Abstract

This paper aims to identify risk awareness through factors that influence the intention to buy people’s life insurance in Daklak province of Vietnam and provide implications for life insurance companies. The data resources were conducted from the survey of 250 people in Daklak Province and applied the ordinal logit model for the analysis. Remarkably, as we conducted the study during the COVID-19 pandemic period, a dummy variable of COVID-19 was included in the analysis. The results of this research have some similarities and differences with other studies. As with the references, saving motivation was the most crucial factor affecting the dependent variable. Saving motivation, financial literacy, brand name, and risk awareness have a positive impact. While age and gender were differences that have a negative effect on the intention to buy life insurance, which means that young people and women have more intention to purchase life insurance than younger men. The four factors consisting of financial literacy, brand name, risk awareness, and gender were considered the second most important factors. COVID-19 and attitude were the third critical effect on the intention to purchase life insurance. Income was the less important factor.

1. Introduction

Risks always exist in human life. It often happens unexpectedly, without knowing the damage it will bring. One of the ways to deal with risks is holding insurance. Insurance can provide financial protection against risks to property, civil liability, or people. There was a question if a person had a goose that laid golden eggs, would he insure the goose or insure the eggs? (Bautis Financial 2013). It is a fact that many people in Vietnam own all kinds of insurance for material assets such as houses, cars, goods, and construction works, but they have not yet insured themself who create material wealth. As we raise a goose that lays golden eggs, we only hedge the risks for the eggs, while the goose that produces those eggs is completely unprotected. Especially, in Vietnam, at the end of 2020, the number of people who had life insurance policies was only about 10% of the population (Helen 2021).

COVID-19 is also an associated risk factor. Although Vietnam had succeeded in keeping zero cases in the first, second, and third waves of COVID-19, at the end of April 2021, the highly transmissible Delta strain began to spread, and the country faced a fourth wave (Tough 2021). In the fourth wave, the number of COVID-19 cases in Vietnam was around 100 times higher than the total of the previous three waves. The number of deaths due to COVID-19 increased (Health Minister 2021). The risk of the COVID-19 pandemic required life insurance companies to pay more for the customers’ higher risk of illness and mortality rate (Kirti and Shin 2020; Babuna et al. 2020). However, people may be aware of the risks leading to the financial loss of individuals and families during the pandemic, so they may look for financial protection measures against hazards, such as participating in life insurance (Babuna et al. 2020). Usually, products and services are bought when people need them immediately. However, insurance products are different due to the characteristics of insurance, collecting premiums in advance and indemnifying or paying when there is risk or maturity. Thus, when a person wants to get insurance but has already suffered a financial loss related to the insured object, he cannot participate in insurance anymore. For example, when a person is over 70 years old, they cannot participate in life insurance to enjoy old age. When participating in life insurance, the younger the age, the lower the premium, and vice versa. That is, with an insurance product, when the buyer does not need to use it, he can buy it, and if the buyer needs to use it, he cannot buy it. Insurance is not only needed for the insured but also meaningful for the whole economy. When buying insurance, both the buyer and the insurance company must apply safety measures to the insured object, which helps to ensure the safety of each individual and the whole society. Insurance also holds a large amount of idle capital to reinvest in the economy. Up to now (2022), there has been neither any specific information about the life insurance market in Daklak province, Vietnam, nor research about life insurance in this area. When conducting a trial survey before the official study, randomly 30 people in Buon Ma Thuot city, Daklak province, only 5/30 people have purchased life insurance for their families. Therefore, more than 80% of people surveyed still did not have a life insurance policy yet. Primarily, there is still no research on the intention to buy life insurance during the COVID-19 pandemic in Vietnam as well as over the world. With the desire to help increase the participation rate of life insurance in the future to help families in Daklak province have solid financial protection in life during normal times as well as during the COVID-19 (Covid) pandemic time, and help the economy attract more idle capital from life insurance.

The study “Risk Awareness for Vietnamese’s Life Insurance on Financial Protection: The Case Study of Daklak Province, Vietnam,” was proposed to determine the factors affecting the intention to buy life insurance.

In this research, we add one more factor, Covid, besides the conventional factors to investigate whichare the key factors affecting the intention to buy life insurance in the research area. The study can help life insurance companies in the research area to have appropriate solutions to ensure finances for the family in all life situations, increase the rate of life insurance ownership in the entire population and attract idle capital for the economy.

The rest of the paper is organized as follows: Section 2 provides a literature review. Section 3 presents the research methodology, including group discussion, data collection, research model, and data analysis. Section 4 presents the research results. Section 6 is the conclusion, along with our remarks.

2. Literature Reviews

According to the insurance law of Vietnam, “Life insurance is a type of insurance in case the insured lives or dies.” “The subject matter of a life insurance contract is the life span, human life” (Law No. 08/2022/QH15 2022). The most extensively utilized personal financial security planning product in the world is life insurance (Ayenew et al. 2020; Chen et al. 2006; Lin et al. 2017; Tien 2021). It is a type of insurance against risks related to human life that came from an idea by an English captain in 1583. He asked the insurance company for his life insurance with his explanation that if the boat was insured then the owner of the boat should also be insured (Fouse 1905). Due to the specificity of the insurance, collecting premiums in advance and indemnifying or paying at risk or maturity, there exists a period of capital idleness from the accumulated premiums. That idle money will be invested back into the economy. An essential principle in insurance is that the many compliments the few. Therefore, the more people participate in the same insurance business, the larger the risk-offering fund, the more accessible, and the more idle money is available to invest back into the economy. Several previous studies have found a beneficial association between economic growth and insurance (Arena 2008; Ćurak et al. 2009; Ege and Saraç 2011; Vadlamannati 2008).

