Determinants of the Price Paid at Auctions of Contemporary Art for Artworks by Twelve Artists

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data

2.2. Regression Modelling

3. Results and Discussion

3.1. Explanatory Performance

3.2. Type of Title

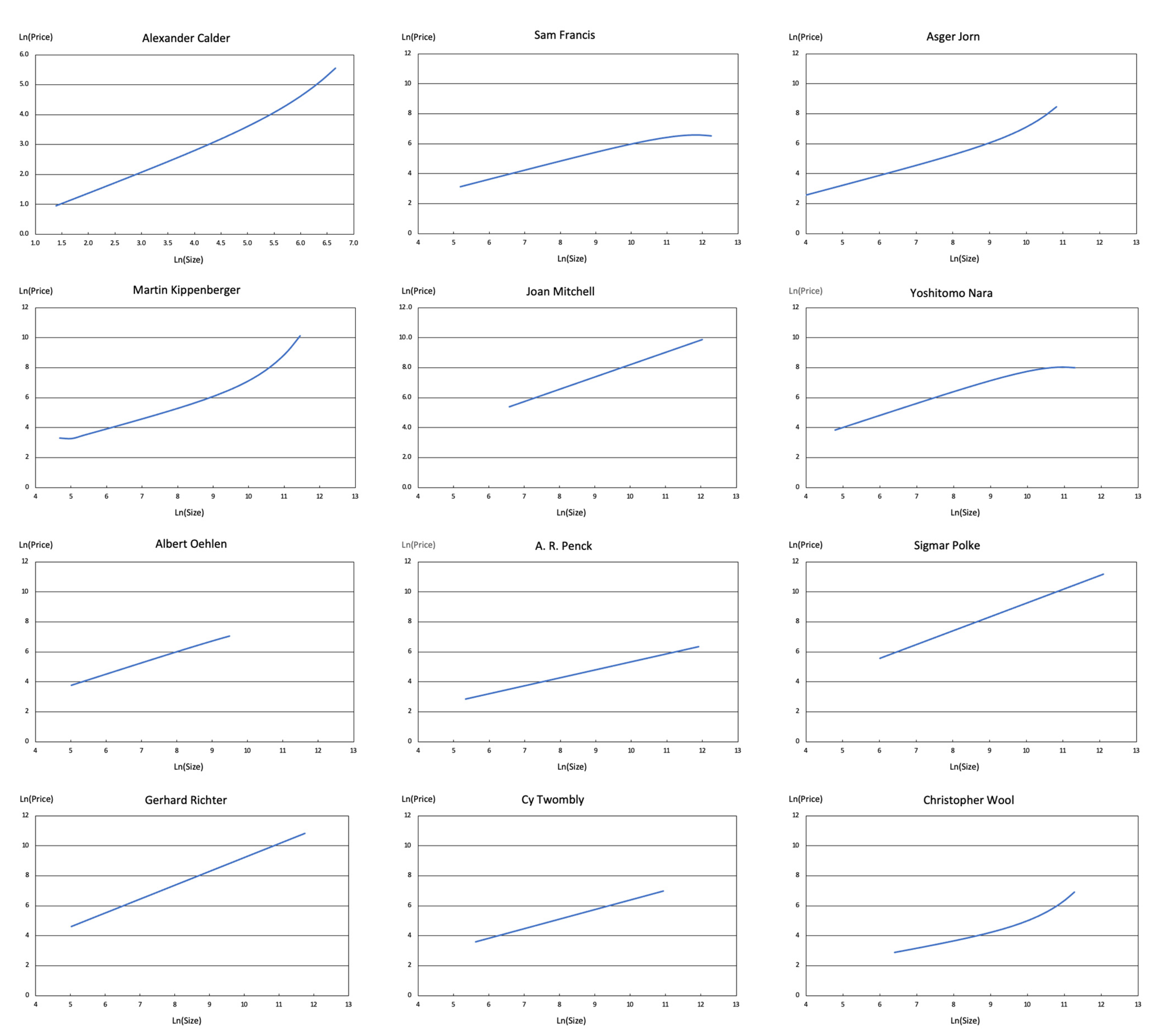

3.3. Size of Painting

3.4. Medium

