1. Introduction

The Fourth Industrial Revolution, which is centered on digital technology, has brought enormous opportunities and driven the emergence of a new wave of entrepreneurship. However, due to the shortcomings of start-up enterprises, such as lack of experience and weak risk-resistance ability, the failure rate of entrepreneurship in start-up enterprises is generally high [

1,

2,

3]. Therefore, the formidable challenge confronted by numerous start-up enterprises revolves around elevating the caliber of entrepreneurial endeavors and fostering the growth of businesses [

4].

Under the trend of digital transformation, various types of data experience explosive growth. The production and operation of enterprises, the changing demands of customers, and the fluctuations in market policies and environmental conditions give rise to a vast amount of structured and unstructured data. These data embody immense value and market prospects [

5]. The big data analytic capability refers to the ability to employ big data technologies for the management, processing, and analysis of extensive data [

6]. With the aid of big data technologies, enterprises can amass and manipulate copious amounts of data, thereby transmuting tem into invaluable insights and erudition, thus bridging the void that plagues fledgling enterprises in terms of experiential deficiency. Through in-depth analysis of data, start-up enterprises can better grasp customer needs and market trends, improve market insights, and formulate more targeted marketing strategies and product solutions to enhance the competitiveness of enterprises [

7,

8,

9]. Therefore, the construction of big data analytic capability is of great significance for start-up enterprises to improve entrepreneurial efficacy and expand the realm of survival and growth.

The existing research findings have confirmed a positive correlation between the big data analytic capability and the promotion of enterprise growth [

10,

11,

12]. These studies provide valuable guidance to enterprises in utilizing the big data analytic capability to promote their growth. However, these studies have not been examined in the context of startup enterprises, which lack the resource advantage compared to mature enterprises. Although the enhancement of big data analytic capabilities improves the competitiveness of businesses, the establishment of such capabilities requires continuous resource investment, which may increase the company’s cost expenditure, thereby leading to a decline in return on investment [

13]. Therefore, it is worth questioning whether the research findings are applicable to the growth process of startup enterprises. This study selects startup enterprises as the research subjects to explore the relationship between big data analytic capabilities and the growth performance of startup enterprises to fill the existing research gap.

Furthermore, scholars have currently drawn most attention on the pathways of the role between big data analytic capabilities and growth performance of enterprises from various perspectives. For instance, Wamba, et al. [

14] elucidated from the standpoint of supply chain management that the big data analytic capability can effectively align the relationship between consumers and suppliers, thereby fostering mutually beneficial associations, reducing costs, and enhancing operational efficiency, consequently leading to growth performance. Gupta and George [

15] and Mikalef, et al. [

16] expound from the perspective of dynamic capabilities, asserting that due to the inherently dynamic nature of the business environment, the facilitative impact of big data analytic capability on growth performance necessitates the realization through organizational dynamic capabilities. Jian, et al. [

17] emphasized the perspective of decision support, contending that managers can acquire insights and optimize strategic decision-making by leveraging the big data analytic capability and application, thereby facilitating growth performance. However, these studies predominantly focus on the discussion of digital transformation in mature enterprises, thus making it highly imperative to explore pathways that minimize risks and cater to the growth process of start-up enterprises’ investing in big data analytic capabilities.

Entrepreneurial process theory suggests that entrepreneurial opportunity is the core of the entrepreneurial process, and recognizing and exploiting entrepreneurial opportunities are crucial for firms to gain sustained competitive advantage and enhance performance [

18]. In the digital age, entrepreneurial opportunities have fragmented and dynamic characteristics [

19], making it difficult for entrepreneurs to accurately and quickly identify them. Some scholars suggest that companies with big data analytic capabilities can more accurately and quickly obtain customer and partner demand information, identify unknown and known entrepreneurial opportunities in the market, and efficiently develop entrepreneurial opportunities through rational resource allocation [

20,

21]. Therefore, the recognition and exploitation of entrepreneurial opportunities may play a very important role in the path of big data analytic capabilities’ impact on the performance of start-up enterprises. However, this issue has not been discussed in existing research, and there is a lack of theoretical and empirical testing. Based on this, this study aims to explore the path of achieving growth performance for start-up enterprises from the perspective of entrepreneurial opportunity. This study attempts to address the following questions:

Question 1: Could the growth performance of start-up enterprises be enhanced through the big data analytic capabilities?

