1. Introduction

Traditional industries, including sectors such as metal machinery, the chemical industry, and subsistence industries, have played pivotal roles in Taiwan’s economic development, trade, and industrial evolution over the years. However, in recent years we have witnessed the emergence of economic powerhouses and the rapid progress of regional economic and trade partnerships like ASEAN, resulting in significant changes to the global economic and trade landscape. As a result, these industries are now operating within a new and highly competitive environment. In this era of rapid transformation, these industries must identify the essential factors that will enable them to maintain and enhance their positions on the international stage.

Investors seek to achieve multiple objectives through the election of a company’s board of directors. They aim to enhance corporate governance, safeguard the rights and interests of shareholders, and anticipate that the board will contribute expertise to improve the decision-making prowess of the board itself. Ultimately, this is expected to enhance the company’s overall performance. Consequently, whether the board of directors can positively impact corporate performance has remained a significant research focus in management and academia.

While many studies have explored the relationship between the board of directors’ characteristics and company performance, a notable need exists for more in-depth articles examining the professional backgrounds of the board members and CEOs and how their leadership qualities influence financial performance. This gap in research underscores the need for a more comprehensive understanding of the intricate dynamics between leadership, professional expertise, and corporate financial outcomes.

Over the past four decades, numerous studies have identified the common attributes of effective corporate boards. Board structure has consistently taken center stage in scholarly discussions among the myriad factors explored. The primary roles of a board of directors encompass leadership and decision-making. Board members hold a prominent position where they oversee the bigger picture, conduct macro-level analysis and assessments in line with the organization’s overarching vision, steer the general direction of the company, and guide the company’s proactive responses to societal shifts. The fundamental purpose of the board of directors is to govern the company, making it the backbone of the entire organization.

Jensen and Zajac (

2004) have contended that boards comprising highly educated members tend to be more amenable to embracing changes in a company’s structure or strategy. This receptivity arises from their ability to mitigate systemic risks associated with future changes, owing to their unique strategic perspectives, nimble problem-solving abilities, and in-depth comprehension of their respective businesses. Numerous studies, including those conducted by

Hambrick and Mason (

1984) and

Kor and Sundaramurthy (

2009), have reached a consensus that top management possessing specialized knowledge, particularly a deep understanding of the business and its operational intricacies, tends to lead to more effective business operations. Educational qualifications serve as a crucial indicator of knowledge, with degrees in finance, accounting, economics, research, and law being particularly relevant due to their extensive application in corporate governance.

Recent studies provide compelling evidence for the intricate link between board composition and performance.

Amini and Zhang (

2022) explored the impact of “industry-specific human capital” on board composition, demonstrating a positive correlation between relevant board member experience and firm risk management effectiveness. Similarly,

Aguilera et al. (

2021) highlight the importance of “functional expertise” on boards, finding that firms with directors possessing financial expertise exhibit superior financial performance, particularly during periods of economic downturn. Beyond expertise, the broader background of board members also plays a crucial role. A study by

Francoeur et al. (

2021) examined the impact of “boardroom gender diversity” on firm performance, revealing a positive association between diverse boards and higher return on assets (ROA) and return on equity (ROE). Likewise,

Luo et al. (

2020) investigated the effect of “board age diversity”, with results suggesting that a balanced age mix on boards can enhance firm innovation and performance, particularly in technology-intensive industries. However, the relationship between board makeup and performance remains nuanced. As

Klein and Zurbrügg (

2023) pointed out, the effectiveness of specific board characteristics hinges on various moderating factors, including firm size, industry context, and corporate governance practices. Moreover, boardroom dynamics, leadership, and information flow between the board and management play significant roles in translating individual expertise and diverse backgrounds into tangible performance gains.

This paper emphasizes the critical role of board composition in organizational success. Business managers are advised to recruit board members with diverse expertise in accounting and finance to enhance decision-making and financial oversight. They should carefully evaluate board size to balance diverse perspectives with efficient communication. Additionally, managers must monitor for unethical profit management practices, leveraging predictive analytics for strategic insights. Contextualizing their findings within their specific industry and organizational context is crucial for effective implementation and sustained growth.

