Abstract

Green innovation in heavily polluting firms is crucial for sustainable development, yet financial constraints remain a major barrier. This study employs a Spatial Durbin Model to analyze how financialization influences green innovation in China’s A-share listed firms. The results indicate that financialization intensifies financing constraints, leading to a suppression of green innovation. This effect is primarily driven by the “crowding-out effect”, which outweighs the “reservoir effect” that financialization may provide. Additionally, industry-wide peer effects further spread the negative impact, while agency conflicts and managerial incentives exacerbate the problem. Regional disparities are also observed, with stronger negative effects in eastern and central regions and among firms with high managerial compensation. To address these issues, the study recommends strengthening policy guidance, expanding green finance mechanisms, promoting industry collaboration, and improving corporate governance. These findings enhance our understanding of the dual impact of financialization on green innovation and provide actionable policy recommendations for achieving sustainable development in high-pollution industries.

1. Introduction

In recent years, green innovation has become a central pillar of sustainable development, particularly in heavily polluting industries that play a crucial role in energy conservation, emissions reduction, and environmental protection. The global push for green transformation has led to increased academic and policy interest in understanding the factors that drive or hinder corporate green innovation. However, despite the widespread recognition of its importance, green innovation remains constrained by significant financial barriers, particularly in industries characterized by high pollution and resource intensity.

Existing research has explored various determinants of green innovation, including environmental regulations [1,2], market competition [3], corporate social responsibility [4], and government subsidies [5]. However, the role of financialization—the increasing reliance of firms on financial activities rather than productive investments—has received relatively less attention in the context of green innovation. While some scholars argue that financialization can serve as a “reservoir” by providing additional liquidity for innovation [6,7], others contend that it leads to an “investment substitution effect”, diverting resources from long-term innovation toward short-term financial gains [8,9]. This debate remains unresolved, particularly in industries where innovation is capital-intensive and requires long payback periods.

Furthermore, limited research has examined the spatial spillover effects of financialization on green innovation. The innovation diffusion theory suggests that corporate innovation decisions are influenced not only by internal firm characteristics, but also by industry-wide peer effects [10]. If financialization suppresses green innovation at the firm level, it may also generate negative spillovers across industries, exacerbating the overall decline in sustainable investments. However, empirical studies on this phenomenon remain scarce, particularly in the context of heavily polluting firms, which are highly susceptible to regulatory and market-driven environmental transitions.

To address these gaps, this study employs a Spatial Durbin Model (SDM) to examine how financialization influences green innovation in heavily polluting firms, considering both direct and industry-wide spillover effects. Using firm-level data from China’s A-share market (2012–2021), we analyze whether financialization alleviates or exacerbates financing constraints and explore the role of regional and managerial heterogeneity in shaping its impact.

The remainder of this paper is structured as follows. Section 2 reviews the literature on financialization and green innovation, identifying key research gaps. Section 3 presents the theoretical framework and research hypotheses. Section 4 describes the empirical methodology, including data sources, variable definitions, and model specifications. Section 5 discusses the empirical findings, including robustness checks and heterogeneity analysis. Section 6 interprets the results in the context of the financialization theory, innovation diffusion, and agency theory. Finally, Section 7 concludes with policy recommendations and suggestions for future research.

2. Literature Review

2.1. Research on Green Innovation

Since Schumpeter introduced the “innovation theory”, scholars have extensively explored the concept of “innovation” [11]. With growing environmental concerns, green innovation—an extension of traditional innovation theories—has become a key academic focus.

Early research defined green technological innovation as advancements designed to promote energy conservation, emission reduction, and environmental protection [12]. Later studies emphasized its dual role in ecological preservation and corporate economic benefits [13,14]. Subsequent research further refined the concept, framing green innovation as technology improvements driven by environmental principles [15]. Other researchers enriched the concept by addressing green innovation from the perspectives of eco-organizations, eco-processes, and eco-products, proposing pathways to achieve environmental and economic balance [16]. In addition, green technology was defined as encompassing technologies, processes, or products that reduce environmental pollution and resource consumption, emphasizing that green innovation primarily involves green technological advancements [17]. More recently, green innovation was conceptualized as an innovation model involving improvements in products, processes, or management, which facilitate green transformation in enterprises [18]. Other studies highlighted the high-investment, high-risk, and long payback period characteristics of green innovation, underscoring the necessity of external support and supervision for enterprises engaging in green innovation activities [19].

International organizations have also provided insightful interpretations of green innovation. The Organization for Economic Co-operation and Development (OECD) outlined green innovation from the perspectives of objectives, mechanisms, and impacts, asserting that it combines attributes of technological innovation while reducing environmental pollution and promoting societal green transitions [20]. The World Intellectual Property Organization (WIPO) identified green innovation as encompassing pollution control and climate change mitigation technologies and provided a detailed classification of related patents [17]. Synthesizing these studies, this paper defines green innovation as a form of technological innovation driven by advancements in green technology, aiming to achieve sustainable development while balancing environmental and economic benefits. Green innovation, therefore, can be regarded as a continuous source of momentum for societal sustainability.

Regarding the factors influencing green innovation, existing research primarily examines external and internal drivers at the firm level.

External Drivers: Environmental regulations have been a focal point in green innovation studies. Some scholars argue that environmental regulations fail to effectively stimulate green innovation [21]. However, based on Porter’s “Porter Hypothesis” [1], other studies have verified the positive effects of moderate environmental regulations on green innovation using US and Chinese firm data, respectively [2,22]. Implementing environmental responsibility mechanisms was found to boost the quantity of green patents, but potentially reduce innovation quality [23]. Green credit policies have also been identified as effective tools for promoting corporate green innovation [24,25,26]. Some studies demonstrated the positive role of green credit policies from the perspective of heavily polluting firms [27,28], while others argued that when green credit policies lacked tolerance for short-term failures, they could negatively impact green innovation [29]. Other external factors influencing green innovation include emissions trading markets [17], financing environments [30,31], government subsidies [5], and economic policy uncertainty [32].

Internal Drivers: Key internal factors include firms’ fundamental characteristics, operational and profitability capacities, and managerial influences. For example, younger firms were found to be more innovative, rendering them more likely to engage in green innovation [33]. Profitable firms were shown to be more inclined to invest in green innovation to secure a first-mover advantage in energy-saving technologies [34]. Firm size, profitability, and corporate governance were also reported to significantly impact green innovation activities [35]. Additionally, factors such as corporate social responsibility [4], executives’ educational backgrounds [36], CEO hometown ties [37], CEO power and ownership concentration [38], and green-experienced interlocking boards [39] play significant roles in shaping firms’ green innovation activities.

Recent studies emphasize the significant role of peer effects in corporate technological innovation, particularly in green innovation. For example, significant and positive peer effects were found in firms’ technological innovation [40]. Evidence of local innovation spillovers among the listed companies suggested that one firm’s innovation can stimulate innovation in neighboring firms [10]. In the context of green innovation, peer effects were shown to positively impact green innovation quality [41]. Other studies empirically demonstrated peer effects on green technological innovation using data from the listed manufacturing firms [42]. The presence of significant peer effects on the green innovation behaviors of heavily polluting firms was also validated based on data from China’s A-share listed companies [43].

