1. Introduction

Cross-border mergers and acquisitions are seen as a crucial means by which multinational corporations are able to acquire external knowledge and overcome domestic market resource shortages, but this is especially apparent in emerging countries characterized by inefficient resource allocation and weak technological capabilities [

1,

2]. While the financial performance and productivity effects of international mergers and acquisitions have been widely studied, these studies often present complex and contradictory conclusions, particularly regarding how firms can enhance productivity through strategic geographic choices in host countries of cross-border acquisitions [

3,

4]. Revealing the mechanisms behind the impact of cross-border acquisitions in emerging countries on firm productivity, especially long-term productivity, not only aids in understanding the economic geographic strategic decisions during the internationalization process of firms [

5] but also deepens our understanding of the dynamics of the global economic system [

6,

7].

Research has extensively examined how host country heterogeneity affects the acquired firms’ performances, particularly through the potential for productivity growth via technological spillovers. In technologically advanced countries, these spillovers are pronounced [

8,

9], while in less advanced nations, the effects are generally weaker [

10,

11]. Technological spillovers are influenced by various factors, including host countries’ intellectual property regimes and cultural differences, impacting firm integration and efficiency [

12,

13,

14]. Acquisition motives often include gaining strategic resources, brands, market expansion, and technological knowledge [

15,

16]. Despite attention towards technological spillovers and market size effects, the interaction between these multi-dimensional motives and their impact on productivity lacks thorough discussion. Knowledge management theory highlights the importance of technological absorption capacity in boosting acquired firms’ productivity [

17], noting the significant timing impact of cross-border acquisitions. Although immediate productivity improvements may be unclear, the long-term benefits, especially in developed regions, are more significant [

4,

18], emphasizing the need to control the acquisition timeline. This study sought to address how market size effects, at varying technological distances, influence productivity, aiming to close this research gap and provide a foundation for more effective cross-border acquisition strategies.

The productivity spillover effects of foreign direct investment (FDI) are not automatic but significantly depend on the absorptive capacity of the host country, often measured by technological distance, which indicates that productivity growth is related to the technological differences between countries [

19,

20]. Although a larger technological distance provides learning opportunities for developing economies, it does not guarantee that they can match the technological level of developed countries, as the catch-up process depends on the actual technological efforts of each country [

21]. To address the gaps in existing research, this paper conceptualizes the technological absorption efforts at the firm level as the macro-level technological gap between the home and host countries, representing the ongoing investment required by firms in host countries. This study addresses three key questions: (1) Do cross-border acquisitions by emerging market enterprises enhance long-term productivity? (2) How does the market size effect in the host country influence the post-acquisition productivity changes of emerging market firms? (3) How can the technological distance between the home and host countries and the scale effect of the host country market jointly affect the relationship between cross-border mergers and acquisitions and enterprise productivity? By developing a moderated U-shaped mediation model and establishing a framework based on the spatial structure selection of the host country, this study focuses on the interaction between spatial technological distance and market size effects and their impact on long-term corporate productivity. This paper aims to elucidate how cross-border acquisitions of companies affect both short- and long-term productivity through adaptive selection in a heterogeneous spatial structure. This paper emphasizes the importance and dynamics of enterprise technology absorption efforts and the market-scale effect for the improvement of long-term productivity, filling in research gaps at the macro level of research on heterogeneity in the host country.

The contributions of this study are manifold. Firstly, we have developed a moderated U-shaped mediation model that examines the interaction between spatial technological distance and market size effects. This novel model elucidates how these interactions influence post-acquisition productivity in emerging market firms, addressing a gap in current research. Secondly, a new measurement technique introduced in this study effectively captures nuances in acquisition strategies. By controlling the acquisition strategy over a five-year period, we provide detailed insights into long-term corporate productivity changes, minimizing biases from incomplete strategic integration. Furthermore, by analyzing 507 completed cross-border acquisitions by Chinese firms from 2008 to 2016, this research enhances our understanding of productivity changes in the years following an acquisition, enriching the literature concerning the productivity impacts of cross-border acquisitions. Finally, this study emphasizes the importance of considering the structural adaptability of the host market in the strategic decision making of economic geography. We recommend that emerging market firms assess how the adaptability of the host market impacts their strategic goals. This is vital for making informed strategic decisions and optimizing resource allocation, thereby aiding firms in maintaining a competitive edge in the global market.

The remainder of this article is structured as follows:

Section 1 presents the introduction.

Section 2 offers a comprehensive literature review and our research hypothesis.

Section 3 details our methodological approach, describing the basic regression model and its moderated nonlinear conduction effects. In

Section 4, we delve into the empirical results derived from our analysis.

Section 5 is dedicated to examining the mechanism of moderated nonlinear conduction through a series of tests. The discussion and conclusions are presented in

Section 6, where we integrate our findings in the context of existing knowledge. Finally,

Section 7 outlines the practical implications of our findings and limitations.

2. Literature Review and Research Hypothesis

2.1. Cross-Border M&As and Enterprise Productivity

Based on Resource Dependence Theory, cross-border mergers and acquisitions (M&As) are considered a strategic approach for multinational companies to overcome domestic market resource deficiencies and acquire external knowledge, particularly in emerging markets characterized by inefficient resource allocation and weak technological capabilities [

1,

2]. Although the financial performance and productivity outcomes of cross-border M&As have received extensive attention, studies often present complex and contradictory conclusions [

3,

4,

8,

10], especially concerning how to enhance firm productivity through strategic choices of host country market structures.

Studies indicate that cross-border M&As enable firms to leverage local resources to acquire new technologies and market-specific non-transferable advantages, thus enhancing synergistic effects and fostering unilateral or bilateral knowledge diffusion within the firm. This diffusion significantly improves the total factor productivity (TFP), especially when the target company is located in a more competitive country, which offers ample learning opportunities that can spill over to domestic productivity [

18,

22]. Additionally, cross-border M&As stimulate domestic investments that further boost productivity [

23], emphasizing that learning benefits require substantial and purposeful efforts and do not occur automatically [

19].

The heterogeneity of host nations in foreign direct investment (FDI) studies suggests ambiguous impacts on productivity due to differences in human capital and economic development levels affecting technology transfer and market demand potential. However, in more advanced host countries, cross-border M&As are relatively more effective at enhancing TFP compared to greenfield FDI [

24]. As posited by the Springboard Theory, emerging market multinationals often invest in countries rich in technological resources to access innovative assets, such as developed R&D, infrastructure, and skilled labor [

25,

26]. Through these investments, firms overcome domestic constraints and competitive disadvantages, as shown in empirical studies indicating improvements in domestic productivity following cross-border acquisitions [

27,

28]. Given the above literature, this study proposes the following hypothesis:

Hypothesis 1. Cross-border mergers and acquisitions by emerging market enterprises facilitate the enhancement of productivity.

