The Sustainability of Investing in Cryptocurrencies: A Bibliometric Analysis of Research Trends

Abstract

1. Introduction

2. Background

2.1. Financial and Non-Financial Sustainability of Cryptocurrencies

2.2. Bibliometric Cryptocurrency Analysis

3. Methodology

3.1. Sample Size and Data Collection

3.1.1. Choosing a Research Database

3.1.2. Detection of Keywords

3.1.3. Detection of Relevant Documents

3.2. Data Analysis

3.2.1. Selection of Science Mapping Tool

3.2.2. Scientometric Techniques

4. Findings and Discussion

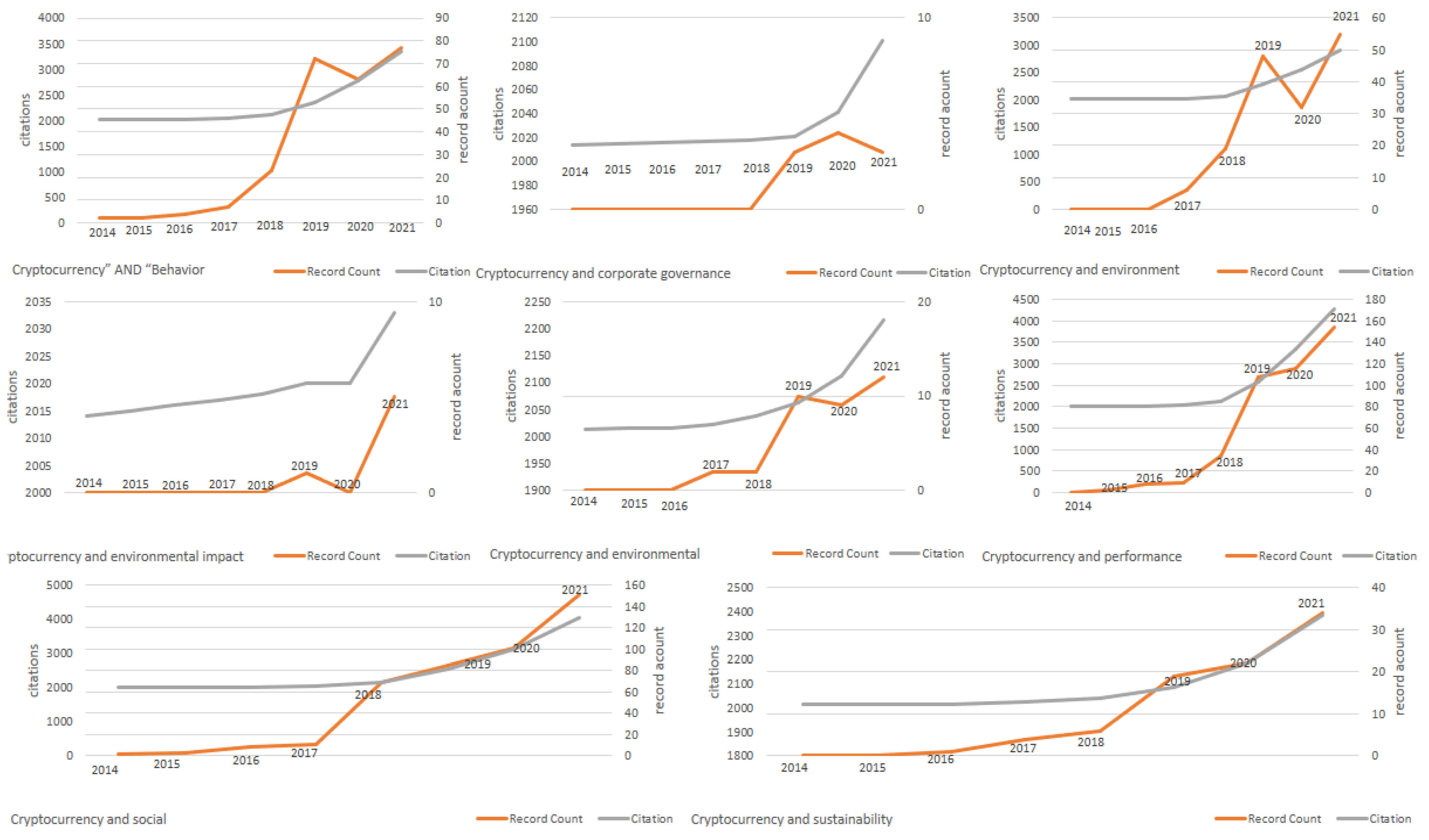

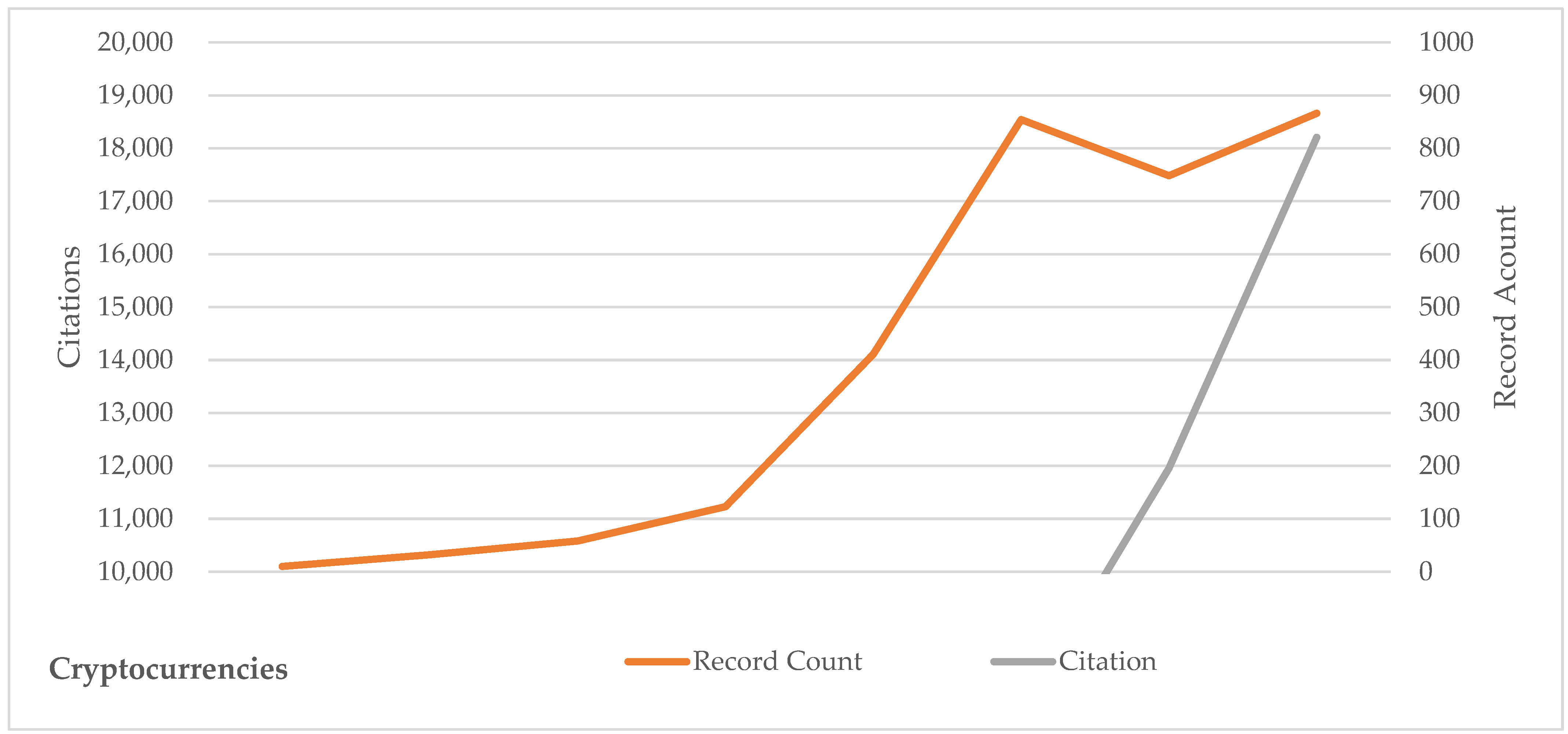

4.1. Publication Output and Growth Trend: Evolution of Cryptocurrency Research

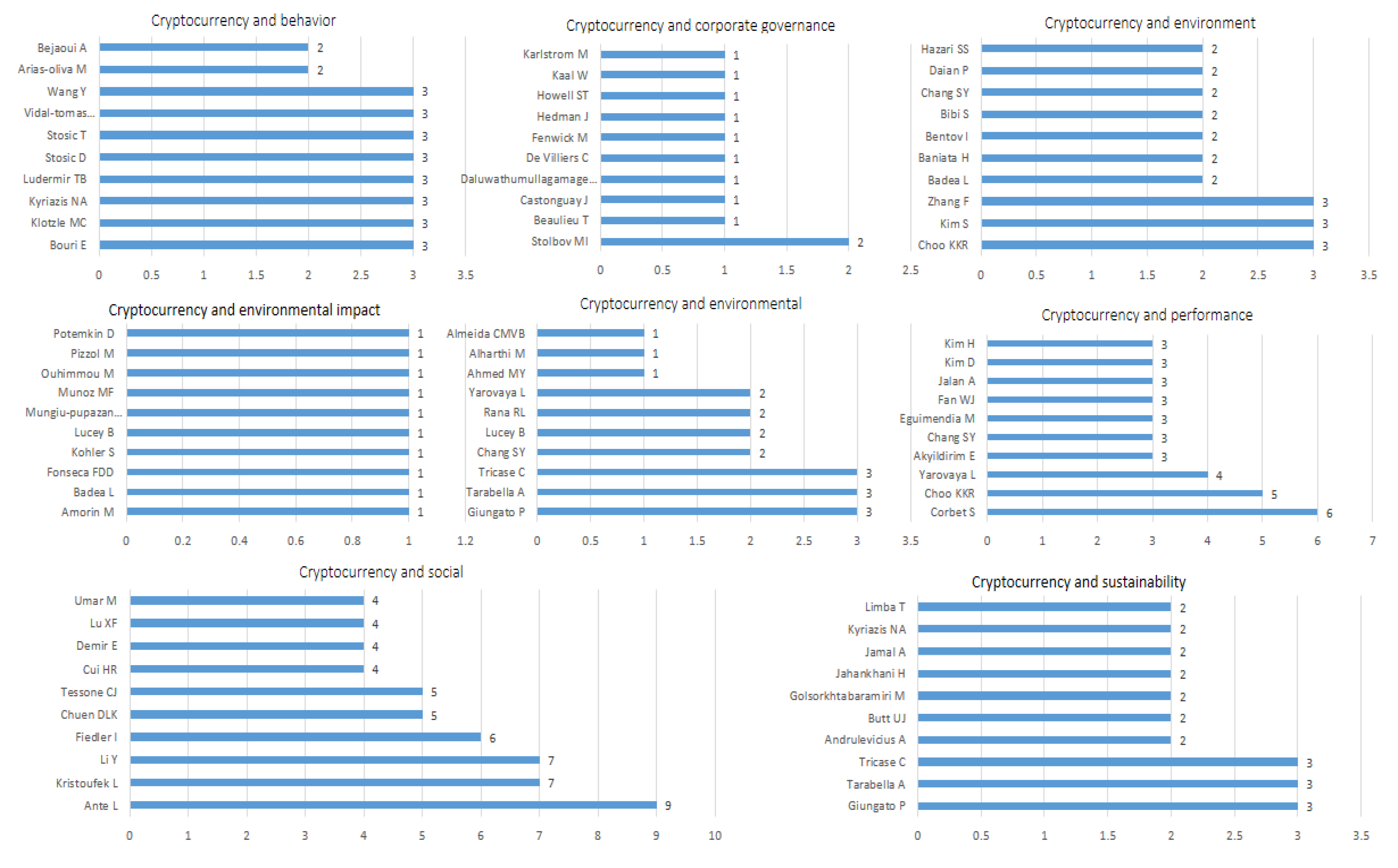

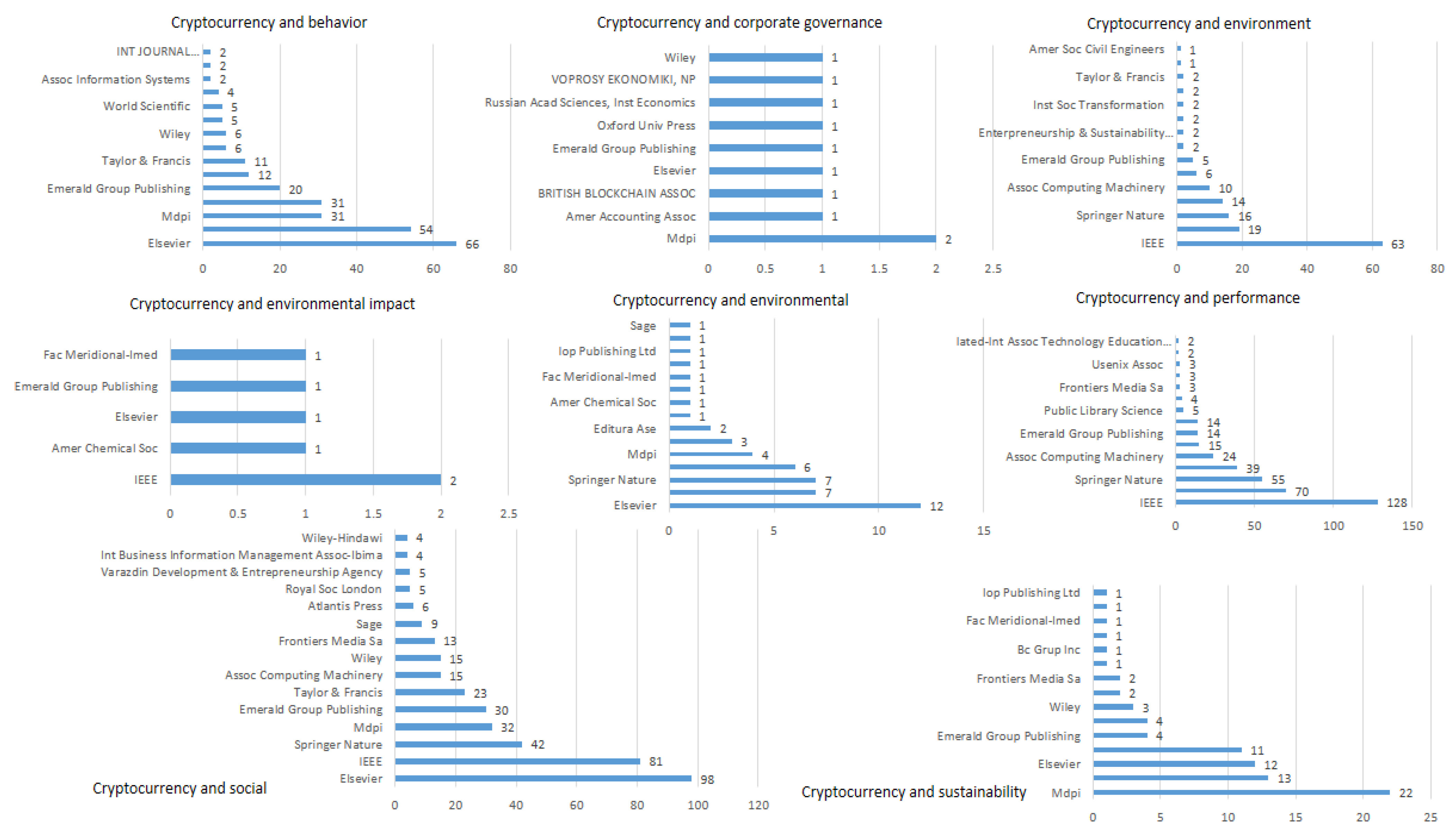

4.2. Top Papers, Authors, and Publishers on Cryptocurrency Reporting

4.3. Bibliometric Analysis: Mapping and Visualizing

4.3.1. Keyword Co-Occurrence Analysis

4.3.2. Research Trends Related to Cryptocurrency Issues

- Cluster 1: “In cryptocurrency marketplaces, there is efficiency and inefficiency, as well as volatility and risk”

- Cluster 2: “A review of cryptocurrency acceptability, financial performance, and market characteristics”

- Cluster 3: “A look into cryptocurrencies and why bitcoin has such a large market share”

- Cluster 4: “Cryptocurrencies and sustainability”

- Cluster 5: “An examination of the financial behavior of cryptocurrencies”

