3.1. Self-Similarity and Time Translation Invariance

According to Isaac Newton and Murray Gell-Mann, the laws of nature are somehow self-similar. The laws of Newtonian mechanics are invariant with respect to the Galilean group, expressing Galileo’s principle of relativity [

52]. The group includes time-translation invariance, or else the laws of classical mechanics are self-similar.

What should be the underlying symmetry for price dynamics? Mind that in normal times the average price trajectory is exponential, because of the compounding interests, and we enjoy an almost constant return (or price growth rate) [

53]. Indeed, let

be an underlying security (index) price at

. Let

be the fair value of the future requiring a risk associated expected return

[

43]. Then (see, e.g., [

43]), expected forward price

For example, a share of a stock would be correctly priced with the expected return calculated as the return of a risk-free money market fund minus the payout of the asset, being a continuous dividend for a stock [

43]. Thus, rather simple and natural exponential estimates are constantly made for stocks and the alike. The formula for the forward price is self-similar, or time-translation invariant, as explained below.

However, as noted in [

48,

53], prices often significantly deviate from such a simple description. Bubbles can be formed, as well as other presumed patterns of technical analysis. Asset prices strongly deviate from the fundamental value over significant intervals of time. The fundamental value is not truly observable, making definition of such intervals somewhat elusive. There are some very real mechanisms in work, acting to increase and even accelerate the deviation from fundamental value. The causes of deviation could be “option hedging, portfolio insurance strategies, leveraging and margin requirements, imitation and herding behavior”, as is the authoritative opinion expressed in [

48,

53].

Recall also that meaningful technical analysis starts from recasting the time series data using some polynomial representation to serve as the expansion [

38]. The regression is constructed in standard fashion by minimizing mean-square deviation, with the effective result that the high-frequency component of the price is getting average out. Then, one can consider self-similarity in averages [

49]. Indeed, the standard polynomial regressions are invariant under time-translation, retaining their form after arbitrary selection of origin of time with simple redefinition of all parameters. The position of origin in time can be explicitly introduced into the regression formula and included into the coefficients, but actual results of calculations with any arbitrary chosen origin will remain the same. Such property can be expressed as some symmetry.

We put forward the idea that it is the onset of broken time-translation invariance that signifies the birth of a bubble, or of some other temporal pattern preceding a crash. End of pattern corresponds to the restoration of time-translation invariance, partially or fully. Our task is to express this idea in quantitative terms by making explicit transformation from the regression-based technical analysis to the valuation formula in the exponential form, taking into account strong deviations from the standard valuation formulae.

Assume that a time series dynamics is predominantly governed by its own internal laws. This is the same as to write down a self-similar evolution for the marker price

s [

54], meaning that, for arbitrary shift

, one can see that

with the initial condition

[

55,

56]. The value of the self-similar function

s in the moment

with given initial condition, is the same as in the moment

t, with the initial condition shifted to the value of

s in the moment

.

When

t stands for true time, the property of self-similarity means the time-translation invariance. Formally understood, Equation (

43) gives a background for the field-theoretical RG, with addition of some perturbation expansion for the sought quantity, which should be resummed in accordance with self-similarity expressed in the form of ODE [

55,

56,

57]. The time-translation invariance expressed by (

43) means that the law for price evolution exists and remains unchanged with time, with proper transformation of the initial conditions [

52]. The role of perturbation expansion when price dynamics is concerned, is accomplished by meaningful technical analysis, by recasting data in the form of some polynomial representation [

38]. There is no formal difference in treating polynomials and expansions, as already mentioned in

Section 2.

Consider first the simplest case of technical analysis. The linear function can be formally considered as the function of time and initial condition

a, namely

and

. The linear function (regression) is self-similar, or time-translation invariant, as can be checked directly, by substitution into (

43).

Through some standard procedure, let us obtain the linear regression on the data around the origin

, so that

Note that the position of origin is arbitrary, and it can be moved to arbitrary position given by real number

r, so that

with new and different coefficients. It turns out that the coefficients are related as follows

so that

By shifting the origin, we create an

r-dependent form of the linear regression

, which can be used constructively. Thus, instead of a single regression we have its

r-replicas, equivalent to the original form of regression, and all replicas respect time-translation symmetry. In such a sense, one can speak about replica symmetry. Of course, we would like to avoid such redundancy in data parameterization and to find the origin(s) by imposing some optimal conditions (see

Section 3.2).

The position of origin in time can be explicitly introduced into the regression formula and included into the coefficients, but actual results of calculations with any arbitrary chosen origin will remain the same. Such property can be expressed as some symmetry. However, intuitively, one would expect that the result of extrapolation with chosen predictors should be dependent on the point of origin r. Indeed, various patterns such as “heads and shoulders”, “cup-with-handle”, “hockey stick”, etc., considered by technical analysts do depend on where the point of origin is placed. In physics, the point of origin (Big Bang) plays a fundamental role. We should find a way to break the replica symmetry.

As discussed above, it is exponential shapes that are natural in pricing. Exponential function

with initial condition

a and arbitrary

satisfy functional self-similarity as well as the linear functions. It can be replicated as

Having

dependent on

r is going to

violate the time-translation and replica symmetry. Instead of a global time-translation invariance, we have a set of

r local “laws” near each point of origin. However, having

r in Formula (

44) fixed, by imposing some additional condition, or just being integrated out, should

restore the global time-translation invariance completely as long as the exponential function is considered. Moreover, stability of the exponential function is measured by the exponential function with the same symmetry (see Formula (

46)). Not only is exponential function time-translation invariant, but the expected return

has the same property. For exponential functions, the expected (predicted) value of return per unit time exactly equals

.

Another simple rational function, known as hyperbolic discounting function [

58],

where

a is the initial condition and

b is arbitrary, is time-translation invariant. Note that shifted exponential function

with initial condition

a and arbitrary

b and

c, is invariant under time-translation as well.

Another interesting symmetry is shape invariance [

59], meaning

and an exponential function is shape invariant with

, leaving the expected return unchanged. Keep in mind that our task is to calculate

from the time series. In principle, one can think about breaking/restoration of shape invariance, as a guide for construction of the concrete scheme for calculations.

A critical phenomenon, an underlying symmetry of the formula for the observable, is scaling

where

. The class of power laws,

, with critical index

, is scaling-invariant. The central task is to calculate

c. The statistical renormalization group formulated by Wilson [

37] explains well the critical index in equilibrium statistical systems. When information on the critical index is encoded in some perturbation expansion, one can use resummation ideas to extract the index, even for short expansions and for non-equilibrium systems [

11,

12,

18]. Some of the methods are discussed in the preceding section (see also [

12,

16]).

Working with power-law functions will not leave the return unchanged. However, one can envisage the scheme with broken scaling invariance, as an alternative to the former schemes. The log-periodic solutions extend the simple scaling [

60] and are extensively employed in the form of a sophisticated seven-parametric fit to long historical dataset [

53], as well as of its extensions [

61]. The fit is tuned for prediction of the crossover point to a crash, understood as catastrophic downward acceleration regime [

48]. However, one cannot exclude the possibility of the solutions with different time symmetries (scaling and time-invariance, for instance) competing to win over, or to coexist, all measured in terms of their stability characteristics.

