Abstract

While digitalization offers new opportunities for small- and medium-sized enterprises (SMEs), it also introduces the phenomenon of the “digitalization paradox”. This paper develops a theoretical model comprising digitalization, digital technology–business alignment, external social capital, and SMEs’ performance, rooted in strategic alignment theory (SAT) and social capital theory (SCT). The necessary data for the study were obtained by distributing questionnaires to 352 small and medium-sized enterprises engaged in digital practices in China, and hierarchical regression analysis was employed to investigate the impact of digitalization on the performance of SMEs and its boundaries of influence. The results indicate an inverted U-shaped relationship between digitalization and SME performance, with both digital technology–business alignment and external social capital serving as positive moderators. Specifically, digital technology–business alignment and external social capital both enhance the positive impact of digitalization on the performance of SMEs and mitigate its negative effects. The findings enhance comprehension of the “digitalization paradox” and offer new insights and solutions for SMEs to navigate the opportunities and challenges of digitalization.

1. Introduction

The rapid development of digital technology has fundamentally reshaped the business environment, impacting not only how companies interact with the market and customers but also profoundly influencing their internal operations and product innovation processes [1]. As the core engine behind this change, digitalization is not merely the computerization of traditional business processes but entails a comprehensive upgrade and transformation of all aspects of product design, production, and marketing through the use of cutting-edge information technology [2,3]. In this process, enterprises leverage digital technology to integrate originally isolated and scattered business segments, facilitating an efficient flow of information and optimal resource allocation. Digitalization enhances enterprises’ operational efficiency and market responsiveness and empowers enterprises to navigate the increasingly complex and volatile business environment in a more intelligent and automated manner [4,5]. Confronted with increasingly complex business challenges, an increasing number of enterprises acknowledge the importance of digitalization and proactively engage in the wave of digital transformation to secure a competitive advantage.

In recent years, Chinese SMEs’ digitalization investment has exhibited significant growth. Data from the SME Digital Transformation Development Report 2022 unveil a striking phenomenon: more than half of SMEs, specifically 57.6%, allocate more than 20% of their annual revenue to digital transformation. This figure demonstrates the high priority SMEs assign to digitalization, highlighting their determination and proactive approach in responding to market changes and technological innovations. Meanwhile, the Accenture China Digital Transformation Index 2022 offers deeper insights. It indicates that nearly 60% of enterprises have explicitly stated their willingness to augment their investment in digitalization in the next one to two years. Most notably, the percentage of companies intending to boost their digital investments by more than 15% has reached 33%, marking an increase of 11% compared with the previous year. However, only 17% of enterprises have evolved into leaders through digitalization, which, from another perspective, suggests that as many as 83% of enterprises have not achieved significant results in their digital transformation journey.

The phenomenon of companies not achieving the expected revenue growth despite investing in digitalization is referred to as the “digitalization paradox” [6]. Recently, attention has shifted toward the digitalization paradox. For example, Kamp et al. [7] employed a qualitative multi-case study approach to deeply explore the dilemmas faced by four machine tool manufacturers during their digital transformation. The results validate the existence of the smart service paradox, which represents a significant threat to industrial enterprises. Guo et al. [8] examined the “double-edged sword effect” of digital transformation on enterprise operations, utilizing detailed data from A-share listed companies in China from 2013 to 2020. The study demonstrates that digital transformation can significantly enhance the total factor productivity of enterprises, yielding substantial benefits. However, digital transformation is likewise associated with increased operating costs, reduced total asset turnover, and higher administrative expenses, collectively exerting a negative impact on enterprise performance. Overall, academic research on the digitalization paradox remains nascent, with most studies centering on superficial concerns and initial descriptions of the phenomenon. Although some studies have addressed the impact of digitalization on enterprise performance, this exploration remains inadequate. Especially from the perspective of SMEs, a systematic exploration of how digitalization specifically impacts enterprise performance and the existing boundary conditions is still an area that needs to be strengthened in current research.

SMEs have shown a strong willingness to digitize and invested a lot of resources, but the improvement effect is often unsatisfactory. The reasons for this phenomenon are complex, but strategic misalignment is undoubtedly a critical factor. Digitalization entails more than a technological upgrade; it necessitates changes in various aspects of enterprise strategy, organizational structure, and business processes [9,10]. In the absence of adequate strategic planning and positioning, or a disconnect between strategy and actual needs upon implementation, the invested resources might not be effectively utilized, resulting in poor improvements [11]. SAT offers a valuable perspective for SMEs to address this issue. The theory emphasizes that enterprise strategies should be matched with the enterprise’s internal resources and external environment to achieve optimal performance. This implies that within the context of digitalization, the digital technologies adopted by SMEs should align with market demand, business model, and overall strategy to focus limited resources on the most critical areas, thereby promoting the digitalization process and achieving expected results [12,13,14]. The resource dilemma represents another significant challenge that hinders the digitalization process of SMEs [15]. Compared to with enterprises, SMEs often find themselves at a disadvantage in terms of capital, technology, and talent. This resource dilemma can make SMEs seem overwhelmed by the investment in digital transformation, making it challenging for them to support comprehensive and in-depth digital reform. Furthermore, SMEs tend to be relatively weak in this area. A lack of capital can limit the ability to introduce advanced technology and equipment, whereas insufficient technical talent can hinder the understanding and application of digital technology [16]. SCT offers another practical perspective for SMEs to overcome resource dilemmas [17]. Through their relationship networks, trust bases, and common norms with external organizations, institutions, and individuals, SMEs can enhance their ability to access and utilize resources in their social networks, thereby effectively compensating for resource shortcomings [18,19]. Current research on SME digitalization lacks an exploration of its impact on performance from the perspectives of strategic matching and social capital, particularly in terms of boundary conditions.

Given this backdrop, this study aims to delve into the following research questions:

Question 1: What kind of relationship exists between the digitalization level of SMEs and their performance?

Question 2: How does the digital technology–business alignment moderate the impact of digitalization on the performance of SMEs?

Question 3: Can external social capital serve as a moderating factor influencing the relationship between digitalization and the performance of SMEs?

To address the issues outlined above, this paper constructs a theoretical framework that integrates digitalization, digital technology–business alignment, external social capital, and SME performance, firmly rooted in SAT and SCT. Through empirical analysis, we aim to assess the direct influence of digitalization on SME performance and delve into the moderating role played by digital technology–business alignment and external social capital in shaping the relationship between digitalization and SME performance. Ultimately, our objective is to empirically unpack these dynamics and offer valuable insights into how small and medium-sized enterprises navigate and respond to the complexities of the digital paradox.

This paper is structured as follows: Section 2 reviews existing research and introduces our research hypotheses. Section 3 provides a detailed account of the empirical research design, including data collection methods, selected scales, and specific empirical research techniques. In Section 4, we conduct an in-depth empirical analysis of the collected survey data using SPSS 24.0. Section 5 delves into the results of the empirical analysis, offering interpretations and discussions. Finally, Section 6 summarizes the core findings of this study, clarifies its theoretical contributions and implications for management, and highlights the limitations of the study as well as potential areas for improvement in future research.

2. Literature Review and Research Hypotheses

2.1. Enterprise Digitalization

The concept of enterprise digitalization continues to be explored and expanded upon in academia. Initially introduced by Patel and McCarthy [20] without a clear definition, they underscored its profound impact on an enterprise’s core business, management style, and its pivotal role in business model transformation. As the digital economy has flourished, scholars’ understanding of digitalization has grown more comprehensive and in-depth.

