1. Introduction

Compound option is a standard option with mother standard option being the underlying asset. Compound options have been extensively used in corporate finance. When the total value of a firm’s assets is regarded as the risky underlying asset, the various corporate securities can be valued as claim contingent on underlying asset, and the option on the security is termed a compound option. The compound option models were first used by Geske [

1] to value options on a share of common stock. Richard [

2] extended Geske’s work and obtained a closed-form solution for the price of an American call. Selby and Hodges [

3] studied the valuation of compound options.

Extendible options are a generalized form of compound options whose maturities can be extended on the maturity date, at the choice of the option holder, and this extension may require the payment of an additional premium. They are widely applied in financial fields such as real estate, junk bonds, warrants with exercise price changes, and shared-equity mortgages, so many researchers carry out the theoretical models for pricing the options.

Prior valuation of extendible bonds was presented by Brennan et al. [

4] and Ananthanaray et al. [

5]. Longstal [

6] extended their work to develop a set of pricing model for a wide variety of extendible options. Since these models assume the asset price follows geometric Brownian motion, they are unlikely to translate the abnormal vibrations in asset price when the arrival of important new information come out. Merton [

7] considered the impact of a sudden event on the asset price in the financial market and proposed a geometric Brownian motion with jumps to match the abnormal fluctuation of financial asset price, which was introduced into derivation of the option pricing model. Based on this theory, Dias and Rocha [

8] considered the problem of pricing extendible options under petroleum concessions in the presence of jumps. Kou [

9] and Cont and Tankov [

10] also considered the problem of pricing options under a jump diffusion environment in a larger setting. Moreover, Gukhal [

11] derived a pricing model for extendible options when the asset dynamics were driven by jump diffusion process. Hence, the analysis of compound and extendible options by applying jump process is a significant issue and provides the motivation for this paper.

All this research above assumes that the logarithmic returns of the exchange rate are independent identically distributed normal random variables. However, the empirical studies demonstrated that the distributions of the logarithmic returns in the asset market generally reveal excess kurtosis with more probability mass around the origin and in the tails and less in the flanks than what would occur for normally distributed data [

10]. It can be said that the properties of financial return series are nonnormal, nonindependent, and nonlinear, self-similar, with heavy tails, in both autocorrelations and cross-correlations, and volatility clustering [

12,

13,

14,

15,

16]. Since fractional Brownian motion

has two substantial features such as self-similarity and long-range dependence, thus using it is more applicable to capture behavior from financial asset [

17,

18,

19,

20,

21]. Unfortunately, due to

is neither a Markov process nor a semimartingale, we are unable to apply the classical stochastic calculus to analyze it [

22]. To get around this problem and to take into account the long memory property, it is reasonable to use the mixed fractional Brownian motion

to capture fluctuations of the financial asset [

23,

24]. The

is a linear combination of Brownian motion and

processes. Cheridito [

23] proved that, for

, the mixed model with dependent Brownian motion and

was equivalent to one with Brownian motion, and hence it is arbitrage-free. For

, Mishura and Valkeila [

25] proved that the mixed model is arbitrage-free.

In this paper, to capture the long-range property, to exclude the arbitrage in the environment of

and to get the jump or discontinuous component of asset prices, we consider the problem of compound option in a jump mixed fractional Brownian motion

environment. We then exert the result to value extendible options. We also provide representative numerical results. The

is based on the assumption that the underlying asset price is generated by a two-part stochastic process: (1) small, continuous price movements are generated by a

process, and (2) large, infrequent price jumps are generated by a Poisson process. This two-part process is intuitively appealing, as it is consistent with an efficient market in which major information arrives infrequently and randomly. The rest of this paper is as follows. In

Section 2, we briefly state some definitions related to

that will be used in forthcoming sections. In

Section 3, we analyze the problem of pricing compound option whose values follow a

process and present an explicit pricing formula for compound options. In

Section 4, we derive an analytical valuation formula for pricing extendible option by compound option approach with only one extendible maturity under risk neutral measure, then extend this result to the valuation of an option with

N extendible maturity.

