The Opportunities and Challenges of Biobased Packaging Solutions

Abstract

1. The Necessity to Defossilize the Materials Sector

2. Current Range of Major Plastic Packaging Solutions

| Property | LDPE | HDPE | iPP Ø | PET | PVC # | PS | PC | PA-6 | ABS |

|---|---|---|---|---|---|---|---|---|---|

| Clarity | Tr * | Opaq * | Opaq | Clear | Clear | Clear | Clear | Opaq | Opaq |

| Tensile Strength (MPa) | 4–16 | 21–38 | 25–40 (130–300 biax) | 80 (190–260 biax) | 25–70 | 30–100 | 55–75 | 78 | 41–45 |

| Tensile Modulus (MPa) | 100–300 | 400–1200 | 900–1500 (2200–4200 biax) | 2000–4000 | 2500–4000 | 2300–4100 | 2300–2400 | 2600–3000 | 2100–2400 |

| Notched Izod Impact Strength (J/m) | no break | 27–1000 | 20–100 | 13–35 | 20–100 | 19–24 | 600–850 | 30–250 | 200–400 |

| Chemical Resistance | High | Exc | Exc | Good | Exc | Mod | Exc | Exc | Good |

| Moisture Barrier (g/m2·day@38 °C, 90% RH 25 μm) | 16–23 | 5–8 | 9–11 | 16–20 (biax) | 10–15 | Good | Exc | Mod | |

| O2 Barrier (cc/m2·day@23 °C, 0% RH 25 μm) | 7000–8500 | 2300–3100 | 2300–3100 | 31–93 | 100–300 | 4350–6200 | 100–300 | 20–40 | 500–1000 (est.) |

| Heat Resistance | Low | Mod | Mod | High | Mod | Low | High | High | Mod |

| Recyclability | Good | Good | Good | Exc | Mod | Low | Mod | Mod | Mod |

| Biodegradability | Low/Poor | Poor | Poor | Low | Poor | Poor | Poor | Low | Poor |

| Cost (€/kg) | 1.00–1.50 | 1.00–1.50 | 1.00–1.50 | 1.00–1.50 | 1.00–1.50 | 1.00–1.50 | 2.00–3.00 | 2.00–3.00 | 1.50–2.00 |

3. What Biobased Polymers Do We Want? Drop-In Versus New Functionality Polymers and Polyolefins Versus Polyesters

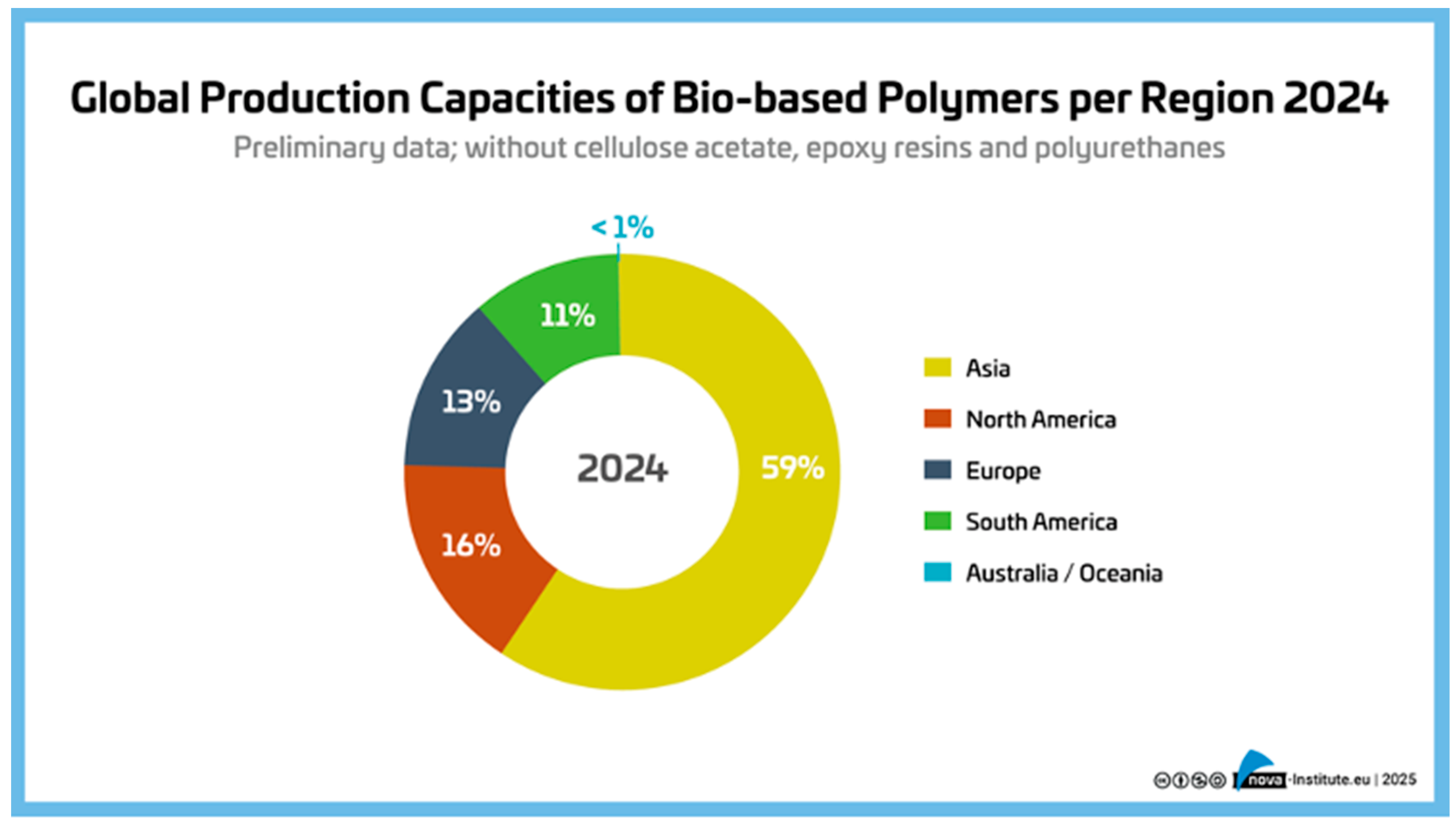

4. Biobased Plastics, State of the Art

5. Biobased Packaging Solutions

- PEF

- b.

- Bio-PE

- c.