2.2. U-Shaped Mediating Role of the Host Country Market Size Effect

In the domain of international investment, the role of the host country’s market size in influencing enterprise productivity through cross-border mergers and acquisitions (M&As) is critical. Research suggests that the market size not only directly affects firms’ decisions to enter international markets but also shapes productivity outcomes through various dynamic mechanisms [

29,

30]. Emerging market firms often incur substantial Liability of Foreignness (LOF) costs when entering larger markets. These costs are associated with adapting to the host country’s political and economic systems and acquiring accurate market information [

31]. Moreover, market-driven motives leverage benefits like market proximity effects that align with consumer preferences and product standards, allowing access to cutting-edge technologies and the latest product designs in the host country [

9].

According to the new economic geography theory, spatial externalities encourage firms to agglomerate in core areas or larger markets due to advantages such as better labor pools, economic linkages, shared infrastructure, and supportive policies [

32]. However, the intense competition and high operational costs in these markets may also initiate a crowding-out effect, especially affecting firms with lower productivity [

33]. Despite the initial barriers of LOF and intense competition, larger markets eventually support the development of economies of scale that facilitate the achievement of higher minimum-efficiency scales that are necessary for competing in expansive markets, which helps mitigate higher operational costs and risks [

34,

35]. The influences of market proximity and market size significantly reduce the cultural distance impacts on international market entry, thus diminishing the negative effects of LOF [

36,

37]. Empirical evidence also indicates a positive relationship between market size and the magnitude of cross-border M&As, underscoring the larger market’s potential in attracting international acquisitions.

In market expansion-oriented M&As, leveraging the acquired firm’s established production capabilities and sales networks in the host country not only reduces market entry costs but also expedites market expansion [

37]. Despite the initial adverse effects of LOF and market competition, market proximity effects, market size, and local industry chain externalities eventually enable firms to overcome LOF and enhance productivity once they integrate into the local market and acquire even larger economies of market scale. Based on these discussions, the following hypothesis is proposed:

Hypothesis 2. Cross-border acquisitions by firms from emerging markets influence enterprise productivity progression through a U-shaped mediation mechanism driven by the host country’s market size effect.

2.3. The Moderating Role of Technological Distance between Home and Host Countries

In international investment theory, the technological distance between home and host countries plays a crucial role in moderating the outcomes of cross-border mergers and acquisitions (M&As). The literature suggests that technological distance influences the extent to which firms can capitalize on foreign direct investment (FDI) for productivity improvements [

38,

39]. Findlay’s relative backwardness theory proposes that larger technological gaps can enhance productivity spillovers, provided that the recipient country possesses the capacity to assimilate advanced technologies. However, excessive technology gaps might hinder effective technology transfer and assimilation, limiting the spillover benefits [

39].

Empirical research demonstrates that the technological distance between the home and host countries can moderate the relationship between outward FDI and innovation performance, with regions having substantial yet manageable technological gaps experiencing greater benefits. This suggests that both macro- and micro-level factors related to technological distance significantly influence how M&As impact firm innovation and productivity. At the micro level, firms closer in technology to their competitors are able to optimize innovation performance with relatively less external R&D investment, suggesting a nuanced interplay between technology distance and firm capabilities [

9].

Moreover, geographical and institutional distances contribute to the Liability of Foreignness (LOF), imposing additional operational costs on multinational corporations (MNCs) [

31]. This aspect is particularly crucial for MNCs from emerging markets, which might lack the ‘insider’ advantages enjoyed by firms from developed economies due to existing bilateral agreements or economic integrations [

26]. The disparities in economic and technological advancement between home and host countries mean that emerging market MNCs must navigate not only the LOF but also the competitive and regulatory landscapes of developed markets [

26,

40].

Furthermore, the economic and technological levels of the host country can amplify the effects of market size on M&As [

41]. High market potential coupled with advanced technological capabilities in the host country can create a conducive environment for achieving economies of scale and fostering technological spillovers. However, the intensity and benefits of such spillovers are contingent on the technological distance, which can either enhance or diminish the potential productivity gains from cross-border M&As [

14,

42].

Given these dynamics, it is posited that technological distance plays a critical moderating role in shaping the U-shaped relationship between the market size of the host country and enterprise productivity in the context of cross-border M&As by emerging market firms. At higher levels of technological distance, the positive effects of large market sizes on productivity are expected to be more pronounced, enhancing the upward slope of the U-shaped curve. Conversely, at lower levels of technological distance, the relationship might weaken or even invert, indicating a complex interplay between market potential, technological assimilation capacity, and external competitive pressures. Based on these considerations, the following hypothesis is proposed:

Hypothesis 3. The technological distance between home and host countries positively moderates the U-shaped relationship between the market size of the host country and enterprise productivity. Specifically, at higher levels of technological distance, the U-shaped relationship may be strengthened, while at lower levels of technological distance, the relationship tends to weaken or may even invert.