Question 2: Can the recognition and exploitation of entrepreneurial opportunities play an mediating role between the big data analytic capabilities and the growth performance of start-up enterprises?

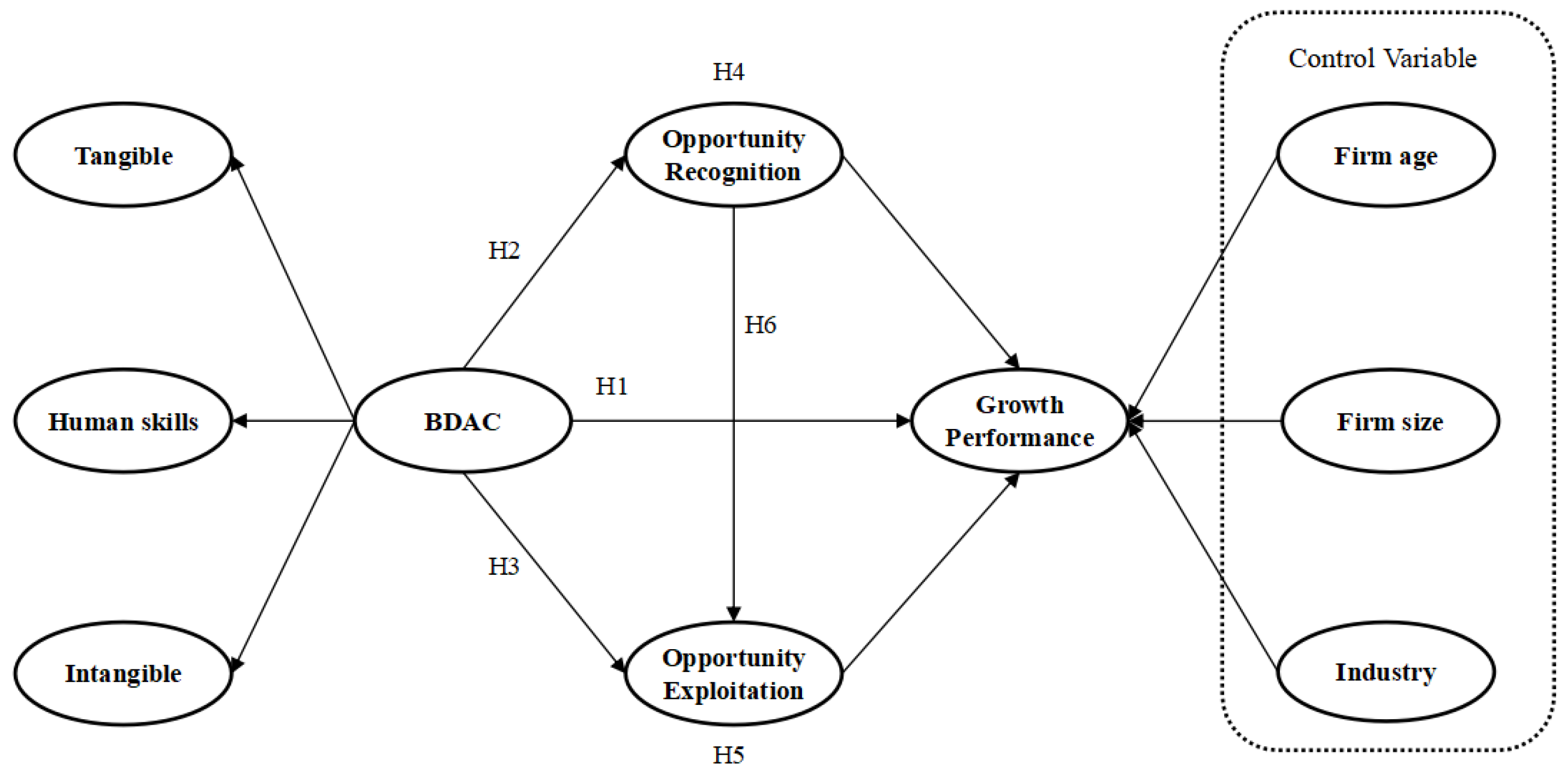

To address these research questions, this research framework is arranged as follows: in

Section 2, a thorough literature review elucidates the definitions of variables pertaining to big data analytic capabilities, recognition, and exploitation of entrepreneurial opportunities, along with the presentation of hypotheses.

Section 3 introduces the design of the questionnaire and the collection of data.