Our primary concern is the crash per se, not the regime preceding it. We start analyzing crashes with the polynomial approximation that respects time-translation symmetry, have the symmetry broken, and then restored (completely or partially), by means of some optimization. Such sequence ends with a non-trivial outcome:

becomes renormalized

, with

r being found using the optimization procedure(s) defined below. We discuss in

Section 2.1 a general technique for correcting

directly, which accounts for higher order terms in regression, making it time-dependent.

In [

38], the framework for technical analysis of time series was developed, based on second-degree regression and asymptotically equivalent exponential approximants, with some rudimentary, implicit breaking of the symmetry. We intend to go to higher-degree regressions and develop a consistent technique for explicit symmetry breaking with its subsequent restoration. According to textbooks, the fourth order should be considered as “high”. Taleb (see footnote on p. 53 in [

43]) also considered models with five parameters as more than sufficient.

3.2. Optimization, Approximants, Multipliers

Higher-order regressions allow for replica symmetry. For instance, the quadratic regression

can be replicated as follows:

with

With such transformed parameters, we find that

In fact, one can still formulate self-similarity analogous to (

43), but in vector form with increased number of parameters/initial conditions in place of

a [

57]. However, if only the linear part of quadratic regression, or trend, is taken into account, we return to the conventional functional self-similarity ≡ time-translation invariance, discussed above extensively.

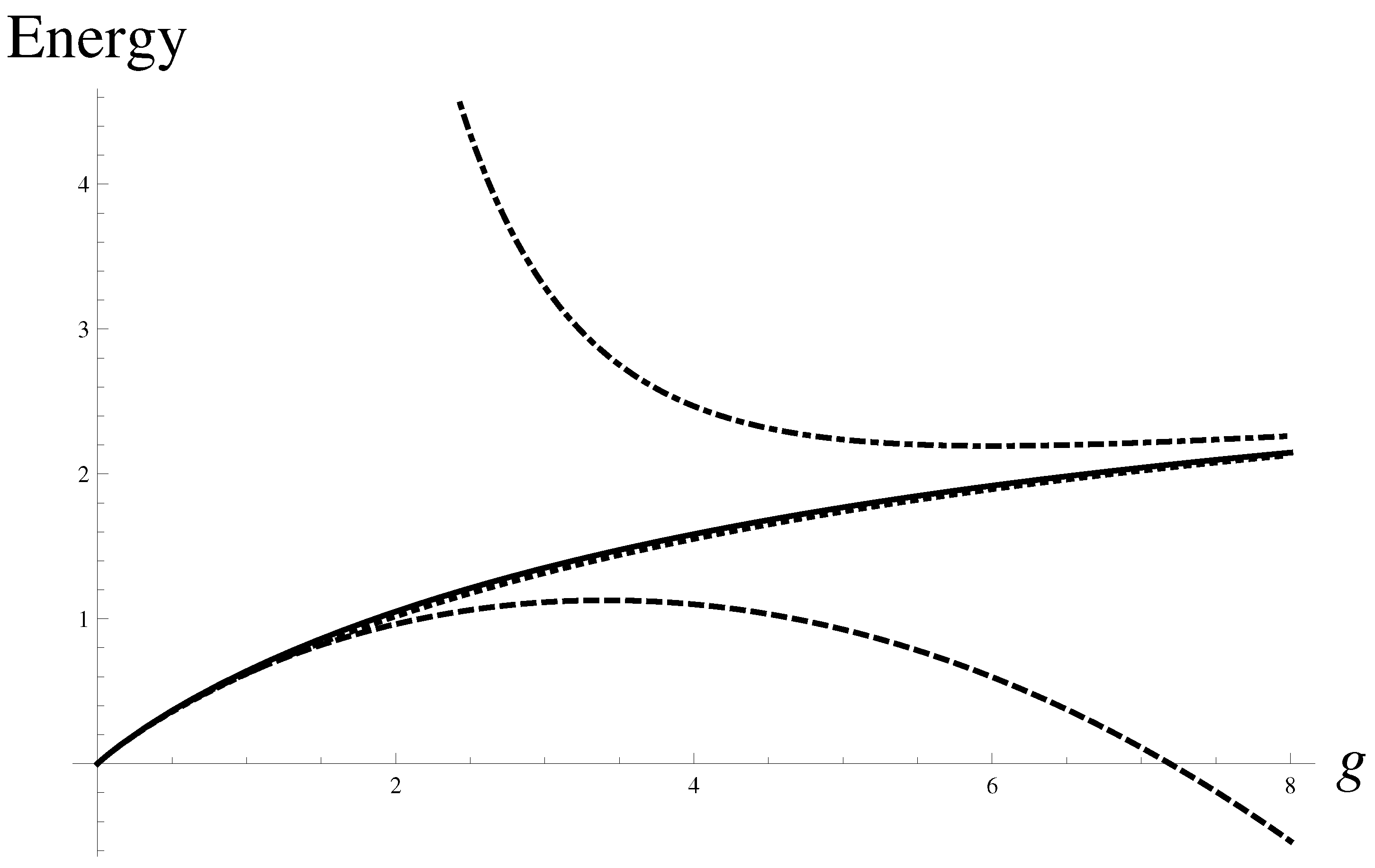

Such effective linear/trend approach to higher-order regressions allows applying the same idea at all orders and observe how the exponential structures change with increasing regression order. Note that, in the course of trading, a common pattern is trend following, which appears to be a collective, self-reinforcing motion that, intuitively, lends itself to a self-similar description. Indeed, some participants are waiting for a market confirmation of the trend before acting on it, which in turn acts as a confirmation for others. Having a universal model explaining this dynamics (if not predicting it) would be quite useful.

To take into account the dependence on origin, the replica symmetry has to be broken. Breaking of the symmetry means the dependence on origin of actual extrapolations with non-polynomial predictors. As the primary predictors, we suggest the simplest exponential approximants considered as the function of origin

r and time,

independent on the order of polynomial regression. The approximants (

45) are constructed by requiring an asymptotic equivalence with the linear part of chosen polynomial regression. If the extrapolations

are made by each of the approximants, they appear to be different for various

r, meaning breaking of the replica symmetry and of the time-translation symmetry. Passage from polynomials to exponential functions leads to emergence of the continuous spectrum of relaxation (growth) times.

To compare the approximants quality, one can look at their stability. Stability of the approximants is characterized by the so-called multipliers defined as the variation derivative of the function with respect to some initial approximation function [

45]. Following Yukalov and Gluzman [

62], one can take the linear regression as zero approximation and find the multiplier

The simple structure of multipliers (

46) allows avoiding appearance of spurious zeroes which often complicate analysis with more complex approximants/multipliers.

Because of the multiplicity of solutions, embodied in their dependence on origin, it is both natural and expedient to introduce probability for each solution. As explained in [

45], one can introduce

with proper normalization, as shown below in Formula (

48). Probability appears to be of a pure dynamic origin and is expressed only from the time series itself. When the approximants and multipliers of the first order are applied to the starting terms of the quadratic, third- or fourth-order regression, we are confined to

effective first-order models, with velocity parameter from [

38] dependent also on higher-order coefficients and origin.

