The Influential Factors of Internal Audit Effectiveness: A Conceptual Model

Abstract

:1. Introduction

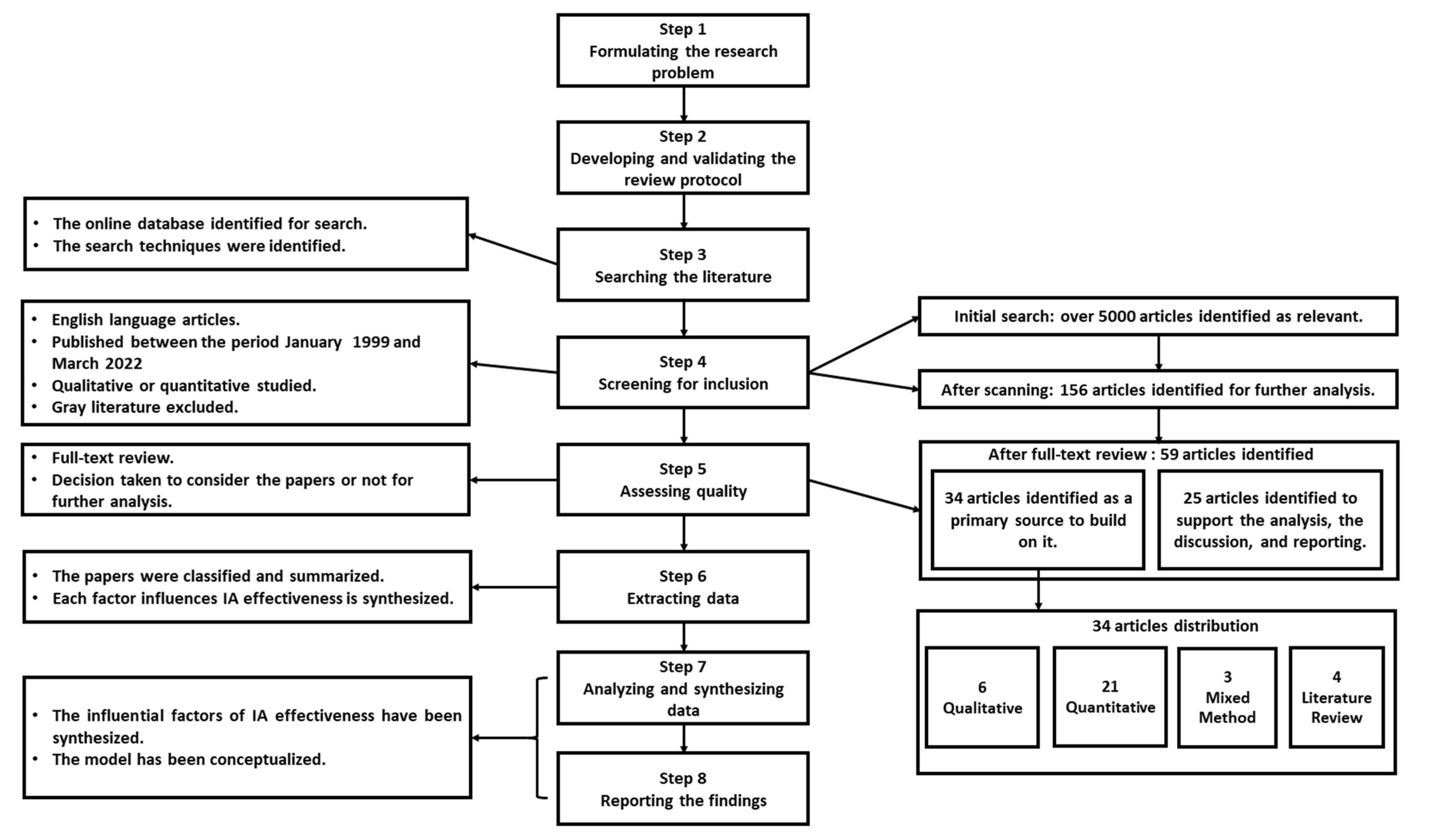

2. Internal Audit Effectiveness

3. Methodology

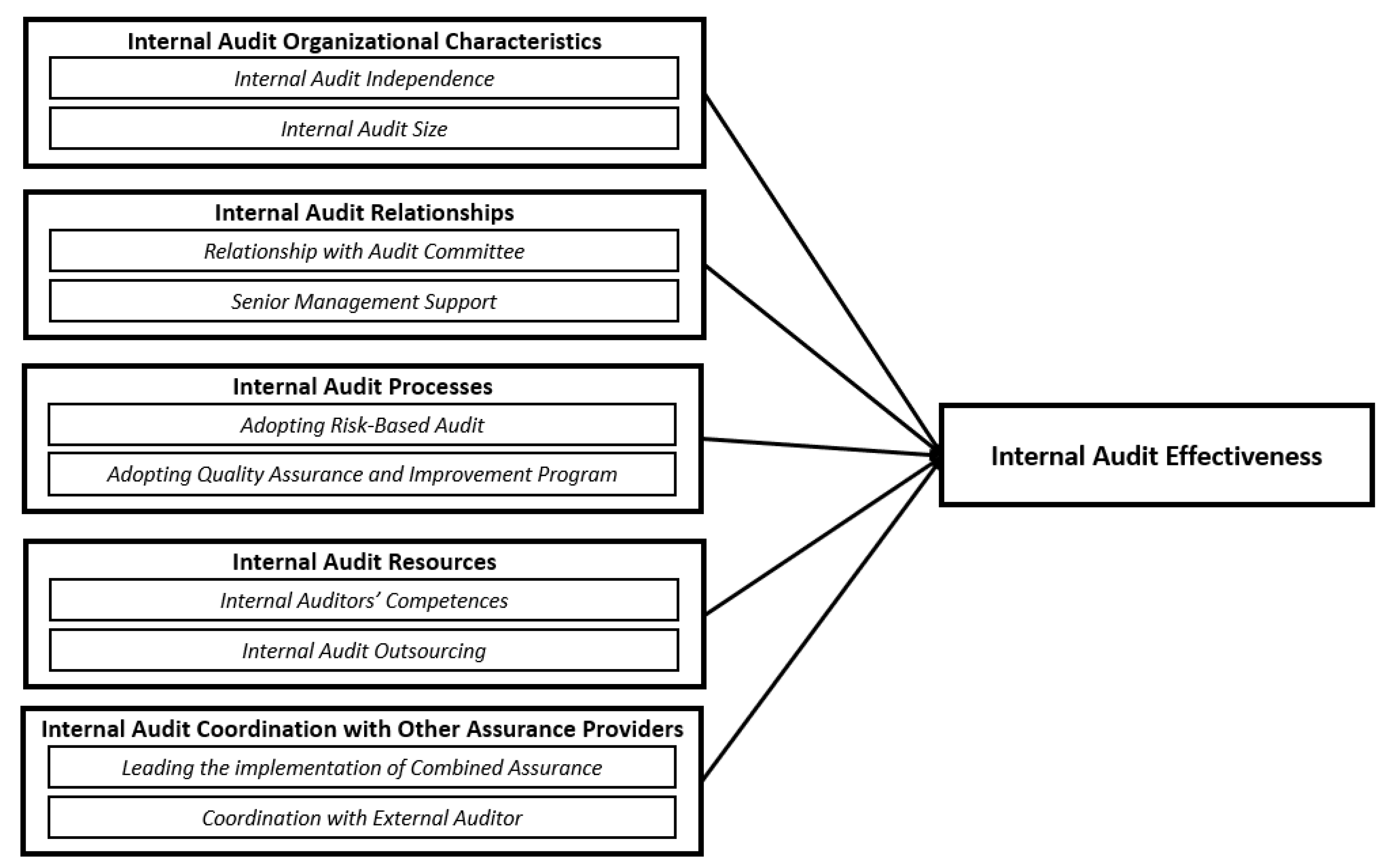

4. The Influential Factors

4.1. Internal Audit Organizational Characteristics

4.1.1. Internal Audit Independence

4.1.2. Internal Audit Size

4.2. Internal Audit Relationships

4.2.1. Relationship with Audit Committee

4.2.2. Senior Management Support

4.3. Internal Audit Processes

4.3.1. Adopting Risk-Based Audit

4.3.2. Adopting a Quality Assurance and Improvement Program

4.4. Internal Audit Resources

4.4.1. Internal Auditors’ Competences

4.4.2. Internal Audit Outsourcing

4.5. Coordination with Other Assurance Providers

4.5.1. Leading the Implementation of Combined Assurance

4.5.2. Internal Audit Coordination with External Auditor

5. The Conceptual Model

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| No. | Author (Year) | Type of Research | Factors of Internal Audit Effectiveness |

