Abstract

This study develops the Information Systems–Organizational Fit Alignment Model (ISOFAM) to evaluate information systems (IS) alignment during the pre-combination phase of mergers and acquisitions (M&A)—a critical yet underexplored stage in integration planning. Through constructivist grounded theory and the reanalysis of qualitative data from two anonymized M&A cases—one domestic (Slovenian) and one cross-border (European)—this study identifies four diagnostic dimensions: Technical Compatibility, Functional Complementarity, Cultural and Governance Fit, and Planning Maturity. ISOFAM is operationalized through visual tools, including the Risk–Opportunity Diagnostic Matrix, IS Misalignment Escalation Flowchart, and Temporal Integration Framework, which facilitate early alignment and strategic foresight. These contributions position IS as a strategic pre-combination priority, enhancing both theoretical and practical outcomes in digital M&A.

1. Introduction

Information systems (ISs) integration is a critical dimension of mergers and acquisitions (M&A) success [1]. Henningsson and Kettinger [1] estimate that 45–60% of M&A benefits depend on effective IS integration, yet deficiencies such as operational disruptions or capability losses often undermine value creation. Despite global M&A deal values reaching approximately USD 3.5 trillion in 2024 [2], aligning IS infrastructure remains a significant challenge, jeopardizing integration outcomes. Tanriverdi and Uysal [3] emphasize that IT capability asymmetries further exacerbate these risks, highlighting the need for diagnostic tools to assess IS alignment in the pre-combination phase.

Although IS integration has received growing attention in M&A research, studies such as Tanriverdi and Uysal [3] and applications of the Strategic Alignment Model (SAM) and the GE Pathfinder Model [4,5] provide limited guidance on pre-combination alignment. Both frameworks are typically applied post-merger or focus on leadership and organizational dynamics, offering minimal emphasis on early-stage IS diagnostics, thus underscoring ISOFAM’s relevance [3].

This study addresses the following research question: How can IS alignment be systematically assessed during the pre-combination phase of M&A to enhance integration success? We assume that systematic IS alignment diagnostics enhance M&A outcomes by mitigating pre-combination risks, extending organizational fit frameworks [3,6]. Building on the main research question, the analysis explores how IS alignment can be assessed through four interrelated areas of inquiry: the roles of Technical Compatibility and Planning Maturity in shaping integration foresight, and the influence of functional, cultural, and governance alignments on pre-combination integration readiness. These focal areas guided our grounded theory process and contributed to the development of the ISOFAM.

Bertoncelj et al. [6] highlight the role of organizational competencies in shaping adaptive capabilities, while Marks and Mirvis [7] stress the need to address organizational fit in the early stages of M&A integration.

Grounded in dynamic capabilities [8] and constructivist grounded theory [9], ISOFAM integrates concepts from Tanriverdi and Uysal [3], Bachmann [5], and Bertoncelj et al. [6]. Using qualitative data from two anonymized M&A cases—one domestic (Slovenian) and one cross-border (European)—we identify four diagnostic dimensions: Technical Compatibility, Functional Complementarity, Cultural and Governance Fit, and Planning Maturity. These dimensions, validated through manual coding, form ISOFAM’s empirical and conceptual foundation, providing actionable insights for pre-combination planning.

This study makes three contributions, responding to calls for grounded, actionable frameworks [7,10,11]. First, it proposes ISOFAM as a diagnostic model that establishes new relationships among technical, functional, cultural, and planning constructs [7]. Second, it leverages reanalyzed M&A data to generate novel insights into IS alignment, exemplifying methodological innovation grounded in qualitative rigor [11]. Third, it offers visual tools: the ISOFAM schema, Risk–Opportunity Matrix, and Misalignment Escalation Flowchart—that support integration foresight and pre-merger risk assessment, meeting both scientific standards and practitioner needs [11]. The subsequent sections review the relevant literature, detail the research design, present findings, and discuss theoretical and practical implications.

2. Literature Review

Organizational fit is critical to M&A success, spanning operational, cultural, governance, and technological dimensions [6]. Bertoncelj et al. [6] emphasize how organizational competencies underpin strategic adaptation—essential for effective early IS alignment. Theoretical clarity is essential in developing such frameworks. Whetten [12] stresses that well-specified constructs and relationships are central to meaningful theoretical contribution. Gawel [13] highlights post-acquisition knowledge transfer via IS capabilities, supporting ISOFAM’s focus on Functional Complementarity. Goerzen’s work on alliance networks further reinforces this dimension [14].

Cognitive biases skew pre-combination assessments, causing executives to underestimate IS integration complexities [8,15]. Aschbacher and Kroon [15] demonstrate that advisors and executives often rely on heuristics and exhibit confirmation and anchoring biases during due diligence, which can obscure critical technical and governance risks. Teece [8] further highlights how bounded rationality and limited sensing capabilities can hinder organizational foresight. These findings underscore the need for structured diagnostics like ISOFAM to identify latent misalignments before deal closure.

Effective M&A integration depends on a balanced approach between hard factors (such as information systems) and soft factors (such as organizational culture), with the early detection of misalignments significantly improving success outcomes [6,10]. Bauer et al. [10] demonstrate that pre- and post-combination mechanisms interact dynamically, reinforcing the need to address technical and cultural compatibility early. Bertoncelj et al. [6] similarly highlight that organizational success depends on adaptive competencies that align operational systems with evolving environments. This supports ISOFAM’s diagnostic focus on the pre-combination phase, which addresses an observed gap in existing integration frameworks [15].

IS alignment—defined as the congruence of IS strategies, structures, and capabilities with organizational objectives—is a critical determinant of M&A success [4]. The Strategic Alignment Model (SAM) [4] remains a foundational framework in IS research but is predominantly applied in post-merger settings, offering limited guidance during the due diligence phase. This neglects early-stage architectural fit and governance maturity, both crucial for identifying integration risks [6]. Likewise, the GE Pathfinder Model emphasizes leadership and cultural planning, relegating IS concerns to later integration stages [5]. In contrast, recent research positions digital transformation as a dynamic capability, reinforcing ISOFAM’s theoretical foundation for enabling adaptive pre-combination alignment [8,16].

The Strategic Alignment Model (SAM) [4] and GE Pathfinder Model [5] prioritize post-merger or non-IS factors, failing to address pre-combination IS challenges. ISOFAM integrates dynamic capabilities [8] and recent empirical insights into digital-driven M&A outcomes [16,17], bridging IT strategy and operational planning before deal closure.

Dynamic capabilities theory, per Teece [8], posits that firms succeed in volatile environments by sensing, seizing, and reconfiguring resources. Information technology infrastructure flexibility supports post-merger reconfiguration and integration performance [18]. ISOFAM extends this logic by emphasizing pre-combination diagnostic capabilities to detect misalignments before deal execution—enabling proactive sensing and governance readiness [8].

Flexible organizations outperform in post-merger integration, supporting ISOFAM’s Technical Compatibility and Functional Complementarity dimensions [3]. Existing diagnostic models—such as GE Pathfinder Model—overlook IS-specific evaluation, reinforcing ISOFAM’s novelty [5].

ISOFAM integrates IS alignment into pre-combination diagnostics, prioritizing technology assessment to enable foresight and address the critical gap in existing M&A frameworks, which largely focus on post-merger phases [3]. Firms with superior IT integration capabilities achieve higher M&A returns [3], yet the lack of early-stage diagnostics often leads to reactive post-merger recovery. By emphasizing proactive strategic planning, ISOFAM shifts the integration focus to mitigate risks before deal closure, reinforcing its novelty and practical utility.

Despite calls for IS-aware M&A frameworks [10,12], few studies offer granular diagnostics focused on the pre-combination phase. As practitioners increasingly integrate AI into early-stage M&A, about 16% now use generative AI for screening and due diligence, with adoption expected to reach 80% within three years [19]. Integration challenges remain significant. For instance, 48% of M&A professionals report using AI to inform due diligence—up from 20% in 2018 [20]. These trends reinforce the need for structured, tech-oriented diagnostics like ISOFAM to uncover latent misalignments prior to deal closure.

Platform modularity’s rise as a post-2020 M&A success factor has further complicated IS integration, especially when coupled with the challenges of acquiring advanced technologies like AI [16]. As AI-driven deals increase, frameworks like ISOFAM, built on constructivist grounded theory [11] and enriched with visual planning tools, directly address this emerging requirement. This study contributes to the IS alignment literature by providing pre-merger diagnostics and equipping integration teams with actionable tools, addressing long-standing calls for both theoretical rigor and practical relevance [5,11].