3.5. Auction House and Location of Sale

3.6. Rate of Appreciation

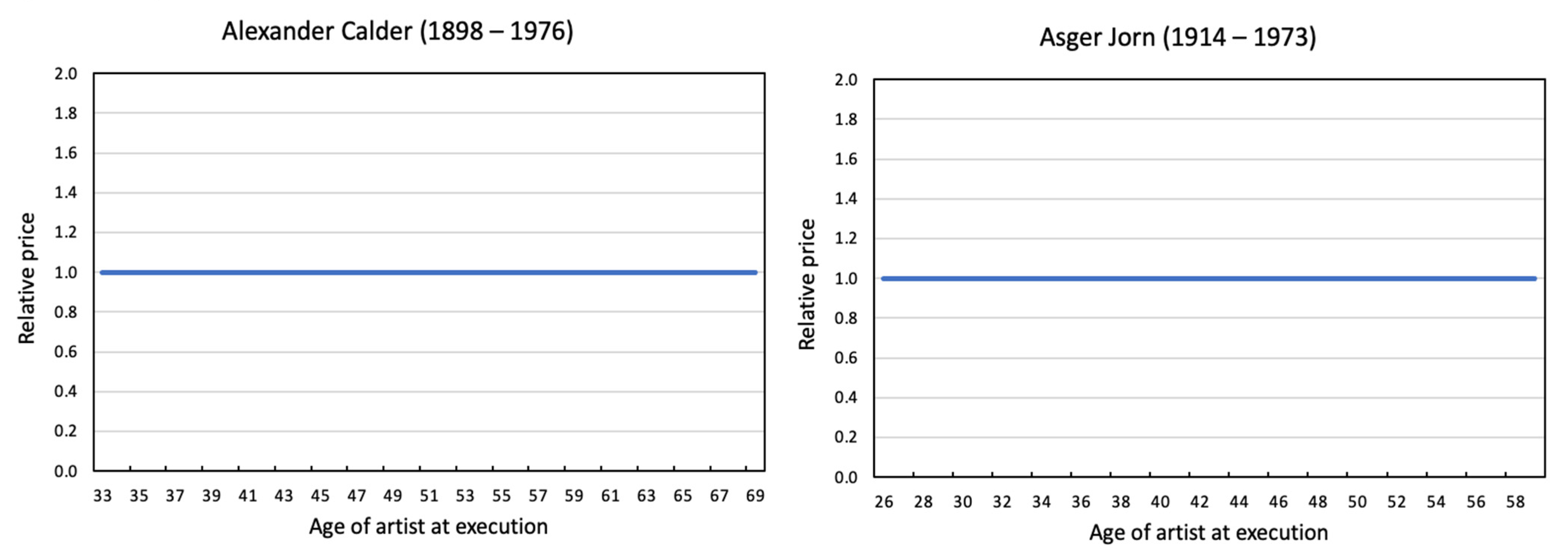

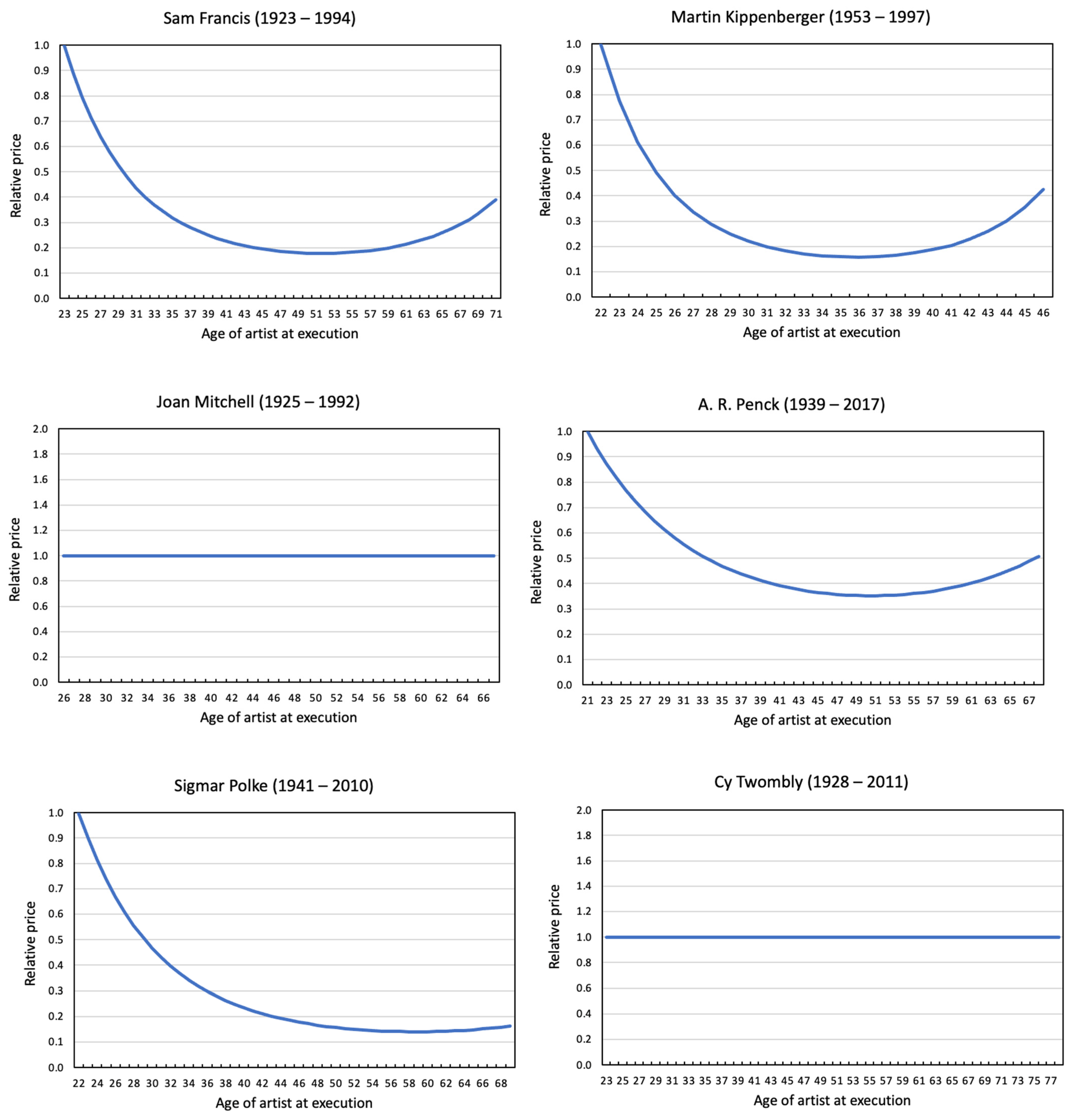

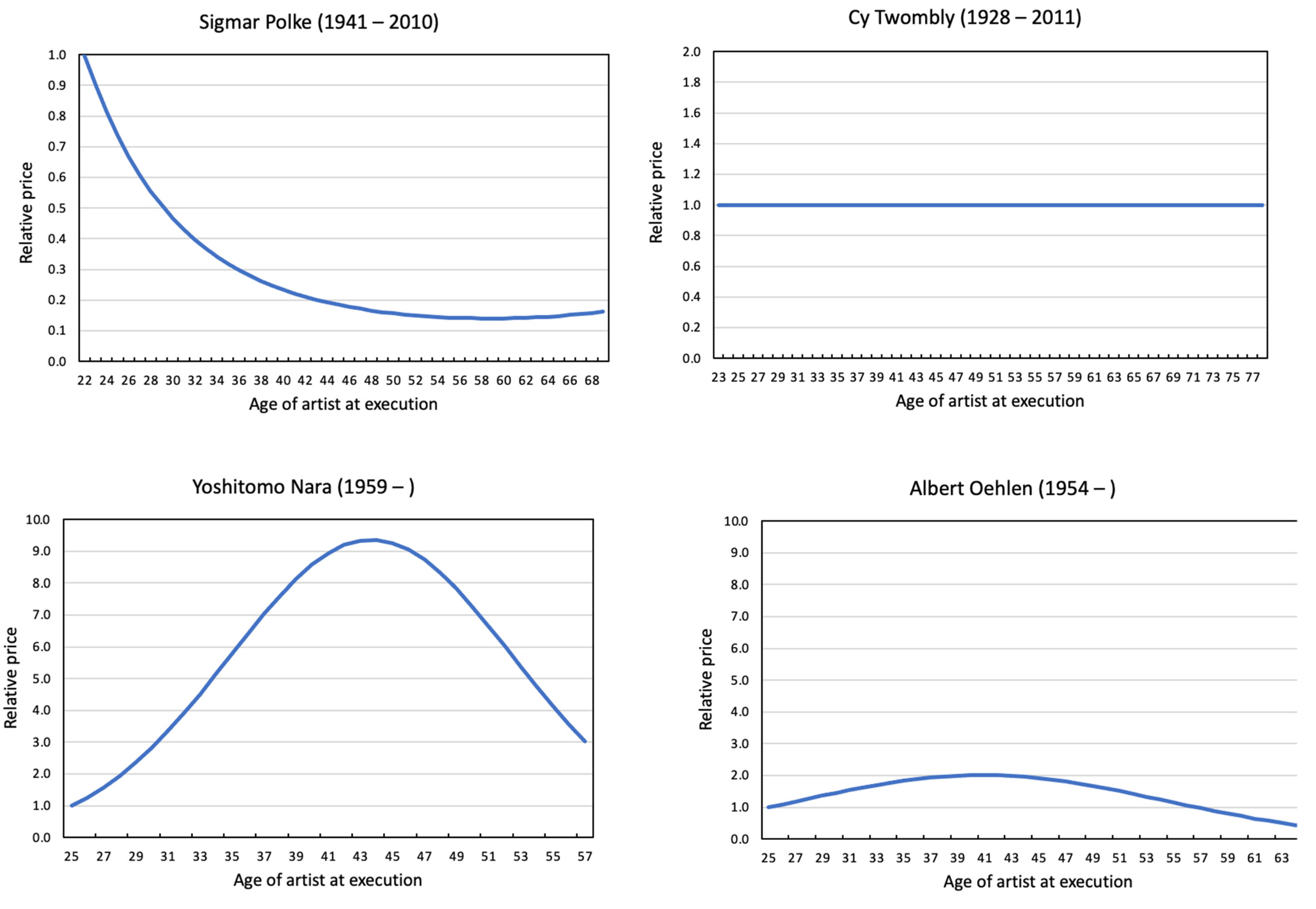

3.7. Age of Artist at Execution

4. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Appendix A. Descriptive Statistics on Sales Data