|---|---|---|---|

| 1 | Alqudah et al. (2019) | Quantitative Research | IA Independence, Top Management Empowerment, and External Auditor’s Cooperation |

| 2 | Al-Shbail and Turki (2017) | Theoretical Review | IA Independence, IA scope of Work, Management Support, Auditee Cooperation, and Satisfaction of Internal Auditors |

| 3 | Al-Twaijry et al. (2003) | Mixed Method | IA Independence, IA Size, IA Scop of work, and Management Support |

| 4 | Alzeban and Gwilliam (2014) | Quantitative Research | Internal Auditors’ Competences, IA Size, IA Relationship with EA, Management Support, IA Independence |

| 5 | Arena and Azzone (2009) | Mixed Method Empirical Analysis based on Multiple Case Study | Characteristics of The IAF, Characteristics of the Internal Auditors, The Organizational Environment |

| 6 | Ashfaq et al. (2021) | Mixed Method | IAF Objectivity, Competence, Work Performance, Sourcing, Internal Control System’s Assessment |

| 7 | Azzali and Mazza (2018) | Quantitative Research | IA Organizational Characteristics, IA Process, and IA Relationships |

| 8 | Badara and Saidin (2014) | Quantitative Research | Risk Management, Internal Control Systems, Audit Experience, Cooperation Between IA and EA, and IA Performance Management |

| 9 | Bednarek (2018) | Quantitative Research | Size of IA Team, Competencies of Internal Auditors, IA’s Commitment to Ensuring and Improving IA Quality, Cooperation of AC, and IA’s Commitment to Executing Commissioned Audits |

| 10 | Coetzee and Erasmus (2017) | Quantitative Research | CAE Profile (Leadership), IA Independence, Functioning of IA, IA Status, IA Competences, IA Services, and Role |

| 11 | Cohen and Sayag (2010) | Quantitative Research | The sector to which an organization belongs, professional proficiency of internal auditors, Quality of IA, IA Independence, Career Advancement for Internal Auditors, and Top Management Support |

| 12 | Dellai and Omri (2016) | Quantitative Research | Competence of IA, Independence and Objectivity of IA, Outsourcing of IA, Management Support, and Use of IAF as a Management Training Ground |

| 13 | D’Onza et al. (2015) | Quantitative Research | IA independence and objectivity, Use of The IIA standards, Relationship with AC, Number of Activities Carried Out by The IA, Number of Internal Auditing Tools Used, Systematic Approach to Evaluate the Effectiveness of Internal Controls, and Systematic Approach to Evaluate the Effectiveness of Risk Management, and Systematic Approach to Evaluate the Effectiveness of Corporate Governance |

| 14 | Elmghaamez and Ntim (2016) | Quantitative Research | Internal Auditors’ Professional Skills, Internal Auditors’ Interpersonal Skills, Internal Auditors’ Technical Skills, Internal Auditors’ Audit Skills |

| 15 | Endaya and Hanefah (2013) | Theoretical Review | Internal Auditors’ Characteristics, IA Performance, and Management Support, |

| 16 | Endaya and Hanefah (2016) | Quantitative Research | Internal Auditors’ Characteristics, and Management Support |

| 17 | Erasmus and Coetzee (2018) | Quantitative Research | IA Function Influence Sphere, IAF Standing, IAF Services and Role Performed, IAF Size, Internal Auditor Competence, IAF Conducts Risk Consulting and Risk-Based Audit, IAF Understand Operations, IAF Functional Reporting Structure Competent Leadership of IAF, and No Scope Limitation on IAF |

| 18 | Feizizadeh (2012) | Literature Review | IA Alignment with Stakeholder Needs, Achieves Best-in-Class Capabilities, Complies with Applicable Professional Standards, and Measures Results |

| 19 | George et al. (2015) | Quantitative Research | Quality of IA, Competence of IA Team, Independence of IA, Management Support |

| 20 | Kurnia and Yulian (2018) | Qualitative Research | Internal audit’s role as a coordinator of combined assurance implementation |

| 21 | Lenz and Hahn (2015) | Literature Review | Organizational Characteristics, IA Resources, IA Processes, IA Relationships |