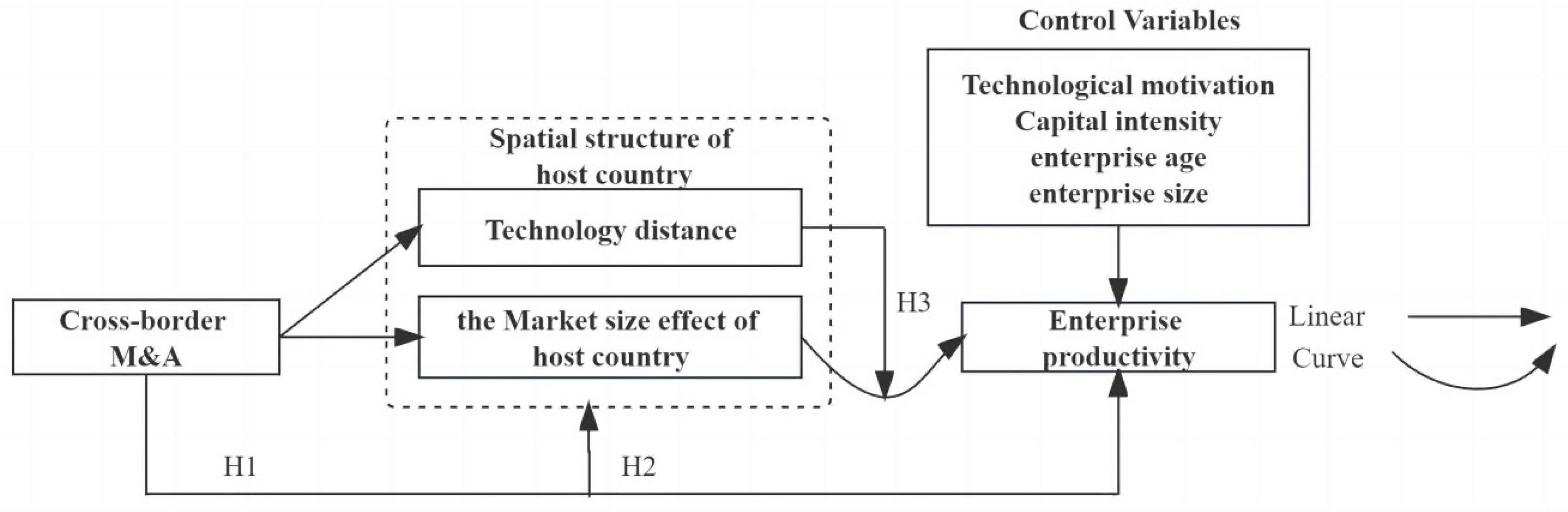

Figure 1 in this paper illustrates the proposed host country spatial structure framework. The framework is visually represented with two types of arrows: straight arrows symbolize linear relationships, while curved arrows denote a nonlinear relationship. This schematic representation aids in conceptualizing the interactions with the host country’s spatial structure as related to our study.

3. Results

3.1. Modeling

Drawing from the theoretical analysis presented above, this study posits that cross-border M&As by enterprises in emerging countries influence enterprise productivity through a U-shaped mediation role of the host country market size effect. To explore this, we developed nonlinear Equation (1) as the baseline model testing and endogenous treatment. However, technological advancements within a region often influence market potential, which may moderate the impact of the market size effect on productivity. Our aim was to construct a conditional nonlinear mediation model in an attempt to explain how and under what conditions the mediation role occurs, which requires appropriate methods for estimation [

43]. Our model, detailed in Equation (2), incorporates a moderated mediation effect. The testing and validation of this model are presented in

Section 5.2In Equation (1), the dependent variable Tfpit denotes the enterprise productivity, where i denotes the acquiring enterprise and t denotes time, spanning from 1 to 5 years post-acquisition. The year of cross-border acquisition is considered the initial year. Our primary purpose is to examine the changes in enterprise productivity over the first five years following the acquisition. The principal explanatory variables in this model include cross-border M&As, the market size effect of the host country, and the technological distance between the home and host countries. Cross-border M&As (Merge) are quantified by the number of M&As, indicating the enterprises’ preference for the host country. We anticipate a positive coefficient (δ1) for this variable, further scrutinized in a robustness test through cross-border M&A flows (Merg_flow). The market size effect of the host country (lnmark_scal) is measured by the GDP per capita; a larger market size effect in the host country is likely to initially subject the firm to greater LOF and intense market competition. We expect the coefficient of the quadratic term (δ3) to be positive, reflecting an increase in market size effects based on technology absorption efforts as the firm becomes locally embedded. Technology distance (lntech_dist) is evaluated based on the disparity in technology R&D investment levels between China and the host country, specifically the difference in the ratio of R&D investment to GDP between the two countries. The anticipated coefficient (δ4) for this variable carries a negative sign. Equation (2) involves the coefficient δ5, representing the linear moderating effect, with an expected positive sign. Meanwhile, δ6 captures the nonlinear mediation effect, where the market size effect of the host country is moderated by technological distance.

Xit represents a set of control variables that capture the diverse characteristics of enterprise heterogeneity. These include the motivation of M&As, capital intensity, enterprise size, and enterprise age, each quantified as follows: Motivation is captured using dummy variables (dum_tech), which reflect the technological intensity of the industry. The variable is assigned a value 1 for technology-intensive industries, and 0 otherwise. Enterprise size (lnsize) is measured based on the annual average number of employees in the organization. Capital intensity (lnkdensity) is quantified by dividing the annual average balance of net fixed assets by the number of employees. Enterprise age (lnage) is calculated from its year of establishment to the year of the cross-border M&A, with increments of one. To mitigate the effects of temporal variations, a time dummy variable is included in the model. ε represents a random error term; δ0 is a constant term. θi stands for the coefficient of the control variable. In this study, clustering-robust standard errors are employed to solve potential issues of heteroscedasticity and serial correlation.

3.2. Variables and Descriptions

Regarding the measurement of total enterprise productivity (

Tfp), scholarly articles typically adopt the Solow residual method for measuring the total factor productivity of an enterprise. This method calculates the Solow residual or “Solow surplus” [

44], representing the portion of the total output that remains after accounting for the contribution of input factors. The core concept involves estimating the gross production function and then deriving the residual by subtracting the growth rates of the input factors from the output growth rate. This approach is commonly referred to as the production function method. The estimation is based on the Cobb–Douglas production function, expressed as Y = AK

αL

β, where

Y signifies the actual output,

L is the labor input,

K is the capital stock, and

α and

β are the respective contribution factors of these inputs. Under the assumption of constant returns to scale, taking the natural logarithm of both sides of this equation allows for the approximation of the total factor productivity as a residual, which is estimated directly using the Least Squares Method. Although the Solow residual method may be subject to some measurement errors [

45], the focus of this paper is on the changes in enterprise productivity following cross-border mergers and acquisitions. Consequently, the potential impact of these measurement inaccuracies on our findings is expected to be limited.

In our analysis, we employ the Solow residual value method, taking the year of the M&As as the initial year. We then track the changes in firm productivity in the subsequent years, denoting t as ranging between 1 and 5 years post-M&A. This study specifically focuses on the data pertaining to cross-border M&As undertaken by Chinese firms from 2008 to 2016, with the aim of examining the productivity effect experienced by these enterprises in the first five years following cross-border M&A. The selection of core explanatory and control variables is largely informed by previous studies. Descriptive statistics of the variables under consideration are shown in

Table 1.

3.3. Data Sources

The micro-level data of Chinese enterprises come from multiple databases. The cross-border merger and acquisition (M&A) data are primarily sourced from the Zephyr database. Specifically, we filtered transactions recorded between 2008 and 2016 where the buyer was a Chinese company, selecting 507 completed M&A transactions out of 1313 events for analysis. Each transaction status was manually verified to ensure accuracy. To further ensure the authenticity of the data, the names of the parent companies from the Zephyr database M&A section were manually validated using the China Tonghuashun database. Macro-level national data were mainly derived from the World Bank database.

