Research on Timing Sequence Update Strategy Decision of Project Portfolio Based on Coupling Benefits in Strategic Period

Abstract

:1. Introduction

- (1)

- In this study, we advocate for the adoption of strategic period coupling benefits as the foundational criterion for project portfolio selection. Contrary to solely focusing on enterprise benefits, coupling benefits encompass both the alignment of a project with enterprise strategies and the economic advantages of each project. This approach more effectively realizes enterprise strategic objectives and offers a novel perspective on project portfolio selection.

- (2)

- In recognition of the extended duration over which the selected portfolio will be implemented, we introduce a decision model for the sequential strategic updating of portfolios that is rooted in the concept of coupling benefits over the strategic period. Viewing the entirety of the strategic period, it is segmented into distinct phases. This approach facilitates the strategic selection of projects at any decision-making juncture within the overarching strategic period.

- (3)

- Regarding research methodologies, traditional operation research optimization algorithms encounter challenges in addressing the dynamic project combination problems presented in this study. While multi-agent reinforcement learning (MSA) is an algorithm that was only recently introduced, it remains underexplored in the realm of project portfolio optimization. In this study, we employ the multi-agent reinforcement learning algorithm to investigate project portfolio selection and monitor the implementation of decision-making processes.

2. Literature Review

3. Construction of Coupling Benefits Model for Project Portfolio Selection in Strategic Period

3.1. Strategic Matching Degree of Project Portfolio Based on Compound Fuzzy Matter–Element Theory

3.2. Project Portfolio Selection Model Based on Coupling Benefits Maximization in Strategic Period

4. Portfolio Timing Sequence Strategy Update Decision under Coupling Benefits Maximization in Strategic Period

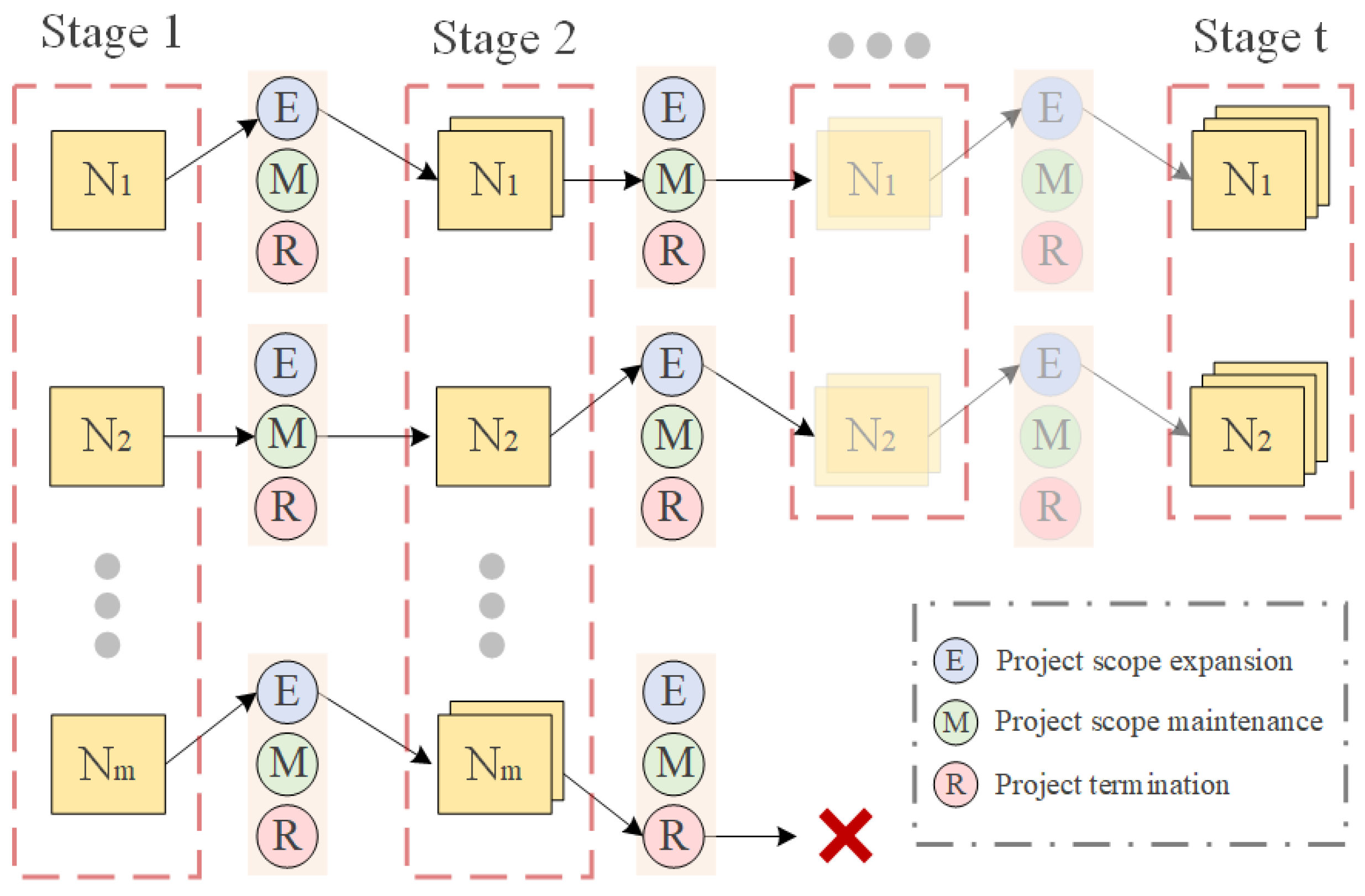

4.1. Multi-Stage Decision Analysis of Project Portfolio Timing Sequence Strategy Update

4.2. Portfolio Timing Sequence Strategy Update Problem Description

4.3. Construction of Project Portfolio Sequential Strategy Updating Model under Coupling Benefit Maximization in Strategic Period

