite congruency with developed economies in some respects (e.g., signalling effect), South Africa clearly demonstrates a unique share-repurchase environment which might influence the influence the relationship between share repurchases and corporate sustainability in South Africa. With this as the background, the concept of corporate sustainability is considered next.

2.2. Corporate Sustainability

“Sustainable development seeks to meet the needs and aspirations of the present without compromising the ability to meet those of the future” (WCED 1987). By extension, one can derive the definition of corporate sustainability as satisfying the immediate needs and wants of all stakeholders of the business, without impeding its capacity to satisfy the needs of stakeholders in the future (Dyllick and Hockerts 2002). The prior literature on corporate sustainability and its derivatives centred its research on the business case (i.e., financial case) for its implementation. Scholars have argued that sustainable business practices do not require trade-offs but rather represent a mutually beneficial goal to strive for that can bear sustainable economic fruit (McWilliams and Siegel 2001). Despite some studies showing a positive association between corporate sustainability and company financial performance, shareholders are often discouraged by management’s decision to invest in sustainability initiatives due to the existence of an economic discount rate wherein the short term is valued higher than the long term (Dyllick and Hockerts 2002). However, Dyllick and Hockerts (2002) argue that, to achieve true longevity, companies must responsibly manage their economic, social and environmental resources.

Critics of the sustainable development movement would argue that the use of ambiguous terms prevent managers from acting in the spirit of what is morally sustainable (Montiel 2008). Montiel (2008) suggests that the terms are used inconsistently and present points of overlap, as well as key differences. Thus, for the purposes of this study, to avoid ambiguity, ESG was the metric used to represent corporate sustainability performance. ESG differs from other corporate sustainability metrics due to its inclusion of the governance dimension. The governance framework of South Africa (King IV) defines corporate governance as a continuous objective of ethical and effective leadership by management to instil an ethical culture which aims to satisfy the interests of a company’s broader stakeholder community (IoDSA 2016). Therefore, ESG transcends social and environmental responsibility, as it captures another ethical dimension. It is clear that the growing prevalence of ESG is rooted in stakeholder theory, which characterises the company as a custodian of a multitude of stakeholder interests. Hence, ESG would serve as an appropriate proxy for corporate sustainability in the context of this study.

Corporate sustainability initiatives undertaken by companies reflect companies’ stakeholder priorities (Cheruiyot-Koech and Reddy 2022). Thus, it can be inferred that different nationalities reasonably ought to view ESG investment differently based on national idiosyncrasies. Despite institutional investors globally assigning greater weight to ESG metrics in its investment decisions than ever before (Cohen et al. 2022), South African institutional investors still view a company’s financial metrics as more important than ESG metrics (Johnson et al. 2019; Schulschenk 2013). Of the three ESG dimensions, the governance dimension seems to receive the most attention in South Africa; corporate governance was perceived to be a matter of urgency due to rising levels of corruption (Schulschenk 2013). South Africa is also renowned for its sophisticated corporate governance regulations for listed companies (Mokabane and Du Toit 2022; Johnson et al. 2019; Wesson et al. 2018), including the following:

- A well-regulated stock exchange;

- Mandatory compliance with the internationally acclaimed King Report on Corporate Governance (of which the fourth iteration was recently issued);

- Requiring companies to prepare an annual integrated report, which provides a holistic picture of the value creation of the company for all stakeholders, using both financial and non-financial metrics.

As such, listed South African companies have relatively high governance scores relative to their environmental and social scores (Mokabane and Du Toit 2022; Johnson et al. 2019). However, South Africa also has a complex political history (including Apartheid and a history of racial segregation and economic exclusion), of which the consequences are still evident today. Hence, regulatory bodies have prioritised addressing issues such as income inequality and poverty with legislative intervention by introducing the Employment Equity Act (No. 55 of 1998) and the Broad-Based Black Economic Empowerment (B-BBEE) Act (No. 53 of 2003) (Johnson et al. 2019). Cheruiyot-Koech and Reddy (2022) argue that companies feel obliged to address these social issues. As a result, social initiatives receive greater funding than environmental issues (such as climate change, habitat destruction and pollution). The most common areas of corporate social responsibility include education (e.g., bursaries), training and skills development (e.g., learnership programmes for the unskilled) and charitable donations. The fact that corporate sustainability is viewed and approached differently in South Africa when compared to the developed world (Cheruiyot-Koech and Reddy 2022) might affect the relationship between share repurchases and corporate sustainability.

