Abstract

In this paper, we look at two research questions. First, can lower ad-valorem taxes, on the selling of news and on the selling of advertising, conduce to lower prices in the media sector? Second, can lower ad-valorem taxes stimulate firms to increase the diversity of content that they offer? The purpose of this work is to give tax political guidelines to policy makers for the media sector. This is important for a sector that has seen the reduction in payment subscriptions by readers (due to competition from free news from the Internet), and reduction of advertisement revenues due to competition from media giants like Google and Facebook. With this purpose we build on the Hoteling product competition model, which is the workhorse model in media economics. We show that ad-valorem taxes on the selling of advertising are preferable to ad-valorem taxes on the selling of news because the former conduce to reduction in prices of newspaper. However, both ad-valorem taxes on the selling of news and on the selling of advertisement reduces media diversity, because they reduce revenues that media firms can use to invest in media content.

JEL Classification:

D11; D21; H25; L13; L82

1. Introduction

Newspapers sell news to readers and advertising space do advertisers, i.e., news media operate in a two-sided market. On one hand, the more readers a newspaper attracts, the more valuable a newspaper is for advertisers. On the other hand, the more advertisers a newspaper attracts, the more revenues a newspaper gets to finance the production of news content. In turn, many argue that media diversity is essential to democracy and the society (see for instance, Strömberg [1,2,3,4,5]; Sunstein [6,7]; Gentzkow et al. [8,9].1

Given the importance of newspapers to democracy, some countries offer special tax treatment to the media sector, like reduced VAT rates (see Foros et al. [16]; European Commission [17]). The issue of given special tax treatment to the media industry has become even more relevant in the last decades since the inception of the Internet. As it is well known, the Internet had two main impacts in the news sector (see for instance The Pew Research Center [10,11,12,13,14,15]; Centre for Media Pluralism and Media Freedom [18]). First, there was a migration of content from print newspapers to online news sites, which reduced the subscriptions of printed newspapers, and therefore caused a reduction on printed revenues, from both subscriptions and advertising. Furthermore, the Internet opened the door to many free news, which mean that online news revenues have not compensated for the loss on printed news revenues. Second, news firms face stronger competition in the advertising market from Internet giants, such as Google and Facebook. This means online advertising revenues have also not yet compensated for the loss in advertising revenues from printed newspapers. As a result, the newspaper industry has seen a reduction on employment of journalists and a reduction on investment on content development, in particular investigative journalism.

In this scenario, the question is if government policy, like taxes on newspapers, can be used to help the media sector to face these challenges. The idea of the special tax treatment is twofold. First, can lower taxes on newspapers help news firms to be able to reduce prices to readers and therefore increase the sales of newspapers (both print and online)? Second, can lower taxes on newspapers free revenues that newspapers can use to invest in content, and therefore increase media diversity in the news market?

In this paper, we then analyze the role of ad-valorem taxes when applied to the two sides of the news market: ad-valorem taxes on the selling of news; and ad-valorem taxes on the selling of advertising. We are interested on the effects of these two taxes on the prices of news and on media diversity. In particular, we try to answer the following two questions:

- (1)

- Can lower ad-valorem taxes (on the selling of news and on the selling of advertising) conduce to lower prices in the media sector?

- (2)

- Can lower ad-valorem taxes (on the selling of news and on the selling of advertising) promote firms to increase the diversity of content that they offer?

In order to answer these two questions, we adopt the Hotelling model [19] of horizontal product differentiation (see also d’Aspremont et al. [20]). This model is work-horse model in media economics to analyze two-sided markets (see for instance, Rochet and Tirole [21]; Anderson and Coate [22]; Armstrong [23]).2 We consider both single-homing consumers (that consume from only one media firm) and multi-homing consumers (that consume from two media firms). For models with multi-homing consumers see for instance Doganoglu and Wright [35,36]; Kim and Serfes [37]; Choi [38]; Anderson et al. [39].

In turn, content diversification is introduced in the following way. In the standard Hotelling model, firms only supply the market with one variety, i.e., one point in the line. Instead, like in Dewan et al. [40] and Alexandrov [41], we allow firms to supply the market with different varieties, i.e., a line segment.