- Bio-PP

- d.

- Bio-PA

- e.

- Bio-PET

- f.

- Bio-PTT

6. Biodegradable Packaging Solutions

- a.

- PLA

- b.

- PHA

- Amorphous PHA (aPHA): Soft and rubbery, used as a modifier to improve the properties of other polymers like polylactic acid (PLA).

- Semi-crystalline PHA (scPHA): Offers greater stiffness and high-heat stability, suitable for rigid packaging.

- c.

- Thermoplastic starch (TPS)

- d.

- Cellulose derivatives (CDs)

- e.

- PBAT and PBxF

- f.

- PBS

| Property | Bio-PE | Bio-PET | PLA | PLGA 9/91 | PBS | TPS | PHA | CD | PEF | PBAT # |

|---|---|---|---|---|---|---|---|---|---|---|

| Clarity | Tr * | Clear | Clear | Clear | Tr | Tr | Tr | Tr | Clear | Tr |

| Tensile Strength (MPa) | 4–28 | 80 (190–260 biax) | 60–70 | 15–18 | 30–50 | 5–20 | 20–40 | Mod | 50–70 | 10–35 |

| Tensile Modulus (MPa) | 410–1400 | 2000–4000 | 2700–3500 | 25–40 | 300–500 | 50–200 | 1000–3500 | Mod | 3000 | 100–200 |

| Notched Izod Impact Strength (J/m) | 27–>1000 | 13–35 | 2000–4000 | low | 4000–50,000 | Very Low | 2000–10,000 | Mod | Mod. | 20,000–50,000 |

| Chemical Resistance | Exc * | Good | Mod | Mod | Mod | Low | Mod | Mod | Exc | Mod |

| Moisture Barrier (g/m2·day@38 °C, 90% RH) 25 μm) | 5–23 | 16–20 | 40–60 | 3 | 20–30 | 50–80 | 10–20 | Mod | 14 | 40–60 |

| Heat Resistance | Mod | High | Mod | Mod | Mod | Low | Low | Mod | High | Mod |

| Recyclability | Mod | High | Mod | Mod | Mod | Low | Low/Mod | High | High | High |

| O2 Barrier (cc/m2·day@23 °C, 0% RH 25 μm) | 2300–8500 | 31–93 | 1500–3000 | 5 | 1000–2000 | 3000–5000 | 100–500 | Low | 1–10 | 2000–4000 |

| Biodegradability | Poor | Poor | Mod | High | High | High | Good/High | Low | Low | Mod/Good |

| Cost (€/kg) | 2.00–3.00 | 1.50–2.00 (20% bio) | >4.00 | 5.00–10.00 | >4.00 | Mod | >4.00 | High | 10.00 ø | 3.00–4.00 |

- g.

- Aliphatic polycarbonates (APCs)

- h.

- Novel biobased polymers

7. Recyclability of Biobased Packaging Solutions

7.1. Mechanical Recycling

Mechanical Recycling of Biobased Plastics

- Innovative biobased plastics that are (limited) compatible with current recycling streams: Based on a thorough assessment, x percentage of the innovative material can be allowed, sorted, and recycled, together with the incumbent material, without harming the quality of the recycling stream. A dedicated recycling stream can be created via, for example, NIR (near infrared) sorting once the critical mass is reached.

- Innovative biobased plastics that are not compatible with current recycling streams: A bulk stream can be created that sorts all non-compatible biobased materials together. This dedicated mix of biobased materials goes to a specialized, biobased recycler that further sorts and recycles the biobased materials.

7.2. Chemical Recycling

7.3. Advantages of Closed-Loop Recycling

8. Sustainability of Biobased Plastics

9. Biobased/Biodegradable Packaging Solutions Versus the Formation of Microplastics

10. Safe and Sustainable by Design (SSbD) of Plastic Packaging Solutions

11. Plastic Packaging Solutions Versus Glass, Aluminum, and Paper Packaging

12. Opportunities and Threats of European Regulations and Directives

- a.

- Clean Industrial Deal

- b.

- EU policy framework on biobased, biodegradable, and compostable plastics

- c.

- Packaging and Packaging Waste Regulation (EU 2025/40)

- d.

- Extended Producer Responsibility

- e.

- Implementation in the EU member states

13. Scaling the Biobased Industry in Europe

14. Conclusions and Outlook Based on a SWOT Analysis

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ABS | Acrylonitrile butadiene styrene |

| APCs | Aliphatic polycarbonates |

| BPA | Bisphenol A |

| CAPEX | Capital expenditures |

| CBAM | Carbon Border Adjustment Mechanism |

| CBE-JU | Circular Biobased Europe Joint Undertaking |

| CCU | Carbon capture and utilization |

| CDs | Cellulose derivatives |

| CHDM | 1,4-Cyclohexanedimethanol |

| CSDs | Carbonated soft drinks |

| EFSA | European Food Safety Authority |

| EPR | Extended Producer Responsibility |

| FDCA | 2,5-Furandicarboxylic acid |

| FOAK | First-of-a-Kind |

| LCA | Life Cycle Assessment |

| LDPE | Low-density polyethylene |

| HDPE | High-density polyethylene |

| NOAK | Nth-of-a-Kind |

| PA | Polyamide |

| PBAT | Polybutylene adipate terephthalate |

| PBS | Polybutylene succinate |

| PEF | Polyethylene furanoate |

| PET | Polyethylene terephthalate |

| PHA | Polyhydroxyalkanoate |

| PIBT | Polyisosorbide-co-butanediol terephthalate |

| PICT | Poly-isosorbide-co-cyclohexane di-methanol terephthalate |

| PIPT | poly-isosorbide-co-propanediol terephthalate |

| PISOX | Polyisosorbide oxalate |

| PLA | Polylactic acid |

| PLGA | Polylactic-co-glycolic acid |

| (i)PP | (isotactic)Polypropylene |

| PPWR | Packaging and Packaging Waste Regulation |

| PS | Polystyrene |

| PVC | Polyvinyl chloride |

| RCI | Renewable carbon initiative |

| TPS | Thermoplastic starch |

| TRL | Technology Readiness Level |

References

- de Jong, E.; Stichnothe, H.; Bell, G.; Jørgensen, H. Biobased Chemicals, a 2020 Update. IEA Bioenergy. ISBN 978-1-910154-69-4. Available online: https://task42.ieabioenergy.com/publications/bio-based-chemicals-a-2020-update/ (accessed on 29 July 2025).