2.3. The Relationship between Share Repurchases and Corporate Sustainability

To date, no study investigating the relationship between share repurchases and corporate sustainability has been conducted in South Africa or any other emerging economy. Thus, in this paper, existing theories and prior literature from developed economies were employed when conceptualising the relationship between share repurchases and corporate sustainability in South Africa. Life-cycle theory suggests that a company’s payout policy is a function of a company’s life cycle (Fama and French 2001; Mueller 1972). In a company’s infancy, growth opportunities outstrip internal capital, leading to the company not having the required funding to distribute funds to its shareholders. Conversely, mature companies typically have less growth opportunities to capitalise on and more surplus retained earnings, leading to greater shareholder distribution (Grullon and Michaely 2004). Within a corporate-sustainability context, mature companies are more likely to invest in sustainability initiatives, as they have more cash resources at their disposal and managerial expertise to navigate the potential pitfalls (Attig et al. 2013). It can be deduced that mature (and larger) companies are more likely to simultaneously participate in share repurchases and ESG investment according to this theory.

According to stakeholder theory, company managers must serve the interests of all of the company’s stakeholders, not only its shareholders (Freeman 1984). Gallo (2004) argues that companies are social institutions which have internal and external responsibilities. One of the primary responsibilities is an equitable distribution of its wealth to its stakeholders, i.e., those who contributed. Therefore, companies’ payout policy should not merely serve to meet shareholder return expectations but also address ethical concerns of wealth distribution. ESG investments are often viewed by shareholders as financial commitments with intangible benefits and less certainty of financial return. As a result, it can potentially cause stakeholder conflict, which can be addressed by increased payouts, i.e., share repurchases (He et al. 2012). In other words, to appease financially motivated shareholders who do not approve of ESG commitments, companies may increase shareholder payouts. Alternatively, to maintain legitimacy in an environment that is increasingly focused on ESG, companies that enact share repurchases might feel compelled to also illustrate their commitment to corporate sustainability by increasing their ESG-related disclosures or performance. Based on this expectation, one would expect a positive association between share repurchases and corporate sustainability.

Another source of conflict can be characterised by agency theory. Agency theory suggests that a conflict of interests arises when one entity (i.e., management) acts on behalf of another entity (i.e., shareholders) (Jensen and Meckling 1976). For instance, according to Jensen and Meckling (1976), executives have a proclivity to use company resources to further their own interests as opposed to shareholder interests. Consequently, virtue-signalling executives may use excessive corporate philanthropy as a means of enhancing personal reputation to the detriment of company value (Samet and Jarboui 2017). However, Jensen (1986) proposes that an appropriate payout policy can limit self-serving managers’ access to free cash flow, thereby eliminating potential agency costs. According to Fama and French (2001), share-repurchase popularity is due to improved governance. Dividend payments are the preferred payout method for shareholders of poorly governed companies, as they require a board-level commitment, since shareholders typically expect a stable return, thereby reducing excess cash at the disposal of self-serving managers (John et al. 2015). Conversely, share repurchases provide greater flexibility, as shareholders do not have an expectation of stable annual repurchases (Jagannathan et al. 2000). Adequate governance mechanisms ensure that managers do not inappropriately utilise cash holdings in the event of non-payout. Naturally, improved governance is also positively associated with improved ESG scores due to its contribution to the governance score. This theoretical background further supports the notion that share repurchases are positively associated with corporate sustainability.

The relationship between share repurchases and corporate sustainability has been investigated in various developed countries (mainly Europe and the USA), with mixed results being reported. Tran (2021) (and Samet and Jarboui (2017)) studied companies in the STOXX Europe total market index (STOXX Europe TMI) between 2006 and 2019 (2009 and 2014) and found a positive relationship between ESG performance and share repurchases. Benlemlih (2019), considering companies based in the USA between 1991 and 2012, found shareholder payouts to be positively associated with ESG ratings, suggesting shareholder distribution to be an agency cost remedy in line with Jensen’s (1986) cash-flow hypothesis. Although Benlemlih (2019) focussed primarily on dividend policy, the study also found a positive association between share repurchases and ESG rating.

Vaupel et al. (2022) conducted research on a sample of S&P 500 listed companies in the USA for the period 2004–2016 to investigate the association of share repurchases with environmental and social performance. Contrary to Benlemlih (2019), who employed payouts as a dependent variable and ESG scores as an independent variable, Vaupel et al. (2022) placed the focus on environmental and social performance by designating ESG scores as the dependent variable (with share repurchases, and not payout more globally, as the independent variable of interest). Environmental and social performance was found to be negatively related to share repurchases, suggesting that a trade-off occurs between short-term benefits derived from share repurchases and the long-term benefits of ESG initiatives (Vaupel et al. 2022). Notably, Vaupel et al. (2022) imply that window dressing may be a possible concern with respect to ESG disclosure. This further illustrates intangible reputational benefits for those charged with governance that can be obtained from ESG initiatives, as highlighted by agency theory (Samet and Jarboui 2017; Jensen and Meckling 1976).