To make extrapolation with approximants (

45), one has still to know the origin. In other words, the time-translation symmetry has to be restored completely or partially, so that a specific predictor with specifically selected origin, or as close as possible to a time-translation invariant form, is devised. Fixing unique origin also selects unique relaxation (growth) time, during which the price is supposed to find a time-translation invariant state.

Exponential functions are chosen above because they are invariant under time translation. Any shift in origins is absorbed by the pre-exponential amplitude and does not influence the return

R. A similar in spirit view that broken symmetries have to be restored in a correct theory was expressed by Duguet and Sadoudi [

63].

In the approach predominantly adopted in this section, we keep the form and order of approximants the same in all orders, but let the series/regressions evolve into higher orders. Independent of the order of regression, we construct the same approximant, based only on the first-order terms, only with parameters changing with increasing order of regression. In the framework of the effective first-order theories, we employ exponential approximants.

Consider the value of origin as an optimization parameter [

30]. To find it and restore the time-translation symmetry, we have to impose an additional condition directly on the exponential predictors with known last closing price,

One has to solve the latter equation to find the particular origin(s) . In this case, we consider a discrete spectrum of origins, consisting of several isolated values. To avoid double-counting when the last closing price enters both regression and optimization, one can determine the regression parameters in the segment limited from above by . Alternatively, one can consider the two ways to define regression parameters and choose the one which leads to more stable solutions. Unless otherwise stated, we consider that such comparison was performed and the most stable way was selected.

The extrapolation for the price is simply

. The condition imposed by Equation (

47) is natural, because then a first-order approximation to Formula (

42),

, is recovered (see, e.g., [

39]), as one would expect intuitively.

The procedure embodied in (

47), leads to a radical reduction of the set of

r-predictors to just a few. Set of predictors and corresponding to each multiplier, define the probabilistic, poor man’s order book. Instead of an unknown to us true numbers of buy and sell orders, we calculate a priori probabilities for the price going up or down and corresponding levels. Target price is estimated through weighted averaging developed in [

45,

62], in its concrete form (

48) given below.

For the sake of uniqueness, one can simply choose the most stable result among such conditioned predictors. One can also consider extrapolation with a weighted average of all such selected solutions. With

solutions, their weighted average

for the time

is given as follows,

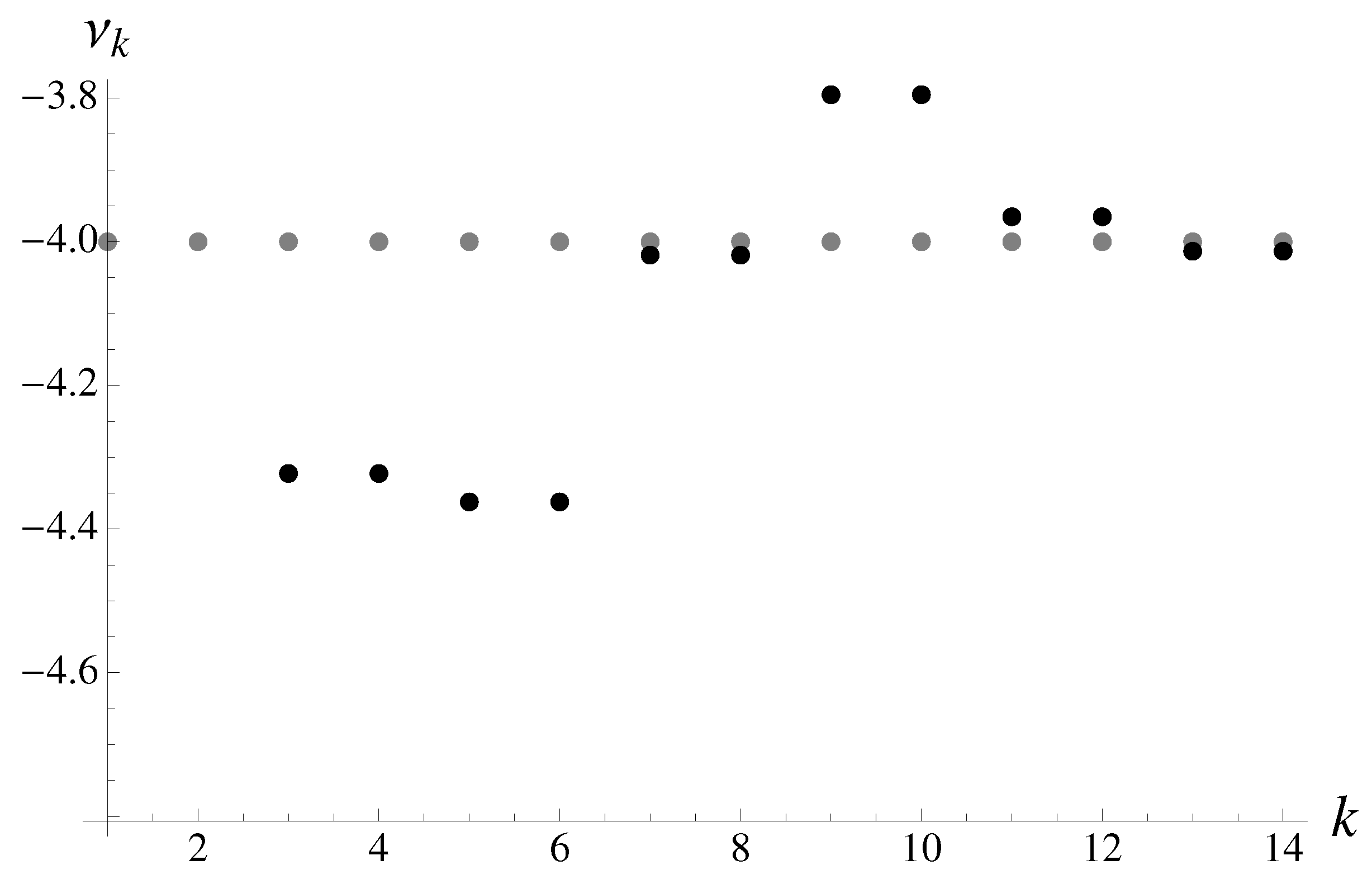

Within the discrete spectrum, we can find solutions with varying degrees of adherence to the original data. They can follow data rather closely or be loosely defined by the parameters of regression. The former could be called “normal” solutions, and tend to be less stable, with multipliers ∼1, but the latter are “anomalous” solutions, since they cut through the data and typically are the most stable with small multipliers. Anomalous solutions are crashes (meltdowns) and melt-ups. The typical situation with the solutions in the discrete spectrum is presented in

Figure 1. The novel feature introduced through (

48) is that averaging is performed over all approximants of the same order, compatible with constraints expressed by (

47).