- Gruter, G.-J.M. Using Carbon Above the Ground as Feedstock to Produce our Future Polymers. Curr. Opin. Green Sustain. Chem. 2023, 40, 100743. [Google Scholar] [CrossRef]

- vom Berg, C.; Carus, M.; Stratmann, M.; Dammer, L. RCI’s Scientific Background Report: “Renewable Carbon as a Guiding Principle for Sustainable Carbon Cycles (Update)” Renewable Carbon Publications. 2023. Available online: https://renewable-carbon.eu/publications/product/renewable-carbon-as-a-guiding-principle-for-sustainable-carbon-cycles-pdf-2023/ (accessed on 18 March 2025).

- Lopez, G.; Keiner, D.; Fasihi, M.; Koiranen, T.; Breyer, C. From Fossil to Green Chemicals: Sustainable Pathways and New Carbon Feedstocks for the Global Chemical Industry. Energy Environ. Sci. 2023, 16, 2879–2909. [Google Scholar] [CrossRef]

- Carus, M.; Porc, O.; vom Berg, C.; Kempen, M.; Schier, F.; Tandetzki, J. Is There Enough Biomass to Defossilise the Chemicals and Derived Materials Sector by 2050; nova-Institut GmbH: Hürth, Germany, 2025; Available online: https://renewable-carbon.eu/publications/product/is-there-enough-biomass-to-defossilise-the-chemicals-and-derived-materials-sector-by-2050-a-joint-bic-and-rci-scientific-background-report/ (accessed on 18 March 2025).

- Global Plastic Use by Application. Statista 2025. Available online: https://www.statista.com/chart/32140/global-plastics-use-by-application/ (accessed on 28 March 2025).

- Distribution of Projected Plastic Use for Packaging Worldwide in 2060, by Polymer. Statista 2025. Available online: https://www.statista.com/statistics/1338991/global-plastic-use-packaging-outlook-by-polymer/ (accessed on 28 March 2025).

- European Environment Agency. The Role of Plastics in Europe’s Circular Economy [Internet]. European Environment Agency. 2024. Available online: https://www.eea.europa.eu/publications/the-role-of-plastics-in-europe (accessed on 28 March 2025).

- Ibrahim, I.D.; Hamam, Y.; Sadiku, E.R.; Ndambuki, J.M.; Kupolati, W.K.; Jamiru, T.; Eze, A.A.; Snyman, J. Need for Sustainable Packaging: An Overview. Polymers 2020, 14, 4430. [Google Scholar] [CrossRef] [PubMed]

- Katiyar, V. Biobased Plastics for Food Packaging Applications. Smithers Pira. 2017. Available online: http://www.polymer-books.com (accessed on 28 March 2025).

- Rosenboom, J.G.; Langer, R.; Traverso, G. Bioplastics for a Circular Economy. Nat. Rev. Mater. 2022, 7, 117–137. [Google Scholar] [CrossRef] [PubMed]

- Plastics—The Fast Facts 2024. Plastics Europe [Internet]. Plastics Europe. 2024. Available online: https://plasticseurope.org/knowledge-hub/plastics-the-fast-facts-2024/ (accessed on 20 April 2025).

- Microsoft. Copilot (GPT-4) [Large Language Model]. 2025. Available online: https://copilot.microsoft.com (accessed on 25 June 2025).

- Seymour, R.B.; Carraher, C.E., Jr. Properties of Polyolefins. In Structure—Property Relationships in Polymers; Springer: Boston, MA, USA, 1984; pp. 133–145. [Google Scholar] [CrossRef]

- Venkatachalam, S.; Nayak, S.G.; Labde, J.V.; Gharal, P.R.; Rao, K.; Kelkar, A.K. Degradation and Recyclability of Poly(Ethylene Terephthalate). In Polyester; Saleh, H.M., Ed.; IntechOpen: London, UK, 2012. [Google Scholar] [CrossRef]

- Klein, R. Material Properties of Plastics. In Laser Welding of Plastics: Materials, Processes and Industrial Applications; Wiley-VCH Verlag GmbH & Co. KGaA: Weinheim, Germany, 2012; 251p. [Google Scholar] [CrossRef]

- Polymers Properties—Materials Data, Matmake. 2025. Available online: https://matmake.com/polymers.html (accessed on 18 May 2025).

- Edo, G.I.; Ndudi, W.; Ali, A.B.M.; Yousif, E.; Zainulabdeen, K.; Onyibe, P.N.; Ekokotu, H.A.; Isoje, E.F.; Igbuku, U.A.; Essaghah, A.E.A.; et al. Poly(Vinyl Chloride) (PVC): An Updated Review of its Properties, Polymerization, Modification, Recycling, and Applications. J. Mater. Sci. 2024, 59, 21605–21648. [Google Scholar] [CrossRef]

- Material Property Tables LDPE/HDPE. Available online: https://plastecprofiles.com/uploads/1/3/0/4/13043900/material_property_tables_pe.pdf (accessed on 4 August 2025).

- Mechanical Properties of Plastics. Available online: https://www.professionalplastics.com/professionalplastics/MechanicalPropertiesofPlastics.pdf (accessed on 4 August 2025).

- Singh, A.; Chauhan, A.; Gaur, R. A Comprehensive Review on the Synthesis, Properties, Environmental Impacts, and Chemiluminescence Applications of Polystyrene (PS). Discov. Chem. 2025, 2, 47. [Google Scholar] [CrossRef]

- Gruter, G.-J.M.; Lange, J.-P. Tutorial on Polymers—Manufacture, Properties, and Applications. In Biodegradable Polymers in the Circular Plastics Economy; Dusselier, M., Lange, J.-P., Eds.; Wiley-VCH: Weinheim, Germany, 2022; pp. 83–111. [Google Scholar] [CrossRef]

- Water Vapor Transmission Rate—Poly Print. Available online: https://www.polyprint.com/understanding-film-properties/flexographic-wvtr/ (accessed on 3 August 2025).

- Oxygen Transmission Rate—Poly Print. Available online: https://www.polyprint.com/understanding-film-properties/flexographic-otr/ (accessed on 3 August 2025).

