Abstract

Turkey’s e-commerce market is rapidly expanding, and the country is ranked first in the world in monthly mobile purchases. The purpose of this study is to determine the factors that influence the adoption of online payments systems among the customers of a Turkish bank during the COVID-19 pandemic. The research model extends the technology acceptance model (TAM) by further examining the impact of 11 factors on attitude, behavioral intention and actual usage. The results suggest a strong influence of these factors on attitude and behavioral intention. Relative advantage, perceived trust, perceived usefulness, personal innovativeness, perceived integrity, perceived ease of use, health and epidemic effects, income, private sector employment and self-employment all have a positive effect on actual online payment system usage. However, perceived risk and age have a negative impact on the actual online payment system usage.

1. Introduction

The concept of e-commerce evolved as internet usage increased, and financial technology advancement first appeared on e-commerce platforms. The rise of financial technologies (fintech) has increased in recent years. Financial technology is now widely used in a variety of applications, the most prominent of which are online payment systems. Due to technological advances, the process of transitioning from cash to card payments and then from card payments to online payments has accelerated. Digital payments are defined as any payments made using digital instruments. In digital payment, the payer and the payee both use electronic modes to send and receive money. No hard cash is used (Kumar 2019). The online payment method is called the methods of payments made through the internet. These methods are the money order/electronic fund transfer (EFT) method, mobile wallet method, online wallet method, credit card, debit card (debit card), prepaid cards and virtual cards (Khan et al. 2017). Payments made with card payment systems are now the most common electronic payment option. Card payment methods are non-cash payments for goods or services made with cards linked to an account. The two most common types of card payment instruments are debit cards and credit cards (Sumanjeet 2009). Mobile payment refers to the payment of goods, services and invoices using a mobile device that uses wireless and other communication technologies. Mobile payment can also be expressed as a channel that is used to enable users to perform their financial transactions accurately and in a timely manner (Meharia 2012). The amount after the payment transaction is completed in these transactions is made available via mobile phone. It is reflected on the customer’s invoice (payment made on postpaid lines) or via e-money, which is uploaded to the phone after the funds have previously been transferred to the customer’s organization account (prepaid lines) (Magnier-Watanabe 2014).

Turkey led the market in monthly mobile transactions in 2016 (Interactive Advertising Bureau 2016). According to J.P. Morgan (2020), Turkish e-commerce has seen excellent revenue growth in recent years: in 2018, the market increased by 42 percent, followed by 31 percent in 2019. Currently, 67 percent of the Turkish population makes online purchases (We Are Social 2022). Turkey is a growing e-commerce market, with excellent sales growth over the last three years. Consumer behavior is fast changing as a younger generation uses cellphones and social media to find and buy things. Cards are the most commonly used online payment option in Turkey. Card usage is increasing, and by 2023, cards will account for 71% of all transactions. According to projections, e-commerce volume will more than double in dollars by 2025 (Statista 2021). Consumption expenditures decreased in the early months of the epidemic due to concern for the future, but online payments increased significantly during the quarantine process (Kalkan 2021). As of October 2020, 74.8 million credit cards and 183.4 million debit cards, for a total of 258.2 million cards, were used in Turkey, representing a 52 percent increase in card payment volume over the same period in 2019. The proportion of online card payments in total card payments increased from 18% to 22% (BKM 2020). Given that the epidemic is not expected to cause a significant decline in income elements in the short-term, card payments made over the internet are expected to rise. It has been concluded that the growth in card payments made via the internet is not solely due to constraints, but also due to the epidemic’s effect on payment and shopping habits, and that the increase is projected to continue growing in the future.

This study is one of the few investigating the factors affecting the adoption of online payments during COVID-19 pandemic. The findings can be used forr future research on other fintech products. Data were gathered from Turkey, which has one of the highest rates of online payment use. The major goal was to investigate factors that influence the attitude, behavioral intention and actual usage of online payment systems from the viewpoint of internet banking users in Urla, Izmir. The technology acceptance model (TAM) was extended with a number of influential factors in the online payments system adoption. This work aimed to contribute to online payment services, the effects of which can be seen in the nation’s e-commerce activities. The next section presents a literature review, and the third section covers the research methodology and results. The last section is the concluding remarks.

2. Literature Review

2.1. Next-Generation Payment Instruments

Mobile payment is a relatively recent development in comparison to other financial technological advancements. With the proliferation of smartphones, financial service providers have the opportunity to improve business efficiency and market share. Financial users have more favorable access to financial products. While the benefits of this new financial service are numerous, usage has not yet reached the anticipated level. While mobile phone subscriptions account for 96% of the global population, mobile phone users account for 8% of the global population (Shaikh and Karjaluoto 2015). It is seen that the number of people using mobile payment systems is quite low compared to the number of mobile phones registered in the world. On the other hand, this situation shows that there are still new opportunities in terms of developing and marketing these payment systems. In recent years, electronic payment systems have begun to replace cash payment methods. With the COVID-19 pandemic affecting the entire world in 2020, online purchasing became more popular, and the demand for next-generation payment tools increased. Recent studies include QR digital payment system adoption (Jiang et al. 2021), e-money (Fabris 2019; Omodero 2021) and central bank digital currencies (Náñez Alonso et al. 2020; Náñez Alonso et al. 2021; Cunha et al. 2021). Table 1 addresses the most recent generation of electronic payment instruments, whose use has expanded recently.

Table 1.

Next-Generation Payment Instruments.

2.2. Factors Affecting the Adoption of Online Payment Systems

The adoption of online payments services is measured with the attitude, behavioral intention and actual usage. Attitude is defined as the consumer’s degree of positive and negative judgments of the fintech service (Ajzen 2002). An individual’s attitude can be defined as his or her assessment of his or her readiness to use a particular system (Lederer et al. 2000). Attitude is influenced by the individual’s prior experiences, as well as the situation in which he finds himself, and it can change over time. As a result, it influences the proclivity to behave in a particular way (Pazvant 2017). Numerous studies have shown that an individual’s attitude has a direct and significant effect on their behavioral intention to use a specific e-application (Moon and Kim 2001; Püschel et al. 2010; George 2002; Zheng and Li 2020). The subjective judgments of consumers regarding the likelihood of their willingness to use the fintech Service in the future can be expressed as behavioral intention (Ajzen 2002). The main dependent variable in TAM studies is the intention to use, which is defined as an individual’s likelihood of using technology (Venkatesh et al. 2003). Behavioral intention is an individual’s ability to perform a specific behavior and is the determinant of the behavior. According to the technology acceptance model, perceived usefulness and attitude influence behavioral intention (Fishbein and Ajzen 1975; Davis et al. 1989). Factors included in this study are defined in Table 2.

Table 2.

Factors Affecting the Adoption of Online Payment Systems.

2.3. Theoretical Framework

Ajzen and Fishbein (1980) used the theory of reasoned action (TRA) to develop a general structure for explaining human behavior. When predicting an individual’s behavior, the role of beliefs, according to this framework, should be considered. According to TRA, an individual’s behavioral intention to exhibit a specific behavior is formed in response to his or her attitude toward the behavior and perceived subjective norms. The attitude towards behavior refers to a person’s perception that his or her actions have consequences, as well as the person’s assessment of those consequences, whether positive or negative. The more positive one is, the more powerful the behavioral intention. Attitude toward a given system is also a significant predictor of intention to use it, which results in actual usage behavior.

Davis (1989) developed the Technology Acceptance Model (TAM) to explain how users adopt computer-based information systems. According to the TAM, perceived usefulness (PU) and perceived ease of use (PEU) determine technology adoption. The main premise of the effect of other variables on intention to use, according to TAM, is a person’s attitude toward using technology. The attitude determinant of intention, according to the technology acceptance model, is attitude. User behavior is determined by intent (Davis 1989; Davis et al. 1989). A person’s belief that utilizing a particular system will improve job performance is referred to as PU. The PEU is defined as the degree to which an individual believes that using the system will be effortless. TAM was used to predict the adoption of mobile payment systems in which new factors influencing adoption were determined and resulted in the formation of an extended TAM (E-TAM) research stream (Raleting and Nel 2011; Aboelmaged and Gebba 2013; Hanafizadeh et al. 2014). Venkatesh et al. (2003) developed the Unified Theory of Acceptance and Use of Technology (UTAUT). The incentive for user behavior, such as perceived usefulness or relative advantage, is the emphasis of UTAUT theory. This model is essentially an expanded version of the TAM model. It is based on four factors: performance expectancy, effort expectancy, social influence (SI) and facilitating conditions. Participants’ gender, age, experience and volunteerism are also taken into account by UTAUT.

