RETRACTED: Can Digital Financial Inclusion Help Reduce Urban Crime? Evidence from Chinese Criminal Judgment on Theft Cases

Abstract

1. Introduction

2. Literature Review

2.1. Factors Influencing Criminal Activities

2.2. The Economic Impacts of Digital Financial Inclusion

3. Theoretical Analysis and Research Hypothesis

4. Methodology, Variables, and Data Sources

4.1. The Specification of a Panel Econometric Model

4.2. Variables Selection

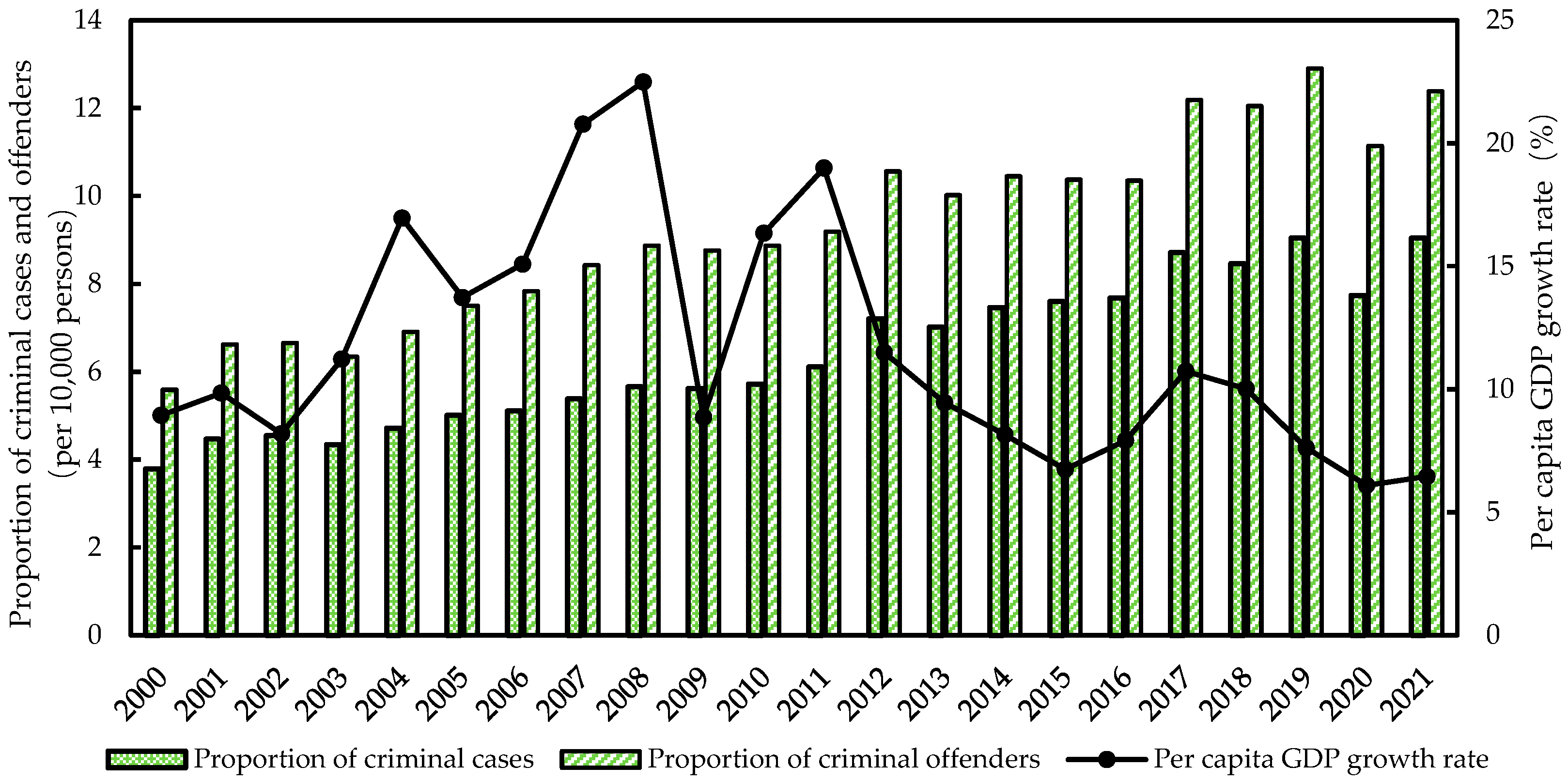

4.3. Data Sources and Description

5. Empirical Analysis

5.1. Baseline Regression Analysis

5.2. Robustness Analysis

5.3. Instrumental Variable Regression Analysis

5.4. Heterogeneity Analysis

5.4.1. Heterogeneity of the Fines

5.4.2. Heterogeneity of the Defendant’s Education Level

5.5. Transmission Mechanism Analysis

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Dinlersoz, E.M.; Fu, Z. Infrastructure investment and growth in China: A quantitative assessment. J. Dev. Econ. 2022, 158, 102916. [Google Scholar] [CrossRef]

- Li, J.; Wan, G.H.; Wang, C.; Zhang, X.L. Which indicator of income distribution explains crime better? Evidence from China. China Econ. Rev. 2019, 54, 51–72. [Google Scholar] [CrossRef]

- Song, Z.; Yan, T.H.; Jiang, T.Y. Can the rise in housing price lead to crime? An empirical assessment of China. Int. J. Law Crime Justice 2019, 59, 100341. [Google Scholar] [CrossRef]

- Halicioglu, F.; Andres, A.R.; Yamamura, E. Modeling crime in Japan. Econ. Model. 2012, 29, 1640–1645. [Google Scholar] [CrossRef]

- Wu, H.T.; Xia, Y.F.; Yang, X.D.; Hao, Y.; Ren, S.Y. Does environmental pollution promote China’s crime rate? A new perspective through government official corruption. Struct. Chang. Econ. Dyn. 2021, 57, 292–307. [Google Scholar] [CrossRef]

- Zhang, S.Y. Immigration and crime in frictional labor markets. Rev. Econ. Dyn. 2022, 44, 152–183. [Google Scholar] [CrossRef]