Additional micro-level data for this study were sourced from the CSMAR (China Stock Market & Accounting Research) database and WIND. We manually matched and verified the key non-financial data for the 507 sample companies selected, resulting in a total of 1622 sample observations. To mitigate the potential impact of outliers in our observation sample, we applied a 1% truncation at both tails for the continuous variables. Our sample selection criteria were as follows: (i) The acquired firm must be based in a country other than China, excluding Hong Kong, Taiwan, and Macao. (ii) We omitted acquisitions involving tax havens, such as the Virgin Islands. (iii) To reduce the effects of heteroscedasticity, a natural logarithm transformation was applied to relevant variables. The descriptive statistics of these variables are presented in

Table 1.

4. Empirical Results

In this section, we employ the Least Squares (OLS) Method to examine the U-shaped conduction effect of the host country’s market size on the productivity impact of cross-border M&As in emerging countries. Additionally, we analyze the moderating role of spatial technological distance in this relationship. Our analysis begins with a variance inflation factor (VIF) test to assess multicollinearity, followed by reporting the regression results of our baseline model with OLS and the random effects model (RE). To address potential endogenous concerns, we then apply the Two-Stage Least Squares Method (2SLS) and the Generalized Method of Moments (GMM). These methods provide a robust framework for analyzing the causal relationships within our model. Lastly, we test the robustness of our model using alternative core explanatory variables, specifically focusing on cross-border M&A flows. Throughout the test, we observed that the coefficient and signs of our model remain consistent and did not undergo significant changes, affirming the robustness of our results.

4.1. Estimation Results of the Baseline Model

Initially, we conducted a variance inflation factor (VIF) test on our explanatory variables to assess multicollinearity. The results showed that the squared term of the host country’s market size, after centering, had a mean VIF of 1.41. Furthermore, the variance inflation factors for all explanatory variables were below two, indicating an absence of multicollinearity concerns.

Table 2 presents the regression outcomes, examining the impact of cross-border M&As on enterprise productivity. Columns 1 to 3 display the results from the Ordinary Least Squares (OLS) Method, while columns 4 to 6 detail findings from the random effects model (RE). The regression coefficients from both the OLS and RE models consistently demonstrate that cross-border M&As significantly enhance firm productivity at a 1% confidence level. This finding robustly supports Hypothesis 1, affirming that cross-border M&As in emerging markets are indeed conducive to boosting enterprise productivity.

Our analysis revealed that both technology distance and the host country’s market size significantly and negatively impact firm productivity. For instance, as illustrated in column 3, technological distance (β2 = −0.106, p < 0.05) exerted a more substantial negative influence compared to the host country’s market size (β3 = −0.0376, p < 0.01). This finding indicates that a larger technological distance and host country market size are generally detrimental to the productivity improvement of firms engaged in cross-border M&As. That is, the effects of LOF are evident, with the adverse impact of technological distance being more pronounced.

Columns 3 and 6 present the nonlinear relationship between the host country market size effect and firm productivity under different estimation models. The data demonstrate that the primary coefficient of the host country’s market size effect was significantly negatively correlated at the 1% and 5% levels. Conversely, the quadratic coefficient was significantly positive at the 5% level. This pattern suggests a U-shaped influence of the host country’s market size on enterprise productivity. It implies that the initial negative effect of the host country’s market size at the onset of M&As eventually transitions into a positive influence on enterprise productivity as the market size effect increases.

In our examination of control variables, we observed that technological motivation displayed a significantly negative correlation. This suggests that a stronger emphasis on technological motivation may actually hinder productivity improvement. This alternate intuitive finding could be attributed to the challenges associated with knowledge absorption efforts and the learning curve faced by merging enterprises. Furthermore, the age of an enterprise emerged as a significant and positive factor influencing productivity. Regarding capital intensity, our analysis indicated that its effect on productivity was not significant. This finding suggests that the amount of capital invested per employee does not necessarily translate into higher productivity within the context of our study. Lastly, enterprise size demonstrated a significant and negative impact on productivity in the random effects model. This could be interpreted as larger enterprises facing more challenges in adapting to the host country’s market, which, in turn, negatively affects their productivity. This aspect highlights the importance of market adaptability and the need for tailored strategies for larger enterprises engaging in cross-border M&As.

4.2. Endogenous Treatment

The potential for reverse causality arises in our model due to the likelihood that an enterprise with high productivity is more inclined to pursue cross-border M&As, thereby boosting their productivity further. This scenario could lead to endogenous bias. We employed the Two-Stage Least Squares (2SLS) estimation, using one and two lags of corporate cross-border M&As as instrumental variables. This approach is predicated on the assumption that, while the current period value of these variables may correlate with the error term, their lagged values will not exhibit such correlation with the current period’s error term. Additionally, the chi-squared value test indicated a

p-value of less than 0.05, leading to the rejection of the null hypothesis and confirming the endogenous nature of the tested variable. In case of heteroscedasticity, the Generalized Method of Moments (GMM) offers greater efficiency than 2SLS. Accordingly, this paper also presents the coefficient estimation results using the GMM approach.

Table 3 reports the regression results of OLS, 2SLS, and GMM in columns 1 to 2, 3 to 4, and 5 to 6, respectively. Post endogeneity control, the significance levels and signs of the coefficients of cross-border M&A effects in the 2SLS model remained largely consistent, yet the values of these coefficients increased. Furthermore, all other variables displayed significantly higher values compared to the original estimates, underscoring the necessity and effectiveness of 2SLS estimation in mitigating endogeneity effects. The GMM coefficients were significant at the 10% level, with their estimated values aligning more closely with those derived from 2SLS. The Hansen test’s

p-value exceeded 0.1, suggesting that the null hypothesis regarding the validity of the instrumental variables could not be rejected. This finding validates the effectiveness of the instrumental variable selection and indicates no issues of over-identification.