As all theoretical arguments and most prior empirical evidence support the existence of a positive relationship between share repurchases and corporate sustainability, the following hypothesis was articulated:

Hypothesis 1 (H1).

There is a positive relationship between share repurchases and corporate sustainability in the South African context.

3. Methods and Materials

3.1. Research Process and Sample Selection

In this study, a positivist approach was used to assess the relationship between share repurchases and corporate sustainability in a South African context. Secondary data from companies were obtained from IRESS and Bloomberg and then analysed using descriptive and inferential statistics.

Data were collected on all JSE-listed companies; however, the sample is dependent on the availability of ESG scores on Bloomberg. The companies included in the study operate in the following industries: basic materials, consumer discretionary, consumer staples, energy, health care, industrials, real estate, technology and telecommunications. The financial industry is excluded due to the stringent and materially different regulations that exist pertaining to share repurchases (Steenkamp and Wesson 2020).

The research focused on the period 2011–2019. There are various reasons for this period being chosen. The King III Report, which contained regulations relating to integrated reporting, became effective on 1 March 2010—this is the first South African corporate governance framework that regulated ESG disclosures for JSE-listed companies. Moreover, it was decided to exclude periods of financial distress, such as financial crises, which could have affected the relationship between share repurchases and corporate sustainability in the short term. The global financial crisis of 2008/2009 is deemed to have ended by 2011, while the year 2019 was the last year not affected by the COVID-19 pandemic—resulting in the period 2011–2019 being selected.

3.2. Measurement of Variables and Data Collection

In line with Vaupel et al. (2022), it was decided to employ corporate sustainability as a dependent variable to investigate the possible trade-off that occurs between share repurchases as a short-term measure and corporate sustainability as a long-term initiative. This also allowed the researchers to focus separately on the three sub-components of corporate sustainability (environmental, social and governance), as they have different impacting factors in the South African context. The ESG scores, obtained from the Bloomberg database, are used as a proxy for corporate sustainability (dependent variable). Individual disclosure of environmental, social and corporate governance performance is evaluated using certain criteria, which are combined to form one score, ranging between 0 and 100, for each component (environmental, social and governance). The scores are determined using a comprehensive list of criteria. For example, the environmental score includes, but is not limited to, total energy consumption, total wastage, direct and indirect carbon dioxide emissions, greenhouse gas emissions and paper consumption. The social performance score contains community spending, employee turnover, minorities and women in management and total fatalities, to name a few components. The corporate governance score includes the board size, number of board meetings and percentage of independent directors.

The share repurchase (SR) data (independent variable of interest) were collected from the IRESS database, with specific attention paid to the statement of changes in equity. Other company financial variables were employed as control variables and collected from the IRESS financial database. Based on the life-cycle theory, it is expected that spending on ESG will increase as the company moves into the mature phase, because of greater available cash flow and more strategic investing (Samet and Jarboui 2017). Due to this effect, company size, measured by market capitalisation, is used as a control variable. As larger and more profitable companies typically invest in ESG measures (Rakotomavo 2012) and enact share repurchases (Samet and Jarboui 2017), return on assets (ROA) is employed as a measure of profitability. According to life-cycle theory, mature companies with less growth opportunities repurchase more shares than companies in their infancy with more growth opportunities (Grullon and Michaely 2004); as such, the price-to-book (PB) ratio is used as a proxy for growth opportunities. Furthermore, the PB ratio also controls for the influence of share price on ESG reporting. Company leverage affects financial flexibility, i.e., access to cash to finance share repurchases and ESG investment. In other words, a company with a low leverage factor has a greater capacity to repurchase shares, as well as acquire debt, to finance ESG investment. Therefore, the leverage factor is also used as a control variable. The measurement of all variables is shown in Table 1.

Table 1.

Table of variables.

3.3. Data Analysis

First, the dataset was analysed using a trend analysis and descriptive statistics. Then, regression analyses were employed to investigate the relationship between share repurchases and corporate sustainability. The composite ESG score and its three components were applied, as shown below, in separate regression analyses.