One can also integrate out the dependence on origin

r, considered as a continuous variable, by applying an averaging technique of weighted fixed points suggested in [

45]. The dependence on origin enters the integration limit through parameter

T. Integration can be performed numerically for the simplest exponential predictors according to the formula

To optimize the integral, we have to impose an additional condition on the weighted average/integral. It is natural to force it to pass precisely through the last historical point.

and solve the latter equation to find the integration limit

. The sought extrapolation value for the price

s is simply

We prefer to take into account the broadest possible region of integration. Under such conditions, if and when the solution to (

50) exists, it is unique. The value of

may enter the consideration twice: in the regression parameters and in the optimization condition (

50). To avoid counting twice the last known value

, one can slightly different definition

As an additional condition to find origin, one can also consider the minimal difference requirement on the lowest order predictors, as first suggested in [

49]. Such approach is analogous to the technique discussed in

Section 2.2. However, instead of a critical index, we calculate relaxation time. To this end, one has to construct the second order super-exponential approximant

and minimize its difference with the simplest exponential approximant in the time of interest

. Namely, one has to find all roots of the equation

with respect to real variable

r. Corresponding multiplier

can be found as well.

The discrete spectrum optimization seems to be the most natural and transparent. Our goal is to find the approximants and probabilistic distributions in the last available historical point of time series. Crashes are attributed to the stable solutions with large negative

r, meaning that the origin of time has to be moved to the deep past to explain the crash in near future. Preliminary results of Gluzman [

30] suggest that, in the overwhelming majority of cases, a crash is preceded by similar, asymmetric probability pattern(s), of the type shown in the figures below. As noted in [

51], Kahneman and Tversky explained that people tend to judge current events by their similarity to memories of representative events.

There are also additional solutions with multipliers of the order of unity, coming from the region of moderate r, and it is often possible to find some rather stable upward solution for large positive r. One can think that, for such stable time series as describing population dynamics, only the region of moderate r gives relevant solutions, while for time series describing price dynamics all types of solutions may exist simultaneously.

Within our approach to constructing approximants, one can also try to exploit the second order terms in regression. Instead of exponential approximants, one should try some other, higher-order approximants, but with time-translation invariance property. Such approximants are presented below. They are considered ad hoc, because they can be written in closed form only in special, low-order situations. It is not feasible to extend them systematically into arbitrary high order. Hence, our interest in special forms with desired symmetry. Sometimes, it is even not possible to find stable solutions with a single approximant, but it is still possible with corrected approximants.

Recall that exponential function can be obtained as the solution to simple linear first-order ODE. In the search for second-order approximants with time-translation invariance, we turned to some explicit formulas, emerging in the course of solving some first-order ODE with added nonlinear term with arbitrary positive power, which generalizes ODE for simple exponential growth. It is known as Bertalanffy–Richards (BR) growth model [

64,

65]. Among its solutions in the case of second-order nonlinear term, there is a celebrated logistic function [

64],

where

is the initial condition. The logistic function is widely used to describe population growth phenomena and is also known to be the solution to the logistic equation of growth. The logistic function written in the form

, dependent on the initial condition

, with arbitrary

, is time-translation invariant. One can also introduce the second-order logistic approximant which generalizes logistic function [

30]. In addition to describing situations with saturation at infinity, the logistic approximant include also the case of so-called finite-time singularity, which makes it redundant, since such solutions were axiomatically excluded from the price dynamics [

38].

Another solution to the BR model in the case when the nonlinear term has power only slightly differing from unity, is known as Gompertz function [

64],

used to describe growth (relaxation, decay) phenomena. However, as we demonstrate in

Section 2.1, it is possible to explain

directly from the resummation technique leading to Formula (

16), without resorting to BR. Relaxation (growth) time behaves exponentially with time. The Gompertz function is

-time-translation invariant.

One can consider the second order Gompertz approximant. It simply generalizes the Gompertz function. Namely, one can find Gompertz approximant in the following form

with the multiplier

The Gompertz approximant, of course, is not limited to the situations with saturation at infinity, as it can also describe very fast decay (growth) at infinity.

With

r to be found from some optimization procedure, the return

R generated by Gompertz approximant is time-translation invariant and has a compact form

For small

, it becomes particularly transparent:

with the pre-factor giving the return per unit time. The inverse return per unit time has the physical meaning of the effective time for growth (relaxation)

considered at the moment

. Here, we employ the the effective relaxation (growth) time (see

Section 2.1),

and replicate it. We find that the return for Gompertz approximant is solely determined by relaxation time

allowing to express the log return in a compact form

Thus, the return for Gompertz approximant appears as purely dynamic quantity, not involving any consent about equilibrium, fundamental value, etc. If relaxation time is found from the data to be very large as it should be close to equilibrium conditions [

66], we have no potential for returns, i.e., near-equilibrium yields dull, everyday mundane events that are repetitive and lend themselves to statistical generalizations [

48]. If relaxation time is anticipated to be very short, we have potentially huge returns. The far-from-equilibrium conditions give rise to unique, historic events [

48], or to some very fast relaxation events/crashes. The latter condition makes real markets fragile [

67].

Gompertz approximant can go at infinity faster or slower than exponential, and in some important examples such differences amounting to a few percent, can be detected. The function

, could be called a gauge function for the price, expressing arbitrariness of choice of the price unit, as it does not enter the return. The time-translation invariance of return and gauge invariance for the price are considered very desirable in price model formulation [

38], both properties are pertinent to exponential and Gompertz approximations for the price temporal dynamics.

We are interested in market prices on a daily level, and consider only significant market price drops/crashes with magnitude more than . Such magnitude is selected to be comparable to the typical yearly return of Dow Jones Industrial Average index. Typically, a 2% daily move is considered as big, but not at the times of various turmoils.

It is widely accepted in practical finance that asset price moves in response to unexpected fundamental information. The information can be identified as well as the tone, positive versus negative. It is found that news arrival is concentrated among days with large return movements, positive or negative [

68]. Spontaneously emerging narratives, a simple story or easily expressed explanation of events, might be considered as largely exogenous shocks to the aggregate economy [

51]. Simply put, one should analyze what people are talking about in the search for the source of economic fluctuations. Moreover, as in true epidemics governed by evolutionary biology, mutations in narratives spring up randomly, and if contagious generate unpredictable changes in the economy [

51]. As noted by Harmon et al. [

69], panic on the market can be due to external shocks or self-generated nervousness.

It is argued [

70] that cause and effect can be cleanly disentangled only in the case of exogenous shocks, as it is only needed to select some interesting set of shocks to which price is likely to respond. Effects of positive and negative oil price shocks on the stock price need not be symmetric. In macroeconomics, it is even accepted that only positive changes in the price of oil have important effects. Periods dominated by oil price shocks are reasonably easy to identify, and they can indeed be considered as exogenous as well as, often, strong, although difficult to model. Oil price shocks are the leading alternative to monetary shocks and may very well have similar effects [

70].

Our goal here is not to forecast/timing the crash, but to study the crash as a particular phenomenon created by spontaneous, time-translation symmetry breaking/restoration. In essence, we ask the following questions:

What probabilistic pattern would an observer see the day before crash,

What would be the market reaction (expressed through the index), if we are aware that a Swan of some color has already arrived?

In our opinion, in the presence of a Swan, understood as a shock of unspecified strength, the problem simplifies, because of a reduced set of outcomes, dominated by the most extreme, very stable downward solution. Consider that, in natural sciences, most efforts are dedicated to creating a correct experimental setup. Studying reaction to shock is the only current viable substitute for clean experimental conditions.