Section 4 analyzes the data and validates the research hypotheses and model.

Section 5 summarizes and reflects upon the limitations of this study, thereby proposing future research recommendations. Finally,

Section 6 presents the conclusive findings of this paper.

5. Discussion, Contribution, and Limitations

5.1. Discussion

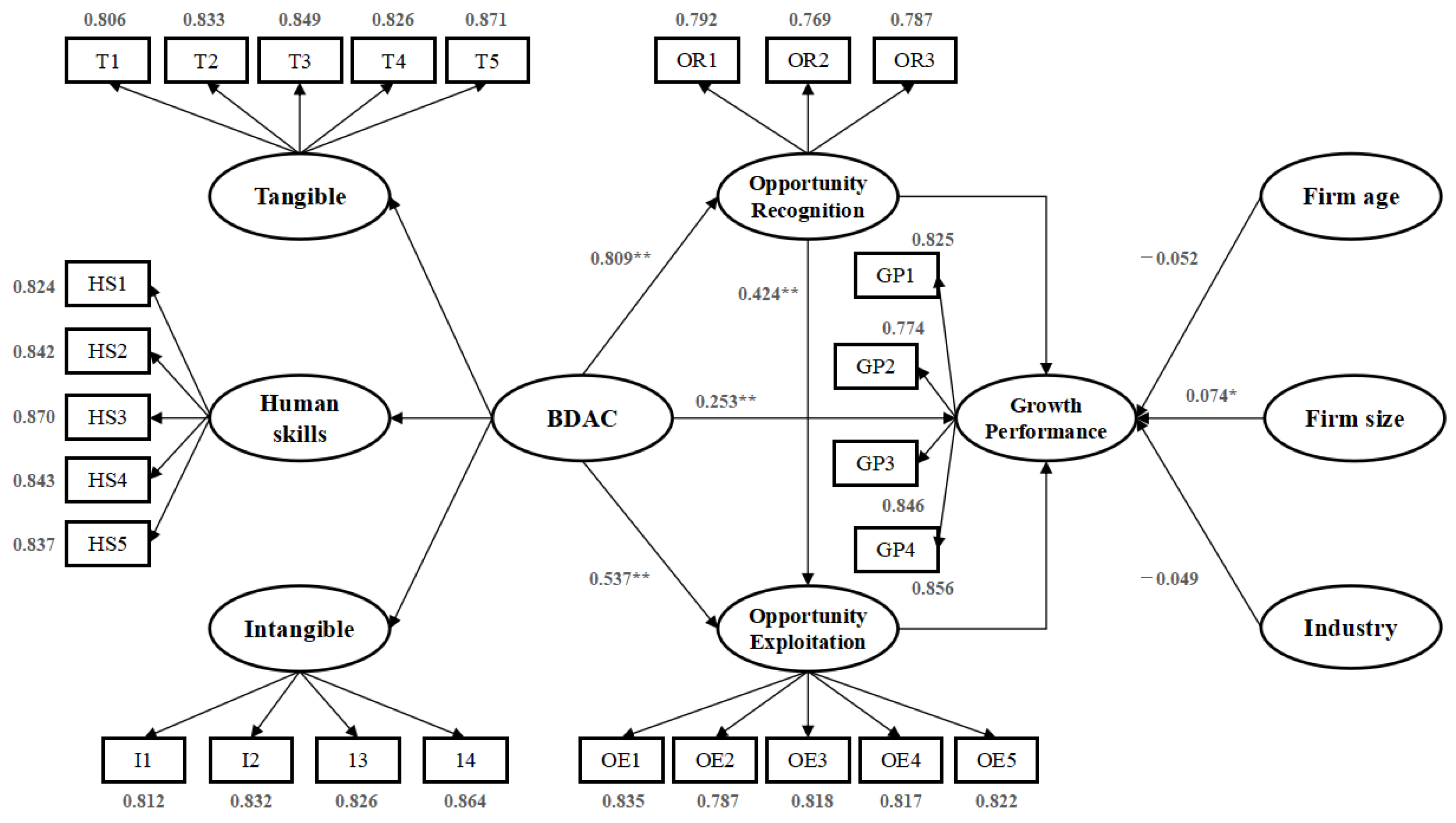

This study examined the relationship between big data analytic capability, entrepreneurial opportunity recognition, entrepreneurial opportunity exploitation, and the growth performance of 501 start-up enterprises through empirical research. The results of this study revealed the impact mechanism of big data analytic capability on the growth performance of start-up enterprises. Among the six hypotheses, all but H4 were supported by the research findings. The detailed discussion is as follows.