3. Information Systems–Organizational Fit Alignment Model (ISOFAM)

Building on the literature reviewed, we developed the Information Systems–Organizational Fit Alignment Model (ISOFAM), integrating organizational fit theory [10], IS alignment principles [4], and dynamic capabilities perspectives [8]. This model addresses the critical need for pre-combination IS diagnostics in M&A [3]. Unlike existing frameworks, such as the Strategic Alignment Model (SAM) [4] or GE Pathfinder Model [5], which focus on post-merger alignment or non-IS factors, ISOFAM prioritizes proactive IS assessment to mitigate integration risks effectively.

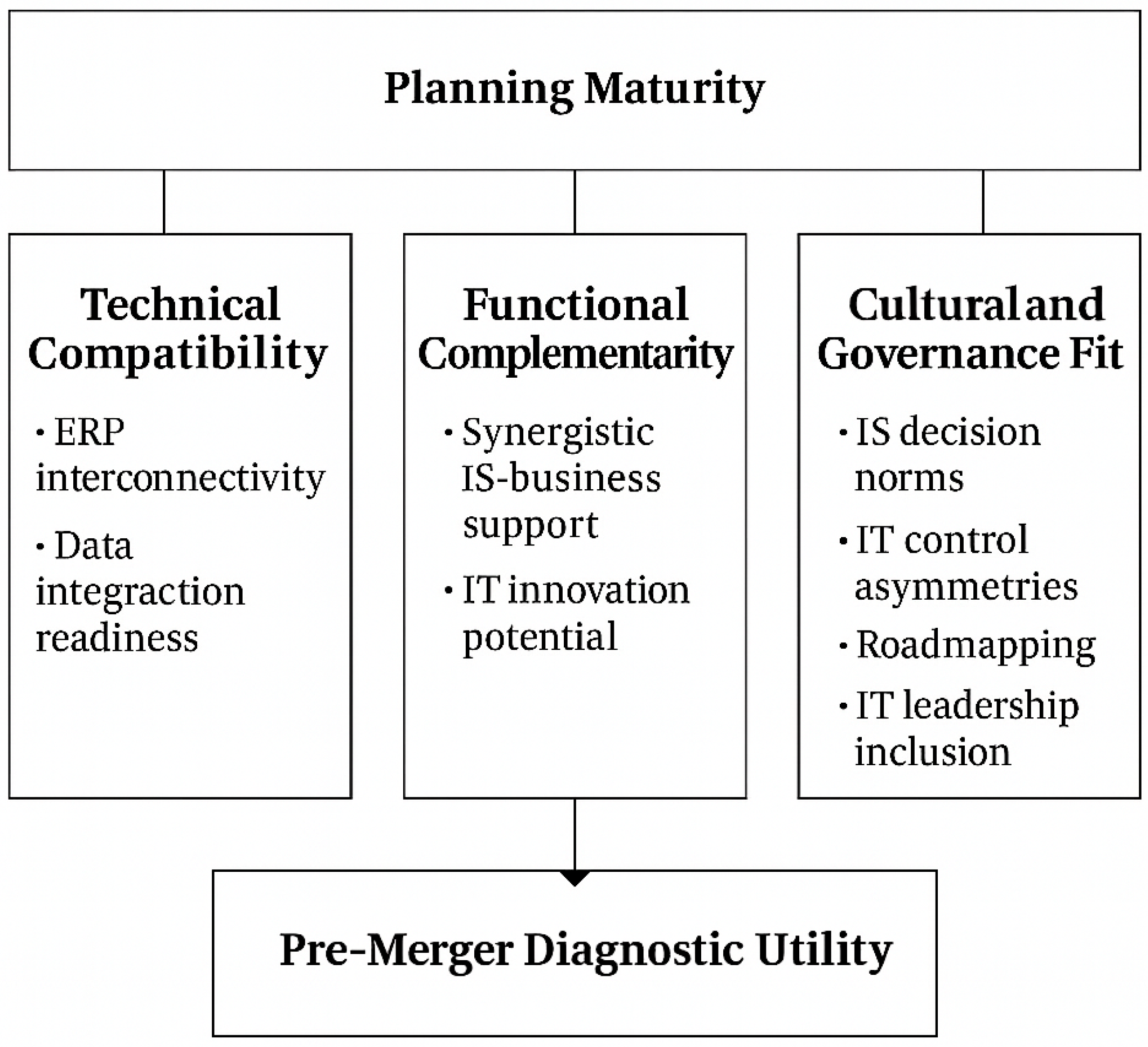

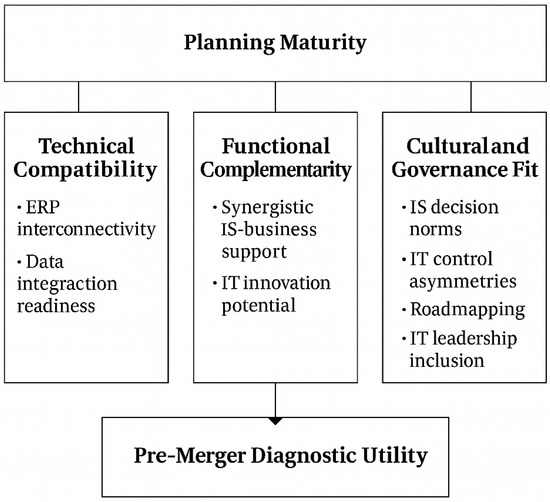

The ISOFAM framework synthesizes three theoretical streams—organizational fit [10], IS alignment [4], and dynamic capabilities [8]—to inform four diagnostic dimensions: Technical Compatibility, Functional Complementarity, Cultural and Governance Fit, and Planning Maturity. Technical Compatibility, derived from infrastructural interoperability needs [15], ensures interoperable IS infrastructures. Functional Complementarity, rooted in strategic alignment principles [4], aligns IS capabilities with M&A goals. Cultural and Governance Fit, based on organizational congruence [3], addresses IS decision-making alignment. Planning Maturity, informed by readiness assessments [6], evaluates integration preparedness.

The diagram in Figure 1 visually integrates ISOFAM’s four dimensions, depicting their interrelationships as a cohesive framework for identifying IS alignment risks in the pre-combination phase of M&A. It serves as a practical diagnostic tool for integration teams and decision-makers. To support implementation, Table 1 provides detailed definitions, illustrative indicators, and associated theoretical foundations for each diagnostic dimension.

Figure 1.

ISOFAM framework. Visual representation of the relationships among Technical Compatibility, Function Complementarity, Cultural and Governance Fit, and Planning Maturity—key diagnostic dimensions for pre-merger integration planning.

Table 1.

ISOFAM dimensions—summary of definitions and theoretical foundations of ISOFAM’s diagnostic dimensions, offering a clear reference for pre-combination IS evaluation.

Table 1 provides a structured, IS-specific diagnostic tool, grounded in constructivist grounded theory [9], to enhance M&A success through early misalignment detection [5,11].

4. Methods

This study employs a qualitative methodology grounded in constructivist grounded theory, which emphasizes reflexivity and co-constructed meaning to develop context-sensitive insights [9]. Drawing on data from a doctoral dissertation focused on pre-combination phases of M&A—initially centered on strategic, organizational, and financial factors—we reanalyze this material through a novel lens to explore information systems (IS) alignment [21]. This reinterpretation supports the development of the Information Systems–Organizational Fit Alignment Model (ISOFAM), addressing a previously underexamined dimension of the original dataset.

Our methodological rationale relies on qualitative data’s capacity, when reanalyzed through alternative theoretical lenses, to uncover novel patterns and contributions [22,23]. Thornberg and Charmaz [22] emphasize that grounded theory supports theoretical reinterpretation, allowing researchers to construct new conceptual understandings from existing qualitative material. Likewise, Miles et al. [23] underscore that flexible, iterative coding techniques are critical to extracting novel insights when data are viewed through new analytical frameworks. By adapting constructivist grounded theory procedures—such as reflexive coding (Section 4.3) and researcher positionality (Section 4.1), we foreground digital and infrastructural readiness as antecedents to M&A integration success.

4.1. Data Sources and Case Selection

The dataset consists of anonymized interview transcripts from two real-world M&A cases involving Slovenian firms: one domestic (Case A) and one cross-border (European-Case B). These cases were purposefully selected using maximum variation sampling to capture diverse perspectives on IS alignment in M&A contexts [23]. Selection criteria included sectoral diversity (e.g., manufacturing vs. services), organizational scale, integration complexity, and differing levels of IS infrastructure maturity—conditions that enhance analytical generalizability in qualitative research.

