1. Introduction

Digitalization in banking means integration and adoption of digital and latest technology to enhance operational capacity and performance, delivering better and faster customer services, and paperless transactions through different banking applications [

1].

Previous studies in the banking field have shown that digitalization in the banking industry revolutionizes the operationalization of overall financial institutions [

2]. Digital banking helps improve customer relationships and banking processes, providing a better experience for both customers and employees. Therefore, the performance of financial institutions enhanced dramatically all around the world. Romania is also transforming its banking industry to digital banking by adopting emerging technologies and innovations.

Other studies discussing the issue of banking digitalization acknowledge that new technologies will also further improve the quality of services and intensify the growth in the banking sector, as well as the economic growth of the country [

3,

4]. Banking automation and digitalization will continue due to ongoing innovation in the banking system and also due to pressure from adjacent industries competing with the banking system in various segments.

Considering the COVID-19 epidemic effects, the traditional banking strategy has also been shaken. The crisis emphasized that it is no longer profitable to use traditional banking and therefore, it is required to rely on digital banking. As the pandemic accelerated the automation and digitalization of various processes in different market segments [

2,

5], the efforts for digital banking become faster than before, in order to embrace the new normal [

6].

Artificial intelligence has also forced the banking sector to move forward with digital banking. The new methods of machine and deep learning enable banking and financial organizations to perform better and enhance their capabilities for devising investment strategies in profitable securities and instruments. Connectivity, automation, Big Data, and innovation are the directions in which digital banking will influence the way value is created in banking [

7].

Understanding customer expectations forces banks to adapt their products and services. Interestingly, in Romania, the key component to be addressed in the development of financial services (in the post-Soviet context) is financial anxiety. Unlike in Western countries, in Central, Eastern, and South-Eastern Europe (CESEE), financial education is not always a panacea. In addition, financial security is not always the most important goal for consumers [

8]. Therefore, other parties should be involved in the digitalization of the banking sector in Romania, such as the Romanian Government, the European Union, the World Bank, and some other financial institutions that are interested in stimulating the banking industry of Romania to behave digitally. Government stability and public authority initiatives can generate trust in the banking sector and moreover, political events can also have an impact on the financial markets [

9]. Without government involvement, no policy can be implemented in any sector, so the suggestions for making policies and strategies by the Romanian Government for the adoption and transformation of a digital environment in the banking sector will be discussed further.

In this scenario, the goal of the current study is to scrutinize and understand the evolution of digitalization within the Romanian banking sector. We will introduce and discuss the new digital avenues of banking that have emerged in Romania, outlining their functional and operational procedures, as well as identifying the facilitators and obstacles encountered in the digitalization journey. Furthermore, given that individuals or customers constitute the central element in the banking sector, this paper intends to examine their attitudes towards digitalization, considering factors such as public accessibility to digital amenities (like the Internet and smartphones), customer familiarity with digital banking mediums, and the usage patterns of digital banking applications.

Proceeding forward, this research paper will inaugurate with an extensive and detailed literature review, which leans heavily on prior research pertaining to digital banking, with a special emphasis on the Romanian digital banking environment. Following the literature review section, we will articulate the hypotheses that guide this study. The methodology will delineate the research design, encompassing elements such as data collection procedures, data preparation, and the methods and techniques implemented for data analysis in this study. The section dedicated to data analysis and results will elucidate the research outcomes derived from the amassed data.

In the ensuing discussion segment, we will map the results in alignment with the insights garnered from the literature review. To conclude, the final segment will encapsulate the comprehensive findings of the study, offering pertinent recommendations to enhance the degree of digitalization in the Romanian banking sector.

4. Data Analysis and Results

The availability of data, which were published by the World Bank through The Global Findex Database [

65] narrows the view of the studied period. The Global Findex Database has been available since 2011, with this being collected only every 3 years, confining the data points to 2011, 2014, 2017, and 2021. For further advances in the study, we are looking forward to new available data sets, as the World Bank is one of the most comprehensive and regulated sources of supply side information.

When examining the use of various banking services in Romania compared to other regional countries (

Table 3), 2021 data indicates that 69% of Romanians possessed a bank account. This figure is lower than in neighboring countries, with Slovenia leading at a staggering 99%.

In terms of debit or credit card ownership in the same year, Romania lagged behind with only 55% of its population having one. This is in contrast to Bulgaria’s 72% and Croatia’s 73%. Once again, Slovenia topped the chart with 97%.

Furthermore, when considering the actual usage of debit or credit cards for transactions, only 42% of Romanians used these services in 2021. This stands in contrast with Bulgaria at 50%, Croatia at 60%, Poland at 81%, and Slovenia again dominating the leaderboard at 90%.