3.3. Examples

Consider as example a

drop in the value of Shanghai Composite index related to the first COVID-19 crash, which occurred on 3 February 2020. With

, as recommended in [

38], the following data points are available,

The value of

is to be “predicted”. From the whole set of daily data, we employ only several values of the closing price. Such coarse-grained description of the time series may be justified if one is interested in the phenomenon not dependent on the fine details, such as crash. In the examples presented below, we keep the number of data points per quartic regression parameter in the range 3–4. Lower order calculations can be found in [

30]. Here, we show only the quartic regression

and based on it optimize approximants and multipliers. It can be replicated as follows:

with

With such transformed parameters, we have

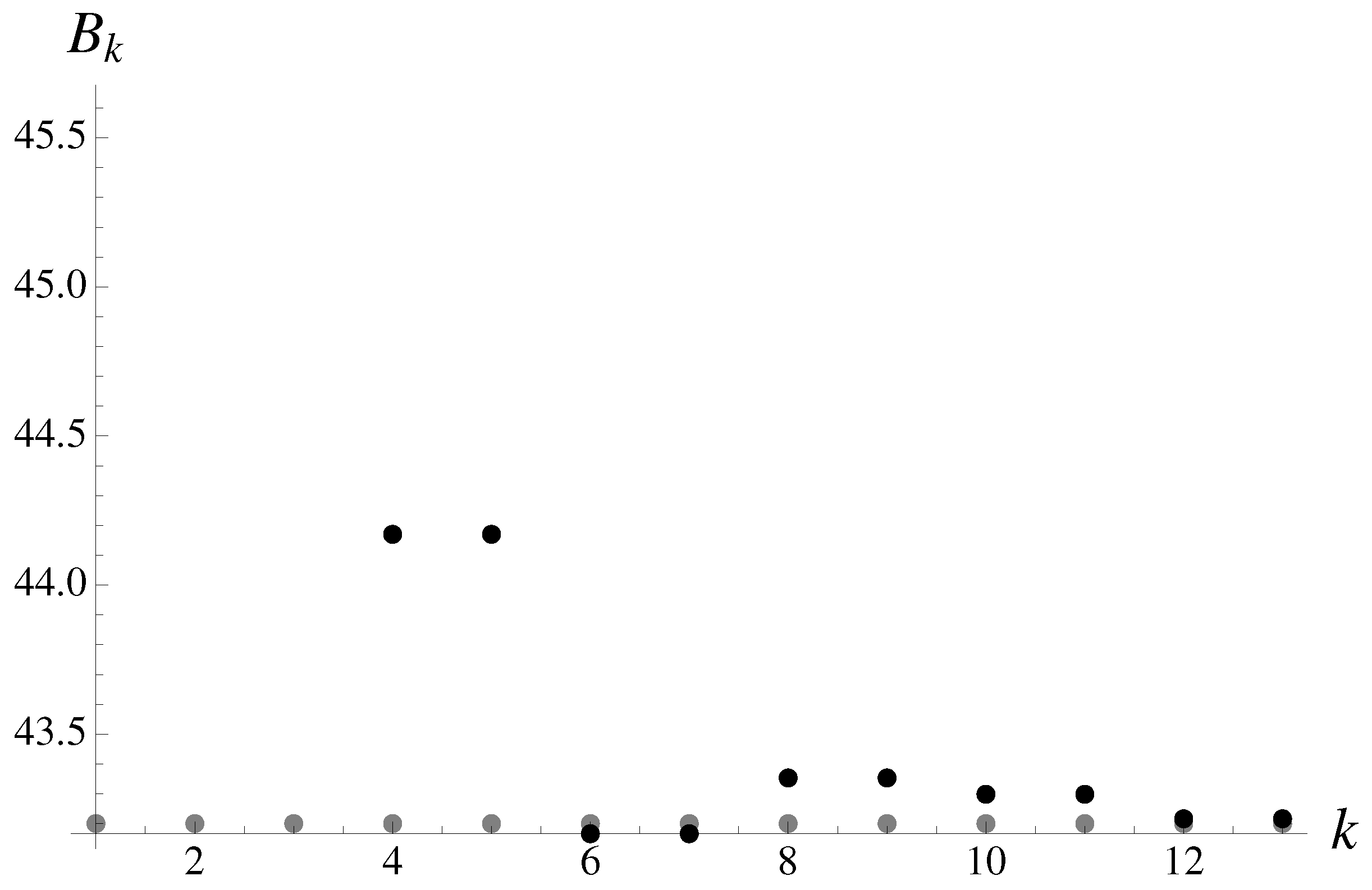

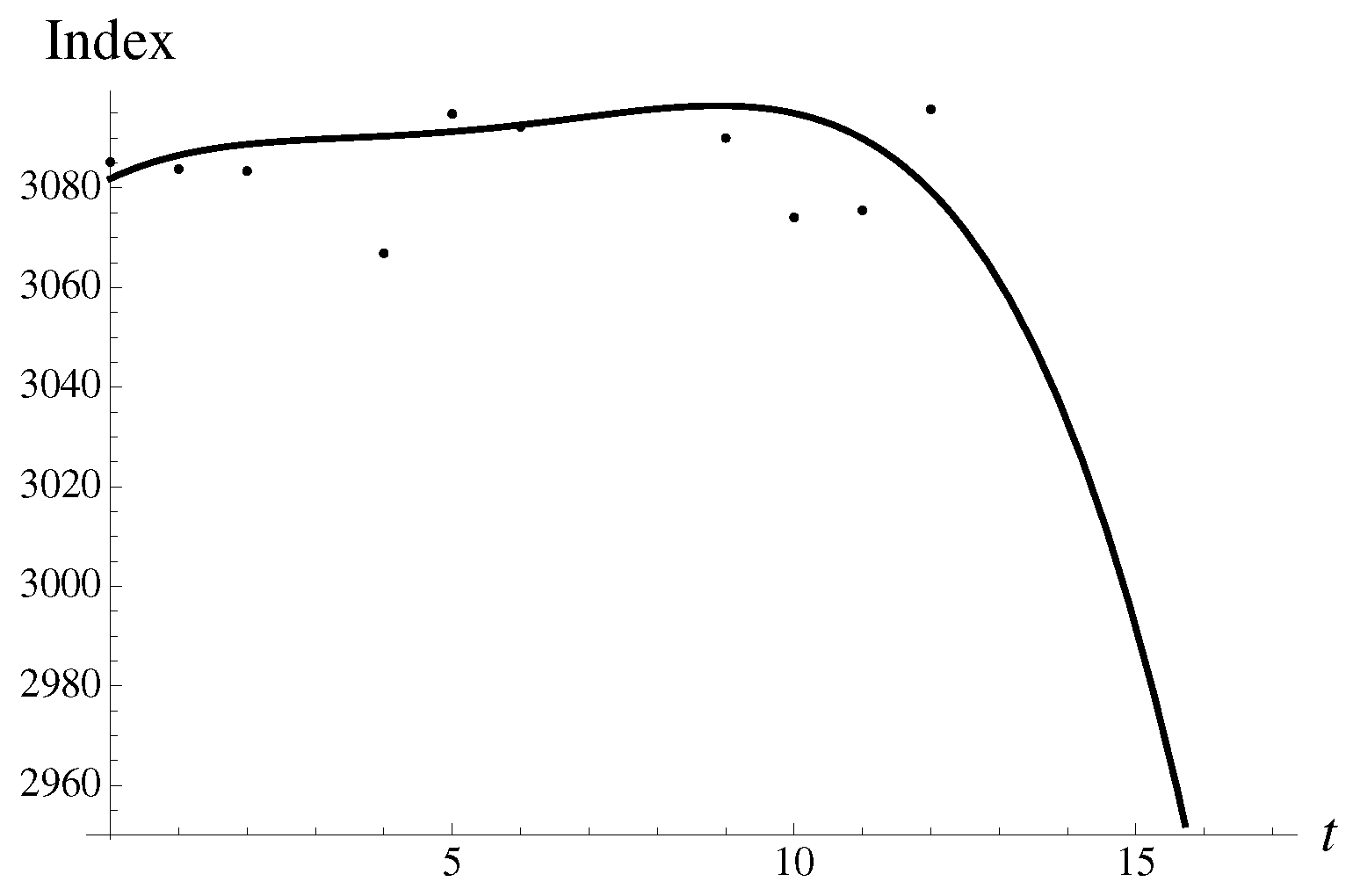

Within the data shown in

Figure 2, one can discern competing trends. First, let us show the data compared to the regression. There are two obvious trends, “up” and “down”, as can be seen in

Figure 2.

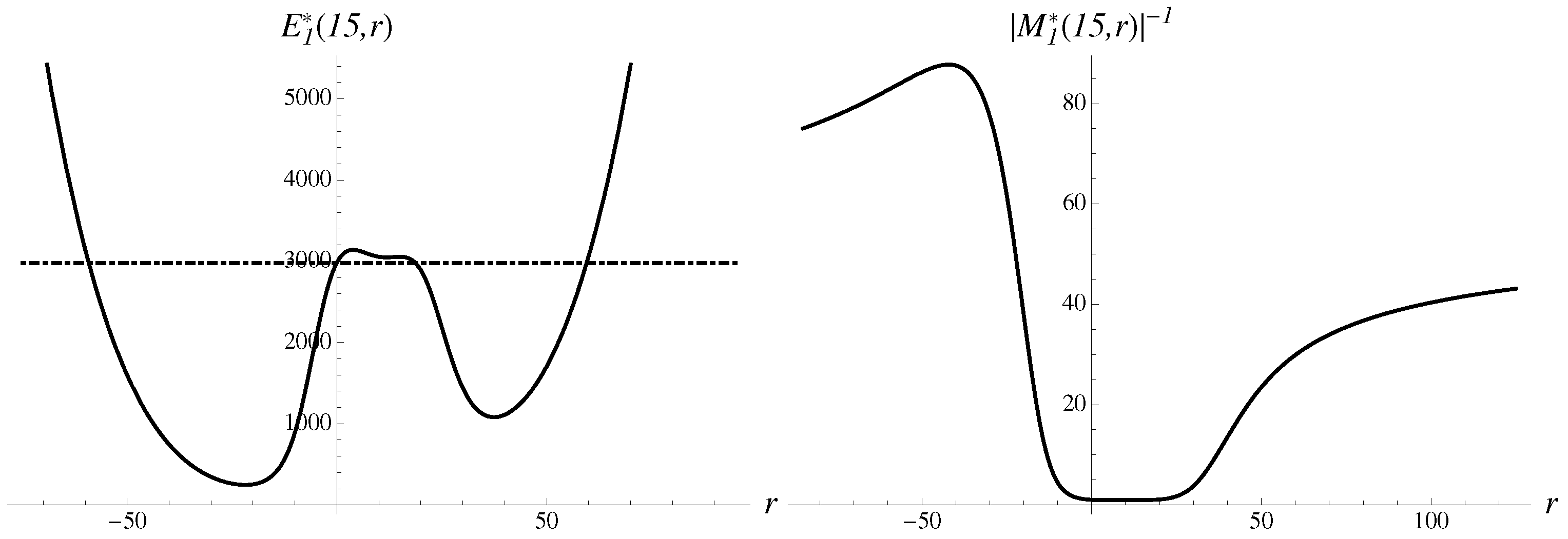

Our analysis indeed finds highly probable solutions of both types, with the downward trend developing into fast exponential decay. Let us analyze the typical approximant and multiplier dependencies on origin, for fixed time

. The inverse multiplier is shown as a function of the origin

r in

Figure 3 as well as the first-order approximant.

There are two uneven humps in the probabilistic inverse multiplier, suggesting that large negative and large positive

r dominate, with more weight put on the negative region. Such dependence on

r manifests the time-translation invariance violation, which should be lifted by finding appropriate origin. More details on the example can be found in [

30]. Below, we discuss only the fourth-order calculations.

The results of extrapolation by method expressed by Equation (

47) is given as

with relative percentage error of

