Abstract

The study examined the impact of perceived value, insurance literacy and perceived trust on insurance inclusion in Uganda. The study employed a cross-sectional design to solicit responses from 400 individuals that voluntarily enrolled on an insurance programme. The study hypotheses were tested using Covariance-Based Structural Equation Modelling. The results showed that perceived value, insurance literacy and perceived trust have a significant and positive prediction of insurance inclusion in Uganda. However, perceived trust explained more of the variations in insurance inclusion than perceived value and insurance literacy. Overall, the predictor variables explained 63.2% of the variance in insurance inclusion. This study contributes to the limited nascent literature on insurance inclusion. The implication of this study is that insurance providers need to focus on trust and delivering value to customers in order to promote insurance inclusion. Further, the study proffers advice to policymakers to include insurance literacy in the national financial inclusion strategies to foster insurance inclusion.

1. Introduction

Access to financial services by people within the uncovered segments of the population is vital to inclusive growth and equity promotion (Nandru et al. 2016). In that respect, Cheston et al. (2018) connote insurance inclusion as a “state of access to and use of appropriate and affordable insurance products for the unserved and underserved”. Inclusive growth is critical to ensuring the long-term sustainability of destitute, remote and socially excluded sections of societies (Nandru et al. 2016; Wanczeck et al. 2017). On that note, insurance inclusion is recognised as a solution for stabilising and improving the livelihood for individual households and businesses. Insurance aids individuals in accessing credit, guaranteeing savings and money transfer safety, and it protects middle- and low-income households from transactional financial losses (Dassanou and Sherchan 2018). As a risk control strategy, insurance enables low-income and middle-income people to safeguard and increase their assets (Wanczeck et al. 2017).

Despite the potency of insurance inclusion in fostering economic growth and development (Bayar et al. 2021; Zulfiqar et al. 2020), global insurance inclusion levels have remained low (Swiss Re Institute 2019; Access to Insurance Initiative (AII 2019)). In the context of Uganda, despite having a 78% financial inclusion rate, insurance inclusion remains very low. Only 1% of adult Ugandans (0.22 million) have formal insurance cover. The Finscope survey (2018) further notes a higher increase in informal insurance uptake compared to that of formal insurance usage, yet informal mechanisms do not guarantee risk protection. Notably, 40% of adult Ugandans use informal risk protection mechanisms, while 59% of adult Ugandans have no form of risk protection (Financial Sector Deepening 2018).

Notwithstanding, inclusive financial systems that are free of price and non-price restrictions enhance the social-economic wellbeing of the people (Demirguc-Kunt and Klapper 2012). Short of inclusive financial systems, people resort to informal risk coping mechanisms such as depleting savings, selling assets and borrowing from acquaintances when lifecycle shocks occur (Cheston et al. 2018). In this regard, insurance is a robust financial risk mitigation approach that enables the poor to effectively cope with risks (Zuliani and Rahman 2018). Thus, Dassanou and Sherchan (2018) concluded that inclusive insurance fosters financial resilience, hence keeping people out of poverty owing to economic disruptions.

Despite the significance accorded to the need for insurance inclusion, empirical literature on insurance inclusion in Uganda is remarkably sparse. Empirical studies on insurance inclusion have had a supply-side bias (Tolani et al. 2019; Lin et al. 2019) and have ignored the demand-driven determinants such as perceived value, insurance literacy and perceived trust, which can explain the increased usage and uptake of insurance services by the poor. In that regard, the value perceptions constructed by clients largely influence their buying decisions (Wu et al. 2018). The extant literature has emphasised the importance of perceived value on influencing purchase and repurchase intentions among customers (see, for instance, Yan 2019; Ramadhan 2019). On that note, Liu et al. (2019) contend that an individual’s value perception increment influences an equal increase towards value antecedents of trust and the insurance company’s reputation. Similarly, in the insurance sector, Marcos and Coelho (2017) and Nguyen et al. (2019) demonstrate that service quality influences loyalty, and hence, the customers make repeat purchases. However, several empirical studies have investigated the influence of perceived value on customer satisfaction in the services industry, and they had mixed findings. For instance, Kwon et al. (2015) found that customer satisfaction is more price- and not value-driven. On the contrary, Wu et al. (2018) found that the association between the customer’s value and satisfaction was insignificant. As such, Nguyen et al. (2019) suggests the need for further research on the critical factor of customer value and satisfaction in insurance.

Regarding insurance literacy, Tennyson (2011) connotes that unlike the saving and borrowing components of financial inclusion, insurance purchase decisions are more complex. In that regard, due to the failure to understand what is covered and what is not, consumers end up buying inappropriate insurance policies (Reece Warner 2016). In addition, unserved and underserved individuals might not be aware of the fundamentals of insurance and the potential risks they face (Uddin 2017). That aside, even when they are mindful, a lack of knowledge about insurance products and services negatively affects the insurance decisions (McCord 2012). Generally, low-income consumers are inexperienced in the insurance aspect (International Association of Insurance Supervisors (IAIS 2015)). According to Kubitza et al. (2019), consumers confuse insurance with savings by expecting a return for the premium paid. As such, researchers believe that in addition to elementary maths and reading, people need insurance literacy to ably evaluate insurance policies (Mathur et al. 2018).

From the trust perspective, Weedige et al. (2019) assert that loyal customers may develop distrust when financial services providers focus on the financial goals instead of delivering on their promise. Therefore, given that insurance is inherent in nature, clients might probably feel a risk exposure owing to the nature of the insurance. In that regard, trust mediates the clients’ perceived risk and insurance enrolment (Dayour 2020). Although inclusive insurance intends to reach out to those that are unserved and underserved by insurance, Dercon et al. (2012) connote that low-income people distrust formal insurance providers. On the contrary, in Ghana, Asseldonk and Belissa (2019) found that index insurance uptake doubled when it was sold through informal providers that the people trusted. Notably, trust in insurance providers may negatively be affected by rumours of delayed pay-outs or rejections, even when they are valid, hence, deterring insurance repurchases (IAIS 2015).

Therefore, based on the foregoing research, this study intends to combine insurance literacy, perceived value and perceived trust, which may offer a better explanation for insurance inclusion in Uganda. In that regard, a correlational cross-sectional research design was adopted to collect data from adult Ugandans that voluntarily applied for an insurance policy. Covariance-Based Structural Equation Modelling (CB-SEM) was used to test the study hypotheses. The results showed that perceived value has a significant positive influence on insurance inclusion. In addition, the findings showed that insurance literacy has a significant and positive influence on insurance inclusion. Similarly, it was found that perceived trust has a significant positive influence on insurance inclusion. Additionally, compared to perceived value and insurance literacy, trust was found to have a stronger practical and statistical significance towards explaining insurance inclusion in the Ugandan context.

2. Literature Review and Hypotheses Development

2.1. Theoretical Review

This study employed a multi-theoretical approach to estimate the impact of perceived value, insurance literacy and perceived trust on insurance inclusion in Uganda. Firstly, the theory of trust by Mayer et al. (1995) was employed to elucidate the relationship between perceived trust and insurance inclusion. The theory of trust (Mayer et al. 1995) proffers the indicators of integrity, reliability, benevolence, competence and capability as being key towards building trust in client–business relationships. In that regard, insurance inclusion can be fostered when the insurance providers promptly fulfil their obligations and act fairly and competently. As such, the theory posits that institutions must be ethical and trustworthy in their business conduct (Kasper-Fuehrera and Ashkanasy 2001). The extant studies have found that effective and successful firms embed trust in their business operations (Zucker 2008; Nooteboom 2002). Accordingly, considering that insurance is a financial undertaking between parties to guarantee risk taking, trust is a vital foundation of the agreement (Mohy-Ul-Din et al. 2019). Notably, although Mayer et al.’s (1995) trust theory has been applied widely in marketing studies and found to influence purchase intentions, the theory of trust has not been tested in the insurance context. Accordingly, this study has used the trust indicators of benevolence, integrity, capability and reliability to explain the relationship between perceived trust and insurance inclusion.