The Innovation Diffusion Theory (IDT) was developed by E.M. Rogers (1995). A new concept, practice or object is perceived as novel by an individual or another unit of adoption. Diffusion is the process by which an innovation spreads over time among members of a social system via specific channels. According to the IDT theory, potential users decide whether to embrace or reject an innovation based on their beliefs about the innovation. IDT is made up of five innovation qualities: relative advantage, compatibility, complexity, triability and observability. Table 3 provides a taxonomy of prior studies in light of the theories discussed. Recent research includes literature reviews on the adoption of digital payments (Ghosh 2021; Sahi et al. 2021). Additionally, Bommer et al. (2022) conducted a meta-analysis of e-Wallet adoption using the UTAUT model. The classifications of previous studies are summarized in Table 3.

Table 3.

Taxonomy of prior studies.

3. Research Methodology

3.1. Measures and Data Collection

The purpose of this study is to determine the factors that affect users’ attitudes, behavioral intentions and actual usage of online payment systems from the perspectives of internet banking customers at a bank branch in Urla, Izmir. With the COVID-19 pandemic, substantial changes in working circumstances occurred, and many organizations encouraged staff to work from home during periods of higher pandemic danger. As the pandemic’s effectiveness declined, some businesses ceased working from home entirely and returned to the office environment, while others continued to work alternately from home and the office. The predominance of working from home and the fact that it will remain for an extended period of time as a result of the pandemic has generated psychological strain on employees, which has resulted in many opting for detached houses over apartment living. People have begun to favor residential regions with isolated settlements that are calm. The Urla district in Izmir is one of the districts that fits this criterion. Urla, as a district largely free of noise, where natural life can flourish to the maximum extent possible, and as a district with the lowest carbon imprint in Turkey, is a place where working, retired and student populations coexist, particularly during the pandemic season. It has grown in popularity as a result. Urla was chosen as the selection point in our analysis based on these factors. The research revealed the factors influencing the adoption of online payment transactions by consumers in the Urla district. To obtain the study’s results and analyses, data were collected through questionnaires presented to 348 internet banking users using a simple random sample procedure. A questionnaire was developed using a five-point Likert scale of 1 = strongly disagree to 5 = strongly agree. Table A1 presents 80 statements from existing literature across 18 dimensions.

3.2. Descriptive Statistics

The survey was conducted among the online payment users. As shown in Table 4, the female density of the 345 individuals who participated in the study was 57.3%; the male population was 42.7%. The majority of the respondents were university graduates or above (95.1%). 24.8% of the respondents were working in the public sector, while 36.6% were working in the private sector. The majority of the respondents were between 18–45 years of age (89.5%).

Table 4.

Descriptive statistics.

3.3. Analyses

In the first stage, an exploratory factor analysis was used to determine the most important factors in online payments adoption. Using the results of the previous stage, a multiple regression analysis was performed in the second stage to determine the factors that influence behavioral intention.

3.3.1. Exploratory Factor Analysis

Factor analysis determines the interrelationships (correlations) between a large number of variables by defining sets of variables that are highly interrelated, known as factors. The variable groups (factors) are assumed to represent dimensions in the data. In general, the researcher would not analyze factors with a sample fewer than 50 observations, and ideally, the sample size should be 100 or larger. A statistically significant Bartlett’s test of sphercity (sig. < 0.05) indicates that sufficient correlations exist among the variables to proceed. Measure of sampling adequacy (MSA) values must be greater than 0.50 for both the overall test and each variable (Hair et al. 2006). Variables with values less than 0.50 should be omitted from the factor analysis. A component factor analysis is a data reduction technique that focuses on the minimum number of factors required to account for the greatest proportion of the total variance represented in the original set of variables. A factor analysis was carried out in this study. The survey asked users of online payments about the 18 factors listed in Table A1. The results were obtained using IBM SPSS Statistics 20 for Windows. Ozturkoglu et al. (2016) presented an outline of the factor analysis research methodology used to investigate the primary factors influencing online payment adoption. To improve the interpretation, a varimax rotation was used.

3.3.2. Regression Analysis

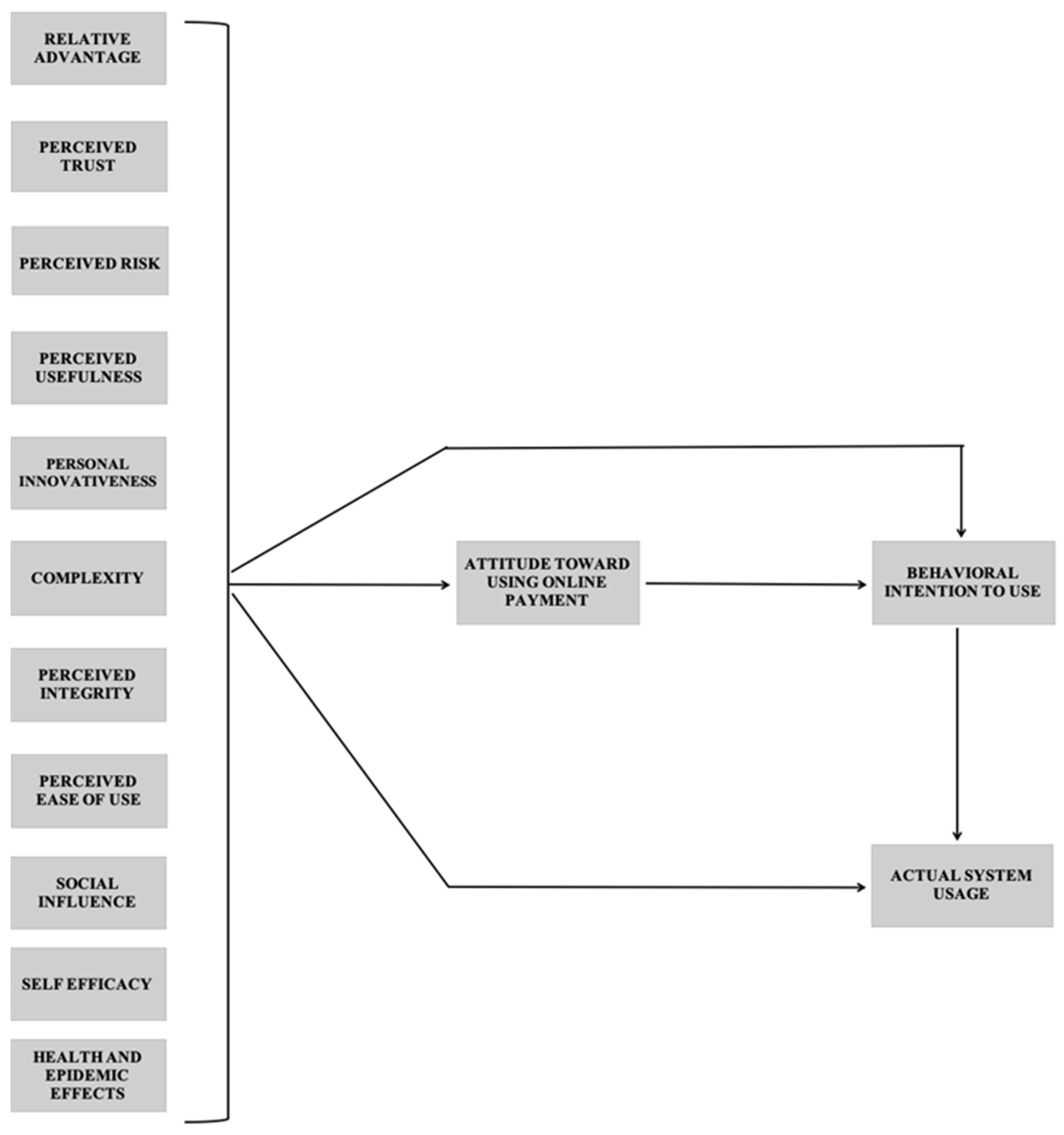

A regression analysis is a highly reliable method for measuring correlations between multiple variables (Higgins 2005). With the factor analysis, 18 factors were reduced to 11 factors. The regression analysis was used to identify the impact of the factors obtained through the exploratory factor analysis on behavioral intention, attitude and actual usage. The analysis included the factors given in Figure 1. Furthermore, dummy variables for gender, education, job, age and gender were created.

Figure 1.

Proposed research model.