In pursuing this investigation, this paper has harnessed a vast dataset comprising 5309 observations across 331 companies, spanning from 2000 to 2021, as its research foundation. The employed methodology centers on applying the threshold analysis technique to unveil the influence of board characteristics on business performance, focusing on identifying overarching trends regarding Return on Assets (ROA). These findings subsequently serve as the bedrock for developing an Artificial Neural Network (ANN) tailored for forecasting financial performance. Compared to existing research, this paper sets itself apart through its innovative approach, offering a novel research model within this domain.

This paper represents one of the pioneering attempts to meld the ANN model with the multi-threshold technique to predict a firm’s ROA based on the attributes of its board of directors. The research outcomes reveal that a board of directors boasting a more significant number of members with accounting qualifications contributes to a consistent and stable increase in ROA. Conversely, an augmented presence of members with financial expertise yields a more pronounced yet less stable impact on ROA. Moreover, members with legal expertise appear to exert no significant favorable influence on ROA. Furthermore, directors holding more company shares exhibit the capacity to enhance ROA, but this effect materializes only when ROA surpasses the threshold of 14.96%. Additionally, when considering the factor of simultaneously serving on the board of directors, the positive effect becomes more prominent. In essence, directors who are actively engaged in managing and participating in the company’s decision-making processes exhibit a heightened ability to bolster profitability.

2. Related Literature

Fueled by market growth and increasing complexity, the ever-expanding business landscape presents firms with a critical challenge: securing essential resources for survival and success. Resource Dependence Theory (RDT) offers a powerful lens through which to examine this dynamic, highlighting how organizations rely on external resources and how this dependence shapes their actions and, ultimately, their performance. Within this framework, boards of directors emerge as critical players tasked with strategically acquiring and managing these resources.

RDT emphasizes the significance of board expertise in building bridges to critical resources. Boards with members possessing relevant industry experience, financial literacy, and functional expertise are better equipped to attract investments, partnerships, and talent (

Krishnan and Santos 2008;

Rynes et al. 2007). This expertise empowers them to assess opportunities, build trust with external stakeholders, and navigate complex resource dependencies effectively. By leveraging their knowledge and networks, they can unlock doors to critical resources that drive firm growth and competitiveness.

However, RDT goes beyond mere expertise, recognizing the value of board diversity in accessing a more comprehensive range of resources. The educational backgrounds, professional affiliations, and past experiences of board members bring unique perspectives and networks to the table (

Boone and Lüdema 2018). This diversity fosters innovation, enhances problem-solving, and opens doors to previously untapped resources, ultimately enriching the firm’s resource portfolio. By embracing diversity, boards gain access to a broader spectrum of knowledge, connections, and experiences, allowing them to identify and secure resources that may have been overlooked with a more homogenous composition.

RDT acknowledges that resource dependence is not without its nuances. While larger boards offer the potential for broader expertise and diverse perspectives, concerns about communication complexity and efficiency can arise (

Adams and Ferreira 2007). Similarly, attracting highly qualified board members might involve increased compensation, necessitating a careful cost-benefit analysis. Additionally, the effectiveness of board composition hinges on factors like firm size, industry context, and internal governance practices (

Hambrick 2005). Recognizing these trade-offs and moderating factors is crucial for optimizing board composition and ensuring that resource acquisition efforts translate into tangible benefits for the firm.

Emerging research continues to solidify the link between board composition and resource acquisition, consequently impacting performance.

Amini and Zhang (

2022) found a positive correlation between industry-specific board experience and risk management effectiveness, highlighting the role of expertise in securing critical resources. Similarly,

Aguilera et al. (

2021) demonstrated that firms with financially literate boards exhibited superior financial performance, suggesting access to capital as a potential benefit. These findings, alongside others exploring the positive impact of board diversity (

Francoeur et al. 2021;

Luo et al. 2020), showcase the increasingly recognized role of board composition in resource acquisition and firm success.

By adopting an RDT perspective, we understand how boards navigate resource dependencies and influence firm performance. Recognizing the interplay between expertise, diversity, and moderating factors is crucial for optimizing board composition and securing the resources that drive sustainable success in our ever-evolving business landscape.

