Hidden Blemish in European Law: Judgements on Unconventional Monetary Programmes

Abstract

1. Introduction

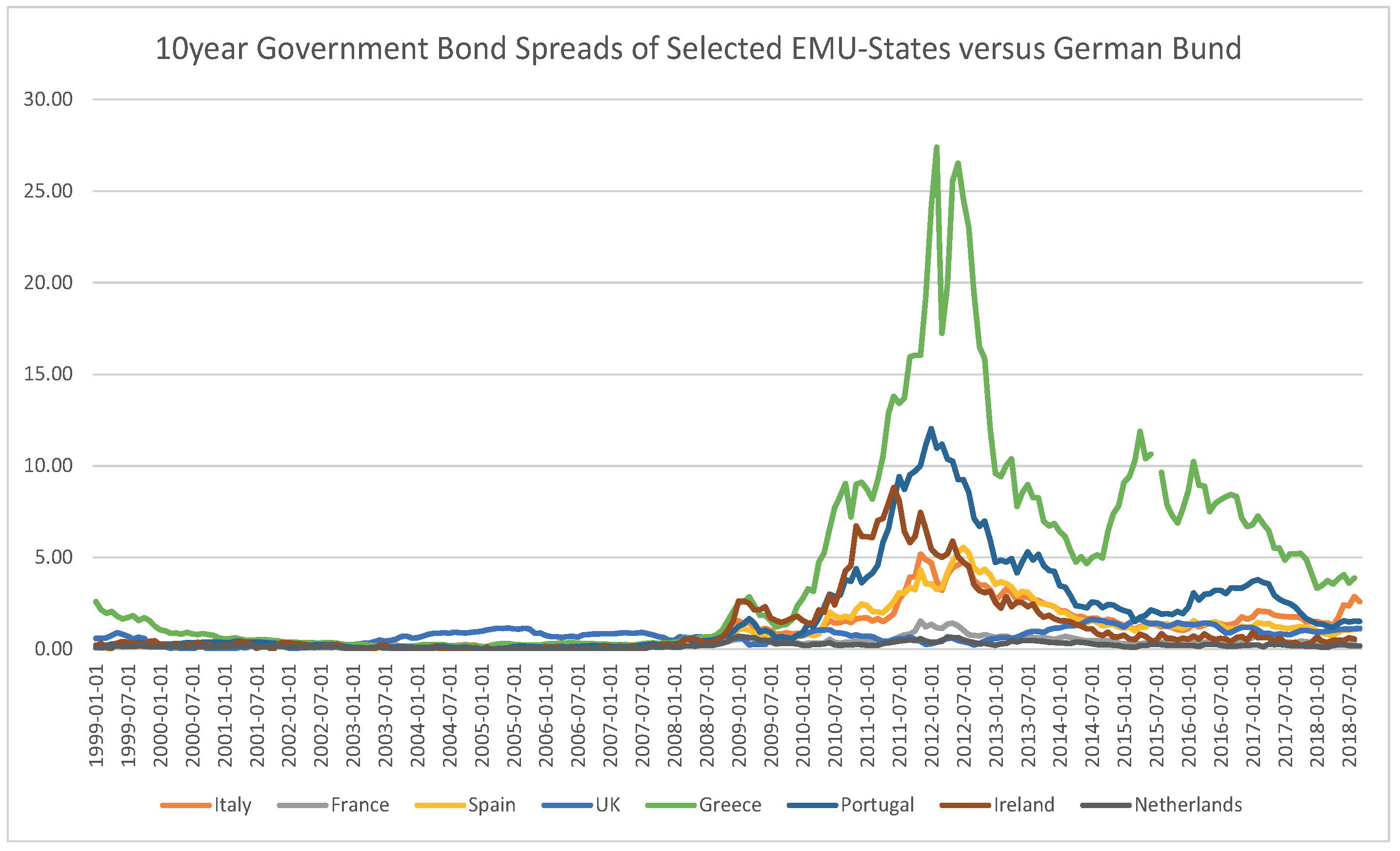

2. Literature: Genesis of the OMT and PSPP Programmes

Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.

3. Working of the European Central Bank

4. What Kind of Central Bank Is the ECB?

The Governing Council of the European Central Bank decided to maintain the current level of Emergency Lending Assistance (ELA) until Monday, 25 March 2013. Thereafter, Emergency Lending Assistance (ELA) could only be considered if an EU/IMF program is in place that would ensure the solvency of the concerned banks (ECB 2013).