4. Results and Discussion

4.1. Exploratory Factor Analysis

Table 5 shows the KMO and Bartlett’s results. The KMO measures the sampling adequacy and would be expected to be greater than 0.5. The KMO value was 0.911, which revealed the sufficiency of the data set for factor analysis. This value is higher than the recommended value. Therefore, the data obtained are suitable for factor analysis. The sufficiency of the correlations among items was tested through Barlett’s test of sphericity. Bartlett’s test examines whether there is a relationship between variables based on partial correlations. Barlett’s test provided that the correlations, when taken collectively, were highly significant at the 0.000 level. Both results showed that the sample size was suitable for factor analysis.

Table 5.

KMO and Bartlett’s Test.

In the first round of factor analysis, 18 factors were examined. The Varimax method (orthogonal rotation) was used in the rotation process. Those with components below 0.50 were removed, and the analysis was repeated. As shown in Table A2, the first factor explained relatively large amounts of variance of 29.606%. The factor analysis revealed 11 distinct factors with eigenvalues greater than 1.0, explaining 63.753% of the variance. As seen from Table A3, all the factor loadings were found to be greater than 0.5. The reliability analysis provides information about relationships between individual items in the scale. In the factor analysis, the Measure of Sampling Adequacy (MSA) tests the convenience of each question. In the MSA test, items with values under 0.5 should be removed from the analysis. Table 6 shows the Cronbach’s alpha values for each factor.

Table 6.

Factors and related items.

4.2. Regression Analysis

The factor analysis reduced 18 factors to 11 factors. The regression analysis was used to identify the impact of the factors obtained through an exploratory factor analysis on behavioral intention, attitude and actual usage. Table 7 and Table 8 show the results for seven alternate regression specifications. Since heteroscedasticity was present according to the White test, all estimates were obtained by using White’s heteroscedasticity-consistent covariance matrix. According to the models A1, A2 and B1 in Table 7, relative advantage, perceived trust, perceived usefulness, personal innovativeness, perceived integrity, perceived ease of use, social influence, self-efficacy, health and epidemic effects and gender being male have a positive impact on the attitude and behavioral intention to use an online payment system. There was no relationship between complexity and attitude, but perceived risk has a negative impact on attitude and behavioral intention. According to model B2, relative advantage, perceived usefulness, personal innovativeness, perceived integrity, perceived ease of use, social influence, self-efficacy and attitude have a positive effect on behavioral intention. When attitude was brought into the model, the effects of perceived trust, perceived risk, health and epidemic effects and gender being male on behavioral intention were eliminated.

Table 7.

Least Squares Estimations.

Table 8.

Ordered Logit Estimations.

According to the models C1 and C2 in Table 8, relative advantage, perceived trust, perceived usefulness, personal innovativeness, perceived integrity, perceived ease of use, health and epidemic effects, income, private sector employment and self-employment all have a positive effect on actual online payment system usage. Perceived risk and age have a negative impact on the actual online payment system usage. According to model C3, behavioral intention, income, private sector employment and self-employment all have a positive effect on actual online payment system usage. Age has a negative impact on actual online payment system usage. When behavioral intention was brought into the model, the effects of relative advantage, perceived trust, perceived usefulness, personal innovativeness, perceived integrity, perceived ease of use and health and epidemic effects on actual online payment system usage were eliminated. The findings in Table 7 and Table 8 are consistent with previous research.

4.3. Discussion

According to the findings, the first factor is a multidimensional factor that includes relative advantage, compatibility, quality of internet connection, ubiquity, perceived enjoyment and facilitating conditions. Among these factors, the most comprehensive of these factors is relative advantage; thus, this it is called relative advantage. Previous research identified 23 antecedents for relative advantage, which are the expected benefits provided by an innovation (Kapoor et al. 2014). The compliance of online payment transactions with the users’ lifestyles and ways of doing business will have a positive impact on the users’ adaptation to the online payment process. Users will be able to better adapt to payment transactions if transactions are completed more quickly. The fact that customers will continue to transact despite the epidemic will have a positive impact on their adoption. Users who make card transactions online will be more likely to adopt if they have a positive and smart feeling about it. Improving conditions, such as providing customers with the necessary resources and information when making online payments, as well as easy access to help in the event of a problem, will increase user adoption. The fact that users can conduct transactions whenever and wherever they want will encourage them to make online payments. Relative advantage has a positive impact on attitude and behavioral intention, where the findings are consistent with the previous research (Chitungo and Munongo 2013; Lin 2011; Shaikh and Karjaluoto 2015).

The second factor is perceived trust, which is one of the most important factors for user adoption. When users have sufficient confidence in transaction security, security and privacy of their information, their feeling of trust increases, and they adopt at a greater level. Users’ trust in the transaction processes that occur while executing payment transactions, as well as their trust that the information they provide while the process is in progress, will favorably influence their adoption of the procedure. The third component in the analysis is perceived risk. Reducing risks such as transaction risk, system risk, payment risk, security risk and financial risk will have a positive impact on user adoption of online payment transactions and ensure a better degree of user adoption. As Hanafizadeh et al. (2014) also report, the results indicate that perceived trust positively influences behavioral intention and attitude, while perceived risk negatively affects them.

Perceived usefulness is the fourth factor. The fact that users save time and effort while performing card payment transactions online increases their efficiency and productivity and will have a positive impact on their adoption. The fact that users believe they have control over the transactions they conduct will also ensure that adoption occurs at a higher level. Personal innovativeness is another factor. Receiving suggestions about new products and developments from the family of the innovative users will help them adapt better. Users who explore new products by following technological developments and purchasing new and different products will have a positive impact on their payment transaction adoption. Perceived usefulness and personal innovativeness positively influence attitude and behavioral intention. The findings are supported by earlier studies (Zhou 2012; Akturan and Tezcan 2012; Cao 2016).

Complexity is the sixth factor. Financial barriers are one of the most significant barriers stopping users from experimenting with payment methods, and efforts to remove these barriers will have a good impact on user adaptability. Furthermore, the assumption that the confusion in online transactions would need users to exert more mental effort and that they must have technical abilities to complete the transactions will have a negative impact on consumers’ perceptions of the transaction procedures. Complexity has a negative impact on actual usage, corroborating Rogers’ (1983) generalization stating that “the complexity of an innovation, as perceived by members of a social system, is negatively related to its rate of adoption”. Perceived integrity is the eighth factor. Users are involved with companies in the operations of online card payment transactions. The experiences of users with the other party in their transactions are crucial. The integrity of the transaction processes increases as users perceive that the company they are dealing with is honest, that they will fulfill their commitments, and that there will be no deviations in the information they convey about the transactions. This ensures that adoption occurs at a higher level. Perceived integrity positively affects attitude and behavioral intention, confirming Lin (2011).

The eighth factor is perceived ease of use. One of the most important known factors influencing adoption is perceived ease of use, and making payments by completing transactions easily has a good impact on consumers’ adoption. Perceived ease of use has a positive impact on attitude and behavioral intention, supporting the results of Shaikh and Karjaluoto (2015). Social influence is another factor which affects users while making financial transactions. Users tend to perform more online transactions, which promotes their adoption positively. depending on their social position and the recommendations they receive from their relatives. The 10th factor is self-efficacy. Directions are one of the variables that must be present for users to have a great transaction experience. The system’s directions during the transaction process have a favorable impact on user adoption. Furthermore, seeing the transaction procedures of other users before performing their own transactions will increase their adoption. Social influence and self-efficacy positively affect attitude and behavioral intention, in line with the previous research (Abdullah et al. 2018; Shaikh and Karjaluoto 2015).

The 11th and last aspect is health and epidemic effects. Problems originating from health and epidemic effects have changed consumers’ perspectives on online payment, and they have increased their adoption by taking into account the efficiency and effectiveness of transactions, as well as the rapid improvements made in processes. Health and epidemic affects have a positive impact on attitude, behavioral intention and actual usage. This is a contribution of this research. Another contribution is that relative advantage, perceived trust, perceived usefulness, personal innovativeness, perceived integrity, perceived ease of use, health and epidemic effects, income, private sector employment and self-employment all have a positive effect on actual online payment system usage. Perceived risk and age have a negative impact on the actual online payment system usage. The findings are summarized in Table 9.

Table 9.

Summary results.

Limitations

This study provides the perspectives of bank customers in Izmir, Turkey’s third largest city. The study was conducted among one bank branch’s 345 online payment users. This is the study’s primary limitation. Future studies, according to the authors, should collect data from additional locations and countries. This study focused on online payments, although additional research on the adoption of next-generation payment instruments, such as digital wallets, NFC and QR codes, could be done.