- (1)

- ESGi,t = β0 + β1SRi,t + β2SIZEi,t + β3LEVi,t + β4ROAi,t + β5PBi,t

- (2)

- Ei,t = β0 + β1SRi,t + β2SIZE,t + β3LEVi,t + β4ROAi,t + β5PBi,t

- (3)

- Si,t = β0 + β1SRi,t + β2SIZEi,t + β3LEVi,t + β4ROAi,t + β5PBi,t

- (4)

- Gi,t = β0 + β1SRi,t + β2SIZEi,t + β3LEVi,t + β4ROAi,t + β5PBi,t

4. Results

The dataset contained 2277 line items for JSE-listed companies for the period 2011–2019. Line items that contained missing or obviously incorrect data were removed from the dataset; for example, 1538 line items did not have ESG scores available on Bloomberg, 8 line-items did not have a PB ratio in IRESS and 3 line items had negative PB ratios. The final dataset therefore contained 728 observations. Some outliers were evident in LEV, ROA and PB (which might have resulted from capturing errors on IRESS), and therefore these variables were winsorised at 5% and 95%. Trends relating to the dependent and independent variables are discussed first, followed by the descriptive statistics and pairwise correlation test that preceded the regressions executed. The regressions executed are then reported.

4.1. Trends Relating to ESG and Share Repurchases

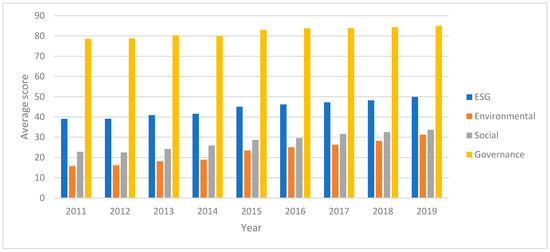

The average ESG scores over the target period are shown in Figure 1.

Figure 1.

Trend relating to average ESG scores.

Figure 1 shows a clear increase in the average ESG scores of JSE-listed companies during the target period (the average ESG score was 39% in 2011 and increased to 50% in 2019). The positive trend in ESG scores is consistent with Ioannou and Serafeim’s (2017) expectation of the consequences associated with mandatory corporate sustainability disclosures (in South Africa, this is done through a requirement for listed companies to prepare an integrated report). The increase in average ESG scores is also indicative of an increased focus on and improvement in corporate sustainability performance by JSE-listed companies.

Although the increase was apparent for all components of the ESG score, it was evident that JSE-listed companies emphasised governance aspects over social and environmental disclosures—as was also reported by Mokabane and Du Toit (2022) and Johnson et al. (2019). This could be attributed to the development of the King Code in South Africa and its subsequent compulsory integration for JSE-listed companies, and that governance is more easily measurable than the other components of ESG (Johnson 2020). The lower social and environmental scores are in line with other emerging economies (Cahan et al. 2016). In South Africa, greater emphasis seems to be placed on social issues than environmental issues (Cheruiyot-Koech and Reddy 2022).

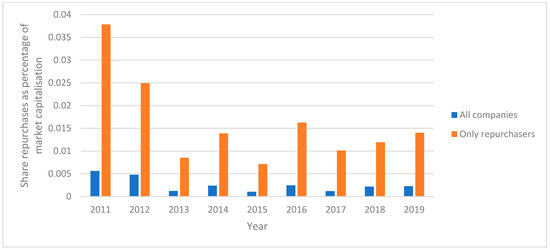

Figure 2 indicates the share-repurchase activity of JSE-listed companies over the target period. Like the results reported by Steenkamp and Wesson (2020), the monetary value of share repurchases oscillated over the target period. Only 115 of the 728 observations (16%) pertained to years in which companies repurchased shares; for these repurchasers, the average share-repurchase value as the percentage of market capitalisation ranged between 0.7% and 3.8%.

Figure 2.

Share-repurchase trends.

4.2. Descriptive Statistics and Correlations

The descriptive statistics pertaining to the variables employed in the regression analyses are presented in Table 2. The descriptive statistics include the number of observations, as well as the mean, standard deviation, minimum and maximum for each variable.

Table 2.

Descriptive statistics.

A pairwise correlation was performed to determine if there was multicollinearity between two variables. The pairwise correlation is presented in Table 3.

Table 3.

Pairwise correlations of variables.

Table 3 indicates that no independent variables were highly correlated (had a coefficient greater than 0.6). Therefore, all independent variables were used in the regressions that follow.

4.3. The Relationship between Share Repurchases and ESG

Table 4 provides the results of the panel regressions performed when considering all company years. The dependant variables are shown at the top of the columns, namely ESG, environmental, social and governance scores. The Hausman test showed that the company fixed-effects model is most appropriate, and robust standard errors were employed.

Table 4.

Regressions for all companies.

