Conciseness, Financial Disclosure, and Market Reaction: A Textual Analysis of Annual Reports in Listed Chinese Companies

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

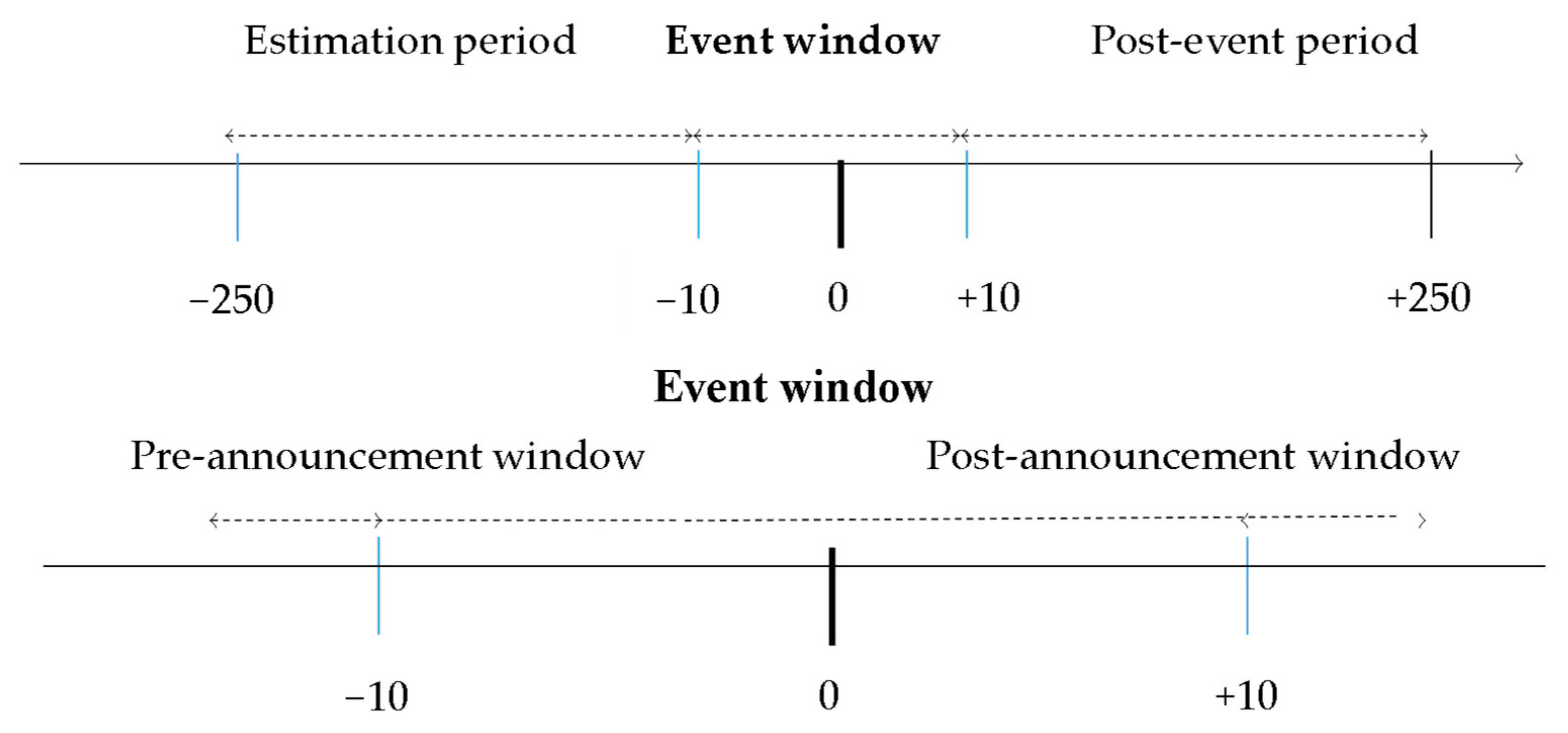

3. Research Methodology

3.1. Sample Selection and Data Sources

3.2. Variables

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Control Variable

3.3. Empirical Models

+ β5ROEit + β6BIG4it + β7lossit + β8NIDit + β9SIZEit

+ β10Growthit + β11BTMit + β12Volatilityit

+ Industry fixed effects + Year fixed effects + εit,

+ β5ROEit + β6BIG4it + β7lossit + β8NIDit + β9SIZEit

+ β10Growthit + β11BTMit + β12Volatilityit

+ Industry fixed effects + Year fixed effects +εit,

+ β5SUPRit + β6ROEit + β7BIG4it + β8lossit + β9NIDit + β10SIZEit

+ β11Growthit + β12BTMit + β13Volatilityit

+ Industry fixed effects + Year fixed effects + εit,

4. Empirical Results and Discussion

4.1. Descriptive Statistics

4.2. The Effect of Readability on Cumulative Abnormal Returns (Testing H1a)

4.3. The Effect of Length and Fog Index on Future Stock Returns (Testing H1b)

4.4. Effect of Length and Fog Index on Trading Volume (Testing H2a and H2b)

4.5. Robustness: Two-Stage Least Squares (2SLS) Regression Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | The listed annual reports of companises came from the following website: http://www.cninfo.com.cn/ (accessed on 12 April 2022). |