Semi-structured interviews engaged 24 key informants, each contributing a single in-depth interview. Participants included CEOs, CIOs, IT managers, integration team members, and external consultants—spanning strategic, operational, and technological domains. Interviews averaged 71 min (range: 45–90 min) and were designed to elicit IS-related insights in conjunction with strategic and financial considerations. Interview guides allowed for adaptive probing, consistent with constructivist grounded theory principles. Table 2 summarizes the data sources and participant roles.

Table 2.

Summary of data sources.

Table 2 outlines the qualitative data sources underpinning ISOFAM’s development, providing transparency in case selection and interview scope. Following best practices in qualitative research documentation [23], interview durations are reported in minutes, with averages and ranges by case to reflect depth and variability across roles. This detail supports transferability and helps contextualize the interpretive analysis used to construct ISOFAM.

Following trustworthiness principles outlined by Elo et al. [24], we maintained critical awareness of how our positionality—shaped by prior M&A research experiences [23]—influenced interpretations of IS alignment challenges. This reflexive stance was particularly important in the reanalysis context, where our theoretical perspective on IS integration had evolved since the original data collection [23]. To enhance analytical credibility, we conducted regular peer debriefing sessions to challenge emerging interpretations and mitigate confirmation bias. Sample codes (e.g., ‘ERP mismatch’ → Technical Compatibility, ‘cultural resistance’ → Cultural and Governance Fit) were cross-validated through peer debriefing, ensuring coding consistency. This iterative coding and validation process aligns with principles of constructivist grounded theory [9], supporting the transparency and trustworthiness of ISOFAM’s development.

While the original analysis [23] examined strategic, organizational, and financial factors in pre-combination M&A phases, this study reanalyzes a subset of IS-related data that had previously been collected but not explored from an IS alignment perspective. These data, drawn from 24 interviews (Table 2), include stakeholder reflections on legacy platform integration, data migration strategies, timeline coordination, and inconsistencies in IS governance. This targeted focus, guided by constructivist grounded theory [9], supports the development of ISOFAM by surfacing previously overlooked IS alignment challenges [24].

4.2. Ethical Considerations and Data Reuse

All participants provided informed consent during the original data collection [21], and institutional ethics approval was obtained. In line with principles of secondary qualitative analysis [23,25], we reanalyzed the dataset with new research objectives and distinct analytic categories that are centered on IS alignment. While the data itself were previously collected, this study’s empirical contribution is novel in its interpretive framing—offering new insights into IS integration in M&A contexts. This reanalysis advances the development of ISOFAM by applying constructivist grounded theory methodology [9] to uncover latent alignment challenges and diagnostic opportunities.

4.3. Coding Strategy

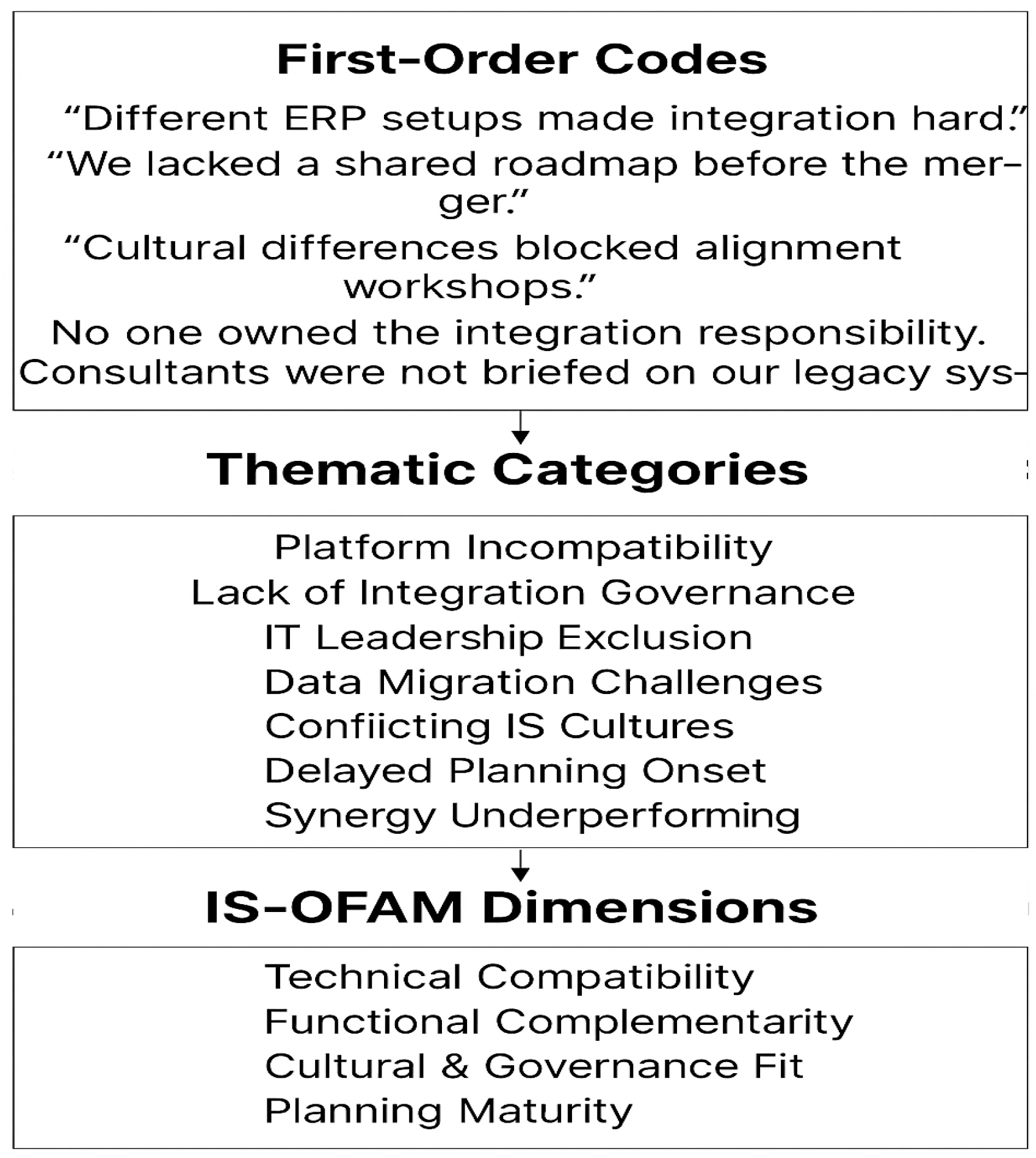

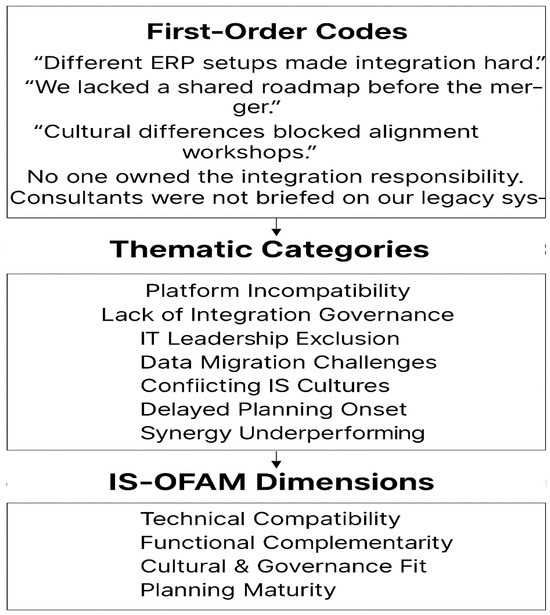

To derive IS-specific insights, we applied a three-phase manual coding procedure, structured interpretively to ensure contextual sensitivity. Manual coding was chosen over CAQDAS to preserve interpretive rigor, as constructivist grounded theory emphasizes the researcher’s close interaction with data and the value of human judgment in capturing complex organizational phenomena [9]. This approach allowed deeper engagement with nuanced narratives surrounding IS alignment, maintaining interpretive integrity. Grounded in constructivist grounded theory [9], this analysis of IS-related data from 24 interviews (Table 2) supported ISOFAM’s development:

- Exploratory Framing: We reread the full transcript corpus, focusing exclusively on IS integration narratives, and identified statements referencing digital resource overlaps, software architecture mismatches, and planning breakdowns. Reflective memoing practices supported by Charmaz [9] helped surface implicit assumptions, emerging concerns, and interpretive leads, ensuring a nuanced understanding of IS alignment challenges.