5. Conclusions

The Coronavirus pandemic began in December 2019 in Wuhan, China, the world’s second-largest economy, and has spread globally since 2020. In 2022, the virus is still active. Millions of people became ill, and millions died about two years later. Without a doubt, given the close economic ties that countries have with one another and the dimensions of global trade, it will be useful to assess the effects of the Corona epidemic that has affected the entire world, as well as the potential for new epidemics and/or environmental disasters in the future. To promote recovery and facilitate the transition to the new normal, it is critical for the digital payments ecosystem to expand rapidly and contribute to the shaping of the post-COVID age. Governments, regulators and banks will all continue to push for the adoption of digital payments. As digital payment methods gain popularity and acceptance, they will transform from a convenience to a need. There will be an increase in the issuance and use of virtual cards. Small- and medium-sized businesses now have a stronger internet presence. Consumer behavior will shift due to the increased acceptance of digital payments. Concerns about virus spreading via physical currency exchange already increase online card transactions. Fund transfers to and from bank accounts are projected to increase as people abandon cash in favor of digital transfers (J.P. Morgan 2020).

Online payment systems are a critical component of fintech services. This study contributes to existing research on the adoption of fintech instruments by empirically analyzing the factors influencing online payment system adoption from the perspective of Turkish bank customers. The factors were identified through a review of existing UTAUT, IDT, TAM and E-TAM research. Several major conclusions are reached as a result of the research. To begin, this study is a pioneer in incorporating the impact of a pandemic as a new factor into the E-TAM model. The results indicate that health and epidemic effects influence attitudes, behavioral intentions, and actual use of online payment systems. Another contribution is that prior E-TAM models indicated a multitude of adoption factors, but this study reduced 18 factors to 11. Relative advantage is a multidimensional characteristic that includes compatibility, internet connection quality, ubiquity, perceived enjoyment and facilitating conditions. Previous research on the antecedents of relative advantage supports the findings (Kapoor et al. 2014). The conclusions about the factors are summarized as follows: Relative advantage, perceived usefulness, personal innovativeness, perceived integrity, perceived ease of use and health and epidemic effects all have a positive impact on attitude, behavioral intention and actual online payment usage. Perceived trust, social influence and self-efficacy all have a positive effect on attitude and behavioral intention, whereas perceived risk has a negative effect. Income, private sector employment and self-employment all have a positive effect on actual online payment system usage; however, complexity and age have a negative effect. When behavioral intention and adoption factors are examined in the same model, behavioral intention has no effect on actual usage. The high rate of online payment usage in Turkey explains this issue. The findings of this study will contribute to future research on the adoption of next-generation payment instruments.

Author Contributions

Conceptualization, M.C. and E.S.; methodology, E.S. and M.O.K.; software, E.S. and M.O.K.; formal analysis, E.S. and M.O.K.; investigation, E.S.; resources, M.C.; data curation, M.C.; writing—original draft preparation, M.C.; writing—review and editing, E.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Institutional Review Board (or Ethics Committee) of Yasar University (Meeting No.4, Date of Approval: 9 February 2021).

Informed Consent Statement

Informed consent was obtained from all participants involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not available due to privacy and legal issues.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

Index of Acronyms

| CFA | Confirmatory Factor Analysis |

| CMPA | Compatibility |

| COMPE | Complexity |

| EFA | Exploratory Factor Analysis |

| EFT | Electronic Fund Transfer |

| E-TAM | Extended Technology Acceptance Model |

| FC | Facilitating Conditions |

| Fintech | Financial Technologies |

| HE | Health and Epidemic Effects |

| IDT | Innovation Diffusion Theory |

| NFC | Near Field Communication |

| PC | Perceived Cost |

| PCR | Perceived Credibility |

| PE | Perceived Enjoyment |

| PEU | Perceived Ease of Use |

| PI | Perceived Integrity |

| PIN | Perceived Innovativeness |

| PR | Perceived Risk |

| PT | Perceived Trust |

| PU | Perceived Usefulness |

| RA | Relative Advantage |

| QIC | Quality of Internet Connection |

| QR | Quick Response Code |

| SE | Self-Efficacy |

| SEM | Structural Equation Modeling |

| SI | Social Influence |

| TAM | Technology Acceptance Model |

| TRA | Theory of Reasoned Action |

| UB | Ubiquity |

| UTAUT | Unified Theory of Acceptance and Use of Technology |

Appendix A

Table A1.

Measurement Items.

Table A1.

Measurement Items.

| FACTORS | ITEMS | SOURCE |

|---|---|---|

| 1. PERCEIVED EASE OF USE (PEU) | (PEU1) It is easy for me to make my payment transactions online. | Davis et al. (1989); Venkatesh and Davis (2000); Schierz et al. (2010); Lin (2011); Chuang et al. (2016) |

| (PEU2) The online payment process is clear and understandable. | ||

| (PEU3) I can easily perform my transactions such as shopping, public payments (invoices, taxes, etc.) online. | ||

| (PEU4) I find it easy to complete my payment transactions online. | ||

| (PEU5) I believe it is easy to adapt to paying online. | ||

| 2. PERCEIVED USEFULNESS (PU) | (PU1) Making my payment transactions online increases my productivity, efficiency and performance. | Davis (1989); Hanafizadeh et al. (2014); Schierz et al. (2010); Gu et al. (2009); Raleting and Nel (2011) |

| (PU2) I save a lot of time and effort by making my payments online. | ||

| (PU3) Making my payments online gives me more control over my payment transactions. | ||

| (PU4) Paying online is useful when processing my payment transactions. | ||

| (PU5) I find it very useful to make my payments online. | ||

| 3. PERCEIVED TRUST (PT) | (PT1) I am not worried about paying online, as I know my transactions will be safe and secure. | Gefen et al. (2003); Al-Somali et al. (2009); Hanafizadeh et al. (2014) |

| (PT2) While I make my payment transactions online, I feel safe when sending sensitive information requested for the transaction. | ||

| (PT3) Sites where I pay online will not disclose any information to a third party unless I give my permission. | ||

| (PT4) I believe that privacy is guaranteed for sites where I pay online. | ||

| (PT5) I trust my online payment transactions as if I made a physical payment. | ||

| 4. PERCEIVED RISK (PR) | (PR1) I think that making payments online is more risky than other traditional payment services. | Rogers (1983); Bauer et al. (2005); Raleting and Nel (2011) |

| (PR2) When paying online, the system I receive service may not perform well and may perform the payment incorrectly. | ||

| (PR3) Paying online is risky. | ||

| (PR4) I am afraid of the misuse of personal information when making payments online. | ||

| (PR5) I am afraid that I will lose my money while making any payment transactions online. | ||

| (PR6) I am afraid of making payments online because I think people will access my account and personal information. | ||

| 5. SOCIAL INFLUENCE (SI) | (SI1) Suggestions from friends/family members/mass media influence my decision to make payments online. | Venkatesh and Davis (2000); Venkatesh et al. (2003); Sivathanu (2018); Gu et al. (2009) |

| (SI2) Many people who have an important place in my life think that I need to make payments online. | ||

| (SI3) In general, when I use any new technology, I trust my own instincts more than anyone else’s advice. | ||

| (SI4) Most people around me make their payments online. | ||

| (SI5) Making my payments online improves my status in society. | ||

| 6. COMPATIBILITY (CMPA) | (CMPA1) Making payments online is suitable for my lifestyle. | Rogers (1983); Agarwal and Prasad (1998); Hanafizadeh et al. (2014); Schierz et al. (2010) |

| (CMPA2) Making my payments online is compatible with the way I manage my payment transactions. | ||

| (CMPA3) Adopting the internet card payment system to be able to make payments online fits my way of working. | ||

| 7. SELF EFFICACY (SE) | (SE1) I am sure that I will prefer to make payments online even if I have never made a transaction before. | Venkatesh and Davis (1996); Gu et al. (2009); Boonsiritomachai and Pitchayadejanant (2017) |

| (SE2) If there are directions in the system about how to make transactions, I can make my payments online. | ||

| (SE3) If I had seen someone else use it before trying it myself, I could have made my payments online. | ||

| 8. RELATIVE ADVANTAGE (RA) | (RA1) I can access and make my payment transactions over the internet anytime and anywhere. | Rogers (1983); Moore and Benbasat (1991); Lin (2011) |

| (RA2) Making my payment transactions online enables me to perform my daily work quickly. | ||

| (RA3) My adaptation to online card payment is useful for managing my payment transactions. | ||

| 9. PERCEIVED CREDIBILITY (PCR) | (PC1) Making my payment transactions online does not disclose my personal information. | Wang et al. (2003); Hanafizadeh et al. (2014) |