4.3.3. Bibliographic Coupling of Countries

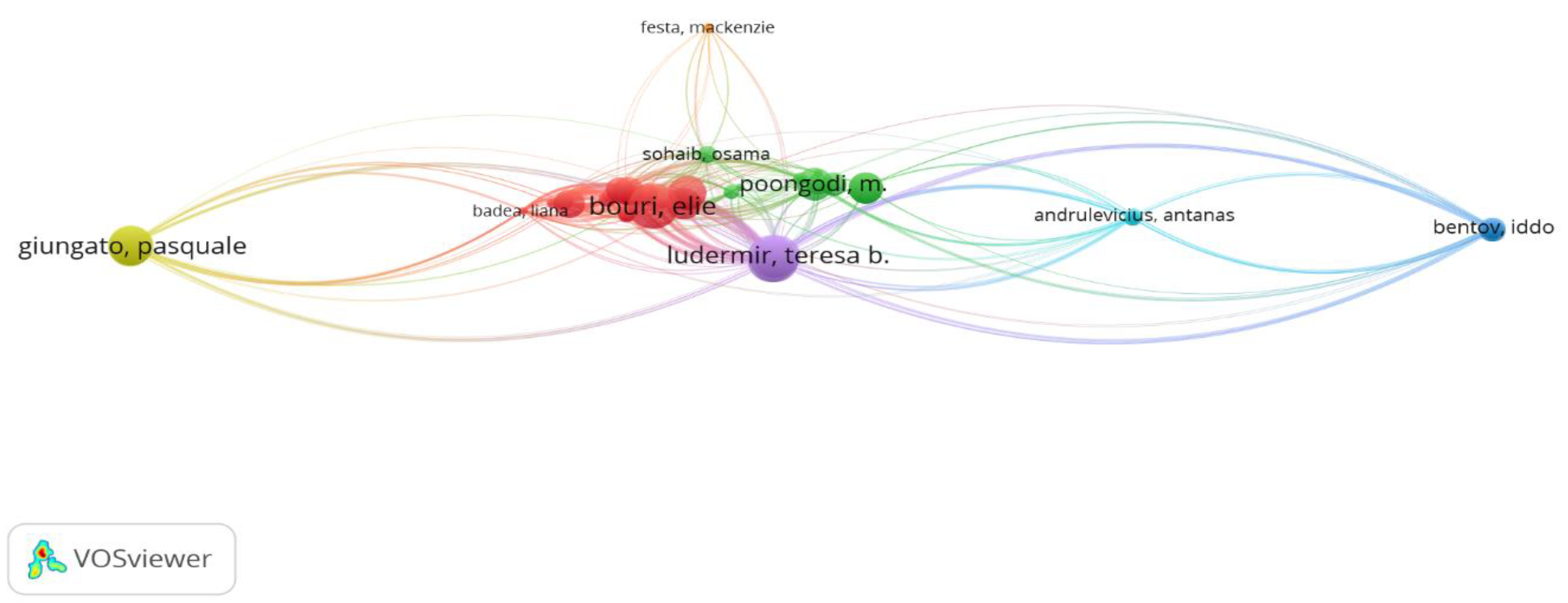

4.3.4. Bibliographic Coupling of Authors

5. Conclusions, Future Research Directions, and Limitations

5.1. Future Research Directions

5.2. Limitations

Author Contributions

Funding

Informed Consent Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

Appendix C

References

- Abakah, Emmanuel Joel Aikins, Gil-Alana Luis Alberiko, Madigan Godfrey, and Romero-Rojo Fatima. 2020. Volatility persistence in cryptocurrency markets under structural breaks. International Review of Economics and Finance 69: 680–91. [Google Scholar] [CrossRef]

- Ahmad, Khurshid, Arslan Sheikh, and Muhammad Rafi. 2019. Scholarly research in Library and Information Science: An analysis based on ISI Web of Science. Performance Measurement and Metrics 21: 18–32. [Google Scholar] [CrossRef]

- Alexander, Carol, and Michael Dakos. 2020. A critical investigation of cryptocurrency data and analysis. Quantitative Finance 20: 173–88. [Google Scholar] [CrossRef]

- Alfieri, Elise, Radu Burlacu, and Geoffroy Enjolras. 2019. On the nature and financial performance of bitcoin. The Journal of Risk Finance 20: 114–37. [Google Scholar] [CrossRef]

- Arps, Jan-Philipp. 2018. Understanding Cryptocurrencies from a Sustainable Perspective: Investigating Cryptocurrencies by Developing and Applying an Integrated Sustainability Framework. Master’s thesis, Jönköping University, Jönköping, Sweden; p. 140. [Google Scholar]

- Azarenkova, Galyna, Shkodina Iryna, Samorodov Borys, Babenko Maksym, and Onishchenko Iryna Oleksandrivna. 2018. The influence of financial technologies on the global financial system stability. Investment Management & Financial Innovations 15: 229–38. [Google Scholar]

- Brennan, Niamh, Nava Subramaniam, and Chris Van Staden. 2019. Corporate governance implications of disruptive technology: An overview. The British Accounting Review 51: 100860. [Google Scholar] [CrossRef]

- Chatterjee, Gaurav, Damodar Reddy Edla, and Venkatanareshbabu Kuppili. 2020. Cryptocurrency: A comprehensive analysis. In Smart Trends in Computing and Communications. Singapore: Springer, pp. 365–74. [Google Scholar] [CrossRef]

- Chuen, David Lee Kuo, Li Guo, and Yu Wang. 2017. Cryptocurrency: A new investment opportunity? The Journal of Alternative Investments 20: 16–40. [Google Scholar] [CrossRef]

- Conesa, Carlos. 2019. Bitcoin: A Solution for Payment Systems or a Solution in Search of a Problem. Banco de EspañaSpan. DocumentosDocuments Ocasionalesoccasional Nº 1901. Madrid: Repositorio Institucional. ISSN 1696-2230. [Google Scholar]

- Corbet, Shaen, and Larisa Yarovaya. 2020. The environmental effects of cryptocurrencies. Cryptocurrency and Blockchain Technology 1: 149. [Google Scholar]

- Corbet, Shaen, Douglas J. Cumming, Brian M. Lucey, Maurice Peat, and Samuel Vigne. 2019. Investigating the dynamics between price volatility, price discovery, and criminality in cryptocurrency markets. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Coskun, Esra Alp, Chi Keung Marco Lau, and Hakan Kahyaoglu. 2020. Uncertainty and herding behavior: Evidence from cryptocurrencies. Research in International Business and Finance 54: 101284. [Google Scholar] [CrossRef]