According to the Theory of Planned Behavior, purchase intention influences customer behavior (Ajzen 1991). In the covid pandemic, especially in the fourth wave, people in Vietnam face a lot of risks such as loss of breadwinners and health risks during and after covid. Therefore, people may intend to buy insurance for themselves and their family members against financial losses caused by covid risks. Managers use purchase intention as critical in forecasting future sales and identifying initiatives to influence client behavior (Jamieson and Bass 1989). Purchase intention is sometimes used to gauge demand for a new product. Purchase intention is often used by marketing executives to predict future demand for their products and to assess the impact of their marketing efforts on future sales (Morwitz 2014).

Many studies suggest that purchase intention is a type of rational decision-making when a buyer chooses to purchase from a specific brand name (Brand_name) (Jackson 2017; Saad et al. 2012; Tariq et al. 2013). According to the Theory of Reasoned Action (TRA) proposed by Ajzen and Fishbein (1975) cited in Rutter and Bunce (1989), and the Theory of Planned Behavior (TPB), an individual’s purchase intention is influenced by two factors, namely attitude and subject norm (Sub_norm) (Ajzen 2011; Ajzen and Fishbein 1980; Rutter and Bunce 1989; Sheppard et al. 1988). Life insurance is a type of insurance that protects against financial risks related to people’s lifespans. Therefore, risk awareness (Risk_awa) is an essential factor affecting people’s intention to buy life insurance (Qin and Zhang 2012; Jahan and Sabbir 2019). Saving motivation (Sav_moti) and financial literacy (Financial_lite) are two more factors that influence the desire to get life insurance (Zakaria et al. 2016; Jahan and Sabbir 2019). In addition, the COVID-19 pandemic is also a factor affecting the insurance industry. Although there have been no studies on the intention to participate in life insurance and the COVID-19 (Covid) pandemic. Moreover, demographics are also one of the important factors that affect the intention to buy life insurance (Beck and Webb 2003)

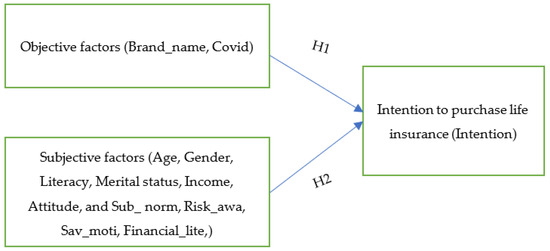

Based on the theoretical overview, the author would like to divide the factors into two groups: subjective and objective factors. The hypotheses about the factors affecting the intention to buy life insurance are proposed in this study as follows:

H1.

Subjective factors consist of Age, Gender, Education, Marital status, Income, Attitude, Sub_norm, Risk_awa, Sav_moti, Financial_lite, influence the intention to purchase life insurance.

H2.

Objective factors consist of Brand_name and Covid effect on the intention to purchase life insurance.

The explanation of H1 and H2 are illustrated in Table 1.

Table 1.

Explanation of the hypothesis.

Due to the characteristics of insurance, collecting premiums in advance and indemnifying or paying when there is risk or maturity. Therefore, there exists an idle period of capital from the collected premium. That amount of idle money will be invested back into the economy. An essential principle in insurance is that the majority complement the few; hence the more people participating in the same insurance business, the greater the monetary fund for more accessible risk compensation, and the amount of idle money is also more to invest back into the economy. Some prior research had found a beneficial association between economic growth and insurance (Arena 2008; Vadlamannati 2008).

In general, previous studies have identified factors affecting the intention to purchase life insurance for people in many parts of the world. However, there has not been a study conducted in Daklak province of Vietnam, and no research has mentioned the risk factors of COVID-19 to the intention to buy life insurance. In this study, the author develops previous studies with adjustments to suit the research area and adds the COVID-19 factor, which is one of the new risk events appearing in 2019 that badly affected the lives of people.

3. Methodology

3.1. Group Focus Discussion

In designing the survey questionnaire for data collection, we formed a group of specialists, current customers, and potential ones through collective efforts of forming, norming, and storming.