| (PC2) I can find it safe to pay by card on the internet while carrying out the process of my payment transactions. | ||

| (PC3) I can find the internet safe while requesting and receiving other information. | ||

| 10. HEALTH AND EPIDEMIC EFFECTS (HE) | (HE1) Despite the COVID-19 pandemic, I did not delay the card payment transactions I made online. | Acemoğlu and Johnson (2007) |

| (HE2) With the COVID-19 pandemic, I made all my possible payment transactions online. | ||

| (HE3) During the quarantine process caused by the COVID-19 pandemic, the number of my payment transactions (online shopping, invoices, etc.) increased compared to the online payment transactions I made in the normal period. | ||

| (HE4) The COVID-19 pandemic has changed my perception of my online payment transactions. | ||

| (HE5) Even after the COVID-19 pandemic is over, I will try to make my payments online. | ||

| 11. QUALITY OF INTERNET CONNECTION (QIC) | (QIC1) My access to the internet is easy. | Sathye (1999); Al-Somali et al. (2009); |

| (QIC2) The Internet enables me to handle my online financial transactions accurately. | ||

| (QIC3) Using the internet for handling online financial transactions is efficient. | ||

| (QIC4) The Internet guarantees that all transactions to the bank have been completed. | ||

| 12. PERCEIVED COST (PC) | (PC1) It would be very costly to use the internet for my payment transactions. | Sathye (1999); Hanafizadeh et al. (2014) |

| (PC2) I think that using the internet for my payment transactions will have a high cost of internet access. | ||

| (PC3) I have financial barriers (eg internet access cost) to use the internet for my payment transactions. | ||

| 13. PERCEIVED INTEGRITY (PI) | (PI1) I think the companies I pay for are honest. | Bhattacherjee (2000); Lin (2011) |

| (PI2) I think the companies I make payment transactions will with fulfill their commitments. | ||

| (PI3) I think the companies with which I make payment transactions give unbiased information about the transactions. | ||

| 14. PERCEIVED ENJOYMENT (PE) | (PE1) Making my payments online is fun. | Davis et al. (1992); Pikkarainen et al. (2004) |

| (PE2) Making my payments online is positive. | ||

| (PE3) Making my payments online is exciting. | ||

| (PE4) Making my payments online is wise. | ||

| 15. FACILITATING CONDITIONS (FC) | (FC1) I have the necessary resources to make my payment transactions online. | Taylor and Todd (1995); Burnett (2000); Yu (2012) |

| (FC2) I have the necessary knowledge to make my payment transactions online. | ||

| (FC3) Making my payment transactions online is compatible with my life. | ||

| (FC4) Help can be obtained when I have problems while making my payment transactions online. | ||

| 16. UBIQUITY (UB) | (UB1) I can make my payment transactions from anywhere on the internet. | Anderson and Narus (1990); Zhou (2012) |

| (UB2) I can make my payment transactions online whenever I want. | ||

| (UB3) If necessary, I can make my payment transactions online anytime, anywhere. | ||

| 17. COMPLEXITY (COMPE) | (COMPE1) Making payments online requires a lot of mental effort. | Rogers (1983); Taylor and Todd (1995) |

| (COMPE2) Making payments online requires technical skills. | ||

| (COMPE3) Making payments online can be frustrating. | ||

| 18. PERSONAL INNOVATIVENESS (PIN) | (PI1) My friends and neighbors often come to me for advice about new products and innovations. | Agarwal and Karahanna (2000); Sulaiman et al. (2007); Lee et al. (2007) |

| (PI2) I like to buy new and different things. | ||

| (PI3) I am usually among the first to try new products. | ||

| (PI4) I like to keep up with technological advances. | ||

| (PI5) It is very important to me to feel that I am a part of a group. | ||

| ATTITUDE (AT) | (AT1) I think it is a wise idea to make payments online. | Davis (1989); Schierz et al. (2010); Lin (2011) |

| (AT2) I am not satisfied with the traditional payment system. | ||

| (AT3) Using the internet while purchasing products and services and paying bills is a nice experience. | ||

| (AT4) I will encourage online card payments among my colleagues. | ||

| (AT5) Overall, my attitude towards online card payment is positive. | ||

| BEHAVIORAL INTENTION TO USE (BI) | (BI1) I am thinking of making all my payments over the internet. | Davis (1989); Venkatesh et al. (2003); Gefen et al. (2003); Schierz et al. (2010); Lin (2011) |

| (BI2) I am thinking of making payments online frequently. | ||

| (BI3) I believe that it is valuable for me to adopt online payment transactions with a card. |

Table A2.

Total Variance Explained.

Table A2.

Total Variance Explained.

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | ||||

|---|---|---|---|---|---|---|

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 21.316 | 29.606 | 29.606 | 21.316 | 29.606 | 29.606 |

| 2 | 5.440 | 7.556 | 37.162 | 5.440 | 7.556 | 37.162 |

| 3 | 4.735 | 6.576 | 43.738 | 4.735 | 6.576 | 43.738 |

| 4 | 2.571 | 3.571 | 47.309 | 2.571 | 3.571 | 47.309 |

| 5 | 2.177 | 3.024 | 50.333 | 2.177 | 3.024 | 50.333 |

| 6 | 1.923 | 2.671 | 53.004 | 1.923 | 2.671 | 53.004 |

| 7 | 1.797 | 2.497 | 55.501 | 1.797 | 2.497 | 55.501 |

| 8 | 1.641 | 2.279 | 57.780 | 1.641 | 2.279 | 57.780 |

| 9 | 1.555 | 2.160 | 59.939 | 1.555 | 2.160 | 59.939 |

| 10 | 1.434 | 1.991 | 61.931 | 1.434 | 1.991 | 61.931 |

| 11 | 1.312 | 1.822 | 63.753 | 1.312 | 1.822 | 63.753 |

| Extraction Method: Principal Component Analysis. | ||||||

Table A3.

Total Variance Explained.

Table A3.

Total Variance Explained.

| Factor 1 | Factor 2 | Factor 3 | Factor 4 | Factor 5 | Factor 6 | Factor 7 | Factor 8 | Factor 9 | Factor 10 | Factor 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UB2 | 0.840 | ||||||||||

| UB3 | 0.816 | ||||||||||

| FC1 | 0.806 | ||||||||||

| UB1 | 0.779 | ||||||||||

| FC2 | 0.767 | ||||||||||

| FC3 | 0.742 | ||||||||||

| RA1 | 0.681 | ||||||||||

| QIC2 | 0.649 | ||||||||||

| HE5 | 0.648 | ||||||||||

| QIC3 | 0.639 | ||||||||||

| RA2 | 0.624 | ||||||||||

| CMPA3 | 0.616 | ||||||||||

| PE4 | 0.609 | ||||||||||

| CMPA2 | 0.602 | ||||||||||

| PE2 | 0.591 | ||||||||||

| FC4 | 0.590 | ||||||||||

| HE1 | 0.573 | ||||||||||

| CMPA1 | 0.569 | ||||||||||

| RA3 | 0.549 | ||||||||||

| QIC1 | 0.536 | ||||||||||

| HE2 | 0.516 | ||||||||||

| PT4 | 0.828 | ||||||||||

| PT3 | 0.823 | ||||||||||

| PT2 | 0.642 | ||||||||||

| PC1 | 0.633 | ||||||||||

| PT5 | 0.633 | ||||||||||

| PC2 | 0.558 | ||||||||||

| PC3 | 0.549 | ||||||||||

| PT1 | 0.515 | ||||||||||

| PR5 | 0.760 | ||||||||||

| PR3 | 0.738 | ||||||||||

| PR4 | 0.730 | ||||||||||

| PR6 | 0.721 | ||||||||||

| PR1 | 0.703 | ||||||||||

| PR2 | 0.688 | ||||||||||

| PU2 | 0.760 | ||||||||||

| PU1 | 0.721 | ||||||||||

| PU3 | 0.710 | ||||||||||

| PU5 | 0.699 | ||||||||||

| PU4 | 0.681 | ||||||||||

| PIN3 | 0.809 | ||||||||||

| PIN2 | 0.766 | ||||||||||

| PIN4 | 0.672 | ||||||||||

| PIN1 | 0.610 | ||||||||||

| COMPE1 | 0.828 | ||||||||||

| COMPE2 | 0.809 | ||||||||||

| COMPE3 | 0.612 | ||||||||||

| PC3 | 0.519 | ||||||||||

| PI2 | 0.697 | ||||||||||

| PI3 | 0.681 | ||||||||||

| PI1 | 0.650 | ||||||||||

| PEU1 | 0.742 | ||||||||||

| PEU3 | 0.609 | ||||||||||

| PEU4 | 0.538 | ||||||||||

| SI2 | 0.745 | ||||||||||

| SI1 | 0.550 | ||||||||||

| SI5 | 0.514 | ||||||||||

| SE2 | 0.710 | ||||||||||

| SE3 | 0.651 | ||||||||||

| HE4 | 0.794 | ||||||||||

| HE3 | 0.737 |

References

- Abdullah, Engku Mohamad Engku, Aisyah Abdul Rahman, and Ruzita Abdul Rahim. 2018. Adoption of financial technology (Fintech) in mutual fund/unit trust investment among Malaysians: Unified Theory of Acceptance and Use of Technology (UTAUT). International Journal of Engineering & Technology 7: 110–18. [Google Scholar]