5. Timing Sequence Strategy Update of Project Portfolio Based on Nash Q-Learning Algorithm

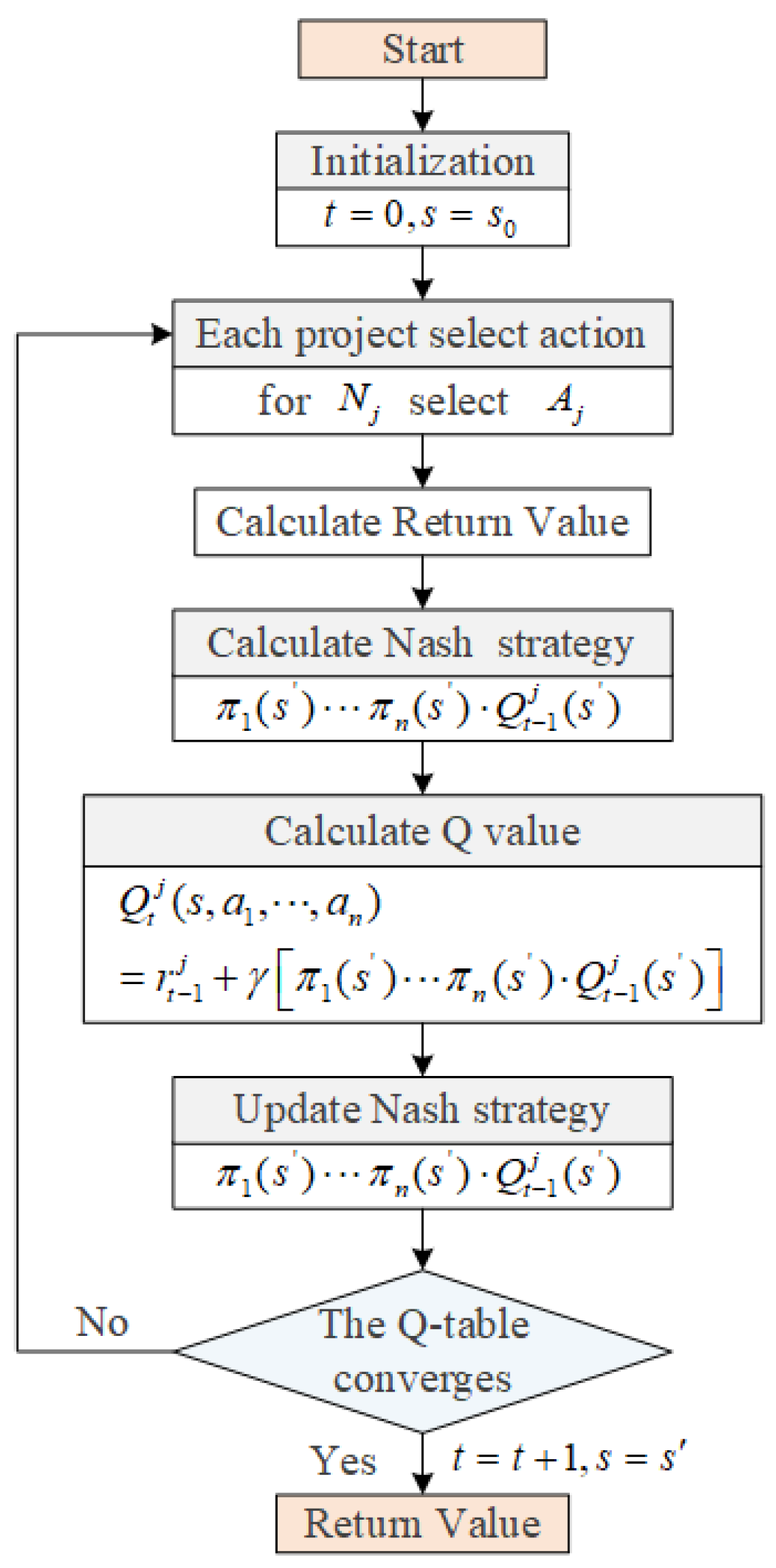

5.1. Update Decision Analysis of Project Portfolio Timing Sequence Strategy Based on Multi-Agent Nash Q-Learning Algorithm

5.2. The Principle of Portfolio Sequential Strategy Updating Based on the Nash Q-Learning Algorithm

5.3. Calculation Steps of Project Portfolio Timing Strategy Update Solution Based on Nash Q-Learning Algorithm

6. Case Study

6.1. Case Background

6.2. Alternative Project Description

6.3. Evaluation of Project Portfolio Strategy Matching

6.4. Project Portfolio Selection and Sequential Strategy Updating Solution under Coupling Benefit Maximization

6.5. Results Analysis

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Clegg, S.; Killen, C.P.; Biesenthal, C.; Sankaran, S. Practices, projects and portfolios: Current research trends and new directions. Int. J. Proj. Manag. 2018, 36, 762–772. [Google Scholar] [CrossRef]

- Meskendahl, S. The influence of business strategy on project portfolio management and its success—A conceptual framework. Int. J. Proj. Manag. 2010, 28, 807–817. [Google Scholar] [CrossRef]

- Martinsuo, M.; Geraldi, J. Management of project portfolios: Relationships of project portfolios with their contexts. Int. J. Proj. Manag. 2020, 38, 441–453. [Google Scholar] [CrossRef]

- Kock, A.; Heising, W.; Gemuenden, H.G. A Contingency Approach on the Impact of Front-End Success on Project Portfolio Success. Proj. Manag. J. 2016, 47, 115–129. [Google Scholar] [CrossRef]

- Marcondes, G.; Leme, R.C.; Carvalho, M.M. Framework for Integrated Project Portfolio Selection and Adjustment. IEEE Trans. Eng. Manag. 2019, 66, 677–688. [Google Scholar] [CrossRef]

- Mohagheghi, V.; Mousavi, S.M.; Antuchevičienė, J.; Mojtahedi, M. Project portfolio selection problems: A review of models, uncertainty approaches, solution techniques, and case studies. Technol. Econ. Dev. Econ. 2019, 25, 1380–1412. [Google Scholar] [CrossRef]