Synthesizing the above literature, this paper observes that the high-investment, high-risk, and long payback period of green innovation necessitate stable and long-term financial support for firms [31,44]. Existing research has explored funding mechanisms for green innovation from various dimensions, such as green credit policies, financing environments, government subsidies, and corporate profitability, offering robust theoretical support for financial security in green innovation. Additionally, green innovation intent is recognized as a critical channel influencing firms’ green innovation activities. Factors such as appropriate environmental regulations, corporate social responsibility, and executives’ educational backgrounds can enhance firms’ green innovation intent, thereby promoting green innovation activities [2,4,22,36]. Thus, financial security and green innovation intent are deemed as two pivotal channels affecting firms’ green innovation. Furthermore, studies on heavily polluting firms consistently validate the significant and positive peer effects on green innovation, highlighting peer effects as a key driver of green innovation activities and providing new directions for future research.

2.2. Research on Financialization of Heavily Polluting Firms and Green Innovation

Research on the relationship between financialization and innovation presents diverse perspectives, forming two primary viewpoints. Some scholars argue that financialization positively drives corporate innovation. For instance, financialization has been found to broaden funding sources and alleviate financial constraints, thereby providing stable financial support for innovation activities [45]. It has also been emphasized that financialization enhances funding efficiency, facilitates effective capital allocation, and injects vitality into corporate innovation [46]. In the Chinese context, financial asset holdings have been shown to positively correlate with R&D innovation, suggesting that financialization supports future innovation activities [47]. Similarly, the precautionary motive for financialization has been found to indirectly support its positive effect on innovation in developed countries [48]. Furthermore, moderate financialization levels have been demonstrated to stimulate sustained innovation activities in Chinese manufacturing firms [7].

However, other scholars argue that financialization inhibits corporate innovation. For example, financialization has been found to significantly “crowd out” innovation investment in Chinese manufacturing firms [49]. In the UK, financialization has been shown to marginalize real investments in non-financial firms, weakening productivity and innovation capabilities [8]. Negative impacts of financialization on innovation have also been demonstrated across various dimensions, such as R&D expenditure, patent activity, and core business growth potential [9]. Financial investment behavior has been reported to adversely affect both innovation input and output [50]. Based on the agency theory, the “crowding-out” effect of financialization on green innovation has been elaborated, emphasizing its inhibitory impact [51].

Synthesizing this literature, financialization emerges as a critical determinant of innovation activities, but studies specifically focusing on green innovation remain insufficient. Disputes persist regarding the relationship between financialization and innovation. Existing research predominantly explores the motives of financialization, with some scholars emphasizing its “reservoir” effect, suggesting that financialization provides essential funding for innovation. Conversely, other scholars have highlighted its “crowding-out” effect, contending that financialization diverts funds from innovation, thereby impeding it. Consequently, the motivation behind financialization is seen as a key factor in shaping its relationship with innovation. As green concepts gain prominence, green innovation has become a new academic focus. However, most studies on financialization and green innovation overlook the peer effects of green innovation, creating new opportunities and directions for future exploration.

3. Theoretical Analysis and Research Hypotheses

3.1. Impact of Financialization on Green Innovation in Heavily Polluting Firms

This study identifies three key findings from the literature. First, financial support and green innovation awareness are the two main pathways influencing corporate green innovation. Second, peer effects significantly shape green innovation decisions in heavily polluting firms [41,42]. Third, the motivation behind corporate financialization is a key factor in determining its impact on green innovation. Based on these insights, this section explores the complex relationship between financialization and green innovation in heavily polluting firms.

The impact of green innovation varies based on the motives driving corporate financialization. From the perspective of the precautionary savings theory, firms maintain cash reserves to mitigate risks and ensure stable operations [52]. As financial markets develop, firms increasingly prefer liquid, income-generating financial assets over traditional cash reserves, leading to financialization behaviors driven by “precautionary motives” [48,53]. Such financialization behavior views financial investments as a “reservoir” for funds [44], helping to alleviate financing pressures [45,54], smooth investment fluctuations [55], and reduce negative impacts on production and innovation caused by funding disruptions [56,57]. This resulting “reservoir effect” [54,58] positively promotes corporate green innovation activities.

On the other hand, from the perspective of the portfolio theory, rational investors aim to maximize expected returns under a given level of risk [59]. When financialization enables firms to achieve short-term excess returns and maximize profits, they tend to allocate resources to financial markets rather than the high-risk, high-investment, and long-term returns of green innovation activities [19]. The financialization behaviors driven by “investment substitution motives” emerge under these circumstances [6,60,61]. Within the framework of Tobin’s Q theory, there is a clear substitution relationship between financial and physical investments under a given total capital constraint [62]. Consequently, the financialization behaviors driven by “investment substitution motives” lead to reduced resource allocation for physical investments, including green innovation, creating a negative “crowding-out effect” [8,50,58]. Additionally, agency conflicts exacerbate this crowding-out effect, as corporate agents may prioritize personal gains over shareholders’ long-term interests, preferring financial market investments for higher profits [54,55].

Heavily polluting firms face a dilemma: they bear the full costs of green innovation but often fail to capture all its benefits, reducing their incentive to invest in it [63,64,65]. Additionally, due to externalities, private returns from green innovation are lower than social returns, while environmental costs are often underestimated. This makes green innovation more expensive than pollution [63,64]. Consequently, these firms, driven by economic self-interest, allocate fewer resources to green innovation [66]. This weakens the positive “reservoir effect” of financialization while amplifying the negative “crowding-out effect” from “investment substitution motives”. Ultimately, financialization inhibits green innovation in heavily polluting firms.

Moreover, existing research highlights significant industry peer effects on the green innovation of heavily polluting firms, indicating that green innovation activities are influenced by information flow and imitation within the same industry, leading to homogenized decision-making [43]. Therefore, the inhibitory effect of financialization on green innovation in one firm can spread to neighboring firms within the same industry through peer effects, negatively impacting their green innovation efforts.

Based on this analysis, the following hypothesis is proposed:

Hypothesis 1.

The financialization behaviors of heavily polluting firms inhibit green innovation, and this inhibitory effect propagates through peer effects, negatively affecting the green innovation of neighboring firms within the same industry.

3.2. Financing Constraint Mechanism

According to the Modigliani–Miller (MM) theorem [67], in an idealized perfect capital market, internal and external capital are perfectly substitutable. This implies that a firm’s investment behavior is driven solely by its investment needs and is not related to its financial status. However, real-world capital markets deviate significantly from this ideal due to information asymmetry and agency problems. As a result, external financing costs often exceed internal financing costs, which constrains firms’ investment decisions based on their financing capacities. Against this backdrop, the pecking order theory asserts that firms follow a hierarchical preference in financing decisions, prioritizing internal financing over external resources [68]. This theoretical framework provides a critical perspective for comprehending corporate financing behaviors.