References

- Alduais, Fahd. 2022. Textual Analysis of the Annual Report and Corporate Performance: Evidence from China. Journal of Financial Reporting and Accounting. ahead-of-print. [Google Scholar] [CrossRef]

- Allini, Alessandra, Luca Ferri, Marco Maffei, and Annamaria Zampella. 2017. From Accountability to Readability in the Public Sector: Evidence from Italian Universities. International Journal of Business and Management 12: 27. [Google Scholar] [CrossRef]

- Alm El-Din, Mai Mohammed, Atef Mohammed El-Awam, Farid Moharram Ibrahim, and Ahmed Hassanein. 2022. Voluntary Disclosure and Complexity of Reporting in Egypt: The Roles of Profitability and Earnings Management. Journal of Applied Accounting Research 23: 480–508. [Google Scholar] [CrossRef]

- Al-Shaer, Habiba, Khaldoon Albitar, and Khaled Hussainey. 2022. Creating Sustainability Reports That Matter: An Investigation of Factors behind the Narratives. Journal of Applied Accounting Research 23: 738–63. [Google Scholar] [CrossRef]

- Anh-Tuan, Le, Nguyen Thi Huyen-Tram, Nguyen Xuan-Hung, and Nguyen Vuong Thanh-Long. 2022. Disclosure of Environmental Accounting Information at Business Enterprises in the Hotel Sector: Case Study in Vietnam. GeoJournal of Tourism and Geosites 42: 700. [Google Scholar] [CrossRef]

- Asay, H. Scott, Robert Libby, and Kristina Rennekamp. 2018. Firm Performance, Reporting Goals, and Language Choices in Narrative Disclosures. Journal of Accounting and Economics 65: 380–98. [Google Scholar] [CrossRef]

- Ball, Ray, and Philip Brown. 1968. An Empirical Evaluation of Accounting Income Numbers. Journal of Accounting Research 6: 159. [Google Scholar] [CrossRef]

- Biddle, Gary C., Gilles Hilary, and Rodrigo S. Verdi. 2009. How Does Financial Reporting Quality Relate to Investment Efficiency? Journal of Accounting and Economics 48: 112–31. [Google Scholar] [CrossRef]

- Bloomfield, Robert J. 2002. The ‘Incomplete Revelation Hypothesis’ and Financial Reporting. Accounting Horizons 16: 233–43. [Google Scholar] [CrossRef]

- Bloomfield, Robert J. 2008. Discussion of ‘Annual Report Readability, Current Earnings, and Earnings Persistence’. Journal of Accounting and Economics 45: 248–52. [Google Scholar] [CrossRef]

- Bonsall, Samuel B., and Brian P. Miller. 2017. The Impact of Narrative Disclosure Readability on Bond Ratings and the Cost of Debt. Review of Accounting Studies 22: 608–43. [Google Scholar] [CrossRef]

- Bonsall, Samuel B., Andrew J. Leone, Brian P. Miller, and Kristina Rennekamp. 2017. A Plain English Measure of Financial Reporting Readability. Journal of Accounting and Economics 63: 329–57. [Google Scholar] [CrossRef]

- Botosan, Christine A. 1997. Disclosure Level and the Cost of Equity Capital. The Accounting Review 72: 323–49. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Dimitrios Gounopoulos, and Hatem Rjiba. 2019. Annual Report Readability and Stock Liquidity. Financial Markets, Institutions and Instruments 28: 159–86. [Google Scholar] [CrossRef]

- Brennan, Niamh M., Encarna Guillamon-Saorin, and Aileen Pierce. 2009. Impression Management: Developing and Illustrating a Scheme of Analysis for Narrative Disclosures—A Methodological Note. Accounting, Auditing and Accountability Journal 22: 789–832. [Google Scholar] [CrossRef]

- Brochet, François, Patricia Naranjo, and Gwen Yu. 2016. The Capital Market Consequences of Language Barriers in the Conference Calls of Non-U.S. Firms. The Accounting Review 91: 1023–49. [Google Scholar] [CrossRef]

- Cazier, Richard A., and Ray J. Pfeiffer. 2016. Why Are 10-K Filings So Long? Accounting Horizons 30: 1–21. [Google Scholar] [CrossRef]

- Chakraborty, Bijitaswa, and Titas Bhattacharjee. 2020. A Review on Textual Analysis of Corporate Disclosure According to the Evolution of Different Automated Methods. Journal of Financial Reporting and Accounting 18: 757–77. [Google Scholar] [CrossRef]

- Cheung, Esther Wai Yin. 2014. Readability of Financial Reports and IFRS Adoption in Australia. Ph.D. thesis, Macquarie University, Sydney, Australia. Available online: http://hdl.handle.net/1959.14/1059107 (accessed on 15 May 2022).