- Siracusa, V.; Blanco, I. Bio-Polyethylene (Bio-PE), Bio-Polypropylene (Bio-PP) and Bio-Poly(Ethylene Terephthalate) (Bio-PET): Recent Developments in Biobased Polymers Analogous to Petroleum-Derived Ones for Packaging and Engineering Applications. Polymers 2020, 12, 1641. [Google Scholar] [CrossRef] [PubMed]

- Bastioli, C. Handbook of Biodegradable Polymers; Rapra Technology Ltd.: Shrewsbury, UK, 2023; 566p. [Google Scholar] [CrossRef]

- de Jong, E.; Visser, H.A.; Sousa Dias, A.; Harvey, C.; Gruter, G.-J.M. The Road to Bring FDCA and PEF to the Market. Polymers 2022, 14, 943. [Google Scholar] [CrossRef]

- Sousa, A.F.; Vilela, C.; Fonseca, A.C.; Matos, M.; Freire, C.; Gruter, G.-J.; Coelho, J.F.J.; Silvestre, A.J.D. Biobased Polyesters and Other Polymers from 2,5-Furandicarboxylic Acid: A Tribute to Furan Excellency. Polym. Chem. 2015, 6, 5961–6098. [Google Scholar] [CrossRef]

- Wang, Y.; Murcia Valderrama, M.A.; van Putten, R.; Davey, C.J.E.; Tietema, A.; Parsons, J.R.; Wang, B.; Gruter, G.-J.M. Biodegradation and Non-Enzymatic Hydrolysis of Poly(Lactic-co-Glycolic Acid) (PLGA12/88 and PLGA6/94). Polymers 2022, 14, 15. [Google Scholar] [CrossRef]

- Murcia Valderrama, M.A.; van Putten, R.-J.; Gruter, G.-J.M. PLGA Barrier Materials from CO2. The Influence of Lactide Comonomer on Glycolic Acid Polyesters. ACS Appl. Polym. Mater. 2020, 2, 2706–2718. [Google Scholar] [CrossRef]

- Skoczinski, P.; Carus, M.; Tweddle, G.; Ruiz, P.; Dammer, L.; Zhang, A.; Poranki, N.; Börger, L.; de Guzman, D.; Passenier, R.; et al. Biobased Building Blocks and Polymers—Global Capacities, Production and Trends 2024–2029; nova-Institute: Hürth, Germany, 2025. [Google Scholar] [CrossRef]

- European Commission. Packaging Waste [Internet]. 2025. Available online: https://environment.ec.europa.eu/topics/waste-and-recycling/packaging-waste_en (accessed on 28 April 2025).

- De Almeida Oroski, F.; Alves, F.C.; Bomtempo, J.V. Bioplastics Tipping Point: Drop-in or Non-drop-in? J. Bus. Chem. 2014, 11, 27–42. [Google Scholar]

- Kadac-Czapska, K.; Knez, E.; Gierszewska, M.; Olewnik-Kruszkowska, E.; Grembecka, M. Microplastics Derived from Food Packaging Waste—Their Origin and Health Risks. Materials 2023, 16, 674. [Google Scholar] [CrossRef]

- Gruter, G.-J.M. Confusion about Biopolymer and Biodegradation. Chem. Today 2019, 37, 54–55. [Google Scholar]

- Carus, M. Biobased Polymers Worldwide. Renewable Carbon News. 2025. Available online: https://renewable-carbon.eu/publications/product/bio-based-polymers-worldwide-pdf/ (accessed on 26 June 2025).

- Manger, C. EU Policy Framework on Bioplastics. European Bioplastics e.V. Available online: https://www.european-bioplastics.org/policy/eu-policy-framework-on-bioplastics/ (accessed on 7 April 2025).

- de Jong, E.; Dam, M.A.; Sipos, L.; Gruter, G.-J.M. Furandicarboxylic Acid (FDCA), a Versatile Building Block for a Very Interesting Class of Polyesters; ACS Symposium Series “Biobased Monomers, Polymers and Materials”; Smith, P.B., Gross, R., Eds.; American Chemical Society: Washington, DC, USA, 2012; pp. 1–13. [Google Scholar] [CrossRef]

- Burgess, S.K.; Karvan, O.; Johnson, J.R.; Kriegel, R.M.; Koros, W.J. Oxygen Sorption and Transport in Amorphous Poly(Ethylene Furanoate). Polymer 2014, 55, 4748–4756. [Google Scholar] [CrossRef]

- Burgess, S.K.; Kriegel, R.M.; Koros, W.J. Carbon Dioxide Sorption and Transport in Amorphous Poly(Ethylene Furanoate). Macromolecules 2015, 48, 2184–2193. [Google Scholar] [CrossRef]

- Burgess, S.K.; Mikkilineni, D.S.; Yu, D.B.; Kim, D.J.; Mubarak, C.R.; Kriegel, R.M.; Koros, W.J. Water Sorption in Poly(Ethylene Furanoate) Compared to Poly(Ethylene Terephthalate). Part 2: Kinetic Sorption. Polymer 2014, 55, 6870–6882. [Google Scholar] [CrossRef]

- Khedr, M.S.F. Biobased Polyamide. Phys. Sci. Rev. 2023, 8, 827–847. [Google Scholar] [CrossRef]

- Chanda, A.; Adhikari, J.; Ghosh, M.; Saha, P. PTT-Based Green Composites. In Poly Trimethylene Terephthalate. Materials Horizons: From Nature to Nanomaterials; Ajitha, A.R., Thomas, S., Eds.; Springer: Singapore, 2023; pp. 167–185. [Google Scholar] [CrossRef]

- Nova Institute; Normec OWS; Hydra Marine Science; IKT Stuttgart; Wageningen University & Research. Biodegradable Polymers in Various Environments According to Established Standards and Certification Schemes. 2024, 1p. Available online: https://renewable-carbon.eu/publications/product/biodegradable-polymers-in-various-environments-according-to-established-standards-and-certification-schemes-graphic-current-version/ (accessed on 29 July 2025).

