Abstract

Social media usage has grown rapidly in recent years, and with it companies’ interest in interacting with their customers on these platforms. It is, however, not yet clear whether customers welcome more intense relationships on social media and what drives this acceptance in more detail. Our research aims at understanding how age, gender, geography, usage, type of platform, personality, and current insurance provider impact customers’ attitudes towards interacting with insurance companies in the Swiss market. We find that age and frequency of use, in particular, impact acceptance, with younger customers much more open to interactions and insurance presence more welcome on more frequently used tools. This is an encouraging result for insurers, as customers tend to welcome them where customers are already frequently present. In addition, insurers can look forward to increasing interaction as younger individuals, who are more open to social media, age into core customers. Social context, on the other hand, plays only a minor role in customer preferences. The current insurance provider plays no significant role, in spite of insurance companies in the sample following widely different approaches to digital offerings and communication. This may be due to the early stage of development of the industry.

1. Introduction

Social media platforms have enjoyed explosive growth in recent years. This, together with the opportunity they offer for cost-effective bidirectional communication, make them very interesting tools for companies to develop effective relationships with their customers and other stakeholders (Tajudeen et al. 2018). Social media is revolutionizing customer interaction, transforming the way companies handle employees, and accelerating the development and implementation of new products. However, more research is needed to understand how social media is transforming business, with specific focus on (a) how consumers and firms use social media features; (b) how consumers and firms create social media strategies; (c) how firms allocate and manage resources for social media; and (d) how consumers and firms measure and capture value on social media (Aral et al. 2013). Thus, a better understanding of social media management, and its use and adoption by organizations is crucial for academia and practice (Chung et al. 2017).

Insurance companies, like other companies, rely on several communication channels for interacting with their customers. The characteristics of risk transfer products, customer sentiment, business practices, and regulatory constraints, however, make the modes, challenges, and benefits of customer interaction specific to insurance. In particular, insurance companies can develop deep insights into risk behavior, then they can leverage in their product and service development, underwriting, and claims processes. Customers, on the other hand, are concerned about privacy, although they do not always act accordingly, and find dealing with permeable social context boundaries challenging—yet personality can play a mediating role in engagement on social media and interaction with insurance and other companies (Davis and Jurgenson 2014; Hughes et al. 2012). In this complex and potentially high-impact environment, it is important for insurance companies to understand the drivers of customer engagement on social media.

As a contribution to the research on understanding how customers and firms use social media, this study investigates when and how customers are open to interactions with insurers on social media rather than on other channels. In addition, this information should provide valuable insights for the development of social media strategies. The research is part of a broader research effort to understand the evolution of social media in the context of the Swiss insurance market. This paper attempts to provide clarity and insights on this problem by addressing the following research question: what factors impact customers’ opinions towards communication from insurers on social media versus other channels? More specifically, how do geography, gender, age, frequency of use, type of use, personality, and current insurance provider impact these results?

2. Literature Review

Three distinct but interconnected research streams are relevant to our investigation: first, how social media has developed and the drivers and challenges of this development; second, how personality can impact interaction on social media; and third, how customers have been willing to facilitate and add value to the exchange by sharing personal information.

2.1. Social Media Use

Usage of social media has exploded in the last fifteen years. In the US, for example, 7% of all adults were using social media in 2005. This number had grown to 65% by 2015. There were significant differences with age, with 90% of Americans under 30 using social media, but only 35% of those 65 and above. Some differences also persist driven by socioeconomic status, with higher income, more educated, non-rural citizens more likely to be on social media (Perrin 2015). This pattern has continued since, but differentiated usage is becoming more evident. The general trend holds true for the most beloved platform, YouTube, used by 81% of all Americans. Facebook usage, on the other hand, has plateaued overall and is decreasing among younger users. Other platforms, such as Snapchat, Twitter, and TikTok are much more prevalent among the younger age cohort, indicating the potential for the evolution of generational platforms (Auxier and Anderson 2021).

The development in Switzerland has been very similar in many ways, with 66% of the population using social media platforms in 2019 and similar age patterns (Latzer et al. 2020). More than 98% of Swiss youth between the ages of 14 and 19 use social media, with a usage pattern similar to the one shown by the US data. An overwhelming majority use Instagram, Snapchat, YouTube, and TikTok, while Facebook usage has dropped to 50%. Unlike in the United States, most users message on WhatsApp (Bernath et al. 2020).

Users of social media need to understand and navigate the social context in which they are operating, since social settings have a strong impact on people’s self-presentation and communication behavior (Goffman 1959). Social contexts, however, can collapse when previously separate interaction groups start to commingle – for example, when both family friends and work colleagues are invited to a barbeque and thus start to form a single group. Context collapse can leave people without a social framework to guide communication or expose them to unpleasant situations when information meant for a particular group is shared with another. Context collapse was first identified in broadcasting settings with communication targeted at different racial groups (Meyrowitz 1985), and thus predates social media. Several, especially early versions of, social media platforms, however, used very porous default boundary settings, leading to context collapse. This is the case, for example, for Facebook or Twitter, but not for LinkedIn, where the context has been defined as a business setting instead (Davis and Jurgenson 2014). The problem is exacerbated by the permanency of social media posts, so that context collapse occurs both in space and over time, for example when older photos resurface after several years (Brandtzaeg and Lüders 2018). Users have developed several strategies for dealing with the issue, including self-censorship, creating multiple identities, configuring privacy settings, encoding so they can only be understood by a particular audience, and maintaining ambiguity (Guerrero-Solé et al. 2020). Newer platforms are designed to manage boundary porousness through privacy settings, for example by creating groups to manage social context within the same platform (Davis and Jurgenson 2014).