| 22 | Lenz et al. (2014) | Quantitative Research | Organizational Characteristics, IA Resources, IA Processes, IA Relationships |

| 23 | Mahyoro and Kasoga (2021) | Quantitative Research | IA Quality, IA Organization Setting, Auditee Attributes, |

| 24 | Mihret and Yismaw (2007) | Case Study, Qualitative Research | IA Organizational Setting, IA Quality, Management Support, Auditee Attributes |

| 25 | Onay (2021) | Quantitative Research | IA Independence, IA Size, IA Competence, Management Support, Cooperation with EA, Carrying Out Risk-Based Activities |

| 26 | Onumah and Krah (2012) | Quantitative Research | The legislative framework of IA, IA Professional proficiency, Management Perception of IA, Role Recognition of Internal Auditors, Relationship with AC |

| 27 | Oussii and Boulila (2021) | Quantitative Research | Audit Committee Financial Expertise, Senior Management Support, AC involvement in reviewing the IA plans and results, The number of years the CAE has been in his/her position, the company audited by one of the Big 4 EA, Form Size (Total Assets), Company’s Affiliation to the Finance Industry |

| 28 | Roussy et al. (2020) | Qualitative Research | Organizational Characteristics, IA Resources, IA Processes, IA Relationships |

| 29 | Sarens and De Beelde (2006a, 2006b) | Qualitative Research | Role of IA in Risk Management |

| 30 | Salehi (2016) | Case Study, Quantitative Research | Competency of IA Staff, Size of IA Department, Communications between IA and EA, Management’s Support for IA, Independence IA |

| 31 | Schreurs and Marais (2015) | Qualitative Research | Implementation of Combined Assurance |

| 32 | Soh and Martinov-Bennie (2011) | Qualitative Research | IAF Structure, Status, and relationships of the IAF, Human Resources in terms of staffing and competencies |

| 33 | Ta and Doan (2022) | Quantitative Research | IA Independence, Competence of internal auditors, Management Support for IA, Quality of IA work |

| 34 | Yee et al. (2008) | Quantitative Research | IA Independence, IA Competences, Relationship with EA, IA services and Role, and Quality of IA |

References

- Abbott, Lawrence, Susan Parker, Gary Peters, and Dasaratha Rama. 2007. Corporate governance, audit quality, and the Sarbanes-Oxley Act: Evidence from internal audit outsourcing. The Accounting Review 82: 803–35. [Google Scholar] [CrossRef]

- Ahlawat, Sunita S., and D. Jordan Lowe. 2004. An Examination of Internal Auditor Objectivity: In-House versus Outsourcing. Auditing: A Journal of Practice and Theory 23: 147–58. [Google Scholar] [CrossRef]

- Ahmad, Nasibah, Radiah Othman, Rohana Othman, and Kamaruzaman Jusoff. 2009. The effectiveness of internal audit in Malaysian public sector. Journal of Modern Accounting and Auditing 5: 53–62. [Google Scholar]

- Alhajri, Meshari O. 2017. Factors associated with the size of internal audit functions: Evidence from Kuwait. Managerial Auditing Journal 32: 75–89. [Google Scholar] [CrossRef]

- Alqudah, Hamza, Noor Amran, and Haslinda Hassan. 2019. Factors affecting the internal auditors’ effectiveness in the Jordanian public sector. EuroMed Journal of Business 14: 251–73. [Google Scholar] [CrossRef]

- Al-Shbail, Awn, and Turki Turki. 2017. A theoretical discussion of internal audit effectiveness in Kuwaiti industrial SMEs. International Journal of Academic Research in Accounting, Finance and Management Sciences 7: 107–16. [Google Scholar]

- Al-Twaijry, Abdulrahman A. M., John A. Brierley, and David R. Gwilliam. 2003. The development of internal audit in Saudi Arabia: An institutional theory perspective. Critical Perspective on Accounting 14: 507–31. [Google Scholar] [CrossRef]

- Alzeban, Abdulaziz. 2010. The Effectivness of Internal Audit in The Saudi Public Sector. Ph.D. thesis, University of Exeter, Exeter, UK. [Google Scholar]

- Alzeban, Abdulaziz. 2020. The relationship between the audit committee, internal audit and firm performance. Journal of Applied Accounting Research 21: 437–54. [Google Scholar] [CrossRef]