In the realm of corporate governance research, the common thread is the measurement of business performance (

Hakim and Liu 2021;

Li and Patel 2019). This focus stems from businesses’ fundamental goal, profit generation, and the paramount importance of safeguarding shareholders’ rights and interests. Additionally, discussions about the impact of corporate governance extend to areas such as earnings management (

Warfield et al. 1995;

Klein 2002;

Chang et al. 2007), earnings forecast errors (

Hlel et al. 2020), and the influence of accountants issuing going concern opinions (

DeFond et al. 2002;

Wu et al. 2011). Amidst this, corporate governance is bifurcated into internal and external governance, with the board of directors serving as the core of internal governance. Consequently, when exploring the supervisory mechanisms of corporate governance, the board of directors’ soundness, composition, and characteristics emerge as standard independent variables.

The educational background of board members imparts diverse perspectives and mindsets regarding the company’s ultimate goals, which can significantly influence its performance and purpose. Educational backgrounds offer nuanced insights into an individual’s values and preferences, influenced by variations in educational programs (

Hambrick and Mason 1984). The educational diversity among board members is linked to the financial performance of companies, with a stronger positive relationship observed for firms with higher levels of internationalization (

Carpenter 2002). Additionally, women and directors with accounting backgrounds tend to enhance compassion and reciprocity in CSR decision-making, especially in companies with larger boards (

Nguyen and Huang 2020).

The board plays a pivotal role in mitigating agency problems, and the effectiveness of this role is closely linked to its composition (

Fama and Jensen 1983). Typically, the board of directors comprises internal and external directors. Since 2002, Taiwan has mandated that newly established companies must have at least two independent directors on their boards. This move aims to bring impartial and objective professionals into managerial roles, thus enhancing the quality and efficiency of board decision-making. However, concerns exist about performance evaluation’s supervisory function and objectivity when internal directors are involved in a company (

Weisbach 1988). Additionally, unfamiliarity with the company may lead to increased communication costs for the board (

Pucheta-Martínez and Gallego-Álvarez 2020).

In recent years, directors’ characteristics have become a new focus in board characteristics, including gender, expertise, education level, industrial background, and experience. Researchers have shown that senior managers’ specific skills can enhance business operations from the social capital perspective, and gender diversity on boards can enhance corporate value (

Kor and Sundaramurthy 2009;

Kim and Starks 2016). Higher levels of education, professional knowledge, generalist skills, and experience among board members are associated with improved firm performance (

Jensen and Zajac 2004;

Hakim and Liu 2021). Furthermore, industry experience among directors is linked to enterprise value, and experiences from upstream and downstream industries can bring benefits in terms of information and industry expertise, potentially outweighing any concerns about conflicts of interest (

Dass et al. 2014). Finally, directors from the same geographical area as the company may have stronger local connections due to their understanding of the local business environment, which can significantly impact the company’s value (

Sun 2021).

Various factors likely moderate the impact of board expertise and background. Board size, composition (independence, diversity), and internal firm environment (culture, leadership structure) can influence how effectively their expertise is utilized (

Adams and Ferreira 2007;

Hambrick 2005).

Based on the reviewed literature, we propose the following hypotheses:

Larger boards offer the potential for broader expertise and diverse perspectives, which may lead to improved decision-making and firm performance. However, concerns exist about communication complexity and potentially reduced efficiency in larger boards.

Hypothesis 1. Boards with a higher number of members demonstrate increased profitability.

Accounting expertise equips board members to understand financial information better, assess risk, and monitor management financial decisions, potentially leading to more consistent and stable profitability.

Hypothesis 2. A more significant presence of board members with accounting expertise contributes to more consistent profits.

Given the financial nature of a firm’s performance, financial expertise may positively influence profitability compared to other types of expertise.

Hypothesis 3. An increased presence of members with financial expertise has a more pronounced impact on profitability than expertise in other domains.

This study is motivated by the pressing need to comprehensively address gaps in the existing research, explore the potential insights advanced methodologies can yield, and investigate the evolving economic landscape that demands a deeper understanding of the dynamics within boardrooms. Through these efforts, it aims to contribute knowledge that can inform both academia and industry, ultimately enhancing the grasp of the critical factors shaping corporate financial outcomes.