Due to the level of activity and explosive development of social media, it is natural for companies to explore this space in order to communicate with their customers. In Switzerland, 89% of all companies have a social media strategy, with 54% having had one in place for more than 6 years. Almost all companies are present on YouTube, LinkedIn, Twitter, Facebook, and Instagram. Three quarters are looking to build visibility and reputation, while only a very small minority of companies (<10%) are looking to generate leads, reduce costs, or grow sales through social media (Bernet 2020). Reputation on social media has a positive influence on the performance of banks, and should be considered a strategic resource that can lead to a competitive advantage (Ballouk et al. 2022). Insurance companies, however, can also mine information available on social media and from other sources to develop more sophisticated risk and pricing models or even to inform the claims adjusting process (Borna and Avila 1999; Chapeyama Mdala 2022). This is part of a long-term development in insurance to provide more personalized services (Kotalakidis et al. 2016) and products better tailored to individual risk profiles (Rothschild and Stiglitz 1976; Baecke and Bocca 2017).

Social media also influences a number of investment and management decisions in financial services. Investors tend to buy equity exchange-traded funds whose underlying stocks are more talked about on social media, causing temporary overpricing of these funds (Liu 2023). The number of mentions on Twitter is a significant driver of Bitcoin’s trading volume on the following day (Shen et al. 2019), and social media activity also drives price distortion after rumor clarification (Wu et al. 2022). Aharon et al. (2022) find a strong link between sentiments of market uncertainty expressed on social media and the performance of cryptocurrencies as an alternative asset class.

2.2. The Impact of Personality Traits

The Big Five personality model has been used extensively in investigating the link between personality and internet use (Hughes et al. 2012). The model is based on five broad personality types (Costa and McCrae 1992):

- Neuroticism: a measure of affect and emotional control, with high-scoring individuals being sensitive and nervous, with a propensity to worry.

- Extraversion: linked to adventurous, sociable, and talkative behavior.

- Openness to Experience: indicating broad interests and novelty-seeking.

- Agreeableness: linked to being friendly, kind, sympathetic, and warm.

- Conscientiousness: referring to a person’s work ethic, orderliness, and thoroughness.

de Zuñiga et al. (2017) investigate the impact of personality on three types of social media use (frequency of social media use, social media news use, and social media social interaction) in 20 countries. They find “a mild but consistent relationship between people’s personality traits and the way they use social media”. Extraversion, agreeableness, and conscientiousness positively correlate with social media usage, whereas emotional stability shows a negative correlation. Openness predicts frequency of use, yet decreases usage for news and social interaction. People who are more comfortable speaking with others, empathize with them, like order, and are open to experience are more often on social media, whereas emotionally stable individuals use social media less often. The authors conclude that the drivers of in-person behavior, perhaps unsurprisingly, extend to social media. In addition, they find that younger people, women, and minorities use social media more often, but that interest in politics negatively correlates with social media usage.

These results are largely consistent with previous research. Individuals with a high degree of neuroticism use the internet frequently to avoid loneliness (Butt and Phillips 2008), spend more time on Facebook (Ryan and Xenos 2011), and message more frequently (Correa et al. 2010). Extraversion and openness correlate with the use of social networking sites (Correa et al. 2010) and extraverts are part of significantly more social groups and have more “friends”. However, they tend to make these friends offline and then use the internet to maintain contact (Ross et al. 2009). Agreeableness has not generally been found to be correlated with social media usage (Ross et al. 2009; Correa et al. 2010). Finally, Butt and Phillips (2008) suggest that conscientious individuals tend to avoid social media because it is a distraction, and Ryan and Xenos (2011) find a significant negative correlation with time spent on Facebook. Ross et al. (2009), however, find no significant correlation.

Hughes et al. (2012), who investigate the impact of the Big Five personality traits, need for cognition, and sociability on the usage of Facebook and Twitter, find different drivers of behavior on these two platforms. While sociability and neuroticism correlate with Facebook use, Twitter use was driven by conscientiousness, openness and sociability. This suggests that more gregarious and social individuals will be on Facebook more often, while those seeking cognitive stimulation will look to Twitter.