- Dos Santos, Saulo, Japjeet Singh, Ruppa Thulasiram, Shahin Kamali, Louis Sirico, and Lisa Loud. 2022. A new era of blockchain-powered decentralized finance (DeFi)—A review. Paper present at the 2022 IEEE 46th Annual Computers, Software, and Applications Conference (COMPSAC), Los Alamitos, CA, USA, June 27–July 1; pp. 1286–92. [Google Scholar] [CrossRef]

- Ebizie, Promise I., Anayo D. Nkamnebe, and Obinna C. Ojiaku. 2022. Factors Influencing Cryptocurrency Adoption Among Nigerian University Fintech Entrepreneurs: An UTAUT perspective. British Journal of Marketing Studies 10: 25–37. [Google Scholar] [CrossRef]

- Fahimnia, Behnam, Joseph Sarkis, and Hoda Davarzani. 2015. Green supply chain management: A review and bibliometric analysis. International Journal of Production Economics 162: 101–14. [Google Scholar] [CrossRef]

- Ferri, Luca, Spanò Rosanna, Ginesti Gianluca, and Theodosopoulos Grigorios. 2020. Ascertaining auditors’ intentions to use blockchain technology: Evidence from the Big 4 accountancy firms in Italy. Meditari Accountancy Research 29: 1063–87. [Google Scholar] [CrossRef]

- Fetscherin, Marc, and Daniel Heinrich. 2015. Consumer brand relationships research: A bibliometric citation meta-analysis. Journal of Business Research 68: 380–90. [Google Scholar] [CrossRef]

- Fidrmuc, Jarko, Svatopluk Kapounek, and Frederik Junge. 2020. Cryptocurrency Market Efficiency: Evidence from Wavelet Analysis. Finance a User: Czech Journal of Economics and Finance 70: 178–202. [Google Scholar]

- Fry, John, and Jean-Philippe Serbera. 2020. Quantifying the sustainability of Bitcoin and Blockchain. Journal of Enterprise Information Management 33: 1243–63. [Google Scholar] [CrossRef]

- García-Corral, Francisco Javier, José Antonio Cordero-García, Jaime de Pablo-Valenciano, and Juan Uribe-Toril. 2022. A bibliometric review of cryptocurrencies: How have they grown? Financial Innovation 8: 1–31. [Google Scholar] [CrossRef]

- Geuder, Julian, Harald Kinateder, and Niklas F. Wagner. 2019. Cryptocurrencies as financial bubbles: The case of Bitcoin. Finance Research Letters 31: 221–26. [Google Scholar] [CrossRef]

- Giudici, Giancarlo, Alistair Milne, and Dmitri Vinogradov. 2020. Cryptocurrencies: Market analysis and perspectives. Journal of Industrial and Business Economics 47: 1–18. [Google Scholar] [CrossRef]

- Gronwald, Marc. 2019. Is Bitcoin a Commodity? On price jumps, demand shocks, and certainty of supply. Journal of International Money and Finance 97: 86–92. [Google Scholar] [CrossRef]

- Guo, Xiaochun, and Petko Donev. 2020. Bibliometrics and network analysis of cryptocurrency research. Journal of Systems Science and Complexity 33: 1933–58. [Google Scholar] [CrossRef]

- Hasan, Mudassar, Muhammad Abubakr Naeem, Muhammad Arif, Syed Jawad Hussain Shahzad, and Xuan Vinh. 2022. Liquidity connectedness in cryptocurrency market. Financial Innovation 8: 3. [Google Scholar] [CrossRef]

- Hoepner, Andreas, Arleta Majoch, and Xiao Zhou. 2021. Does an asset owner’s institutional setting influence its decision to sign the principles for responsible investment? Journal of Business Ethics 168: 389–414. [Google Scholar] [CrossRef]

- Ingram Bogusz, Claire, and Marcel Morisse. 2018. How infrastructures anchor open opens entrepreneurship: The case of Bitcoin and stigma. Information Systems Journal 28: 1176–212. [Google Scholar] [CrossRef]

- Jalal, Raja Nabeel-Ud-Din, Ilan Alon, and Andrea Paltrinieri. 2021. A bibliometric review of cryptocurrencies as a financial asset. Technology Analysis and Strategic Management 33: 1–16. [Google Scholar] [CrossRef]

- Kang, Ho-Jun, Sang-Gun Lee, and Soo-Yong Park. 2021. Information Efficiency in the Cryptocurrency Market: The Efficient-Market Hypothesis. Journal of Computer Information Systems 62: 622–31. [Google Scholar] [CrossRef]

- Kasri, Rahmatina Awaliah, and Adela Miranti Yuniar. 2021. Determinants of digital zakat payments: Lessons from Indonesian experience. Journal of Islamic Accounting and Business Research 12: 362–79. [Google Scholar] [CrossRef]

- Khan, Abdul Ghaffar, Zahid Amjad Hussain, Hussain Muzammil, and Riaz Usama. 2019. Security of cryptocurrency using hardware wallet and QR code. Paper presented at the 2019 International Conference on Innovative Computing (ICIC), Lahore, Pakistan, November 1–2; pp. 1–10. [Google Scholar] [CrossRef]

- Kim, Minseong. 2021. A psychological approach to Bitcoin usage behavior in the era of COVID-19: Focusing on the role of attitudes toward money. Journal of Retailing and Consumer Services 62: 102606. [Google Scholar] [CrossRef]

- Küfeoğlu, Sinan, and Mahmut Özkuran. 2019. Bitcoin mining: A global review of energy and power demand. Energy Research and Social Science 58: 101273. [Google Scholar] [CrossRef]

- Kurihara, Yutaka, and Akio Fukushima. 2017. The market efficiency of Bitcoin: A weekly anomaly perspective. Journal of Applied Finance and Banking 7: 57. [Google Scholar]