- Thematic Grouping: Relevant excerpts were clustered into emergent categories aligned with ISOFAM’s conceptual architecture. Themes—Technical Compatibility, Functional Complementarity, Cultural and Governance Fit, and Planning Maturity—were populated through cross-case code mapping, contrastive informant perspectives, and relational coding practices. Linked memo entries were retained within each thematic cluster to preserve interpretive depth and contextual integrity [9].

- Conceptual Consolidation: Within each theme, we refined diagnostic indicators using comparative interpretation and axial coding methods as outlined by Thornberg and Charmaz [22]. This allowed for the articulation of second-order constructs and diagnostic relationships, forming the empirical foundation for ISOFAM’s framework. This phase advanced IS alignment insights within the underexplored pre-combination stage of M&A [9].

The resulting data structure is visualized in Figure 2, which traces the progression from initial coding to aggregate dimensions, illustrating how empirical categories underpin the ISOFAM diagnostic model.

Figure 2.

Data structure diagram—illustrates the progression from first-order codes to second-order themes and aggregate dimensions in the coding process, underpinning ISOFAM’s diagnostic framework.

The manual coding approach depicted in Figure 2 preserved semantic granularity, allowing for the capture of latent organizational tensions and nuanced IS integration misalignments. This interpretive depth enabled richer analysis of interviewees’ language, cognitive frames, and strategic blind spots, thereby reinforcing ISOFAM’s empirical grounding and enhancing its diagnostic relevance [9,15,22].

4.4. Rationale for Theoretical Reanalysis

This study advances theory-building by demonstrating how grounded reanalysis of qualitative data can reveal novel constructs and enhance the empirical utility of conceptual models [9]. The ISOFAM framework emerges as a distinct theoretical construct, grounded in newly derived diagnostic categories, the updated literature, and practitioner-oriented visual tools. This aligns with Corley and Gioia’s emphasis on meaningful theoretical contributions, particularly those offering originality, clarity, and practical relevance [5,9]. Foundational insights from earlier research—such as Aschbacher and Kroon’s work on cognitive biases in M&A decision-making [15] and van den Berg’s guidelines on data reuse and interpretive ethics [25]—validate the use of secondary analysis. These are further reinforced by the recent literature highlighting digital transformation and its impact on integration complexity in M&A [16,17].

Methodological support for our multi-case approach is provided by He and Wong [26], whose work on exploration versus exploitation offers a foundation for balancing divergent and convergent inquiry across case settings. This theoretical lens, relevant to understanding M&A decision-making complexity, supports the diagnostic intent of ISOFAM. In parallel, Graebner et al. [27] argue that qualitative inquiry in strategy research benefits from structured flexibility—“cooking without a recipe”—which aligns with our grounded reanalysis. Their emphasis on emergent logic and adaptive coding practices reinforces the validity of our constructivist approach to IS alignment [9,26,27]. These methods collectively underpin the empirical findings presented in Section 5.

5. Results

The findings from the reanalyzed transcript data (Table 2) are structured around ISOFAM’s four diagnostic dimensions: Technical Compatibility, Functional Complementarity, Cultural and Governance Fit, and Planning Maturity. Each dimension encapsulates integration-critical themes that emerged from the two case studies, reflecting consistent empirical patterns in participant narratives. These categories serve as the foundation for ISOFAM’s diagnostic framework, deepening IS alignment insights within M&A contexts (Figure 1).

5.1. Technical Compatibility

The reanalyzed transcript data (Table 3) revealed significant infrastructure misalignments in both case studies, particularly concerning system architecture and legacy software integration. In Case A, respondents reported enterprise resource planning (ERP) platform incompatibilities that posed data loss risks and led to dual-reporting inefficiencies—60% of excerpts referenced ERP-related challenges. In Case B, divergent security protocols and middleware limitations caused operational friction, with 45% of excerpts highlighting middleware issues. An IT manager remarked: “We had two very different philosophies—one centralized, the other federated. No one mapped how they would connect.” These findings reveal the absence of systematic pre-merger technical audits, reinforcing the relevance of ISOFAM’s Technical Compatibility dimension as a critical diagnostic lens for integration planning.

Table 3.

Representative excerpts on technical compatibility—presents representative excerpts illustrating technical compatibility challenges in Case A and Case B.

Table 3 illustrates recurring Technical Compatibility challenges identified across interviews, with excerpts paraphrased for clarity.

5.2. Functional Complementarity

The reanalyzed transcript data (Table 2) revealed varying degrees of alignment between IS capabilities and strategic objectives across both case studies. In Case A, overlapping functionalities—such as parallel CRM systems—resulted in underutilized integration potential, with 55% of excerpts referencing CRM redundancies. Conversely, Case B’s legacy systems lacked interoperability, hindering opportunities for shared service synergies, with 50% of excerpts identifying interoperability constraints. A senior planner remarked, “We had two systems doing similar things differently—it made integration planning guesswork.” These findings underscore the importance of evaluating system functionality within its strategic context, reinforcing ISOFAM’s Functional Complementarity dimension as a vital pre-combination diagnostic tool.

An actuarial approach to technical risk scoring complements the evaluation of Functional Complementarity, particularly in Case A, where parallel systems incurred quantifiable redundancy costs and heightened integration risks. While this study primarily employs qualitative methods, incorporating a quantitative perspective—such as systematic risk modeling—reinforces the value of structured assessment. This aligns with Graebner et al. [27], who emphasize the utility of methodological pluralism in theory development, and with He and Wong’s [26] support for balancing exploration and exploitation when managing integration complexity in dynamic environments. These perspectives underscore the need for hybrid diagnostics in Functional Complementarity evaluation within M&A contexts.

5.3. Cultural and Governance Fit

The reanalyzed transcript data (Table 2) identified governance practices and cultural expectations as critical mediators of IS integration. In Case A, resistance to change stemmed from concerns over system discontinuity and perceived shifts in IT department authority, with 50% of excerpts citing such resistance. In Case B, centralized procurement protocols clashed with a decentralized IT culture, complicating integration, with 60% of excerpts referencing governance conflicts. As one CIO observed, “The merger didn’t just integrate systems—it created power struggles about who owns decisions.” These findings highlight the necessity of governance foresight and cultural alignment, underscoring ISOFAM’s Cultural and Governance Fit dimension as an essential pre-combination diagnostic lens.

Teece’s research on dynamic capabilities [8] further contextualizes these challenges—especially in Case B’s cross-border M&A—by showing how governance structures and cultural norms affect knowledge transfer and resource reconfiguration. Such dynamics directly shape IS integration effectiveness across firm boundaries. This theoretical perspective strengthens ISOFAM’s emphasis on Cultural and Governance Fit as a foundational enabler of IS alignment during pre-merger planning.

5.4. Planning Maturity

The reanalyzed transcript data (Table 2) identified insufficient integration planning as the most pervasive IS misalignment factor across both cases. In Case A, IS due diligence was largely improvised, with 65% of excerpts referencing ad hoc planning. In Case B, digital strategy was deprioritized, with 70% of excerpts describing reactive or delayed integration responses. As one project manager from Case B noted, “IS was always a follow-up topic. We had no roadmap—just firefighting.” The absence of structured planning, benchmarking, and architectural simulation severely constrained pre-merger foresight and risk mitigation. These findings emphasize the critical role of ISOFAM’s Planning Maturity dimension in enhancing pre-combination diagnostic capabilities.

Taken together, these insights empirically validate ISOFAM by linking observed integration challenges directly to its diagnostic categories. The recurring absence of IS risk foresight, inconsistent assessments of Technical Compatibility, and overlooked governance misalignments highlight the necessity of structured, pre-merger IS diagnostics. Table 4 summarizes these cross-case insights, demonstrating ISOFAM’s utility in anticipating and mitigating integration failures during M&A planning.

Table 4.

Summary of ISOFAM dimensions across cases—summarizes key integration challenges associated with ISOFAM’s diagnostic dimensions in Case A (domestic) and Case B (cross-border) M&A contexts.

Table 4 presents a cross-case comparison of integration challenges, validating ISOFAM’s diagnostic dimensions as a robust framework for identifying IS-related risks in both domestic and cross-border M&A. These patterns reinforce ISOFAM’s practical relevance by directing integration teams toward focused, pre-combination diagnostics.