3. Research Methodology

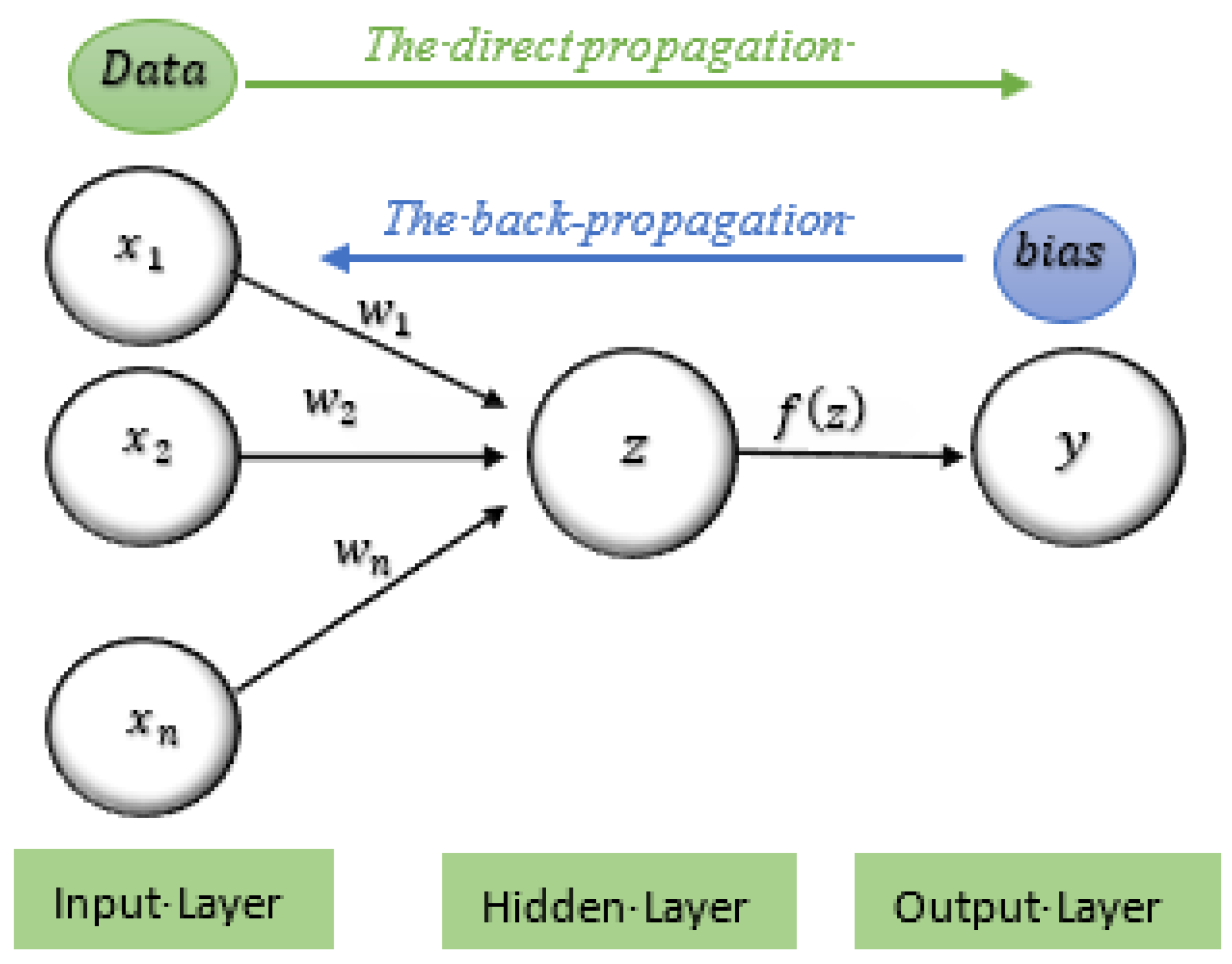

The ANN architecture is derived from the idea of simulating the human brain. Like humans, ANNs learn by experience, saving and using those experiences in the right situations. An ANN usually organizes neurons into layers, each responsible for a specific task. An ANN usually has three layers, an input layer, a hidden layer, and an output layer: (1) The input layer provides the network with the necessary data. The number of neurons in the input layer corresponds to the number of input parameters given to the network, and these input parameters are assumed to be in vector form. (2) The hidden layer contains hidden neurons that connect input values to output values. A neural network may have one or more hidden layers primarily responsible for processing the neurons of the input layer and delivering information to the neurons of the output layer. These neurons are suitable for classifying and identifying the relationship between input parameters and output parameters. (3) The output layer contains output neurons which transfer the output information of computations from the ANN to the user. An ANN can be built to have multiple output parameters. The problem will decide the number of neurons in the input layer, the output layer, and the number of hidden layer neurons; the input will decide the number of hidden layers. However, choosing the type and quantity of input parameters has a class effect on the quality of the network. The mathematical model of a straight-propagation ANN is presented as follows:

