1. Introduction

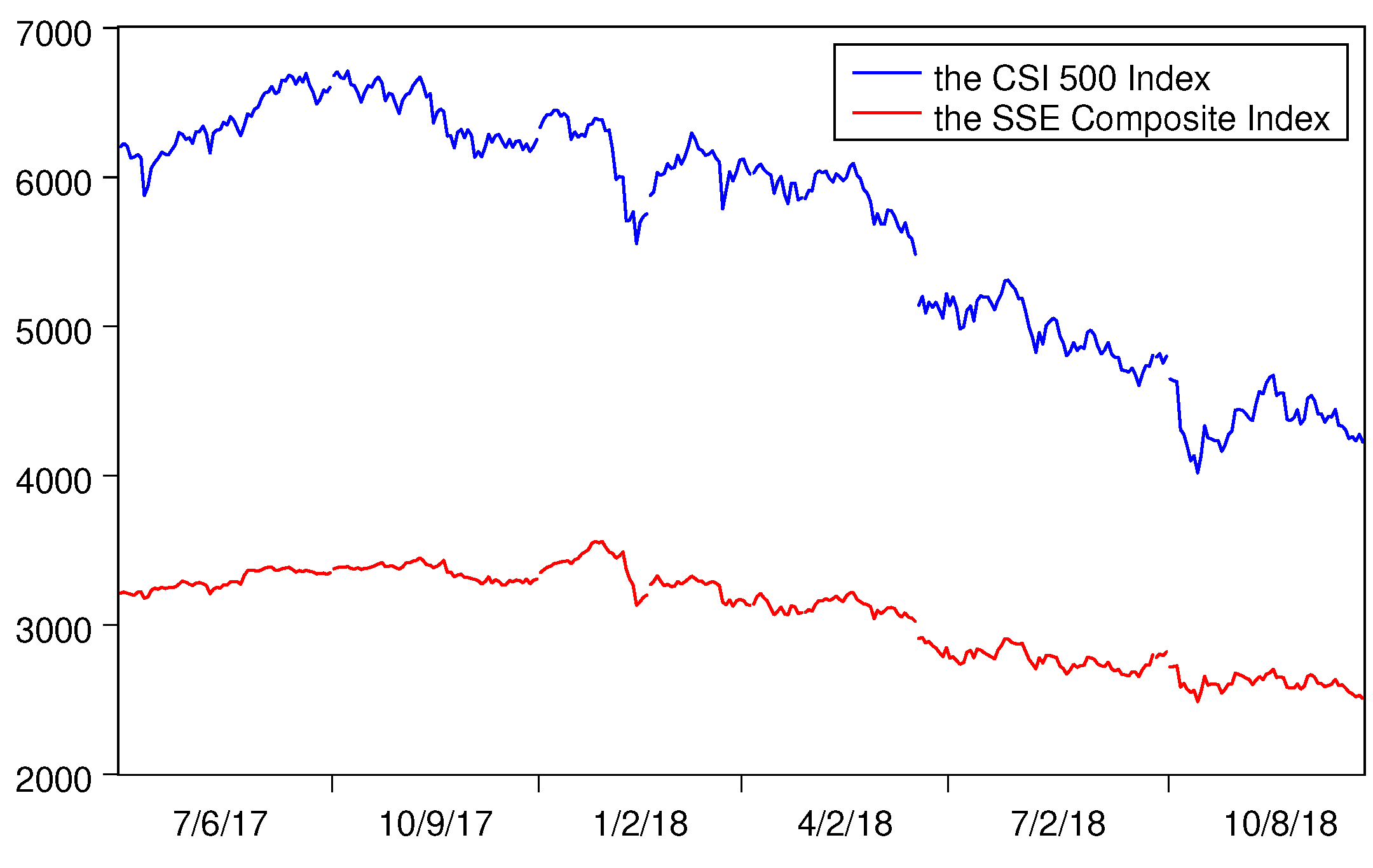

In recent years, due to the acceleration of financial deleveraging and other policies, China’s stock markets have experienced many instances of volatility, which have brought large losses to investors and triggered economic turmoil. In this context, scientifically analyzing the structural changes in stock prices is crucial for investors’ investment decisions and regulators’ risk prevention and control.

With the widespread application of statistical inference theories and methods in the financial industry, more scholars have found that the study of change point problems has good predictive effects for identifying major events such as financial crises. Change points are actually qualitative changes in the data structure. It is very meaningful to accurately judge or predict the occurrences or locations of change points based on existing, historical, and all observable information [

1].