- Gibson, J.; Kim, B. The effect of reporting errors on the cross-country relationship between inequality and crime. J. Dev. Econ. 2008, 87, 247–254. [Google Scholar] [CrossRef]

- Enamorado, T.; Lopez-Calva, L.F.; Rodriguez-Castelan, C.; Winkler, H. Income inequality and violent crime: Evidence from Mexico’s drug war. J. Dev. Econ. 2016, 120, 128–143. [Google Scholar] [CrossRef]

- Buonanno, P.; Montolio, D. Identifying the socio-economic and demographic determinants of crime across Spanish provinces. Int. Rev. Law Econ. 2008, 28, 89–97. [Google Scholar] [CrossRef]

- Clément, M.; Piaser, L. Do inequalities predict fear of crime? Empirical evidence from Mexico. World Dev. 2021, 140, 105354. [Google Scholar] [CrossRef]

- Blumen, O.; Rattner, A. Urbanized peripheries: A regional study of crime in Israel. Sociol. Spectr. 2002, 22, 407–443. [Google Scholar] [CrossRef]

- Justino, P.; Martorano, B. Welfare spending and political conflict in Latin America, 1970–2010. World Dev. 2018, 107, 98–110. [Google Scholar] [CrossRef]

- Liu, G.C.; Zhang, C.S. Does financial structure matter for economic growth in China. China Econ. Rev. 2020, 61, 101194. [Google Scholar] [CrossRef]

- Chen, C.Y.; Li, M.H. Does digital finance impact debt concentration of Chinese firms? Appl. Econ. Lett. 2023, 30, 871–874. [Google Scholar] [CrossRef]

- Xue, L.; Zhang, X.M. Can Digital Financial Inclusion Promote Green Innovation in Heavily Polluting Companies? Int. J. Environ. Res. Public Health 2022, 19, 7323. [Google Scholar] [CrossRef]

- Yu, N.A.; Wang, Y.Z. Can Digital Inclusive Finance Narrow the Chinese Urban–Rural Income Gap? The Perspective of the Regional Urban–Rural Income Structure. Sustainability 2021, 13, 6427. [Google Scholar] [CrossRef]

- Lai, J.N.T.; Yan, I.K.M.; Yi, X.J.; Zhang, H. Digital Financial Inclusion and Consumption Smoothing in China. China World Econ. 2020, 28, 64–93. [Google Scholar] [CrossRef]