Secondly, the social learning theory by Bandura (1971) was employed to explain the relationship between insurance literacy and insurance inclusion. The social learning theory advances that as people interact socially, they acquire knowledge through modelling, imitation and observation of one another (Bandura 1971). Thus, this study conceptualised insurance literacy to include knowledge, skills, attitude and behaviour, as suggested by Cheston et al. (2018). Notably, the social learning theory considers knowledge, skills, attitudes and behaviours as socially learned attributes (Bandura 1971). In that regard, insurance inclusion can be fostered when individuals acquire insurance literacy by observing and interacting with peers they believe and trust to have the requisite knowledge, skills, attitudes and behaviours. The social learning theory proffers three main aspects; observational learning, modelled learning and imitation learning (Ormrod 1999). Accordingly, Susan and Robyn (1994) postulated that in social learning theory, behavioural change occurs through modelled re-enforcements. Hence, drawing from the social learning theory, people learn about insurance as they interact in their societies, through which they acquire insurance knowledge, and they positively change their attitude and behaviour towards insurance.

Thirdly, the perceived value theory by Zeithaml (1988) and Sweeney and Soutar (2001) was employed to explain the association between perceived value and insurance inclusion in Uganda. The perceived value theory advances that consumers derive value when a product offers superior benefits compared to the sacrifice that is made by the consumer. In that perspective, full insurance inclusion can be achieved when insurance consumers derive the desired benefits from an insurance contract. In addition, the insurance service must be of satisfactory quality to foster insurance inclusion since from every service or product that is purchased, the consumers expect quality and various psychological benefits (Nguyen et al. 2019; Zeithaml 1988). To purchase or repurchase insurance, consumers must derive value through the endowed benefits (Nshakira-Rukundo et al. 2019). Accordingly, Weedige et al. (2019) elucidated perceived value as the consumer’s conviction regarding how better off they will be when they purchase an insurance policy. Thus, the current study has adopted the perceived value dimensions of benefits and quality to establish the impact of perceived value on insurance inclusion in Uganda.

2.2. Hypothesis Development

2.2.1. Perceived Value and Insurance Inclusion

Over time, researchers have described perceived value as what the consumers assesses of a product’s value compared to how they perceive what they acquired in return for what they gave (Quach and Thaichon 2017; Zeithaml 1988). From an insurance perspective, Weedige et al. (2019) elucidated perceived value as the consumer’s conviction regarding how better off they will be when they purchase an insurance policy. In that regard, Cvitanović (2018) posited that in assessing an insurance provider, the firm’s tradition in doing business, its stability and the quality of the insurance service are vital. Hence, clients choose products that offer the highest positive variation regarding the product benefits compared to the product usage costs (Mukangendo et al. 2018). Such purchase solutions provide the highest perceived value and quality (Nguyen et al. 2019). Additionally, according to Weedige et al. (2019), insurance consumers purchase insurance policies based on various perceived benefits, including loss payment, guaranteeing financing credit, risk control promotion, the management of uncertain cash inflows and the legal requirements of compliance. Furthermore, Weedige and Ouyang (2019) add that unlike perceived risk, how consumers perceive the value of insurance products is a significant motivator in acquiring insurance policies.

In line with the insurance industry, Gera (2011) found that the service’s quality strongly impacts the perceived value. Hence, the service’s quality from the insurance firm affects the perceptions of the value of insurance (Fadlallah et al. 2018). Consequently, insurance providers can be guaranteed a future relational exchange through repeat purchases and word-of-mouth recommendations when the clients experience high service quality and tangible benefits (Marcos and Coelho 2017).

Furthermore, although descriptive studies have interrogated and found perceived value measures of benefits and quality to be determinants of insurance uptake (Nageso et al. 2020; Weedige et al. 2019; Nshakira-Rukundo et al. 2019; Okunogbe 2018), there is a lack of research that has attempted to establish the magnitude and direction of the relationship between perceived value and insurance inclusion from a developing country perspective. Yet, it is vital to know the perceived value’s (benefits and quality) contribution to influencing insurance inclusion. Although Uganda’s insurance sector is still underdeveloped, insurance remains essential to most business operations (Insurance Regulatory Authority (IRA 2019)). Despite the blossoming of the insurance sector, it has not attracted much interest from academicians. In particular, there are barely any study on customer-perceived value and insurance inclusion in Uganda’s insurance market. Thus, this study seeks to provide knowledge in this gap. Nonetheless, it can be deduced from the preceding research that the empirical literature concurs that insurance consumers buy insurance based on the conviction that they will be better off when they take up an insurance contract (Mukangendo et al. 2018). Furthermore, when the consumers see insurance products as being of the desired quality, a positive attitude will be adopted towards insurance (Jensen and Barrett 2017). Therefore, it is hypothesised that:

Hypothesis 1 (H1).

There is a positive relationship between perceived value and insurance inclusion.

2.2.2. Insurance Literacy and Insurance Inclusion

According to Weedige et al. (2019), achieving financial sustainability for the population will remain unlikely if financial illiteracy and underinsurance are not addressed. Hence, there is need to equip people with financial literacy in order for them to make rational financial decisions for sustainable wellbeing (OECD 2017). In that regard, to curb insurance exclusion, insurance consumers must be aware of the facets of insurance. Additionally, the likelihood of insurance uptake increases when people are familiar with insurance products and services (Tennyson 2011). In tandem with extant studies that have found financial literacy to positively influence financial behaviour, Ruefenacht (2018) argues that people become more knowledgeable about insurance products and services when they are insurance literate. Such insurance knowledge enables the consumers to comprehend insurance information and buy insurance policies that fit their insurance requirements (Lin et al. 2019).

Although a few studies on insurance literacy have been conducted (for example, Weedige et al. 2019; Weedige and Ouyang 2019; Lin et al. 2019), the empirical evidence shows that people without insurance knowledge will not be able to make rational insurance decisions (Driver et al. 2018). Thus, insurance literacy directly and significantly influences behavioural intent (Tennyson 2011). Nonetheless, in developing countries, very few people have been found to possess the ability to comprehend basic insurance information (Weedige et al. 2019). Furthermore, given that being financially literate does not guarantee being insurance literate, understanding how people cope with risks and uncertainties becomes hard (Lin et al. 2019). Accordingly, scholars have pointed to the dearth of insurance knowledge as a major hinderance to insurance purchases (Giné et al. 2008). When people are financially literate, the chances that they will demand more insurance increases (Cole et al. 2013).

Furthermore, although studies have emphasised the importance of knowledge and financial accessibility (see, for instance, Bongomin et al. 2018; McCord 2012; Atkinson and Messy 2013), such studies have majorly focused on financial literacy and financial institutions in general. Insurance literacy, specifically, and its impact on insurance inclusion have not been sufficiently studied. Furthermore, while an increasing number of studies are investigating the importance of financial literacy in financial decision making, especially in investments and saving for retirement, studies on the impact of insurance literacy on insurance uptake are sparce, as stated by Kubitza et al. (2019). Yet, as argued by Lin et al. (2019), being financially literate does not guarantee being insurance literate.

However, attaining general education (secondary or tertiary) does not imply financial literacy. According to Ćurak et al. (2020), undertaking tertiary education does not guarantee someone’s understanding of complex insurance services, as this may not be taught in schools. Furthermore, Lusardi et al. (2017) claims that insurance knowledge and an awareness of insurance do not necessarily translate into an increased insurance demand. For example, Simões (2021) found that whereas consumer education stimulated the demand for index insurance, the same did not affect health microinsurance. Additionally, Martin et al. (2017) argued that consumer education increases the probability of insurance contract renewals since the clients will only renew a contract on a product they have tested and understand how it works. Nonetheless, Dercon et al. (2012) established that financial literacy training did not impact the insurance demand. Hence, the foregoing discussion creates the need to interrogate insurance literacy further in a developing country context. Therefore, this study seeks to fill this gap in knowledge by examining the relationship between insurance literacy and its influence on insurance inclusion in a Ugandan context. Therefore, it is hypothesised that:

Hypothesis 2 (H2).

There is a positive relationship between insurance literacy and insurance inclusion.

2.2.3. Perceived Trust and Insurance Inclusion

Insurance scholars and development partners generally agree that an insurance agreement survives on the principle of good faith (Weedige and Ouyang 2019). As such, without trust, the continuity of insurance agreements is jeopardized (Weedige et al. 2019). On that note, Fungáčováa et al. (2017) postulated that without trust, financial service providers may not attract willing borrowers, savers and those in need of insurance. Accordingly, financial services providers should entrench and build a culture of trust to attract and retain financial services consumers (Mohy-Ul-Din et al. 2019; Moin et al. 2015). Extant marketing literature has found that trust positively influences the clients’ buying behaviour (Sarantidou 2018; Liu et al. 2019). McCord (2012) contends that insurance firms must be reliable brands, owing to the long-term nature of the relationship between the client and the insurance firm.