As previously discussed, the dual externalities of green innovation exacerbate the dominance of the “crowding-out effect” caused by financialization in heavily polluting firms. Within Tobin’s Q theory framework, the substitution relationship between financial and physical investments implies that greater financialization reduces the resources available for physical investments [6,62]. For green innovation, which requires substantial and stable long-term funding, insufficient internal financing forces firms to seek external financing.

In markets characterized by information asymmetry, agency problems further widen the gap between external and internal financing costs. Agents who prioritize their own interests over those of investors are likely to demand risk premiums from external investors to compensate for potential risks [69]. Given the inherent risks of financial markets and the uncertainty introduced by corporate financialization, external investors require higher premiums to offset risks. This raises external financing costs, exacerbates the financing constraints of heavily polluting firms, and ultimately negatively impacts green innovation activities.

In summary, the financialization behaviors of heavily polluting firms not only reduce the internal resources available for green innovation, but also increase external financing costs, intensifying financing constraints. These dual effects significantly inhibit green innovation activities. Accordingly, the following hypothesis is proposed:

Hypothesis 2.

The financialization of heavily polluting firms exacerbates their financing constraints, thereby inhibiting green innovation.

4. Empirical Research Design

4.1. Empirical Model Setup

This study employs spatial econometric models to empirically test the research hypotheses proposed in Section 3. Constructing such models requires the selection of spatial weight matrices, spatial correlation tests for variables, and model specification tests to identify the most appropriate model form. Below, the methods for setting up the empirical model are introduced.

4.1.1. Selection of the Spatial Weight Matrix

The spatial weight matrix is a tool used in spatial econometric models to measure spatial dependencies between variables. As research has evolved, spatial weight matrices have expanded from those based solely on geographical proximity to those incorporating economic, industrial, and other adjacency relationships. To better account for the spatial effects of peer influence within industries, this study adopts the approach of [41] and constructs an industry adjacency weight matrix. This matrix assigns a weight of 1 if two firms belong to the same industry and 0 otherwise. To ensure the convergence of parameter estimation, the spatial weight matrix is row-standardized in the empirical analysis.

4.1.2. Spatial Correlation Tests

Various methods exist for testing spatial correlation, including Moran’s I, Geary’s C, Getis-Ord G, and Ripley’s K function. Moran’s I and Geary’s C are among the most commonly used indices, each with distinct characteristics. While Geary’s C is more sensitive to local variations and emphasizes the differences between neighboring observations, Moran’s I is particularly effective in detecting global spatial autocorrelation, making it a robust choice for analyzing overall spatial dependence [70]. Getis-Ord G is more suitable for identifying hot spots rather than measuring overall spatial correlation, and Ripley’s K function is mainly used for point pattern analysis rather than regional economic data [71].

Given the study’s focus on detecting the overall spatial correlation of corporate financialization and green innovation levels across firms, Moran’s I is chosen due to its robustness and sensitivity to extreme values. Its ability to capture both positive and negative spatial autocorrelation while providing a clear, interpretable global measure makes it particularly suitable for this study.

The formula for the global Moran’s I is as follows:

where represents the i-j-th element of the spatial weight matrix , represents the financialization or green innovation level of firm i, and are the sample mean and variance, respectively, and is the total number of samples. Moran’s I ranges from −1 to 1; values greater than 0 indicate a positive spatial correlation, values less than 0 indicate a negative spatial correlation, and a value of 0 indicates no spatial correlation. A higher absolute value signifies stronger spatial correlation.

To further explore the spatial dependency patterns of corporate financialization and green innovation, this study also employs the local Moran’s I for localized spatial correlation tests, as it allows for the identification of spatial clusters and outliers. The formula for the local Moran’s I is as follows:

The local Moran’s I categorizes the observations into four types: high-high (H-H), high-low (H-L), low-low (L-L), and low-high (L-H). H-H indicates clusters of high financialization or green innovation levels, while L-L indicates clusters of low levels. H-L and L-H suggest the interactions between firms with high and low financialization or green innovation levels, respectively.

4.1.3. Spatial Model Specification Tests

The general form of a spatial econometric model is as follows:

where is the dependent variable, represents the explanatory variables, is the spatial lag coefficient, , and are the coefficients for variables, is the spatial error coefficient, and are the individual and temporal effects, and are the spatial error and random disturbance term, respectively. Depending on the constraints, the model can take three forms: (1) Spatial Lag Model (SLM): , and ; (2) Spatial Error Model (SEM): , and ; (3) Spatial Durbin Model (SDM): , and .

Before conducting the empirical analysis, model specification tests are required to determine the optimal model form, which involves two steps:

First, the necessity of constructing a spatial model is determined using the classical LM test and the robust LM test. The classical LM test includes the lag effect test (LM-lag) and the error effect test (LM-error), with the null hypotheses being and , respectively, which correspond to the absence of spatial lag effects and spatial error effects [72]. The robust LM test methods (robust LM-lag and robust LM-error) were further developed by [73].

Next, if the above tests support the construction of a spatial model, the Spatial Durbin Model (SDM) is estimated. Following the methods proposed by [73], Wald tests (Wald-lag and Wald-error) and LR tests (LR-lag and LR-error) are conducted. The null hypotheses for these tests are that the SDM can degenerate into the Spatial Lag Model (SLM) for Wald-lag and LR-lag tests, and into the Spatial Error Model (SEM) for Wald-error and LR-error tests. These tests determine whether to adopt the SLM, SEM, or SDM. If the null hypotheses are rejected, the optimal model is the Spatial Durbin Model.

The specific form of the SDM constructed in this study is as follows:

where represents the green innovation level of firm i in year t, denotes the financialization level of firm i in year t, and represents the control variables.

4.1.4. Mechanism Testing

To test the role of financing constraints in the relationship between financialization and green innovation in heavily polluting firms, this study follows [74] by replacing the dependent variable in Equation (4) with financing constraints, constructing the following model:

where represents the financing constraints.

4.2. Data and Variables

4.2.1. Variables and Measurements

- (1)

- Dependent variable: green innovation (GreenPa)

Green patent counts are widely used as a measure of green innovation [63,65,75]. This study uses granted green patents as they better reflect the realized green innovation levels [17]. A natural log transformation is applied to the count of granted green patents plus one to mitigate heteroskedasticity and multicollinearity.

- (2)

- Key explanatory variable: financialization (Fin)

This study draws on [6,9,76] to define the financialization of heavily polluting firms as the behavior of reallocating internal resources (including reserves and investments in physical sectors) toward financial markets to achieve higher economic returns. A review of existing literature reveals that most studies focus on measuring corporate financialization from the perspective of asset allocation [9,51,54].

Following the methodology of [54], this study includes six types of assets in the measurement of financial assets: “trading financial assets”, “derivative financial assets”, “net loans and advances”, “net available-for-sale financial assets” (prior to 2018), “net held-to-maturity investments” (prior to 2018), and “net investment properties”. The total financial assets are obtained by summing these six categories, and the ratio of total financial assets to total corporate assets serves as the quantitative indicator of corporate financialization.