- Vink, E.T.; Davies, S. Life Cycle Inventory and Impact Assessment Data for 2014 Ingeo™ Polylactide Production. Industr. Biotechnol. 2015, 11, 167–180. [Google Scholar] [CrossRef]

- Morão, A.; de Bie, F. Life Cycle Impact Assessment of Polylactic Acid (PLA) Produced from Sugarcane in Thailand. J. Polym. Environ. 2019, 27, 2523–2539. [Google Scholar] [CrossRef]

- Atarés, L.; Chiralt, A.; González-Martínez, C.; Vargas, M. Production of Polyhydroxyalkanoates for Biodegradable Food Packaging Applications Using Haloferax mediterranei and Agrifood Wastes. Foods 2024, 13, 950. [Google Scholar] [CrossRef] [PubMed]

- Clarke, R.W.; Rosetto, G.; Uekert, T.; Curley, J.B.; Moon, H.; Knott, B.C.; McGeehan, J.E.; Knauer, K.M. Polyhydroxyalkanoates in Emerging Recycling Technologies for a Circular Materials Economy. Mater. Adv. 2024, 5, 6690–6701. [Google Scholar] [CrossRef]

- Surendren, A.; Mohanty, A.K.; Liu, Q.; Misra, M. A Review of Biodegradable Thermoplastic Starches, Their Blends and Composites: Recent Developments and Opportunities for Single-Use Plastic Packaging Alternatives. Green Chem. 2022, 24, 8606–8636. [Google Scholar] [CrossRef]

- Jiang, Z.; Ngai, T. Recent Advances in Chemically Modified Cellulose and its Derivatives for Food Packaging Applications: A Review. Polymers 2022, 14, 1533. [Google Scholar] [CrossRef]

- Yekta, R.; Abedi-Firoozjah, R.; Azimi Salim, S.; Khezerlou, A.; Abdolmaleki, K. Application of Cellulose and Cellulose Derivatives in Smart/Intelligent Biobased Food Packaging. Cellulose 2023, 30, 9925–9953. [Google Scholar] [CrossRef]

- Roy, S.; Ghosh, T.; Zhang, W.; Rhim, J.W. Recent Progress in PBAT-based Films and Food Packaging Applications: A Mini-Review. Food Chem. 2024, 437, 137822. [Google Scholar] [CrossRef]

- Iuliano, A.; Nowacka, M.; Rybak, K.; Rzepna, M. The Effects of Electron Beam Radiation on Material Properties and Degradation of Commercial PBAT/PLA Blend. J. Appl. Polym. Sci. 2020, 137, 48462. [Google Scholar] [CrossRef]

- Sahu, P.; Sharma, L.; Dawsey, T.; Gupta, R.K. Fully Biobased High-Molecular-Weight Polyester with Impressive Elasticity, Thermo-Mechanical Properties, and Enzymatic Biodegradability: Replacing Terephthalate. Macromolecules 2024, 57, 9302–9314. [Google Scholar] [CrossRef]

- Aliotta, L.; Seggiani, M.; Lazzeri, A.; Gigante, V.; Cinelli, P. A Brief Review of Poly (Butylene Succinate) (PBS) and its Main Copolymers: Synthesis, Blends, Composites, Biodegradability, and Applications. Polymers 2022, 14, 844. [Google Scholar] [CrossRef]

- Della Monica, F.; Brandolese, A.; Di Carmine, G.; Selva, M.; Fiorani, G.; Izzo, L. En Route toward Sustainable Polycarbonates via Large Cyclic Carbonates. ChemSusChem 2025, 18, e202500030. [Google Scholar] [CrossRef] [PubMed]

- Darie-Niță, R.N.; Râpă, M.; Frąckowiak, S. Special Features of Polyester-based Materials for Medical Applications. Polymers 2022, 14, 951. [Google Scholar] [CrossRef]

- Gonella, S.; Huijbregts, M.A.J.; de Coninck, H.; de Gooyert, V.; Hanssen, S.V. Greenhouse Gas Reduction Potential of Novel CO2-Derived Polylactic-co-Glycolic Acid (PLGA) Plastics. ACS Sust. Chem. Eng. 2025, 13, 5798–5807. [Google Scholar] [CrossRef]

- Schuler, E.; Grooten, L.; Oulego, P.; Shiju, N.R.; Gruter, G.-J.M. Selective Reduction of Oxalic Acid to Glycolic Acid at Low Temperature in a Continuous Flow Process. RSC Sustain. 2023, 1, 2072–2080. [Google Scholar] [CrossRef]

- Murcia Valderrama, M.A. Stepping Stones in CO2 Utilization. Synthesis and Evaluation of Oxalic- and Glycolic acid (Co)Polyesters. Ph.D. Thesis, University of Amsterdam, Amsterdam, The Netherlands, 2022; 202p. Available online: https://dare.uva.nl/search?identifier=a2963f86-4f79-4934-8794-574cc43e18be (accessed on 15 May 2025).

- Gruter, G.-J.M. Recent Developments in Sustainable High Tg (Co)Polyesters from 2,5-Furandicarboxylic Acid, Isosorbide, and Oxalic Acid. Performance and Social Perspectives. Curr. Opin. Green Sustain. Chem. 2025, 53, 101013. [Google Scholar] [CrossRef]

- Bottega Pergher, B.; Weinland, D.H.; van Putten, R.J.; Gruter, G.-J.M. The Search for Rigid, Tough Polyesters with High Tg—Renewable Aromatic Polyesters with High Isosorbide Content. RSC Sustain. 2024, 2, 2644–2656. [Google Scholar] [CrossRef] [PubMed]

- Weinland, D.H.; van der Maas, K.; Wang, Y.; Bottega Pergher, B.; van Putten, R.-J.; Wang, B.; Gruter, G.-J.M. Overcoming the Low Reactivity of Biobased, Secondary Diols in Polyester Synthesis. Nat. Commun. 2022, 13, 7370. [Google Scholar] [CrossRef]

- van der Maas, K.; Wang, Y.; Weinland, D.H.; van Putten, R.-J.; Wang, B.; Gruter, G.-J.M. PISOX Copolyesters—Bio- and CO2-based Marine-Degradable High-Performance Polyesters. ACS Sustain. Chem. Eng. 2024, 12, 9822–9832. [Google Scholar] [CrossRef]

- Nath, D.; Misra, M.; Al-Daoud, F.; Mohanty, A.K. Studies on Poly (Butylene Succinate) and Poly (Butylene Succinate-Co-Adipate)-Based Biodegradable Plastics for Sustainable Flexible Packaging and Agricultural Applications: A Comprehensive Review. RSC Sustain. 2025, 3, 1267–1302. [Google Scholar] [CrossRef]

- Rosenow, P.; Fernández-Ayuso, C.; López-García, P.; Minguez-Enkovaara, L.F. Design, New Materials, and Production Challenges of Bioplastics-Based Food Packaging. Materials 2025, 18, 673. [Google Scholar] [CrossRef]