2.3. Willingness to Share Information

Participating in social media implies disclosing personal information. While disclosure is not forced, it is highly encouraged by the design and the business model of social media platforms (Acquisti and Gross 2006). The need to disclose information to organizations is not unique to social media and it is present in most consumer transactions. This information can be a source of competitive advantage for the companies involved, but can raise privacy concerns. Privacy calculus posits that customers evaluate the perceived benefits of providing the information vs. the potential costs and risks, and decide accordingly (Smith et al. 2011). Trust has been found to play a key role in information disclosure (Metzger 2004; Simpson 2012). Customers are more willing to share information when (a) information is collected in the context of an existing relationship; (b) they can control the future use of the information; (c) the information is relevant to the transaction; and (d) the information can be used to draw reliable and valid inferences (Stone and Stone 1990). Companies can institute procedural fairness to mediate trust in settings with social distance (Culnan and Armstrong 1999). Pre-existing attitudes and dispositions, general institutional trust, as well as the momentary affective state, heavily influence how people weigh the risks and benefits of data sharing and are thus crucial for their willingness to disclose private data (Kehr et al. 2015). Internet users are highly concerned about privacy and the collection and use of their personal information. However, in practice, they are willing to trade their information for relatively small rewards, giving rise to the “privacy paradox” (Kokolakis 2017). This phenomenon may be related to instant gratification, bounded rationality, information asymmetry, or habits, and it is context-dependent (Kehr et al. 2013; Kokolakis 2017; Fernandes and Pereira 2021). In fact, trust may not be necessary to share information and develop relationships on social media, as has been demonstrated for some sites with weak perceived trust and privacy safeguards (Dwyer et al. 2007). In their survey article, Kern et al. (2018) find that trust and privacy concerns, as well as the purpose and the procedure of data collection, are key factors in deciding whether or not to disclose private data. The role of personality traits, gender, and social influences, on the other hand, seems to be still unclear.

In a Swiss insurance context, customers have been shown to be willing to share personal information with their insurers, especially in order to provide risk mitigation and other insurance-adjacent services (Pugnetti and Seitz 2021). This willingness is not linked to specific insurance companies. Rather, it correlates with several general factors, including trust, risk behavior, rewards offered, and type of information, with more personal information held more closely (Pugnetti and Elmer 2020; Pugnetti and Seitz 2021). Personality type also impacts the willingness to interact with insurance companies in ways that are similar, but not identical, to the willingness to engage in social media described in Section 2.2. Thus, while conscientiousness, neuroticism and extraversion are linked to higher willingness to share information, openness and agreeableness are not (Pugnetti et al. 2022).

3. Results

After describing the methodology, we provide results and comments for the overall sample, and more detailed analyses by gender, region, and age of respondents; frequency and type of use by social media platform; and, finally, personality, purchasing behavior, and current insurance provider of respondents.

3.1. Methodology

The research question was addressed through a survey in German and in French of Swiss insurance customers, conducted in June 2021 by the market research company Bilendi. The survey was steered to obtain a comparable sample size between genders, across four geographical regions (Romandie, Alps, Western Midlands, and Eastern Midlands), and five age cohorts (15–24, 25–34, 35–44, 45–59, 60–74), for a total of 1212 responses. Only current insurance customers were selected. Samples of more than 100 customers were obtained for seven insurance companies (Allianz, AXA, Basler, Generali, Helvetia, Mobiliar, Zurich), although this was not actively steered in the survey. Personal identifiers were not captured in the survey to guarantee anonymity.

After asking respondents for the information above in order to guide sample sizes, the survey was structured in three sections:

(a) Frequency and type of usage of social media across 12 social media platforms, as well as of traditional and emergent channels. Frequency was measured on a four-point scale (1 = daily/multiple times per day; 2 = weekly/multiple times per week; 3 = less than once per week; 4 = never); type of usage with the selection of one or more of seven categories (communication with friends and family; communication with colleagues or employer; communication with experts; communication with companies; entertainment; reading the news; general information gathering). The decision of which platforms to include was taken by the authors based on published frequency of use, perceived importance, and potential applicability to insurance.

(b) Insurance-specific questions. Selection of the primary P/C carrier with a drop down of the twelve largest companies by market share; level of trust with and how well respondents feel informed by this company; opinion regarding communication with their insurance company by platform. Respondents answered the question: “How would you like to be able to communicate with your insurance company on the following channel?” using a five-point scale (1 = very good; 2 = good; 3 = neither; 4 = not good; 5 = not good at all)1.

(c) Customer personality and purchasing behavior. Personality was elicited through ten questions defined by Rammstedt et al. (2013) to score respondents on the Big 5 personality traits. The questionnaire comprised two questions per trait, with both negative and positive correlations with the relevant trait. The retest reliability rtt lies between 0.84 for extraversion and 0.58 for agreeableness and is within the acceptable range (Aiken and Groth-Marnat 2006). Selecting this approach allowed us to greatly reduce the number of questions devoted to personality traits without any significant loss of accuracy. In addition, the questions were already formulated and tested in German. Purchasing behavior was determined through six direct questions (look for cheapest offer, research by myself, trust in insurance agent, trust in company, trust in experts, look for sustainable products) defined by the authors to match common customer segmentation criteria in the Swiss insurance market.

3.2. Overall Results

The results by channel are tabulated in Table 1. The channels are organized by type (social media, traditional, and emergent) and ranked by frequency of daily use within each category. WhatsApp, for example, is used daily by more than 85% of all respondents, higher than email at 81%. The rate of use of social media platforms drops off quickly, and only four platforms achieve more than 30% daily usage overall. Traditional channels, on the other hand, are used by more than 50% of respondents daily, and emergent channels are not yet in frequent common use. More detail on the frequency of use will be given in Section 3.3 and Section 3.4. The overall customer opinion on communication from insurers on social media is slightly negative to negative (slightly above the midrange point of 3), whereas communication through traditional channels is perceived significantly more positively. The opinion on emergent channels is more neutral, but chat opportunities are seen positively. There are few significant differences with gender or with geography in the customer survey, with women rating social media channels worse and traditional channels better than men, and respondents from the Alps most open and those from the Romandie least open to interaction on social media. Otherwise, there seems to be no clear discernable pattern in these differences.