4.3. Robustness Testing with Alternative Explanatory Variables

To validate the robustness of our findings, we conducted tests using alternative core explanatory variables. Specifically, we substituted the metric of corporate cross-border M&A count with the flows of an enterprise’s cross-border M&As. This approach aimed to re-examine the robustness of our study’s conclusions, as detailed in

Table 4. The analysis revealed that after replacing the core variables, the impact coefficient of corporate cross-border M&As became significantly larger and more sensitive. Notably, this positive impact was statistically significant at the 1% level in the random effects model. However, it did not reach significance in the Ordinary Least Squares (OLS) model. This discrepancy suggests that the influence of cross-border M&A flows on enterprise productivity may be more nuanced and sensitive than initially anticipated. Furthermore, the negative impact of spatial technological distance on enterprise productivity remained significant at the 5% level. For instance, in Model (2), the primary term of market size did not significantly affect enterprise productivity. However, the quadratic term of market size exhibited a significant positive impact on enterprise productivity at the 5% level (

β4 = 0.022,

p < 0.05). This finding reinforces the U-shaped conduction effects of market size on enterprise productivity. Overall, these results align closely with those of the baseline model, underscoring the robustness and reliability of our study’s findings.

5. Mechanism Analysis

5.1. Examining U-Shaped Mediation

In this section, we examine the U-shaped conduction effect of the host country market size effect on the relationship between cross-border M&As and enterprise productivity, thereby addressing Hypothesis 2. To conduct this analysis, we employed a layered testing approach using a recursive equation methodology [

46] (refer to Equations (3) and (4)). In these equations,

Mit represents the mediation variables, specifically the primary and quadratic terms of the host country market size effect. The inclusion of these terms allows us to comprehensively assess the nonlinear dynamics at play. The remaining variables retain their definitions as established in the baseline model.

Table 5, columns 1 to 4, presents the outcomes of the nonlinear mediation associated with the host country market size effect. Column 2 reveals that the influence of cross-border M&As on the host country market size effect was significantly positive at the 1% level. However, its impact on enterprise productivity displayed a significant negative impact. This finding suggests the existence of a negative mediation effect in the initial term of the host country market size effect, accounting for 36% of the direct effect. Column 3 illustrates that cross-border M&As exerted a significantly positive influence on both the quadratic term of the host country market size effect and enterprise productivity, each at the 1% level. This indicates the presence of a promoting effect in the conduction of the host country market size effect quadratic term, contributing to 18% of the direct effect. Therefore, Hypothesis 2 is substantiated, demonstrating that enterprise productivity in emerging markets undergoing cross-border M&As is influenced by the U-shaped conduction effect of the host country market size effect.

5.2. Moderated Effects

The findings of our study indicate that, while cross-border M&As influence enterprise productivity via the host country market size effect, the regional level of technological development can potentially moderate this relationship. Specifically, it may affect the strength of the market size effect on enterprise productivity. The results of the moderated nonlinear mediation of technological distance are detailed in columns 1 to 3 in

Table 6. In Equation (2), the moderating impact is represented by the coefficients

δ5 and

δ6, which correspond to the primary and quadratic terms of the interaction between the technological distance and the host country market size effect, respectively.

Our analysis reveals that technological distance diminishes the negative influence of the host country market size effect linear term on enterprise productivity at a 1% significance level. Conversely, it amplifies the positive impact of the quadratic term of the market size effect on enterprise productivity at the 5% level. Employing the nonlinear complex moderated effect test method as a reference, we determined the coefficient of the primary (

δ5) and quadratic (

δ6) terms [

43]. The determination was based on whether the coefficients fell within the 95% confidence interval without crossing zero, supplemented by a bootstrap test with 1000 replications. The findings indicate that the moderating role of technological distance on large and small market size effects equaled 0.003 and 0.107, respectively, with a difference of 0.104 [0.001, 0.006], where the 95% confidence interval did not include zero. Consequently, Hypothesis 3 is corroborated, suggesting that the U-shaped conduction effect of the host country market size effect is weakened at lower levels of technological distance, while it is intensified at higher technological distances.