McAffee et al. [21] identified the application of digital technologies such as big data, cloud computing, and the Internet of Things (IoT) as fundamental for enterprises to achieve digitalization. These technologies provide enterprises with powerful data processing and analysis capabilities that fuel business process optimization and innovation. El Sawy et al. [22], Ritter and Pedersen [23], and Vial [24] elaborate that the essence of enterprise digitalization transcends merely transferring offline work to online or the mere reliance on Internet tools and significant investments in various enterprise management software, office automation systems or customer relationship management systems. Instead, it necessitates that enterprises utilize digitalization, technology, and methodology to thoroughly revamp and enhance their traditional business models, product lines, and business processes to more effectively adapt to market changes and meet consumer needs.

This perspective is reinforced by Gavrila and de Lucas Ancillo [25], who contend that digitalization signifies a fundamental shift in an enterprise’s business model—a transformation to a new model grounded in digital technology. This transformation alters not only the way enterprises operate and their service models but also introduces new competitive advantages and growth opportunities. Legner et al. [26] and Crupi et al. [27] broaden the conceptual scope of digitalization, asserting it encompasses a variety of socio-technical phenomena and processes that utilize digital technologies across the contexts of individuals, organizations, and societies.

In summary, this paper proposes that enterprise digitalization entails the use of digital technology by enterprises to foster comprehensive changes in all aspects such as organizational structure, business processes, products, and services. This transformation extends beyond the mere application of digital technology or investment in digital assets for improving resource allocation efficiency and profitability; it also encompasses the use of digital technology to reshape the trajectory of enterprise value creation and the subsequent transformation of the enterprise within the social environment. Enterprise digitalization represents a comprehensive process aimed at deeply integrating digital technology into all facets of the enterprise, thus achieving comprehensive upgrading and development.

2.2. The Impact of Digitalization on SME Performance

Performance serves as a comprehensive indicator that reflects the development of an enterprise over a specific operating period [28]. Specifically, it is reflected across various dimensions, including the profitability of the enterprise, asset operation level, and future development potential. In the current era, as digitalization encompasses the globe, the SME, as an integral component of the economic system, has its performance significantly influenced by digitalization.

Both academics and practitioners have confirmed the positive impact of digitalization. Initially, adopting cutting-edge technologies like cloud computing, big data, and the IoT has markedly enhanced SMEs’ operational efficiency and innovation [5,29,30]. Utilizing these technologies has enabled enterprises to allocate resources more efficiently, minimize redundancy and waste, and thereby reduce operational costs [31,32]. Furthermore, these technologies foster enterprise agility in responding to market changes, facilitating the rapid launch of new products or services that meet consumer demands [33]. Moreover, digitalization expands the market reach for SMEs. Digitalization dissolves traditional geographical barriers, enabling SMEs to access new customer groups previously out of reach through online platforms [34]. This seamless blend of online and offline strategies not only boosts market share but also significantly strengthens brand influence [35].

Nevertheless, the impact of digitalization on SME performance includes negative effects as well [36]. Financially, adopting digitalization technology demands significant investment in hardware, software, system integration, and training, potentially exacerbating financial pressure for cash-strapped SMEs and impacting daily operations [6]. Regarding human resources, SMEs frequently encounter talent shortages. Digitalization necessitates teams with specific technical skills for operation and maintenance [37]. However, recruiting and nurturing such talent demands substantial time and financial resources. Technologically, the swift evolution of digital technologies compels SMEs to persistently monitor and adapt to new trends. Failing to adapt to technological advancements in a timely manner may lead enterprises into technological obsolescence and diminished market competitiveness [38].

The aforementioned studies indicate that digitalization’s impact on SME performance is not uniformly positive, with a linear relationship insufficient to account for the divergence in scholarly perspectives, suggesting a complex, non-linear connection between digitalization and SME performance. At the business process level, digitalization enables SMEs to optimize and automate processes, thereby improving efficiency, reducing costs, and enhancing responsiveness to market dynamics. During the initial stages of digitalization, these advantages typically result in significant performance enhancements for enterprises. As digitalization advances, the need for substantial investments in resources such as capital, technology, and talent to maintain and enhance digital systems may lead to resource allocation imbalances, potentially diminishing enterprise performance. From a product and service standpoint, leveraging technologies like big data analytics and artificial intelligence enables enterprises to gain precise insights into consumer demand, facilitating the launch of personalized offerings and boosting market competitiveness. However, as competition in digitalization intensifies, continuous investment in technological research and development and marketing becomes essential for maintaining a competitive edge. This ongoing investment can escalate costs, potentially without commensurate market returns. A disruption in the balance between inputs and returns adversely affects enterprise performance. Based on this analysis, this paper proposes the following hypothesis:

Hypothesis 1 (H1).

An inverted U-shaped curve characterizes the relationship between digitalization and SME performance.

2.3. The Moderating Effect of Digital Technology–Business Alignment

SAT underscores the necessity for enterprises to align their internal resources and capabilities with the external environment during strategy formulation and implementation, aiming to secure coherence, synergy, and enduring competitive advantage [39,40,41]. Since the 1990s, IT–business alignment has emerged as a crucial means for attaining strategic alignment [42,43,44], seeking to merge information technology (IT) with an enterprise’s core processes, management systems, and strategies, enhancing operational efficiency and market competitiveness. However, the swift evolution and ongoing enhancement of digital technology have significantly magnified its impact on enterprise performance and competitiveness, leading to the emergence of the digital business strategy (DBS) concept. Within this strategic framework, enterprises must not only achieve deep alignment with information technology (IT) but also ensure comprehensive integration with digital technology to stay ahead of the competition in the fierce market [45,46]. Digital technology–business alignment extends beyond IT, encompassing advanced digital technologies like artificial intelligence, IoT, and blockchain. This alignment underscores the integration of digital technologies with the enterprise’s overarching strategy, innovation model, and value-creation processes [47]. Effective digital technology and business alignment facilitate the micro-matching of internal strategies, ensuring consistency and synergy across all business activities. Furthermore, this alignment aids in macro-matching between the enterprise and the external environment, ensuring that enterprise strategies are coordinated and consistent with the business landscape, thereby bolstering competitive advantage and sustainability [48].

Infrastructure alignment, business process alignment, and strategic alignment constitute the core elements enabling enterprises to synergize technology and business in the digitalization process. Infrastructure alignment serves as the foundational pillar for effective technology–business integration throughout the digitalization journey. At the onset of digitalization, infrastructure alignment secures the stability, scalability, and security of IT systems, laying a robust foundation for swift business growth and innovation—factors that positively influence SME performance [49]. As digitalization progresses, infrastructure alignment aids enterprises in managing technological upgrade pressures, sustaining system stability and adaptability, and mitigating performance decline trends, thereby serving as a protective buffer.

Business process alignment integrates digital technologies with an enterprise’s core processes to optimize and re-engineer them. In the early stages of digitalization, business process alignment fosters automation, intelligentization, and standardization, markedly boosting work efficiency and quality, enhancing market competitiveness, and consequently elevating SME performance. However, excessive automation can curtail employee creativity and flexibility, adversely affecting performance. Thus, at advanced stages of digitalization, business process alignment encourages collaborative innovation, cross-border cooperation, and integration, preserving the enterprise’s innovative dynamism and flexibility [50,51]. This approach serves as a critical buffer against the decline in SME performance.