Table 1.

Opinion on communication from insurers by channel (1 = very good, 5 = not good at all).

3.3. Results by Age Cohort

Unlike gender or region, age plays an important role in understanding a customer’s opinion on communication through social media. Table 2 summarizes the results, with the first three columns repeating the information in Table 1 to better frame the data. The differences are significant for half of the social media platforms investigated, including the top four with more than 30% daily usage across all customers. More importantly, the pattern is consistent, with younger age cohorts more open to communication over social media than older ones. Traditional channels—email and telephone—are widely accepted across all age groups, as are chats. For videochats, on the other hand, we observe the same pattern as for social media, with younger age cohorts more open to this communication channel.

Table 2.

Opinion on communication from insurers by channel (1 = very good, 5 = not good at all).

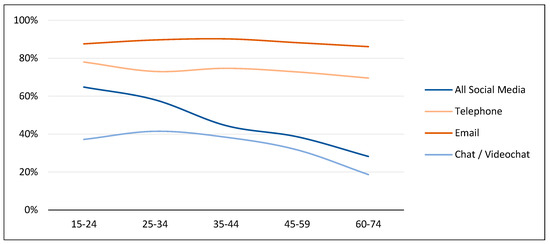

The results presented in Table 2 are summarized across all platforms for social media and emergent channels and compared to email and telephone in Figure 1. Email and telephone are widely accepted, with email being more widely accepted, presumably because it is asynchronous and not likely to disturb customers at inappropriate times. The acceptance for emergent channels is relatively low and drops off among the older age cohorts. More interesting is the acceptance profile for social media. Among the younger generations, acceptance is nearing that of traditional channels, dropping off rapidly as age increases. The implications of these results are potentially quite profound, with a tidal wave of opportunities to communicate on social media as younger customer cohorts age into core insurance customers.

Figure 1.

Positive opinion (1–2) on communication from insurer by age cohort.

3.4. Results by Frequency of Use

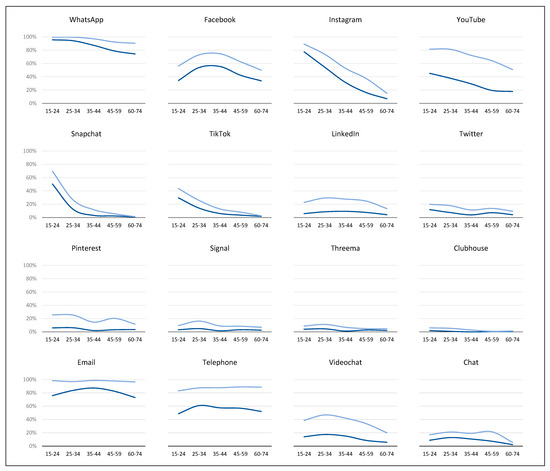

The frequency of use of the different social media platforms and communication channels varies with age. Figure 2 shows the daily and weekly frequency of use of channel across age cohorts. As before, the order of presentation is defined by the type of channel and the overall frequency of usage for each platform.

Figure 2.

Daily (dark blue) and weekly (light blue) usage by age cohort.

WhatsApp has broad and frequent use in Switzerland, with even 90% of older customers using the platform at least weekly. Facebook, in contrast, is exhibiting a particular age-cohort usage pattern. Younger and older users are not as invested as middle-aged customers. Because of this result, it is plausible that Facebook will encounter increasing challenges in the Swiss market. Instagram is a platform clearly preferred by younger generations, as are Snapchat and TikTok. YouTube exhibits a similar pattern, albeit with the highest proportion of weekly users among all platforms. Several other platforms, especially some newer and promising ones at the time of the survey, such as Signal, Threema, and Clubhouse, have low usage across all age groups. Email is widely used, but daily usage among younger customers drops off, signaling that the continued preference for email may be challenged in the future. Telephone follows a similar age-dependent pattern, but with a much lower frequency of daily usage. Emerging channels, videochat in particular, show relatively high weekly usage. This can, at least in part, be explained by the need for remote work during the COVID-19 pandemic. It will be interesting to investigate how a return to in-person interaction will impact this pattern.

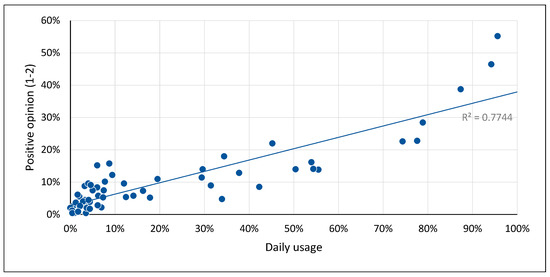

Figure 3 displays how the frequency of use impacts the acceptance of communication from insurers, with each dot representing the results for one combination of age cohort and social media platform. Traditional and emergent communication channels are not plotted. Despite significant variations, especially among the tools with lower usage frequency, daily usage clearly correlates with acceptance of communication from an insurer on social media (correlation coefficient 0.35; p-value < 0.001). This is, overall, positive news for insurers, as customers are more open to their presence on the platforms the customers themselves use most frequently.

Figure 3.

Positive opinion (1–2) on communication from insurer on social media by daily use.