The ECB appears both as a hero and a victim of the crisis (…). As an institution, however, it suffered collateral damage. (…) despite the power shift away from EU institutions, the ECB is the only one that grew in power. (…) but in becoming more powerful, the ECB also had become more vulnerable. An independent central bank just seemed to be making too many decisions (Brunnermeier 2018, p. 374).

5. Further Blind Spots of Legal Analysis

5.1. Moral Hazard

5.2. Redistribution

come[s] close to constituting hidden transfers, directly to benefiting some Member States (…) and some financial institutions (…), while indirectly benefiting creditors of (…) Euro area core countries (Tucker 2015; Tuori and Tuori 2014).

5.3. Infringement of No-Bailout Article 125 TFEU

5.4. Infringement of Prohibition of Monetary Funding Article 123 TFEU

In the light of those considerations, it is apparent that a programme such as that announced in the press release, in view of its objectives and the instruments provided for achieving them, falls within the area of monetary policy. The programme is contributing to the stability of the euro area, (…) [even if it] interferes in economic policy (ECJ 2015, Rn 45).

6. Beyond the Economists’ Toolkit

6.1. Democratic Legitimacy

6.2. Philosophical Misconception

7. Concluding Thoughts

(…) monetary policies are usually of a controversial nature (…). [Further] (…) any policy instrument should be assessed in respect to the threat of domestic interference and the related liability risks (…) (ECJ 2015, Rn 75,125f.).

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ECJ | European Court of Justice |

| ECB | European Central Bank |

| BVerfG | Bundesverfassungsgericht/German Federal Constitutional Court |

| TEU | Treaty of the European Union |

| TFEU | Treaty of the Function of the European Union |

| Rn | Randnumber/Reference number |

| OMT | Outright Monetary Transaction |

| PSPP | Public Sector Purchase Programme |

References

- Ariely, Dan, Anat Bracha, and Stephan Meier. 2009. Doing good or going well? Image motivation and monetary incentives in behaving prosocially. American Economic Review 99: 544–55. [Google Scholar] [CrossRef]

- Arnone, Marco, and Davide Romelli. 2013. Dynamic Central Bank Independence Indices and Inflation Rate: A New Empirical Exploration. Journal of Financial Stability 9: 385–98. [Google Scholar] [CrossRef]

- Arrow, Kenneth J. 1972. Gifts and Exchanges. Philosophy & Public Affairs 1: 343–62. [Google Scholar]

- Bagehot, Walter. 1873. Lombard Street: A Description of the Money Market. New York: Charles Scribner’s Sons. [Google Scholar]

- Beetsma, Roel, and Lans Bovenberg. 1999. Does monetary unification lead to excessive debt accumulation? Journal of Public Economics 74: 299–325. [Google Scholar] [CrossRef]

- Beetsma, Roel, and Lans Bovenberg. 2003. Strategic debt accumulation in a heterogeneous monetary union. European Journal of Political Economy 19: 1–15. [Google Scholar] [CrossRef]

- Bénabou, Roland, and Jean Tirole. 2003. Intrinsic and extrinsic motivation. Review of Economic Studies 70: 489–62. [Google Scholar] [CrossRef]

- Bénabou, Roland, and Jean Tirole. 2006. Incentives and prosocial behaviour. American Economic Review 96: 1652–78. [Google Scholar] [CrossRef]

- Bernanke, Ben. 1983. Irreversibility, Uncertainty and Cyclical Investment. Quarterly Journal of Economics 97: 85–106. [Google Scholar] [CrossRef]

- Bindseil, Ulrich, and Philipp J. König. 2012. TARGET2 and the European Sovereign Debt Crisis. Kredit und Kapital 45: 135–74. [Google Scholar] [CrossRef]

- Boland, Vincent, and Peter Spiegel. 2014. ECB Threatened to End Funding Unless Ireland Sought Bailout. Financial Times 6: 11. [Google Scholar]

- Brainard, William C. 1967. Uncertainty and the Effectiveness of Policy. American Economic Review Papers and Proceedings 57: 411–25. [Google Scholar]

- Brunnermeier, Markus. 2018. The Euro and the Battle of Ideas. Princeton: Princeton University Press. [Google Scholar]

- Brunnermeier, Markus, and Hans Gersbach. 2012. True Independence for the ECB: Triggering Power-No More, No Less. Available online: http://www.voxeu.org/article/true-independence-ecb-triggering-power-no-more-no-less (accessed on 20 December 2019).