Furthermore, considering the changes in Chinese accounting standards in 2018, this study adopts the approach of [77] to adjust the scope of financial assets post-2018. Specifically, the categories “available-for-sale financial assets” and “held-to-maturity investments” were removed, while “debt investments”, “other debt investments”, “other equity investments”, and “other non-current financial assets” were incorporated into the measurement of financial assets.

- (3)

- Mechanism variable: financing constraints (SA)

To measure the financing constraints, the SA index developed by [57,78] is employed due to its lower endogeneity compared to the KZ and WW indices as follows:

where SIZE and AGE denote the total asset size and firm age, respectively. A negative SA value indicates financing constraints, with larger absolute values reflecting more severe constraints.

- (4)

- Control variables

Control variables include firm age, board size, market competition, ownership concentration, growth, asset structure, financial leverage, executive financial background, and quick ratio. The definitions and measurement methods are summarized in Table 1, where the Lerner index is calculated as follows:

Table 1.

Definitions and measurement methods of control variables.

A higher Lerner index indicates a stronger competitive position within the industry.

4.2.2. Data Sources

This study selects the heavily polluting firms listed on China’s A-share market from 2012 to 2021 as the research sample. The original data were obtained from the CSMAR database. The sample selection process is as follows:

Firstly, referencing the methods for defining the heavily polluting industries in existing literature [29], the classification standards outlined in the Industry Classification for Environmental Verification of Listed Companies (issued by the former Ministry of Ecology and Environment of China in 2008) were used to identify 16 heavily polluting industries, including thermal power, steel, cement, electrolytic aluminum, etc. These industries were then matched with the specific codes in the Industry Classification Guidelines for Listed Companies issued by the China Securities Regulatory Commission (CSRC) in 2012 to identify the corresponding heavily polluting firms.

Secondly, given that the Industry Classification Guidelines for Listed Companies were released in 2012 and green patent data after 2021 are significantly incomplete, the sample period is restricted to 2012–2021 to ensure data validity.

Finally, to ensure randomness and representativeness, observations with missing or anomalous values, ST/*ST companies, and insolvent firms were excluded. Continuous variables were minorized at the 1% level.

The final dataset contains 6670 firm-year observations. Descriptive statistics indicate low overall green innovation levels, substantial variation across firms, and pervasive financing constraints among heavily polluting firms. The detailed results are presented in Table 2.

Table 2.

Descriptive statistics of the main variables.

5. Empirical Results and Analysis

5.1. Results of Spatial Correlation Tests

5.1.1. Results of Global Spatial Correlation Tests

Using the methods introduced in Section 4.1.2, we conducted global spatial correlation tests on the financialization level and green innovation level of 667 heavily polluting enterprises in China from 2012 to 2021. The specific results are presented in Table 3. According to Table 3, the Moran’s I values for all years are significantly positive at the 1% confidence level. This indicates a significant positive spatial correlation between the financialization level and green innovation level of heavily polluting enterprises. This finding suggests an industry convergence phenomenon in financialization and green innovation levels among heavily polluting enterprises.

Table 3.

Results of global spatial correlation tests.

5.1.2. Results of Local Spatial Correlation Tests

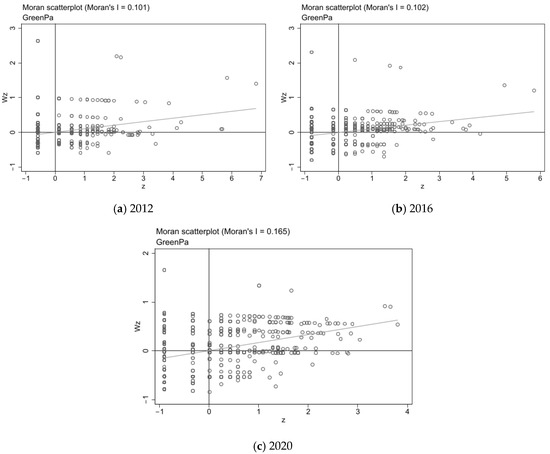

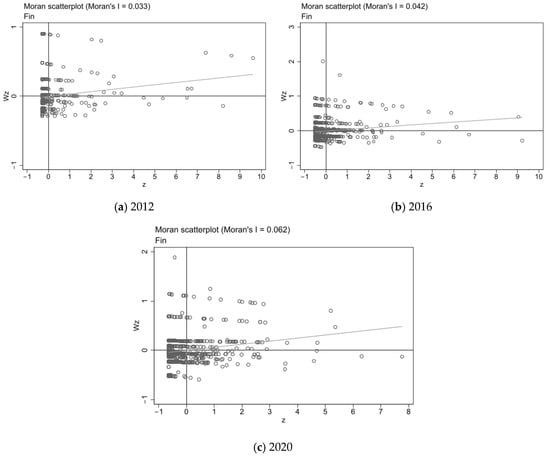

To further explore the spatial dependence characteristics of financialization and green innovation levels, we conducted local spatial correlation tests following the methodology outlined in Section 4.1.2. Figure 1 and Figure 2 illustrate the scatterplots of the local Moran’s I indices for the financialization and green innovation levels of heavily polluting enterprises in three key years: 2012, 2016, and 2020.

Figure 1.

The local Moran’s I scatterplots for green innovation levels in 2012, 2016, and 2020.

Figure 2.

The local Moran’s I scatterplots for financialization levels in 2012, 2016, and 2020.

According to Figure 1 and Figure 2, most of the Moran’s I indices of enterprises for both the financialization and green innovation levels are concentrated in the first and third quadrants. This indicates strong positive spatial correlations within the industry, which align with the results of the global spatial correlation tests. Furthermore, the figures reveal a trend over time: (1) the number of enterprises falling in the first and third quadrants has gradually increased, while the number in the second and fourth quadrants has decreased. This suggests that the industry convergence in financialization and green innovation levels among heavily polluting enterprises has strengthened over time.

The results from both global and local spatial correlation tests demonstrate significant industry clustering in financialization and green innovation levels. These findings underscore the need to account for spatial effects in empirical analysis. Accordingly, the spatial correlation of financialization and the spatial spillover effects of green innovation should be incorporated into the empirical model. This provides preliminary justification for using spatial econometric models in empirical testing.

5.2. Results of Spatial Model Specification Tests

Next, we conducted spatial model specification tests using the methods described in Section 4.1.3 to determine the optimal spatial model for this study.

First, we employed the LM test to assess whether spatial models are necessary. The results, presented in the left panel of Table 4, show that the null hypotheses of no spatial lag effects and no spatial error effects are rejected at the 1% significance level, for both the classic LM and robust LM tests. This indicates that spatial interaction terms should be incorporated into the model to account for spatial effects (lag or error).

Table 4.

Spatial tests for spatial model specification.

Subsequently, we used the Wald and LR tests to further determine whether the Spatial Durbin Model (SDM) is required. The results, shown in the right panel of Table 4, reject the null hypothesis at the 1% significance level, indicating that the SDM does not degenerate into either the spatial lag model or the spatial error model. Therefore, the SDM is identified as the most suitable model for this study.