Despite advancements in Romania’s banking sector in areas like bank account accessibility and debit/credit card ownership and usage, the country still ranks at the bottom within the EU.

When examining digital banking (

Table 4), one factor to consider is the utilization of mobile phones or the Internet to review account balances [

54]. In 2021, 40% of Romanians employed this method, which was lower than several regional countries: Bulgaria with 46%, Croatia with 56%, and Hungary with 71%. Slovenia, once again, led the region, with 67% of its population using smartphones to check their bank account balances, as reported by The Findex Database from the World Bank.

When examining the adoption of various digital banking services, Romania registered a digital payment usage of 64% in 2021. This was lower than several neighboring countries, including Bulgaria at 75%, Croatia at 87%, the Slovak Republic at 95%, and Slovenia at a notable 97%. Analyzing the data in the context of educational levels reveals that in 2021, Romanians with primary education or less utilized digital banking tools at a rate of 33%, whereas those with secondary education or higher had a usage rate of 70%. This trend is consistent with the patterns observed in the other countries selected for this study. Additionally, a deeper dive into the data on digital payment usage based on income levels suggests that individuals with higher incomes tend to adopt digital payments more frequently.

Another aspect of digital banking explored in this study is the use of mobile phones or the Internet for utility bill payments [

55]. The 2021 data indicates that 34% of Romanians used these platforms for such payments. This was marginally higher than Bulgaria’s 31%, yet lower than Croatia’s 43%, Hungary’s 54%, Poland’s 70%, and the Slovak Republic’s 72%.

The findings highlight that Romania’s progress in banking digitalization, as gauged by the uptake of debit/credit cards, bank account ownership, and the use of digital platforms for account transactions, generally trails that of neighboring nations. Yet, it is significant to mention that Romania has shown consistent growth over time, with a notable increase in the adoption of these digital banking services.

We used several variables for our analysis listed in

Table 5. The correlation analysis in

Table 6 shows the association between digitalization and several aspects of the banking sector in Romania over the years. The results revealed a strong positive correlation between banking system Z-scores and other variables such as bank return on equity, bank return on assets, bank liquid assets to deposits, and short-term funding, suggesting that as digitalization improved in the country, it can be noticed an enhancement in the financial condition and stability of the banking industry over a period of time. Furthermore, the positive correlation between banking system capital and the Z-score shows that as digitalization progresses, there is an upsurge in the capitalization of banks. However, the negative relationship between bank non-interest income to total income and banking Z-score advocates that as digitalization improves, there may be a decrease in non-interest income due to self-digital services and non-cash transactions. These outcomes highlight the progressive correlation between digitalization and key financial indicators of the banking sector in Romania, contributing to its overall efficiency and stability.

The Globalization Index measures the extent to which a country is integrated into the global economy. It typically takes into account various variables that reflect a country’s level of economic, social, and political globalization.

Globalization often leads to expanded markets and opportunities, potentially increasing the profitability (and thus ROE) of banks that can successfully navigate the international market [

66]. Similar to ROE, globalization can potentially enhance ROA through increased business opportunities and efficiencies. However, the diversification of assets across borders can also bring new risks, potentially affecting ROA [

67].

In a globalized environment, banks have more opportunities for diversification, potentially affecting their liquidity positions [

64,

68]. Globalization encourages increased capital flows, potentially affecting the capital structures of banks [

69].

Globalization often spurs technological advancements and facilitates the integration of technology into daily life. In a globalized society, there is usually a higher penetration of Internet usage as countries aim to stay connected and competitive. Countries with a high Globalization Index often have better-developed infrastructures, including widespread Internet connectivity. This can mean that a larger proportion of the population has access to the Internet, either through public initiatives or private enterprise [

70].

The correlation analysis in

Table 7 between the Globalization Index and various banking indicators in the context of digitalization in Romania’s banking sector revealed a negative correlation between the Globalization Index and banking system Z-scores, saying that as globalization in the world grows, it poorly relates to the stability and soundness of the banking system. On the other side, positive relationships are observed among the Globalization Index and return on equity as well as bank return on assets, indicating that a higher degree of globalization may be connected with better productivity for banks in Romania. The weakly positive correlation between bank non-interest income to total income indicates a moderate relation due to digitalization and globalization.

Interestingly, the Globalization Index demonstrates slightly negative relationships with Internet users and mobile phone subscribers, representing that the progress in these digital facilities within Romania’s banking sector might be insignificantly related to the growing globalization.