3.5. Results by Type of Use

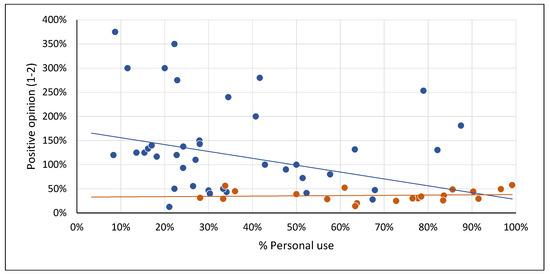

Context collapse (Meyrowitz 1985) suggests that the type, rather than the frequency of use, should dictate whether insurers are accepted on social media, with platforms more heavily used for personal communication being less available for commercial purposes in general, and for insurers’ communication in particular. The results of this investigation are shown in Figure 4. On the horizontal axis we plot the percentage of the respondents using a platform for personal communication; on the vertical axis we plot the number of respondents with a positive opinion on communication from insurers as a percentage of daily users. A number higher than 100% indicates that several non-frequent users are open to insurance communication on that platform. This approach removes frequency effects from the results. Again, individual data points indicate combinations of platform and age cohort. The results show a correlation between the type of usage and the acceptance of insurance communication, namely a negative correlation between the degree of personal use and acceptance for insurance communication, as predicted by the theory (regression coefficient −1.42; p-value 0.001). However, this effect is relatively weak, and disappears completely when we focus the analysis on the four most frequently used platforms with more than 30% overall daily usage: WhatsApp, Facebook, Instagram and YouTube (regression coefficient 0.05; p-value 0.68). This indicates that while more niche or specialized platforms may be better or less well suited to different types of communication in the mind of consumers, once a platform reaches a certain penetration and becomes a de-facto standard/preferred channel, customers are open to several communication types, including communication from their insurer. We postulate that this is driven by convenience. Once the customers use a platform frequently, it may be more difficult to switch to other platforms for specialized tasks. This finding may also indicate that special-purpose, branded apps will continue to have difficulties in establishing themselves unless they can provide frequent and meaningful interaction. Once they become established, however, they may need to continue to expand their scope in order to retain relevance as users’ acceptance of multiple purposes seems to grow with usage.

Figure 4.

Positive opinion (1–2) on communication from insurer on social media by personal use (blue all social media; red WhatsApp, Facebook, Instagram, and YouTube only).

3.6. Results by Personality, by Purchasing Behavior, and by Company

The effects of personality and purchasing behavior are summarized in Table 3. High conscientiousness correlates with a more negative opinion on insurance communication on social media. The same is true for openness to new experience, albeit much more weakly. Because of the way the dimensions are scored, high agreeableness and high neuroticism weakly correlate with a more positive attitude towards insurance communication on social media.

Table 3.

Impact of personality type on the opinion on insurance communication on social media.

On the other hand, almost all purchasing behaviors surveyed correlate with a positive opinion on insurance communication on social media. Customers looking for the cheapest offer, trusting in agents, the company, or other experts, or looking for sustainable products, are all more open to interacting with insurance companies on social media.

The responses were also investigated for the opinion on insurance communication from the customers of each insurance company, both for each individual platform and in aggregate across categories. The results do not show any significant difference among the companies and do not seem to be dependent on the companies’ online marketing strategies. This may indicate that customer self-selection has not yet occurred and suggests that addressing customers on social media may not be tackled successfully with an own-brand online approach only.

4. Discussion

The overall customer acceptance of communication with insurance companies via social media in Switzerland is relatively low, especially when compared with more traditional communication channels. Even the most accepted social media channel, WhatsApp, is a full point behind telephone and one and a half points behind email on a five-point scale. This picture is consistent across genders and geographic regions. Where there are gender differences, men tend to be more open to communication on social media and emerging channels, while women are more open to interactions over traditional channels. Age, on the other hand, has a significant impact on customers’ openness to interaction via social media. Younger customers are significantly more likely to accept communication on social media platforms than older ones. This is an important difference from the results for traditional and emergent channels, where this difference is not detectable, with the exception of videochat. For customers under 35, social media is almost as acceptable as traditional channels. Insurance companies can, therefore, look forward to additional channels on which to interact with their customers. At the same time, they will potentially face increasing competition and a learning curve to understand how to best address their customers and capitalize on the relationship to deliver mutual benefits on each specific channel.

Frequency of use of social media also depends on the age cohort. While, in general, younger users are more active on social media, the actual pattern depends on the platform. While, for instance, Instagram, YouTube, Snapchat, and TikTok are clearly preferred by younger users, WhatsApp is widespread among all age groups, and Facebook and email show clear decreases in use among younger customers. This indicates that there is the potential for the emergence of age cohort-specific communication platforms. The implications for insurance companies are wide-ranging. First, communication can potentially be focused on specific age groups by platform and may simplify the need to adapt cohort-specific communication to the different styles prevalent on different platforms. Second, it may also mean that platforms are transitory. The very successful ones will accompany an age cohort and fade out over time. This will, in turn, require a dynamic adaptation of content curation to match cohort needs. This phenomenon may even impact email, whose usage is lagging among younger cohorts. The process and pace of emergence of social media platforms is another issue for insurance companies, as platforms emerge both rapidly and unpredictably. This was the case when WhatsApp became popular and even the Credit Suisse Youth Barometer only included it in its survey after it had achieved 80% penetration and overtaken Facebook in 2014 (Golder et al. 2014). The opposite is also true, with promising platforms failing to reach critical size in spite of early hype. In this study, for example, we decided to include Threema and Clubhouse due to the sentiment among insurance professionals in 2021 that these platforms had the potential to become essential for customer interactions. This expectation, however, has not materialized, as the results clearly indicate.