3.2. Data Collection

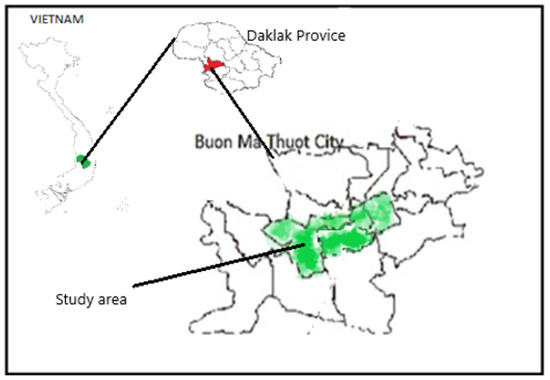

This study was conducted in Buon Ma Thuot city, the largest city in the Central Highlands, located in the center of the province and the city in the center of the Central Highlands of Vietnam (Statistic office of Daklak 2019). According to Vietnamese civil law 2015, a minor is a person under the age of eighteen. The people who sign the insurance policy must be older than 18 (Vietnamese Civil Law 2015). Therefore, in this study, we used stratified random sampling to select a survey with 250 citizens over 18 years old in Buon Ma Thuot city Daklak province. A pre-survey with 30 questionnaires was sent to the respondees to ensure that all the questions were understandable. The actual survey was conducted from May to June 2021. The research area is illustrated in Figure 1.

Figure 1.

The study area (Source: Dak Lak Provincial People’s Committee Portal 2022).

3.3. Research Model and Data Analysis

Figure 2.

Research Model.

Purchase intention is the probability that a person will choose to buy a product or service in the future. This probability ranges from 0–1 or 0 to 100%. To measure purchase intention, researchers often conduct surveys with a sample and ask respondents to answer questions about purchase intent, such as “Do you intend to purchase item x shortly?”. On a scale with feedback options such as “will buy” (100% probability), “probably will buy,” “may or may not buy,” “probably won’t buy,” “will buy,” and “do not buy” (0% probability) (Morwitz 2014). In this study, the dependent variable (intention) was proposed with five options (0 to 4) as above.

An ordered logit model investigated the correlation between the dependent variable (intention) and the other independent variables. In H1 and H2, the independent variables, including Brand name, Risk, Covid, Attitude, Sub_norm, Sav_moti, and Financial were developed using a 5-point Likert scale with 5 indicating high agreement and 1 indicating significant disagreement (detail in the Appendix A). Demographics including Age, Gender, Literacy, Marital status, and Income are explained in Table 1.

To eliminate non-conforming variables, reliability analysis and exploratory factor analysis were performed with the variables that consist of the question in the 5-point Likert scale before running the ordinal logit model. Furthermore, the multicollinearity diagnosis was established to assess the link between the independent variables, resulting in an erroneous model.

Cronbach’s alpha was used to examine the association in the study’s reliability analysis, revealing the close relationship between the object groups. Correct Item-total Correlation indexes in Cronbach’s alpha analysis reflect the contribution of variables. When Cronbach’s alpha coefficient is 0.7 and the Correct Item-total Correlation is more than 0.3, reliability is regarded as appropriate (Nunnally 1978).

The incorrect variables were deleted after the reliability analysis, and Exploratory Factor Analysis (EFA) was performed to define the elements determining the significance of participation in life insurance.

Bartlett test (Sig. ≤ 0.05) and Total Variance Explained > 50%

Load Factor > 0.5 and Kaiser-Meyer-Olkin (KMO) 0.5 KMO 1

Variables with a KMO of less than 0.5 will be eliminated from the model (Nunnally 1978).

The phenomenon of multicollinearity occurs when the independent variables are strongly connected. A regression model with multicollinearity will make quantitative research findings inconsistent and inaccurate. VIF (Variance Inflation Factors) is employed to determine multicollinearity, and Tolerance Values are used to evaluate multicollinearity. Tolerance Values of 0.20 are a serious concern. Multicollinearity can occur when tolerance values are less than 0.10. Because Tolerance Values are the polar opposite of VIF, Tolerance Values 0.20 applies to rule 5 and 0.10 to rule 10 (Menard 2001). Hair et al. (1995) demonstrated that if the VIF is less than ten, the model is not multicollinear (Hair et al. 1995). VIF > 10 indicates undesirable collinearity for the study model’s conclusions (Kennedy 2008).

An ordered logit model was applied after analyzing Reliability, Exploratory Factor Analysis, and Multicollinearity.

The model to determine the influencing factors is as follows:

Intention = β0 + β1Age + β2Gender + β3Literacy + β4Maritalstatus +

β5Income + β6Brand_name + β7Sub_norm + β8Financial_lite +

β9Covid + β10Sav_moti + β11Attitude + β12Risk_awa + ε

β5Income + β6Brand_name + β7Sub_norm + β8Financial_lite +

β9Covid + β10Sav_moti + β11Attitude + β12Risk_awa + ε

In this study, 250 individuals were surveyed to find out about their intention to buy life insurance. Suppose the proportion of people who intend to purchase life insurance who would answer “do not intend to purchase life insurance,” “may not purchase life insurance,” “may or may not purchase life insurance,” and “may purchase life insurance” are p1, p2, p3, p4, p5, respectively. The logarithms of the odds (rather than the logarithms of the probabilities) of answering in particular ways are then calculated as follows.

Do not intend to purchase life insurance: , 0

Do not intend to purchase life insurance, or may not purchase life insurance: 1

Do not intend to purchase life insurance, may not purchase life insurance, or may or may not purchase life insurance: , 2

Do not intend to purchase life insurance, may not buy life insurance, may or may not purchase life insurance, or may purchase life insurance: , 3.