| Alexander Calder | Sam Francis | Asger Jorn | Martin Kippenberger | |

| Number of sales | 853 | 489 | 868 | 311 |

| Oil | n/a | 144 | 734 | 141 |

| Other medium | n/a | 345 | 134 | 170 |

| Sale at Sotheby’s or Christie’s | 797 | 375 | 391 | 182 |

| Sale at another auction house | 56 | 114 | 477 | 129 |

| Sale in the United States | 644 | 294 | n/a | 69 |

| Sale in the United Kingdom | 164 | 71 | 222 | 152 |

| Sale in France | n/a | n/a | 49 | n/a |

| Sale in Italy | n/a | n/a | 47 | n/a |

| Sale in the Netherlands | n/a | n/a | 135 | n/a |

| Sale in Hong Kong | n/a | n/a | n/a | n/a |

| Sale in China | n/a | n/a | n/a | n/a |

| Sale in native country (not US) | n/a | n/a | 341 | 63 |

| Sale in other country | 45 | 124 | 74 | 27 |

| Generic title | 311 | 330 | 267 | 63 |

| Generic title with bracketed subtitle | n/a | n/a | n/a | 36 |

| Specific title | 542 | 159 | 601 | 210 |

| Joan Mitchell | Yoshitomo Nara | Albert Oehlen | A. R. Penck | |

| Number of sales | 326 | 483 | 233 | 537 |

| Oil | n/a15 | 58 | 141 | 144 |

| Other medium | n/a | 425 | 92 | 393 |

| Sale at Sotheby’s or Christie’s | 289 | 288 | 158 | 258 |

| Sale at another auction house | 37 | 195 | 75 | 279 |

| Sale in the United States | 264 | 114 | 70 | 66 |

| Sale in the United Kingdom | n/a | 55 | 129 | 180 |

| Sale in France | n/a | n/a | n/a | n/a |

| Sale in Italy | n/a | n/a | n/a | 32 |

| Sale in the Netherlands | n/a | n/a | n/a | 28 |

| Sale in Hong Kong | n/a | 148 | n/a | n/a |

| Sale in China | n/a | 37 | n/a | n/a |

| Sale in native country (not US) | n/a | 100 | n/a | 166 |

| Sale in other country | 62 | 29 | 34 | 65 |

| Generic title | 152 | 105 | 81 | 153 |

| Generic title with bracketed subsitle | n/a | n/a | n/a | n/a |

| Specific title | 174 | 378 | 152 | 384 |

| Sigmar Polke | Gerhard Richter | Cy Twombly | Christopher Wool | |

| Number of sales | 412 | 458 | 232 | 364 |

| Oil | 34 | n/a16 | 102 | n/a17 |

| Other medium | 378 | n/a | 130 | n/a |

| Sale at Sotheby’s or Christie’s | 306 | 390 | n/a18 | 278 |

| Sale at another auction house | 106 | 68 | n/a | 86 |

| Sale in the United States | 136 | 191 | 150 | 262 |

| Sale in the United Kingdom | 188 | 212 | n/a | n/a |

| Sale in France | n/a | n/a | n/a | n/a |

| Sale in Italy | n/a | n/a | n/a | n/a |

| Sale in the Netherlands | n/a | n/a | n/a | n/a |

| Sale in Hong Kong | n/a | n/a | n/a | n/a |

| Sale in China | n/a | n/a | n/a | n/a |

| Sale in native country (not US) | 63 | 26 | n/a | n/a |

| Sale in other country | 25 | 29 | 82 | 102 |

| Generic title | 239 | 381 | 138 | 293 |

| Generic title with bracketed subtitle | n/a | n/a | 20 | n/a |

| Specific title | 173 | 77 | 94 | 71 |

| Alexander Calder | Sam Francis | Asger Jorn | Martin Kippenberger | |

| All sales | $969,444 | $387,312 | $99,918 | $439,290 |

| Oil | n/a | $947,878 | $111,553 | $695,978 |

| Other medium | n/a | $153,337 | $36,186 | $226,390 |

| Sale at Sotheby’s or Christie’s | $976,315 | $461,743 | $107,825 | $617,932 |

| Sale at another auction house | $871,657 | $142,475 | $93,436 | $187,252 |

| Sale in the United States | $1,018,565 | $521,982 | n/a | $643,008 |

| Sale in the United Kingdom | $869,191 | $219,454 | $124,395 | $559,833 |

| Sale in France | n/a | n/a | $73,478 | n/a |

| Sale in Italy | n/a | n/a | $80,225 | n/a |

| Sale in the Netherlands | n/a | n/a | $86,623 | n/a |

| Sale in Hong Kong | n/a | n/a | n/a | n/a |

| Sale in China | n/a | n/a | n/a | n/a |

| Sale in native country (not US) | n/a | n/a | $100,233 | $47,640 |

| Sale in other country | $631,837 | $164,128 | $81,125 | $153,914 |

| Generic title | $745,067 | $178,264 | $56,565 | $469,845 |