- Alzeban, Abdulaziz, and David Gwilliam. 2014. Factors affecting the internal audit effectiveness: A survey of the Saudi public sector. Journal of International Accounting, Auditing and Taxation 23: 74–86. [Google Scholar] [CrossRef]

- Arena, Marika, and Giovanni Azzone. 2009. Identifying organizational drivers of internal audit effectiveness. International Journal of Auditing 13: 43–60. [Google Scholar] [CrossRef]

- Ashfaq, Khurram, Shafique Ur Rehman, Moeez Ul Haq, and Muhammad Usman. 2021. Factors influencing stakeholder’s judgment on internal audit function’s effectiveness and reliance. Journal of Financial Reporting and Accounting. Ahead-of-print. [Google Scholar] [CrossRef]

- Azzali, Stefano, and Tatiana Mazza. 2018. The Internal Audit Effectiveness Evaluated with an Organizational, Process and Relationship Perspective. International Journal of Business and Management 13: 238–54. [Google Scholar] [CrossRef]

- Badara, Mu’azu, and Siti Zabedah Saidin. 2013. The journey so far on internal audit effectiveness: A calling for expansion. International Journal of Academic Research in Accounting, Finance and Management Sciences 3: 340–51. [Google Scholar] [CrossRef]

- Badara, Mu’azu, and Siti Zabedah Saidin. 2014. Empirical evidence of antecedents of internal audit effectiveness from Nigerian perspective. Middle-East Journal of Scientific Research 19: 460–71. [Google Scholar]

- Bednarek, Piotr. 2018. Factors affecting the internal audit effectiveness: A survey of the polish private and public sectors. In Efficiency in Business and Economics. Springer Proceedings in Business and Economics. Edited by Tadeusz Dudycz, Grażyna Osbert-Pociecha and Bogumiła Brycz. Cham: Springer, pp. 1–16. [Google Scholar]

- Behrend, Joel, and Marc Eulerich. 2019. The evolution of internal audit research: A bibliometric analysis of published documents (1926–2016). Accounting History Review 29: 103–39. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Asma Houcine, Zied Ftiti, and Hatem Masri. 2018. Does audit quality affect firms’ investment efficiency? Journal of the Operational Research Society 69: 1688–99. [Google Scholar]

- Brender, Nathalie, Bledi Yzeiraj, and Emmanuel Fragniere. 2015. The management audit as a tool to foster corporate governance: An inquiry in Switzerland. Managerial Auditing Journal 30: 785–811. [Google Scholar] [CrossRef]

- Cambridge University. 2022. Cambridge Dictionary. Available online: https://dictionary.cambridge.org/dictionary/english/influential (accessed on 21 February 2022).

- Castanheira, Nuno, Lu’cia Rodrigues, and Russell Craig. 2010. Factors associated with the adoption of risk-based internal auditing. Managerial Auditing Journal 25: 79–98. [Google Scholar]

- Chambers, Andrew D., and Marjan Odar. 2015. A new vision for internal audit. Managerial Auditing Journal 30: 34–55. [Google Scholar] [CrossRef]

- Chartered Institute of Internal Auditors, UK and Ireland. 2020. Position Paper: Internal Audit’s Relationship with External Audit. London: Chartered Institute of Internal Auditors in UK and Ireland. [Google Scholar]

- Christopher, Joe, Gerrit Sarens, and Philomena Leung. 2009. A critical analysis of the independence of the internal audit function: Evidence from Australia. Accounting, Auditing and Accountability Journal 22: 200–20. [Google Scholar] [CrossRef]

- Coetzee, Philna, and Dave Lubbe. 2013. Improving the efficiency and effectiveness of risk-based internal audit engagements. International Journal of Auditing 18: 115–25. [Google Scholar] [CrossRef]

- Coetzee, Philna, and Lourens J. Erasmus. 2017. What drives and measures public sector internal audit effectiveness? Dependent and independent variables. International Journal of Auditing 21: 237–48. [Google Scholar] [CrossRef]

- Cohen, Aaron, and Gabriel Sayag. 2010. The effectiveness of internal auditing: An empirical examination of its determinants in Israeli organisations. Australian Accounting Review 20: 296–307. [Google Scholar] [CrossRef]