- Xie, W.W.; Wang, T.; Zhao, X. Does Digital Inclusive Finance Promote Coastal Rural Entrepreneurship? J. Coast. Res. 2020, 103, 240–245. [Google Scholar] [CrossRef]

- Li, G.H.; Lv, X.; Han, X. Digital financial inclusion and household debt in China. Appl. Econ. Lett. 2022, 8, 1–5. [Google Scholar] [CrossRef]

- Gallego-Losada, M.J.; Montero-Navarro, A.; Garcia-Abajo, E.; Gallego-Losada, R. Digital financial inclusion. Visualizing the academic literature. Res. Int. Bus. Financ. 2023, 64, 101862. [Google Scholar] [CrossRef]

- Arthur, J.A.; Marenin, O. Explaining crime in developing countries: The need for a case study approach. Crime Law Soc. Chang. 1995, 23, 191–214. [Google Scholar] [CrossRef]

- Maxwell, C.D.; Robinson, A.L.; Post, L.A. The impact of race on the adjudication of sexual assault and other violent crimes. J. Crim. Justice 2003, 31, 523–538. [Google Scholar] [CrossRef]

- Becker, G.S. Crime and Punishment: Economic Approach. J. Polit. Econ. 1968, 76, 169–217. [Google Scholar] [CrossRef]

- Chiu, W.H.; Madden, P. Burglary and income inequality. J. Public Econ. 1998, 69, 123–141. [Google Scholar] [CrossRef]

- Fender, J. A general equilibrium model of crime and punishment. J. Econ. Behav. Organ. 1999, 39, 437–453. [Google Scholar] [CrossRef]

- Conley, J.P.; Wang, P. Crime and ethics. J. Urban Econ. 2006, 60, 107–123. [Google Scholar] [CrossRef]

- Kennedy, B.P.; Kawachi, I.; Prothrow-Stith, D.; Lochner, K.; Gupta, V. Social capital, income inequality, and firearm violent crime. Soc. Sci. Med. 1998, 47, 7–17. [Google Scholar] [CrossRef] [PubMed]

- Imrohoroglu, A.; Merlo, A.; Rupert, P. On the political economy of income redistribution and crime. Int. Econ. Rev. 2000, 41, 1–25. [Google Scholar] [CrossRef]

- Fajnzylber, P.; Lederman, D.; Loayza, N. Inequality and violent crime. J. Law Econ. 2002, 45, 1–40. [Google Scholar] [CrossRef]

- Sachsida, A.; de Mendonca, M.J.C.; Loureiro, P.R.A.; Gutierrez, M.B.S. Inequality and criminality revisited: Further evidence from Brazil. Empir. Econ. 2009, 39, 93–109. [Google Scholar] [CrossRef]

- Buonanno, P.; Vargas, J.F. Inequality, crime, and the long run legacy of slavery. J. Econ. Behav. Organ. 2019, 159, 539–552. [Google Scholar] [CrossRef]

- Corvalan, A.; Pazzona, M. Inequality, crime and private protection. Econ. Lett. 2022, 210, 110184. [Google Scholar] [CrossRef]

- Buonanno, P.; Montolio, D.; Raya-Vilchez, J.M. Housing prices and crime perception. Empir. Econ. 2013, 45, 305–321. [Google Scholar] [CrossRef]

- Wang, C.H.; Liu, X.F.; Yan, Z.Z.; Zhao, Y. Higher education expansion and crime: New evidence from China. China Econ. Rev. 2022, 74, 101812. [Google Scholar] [CrossRef]

- Lochner, L.; Moretti, E. The Effect of Education on Crime: Evidence from Prison Inmates, Arrests, and Self-Reports. Am. Econ. Rev. 2004, 94, 155–189. [Google Scholar] [CrossRef]

- Buonanno, P.; Montolio, D. Juvenile crime in Spain. Appl. Econ. Lett. 2009, 16, 495–500. [Google Scholar] [CrossRef]

- Ivaschenko, O.; Nivorozhkin, A.; Nivorozhkin, E. The Role of Economic Crisis and Social Spending in Explaining Crime in Russia. East. Eur. Econ. 2014, 50, 21–41. [Google Scholar] [CrossRef]