| Generic title with bracketed subtitle | n/a | n/a | n/a | $1,260,387 |

| Specific title | $1,098,192 | $821,187 | $119,178 | $289,073 |

| Joan Mitchell | Yoshitomo Nara | Albert Oehlen | A. R. Penck | |

| All sales | $1,400,519 | $324,640 | $457,214 | $54,439 |

| Oil | n/a | $221,139 | $483,122 | $68,525 |

| Other medium | n/a | $338,765 | $417,507 | $49,278 |

| Sale at Sotheby’s or Christie’s | $1,459,793 | $417,334 | $561,366 | $72,628 |

| Sale at another auction house | $937,452 | $187,739 | $237,799 | $37,620 |

| Sale in the United States | $1,452,888 | $332,650 | $430,298 | $73,074 |

| Sale in the United Kingdom | n/a | $303,981 | $575,070 | $76,560 |

| Sale in France | n/a | n/a | n/a | n/a |

| Sale in Italy | n/a | n/a | n/a | $33,364 |

| Sale in the Netherlands | n/a | n/a | n/a | $72,269 |

| Sale in Hong Kong | n/a | $573,967 | n/a | n/a |

| Sale in China | n/a | $226,949 | n/a | n/a |

| Sale in native country (not US) | n/a | $56,131 | n/a | $31,057 |

| Sale in other country | $1,117,528 | $110,448 | $65,469 | $36,669 |

| Generic title | $1,018,942 | $130,621 | $416,512 | $43,178 |

| Generic title with bracketed subtitle | n/a | n/a | n/a | n/a |

| Specific title | $1,733,851 | $378,535 | $478,903 | $58,926 |

| Sigmar Polke | Gerhard Richter | Cy Twombly | Christopher Wool | |

| All sales | $721,184 | $2,747,043 | $3,752,253 | $1,490,854 |

| Oil | $517,753 | n/a | $2,094,308 | n/a |

| Other medium | $739,482 | n/a | $5,053,102 | n/a |

| Sale at Sotheby’s or Christie’s | $910,316 | $3,057,826 | n/a | $1,698,828 |

| Sale at another auction house | $175,199 | $964,610 | n/a | $818,567 |

| Sale in the United States | $854,405 | $3,817,282 | $4,696,690 | $1,503,931 |

| Sale in the United Kingdom | $887,531 | $2,309,526 | n/a | n/a |

| Sale in France | n/a | n/a | n/a | n/a |

| Sale in Italy | n/a | n/a | n/a | n/a |

| Sale in the Natherlands | n/a | n/a | n/a | n/a |

| Sale in Hong Kong | n/a | n/a | n/a | n/a |

| Sale in China | n/a | n/a | n/a | n/a |

| Sale in native country (not US) | $114,049 | $298,474 | n/a | n/a |

| Sale in other country | $275,511 | $1,091,889 | $2,024,622 | $1,457,266 |

| Generic title | $354,047 | $2,365,214 | $3,537,800 | $1,338,854 |

| Generic title with brackted subtitle | n/a | n/a | $10,619,591 | n/a |

| Specific title | $1,228,385 | $4,636,350 | $2,560,324 | $2,118,125 |

| Alexander Calder | Sam Francis | Asger Jorn | Martin Kippenberger | |

| Real price: | ||||

| Mean | $969,444 | $387,312 | $99,918 | $439,290 |

| Standard deviation | ($1,314,641) | ($803,063) | ($127,566) | ($1,117,812) |

| Maximum | $10,253,968 | $6,574,452 | $1,338,200 | $11,848,249 |

| Minimum | $9987 | $3653 | $2267 | $1682 |

| Size: | ||||

| Mean | 117 | 18,758 | 4663 | 14,538 |

| Standard deviation | (96) | (25,056) | (4855) | (17,203) |

| Maximum | 777 | 209,000 | 50,301 | 93,183 |

| Minimum | 4 | 180 | 54 | 108 |

| Joan Mitchell | Yoshitomo Nara | Albert Oehlen | A. R. Penck | |

| Real price: | ||||

| Mean | $1,400,519 | $324,640 | $457,214 | $54,439 |

| Standard deviation | ($2,137,487) | ($522,930) | ($702,689) | ($65,412) |

| Maximum | $14,759,583 | $3,701,134 | $6,419,070 | $524,677 |

| Minimum | $6983 | $2360 | $3051 | $3575 |

| Size: | ||||

| Mean | 25,446 | 8217 | 38,097 | 17,624 |

| Standard deviation | (25,453) | (11,811) | (23,430) | (20,438) |

| Maximum | 168,534 | 80,155 | 131,130 | 145,000 |

| Minimum | 720 | 120 | 154 | 208 |

| Sigmar Polke | Gerhard Richter | Cy Twombly | Christopher Wool | |

| Real price: | ||||

| Mean | $721,184 | $2,747,043 | $3,752,253 | $1,490,854 |

| Standard deviation | ($1,886,358) | ($5,634,997) | ($8,874,366) | ($3,312,582) |