- Coram, Paul, Colin Ferguson, and Robyn Moroney. 2008. Internal audit, alternative internal audit structures and the level of misappropriation of assets fraud. Accounting and Finance 48: 543–59. [Google Scholar] [CrossRef]

- Davidson, Bruce, Naman Desai, and Gerory Gerard. 2013. The effect of continuous auditing on the relationship between internal audit sourcing and the external auditor’s reliance on the internal audit function. Journal of Information Systems 27: 41–59. [Google Scholar] [CrossRef]

- Desai, Naman, Gerory Gerard, and Arindam Tripathy. 2011. Internal audit sourcing arrangements and reliance by external auditors. Auditing: A Journal of Practice & Theory 30: 149–71. [Google Scholar]

- D’Onza, Giuseppe, Georges M. Selim, Rob Melville, and Marco Allegrini. 2015. A Study on Internal Auditor Perceptions of the Function Ability to Add Value. International Journal of Auditing 19: 182–94. [Google Scholar] [CrossRef]

- Decaux, Loïc, and Gerrit Sarens. 2015. Implementing combined assurance: Insights from multiple case studies. Managerial Auditing Journal 30: 56–79. [Google Scholar] [CrossRef]

- Dellai, Hella, and Mohamed Ali Brahim Omri. 2016. Factors affecting the internal audit effectiveness in Tunisian organizations. Research Journal of Finance and Accounting 16: 208–21. [Google Scholar]

- Dittenhofer, Mort. 2001. Internal auditing effectiveness: An expansion of present methods. Managerial Auditing Journal 16: 443–50. [Google Scholar] [CrossRef]

- Elmghaamez, Ibrahim, and Collins Ntim. 2016. Assessing the effectiveness of internal governance controls: The case of internal auditors skills and challenges in Libya. Corporate Ownership and Control Journal 13: 46–59. [Google Scholar] [CrossRef]

- Endaya, Khaled Ali. 2014. Coordination and cooperation between internal and external auditors. Research Journal of Finance and Accounting 5: 76–80. [Google Scholar]

- Endaya, Khaled, and Mustafa Hanefah. 2013. Internal audit effectiveness: An approach proposition to develop the theoretical framework. Research Journal of Finance and Accounting 4: 92–102. [Google Scholar]

- Endaya, Khaled, and Mustafa Hanefah. 2016. Internal auditor characteristics, internal audit effectiveness, and moderating effect of senior management. Journal of Economic and Administrative Sciences 32: 160–76. [Google Scholar] [CrossRef]

- Erasmus, Lourens, and Philna Coetzee. 2018. Drivers of stakeholders’ view of internal audit effectiveness: Management versus audit committee. Managerial Auditing Journal 33: 90–114. [Google Scholar] [CrossRef]

- Eulerich, Marc, Joleen Kremin, and David A. Wood. 2019. Factors that influence the perceived use of the internal audit function’s work by executive management and audit committee. Advances in Accounting 45: 100410. [Google Scholar] [CrossRef]

- Feizizadeh, Ahmad. 2012. Strengthening internal audit effectiveness. Indian Journal of Science and Technology 5: 2777–78. [Google Scholar] [CrossRef]

- George, Drogalas, Karagiorgos Theofanis, and Arampatzis Konstantinos. 2015. Factors associated with internal audit effectiveness: Evidence from Greece. Journal of Accounting and Taxation 7: 113–22. [Google Scholar]

- Goodwin-Stewart, Jenny, and Pamela Kent. 2006. The use of internal audit by Australian companies. Managerial Auditing Journal 21: 81–101. [Google Scholar] [CrossRef]

- Karagiorgos, Theofanis, George Drogalas, and Nikolaos Giovanis. 2011. Evaluation of the effectiveness of internal audit in Greek Hotel Business. International Journal of Economic Sciences and Applied Research 4: 19–34. [Google Scholar]

- Kurnia, Rama, and Lufti Yulian. 2018. Internal audit’s role as a coordinator of combined assurance implementation. In Competition and Cooperation in Economics and Business. London: Taylor and Francis Group, Routledge, pp. 41–46. [Google Scholar]

- Lenz, Rainer, and Ulrich Hahn. 2015. A synthesis of empirical internal audit effectiveness literature pointing to new research opportunities. Managerial Auditing Journal 30: 5–33. [Google Scholar] [CrossRef]