5.3. Estimation Results of the Spatial Durbin Model

Based on the model specification tests, the SDM was selected as the appropriate approach for examining the spatial relationship between financialization and green innovation in heavily polluting enterprises (Model 4). The parameter estimates for Model 4 are reported in Column 2 of Table 5, while Columns 3–5 provide the decomposition of the effects of each variable on green innovation, corresponding to the direct, indirect, and total effects, respectively.

Table 5.

Regression results of the Spatial Durbin Model.

From Column 1 of Table 5, the coefficient of the core explanatory variable, Fin, is significantly negative at the 5% level. This indicates that financialization negatively impacts green innovation in heavily polluting enterprises. Additionally, the coefficient of W×Fin, which is significant at the 1% level, suggests that financialization has a negative spillover effect on the green innovation activities of other firms within the same industry. These results confirm Hypothesis 1: financialization in heavily polluting enterprises suppresses green innovation and exerts a negative spillover effect on the green innovation activities of other firms in the same sector. Furthermore, the spatial lag coefficient is significantly positive at the 1% level. This highlights that green innovation has positive externalities, leading to significant co-movement effects within the industry.

The effect decomposition results in Columns 3–5 of Table 5 show that the direct, indirect, and total effects of the core explanatory variable, Fin, are all significantly negative. This suggests that financialization not only negatively impacts a firm’s own green innovation, but also significantly suppresses the green innovation of other firms within the same industry. These findings further corroborate Hypothesis 1.

5.4. Robustness Tests

To ensure the robustness of the model estimation results, we re-estimated the Spatial Durbin Model (SDM) (Model (4)) using the instrumental variable method, variable replacement method, and subsample method.

First, to address the potential endogeneity issues caused by reverse causality or omitted variables, we followed [54] and used the lagged financialization of heavily polluting firms (Lag_Fin) as an instrumental variable. The model was re-estimated using the two-stage least squares (2SLS) method, and the results are presented in Column (1) of Table 6.

Table 6.

Robustness test results.

Second, to avoid the instability caused by measurement errors in variables, we conducted robustness checks by replacing the core explanatory variable. Specifically, following [79], we redefined financial assets by excluding “derivative financial assets” and “net investment property” while adding “purchased repos financial assets”. The recalculated core explanatory variable, Fin2, replaced the original Fin, and the results are shown in Column (2) of Table 6.

Lastly, inspired by [50], we re-estimated Model (4) using a subsample that excluded data from 2012 to 2014. The results are reported in Column (3) of Table 6.

5.5. Heterogeneity Tests

Considering that this study examines all the listed heavily polluting firms in China, the regional differences in economic development, industrial structure, environmental regulations, and policy environments may influence the relationship between financialization and green innovation. From a micro perspective, monetary compensation incentives, as a short-term incentive for management, may also impact the motives of financialization in heavily polluting firms, thereby affecting green innovation. To address these factors, we conducted heterogeneity tests based on regional differences and managerial monetary compensation differences. The results are presented in Table 7.

Table 7.

Heterogeneity test results.

The results in Table 7 indicate that the impact of financialization on green innovation in heavily polluting firms exhibits significant heterogeneity due to the differences in regions and managerial monetary compensation incentives.

Regional Heterogeneity: In the eastern and central regions of China, financialization of heavily polluting firms has a significant negative impact on green innovation, while this effect is not significant in the western regions. This suggests that regional differences play a crucial role in shaping the impact of financialization on green innovation. The likely reason is that the eastern and central regions have stronger economic foundations and more developed financial markets, providing firms with abundant funding sources. This increases the likelihood of profit-seeking in financial markets, making the “crowding-out effect” more pronounced and leading to a stronger negative impact on green innovation. In contrast, the underdeveloped financial markets in the western regions weaken the potential influence of financialization on green innovation.

Managerial Compensation Heterogeneity: When high monetary compensation incentives are provided to management, financialization significantly inhibits green innovation in heavily polluting firms. However, when managerial compensation is low, the impact of financialization on green innovation becomes insignificant. The coefficient of the explanatory variable, Fin, is significantly negative. This indicates that an increase in the level of financialization exacerbates the financing constraints of heavily polluting firms, thereby inhibiting green innovation, which, in turn, negatively impacts green innovation. In contrast, lower compensation provides limited incentives, thereby weakening the potential influence of financialization on green innovation.

5.6. Testing of the Financing Constraint Mechanism

Next, we estimate Model (5) to examine whether financialization in heavily polluting firms affects green innovation through the financing constraint mechanism. The results are presented in Table 8. According to the estimates in Table 8, the coefficient of the explanatory variable, Fin, is significantly negative. This indicates that an increase in the level of financialization exacerbates the financing constraints of heavily polluting firms, thereby inhibiting green innovation. This finding validates Hypothesis 2.

Table 8.

Mechanism test results.

6. Discussion

This study explores the relationship between financialization and green innovation in heavily polluting firms, revealing the complex mechanisms through which financialization affects corporate innovation decisions. The findings contribute to the financialization theory, innovation theory, and agency theory by providing empirical validation and theoretical extensions.

6.1. Dual Impact of Financialization on Green Innovation: Implications for the Financialization Theory

The study confirms that financialization exerts both a “reservoir effect” (providing liquidity for innovation) and a “crowding-out effect” (diverting funds from productive investments). However, due to the high risks, long payback periods, and uncertainty of green innovation, the crowding-out effect dominates, ultimately suppressing green innovation activities. This aligns with Tobin’s Q theory [62], which suggests that firms allocate resources based on expected returns. In the context of heavily polluting firms, our findings extend this theory by demonstrating that financialization leads firms to prioritize short-term, high-yield financial investments over long-term, uncertain innovation projects.

This result also supports the investment substitution hypothesis [6], showing that financialization increases firms’ preference for financial asset accumulation rather than real economic investments. The findings suggest that while financial markets provide liquidity, they also generate systemic risks that hinder firms’ innovation capabilities, especially in industries requiring long-term investments, such as green technology. Future research could explore whether different financialization structures (e.g., equity-based vs. debt-based financialization) influence innovation incentives differently.

6.2. Peer Effects and Industry-Wide Spillovers: Expansion of the Innovation Theory

This study finds that green innovation in heavily polluting firms exhibits significant peer effects, where the negative impact of financialization on one firm spreads through industry networks, amplifying the suppression of green innovation. This finding contributes to the innovation diffusion theory [10], which emphasizes the role of industry spillovers in shaping corporate innovation behavior. The results suggest that negative financialization spillovers may weaken overall industry innovation, reinforcing the argument that firm-level decisions are not made in isolation but are influenced by broader competitive dynamics.

This study highlights the necessity for industry-level policy interventions. Future research should explore whether network-based regulatory policies, such as sector-wide green innovation subsidies or industry-coordinated financial policies, could mitigate these spillover effects and enhance firms’ willingness to invest in sustainable innovation.