- Clarkson, Peter M., Jordan Ponn, Gordon D. Richardson, Frank Rudzicz, Albert Tsang, and Jingjing Wang. 2020. A Textual Analysis of US Corporate Social Responsibility Reports. Abacus 56: 3–34. [Google Scholar] [CrossRef]

- Clatworthy, Mark, and Michael John Jones. 2001. The Effect of Thematic Structure on the Variability of Annual Report Readability. Accounting, Auditing & Accountability Journal 14: 311–26. [Google Scholar] [CrossRef]

- Collins, Daniel W., and S. P. Kothari. 1989. An Analysis of Intertemporal and Cross-Sectional Determinants of Earnings Response Coefficients. Journal of Accounting and Economics 11: 143–81. Available online: http://www.sciencedirect.com/science/article/pii/0165410189900049 (accessed on 15 May 2022). [CrossRef]

- Collins, Daniel W., Sagar P. Kothari, Jay Shanken, and Richard G. Sloan. 1994. Lack of Timeliness and Noise as Explanations for the Low Contemporaneuos Return-Earnings Association. Journal of Accounting and Economics 18: 289–324. [Google Scholar] [CrossRef]

- Cotra, Marko, and Fredrik Jacobson. 2014. The Effects of Annual Report Readability on Subsequent Stock Price Volatility. Bachelor thesis, Gothenburg University, Gothenburg, Sweden. [Google Scholar]

- Courtis, John K. 2004. Corporate Report Obfuscation: Artefact or Phenomenon? British Accounting Review 36: 291–312. [Google Scholar] [CrossRef]

- Courtis, John K., and Salleh Hassan. 2002. Reading Ease of Bilingual Annual Reports. Journal of Business Communication 39: 394–413. [Google Scholar] [CrossRef]

- Cui, Xiao. 2016. Calisthenics with Words: The Effect of Readability and Investor Sophistication on Investors’ Performance Judgment. International Journal of Financial Studies 4: 1. [Google Scholar] [CrossRef]

- Dalwai, Tamanna, Gopalakrishnan Chinnasamy, and Syeeda Shafiya Mohammadi. 2021. Annual Report Readability, Agency Costs, Firm Performance: An Investigation of Oman’s Financial Sector. Journal of Accounting in Emerging Economies 11: 247–77. [Google Scholar] [CrossRef]

- Davis, Angela K., and Isho Tama-Sweet. 2012. Managers’ Use of Language Across Alternative Disclosure Outlets: Earnings Press Releases versus MD&A. Contemporary Accounting Research 29: 804–37. [Google Scholar] [CrossRef]

- De Franco, Gus, Ole-Kristian Hope, Dushyantkumar Vyas, and Yibin Zhou. 2015. Analyst Report Readability. Contemporary Accounting Research 32: 76–104. [Google Scholar] [CrossRef]

- de Souza, João Antônio Salvador, Jean Carlo Rissatti, Suliani Rover, and José Alonso Borba. 2019. The Linguistic Complexities of Narrative Accounting Disclosure on Financial Statements: An Analysis Based on Readability Characteristics. Research in International Business and Finance 48: 59–74. [Google Scholar] [CrossRef]

- Dey, R. Mithu, and Lucy Lim. 2015. Accrual Reliability, Earnings Persistence, and Stock Prices: Revisited. American Journal of Business 30: 22–48. [Google Scholar] [CrossRef]

- du Toit, Elda. 2017. The Readability of Integrated Reports. Meditari Accountancy Research 25: 629–53. [Google Scholar] [CrossRef]

- Dyer, Travis, Mark Lang, and Lorien Stice-Lawrence. 2016. Do Managers Really Guide through the Fog? On the Challenges in Assessing the Causes of Voluntary Disclosure. Journal of Accounting and Economics 62: 270–76. [Google Scholar] [CrossRef]

- Ertugrul, Mine, Jin Lei, Jiaping Qiu, and Chi Wan. 2017. Annual Report Readability, Tone Ambiguity, and the Cost of Borrowing. Journal of Financial and Quantitative Analysis 52: 811–36. [Google Scholar] [CrossRef]

- Ezat, Amr Nazieh. 2019. The Impact of Earnings Quality on the Association between Readability and Cost of Capital: Evidence from Egypt. Journal of Accounting in Emerging Economies 9: 366–85. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1998. Market Efficiency, Long-Term Returns, and Behavioral Finance. Journal of Financial Economics 49: 283–306. [Google Scholar] [CrossRef]

- Fama, Eugene F., Lawrence Fisher, Michael Jensen, and Richard Roll. 1969. The Adjustment of Stock Prices to New Information. International Economic Review 10: 1–21. [Google Scholar] [CrossRef]

- Francis, Jennifer, Ryan Lafond, and Katherine Schipper. 2002. The Market Pricing of Earnings Quality. Journal of Accounting and Economics 39: 295–327. [Google Scholar] [CrossRef]

- Goel, Sunita, and Jagdish Gangolly. 2012. Beyond the Numbers: Mining the Annual Reports for Hidden Cues Indicative of Financial Statement Fraud. Intelligent Systems in Accounting, Finance and Management 19: 75–89. [Google Scholar] [CrossRef]

- Goel, Sunita, Jagdish Gangolly, Sue R. Faerman, and Ozlem Uzuner. 2010. Can Linguistic Predictors Detect Fraudulent Financial Filings? Journal of Emerging Technologies in Accounting 7: 25–46. [Google Scholar] [CrossRef]

- Gong, Minggen, Yifei Lu, and Jing Yao. 2016. Annual Report Opacity and Stock Returns: Evidence from China. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Gonidakis, Fragiskos K., Andreas G. Koutoupis, Anastasios D. Tsamis, and Maria Eleni K. Agoraki. 2020. Risk Disclosure in Listed Greek Companies: The Effects of the Financial Crisis. Accounting Research Journal 33: 615–33. [Google Scholar] [CrossRef]

- Grossman, Sanford J., and Joseph E. Stiglitz. 1980. On the Impossibility of Informationally Efficient Markets. The American Economic Review 70: 393–408. Available online: http://www.jstor.org/stable/1805228 (accessed on 15 May 2022).