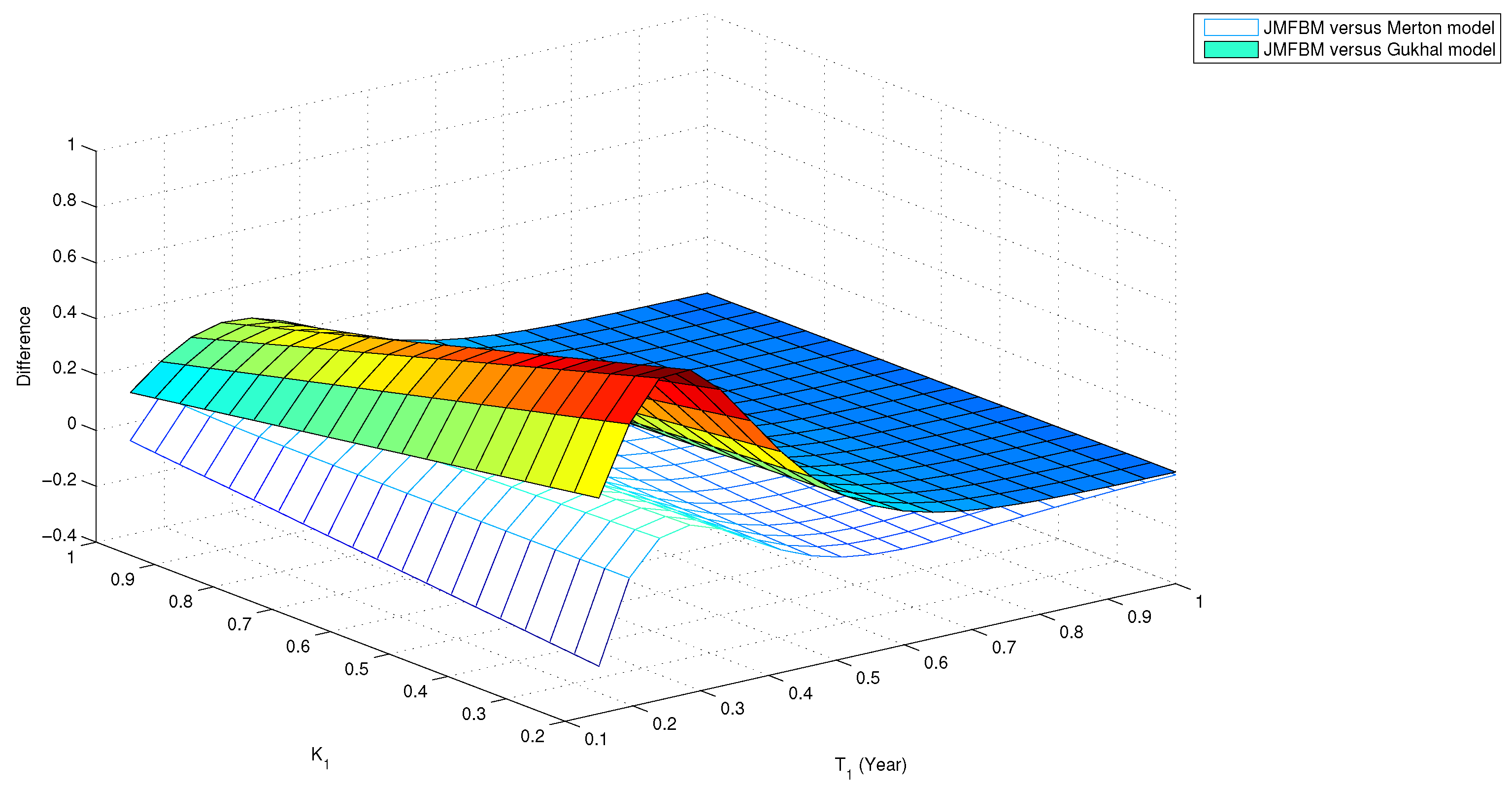

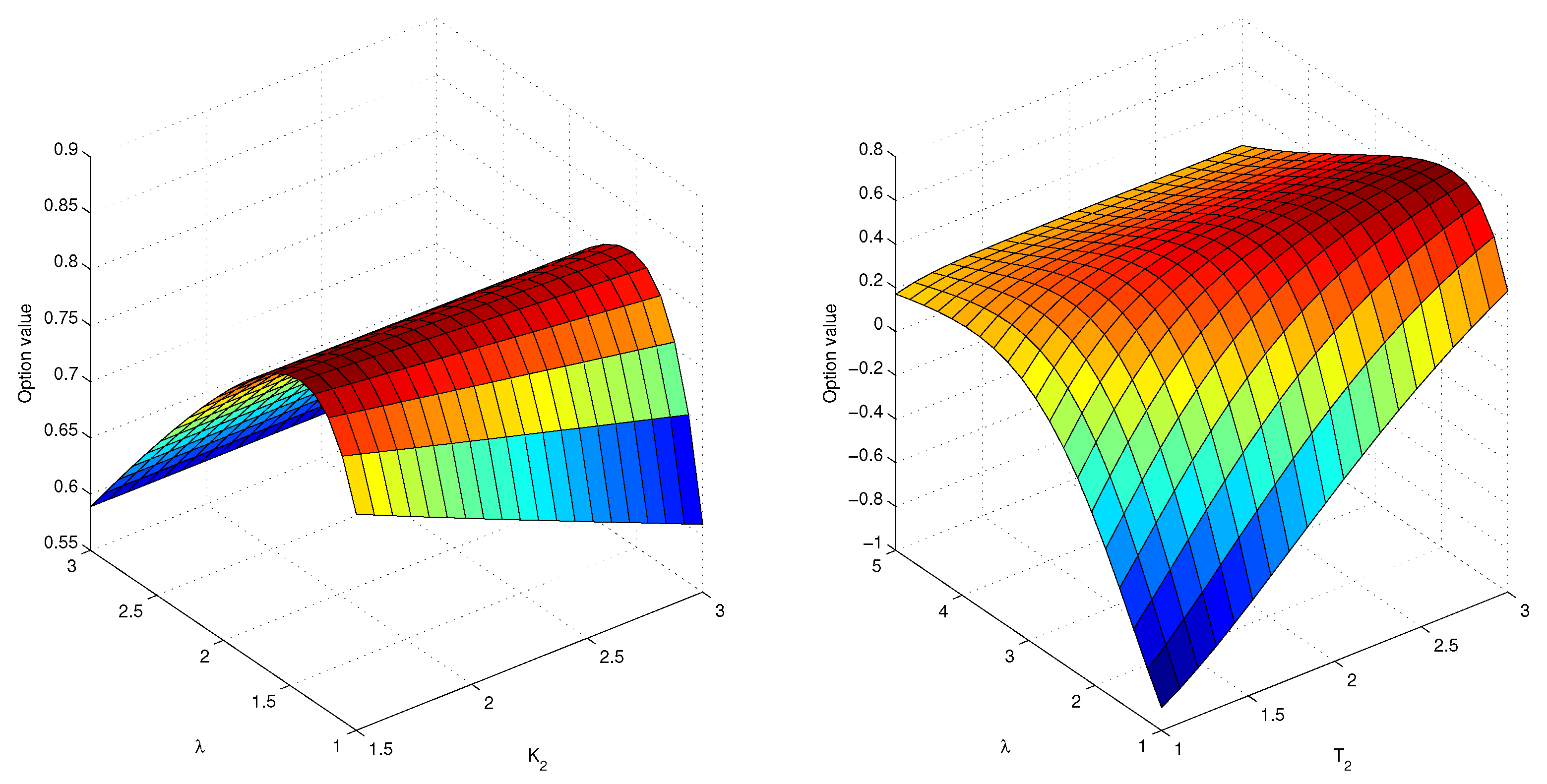

Section 5 deals with the simulation studies for our pricing formula. Moreover, the comparison of our

model and traditional models is undertaken in this section.

Section 6 is assigned to conclusion.

2. Auxiliary Facts

In this section, we recall some definitions and results which we need for the rest of paper [

21,

24,

25].

Definition 1. A of parameters and H is a linear combination of and Brownian motion, under probability space for any by:where is a Brownian motion, is an independent with Hurst parameter , ϵ and α are two real invariant such that . Consider a frictionless continuous time economy where information arrives both continuously and discontinuously. This is modeled as a continuous component and as a discontinuous component in the price process. Assume that the asset does not pay any dividends. The price process can hence be specified as a superposition of these two components and can be represented as follows:

where

are constant,

is a standard Brownian motion,

is an independent

and with Hurst parameter

H,

is a Poisson process with rate

,

is the proportional change due to the jump and

. The Brownian motion

, the

,

, the Poisson process

and the jump amplitude

J are independent.

Using Ito’s Lemma [

26], the solution for stochastic differential Equation (

2) is

where

for

,

is independently and identically distributed and

;

n is the Poisson distributed with parameter

. Let

. From Equation (

3) easily get

Consider a European call option with maturity

T and the strike price

K written on the stock whose price process evolves as in Equation (