A statistically significant positive association was noted between share-repurchase activity and a company’s ESG score, indicating that companies that choose to enact share repurchases had better ESG scores. This result agrees with the findings of Tran (2021) and Samet and Jarboui (2017) in the European context and Benlemlih’s (2019) results in the USA. A similar relationship was noted when considering only companies’ social score, which indicates that the positive results pertaining to the overall ESG score was mainly driven by the social score. This result provides support for stakeholder theory, whereby companies may feel a responsibility to serve the interests of internal and external stakeholders (Freeman 1984). In other words, companies distributed wealth to their shareholders by means of share repurchases, as well as through social initiatives. Alternatively, this could be an indication of window dressing or ‘social washing’ (Vaupel et al. 2022), i.e., emphasising disclosures relating to social initiatives in years when share repurchases are executed to avoid negative backlash.

The finding that disclosures relating to the social dimension of ESG, specifically, were positively related to share-repurchase activity might be a result of the unique South African environment. Company stakeholders in South Africa, such as employees and customers, are acutely aware of the social problems existing in South Africa (e.g., poverty, unemployment and income inequality). As a result, Cheruiyot-Koech and Reddy (2022) argued that companies often feel pressurised to address these social problems. Especially in years when companies are spending large amounts on share repurchases, stakeholders would want to be assured (through extensive disclosures in the integrated report) that companies are also contributing to alleviating societal problems. There is, however, a danger of ‘social washing’ (e.g., making inaccurate claims in the integrated report about a company’s impact on its employees, customers or society in general), which has also been emphasised in the popular media (ESI-Africa 2022) and in industry reports (FSCA 2024).

Table 4 provides evidence that company size had a positive relationship with ESG disclosure (thus, larger companies had better ESG disclosures than smaller companies). This could be due to the increase in external pressure on bigger companies to provide sustainability-related disclosures (Drempetic et al. 2019). Furthermore, larger mature companies have greater retained earnings and the business acumen required to make ESG investments and related disclosures (Attig et al. 2013).

At a 10% level of significance, highly leveraged companies had higher governance scores—possibly to manage their credit ratings and to honour agreements with their banks. Also at a 10% significance level, a negative relationship existed between ROA and companies’ environmental score. Thus, companies with lower ROA had better environmental disclosure. This provides marginal support for Vaupel et al.’s (2022) concern of window dressing (‘green washing’), especially in financially challenging times. Companies performing poorly from a profitability standpoint may be more inclined to accentuate ESG disclosure.

As a robustness check, the regression was performed a second time, but only for repurchasers, i.e., company years in which companies performed a share repurchase. Table 5 shows the results, with only 115 observations (38 separate companies) being included.

Table 5.

Regressions focusing only on repurchasers.

In Table 5, similar results are found as in Table 4: a positive relationship existed between share repurchases and ESG disclosures scores. The positive association between share repurchases and companies’ social score was, however, no longer statistically significant. Overall, the results in both Table 4 and Table 5 are aligned with the hypothesis (H1) that a positive relationship between share repurchases and corporate sustainability exists in the South African context.

5. Conclusions

The ubiquitous nature of corporate sustainability is being felt by company executives as stakeholders increasingly demand sustainability disclosures (De Silva Lokuwaduge and De Silva 2022). Although some studies in the USA have proposed a negative association between share repurchases and corporate sustainability (Vaupel et al. 2022; Lazonick and Jacobson 2019), most evidence from developed economies supports a positive relationship between the two variables (Samet and Jarboui 2017; Benlemlih 2019; Tran 2021). No prior studies investigated the relationship between share repurchases and corporate sustainability in emerging economies. Consequently, the objective of this study was to investigate the relationship between share repurchases and corporate sustainability in the South African context. The regression analyses showed a significant positive relationship between share repurchases and ESG scores, specifically social scores, in the South African context. South Africa’s socio-economic difficulties may have prompted companies to prioritise social initiatives over environmental ones.

5.1. Theoretical Implications

As the first study to empirically assess the relationship between share repurchases and corporate sustainability in the setting of an emerging economy, this study adds to the body of knowledge. It lends credence to the stakeholder theory, which emphasises that companies should distribute earnings to both shareholders (via share repurchases) and other stakeholders (via ESG projects). The results agree with prior empirical evidence from Europe (Samet and Jarboui 2017; Tran 2021), but they disagree with the studies from the USA (Vaupel et al. 2022; Lazonick and Jacobson 2019). This emphasises that the interaction between share repurchases and corporate sustainability might be context-specific, and that the negative association reported in the USA could have resulted from the larger amounts being spent on share repurchases in that context.