5.5. Cross-Case Synthesis

Case A’s domestic context revealed siloed IT structures that amplified technical incompatibilities, while Case B’s cross-border dynamics introduced governance tensions that impeded cultural alignment. These divergent integration challenges highlight the relevance of context-specific diagnostics and validate ISOFAM’s adaptability across diverse organizational and geographic settings. Grounded in the dynamic capabilities view [8], ISOFAM supports proactive sensing of misalignment risks, offering a versatile tool for M&A practitioners navigating heterogeneous integration environments.

6. Discussion

This section interprets the empirical findings from Section 5 to advance ISOFAM as a diagnostic tool for pre-merger evaluation. The multidimensional misalignments identified across cases (Table 4) illustrate the persistent challenges of IS integration during the pre-combination phase of M&A. These findings affirm the need for structured, forward-looking tools that assess technical, functional, cultural, and planning dimensions before integration begins.

ISOFAM’s framework integrates strategic alignment principles [4], dynamic capabilities theory [8], and diagnostic modeling grounded in constructivist grounded theory [9]. Together, these perspectives reinforce ISOFAM’s utility as a strategic foresight mechanism, enabling firms to sense and mitigate misalignment risks prior to deal closure. Rather than relying solely on post-merger adjustments, ISOFAM shifts attention to early-stage readiness, complementing existing integration models with a proactive, IS-centric lens.

6.1. Linking ISOFAM to Dynamic Capabilities

ISOFAM’s diagnostic dimensions—Technical Compatibility, Functional Complementarity, Cultural and Governance Fit, and Planning Maturity—map directly onto the core components of dynamic capabilities theory: sensing, seizing, and reconfiguring [8]. Specifically, Technical Compatibility facilitates the sensing of infrastructural vulnerabilities and integration barriers. Functional Complementarity enables firms to seize synergies through aligned digital capabilities and business processes. Cultural and Governance Fit supports the reconfiguring of organizational structures, decision rights, and knowledge flows across merging entities. Finally, Planning Maturity reinforces all three capabilities by promoting integration foresight, scenario preparation, and adaptive planning. Together, these dimensions enhance firms’ pre-combination IS readiness and integration resilience in volatile environments.

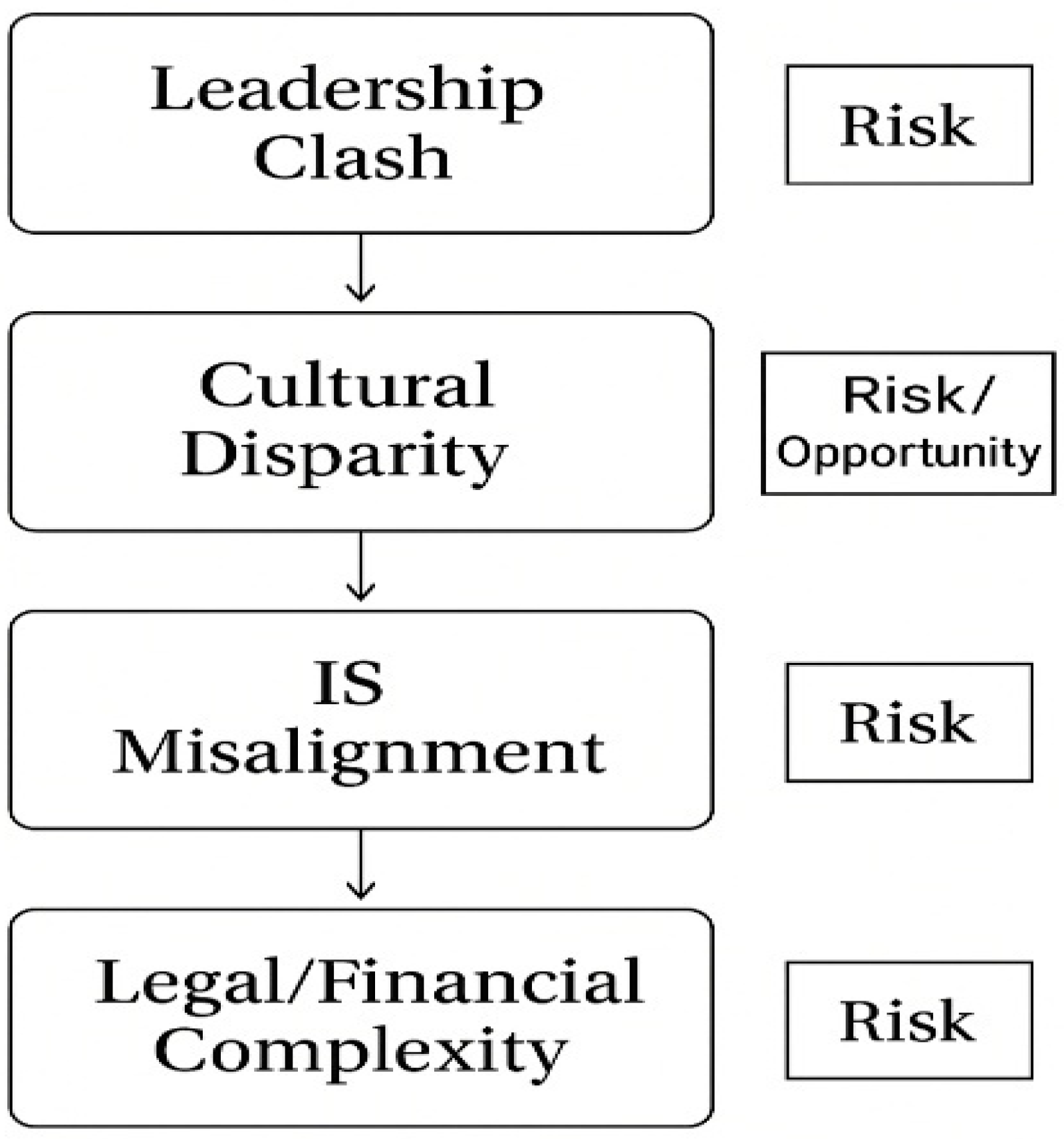

6.2. Strategic Triggers and the IS Misalignment Escalation Flowchart

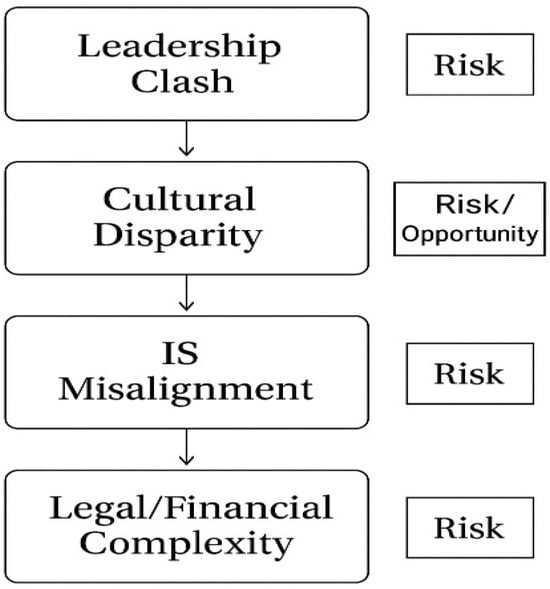

To elucidate how IS misalignments materialize during M&A, we developed a Pre-combination IS Misalignment Escalation Flowchart (Figure 3). This visual tool models a recurring escalation trajectory that often begins with strategic or leadership misalignment, cascades into cultural and governance friction, and culminates in technical dysfunctions and legal–financial complications. The flowchart demonstrates how latent interpersonal and cultural tensions—often underestimated in due diligence—can trigger systemic IS vulnerabilities. By tracing this escalation pattern, the flowchart underscores the critical importance of early-stage diagnostics and reinforces ISOFAM’s value in detecting alignment issues before they translate into post-merger failures.

Figure 3.

Pre-combination IS Misalignment Escalation Flowchart—illustrates how IS misalignments escalate in M&A—from leadership misalignment through cultural gaps to technical risks and legal–financial complexities. Synthesized from cross-case patterns (Table 4, Section 5), the flowchart underscores ISOFAM’s role in identifying cascading risks before integration begins.

The escalating nature of IS misalignments observed in both cases is synthesized in Figure 3, which models the trajectory from early organizational disconnects to downstream integration risks. This visualization distills empirical patterns identified in Section 5 and summarized in Table 4, demonstrating how misalignments compound over time if left unaddressed.