When there is a significant fluctuation in the stock market, it is usually accompanied by limit up and limit down changes in individual stock prices. The price limits of the Chinese stock markets form a type of price stability mechanism, which is an institutional tool used by exchanges to control abnormal market fluctuations. They externally control trading prices within a certain range rather than as a natural result of price formation. Therefore, most scholars are concerned about how they affect the pricing efficiency of the market, i.e., whether there is a “cooling effect”, a “magnetic attraction effect”, or a “volatility spillover” [

2,

3,

4], and few scholars have focused on their impact on the statistical characteristics of securities market prices. From the perspective of statistical inference, the impact of price limits on the market is short-term market friction formed by trading mechanisms on stock prices, which should not cause structural changes in price time series but may cause statistical bias. If this issue is ignored, there may be a certain degree of deviation in the estimation of the change point.

The statistical biases due to price limits in stock markets may originate from price latency problems. Price latency is the phenomenon of lagging price adjustments to traded assets under market friction. Previous studies have shown that low stock liquidity can lead to price delays, resulting in spurious auto-positive correlation in the index yield series and spurious auto-negative correlation in the time series of bases, which lead to statistical artifacts [

3,

5]. Harris pointed out that price limits can also lead to price latency problems [

6]. In our preliminary work, we found that after correcting for the price distortion caused by price limits on CSI 500 Index components, the autocorrelation of index returns disappeared. Obviously, if the problem of statistical artifacts caused by price delays is ignored, the market may be misinterpreted; thus, wrong conclusions may be drawn. Therefore, during periods of significant market volatility, if the statistical biases caused by price limits can be corrected to some extent, this is expected to improve the accuracy of change point detection.

The study of statistical inference for change point problems started with Page [

7] and has been a branch of research in statistics; it effectively integrates fixed sampling methods, successive sampling methods, hypothesis testing, statistical controls, Bayes methods, and other methods to solve the problems of change point occurrence and position estimation.

Based on their statistical methods, the existing studies can be divided into two categories. One category uses parameters and semi-parameters for change point testing and estimation; the other category uses the nonparametric testing and estimation of change points. For research on the change point problem in finance, due to the consensus in the academic community that ARCH models are suitable for analyzing financial market data, and the relatively low efficiency of nonparametric tests and their poor ability to detect differences, the estimation of change point parameters based on ARCH models has been widely adopted.

These studies achieve change point estimation based on the cumulative sums of residuals, likelihood functions, distribution functions, and Bayes methods. Among them, the studies presented by Kokoszka and Leipus [

8,

9], Lee et al. [

10,

11,

12], Kim [

13], and Andreou and Ghysels et al. [

14] mainly constructed the cumulative sum of the residuals by the least squares method and used this statistic to estimate a solution to the change point problem based on the ARCH term parameters, mean, variance, and cross-covariance by using ARCH or GARCH models. In the study of estimating change points by using likelihood functions, it is common to construct statistics based on likelihood functions to identify the occurrence of change points. For example, Carsoule and Franses [

15] proposed a sequential testing approach based on a maximum likelihood estimation method to solve the variance estimation problem and the ARCH model in the EUR exchange rate market. Berkes et al. [

16] used a quasi-likelihood method to construct scoring statistics to solve the problem of change point estimation when using a GARCH model. Bardet and Kengne [

17] proposed a change point estimation method suitable for a cluster of causal models (such as AR(

∞), ARCH(

∞), TARCH(

∞), and ARMA-GARCH); the authors discussed a quasi-likelihood estimation index. In a study using distribution functions, Horvath and Kokoszka [

18] derived the asymptotic distribution of a squared empirical residual term and applied it to the variation point detection problem by using an ARCH model. Na et al. [

19] considered the problem of monitoring distribution change points for independent random sequences by using GARCH and other models by implementing an empirical distribution function model and empirical feature function type statistics. In the study of the change point problem using classical Bayes methods, parameter estimation is often carried out for models with relatively complex forms; e.g., Lai and Xing [

20] studied the Bayesian change point parameter estimation problem by using an ARX-GARCH model. Wang et al. [

21] proposed a quantile regression model with multiple random change points for a special panel to analyze the potential structural changes in the price capacity relationship after short-term stock issuances on the Chinese growth enterprise market. There are also some studies that focused on the detection of multivariate points in time-series models. Most of these studies transform multivariate point detection into a single-change point detection problem through binary segmentation. Representative studies include Fryzlewic and Rao [

22], Cho and Fryzlewicz [

23], etc.

In addition, since the Bayes method avoids the difficulty of finding a sampling distribution, it can also solve the problem of change point estimation through a general programming process under the condition of an abnormal prior assumption. Therefore, it has been widely applied in other fields. For example, Chen et al. [

24] studied the identification of change points under the condition that climate change follows the Pareto distribution. Monfared, Dehghan and Fazlollah [

25] studied change point identification under the assumption of a gamma distribution. Bianchi et al. [

26] assumed that the volatility of macroeconomic risk exposure factors follows a breakpoint latent process and estimated the change point problem of risk factors. Jung, Song, and Chung [

27] studied change point estimation under the condition of dynamic level distribution. Cai et al. [

28] constructed a Bayes probability statistical inference model by using the Poisson distribution, the power-law distribution, and the log-normal distribution as prior distributions to test the change points of crude oil.