5.2. Policy Implications

Company stakeholders should be mindful that increased disclosures on the social component of ESG in years when share repurchases are executed may be window-dressing (also known as ‘social washing’) and may not result in quantifiable advancements in this area. As a result, stakeholders in South Africa can use the findings to assess the legitimacy of companies’ sustainability commitments. Financial regulators and shareholder activists should continue to monitor companies’ ESG disclosures, assess the risks of window-dressing and implement initiatives to hold companies accountable for their ESG-related promises.

5.3. Research Limitations and Recommendations for Future Research

A limitation of this study is that it is based on JSE-listed companies and, given the unique socio-economic conditions of South Africa, cannot be generalised to other emerging economies. Future research could replicate this study in another emerging economy. From a corporate-sustainability point of view, ESG disclosure scores may not truly reflect companies’ sustainability efforts (Johnson et al. 2019). Therefore, in answering the research question on whether there is a relationship between share repurchases and corporate sustainability, actual ESG performance may present a different result compared to ESG disclosure scores. Future research can focus on different timeframes, such as during the COVID-19 pandemic and the post-pandemic period, to investigate the influence of a crisis and how it changes companies’ attitudes towards its various stakeholders (i.e., how they prioritise various stakeholder interests). It may also be informative to investigate the influence of executive share-based remuneration on the relationship between share repurchases and ESG in South Africa.

Author Contributions

Conceptualisation and methodology, G.S.; formal analysis and writing—original draft preparation, F.M., C.L., G.C. and W.H.; writing—review and editing, and supervision, G.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available in the IRESS and Bloomberg financial databases, and the raw data employed is available from the corresponding author on request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Attig, Najah, Narjess Boubakri, Sadok El Ghoul, and Omrane Guedhami. 2013. International Diversification and Corporate Social Responsibility. School of Business and Management Working Paper Series, American University of Sharjah. Available online: https://dspace.aus.edu/xmlui/bitstream/handle/11073/5962/WPS_Attig-Boubakri-ElGhoul-Guedham.pdf?sequence=1 (accessed on 13 June 2024).

- Bansal, Pratima, and Hee-Chan Song. 2017. Similar but not the same: Differentiating corporate sustainability from corporate responsibility. Academy of Management Annals 11: 105–49. [Google Scholar] [CrossRef]

- Bendig, David, Daniel Willmann, Steffen Strese, and Malte Brettel. 2018. Share repurchases and myopia: Implications on the stock and consumer markets. Journal of Marketing 82: 19–41. [Google Scholar] [CrossRef]

- Benhamouda, Zoubeida, and Robert Watson. 2010. A research note on the determinants of UK corporate share repurchase decisions. Applied Financial Economics 20: 529–41. [Google Scholar] [CrossRef]

- Benlemlih, Mohammed. 2019. Corporate social responsibility and dividend policy. Research in International Business and Finance 47: 114–38. [Google Scholar] [CrossRef]

- Brav, Alon, John R. Graham, Campbell R. Harvey, and Roni Michaely. 2005. Payout policy in the 21st century. Journal of Financial Economics 77: 483–527. [Google Scholar] [CrossRef]

- Cahan, Steven F., Charl De Villiers, Debra J. Jeter, Vic Naiker, and Chris J. Van Staden. 2016. Are CSR disclosures value relevant? Cross country evidence. The European Accounting Review 25: 579–611. [Google Scholar] [CrossRef]

- Cheruiyot-Koech, Roselyne, and Colin D. Reddy. 2022. Corporate social responsibility preferences in South Africa. Sustainability 14: 3792. [Google Scholar] [CrossRef]

- Cohen, Shira, Igor Kadach, Gaizka Ormazabal, and Stefan Reichelstein. 2022. Executive compensation tied to ESG performance: International evidence. European Corporate Governance Institute 825: 1–64. [Google Scholar] [CrossRef]

- Crotty, Ann. 2012. Share Buy-Backs Ban Moved to a Virtual-Free-For All. Independent Online. June 21. Available online: https://www.pressreader.com/south-africa/cape-times/20120621/282218007870879 (accessed on 20 January 2023).

- De Silva Lokuwaduge, Chitra S., and Keshara M. De Silva. 2022. ESG risk disclosure and the risk of greenwashing. Australasian Accounting, Business and Finance Journal 16: 146–59. [Google Scholar] [CrossRef]

- Drempetic, Samuel, Christian Klein, and Bernhard Zwergel. 2019. The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings Under Review. Journal of Business Ethics 167: 348. [Google Scholar] [CrossRef]

- Dyllick, Thomas, and Kai Hockerts. 2002. Beyond the business case for corporate sustainability. Business Strategy and Environment 11: 130–41. [Google Scholar] [CrossRef]

- ESI-Africa. 2022. Op-Ed on ESG: Not All ‘Washing’ Is Squeaky Clean. Available online: https://www.esi-africa.com/event-news/op-ed-on-esg-not-all-washing-is-squeaky-clean/ (accessed on 13 June 2024).