Firstly, the big data analytic capabilities have a significant positive impact on the growth performance of start-up enterprises (H1 is supported). The findings of this study once again confirm the empirical research conclusions in the literature of business management regarding the relationship between the big data analytic capabilities and growth performance [

10,

66,

67], which mainly focused on the relationship between big data analytic capabilities and enterprise performance, and emphasized providing theoretical and practical guidance for the digital transformation of enterprises. In contrast, this study focused on start-up enterprises in the micro market and has demonstrated positive results. This suggests that with the development and popularization of big data technology, its application scenarios have been further expanded. Big data analytic capabilities can not only support the digital transformation of mature enterprises but also play an important role in the survival and development of start-up enterprises. This aligns perfectly with the perspective of how digital technology fosters entrepreneurial activities [

4,

68].

Secondly, the big data analytic capabilities have a significant positive impact on the recognition and exploitation of entrepreneurial opportunities (H2 and H3 are supported). Previous researchers have primarily focused on the impact of individual cognitive abilities of entrepreneurs on the recognition and exploitation of entrepreneurial opportunities [

69,

70]. However, with the advancement of the economy, fragmentation and dynamism have emerged as two prominent characteristics of entrepreneurial opportunities in the digital era [

71]. Relying solely on the individual cognitive abilities of entrepreneurs has become increasingly challenging in accurately identifying highly dispersed and transient entrepreneurial opportunities. This study shifts its focus from the abilities of individual entrepreneurs to the capabilities possessed by the enterprises. The findings suggest that big data analytic capabilities can aid enterprises in rapidly integrating market information, while the big data mining techniques can help them discover the underlying business value, thereby assisting enterprises in recognizing and exploiting entrepreneurial opportunities in the market. The existing literature has yet to explore the relationship between the big data analytic capability and the recognition and exploitation of entrepreneurial opportunities, and this conclusion to some extent fills the research gap in this relevant field.

Thirdly, the recognition and exploitation of entrepreneurial opportunities play a mediating role between big data analytic capabilities and the growth performance of start-up enterprises (H6 is supported). The exploitation of entrepreneurial opportunities has a significant mediating effect between big data analytic capabilities and the growth performance of start-up enterprises (H5 is supported), which validates the viewpoint proposed by Yang, et al. [

72] that IT capability, through entrepreneurial opportunity exploration, can influence entrepreneurial performance.

However, the mediating effect of the recognition of entrepreneurial opportunities between big data analytic capabilities and the growth performance of start-up enterprises is not significant (H4 is not supported). This may be because, although new entrepreneurial enterprises can recognize commercial opportunities in the market through big data analytic capabilities, opportunities cannot generate profits for enterprises before they are exploited. The core of enterprise growth lies in how to use opportunities to gain more profits. After recognizing entrepreneurial opportunities, enterprises need to invest manpower and financial support in exploiting these opportunities and improve or innovate products and services based on new entrepreneurial opportunities to improve their market competitiveness, which also partially elucidates the paradoxical phenomena observed in related research findings regarding IT investment and productivity enhancement [

73,

74]. Although big data analytic capabilities can increase the probability of recognizing entrepreneurial opportunities, if enterprise resources cannot match opportunities and exploit them effectively, then big data analytic capabilities cannot effectively promote the growth performance of start-up enterprises.

5.2. Theoretical Contribution

This study focuses on start-up enterprises in the digital era and constructs an integrated model of the impact of big data analytic capabilities on the growth performance of start-up enterprises by combining relevant theories and the literature and conducting empirical tests. It has the following theoretical significance: first, the category of big data analytic capabilities has received considerable attention from scholars in the field of information systems research. This study extends this category to the field of digital entrepreneurship and, based on the resource-based theory, verifies the positive effect of big data analytic capabilities on the growth performance of start-up enterprises, enriches the theoretical connotation of big data analytic capabilities, and expands the research content of big data analytic capabilities. Second, based on the theory of the entrepreneurial process, this study proposes the internal relationship pathway of the impact of big data analytic capabilities on the growth performance of start-up enterprises. Currently, the relationship between big data analytic capabilities and enterprise growth performance has received attention from the academic community [

10,

66,

67]. However, existing research lacks in-depth exploration of the internal relationship pathway between big data analytic capabilities and the growth performance of start-up enterprises. Based on the logic of “ability-behavior-performance,” this study explores the mediating mechanism of entrepreneurial opportunity recognition and entrepreneurial opportunity exploitation in the relationship between big data analytic capabilities and the growth performance of start-up enterprises. It provides enlightening significance for opening the black box of the effect mechanism of big data analytic capabilities on the growth performance of start-up enterprises and fills the deficiency of existing research in explaining the internal mechanism between the two.