Usage is a key driver for the acceptance of insurance communication on social media, with higher usage correlating with higher acceptance across platforms and age cohorts. This result is a very positive signal for insurance companies, indicating that they are welcome to participate in platforms where their customers typically operate. The picture becomes more differentiated when looking into the type of communication customers engage in on these platforms. Our results show a weak negative correlation between personal use and acceptance of insurance, possibly due to the pressure of social context. Thus, insurance companies are relatively less welcome on platforms primarily used for personal exchanges with friends and family. This correlation, however, does not seem to hold for platforms used very frequently. On the four most frequently used platforms (WhatsApp, Facebook, Instagram, and YouTube), insurance companies are welcome at similar rates independently of the proportion of personal use. This may be inherent to the platforms themselves, but it is nonetheless an encouraging sign for insurance companies.

The results for the other potential drivers of acceptance are potentially less insightful. Among personality traits, high conscientiousness is linked with a lower acceptance of insurance communication, as is openness, albeit to a lower extent. Agreeableness and neuroticism are weakly linked to higher acceptance of insurance communication. High identification with almost all of the purchasing behaviors we surveyed, on the other hand, are linked with higher acceptance of insurance communication. Customers of different insurance companies also did not respond differently. This result was somewhat unexpected, as companies identified in the sample have tended to pursue different strategies with regard to online and social media communication. Some, such as Mobiliar, have focused on their in-person agent distribution and traditional channels; most, such as AXA, have actively pursued an omni-channel strategy; still others, such as smile, have focused on digital channels. This, however, does not yet seem to make a significant difference to the customers’ acceptance of communication via social media. We posit that this is due to the relatively early stage of development and the slow pace of customer portfolio turnover in insurance, and that we may observe customer self-selection in future studies.

5. Conclusions

Two sets of results are potentially of particular significance, one for research, the other one for practice. For research, the very limited impact of usage pattern and the large impact of frequency on the acceptance of communication with insurance companies is a potentially significant finding. This indicates that social context is playing a weaker role than in other studies (Davis and Jurgenson 2014; Brandtzaeg and Lüders 2018). We posit that platform functionality, user sophistication, and the high level of trust in insurance companies may have reached a point where managing different social settings may have become less challenging. Furthermore, also not in line with other studies (e.g., Correa et al. 2010; de Zuñiga et al. 2017), personality does not seem to play a significant role in customers’ attitudes to communication on social media. In addition, the use of different platforms across age cohorts may signal an emergent phenomenon of stable and cohort-specific social media platforms. In this scenario, platforms become popular in a particular age group and remain popular with that group as they age, with limited network effects in other groups.

For insurance practitioners, our results show that social media is also a growing phenomenon in Switzerland. Market pull for communication on these channels is likely to originate from generational shifts in their customer portfolios pushing penetration rates of social media, rather than from changes in behavior of individual customers. On the other hand, there do not seem to be significant differences in the social media behavior and expectations among the customers of different insurance companies, potentially indicating an early stage of development and sophistication in the industry. Our research program is planning to continue to monitor usage pattern and accompany this potential transition.

Author Contributions

Conceptualization, C.P. and C.Z.; methodology, C.P. and J.B.; formal analysis, C.P. and J.B.; writing—original draft preparation, C.P.; writing—review and editing, C.P., J.B., C.Z.; visualization, C.P.; funding acquisition, C.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | Answering this question with “good” vs. “not good” is grammatically correct in German. |

References

- Acquisti, Alessandro, and Ralph Gross. 2006. Imagined Communities: Awareness, Information Sharing, and Privacy on the Facebook. Paper presented at the 6th Workshop on Privacy Enhancing Technologies, Cambridge, UK, June 28–30. [Google Scholar]

- Aharon, David Y., Ender Demir, Chi Keung Marco Lau, and Adam Zaremba. 2022. Twitter-Based uncertainty and cryptocurrency returns. Research in International Business and Finance 59: 101546. [Google Scholar] [CrossRef]

- Aiken, Lewis R., and Gary Groth-Marnat. 2006. Psychological Testing and Assessment, 12th ed. Boston: Pearson. [Google Scholar]

- Aral, Sinan, Chrysanthos Dellarocas, and David Godes. 2013. Introduction to the Special Issue: Social Media and Business Transformation: A Framework for Research. Information Systems Research 24: 3–13. [Google Scholar] [CrossRef]

- Auxier, Brooke, and Monica Anderson. 2021. Social Media Use in 2021. Washington: Pew Research Center. Available online: https://www.pewresearch.org/internet/wp-content/uploads/sites/9/2021/04/PI_2021.04.07_Social-Media-Use_FINAL.pdf (accessed on 1 September 2022).