| Maximum | $25,850,726 | $44,897,321 | $67,722,441 | $28,543,510 |

| Minimum | $4263 | $10,519 | $17,665 | $2396 |

| Size: | ||||

| Mean | 18,779 | 17,196 | 16,699 | 24,762 |

| Standard deviation | (20,678) | (21,930) | (17,425) | (17,613) |

| Maximum | 180,000 | 126,266 | 160,550 | 78,111 |

| Minimum | 411 | 151 | 345 | 599 |

Appendix B. Regression Modelling Results

| Alexander Calder | Sam Francis | Asger Jorn | Martin Kippenberger | |

| Constant | 8.6766 *** (0.646) | 11.2378 *** (0.840) | 5.0770 *** (0.618) | 13.6768 *** (2.070) |

| Logarithm of Size | 0.6821 *** (0.044) | 0.6072 *** (0.036) | 0.6603 *** (0.040) | 0.7029 *** (0.085) |

| Size | 0.0013 *** (0.0004) | −0.0000044 * (0.0000025) | 0.000028 *** (0.000008) | 0.0000214 *** (0.000007) |

| Oil | n/a | 0.5245 *** (0.107) | 0.8736 *** (0.064) | 0.7706 *** (0.110) |

| Sale at Sotheby’s or Christie’s | 0.1526 ** (0.071) | 0.2812 *** (0.091) | 0.0897 (0.090) | 0.3451 ** (0.145) |

| Sale in the United States | 0.1515 * (0.087) | −0.1786 * (0.101) | n/a | 0.3756 * (0.202) |

| Sale in the United Kingdom | 0.1471 (0.093) | −0.3021 ** (0.117) | 0.0229 (0.106) | 0.2802 (0.191) |

| Sale in France | n/a | −0.0922 (0.110) | n/a | n/a |

| Sale in Italy | n/a | n/a | 0.1390 (0.109) | n/a |

| Sale in the Netherlands | n/a | n/a | −0.0346 (0.105) | n/a |

| Sale in Hong Kong | n/a | n/a | n/a | n/a |

| Sale in China | n/a | n/a | n/a | n/a |

| Sale in native country | n/a | n/a | 0.0457 (0.080) | 0.2308 (0.208) |

| Auction date, month | 0.0072 *** (0.0002) | 0.0014 *** (0.003) | 0.0006 ** (0.0002) | 0.0056 *** (0.001) |

| Specific title | 0.1149 *** (0.036) | 0.3135 *** (0.074) | 0.1977 *** (0.050) | 0.2548 ** (0.127) |

| Generic title with subtitle in brackets | n/a | n/a | n/a | 0.2041 (0.215) |

| Artist’s age at execution of work | −0.0277 (−0.020) | −0.2175 *** (0.028) | −0.0359 (0.025) | −0.6883 *** (0.121) |

| Artist’s age squared | 0.000039 (−0.00017) | 0.0020 *** (0.0003) | 0.0005 (0.0004) | 0.0096 *** (0.002) |

| Market dummy | inc. | inc. | inc. | n/a |

| Artist-specific dummy | n/a | inc. | inc. | n/a |

| R2 | 0.824 | 0.779 | 0.710 | 0.776 |

| Joan Mitchell | Yoshitomo Nara | Albert Oehlen | A. R. Penck | |

| Constant | 1.8675 ** (0.793) | −10.9991 *** (1.340) | −5.1928 *** (1.286) | 7.9502 *** (0.845) |

| Logarithm of Size | 0.8223 *** (0.062) | 0.8058 *** (0.038) | 0.7451 *** (0.065) | 0.5371 *** (0.055) |

| Size | −0.000044 (0.000034) | −0.000014 *** (0.000004) | −0.0000081 *** (0.0000027) | 0.0000012 (0.0000027) |

| Oil | n/a | 0.2348 ** (0.091) | 0.0820 (0.102) | 0.2030 *** (0.070) |

| Sale at Sotheby’s or Christie’s | 0.1177 (0.120) | 0.0869 (0.090) | 0.1893 * (0.102) | 0.0424 (0.136) |

| Sale in the United States | −0.1598 (0.134) | −0.0728 (0.153) | 0.3671 ** (0.153) | 0.1239 (0.178) |

| Sale in the United Kingdom | n/a | −0.0421 (0.164) | 0.3517 ** (0.154) | 0.3086 ** (0.154) |

| Sale in France | −0.2380 (0.164) | n/a | n/a | n/a |

| Sale in Italy | n/a | n/a | 0.2031 (0.141) | |

| Sale in the Netherlands | n/a | n/a | 0.2594 0.204 | |

| Sale in Hong Kong | n/a | 0.1002 (0.164) | n/a | n/a |

| Sale in China | n/a | 0.0194 (0.182) | n/a | |

| Sale in native country | n/a | −0.3755 ** (0.157) | n/a | −0.0836 (0.088) |

| Auction date, month | 0.0097 *** (0.0003) | 0.0096 *** (0.001) | 0.0120 ** (0.001) | 0.0002 (0.0005) |

| Specific title | −0.0289 (0.079) | 0.4627 *** (0.080) | 0.2172 ** (0.105) | 0.1371 ** (0.063) |

| Generic title with subtitle in brackets | n/a | n/a | n/a | n/a |

| Artist’s age at execution of work | 0.0173 (0.0026) | 0.5495 *** (0.064) | 0.2287 *** (0.056) | −0.1180 *** (0.026) |

| Artist’s age squared | −0.0003 (0.0002) | −0.0062 *** (0.001) | −0.0028 *** (0.0007) | 0.0011 *** (0.0003) |