Strategic alignment merges digital technologies with an enterprise’s overarching strategic objectives, fostering a strategic synergy between technology and business operations. In the early stages of digitalization, strategic alignment delineates the enterprise’s direction and objectives, formulating a scientific digital strategy that significantly boosts SME performance. As digitalization deepens, enterprises must increasingly focus on long-term benefits and sustainable development, eschewing short-sighted tactics [52]. Strategic alignment enables enterprises to conduct a thorough analysis of the market environment, technological trends, and internal capabilities, leading to the formulation of a more reasoned digitalization strategy [53]. Hence, strategic alignment assumes a pivotal buffering role during phases where digitalization might otherwise dampen SME performance. Based on this analysis, this paper proposes the following hypothesis:

Hypothesis 2 (H2).

Digital technology–business alignment positively moderates the curvilinear relationship between digitalization and SME performance.

2.4. The Moderating Effect of External Social Capital

SCT emphasizes the importance of social networks and their relationships, suggesting that these networks provide substantial benefits and value to enterprises [54]. At the enterprise level, social capital is defined as the enterprise’s position within its social networks, the relational resources at its disposal, and the potential benefits these resources offer [55]. For SMEs lacking internal resources, SCT offers a perspective for comprehending and tackling their challenges. These enterprises frequently encounter shortages of capital, technology, and talent, and external social capital serves as a means to supplement and enhance these areas [18,56]. External social capital is categorized into three dimensions: structural, relational, and cognitive social capital.

Structural social capital concerns how organizations within a social network connect and the overall network structure, highlighting the role of network structure in influencing an organization’s access to resources and information [57]. Structural social capital enhances the positioning of SMEs within digitalization networks, facilitating more efficient access to core resources, information, and technology. This advantageous positioning not only expedites the adaptation of enterprises to digitalization trends but also bolsters their operational effectiveness, thereby amplifying the positive impact of digitalization on enterprise performance. Similarly, structural social capital provides diverse resources and information channels to enterprises, reducing their over-reliance on specific channels or technologies and alleviating potential shocks and adverse effects of digitalization.

Relational social capital reflects the degree of mutual trust and reciprocity of connections between organizations [58]. Relational social capital plays a key catalytic role in the process of digitalization driving enterprise performance. By enhancing mutual trust and collaboration between enterprises and other organizations, it significantly reduces transaction costs and market uncertainty, enabling enterprises to be more agile in responding to market changes and enhancing competitiveness. This trust-woven network of relationships provides strong support for enterprises to better use digitalization to enhance the quality of their products and services, thus further amplifying the gainful effects of digitalization on performance. However, relational social capital plays the role of a buffer when digitalization has a dampening effect on enterprise performance. It provides enterprises with emotional support and substantive cooperation assistance, helping them to stabilize through difficult times and explore new market opportunities and expansion space, thus effectively mitigating the negative impact of digitalization on enterprise performance.

Cognitive social capital comprises cognitive frameworks and explanatory mechanisms shared among organizations in a network, highlighting the importance of shared understanding and explanations for promoting cooperation and coordinated action [59]. It enhances strategic synergies and innovation capabilities by facilitating shared understanding, interpretation, and cognition among the enterprise and external organizations, leading to the rapid development of common goals and visions and fostering external collaboration, thus enhancing the positive impact of digitalization on performance. In situations where digitalization inhibits performance, external cognitive social capital offers common problem-solving approaches, aiding enterprises in navigating market and technological challenges and buffering negative impacts. Based on this analysis, we propose the following hypothesis:

Hypothesis 3 (H3).

External social capital positively moderates the curvilinear relationship between digitalization and SMEs’ performance.

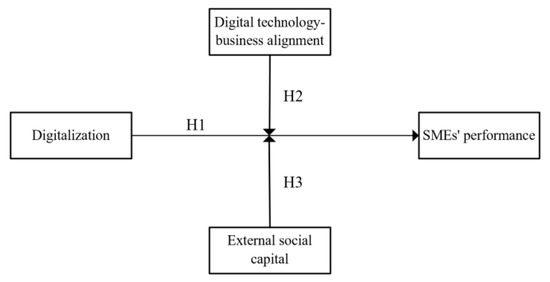

Based on the theoretical analysis and hypothesis deduction above, this paper constructs a theoretical model of the interaction between digitalization, digital technology–business alignment, external social capital, and SME performance. As shown in Figure 1.

Figure 1.

Research model.

3. Research Design

3.1. Sample Selection and Data Collection

Given the significant impact of sample quality on study results, selecting the sample scientifically is crucial to ensuring the accuracy and reliability of the findings. Initially, we employed a mixed-method approach for data collection, utilizing both online and offline survey methods, effectively implementing a non-probability convenience sampling technique through the research team’s social resources. To verify digitalization practices among surveyed enterprises, we included the question “Has your enterprise carried out digitalization practices?” in the questionnaire, excluding enterprises without such practices. The survey, conducted from October 2 to December 8, 2023, involved distributing 425 questionnaires, with 352 valid responses received, yielding an effective response rate of 82.8%. In addition, an independent samples t-test was conducted to compare the early (first 10%) and late (last 10%) respondents. The results showed no significant difference in the performance of SMEs, indicating minimal non-response bias in the sample data.

Descriptive statistics were performed on the recovered sample data, with Table 1 offering a comprehensive overview of the sample’s distribution across various dimensions. Included dimensions are the enterprise’s age, size, industry, region, and the respondent’s position, providing insights into the sample’s characteristics and diversity. Size is measured by the number of employees, featuring a balanced representation of small and medium-sized enterprises. Industry classification follows the Economic Industry Classification by the Chinese government, divided into digital economy industries and traditional industries. The digital economy industries include the computer, communication, and other electronic equipment manufacturing industries; the Internet industry; and software and information technology services, while the non-digital economy industries are collectively referred to as traditional industries. The proportion of digital economy industries slightly exceeds that of traditional industries, indicating a higher concentration of digitalization practices within the digital economy sector, aligning with China’s economic development. The sample spans coastal and inland provinces in China. Given the economic development disparity, digitalization is generally more prevalent in coastal provinces. Yet, the sample’s balanced regional representation indicates strong representativeness. Acknowledging that digital technicians and managers possess a more comprehensive understanding of enterprise digitalization, the table includes samples from these personnel categories. The research team ensures strict confidentiality of questionnaire responses, using the data and results solely for scientific research, thereby guaranteeing the questionnaire’s authenticity and validity.

Table 1.

Sample Characteristic Statistics (N = 352).

3.2. Variable Measurement

This study employed the classic Likert seven-point scale for respondent measurement, where 1 signifies “not at all consistent” and 7 denotes “completely consistent” with higher scores indicating greater respondent agreement with the question items. For measurement scale selection, we relied on prior research, choosing scales of high reliability and validity, and revised certain measurement items based on expert scholars’ suggestions to enhance item accuracy. Digitalization measurement integrates findings from Proksch et al. [60], Ribeiro-Navarrete et al. [61], Skare et al. [62] and Yu et al. [38], resulting in an 8-item scale across two dimensions. “Digitalization of business processes” encompasses adopting current digital technologies to support standard processes, leveraging digital solutions to link fundamental business activities with customers, suppliers, employees, and assets, and utilizing digital information systems for data management and decision making. Meanwhile, “product and service digitalization” involves using smart components and technologies to digitalize products and services, facilitating information transmission, dynamic feedback, and network connectivity to improve user experience and operational efficiency. Enterprise performance, as defined by Adomako et al. [63], is measured through five items: sales revenue, return on investment, profitability, production cost, and market share. Digital technology–business alignment, drawing on Chau et al. [64] and Panda [65], is assessed through three dimensions: infrastructure, business process, and strategy alignment, offering a comprehensive measure of the enterprise’s alignment level. External social capital, based on Marco-Lajara et al. [66] and Ozanne et al. [67], is evaluated through structural, relational, and cognitive dimensions, with specific measurement questions detailed.