where

y(

x) is the output value according to the variable

x;

f is the activation or transfer function;

wi is the link weight of neuron

xi;

xi is the input value.

Figure 1 explains the nature of the operating principle of a direct propagation ANN for the network’s training. Specifically, the training process often uses a back-propagation algorithm to find the derivative for each parameter in the network.

The straight propagation phase consists of six steps, as follows:

The input parameter vector is input to the neurons in the input layer:

At the

jth hidden layer neuron, the value of the signal received from the input layer is summed up as the weighted (

…,

sum of all the input data by adding all the products of each input data and the association weights (

z) between the hidden layers and input class.

b is the bias coefficient.

Then, the activation function (transfer function) will be used to convert the received value into the output value.

Next, the output value at the hidden layer neuron j continues to be transmitted to the output neuron

k in the same way as from the input layer to the hidden layer.

Then, the transfer function is used to compute the output value of the neuron at the output layer.

The direct propagation phase ends, and the network will move to the back-propagation phase.

During the input phase, the input data includes input and actual values. Following this, for each data set, each corresponding output error is calculated. This value is called the loss function (Cost Function—

J).

From the cost function just found, we calculate the derivative of this function according to the weight (

…,

between the hidden layer—the output layer, and the weight between the input layer—the hidden layer.

Next, the association weight value between the hidden layer and the output layer and the link weight value between the input layer and the hidden layer are adjusted simultaneously.

While ANN has a well-established presence in financial modeling, our study’s originality lies in its unique combination of an ANN and multi-threshold analysis within the specific domain of corporate governance and financial performance prediction.

5. Conclusions

The research results show that, for companies in traditional industries that are listed on the Taiwanese stock market, the composition of the board of directors impacts the business’s financial performance.

Boards with more members may have a greater capacity for overseeing corporate governance. A greater representation of board members with accounting expertise tends to lead to more consistent corporate profits, whereas an increased presence of members with financial expertise results in more pronounced profit fluctuations. Additionally, in the case of companies with lower profits, managers may face pressure from loan contracts or receive limited attention from investors, potentially leading to heightened practices related to profit management. Managers may aim to maximize their benefits. At this time, the return on assets is high, and the managers obtain the expected benefits. Thus, to restrain the profit management behavior of managers, enterprises need to have a broader view and have specific judgments and analyses in each enterprise to build organizational structure and procedures. The operation of the board of directors is more effective because of the industry’s characteristics, the enterprise’s size, the capital structure, and the performance of the enterprise. Finally, this study used deep learning and big data techniques to build an Artificial Neural Network (ANN) model that specializes in predicting the ROA of companies based on most factors related to board structure, with a prediction accuracy of over 78%.

While the research confirms a link between board composition and financial performance in traditional Taiwanese companies, the impact of specific expertise reveals intriguing nuances. Larger boards, per Hypothesis 1, might enhance decision-making capacity due to broader expertise, but communication challenges remain a concern. Hypothesis 2 is validated, as board members with accounting expertise promote stable profits through better financial oversight. Interestingly, Hypothesis 3’s predicted substantial impact of financial expertise was found to likely lead to profit fluctuations, suggesting a focus on aggressive, short-term gains over long-term stability. This paper delves further, highlighting potential profit management practices in low-profit companies due to external pressure, emphasizing the need for closer monitoring. Notably, it introduces an Artificial Neural Network model capable of predicting a company’s return on assets with impressive accuracy based on board structure factors. In conclusion, this research offers valuable insights by analyzing how different expertise and factors like board size impact performance, aiding companies in optimizing their board composition for informed decision-making and sustainable success.