- Lenz, Rainer, Gerrit Sarens, and Kenneth D’Silva. 2014. Probing the discriminatory power of characteristics of internal audit functions: Sorting the wheat from the chaff. International Journal of Auditing 18: 126–38. [Google Scholar] [CrossRef]

- Lenz, Rainer, Gerrit Sarens, and Kim Jeppesen. 2018. In search of a measure of effectiveness for internal audit functions: An institutional perspective. EDPACS 58: 1–36. [Google Scholar] [CrossRef]

- Lois, Petros, George Drogalas, Michail Nerantzidis, Ifigenia Georgiou, and Eleni Gkampeta. 2021. Risk-based internal audit: Factors related to its implementation. Corporate Governance 21: 645–62. [Google Scholar] [CrossRef]

- Mahyoro, Kalokola, and Pendo Kasoga. 2021. Attributes of the internal audit function and effectiveness of internal audit services: Evidence from local government authorities in Tanzania. Managerial Auditing Journal 36: 999–1023. [Google Scholar] [CrossRef]

- Marais, M. 2004. Quality assurance in internal auditing: An analysis of the standards and guidelines implemented by the Institute of Internal Auditors (IIA). Meditari Accountancy Research 12: 85–107. [Google Scholar] [CrossRef]

- Mihret, Dessalegn Getie, and Aderajew Wondim Yismaw. 2007. Internal audit effectiveness: An Ethiopian public sector case study. Managerial Auditing Journal 22: 470–84. [Google Scholar] [CrossRef]

- Onay, Ahmet. 2021. Factors affecting the internal audit effectiveness: A research of the Turkish private sector organizations. Ege Academic Review 21: 1–15. [Google Scholar] [CrossRef]

- Onumah, Joseph M., and Redeemer Yao Krah. 2012. Barriers and catalysts to effective internal audit in the Ghanaian public sector. Accounting in Africa 12: 177–207. [Google Scholar]

- Oussii, Atef, and Neila Boulila. 2021. Evidence on the relation between audit committee financial expertise and internal audit function effectiveness. Journal of Economic and Administrative Sciences 37: 659–76. [Google Scholar] [CrossRef]

- Prawitt, Douglas, Nathan Sharp, and David Wood. 2012. Internal audit outsourcing and the risk of misleading or fraudulent financial reporting: Did Sarbanes-Oxley get it wrong? Contemporary Accounting Research 29: 1109–36. [Google Scholar] [CrossRef]

- Ridley, Jeffery. 2008. Cutting Edge Internal Auditing. West Sussex: John Wiley and Sons. [Google Scholar]

- Rossouw, Duane. 2015. The Impact of Combined Assurance on the Internal Audit Function. Mater’s thesis, University of Pretoria, Northen Sotho, South Africa. [Google Scholar]

- Roussy, Mélanie, Odile Barbe, and Sophie Raimbault. 2020. Internal audit: From effectiveness to organizational significance. Managerial Auditing Journal 35: 322–42. [Google Scholar] [CrossRef]

- Rupšys, Rolandas, and Vytautas Boguslauskas. 2007. Measuring performance of internal auditing: Empirical evidence. Engineering Economics 55: 9–15. [Google Scholar]

- Salehi, Tabandeh. 2016. Investigation factors affecting the effectiveness of internal auditors in the company: Case study Iran. Review of European Studies 8: 224–35. [Google Scholar] [CrossRef]

- Sarens, Gerrit, and Ignace De Beelde. 2006a. Internal auditors’ perception about their role in risk management. Managerial Auditing Journal 21: 63–80. [Google Scholar] [CrossRef]

- Sarens, Gerrit, and Ignace De Beelde. 2006b. The relationship between internal audit and senior management: A qualitative analysis of expectations and perceptions. International Journal of Auditing 10: 219–41. [Google Scholar] [CrossRef]

- Sarens, Gerrit, and Mohammad J. Abdolmohammadi. 2011. Monitoring effects of the internal audit function: Agency theory versus other explanatory variables. International Journal of Auditing 15: 1–20. [Google Scholar] [CrossRef]

- Sarens, Gerrit, Ignace De Beelde, and Patricia Everaert. 2009. Internal audit: A comfort provider to the audit committee. The British Accounting Review 41: 90–106. [Google Scholar] [CrossRef]