Furthermore, to mitigate the influence of extraneous variables and ensure the accuracy and reliability of the results, we controlled for several factors that could impact this study: Older enterprises, with their rich experience and resource accumulation, and larger enterprises, known for their significant market influence and scale effects, could both impact enterprise performance. Similarly, industries vary in business characteristics and technology application levels, with digital economy sectors typically prioritizing technological innovation and digitalization more than non-digital economy sectors. Therefore, this study controls for enterprise age, size, and industry to more accurately determine the impact of digitalization on performance.

3.3. Research Methods

This study combines quantitative analysis with deductive reasoning, guiding our approach to processing the data through scientific analytical methods. Initially, we rigorously administered an array of meticulous tests, encompassing common method bias tests, factor analyses, and model fit assessments, to ensure both the reliability and validity of the amassed data. With the assurance of high-quality sample data, we further utilized hierarchical regression analysis techniques to delve into the data and validate the three hypotheses proposed in this paper. Finally, by integrating the empirical results from data analysis with existing theoretical frameworks, we conducted a deeper exploration of the relationships between variables, leading to more precise conclusions.

4. Empirical Analysis and Results

4.1. Common Method Bias Controls and Tests

Common method biases constitute systematic errors resulting from identical data sources, research subjects, measurement environments, and questionnaire contexts. Such biases often yield inaccurate or skewed research outcomes, potentially leading researchers to misinterpret the results of one measurement for another or overlook the impact of certain variables on study outcomes. In response, this study implemented measures such as adhering to brevity and conciseness in questionnaire design to reduce item ambiguity and inviting respondents from varied regions, industries, and titles during data collection to diversify data sources. Despite employing program control, the extensive number of questionnaire items and their completion by the same respondents still present a potential risk for a significant common method bias effect. To address this, the study utilized Harman’s single-factor test [68] to further assess potential common method biases. The findings, presented in Table 2, reveal that all questionnaire items naturally grouped into four factors with eigenvalues exceeding 1, with the explained variable of the first factor before rotation accounting for 40.828%, which is below the critical threshold of 50%. This indicates effective control of common method biases within the sample.

Table 2.

Total Variance Explained for Sample.

4.2. Test on Reliability and Validity

To ensure the study’s quality and enhance the reliability and generalizability of its findings, this study assessed the scale’s reliability and validity, with the outcomes detailed in Table 3.

Table 3.

Scale reliability and validity tests.

Initially, Cronbach’s alpha coefficient served as the criterion for assessing the scale’s internal consistency. Table 3 reveals that Cronbach’s alpha for digitalization, enterprise performance, digital technology–business alignment, and external social capital exceeds 0.8, indicating the high reliability of the measurement scale [69].

Furthermore, using SPSS 24.0, the KMO and Bartlett test for the significance of the data revealed KMO values of the variables ranging from 0.883 to 0.947, aligning with recommended standards. Meanwhile, the Bartlett’s tests of all the variables were significant, providing a solid basis for factor analysis of the data.

Ultimately, the scale’s validity was evaluated across three dimensions: convergent validity, construct validity, and discriminant validity. Factor loadings of each item of the scale, calculated using SPSS 24.0, revealed a minimum of 0.694 (greater than 0.5). The AVE and CR values of each variable were calculated based on the factor loadings, with the minimum AVE value being 0.531 (greater than 0.5) and the minimum CR value being 0.850 (greater than 0.7). These values were higher than the acceptable thresholds [70,71], suggesting good convergent validity and combinatorial reliability of the measurement scale. Confirmatory factor analysis using AMOS 24.0 showed that the overall fit indices of the model were c2/df = 1.944, RMSEA = 0.052, SRMR = 0.041, IFI = 0.946, TLI = 0.941, and CFI = 0.946, with all the indices meeting the criteria for taking the values, indicating that the scales were well fitted to the data [72]. In addition, by examining the output of Table 4, it can be found that the AVE square root values are greater than the two-by-two correlation coefficients for any of the variables, suggesting that the measurement scale has good discriminant validity [73,74].

Table 4.

Correlation coefficient matrix and descriptive statistics (N = 352).

4.3. Descriptive Statistics and Correlation Analysis

Descriptive statistics and Pearson correlation analysis were performed on the study’s variables using SPSS 24.0, with the outcomes presented in Table 4. This analysis revealed significant correlations among the primary variables: digitalization (DT), enterprise performance (EP), digital technology–business alignment (DBA), and external social capital (ESC), affirming the data’s alignment with expectations and suitability for subsequent phases of the study.

4.4. Hypothesis Testing

Given the unique interplay among the research variables—specifically, to validate that digitalization has an inverted U-shaped impact on SME performance and that digital technology–business alignment and external social capital significantly moderate this relationship—the moderated regression analysis technique proposed by Aiken et al. [75] was employed. Three models were used to test the hypotheses: the direct effect model, the nonlinear effect model, and the moderating effect model, with adjusted R2 serving to evaluate the models’ significance. The previously proposed hypotheses were individually tested via hierarchical regression analysis using SPSS 24.0, with findings detailed in Table 5.

Table 5.

Hierarchical multiple regression results.

Model 2, representing the direct effect of digitalization on SME performance, elucidates that digitalization accounts for 41% of the variance in SME performance, demonstrating a significant positive correlation (β = 0.643, p < 0.001). Building on Model2, the squared term of digitalization is introduced in Model3 to examine its nonlinear effects on SME performance. In the nonlinear effect model (Model3), while the positive impact of digitalization on SME performance remains significant (β = 0.465, p < 0.001), the squared term of digitalization significantly negatively affects SME performance (β = −0.334, p < 0.001), indicating an inverted U-shaped relationship between digitalization and SME performance, thus validating Hypothesis H1.

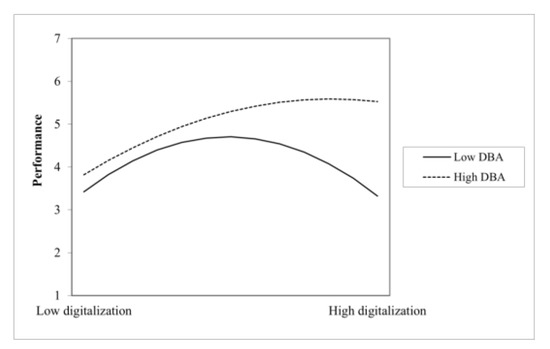

Secondly, to examine the moderating effect of digital technology–business alignment, interaction terms between digitalization and digital technology–business alignment, as well as squared digitalization and digital technology–business alignment, were incorporated into Model3 to derive Model4. To mitigate multicollinearity issues, interaction terms were standardized prior to their inclusion in the regression equations. The results indicate a significantly positive effect of the interaction between digitalization and digital technology–business alignment (β = 0.301, p < 0.001) as well as the interaction of its squared term with alignment (β = 0.158, p < 0.05), demonstrating that both the primary and squared terms of digitalization significantly impact SME performance, thereby validating Hypothesis H2.