- Petit, Y.; Hobbs, B. Project portfolios in dynamic environments: Sources of uncertainty and sensing mechanisms. Proj. Manag. J. 2010, 41, 46–58. [Google Scholar] [CrossRef]

- Wang, L.; Kunc, M.; Bai, S.-J. Realizing value from project implementation under uncertainty: An exploratory study using system dynamics. Int. J. Proj. Manag. 2017, 35, 341–352. [Google Scholar] [CrossRef]

- Song, S.; Yang, F.; Xia, Q. Multi-criteria project portfolio selection and scheduling problem based on acceptability analysis. Comput. Ind. Eng. 2019, 135, 793–799. [Google Scholar] [CrossRef]

- Jafarzadeh, H.; Akbari, P.; Abedin, B. A methodology for project portfolio selection under criteria prioritization, uncertainty and projects interdependency–combination of fuzzy QFD and DEA. Expert Syst. Appl. 2018, 110, 237–249. [Google Scholar] [CrossRef]

- Bai, L.; Han, X.; Wang, H.; Zhang, K.; Sun, Y. A method of network robustness under strategic goals for project portfolio selection. Comput. Ind. Eng. 2021, 161, 107658. [Google Scholar] [CrossRef]

- Ansari, R.; Shakeri, E.; Raddadi, A. Framework for aligning project management with organizational strategies. J. Manag. Eng. 2015, 31, 04014050. [Google Scholar] [CrossRef]

- Kester, L.; Hultink, E.J.; Lauche, K. Portfolio decision-making genres: A case study. J. Eng. Technol. Manag. 2009, 26, 327–341. [Google Scholar] [CrossRef]

- Anderson, D.K.; Merna, T. Project Management Strategy—Project management represented as a process-based set of management domains and the consequences for project management strategy. Int. J. Proj. Manag. 2013, 21, 387–393. [Google Scholar] [CrossRef]

- Huang, X.; Su, X.; Zhao, T. Optimal multinational project adjustment and selection with random Parameters. Optim. J. Math. Program. Oper. Res. 2014, 63, 1583–1594. [Google Scholar] [CrossRef]

- Bai, L.; Zhang, R.; Bai, S.; Du, Q. Competition congestion of shared resources for project portfolio based on catastrophe theory. J. Ind. Eng. Eng. Manag. 2020, 34, 205–212. [Google Scholar]

- Mohagheghi, V.; Mousavi, S.M. A new multi-period optimization model for resilient-sustainable project portfolio evaluation under interval-valued Pythagorean fuzzy sets with a case study. Int. J. Mach. Learn. Cybern. 2021, 12, 3541–3560. [Google Scholar] [CrossRef]

- Wang, B.; Feng, Z.; Feng, J.; Yu, P.; Cui, L. Decision making on investments in photovoltaic power generation projects based on renewable portfolio standard: Perspective of real option. Renew. Energy 2022, 189, 1033–1045. [Google Scholar]

- Tavana, M.; Khosrojerdi, G.; Mina, H.; Rahman, A. A New Dynamic Two-Stage Mathematical Programming Model under Uncertainty for Project Evaluation and Selection. Comput. Ind. Eng. 2020, 149, 678–692. [Google Scholar] [CrossRef]

- Ning, Y.; Kwak, Y.H. How Do Consulting Firms with Different Project Experience Configure Dynamic Capabilities? J. Manag. Eng. 2022, 38, 267–276. [Google Scholar] [CrossRef]

- Ghannad, P.; Lee, Y.-C.; Friedland, C.J.; Choi, J.O.; Yang, E. Multiobjective Optimization of Postdisaster Reconstruction Processes for Ensuring Long-Term Socioeconomic Benefits. J. Manag. Eng. 2020, 36, 04020038. [Google Scholar] [CrossRef]