. There is also a less stable “upward” solution

in agreement with intuitive picture based on naive data analysis. There are also two additional solutions in between with multipliers close to 1. They do not affect averages much, but in real time the metastable solutions, similar to the metastable phases in condensed matter, may show up under special conditions. Metastable solutions when realized violate the principle of maximal stability over the observation timescale, complicating or even negating a unique forecast, based on weighted averages or the most stable solution.

Calculation of the discrete spectrum can be extended to different approximants. For instance, one can also construct the second-order Gompertz approximant introduced above, and solve the following equation on origins:

The most stable Gompertz approximant gives the most accurate estimate

with a very small error of

. There are altogether five solutions to (

56), in the discrete spectrum, as shown in

Figure 1.

Thus, the Gompertz approximant of second order with log-time-translation invariance gives better results than symmetric exponential approximant

. Although Taleb’s Black Swan did seem to materialize, the short-time stock market response was not different than in somewhat comparable instances of crashes brought up in [

30], making it look like a Grey Swan. Indeed, it is plausible that the holiday season in China played the role here. It also helped our cause, effectively pinpointing the day for crash. One can think that all solutions, except the most extreme downward solution, were simply not considered.

Consider several most spectacular examples of crashes from the tumultuous spring and summer of 2020, caused by combination of economic causes such as oil anti-shock and COVID-19 related, enormous disruptions—a rare constellation of Two Swans of Gray coming together! There was a month long delay until DJ crashed. All three conspicuous crashes from March 2020 can be considered as an exponentially accelerated decay.