- Laboure, Marion, Markus H.-P. Müller, Gerit Heinz, Sagar Singh, and Stefan Köhling. 2021. Cryptocurrencies and cbdc: The route ahead. Global Policy 12: 663–76. [Google Scholar] [CrossRef]

- Latifa, Er-Rajy, El Kiram My Ahmed, El Ghazouani Mohamed, and Achbarou Omar. 2017. Blockchain: Bitcoin wallet cryptography security, challenges, and countermeasures. Journal of Internet Banking and Commerce 22: 1–29. [Google Scholar]

- Levillain, Kevin, and Blanche Segrestin. 2019. From primacy to purpose commitment: How emerging profit-with-purpose corporations open new corporate governance avenues. European Management Journal 37: 637–47. [Google Scholar] [CrossRef]

- Li, Huajiao, Haizhong An, Yue Wang, Jiachen Huang, and Xiangyun Gao. 2016. Evolutionary features of academic articles co-keyword network and keywords co-occurrence network: Based on two-mode affiliation network. Physica A: Statistical Mechanics and its Applications 450: 657–69. [Google Scholar] [CrossRef]

- Lipton, Alexander, and Adrien Treccani. 2021. Blockchain and Distributed Ledgers: Mathematics, Technology, and Economics. Singapore: World Scientific. [Google Scholar]

- Lozano, Sebastián, Laura Calzada-Infante, Belarmino Adenso-Díaz, and Silvia García. 2019. Complex network analysis of keywords co-occurrence in the recent efficiency analysis literature. Scientometrics 120: 609–29. [Google Scholar] [CrossRef]

- Majoch, Arleta A. A., Andreas G. F. Hoepner, and Tessa Hebb. 2017. Sources of stakeholder salience in the responsible investment movement: Why do investors sign the principles for responsible investment? Journal of Business Ethics 140: 723–41. [Google Scholar] [CrossRef]

- Makanyeza, Charles, and Simolini Mutambayashata. 2018. Consumers’ acceptance and use of plastic money in Harare, Zimbabwe: Application of the unified theory of acceptance and use of technology 2. International Journal of Bank Marketing 36: 379–92. [Google Scholar] [CrossRef]

- Masciandaro, Donato. 2018. Central Bank Digital Cash and Cryptocurrencies: Insights from a New Baumol–Friedman Demand for Money. Australian Economic Review 51: 540–50. [Google Scholar] [CrossRef]

- Merediz-Solà, Ignasi, and Aurelio Bariviera. 2019. A bibliometric analysis of bitcoin scientific production. Research in International Business and Finance 50: 294–305. [Google Scholar] [CrossRef]

- Mikhaylov, Alexey, Mir Sayed Shah Danish, and Tomonobu Senjyu. 2021. A New Stage in the Evolution of Cryptocurrency Markets: Analysis by Hurst Method. In Strategic Outlook in Business and Finance Innovation: Multidimensional Policies for Emerging Economies. Bingley: Emerald Publishing Limited. [Google Scholar]

- Momtaz, Paul. 2020. Initial coin offerings. PLoS ONE 15: e0233018. [Google Scholar] [CrossRef]

- Momtaz, Paul. 2021. The pricing and performance of cryptocurrency. The European Journal of Finance 27: 367–80. [Google Scholar] [CrossRef]

- Mora, Higinio, Pujol-López Francisco, Mendoza-Tello Julio, and Morales-Morales Mario Raul. 2020. An education-based approach for enabling the sustainable development gear. Computers in Human Behavior 107: 105775. [Google Scholar] [CrossRef]

- Muhuri, Pranab K., Amit K. Shukla, and Ajith Abraham. 2019. Industry 4.0: A bibliometric analysis and detailed overview. Engineering Applications of Artificial Intelligence 78: 218–35. [Google Scholar] [CrossRef]

- Näf, Marco, Thomas Keller, and Roger Seiler. 2021. Proposal of a methodology for the sustainability assessment of cryptocurrencies. Paper presented at the 54th Hawaii International Conference on System Sciences, Grand Wailea, HI, USA, January 5–8; pp. 5617–26. [Google Scholar] [CrossRef]

- Nasir, Adeel, Shaukat Kamran, Khan Kanwal Iqbal, Hameed Ibrahim, Alam Talha Mahboob, and Luo Suhuai. 2020. What is core and what future holds for blockchain technologies and cryptocurrencies: A bibliometric analysis. IEEE Access 9: 989–1004. [Google Scholar] [CrossRef]

- Nawaz, Muhammad Atif, Seshadri Usha, Kumar Pranav, Aqdas Ramaisa, Patwary Ataul Karim, and Riaz Madiha. 2021. Nexus between green finance and climate change mitigation in N-11 and BRICS countries: Empirical estimation through difference in differences (DID) approach. Environmental Science and Pollution Research 28: 6504–19. [Google Scholar] [CrossRef]

- OECD Blockchain Policy Series. 2020. The Tokenisation of Assets and Potential Implications for Financial Markets. The Secretary General of the OECD (France). Available online: https://www.oecd.org/finance/The-Tokenisation-of-Assets-and-Potential-Implications-for-Financial-Markets.htm (accessed on 1 January 2023).

- Pedini, Luca, and Sabrina Severini. 2022. Exploring the Hedge, Dversifier and Safe Haven Properties of ESG Investments: A Cross-Quantilogram Analysis. Munich Personal RePEc Archive, University Library; Geschwister-Scholl-Platz 1; D-80539 Munich; Germany. Available online: https://mpra.ub.uni-muenchen.de/id/eprint/112339 (accessed on 1 January 2023).