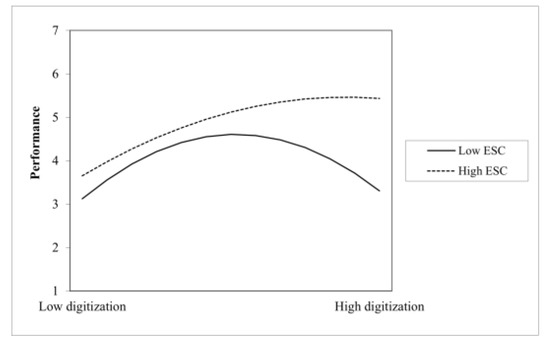

Subsequently, the study examines the moderating effect of external social capital. Similarly, standardized interaction terms of digitalization with external social capital, and squared digitalization with external social capital, were added to Model3 to derive Model5. The outcomes reveal significantly positive coefficients for the interaction terms of digitalization’s primary and squared terms with external social capital (β = 0.257, p < 0.001; β = 0.267, p < 0.001), indicating that both the primary and squared terms of digitalization significantly impact SME performance, thus validating Hypothesis H3. Furthermore, with all models showing a value of VIF less than 5, this indicates the absence of multicollinearity concerns [76].

To visualize the moderating effect’s impact, this study employs the methodology of [77] by plotting the fitted regression lines for digitalization’s impact on SME performance at high and low levels of digital technology–business alignment, operationalized as one standard deviation above and below the mean, respectively. Figure 2 illustrates that at low levels of digital technology–business alignment, the relationship between digitalization and SME performance forms an inverted U-shaped curve, which steepens in its first half and flattens in its second half at high levels of alignment, indicating that digital technology–business alignment enhances SME performance in the initial stages of digitalization and acts as a buffer in later stages where digitalization might inhibit performance, thus revalidating Hypothesis H2. Applying the same method, Figure 3 depicts fitted regression lines for digitalization’s impact on SME performance at varying levels of external social capital. At low levels, an inverted U-shaped relationship emerges, whereas at high levels, digitalization’s positive effects on performance are accentuated and its negative effects diminished, further corroborating Hypothesis H3.

Figure 2.

The moderating effect of digital technology–business alignment.

Figure 3.

The moderating effect of external social capital.

4.5. Robustness Test

The robustness test, a method for revalidating empirical findings by altering parameters or samples, is widely employed in empirical research to assess if evaluation methods and indicators consistently and stably explain outcomes. For the robustness test, this study utilizes split-sample regression [78], dividing the data into two samples for separate regression analyses. Conclusions deemed consistent across both samples are considered robust and reliable. Acknowledging regional economic development differences and varying enterprise digitalization levels, this study stratifies the sample based on enterprise location into coastal and inland province groups for hierarchical regression analysis. The results, presented in Table 6, show slight variations in regression coefficients, yet the direction and significance of each key variable’s impact across both data groups remain consistent, indicating the robustness of the empirical findings.

Table 6.

Robustness test results.

5. Discussions

Drawing on SAT and SCT, this study develops a theoretical model to elucidate the impact of digitalization on SME performance and proposes research hypotheses tested with data from Chinese SMEs that have implemented digitalization practices.

Empirical analysis revealed that enterprise digitalization’s impact on SME performance is not linear but instead exhibits an inverted U-shaped relationship. This suggests that initial digitalization boosts SME performance, yet beyond a threshold, further digitalization may hinder performance. This finding differs from most existing studies, which suggest that digitalization brings new opportunities for enterprises [79], that the application of digital technologies can optimize internal business processes and improve operational efficiency [46], and that digitalization can help enterprises more easily access external knowledge and resources and collaborate with partners in innovation and development [80,81], thus enhancing enterprise competitiveness and improving performance. However, the research findings support the phenomenon of the digitalization paradox observed by Gebauer, Fleisch, Lamprecht, and Wortmann [6], i.e., that digitalization inputs are not proportional to the benefits. This phenomenon is pronounced in SMEs, which are constrained by resources like capital, talent, and technology, hindering their ability to afford digital transformation costs and leverage digitalization benefits due to limited market influence.

Upon comparing and analyzing the divergent viewpoints, it was determined that the benefits of digitalization for SMEs are influenced by various internal and external organizational factors. Consequently, digital technology–business alignment and external social capital were introduced as moderating variables to delve into the boundary conditions under which digitalization impacts SME performance. The findings indicate that both digital technology–business alignment and external social capital positively moderate the curvilinear relationship between digitalization and SME performance, enhancing performance in the initial stages and providing a buffering effect when further digitalization might impede performance. This observation aligns with Liu and Wei [82], who noted that mismatches between technology applications and business strategies can lead to suboptimal digitalization outcomes, and corroborates Kim and Lee [83], who emphasized the role of external social capital in facilitating digital transformation.

6. Conclusions and Implications

6.1. Conclusions

Based on our study, we have drawn the following conclusions regarding the impact of digitalization on SME performance, as well as the moderating effects of digital technology–business alignment and external social capital:

Digitalization has a significant impact on the performance of SMEs, exhibiting an interesting trend: an inverted U-shaped relationship. As digitalization increases, it initially correlates positively with improved performance. However, once a certain threshold is crossed, further digitalization starts to negatively affect performance. This observation validates Hypothesis H1, emphasizing the crucial role of identifying the optimal level of digitalization to maximize SME performance.

Second, digital technology–business alignment plays a crucial moderating role in the relationship between digitalization and SME performance. When this alignment is strong, it amplifies the positive effects and mitigates the negative impacts of digitalization on performance. This observation validates Hypothesis H2, indicating that enterprise digitalization is not merely a pursuit of technological advancement but rather a process that demands tight integration of digital technology with the specific business and strategic processes of the enterprise, aiming to maximize efficiency and optimize resource allocation. Through this approach, enterprises can consistently maintain a leading position in fierce market competition and achieve long-term, stable development.

Last, external social capital also plays a moderating role in the relationship between digitalization and SME performance. Higher levels of external social capital not only enhance the benefits associated with digitalization but also mitigate its potential downsides. This discovery aligns with Hypothesis H3, emphasizing the importance of cultivating strong external relationships for SMEs as they navigate the complexities of digital transformation. By fostering these relationships, SMEs can harness the advantages of digitalization while reducing the risks of adverse effects.

6.2. Theoretical Contributions

First, this study incorporates the concept of “paradox” into digitalization research, offering insights into SMEs’ digitalization constraints and unveiling the paradoxical dynamics underlying these challenges. This application disrupts the conventional linear narrative between digitalization and performance, furnishing a fresh lens to comprehend the complexities of SME digitalization and broadening the theoretical scope of digitalization research. Second, the existing literature rarely deals with the exploration of boundary conditions in the process of digitalization’s impact on SME performance. Leveraging SAT, this research delves into the internal factors impacting SME performance during digital transformation. The findings indicate that the degree of infrastructure alignment, business process alignment, and strategic alignment impact enterprise performance in digitalization, thus broadening the applicable context of SAT in the digital economy. Third, SCT is employed to investigate external factors influencing SME performance in digitalization, revealing variable SME digitalization outcomes across different levels of external social capital. This not only extends SCT’s relevance to digitalization but also elucidates divergences in prior research.

6.3. Practical Implications

First, the inverted U-shaped relationship between digitalization and SME performance suggests optimal outcomes at moderate levels of digitalization, indicating that extremes—either too low or too high—are counterproductive. Hence, SMEs should pursue a balanced approach to digitalization, focusing on risk management and developing competitive strategies that leverage their resource integration capabilities. Given SMEs’ resource constraints, these limitations may impact the efficacy of digitalization strategies. Thus, in evaluating the benefits of digitalization, SMEs should exercise caution, make rational decisions, and identify the optimal digitalization level to boost performance, considering their resource constraints. Second, beyond merely focusing on technology itself, SMEs should prioritize aligning technology with their business operations. Technology’s value is maximized when it is closely integrated with an enterprise’s specific business needs. Therefore, enterprises must carefully evaluate the compatibility of digital technologies with their business models upon selection and application. Third, the significance of external social capital to SMEs extends beyond facilitating inter-enterprise collaboration; it is a vital resource for advancing digitalization and enhancing performance. Therefore, enterprises should actively build and maintain good relationships with external entities such as suppliers, customers, competitors, and industry organizations in order to obtain more resources, information, and support. During phases where digitalization boosts performance, SMEs should leverage external social capital to augment digitalization’s impact. In scenarios where excessive digitalization dampens performance, SMEs should utilize external social networks for support to mitigate adverse effects.