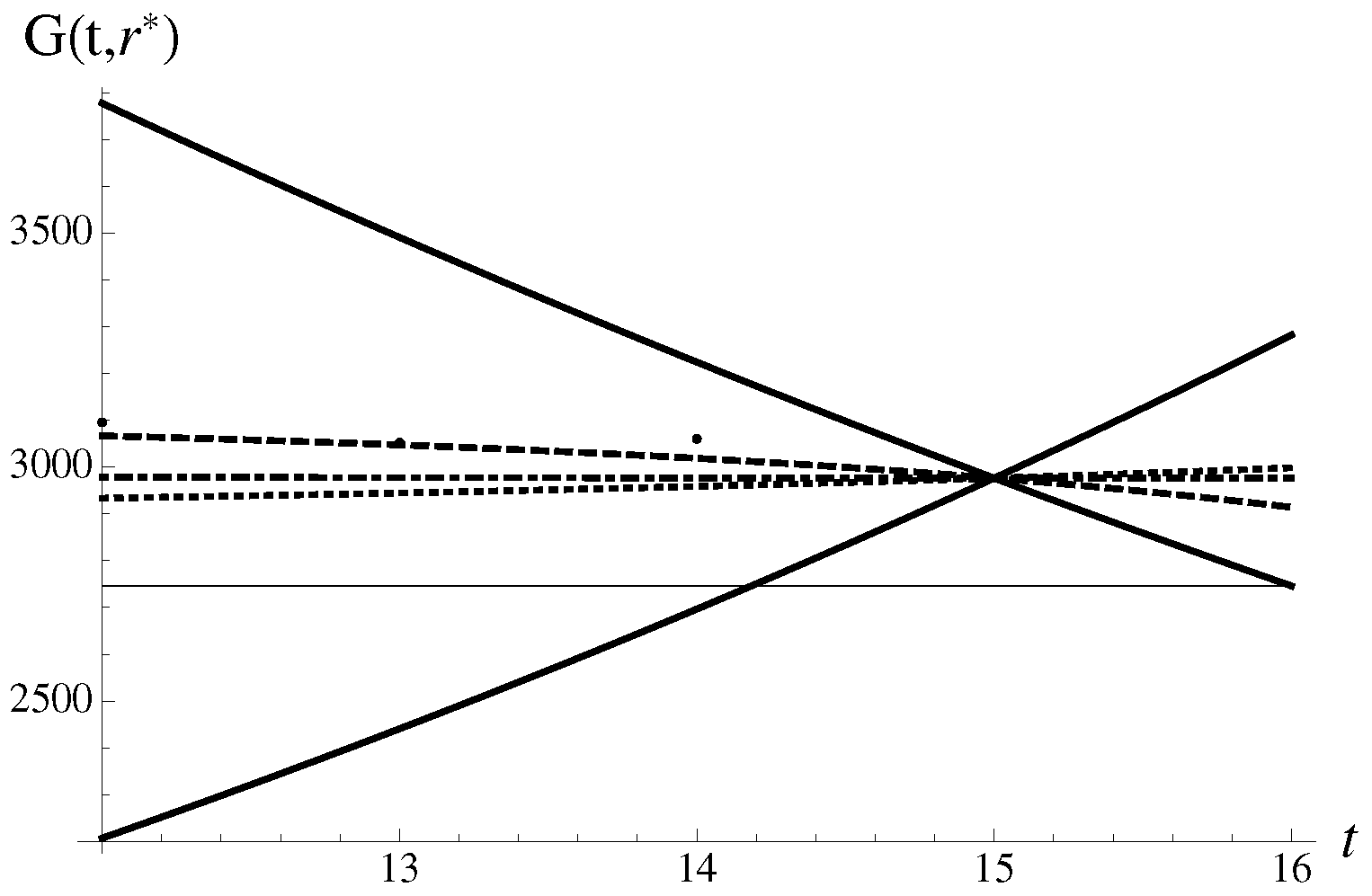

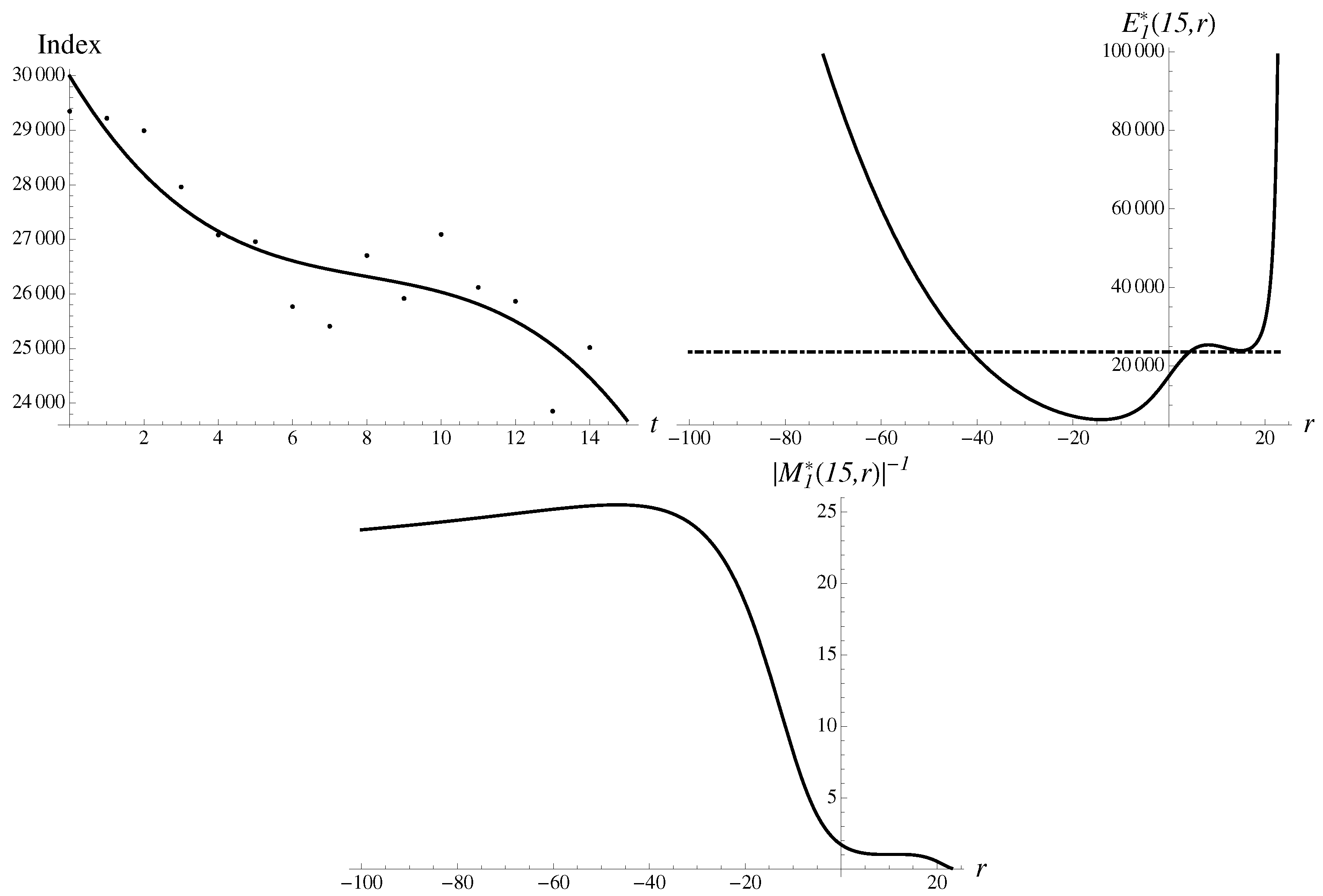

Black Monday I. Drop in DJ Industrial of

was caused by the shock from coronavirus, to the value of

23,851, on 9 March 2020 (Black Monday I), as demonstrated in

Figure 4. The data and the components defining spectrum of scenarios are presented.