- Qudah, Hanan, Sari Malahim, Rula Airout, Mohammad Alomari, Aiman Abu Hamour, and Mohammad Alqudah. 2023. Islamic Finance in the Era of Financial Technology: A Bibliometric Review of Future Trends. International Journal of Financial Studies 11: 76. [Google Scholar] [CrossRef]

- Radhakrishnan, Srinivasan, Erbis Serkan, Isaacs Jacqueline, and Kamarthi Sagar. 2017. Novel keyword co-occurrence network-based methods to foster systematic reviews of scientific literature. PLoS ONE 12: e0172778. [Google Scholar] [CrossRef]

- Rubbaniy, Ghulame, Ali Shoaib, Siriopoulos Costas, and Samitas Aristeidis. 2021. Global Financial Crisis, COVID-19, Lockdown, and Herd Behavior in the US ESG Leader Stocks. In COVID-19, Lockdown, and Herd Behavior in the US ESG Leader Stocks (June 16, 2021). Available online: https://ssrn.com/abstract=3868114 (accessed on 1 January 2023). [CrossRef]

- Sedighi, Mehri. 2016. Application of word co-occurrence analysis method in the mapping of the scientific fields (case study: The field of Informetrics). Library Review 65: 52–64. [Google Scholar] [CrossRef]

- Shynkevich, Andrei. 2020. Pricing efficiency and market efficiency of two bitcoin funds. Applied Economics Letters 27: 1623–28. [Google Scholar] [CrossRef]

- Soliman, Mohammad, Lyulyov Oleksii, Shvindina Hanna Figueiredo Ronnie, and Pimonenko Tetyana. 2021. Scientific Output of the European Journal of Tourism Research: A Bibliometric Overview and Visualization. European Journal of Tourism Research 28: 2801. [Google Scholar] [CrossRef]

- Stavroyiannis, Stavros, and Vassilios Babalos. 2019. Herding behavior in cryptocurrencies revisited: Novel evidence from a TVP model. Journal of Behavioral and Experimental Finance 22: 57–63. [Google Scholar] [CrossRef]

- Strukov, Maksym. 2021. How Elon Musk’s Statements on Social Media Move the Cryptocurrency Market. Available online: https://ekmair.ukma.edu.ua/handle/123456789/21009 (accessed on 1 January 2023).

- Teichmann, Fabian Maximilian Johannes, and Marie-Christin Falker. 2020. Cryptocurrencies and financial crime: Solutions from Liechtenstein. Journal of Money Laundering Control 23: 496–509. [Google Scholar] [CrossRef]

- Urquhart, Andrew. 2016. The inefficiency of Bitcoin. Economics Letters 148: 80–82. [Google Scholar] [CrossRef]

- van Eck, Nees Jan, and Ludo Waltman. 2010. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 84: 523–38. [Google Scholar] [CrossRef]

- van Eck, Nees Jan, and Ludo Waltman. 2011. Text mining and visualization using VOSviewer. arXiv arXiv:1109.2058. [Google Scholar] [CrossRef]

- van Eck, Nees Jan, and Ludo Waltman. 2013. VOSviewer Manual. Leiden: Univeristeit Leiden, vol. 1, pp. 1–53. [Google Scholar]

- van Eck, Nees Jan, and Ludo Waltman. 2017. Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics 111: 1053–70. [Google Scholar] [CrossRef] [PubMed]

- Vaz, John, and Kym Brown. 2020. Sustainable development and cryptocurrencies as private money. Journal of Industrial and Business Economics 47: 163–84. [Google Scholar] [CrossRef]

- Vidal-Tomás, David. 2021. An investigation of cryptocurrency data: The market that never sleeps. Quantitative Finance 21: 2007–24. [Google Scholar] [CrossRef]

- Vidal-Tomás, David. 2023a. Blockchain, sport and fan tokens. Journal of Economic Studies. ahead-of-print. [Google Scholar] [CrossRef]

- Vidal-Tomás, David. 2023b. the illusion of the metaverse and meta-economy. International Review of Financial Analysis 86: 102560. [Google Scholar] [CrossRef]

- Voge, Markus. 2018. The Viridian Project (A Digital Currency to Internalize External Costs for a More Sustainable Economy). Available online: https://www.viridian-project.org/paper/ (accessed on 1 January 2023).

- Waltman, Ludo, Nees Jan Van Eck, and Ed C. M. Noyons. 2010. A unified approach to mapping and clustering of bibliometric networks. Journal of Informetrics 4: 629–35. [Google Scholar] [CrossRef]

- Wasiuzzaman, Shaista, and Hajah Siti Wardah Haji Abdul Rahman. 2021. Performance of gold-backed cryptocurrencies during the COVID-19 crisis. Finance Research Letters 43: 101958. [Google Scholar] [CrossRef] [PubMed]

- Xie, Rain. 2019. Why China had to ban cryptocurrency but the US did not: A comparative analysis of regulations on crypto-markets between the US and China. Washington University Global Studies Law Review 18: 457. [Google Scholar]

- Yue, Yao, Xuerong Li, Dingxuan Zhang, and Shouyang Wang. 2021. How does cryptocurrency affect the economy? A network analysis using bibliometric methods. International Review of Financial Analysis 77: 101869. [Google Scholar] [CrossRef]