On that note, given the perennial nature of insurance payments, consumers tend to enrol with trusted insurance providers (Fungáčováa et al. 2017). As such, the reliability of the insurance brand is considered by the consumers, since reliable firms are reputable. Thus, in the insurance sector, firms aim to provide maximum satisfaction and obtain loyal consumers (Ruefenacht 2018). Consumers can be loyal when insurance providers deliver the expectations of the consumers (Weedige et al. 2019). Although it is generally agreed that trust is vital for customer loyalty (Ben-Ner and Halldorsson 2010), financial institutions entirely thrive on trust, while other traditional businesses do not. Therefore, Cvitanović (2018) postulated that insurance providers should build reliable brands. Reliable brands influence the clients’ insurance purchase decisions, hence loyalty to the provider. According to Agyei et al. (2020) and Deng et al. (2010), consumers tend to recommend financial services providers that deliver on what they promise and remain as customers for longer.

From an insurance perspective, consumers trust an insurance provider when they have a clear understanding of the various insurance policies (Financial Sector Deepening 2018). Additionally, Cvitanović (2018) notes that a client’s perception and attitude towards an insurance provider influence their insurance uptake decision. Thus, since insurance is inherent in nature, trust is an essential determinant of insurance enrolment decisions. According to Dayour (2020), receiving negative information that an insurance provider will not pay claims breeds distrust in the provider. Conclusively, distrust in the insurance provider negatively impacts the insurance demand. Therefore, it is hypothesised that:

Hypothesis 3 (H3).

There is a positive relationship between perceived trust and insurance inclusion.

3. Research Methodology

The study population was composed of 314,501 adult Ugandans that personally purchased insurance policies (Uganda Bureau of Statistics (UBOS 2021)). The study participants were located in 13 sub-regions of Uganda (UBOS 2021). Accordingly, the study sample was composed of 400 respondents. The Yamane (1973) formula [n = N/1 + N (e)2] was adopted to determine the sample size where: n = sample size; N = total population; e = tolerable error (0.05 or 95 percent). A single-stage sampling procedure was adopted to select the respondents. In that regard, a proportional stratified random sampling procedure was employed to select the study participants from 13 sub-regions as the unit of analysis.

The study used a structured close ended five-point Likert scale questionnaire to collect the primary data. The Likert scale ranged from strongly disagree to strongly agree. According to Hair et al. (2019), primary data provide original data and give a better understanding of the aspects of current behaviour. Furthermore, Amin (2005) argued that primary data minimise the occurrence of duplication. Notably, prior to operationalization, the study instrument was tested for validity and reliability. Based on the guidelines by Hair et al. (2019), the instrument’s validity was tested using the content, discriminant and convergent validity indices, while composite reliability was used to test for reliability. Additionally, the study variables were tested for multicollinearity. Thus, Variance Inflation Factors (VIF) were used to test for multicollinearity.

4. Empirical Results Presentation and Analysis

4.1. Diagnostic Tests Results

This study used diagnostics tests to identify and correct for biases in the collected data that would affect the reliability of the study findings. As such, the diagnostic tests of composite reliability, discriminant validity, construct validity, content validity and multicollinearity were adopted.

Composite Reliability, Construct Validity, Multicollinearity and Content Validity

The diagnostic tests are shown in Table 1. The results depict that all of the variables (perceived value, insurance literacy, perceived trust and insurance inclusion) had a content validity index of above the 0.700 threshold. Similarly, the results revealed that all of the variables had composite reliabilities of above the 0.7 threshold and below the 0.95 ceiling. Further, the results in Table 1 show that the average variance extracted for all of the variables is above the 0.5 threshold. In addition, Table 2 shows that all of the HTMT ratios are above 0.9 for all of the variables, based on Voorhees et al.’s (2015) and Henseler et al.’s (2015) guidelines. Accordingly, all of the contracts had less than five VIF values, thus, there was an absence of multicollinearity based on Hair et al.’s (2019) guidelines.

Table 1.

Composite reliability, construct validity, multicollinearity and content validity.

Table 2.

Discriminant validity-Heterotrait Monotrait (HTMT) ratio.

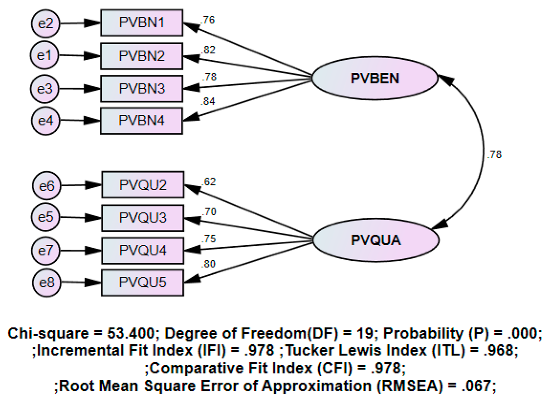

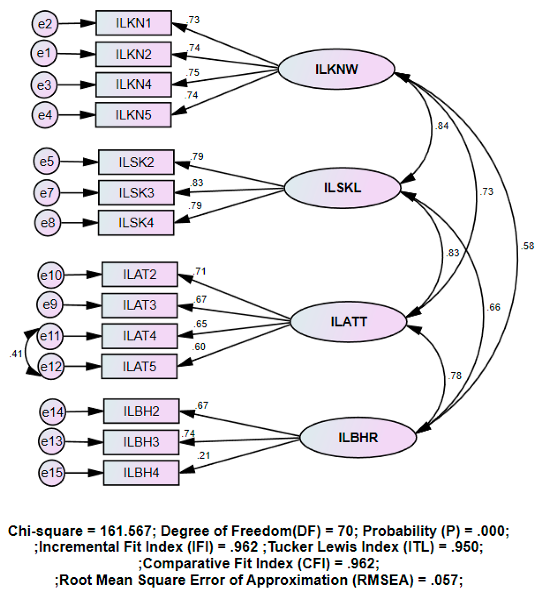

4.2. Exploratory Factor Analysis

Consistent with Qureshi and Reinhard (2020) and Cheston et al. (2018), insurance inclusion was measured in terms of access and usage. Furthermore, perceived value was looked at in terms of the benefits and quality, based on a study by Zeithaml (1988). Regarding insurance literacy, the dimensions of knowledge, skills, attitude and behaviour were adopted, as suggested by Lin et al. (2019); Weedige et al. (2019); Tennyson (2011). Lastly, the construct of perceived trust was measured based on the dimensions of benevolence, credibility, integrity and reliability, as advanced by Mayer et al. (1995); Agyei et al. (2020); Davis et al. (2000). Before performing empirical tests, an exploratory factor analysis (EFA) was conducted to determine the items that most accurately explain the construct indicators (Hair et al. 2019). The EFA results in Table 3 show that benefits and quality explain 68% of the variations in perceived value. However, the benefits explain more of the variance in perceived value, 57% of it, followed by that of quality at 11%. Regarding insurance literacy, the EFA results in Table 4 show that knowledge, skills, attitude and behaviour explain 62% of the variation in insurance literacy. Furthermore, the EFA results in Table 5 show that benevolence, integrity, credibility and reliability explain 70% of the variation in perceived trust. However, benevolence explains more of the variation in perceived trust, 23% of it, followed by those of integrity at 18%, credibility at 16% and reliability at 14%. Lastly, the results in Table 6 reveal that access and usage explain 77.2% of the variation in insurance inclusion, whereby, usage contributes 54% of it, while access contributes 23% of it.

Table 3.

Exploratory factor analysis for perceived value.

Table 4.

Exploratory factor analysis for insurance literacy.

Table 5.

Exploratory factor analysis for perceived trust.

Table 6.

Exploratory factor analysis for insurance inclusion.

4.3. Descriptive Statistics

Descriptive statistics were used to determine whether the collected data truly represents the population from which the data were collected. Indeed, the descriptive results in Table 7 reveal small standard deviations from the mean responses and small errors across the study variables of perceived value, insurance literacy, perceived trust and insurance inclusion. The mean values range between 4.121 and 4.270, with standard deviations of between 0.508 and 0.570. This implies that the respondents generally agreed to the items in the research instruments, with minimal deviations in the responses.

Table 7.

Descriptive statistics.