- Chauhan, K.; Kaur, R.; Chauhan, I. Sustainable Bioplastic: A Comprehensive Review on Sources, Methods, Advantages, and Applications of Bioplastics. Polym.-Plast. Technol. Mat. 2025, 63, 913–938. [Google Scholar] [CrossRef]

- Dmitruk, A.; Ludwiczak, J.; Skwarski, M.; Makuła, p.; Kaczyński, P. Influence of PBS, PBAT and TPS Content on Tensile and Processing Properties of PLA-Based Polymeric Blends at Different Temperatures. J. Mater. Sci 2023, 58, 1991–2004. [Google Scholar] [CrossRef]

- Zhao, X.; Zhang, D.; Yu, S.; Zhou, H.; Peng, S. Recent Advances in Compatibility and Toughness of Poly(Lactic Acid)/Poly(Butylene Succinate) Blends. e-Polymers 2021, 21, 793–810. [Google Scholar] [CrossRef]

- Pan, A. Complete Biodegradable Plastics Compared: PHA, PHB, PBAT, PLA, PBS, PCL, and TPS Explained. 2025. Available online: https://specialty-polymer.com/biodegradable-compared-pha-phb-pbat-pla-pbs-pcl-and-tps/ (accessed on 31 July 2025).

- Polymer Update Academy—Water Vapor Transmission Rate (WVTR) Testing for Plastic Films. 2025. Available online: https://www.polymerupdateacademy.com/WeeklyInsights/Details/1382081 (accessed on 31 July 2025).

- Stanley, J.; Culliton, D.; Jovani-Sancho, A.-J.; Neves, A.C. The Journey of Plastics: Historical Development, Environmental Challenges, and the Emergence of Bioplastics for Single-Use Products. Eng 2025, 6, 17. [Google Scholar] [CrossRef]

- Sazdovski, I.; Serra-Parareda, F.; Delgado-Aguilar, M.; Milios, L.; Azarkamand, S.; Bala, A.; Fullana-i-Palmer, P. Circular Quality of Polymers Test-Based Evidence for Comparison of Biobased and Fossil-Based Polymers. Polymers 2025, 17, 1629. [Google Scholar] [CrossRef] [PubMed]

- Park, H.; He, H.; Yan, X.; Liu, X.; Scrutton, N.S.; Chen, G.Q. PHA is not Just a Bioplastic! Biotechnol. Adv. 2024, 71, 108320. [Google Scholar] [CrossRef] [PubMed]

- Shlush, E.; Davidovich-Pinhas, M. Bioplastics for Food Packaging. Trends Food Sci. Technol. 2022, 125, 66–80. [Google Scholar] [CrossRef]

- Zhao, X.; Cornish, K.; Vodovotz, Y. Narrowing the Gap for Bioplastic Use in Food Packaging: An Update. Environ. Sci. Technol. 2020, 54, 4712–4732. [Google Scholar] [CrossRef]

- Ghasemlou, M.; Barrow, C.J.; Adhikari, B. The Future of Bioplastics in Food Packaging: An Industrial Perspective. Food Packag. Shelf Life 2024, 43, 101279. [Google Scholar] [CrossRef]

- Atiwesh, G.; Mikhael, A.; Parrish, C.C.; Banoub, J.; Le, T.A.T. Environmental Impact of Bioplastic Use: A Review. Heliyon 2021, 7, e07918. [Google Scholar] [CrossRef]

- Hundertmark, T.; Mayer, M.; McNally, C.; Simons, T.J.; Witte, C. How Plastics Waste Recycling Could Transform the Chemical Industry. McKinsey & Company. 2018. Available online: https://www.mckinsey.com/industries/chemicals/our-insights/how-plastics-waste-recycling-could-transform-the-chemical-industry (accessed on 23 March 2025).

- Zhou, J.; Hsu, T.-G.; Wang, J. Mechanochemical Degradation and Recycling of Synthetic Polymers. Angew. Chem. Int. Edit. 2023, 62, e202300768. [Google Scholar] [CrossRef]

- Karlsson, S. Recycled Polyolefins. Material Properties and Means for Quality Determination. In Long Term Properties of Polyolefins. Advances in Polymer Science; Albertsson, A.C., Ed.; Springer: Berlin/Heidelberg, Germany, 2004; Volume 169, pp. 201–229. [Google Scholar] [CrossRef]

- Tamizhdurai, P.; Mangesh, V.L.; Santhosh, S.; Vedavalli, R.; Kavitha, C.; Bhutto, J.K.; Alreshidi, M.A.; Yadav, K.K.; Kumaran, R. A State-of-the-Art Review of Multilayer Packaging Recycling: Challenges, Alternatives, and Outlook. J. Clean Prod. 2024, 447, 141403. [Google Scholar] [CrossRef]

- European Bioplastics Position Paper, Biodegradables and Material Recycling—A Paradox? 2025, 8p. Available online: https://docs.european-bioplastics.org/publications/pp/2025/EUBP_PP_Biodegradables_Sorting_Material_recycling (accessed on 27 May 2025).

- Pioneering Digital Watermarks for Smart Packaging Recycling in the EU, Digital Watermarks Initiative HolyGrail 2.0. Available online: https://www.digitalwatermarks.eu/ (accessed on 18 May 2025).

- Silverwood, L.; Mottoul, M.; Dumont, M.J. A Review of End-of-Life Pathways for Poly(Ethylene Furanoate) and its Derivatives. J. Polym. Environ. 2024, 32, 4130–4142. [Google Scholar] [CrossRef]

- Lee, M. The State of Advanced Plastic Recycling 2025. Lux Research. Available online: https://luxresearchinc.com/blog/the-state-of-advanced-plastic-recycling-2025/ (accessed on 28 May 2025).