- BVerfG. 2014. Judgment of the Second Senate of 18 March 2014-2 BvR 1390/12, Rn. 1–245. [Google Scholar]

- BVerfG. 2016. Urteil des Zweiten Senats vom 21. Juni 2016-2 BvR 2728/13, Rn 1–220. [Google Scholar]

- BVerfG. 2020. Urteil des Zweiten Senats vom 05. Mai 2020-2 BvR 859/15, Rn 1–237. [Google Scholar]

- Carlson, Mark. 2007. A Brief History of the1987 Stock Market Crash with A Discussion of the Federal Reserve Response. FEDS Working Paper 2007-13: 1–25. [Google Scholar]

- Cukierman, Alex. 2008. Central bank independence and monetary policymaking institutions-Past, present and future. European Journal of Political Economy 24: 722–36. [Google Scholar] [CrossRef]

- Degenhart, Christoph. 2015. Legal Limits of Central Banking. In The ECB’s Outright Monetary Transactions in the Courts. Edited by Helmut Siekmann, Vikrant Vig and Volker Wieland. Frankfurt: Interdisciplinary Studies in Monetary and Financial Stability (IMFS). [Google Scholar]

- Draghi, Mario. 2012. President of the European Central Bank at the Global Investment Conference in London. July 26. [Google Scholar]

- ECB. 2011. Analysis of Government Debt Sustainability under the EU/IMF Adjustment Programme for Greece. Monthly Bulletin 7: 29–30. [Google Scholar]

- ECB. 2013. Governing Council decision on Emergency Liquidity Assistance requested by the Central Bank of Cyprus. Press Release, March 21. [Google Scholar]

- ECJ. 2012. Judgment of 27.11.2012. Case C-370/12 Pringle v Ireland (ESM case). [Google Scholar]

- ECJ. 2015. Judgment of 16.6.2015. Case C-62/14 Gauweiler and Others (OMT case). [Google Scholar]

- ECJ. 2018. Judgment of 11.12.2018. Case C-491/17 Weis, Lucke, Gauweiler and Others (PSPP case). [Google Scholar]

- Eijffinger, Sylvester, and Petra Geraats. 2006. How transparent are central banks? European Journal of Political Economy 22: 1–21. [Google Scholar] [CrossRef]

- Fahrholz, Christian, and Andreas Freytag. 2012. Will TARGET2-Balances be Reduced again after an End of the Crisis? Working Papers on Global Financial Markets 30: 1–21. [Google Scholar]

- Falk, Armin, and Nora Szech. 2013. Morals and markets. Science 340: 707–11. [Google Scholar] [CrossRef] [PubMed]

- Fryer, Roland G. Jr. 2011. Financial Incentives and Student Achievements: Evidence from Randomized Trials. Quarterly Journal of Economics 126: 1755–98. [Google Scholar] [CrossRef]

- Gneezy, Uri, and Aldo Rustichini. 2000. A Fine is a Price. Journal of Legal Studies 29: 1–17. [Google Scholar] [CrossRef]

- Hellwig, Martin. 1995. Systemic Aspects of Risk Management in Banking and Finance. Swiss Journal of Economics and Statistics 131: 723–37. [Google Scholar]

- Hellwig, Martin. 2015. Die EZB und die Deutschen in der Griechenlandkrise. Oekonomenstiemme.org, July 3. [Google Scholar]

- Herzog, Bodo, and Katja Hengstermann. 2013. Restoring Credible Economic Governance to the Eurozone. Journal of Economic Affairs 33: 2–17. [Google Scholar] [CrossRef]

- Herzog, Bodo, and Marlene Ferencz. 2019. Disziplinierung ohne politische Diskriminierung: Warum es Marktkräfte in der Währungsunion bedarf! Ifo Schnelldienst 72: 20–22. [Google Scholar]

- Herzog, Bodo. 2012. Die Währungsunion ist keine Einbahnstraße. Ifo Schnelldienst 7: 10–13. [Google Scholar]