According to the proportionate odds assumption, the number added to each of these logarithms to generate the next is the same in all cases. These logarithms, in other words, create an arithmetic series. Ordinary least squares cannot be used to estimate the coefficients in the linear combination consistently. Most of the time, the greatest likelihood is used to estimate them. Iteratively reweighted least squares are used to calculate maximum-likelihood estimates.

Assume that the underlying process to be described is

Y* = XTβ + ε

- ε: logistically distributed error;

- Y* where y* is the precise but unknown dependent variable;

- X is the vector of the independent variables defined in Equation (1);

- β is the regression coefficients vector that we want to estimate.

While we are unable to observe y*, we can only observe the answer categories. Y = 0 if Yj * 1,

Y = 1 if 1 2,

Y = 2 if 2 3,

Y = ………………………,

Y = N if N

The parameters i are the observable categories’ externally imposed endpoints. The ordered logit approach will then fit the parameter vector β using the observations on y, which are a type of censored data on y*.

SPSS v.20 software program was used to define calculations and perform other analyses.

4. Results and Discussion

4.1. Demographics of Respondents

In terms of demographics of the respondents, the author surveyed with information related to the respondents’ age, gender, income per family member in the previous year, education, marital status, and the number of people holding life insurance policies. Details of the survey sample with demographics are shown in Table 2.

Table 2.

Respondents’ profile.

In the sample of 250 people in Buon Ma Thuot city, there were equal males and females. The number of people who graduated from college or university was 56.8%. Income per family member of around 4001–6000 USD accounted for the largest group in the survey (36.4%). The following was the income of 2000–4000 USD and 6001–8000 USD (26.4% and 23.2%, respectively). Most of the people had graduated from high school and university (28.8% and 56.8%, respectively). A total 68.4% of people in the survey were married, while 30.8% of them were single. None of them was divorced and a widow. Only 0.8% were separated. Almost all the people in the survey knew about life insurance. However, only 22% of them had life insurance policies. The detailed information is in Table 2.

4.2. Reliability Statistics

Before running EFA, Cronbach’s alpha was estimated to define the reliability of all variables that consist of the question in the 5-point Likert scale in H1 and H2. Cronbach’s Alpha ≥0.7 and the corrected item-total correlation > 0.3 was acceptable (Nunnally 1978).

As can be seen in Table 3, most of the value of Cronbach’s Alpha is greater than 0.7, except that of Sub_norm (0.620). In which, the Corrected item-total Correlation of Sub_norm1, Sub_norm7, and Sub_norm8 were lower than 0.3. Therefore, those three items must be removed from the model. Revised Cronbach’s alpha for Sub_norm with the same process as shown in Table 4.

Table 3.

Reliability.

Table 4.

Cronbach’s Alpha of Sub_norm after removing Sub_norm1, Sub_norm7 and Sub_norm8.

4.3. Exploratory Factor Analysis (AFA)

After the two were removed, all the independent variables were appropriated. Then EFA was conducted without Sub_norm7 and Sub_norm8. Regarding this step, KMO was found to equal 0.864, which lined between 0.5 and 1 which is suitable for the model. The Bartlett test was 0.000, and the variance explained was 69.485%. All factor loading was greater than 0.5. The detail of factor loading in the rotated component matrix is illustrated in Table 5.

Table 5.

Rotated Component Matrix.

4.4. Multicollinearity Diagnostics

If multicollinearity existed, the results would not be correct and meaningful. Thus, before running an ordinal logistic model, multicollinearity must be diagnosed.

As mentioned in the methodology section, multicollinearity exists when VIF values are greater than 5 and tolerance values are less than 0.2. In this study, all the VIF and tolerance values met the requirement. Thus, no multicollinearity was in the model. The detail of VIF and Tolerance are shown in Table 6.

Table 6.

Multicollinearity diagnostics.

4.5. Ordinal Logistic Model

The ordinal logistic model was used to assess the intention to purchase life insurance of a sample of 250 people in Buon Ma Thuot City, Daklak Province, after the reliability, EFA, and multicollinearity requirements were demonstrated. As previously noted, the intention to purchase was an ordinal dependent variable, with 5 values (0 to 4). Brand name, Subject norm, Financial literacy, Covid effectiveness, Saving motivation, Attitude, and Risk Awareness were the model’s independent variables, as indicated in Table 4, and corresponded to the seven factors generated from the following items:

- Brand_name, = mean (Brand1, Brand2, Brand3, Brand4, Brand5, Brand6);

- Sub_norm = mean(Sub_norm2, Sub_norm3, Sub_norm4, Sub_norm5, Sub_norm6);

- Financial = mean(Financial1, Financial2, Financial3, Financial4);

- Covid = mean(Covid1, Covid2, Covid3, Covid4, Covid5);

- Sav_moti = mean(Sav_moti1, Sav_moti2, Sav_moti3, Sav_moti4);

- Attitude = mean(Attitude1, Attitude2 Attitude3);

- Risk = mean(Risk1, Risk2, Risk3).

Equation (1) was used to predict the dependent variable.

There was 39.2% out of the total 250 respondents indicated that they might intend to purchase life insurance. Only 10% of them intended. Up to 40.4% showed that they may or may not intend to buy life insurance (Table 7).

Table 7.

Summary of Case Processing.