6.4. Limitations and Future Research

Drawing on prior research, this study develops a role mechanism model to analyze the impact of digitalization on SME performance, grounded in pertinent theories. Although this study contributes to both theory and practice, there are still several limitations due to time and space constraints. These limitations mainly include the following:

First, the sample comprises solely registered SMEs in China, suggesting that future research could extend to other countries and regions to broaden the findings’ applicability. Second, data collection via questionnaires captures only a snapshot in time, and it is noted that the effects of digitalization may emerge over time [84], a dynamic not fully captured by this study’s methodology. Future studies could employ longitudinal tracking to examine changes across different development stages, enhancing the validity and reliability of the conclusions. Last, while this paper explores the impact of SME digitalization on performance and its boundary conditions, the drivers of digital transformation are multifaceted [84,85]. The constructed model does not fully examine the variability in digitalization effects across various drivers. Future research could utilize fuzzy qualitative comparative analysis to delve into how different antecedents and combinations influence the digitalization process and enterprise effectiveness.

Author Contributions

Conceptualization, X.C. and X.-e.Z.; methodology, X.C.; software, J.C.; validation, X.C. and Z.C.; formal analysis, X.C. and Z.C.; investigation, X.C. and Z.C.; resources, X.-e.Z.; data curation, J.C.; writing—original draft preparation, X.C.; writing—review and editing, X.C. and Z.C.; visualization, J.C.; supervision, X.-e.Z.; project administration, X.-e.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the Special Project on the Fundamental Research Fund of Jilin University: The measurement of digital orientation and its influence on sustainable performance of agricultural enterprises under the “dual carbon” goals (grant 2022ESD04).

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Acknowledgments

We also thank the anonymous reviewers for providing valuable comments on the manuscript.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Parviainen, P.; Tihinen, M.; Kääriäinen, J.; Teppola, S. Tackling the digitalization challenge: How to benefit from digitalization in practice. Int. J. Inf. Syst. Proj. Manag. 2017, 5, 63–77. [Google Scholar] [CrossRef]

- Vasilev, V.L.; Gapsalamov, A.R.; Akhmetshin, E.M.; Bochkareva, T.N.; Yumashev, A.V.; Anisimova, T.I. Digitalization peculiarities of organizations: A case study. Entrep. Sustain. Issues 2020, 7, 3173–3190. [Google Scholar] [CrossRef] [PubMed]

- Dihovični, D.; Škrbić, S. Fuzzy approach to supply chain management for e-commerce store. Appl. Eng. Lett. 2020, 5, 62–67. [Google Scholar] [CrossRef]

- Autio, E.; Nambisan, S.; Thomas, L.D.; Wright, M. Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strateg. Entrep. J. 2018, 12, 72–95. [Google Scholar] [CrossRef]

- Agostini, L.; Galati, F.; Gastaldi, L. The digitalization of the innovation process: Challenges and opportunities from a management perspective. Eur. J. Innov. Manag. 2020, 23, 1–12. [Google Scholar] [CrossRef]

- Gebauer, H.; Fleisch, E.; Lamprecht, C.; Wortmann, F. Growth paths for overcoming the digitalization paradox. Bus. Horiz. 2020, 63, 313–323. [Google Scholar] [CrossRef]

- Kamp, B.; Zabala, K.; Zubiaurre, A. How can machine tool builders capture value from smart services? Avoiding the service and digitalization paradox. J. Bus. Ind. Mark. 2023, 38, 303–316. [Google Scholar] [CrossRef]

- Guo, X.; Li, M.; Wang, Y.; Mardani, A. Does digital transformation improve the firm’s performance? From the perspective of digitalization paradox and managerial myopia. J. Bus. Res. 2023, 163, 113868. [Google Scholar] [CrossRef]

- Ross, J.; Beath, C.; Sebastian, I.M. How to Develop a Great Digital Strategy; MIT Sloan Management Review: Cambridge, MA, USA, 2016. [Google Scholar]

- Savić, D. From Digitization and Digitalization to Digital Transformation: A Case for Grey Literature Management. Grey J. (TGJ) 2020, 16, 28–33. [Google Scholar]

- Pereira, D.I.D.O.; Lima, E.P.D.; Machado, C.G.; Costa, S.E.G.D. Assessing Challenges, Barriers, Practices and Capability Towards Digitalization. In Proceedings of the Institute of Industrial and Systems Engineers Annual Conference and Expo, New Orleans, LA, USA, 30 May–2 June 2020. [Google Scholar]

- Street, C.T.; Gallupe, B.; Baker, J. Strategic alignment in SMEs: Strengthening theoretical foundations. Commun. Assoc. Inf. Syst. 2017, 40, 20. [Google Scholar] [CrossRef]

- Yeow, A.; Soh, C.; Hansen, R. Aligning with new digital strategy: A dynamic capabilities approach. J. Strateg. Inf. Syst. 2018, 27, 43–58. [Google Scholar] [CrossRef]

- Becker, W.; Schmid, O. The right digital strategy for your business: An empirical analysis of the design and implementation of digital strategies in SMEs and LSEs. Bus. Res. 2020, 13, 985–1005. [Google Scholar] [CrossRef]

- Telukdarie, A.; Dube, T.; Matjuta, P.; Philbin, S. The opportunities and challenges of digitalization for SME’s. Procedia Comput. Sci. 2023, 217, 689–698. [Google Scholar] [CrossRef]

- Hasan, N.A.; Abd Rahim, M.; Ahmad, S.H.; Meliza, M. Digitization of business for small and medium-sized enterprises (SMEs). Environ.-Behav. Proc. J. 2022, 7, 11–16. [Google Scholar] [CrossRef]

- Yani, A.; Eliyana, A.; Sudiarditha, I.K.R.; Buchdadi, A.D. The Impact of Social Capital, Entrepreneurial Competence on Business Performance: An Empirical Study of SMEs. Syst. Rev. Pharm. 2020, 11, 779–787. [Google Scholar]

- Boohene, R.; Gyimah, R.A.; Osei, M.B. Social capital and SME performance: The moderating role of emotional intelligence. J. Entrep. Emerg. Econ. 2020, 12, 79–99. [Google Scholar] [CrossRef]

- Chang, Y.-Y.; Lin, Y.-M.; Chang, T.-W.; Chang, C.-Y. Sustainable corporate entrepreneurship performance and social capital: A multi-level analysis. Rev. Manag. Sci. 2023, 1–23. [Google Scholar] [CrossRef]

- Patel, K.; McCarthy, M.P. Digital Transformation: The Essentials of E-Business Leadership; McGraw-Hill Professional: New York, NY, USA, 2000. [Google Scholar]

- McAffee, A.; Ferraris, P.; Bonnet, D.; Calméjane, C.; Westerman, G. Digital Transformation: A Roadmap for Billion-Dollar Organizations. MIT Sloan Manag. Rev. 2011. Available online: https://www.mendeley.com/catalogue/526dd925-7243-386c-b31c-5bfaea8a784d/ (accessed on 17 April 2024).