- Algahtany, M.; Kumar, L. A Method for Exploring the Link between Urban Area Expansion over Time and the Opportunity for Crime in Saudi Arabia. Remote Sens. 2016, 8, 863. [Google Scholar] [CrossRef]

- Errol, Z.; Madsen, J.B.; Moslehi, S. Social disorganization theory and crime in the advanced countries: Two centuries of evidence. J. Econ. Behav. Organ. 2021, 191, 519–537. [Google Scholar] [CrossRef]

- Savage, J.; Bennett, R.R.; Danner, M. Economic assistance and crime: A cross-national investigation. Eur. J. Criminol. 2008, 5, 217–238. [Google Scholar] [CrossRef]

- McCall, P.L.; Brauer, J.R. Social welfare support and homicide: Longitudinal analyses of European countries from 1994 to 2010. Soc. Sci. Res. 2014, 48, 90–107. [Google Scholar] [CrossRef]

- Fishback, P.V.; Johnson, R.S.; Kantor, S. Striking at the Roots of Crime: The Impact of Welfare Spending on Crime during the Great Depression. J. Law Econ. 2010, 53, 715–740. [Google Scholar] [CrossRef]

- Meloni, O. Does poverty relief spending reduce crime? Evidence from Argentina. Int. Rev. Law Econ. 2014, 39, 28–38. [Google Scholar] [CrossRef]

- Hoffman, I.; Mast, E. Heterogeneity in the effect of federal spending on local crime: Evidence from causal forests. Reg. Sci. Urban Econ. 2019, 78, 103463. [Google Scholar] [CrossRef]

- Melander, E.; Miotto, M. Welfare Cuts and Crime: Evidence from the New Poor Law. Econ. J. 2022, 133, 1248–1264. [Google Scholar] [CrossRef]

- Gabor, D.; Brooks, S. The digital revolution in financial inclusion: International development in the fintech era. New Polit. Econ. 2016, 22, 423–436. [Google Scholar] [CrossRef]

- Shen, Y.; Hueng, C.J.; Hu, W.X. Using digital technology to improve financial inclusion in China. Appl. Econ. Lett. 2019, 27, 30–34. [Google Scholar] [CrossRef]

- Mushtaq, R.; Bruneau, C. Microfinance, financial inclusion and ICT: Implications for poverty and inequality. Technol. Soc. 2019, 59, 101154. [Google Scholar] [CrossRef]

- Liu, Y.; Luan, L.; Wu, W.L.; Zhang, Z.Q.; Hsu, Y. Can digital financial inclusion promote China’s economic growth? Int. Rev. Financ. Anal. 2021, 78, 101889. [Google Scholar] [CrossRef]

- Besong, S.E.; Okanda, T.L.; Ndip, S.A. An empirical analysis of the impact of banking regulations on sustainable financial inclusion in the CEMAC region. Econ. Syst. 2022, 46, 100983. [Google Scholar] [CrossRef]

- Wang, Q.; Yang, J.B.; Chiu, Y.H.; Lin, T.Y. The impact of digital finance on financial efficiency. Manag. Decis. Econ. 2020, 41, 1225–1236. [Google Scholar] [CrossRef]

- Zhao, H.B.; Zheng, X.; Yang, L. Does Digital Inclusive Finance Narrow the Urban-Rural Income Gap through Primary Distribution and Redistribution? Sustainability 2022, 14, 2120. [Google Scholar] [CrossRef]

- Razak, A.A.; Asutay, M. Financial inclusion and economic well-being: Evidence from Islamic Pawnbroking (Ar-Rahn) in Malaysia. Res. Int. Bus. Financ. 2022, 59, 101557. [Google Scholar] [CrossRef]

- Du, Q.Y.; Zhou, F.X.; Yang, T.L.; Du, M. Digital Financial Inclusion, Household Financial Participation and Well-Being: Micro-Evidence from China. Emerg. Mark. Financ. Trade 2022, 12, 1–15. [Google Scholar] [CrossRef]

- Guo, P.; Zhang, C. The impact of bank FinTech on liquidity creation: Evidence from China. Res. Int. Bus. Financ. 2023, 64, 101858. [Google Scholar] [CrossRef]

- Aziz, A.; Naima, U. Rethinking digital financial inclusion: Evidence from Bangladesh. Technol. Soc. 2021, 64, 101509. [Google Scholar] [CrossRef]