As shown in Table 7, the number of people who are hesitant to buy and the number of people considering whether to purchase or not account for a large proportion of the survey sample, 40.4% and 39.2%, respectively. To pursue these people to change the idea of buying life insurance, it is necessary to consider the influencing factors in Table 8.

Table 8.

Results of ordinal logistic model for determining factor effect on the intention to purchase life insurance.

Regarding Model Fitting Information, the two model deviances were given by a −2 Log Likelihood value. The −2 Log-Likelihood of Intercept only (null model) was 627.548, which was greater than the value of the Final model (426.681). Thus, the final model with a full predictor was better than the null model. The Chi-Square was 200.867, the Sig was 0.000, and the df = 12 value was equivalent to the number of independent variables in the model. Therefore, the independent variables of the model were appropriated. In terms of Goodness-of-fit, the sig values of Pearson and Deviance were well greater than 0.05, indicating a good fit to the data of the ordinal logit model. R2 cannot be calculated in the logit model, but Pseudo R-Square can be done due to the characteristic of R2 (Sarstedt 2019). The Pseudo R-Square values revealed the study model’s fit with all independent variables. In this research, the fit of the research model was 0.552 based on Cox & Snell method, 0.501 based on the Nagelkerke method, and 0.320 based on the McFadden method. McFadden suggested that the Pseudo R-Square value was between 0.2–0.4, suitable for the probability research model (McFadden 1973).

Regarding Parameter Estimates in Table 8, the model had four thresholds value because the dependent variable was divided by five values due to the ordinal scale; thus, they were suitable for the model. All the sig. value of the thresholds was lower than 0.05. Thus, they were significant. The slopes (Estimate values) reflected the change in the log-odds of falling from higher to lower dependent variable categories. Sig. value of Marital status was over 0.05. Thus, this factor was insignificant. The ( values of Age and Gender were negative, which means young people and women have a higher intention to purchase life insurance than older ones and men. All the values of Income, Literacy, Brand_name, Sub_norm, Financial_lite, Sav_motive, Covid, Attitude, and Risk_awa were positive, so the higher values of on the independent variable would be associated with a greater intention to purchase life insurance. The odds ratios indicate the multiplicative change in odds per unit increase on the independent variables. The slope of Sav_moti is the highest number (0.837), indicating the most significant crucial factor impacting intention to buy life insurance. Moreover, the odds ratio of Sav_moti was the greatest (2.309), so for every one-unit increase on Sav_moti, the intention to purchase life insurance changes by 2.309 for each category of the dependent variable. The three factors, including Brand_name, Financial_lite, and Risk, had a similar impact on the dependent variable, and those factors were considered to be the second most important factor that affected the intention. These results show that Gender was also the second important factor, but the effect was negative. COVID-19 and Attitude were the third critical effect of the intention. Income was a less critical impact on the intention.

5. Discussion

The results show that Sav_moti was the key factor that influence the intention to purchase life insurance. Therefore, life insurance companies need to consider each family’s savings motivation. Design questions about people’s savings motives and recommend products to suit their needs. In this study, questions about saving associated with family knowledge about life insurance are as follows:

What do you think life insurance is? (you can choose more than one answer)

□ Protection of family’s income (i.e., will have a financial source to replace lost revenue in case the insured is affected by the risk).

□ Investment for the future.

□ Profitable investment, such as bank deposit or stock investment.

□ It is a preparation for old age that does not depend on children’s finances.

□ It is the payment of hospital fees for medicines, hospital beds... when sick.

□ It is payment for the schooling of children.

□Other comments (specify)…………………………………………………….

The results for saving with life insurance are shown in Table 9.

Table 9.

Saving with life insurance.

The research results on risk awareness through factors that influence the intention to purchase life insurance in Daklak province of Vietnam were almost similar to the previous studies. The factors, namely attitude toward life insurance, risk awareness, saving motivation, financial literacy, and brand name have a positive effect on the intention to purchase life insurance. Saving motivation is the key factor that influences the intention to purchase life insurance. Therefore, life insurance companies need to consider each family’s saving motivation.

However, the results of this study have some differences compared with previous studies due to regional characteristics. Specifically, since the sig value of marital status is greater than 0.1, the author still cannot conclude the influence of this factor on the intention to purchase life insurance. Mahdzan and Peter Victorian (2013) show that marital status has a significant effect on the intention as single individuals have the most intention to purchase life insurance, followed by married individuals and the last one was individuals who divorced. Factors such as age and gender also have a difference compared with the research of Ćurak et al. (2013), Yusuf et al. (2009), Gandolfi and Miners (1996), and Ćurak et al. (2013); young people and women intend to buy life insurance more than older people and men. This also helps insurance companies in Daklak province better approach their target customers.