- Gul, Ferdinand A., Jeong-Bon Kim, and Annie A. Qiu. 2010. Ownership Concentration, Foreign Shareholding, Audit Quality, and Stock Price Synchronicity: Evidence from China. Journal of Financial Economics 95: 425–42. Available online: https://www.sciencedirect.com/science/article/pii/S0304405X09002359 (accessed on 15 May 2022). [CrossRef]

- Gunning, Robert. 1952. The Technique of Clear Writing. New York: McGraw-Hill. [Google Scholar]

- Hassan, Mostafa Kamal, Bassam Abu Abbas, and Samy Nathan Garas. 2019. Readability, Governance and Performance: A Test of the Obfuscation Hypothesis in Qatari Listed Firms. Corporate Governance (Bingley) 19: 270–98. [Google Scholar] [CrossRef]

- Hesarzadeh, Reza, Ameneh Bazrafshan, and Javad Rajabalizadeh. 2020. Financial Reporting Readability: Managerial Choices versus Firm Fundamentals. Spanish Journal of Finance and Accounting/Revista Española de Financiación y Contabilidad 49: 452–82. [Google Scholar] [CrossRef]

- Hirshleifer, David, and Siew Hong Teoh. 2003. Limited Attention, Information Disclosure, and Financial Reporting. Journal of Accounting and Economics 36: 337–86. [Google Scholar] [CrossRef]

- Hooghiemstra, Reggy, Yu Flora Kuang, and Bo Qin. 2017. Does Obfuscating Excessive CEO Pay Work? The Influence of Remuneration Report Readability on Say-on-Pay Votes. Accounting and Business Research 47: 695–729. [Google Scholar] [CrossRef]

- Hrasky, Sue, Clare Mason, and Debbie Wills. 2009. The Textual Complexity of Annual Report Narratives: A Comparison of High- and Low-Performance Companies. New Zealand Journal of Applied Business Research 7: 31–45. [Google Scholar]

- Hsieh, Chia Chun, Kai Wai Hui, and Yao Zhang. 2016. Analyst Report Readability and Stock Returns. Journal of Business Finance and Accounting 43: 98–130. [Google Scholar] [CrossRef]

- Humpherys, Sean L., Kevin C. Moffitt, Mary B. Burns, Judee K. Burgoon, and William F. Felix. 2011. Identification of Fraudulent Financial Statements Using Linguistic Credibility Analysis. Decision Support Systems 50: 585–94. [Google Scholar] [CrossRef]

- Hwang, Byoung Hyoun, and Hugh Hoikwang Kim. 2017. It Pays to Write Well. Journal of Financial Economics 124: 373–94. [Google Scholar] [CrossRef]

- Jiang, Haiyan, Ahsan Habib, and Baiding Hu. 2011. Ownership Concentration, Voluntary Disclosures and Information Asymmetry in New Zealand. British Accounting Review 43: 39–53. [Google Scholar] [CrossRef]

- Jones, Michael John, and Paul A. Shoemaker. 1994. Accounting Narratives: A Review of Empirical Studies of Content and Readability. Journal of Accounting Literature 13: 142. Available online: https://search.proquest.com/openview/e6a9b341cb35264bfa683df5eb62f131/1?pq-origsite=gscholar&cbl=31366 (accessed on 15 May 2022).

- Kong, Dongmin, Lu Shi, and Fan Zhang. 2021. Explain or Conceal? Causal Language Intensity in Annual Report and Stock Price Crash Risk. Economic Modelling 94: 715–25. [Google Scholar] [CrossRef]

- Koonce, Lisa, Zheng Leitter, and Brian J. White. 2016. The Effect of a Cautionary Notice on Investorss Reactions to More and Less Readable Disclosures. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Kothari, Sabino P., Xu Li, and James E. Short. 2009. The Effect of Disclosures by Management, Analysts, and Business Press on Cost of Capital, Return Volatility, and Analyst Forecasts: A Study Using Content Analysis. Accounting Review 84: 1639–70. [Google Scholar] [CrossRef]

- Kristandl, Gerhard, and Nick Bontis. 2007. The Impact of Voluntary Disclosure on Cost of Equity Capital Estimates in a Temporal Setting. Journal of Intellectual Capital 8: 577–94. [Google Scholar] [CrossRef]

- Lang, Mark H., and Russell J. Lundholm. 1996. Corporate Disclosure Policy and Analyst Behavior. The Accounting Review 71: 467–92. [Google Scholar] [CrossRef]

- Lang, Mark. 2015. Textual Analysis and International Financial Reporting: Large Sample Evidence. Journal of Accounting and Economics 60: 110–35. [Google Scholar] [CrossRef]

- Larcker, David F., and Tjomme O. Rusticus. 2010. On the Use of Instrumental Variables in Accounting Research. Journal of Accounting and Economics 49: 186–205. Available online: https://www.sciencedirect.com/science/article/pii/S0165410109000718 (accessed on 15 May 2022). [CrossRef]