- El Sawy, O.A.; Kræmmergaard, P.; Amsinck, H.; Vinther, A.L. How LEGO built the foundations and enterprise capabilities for digital leadership. In Strategic Information Management; Routledge: London, UK, 2020; pp. 174–201. [Google Scholar]

- Ritter, T.; Pedersen, C.L. Digitization Capability and the Digitalization of Business Models in Business-to-business Firms: Past, Present, and Future. Ind. Mark. Manag. 2019, 86, 180–190. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. In Managing Digital Transformation; Routledge: London, UK, 2021; pp. 13–66. [Google Scholar]

- Gavrila, S.G.; de Lucas Ancillo, A. Spanish SMEs’ digitalization enablers: E-Receipt applications to the offline retail market. Technol. Forecast. Soc. Change 2021, 162, 120381. [Google Scholar] [CrossRef] [PubMed]

- Legner, C.; Eymann, T.; Hess, T.; Matt, C.; Böhmann, T.; Drews, P.; Mädche, A.; Urbach, N.; Ahlemann, F. Digitalization: Opportunity and challenge for the business and information systems engineering community. Bus. Inf. Syst. Eng. 2017, 59, 301–308. [Google Scholar] [CrossRef]

- Crupi, A.; Del Sarto, N.; Di Minin, A.; Gregori, G.L.; Lepore, D.; Marinelli, L.; Spigarelli, F. The digital transformation of SMEs–a new knowledge broker called the digital innovation hub. J. Knowl. Manag. 2020, 24, 1263–1288. [Google Scholar] [CrossRef]

- Laskovaia, A.; Shirokova, G.; Morris, M.H. National culture, effectuation, and new venture performance: Global evidence from student entrepreneurs. Small Bus. Econ. 2017, 49, 687–709. [Google Scholar] [CrossRef]

- Trantopoulos, K.; von Krogh, G.; Wallin, M.W.; Woerter, M. External knowledge and information technology. MIS Q. 2017, 41, 287–300. [Google Scholar] [CrossRef]

- Eller, R.; Alford, P.; Kallmünzer, A.; Peters, M. Antecedents, consequences, and challenges of small and medium-sized enterprise digitalization. J. Bus. Res. 2020, 112, 119–127. [Google Scholar] [CrossRef]

- Denner, M.-S.; Püschel, L.C.; Röglinger, M. How to exploit the digitalization potential of business processes. Bus. Inf. Syst. Eng. 2018, 60, 331–349. [Google Scholar] [CrossRef]

- Bouwman, H.; Nikou, S.; de Reuver, M. Digitalization, business models, and SMEs: How do business model innovation practices improve performance of digitalizing SMEs? Telecommun. Policy 2019, 43, 101828. [Google Scholar] [CrossRef]

- Rachinger, M.; Rauter, R.; Müller, C.; Vorraber, W.; Schirgi, E. Digitalization and its influence on business model innovation. J. Manuf. Technol. Manag. 2018, 30, 1143–1160. [Google Scholar] [CrossRef]

- Westerlund, M. Digitalization, Internationalization and Scaling of Online SMEs. Technol. Innov. Manag. Rev. 2020, 10, 48–57. [Google Scholar] [CrossRef]

- Jia, Y.; Su, J.; Cui, L.; Wu, L.; Tan, K.H. Platform business model innovation in the digitalization era: A “driver-process-result” perspective. J. Bus. Res. 2023, 160, 113818. [Google Scholar] [CrossRef]

- Trittin-Ulbrich, H.; Scherer, A.G.; Munro, I.; Whelan, G. Exploring the dark and unexpected sides of digitalization: Toward a critical agenda. Organization 2021, 28, 8–25. [Google Scholar] [CrossRef]

- Urbach, N.; Ahlemann, F.; Böhmann, T.; Drews, P.; Brenner, W.; Schaudel, F.; Schütte, R. The impact of digitalization on the IT department. Bus. Inf. Syst. Eng. 2019, 61, 123–131. [Google Scholar] [CrossRef]

- Yu, F.F.; Cao, J.Y.; Du, H.Y. Digitalization Paradox: Double-Edged Sword Effect of Enterprise Digitalization on Innovation Performance. RD Manag. 2022, 34, 1–12, (Translated from Chinese). [Google Scholar]

- Venkatraman, N.; Camillus, J.C. Exploring the Concept of \"Fit\" in Strategic Management. Acad. Manag. Rev. 1984, 9, 513–525. [Google Scholar]

- McAdam, R.; Miller, K.; McSorley, C. Towards a contingency theory perspective of quality management in enabling strategic alignment. Int. J. Prod. Econ. 2019, 207, 195–209. [Google Scholar] [CrossRef]

- Reed, J. Strategic agility in the SME: Use it before you lose it. J. Small Bus. Strategy (Arch. Only) 2021, 31, 33–46. [Google Scholar] [CrossRef]

- Héroux, S.; Fortin, A. The influence of IT governance, IT competence and IT-business alignment on innovation. Cah. Rech. 2016, 4, 1–36. [Google Scholar]

- Luftman, J.; Lyytinen, K.; Zvi, T.b. Enhancing the measurement of information technology (IT) business alignment and its influence on company performance. J. Inf. Technol. 2017, 32, 26–46. [Google Scholar] [CrossRef]

- Sabherwal, R.; Sabherwal, S.; Havakhor, T.; Steelman, Z. How does strategic alignment affect firm performance? The roles of information technology investment and environmental uncertainty. MIS Q. 2019, 43, 453–474. [Google Scholar] [CrossRef]

- Johnson, J.S.; Friend, S.B.; Lee, H.S. Big data facilitation, utilization, and monetization: Exploring the 3Vs in a new product development process. J. Prod. Innov. Manag. 2017, 34, 640–658. [Google Scholar] [CrossRef]

- Kindermann, B.; Beutel, S.; de Lomana, G.G.; Strese, S.; Bendig, D.; Brettel, M. Digital orientation: Conceptualization and operationalization of a new strategic orientation. Eur. Manag. J. 2021, 39, 645–657. [Google Scholar] [CrossRef]

- Kahre, C.; Hoffmann, D.; Ahlemann, F. Beyond Business-IT Alignment-Digital Business Strategies as a Paradigmatic Shift: A Review and Research Agenda. 2017. Available online: https://aisel.aisnet.org/hicss-50/os/digital_innovation/2/ (accessed on 17 April 2024).

- Quinton, S.; Canhoto, A.; Molinillo, S.; Pera, R.; Budhathoki, T. Conceptualising a digital orientation: Antecedents of supporting SME performance in the digital economy. J. Strateg. Mark. 2018, 26, 427–439. [Google Scholar] [CrossRef]

- Cheng, R.C.-N.; Men, X.; Hsieh, J.P.-A.; Cheng, Z.J.; Cui, X.; Wang, T.; Hsu, S.-H. The effects of IT chargeback on strategic alignment and performance: The contingent roles of business executives’ IT competence and CIOs’ business competence. Internet Res. 2023, 33, 57–83. [Google Scholar] [CrossRef]

- Ajibade, P.; Mutula, S.M. Promoting SMEs effectiveness through innovative communication strategies and business-IT alignment. Probl. Perspect. Manag. 2020, 18, 233–244. [Google Scholar] [CrossRef]

- Al-Surmi, A.; Cao, G.; Duan, Y. The impact of aligning business, IT, and marketing strategies on firm performance. Ind. Mark. Manag. 2020, 84, 39–49. [Google Scholar] [CrossRef]