4.4. Correlation Analysis Results

The correlations between the study variables were analysed through a Pearson correlation to establish the relationships between perceived trust, insurance literacy and perceived value on insurance inclusion in Uganda. Zero-order correlations were performed between the variables, as shown in Table 8. The results reveal that perceived value has a significant and positive association with insurance inclusion (r = 0.522, p < 0.01). The finding suggests that as the perceived value increases, the rate of insurance inclusion also significantly increases. We also find that insurance literacy is significantly and positively associated with insurance inclusion (r = 0.619, p < 0.01). Thus, an increase in people’s insurance literacy is associated with an increased rate of insurance inclusion. Furthermore, the results show that perceived trust has a significant and positive relationship with insurance inclusion (r = 0.699, p < 0.01). The finding suggests that as perceived trust increases, the rate of insurance inclusion increases.

Table 8.

Pearson’s correlation results between study variables.

4.5. Structural Equation Modelling Results

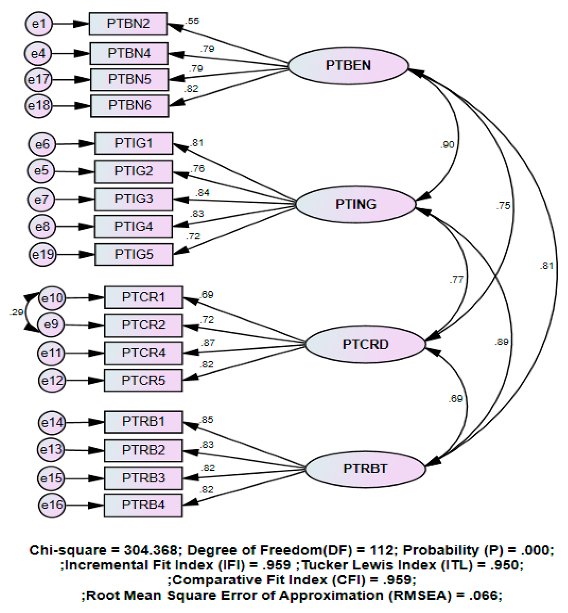

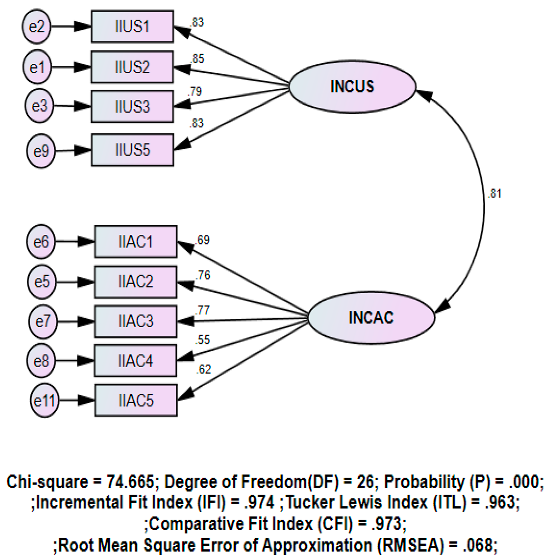

CB-SEM was undertaken to establish the impact of perceived value, insurance literacy and perceived trust on insurance inclusion in Uganda. Before undertaking CB-SEM, confirmatory factor analysis (CFA) was employed to ascertain how well the manifest variables converged as valid indicators of the global latent variables. As such, four measurement models of perceived value, insurance literacy, perceived trust and insurance inclusion were estimated. All of the variables in the four measurement models were found to be valid and they fitted, as indicated in Appendix A, Appendix B, Appendix C and Appendix D. The measurement models have goodness-of-fit indices that are above the 0.900 recommended cut-off. In addition, the RMSEA values are below the 0.08 recommended threshold. As such, the CFA results indicate the presence of convergent validity of the items towards measuring the latent constructs. However, with the exception of perceived value, some measurement items were dropped in the CFA of insurance literacy, perceived trust and insurance inclusion. These measurement items had insignificant loadings on the latent constructs.

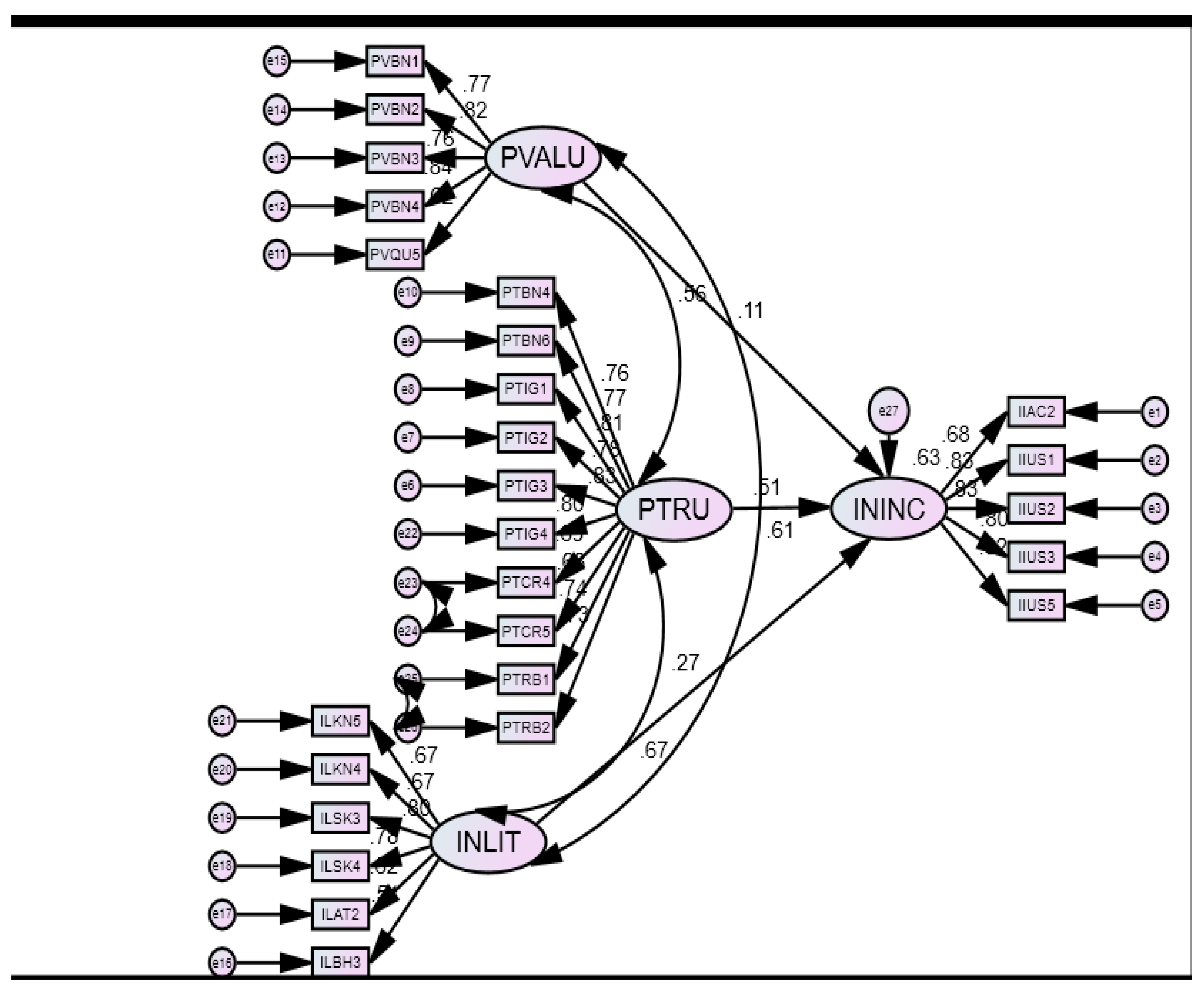

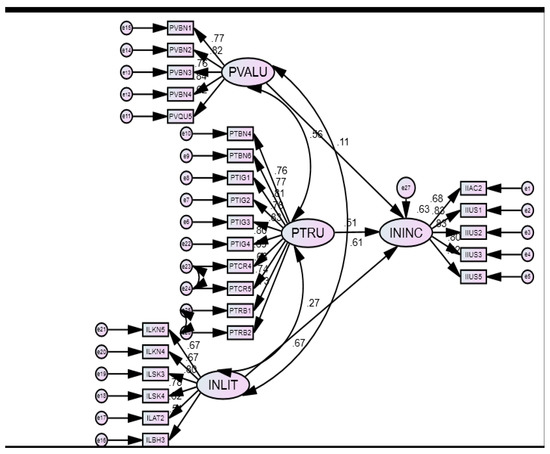

Subsequently, the manifest and global latent variables were specified into a structural model to denote three exogenous variables (perceived value, insurance literacy and perceived trust) and one endogenous variable (insurance inclusion). However, not all of the manifest variables of the latent constructs in CFA were retained for estimating the structural model. Overall, three manifest variables (PVQU2, PVQU3 and PVQU4) were dropped for perceived value. Eight manifest variables (ILKN1, ILKN2, ILSK2, ILAT3, ILAT4, ILAT5, ILBH2 and ILBH4) were dropped for insurance literacy. Regarding perceived trust, seven manifest variables (PTBN4, PTBN5, PTIG5, PTCR2, PTCR1, PTRB3 and PTRB 4) were dropped. Lastly, four manifest variables (IIAC1, IIAC3, IIAC4 and IIAC5) were dropped for insurance inclusion, while estimating the overall structural model. Overall, with the retained variables, the structural model fit was attained. All of the model goodness-of-fit indices meet the 0.900 recommended cut-off. In addition, the RMSEA is below the 0.08 recommended threshold, as indicated in Figure 1. This implies that the estimated structural model confirms the proposed hypothesis as valid.