- Sarens, Gerrit, Loïc Decaux, and Rainer Lenz. 2012. Combined Assurance, Case Studies on a Holistic Approach to Organizational Governance. Altamonte Springs: The Institute of Internal Auditors Research Foundation. [Google Scholar]

- Saunders, Mark, Philip Lewis, and Adrian Thornhill. 2019. Research Methods for Business Students, 8th ed. Essex: Pearson Education Limited. [Google Scholar]

- Schreurs, H. K., and Marinda Marais. 2015. Perspectives of chief audit executives on the implementation of combined assurance. Southern African Journal of Accountability and Auditing Research 17: 73–86. [Google Scholar]

- Selim, Georges, and Aristodemos Yiannakas. 2000. Outsourcing the internal audit function: A survey of the UK public and private sectors. International Journal of Auditing 4: 213–26. [Google Scholar] [CrossRef]

- Sharma, Divesh, and Nava Subramaniam. 2005. Outsourcing of internal audit services in Australian firms: Some preliminary evidence. Asian Academy of Management Journal of Accounting and Finance 1: 33–52. [Google Scholar]

- Soh, Dominic S. B., and Nonna Martinov-Bennie. 2011. The internal audit function: Perceptions of internal audit roles, effectiveness and evaluation. Managerial Auditing Journal 26: 605–22. [Google Scholar] [CrossRef]

- Sudsomboon, Seerungrat. 2011. The effects of internal audit outsourcing effectiveness on firm sustainability: An empirical research of ISO 9001 business in Thailand. International Journal of Business Research 11: 217–25. [Google Scholar]

- Ta, Thu Trang, and Thanh Nga Doan. 2022. Factors Affecting Internal Audit Effectiveness: Empirical Evidence from Vietnam. International Journal of Financial Studies 10: 37. [Google Scholar] [CrossRef]

- The Institute of Internal Auditors, IIA. 2011. Practices Guide: Reliance by Internal Audit on Other Assurance Providers. Altamonte Springs: The Institute of Internal Auditors Research Foundation. [Google Scholar]

- The Institute of Internal Auditors, IIA. 2017. International Professional Practices Framework (IPPF). Altamonte Springs: The Institute of Internal Auditors Research Foundation. [Google Scholar]

- The Institute of Internal Auditors, IIA. 2019. Implementations Guidance for the IIA’s Code of Ethics and the in International Standards for the Professional Practices of Internal Auditing. Altamonte Springs: The Institute of Internal Auditors Research Foundation. [Google Scholar]

- Turetken, Oktay, Stevens Jethefer, and Baris Ozkan. 2019. Internal audit effectiveness: Operationalization and influencing factors. Managerial Auditing Journal 35: 238–71. [Google Scholar] [CrossRef]

- Xiao, Yu, and Maria Watson. 2019. Guidance on conducting a systematic literature review. Journal of Planning Education and Research 39: 93–112. [Google Scholar] [CrossRef]

- Yee, Cassandra S. L., Ahmad Sujan, Kieran James, and Jenny K. S. Leung. 2008. The perception of the Singaporean internal audit customers regarding the role and effectiveness of internal audit. Asian Journal of Business and Accounting 1: 147–74. [Google Scholar]

- Zainal Abidin, Nor. 2017. Factors influencing the implementation of risk-based auditing. Asian Review of Accounting 25: 361–75. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abdelrahim, A.; Al-Malkawi, H.-A.N. The Influential Factors of Internal Audit Effectiveness: A Conceptual Model. Int. J. Financial Stud. 2022, 10, 71. https://doi.org/10.3390/ijfs10030071

Abdelrahim A, Al-Malkawi H-AN. The Influential Factors of Internal Audit Effectiveness: A Conceptual Model. International Journal of Financial Studies. 2022; 10(3):71. https://doi.org/10.3390/ijfs10030071

Chicago/Turabian StyleAbdelrahim, Ayman, and Husam-Aldin N. Al-Malkawi. 2022. "The Influential Factors of Internal Audit Effectiveness: A Conceptual Model" International Journal of Financial Studies 10, no. 3: 71. https://doi.org/10.3390/ijfs10030071

APA StyleAbdelrahim, A., & Al-Malkawi, H.-A. N. (2022). The Influential Factors of Internal Audit Effectiveness: A Conceptual Model. International Journal of Financial Studies, 10(3), 71. https://doi.org/10.3390/ijfs10030071