2). The value of this call option is known from [

27] and is given by

where

where

,

and

is the cumulative normal distribution.

3. Compound Options

To derive a compound option pricing formula in a jump mixed fractional market, we make the following assumptions.

- (i)

There are no transaction costs or taxes and all securities are perfectly divisible;

- (ii)

security trading is continuous;

- (iii)

there are no riskless arbitrage opportunities;

- (iv)

the short-term interest rate r is known and constant through time;

- (v)

the underlying asset price is governed by the following stochastic differential equation

Consider a compound call option written on the European call

with expiration date

and exercise price

, where

. Assume

denotes this compound option. This compound option is exercised at time

when the value of the underlying asset,

, exceeds the strike price

. When

, it is not optimal to exercise the compound option and hence expires worthless. The asset price at which one is indifferent between exercising and not exercising is specified by the following relation:

Let,

shows the price of indifference which can be obtained as the numerical solution of Equation (

6). When it is optimal to exercise the compound option at time

, the option holder pays

and receives the European call

. This European call can in turn be exercised at time

when

exceeds

K and expires worthless otherwise. Hence, the cashflows to the compound option are an outflow of

at time

when

, a net cashflow at time

of

when

and

, and none in the other states. The value of the compound option is the expected present value of these cashflows as follows:

where

is given in Equation (

5).