Figure 1.

Structural model for insurance inclusion. Chi-Square = 665.803; Degree of Freedom (DF) = 291; Probability (p) = 0.000; Incremental Fit Index (IFI) = 0.942; Tucker–Lewis Index (TLI) = 0.935; Comparative Fit Index (CFI) = 0.942 Root Mean Square Error of Approximation (RAMSEA) = 0.057. Notes: PVALU = Perceived Value; PVBN = Benefits; PVQU = Quality; INLIT = Insurance Literacy; ILKN = Knowledge; ILSK = Skills; ILAT = Attitude; ILBH = Behaviour; PTRU = Perceived trust; PTBN = Benevolence; PTIG = Integrity; PTCR = Credibility; PTRB = Reliability; ININC = Insurance inclusion; IIAC = Access; IIUS = Usage.

In that regard, the SEM results in Figure 1 reveal that perceived value, insurance literacy and perceived trust explain 63.2% of the variations in insurance inclusion (R2 = 0.632). The results show that perceived value has a significant and positive influence on insurance inclusion in Uganda (β = 0.112, p < 0.01). Therefore, hypothesis H1 is supported. Additionally, insurance literacy has a significant and positive effect on insurance inclusion in Uganda (β = 0.266, p < 0.01). This finding lends support to hypothesis H2. Furthermore, the results indicate that perceived trust has a significant and positive effect on insurance inclusion (β = 0.514, p < 0.01). Hence, hypothesis H3 is supported. In addition, the results show that perceived trust has the strongest impact on insurance inclusion in the model. Perceived trust has the largest β value (β = 0.514, p < 0.01).

5. Discussion of Findings

5.1. Perceived Value and Insurance Inclusion

The current study ascertained that perceived value significantly determines insurance inclusion. This finding suggests that insurance consumers will use insurance on the belief that insurance will give them the benefit of financial protection. In this perspective, people need insurance for life and non-life protection. The findings suggest that the clients’ value perceptions influence the insurance purchase decision. Hence, the results show that people will only buy insurance that provides financial security for the policyholders, their family members and their property. The benefit that uncertain and outstanding financial obligations will be covered propels insurance enrolment decisions. This finding resonates with those of Aggarwal et al. (2013). They argued that people acquire insurance believing they will have financial security for their family members by paying for their dependent’s support and footing outstanding financial obligations, especially when the policyholder dies. Regarding non-life insurance, the clients derive value when their property is protected from adverse events that might detrimentally affect business activities. The findings are supported by those of Qureshi and Reinhard (2020) and Mukangendo et al. (2018). They deduced that insurance consumers would only buy insurance based on the conviction that they will become better off when they take up an insurance contract. The higher the value perception is, the higher the chances that the consumers will purchase and repurchase insurance. On the same vein, the findings are in tandem with those of Weedige et al. (2019). They asserted that insurance consumers purchase insurance policies based on various benefits, including loss payment, risk control promotion and the management of uncertain cash inflows.

Furthermore, insurance quality through adequate complaints handling and provision of the necessary information about the insurance contract influences the decision to buy or not buy insurance. Overall, individuals derive satisfaction from quality insurance services, and hence, this increases the possibility of renewing their insurance contracts. When insurance firms offer quality services, the value perceptions of the clients will be positively influenced, thus, they will make repeat purchases. These findings are consistent with those of Jensen and Barrett (2017), who argued that when consumers see insurance products as being of the desired quality, they develop a positive attitude towards insurance. Additionally, our study findings agree with those of Nageso et al. (2020), who posited that customers attach value based on the ability of an insurance policy to satisfy a need. Similarly, Marcos and Coelho (2017) demonstrated that the service quality influences loyalty, and it leads to repeat purchases.

5.2. Insurance Literacy and Insurance Inclusion

The findings show that insurance literacy significantly influences insurance inclusion. As a starting point, consumers must be aware of insurance prior to buying insurance. As such, the study findings suggest that being knowledgeable about different insurable risks eases the process of choosing what to insure, since not all of the risks are insurable. Moreover, the findings indicate that people not only need to acquire knowledge about where to buy insurance, but they must also have knowledge about the premium or price of insurance cover. Such knowledge influences insurance usage. Accordingly, these findings are in line with those of Driver et al. (2018), who connote that when people lack insurance knowledge, they cannot make good insurance decisions. Furthermore, the findings concur with those of Ruefenacht (2018), who advocated for insurance providers and insurance development partners to provide insurance education about the fundamentals of insurance to enhance insurance enrolment. Accordingly, McCord (2012) noted that lack of insurance knowledge has a negative effect on insurance uptake decisions.

Additionally, the findings revealed that in addition to insurance knowledge, people need to be skilled on how to evaluate various insurance aspects and policies. Thus, the results showed that one must have the ability to find and choose an insurance cover that fits their needs. Such abilities positively influence insurance acquisition decisions. Notably, to buy insurance, people need to be able to evaluate various insurance policies regarding their affordability for the insurance policies. On that note, these findings concur with those of Lusardi and Mitchell (2014). According to Lusardi and Mitchell (2014), unlike the saving and borrowing aspects of financial inclusion, insurance is a more complex aspect, hence, there is a need for evaluative skills in making insurance decisions. Additionally, Reece Warner (2016) notes that, often, consumers purchase inappropriate insurance owing to a misunderstanding of what is insurable and what is not insurable. Therefore, as suggested by Bongomin et al. (2020), people need to have some basic financial comprehension coupled with financial skills to evaluate insurance policies.

Even with the requisite knowledge and skills, the findings suggest that individual attitudes towards insurance largely influence insurance enrolment decisions. The findings showed that before applying for insurance, people must carefully read the insurance contract’s contents, in addition, people must take utmost care to differentiate between necessary and unnecessary policies. Such attitudes shape the insurance acquisition decision. Thus, these findings concur with those of Finscope (2018) which notes that people’s attitudes influence trust, which in turn influences the decisions to buy insurance. The findings also agree with those of Qureshi and Reinhard (2020) who connote that negative insurance perceptions largely contribute to insurance exclusion in developing countries.

Notwithstanding, from the behavioural aspect of insurance literacy, this study found that behaviour positively influences people’s decisions to use insurance. Specifically, the results showed that one’s willingness to pay for insurance contributes to insurance buying behaviour. The findings concur with those of Mutlu and Özer (2022), and they argued that financial behaviour is a conduit for financial literacy toward the uptake of financial services. Specifically, from an insurance context, the study’s findings are supported by those of Qureshi and Reinhard (2020), who indicated that the financial behaviour of individuals determines the default in premium payments.

5.3. Percieved Trust and Insurance Inclusion

The findings show that perceived trust significantly predicts insurance inclusion. In addition, it was found that perceived trust had the highest predictive power on insurance inclusion compared to perceived value and insurance literacy. Regarding credibility, the results indicate that people apply for insurance when insurance firms deliver on their obligations. People apply for insurance with the expectation that they will be compensated when loss and uncertainties befall them. The insurance providers’ failure to deliver on their promise negatively affects continued insurance usage. These findings concur with those of Devlin et al. (2015) who postulated that people would forego the current consumption for insurance if they significantly trust that the insurance provider will indemnify them upon incurring loss or befalling an uncertainty. Furthermore, the IAIS (2015) noted that even when insurance providers genuinely delay or reject to make pay-outs, the trust in the insurance provider will be lost (IAIS 2015). More still, insurance consumers will not apply for insurance due to doubts in the insurance products (Dayour 2020).