In this set-up, we obtain three main results. First, we show that when we do not allow firms to diversify content, ad-valorem taxes on the selling of news and ad-valorem taxes on the selling of advertisement have different effects on prices. While ad-valorem taxes on selling of news decreases prices (as in Foros et al. [16]), ad-valorem taxes on selling of advertising increase prices of newspapers. This difference arises because ad-valorem taxes on selling of news increases price competition. In turn, ad-valorem taxes on selling of advertising have no effects on price competition, but since they reduce advertisement revenues, media platforms try to recoup these losses by increasing prices to consumers.

Second, when we allow firms to diversify content, ad-valorem taxes on selling of news do not anymore always increase the prices of news relatively to the no taxes scenario. This will depend on consumer’s preference for their ideal variety. Accordingly, if consumers have a strong preference for their ideal variety, ad-valorem taxes on selling of news increases prices relatively to the case with no taxes.

Third, we show that both ad-valorem taxes on selling of news and ad-valorem taxes on selling of advertising reduce content diversification by firms, reducing therefore media diversity.

The rest of the paper is organized as follows. In the next section, we review the literature in the field. Then, we present the theoretical model. After, we look to the case with no content diversification for the benchmark case with no taxation, then with ad-valorem taxes on the selling of news, and with ad-valorem taxes on the selling of advertising. Then, we consider the case with content diversification for the benchmark case with no taxation, then with ad-valorem taxes on the selling of news, and the with ad-valorem taxes on the selling of advertising. We close the paper by first discussing our results and then concluding.

2. Literature Review

As we can see from the discussion in the Introduction, our paper analyzes the role of tax policy for the media and the impact on prices and content provision. This debate has been very active especially in the European Union and other European countries (see for instance Foros et al. [16]; European Commission [17]; Centre for Media Pluralism and Media Freedom [18]).

Our paper is closely related with the work of Foros et al. [16]. We differ from Foros et al. [16] in two ways. First, Foros et al. [16] only look to the effects of ad-valorem taxes on the selling of news. In other words, they do not analyze ad-valorem taxes on selling of advertising. Foros et al. [16] find that lower ad-valorem taxes on the selling of news can led to higher prices, because this reduces price competition. We then show that this result does not always hold when: (1) ad-valorem taxes fall on advertising; (2) when firms invest in content diversification.

Second, Foros et al. [16] contrary to us, do not analyze the effects of ad-valorem taxes on the diversity of content offered by media firms. They focus only on the effects of ad-valorem taxes (on the selling of news) on multi-homing. Accordingly, they consider that if consumers single-home, consumers have access to less content than when they multi-home, since with single-homing readers only consume news from one media source, while with multi-homing they have access to different media sources. In this sense, multi-homing by readers, according to Foros et al. [16], leads to more media diversity relatively to single-homing. In this set-up, they show that ad-valorem taxes increase multi-homing, because relatively to the no tax scenario, prices are lower. Accordingly, with lower prices, a reader is more likely to buy two newspapers, instead of just one.

We extend this view of media diversity by considering the effects of taxes on media firms’ incentives to diversify content. The more content a media firm supplies the market, more content diversity, and vice-versa. The idea is that in what concerns media diversity, it is not only important how many sources consumers access, but also how much content each media firms supply the market.

Besides Foros et al. [16], our paper is also related with other papers that look at taxes in two-sided media markets. Kind et al. [42] and Kind and Koethenbuerger [43], like Foros et al. [16] also show that lowering taxes in a two-sided market can increase prices. In addition, Kind et al. [42] demonstrate that a low tax regime increases product differentiation relatively to the social optimum. Kind et al. [44] in turn, show that a monopolist may have a higher output relatively to the social optimum. They argue that this can be corrected by a subsidy or by a specific tax. Belleflamme and Toulemonde [45] look to a broader set of taxes besides ad-valorem taxes. They show that specific taxes are passed to the agents on the side on which they are imposed, transaction taxes hurt agents on both sides and benefit media firms, ad-valorem taxes allow tax authorities to capture part of the media firms’ profits, and asymmetric taxes benefit agents on the untaxed side.3