| Market dummy | inc. | n/a | inc. | inc. |

| Artist-specific dummy | n/a | n/a | n/a | inc. |

| R2 | 0.865 | 0.798 | 0.812 | 0.604 |

| Sigmar Polke | Gerhard Richter | Cy Twombly | Christopher Wool | |

| Constant | 4.6865 *** (0.909) | 1.0582 (1.916) | 4.3797 ** (1.701) | −11.4618 *** (2.909) |

| Log of Size | 0.9250 *** (0.067) | 0.9233 *** (0.048) | 0.6386 *** (0.173) | 0.4476 *** (0.126) |

| Size | −0.0000032 (0.0000028) | −0.000003 (0.000003) | 0.000014 (0.000013) | 0.0000241 *** (0.000007) |

| Oil | −0.0581 (0.148) | n/a | −0.1123 (0.133) | n/a |

| Sale at Sotheby’s or Christie’s | 0.1314 (0.159) | 0.2072 ** (0.103) | n/a | 0.2418 ** (0.122) |

| Sale in the United States | 0.7140 *** (0.200) | 0.4170 *** (0.147) | 1.0012 *** (0.299) | 0.0828 (0.126) |

| Sale in the United Kingdom | 0.8170 *** (0.203) | 0.3989 *** (0.146) | 0.9064 *** (0.300) | n/a |

| Sale in France | n/a | n/a | n/a | n/a |

| Sale in Italy | n/a | n/a | n/a | n/a |

| Sale in the Netherlands | n/a | n/a | n/a | n/a |

| Sale in Hong Kong | n/a | n/a | n/a | n/a |

| Sale in China | n/a | n/a | n/a | n/a |

| Sale in native country | 0.3243 (0.200) | 0.4449 ** (0.209) | n/a | n/a |

| Auction date, month | 0.0075 *** (0.0005) | 0.0119 *** (0.0003) | 0.0085 *** (0.001) | 0.0153 *** (0.001) |

| Specific title | 0.2485 *** (0.092) | 0.0692 (0.087) | −0.4015 *** (0.127) | 0.3725 *** (0.143) |

| Generic title with subtitle in brackets | n/a | n/a | 0.0142 (0.250) | |

| Artist’s age at execution of work | −0.1706 *** (0.029) | 0.1541 ** (0.069) | −0.0077 (0.045) | 0.6480 *** (0.139) |

| Artist’s age squared | 0.0014 *** (0.0003) | −0.0012 ** (0.001) | −0.00007 (0.0004) | −0.0080 *** (0.002) |

| Market dummy | inc. | inc. | inc. | n/a |

| Artist-specific dummy | n/a | n/a | n/a | n/a |

| R squared | 0.705 | 0.862 | 0.719 | 0.725 |

| 1 | For an introduction to hedonic modelling see Sopranzetti (2014). |

| 2 | The many ways in which artists have used such titles is one of the themes traced out by John Welchman in his history of titles in the Western visual arts tradition (Welchman 1997). For a quantitative art historical analysis see Bowman (2022) (accessed on 20 March 2022). |

| 3 | The Artprice database can be found at https://Artprice.com (acessed on 20 March 2022). |

| 4 | The Artprice database allows the user to search by the title of the work and automatically translates all searches in English into Chinese, French, German, Italian, and Spanish. |

| 5 | In doing this I have relied upon the categorisation given by Artprice, which groups works into sculptures, paintings, drawings, and prints or editions. |

| 6 | Artprice defines a ‘contemporary’ artist as someone born after 1945. |

| 7 | Gerhard Richter’s official website can be found at http://www.gerhardrichter.com/ (accessed on 20 March 2022). |

| 8 | June 2019, the most recent month for which auction sales data was obtained, is the reference month. Prices have been adjusted using the CPI. |

| 9 | Examination of the Artprice data showed that in some instances the same work was reported as being in oil by one auction house and in unspecified ‘mixed media’ by another. To the extent that collectors were influenced by the description of the medium rather than that of the painting itself, this will have affected my modelling results, tending to reduce the size and significance of any impact on the sales price of a painting being in oil compared to other media. |

| 10 | My models include the natural logarithms of the price and size. These transformations improve the model fit as the distributions of price and size for all of the artists are skewed with small numbers of very high price and very large artworks. |

| 11 | For Joan Mitchell, A. R. Penck, Sigmar Polke, Gerhard Richter and Cy Twombly the coefficient of size was not statistically significant and has been set to zero. |

| 12 | All of the paintings in my dataset by Joan Mitchell and by Gerhard Richter were executed in oil, whereas only two of Christopher Wool’s are recorded as having been executed in oil. |

| 13 | As a result of the different ways in which auction houses and locations are categorised it is not possible to make a quantitative comparison between my results and other studies, nor between those studies themselves. |

| 14 | Artprice excludes works by artists born pre-war such as Alexander Calder, Gerhard Richter and Cy Twombly whose auction sales remain concentrated in the United States and Europe. If these artists are included, sales of contemporary art in London continue to exceed those in China. |

| 15 | All of Joan Mitchell’s sales were for paintings exexuted in oil. |

| 16 | 456 of Gerhard Richter’s sales were of paintings executed in oil. |

| 17 | 362 of Christopher Wool’s sales were of paintings not executed in oil. |

| 18 | 213 of Cy Twombly’s sales were at auctions held by Sotheby’s or Christie’s. |

| 19 | For Alexander Calder the size is in cm, for all other artists the size is in cm2. |

References

- Agnello, Richard J., and Renée K. Pierce. 1996. Financial Returns, Price Determinants, and Genre Effects in American Art Investment. Journal of Cultural Economics 20: 359–83. [Google Scholar] [CrossRef]

- Anderson, Robert C. 1974. Painting as an Investment. Economic Inquiry 12: 13–26. [Google Scholar] [CrossRef]

- Artprice. 2019. The Art Market Report in 2019. Available online: https://www.Artprice.com/artprice-reports/the-art-market-in-2019 (accessed on 20 March 2022).

- Artprice. 2020. 20 Years of Contemporary Art Auction History. Available online: https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2020 (accessed on 20 March 2022).