Furthermore, the findings showed that perceived trust in the integrity of insurance providers strongly influences insurance enrolment decisions. Specifically, results showed that when insurance providers stick to what they promise, people buy and renew insurance policies. When the clients become sceptical that an insurance pay-out might not be made, they will not recommend others to buy insurance. In addition, the existing clients will not renew their insurance contracts. Additionally, the results show that the insurer’s reputation influences the insurance uptake decisions. When the providers fail to make pay-outs, the image of the provider is negatively affected. Thus, this deters new enrolments and insurance contract renewals. Additionally, given that indemnification occurs in the future, the results show that insurance providers must be honest to guarantee future and current insurance usage. These findings are in line with those of Weedige et al. (2019). They postulate that insurance consumers become loyal to insurance providers that meet the consumer’s expectations. Additionally, the findings concur with those of Weedige and Ouyang (2019). They contend that there must be mutual trust for an insurance agreement to thrive. Importantly, the providers must be honest and trustworthy to the clients. Notably, Dayour (2020) argued that when the clients promptly pay insurance premiums and are not compensated, trust in the insurance provider reduces.

The findings also revealed that insurance providers must be reliable to foster insurance inclusion in Uganda. Insurance clients invest all their hope in the insurance provider for protection. Thus, insurance providers must be reliable to provide the sought for and promised protection. Failure to provide protection discourages insurance uptake. These findings concur with those of Cvitanović (2018) who proffered that to have a long-term relationship with insurance consumers, insurance providers must be reliable to consumers. However, although the current study concurs with extant studies that suggest that trust positively influences insurance inclusion, Weedige and Ouyang (2019) argued that with insurance, trust must come from both the demand and supply sides. Additionally, all of the parties in the insurance contract must disclose all of the relevant information for a win–win situation to occur (Dayour 2020). Accordingly, without mutual trust, the initiation and continuation of insurance contracts will be rendered futile (Weedige et al. 2019). Regardless, extant studies on consumer behaviour have advanced that trust in insurance services influences the insurance purchase and repurchased decisions (Driver et al. 2018; Lin et al. 2019).

6. Conclusions

This paper examined the impact of perceived value, insurance literacy, perceived trust and insurance inclusion in Uganda. Using CB-SEM, the current study found that perceived value has a significant and positive impact on insurance inclusion. We also found that insurance literacy has a significant and positive impact insurance inclusion. Similarly, the results show that perceived trust strongly predicts insurance inclusion. Perceived trust has a stronger predictive power of insurance inclusion than perceived value and insurance literacy do. Theoretically, these findings imply that a multiplicative combination of perceived value, insurance literacy and perceived trust significantly explain insurance inclusion. Additionally, the findings confirm that the perceived value theory, social learning theory and trust theory can be adopted to explain insurance inclusion.

To the researchers’ knowledge, this is the first study to estimate the impact of perceived value, insurance literacy and perceived trust in insurance inclusion. Prior empirical studies have focused on investigating the banking component of financial inclusion, while ignoring the insurance component of financial inclusion. Yet, financial inclusion cannot be complete without insurance. Thus, the current study’s novelty lies in uncovering the interplay of perceived value, insurance literacy and perceived trust in predicting insurance inclusion in the context of Uganda.

Accordingly, our results are significant for insurance providers and practitioners wishing to foster insurance inclusion. Thus, it is recommended that insurance providers should focus on delivering value to customers to encourage new and repeat insurance purchases. In addition, insurance providers should provide quality insurance to encourage applications for insurance. In addition, insurance providers should be reliable, work with integrity, be credible and act benevolently to promote new and repeat insurance applications. However, people buy insurance when they are insurance literate. Therefore, our results are significant for policymakers wishing to enhance insurance inclusion. Thus, policymakers should consider providing insurance literacy training programmes in financial literacy education initiatives. Currently, policymakers have focused on financial literacy, yet, according to Lin et al. (2019), being financially literate does not imply that one is insurance literate. In addition, financial literacy education programmes have traditionally focused on fostering saving and banking components of financial inclusion and ignored the insurance component. Therefore, policymakers should include insurance literacy in national financial inclusion strategies to promote insurance inclusion.

However, this study is not devoid of limitations. The study was cross-sectional by design. Over time, people’s views may change. Thus, changes in the behavioural attributes of the sample could not be captured. Yet, behavioural changes could impact on the participants’ insurance decisions. As it is cross-sectional, the study could not conclude the causality between the perceived value, insurance literacy, trust and insurance inclusion. Causality could be inferred if a longitudinal study was conducted. In addition, the study was quantitative, thus, qualitative data were ignored. The current study considered individuals who voluntarily applied for insurance irrespective of their special interests. Therefore, future studies could adopt a mixed methods study with qualitative data for triangulation. The current findings apply to the Ugandan context; however, future studies could be undertaken in different developing countries’ contexts to test the generalisability of the findings. Regardless, this study provides an understanding of predictors of insurance inclusion from a multivariate perspective.

Author Contributions

Conceptualization, A.K. and A.B.S.; methodology, A.K.; software, A.K.; validation, A.K. and A.B.S.; formal analysis, A.K.; investigation, A.K.; resources, A.K. and A.B.S.; data curation, A.K.; writing—original draft preparation, A.K.; writing—review and editing, A.K. and A.B.S.; visualization, A.K. and A.B.S.; supervision, A.B.S.; project administration, A.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data are available on request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. CFA Measurement Model for Perceived Value

Appendix B. CFA Measurement Model for Insurance Literacy

Appendix C. CFA Measurement Model for Perceived Trust

Appendix D. CFA Measurement Model for Insurance Inclusion

References

- Aggarwal, Shilpa, Leora Klapper, and Dorothe Singer. 2013. Financing Businesses in Africa: The Role of Microfinance. Microfinance in Developing Countries: Issues, Policies and Performance Evaluation. pp. 178–98. Available online: https://search.proquest.com/docview/1640477760 (accessed on 11 September 2021).

- Agyei, James, Shaorong Sun, Eugene Abrokwah, Emmanuel Kofi Penney, and Richmond Ofori-Boafo. 2020. Influence of Trust on Customer Engagement: Empirical Evidence from the Insurance Industry in Ghana. SAGE Open 10: 2158244019899104. [Google Scholar] [CrossRef]

- AII/Access to Insurance Initiative. 2019. Inclusive Insurance Innovation Lab. Eschborn: Access to Insurance Initiative. [Google Scholar]

- Amin, Martin Efuetngu. 2005. Social Sciences Research. Conception, Methodology and Analysis. Kampala: Makerere University Printery. [Google Scholar]

- Asseldonk, Marcel, and Temesgen Belissa. 2019. Risk and Ambiguity Aversion Behaviour in Index-Based Insurance Uptake Decisions: Experimental Evidence from Ethiopia 2016–2017. Essex: UK Data Service. [Google Scholar]

- Atkinson, Adele, and Flore-Anne Messy. 2013. Promoting Financial Inclusion through Financial Education. OECD Working Papers on Finance, Insurance and Private Pensions. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Bandura, Albert. 1971. Social Learning Theory. New York: General Learning Press. [Google Scholar]

- Bayar, Yilmaz, Djula Borozan, and Marius Dan Gavriletea. 2021. Banking Sector Stability and Economic Growth in Post-transition European Union Countries. International Journal of Finance and Economics 26: 949–61. [Google Scholar] [CrossRef]

- Ben-Ner, Avner, and Freyr Halldorsson. 2010. Trusting and Trustworthiness: What Are They, How to Measure Them, and What Affects Them. Journal of Economic Psychology 31: 64–79. [Google Scholar] [CrossRef]

- Bongomin, George Okello Candiya, John C. Munene, Joseph Mpeera Ntayi, and Charles Akol Malinga. 2018. Nexus between Financial Literacy and Financial Inclusion. International Journal of Bank Marketing 36: 1190–212. [Google Scholar] [CrossRef]

- Bongomin, George Okello Candiya, Joseph Mpeera Ntayi, and Charles Akol Malinga. 2020. Analyzing the Relationship between Financial Literacy and Financial Inclusion by Microfinance Banks in Developing Countries: Social Network Theoretical Approach. International Journal of Sociology and Social Policy 40: 1257–77. [Google Scholar] [CrossRef]