- Fama, Eugene F., and Kenneth R. French. 2001. Disappearing dividends: Changing firm characteristics or lower propensity to pay? Journal of Financial Economics 60: 3–43. [Google Scholar] [CrossRef]

- Freeman, Robert Edward. 1984. Strategic Management: A stakeholder Approach. Boston: Pitman. [Google Scholar]

- Friedman, Milton. 1970. The Social Responsibility of a Business Is to Increase Its Profits. New York Times Magazine. September 13. Available online: https://www.nytimes.com/1970/09/13/archives/a-friedman-doctrine-the-social-responsibility-of-business-is-to.html (accessed on 13 June 2024).

- FSCA (Financial Sector Conduct Authority). 2024. FSCA Sustainable Finance Consumer Risk Report and Roadmap 2024. Available online: https://www.fsca.co.za/Documents/FSCA%20SF%20Roadmap%20and%20Consumer%20Risk%20Report.pdf (accessed on 13 June 2024).

- Gallo, Miguel Angel. 2004. The family business and its social responsibilities. Family Business Review 17: 135–47. [Google Scholar] [CrossRef]

- Gao, Jijun, and Pratima Bansal. 2013. Instrumental and integrative logics in business sustainability. Journal of Business Ethics 112: 241–55. [Google Scholar] [CrossRef]

- Grullon, Gustavo, and Roni Michaely. 2004. The information content of share repurchases programmes. The Journal of Finance 59: 651–80. Available online: https://www.jstor.org/stable/3694910 (accessed on 13 June 2024).

- He, Tina T., Wilson X. Li, and Gordon Y. Tang. 2012. Dividends behavior in state-versus family-controlled firms: Evidence from Hong Kong. Journal of Business Ethics 110: 97–112. Available online: https://www.jstor.org/stable/41684016 (accessed on 13 June 2024). [CrossRef]

- Ikenberry, David, Josef Lakonishok, and Theo Vermaelen. 1995. Market underreaction to open market share repurchases. Journal of Financial Economics 39: 181–208. [Google Scholar] [CrossRef]

- Institute of Directors in Southern Africa (IoDSA). 2016. King IV: Report on Corporate Governance for South Africa 2016. Available online: https://cdn.ymaws.com/www.iodsa.co.za/resource/collection/684B68A7-B768-465C-8214-E3A007F15A5A/IoDSA_King_IV_Report_-_WebVersion.pdf (accessed on 6 April 2023).

- Ioannou, Ioannis, and George Serafeim. 2017. The consequences of mandatory corporate sustainability reporting. Harvard Business School Research Working Paper. pp. 11–100. Available online: https://ssrn.com/abstract=1799589 (accessed on 13 June 2024).

- Jagannathan, Murali, Clifford P. Stephens, and Michael S. Weisbach. 2000. Financial flexibility and the choice between dividends and stock repurchases. Journal of Financial Economics 57: 355–84. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1986. Agency costs of free cash flow, corporate finance and takeovers. American Economic Review Papers and Proceedings 76: 323–29. Available online: https://www.jstor.org/stable/1818789 (accessed on 13 June 2024).

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- John, Kose, Anzhela Knyazeva, and Diana Knyazeva. 2015. Governance and payout precommitment. Journal of Corporate Finance 33: 101–17. [Google Scholar] [CrossRef]

- Johnson, Ruth. 2020. The link between environmental, social and corporate governance disclosure and the cost of capital in South Africa. Journal of Economic and Financial Sciences 13: a543. [Google Scholar] [CrossRef]

- Johnson, Ruth, Nadia Mans-Kemp, and Pierre D. Erasmus. 2019. Assessing the business case for environmental, social and corporate governance practices in South Africa. South African Journal of Economic and Management Sciences 22: 1–13. [Google Scholar] [CrossRef]

- Kim, Jaemin, Ralf Schremper, and Nikhil P. Varaiya. 2005. Open market repurchase regulations: A cross-country examination. Corporate Finance Review 9: 29–38. [Google Scholar] [CrossRef]

- Lazonick, William. 2014. The big idea—Profits without prosperity. Harvard Business Review 92: 46–55. Available online: https://hbr.org/2014/09/profits-without-prosperity (accessed on 16 January 2023).