3. The Model

Like in Foros et al. [16], we adopt the Hotelling [19] model to compare a market with ad-valorem taxes with a market with no ad-valorem taxes. We do this in order to allow a more direct comparison with Foros et al. [16]. As mentioned in the introduction the Hotelling [19] model is the standard model used in media economics. When necessary, the case with taxation is labeled with the superscript T and the case with no taxation is labeled with the superscript N. Also, similarly to Foros et al. [16], we consider single-homing and multi-homing. When needed, the case with single-homing is labeled with the superscript S and the case with multi-homing with the superscript M. In addition, differently from Foros et al. [16], we also consider how taxes affect media firms’ incentives to diversify content.4

In this sense, we consider different scenarios: no taxation versus taxation, single-homing versus multi-homing, and no content diversification versus content diversification. We have a case with no content diversification in order to replicate the results in Foros et al. [16] and to show that their results do not hold when ad-valorem taxes fall on advertising (instead of on selling of news). We have a case with content diversification to show that taxes affect the diversity of content provided in the market, and that media diversity is more than just single-homing versus multi-homing (i.e., readers having access to one source or two sources of news), but should also include how much content each media outlet supplies the market. Given the different cases considered, it can be helpful to make a list of the different cases right away. The following first three cases do not consider content diversification, the last three cases consider content diversification.

Case 1. No Content Diversification and No Ad-Valorem Taxes. This case is used as a benchmark to compare with the taxation cases 2 and 3, in what respects the effects of taxes on prices.

Case 2. No Content Diversification and Ad-Valorem Taxes on Selling of News. This is the case considered by Foros et al. [16]. The aim of looking at this case is to show that our model without content diversification replicates the results of Foros et al. [16].

Case 3. No Content Diversification and Ad-Valorem Taxes on Selling of Advertisement. The aim of looking at this case is to show that the results of Foros et al. [16] do not hold with ad-valorem taxes on advertising.

Case 4. Content Diversification and No Ad-Valorem Taxes. This case is used as a benchmark to compare with the taxation cases 5 and 6, in what respects the effects of taxes now both in terms of prices and content diversification.

Case 5. Content Diversification and Ad-Valorem Taxes on Selling of News. The aim of looking at this case is to show that when firms invest in content diversification, the results of Foros et al. [16] do not always hold and that taxes have effects on media plurality apart from just single-homing versus multi-homing.

Case 6. Content Diversification and Ad-Valorem Taxes on Selling of Advertisement. The objective of this case is to look to the effects of taxes on selling of advertising on content diversification and prices.

We consider two media firms, L and R, that compete in the Hotelling [19] fashion for consumers. Like in Foros et al. [16], media firm L is located at the left extreme of the Hotelling line, and media firm R is located at the right extreme of the Hotelling line. The two competing media firms derive revenues from advertising and from selling of news (for instance, selling of newspapers and subscriptions).

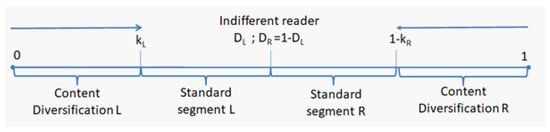

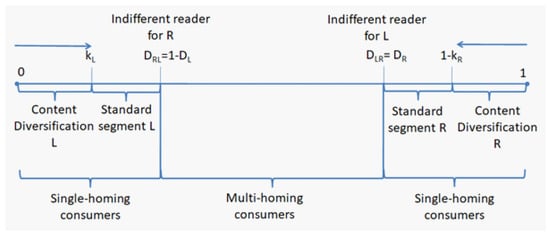

Differently from Foros et al. [16], besides providing content that mirrors their location in the line (a point in the line), media firms can also provide content along the line (a line segment). Accordingly, instead of just providing a point in the line, a media firm can provide a line segment of content (see Dewan et al., [40]. When a media firm supplies a line segment of content, we say that firms diversify content. We represent content diversification by for firm L and for firm R. In this way, a media firm can choose to be single-content, i.e., a point in the line, and , or to be multi-content, i.e., a line segment, for media firm L and for media firm R. See Figure 1 for the single-homing case and Figure 2 for the multi-homing case (note that these figures do not necessarily represent the equilibrium of the model).

Figure 1.

Content Diversification: Single-Homing.

Figure 2.

Content Diversification: Multi-Homing.