- Frączak, D. Chemical Recycling of Polyolefins (PE, PP): Modern Technologies and Products. In Waste Material Recycling in the Circular Economy—Challenges and Developments; Achillas, D.S., Ed.; IntechOpen: London, UK, 2021. [Google Scholar] [CrossRef]

- Vollmer, I.; Jenks, M.J.; Roelands, M.C.; White, R.J.; Van Harmelen, T.; de Wild, P.; van der Laan, G.P.; Meirer, F.; Keurentjes, J.T.; Weckhuysen, B.M. Beyond Mechanical Recycling: Giving New Life to Plastic Waste. Angew. Chem. Int. Ed. 2020, 59, 15402–15423. [Google Scholar] [CrossRef]

- Beghetto, V.; Sole, R.; Buranello, C.; Al-Abkal, M.; Facchin, M. Recent Advancements in Plastic Packaging Recycling: A Mini-Review. Materials 2021, 14, 4782. [Google Scholar] [CrossRef]

- McKeown, P.; Jones, M.D. The Chemical Recycling of PLA: A Review. Sustain. Chem. 2020, 1, 1–22. [Google Scholar] [CrossRef]

- Lamberti, F.M.; Román-Ramírez, L.A.; Wood, J. Recycling of Bioplastics: Routes and Benefits. J. Pol. Environ. 2020, 28, 2551–2571. [Google Scholar] [CrossRef]

- Rajabi-Kafshgar, A.; Seyedi, I.; Tirkolaee, E.B. Circular Closed-Loop Supply Chain Network Design Considering 3D Printing and PET Bottle Waste. Environ. Dev. Sustain. 2024, 27, 20345–20381. [Google Scholar] [CrossRef]

- Zhang, Z.; Yu, L. Differential Game Analysis of Recycling Mode and Power Structure in a Low-Carbon Closed-Loop Supply Chain Considering Altruism and Government’s Compound Subsidy. Ann. Oper. Res. 2024. [Google Scholar] [CrossRef]

- Wong, C.W.Y.; Lai, K.-h.; Lun, Y.H.V.; Cheng, T.C.E. Closed Loop Supply Chain. In Environmental Management; Springer: Cham, Switzerland, 2015; pp. 127–140. [Google Scholar] [CrossRef]

- Brouwer, M.T.; Alvarado Chacon, F.; Thoden van Velzen, E.U. Effect of Recycled Content and rPET Quality on the Properties of PET Bottles, part III: Modelling of Repetitive Recycling. Packag. Technol. Sci. 2020, 33, 373–383. [Google Scholar] [CrossRef]

- Dammer, L.; Carus, M.; Porc, O. The Use of Food and Feed Crops for Biobased Materials and the Related Effects on Food security. Renewable Carbon Initiative, Hürth. 2023. Available online: https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://renewable-carbon.eu/news/the-use-of-food-and-feed-crops-for-bio-based-materials-and-the-related-effects-on-food-security-recognising-potential-benefits/&ved=2ahUKEwjQzbu6yYKPAxVq8bsIHV4cNJUQFnoECB4QAQ&usg=AOvVaw3cdU68tQuTQ-cCwElOlOGu (accessed on 18 March 2025).

- Eerhart, A.J.J.E.; Patel, M.K.; Faaij, A.P.C. Replacing Fossil-based PET with Biobased PEF; Process Analysis, Energy and GHG Balances. Energy Environ. Sci. 2012, 5, 6407–6422. [Google Scholar] [CrossRef]

- Stegmann, P.; Gerritse, T.; Shen, L.; Londo, M.; Puente, Á.; Junginger, M. The Global Warming Potential and the Material Utility of PET and Biobased PEF Bottles over Multiple Recycling Trips. J. Clean. Prod. 2023, 395, 136426. [Google Scholar] [CrossRef]

- Zuiderveen, E.A.R.; Kuipers, K.J.J.; Caldeira, C.; Hanssen, S.V.; van der Hulst, M.K.; de Jonge, M.M.J.; Vlysidis, A.; van Zelm, R.; Sala, S.; Huijbregts, M.A.J. The Potential of Emerging Biobased Products to Reduce Environmental Impacts. Nat. Commun. 2023, 14, 8521. [Google Scholar] [CrossRef] [PubMed]

- Damiani, M.; Ferrara, N.; Ardente, F. Understanding Product Environmental Footprint and Organisation Environmental Footprint Methods; EUR 31236 EN; Publications Office of the European Union: Luxembourg, 2022; ISBN 978-92-76-57214-5. Available online: https://publications.jrc.ec.europa.eu/repository/bitstream/JRC129907/JRC129907_01.pdf (accessed on 18 July 2025).

- EN 18027:2025; Biobased Products—Life Cycle Assessment—Additional Requirements and Guidelines for Comparing the Life Cycles of Biobased Products with Their Fossil-based Equivalents. NEN: Delft, The Netherlands, 2025. Available online: https://www.nen.nl/en/nen-en-18027-2025-en-336921 (accessed on 18 July 2025).

- ISO 59020:2024; Circular Economy—Measuring and Assessing Circularity Performance. ISO: Geneva, Switzerland, 2024. Available online: https://www.iso.org/standard/80650.html (accessed on 17 July 2025).

- Nizamuddin, S.; Chen, C. Biobased, Biodegradable and Compostable Plastics: Chemical Nature, Biodegradation Pathways and Environmental Strategy. Environ. Sci. Pollut. Res. 2024, 31, 8387–8399. [Google Scholar] [CrossRef] [PubMed]

- Jadhav, E.B.; Sankhla, M.S.; Bhat, R.A.; Bhagat, D.S. Microplastics from food packaging: An overview of human consumption, health threats, and alternative solutions. Environ. Nanotechnol. Monit. Mngt. 2021, 16, 100608. [Google Scholar] [CrossRef]

- Osman, A.I.; Hosny, M.; Eltaweil, A.S.; Omar, S.; Elgarahy, A.M.; Farghali, M.; Yap, P.-S.; Wu, Y.-S.; Nagandran, S.; Batumalaie, K.; et al. Microplastic Sources, Formation, Toxicity and Remediation: A Review. Environ. Chem. Lett. 2023, 21, 2129–2169. [Google Scholar] [CrossRef]

- Kochanek, A.; Grąz, K.; Potok, H.; Gronba-Chyła, A.; Kwaśny, J.; Wiewiórska, I.; Ciuła, J.; Basta, E.; Łapiński, J. Micro- and Nanoplastics in the Environment: Current State of Research, Sources of Origin, Health Risks, and Regulations—A Comprehensive Review. Toxics 2025, 13, 564. [Google Scholar] [CrossRef]

- Coffin, S.; Wyer, H.; Leapman, J.C. Addressing the Environmental and Health Impacts of Microplastics Requires Open Collaboration between Diverse Sectors. PLoS Biol. 2021, 19, e3000932. [Google Scholar] [CrossRef]

- European Bioplastics Position Paper, Biodegradable Plastics do not Cause Persistent Microplastics. 2025, 2p. Available online: https://docs.european-bioplastics.org/publications/pp/EUBP_PP_Biodegradable_plastics_do_not_cause_persistent_microplastics.pdf (accessed on 27 May 2025).