- Sakyi-Nyarko, C.; Ahmad, A.H.; Green, C.J. Investigating the well-being implications of mobile money access and usage from a multidimensional perspective. Rev. Dev. Econ. 2021, 26, 985–1009. [Google Scholar] [CrossRef]

- Das, S.; Chatterjee, A. Impacts of ICT and digital finance on poverty and income inequality: A sub-national study from India. Inform. Technol. Dev. 2023, 1, 1–28. [Google Scholar] [CrossRef]

- Luo, J.; Li, B.Z. Impact of Digital Financial Inclusion on Consumption Inequality in China. Soc. Indic. Res. 2022, 163, 529–553. [Google Scholar] [CrossRef]

- Wang, Z.R.; Zhang, D.H.; Wang, J.C. How does digital finance impact the leverage of Chinese households? Appl. Econ. Lett. 2021, 29, 555–558. [Google Scholar] [CrossRef]

- Yue, P.P.; Korkmaz, A.G.; Yin, Z.C.; Zhou, H.G. The rise of digital finance: Financial inclusion or debt trap? Financ. Res. Lett. 2022, 47, 102604. [Google Scholar] [CrossRef]

- Yang, X.L.; Huang, Y.D.; Gao, M. Can digital financial inclusion promote female entrepreneurship? Evidence and mechanisms. N. Am. Econ. Financ. 2022, 63, 101800. [Google Scholar] [CrossRef]

- Li, J.R.; Li, B.W. Digital inclusive finance and urban innovation: Evidence from China. Rev. Dev. Econ. 2021, 26, 1010–1034. [Google Scholar] [CrossRef]

- Yao, L.Y.; Yang, X.L. Can digital finance boost SME innovation by easing financing constraints? Evidence from Chinese GEM-listed companies. PLoS ONE 2022, 17, e0264647. [Google Scholar] [CrossRef] [PubMed]

- Freeman, R.B. Why do so many young American men commit crimes and what might we do about it? J. Econ. Perspect. 1996, 10, 25–42. [Google Scholar] [CrossRef]

- Harbaugh, W.T.; Mocan, N.; Visser, M.S. Theft and Deterrence. J. Labor Res. 2013, 34, 389–407. [Google Scholar] [CrossRef]

- Beck, T.; Pamuk, H.; Ramrattan, R.; Uras, B.R. Payment instruments, finance and development. J. Dev. Econ. 2018, 133, 162–186. [Google Scholar] [CrossRef]

- Ren, X.H.; Zeng, G.D.; Gozgor, G. How does digital finance affect industrial structure upgrading? Evidence from Chinese prefecture-level cities. J. Environ. Manag. 2023, 330, 117125. [Google Scholar] [CrossRef]

- Lee, C.C.; Lou, R.C.; Wang, F.H. Digital financial inclusion and poverty alleviation: Evidence from the sustainable development of China. Econ. Anal. Policy 2023, 77, 418–434. [Google Scholar] [CrossRef]

| Symbol | Definition | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| Crime | the rate of urban theft crime | 1733 | 14.2 | 9.2 | 1.3 | 73.3 |

| Dfi | the index of digital financial inclusion | 1733 | 202.4 | 40.3 | 105.6 | 321.6 |

| PGDP | per capita GDP | 1731 | 10.8 | 0.5 | 9.2 | 12.3 |

| Fiscal | per capita fiscal expenditure | 1732 | 9.1 | 0.4 | 8.0 | 11.7 |

| Finance | the rate of total deposits and loans to GDP | 1732 | 2.6 | 1.4 | 0.7 | 21.3 |

| Pop_density | population density | 1733 | 470.6 | 560.1 | 5.7 | 6626.3 |

| Internet_per | the number of urban Internet users | 1718 | 0.2 | 0.1 | 0.0 | 1.3 |

| Education | the number of higher education students | 1687 | 180.9 | 207.0 | 2.4 | 1148.4 |

| Unemp | registered unemployment rate | 1705 | 0.1 | 0.0 | 0.0 | 0.3 |

| Second_emp | the ratio of secondary industry employment | 1731 | 43.7 | 14.5 | 7.4 | 83.4 |

| Other_crime | the number of other criminal cases excluding theft | 1733 | 52.5 | 24.2 | 2.1 | 318.4 |