6.3. Financialization and Financing Constraints: Contribution to the Capital Market Imperfections Theory

The findings confirm that financialization exacerbates financing constraints, limiting firms’ access to capital for green innovation. This aligns with the capital market imperfections theory [68], which argues that information asymmetry increases external financing costs. Our study extends this theory by showing that financialization not only reduces firms’ reliance on internal funds for innovation, but also heightens external investors’ concerns about firms’ financial stability, thereby increasing financing constraints.

Moreover, the study verifies the pecking order theory of financing [68], demonstrating that heavily polluting firms prioritize internal funds for financial investments rather than innovation, particularly under high financialization. This underscores the importance of developing specialized green financial instruments to address capital constraints and redirect financial resources toward sustainable investments.

6.4. Governance Shortcomings and Managerial Incentives: Implications for the Agency Theory

The study finds that agency conflicts significantly exacerbate the negative impact of financialization on green innovation. This supports the agency theory [80], which posits that misaligned managerial incentives drive short-term financial gains at the expense of long-term value creation. Our findings extend this theory by showing that financialization provides an additional channel for managerial opportunism, allowing executives to allocate resources toward financial markets rather than investing in high-risk green innovation projects.

The observed heterogeneity of the impact of financialization—where firms with high executive monetary compensation exhibit stronger financialization-driven suppression of green innovation—suggests that short-term incentive structures may be counterproductive for long-term sustainability goals. These findings reinforce the need for green innovation-based performance metrics and long-term incentive mechanisms to align managerial decisions with corporate sustainability objectives.

7. Conclusions and Policy Recommendations

This study examines the impact of financialization on green innovation in heavily polluting firms using a Spatial Durbin Model and firm-level data from China’s A-share market (2012–2021). The findings provide empirical evidence on the mechanisms through which financialization influences corporate green innovation and contributes to the financialization theory, innovation diffusion theory, capital market imperfections theory, and agency theory. The main conclusions of this study are as follows:

- (1)

- Financialization inhibits green innovation, validating Hypothesis 1. The results confirm that while financialization has both a “reservoir effect” (providing liquidity for innovation) and a “crowding-out effect” (diverting resources from innovation), the latter dominates due to the high risks, long payback periods, and uncertain returns of green innovation. This aligns with Tobin’s Q theory, reinforcing the idea that firms prioritize short-term financial investments over long-term innovation in capital-constrained environments.

- (2)

- Peer effects amplify the negative impact of financialization, further supporting Hypothesis 2. Green innovation in heavily polluting firms exhibits strong peer effects, where the adverse effects of financialization spill over to other firms within the industry. This supports the innovation diffusion theory, emphasizing that firm-level innovation decisions are influenced by broader industry dynamics and financialization-driven negative spillovers can suppress collective innovation efforts.

- (3)

- Financialization exacerbates financing constraints, confirming Hypothesis 2. Our results demonstrate that financialization reduces internally available funds and raises external financing costs, intensifying financing constraints and further inhibiting green innovation. This is consistent with the capital market imperfections theory and pecking order theory, which highlight how asymmetric information and liquidity constraints hinder firms from investing in long-term innovation.

- (4)

- Corporate governance issues magnify the negative impact of financialization. The study finds that agency conflicts play a critical role in the suppression of the financialization of green innovation. When managerial monetary incentives are high, the negative impact of financialization is more pronounced, as executives prioritize short-term financial gains over high-risk, long-term green investments. This extends the agency theory, demonstrating how financialization offers managers a new channel for opportunistic behavior at the expense of long-term sustainability.

- (5)

- Regional and managerial heterogeneities of the impact of financialization. The study identifies significant variations in the effect of financialization on green innovation based on regional economic development and managerial incentives. The negative impact is stronger in eastern and central China and among firms with high monetary compensation for executives, suggesting that institutional and managerial factors shape the extent of the influence of financialization.

Based on the findings, the following policy recommendations are proposed to further promote green innovation in heavily polluting firms:

- (1)

- Strengthen policy guidance and optimize resource allocation. Governments should counteract the inhibitory effect of financialization by implementing green subsidies, tax incentives, and green credit mechanisms to redirect financial resources toward green innovation. Strengthening carbon trading markets can also create financial incentives for sustainable investments.

- (2)

- Promote industry-level coordination and peer-based governance. Given the strong peer effects, policymakers should encourage the formation of green innovation alliances, facilitate industry-wide information-sharing platforms, and establish sector-specific green innovation standards to promote positive spillovers and mitigate the negative externalities of financialization.

- (3)

- Strengthen the green financial system to alleviate financing constraints. Expanding green financial instruments (e.g., green bonds, sustainability-linked loans) and developing risk-sharing mechanisms (e.g., green insurance, government-backed guarantees) can reduce financing constraints and incentivize firms to engage in long-term green innovation.

- (4)

- Improve corporate governance and align managerial incentives with sustainability goals. Reforming executive compensation structures to include green innovation performance metrics and strengthening corporate transparency and ESG disclosures can align managerial incentives with long-term sustainable development. Encouraging institutional investors to support long-term equity financing can further reduce financialization-driven short-termism.

While this study provides important insights, several areas require further exploration: (1) Cross-country comparative studies to assess whether the impact of financialization on green innovation varies across institutional contexts. (2) Sector-specific analyses to determine whether financialization affects green innovation differently in manufacturing, energy, and technology sectors. (3) Alternative financialization structures, such as debt-based vs. equity-based financialization, to examine whether different financial strategies have varying effects on innovation.

Author Contributions

Conceptualization, Z.Z., L.F. and K.L.; methodology, Z.Z., L.F. and K.L.; software, Z.Z., S.W. and J.H.; validation, Z.Z., L.F. and K.L.; formal analysis, Z.Z., L.F. and K.L.; investigation, Z.Z., S.W. and J.H.; resources, Z.Z., L.F. and K.L.; data curation, Z.Z., S.W. and J.H.; writing—original draft preparation, Z.Z., S.W., J.H., L.F. and K.L.; writing—review and editing, Z.Z., L.F. and K.L.; visualization, Z.Z.; supervision, L.F. and K.L.; project administration, L.F. and K.L.; funding acquisition, L.F. and K.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Fund of China, grant number 22BTJ026.