- Lawrence, Alastair. 2013. Individual Investors and Financial Disclosure. Journal of Accounting and Economics 56: 130–47. [Google Scholar] [CrossRef]

- Lee, Yen Jung. 2012. The Effect of Quarterly Report Readability on Information Efficiency of Stock Priceś. Contemporary Accounting Research 29: 1137–70. [Google Scholar] [CrossRef]

- Lehavy, Reuven, Feng Li, and Kenneth Merkley. 2011. The Effect of Annual Report Readability on Analyst Following and the Properties of Their Earnings Forecasts. Accounting Review 86: 1087–115. [Google Scholar] [CrossRef]

- Lennox, Clive S., and Chul W. Park. 2006. The Informativeness of Earnings and Management’s Issuance of Earnings Forecasts. Journal of Accounting and Economics 42: 439–58. [Google Scholar] [CrossRef]

- Levin, Irwin P., Sandra L. Schneider, and Gary J. Gaeth. 1998. All Frames Are Not Created Equal: A Typology and Critical Analysis of Framing Effects. Organizational Behavior and Human Decision Processes 76: 149–88. [Google Scholar] [CrossRef] [PubMed]

- Li, Edward Xuejun, and K. Ramesh. 2009. Market Reaction Surrounding the Filing of Periodic SEC Reports. The Accounting Review 84: 1171–208. [Google Scholar] [CrossRef]

- Li, Feng. 2006. Annual Report Readability, Earnings, and Stock Returns. Working Paper, No. 1028. Ann Arbor, MI, USA: Stephen M. Ross School of Business. [Google Scholar]

- Li, Feng. 2008. Annual Report Readability, Current Earnings, and Earnings Persistence. Journal of Accounting and Economics 45: 221–47. [Google Scholar] [CrossRef]

- Li, Feng. 2010. Textual Analysis of Corporate Disclosures: A Survey of the Literature. Journal of Accounting Literature 29: 143–65. Available online: http://search.proquest.com/docview/1356647367?pq-origsite=gscholar (accessed on 15 May 2022).

- Li, Shaomin, Seung Ho Park, and Rosey Shuji Bao. 2014. How Much Can We Trust the Financial Report?Earnings Management in Emerging Economies. International Journal of Emerging Markets 9: 33–53. [Google Scholar] [CrossRef]

- Li, Yinghua, and Liandong Zhang. 2015. Short Selling Pressure, Stock Price Behavior, and Management Forecast Precision: Evidence from a Natural Experiment. Journal of Accounting Research 53: 79–117. [Google Scholar] [CrossRef]

- Li, Zhongtian, Jing Jia, and Larelle J. Chapple. 2022. Textual Characteristics of Corporate Sustainability Disclosure and Corporate Sustainability Performance: Evidence from Australia. Meditari Accountancy Research. [Google Scholar] [CrossRef]

- Liu, Ming, and Zhefeng Liu. 2021. Does Annual Report Readability Explain the Accrual Anomaly? Asian Review of Accounting 29: 307–31. [Google Scholar] [CrossRef]

- Lo, Kin, Felipe Ramos, and Rafael Rogo. 2017. Earnings Management and Annual Report Readability. Journal of Accounting and Economics 63: 1–25. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill McDonald. 2009. Plain English, Readability, and 10-K Filings. Unpublished Working Paper-Notre Dame. Available online: https://www.researchgate.net/publication/228458241_Plain_English_Readability_and_10-K_Filings (accessed on 15 May 2022).

- Loughran, Tim, and Bill McDonald. 2011. When Is a Liability Not a Liability? Textual Analysis, Dictionaries, and 10-Ks. Journal of Finance 66: 35–65. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill McDonald. 2014a. Measuring Readability in Financial Disclosures. Journal of Finance 69: 1643–71. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill McDonald. 2014b. Regulatioin and Financial Disclosure: The Impact of Plain English. Journal of Regulatory Economics 45: 94–113. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill McDonald. 2016. Textual Analysis in Accounting and Finance: A Survey. Journal of Accounting Research 54: 1187–1230. [Google Scholar] [CrossRef]

- Lundholm, Russell J., Rafael Rogo, and Jenny Li Zhang. 2014. Restoring the Tower of Babel: How Foreign Firms Communicate with U.S. Investors. Accounting Review 89: 1453–85. [Google Scholar] [CrossRef]

- Luo, Jin hui, Xue Li, and Huayang Chen. 2018. Annual Report Readability and Corporate Agency Costs. China Journal of Accounting Research 11: 187–212. [Google Scholar] [CrossRef]

- Merkley, Ken, Holly Skaife, Tyler Thomas, and Jim Wahlen. 2015. The Structure of Voluntary Disclosure Narratives: Evidence from Conference Calls Kristian D. Allee. Journal of Accounting Research 53: 241–47. [Google Scholar]

- Miller, Brian P. 2010. The Effects of Reporting Complexity on Small and Large Investor Trading. The Accounting Review 85: 2107–43. [Google Scholar] [CrossRef]

- Miller, Brian Paul. 2008. Data Overload and Investor Trading. The Pennsylvania State University. Available online: https://etda.libraries.psu.edu/catalog/9196 (accessed on 15 May 2022).