- Aboelmaged, Mohamed, and Tarek R. Gebba. 2013. Mobile Banking Adoption: An Examination of Technology Acceptance Model and Theory of Planned Behavior. International Journal of Business Research and Development 2: 35–50. [Google Scholar] [CrossRef]

- Acemoğlu, Daron, and Simon Johnson. 2007. Disease and Development: The Effect of Life Expectancy on Economic Growth. Journal of Political Economy 115: 925–85. [Google Scholar] [CrossRef] [Green Version]

- Agarwal, Ritu, and Elena Karahanna. 2000. Time Flies When You’re Having Fun: Cognitive Absorption and Beliefs about Information Technology Usage. MIS Quarterly 24: 665–94. [Google Scholar] [CrossRef]

- Agarwal, Ritu, and Jayesh Prasad. 1998. A Conceptual and Operational Definition of Personal Innovativeness in the Domain of Information Technology. Information Systems Research 9: 204–15. [Google Scholar] [CrossRef]

- Ajzen, Icek. 2002. Perceived Behavioral Control, Self-Efficacy, Locus of Control, and the Theory of Planned Behavior. Journal of Applied Social Psychology 32: 665–83. [Google Scholar] [CrossRef]

- Ajzen, Icek, and Martin Fishbein. 1980. Understanding Attitudes and Predicting Social Behavior. Englewood Cliffs: Prentice-Hall. [Google Scholar]

- Akturan, Ulun, and Nuray Tezcan. 2012. Mobile Banking Adoption of the Youth Market, Perceptions and Intentions. Emerald Insight 30: 444–59. [Google Scholar]

- Aldás-Manzano, Joaquin, Carlos Lassala-Navarre, Carla Ruiz-Mafé, and Silvia Sanz-Blas. 2009. Key Drivers of Internet Banking Services Use. Online Information Review 33: 672–95. [Google Scholar] [CrossRef]

- Al-Somali, Sabah Abdullah, Roya Gholami, and Ben Clegg. 2009. An Investigation into the Acceptance of Online Banking in Saudi Arabia. Technovation 29: 130–41. [Google Scholar] [CrossRef]

- AlSoufi, Ali, and Hayat Ali. 2014. Customers’ perception of m-banking adoption in Kingdom of Bahrain: An empirical assessment of an extended TAM model. arXiv arXiv:1403.2828. [Google Scholar]

- Amin, Hanudin, Mohd Rizal Abdul Hamida, Suddin Ladaa, and Zuraidah Anis. 2008. The adoption of mobile banking in Malaysia: The case of Bank Islam Malaysia Berhad (BIMB). International Journal of Business and Society 9: 43. [Google Scholar]

- Anderson, James C., and James A. Narus. 1990. A Model of Distributor Firm and Manufacturer Firm Working Partnerships. Journal of Marketing 54: 42–58. [Google Scholar] [CrossRef]

- Bankole, Felix O., Omolola O. Bankole, and Irwin Brown. 2011. Mobile banking adoption in Nigeria. The Electronic Journal of Information Systems in Developing Countries 47: 1–23. [Google Scholar] [CrossRef]

- Bauer, Hans H., Tina Reichardt, Stuart J. Barnes, and Marcus M. Neumann. 2005. Driving Consumer Acceptance of Mobile Marketing: A Theoretical Framework and Empirical Study. Journal of Electronic Commerce Research 6: 181–91. [Google Scholar]

- Bhattacherjee, Anol. 2000. Acceptance of E-commerce Services: The Case of Electronic Brokerages. IEEE Transactions on System, Man, and Cybernetics—Part A: Systems and Humans 20: 411–20. [Google Scholar] [CrossRef] [Green Version]

- BKM. 2020. General Statistical Data for Selected Mounth. Available online: https://bkm.com.tr/en/secilen-aya-ait-istatistikler/ (accessed on 12 December 2021).

- Bommer, William H., Shailesh Rana, and Emil Milevoj. 2022. A meta-analysis of e-Wallet adoption using the UTAUT model. International Journal of Bank Marketing 40: 791–819. [Google Scholar] [CrossRef]

- Boonsiritomachai, Waranpong, and Krittipat Pitchayadejanant. 2017. Determinants Affecting Mobile Banking Adoption by Generation Y Based on the Unified Theory of Acceptance and Use of Technology Model Modified by the Technology Acceptance Model Concept. Kasetsart Journal of Social Sciences 40: 349–58. [Google Scholar] [CrossRef]

- Burnett, Rachel. 2000. Legal Aspects of E-commerce. Computing and Control Engineering Journal 11: 111–14. [Google Scholar] [CrossRef]

- Cao, Wen. 2016. FinTech Acceptance Research in Finland–Case Company Plastc. Unpublished Master’s thesis, Aalto University School of Business, Espoo, Finland. [Google Scholar]

- Chitungo, Shallone K., and Simon Munongo. 2013. Extending the technology acceptance model to mobile banking adoption in rural Zimbabwe. Journal of Business Administration and Education 3: 51–79. [Google Scholar]

- Chuang, Li-Min, Chun-Chu Liu, and Hsiao-Kuang Kao. 2016. The Adoption of Fintech Service: TAM perspective. International Journal of Management and Administrative Sciences 3: 1–15. [Google Scholar]

- Crabbe, Margaret, Craig Standing, Susan Standing, and Heikki Karjaluoto. 2009. An Adoption Model for Mobile Banking in Ghana. International Journal of Mobile Communications 7: 515–43. [Google Scholar] [CrossRef]

- Cunha, Paulo Rupino, Paulo Melo, and Helder Sebastião. 2021. From Bitcoin to Central Bank Digital Currencies: Making Sense of the Digital Money Revolution. Future Internet 13: 165. [Google Scholar] [CrossRef]

- Davis, Fred D. 1989. Perceived Usefulness, Perceived Ease of Use and User Acceptance of Information Technology. MIS Quarterly 13: 318–39. [Google Scholar] [CrossRef] [Green Version]

- Davis, Fred D., Richard P. Bagozzi, and Paul R. Warshaw. 1989. User Acceptance of Computer Technology: A Comparison of Two Theoretical Models. Management Science 35: 982–1003. [Google Scholar] [CrossRef] [Green Version]

- Davis, Fred D., Richard P. Bagozzi, and Paul R. Warshaw. 1992. Extrinsic and Intrinsic Motivation to Use Computers in the Workplace. Journal of Applied Social Psychology 22: 1111–32. [Google Scholar] [CrossRef]

- Dmour, Al Ahilyya, Hani Al Dmour, Ran Al-Barghuthi, and Ran Al-Dmour. 2021. Factors Influencing the Adoption of E-Payment During Pandemic Outbreak (COVID-19): Empirical Evidence. In The Effect of Coronavirus Disease (COVID-19) on Business Intelligence. Cham: Springer, pp. 133–54. [Google Scholar]

- Du, Wenyu, Dorothy E. Leidner, Shan L. Pan, and Wenchi Ying. 2018. Affordances, Experimentation and Actualization of FinTech: A Blockchain Implementation Study. Journal of Strategic Information Systems 28: 50–65. [Google Scholar] [CrossRef]

- Fabris, Nikola. 2019. Cashless society–the future of money or a utopia? Journal of Central Banking Theory and Practice 8: 53–66. [Google Scholar] [CrossRef] [Green Version]

- Fishbein, Martin, and Icek Ajzen. 1975. Beliefs, Attitude, Intention and Behaviour: An Introduction to Theory and Research. Reading: Addison-Wesley. [Google Scholar]

- Gefen, David, Elena Karahanna, and Detmar W. Straub. 2003. Trust and TAM in Online Shopping: An Integrated Model. MIS Quarterly 27: 51–90. [Google Scholar] [CrossRef]