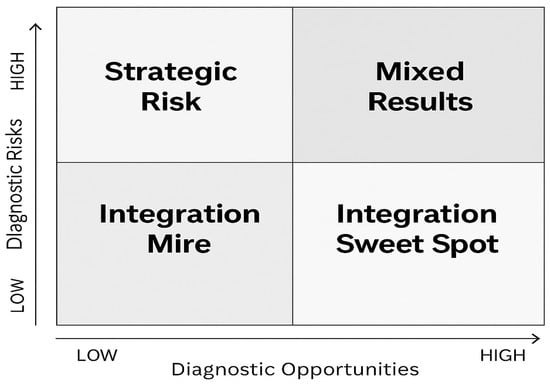

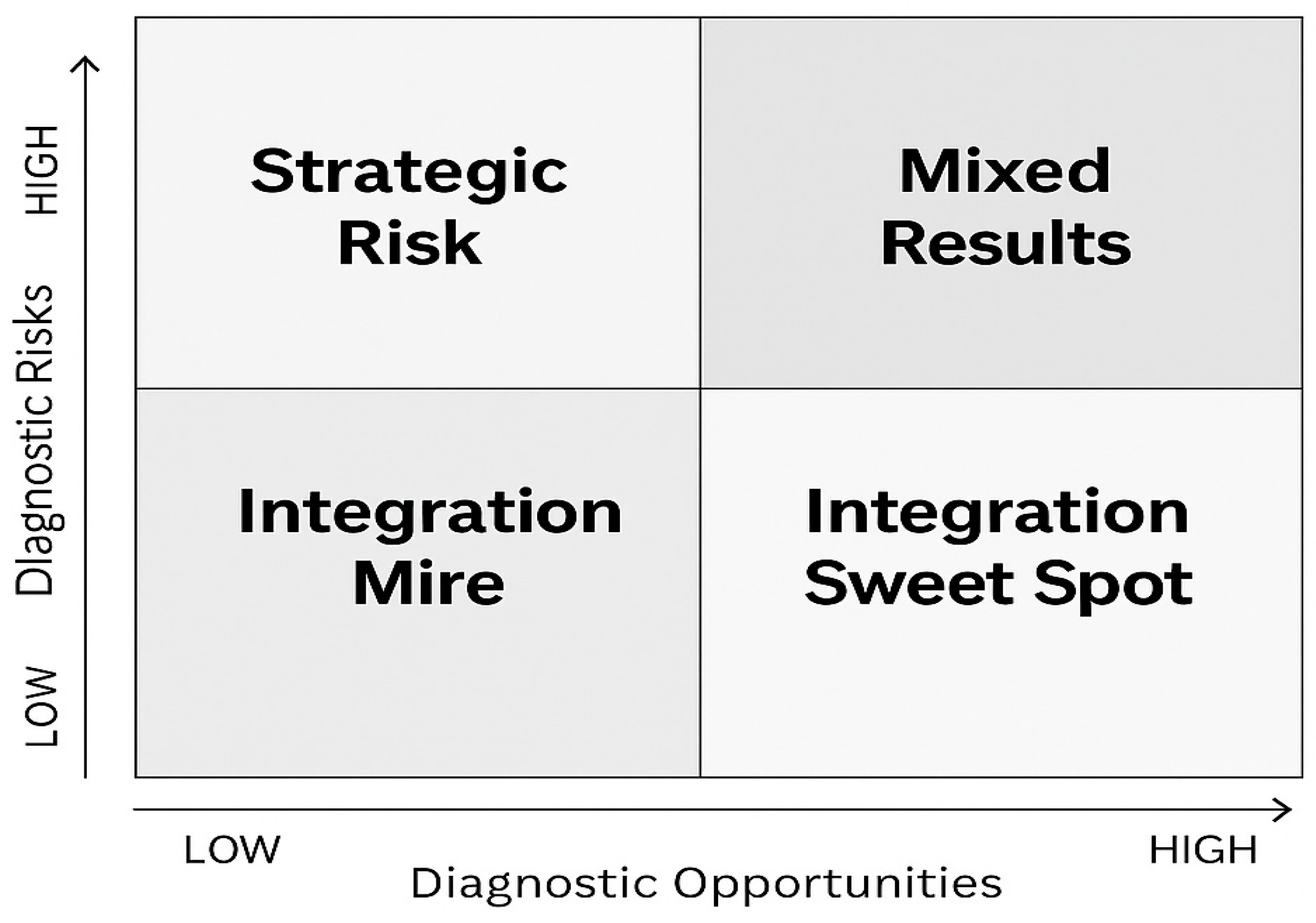

6.3. Visualizing IS Risk–Opportunity Trade-Offs

The Risk–Opportunity Diagnostic Matrix (Figure 4) serves as a decision-support tool for assessing IS integration scenarios in M&A planning. By mapping integration risks against opportunity potential, it identifies four interpretive zones—Integration Mire, Strategic Risk, Mixed Results, and Integration Sweet Spot. Grounded in cross-case insights from Section 5 and Table 4, the matrix enhances ISOFAM’s diagnostic utility by helping planning teams evaluate trade-offs, prioritize IS strategies, and tailor responses to anticipated integration challenges.