- Moreno, Alonso, and Michael John Jones. 2021. Impression Management in Corporate Annual Reports during the Global Financial Crisis. European Management Journal 40: 503–17. [Google Scholar] [CrossRef]

- Pashalian, Siroon, and William J. E. Crissy. 1950. How Readable Are Corporate Annual Reports? Journal of Applied Psychology 34: 244–48. [Google Scholar] [CrossRef] [PubMed]

- Purda, Lynnette, and David Skillicorn. 2015. Accounting Variables, Deception, and a Bag of Words: Assessing the Tools of Fraud Detection. Contemporary Accounting Research 32: 1193–223. [Google Scholar] [CrossRef]

- Rennekamp, Kristina. 2012. Processing Fluency and Investors’ Reactions to Disclosure Readability. Journal of Accounting Research 50: 1319–54. [Google Scholar] [CrossRef]

- Riley, Tracey J., Gün R. Semin, and Alex C. Yen. 2014. Patterns of Language Use in Accounting Narratives and Their Impact on Investment-Related Judgments and Decisions. Behavioral Research in Accounting 26: 59–84. [Google Scholar] [CrossRef]

- Rjiba, Hatem, Samir Saadi, Sabri Boubaker, and Xiaoya (Sara) Ding. 2021. Annual Report Readability and the Cost of Equity Capital. Journal of Corporate Finance 67: 101902. [Google Scholar] [CrossRef]

- Rutherford, Brian A. 2003. Obfuscation, Textual Complexity and the Role of Regulated Narrative Accounting Disclosure in Corporate Governance. Journal of Management and Governance 7: 187–210. [Google Scholar] [CrossRef]

- Rutherford, Brian A. 2018. Narrating the Narrative Turn in Narrative Accounting Research: Scholarly Knowledge Development or Flat Science? Meditari Accountancy Research 26: 13–43. [Google Scholar] [CrossRef]

- Shanthikumar, Devin M. 2003. Small Trader Reactions to Consecutive Earnings Surprises. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Smaili, Nadia, Anne Marie Gosselin, and Julien Le Maux. 2022. Corporate Financial Disclosures and the Importance of Readability. Journal of Business Strategy. ahead-of-print. [Google Scholar] [CrossRef]

- Soepriyanto, Gatot, Sienny Tjokroaminoto, and Arfian Erma Zudana. 2021. Annual Report Readability and Accounting Irregularities: Evidence from Public Listed Companies in Indonesia. Journal of Financial Reporting and Accounting 19: 793–818. [Google Scholar] [CrossRef]

- StataCorp. 2013. Stata Statistical Software: Release 13. Available online: https://www.stata.com/support/faqs/resources/citing-software-documentation-faqs/ (accessed on 15 May 2022).

- Subramanian, Ram, Robert G. Insley, and Rodney D. Blackwell. 1993. Performance and Readability: A Comparison of Annual Reports of Profitable and Unprofitable Corporations. Journal of Business Communication 30: 49–61. [Google Scholar] [CrossRef]

- Sun, Yanqi, Jenny Jing Wang, and Kevin Tairan Huang. 2022. Does IFRS and GRI Adoption Impact the Understandability of Corporate Reports by Chinese Listed Companies? Accounting and Finance 62: 2879–904. [Google Scholar] [CrossRef]

- Tan, Hun Tong, Elaine Ying Wang, and Bo Zhou. 2014. When the Use of Positive Language Backfires: The Joint Effect of Tone, Readability, and Investor Sophistication on Earnings Judgments. Journal of Accounting Research 52: 273–302. [Google Scholar] [CrossRef]

- Tan, Hun Tong, Elaine Ying Wang, and Bo Zhou. 2015. How Does Readability Influence Investors’ Judgments? Consistency of Benchmark Performance Matters. Accounting Review 90: 371–93. [Google Scholar] [CrossRef]

- Xu, Wei, Zhenye Yao, and Donghua Chen. 2019. Chinese Annual Report Readability: Measurement and Test. China Journal of Accounting Studies 7: 407–37. [Google Scholar] [CrossRef]

- You, Haifeng, and Xiao-Jun Zhang. 2009. Financial Reporting Complexity and Investor Underreaction to 10-K Information. Review of Accounting Studies 14: 559–86. [Google Scholar] [CrossRef]

- Zeng, S. X., X. D. Xu, H. T. Yin, and C. M. Tam. 2012. Factors That Drive Chinese Listed Companies in Voluntary Disclosure of Environmental Information. Journal of Business Ethics 109: 309–21. [Google Scholar] [CrossRef]

- Zeng, S. X., X. D. Xu, Z. Y. Dong, and Vivian W. Y. Tam. 2010. Towards Corporate Environmental Information Disclosure: An Empirical Study in China. Journal of Cleaner Production 18: 1142–48. [Google Scholar] [CrossRef]