- Herzog, Bodo. 2016. Liquidity Management at the Zero Lower Bound during an Era of Activism in Central Banking. Journal of Mathematical Finance 6: 48–54. [Google Scholar] [CrossRef][Green Version]

- Herzog, Bodo. 2020a. Informationspopulismus in der liberalen Demokratie—Digitale Echokammern und anti-pluralistische Profilierung im Medienwettbewerb. In Populismus—Staat—Demokratie, Ein interdisziplinäres Streitgespräch. Wiesbaden: Springer. [Google Scholar]

- Herzog, Bodo. 2020b. Das Urteil des Bundesverfassungsgerichts zum Staatsanleihekaufprogramm der Europäischen Zentralbank als Neuanfang. Die Politische Meinung 65: 92–97. [Google Scholar]

- Herzog, Bodo. 2020c. Philosophie des ökonomischen Menschenbilds. Revista Portuguesa de Filosofia 76: 1161–86. [Google Scholar] [CrossRef]

- Herzog, Bodo. 2021. EZB-Urteil des Bundesverfassungsgerichts: Neue Hindernisse für die Europäische Wirtschafts- und Währungsunion. Recht und Politik 57: 26–38. [Google Scholar] [CrossRef]

- Heyman, James, and Dan Ariely. 2004. Effort for Payment. Psychological Science 15: 787–93. [Google Scholar] [CrossRef] [PubMed]

- Hirsch, Fred. 1978. Social Limits to Growth. London: Routledge. [Google Scholar]

- Holmas, Tor Helge, Egil Kjerstad, Hilde Luras, and Odd Rune Straume. 2010. Does monetary punishment crowd out pro-social motivation? A natural experiment on hospital length of stay. Journal of Economic Behavior and Organization 75: 261–67. [Google Scholar] [CrossRef]

- IMF. 2010. Greece: Staff Report on Request for Stand-By Arrangement. Washington, DC: International Monetay Fund, pp. 1–146. [Google Scholar]

- IMF. 2017. Euro Area Policies—Selected Issues. IMF Country Report. Washington, DC: International Monetay Fund, vol. 17, pp. 1–94. [Google Scholar]

- Issing, Otmar. 2017. Overburdened Central Banks. CESifo DICE Report Forum 15: 19–20. [Google Scholar]

- Janssen, Maarten C.W., and Ewa Mendys-Kamphorst. 2004. The Price of a Price: On the Crowding Out and In of Social Norms. Journal of Economic Behavior & Organizaton 55: 377–95. [Google Scholar]

- Jones, Marc. 2015. Factbox: What is ECB Emergency Liquidity Assistance (ELA). Reuters, June 22. [Google Scholar]

- Konrad, Kai. 2013. Bundesverfassungsgericht und Krisenpolitik der EZB—Stellungnahmen der Ökonomen. Wirtschaftsdienst 93: 431–54. [Google Scholar] [CrossRef][Green Version]

- Kydland, Fin, and Edward Prescott. 1977. Rules rather than discretion: The inconsistency of optimal plans. Journal of Political Economy 85: 473–90. [Google Scholar] [CrossRef]

- Lombardi, Domenico, and Manuela Moschella. 2015. The government bond buying programmes of the European Central Bank: An analysis of their policy settings. Journal of European Public Policy 23: 851–70. [Google Scholar] [CrossRef]

- Mankiw, Gregory, and Ricardo Reis. 2018. Friedman’s Presidential Address in the Evolution of Macroeconomic Thought. Journal of Economic Perspectives 32: 93. [Google Scholar] [CrossRef]

- Martin, Michelle. 2012. ECB Saves Greece by Securing Emergency Loans-Paper. Reuters, August 3. [Google Scholar]

- Martinez-Garcia, Enrique. 2017. Good Policies or Good Luck? New Insights on Globalization and the International Monetary Policy Transmission Mechanism. FED of Dallas Working Paper 321: 1–62. [Google Scholar] [CrossRef]

- Masciandaro, Donaato, and Davide Romelli. 2015. Ups and Downs. Central Bank Independence from the Great Inflation to the Great Recession: Theory, Institutions and Empirics. Financial History Review 22: 259–89. [Google Scholar] [CrossRef]

- Mellström, Carl, and Magnus Johannesson. 2008. Crowding Out In Blood Donation: Was Titmuss Right? Journal of the European Economic Association 6: 845–63. [Google Scholar] [CrossRef]