The evaluation of the first and second expectation in Equation (

7), can be complex due to the jumps in the asset price process. this can be conditioning the expectation on the number of jumps in the intervals

and

denoted by

and

, respectively. Let

shows the total number of jumps in the interval

and use the Poisson probabilities, we have

The evaluation of this expectation requires the joint density of two Poisson weighted sums of correlated normal. From this point, we work with the logarithmic return,

, rather than the stock price. It is important to know that the correlation between the logarithmic return

and

depend on the number of jumps in the intervals

and

. Conditioning on the number of jumps

and

,

has a normal distribution with mean

and

where

The correlation coefficient between and is as follows

Evaluating the first expectation in Equation (

7) gives

where

is the standard univariate cumulative normal distribution function and

is the standard bivariate cumulative normal distribution function with correlation coefficient

.

The second expectation in Equation (

7) can be evaluated to give

where

is defined above. Then, the following result for a compound call option is obtained.

Theorem 1. The value of a compound call option with maturity and strike price written on a call option, with maturity , strike K, and whose underlying asset follows the process in Equation (2), is given bywhere and ρ are as defined previously. For a compound option with dividend payment rate q, the result is similar with Theorem 2, only r replaces with .

4. Extendible Option Pricing Formulae

Based on the assumptions in the last Section, let be the value of an extendible call option with time to expiration of . At the time to expiration , the holder of the extendible call can

- (1)

let the call expire worthless if , or

- (2)

exercise the call and get if , or

- (3)

make a payment of an additional premium A to extend the call to with a new strike of if ,

where

is the underlying asset price and strike price at time

,

is the strike price at time

, and Longstaff [

6] refers to

L and

M as critical values, where

.

If at expiration time

the option is worth more than the extendible value with a new strike price of

for a fee of

A for extending the expiration time

to

, then it is best to exercise; that is,

. Otherwise, it is best to extend the expiration time of the option to

and exercise when it is worth more than zero; that is,

. Moreover, the holder of the option should be impartial between extending and not exercising at value

L and impartial between exercising and extending at value

M. Therefore, the critical values

L and

M are unique solutions of

and

. See Longstaff [

6] and Gukhal [

11] for an analysis of the conditions.

The value of a call option,

C at time

with a time to expiration extended to

, as the discounted conditional expected payoff is given by

Then, by the same way of the call compound option, we have

Now, we assume that the asset price satisfies in Equation (

2). Then, by calculating the expectations in Equations (

11) and (

12), the following result is derived.

Theorem 2. The price of an extendible call option with time to expiration and strike price , whose expiration time can extend to with a new strike price by the payment of an additional premium A, is given bywhereis the standard univariate cumulative normal distribution function and is the standard bivariate cumulative normal distribution function with correlation coefficient ρ. Corollary 1. If , the asset price satisfies the Merton jump diffusion equationthen, our results are consistent with the findings in [11]. When

, the asset price follows the

model shown below

and the formula (

15) reduces to the diffusion case. The result is in the following.

Corollary 2. The price of an extendible call option with time to expiration and strike price , whose expiration time can extend to with a new strike price by the payment of an additional premium A and written on an asset following Equation (15) iswhere Let us consider an extendible option with N extended maturity times, the result is presented in the following corollary.

Corollary 3. The value of the extendible call expiring at time , written on an asset whose price is governed by Equation (2) and whose maturity extend to with new strike of by the payment of corresponding premium of , is given bywhere is the j-dimensional multivariate normal integral with upper limits of integration given by the j-dimensional vector and correlation matrix and define . The same as and and defineand . is a diagonal matrix with correlated coefficient as the pth diagonal element, 0 and negative correlated coefficient , respectively, as the first and the last diagonal element, and correlated coefficient . As to the rest of the elements, we note that is equal to negative correlated coefficient when and is equal to zero when the term and respectively represents the jth “time instant” and the critical price as defined previously. As

N increases to infinity the exercise opportunities become continuous and hence the value of the approximate option will converge in the limit to the value of the extendible option. Thus, the values

form a converging sequence and the limit of this sequence is the value of the extendible, i.e.,

. To minimize the impact of this computational complexity, we use the Richardson extrapolation method [

28] with two points. This technique uses the first two values of a sequence of a sequence to obtain the limit of the sequence and leads to the following equation,

where

stands for the extrapolated limit using

and

.