As in Hotelling [19], we assume that consumers are uniformly distributed in a line of length one: . The line represents consumers’ preferences in terms of content. As we have said, we are going to consider both the case where consumers are single-home (i.e., they patronize just one outlet) and the case where consumers can choose to multi-home (they buy content from the two outlets). In both cases, consumers incur in a disutility from buying content that differs from their ideal one. We capture this disutility as in Hotelling with the parameter t, which represents the intensity of consumers’ content preferences, i.e., transport costs. To illustrate, consider consumer x located in the left side of the line. If consumer x is outside the line segment of content provided by media firm L, his disutility is . However, if this consumer is inside the line segment of content provided by firm L, he does not suffer any disutility since his ideal variety is supplied by the newspaper.5

In order to provide a line segment of content, as in Alexandrov (2008), a media firm has to incur in a cost (see also Garcia Pires, [51]:

where is a parameter that captures the informational and flexibility costs to adapt to the consumers’ preferences.

In what concerns the advertising market, we follow Gabszewicz et al. [52], Anderson and Coate [22] and Peitz and Valletti [53]. The demand for ads for media firm i equals:

where is the price of advertising per reader, is the advertising volume. The parameters and reflect the size of the advertising market. Accordingly, a high and a low represent a large advertising market. Then as in Anderson and Coate [22], media firms extract all surplus from advertisers. Gross advertising income, though, depends on if consumers single-home or multi-home. We return to this in the next sub-sections dedicated to single-homing and multi-homing.

In the following, we present our model with no ad-valorem taxes for the single-homing and multi-homing case and at the end we show how the model changes with the introduction of ad-valorem taxes (on selling of news and on selling of advertisement). We present then the model in an encompassing way that can include all the cases mentioned above. When we later solve for each case, we mention how the case in question differs from the encompassing model.

3.1. Single-Homing

Start with single-homing (no taxation). In this case, the utility of consumers in the left and right segments are as follows: 6

where v is the reservation price of consumers, t transport costs, () diversity of content offered by firm i. Remember that the superscript S stands for single-homing. Note that in the no content diversification cases (cases 1 to 3 above), ().

As mentioned above, to calculate gross advertising income, we have to take into consideration demand for each media firm and this depends on if consumers single-home or multi-home. With single-homing (and no taxation), gross advertising revenues are:

where is the demand for media firm i under single-homing. In this sense, the indifferent consumer between buying from L and R equals, . In turn the indifferent consumer between buying from R and L equals . Figure 1 depicts the indifferent consumer under single-homing. It can be shown that the indifferent consumer under single-homing is the one that makes:

Again note that in the no content diversification cases (cases 1 to 3), (). Solving for x in the previous equation, we obtain the indifferent consumer, for firm L and for firm R.

From the above we have that profits for media firm i () in the single-homing case with no taxation equals:

3.2. Multi-Homing

In the multi-homing case, following Foros et al. [16], if a consumer buys content from both media firms, he has the following utility:

where d represents the loss of utility due to overlap of content by consuming from the two media firms. Remember that the superscript M stands for multi-homing.

Differently from the single-homing case, in the multi-homing case there are two indifferent consumers. One for media firm L and another for media firm R. To see this, start with the indifferent consumer for media firm L. It can be seen that the demand for L consists of its exclusive consumers (single-homing consumers of L, that we represent by ) plus the shared consumers with media firm R (multi-homing consumers). The shared consumers equal: , where represents the exclusive consumers of R. Then demand for media firm L in the multi-homing case equals:

Therefore, is the indifferent consumer between buying only from L or from both L and R.

In turn, demand for media firm R equals the exclusive consumers of R (single-homing consumers of R, that as we have just said are represented by ) and the shared consumers (multi homing consumers). The shared consumers as we have seen above equal . Then demand for media firm R in the multi-homing case is:

Then is the indifferent consumer between buying only from R or from both R and L. Figure 2 depicts the indifferent consumers under multi-homing.

In this way, in the multi-homing case (with no taxation), we have that advertising revenues for media firm L and R equal:

With and .