- Atkins, Guy, ed. 1968–1980. Asger Jorn: Catalogue Raisonné. London: Lund Humphries, vols. 1–4. [Google Scholar]

- Aubry, Mathieu, Roman Kräussl, Gustavo Manso, and Christophe Spaenjers. 2019. Biased Auctioneers. SSRN Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3347175 (accessed on 20 March 2022).

- Beggs, Alan, and Kathryn Graddy. 2009. Anchoring Effects: Evidence from Art Auctions. The American Economic Review 99: 1027–39. [Google Scholar] [CrossRef] [Green Version]

- Bowman, Mike. 2022. Writing by Numbers; Case Studies in Digital Art History. Unpublished Ph.D. Thesis, Birkbeck, University of London; pp. 179–83. Available online: https://eprints.bbk.ac.uk/id/eprint/47552/ (accessed on 20 March 2022).

- Calder, Alexander. 1966. Calder: An Autobiography with Pictures. New York: Pantheon Books. [Google Scholar]

- De la Barre, Madeleine, Sophie Docclo, and Victor Ginsburgh. 1994. Returns of Impressionist, Modern and Contemporary European Paintings, 1962–91. Annales d’Économique et de Statistique 35: 143–81. [Google Scholar] [CrossRef]

- Franklin, Margery B., Robert C. Becklen, and Charlotte L. Doyle. 1993. The Influence of Titles on How Paintings Are Seen. Leonardo 26: 103–8. [Google Scholar] [CrossRef]

- Galenson, David. 1997. The Careers of Modern Artists: Evidence from Auctions of Contemporary Paintings. NBER Working Paper 6331. Available online: https://www.nber.org/papers/w6331 (accessed on 20 March 2022).

- Godfrey, Mark. 2012. Tate Modern Panorama Symposium. April 4. Available online: https://www.youtube.com/watch?v=njrU715rW9Y&list=PL906E6634732C1824&index=3&ab_channel=GerhardRichterVideos (accessed on 20 March 2022).

- Halbreich, Kathy, ed. 2014. Alibis: Sigmar Polke 1962–2010. London: Tate Publishing. [Google Scholar]

- Higgs, Helen, and Andrew Worthington. 2005. Financial Returns and Price Determinants in the Australian Art Market, 1973–2003. The Economic Record 81: 113–23. [Google Scholar] [CrossRef] [Green Version]

- Higgs, Helen, and John Forster. 2011. The Auction Market for Artworks and Their Physical Dimensions Including the Golden Ratio: Australia: 1986 to 2009. SSRN Research Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1867836 (accessed on 20 March 2022).

- Hodgson, Douglas J. 2011. Age-price profiles for Canadian painters at auction. Journal of Cultural Economics 35: 287–308. [Google Scholar] [CrossRef] [Green Version]

- Horowitz, Noah. 2011. Art of the Deal: Contemporary Art in a Global Financial Market. Princeton and Oxford: Princeton University Press. [Google Scholar]

- Jacobus, Mary. 2016. Reading Cy Twombly: Poetry in Paint. Princeton: Princeton University Press. [Google Scholar]

- Kurczynski, Karen. 2014. The Art and Politics of Asger Jorn: The Avant-Garde Won’t Give Up. London: Ashgate. [Google Scholar]

- Larry’s List. 2015. Private Art Museum Report. Hong Kong: Larry’s List, Available online: https://www.larryslist.com/report/Private%20Art%20Museum%20Report.pdf (accessed on 20 March 2022).

- Long, J. Scott, and Laurie H. Ervin. 2000. Using Heteroscedasticity Consistent Standard Errors in the Linear Regression Model. The American Statistician 54: 217–24. [Google Scholar]

- Mason, Brook. 2017. What is Driving the Soaring Demand for Art Storage? Apollo: The International Art Magazine, June 27, 67–68. [Google Scholar]

- Mehring, Christine. 2012. Richter’s Willkür. Art Journal 71: 20–35. [Google Scholar] [CrossRef]

- Mullennix, John W., and Julien Robinet. 2018. Art Expertise and the Processing of Titled Abstract Art. Perception 47: 359–78. [Google Scholar] [CrossRef] [PubMed]

- Nochlin, Linda. 2002. Joan Mitchell a Rage to Paint. In The Paintings of Joan Mitchell. Edited by Jane Livingston. Berkeley: University of California Press. [Google Scholar]

- Oosterlinck, Kim, and Anne-Sophie Radermecker. 2018. ”The Master of …”: Creating names for art history and the art market. Journal of Cultural Economics 43: 57–95. [Google Scholar] [CrossRef] [Green Version]

- Park, JooYeon, Jihye Park, and Ji Hyon Park. 2021. What Type of Title Would You Put on Your Paintings? The impact on the Price of Artwork According to Its Title. Empirical Studies of the Arts 40: 57–80. [Google Scholar] [CrossRef]

- Radermecker, Anne-Sophie. 2019. Artworks without names: An insight into the market for anonymous paintings. Joural of Cultural Economics 43: 443–83. [Google Scholar] [CrossRef] [Green Version]

- Renneboog, Luc, and Christophe Spaenjers. 2013. Buying Beauty: On Prices and Returns in the Art Market. Management Science 59: 36–53. [Google Scholar] [CrossRef]

- Renneboog, Luc, and Tom van Houtte. 2002. The Monetary Appreciation of Paintings: From Realism to Magritte. Cambridge Journal of Economics 26: 331–57. [Google Scholar] [CrossRef] [Green Version]

- Smith, Terry. 2009. What is Contemporary Art? Chicago: Chicago University Press. [Google Scholar]

- Sopranzetti, Ben. 2014. Hedonic Regression Models. In Handbook of Financial Econometrics and Statistics. Edited by Cheng-Few Lee and John C. Lee. New York: Springer, pp. 2119–34. [Google Scholar]

- Stepanova, Elena. 2015. The Impact of Color Palettes on the Prices of Paintings. SSRN Research Paper. July. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2807443 (accessed on 20 March 2022).