6. Conclusions

Life insurance is a necessity for protecting financial risks in the life of people and providing a large of idle capital for the economy. However, only around 10% of people in Vietnam hold life insurance policies. The study aims to identify the risk awareness through factors that influence the intention to buy people’s life insurance in Daklak province of Vietnam to encourage people in the research to hold life insurance policies for their life and help the life insurance companies have the right glance to make suitable policies for promoting their life insurance product. The resource data was based on a survey of 250 individuals in Buon Ma Thuot City, the largest city in the Central Highlands, located in the center of the province and the city in the center of the Central Highlands of Vietnam. The data were analyzed by the ordinal logit model to give the research results. The results show that all people in the survey know about life insurance and the most significant number (40.4%) hesitate to buy or not buy a life insurance policy. The majority of them (39.2%) may purchase. Saving motivation is the key factor that affects the intention to buy life insurance. The brand name was also a significant influence. The effect of COVID-19 was added as one of the factors that affect the intention to buy life insurance policies. Still, it is the third critical factor effect on the independent variable. There are differences between this study and previous studies that help policymakers, life insurance companies, and consultants have the best access to customers in the research area. At present, it is still not possible to conclude the influence of marital status on the intention to purchase life insurance in Daklak province. Moreover, the limitation of this study is that it was concentrated only in one province in Vietnam (Daklak province). Therefore, in the future, the effect of factor marital status on the intention to purchase life insurance in the research area will be conducted to clarify this, and future research will be expanded to other areas in the country. The effect of COVID-19 was mentioned and has a significant effect on the intention to purchase life insurance. This could be a new factor that contributes to the literature.

Funding

This research was funded by the grant from Tay Nguyen University (T2022- 81CBTĐ).

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Institutional Review Board of Tay Nguyen University (T2022- 81CBTĐ, 1 January 2022).

Conflicts of Interest

The author declares that there is no conflict of interest.

Appendix A. Explanation of the Variables That Consist of the Question in the 5-Point Likert Scale in H1 and H2

| The brand name has a positive effect on the intention to purchase life insurance (Brand_name) | |

| Brand1 | I find out the reputation of the company when I intend to buy a life insurance policy |

| Brand2 | I believe that a life insurance company with a strong brand will ensure better benefits for customers than other companies. |

| Brand3 | I am interested in a life insurance company with a good after-sales policy |

| Brand4 | I intend to join life insurance at a company with good financial potential |

| Brand5 | I will buy life insurance at a company that always focuses on the interests of the community |

| Brand6 | I look for life insurance companies with foreign brands |

| Intention to buy life insurance is influenced by risk awareness (Risk) | |

| Risk1 | Buying life insurance makes me feel comfortable and comfortable because I have found an effective financial risk management tool for individuals and families |

| Risk2 | Long-term premium rates of life insurance allow the company to best protect interests during the long-term life insurance contract |

| Risk3 | Life insurance helps me fulfill my responsibilities to my family because when the unfortunate happens that I can no longer generate income for my family, I have life insurance to compensate financially for my dependents. |

| The COVID-19 pandemic affects the intention to purchase life insurance (Covid) | |

| Covid1 | The COVID-19 pandemic made me realize the necessity and importance of life insurance for each individual and family |

| Covid2 | I will purchase life insurance for myself and my relatives if there is a payment clause for the risk of COVID-19 |

| Covid3 | I will convince my friends and my relatives to buy life insurance to offset the financial risks caused by covid |

| Covid4 | I think people will buy more life insurance when the mortality rate, the cost of illness, and the amount for emergency use in case of illness during the COVID-19 pandemic |

| Covid5 | Securing the future with life insurance is very important, especially during the COVID-19 pandemic |

| The intention is positively influenced by one’s Attitude toward life insurance (Attitude) | |

| Attitude1 | I have a positive attitude towards life insurance |

| Attitude2 | Purchasing life insurance is not only beneficial for me but also the financial security of my loved ones |

| Attitude3 | Life insurance companies in Vietnam have high safety and security and always ensure the interests of customers under the contract. |

| Subject norm influences the intention (Sub_norm) | |

| Sub_norm1 | All the people who are important to me think that I should buy BHNT |

| Sub_norm2 | My close friends want me to buy BHNT |

| Sub_norm3 | My close colleagues want me to buy BHNT |

| Sub_norm4 | I feel relaxed and can enjoy life more when my loved ones are protected by life insurance. |

| Sub_norm5 | I will be able to save money with life insurance so that old age is not a financial burden for my children and those around me. |

| Sub_norm6 | I am an income generator, so I need life insurance to protect my family’s income if there is a force majeure event that I can no longer generate income. |

| Sub_norm7 | Purchase life insurance helps me maintain the habit of saving for long-term financial plans in the future such as sending my children to study abroad and preparing for life after retirement. |

| Sub_norm8 | Life insurance helps me live a socially responsible life because if I’m lucky I don’t have any risks, and I will save for the less fortunate. Moreover, when the life insurance policy matures, I will still receive the amount for the lucky |

| Intention to purchase life insurance is affected by the saving motivation of each person (Sav_moti) | |

| Sav_moti1 | I save money to cover my retirement expenses |

| Sav_moti2 | I save money to use for emergencies |

| Sav_moti3 | I save money to ensure the future of my dependents if I, unfortunately, run the risk of not generating my current income |

| Sav_moti4 | I want to save money to inherit for those who are important to me |

| Financial literacy of each person affects the intention (Financial) | |

| Financial1 | I know several financial products that can cover my financial needs |

| Financial2 | I understand the terms contained in the life insurance contract |

| Financial3 | Having life insurance is an important factor in taking care of myself and my family financially |

| Financial4 | I feel less stressed when my family members and I are financially protected by life insurance |

| Financial5 | Life insurance is an important element of my financial plan |

References

- Ajzen, Icek. 1991. The Theory of Planned Behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [Google Scholar] [CrossRef]