Again, there are two asymmetric humps in the probabilistic space, and the region of large negative

r dominates. The extrapolation by the most stable solution results in the following result,

of

. There is also less stable by order of magnitude “upward” solution, as well as four additional solutions in between with multipliers of the order of unity. Using the same methodology, we obtain Gompertz approximant, and find that it gives rather good extrapolation

with a very small multiplier, and shows accuracy of

. There is also an upward solution, by order of magnitude less stable. Averaging the two solutions improves the estimate to the error of only

.

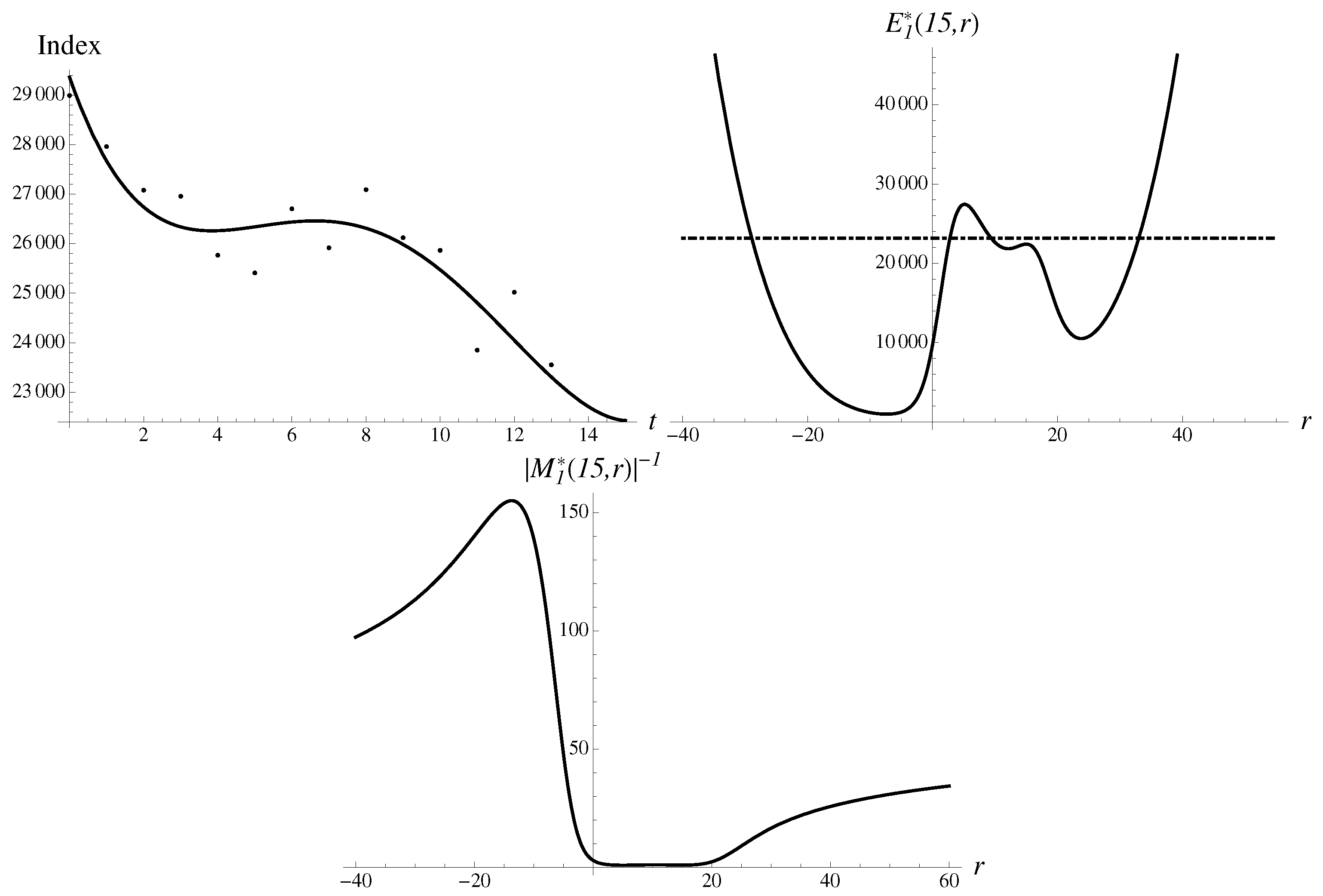

Black Thursday. Drop of

, to the level of

21,200.6 on 12 March 2020 (Black Thursday), is also believed to be caused by the coronavirus-shock. In this case, we use the standard dataset with

and the third-order regression to see the typical pattern shown in

Figure 5.

There is again a marked asymmetry on the graphs for the components in the probabilistic space, as the region of large negative

r prevails. The extrapolation by the most stable solution gives

bringing the numerical error

. There is also a much less stable “upward” solution. Using the same methodology for finding the discrete spectrum, we obtain Gompertz approximant, and find that it gives rather good result

with a very small multiplier and an accuracy of

. There is also an additional solution, even slightly more stable, leading to a super-fast decay almost to zero. Such scenario, obviously, is absent in calculations with pure exponential approximants.

Black Monday II. Consider also the massive crash of

, to the value of

20,188.5 on 16 March 2020 (Black Monday II), caused also by oil anti-shock. Because the USA is the largest producer of oil, the big drop in oil prices (anti-shock) caused an effect typically attributed to oil shock. In this case, we again use the dataset of standard length with

, to see the typical pattern shown in

Figure 6. It demonstrates the data, approximant and multiplier.

There are two typical asymmetric humps in the probabilistic space, and the region of large negative

r dominates. The extrapolation by the most stable solution gives the following values,

bringing the numerical error of

. There is also much less stable “upward” solution,

as well two additional solutions in between, with multipliers of the order of unity. Using the same optimization methodology, we obtain Gompertz approximant, and find extrapolations

with accuracy of

.

Fear of second wave of coronavirus. Bubble configuration corresponds to the price (index) going up monotonously, with rapid change of direction at some point, during the time scale of order of the time-series resolution. The growth finally becomes unsustainable. The crash of 11 June 2020 had started overnight. The index dropped to

25,128.2, corresponding to a mini-crash of 6.9%. For the the dataset of length

, we observe almost a perfect bubble, as shown in

Figure 7. It demonstrates the data, approximant and multiplier as functions of origin.

There is also a marked asymmetry in the probabilistic space, and the region of large negative r dominates. In the current case, the pattern appeared before the very day of crash and evolved into the mini-crash due to the overnight shock.

Extrapolation by the most stable solution results in

bringing the error of

. There is also less stable “upward” solution,

as well two additional solutions in between with multipliers of the order of unity.

Similar calculations with Gompertz approximant, give better estimate for the crash,

with error of just

. One can think that fear of a second coronavirus wave leads to self-generated nervousness, leading to panic [

69], having the net result of a shock. Bubbles are quite rare patterns in DJ index and more typical to Shanghai Composite [

30].