| Moni_jud | per capita judicial monitoring expenditure | 1733 | 1.9 | 1.7 | 0.0 | 7.0 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Dfi | −0.505 *** | −0.613 *** | −0.621 *** | −0.577 *** |

| (−3.31) | (−3.99) | (−3.90) | (−3.98) | |

| PGDP | 0.417 *** | 0.362 *** | 0.343 *** | |

| (3.68) | (2.79) | (2.78) | ||

| Fiscal | −0.069 | −0.187 | −0.157 | |

| (−0.49) | (−1.12) | (−1.08) | ||

| Finance | 0.013 | 0.006 | 0.003 | |

| (0.66) | (0.25) | (0.14) | ||

| Pop_density | −0.000 | −0.000 | ||

| (−1.11) | (−1.10) | |||

| Internet_per | −0.029 | −0.026 | ||

| (−0.15) | (−0.15) | |||

| Education | 0.002 *** | 0.001 ** | ||

| (3.14) | (2.19) | |||

| Unemp | −0.908 | −0.863 | ||

| (−1.23) | (−1.14) | |||

| Second_emp | 0.002 | 0.001 | ||

| (0.48) | (0.31) | |||

| Other_crime | 0.009 *** | |||

| (3.81) | ||||

| Moni_jud | 0.063 ** | |||

| (2.49) | ||||

| _Cons | −0.841 *** | −4.854 *** | −3.419 * | −3.727 ** |

| (−3.95) | (−2.88) | (−1.80) | (−2.21) | |

| Year FE | YES | YES | YES | YES |

| City FE | YES | YES | YES | YES |

| Obs | 1732 | 1730 | 1649 | 1649 |

| R2 | 0.190 | 0.198 | 0.210 | 0.298 |

| F Statistic | 45.96 | 33.05 | 20.60 | 19.37 |

| Number of Cites | 289 | 289 | 287 | 287 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| Dfi | −0.609 *** | −0.575 *** | −3.214 ** | −0.603 *** | −0.400 *** | −0.486 *** | −0.402 *** |

| (−4.26) | (−3.96) | (−2.32) | (−4.31) | (−2.91) | (−3.51) | (−3.11) | |

| _Cons | −4.088 ** | −3.705 ** | −60.154 ** | −4.083 ** | −3.860 *** | −2.426 | −4.936 ** |

| (−2.44) | (−2.19) | (−2.27) | (−2.45) | (−2.64) | (−1.59) | (−2.27) | |

| Control Variable | YES | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES | YES |

| City FE | YES | YES | YES | YES | YES | YES | YES |

| Obs | 1626 | 1649 | 192 | 1649 | 1649 | 1649 | 1632 |

| R2 | 0.307 | 0.298 | 0.395 | 0.304 | 0.301 | 0.276 | 0.429 |

| F Statistic | 19.51 | 19.20 | 6.04 | 19.93 | 20.29 | 14.53 | 11.67 |

| Number of Cites | 283 | 287 | 33 | 287 | 287 | 287 | 282 |

| Variable | Full Sample | Sample Excluding Hangzhou | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Stage One | Stage Two | Stage One | Stage Two | |

| Dfi | Crime | Dfi | Crime | |

| Dfi | −1.720 *** | −0.644 *** | ||

| (−5.90) | (−2.66) | |||

| Distance_HZ | −0.000 *** | −0.000 *** | ||

| (−11.35) | (−10.48) | |||

| Control Variable | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| City FE | YES | YES | YES | YES |

| Obs | 1648 | 1648 | 1588 | 1588 |

| R2 | 0.210 | 0.275 | ||

| F Statistic | 23.58 | 27.76 | ||

| Number of Cites | 286 | 286 | 276 | 276 |

| Fines | Education Level | ||||

|---|---|---|---|---|---|

| Variable | (1) | (2) | (3) | (4) | (4) |

| More than Mean | Less than Mean | Low | Middle | High | |

| Dfi | −0.523 *** | −0.334 ** | −0.470 *** | −0.455 *** | −0.682 ** |

| (−3.56) | (−2.50) | (−3.60) | (−3.62) | (−2.42) | |

| _Cons | −5.363 ** | 0.187 | −3.078 ** | −3.886 *** | −3.820 *** |

| (−2.56) | (0.16) | (−2.05) | (−2.59) | (−2.85) | |

| Control Variable | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes | Yes |