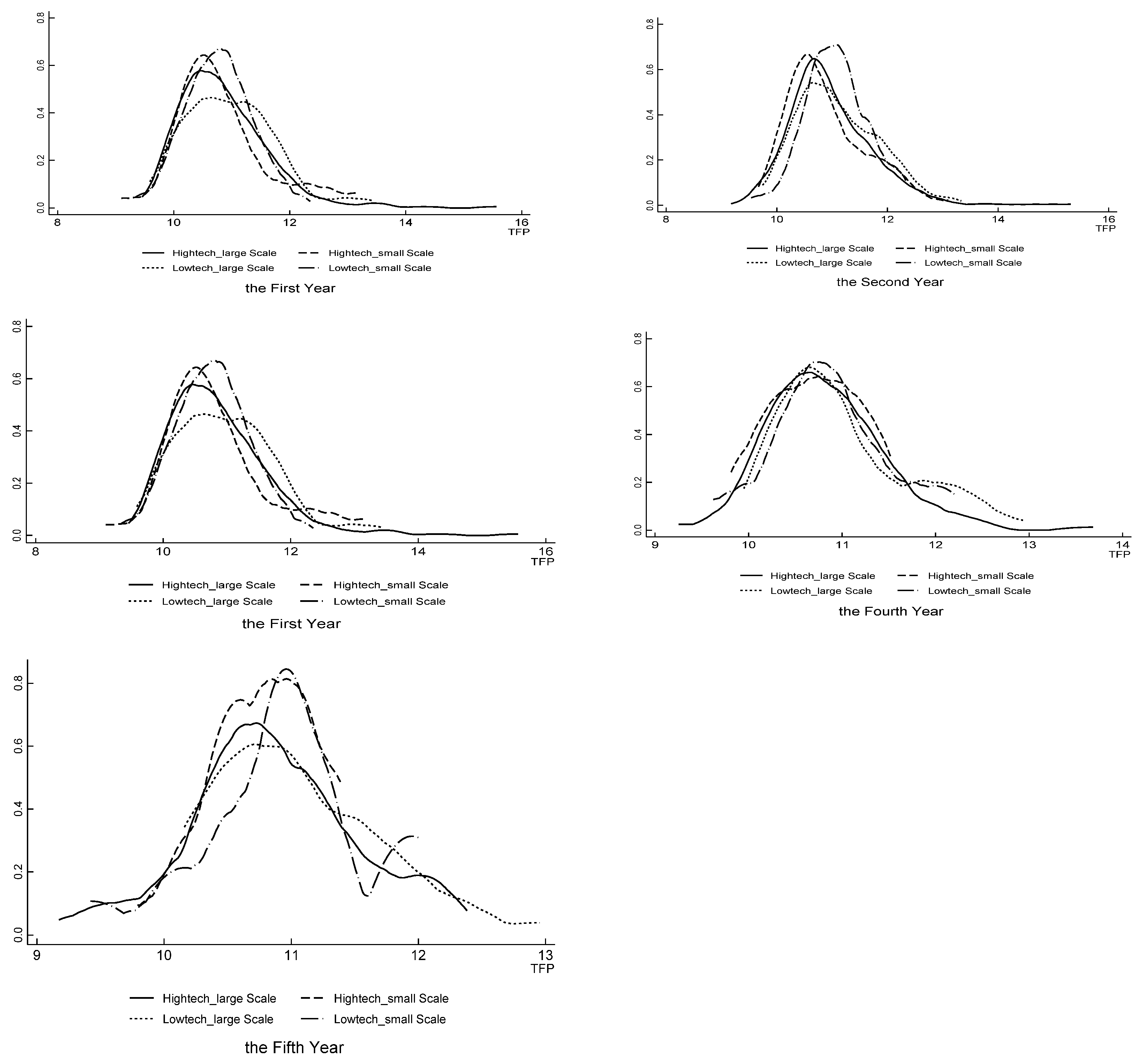

To visualize the moderating role of technological distance in the U-shaped mediation of the market size effect, we divided the data into distinct groups based on high and low technological distance levels, using the mean ± one standard deviation as the dividing criteria. The overall effect and its moderation by technological distance are depicted in

Figure 2. The graph demonstrates a U-shaped relationship for the total effect. In scenarios characterized by high technological distance, the U-shaped mediation role of the market size effect is enhanced, with the curve descending and its curvature becoming more pronounced. When the market size effect exceeds a certain threshold, its mediation role becomes favorable for productivity. Conversely, below this threshold, the mediation role is detrimental to productivity. In contrast, at low technological distance levels, the U-shaped mediation role transitions into an inverted U-shape. Here, beyond the threshold, the market size effect hinders productivity progression, while below the threshold, it facilitates productivity enhancement. This suggests that selecting a host country market with a lower technological distance is conducive to short-term productivity gains. However, this choice may negatively impact long-term sustainable productivity improvement. On the other hand, opting for a host country market with a higher technological distance necessitates a more prolonged effort in knowledge absorption, which is crucial for significant long-term productivity enhancement.

6. Discussion

This section delves into the influence of spatial structure heterogeneity on the relationship between cross-border M&As and enterprise productivity. We categorized spatial structure into four distinct types based on the market size of the host country and technological distance: large markets with high technological distance, large markets with low technological distance, small markets with low technological distance, and small markets with high technological distance. We have graphically represented the kernel density of changes in enterprise productivity over the initial five years post the commencement of cross-border M&As (refer to

Figure 3).

This graphical analysis reveals notable trends in the productivity distribution from the first to the fifth year. Specifically, in large markets with high technological distance, we observed a shortening of the right long tail and an elongation of the left tail. This pattern indicates a significant reduction in high-productivity enterprises and an increase in low-productivity ones, suggesting that such spatial structures may not favor enterprise productivity within a strategic cycle. Conversely, in large markets with low technological distance, there is an extension of the right tail and a substantial shortening of the left tail, signifying a marked improvement in productivity. In small markets with low technological distance, the productivity distribution shifts most significantly to the right, indicating an overall enhancement in productivity. However, in small markets with high technological distance, we notice both right and left truncation. The kernel density diagrams corroborate our research findings, providing a visual understanding of how different spatial structures impact enterprise productivity post cross-border M&As.

This study’s findings affirm that cross-border M&As by enterprises in emerging markets significantly enhance enterprise productivity. This aligns with the existing literature, such as [

27,

28], which underscores the pivotal role of technological spillover and cross-border M&As in driving productivity. Crucially, our research contributes to the ongoing discourse by elucidating how technological distance positively moderates the U-shaped conduction effect of host country market size. This insight bridges contrasting perspectives on productivity effects in cross-border M&As, addressing the uncertainties highlighted and the ambiguities pointed out by [

24]. Our study reveals a critical threshold in the mediation of the host country market size effect. Initially, the market size of the host country exerts a negative effect on the productivity of the acquiring enterprise. However, surpassing this threshold reverses the effect, enhancing productivity. The dualistic nature of the market size effect on productivity not only corroborates the findings of scholars like [

31,

35], who noted its negative aspects, but also aligns with the views of [

36,

37], who emphasized its positive influences. By integrating these diverse perspectives, our study significantly extends the existing body of literature, offering a more comprehensive understanding of the changes in productivity in cross-border M&As.

This study further integrates diverse perspectives on the role of technological distance in influencing productivity spillover effects. Scholars like [

11] argue that a high technological distance hinders technological spillover, advocating that a smaller distance facilitates easier imitation and learning from technology leaders. Other scholars, like [

21,

38], argue for a greater productivity spillover effect in the case of high technological distances. Our research, however, posits a more nuanced view. We suggest that high technological distance necessitates greater efforts in technological absorption. The resultant productivity effects are contingent not merely on technological distance alone but also on the interplay between technological distance and the host country market size effect. This aligns with the assertion of [

19] that productivity spillover does not occur automatically and is significantly influenced by a country’s absorptive capacity. By examining the relationship between technology distance, market size effect, and enterprise productivity, our study offers a comprehensive macro-level understanding of the productivity variation in cross-border M&As with the spatial structure of the host country. This provides pivotal insights for emerging market enterprises in making strategic decisions regarding the selection of host countries, balancing the long- and short-term objectives in their cross-border M&A endeavors.

7. Conclusions and Policy Implications

Cross-border acquisitions have emerged as a crucial strategy for multinational corporations in emerging markets characterized by weak technological capabilities and inefficient resource allocation, addressing domestic market deficiencies and acquiring external knowledge. While the financial and productivity performances of cross-border acquisitions have garnered extensive attention, research results have often been complex and contradictory, particularly regarding the strategic selection of host country market structures to enhance firm productivity. Although the heterogeneity of host countries has been studied, a systematic explanation of how cross-border acquisitions by emerging market enterprises affect long-term productivity through the spatial selection of host countries has not yet been provided. This understanding is critical not only for economic geographic strategic decisions in corporate internationalization but also for a deeper comprehension of global economic dynamics [

1,

2,

3,

4,

5,

6].

To address this research gap, we developed a new spatial structure framework and applied a moderated U-shaped mediation model using data from Chinese enterprise cross-border acquisitions from 2008 to 2016. The findings indicate that the U-shaped mediation role of the host country market size effect, significantly moderated by the technological distance between home and host countries, profoundly impacts long-term firm productivity. In markets with a high technological distance, the market size effect significantly enhances its positive impact on firm productivity; in contrast, in markets with a low technological distance, the market size effect initially exerts a negative impact on productivity, which shifts to a positive one as the market size increases. These findings suggest that initial acquisition efforts should focus on strengthening market size effects, while later phases should increase technological absorption efforts, revealing the complex dynamics between host market potential and technological readiness.