5.3. Practical Implication

The conclusion of this article provides important practical insights for empowering entrepreneurial practice with big data analytic capabilities. Firstly, start-up enterprises should focus on cultivating big data analytic abilities. On the one hand, start-up enterprises should target the construction of big data software and hardware resources based on their own conditions and business needs. This can be achieved by learning and updating big data technologies, introducing skilled personnel in big data and management, and fostering a culture of learning within the organization to lay the foundation for enhancing big data analytic abilities. On the other hand, start-up enterprises need to cultivate a culture of big data and digital thinking internally, actively explore the potential value of big data, and proactively engage in innovative activities of data empowerment to provide diversified options for enterprises to adapt to digital environmental changes. Additionally, start-up enterprises should pay attention to the protection of user privacy when using data, avoid excessive collection and misuse of data, and ensure the reasonable and compliant application of big data.

Secondly, start-up enterprises should attach importance to the critical role of big data analytic capabilities in entrepreneurial opportunity recognition and exploitation in relation to enterprise growth performance. First of all, start-up enterprises should make full use of data collection techniques and integrate internal enterprise data, market data, user data, etc., to provide data-based foundations for recognizing entrepreneurial opportunities. Additionally, mining and analyzing data can provide insights into changes in market demand, recognizing potential entrepreneurial opportunities and providing directional guidance to entrepreneurs. Finally, based on recognized entrepreneurial opportunities, outputs should be made that consist of heterogeneous products, services, and business models to better meet customer needs, thereby increasing the probability of entrepreneurial success.

Thirdly, although big data analytic capabilities are of significant importance to the development of start-up enterprise, building these capabilities requires additional investment. This presents a dilemma for start-up enterprises. Therefore, government departments should encourage and support the application of big data in entrepreneurship and create a good entrepreneurial environment. First, there should be increased investment in basic infrastructure such as big data public information platforms and regional cloud computing centers to help start-up enterprises reduce data acquisition costs and expand data acquisition channels. In addition, start-up enterprises should be encouraged to engage in digital and intelligent construction through policy incentives, financial support, tax concessions, credit support, etc., to help start-up enterprises overcome development and financing difficulties. Yet more, it is necessary to improve the institutional environment that is conducive to digital entrepreneurship in order to help entrepreneurs remove cultural and institutional constraints, create a fair and orderly market competition environment, standardize data activities, improve the data security governance system, safeguard the secure circulation of data, and help create a good ecological environment for data mutual benefit for all parties involved.

5.4. Limitations and Future Studies

Although the research results of this study have certain theoretical contributions and practical implications, due to time and length constraints, there are still some limitations, mainly reflected in the following aspects, which need to be improved in future research.

To begin with, the survey sample has limitations. The focus of this study is on newly registered start-up enterprises within China. Future researchers can further expand the scope of the survey to study enterprises in other countries and regions to expand the adaptability of the conclusions. Additionally, the survey process has limitations. The data collected and analyzed through questionnaire surveys in this article are subjective static cross-sectional data, which can only reflect the current situation of a certain time point of start-up enterprises. However, the growth of start-up enterprises is a dynamic and evolving process, and this processing method cannot reflect more accurate and dynamic rules or describe the sustained impact of variables. Therefore, future research can analyze data of enterprises at different development stages through longitudinal tracking to enhance the effectiveness and credibility of research conclusions. Lastly, the integrated model has limitations. This study has constructed a model for the mechanism of the impact of big data analytic capabilities on the growth performance of start-up enterprises. It has verified the chain-mediated effect of entrepreneurial opportunity recognition and exploitation. However, the process by which big data analytic capabilities impact the growth performance of startup enterprises may be a complex process with multiple factors and influence paths. Therefore, in the future, different research perspectives can be explored, considering whether the integration of other intermediate or moderating variables into the model can further improve and enrich the integrated framework and research findings proposed in this paper.