| Obs | 1649 | 1649 | 1649 | 1649 | 1529 |

| R2 | 0.232 | 0.195 | 0.282 | 0.280 | 0.175 |

| F Statistic | 18.28 | 8.89 | 17.47 | 17.44 | 9.36 |

| Number of Cites | 287 | 287 | 287 | 287 | 265 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Coverage_breadth | 0.129 | 0.061 | ||

| (0.96) | (0.52) | |||

| Usage_depth | −0.262 ** | −0.213 * | ||

| (−1.99) | (−1.79) | |||

| Digitization_level | −0.146 *** | −0.140 *** | ||

| (−4.52) | (−4.40) | |||

| _Cons | 0.469 | −1.206 | −2.029 | −2.583 |

| (0.24) | (−0.64) | (−1.19) | (−1.55) | |

| Control Variable | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| City FE | YES | YES | YES | YES |

| Obs | 1649 | 1649 | 1649 | 1649 |

| R2 | 0.276 | 0.280 | 0.304 | 0.307 |

| F Statistic | 20.21 | 19.01 | 19.99 | 18.52 |

| Number of Cites | 287 | 287 | 287 | 287 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Cash | Phone | E−Bike | |

| Dfi | −0.591 *** | −0.378 ** | −0.108 |

| (−2.69) | (−2.24) | (−0.59) | |

| _Cons | −2.293 | −5.734 *** | −5.205 *** |

| (−0.75) | (−2.87) | (−3.71) | |

| Control Variable | YES | YES | YES |

| Year FE | YES | YES | YES |

| City FE | YES | YES | YES |

| Obs | 1649 | 1649 | 1649 |

| R2 | 0.384 | 0.461 | 0.393 |

| F Statistic | 39.24 | 41.89 | 19.42 |

| Number of Cites | 287 | 287 | 287 |

| Economic Growth | Unemployment | |||||

|---|---|---|---|---|---|---|

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

| High | Low | High | Low | |||

| Dfi | 1.125 *** | −0.567 *** | −0.706 *** | −0.064 | −0.051 | −0.866 *** |

| (3.16) | (−3.90) | (−3.63) | (−0.65) | (−0.34) | (−4.53) | |

| PGDP × Dfi | −0.142 *** | |||||

| (−4.53) | ||||||

| Unemp × Dfi | 1.603 *** | |||||

| (3.25) | ||||||

| _Cons | −1.618 | −4.114 ** | −3.511 | −3.446 * | −4.304 ** | −3.553 |

| (−0.98) | (−2.41) | (−1.16) | (−1.88) | (−2.43) | (−0.92) | |

| Control Variable | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| City FE | YES | YES | YES | YES | YES | YES |

| Obs | 1649 | 1649 | 840 | 809 | 835 | 814 |

| R2 | 0.327 | 0.306 | 0.328 | 0.435 | 0.330 | 0.347 |

| F Statistic | 19.54 | 18.92 | 9.17 | 25.07 | 15.61 | 8.88 |

| Number of Cites | 287 | 287 | 145 | 142 | 147 | 140 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, X.; Yang, Y. RETRACTED: Can Digital Financial Inclusion Help Reduce Urban Crime? Evidence from Chinese Criminal Judgment on Theft Cases. Systems 2023, 11, 203. https://doi.org/10.3390/systems11040203

Xu X, Yang Y. RETRACTED: Can Digital Financial Inclusion Help Reduce Urban Crime? Evidence from Chinese Criminal Judgment on Theft Cases. Systems. 2023; 11(4):203. https://doi.org/10.3390/systems11040203

Chicago/Turabian StyleXu, Xianpu, and Yuxi Yang. 2023. "RETRACTED: Can Digital Financial Inclusion Help Reduce Urban Crime? Evidence from Chinese Criminal Judgment on Theft Cases" Systems 11, no. 4: 203. https://doi.org/10.3390/systems11040203

APA StyleXu, X., & Yang, Y. (2023). RETRACTED: Can Digital Financial Inclusion Help Reduce Urban Crime? Evidence from Chinese Criminal Judgment on Theft Cases. Systems, 11(4), 203. https://doi.org/10.3390/systems11040203