- Ajzen, Icek. 2011. The Theory of Planned Behaviour: Reactions and Reflections. Psychology and Health 26: 1113–27. [Google Scholar] [CrossRef]

- Ajzen, Icek, and Martin Fishbein. 1975. A Bayesian analysis of attribution processes. Psychological bulletin 82: 261. [Google Scholar] [CrossRef]

- Ajzen, Icek, and Martin Fishbein. 1980. Understanding Attitudes and Predicting Social Behavior. Englewood Cliffs: Prentice-Hall. [Google Scholar]

- Arena, Marco. 2008. Does Insurance Market Activity Promote Economic Growth? A Cross-Country Study for Industrialized and Developing Countries. Journal of Risk and Insurance 75: 921–46. [Google Scholar] [CrossRef]

- Ayenew, Zerihun, Kenenisa Lemi, and Shimekit Kelkay. 2020. The Effect of COVID-19 on Industry Sector in Ethiopia. Horn of Africa Journal of Business and Economics (HAJBE), 18–27. [Google Scholar]

- Babuna, Pius, Xiaohua Yang, Amatus Gyilbag, Doris Abra Awudi, David Ngmenbelle, and Dehui Bian. 2020. The Impact of COVID-19 on the Insurance Industry. International Journal of Environmental Research and Public Health 17: 5766. [Google Scholar] [CrossRef] [PubMed]

- Bautis Financial. 2013. How to Protect the Golden Goose. Bautis Financial. Available online: https://bautisfinancial.com/protecting-the-golden-goose/ (accessed on 15 February 2021).

- Beck, Thorsten, and Ian Webb. 2003. Economic, Demographic, and Institutional Determinants of Life Insurance Consumption across Countries. World Bank Economic Review 17: 51–88. [Google Scholar] [CrossRef]

- Chen, Peng, Roger G. Ibbotson, Moshe A. Milevsky, and Kevin X. Zhu. 2006. Human Capital, Asset Allocation, and Life Insurance. Financial Analysts Journal 62: 97–109. [Google Scholar] [CrossRef]

- Ćurak, Marijana, Ivana Dzaja, and Sandra Pepur. 2013. The Effect of Social and Demographic Factors on Life Insurance Demand in Croatia Department of Finance MA in Economics Department of Finance. International Journal of Business and Social Sciences 4: 65–72. [Google Scholar]

- Ćurak, Marijana, Sandra Lončar, and Klime Poposki. 2009. Insurance Sector Development and Economic Growth in Transition Countries. International Research Journal of Finance and Economics 34: 29–41. [Google Scholar]

- Dak Lak Provincial People’s Committee Portal. 2022. Available online: https://daklak.gov.vn/web/english/site-map (accessed on 12 June 2022).

- Ege, İlhan, and Taha Bahadır Saraç. 2011. The Relationship between Insurance Sector and Economic Growth: An Econometric Analysis. International Journal of Economics and Research 2: 1–9. [Google Scholar]

- Fouse, L. G. 1905. Policy Contracts in Life Insurance. The Annals of the American Academy of Political and Social Science 26: 29–48. [Google Scholar] [CrossRef]

- Gandolfi, Anna Sachko, and Laurence Miners. 1996. Gender-Based Differences in Life Insurance Ownership. The Journal of Risk and Insurance 63: 683. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jr., William C. Black, Barry J. Babin, and Rolph E. Anderson. 1995. Multivariate Data Analysis, 3rd ed. New York: Macmillan. [Google Scholar]

- Health Minister. 2021. Fourth Wave of COVID-19 in Vietnam Longer and Much More Serious than Previous Ones. Vietnamnews. Available online: https://vietnamnews.vn/society/994206/fourth-wave-of-covid-19-in-viet-nam-longer-and-much-more-serious-than-previous-ones-health-minister.html (accessed on 10 March 2022).

- Helen, Vu. 2021. Vietnam Insurance Industry Overview 2021. Vietnam Credit. Available online: https://vietnamcredit.com.vn/news/vietnam-insurance-industry-overview-2021_14370 (accessed on 15 June 2021).

- Jackson, Emi Moriuchi Paul. 2017. Role of Brand Names and Product Types on Bicultural Consumers’ Purchase Intentions. Journal of Consumer Marketing 34: 53–65. [Google Scholar] [CrossRef]

- Jahan, Tasmin, and Md. Mahiuddin Sabbir. 2019. Analysis of Consumer Purchase Intention of Life Insurance: Bangladesh Perspective. Khulna University Business Review 13: 13–28. [Google Scholar] [CrossRef]

- Jamieson, Linda F., and Frank M. Bass. 1989. Adjusting Stated Intention Measures to Predict Trial Purchase of New Products: A Comparison of Models and Methods. American Marketing Association 26: 336–45. [Google Scholar]

- Kennedy, Peter. 2008. A Guide to Econometrics, 6th ed. Oxford: Wiley-Blackwell. [Google Scholar]

- Kirti, Divya, and Mu Yang Shin. 2020. Impact of COVID-19 on Insurers. Available online: https://www.imf.org/~/media/Files/Publications/covid19-special-notes/en-special-series-on-covid-19-impact-of-covid-19-on-insurers.ashx (accessed on 10 March 2022).