- 2023 Year In Review: Creating a Path Towards the Future of Plastics Recycling—Association of Plastic Recyclers (APR); APR Design® Recognitions Directory—Association of Plastic Recyclers (APR). Available online: https://plasticsrecycling.org/resources/creating-a-path-towards-the-future-of-plastics-recycling/ (accessed on 29 May 2025).

- European PET Bottle Platform (EPBP) Technical Opinion. Avantium Renewable Polymers BV— PEF as a Barrier Middle Layer in Multilayer PET Bottles. 2025. Available online: https://www.epbp.org/download/374/pef-as-a-barrier-middle-layer-in-multilayer-pet-bottles (accessed on 18 July 2025).

- Cater, L. Italy, Spain Back France’s Plan to Rescue EU Chemicals Industry. POLITICO 13 March 2025. Available online: https://www.politico.eu/article/italy-spain-back-france-chemicals-proposal-industry/ (accessed on 18 May 2025).

- Joint statement of Czech Republic, Hungary, Italy, Netherlands, Romania, Slovakia, Spain and France about the European Chemicals Industry—Presse—Ministère des Finances. Available online: https://presse.economie.gouv.fr/joint-statement-of-czech-republic-hungary-italy-netherlands-romania-slovakia-spain-and-france-about-the-european-chemicals-industry/ (accessed on 11 March 2025).

- EU Policy Framework on Biobased, Biodegradable and Compostable Plastics. European Commission COM(2022) 682 Final. 2022. Available online: https://environment.ec.europa.eu/publications/communication-eu-policy-framework-biobased-biodegradable-and-compostable-plastics_en (accessed on 18 July 2025).

- European Commission. Clean Industrial Deal. 2023. Available online: https://commission.europa.eu/topics/eu-competitiveness/clean-industrial-deal_en (accessed on 28 April 2025).

- Spekreijse, J.; Vikla, K.; Vis, M.; Boysen-Urban, K.; Philippidis, G.; M’barek, R. Biobased Value Chains for Chemicals, Plastics and Pharmaceuticals—A Comparison of Biobased and Fossil-based Value Chains; EUR 30653 EN; Publications Office of the European Union: Luxembourg, 2021; ISBN 978-92-76-32459-1. [Google Scholar] [CrossRef]

| Property | Drop-Ins (e.g., bio-PE, bio-PP, bio-PET) | Novel Polymers (e.g., PEF, PLA, PHA) |

|---|---|---|

| Time to market | +++ * | +/− * |

| Improved properties | 0 | −/+++ |

| CAPEX | −−−− | −− |

| Own market space | −−− | +++ |

| Prices of fossil incumbents | −−−− | ++ |

| Regulatory (Reach/EFSA) | ++ | −−− |

| Legislation (a.o. PPWR) | − | −−− |

| Value chain | ++ | −− |

| Circularity | +++ | −−/+++ |

| Recycling infrastructure | ++ | −−− |

| Production cost from glucose | −− | 0 |

| Packaging Solution | Fossil-Based Plastic | Biobased Plastic |

|---|---|---|

| Carbonated soft drink bottles (CSDs), juice bottles, carbonated water bottles | PET, PA in multilayer | PEF, bio-PET, |

| Water and milk bottles | PET, HDPE | PEF, Bio-PET, Bio-PE |

| Shampoo and detergent bottles | HDPE, PET, LDPP, PVC | PEF, Bio-PE, Bio-PP, PLA |

| Food containers | PC, HDPE, HDPP, PET | PLA, Bio-PE, Bio-PP, Bio-PTT |

| Cosmetic containers | PC, ABS, PBAT, PET, HDPP | PEF, PBxF (a.o. PBAF), PLA, PHA |

| Microwavable containers | PP, LDPE | Bio-PP, bio-PE |

| Thermoforms (a.o. trays, clamshells, blister packs) | PET, PVC, PS, PP, HDPE | PEF, Bio-PET, PLA, PHA, TPS, Bio-PP, bio-PE |

| Agricultural packaging | PBAT, HDPE, LDPE | PBxF, PHA, TPS. Bio-PE |

| Protective packaging (a.o. electronics, pharmaceuticals) | PA, PC, ABS, PVC, PS, LDPP, LDPE | PEF, PLA, TPS (foamed) |

| Multi-layer flexible packaging (a.o. pouches, films) | PA, PE, PP, PET | PEF, Bio-PE, Bio-PET, CD |

| Barrier films and coatings | PA, PET, PP, PE | PEF, PHA, PLGA |

| Stretch, shrink, and cling films | PVC, LDPE | TPS, PLA, PHA |

| Liners (a.o. cereal boxes) | LDPE, HDPE, PET | Bio-PE, PLA, PHA |

| Shopping bags | LDPE, HDPE, LDPP, | TPS, PLA, Bio-PE |

| Bottle sleeving, caps, and closures | HDPP, HDPE, PVC, PET | PLA, PHA |

| Strength | Weaknesses |

|---|---|

|

|

| Opportunities | Threats |

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

de Jong, E.; Goumans, I.; Visser, R.; Puente, Á.; Gruter, G.-J. The Opportunities and Challenges of Biobased Packaging Solutions. Polymers 2025, 17, 2217. https://doi.org/10.3390/polym17162217

de Jong E, Goumans I, Visser R, Puente Á, Gruter G-J. The Opportunities and Challenges of Biobased Packaging Solutions. Polymers. 2025; 17(16):2217. https://doi.org/10.3390/polym17162217

Chicago/Turabian Stylede Jong, Ed, Ingrid Goumans, Roy (H. A.) Visser, Ángel Puente, and Gert-Jan Gruter. 2025. "The Opportunities and Challenges of Biobased Packaging Solutions" Polymers 17, no. 16: 2217. https://doi.org/10.3390/polym17162217

APA Stylede Jong, E., Goumans, I., Visser, R., Puente, Á., & Gruter, G.-J. (2025). The Opportunities and Challenges of Biobased Packaging Solutions. Polymers, 17(16), 2217. https://doi.org/10.3390/polym17162217