Moreover, a weak negative correlation between the Globalization Index and the rate of change in real GDP suggests a slight and moderate relationship with overall economic growth in the banking sector. The indicated correlation coefficients imply that globalization may be related to different facets of digitalization within Romania’s banking sector. When devising policies and strategies, it is vital to take these connections into account to maximize the potential advantages of globalization, while ensuring that digitalization in the banking industry aligns with Romania’s economic and financial objectives.

The regression analysis was conducted using data from the Romanian banking sector, with banking system Z-scores as the dependent variable and several independent variables, including the Globalization Index, bank return on assets, bank return on equity, bank non-interest income to total income, Internet Users, mobile phone subscribers, economic growth, banking system capital, and bank liquid assets to deposits and short-term funding.

First, the regression statistics reveal several important insights. The multiple R of approximately 0.9867 indicates a very strong positive correlation between the dependent variable (banking system Z-scores) and the combination of independent variables. This suggests that these independent variables collectively have a significant impact on the health and stability of the Romanian banking system.

The R-squared (R2) value of 0.9735 is particularly noteworthy. It implies that approximately 97.35% of the variation in banking system Z-scores can be explained by the independent variables included in the model. This high R-squared value signifies that the model is exceptionally effective at capturing the factors influencing the stability and performance of the Romanian banking sector.

The adjusted R-square, though slightly lower at 0.9536, remains strong and accounts for potential model complexity. This adjusted value indicates that even when considering the number of independent variables, the model still provides a robust explanation of the variance in banking system Z-scores.

The standard error of about 0.6066 represents the average deviation of data points from the regression line. A lower standard error suggests that the model fits the data well, indicating that the selected independent variables provide a good fit for predicting banking system Z-scores in the Romanian banking sector.

The ANOVA results demonstrate that the regression model is highly significant. The F-statistic of 48.9516 with a very low p-value (4.3395 × 10−8) suggests that the model as a whole is statistically significant. This means that at least one of the independent variables included in the analysis significantly influences the banking system Z-scores within the Romanian banking sector.

In summary, the regression analysis (

Table 8) indicates that the selected independent variables play a crucial role in explaining the variation in banking system Z-scores in the Romanian banking sector. The model is highly effective, with a very high R-squared value, suggesting that it can be a valuable tool for understanding and predicting the health and stability of Romania’s banking system.

Table 9 contains the coefficients and related statistics for each independent variable in the regression model. The interpretation of these coefficients is the following:

Intercept: The intercept represents the value of the banking system Z-scores when all independent variables are zero. In this case, it is 13.70. A statistically significant intercept suggests that even in the absence of the considered factors, there is still a significant base value for banking system Z-scores.

Globalization Index (0–100): The coefficient for the Globalization Index is 0.01. However, its p-value is 0.82, which is quite high. This suggests that the Globalization Index is not statistically significant in explaining the variation in banking system Z-scores in the Romanian banking sector. The 95% confidence interval (−0.05 to 0.06) also includes zero, reinforcing its lack of significance.

Bank return on assets: The coefficient is 3.75, and the low p-value of 0.00 indicates strong statistical significance. This suggests that bank return on assets is a significant factor in explaining variations in banking system Z-scores. An increase in bank return on assets is associated with an increase in banking system Z-scores.

Bank return on equity: The coefficient is −0.29, and the p-value is 0.03, indicating statistical significance. A negative coefficient implies that a decrease in bank return on equity is associated with higher banking system Z-scores. This might indicate that a lower return on equity is related to higher stability or regulatory compliance.

Bank non-interest income to total income: The coefficient is −0.03, with a p-value of 0.60. This variable does not appear to be statistically significant in explaining the variation in banking system Z-scores.

Internet users: The coefficient is 0.02, but the p-value is 0.13, which is relatively high. This suggests that the number of Internet users as a percentage of the population may not be a statistically significant factor in explaining the banking system Z-scores in Romania.

Mobile phone subscribers: The coefficient is −0.04, with a p-value of 0.12. Similar to the Internet users variable, it does not appear to be statistically significant in this context.

Economic growth: The coefficient is −0.07, with a p-value of 0.11. While it is not highly statistically significant, there is a suggestion that a decrease in economic growth is associated with higher banking system Z-scores.

Banking system capital: The coefficient is 0.02, with a very high p-value of 0.90. This suggests that banking system capital as a percentage of assets is not statistically significant in explaining variations in banking system Z-scores in the Romanian banking sector.

Bank liquid assets to deposits and short-term funding: The coefficient is −0.03, with a p-value of 0.17. Similar to other variables, this does not seem to be statistically significant.