- Law No. 08/2022/QH15. 2022. Bussiness Insurance. Available online: https://thuvienphapluat.vn/van-ban/Bao-hiem/Luat-Kinh-doanh-bao-hiem-2022-465916.aspx (accessed on 7 September 2022).

- Lin, Chaonan, Yu Jen Hsiao, and Cheng Yung Yeh. 2017. Financial Literacy, Financial Advisors, and Information Sources on Demand for Life Insurance. Pacific Basin Finance Journal 43: 218–37. [Google Scholar] [CrossRef]

- Mahdzan, Nurul Shahnaz, and Sarah Margaret Peter Victorian. 2013. The Determinants of Life Insurance Demand: A Focus on Saving Motives and Financial Literacy. Asian Social Science 9: 274–84. [Google Scholar] [CrossRef]

- McFadden, Daniel. 1973. Conditional Logit Analysis of Qualitative Choice Behavior. New York: Academic Press. [Google Scholar]

- Menard, Scott. 2001. Applied Logistic Regression Analysis: Sage University Series on Quantitative Applications in the Social Sciences, 2nd ed. Huntsville: Sam Houston State University. Denver: University of Colorado. [Google Scholar]

- Morwitz, Vicki. 2014. Consumers’ Purchase Intentions and Their Behavior: Foundations and Trends in Marketing. Foundations and Trends in Marketing 7: 181–230. [Google Scholar] [CrossRef]

- Nunnally, Jum C. 1978. Psychometric Theory, 2nd ed.New York: McGraw-Hill. [Google Scholar]

- Qin, Yanhong, and Yingxiu Zhang. 2012. Empirical Study of the Effects of Consumer Attitude to Life-Insurance Purchase Intentions in China. In 2011 International Conference in Electrics, Communication and Automatic Control Proceedings. New York: Springer, chp. 10. [Google Scholar] [CrossRef]

- Rutter, D. R., and D. J. Bunce. 1989. The theory of reasoned action of Fishbein and Ajzen: A test of Towriss’s amended procedure for measuring beliefs. British Journal of Social Psychology 28: 39–46. [Google Scholar] [CrossRef]

- Saad, Syed, Hussain Shah, Jabran Aziz, Ahsan Jaffari, Sidra Waris, and Wasiq Ejaz. 2012. The Impact of Brands on Consumer Purchase Intentions. Asian Journal of Business Management 4: 105–110. [Google Scholar]

- Sarstedt, Marko. 2019. Revisiting Hair Et Al.’s Multivariate Data Analysis: 40 Years Later. In The Great Facilitator. Cham: Springer, pp. 113–19. [Google Scholar] [CrossRef]

- Sheppard, Blair H., Jon Hartwick, and Paul R. Warshaw. 1988. The Theory of Reasoned Action: A Meta-Analysis of Past Research with Recommendations for Modifications and Future Research. Journal of Consumer Research 15: 325. [Google Scholar] [CrossRef]

- Statistic Office of Daklak. 2019. Year Book Statistic of Daklak. Buon Ma Thuot City: Statistic Office of Daklak. [Google Scholar]

- Tariq, Muhammad Irfan, Muhammad Rafay Nawaz, Muhammad Musarrat Nawaz, and Hashim Awais Butt. 2013. Customer Perceptions about Branding and Purchase Intention: A Study of FMCG in an Emerging Market. Journal of Basic and Applied Scientific Research 3: 340–47. [Google Scholar]

- Tien, Hung Nguyen. 2021. Overview of Vietnam’s Insurance Market: Opportunities and Challenges. International Research Journal of Modernization in Engineering Technology and Science 3: 1092–99. [Google Scholar]

- Tough, Rachel. 2021. Ho Chi Minh City during the Fourth Wave of COVID-19 in Vietnam. City and Society 33: 1–12. [Google Scholar] [CrossRef]

- Vadlamannati, Krishna Chaitanya. 2008. Do Insurance Sector Growth and Reforms Affect Economic Development? Empirical Evidence from India. Margin 2: 43–86. [Google Scholar] [CrossRef]

- Vietnamese Civil Law. 2015. Available online: https://thuvienphapluat.vn/van-ban/Quyen-dan-su/Bo-luat-dan-su-2015-296215.aspx (accessed on 15 January 2021).

- Yusuf, Tajudeen Olalekan, Ayabntuji Gbadamosi, and Hamadu Dallah. 2009. Attitudes Of Nigerians Towards Insurance Services: An Empirical Study University of East London, UK. African Journal of Accounting, Economics, Finance and Banking Research 4: 34–46. [Google Scholar]

- Zakaria, Zainuddin, Nurul Marina Azmi, Nik Fakrul Hazri Nik Hassan, Wan Anisabanum Salleh, Mohd Tajul Hasnan Mohd Tajuddin, Nur Raihana Mohd Sallem, and Jannah Munirah Mohd Noor. 2016. The Intention to Purchase Life Insurance: A Case Study of Staff in Public Universities. Procedia Economics and Finance 37: 358–65. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).