- Zheng, Jiajia, and Pengfei Sheng. 2017. The Impact of Foreign Direct Investment (FDI) on the Environment: Market Perspectives and Evidence from China. Economies 5: 8. [Google Scholar] [CrossRef]

| Variable | N | Mean | SD | p50 | p25 | p75 | Min | Max |

|---|---|---|---|---|---|---|---|---|

| CAR[−10,+10] | 268 | 0.00631 | 0.192 | 0.00161 | −0.0653 | 0.0807 | −1.012 | 0.839 |

| CAATV[−5,+5] | 107 | −0.00211 | 0.0673 | 0.00487 | −0.0238 | 0.0336 | −0.451 | 0.140 |

| FI | 268 | 14.30 | 1.999 | 13.73 | 12.72 | 15.90 | 10.96 | 19.03 |

| Length | 268 | 10.64 | 0.544 | 10.74 | 10.18 | 11.05 | 8.645 | 11.69 |

| ROE | 268 | 0.0987 | 0.0981 | 0.0743 | 0.0369 | 0.128 | −0.0392 | 0.730 |

| Return | 268 | 0.298 | 0.828 | 0.120 | −0.229 | 0.575 | −0.764 | 6.098 |

| BIG4 | 268 | 0.317 | 0.466 | 0 | 0 | 1 | 0 | 1 |

| Loss | 268 | 0.784 | 0.413 | 1 | 1 | 1 | 0 | 1 |

| NID | 268 | 3.410 | 0.850 | 3 | 3 | 3.500 | 2 | 6 |

| Size | 268 | 21.84 | 1.349 | 21.69 | 21.00 | 22.74 | 16.86 | 25.82 |

| Growth | 268 | 19.23 | 2.738 | 19.24 | 17.69 | 21.27 | 11.18 | 23.77 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Length | 1.000 | ||||||||||

| FI | −0.415 ** | 1.000 | |||||||||

| ROE | 0.106 * | 0.113 * | 1.000 | ||||||||

| Return | 0.078 | −0.061 | 0.152 ** | 1.000 | |||||||

| CAR | 0.569 ** | −0.283 ** | 0.052 | 0.238 ** | 1.000 | ||||||

| CAATV | 0.493 ** | −0.046 | 0.461 ** | 0.298 ** | 0.606 ** | 1.000 | |||||

| BIG4 | −0.649 ** | 0.542 ** | −0.029 | −0.072 | −0.490 ** | −0.320 ** | 1.000 | ||||

| loss | 0.066 | 0.001 | 0.613 ** | 0.007 | 0.052 | 0.274 ** | 0.023 | 1.000 | |||

| NID | 0.196 ** | 0.107 * | 0.129 ** | 0.016 | 0.277 ** | 0.343 ** | 0.025 | 0.076 | 1.000 | ||

| Size | 0.463 ** | −0.007 | 0.346 ** | 0.020 | 0.572 ** | 0.787 ** | −0.176 ** | 0.315 ** | 0.474 ** | 1.000 | |

| Growth | 0.153 ** | −0.096 * | 0.288 ** | −0.015 | 0.238 ** | 0.400 ** | 0.002 | 0.313 ** | 0.247 ** | 0.627 ** | 1.000 |

| (1) | (2) | |

|---|---|---|

| Variables | CAR[−10,+10] | CAR[−10,+10] |

| FI | 0.112 | |

| (0.124) | ||

| FI × ROE | −0.979 ** | |

| (0.494) | ||

| Length | −0.339 | |

| (0.967) | ||

| Length × ROE | −1.061 * | |

| (0.566) | ||

| ROE | −1.06 × 10−5 | −6.38 × 10−5 |

| (0.000785) | (0.000783) | |

| BIG4 | 0.00549 | 0.00738 |

| (0.0298) | (0.0298) | |

| Loss | −0.0276 | −0.0270 |

| (0.0340) | (0.0341) | |

| NID | 0.451 ** | 0.330 ** |

| (0.207) | (0.167) | |

| Size | 0.0418 * | 0.0427 * |

| (0.0234) | (0.0234) | |

| Growth | −0.0166 | −0.0162 |

| (0.0156) | (0.0156) | |

| Constant | −2.206 | 3.271 |

| (1.951) | (10.80) | |

| Observations | 268 | 268 |

| R-squared | 0.046 | 0.044 |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variable | ∆Returnt+1 | ∆Returnt+2 | ∆Returnt+3 | ∆Returnt+1 | ∆Returnt+2 | ∆Returnt+3 |