In summary, the significant variables that seem to have an impact on the banking system Z-scores in the Romanian banking sector are “Bank Return on Assets” and “Bank Return on Equity.” Other variables like the Globalization Index, Internet users, mobile phone subscribers, and banking system capital do not appear to be statistically significant in this context, as their coefficients have high p-values. Even though these digitalization variables seem to have low or no statistical significance, it could be due to their lagged effect. Digitalization implies higher costs for companies or banks, that are spread out over time. Among banks’ assets, the digitalization process plays a crucial role, as software programs and licenses represent valuable intangible assets.

DESI is an index that measures the digitalization level in a country or region. As banks adopt digital technologies, they become more vulnerable to cyber-attacks. This could be a risk of hacking, data breaches, or other cyber-attacks that can have a direct impact on a bank’s risk profile. Digitalization helps to improve banking operations, which can lead to cost savings over time and streamline processes, which can enhance metrics like return on assets (ROA) and return on equity (ROE). Moreover, improved digital services can attract customers and enhance their experience leading to higher revenues and customer retention. Nevertheless, digitalization is a useful tool that enables banks to diversify their revenue streams. This diversification can contribute to stability, as overreliance on a single source of income is reduced. A well-implemented digital infrastructure can make a bank more resilient. For example, cloud-based solutions can improve disaster recovery capabilities, ensuring the continuity of banking operations during these adverse events. Therefore, banks should be interested in DESI evolution over time.

Looking into the DESI report made by the European Commission [

59], surprisingly, cash-based dealings still hold an extensive share of 31%, meaning that a significant number of customers prefer paying for their online shopping with the cash-on-delivery option. Other payment methods comprise only 1% of total e-commerce transactions. Overall, this data indicates the variety of payment preferences of Romanians regarding card payments, bank transfers, digital wallets, cash-based transactions, and other methods.