- Cheston, Susy, Sonja Kelly, Allyse McGrawth, Conan French, and Dennis Ferenzy. 2018. Insurance Inclusion: Closing the Protection Gap for Emerging Customers. Wahington, DC: Center for Financial Inclusion. [Google Scholar]

- Cole, Shawn A., Xavier Giné, Jeremy Tobacman, Robert M. Townsend, Petia Topalova, and James Vickery. 2013. Barriers to Household Risk Management: Evidence from India. American Economic Journal: Applied Economics 5: 104–35. [Google Scholar] [CrossRef]

- Ćurak, Marijana, Sandra Pepur, and Dujam Kovač. 2020. Does Financial Literacy Make the Difference in Non-Life Insurance Demand among European Countries? Ekonomski Pregled 71: 359–82. [Google Scholar] [CrossRef]

- Cvitanović, Petra Leonora. 2018. Perceived Brand Reliability of Insurance Companies as Customer Loyalty Factor. EFZG Working Paper Series, no. 6 (January); Zagreb: Faculty of Economics and Business, University of Zagreb. [Google Scholar]

- Dassanou, Marieme Esther, and Prapti Sherchan. 2018. Mainstreaming Gender and Targeting Women in Inclusive Insurance: Perspectives and Emerging Lessons. Bonn and Eschborn: Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH. [Google Scholar]

- Davis, James H., F. David Schoorman, Roger C. Mayer, and Hwee Hoon Tan. 2000. The Trusted General Manager and Business Unit Performance: Empirical Evidence of a Competitive Advantage. Strategic Management Journal 21: 563–76. [Google Scholar] [CrossRef]

- Dayour, Frederick. 2020. Insurance Uptake among Small and Medium-Sized Tourism and Hospitality Enterprises in a Resource-Scarce Environment. Tourism Management Perspectives 34: 100674. Available online: http://www.econis.eu/PPNSET?PPN=1703152409 (accessed on 8 February 2021). [CrossRef]

- Demirguc-Kunt, Asli, and Leora Klapper. 2012. Financial Inclusion in Africa: An Overview. Policy File. Wahington, DC: The World Bank. Available online: https://search.proquest.com/docview/1820716457 (accessed on 5 November 2020).

- Deng, Zhaohua, Yaobin Lu, Kwok Kee Wei, and Jinlong Zhang. 2010. Understanding Customer Satisfaction and Loyalty: An Empirical Study of Mobile Instant Messages in China. International Journal of Information Management 30: 289–300. [Google Scholar] [CrossRef]

- Dercon, S., J. W. Gunning, and A. Zeitlin. 2012. Health Insurance Participation: Experimental Evidence from Kenya. Geneva: ILO. [Google Scholar]

- Devlin, James F., Christine T. Ennew, Harjit S. Sekhon, and Sanjit K. Roy. 2015. Trust in Financial Services: Retrospect and Prospect. Journal of Financial Services Marketing 20: 234–45. [Google Scholar] [CrossRef]

- Driver, Tania, Mark Brimble, Brett Freudenberg, and Katherine Helen Mary Hunt. 2018. Insurance Literacy in Australia: Not Knowing the Value of Personal Insurance. Financial Planning Research Journal 4: 53–75. Available online: http://hdl.handle.net/10072/383964 (accessed on 6 December 2021).

- Fadlallah, Racha, Fadi El-Jardali, Nour Hemadi, Rami Z. Morsi, Clara Abou Abou Samra, Ali Ahmad, Khurram Arif, Lama Hishi, Gladys Honein-AbouHaidar, and Elie A. Akl. 2018. Barriers and Facilitators to Implementation, Uptake and Sustainability of Community-Based Health Insurance Schemes in Low- and Middle-Income Countries: A Systematic Review. International Journal for Equity in Health 17: 13. [Google Scholar] [CrossRef] [PubMed]

- Financial Sector Deepening. 2018. Report on Uptake of Insurance Services in Uganda. Financial Sector Deepening Uganda. Kampala: Financial Sector Deepening Uganda. [Google Scholar]

- Finscope. 2018. Finscope Survey: Top Line Findings Summary Report. Financial Sector Deepening Uganda. Kampala: Financial Sector Deepening Uganda. [Google Scholar]

- Fungáčováa, Zuzana, Iftekhar Hasan, and Laurent Weill. 2017. Trust in Banks. Journal of Economic Behavior & Organization 157: 452–76. [Google Scholar]

- Gera, Rajat. 2011. Modelling the Service Antecedents of Favourable and Unfavourable Behaviour Intentions in Life Insurance Services in India: An SEM Study. International Journal of Quality and Service Sciences 3: 225–42. [Google Scholar] [CrossRef]

- Giné, Xavier, Robert Townsend, and James Vickery. 2008. Patterns of Rainfall Insurance Participation in Rural India. The World Bank Economic Review 22: 539–66. [Google Scholar] [CrossRef]

- Hair, Joseph F., William C. Black, Barry J. Babin, and Rolph E. Anderson. 2019. Multivariate Data Analysis. Andover: Cengage Learning, EMEA. [Google Scholar]

- Henseler, Jörg, Christian M. Ringle, and Marko Sarstedt. 2015. A New Criterion for Assessing Discriminant Validity in Variance-Based Structural Equation Modeling. Journal of the Academy of Marketing Science 43: 115–35. [Google Scholar] [CrossRef]

- IAIS/International Association of Insurance Supervisors. 2015. Issues Paper on Conduct of Business in Inclusive Insurance. London: International Association of Insurance Supervisors. [Google Scholar]

- IRA/Insurance Regulatory Authority. 2019. Annual Insurance Market Report. Kampala: Insurance Regulatory Authority. [Google Scholar]

- Jensen, Nathaniel, and Christopher Barrett. 2017. Agricultural Index Insurance for Development. Applied Economic Perspectives and Policy 39: 199–219. [Google Scholar] [CrossRef]

- Kasper-Fuehrera, Eva C., and Neal M. Ashkanasy. 2001. Communicating Trustworthiness and Building Trust in Interorganizational Virtual Organizations. Journal of Management 27: 235–54. [Google Scholar] [CrossRef]

- Kubitza, Christian, Annette Hofmann, and Petra Steinorth. 2019. Financial Literacy and Precautionary Insurance. Frankfurt a. M.: Goethe University Frankfurt, International Center for Insurance Regulation (ICIR). [Google Scholar]

- Kwon, Eun, Eunice Kim, Yongjun Sung, and Chan Yun Yoo. 2015. Brand Followers: Consumer Motivation and Attitude towards Brand Communications on Twitter. International Journal of Advertising 33: 657. [Google Scholar] [CrossRef]

- Lin, Xi, Aaron Bruhn, and Jananie William. 2019. Extending Financial Literacy to Insurance Literacy: A Survey Approach. Accounting and Finance (Parkville) 59: 685–713. [Google Scholar] [CrossRef]

- Liu, Chao, Zheshi Bao, and Chuiyong Zheng. 2019. Exploring Consumers’ Purchase Intention in Social Commerce. Asia Pacific Journal of Marketing and Logistics 31: 378–97. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2014. The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature 52: 5–44. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, Pierre-Carl Michaud, and Olivia S Mitchell. 2017. Optimal Financial Knowledge and Wealth Inequality. The Journal of Political Economy 125: 431–77. [Google Scholar] [CrossRef]

- Marcos, Anabela, and Arnaldo Coelho. 2017. Antecedents and Consequences of Perceived Value in the Insurance Industry. European Journal of Applied Business Management 3: 29–51. [Google Scholar]

- Martin, Kelly D., Abhishek Borah, and Robert W. Palmatier. 2017. Data Privacy: Effects on Customer and Firm Performance. Journal of Marketing 81: 36–58. [Google Scholar] [CrossRef]

- Mathur, Tanuj, Gurudas Das, and Hemendra Gupta. 2018. Examining the Influence of Health Insurance Literacy and Perception on the People Preference to Purchase Private Voluntary Health Insurance. Health Services Management Research 31: 218–32. [Google Scholar] [CrossRef]

- Mayer, Roger C., James H. Davis, and F. David Schoorman. 1995. An Integrative Model of Organizational Trust. The Academy of Management Review 20: 709–34. [Google Scholar] [CrossRef]

- McCord, Michael J. 2012. Briefing Note. The Landscape of Microinsurance in Africa 2012. München: Munich Re Foundation. [Google Scholar]