Through the above literature review, it is found that research on the estimation of change point parameters can be further supplemented in the following aspects: (1) The statistical bias caused by the price limits may be ignored. (2) Most existing studies only give research results on standard ARCH or GARCH models, while there is relatively little research on extended forms of ARCH models, such as the -ARCH model. (3) The characteristics of the sharp peaks and heavy tails of financial asset prices lead to the fact that it is usually difficult to satisfy the assumption of normal distribution of model residuals, and Bayes change point detection using the generalized error distribution as a prior assumption is still rare.

Based on such a research status, this study is planned to be carried out along the following lines: First, in

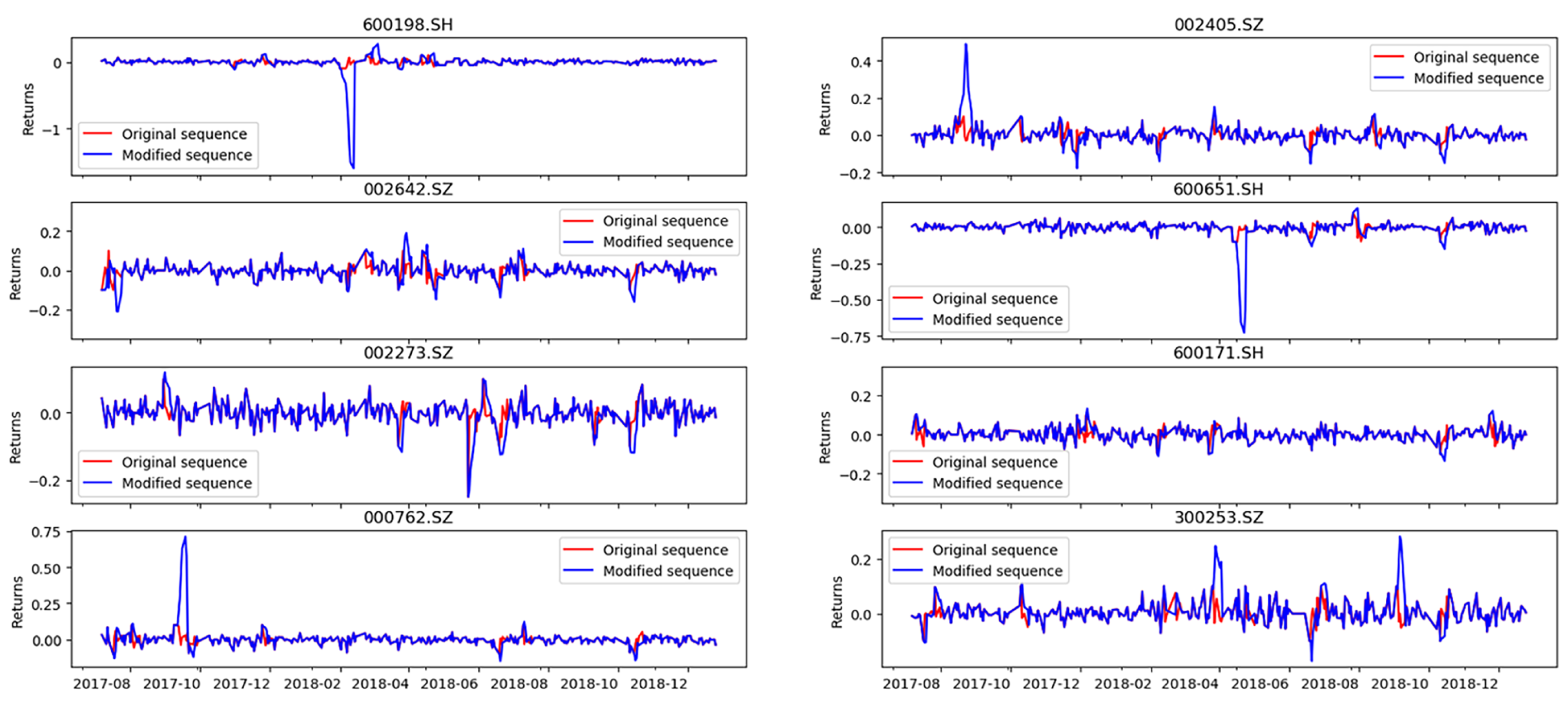

Section 2, a general extension form for the ARCH model, the

-ARCH model assuming that the residual follows a generalized error distribution, uses the classical Bayes methods to solve the parameter estimation problem of identifying the occurrence of change points and determining the position of change points. Then, in

Section 3, by taking individual stocks with high frequency triggering the price limit in the Chinese stock market as an example, we use the Kalman filtering method to correct price distortions caused by price limits. Finally, in

Section 4, the empirical test of change point detection is given, and the corresponding conclusions are obtained for the method proposed in this paper.