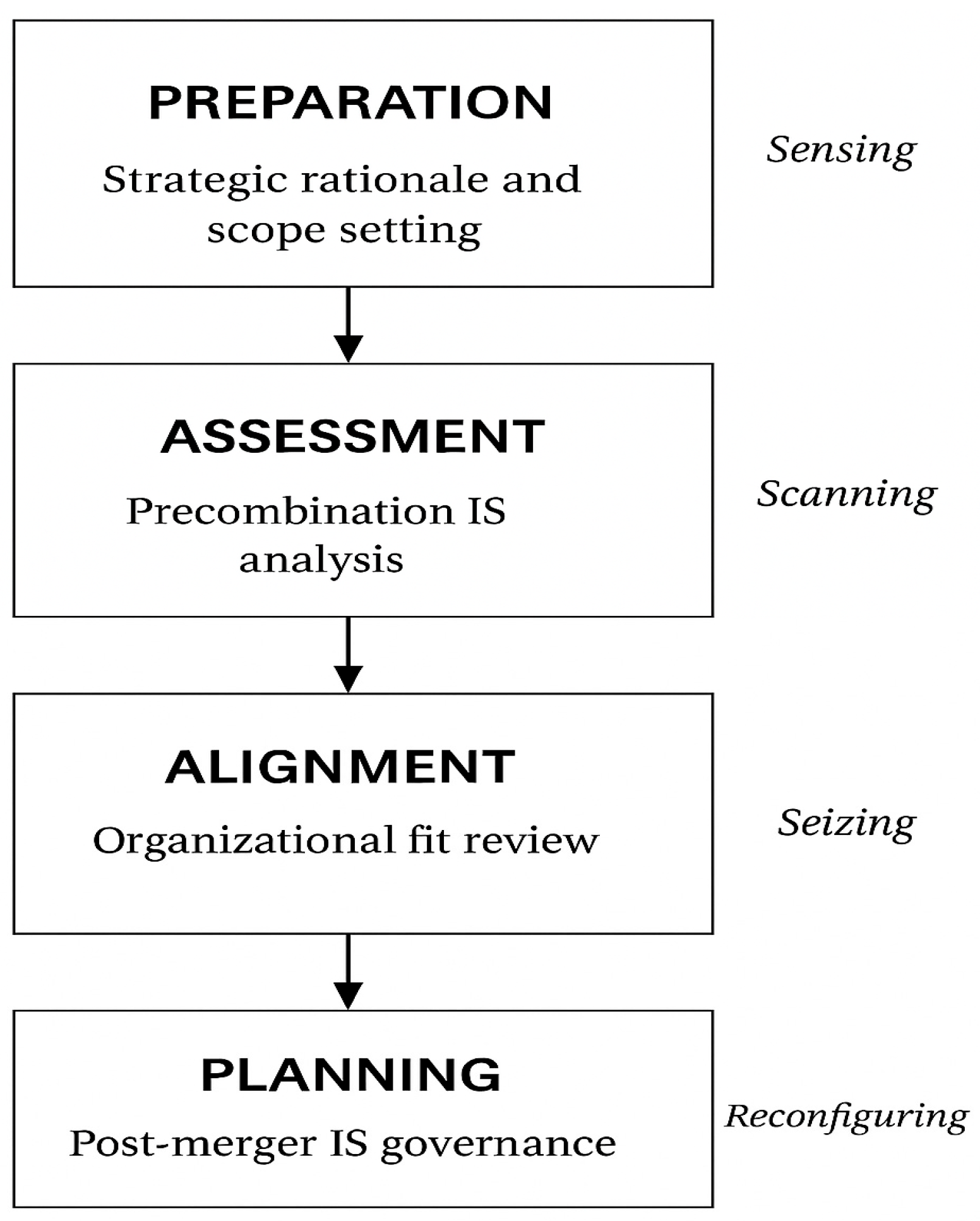

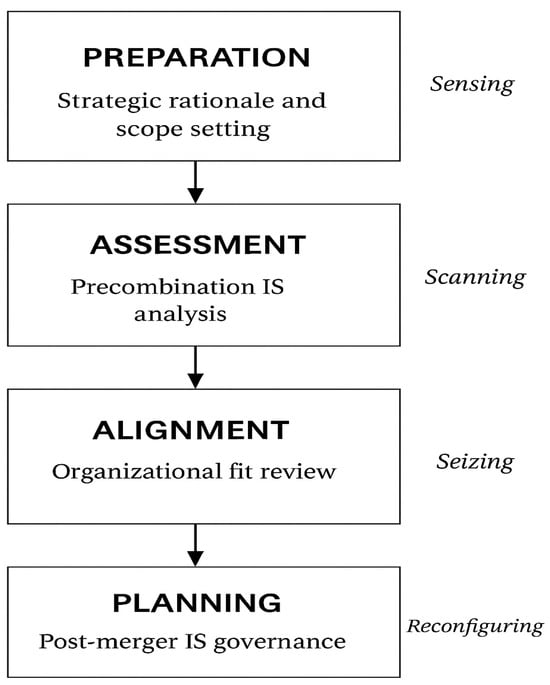

6.4. Operationalizing ISOFAM: A Temporal Framework

The ISOFAM Temporal Framework (Figure 5) outlines a staged process for embedding ISOFAM into pre-combination M&A planning. Spanning from the initial strategic rationale to post-merger governance setup, it defines critical checkpoints for conducting IS alignment diagnostics. Grounded in the cross-case insights summarized in Section 5 and Table 4, the framework enhances ISOFAM’s practical applicability by aligning diagnostic actions with key phases of the M&A lifecycle.

Figure 5.

ISOFAM Temporal Framework—illustrates a sequential process for integrating ISOFAM into pre-combination M&A planning. Based on cross-case findings in Table 4 (Section 5), the framework identifies key alignment checkpoints—from strategic rationale to post-merger governance, to guide early IS diagnostics and mitigate integration risks.

For example, in Case A, it supports early mapping of ERP incompatibilities during due diligence. In Case B, it guides the organization of cross-border governance workshops to preempt cultural misalignments. This staged approach enables integration teams to anticipate risks and adapt interventions proactively.

6.5. Cross-Case Interpretation and Theoretical Contribution

Comparative analysis of the two M&A cases refines ISOFAM’s conceptual utility and positions it more firmly within the IS integration literature. The findings demonstrate that IS misalignments often originate in cultural, governance, and planning deficiencies—amplified by organizational asymmetries—rather than stemming purely from technical incompatibilities. Grounded in the empirical results from Section 5 (Table 4), this interpretation underscores that IS readiness must be recognized as an organizational and strategic imperative, not merely a technological concern.

ISOFAM addresses the Strategic Alignment Model’s post-merger bias [4] and the GE Pathfinder Model’s limited treatment of IS concerns [5], offering a pre-combination diagnostic absent in existing integration frameworks. By integrating dynamic capabilities theory [8], ISOFAM advances IS alignment theory in M&A contexts, bridging a key theoretical gap in early-phase evaluation and planning.

In Case A, strategic ambiguity and ego-driven leadership contributed to technical misfit, impeding IS foresight. Ad hoc planning and siloed IT units rendered functionally similar systems incompatible, exacerbating integration inefficiencies. Conversely, Case B’s legal and operational complexities across jurisdictions obscured IS accountability and diluted planning ownership. Despite consultant involvement, superficial assessments failed to identify IS risks rooted in deeper cultural and governance asymmetries. These findings—linked to Section 5 (Table 4) and visualized in Figure 3—underscore ISOFAM’s value in diagnosing and addressing organizational misalignments before they escalate into integration failures.

The ISOFAM addresses a conceptual and diagnostic gap in IS integration by:

- Framing IS alignment as a multilevel, emergent property of organizational fit;

- Equipping pre-merger practitioners with foresight tools to anticipate downstream integration risks;

Conceptually, ISOFAM extends the Pathfinder Model’s early warning logic [5] by applying it to the IS domain, fostering dynamic capability development through structured planning and governance mechanisms [6]. Methodologically, the grounded reanalysis of existing data reveals novel integration themes, aligning with Bertoncelj et al.’s emphasis on adaptive organizational competencies [6]. Supported by Section 5 findings (Table 4), ISOFAM advances pre-merger learning and enables strategic foresight in complex M&A contexts. These concerns reflect recent evidence that ESG factors and digital readiness significantly influence M&A asset valuation and integration performance, particularly in related-party transactions [28].

Taken together, the cross-case reflections and operational tools position ISOFAM not only as a framework for IS alignment evaluation but also as a mechanism for pre-merger learning, business model innovation, and strategic integration foresight [27]. This aligns with recent findings that underscore the role of institutional, sectoral, and geographic conditions in shaping strategic integration success [29].

7. Conclusions

This study developed and operationalized the Information Systems–Organizational Fit Alignment Model (ISOFAM) as a pre-merger diagnostic tool, addressing a long-standing gap in M&A scholarship: the absence of rigorous, forward-looking IS alignment assessments during early integration planning. Through the constructivist reanalysis of qualitative data from two underexamined M&A cases, ISOFAM demonstrated strong diagnostic potential in uncovering latent integration risks. Its four core dimensions—Technical Compatibility, Functional Complementarity, Cultural and Governance Fit, and Planning Maturity—proved both robust and generative across distinct organizational contexts. Complementary visual tools—the Pre-combination IS Misalignment Escalation Flowchart, the Risk–Opportunity Diagnostic Matrix, and the ISOFAM Temporal Framework—extend the model’s practical utility, equipping integration teams with clear, actionable insights for decision-making.

ISOFAM provides immediate value to M&A practitioners by offering a structured method to assess IS alignment before deal execution. The framework translates abstract theories of organizational fit and IS alignment into actionable diagnostics, enabling integration teams to proactively identify vulnerabilities, allocate resources more strategically, and tailor planning approaches in real time. By embedding diagnostic rigor into pre-merger workflows, ISOFAM supports more coherent and future-oriented integration strategies.

Specifically, ISOFAM delivers four key practitioner-oriented benefits:

- A systematic framework for evaluating IS compatibility during due diligence (e.g., mapping ERP incompatibilities in Case A to identify data migration risks);

- Decision-support tools for communicating IS risks to stakeholders (e.g., using the Risk–Opportunity Matrix to prioritize integration investments in Case B);

- A temporal roadmap for embedding IS alignment into pre-combination planning (e.g., scheduling governance workshops in Case B to align procurement practices);

- Specific indicators for identifying potential misalignments across technical, functional, cultural, and planning dimensions (e.g., assessing middleware documentation gaps in Case B).

Empirical insights from this study affirm a clear link between structured IS integration planning and improved post-merger financial outcomes, underscoring the practical value of ISOFAM. Organizations that adopt pre-combination diagnostics are better positioned to realize synergies and protect value—particularly in cross-border contexts where context-specific strategic alignment and regulatory familiarity are critical [30]. By prioritizing Planning Maturity, ISOFAM reframes IS integration as a strategic pre-deal priority rather than a post-combination challenge—particularly as information asymmetries and limited disclosure remain critical sources of integration risk in M&A involving financial institutions [31].

In doing so, ISOFAM fosters operational efficiency, organizational alignment, and ultimately long-term M&A success. By prioritizing IS readiness early in the process, it reduces post-merger disruption and enhances sustainable value creation. The empirical base—drawn from two case studies within a specific regional and sectoral context—may constrain generalizability. Future research should test ISOFAM across varied industries, digital maturity profiles, and merger types to assess its robustness and adaptability.

This study’s limitations offer productive avenues for future research. The empirical base—two case studies in a specific regional and sectoral context—may limit broader applicability. Future studies should test ISOFAM across diverse industries, digital maturity profiles, and merger types to evaluate its generalizability and adaptability.