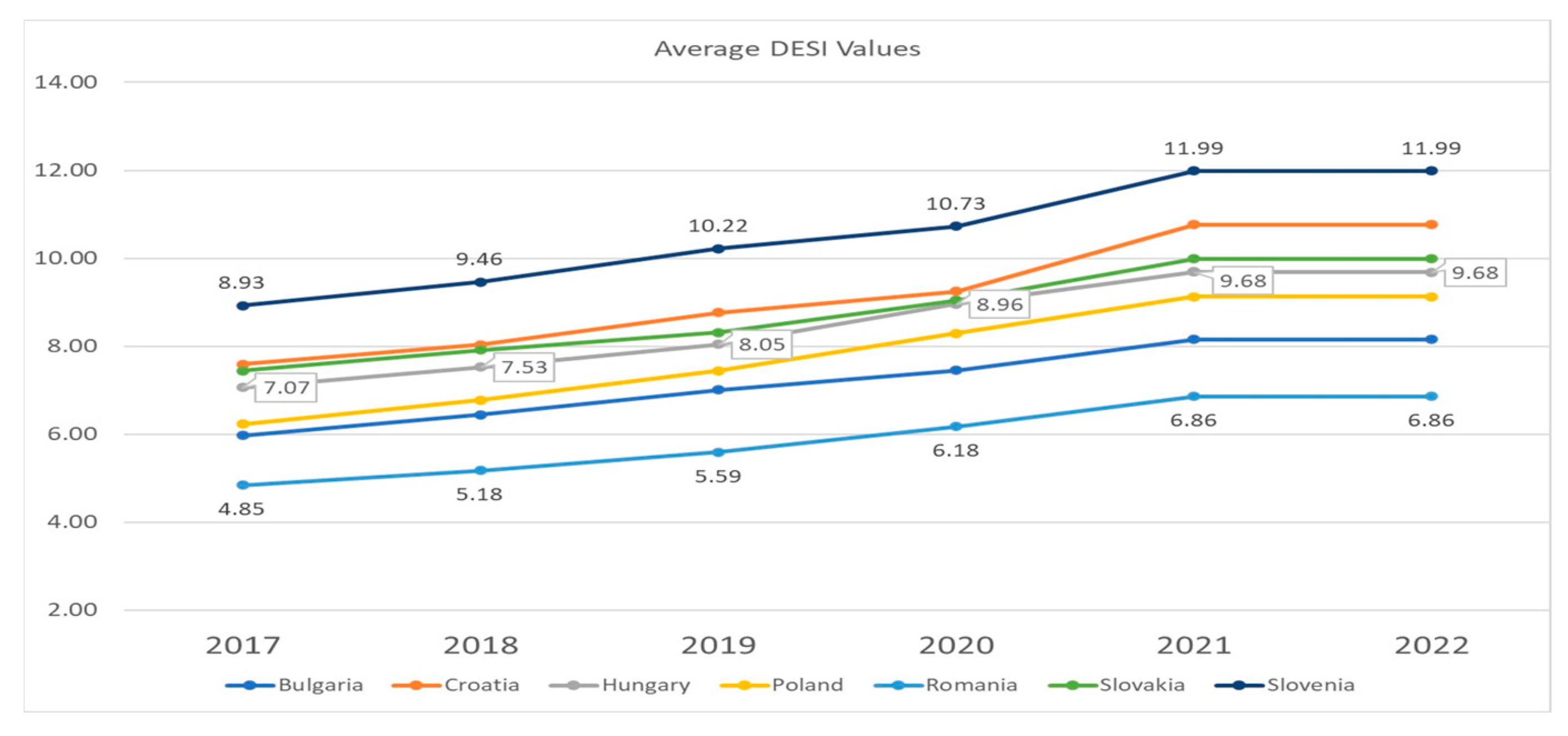

The evolution of the Digital Economy and Society Index (DESI) between 2017–2022 (

Figure 5) indicates Romania’s performance with other countries in the region comparatively.

With respect to Internet connectivity, the rank of Romania is consistently high from 2017 to 2022, with DESI scores of 11 or 12 throughout every year, representing a strong digital adoption and infrastructure. However, Romania is lagging behind with low digital public services, with DESI scores ranging from 4 to 8, suggesting wide room for improvement in this area for providing advanced digital services to the general public. DESI score for human capital development ranges from 2 to 8 representing the moderate level of progress in developing digital skills and knowledge. Lastly, when it comes to the examination of the integration of digital technology, Romania’s DESI score varies from 3 to 7, signifying a comparatively slower pace of transforming and integrating digital technology across sectors compared to other countries in the region. Overall, while Romania displays a strong point in Internet connectivity, there are areas such as human capital development, integration of digital technology, and digital public services, where the country could attempt further growth to catch up with its counterparts in the region.