The conclusions of this study offer a new perspective for international business and global strategic economic geography decision making, emphasizing the crucial role of the interplay between market size effects and technological absorption efforts in influencing productivity over both the short and long term. Additionally, they underscore the necessity of dynamically adjusting strategies according to the acquisition timeline. These insights provide critical guidance for emerging market enterprises in strategic decision making and dynamic resource allocation for acquisitions in a competitive global environment. By thoroughly analyzing the adaptability of the host country market structure and the timeliness of acquisition strategies, this research not only enriches the literature on cross-border acquisitions but also underscores the necessity of conducting comprehensive assessments of market dynamics and technological capabilities in an ever-changing global market environment.

Based on our research findings, this study provides four key managerial and policy implications: (1) Economic, geographic, and strategic decision making: Firms engaging in cross-border mergers and acquisitions must consider the market size effects and technological distances of the host countries. In the short term, markets with lower technological distances may be more suitable for productivity enhancement. However, in the long run, larger markets with greater technological distances, though challenging initially, can provide stronger momentum for long-term productivity growth by enhancing technology absorption and R&D investments. (2) Cross-border merger and acquisition timeline management: during the early stages of acquisitions, firms should focus on market expansion to strengthen market size effects, supporting the economic demands for technology absorption. (3) Policy support and technical assistance: governments should provide specific support to firms entering high-technological-distance markets, such as R&D grants and technical training subsidies, to help overcome initial technological barriers and accelerate technology integration. (4) Adaptive selection of host market structures: in the context of economic decoupling and global supply chain restructuring, Chinese firms should diversify their acquisition market choices to enhance their economic resilience and long-term competitiveness.

However, this study is not without limitations. The primary constraint is the use of cross-border M&A data from a specific period (2008–2016), selected to reflect the suitability of these cross-border M&As in a relatively stable international business environment with lower uncertainty. This choice aimed to minimize the potential market distortions in cross-border M&A activities due to external shocks or high trade barriers. Consequently, the generality of our findings may be limited and thus require further validation. Future research should explore host country market choices in more volatile and uncertain environments, examining their impact on enterprise productivity.

Author Contributions

Conceptualization, X.L.; methodology, X.L. and J.F.; software, X.L. and J.F.; validation, X.L.; formal analysis, X.L. and J.F.; investigation, X.H. and Y.L.; resources, X.H. and Y.L.; data curation, X.H. and Y.L.; writing—original draft preparation, X.L., J.F. and X.H.; writing—review and editing, X.L. and J.F.; visualization, X.L.; supervision, J.F.; project administration, J.F.; funding acquisition, J.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by The Soft Science Research Project of Zhejiang (2024C25002), the Key Project of Philosophy and Social Science Research in Zhejiang Province (23NDJC045Z), General research project of Education Department in Zhejiang Province (Y202249099), and the General Program of the National Social Science Foundation of China (17BGL205).

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

References

- Popli, M.; Akbar, M.; Kumar, V.; Gaur, A. Reconceptualizing cultural distance: The role of cultural experience reserve in cross-border acquisitions. J. World Bus. 2016, 51, 404–412. [Google Scholar] [CrossRef]

- Yin, M.; Tian, R. Cross-border mergers and acquisitions: A double-edged sword for Chinese firms’ innovation performance. Cogent Soc. Sci. 2023, 9, 2272320. [Google Scholar] [CrossRef]

- Chang, J. Completion Factors of Cross-Border Mergers and Acquisitions of Chinese Enterprises; Order No. 28026189 ed.; Benedictine University: Chicago, IL, USA, 2020. [Google Scholar]

- Zhou, Z.; Zhang, L.; He, D. Do Firms Experience Enhanced Productivity After Cross-Border M&As? In Proceedings of the International Conference on Management Science and Engineering Management, Chisinau, Moldova, 30 July–2 August 2020. [Google Scholar]

- Bonardo, D.; Paleari, S.; Vismara, S. The M&A dynamics of European science-based entrepreneurial firms. J. Technol. Transf. 2009, 35, 141–180. [Google Scholar]

- Isaksen, A.; Jakobsen, S.-E.; Njøs, R.; Normann, R. Regional industrial restructuring resulting from individual and system agency. Innov. Eur. J. Soc. Sci. Res. 2019, 32, 48–65. [Google Scholar]

- Seddighi, H.; Mathew, S. Innovation and regional development via the firm’s core competence: Some recent evidence from North East England. J. Innov. Knowl. 2020, 5, 219–227. [Google Scholar] [CrossRef]

- He, X.Y.; Shen, K.R. Modernized Economic System, Total Factor Productivity and High-Quality Development. Shanghai J. Econ. 2018, 6, 25–34. [Google Scholar]

- Jiang, G.H. Cross-border Merger and Acquisitions of Chinses Firms is Failed or Not: Evidence from Effective of Industrial Firms. J. Financ. Res. 2017, 4, 46–60. [Google Scholar]

- Nuruzzaman, N.; Singh, D.; Gaur, A.S. Institutional support, hazards, and internationalization of emerging market firms. Glob. Strategy J. 2020, 10, 361–385. [Google Scholar] [CrossRef]

- Hong, J.; Zhou, C.; Wu, Y. Technology Gap, Reverse Technology Spillover and Domestic Innovation Performance in Outward Foreign Direct Investment: Evidence from China. China World Econ. 2019, 27, 1–23. [Google Scholar] [CrossRef]

- Azman-Saini, W.; Baharumshah, A.Z.; Law, S.H. Foreign direct investment, economic freedom and economic growth: International evidence. Econ. Model. 2010, 27, 1079–1089. [Google Scholar] [CrossRef]

- Sethi, D.; Guisinger, S. Liability of foreignness to competitive advantage: How multinational enterprises cope with the international business environment. J. Int. Manag. 2002, 8, 223–240. [Google Scholar]

- Li, Y.M. The Impact of OFDI Location Selection on the Quality of China’s Export Products. Shandong Soc. Sci. 2016, 7, 142–147. [Google Scholar]

- Luo, Y.; Zhang, H. Emerging market MNE: Qualitative review and theoretical directions. J. Int. Manag. 2016, 22, 333–350. [Google Scholar] [CrossRef]

- Jain, S.; Kashiramka, S.; Jain, P.K. Performance of cross-border acquirers from India and China: Its sustainability in the long-run? Rev. Int. Bus. Strategy 2024, 34, 40–61. [Google Scholar] [CrossRef]