- Storr, Robert, ed. 2002. Gerhard Richter: Forty Years of Painting. New York: The Museum of Modern Art. [Google Scholar]

- Thompson, Don. 2008. The $12 Million Stuffed Shark. London: Aurum. [Google Scholar]

- Ursprung, Heinrich W., and Christian Wiermann. 2008. Reputation, Price, and Death: An Empirical Analysis of Art Price Formation. CESifo Working Paper, No. 2237. Available online: https://www.econstor.eu/handle/10419/26282 (accessed on 20 March 2022).

- Velthuis, Olav. 2005. Talking Prices: Symbolic Meanings of Prices on the Market for Contemporary Art. Princeton and Oxford: Princeton University Press, pp. 97–116. [Google Scholar]

- Vosilov, Rustam. 2015. Art Auction Prices: Home Bias, Familiarity and Patriotism. SSRN Research Paper. August. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2686527 (accessed on 20 March 2022).

- Welchman, John. 1997. Invisible Colors: A Visual Hisory of Titles. New Haven and London: Yale University Press. [Google Scholar]

- Westheider, Ortrud, and Michael Philipp, eds. 2020. Gerhard Richter: Abstraction. Munich: Prestel. [Google Scholar]

- White, Harrison C., and Cynthia A. White. 1965. Canvases and Careers: Institutional Change in the French Painting World. New York: J. Wiley & Sons. [Google Scholar]

| Artist: | Alexander Calder (1898–1976) | Sam Francis (1923–1994) | Asger Jorn (1914–1973) | Martin Kippenberger (1953–1997) |

| Nationality: | American | American | Danish | German |

| Artist: | Joan Mitchell (1925–1992) | Yoshitomo Nara (1959) | Albert Oehlen (1954) | A. R. Penck (1939–2017) |

| Nationality: | American | Japanese | German | German |

| Artist: | Sigmar Polke (1941–2010) | Gerhard Richter (1932) | Cy Twombly (1928–2011) | Christopher Wool (1955) |

| Nationality: | German | German | American | American |

| Calder | Francis | Jorn | Kippenberger | Mitchell | Nara |

| 0.824 | 0.779 | 0.710 | 0.765 | 0.865 | 0.798 |

| Oehlen | Penck | Polke | Richter | Twombly | Wool |

| 0.812 | 0.604 | 0.705 | 0.862 | 0.719 | 0.725 |

| Type of Title | Calder | Francis | Jorn | Kippenberger | Mitchell | Nara |

| Specific | 12.2% | 36.8% | 21.9% | 29.5% | not sig | 58.8% |

| Untitled with bracketed sub-title | n/a | n/a | n/a | not sig | n/a | n/a |

| Type of title | Oehlen | Penck | Polke | Richter | Twombly | Wool |

| Specific | 24.3% | 14.7% | 28.1% | not sig | −33.1% | 45.1% |

| Untitled with bracketed sub-title | n/a | n/a | n/a | n/a | not sig | n/a |

| Calder | Francis | Jorn | Kippenberger | Mitchell | Nara |

| n/a | 69.9% | 139.6% | 116.1% | n/a | 26.5% |

| Oehlen | Penck | Polke | Richter | Twombly | Wool |

| not sig | 22.5% | not sig | n/a | not sig | n/a |

| Calder | Francis | Jorn | Kippenberger | Mitchell | Nara |

| 16.5% | 32.5% | not sig | 41.2% | not sig | not sig |

| Oehlen | Penck | Polke | Richter | Twombly | Wool |

| 20.8% | not sig | not sig | 23.0% | n/a | 27.4% |

| Location | Calder | Francis | Jorn | Kippenberger | Mitchell | Nara |

| US | 16.4% | −16.4% | n/a | 45.6% | not sig | not sig |

| UK | 15.9% | −26.1% | not sig | 32.3% | n/a | not sig |

| France | n/a | not sig | −16.0% | n/a | n/a | n/a |

| Italy | n/a | n/a | not sig | n/a | n/a | n/a |

| Netherlands | n/a | n/a | not sig | n/a | n/a | n/a |

| Hong Kong | n/a | n/a | n/a | n/a | n/a | not sig |

| China | n/a | n/a | n/a | n/a | n/a | not sig |

| Home Country (not US) | n/a | n/a | not sig | not sig | n/a | −31.3% |

| Location | Oehlen | Penck | Polke | Richter | Twombly | Wool |

| US | 44.4% | not sig | 104.3% | 51.7% | 172.2% | not sig |

| UK | 42.2% | 36.2% | 126.4% | 49.0% | 147.5% | n/a |

| France | n/a | n/a | n/a | n/a | n/a | n/a |

| Italy | n/a | not sig | n/a | n/a | n/a | n/a |

| Netherlands | n/a | not sig | n/a | n/a | n/a | n/a |

| Hong Kong | n/a | n/a | n/a | n/a | n/a | n/a |

| China | n/a | n/a | n/a | n/a | n/a | n/a |

| Home Country (not US) | n/a | not sig | 38.4% | 56.0% | n/a | n/a |

| Calder | Francis | Jorn | Kippenberger | Mitchell | Nara |

| 9.0% | 1.7% | 0.7% | 7.0% | 10.9% | 12.2% |

| Oehlen | Penck | Polke | Richter | Twombly | Wool |

| 15.5% | not sig | 9.4% | 15.3% | 10.7% | 20.2% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bowman, M. Determinants of the Price Paid at Auctions of Contemporary Art for Artworks by Twelve Artists. Arts 2022, 11, 66. https://doi.org/10.3390/arts11030066

Bowman M. Determinants of the Price Paid at Auctions of Contemporary Art for Artworks by Twelve Artists. Arts. 2022; 11(3):66. https://doi.org/10.3390/arts11030066

Chicago/Turabian StyleBowman, Mike. 2022. "Determinants of the Price Paid at Auctions of Contemporary Art for Artworks by Twelve Artists" Arts 11, no. 3: 66. https://doi.org/10.3390/arts11030066

APA StyleBowman, M. (2022). Determinants of the Price Paid at Auctions of Contemporary Art for Artworks by Twelve Artists. Arts, 11(3), 66. https://doi.org/10.3390/arts11030066