- Nasiri, M.; Saunila, M.; Rantala, T.; Ukko, J. Sustainable innovation among small businesses: The role of digital orientation, the external environment, and company characteristics. Sustain. Dev. 2022, 30, 703–712. [Google Scholar] [CrossRef]

- Bendig, D.; Schulz, C.; Theis, L.; Raff, S. Digital orientation and environmental performance in times of technological change. Technol. Forecast. Soc. Change 2023, 188, 122272. [Google Scholar] [CrossRef]

- Aribi, A.; Dupouët, O. The role of organizational and social capital in the firm’s absorptive capacity. J. Knowl. Manag. 2015, 19, 987–1006. [Google Scholar] [CrossRef]

- Mishchuk, H.; Bilan, Y.; Androniceanu, A.; Krol, V. Social capital: Evaluating its roles in competitiveness and ensuring human development. J. Compet. 2023, 15, 2. [Google Scholar]

- Kraus, P.; Stokes, P.; Tarba, S.Y.; Rodgers, P.; Dekel-Dachs, O.; Britzelmaier, B.; Moore, N. The ambidextrous interaction of RBV-KBV and regional social capital and their impact on SME management. J. Bus. Res. 2022, 142, 762–774. [Google Scholar] [CrossRef]

- Filieri, R.; McNally, R.C.; O’Dwyer, M.; O’Malley, L. Structural social capital evolution and knowledge transfer: Evidence from an Irish pharmaceutical network. Ind. Mark. Manag. 2014, 43, 429–440. [Google Scholar] [CrossRef]

- Ahmad, M.; Hall, S.G. Trust-based social capital, economic growth and property rights: Explaining the relationship. Int. J. Soc. Econ. 2017, 44, 21–52. [Google Scholar] [CrossRef]

- Claridge, T. Dimensions of Social Capital-structural, cognitive, and relational. Soc. Cap. Res. 2018, 1, 1–4. [Google Scholar]

- Proksch, D.; Rosin, A.F.; Stubner, S.; Pinkwart, A. The influence of a digital strategy on the digitalization of new ventures: The mediating effect of digital capabilities and a digital culture. J. Small Bus. Manag. 2021, 62, 1–29. [Google Scholar] [CrossRef]

- Ribeiro-Navarrete, S.; Botella-Carrubi, D.; Palacios-Marqués, D.; Orero-Blat, M. The effect of digitalization on business performance: An applied study of KIBS. J. Bus. Res. 2021, 126, 319–326. [Google Scholar] [CrossRef]

- Skare, M.; Maria, D.L.M.D.O.; Ribeiro-Navarrete, S. Digital transformation and European small and medium enterprises (SMEs): A comparative study using digital economy and society index data. Int. J. Inf. Manag. 2023, 68, 102594. [Google Scholar] [CrossRef]

- Adomako, S.; Opoku, R.A.; Frimpong, K. Entrepreneurs’ improvisational behavior and new venture performance: Firm-level and institutional contingencies. J. Bus. Res. 2018, 83, 10–18. [Google Scholar] [CrossRef]

- Chau, D.C.K.; Ngai, E.W.T.; Gerow, J.E.; Thatcher, J.B. The Effects of Business-IT Strategic Alignment and IT Governance on Firm Performance: A Moderated Polynomial Regression Analysis. MIS Q. 2020, 44, 1679–1703. [Google Scholar] [CrossRef]

- Panda, S. Strategic IT-business alignment capability and organizational performance: Roles of organizational agility and environmental factors. J. Asia Bus. Stud. 2022, 16, 25–52. [Google Scholar] [CrossRef]

- Marco-Lajara, B.; Úbeda-García, M.; del Carmen Zaragoza-Saez, P.; García-Lillo, F. Agglomeration, social capital and interorganizational ambidexterity in tourist districts. J. Bus. Res. 2022, 141, 126–136. [Google Scholar] [CrossRef]

- Ozanne, L.K.; Chowdhury, M.; Prayag, G.; Mollenkopf, D.A. SMEs navigating COVID-19: The influence of social capital and dynamic capabilities on organizational resilience. Ind. Mark. Manag. 2022, 104, 116–135. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Devine, H.K.A. Editorial: An Author’s Checklist for Measure Development and Validation Manuscripts. J. Pediatr. Psychol. 2009, 34, 691–696. [Google Scholar]

- Gefen, D.; Straub, D.; Boudreau, M.-C. Structural equation modeling and regression: Guidelines for research practice. Commun. Assoc. Inf. Syst. 2000, 4, 7. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Ringle, C. Partial Least Squares Structural Equation Modeling: Indeed a Silver Bullet; Springer: Berlin/Heidelberg, Germany, 2011. [Google Scholar]

- Whittaker, T.A. A Beginner’s Guide to Structural Equation Modeling. Struct. Equ. Model. A Multidiscip. J. 2011. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R: A Workbook; Springer Nature: Berlin/Heidelberg, Germany, 2021. [Google Scholar]

- Aiken, L.S.; West, S.G.; Reno, R.R. Multiple Regression: Testing and Interpreting Interactions; Sage: Thousand Oaks, CA, USA, 1991. [Google Scholar]

- O’brien, R.M. A caution regarding rules of thumb for variance inflation factors. Qual. Quant. 2007, 41, 673–690. [Google Scholar] [CrossRef]

- Haans, R.F.; Pieters, C.; He, Z.L. Thinking about U: Theorizing and testing U-and inverted U-shaped relationships in strategy research. Strateg. Manag. J. 2016, 37, 1177–1195. [Google Scholar] [CrossRef]

- Zhang, D.; Yuan, Y.; Shang, W. Technological Capability of Manufacturing Enterprises and Choice of Intelligent Models. Stud. Sci. Sci. 2023, 41, 1085–1095, (Translated from Chinese). [Google Scholar]

- Rozak, H.A.; Adhiatma, A.; Fachrunnisa, O.; Rahayu, T. Social media engagement, organizational agility and digitalization strategic plan to improve SMEs’ performance. IEEE Trans. Eng. Manag. 2021, 70, 3766–3775. [Google Scholar] [CrossRef]

- Wu, L.; Sun, L.; Chang, Q.; Zhang, D.; Qi, P. How do digitalization capabilities enable open innovation in manufacturing enterprises? A multiple case study based on resource integration perspective. Technol. Forecast. Soc. Change 2022, 184, 122019. [Google Scholar] [CrossRef]

- Benitez, J.; Arenas, A.; Castillo, A.; Esteves, J. Impact of digital leadership capability on innovation performance: The role of platform digitization capability. Inf. Manag. 2022, 59, 103590. [Google Scholar] [CrossRef]

- Liu, Y.; Wei, H. Digital transformation and enterprise financial asset allocation. Appl. Econ. 2024, 1–18. [Google Scholar] [CrossRef]

- Kim, H.K.; Lee, C.W. Relationships among Healthcare Digitalization, Social Capital, and Supply Chain Performance in the Healthcare Manufacturing Industry. Int. J. Environ. Res. Public Health 2021, 18, 1417. [Google Scholar] [CrossRef] [PubMed]

- Wang, Y.; Jiang, Z.; Li, X.; Chen, Y.; Cui, X.; Wang, S. Research on antecedent configurations of enterprise digital transformation and enterprise performance from the perspective of dynamic capability. Financ. Res. Lett. 2023, 57, 104170. [Google Scholar] [CrossRef]

- Annarelli, A.; Battistella, C.; Nonino, F.; Parida, V.; Pessot, E. Literature review on digitalization capabilities: Co-citation analysis of antecedents, conceptualization and consequences. Technol. Forecast. Soc. Change 2021, 166, 120635. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).