Data Availability Statement

The data will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Porter, M.E.; van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strat. Mgmt. J. 2013, 34, 897–909. [Google Scholar] [CrossRef]

- Kesidou, E.; Wu, L. Stringency of environmental regulation and eco-innovation: Evidence from the eleventh five-year plan and green patents. Econ. Lett. 2020, 190, 109090. [Google Scholar] [CrossRef]

- Yuan, B.L.; Cao, X.Y. Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 2022, 68, 101868. [Google Scholar] [CrossRef]

- Xia, L.; Gao, S.; Wei, J.C.; Ding, Q.Y. Government subsidy and corporate green innovation—Does board governance play a role? Energ. Policy 2022, 161, 112720. [Google Scholar] [CrossRef]

- Demir, F. Financial liberalization, private investment and portfolio choice: Financialization of real sectors in emerging markets. J. Dev. Econ. 2009, 88, 314–324. [Google Scholar] [CrossRef]

- Xie, Z.J.; Du, J.; Wu, Y.C. Does financialization of non-financial corporations promote the persistence of innovation: Evidence from A-share listed manufacturing corporations in China. Eurasian Bus. Rev. 2022, 12, 229–250. [Google Scholar] [CrossRef]

- Tori, D.; Onaran, O. The effects of financialization on investment: Evidence from firm-level data for the UK. Camb. J. Econ. 2018, 42, 1393–1416. [Google Scholar] [CrossRef]

- Xu, X.M.; Xuan, C. A study on the motivation of financialization in emerging markets: The case of Chinese nonfinancial corporations. Int. Rev. Econ. Finance 2021, 72, 606–623. [Google Scholar] [CrossRef]

- Matray, A. The local innovation spillovers of listed firms. J. Financ. Econ. 2021, 141, 395–412. [Google Scholar] [CrossRef]

- Schumpeter, J.A. Theory of Economic Development, 1st ed.; The Commercial Press: Beijing, China, 1990. [Google Scholar]

- Braun, E.; Wield, D. Regulation as a means for the social control of technology. Technol. Anal. Strateg. Manag. 1994, 6, 259–272. [Google Scholar] [CrossRef]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Fussler, C.; James, P. Driving Eco-Innovation: A Breakthrough Discipline for Innovation and Sustainability, 1st ed.; Pitman Publishing: London, UK, 1996. [Google Scholar]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The Influence of Green Innovation Performance on Corporate Advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Cheng, C.C.; Shiu, E.C. Validation of a proposed instrument for measuring eco-innovation: An implementation perspective. Technovation 2012, 32, 329–344. [Google Scholar] [CrossRef]

- Qi, S.Z.; Lin, S.; Cui, J. Do Environmental Rights Trading Schemes Induce Green Innovation? Evidence from Listed Firms in China. Econ. Res. J. 2018, 53, 129–143. [Google Scholar]

- Lian, G.H.; Xu, A.T.; Zhu, Y.H. Substantive green innovation or symbolic green innovation? The impact of ER on enterprise green innovation based on the dual moderating effects. J. Innov. Knowl. 2022, 7, 100203. [Google Scholar] [CrossRef]

- Yan, B.; Cheng, M.; Wang, N.H. ESG green spillover, supply chain transmission and corporate green innovation. Econ. Res. J. 2024, 59, 72–91. [Google Scholar]

- Sustainable Manufacturing and Eco-Innovation: Towards a Green Economy. Available online: https://www.greenpolicyplatform.org/sites/default/files/downloads/resource//Sustainable_Manufacturing_and_Eco-innovation_OECD.pdf (accessed on 10 December 2021).

- Wagner, M. On the relationship between environmental management, environmental innovation and patenting: Evidence from German manufacturing firms. Res. Policy 2007, 36, 1587–1602. [Google Scholar] [CrossRef]

- Chen, X.H.; Yi, N.; Zhang, L.; Li, D.Y. Does institutional pressure foster corporate green innovation? Evidence from China’s top 100 companies. J. Clean. Prod. 2018, 188, 304–311. [Google Scholar] [CrossRef]

- Tao, F.; Zhao, J.Y.; Zhou, H. Does environmental regulation improve the quantity and quality of green innovation: Evidence from the target responsibility system of environmental protection. China Ind. Econ. 2021, 2, 136–154. [Google Scholar]

- Li, Z.H.; Liao, G.K.; Wang, Z.Z.; Huang, Z.H. Green loan and subsidy for promoting clean production innovation. J. Clean. Prod. 2018, 187, 421–431. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Y. Research on the green innovation promoted by green credit policies. J. Manag. World 2021, 37, 173–188. [Google Scholar]

- Chen, Z.G.; Zhang, Y.Q.; Wang, H.S.; Ouyang, X.; Xie, Y.X. Can green credit policy promote low-carbon technology innovation? J. Clean. Prod. 2022, 359, 132061. [Google Scholar] [CrossRef]

- Hu, G.Q.; Wang, X.Q.; Wang, Y. Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Zhang, S.L.; Wu, Z.H.; He, Y.N.; Hao, Y. How does the green credit policy affect the technological innovation of enterprises? Evidence from China. Energy Econ. 2022, 113, 106236. [Google Scholar] [CrossRef]

- Guo, J.J.; Fang, Y.; Guo, Y. Environmental regulation, short-term failure tolerance and firm green innovation: Evidence from the practice of green credit policy. Econ. Res. J. 2024, 59, 112–129. [Google Scholar]

- Gorodnichenko, Y.; Schnitzer, M. Financial constraints and innovation: Why poor countries don’t cash up. J. Eur. Econ. Assoc. 2013, 11, 1115–1152. [Google Scholar] [CrossRef]

- Xiang, X.J.; Liu, C.J.; Yang, M. Who is financing corporate green innovation? Int. Rev. Econ. Financ. 2022, 78, 321–337. [Google Scholar] [CrossRef]

- Cui, X.; Wang, C.F.; Sensoy, A.; Liao, J.; Xie, X.C. Economic policy uncertainty and green innovation: Evidence from China. Econ. Model. 2023, 118, 106104. [Google Scholar] [CrossRef]

- Keskin, D.; Diehl, J.C.; Molenaar, N. Innovation process of new ventures driven by sustainability. J. Clean. Prod. 2013, 45, 50–60. [Google Scholar] [CrossRef]

- Ghisetti, C.; Rennings, K. Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117. [Google Scholar] [CrossRef]

- Fang, Z.M.; Kong, X.R.; Sensoy, A.; Cui, X.; Cheng, F.Y. Government’s awareness of environmental protection and corporate green innovation: A natural experiment from the new environmental protection law in China. Econ. Anal. Policy 2021, 70, 294–312. [Google Scholar] [CrossRef]

- He, K.; Chen, W.Y.; Zhang, L.G. Senior management’s academic experience and corporate green innovation. Technol. Forecast. Soc. Chang. 2021, 166, 120664. [Google Scholar] [CrossRef]

- Ren, S.G.; Wang, Y.; Hu, Y.C.; Yan, J. CEO hometown identity and firm green innovation. Bus. Strat. Environ. 2021, 30, 756–774. [Google Scholar] [CrossRef]

- Javeed, S.A.; Latief, R.; Jiang, T.; Ong, T.S.; Tang, Y.J. How environmental regulations and corporate social responsibility affect the firm innovation with the moderating role of chief executive officer (CEO) power and ownership concentration? J. Clean. Prod. 2021, 308, 127212. [Google Scholar] [CrossRef]

- Wang, F.M.; He, J.; Chen, L.L. Will Interlocking directors with green experience promote quantity increase and quality improvement of enterprise green innovation. China Ind. Econ. 2023, 10, 155–173. [Google Scholar]

- Machokoto, M.; Gyimah, D.; Ntim, C.G. Do peer firms influence innovation? Br. Account. Rev. 2021, 53, 100988. [Google Scholar] [CrossRef]

- Tan, X.J.; Yan, Y.X.; Dong, Y.Y. Peer effect in green credit induced green innovation: An empirical study from China’s green credit guidelines. Resour. Policy 2022, 76, 102619. [Google Scholar] [CrossRef]