- Mohy-Ul-Din, Sajid, Sarminah Samad, Mohsin Abdur Rehman, Mirza Zaar Ali, and Usman Ahmad. 2019. The Mediating Effect of Service Provider Expertise on the Relationship between Institutional Trust, Dispositional Trust and Trust in Takaful Services. International Journal of Islamic and Middle Eastern Finance and Management 12: 509–22. [Google Scholar] [CrossRef]

- Moin, S. M. A., James Devlin, and Sally McKechnie. 2015. Trust in Financial Services: Impact of Institutional Trust and Dispositional Trust on Trusting Belief. Journal of Financial Services Marketing 20: 91–106. [Google Scholar] [CrossRef]

- Mukangendo, Mecthilde, Manasse Nzayirambaho, Regis Hitimana, and Assumpta Yamuragiye. 2018. Factors Contributing to Low Adherence to Community-Based Health Insurance in Rural Nyanza District, Southern Rwanda. Journal of Environmental and Public Health 2018: 2624591. [Google Scholar] [CrossRef] [PubMed]

- Mutlu, Ümmühan, and Gökhan Özer. 2022. The Moderator Effect of Financial Literacy on the Relationship between Locus of Control and Financial Behavior. Kybernetes 51: 1114–26. [Google Scholar] [CrossRef]

- Nageso, Dawit, Kebede Tefera, and Keneni Gutema. 2020. Enrollment in Community Based Health Insurance Program and the Associated Factors among Households in Boricha District, Sidama Zone, Southern Ethiopia; a Cross-Sectional Study. PLoS ONE 15: e0234028. [Google Scholar] [CrossRef] [PubMed]

- Nandru, Prabhakar, Byram Anand, and Satyanarayana Rentala. 2016. Micro Insurance Penetration in India: A Tool for Financial Inclusion. International Journal of Advanced Scientific Research and Development 12: 36–38. [Google Scholar]

- Nguyen, Xuan Nhi, Park Thaichon, and Phi Van Nguyen Thanh. 2019. Customer-Perceived Value in Long-Term Buyer-Supplier Relationships: The General B2B Insurance Sector. Services Marketing Quarterly 40: 48–65. [Google Scholar] [CrossRef]

- Nooteboom, Bart. 2002. Trust, Institutions and Development. The Netherlands: Tilburg University. [Google Scholar]

- Nshakira-Rukundo, Emmanuel, Essa Chanie Mussa, Nathan Nshakira, Nicolas Gerber, and Joachim von Braun. 2019. Determinants of Enrolment and Renewing of Community-Based Health Insurance in Households with Under-5 Children in Rural South-Western Uganda. International Journal of Health Policy and Management 8: 593–606. [Google Scholar] [CrossRef]

- OECD. 2017. Technology and Innovation in the Insurance Sector. Washington, DC: Organisation for Economic Cooperation and Development. [Google Scholar]

- Okunogbe, Adeyemi. 2018. Three Essays on Health Financing in Sub-Saharan Africa: Health Shocks, Health Insurance Uptake & Financial Risk Protection. Lagos: ProQuest Dissertations Publishing. [Google Scholar]

- Ormrod, Jeanne Ellis. 1999. Human Learning. Upper Saddle River: Merrill Prentice Hall. [Google Scholar]

- Quach, Sara, and Park Thaichon. 2017. From Connoisseur Luxury to Mass Luxury: Value Co-Creation and Co-Destruction in the Online Environment. Journal of Business Research 81: 163–72. [Google Scholar] [CrossRef]

- Qureshi, Zahid, and Dirk Reinhard. 2020. Coping with Climate Risk. Dhaka, November 5–7. [Google Scholar]

- Ramadhan, Lutfi. 2019. Impact of Customer Perceived Value on Loyalty: In Context Crm. Open Science Framework. [Google Scholar] [CrossRef]

- Ruefenacht, Matthias. 2018. The Role of Satisfaction and Loyalty for Insurers. International Journal of Bank Marketing 36: 1034–54. [Google Scholar] [CrossRef]

- Sarantidou, Paraskevi P. 2018. Store Brand Adoption and Penetration Explained by Trust. Spanish Journal of Marketing—ESIC 22: 359–76. [Google Scholar] [CrossRef]

- Simões, Regina. 2021. Index Insurance: 2020 Status and Regulatory Challenges. Eschborn: Access to Insurance Initiative. [Google Scholar]

- Susan, Golombok, and Fivush Robyn. 1994. Gender Development. Cambridge: Cambridge University Press. [Google Scholar]

- Sweeney, Jillian C., and Geoffrey N. Soutar. 2001. Consumer Perceived Value: The Development of a Multiple Item Scale. Journal of Retailing 77: 203–20. [Google Scholar] [CrossRef]

- Swiss Re Institute. 2019. World Insurance: The Great Pivot East Continues. Zurich: Swiss Re Institute. [Google Scholar]

- Tennyson, Sharon. 2011. Consumers’ Insurance Literacy. Terre Haute: Networks Financial Institute. [Google Scholar]

- Tolani, Sanjay, Ananth Rao, Genanew B. Worku, and Mohamed Osman. 2019. System and Neural Network Analysis of Intent to Buy and Willingness to Pay Insurance Premium. Managerial Finance 45: 147–68. [Google Scholar] [CrossRef]

- UBOS/Uganda Bureau of Statistics. 2021. The Uganda National Household Survey 2019/20. Kampala: Uganda Bureau of Statistics. [Google Scholar]

- Uddin, Mohammed Ahmar. 2017. Microinsurance in India: Insurance Literacy and Demand. Business and Economic Horizons 13: 182–91. [Google Scholar] [CrossRef]

- Voorhees, Clay M., Michael K. Brady, Roger Calantone, and Edward Ramirez. 2015. Discriminant Validity Testing in Marketing: An Analysis, Causes for Concern, and Proposed Remedies. Journal of the Academy of Marketing Science 44: 119–34. [Google Scholar] [CrossRef]

- Wanczeck, Solveig, Michael McCord, Martina Wiedmaier-pfister, and Katie Biese. 2017. Inclusive Insurance and the Sustainable Development Goals: How Insurance Contributes to the 2030 Agenda for Sustainable Development. Bonn and Eschborn: Deutsche Gesellschaft fur Internationale Zusammenarbeit (GIZ) GmbH. [Google Scholar]

- Warner, Reece. 2016. Underinsurance in Australia 2015. Sydney: Rice Warner Actuaries. [Google Scholar]

- Weedige, Sampath Sanjeewa, and Hongbing Ouyang. 2019. Consumers’ Insurance Literacy: Literature Review, Conceptual Definition, and Approach for a Measurement Instrument. European Journal of Business and Management 11: 49–65. [Google Scholar]

- Weedige, Sampath Sanjeewa, Hongbing Ouyang, Yao Gao, and Yaqing Liu. 2019. Decision Making in Personal Insurance: Impact of Insurance Literacy. Sustainability 11: 6795. [Google Scholar] [CrossRef]

- Wu, Wei, Vivian Huang, Xiayu Chen, Robert M. Davison, and Zhongsheng Hua. 2018. Social Value and Online Social Shopping Intention: The Moderating Role of Experience. Information Technology & People 31: 688–711. [Google Scholar] [CrossRef]

- Yamane, Taro. 1973. Statistics, Harper International ed. New York: Harper & Row. [Google Scholar]

- Yan, Bo. 2019. Research on the Influence of Customer Perceived Value on Brand Equity. American Journal of Industrial and Business Management 9: 609–26. [Google Scholar] [CrossRef]

- Zeithaml, Valarie A. 1988. Consumer Perceptions of Price, Quality, and Value: A Means-End Model and Synthesis of Evidence. Journal of Marketing 52: 2. [Google Scholar] [CrossRef]

- Zucker, Lynne. 2008. Production of Trust: Institutional Sources of Economic Structure, 1840–1920. Landmark Papers on Trust 1: 74–132. Available online: https://search.proquest.com/docview/56963283 (accessed on 21 September 2021).

- Zulfiqar, Umera, Sajid Mohy-Ul-Din, Ayman Abu-Rumman, Ata E. M. Al-Shraah, and Israr Ahmed. 2020. Insurance-Growth Nexus: Aggregation and Disaggregation. The Journal of Asian Finance, Economics, and Business 7: 665–75. Available online: http://scholar.dkyobobook.co.kr/searchDetail.laf?barcode=4010028305816 (accessed on 11 November 2021). [CrossRef]

- Zuliani, Rafiza, and Asmak Ab Rahman. 2018. Micro-Takaful in Aceh. New Developments in Islamic Economics. Bingley: Emerald Publishing Limited. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).