- George, Joey F. 2002. Influences on the Intent to Make Internet Purchases. Internet Research 12: 165–80. [Google Scholar] [CrossRef]

- Ghosh, Gourab. 2021. Adoption of digital payment system by consumer: A review of literature. International Journal of Creative Research Thoughts 9: 412–18. [Google Scholar]

- Gu, Ja-Chul, Sang-Chul Lee, and Yung-Ho Suh. 2009. Determinants of Behavioral Intention to Mobile Banking. Expert Systems with Applications 36: 11605–16. [Google Scholar] [CrossRef]

- Guriting, Petrus, and Nelson Oly Ndubisi. 2006. Borneo Online Banking: Evaluating Customer Perceptions and Behavioral Intention. Management Research News 29: 6–15. [Google Scholar] [CrossRef]

- Hair, Joseph F., William C. Black, Barry J. Babin, Rolph E. Anderson, and Ronald L. Tatham. 2006. Multivariate Data Analysis, 6th ed. Upper Saddle River: Pearson Prentice Hall. [Google Scholar]

- Hanafizadeh, Payam, Mehdi Behboudi, Amir Abedini Koshksaray, and Marziyeh Jalilvand Shirkhani Tabar. 2014. Mobile-banking adoption by Iranian bank clients. Telematics and Informatics 31: 62–78. [Google Scholar] [CrossRef]

- Higgins, James. 2005. Introduction to Multiple Regression (Chp4). The Radical Statistician. Available online: https://www.academia.edu/33271787/Chapter_4_Introduction_to_Multiple_Regression (accessed on 7 March 2021).

- Husni, Emir, N. Kuspriyanto, Noor Basjaruddin, Tito Waluyo Purboyo, Sugeng Purwantoro, and Huda Ubaya. 2011. Efficient tag-to-tag near field communication (NFC) protocol for secure mobile payment. Paper presented at 2011 2nd International Conference on Instrumentation, Communications, Information Technology, and Biomedical Engineering, Bandung, Indonesia, November 8–9. [Google Scholar]

- Interactive Advertising Bureau. 2016. A Global Perspective of Mobile Commerce. Available online: https://www.iab.com/wp-content/uploads/2016/09/2016-IAB-Global-Mobile-Commerce-Report-FINAL-092216.pdf (accessed on 5 February 2022).

- Jiang, Yun, Hassan Ahmad, Asad Hassan Butt, Muhammad Nouman Shafique, and Sher Muhammad. 2021. QR digital payment system adoption by retailers: The moderating role of COVID-19 knowledge. Information Resources Management Journal (IRMJ) 34: 41–63. [Google Scholar] [CrossRef]

- J.P. Morgan. 2020. 2020 E-Commerce Payments Trends Report: Turkey. Available online: https://www.jpmorgan.com/merchant-services/insights/reports/turkey-2020 (accessed on 15 June 2021).

- Kalkan, Pınar. 2021. Analysis of The Effects of Pandemic Economy on Internet Shopping. Journals of Social, Humanities and Administrative Sciences 4: 740–58. [Google Scholar]

- Kapoor, Kawaljeet Kaur, Yogesh K. Dwivedi, and Michael D. Williams. 2014. Rogers’ innovation adoption attributes: A systematic review and synthesis of existing research. Information Systems Management 31: 74–91. [Google Scholar] [CrossRef] [Green Version]

- Kazi, Abdul Kabeer, and Mohammad Adeel Mannan. 2013. Factors affecting adoption of mobile banking in Pakistan. International Journal of Research in Business and Social Science (2147–4478) 2: 54–61. [Google Scholar] [CrossRef]

- Khan, Burhan Ul Islam, Rashidah F. Olanrewaju, Asifa Mehraj Baba, Adil Ahmad Langoo, and Shahul Assad. 2017. A Compendious Study of Online Payment Systems: Past Developments, Present Impact, and Future Considerations. International Journal of Advanced Computer Science and Applications 8: 256–71. [Google Scholar]

- Khraim, Hamza Salim, Younes Ellyan Al Shoubaki, and Aymen Salim Khraim. 2011. Factors Affecting Jordanian Consumers’ Adoption of Mobile Banking Services. International Journal of Business and Social Science 2: 96–105. [Google Scholar]

- Kim, Kyung Kyu, and Bipin Prabhakar. 2004. Initial Trust and the Adoption of B2C e-Commerce: The Case of Internet Banking. Database for Advances in Information System 35: 50–64. [Google Scholar] [CrossRef]

- Kim, Yonghee, Jeongil Choi, Young-Ju Park, and Jiyoung Yeon. 2016. The Adoption of Mobile Payment Services for “Fintech”. International Journal of Applied Engineering Research 11: 1058–61. [Google Scholar]

- Kleijnen, Mirella, Martin Wetzels, and Ko De Ruyter. 2004. Consumer Acceptance of Wireless Finance. Journal of Financial Services Marketing 8: 206–17. [Google Scholar] [CrossRef]

- Kumar, Aswin. 2019. Digital Payment and Its Effects in Indian Business. Iconic Research and Engineering Journals 2: 4–7. [Google Scholar]

- Kumar, Dileep, and Yeonseung Ryu. 2009. A Brief Introduction of Biometrics and Fingerprint Payment Technology. International Journal of Advanced Science and Technology 4: 25–38. [Google Scholar]

- Kurnia, Sherah, Benjamin Lim, and Heejin Lee. 2007. Exploring the Reasons for a Failure of Electronic Payment Systems: A Case Study of an Australian Company. Journal of Research and Practice in Information Technology 39: 231–43. [Google Scholar]

- Lederer, Albert L., Donna J. Maupin, Mark P. Sena, and Youlong Zhuang. 2000. The Technology Acceptance Model and the World Wide Web. Decision Support System 29: 269–82. [Google Scholar] [CrossRef]

- Lee, Hae Young, Hailin Qu, and Yoo Shin Kim. 2007. A Study of the Impact of Personal Innovativeness on Online Travel Shopping Behavior-A Case Study of Korean Travelers. Tourism Management 28: 886–97. [Google Scholar] [CrossRef]

- Levitin, Adam J. 2017. Pandora’s Digital Box: The Promise and Perils of Digital Wallets. Penn Law Journals 166: 305. [Google Scholar] [CrossRef] [Green Version]

- Lin, Hsiu-Fen. 2011. An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. International Journal of Information Management 31: 252–60. [Google Scholar] [CrossRef]

- Luarn, Pin, and Hsin-Hui Lin. 2005. Toward an Understanding of the Behavioral Intention to Use Mobile Banking. Computers in Human Behavior 21: 873–91. [Google Scholar] [CrossRef]

- Magnier-Watanabe, Remy. 2014. An Institutional Perspective of Mobile Payment Adoption: The Case of Japan. Paper presented at 47th Hawaii International Conference on System Science, Waikoloa, HI, USA, January 6–9. [Google Scholar]

- Mallat, Niina. 2007. Exploring Consumer Adoption of Mobile Payments—A Qualitative Study. Journal of Strategic Information Systems 16: 413–32. [Google Scholar] [CrossRef]

- Meharia, Priyanka. 2012. Assurance on The Reliability of Mobile Payment System and Its Effects on Its’ Use: An Empirical Examination. Accounting and Management Information Systems 11: 97–111. [Google Scholar]

- Moon, Ji-Won, and Young-Gul Kim. 2001. Extending the TAM for a World Wide Web Context. Information & Management 38: 217–30. [Google Scholar]

- Moore, Gary C., and Izak Benbasat. 1991. Development of an Instrument to Measure the Perceptions of Adoption in Information Technology Innovation. Information Systems Research 2: 192–222. [Google Scholar] [CrossRef] [Green Version]

- Náñez Alonso, Sergio Luis, Javier Jorge-Vazquez, and Ricardo Francisco Reier Forradellas. 2021. Central banks digital currency: Detection of optimal countries for the implementation of a CBDC and the implication for payment industry open innovation. Journal of Open Innovation: Technology, Market, and Complexity 7: 72. [Google Scholar] [CrossRef]

- Náñez Alonso, Sergio Luis, Miguel Ángel Echarte Fernández, David Sanz Bas, and Jarosław Kaczmarek. 2020. Reasons fostering or discouraging the implementation of central bank-backed digital currency: A review. Economies 8: 41. [Google Scholar] [CrossRef]