| Selected Keywords | Number of Exported Documents |

|---|---|

| ALL = (“Cryptocurrency” AND “Behavior”) | 263 documents |

| ALL = (“Cryptocurrency” AND “Corporate governance”) | 10 documents |

| ALL = (“Cryptocurrency” AND “Environment”) | 160 documents |

| ALL = (“Cryptocurrency” AND “Environmental impact”) | 6 documents |

| ALL = (“Cryptocurrency” AND “Environmental”) | 45 documents |

| ALL = (“Cryptocurrency” AND “ESG”) | 1 document |

| ALL = (“Cryptocurrency” AND “Financial behavior”) | 6 documents |

| ALL = (“Cryptocurrency” AND “Financial performance”) | 6 documents |

| ALL = (“Cryptocurrency” AND “Performance”) | 429 documents |

| ALL = (“Cryptocurrency” AND “Social”) | 430 documents |

| ALL = (“Cryptocurrency” AND “Sustainability”) | 86 documents |

| Keywords (Cluster 1): | Links | Total Link Strength | Occurrences |

|---|---|---|---|

| Volatility | 43 | 122 | 29 |

| Risk | 32 | 66 | 15 |

| Inefficiency | 32 | 65 | 13 |

| Returns | 33 | 62 | 12 |

| Cryptocurrency market | 16 | 28 | 11 |

| Gold | 23 | 52 | 11 |

| Hedge | 18 | 39 | 8 |

| Impact | 29 | 43 | 8 |

| COVID-19 | 18 | 28 | 7 |

| Cross-section | 14 | 31 | 7 |

| Bitcoin returns | 19 | 28 | 5 |

| Efficiency | 14 | 24 | 5 |

| Investor attention | 20 | 32 | 5 |

| Liquidity | 13 | 24 | 5 |

| Markets | 20 | 25 | 5 |

| Oil | 22 | 37 | 5 |

| Stock | 12 | 18 | 5 |

| Uncertainty | 22 | 28 | 5 |

| Safe haven | 14 | 23 | 4 |

| Models | 16 | 19 | 4 |

| Keywords (Cluster 2): | Links | Total Link Strength | Occurrences |

|---|---|---|---|

| Technology | 34 | 70 | 14 |

| Performance | 39 | 70 | 12 |

| Management | 30 | 62 | 10 |

| Adoption | 21 | 48 | 8 |

| Information | 35 | 26 | 8 |

| Information technology | 21 | 45 | 8 |

| Innovation | 26 | 48 | 8 |

| Model | 30 | 49 | 8 |

| Trust | 22 | 35 | 8 |

| Blockchain technology | 13 | 21 | 7 |

| Acceptance | 17 | 30 | 6 |

| Smart contracts | 21 | 36 | 6 |

| User acceptance | 16 | 33 | 6 |

| Attitudes | 14 | 33 | 5 |

| Business | 19 | 32 | 5 |

| Challenges | 23 | 31 | 5 |

| Framework | 24 | 36 | 5 |

| Sustainable development | 16 | 21 | 5 |

| Neural network | 10 | 15 | 4 |

| Perceived risk | 15 | 18 | 4 |

| Supply chain | 17 | 25 | 4 |

| Systems | 18 | 28 | 4 |

| Keywords (Cluster 3): | Links | Total Link Strength | Occurrences |

|---|---|---|---|

| Cryptocurrency | 85 | 537 | 187 |

| Bitcoin | 84 | 484 | 140 |

| Ethereum | 15 | 32 | 12 |

| Machine learning | 14 | 22 | 10 |

| Social media | 20 | 33 | 10 |

| Sentiment analysis | 19 | 30 | 8 |

| Finance | 14 | 23 | 7 |

| Investment | 15 | 27 | 7 |

| Currency | 13 | 22 | 6 |

| Deep learning | 11 | 19 | 6 |

| Fintech | 15 | 23 | 6 |

| Internet | 14 | 22 | 5 |

| Money | 11 | 14 | 5 |

| Causality | 12 | 16 | 4 |

| Cryptography | 9 | 15 | 4 |

| Mining | 7 | 15 | 4 |

| Networks | 12 | 14 | 4 |

| Price prediction | 10 | 16 | 4 |

| Time-series | 13 | 17 | 4 |

| 16 | 23 | 4 |

| Keywords (Cluster 4): | Links | Total Link Strength | Occurrences |

|---|---|---|---|

| Blockchain | 60 | 282 | 89 |

| Sustainability | 28 | 70 | 20 |

| Energy consumption | 17 | 37 | 10 |

| Cryptocurrency mining | 9 | 16 | 9 |

| Security | 12 | 23 | 9 |

| Energy | 14 | 17 | 6 |

| Scalability | 6 | 13 | 6 |

| Internet of things | 8 | 9 | 5 |

| Digital currency | 5 | 9 | 4 |

| Distributed ledger technology | 15 | 22 | 4 |

| Privacy | 15 | 19 | 4 |

| Smart contract | 4 | 9 | 4 |

| Keywords (Cluster 5): | Links | Total Link Strength | Occurrences |

|---|---|---|---|

| Cryptocurrencies | 29 | 61 | 23 |

| Behavior | 30 | 58 | 14 |

| Economics | 31 | 60 | 12 |

| Herding behavior | 14 | 30 | 11 |

| Price | 21 | 35 | 8 |

| Corporate governance | 14 | 25 | 6 |

| Exchange | 16 | 23 | 6 |

| Herding | 12 | 23 | 6 |

| Market | 13 | 19 | 5 |

| Tests | 11 | 16 | 5 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alqudah, M.; Ferruz, L.; Martín, E.; Qudah, H.; Hamdan, F. The Sustainability of Investing in Cryptocurrencies: A Bibliometric Analysis of Research Trends. Int. J. Financial Stud. 2023, 11, 93. https://doi.org/10.3390/ijfs11030093

Alqudah M, Ferruz L, Martín E, Qudah H, Hamdan F. The Sustainability of Investing in Cryptocurrencies: A Bibliometric Analysis of Research Trends. International Journal of Financial Studies. 2023; 11(3):93. https://doi.org/10.3390/ijfs11030093

Chicago/Turabian StyleAlqudah, Mohammad, Luis Ferruz, Emilio Martín, Hanan Qudah, and Firas Hamdan. 2023. "The Sustainability of Investing in Cryptocurrencies: A Bibliometric Analysis of Research Trends" International Journal of Financial Studies 11, no. 3: 93. https://doi.org/10.3390/ijfs11030093

APA StyleAlqudah, M., Ferruz, L., Martín, E., Qudah, H., & Hamdan, F. (2023). The Sustainability of Investing in Cryptocurrencies: A Bibliometric Analysis of Research Trends. International Journal of Financial Studies, 11(3), 93. https://doi.org/10.3390/ijfs11030093