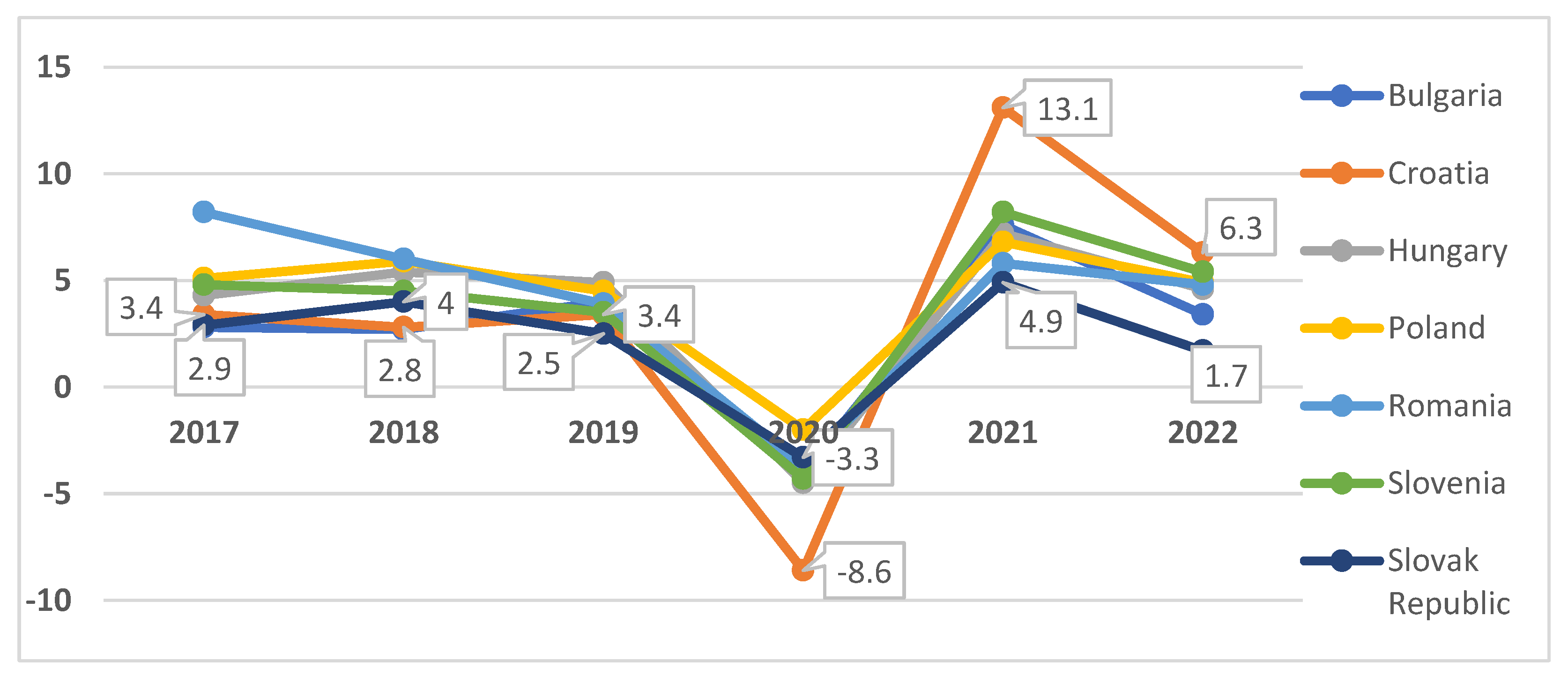

Figure 6 provides a summary of economic growth trends from 2017 to 2022 for the specified nations. In 2020, all these countries experienced a decline in GDP growth, a result of the significant impact of the COVID-19 pandemic. Notably, Slovenia and Croatia exhibited the most substantial GDP growth in 2021 and 2022. Romania had a 5.8% GDP growth in 2021 and 4.8% GDP growth in 2022, while Croatia scored a 13.1% GDP growth in 2021 and 6.3% in 2022. By contrast, Slovakia had a 4.9% GDP growth in 2021 and a 1.7% GDP growth in 2022. A comparison of

Figure 5 and

Figure 6 reveals a consistent trend: as digitalization levels increase, GDP growth also demonstrates higher levels.

The Internet connectivity index ANOVA analysis (

Table 10) with other regional nations indicates that Romania has a quite high level of Internet connectivity in the digital banking sector. Even though a

p-value > 0.05 shows there is no significant difference among means, a 9.76 average connectivity score suggests the country has made noteworthy development in digitizing its banking industry and ensuring reliable and continued Internet access for customers. This high connectivity index score shows the adoption and transformation of digital banking channels, easing online transactions, and improving access to monetary services for the public.

The ANOVA analysis (

Table 11) conducted on the digital public services scores for Romania and other regional countries shows significant differences in the level of digitalization in this segment. Romania’s average digital public services score for the last 6 years of 3.34 indicates a relatively low level of digitalization in providing online services to the public compared to other regional countries. The ANOVA test results (

p-value < 0.001) demonstrate a statistically significant difference in scores of digital public services among the countries. This recommends that Romania has some room and space for further improvement and advancement in terms of offering advanced digital services to its people as these services can help to improve digitalization in banking.

Another ANOVA analysis (

Table 12) of digital human capital index scores for different countries, including Romania, reveals significant disparities in digital human capital development. Romania’s average digital human capital score of 7.17 shows moderate progress in evolving digital skills and knowledge among its population compared to other regional countries. The ANOVA test outcomes show digital human capital scores statistically significant differences among the countries also presenting differences in the development of digital capabilities. Romania might need to emphasize additional efforts to enhance its digital human capital through education and training initiatives to catch up with other European countries that have greater scores.

Also, ANOVA test outcomes (

Table 13) indicate a statistically significant difference in the integration of digital technology scores between the countries, showing variations in the integration level of digital technologies. Romania might need to boost its efforts in integrating digital technology to run at the pace of other regional countries that have higher scores in this aspect. Further investments in digital infrastructure and technology adoption may contribute to enhancement in the digital banking sector in Romania as well.

5. Discussion

Valuable insights are revealed through the analysis in this research paper between digitalization and Romanian banking indicators. The hypothesis states a positive correlation between digital indicators and banking indicators, showing that with an increase in digitalization performance, the efficiency of corresponding banking operations also improves. The data and analysis presented in the research report back this hypothesis, validating a substantial level of digitalization in the Romanian banking sector.