- Nysveen, Herbjørn, Per E. Pedersen, and Helge Thorbjørnsen. 2005. Intentions to Use Mobile Services: Antecedents and Cross-Service Comparisons. Journal of the Academy of Marketing Science 33: 330–46. [Google Scholar] [CrossRef]

- Omodero, Cordelia Onyinyechi. 2021. Fintech Innovation in the Financial Sector: Influence of E-Money Products on a Growing Economy. Studia Universitatis Vasile Goldiş, Arad-Seria Ştiinţe Economice 31: 40–53. [Google Scholar] [CrossRef]

- Ozturkoglu, Omer, Ebru E. Saygılı, and Yucel Ozturkoglu. 2016. A manufacturing-oriented model for evaluating the satisfaction of workers–Evidence from Turkey. International Journal of Industrial Ergonomics 54: 73–82. [Google Scholar] [CrossRef]

- Pazvant, Ece. 2017. Evaluation of the Intention of Using Products with Internet of Things within the Context of Technology Acceptence. Master’s thesis, Duzce University, Duzce, Turkey. [Google Scholar]

- Pikkarainen, Teo, Kari Pikkarainen, Heikki Karjaluoto, and Seppo Pahnila. 2004. Consumer Acceptance of Online Banking: An Extension of the Technology Acceptance Model. Internet Research 14: 224–35. [Google Scholar] [CrossRef] [Green Version]

- Püschel, Júlio, José Afonso Mazzon, and José Mauro C. Hernandez. 2010. Mobile Banking: Proposition of an Integrated Adoption Intention Framework. International Journal of Bank Marketing 28: 389–409. [Google Scholar] [CrossRef] [Green Version]

- Raleting, T., and Jacques Nel. 2011. Determinants of low-income non-users’ attitude towards WIG mobile phone banking: Evidence from South Africa. African Journal of Business Management 5: 212–23. [Google Scholar]

- Riquelme, Hernan E., and Rosa E. Rios. 2010. The Moderating Effect of Gender in the Adoption of Mobile Banking. International Journal of Bank Marketing 28: 328–41. [Google Scholar] [CrossRef]

- Rogers, E. M. 1983. Diffusion of Innovations, 3rd ed. New York: Free Press. [Google Scholar]

- Rogers, E. M. 1995. Diffusion of Innovations, 4th ed. New York: Free Press. [Google Scholar]

- Safeena, Rahmath, Hema Date, Abdullah Kammani, and Nisar Hundewale. 2012. Technology Adoption and Indian Consumers: Study on Mobile Banking. International Journal of Computer Theory and Engineering 4: 1020–24. [Google Scholar] [CrossRef] [Green Version]

- Sahi, Alaa Mahdi, Haliyana Khalid, and Alhamzah Fadhil Abbas. 2021. Digital Payment Adoption: A Review (2015–2020). Journal of Management Information & Decision Sciences 24: 1–9. [Google Scholar]

- Sathye, Milind. 1999. Adoption of Internet Banking by Australian Consumers: An Empirical Investigation. International Journal of Bank Marketing 17: 324–34. [Google Scholar] [CrossRef]

- Saygili, Ebru E., and Tuncay Ercan. 2021. An Overview of International Fintech Instruments Using Innovation Diffusion Theory Adoption Strategies. Innovative Strategies for Implementing FinTech in Banking 3: 46–66. [Google Scholar]

- Schierz, Paul Gerhardt, Oliver Schilke, and Bernd W. Wirtz. 2010. Understanding Consumer Acceptance of Mobile Payment Services: An Empirical Analysis. Electronic Commerce Research and Applications 9: 209–16. [Google Scholar] [CrossRef]

- Shaikh, Aijaz A., and Heikki Karjaluoto. 2015. Mobile Banking Adoption: A Literature Review. Telematics and Informatics 32: 129–42. [Google Scholar] [CrossRef] [Green Version]

- Sheng, Min, Lu Wang, and Yinjun Yu. 2011. An Emprical Model of Individual Mobile Banking Acceptance in China. Paper presented at International Conference on Computational and Information Sciences, Chengdu, China, October 21–23; pp. 434–37. [Google Scholar]

- Sivathanu, Brijesh. 2018. Adoption of digital payment systems in the era of demonetization in India: An empirical study. Journal of Science and Technology Policy Management 10: 143–71. [Google Scholar] [CrossRef]

- Soon, Tan Jin. 2008. QR Code. Synthesis Journal 2008: 59–78. [Google Scholar]

- Statista. 2021. E-Commerce Report 2021. Available online: https://www.statista.com/outlook/dmo/ecommerce/turkey (accessed on 21 February 2022).

- Sulaiman, Ainin, Noor Ismawati Jaafar, and Suhana Mohezar. 2007. An Overview of Mobile Banking Adoption Among the Urban Community. International Journal Mobile Communications 5: 157–68. [Google Scholar] [CrossRef]

- Sumanjeet, Singh. 2009. Emergence of Payment Systems in the Age of Electronic Commerce: The State of Art. Global Journal of International Business Research 2: 17–36. [Google Scholar]

- Tarhini, Ali, Kate Hone, and Xiaohui Liu. 2015. A Cross-Cultural Examination of the Impact of Social, Organisational and Individual Factors on Educational Technology Acceptance between British and Lebanese University Students. British Journal of Educational Technology 46: 739–55. [Google Scholar] [CrossRef] [Green Version]

- Taylor, Shirley, and Peter A. Todd. 1995. A Test of Competing Models. Information Systems Research 6: 144–76. [Google Scholar] [CrossRef]

- Teo, Thompson S. H., Vivien K. G. Lim, and Raye Y. C. Lai. 1999. Intrinsic and Extrinsic Motivation in Internet Usage. Omega International Journal of Management Science 27: 25–37. [Google Scholar] [CrossRef]

- Tobbin, Peter, and J. K. Kuwornu. 2012. Adoption of Mobile Money Transfer Technology: Structural Equation Modeling Approach. European Journal of Business and Management 3: 58–77. [Google Scholar]

- Venkatesh, Viswanath. 2000. Determinants of Perceived Ease of Use: Integrating Control, Intrinsic Motivation, and Emotion into the Technology Acceptance Model. Information Systems Research 11: 342–65. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, Viswanath, and Fred D. Davis. 1996. A model of the antecedents of perceived ease of use: Development and test. Decision Sciences 27: 451–81. [Google Scholar] [CrossRef]

- Venkatesh, Viswanath, and Fred D. Davis. 2000. A Theoretical Extension of The Technology Acceptance Model: Four Longitudinal Field Studies. Management Science 46: 186–204. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, Viswanath, and Xiaojun Zhang. 2010. Unified Theory of Acceptance and Use of Technology: US vs. China. Journal of Global Information Technology Management 13: 5–27. [Google Scholar] [CrossRef]

- Venkatesh, Viswanath, Michael G. Morris, Gordon B. Davis, and Fred D. Davis. 2003. User Acceptance of Information Technology: Toward A Unified View. Management Information Systems Research Center, University of Minnesota 27: 425–78. [Google Scholar] [CrossRef] [Green Version]

- Wang, Yi-Shun, Yu-Min Wang, Hsin-Hui Lin, and Tzung-I Tang. 2003. Determinant of User Acceptance of Internet Banking: An Empirical Study. International Journal of Service Industry Management 14: 501–20. [Google Scholar] [CrossRef]

- We Are Social. 2022. Digital 2022: Another Year of Bumper Growth. Available online: https://wearesocial.com/uk/blog/2022/01/digital-2022-another-year-of-bumper-growth-2/ (accessed on 3 May 2022).

- Wessels, Lisa, and Judy Drennan. 2010. An Investigation of Consumer Acceptance of M-Banking. Faculty of Business, Queensland University of Technology, Brisbane, Australia 28: 547–68. [Google Scholar] [CrossRef]

- Yan, Hong, and Zhonghua Yang. 2015. Examining Mobile Payment User Adoption from the Perspective of Trust. International Journal of u- and Virtual e- Service Science and Technology 8: 117–30. [Google Scholar]

- Yu, Chian-Son. 2012. Factors Affecting Individuals to Adopt Mobile Banking: Empirical Evidence from the UTAUT Model. Journal of Electronic Commerce Research 13: 104–21. [Google Scholar]

- Zheng, Juan, and Shan Li. 2020. What Drives Students’ Intention to Use Tablet Computers: An Extended Technology Acceptance Model. International Journal of Educational Research 102: 101612. [Google Scholar] [CrossRef]

- Zhou, Tao. 2012. Examining Mobile Banking User Adoption from the Perspectives of Trust and Flow Experience. Information Technology Management 13: 27–37. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).