- Lazonick, William, and Ken Jacobson. 2019. How Stock Buybacks Undermine Sustainable Prosperity. The American Prospect. March 13. Available online: https://prospect.org/economy/stock-buybacks-undermine-sustainable-prosperity (accessed on 13 June 2024).

- Manconi, Alberto, Urs Peyer, and Theo Vermaelen. 2019. Are buybacks good for long-term shareholder value? Evidence from buybacks around the world. Journal of Financial and Quantitative Analysis 54: 1899–935. [Google Scholar] [CrossRef]

- McWilliams, Abagail, and Donald Siegel. 2001. Corporate social responsibility: A theory of the firm perspective. The Academy of Management Review 26: 117–27. [Google Scholar] [CrossRef]

- Mokabane, Maatabudi, and Elda Du Toit. 2022. The value of integrated reporting in South Africa. South African Journal of Economic and Management Sciences 25: 1–8. [Google Scholar] [CrossRef]

- Montiel, Ivan. 2008. Corporate social responsibility and corporate sustainability: Separate pasts, common futures. Organization & Environment 21: 245–69. [Google Scholar] [CrossRef]

- Mueller, Dennis C. 1972. A life cycle theory of the firm. The Journal of Industrial Economics 20: 199–219. [Google Scholar] [CrossRef]

- Rakotomavo, Michel. 2012. Corporate investment in social responsibility versus dividends? Social Responsibility Journal 8: 199–207. [Google Scholar] [CrossRef]

- Rappaport, Alfred. 2006. Ten ways to create shareholder value. Harvard Business Review 84: 66–77. Available online: https://hbr.org/2006/09/ten-ways-to-create-shareholder-value (accessed on 13 June 2024).

- Samet, Marwa, and Anis Jarboui. 2017. Corporate social responsibility and payout decisions. Managerial Finance 43: 982–98. [Google Scholar] [CrossRef]

- Schulschenk, Jess. 2013. Corporate Governance Research Programme: Lessons Learnt from the South African Experience. Available online: https://www.chartsec.co.za/documents/speakerPres/2013/JessSchulschenk.pdf (accessed on 13 June 2024).

- Steenkamp, Gretha, and Nicolene Wesson. 2020. Post-recession share repurchase behaviour by JSE-listed companies: Transparent or not? Journal of Accounting in Emerging Economies 10: 465–86. [Google Scholar] [CrossRef]

- Steenkamp, Gretha, Nicolene Wesson, and Eon Smit. 2023. Camouflaged compensation: Do South African executives increase their pay through share repurchases? Journal of Risk and Financial Management 16: 177. [Google Scholar] [CrossRef]

- Tran, Phuong. 2021. Corporate Social Responsibility and Share Repurchases: European Evidence. Unpublished. Masters’ dissertation, University of Vaasa, Vaasa, Finland. Available online: https://urn.fi/URN:NBN:fi-fe2021120359159 (accessed on 13 June 2024).

- Unruh, Gregory, David Kiron, Nina Kruschwitz, Martin Reeves, Holger Rubel, and Alexander Meyer zum Felde. 2016. Investing for a sustainable future: Findings from the 2016 sustainability & innovation global executive study and research project. MIT Sloan Management Review 57: 1–32. [Google Scholar]

- Vaupel, Mario, David Bendig, Denise Fischer-Kreer, and Malte Brettel. 2022. The role of share repurchases for firms’ social and environmental sustainability. Journal of Business Ethics 183: 401–28. [Google Scholar] [CrossRef]

- Vermaelen, Theo. 2005. Share repurchases. Foundations and Trends in Finance 1: 171–268. [Google Scholar] [CrossRef]

- Wesson, Nicolene, Chris Muller, and Mike Ward. 2014. Market underreaction to open market share repurchases on the JSE. South African Journal of Business Management 45: 59–69. [Google Scholar] [CrossRef][Green Version]

- Wesson, Nicolene, Eon Smit, Martin Kidd, and Willie Hamman. 2018. Determinants of the choice between share repurchases and dividend payments. Research in International Business and Finance 45: 180–96. [Google Scholar] [CrossRef]

- Wesson, Nicolene, Wilna Bruwer, and Willie Hamman. 2015. Share repurchase and dividend payout behaviour: The South African experience. South African Journal of Business Management 46: 43–54. [Google Scholar] [CrossRef]

- World Commission on Environment and Development (WCED). 1987. Report of the World Commission on Environment and Development: Our Common Future. Available online: https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf (accessed on 17 January 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).