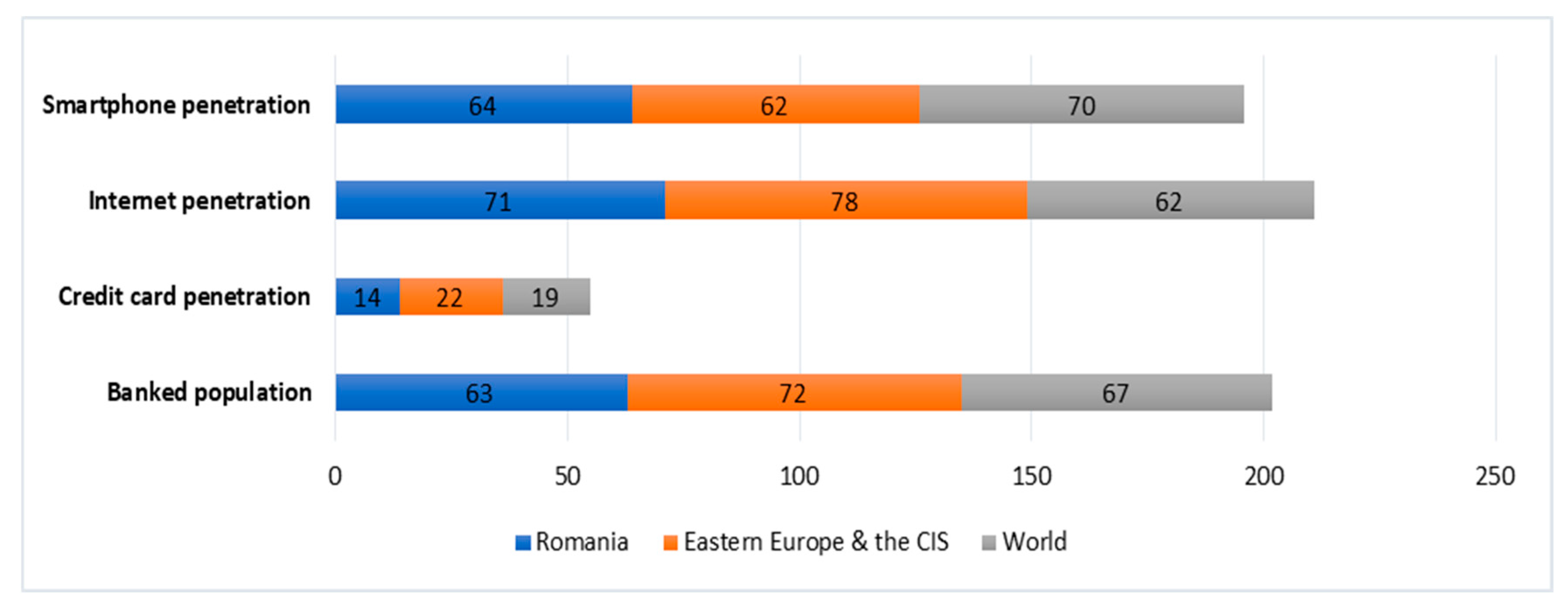

According to the data, an enormous proportion of the population in Romania employs many digital financial products and services. Contactless bank cards have gained extensive acceptance, with 70% of people utilizing them for payments. Mobile banking apps and Internet banking for browsers are also extensively utilized modes of payment, with acceptance rates of 65% and 53%, respectively. These statistics show a liking for online access to financial services. While mobile smart-watch payments and Revolut bank cards have lower adoption rates at 31% and 25%, respectively, they still contribute to the digitalization of the banking industry. On the other hand, digital signatures and consultation with bank staff through messenger apps have comparatively lesser acceptance rates at 11% and 8%, respectively.

When Romania is compared with other regions with respect to digital payment methods, it is observed that it lags behind in terms of credit card penetration, with a lower percentage compared to the Eastern Europe and the CIS region and the global average. However, Romania increased high Internet and smartphone penetration rates, representing promising conditions for the implementation of digital payment solutions. This proposes that while credit card practice may be less prevalent, the potential for further expansion of the digital payment network in Romania is significant.

A diverse range of payment preferences has been revealed through the analysis of e-commerce payments in Romania. Digital wallets and card-based payments are widespread ways and means, accounting for a substantial share of transactions. Bank transfers also found a significant share of payments, whereas cash-based dealings still grip a significant portion. This data highlights the diverse payment preferences of Romanian consumers in the e-commerce sector.

In terms of the correlation analysis, the financial health and stability of the banking industry observed a positive relation with the progression in digitalization. Strong positive associations are found between banking system Z-scores and other banking indicator variables such as return on equity, bank return on assets, bank liquid assets to deposits, and short-term funding. These outcomes recommend that digitalization can contribute to the overall stability and efficiency of the banking industry in Romania.

Further correlation analysis discloses the association between the Globalization Index and several banking variables. Whereas a negative correlation between the Globalization Index and banking system Z-scores suggests a weak relation between the strength of the banking organization, return on assets, and return on equity presents positive correlations with the Globalization Index. This advocates that a higher globalization level may lead to increased profitability for banks in Romania. Furthermore, a weak positive correlation between bank non-interest income to total income suggests the need to work on these indicators to improve performance and profitability. Interestingly, slightly negative correlations between the Globalization Index and Internet users, as well as mobile phone subscribers have been found in the analysis, showing a weak relationship between growing globalization and the progress of these digital services in the banking industry. Also, a weak negative correlation is observed between the Globalization Index and the degree of change in real GDP, leading to minor variations of overall economic development in the banking sector as globalization progresses.