- Baecke, Philippe, and Lorenzo Bocca. 2017. The Value of Vehicle Telematics Data in Insurance Risk Selection Processes. Decision Support Systems 98: 69–79. [Google Scholar] [CrossRef]

- Ballouk, Houssein, Sami Ben Jabeur, Sabri Boubaker, and Salma Mefteh-Wali. 2022. The effect of social media on bank performance: An fsQCA approach. Electronic Commerce Research 22: 1–19. [Google Scholar] [CrossRef]

- Bernath, Jael, Lilian Suter, Gregor Waller, Céline Külling, Isabel Willemse, and Daniel Süss. 2020. JAMES—Jugend, Aktivitäten, Medien–Erhebung Schweiz. Zurich: Zurich University of Applied Sciences. [Google Scholar]

- Bernet, Relations AG. 2020. Social Media in Organisationen und Unternehmen: Viel Konstanz–auch in Zeiten von Corona. Available online: http://bernet.ch/socialmediastudie (accessed on 30 August 2022).

- Borna, Shaheen, and Stephen Avila. 1999. Genetic Information: Consumers’ Right to Privacy Versus Insurance Companies’ Right to Know a Public Opinion Survey. Journal of Business Ethics 19: 355–62. [Google Scholar] [CrossRef]

- Brandtzaeg, Petter Bae, and Monika Lüders. 2018. Time Collapse in Social Media: Extending the Context Collapse. Social Media + Society 4: 1–10. [Google Scholar] [CrossRef]

- Butt, Sarah, and James G. Phillips. 2008. Personality and self reported mobile phone use. Computers in Human Behavior 24: 346–60. [Google Scholar] [CrossRef]

- Chapeyama Mdala, Salome. 2022. Premium Based on ‘Like, Share and Post’: Use of Social Media Data in Life Insurance and Proxy Discrimination. Available online: https://ssrn.com/abstract=4192294 (accessed on 1 September 2022).

- Chung, Alexander Q.H., Pavel Andreev, Morad Benyoucef, Aidan Duane, and Philip O’Reilly. 2017. Managing an organisation’s social media presence: An empirical stages of growth model. International Journal of Information Management 37: 1405–17. [Google Scholar] [CrossRef]

- Correa, Teresa, Amber Willard Hinsley, and Homero Gil de Zuñiga. 2010. Who interacts on the Web?: The intersection of users’ personality and social media use. Computers in Human Behavior 26: 247–53. [Google Scholar] [CrossRef]

- Costa, Paul T., Jr., and Robert R. McCrae. 1992. Revised NEO Personality Inventory (NEO-PI-R) and NEO Five-Factor Inventory (NEO-FFI) Professional Manual. Odessa: Psychological Assessment Resources. [Google Scholar]

- Culnan, Mary J., and Pamela K. Armstrong. 1999. Information Privacy Concerns, Procedural Fairness, and Impersonal Trust: An Empirical Investigation. Organization Science 10: 104–15. [Google Scholar] [CrossRef]

- Davis, Jenny L., and Nathan Jurgenson. 2014. Context collapse: Theorizing context collusions and collisions. Information, Communication & Society 17: 476–85. [Google Scholar] [CrossRef]

- de Zuñiga, Homero Gil, Trevor Diehl, Brigitte Huber, and James Liu. 2017. Personality Traits and Social Media Use in 20 Countries: How Personality Relates to Frequency of Social Media Use, Social Media News Use, and Social Media Use for Social Interaction. Cyberpsychology, Behavior, and Social Networking 20: 540–52. [Google Scholar] [CrossRef] [PubMed]

- Dweyer, Catherine, Starr Roxanne Hill, and Katia Passerini. 2007. Trust and Privacy Concerns Within Social Networking Sites: A Comparison of Facebook and MySpace. Paper presented at the 13th Americas Conference on Information Systems (AMCIS) 2007, Keystone, CO, USA, August 10–12. [Google Scholar]

- Fernandes, Teresa, and Nuno Pereira. 2021. Revisiting the privacy calculus: Why are consumers (really) willing to disclose personal data online? Telematics and Informatics 65: 101717. [Google Scholar] [CrossRef]

- Goffman, Erving. 1959. The Presentation of Self in Everyday Life. London: Penguin Books. [Google Scholar]

- Golder, Lukas, Claude Longchamp, Cindy Beer, Martina Imfeld, Stephan Tschöpe, Meike Müller, Philippe Rochat, Carole Gauch, Cloé Jans, and Johanna Schwab. 2014. Credit Suisse Youth Barometer Switzerland. Berne: gfs.bern. Available online: https://www.credit-suisse.com/about-us/en/reports-research/studies-publications/youth-barometer/download-center.html (accessed on 1 September 2022).

- Guerrero-Solé, Frederic, Sara Suárez-Gonzalo, Cristòfol Rovira, and Lluís Codina. 2020. Social media, context collapse and the future of data-driven populism. Profesional de la Información 29: e290506. [Google Scholar] [CrossRef]

- Hughes, David John, Moss Rowe, Mark Batey, and Andrew Lee. 2012. A tale of two sites: Twitter vs. Facebook and the personality predictors of social media usage. Computers in Human Behavior 28: 561–69. [Google Scholar] [CrossRef]

- Kehr, Flavius, Daniel Wentzel, and Peter Mayer. 2013. Rethinking the Privacy Calculus: On the Role of Dispositional Factors and Affect. Paper presented at the 34th International Conference on Information Systems, Milan, Italy, December 15–18. [Google Scholar]