- Xu, X.; Wang, Q.; Lu, Y. Research on Optimal Decision of Multi-project Portfolio Investment Based on RWCS Search Algorithm. Sci. Technol. Ind. 2019, 19, 69–76. [Google Scholar]

- Wang, Y.; He, Z.; Kerkhove, L.-P.; Vanhoucke, M. On the performance of priority rules for the stochastic resource constrained multi-project scheduling problem. Comput. Ind. Eng. 2017, 114, 223–234. [Google Scholar] [CrossRef]

- Yan, L.; Wu, J. Dynamic population size coevolution algorithm for multi-objective portfolio optimization problem. Math. Pract. Underst. 2019, 49, 9–17. [Google Scholar]

- Guo, Q.; Li, J.; Zou, C.; Guo, Y.; Yan, W. A class of multi-period semi-variance portfolio for petroleum exploration and development. Int. J. Syst. Sci. 2012, 43, 1883–1890. [Google Scholar] [CrossRef]

- Zhang, B.; Bai, L.; Zhang, K.; Kang, S.; Zhou, X. Dynamic assessment of project portfolio risks from the life cycle perspective. Comput. Ind. Eng. 2023, 176, 108922. [Google Scholar] [CrossRef]

- Li, X.; Wang, Y.; Yan, Q.; Zhao, X. Uncertain mean-variance model for dynamic project portfolio selection problem with divisibility. Fuzzy Optim. Decis. Mak. 2019, 18, 37–56. [Google Scholar] [CrossRef]

- Fang, C.D.; Cheng, J.H.; Zhao, P.D. Temporal and spatial evolution of Mineral-Economic-Environment coordination degree in the Yangtze River Economic Belt under the Great Protection Strategy. China Popul. Resour. Environ. 2019, 29, 65–73. [Google Scholar]

- Beseiso, M.; Kumar, G. A fuzzy computational approach for selecting interdependent projects using prioritized criteria. J. Intell. Fuzzy Syst. 2021, 40, 11341–11354. [Google Scholar] [CrossRef]

- Fang, Z.; Liu, Y.; Lu, Q.; Pitt, M.; Hanna, S.; Tian, Z. BIM-integrated portfolio-based strategic asset data quality management. Autom. Constr. 2022, 134, 104070. [Google Scholar] [CrossRef]

- Nowak, M.; Trzaskalik, T. A trade-off multiobjective dynamic programming procedure and its application to project portfolio selection. Ann. Oper. Res. 2022, 311, 1155–1181. [Google Scholar] [CrossRef]

- Han, R.; Shen, Z.; Li, X. A Two-Stage Method for Strategy-Oriented Dynamic Project Portfolio Selection Considering Project Substitution. IEEE Trans. Eng. Manag. 2023. [Google Scholar] [CrossRef]

- Mnih, V.; Kavukcuoglu, K.; Silver, D.; Rusu, A.A.; Veness, J.; Bellemare, M.G.; Graves, A.; Riedmiller, M.; Fidjeland, A.K.; Ostrovski, G.; et al. Human-level control through deep reinforcement learning. Nature 2015, 518, 529–533. [Google Scholar] [CrossRef]

- Jung, W.; He, S.H.; Lee, K.W. Country Portfolio Solutions for Global Market Uncertainties. J. Manag. Eng. 2012, 28, 372–381. [Google Scholar] [CrossRef]

- Mohammadnazari, Z.; Mousapour Mamoudan, M.; Alipour-Vaezi, M.; Aghsami, A.; Jolai, F.; Yazdani, M. Prioritizing post-disaster reconstruction projects using an integrated multi-criteria decision-making approach: A case study. Buildings 2022, 12, 136. [Google Scholar] [CrossRef]

| The Initial Investment | Annual Revenue | The Cost of Expanding the Project | Net Cash Flow to Be Increased after Expansion of the Project | |