The Romanian banking sector’s Z-scores appear to be primarily influenced by “Bank Return on Assets” (ROA) and “Bank Return on Equity” (ROE) as the regression analysis shows. In this context, other factors such as the Globalization Index, Internet users, mobile phone subscribers, and banking system capital do not exhibit statistical significance, as indicated by their high p-values. Hence, further studies are recommended subject to data availability to analyze the connection between digitalization and ROA and ROE. Digitalization can streamline operations, reduce costs, and improve efficiency.

The research paper also examines the performance of Romania in the Digital Economy and Society Index (DESI) in comparison with other countries in the region. Romania registers higher ranks in Internet connectivity, demonstrating a strong and sound digital infrastructure. However, the country is behind in human capital development, digital public services, and the integration of digital technology; these areas offer opportunities for progress to compete with counterparts in the respective region.

The Internet connectivity index analysis specifies that Romania has a high level of Internet connectivity in comparison with the EU-selected countries, which is very supportive of the digitalization of the banking industry. Although ANOVA did not find a significant difference among means, Internet connectivity offers a solid and sound footing for further digital advancements and innovation within the banking business, as it has one of the highest scores for 2017–2022 when compared with the analyzed countries.

On the subject of digital public services, Romania’s performance is somewhat lower compared to other countries in the region. The analysis recommends that efforts should be made to expand the accessibility and quality of digital public services, as they play a vital part in improving the overall digital environment and providing a unified experience for users.

The research paper highlights that there is a necessity for developing digital skills and knowledge among people to enable them to use digital banking services. While statistics show some progress in Romania in this sector, there is still room for improvement. Improving digital education and training programs can lead to a more digitally skilled workforce and consumers, fostering innovation and productivity.

Another important aspect in this study that has been discussed is the integration of digital technology across sectors in order to gain economic sustainability. Data-driven strategies and innovations in business processes considerably influence customer engagement, with the effects of data-driven approaches surpassing that of innovation. Furthermore, customer engagement markedly impacts a company’s competitive edge [

71]. The statistics show that when the banking industry adopted a high level of digitalization, other industries displayed varying digital adoption. The digital prowess of an organization should be shaped by digital innovation, which in turn can enhance the strategic performance of the business [

72]. Digitalization also encourages environmentally sustainable behaviors, which improves corporate social responsibility [

73,

74]. This advocates the need for stimulating digital transformation across all sectors and encouraging the growth of digital technologies to drive economic growth and effectiveness.

Theoretical and Practical Implications

Research on the digital transformation of the Romanian banking sector can have several theoretical implications, including shedding light on broader concepts and contributing to the academic understanding of various fields.

The research provides a deeper understanding of how consumers’ banking behaviors and preferences are changing with the advent of digital technology. This can potentially help in the development of more consumer-centric banking products and services. Also, it helps in understanding how digital transformation can lead to improved operational efficiencies and higher profitability for banks.

Moreover, our study discusses the regulatory implications of digital transformation. It can propose new regulatory frameworks that can ensure the safe and responsible growth of digital banking in Romania. However, another crucial aspect to note is the potential of digital transformation to ignite innovation within the banking sector, offering a significant competitive edge to those banks that rapidly integrate new technologies.

The research might delve into the larger societal impacts of the digital transformation of the banking sector, including its effects on job markets, economic growth, and societal well-being. Therefore, it examines how digital transformation can aid in increasing financial inclusion in Romania, particularly in remote and rural areas where traditional banking services might be limited.

The research provides theoretical insights into how the developments in the Romanian banking sector align with the broader trends and indicators as noted in the DESI. Our study highlights the theoretical implications of understanding how the Romanian banking sector compares with other European or global counterparts in terms of digital transformation, and what lessons can be learned from these comparisons.

In summary, research on the digital transformation of the Romanian banking sector has the potential to advance various theoretical domains, ranging from digital transformation theories to innovation, organizational change, customer behavior, and regulatory frameworks. These theoretical implications can provide valuable insights not only for academia but also for policymakers, practitioners, and stakeholders in the banking industry.

According to our research findings, digitalization exerts a favorable impact on bank returns. While the adoption of digital solutions may initially incur added expenses, Romanian banks are poised to reap long-term benefits by expediting customer query resolution. The digital transformation of Romanian banks presents the potential to curtail costs related to personnel and physical spaces, given the shift towards digital operations. These cost savings are expected to translate into augmented profits, reflected in elevated ROA and ROE metrics.