- Kehr, Flavius, Tobias Kowatsch, Daniel Wentzel, and Elgar Fleisch. 2015. Blissfully ignorant: The effects of general institutional trust, and affect in the privacy calculus. Information Systems Journal 25: 607–35. [Google Scholar] [CrossRef]

- Kern, Jana, Benjamin Fabian, and Tatiana Ermakova. 2018. Experimental Privacy Studies—An Initial Review of the Literature. Working Paper. Berlin: Humboldt University of Berlin. [Google Scholar]

- Kokolakis, Spyros. 2017. Privacy attitudes and privacy behaviour: A review of current research on the privacy paradox phenomenon. Computers & Security 64: 122–34. [Google Scholar] [CrossRef]

- Kotalakidis, Nikos, Henrik Naujoks, and Florian Mueller. 2016. Digitalisierung der Versicherungswirtschaft: Die 18-Milliarden-Chance. Munich and Zurich: Bain & Company. [Google Scholar]

- Latzer, Michael, Moritz Büchi, and Noemi Festic. 2020. Internet Use in Switzerland 20112019: Trends, Attitudes and Effects. Summary Report from the World Internet Project–Switzerland. Zurich: University of Zurich. Available online: http://mediachange.ch/research/wip-ch-2019 (accessed on 1 September 2022).

- Liu, Sha. 2023. Do investors and managers of active ETFs react to social media activities? Finance Research Letters 51: 103454. [Google Scholar] [CrossRef]

- Metzger, Miriam J. 2004. Privacy, Trust, and Disclosure: Exploring Barriers to Electronic Commerce. Journal of Computer-Mediated Communication 9: JCMC942. [Google Scholar] [CrossRef]

- Meyrowitz, Joshua. 1985. No Sense of Place: The Impact of Electronic Media on Social Behavior. Oxford: Oxford University Press. [Google Scholar]

- Perrin, Andrew. 2015. Social Media Usage 2005–2015. Washington: Pew Research Center. Available online: http://www.pewinternet.org/2015/10/08/2015/Social-Networking-Usage-2005-2015/ (accessed on 30 August 2022).

- Pugnetti, Carlo, and Mischa Seitz. 2021. Data-Driven Services in Insurance. Potential Evolution and Impact in the Swiss Market. Journal of Risk and Financial Management 14: 227. [Google Scholar] [CrossRef]

- Pugnetti, Carlo, and Sandra Elmer. 2020. Self-Assessment of Driving Style and the Willingness to Share Personal Information. Journal of Risk and Financial Management 13: 53. [Google Scholar] [CrossRef]

- Pugnetti, Carlo, Pedro Henriques, and Ulrich Moser. 2022. Goal Setting, Personality Traits, and the Role of Insurers and Other Service Providers for Swiss Millennials and Generation Z. Journal of Risk and Financial Management 15: 185. [Google Scholar] [CrossRef]

- Rammstedt, Beatrice, Christoph J. Kemper, Mira Céline Klein, Constanze Beierlein, and Anastassiya Kovaleva. 2013. Eine kurze Skala zur Messung der fünf Dimensionen der Persönlichkeit: Big Five Inventory 10 (BFI 10). Genesis Working Paper 2012-13. Mannheim: Leibnitz Institut für Sozialwissenschaften. [Google Scholar]

- Ross, Craig, Emily S. Orr, Mia Sisic, Jaime M. Arseneault, Mary G. Simmering, and R. Robert Orr. 2009. Personality and motivations associated with Facebook use. Computers in Human Behavior 25: 578–86. [Google Scholar] [CrossRef]

- Rothschild, Michael, and Joseph Stiglitz. 1976. Equilibrium in Competitive Insurance Markets: An Essay on the Economics of Imperfect Information. Quarterly Journal of Economics 90: 629–49. [Google Scholar] [CrossRef]

- Ryan, Tracii, and Sophia Xenos. 2011. Who uses Facebook? An investigation into the relationship between the Big Five, shyness, narcissism, loneliness, and Facebook usage. Computers in Human Behavior 27: 1658–64. [Google Scholar] [CrossRef]

- Shen, Dehua, Andrew Urquhart, and Pengfei Wang. 2019. Does Twitter predict Bitcoin? Economic Letters 174: 118–22. [Google Scholar] [CrossRef]

- Simpson, Thomas W. 2012. What Is Trust? Pacific Philosophical Quarterly 93: 550–69. [Google Scholar] [CrossRef]

- Smith, H. Jeff, Tamara Dinev, and Heng Xu. 2011. Information Privacy Research: An Interdisciplinary Review. MIS Quarterly 35: 989–1015. [Google Scholar] [CrossRef]

- Stone, Eugene F., and Dianna L. Stone. 1990. Privacy in Organizations: Theoretical Issues, Research Findings, and Protection Mechanisms. Research in Personnel and Human Resources Management 8: 349–411. [Google Scholar]

- Tajudeen, Farzana Parveen, Noor Ismawati Jaafar, and Sulaiman Ainin. 2018. Understanding the usage of social media among organizations. Information & Management 55: 308–21. [Google Scholar] [CrossRef]

- Wu, Chunying, Xiong Xiong, Ya Gao, and Jin Zhang. 2022. Does social media distort price discovery? Evidence from rumor clarifications. Research in International Business and Finance 62: 101749. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).