|---|---|---|---|---|

| Project | 27,000 | 2396 | 1350 | +405 |

| Project | 21,780 | 1912 | 1089 | +326.7 |

| Project | 16,545 | 1428 | 827.25 | +248.18 |

| Project | 14,783 | 1551 | 739.15 | +221.75 |

| Project | 20,619 | 1896 | 1030.95 | +309.29 |

| Project | 13,520 | 1049 | 676 | +202.8 |

| Project | 9875 | 832 | 493.75 | +148.13 |

| Project | 12,910 | 1143 | 645.5 | +193.65 |

| Project | 10,200 | 985 | 510 | +153 |

| Project | 8090 | 797 | 404.5 | +121.35 |

| Strategic Dimensions | Objective | Evaluation Index |

|---|---|---|

| Economic benefit dimension | The benefits are optimal in the strategic period | Rate of return on investment |

| Ecological benefit dimension | Ecological restoration benefit | Ecological service value completion rate |

| Public service dimensions | Improved public satisfaction | Public satisfaction index |

| Organizational growth dimension | Degree of perfection of enterprise informatization | Level of informatization application |

| Internal process dimension | Project fund management | The effective utilization rate of water conservancy investment |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | |

| -L | -L | -L | −404.5 | 797 | 1078.66 | -L | -L | -L | -L | -L | -L | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | −404.5 | 918.35 | 849.45 | -L | -L | -L | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | −404.5 | 797 | 809 | -L | -L | -L | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | −404.5 | 1039.65 | 566.3 | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | −404.5 | 797 | 539.33 | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | −404.5 | 1161.15 | 283.14 | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | −404.5 | 797 | 269.66 | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | |

| -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L | -L |

| Stage 1–2 | …… | |||||

|---|---|---|---|---|---|---|

| −406.46 | −165.93 | −178.46 | 133.7 | 121.17 | …… | |

| −406.46 | −188 | −185.81 | 111.63 | 113.82 | …… | |

| −406.46 | −165.94 | −178.46 | 105.88 | 93.35 | …… | |

| −406.46 | −188 | −185.82 | 83.82 | 86 | …… | |

| −406.46 | −165.94 | −178.46 | 105.88 | 93.35 | …… | |

| …… | …… | …… | …… | …… | …… | …… |

| Project Portfolio | Normalized Strategic Matching Degree | Strategic Period Total Benefits |

|---|---|---|

| 0.09 | 263,360 | |

| 0.18 | 253,263.4 | |

| 0.18 | 261,312 | |

| 0.09 | 245,436 | |

| 0.18 | 263,350 | |

| 0.18 | 241,992 |

| Project Portfolio | Normalized Strategic Matching Degree | Strategic Period Coupling Benefits |

|---|---|---|

| 0.09 | 6503.273 | |

| 0.18 | 6246.982 | |

| 0.18 | 3228.727 | |

| 0.09 | 6063.273 | |

| 0.09 | 6504.727 | |

| 0.18 | 5974.545 |

| Stage | ||||||

|---|---|---|---|---|---|---|

| Project | ||||||

| - | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, K.; Feng, J.; Li, S.; Zhang, K.; Hu, D. Research on Timing Sequence Update Strategy Decision of Project Portfolio Based on Coupling Benefits in Strategic Period. Water 2023, 15, 3769. https://doi.org/10.3390/w15213769

Wu K, Feng J, Li S, Zhang K, Hu D. Research on Timing Sequence Update Strategy Decision of Project Portfolio Based on Coupling Benefits in Strategic Period. Water. 2023; 15(21):3769. https://doi.org/10.3390/w15213769

Chicago/Turabian StyleWu, Kaili, Jingchun Feng, Sheng Li, Ke Zhang, and Daisong Hu. 2023. "Research on Timing Sequence Update Strategy Decision of Project Portfolio Based on Coupling Benefits in Strategic Period" Water 15, no. 21: 3769. https://doi.org/10.3390/w15213769

APA StyleWu, K., Feng, J., Li, S., Zhang, K., & Hu, D. (2023). Research on Timing Sequence Update Strategy Decision of Project Portfolio Based on Coupling Benefits in Strategic Period. Water, 15(21), 3769. https://doi.org/10.3390/w15213769