- Reinhart, Carmen, and Kenneth Rogoff. 2009. The Aftermath of Financial Crises. American Economic Review 99: 466–72. [Google Scholar] [CrossRef]

- Reinhart, Carmen, and Kenneth Rogoff. 2011. From Financial Crash to Debt Crisis. American Economic Review 101: 1676–706. [Google Scholar] [CrossRef]

- Rudebusch, Glenn D. 2001. Is the FED too timid? Monetary Policy in an uncertain world. Review of Economic Studies 82: 203–17. [Google Scholar] [CrossRef]

- Sandel, Micheal J. 2012. What Money Can’t Buy. New York: Farrar Straus & Giroux. [Google Scholar]

- Sandel, Michael J. 2013. Market Reasoning as Moral Reasoning: Why Economists Should Re-engage with Political Philosophy. Journal of Economic Perspectives 27: 121–40. [Google Scholar] [CrossRef]

- Scharpf, Fritz W. 1999. Governing in Europe: Effective and Democratic? Oxford: Oxford University Press. [Google Scholar]

- Scharpf, Fritz W. 2011. Monetary Union, Fiscal Crisis and the Preemption of Democracy. In MPIfG Discussion Paper. Köln: Max-Planck-Institute. [Google Scholar]

- Schmidt, Vivien A. 2006. Democracy in Europe: The EU and National Polities. Oxford: Oxford University Press. [Google Scholar]

- Schmidt, Vivien A. 2012. Democracy and Legitimacy in the European Union Revisited: Input, Output and ‘Throughput’. Political Studies 61: 2–22. [Google Scholar] [CrossRef]

- Siekmann, Helmut, and Volker Wieland. 2015. The German Constitutional Court’s decision on OMT: Have markets misunderstood? In The ECB’s Outright Monetary Transactions in the Courts. Edited by Helmut Siekmann, Vikrant Vig and Volker Wieland. Frankfurt: Interdisciplinary Studies in Monetary and Financial Stability. [Google Scholar]

- Sinn, Hans-Werner. 2012. Schranken für die EZB. Wirtschaftswoche 38: 44. [Google Scholar]

- Taylor, John. 2016. Independence and the Scope of the Central Bank’s Mandate. Sveriges Riksbank Economic Review 3: 96–103. [Google Scholar]

- Taylor, John. 2017. Rethinking the International Monetary System. The Cato Journal 36: 239–50. [Google Scholar]

- Titmuss, Richard M. 1971. The Gift Relationship: From Human Blood to Social Policy. Bristol: Policy Press. [Google Scholar]

- Tucker, Paul. 2015. How Can Central Banks Deliver Credible Commitments to Be Emergency Institutions? Standord: Hoover Institution, Stanford University. [Google Scholar]

- Tuori, Kaarlo, and Klaus Tuori. 2014. The Eurozone Crisis. A Constitutional Analysis. New York: Cambridge University Press. [Google Scholar]

- Tuori, Klaus. 2016. Has Euro Area Monetary Policy Become Redistribution by Monetary Means? ‘Unconventional Monetary Policy as a Hidden Transfer Mechanism. European Law Journal 22: 838–68. [Google Scholar] [CrossRef]

- Uhlig, Harald. 2015. Remarks on the OMT Program of the ECB. In The ECB’s Outright Monetary Transactions in the Courts. Edited by Helmut Siekmann, Vikrant Vig and Volker Wieland. Frankfurt: Interdisciplinary Studies in Monetary and Financial Stability. [Google Scholar]

- Volpp, Kevin, Adnrea B. Troxel, Mark V. Pauly, Henry A. Glick, Andrea Puig, and David A. Asch. 2009. Randomized, Controlled Trail of Financial Incentives for Smoking Cessation. New England Journal of Medicine 390: 699–709. [Google Scholar] [CrossRef]

- Weidmann, Jens. 2011. Aktuelle Herausforderungen für Zentralbanken—Betrachtungen im Lichte der Finanz- und Wirtschaftskrise. Center for Financial Studies 1: 1–21. [Google Scholar]

- Weidmann, Jens. 2012. Alles fließt? Zur künftigen Rolle der Geldpolitik. Mannheim: ZEW Wirtschaftsforum. [Google Scholar]