Furthermore, the retrospective nature of the data may introduce recall bias, as participants reflected on planning decisions after the fact. Prospective, real-time applications of ISOFAM during active M&A processes would help validate its predictive capabilities and operational reliability.

Given the rapid evolution of digital technologies, ISOFAM should also evolve. Future research could expand the framework to incorporate AI readiness, platform integration maturity, and agile leadership capacity—factors increasingly critical in digital-first and innovation-driven M&A environments.

As technology-driven dealmaking becomes the norm, ISOFAM’s value lies in its ability to anticipate alignment gaps before they materialize. This need is particularly acute in cross-border M&A, where institutional differences and geographic distance introduce governance and reporting risks, including earnings management, compromise strategic planning if unaddressed [32]. Extending the model to address emerging complexities in digital integration and organizational transformation will ensure its continued relevance for both researchers and practitioners. ISOFAM can also be embedded within standard due diligence protocols to support early-stage IS alignment and reduce post-combination integration risks.

Author Contributions

Conceptualization, A.N. and A.B.; methodology, A.N.; resources, A.N.; formal analysis, A.N.; writing—original draft preparation, A.N.; writing—review and editing, T.B.; supervision, T.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data are accessible from andrej.naralocnik@siol.net upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Henningsson, S.; Kettinger, W.J. Understanding Information Systems Integration Deficiencies in Mergers and Acquisitions: A Configurational Perspective. J. Manag. Inf. Syst. 2016, 33, 942–977. [Google Scholar] [CrossRef]

- Bain & Company. Global M&A Deal Value on Track to Reach $3.5 Trillion in 2024. 2024. Available online: https://www.bain.com/about/media-center/press-releases/2024/global-ma-deal-value-on-track-to-reach-$3.5-trillion-in-2024bain--company (accessed on 23 May 2025).

- Tanriverdi, H.; Uysal, V.B. When IT capabilities are not scale-free in merger and acquisition integrations. Eur. J. Inf. Syst. 2015, 24, 145–158. [Google Scholar] [CrossRef]

- Henderson, J.C.; Venkatraman, N. Strategic alignment: Leveraging information technology for transforming organizations. IBM Syst. J. 1993, 32, 4–16. [Google Scholar] [CrossRef]

- Bachmann, C.W.R. Synergie-und Nutzungspotenziale von Unternehmenszusammenschlüssen: Analyse der Post-Merger-Integration am Beispiel der GE-Capital Pathfinder-Modelle; Gabler Edition Wissenschaft; Deutscher Universitätsverlag: Heidelberg, Germany, 2001. [Google Scholar] [CrossRef]

- Bertoncelj, A.; Kovač, D.; Bertoncel, R. Success factors and competencies in organisational evolution. Kybernetes 2009, 38, 1508–1517. [Google Scholar] [CrossRef]

- Marks, M.L.; Mirvis, P.H. Merge Ahead: A Research Agenda to Increase Merger and Acquisition Success. J. Bus. Psychol. 2011, 26, 161–168. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Charmaz, K. Constructing Grounded Theory: A Practical Guide through Qualitative Analysis; SAGE Publications: London, UK, 2006. [Google Scholar]

- Bauer, F.; Strobl, A.; Dao, M.A.; Matzler, K.; Rudolf, N. Examining links between pre and post M&A value creation mechanisms—Exploitation, exploration and ambidexterity in Central European SMEs. Long Range Plan. 2018, 51, 185–203. [Google Scholar] [CrossRef]

- Corley, K.G.; Gioia, D.A. Building theory about theory building: What constitutes a theoretical contribution? Acad. Manag. Rev. 2011, 36, 12–32. [Google Scholar] [CrossRef]

- Whetten, D.A. What constitutes a theoretical contribution? Acad. Manag. Rev. 1989, 14, 490–495. [Google Scholar] [CrossRef]

- Gawel, A. International competitiveness through post-acquisition knowledge transfer. J. Int. Bus. Stud. 2019, 50, 673–689. [Google Scholar] [CrossRef]

- Goerzen, A. Alliance networks and firm performance: The impact of repeated ties. Strateg. Manag. J. 2007, 28, 999–1015. [Google Scholar] [CrossRef]

- Aschbacher, J.; Kroon, D.P. Falling prey to bias? The influence of advisors on the manifestation of cognitive biases in the pre-M&A phase of organizations. Group Organ. Manag. 2023, 48, 477–505. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Marante, C.A. A Systematic Review of the Literature on Digital Transformation: Insights and Implications for Strategy and Organizational Change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Tan, L.; Zhang, X.; Song, Y.; Zou, F.; Liao, Q. The impact of serial mergers and acquisitions on enterprises’ total factor productivity: The mediating role of digital transformation. PLoS ONE 2024, 19, e0311045. [Google Scholar] [CrossRef]

- Benitez, J.; Ray, G.; Henseler, J. Impact of Information Technology Infrastructure Flexibility on Mergers and Acquisitions. MIS Q. 2018, 42, 25-A12. [Google Scholar] [CrossRef]

- Bain & Company. Generative AI in M&A: Where Hope Meets Hype. 2024. Available online: https://www.bain.com/insights/generative-ai-m-and-a-report-2024/ (accessed on 23 June 2025).

- Rashid, M.M.; Ullah, N.; Uddin, M.; Rahman, M.A. Artificial intelligence on merger and acquisition processes: Observation from the target identification and due diligence perspective. Int. J. Innov. Res. Multidiscip. Eng. 2025, 4, 21–27. [Google Scholar] [CrossRef]

- Naraločnik, A. Precombination M&A Phase of Merger and Acquisition: An Exploratory Case Study. Ph.D. Thesis, IEDC–Bled School of Management, Bled, Slovenia, 2020. [Google Scholar]

- Thornberg, R.; Charmaz, K. Grounded theory and theoretical coding. In The SAGE Handbook of Qualitative Data Analysis; Flick, U., Ed.; SAGE Publications Ltd.: London, UK, 2014; pp. 153–169. [Google Scholar] [CrossRef]

- Miles, M.B.; Huberman, A.M.; Saldaña, J. Qualitative Data Analysis: A Methods Sourcebook, 4th ed.; SAGE Publications: Thousand Oaks, CA, USA, 2020. [Google Scholar]

- Elo, S.; Kääriäinen, M.; Kanste, O.; Pölkki, T.; Utriainen, K.; Kyngäs, H. Qualitative content analysis: A focus on trustworthiness. SAGE Open 2014, 4, 2158244014522633. [Google Scholar] [CrossRef]

- Van den Berg, H. Reanalyzing Qualitative Interviews from Different Angles: The Risk of Decontextualization and Other Problems of Sharing Qualitative Data. Forum Qual. Sozialforschung/Forum Qual. Soc. Res. 2005, 6, 179–192. [Google Scholar] [CrossRef]

- He, Z.-L.; Wong, P.-K. Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organ. Sci. 2004, 15, 481–494. [Google Scholar] [CrossRef]

- Graebner, M.E.; Martin, J.A.; Roundy, P.T. Qualitative data: Cooking without a recipe. Strateg. Organ. 2012, 10, 276–284. [Google Scholar] [CrossRef]

- Dang, Y.; Li, B.; Qin, L. The Impact of ESG Practices on the Valuation of Related Party M&A Assets: The Moderating Role of Digital Economy. Sustainability 2025, 17, 3947. [Google Scholar] [CrossRef]

- Chiriac, I.; Rusu, V.D. The Institutional Roots of M&A Success: Evidence from European Business Environments. Adm. Sci. 2025, 15, 244. [Google Scholar] [CrossRef]

- Satapathy, D.P.; Soni, T.K.; Patjoshi, P.K.; Jamwal, D.S. The Effect of Cross-Border Mergers and Acquisitions Performance on Shareholder Wealth: The Role of Advisory Services. J. Risk Financ. Manag. 2025, 18, 107. [Google Scholar] [CrossRef]

- Chen, B.; Chen, W.; Yang, X. Does Information Asymmetry Affect Firm Disclosure? Evidence from Mergers and Acquisitions of Financial Institutions. J. Risk Financ. Manag. 2025, 18, 64. [Google Scholar] [CrossRef]

- Dokas, I.; Leontidis, C.; Zervoudi, E.K. Accrual-Based Earnings Management in Cross-Border Mergers and Acquisitions: The Role of Institutional Differences and Geographic Distance. J. Risk Financ. Manag. 2025, 18, 50. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).