- Hejazi, W.; Tang, J.; Collings, D.; Doh, J. Absorptive capacity, learning and profiting from outward FDI: Evidence from Canadian firms. J. World Bus. 2023, 58, 101427. [Google Scholar] [CrossRef]

- Sun, W.; Xie, D. Cross-border M&As and the performance of Chinese acquiring firms. World Econ. 2022, 45, 1614–1647. [Google Scholar]

- Blomstrom, M.; Kokko, A. Foreign direct investment and spillovers of technology. Int. J. Technol. Manag. 2001, 22, 435–454. [Google Scholar] [CrossRef]

- Yu, H.; Zhang, J.; Zhang, M.; Fan, F. Cross-national knowledge transfer, absorptive capacity, and total factor productivity: The intermediary effect test of international technology spillover. Technol. Anal. Strat. Manag. 2021, 34, 625–640. [Google Scholar] [CrossRef]

- Jordaan, J.A. Firm heterogeneity and technology transfers to local suppliers: Disentangling the effects of foreign ownership, technology gap and absorptive capacity. J. Int. Trade Econ. Dev. 2013, 22, 75–102. [Google Scholar] [CrossRef]

- Buckley, P.J.; Munjal, S. The Role of Local Context in the Cross-border Acquisitions by Emerging Economy Multinational Enterprises. Br. J. Manag. 2017, 28, 372–389. [Google Scholar] [CrossRef]

- Bertrand, O.; Zitouna, H. Domestic versus cross-border acquisitions: Which impact on the target firms performance? Appl. Econ. 2008, 40, 2221–2238. [Google Scholar] [CrossRef]

- Ashraf, A.; Herzer, D.; Nunnenkamp, P. The effects of Greenfield FDI and cross-border M&As on total factor productivity. World Econ. 2016, 39, 1728–1755. [Google Scholar]

- Huang, Y.; Zhang, Y. How does outward foreign direct investment enhance firm productivity? A heterogeneous empirical analysis from Chinese manufacturing. China Econ. Rev. 2017, 44, 1–15. [Google Scholar] [CrossRef]

- Cuervo-Cazurra, A.; Genc, M. Transforming disadvantages into advantages: Developing-country MNEs in the least developed countries. J. Int. Bus. Stud. 2008, 39, 957–979. [Google Scholar] [CrossRef]

- Guo, J. Cross-border acquisition activity by Chinese multinationals and domestic-productivity upgrading. Asia Pac. J. Manag. 2020, 39, 659–695. [Google Scholar]

- Pradhan, J.P.; Singh, N. Outward FDI and Knowledge Flows: A Study of the Indian Automotive Sector. Int. J. Inst. Econ. 2008, 1, 156–187. [Google Scholar]

- Whitelock, J.; Jobber, D. An evaluation of external factors in the decision of UK industrial firms to enter a new non-domestic market: An exploratory study. Eur. J. Mark. 2004, 38, 1437–1455. [Google Scholar] [CrossRef]

- Zhang, X.; Zhu, Y.M.; Li, Y.J. Firm Productivity and Firm Selection in the Presence of Agglom-eration Economies: The Perspective of Heterogeneous Firm Productivity. Econ. Rev. 2016, 6, 97–122. [Google Scholar]

- Zaheer, S. Overcoming the Liability of Foreignness. Acad. Manag. J. 1995, 38, 341–363. [Google Scholar] [CrossRef]

- Behrens, K.; Duranton, G.; Robert Nicoud, F. Productive Cities: Sorting, Selection, and Ag-glomeration. J. Political Econ. 2014, 122, 507–553. [Google Scholar] [CrossRef]

- Syverson, C. Product Substitutability and Productivity Dispersion. Rev. Econ. Stat. 2003, 86, 534–550. [Google Scholar] [CrossRef]

- Ellis, K.M.; Reus, T.H.; Lamont, B.T. The Effects of Procedural and Informational Justice in The Integration of Related Acquisitions. Strateg. Manag. J. 2009, 30, 137–161. [Google Scholar] [CrossRef]

- Narula, R. Do We Need Different Frameworks to Explain Infant MNEs from Developing Countries? United Nations University: Tokyo, Japan, 2011. [Google Scholar]

- Head, C.K.; Ries, J.C. Offshore Production and Skill Upgrading by Japanese Firms. J. Int. Econ. 2002, 58, 81–105. [Google Scholar] [CrossRef]

- Gugler, K.; Mueller, D.C.; Yurtoglu, B.; Zulehner, C. The effects of mergers: An international comparison. Int. J. Ind. Organ. 2003, 21, 625–653. [Google Scholar] [CrossRef]

- Findlay, R. Relative Backwardness, Direct Foreign Investment, and the Transfer of Technology: A Simple Dynamic Model. Q. J. Econ. 1978, 92, 1–16. [Google Scholar] [CrossRef]

- Li, X.; Liu, X. Foreign Direct Investment and Economic Growth: An Increasingly Endogenous Relationship. World Dev. 2005, 33, 393–407. [Google Scholar] [CrossRef]

- Buckley, P.; Forsans, N.; Munjal, S. Host-home country linkages and host home country specific advantages as determinants of foreign acquisitions by Indian firms. Int. Bus. Rev. 2012, 21, 878–890. [Google Scholar] [CrossRef]

- Cheng, H.; Li, Z. Multi-dimensional Distance Heterogeneity and Technology Transfer: Based on the Perspective of Enterprise Technology Absorption. Sci. Technol. Manag. Res. 2020, 5, 25–34. [Google Scholar]

- Deng, P.; Yang, M. Cross-border mergers and acquisitions by emerging market firms: A comparative investigation. Int. Bus. Rev. 2015, 24, 157–172. [Google Scholar] [CrossRef]

- Preacher, K.J.; Rucker, D.D.; Hayes, A.F. Addressing Moderated Mediation Hypotheses: Theory, Methods, and Prescriptions. Multivar. Behav. Res. 2007, 42, 185–227. [Google Scholar] [CrossRef]

- Solow, R.M. Technical change and the aggregate production function. Rev. Econ. Stat. 1957, 39, 554–562. [Google Scholar] [CrossRef]

- Guo, Q.W.; Jia, J. Estimating Total Factor Productivity in China. Econ. Res. 2005, 6, 51–60. [Google Scholar]

- Wen, Z.L.; Ye, B.J. Different Methods for Testing Moderated Mediation Models: Competitors or Backups? Acta Psychol. Sin. 2014, 46, 714–726. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).