- Wolf, Martin. 2012. Lunch with the FT: Jean-Claude Trichet. Financial Times, July 6. [Google Scholar]

- Wyplosz, Charles. 2015. Grexit: The Staggering Cost of Central Bank Dependence. June 29. Available online: http://voxeu.org/article/grexit-staggeringcost-central-bank-dependence (accessed on 20 December 2019).

| 1. | Stability and Growth Pact Council Regulation (EC) 1466/97 and 1467/97 and the updates 1055/05 and 1056/05 and recently Regulations (EU) No. 1173/2011, No. 1174/2011, No. 1176/2011, and No. 472/2013 and No. 473/2013. |

| 2. | This holds despite the principle of conferral in Article 5(2) TEU. |

| 3. | The ECJ argues similarly, otherwise the ECB would no longer be in a position to fulfil its mandate. Economists note, however, that unconventional instruments intensify the misallocation of capital and impair the treaty provision of an open market economy in Article 119 TFEU. |

| 4. | Decision (EU) 2015/774 of the European Central Bank of 4 March 2015 on secondary markets public sector asset purchase programme. |

| 5. | ECB, available: www.ecb.europa.eu/mopo/implement/omt/html/index.en.html (accessed on 15 December 2018). |

| 6. | ESM—Article 5(1) and 5(2) EU2015/774. |

| 7. | More generally, Article 3(1)(c) TFEU states that the Union is to have exclusive competence whose currency is the euro. In conjunction with Article 282(1) and (4) TFEU, the ECB conducts the monetary policy of the Union and adopts the measures necessary to carry out its task defined in Articles 127 to 133 TFEU. |

| 8. | Technically, this is like a repo with three exceptions (Article 14.4 ECB Statute). First, under ELA low-quality collateral is sufficient. Second, the risk of ELA stays at the national central banks. Third, the ELA funding is usually more expensive for banks. The ECB’s Governing Council must approve each ELA with a two-thirds majority. |

| 9. | This follows from Article 119(2) TFEU and Article 127(1) TFEU, read in conjunction with Article 5(4) TEU. |

| 10. | |

| 11. | The ECB put pressure on Ireland to use taxpayers’ money to bail out Irish banks (Report on Irish Crisis, 2016). |

| 12. | There are several examples: ELA to bailout Hypo Real Estate in 2008, Irish banks in 2010, Cypriot banks in 2013, and Greek banks in 2012 and 2015. |

| 13. | Many economists show that in other monetary unions such as the United States, bailouts have been rigorously excluded for more than 150 years. President Obama, for instance, refused to bail out California in 2009. The US has a credible no-bail provision. |

| 14. | Indeed, the PSPP increases the ECB’s balance sheet by 1266 percent. |

| 15. | |

| 16. | Economists call it a ‘Greenspan-put’ (Carlson 2007). |

| 17. | |

| 18. | They stick to painful commitments due to intrinsic virtue. Examples are Ireland and the UK in the 1980s. Both countries made painful social cuts due to high unemployment and a weak economy. In Germany in the year 2000, after imposing reforms called AGENDA 2010, Chancellor Gerhard Schroeder changed the long-run growth trajectory. Despite violent protests across the country, German politics adhered to the intrinsic reform commitment. In return the German economy benefited and is now the powerhouse of Europe. Reference: Economist. The sick man of the euro: the biggest economy in the euro area, Germany’s, is in a bad way. Special Report, 3 June 1999. |

| 19. | New York Times, 12 May 2017. www.nytimes.com/2017/05/12/business/economy/allan-h-meltzer-dead-conservative-economist.html; retrieved 15 May 2017. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Herzog, B. Hidden Blemish in European Law: Judgements on Unconventional Monetary Programmes. Laws 2021, 10, 18. https://doi.org/10.3390/laws10020018

Herzog B. Hidden Blemish in European Law: Judgements on Unconventional Monetary Programmes. Laws. 2021; 10(2):18. https://doi.org/10.3390/laws10020018

Chicago/Turabian StyleHerzog, Bodo. 2021. "Hidden Blemish in European Law: Judgements on Unconventional Monetary Programmes" Laws 10, no. 2: 18. https://doi.org/10.3390/laws10020018

APA StyleHerzog, B. (2021). Hidden Blemish in European Law: Judgements on Unconventional Monetary Programmes. Laws, 10(2), 18. https://doi.org/10.3390/laws10020018