- Wang, X.; Chu, X. Research on the peer group effect of green technology innovation in manufacturing enterprises: Reference function based on multi-level situation. Nankai Bus. Rev. 2022, 25, 68–81. [Google Scholar]

- Zhang, Z.; Wang, Y.Y.; Jia, M. Sheep or wolves? Peer effect in the green innovation behavior of heavy polluting companies. Manag. Rev. 2024, 36, 119–132. [Google Scholar]

- Ardito, L.; Petruzzelli, A.M.; Pascucci, F.; Peruffo, E. Inter-firm R&D collaborations and green innovation value: The role of family firms’ involvement and the moderating effects of proximity dimensions. Bus. Strat. Env. 2019, 28, 185–197. [Google Scholar]

- Bonfiglioli, A. Financial integration, productivity and capital accumulation. J. Int. Econ. 2008, 76, 337–355. [Google Scholar] [CrossRef]

- Gehringer, A. Growth, productivity and capital accumulation: The effects of financial liberalization in the case of European integration. Int. Rev. Econ. Financ. 2013, 25, 291–309. [Google Scholar] [CrossRef]

- Liu, G.C. Financial asset allocations and the firms’ R & D activity in China: Crowding-out or crowding-in? Stat. Res. 2017, 34, 49–61. [Google Scholar]

- Duchin, R.; Gilbert, T.; Harford, J.; Hrdlicka, C. Precautionary savings with risky assets: When cash is not cash. J. Financ. 2017, 72, 793–852. [Google Scholar] [CrossRef]

- Wang, H.J.; Cao, Y.Q.; Yang, Q.; Yang, Z. Does the financialization of non-financial enterprises promote or inhibit corporate Innovation. Nankai Bus. Rev. 2017, 20, 155–166. [Google Scholar]

- Duan, J.S.; Zhuang, X.D. Financial investment behavior and enterprise technological innovation—Motivation analysis and empirical evidence. China Ind. Econ. 2021, 1, 155–173. [Google Scholar]

- Huang, Y.J.; Xu, Z.Y. The role of principal-agent in corporate financialization and green innovation. Financ. Res. Lett. 2024, 63, 105391. [Google Scholar] [CrossRef]

- Keynes, J.M. The General Theory of Employment, Interest and Money, 1st ed.; Macmillan: London, UK, 1936. [Google Scholar]

- Cao, W.; Qi, H.D.; Zhao, C. Research on the motivation for financial asset allocation: Analysis based on the nature of property rights and the reform of mixed-ownership. China Ind. Econ. 2023, 2, 150–168. [Google Scholar]

- Du, Y.; Zhang, H.; Chen, J.Y. The impact of financialization on future development of real enterprises’ core business: Promotion or inhibition. China Ind. Econ. 2017, 12, 113–131. [Google Scholar]

- Liu, G.C.; Liu, Y.Y.; Zhang, J. Financial asset allocations and fixed investment fluctuations of Chinese listed companies. China Econ. Q. 2019, 18, 573–596. [Google Scholar]

- Brown, J.R.; Petersen, B.C. Cash holdings and R&D smoothing. J. Corp. Financ. 2011, 17, 694–709. [Google Scholar]

- Ju, X.S.; Dic, L.; Yu, Y.H. Financing constraints, working capital management and the persistence of firm innovation. Econ. Res. J. 2013, 48, 4–16. [Google Scholar]

- Hu, Y.M.; Wang, X.T.; Zhang, J. The motivation for financial asset allocation: Reservoir or substitution? Evidence from Chinese listed companies. Econ. Res. J. 2017, 52, 181–194. [Google Scholar]

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Tang, H.Q.; Zhang, C.S. Investment risk, return gap, and financialization of non-listed non-financial firms in China. Pac. Basin Financ. J. 2019, 58, 101213. [Google Scholar] [CrossRef]

- Feng, Y.Q.; Zhang, H.L.; Ni, J. Motivations for investment in financial assets of entity enterprises: Heterogeneous impacts of monetary policy and moderating effects of digital finance. China Ind. Econ. 2024, 2, 118–136. [Google Scholar]

- Tobin, J. Money and economic growth. Econometrica 1965, 33, 671–684. [Google Scholar] [CrossRef]

- Bai, Y.; Song, S.Y.; Jiao, J.L.; Yang, R.R. The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar]

- Nordhaus, W.D. The Spirit of Green: The Economics of Collisions and Contagions in a Crowded World, 1st ed.; China CITIC Press: Beijing, China, 2022. [Google Scholar]

- Wang, H.; Feng, Z.; Yuan, L.; Lin, W.F. Green R&D intervention of public research institutions and green innovation of enterprises: From the perspective of environmental externalities. China Ind. Econ. 2024, 9, 81–99. [Google Scholar]

- Hu, C.; Mao, J.H.; Tian, M.; Wei, Y.Y.; Guo, L.Y.; Wang, Z.H. Distance matters: Investigating how geographic proximity to ENGOs triggers green innovation of heavy-polluting firms in China. J. Environ. Manag. 2021, 279, 111542. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M.H. The cost of capital, corporation finance, and the theory of investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Bernanke, B.; Gertler, M. Agency costs, net worth, and business fluctuations. Am. Econ. Rev. 1989, 79, 14–31. [Google Scholar]

- Cliff, A.; Ord, J. Spatial Processes: Models and Applications; Pion: London, UK, 1981. [Google Scholar]

- Anselin, L. Local Indicators of Spatial Association—ISA. Geogr. Anal. 2010, 27, 93–115. [Google Scholar] [CrossRef]

- Anselin, L.; Gallo, J.L.; Jayet, H. Spatial panel econometrics. In The Econometrics of Panel Data, 1st ed.; Springer: Berlin/Heidelberg, Germany, 2008; pp. 625–660. [Google Scholar]

- Elhorst, J.P. Spatial panel data models. In Spatial Econometrics, 1st ed.; Springer: Berlin/Heidelberg, Germany, 2014; pp. 37–93. [Google Scholar]

- Xie, H.J.; Lyu, X. Responsible multinational investment: ESG and Chinese OFDI. Econ. Res. J. 2022, 57, 83–99. [Google Scholar]

- Li, D.Y.; Zheng, M.; Cao, C.C.; Chen, X.H.; Ren, S.G.; Huang, M. The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. J. Clean. Prod. 2017, 141, 41–49. [Google Scholar] [CrossRef]

- Krippner, G.R. The financialization of the American economy. Socio-Econ. Rev. 2005, 3, 173–208. [Google Scholar] [CrossRef]

- Zhang, C.S.; Zheng, N. What drives the financialization of China’s real sector: Monetary expansion, profit—Seeking capital or risk aversion? J. Finan. Res. 2020, 9, 1–19. [Google Scholar]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Liu, j.; Sheng, H.Q.; Ma, Y. The mechanism of corporate enterprises participating in shadow banking businesses and its model analysis of social—Welfare net loss. J. Financ. Res. 2014, 5, 96–109. [Google Scholar]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).