| FI | 0.0234 | 0.0351 | 0.117 | |||

| (0.0374) | (0.0560) | (0.187) | ||||

| FI × ROE | −0.117 *** | −0.175 *** | −0.584 *** | |||

| (0.0447) | (0.0671) | (0.224) | ||||

| Length | 0.0259 | 0.0389 | 0.130 | |||

| (0.108) | (0.162) | (0.540) | ||||

| Length × ROE | −0.0228 * | −0.0342 * | −0.114 * | |||

| (0.0129) | (0.0193) | (0.0644) | ||||

| ROE | −0.930 *** | −1.395 *** | −4.652 *** | 0.729 * | 1.093 * | 3.643 * |

| (0.357) | (0.535) | (1.783) | (0.412) | (0.617) | (2.058) | |

| BIG4 | −0.00162 | −0.00243 | −0.00809 | 0.00330 | 0.00495 | 0.0165 |

| (0.0105) | (0.0158) | (0.0526) | (0.0114) | (0.0171) | (0.0572) | |

| Loss | −0.0117 | −0.0175 | −0.0583 | −0.0178 | −0.0267 | −0.0889 |

| (0.0121) | (0.0181) | (0.0603) | (0.0121) | (0.0182) | (0.0607) | |

| NID | 0.00593 | 0.00889 | 0.0296 | 0.00817 | 0.0123 | 0.0409 |

| (0.0136) | (0.0204) | (0.0681) | (0.0137) | (0.0206) | (0.0686) | |

| Size | 0.0178 ** | 0.0266 ** | 0.0888 ** | 0.0169 ** | 0.0253 ** | 0.0844 ** |

| (0.00698) | (0.0105) | (0.0349) | (0.00717) | (0.0107) | (0.0358) | |

| Growth | −0.00617 | −0.00925 | −0.0308 | −0.00554 | −0.00831 | −0.0277 |

| (0.00492) | (0.00739) | (0.0246) | (0.00500) | (0.00750) | (0.0250) | |

| Constant | −0.333 * | −0.499 * | −1.663 * | −0.335 | −0.503 | −1.676 |

| (0.177) | (0.265) | (0.884) | (0.286) | (0.429) | (1.429) | |

| Observations | 359 | 359 | 359 | 359 | 359 | 359 |

| R-squared | 0.070 | 0.177 | 0.089 | 0.438 | 0.103 | 0.085 |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| (1) | (2) | |

|---|---|---|

| Variable | CAATV[−5,+5] | CAATV[−5,+5] |

| FI | 0.236 * | |

| (0.128) | ||

| FI × SURP | −24.55 ** | |

| (10.46) | ||

| Length | 4.650 | |

| (14.09) | ||

| Length × SURP | −0.0208 *** | |

| (0.0080) | ||

| SUPR | 0.07105 | −0.02594 |

| (0.384) | (0.720) | |

| ROE | 0.00405 | −0.00776 |

| (0.184) | (0.202) | |

| BIG4 | 0.932 ** | 0.552 |

| (0.442) | (0.472) | |

| Loss | 1.263 * | 1.381 |

| (0.719) | (0.852) | |

| NID | −0.259 | −0.459 |

| (0.296) | (0.335) | |

| Size | 0.270 | 0.0965 |

| (0.175) | (0.181) | |

| Growth | 0.000959 | 0.000292 |

| (0.000598) | (0.000555) | |

| Constant | −10.36 | 40.39 |

| (7.519) | (135.7) | |

| Observations | 59 | 59 |

| R-squared | 0.255 | 0.146 |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| Variables | Shea Partial R2 | Partial R2 | Robust F (30,226) | Prob > F |

|---|---|---|---|---|

| FI_industry | 0.1071 | 0.3263 | 3.43 | 0.000 |

| FI_location | 0.3890 | 0.4015 | 4.17 | 0.000 |

| 1 | 2 | |

|---|---|---|

| First Stage (OLS) | Second Stage (2SLS) | |

| Variable | FI | CAR[−1,+1] |

| FI_industry | 0.343 *** | |

| (0.0573) | ||

| FI_location | 0.188 *** | |

| (0.0534) | ||

| FI_P | −0.00464 | |

| (0.0236) | ||

| FI × ROE_P | −0.219 * | |

| (0.116) | ||

| ROE | −0.0400 | 0.581 * |

| (0.0669) | (0.310) | |

| BIG4 | 1.877 *** | 0.0158 *** |

| (0.203) | (0.00497) | |

| Loss | 0.00373 | 0.00887 * |

| (0.222) | (0.00453) | |

| NID | −0.00424 | 0.0172 *** |

| (0.262) | (0.00535) | |

| Size | −0.0637 | −0.00270 |

| (0.166) | (0.00324) | |

| Growth | 0.0389 | 0.00356 * |

| (0.100) | (0.00205) | |

| Constant | 11.45 *** | −0.0975 |

| (3.876) | (0.0954) | |

| Observations | 267 | 269 |

| R-squared | 0.525 | 0.176 |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alduais, F.; Ali Almasria, N.; Samara, A.; Masadeh, A. Conciseness, Financial Disclosure, and Market Reaction: A Textual Analysis of Annual Reports in Listed Chinese Companies. Int. J. Financial Stud. 2022, 10, 104. https://doi.org/10.3390/ijfs10040104

Alduais F, Ali Almasria N, Samara A, Masadeh A. Conciseness, Financial Disclosure, and Market Reaction: A Textual Analysis of Annual Reports in Listed Chinese Companies. International Journal of Financial Studies. 2022; 10(4):104. https://doi.org/10.3390/ijfs10040104

Chicago/Turabian StyleAlduais, Fahd, Nashat Ali Almasria, Abeer Samara, and Ali Masadeh. 2022. "Conciseness, Financial Disclosure, and Market Reaction: A Textual Analysis of Annual Reports in Listed Chinese Companies" International Journal of Financial Studies 10, no. 4: 104. https://doi.org/10.3390/ijfs10040104

APA StyleAlduais, F., Ali Almasria, N., Samara, A., & Masadeh, A. (2022). Conciseness, Financial Disclosure, and Market Reaction: A Textual Analysis of Annual Reports in Listed Chinese Companies. International Journal of Financial Studies, 10(4), 104. https://doi.org/10.3390/ijfs10040104