In the multi-homing case, profits with no taxation are then:

3.3. Taxation of Selling of News and Advertising

As we have mentioned above, to consider the effects of taxation on content diversification in a two-sided market, we consider two cases: with no taxation (see above) and with ad-valorem taxes on selling of news and on selling of advertising. The only difference between taxation and no taxation case is on what concerns revenues from selling news and from selling advertising.

In the case of ad-valorem taxes on selling of news (which is the one studied by Foros et al. [16]), we have that revenues from selling news are now:

In turn, in the case of ad-valorem taxes on selling of advertising, we have that advertising revenues equal now:

Next, we derive the equilibrium of the different cases.

Method

As mentioned above, the Hotelling [19] model is the work-horse model to study competition in the media market. The theoretical model is solved in the usual fashion. First, we find the indifferent consumer under single homing and the indifferent consumers under multi-homing (remember, as we have mentioned above, that under multi-homing there are two indifferent consumers, while under single-homing just one). Then we solve the model for the First Order Conditions (FOCs) in relation to price of news (, ), price advertising (, ), and level of content diversification by each media firm (, ). We do these steps for each of the different cases considered (see above): no content provision versus content provision; single-homing versus multi-homing; no taxation versus taxation. We then compare the equilibrium of the model under taxation and no taxation to see which of these two scenarios have higher prices and content provision.

4. No Content Diversification and No Ad-Valorem Taxes

In this section, we consider the case with no taxes. This means that we have the model above without content diversification (i.e., , ). This can be considered a benchmark case that we will use later to compare with the taxation cases. We start with the single-homing case and then turn to the multi-homing case.

4.1. Single-Homing

The first thing to note, is that if there is no content diversification, the indifferent consumer equals:

We can now solve for advertising levels. The First Order Conditions (FOCs) for advertising equals (all Second Order Conditions, SOCs, are in Appendix A–Appendix F):

Solving the FOCs for advertising for and , we get:

In turn, the FOCs for prices equal:

Solving for prices, we get:

4.2. Multi-Homing

We now turn to multi-homing case. We start again with the indifferent consumer. As noted above, in the multi-homing case, we have two indifferent consumers.

Start by noticing that the utility of consuming from both L and R is:

The consumer that is indifferent from buying from L or both L and R has a utility , with . Solving for x, we get the indifferent consumer from buying from L or both L and R:

In turn, the consumer that is indifferent from buying from R or both R and L has a utility , with . Solving for x, we get the indifferent consumer from buying from R or both R and L:

The FOCs for advertising then equal:

As we can see, an important difference relatively to single-homing case is that prices for the rival firm do not enter the FOCs for advertising. The reason is that with multi-homing, consumers buy from both media firms, and therefore competition is reduced. This is a known result from multi-homing literature, that multi-homing can soften competition, since consumers by consuming from all the firms, reduces firms’ competition for consumers. See for instance, Doganoglu and Wright [35,36]; Kim and Serfes [37]; Choi [38]; Anderson et al. [39].

Solving the FOCs for advertising levels, we get the same levels of advertising as under single-homing, .

In turn the FOCs for prices equal:

As for the FOCs for advertising, prices of the rival do not enter the FOCs for prices. This is as we have just explained because multi-homing reduces price competition.

Solving the FOCs for prices we get:

5. No Content Diversification and Ad-Valorem Taxes on Selling of News

In this section, we look to the case with ad-valorem taxes on the selling of news (and no content diversification). We continue then to have the model above without content diversification (i.e., , ). We present this case to replicate the results of Foros et al. [16] with ad-valorem taxes on the selling of news. With this exercise, we want to show that what drives our results are not the (small) differences between our model and that of Foros et al. [16]. We start with the single-homing case and then turn to the multi-homing case. In the end of this section, we compare this taxation case with the no taxation case from the previous section.

5.1. Single-Homing

The first thing to note is that the indifferent consumer under ad-valorem taxes on selling of news is the same as with no taxation above. Note also that FOCs for advertising are the same under taxation and no taxation. Then, advertising levels are also the same.

In turn, the FOCs for prices equal now:

Solving for prices, we get:

5.2. Multi-Homing

We turn now to the multi-homing case. Again, the indifferent consumers under multi-homing with ad-valorem taxes on selling of news are the same as for the no taxation case above. We can also see that FOCs for advertising under ad-valorem taxes on selling of news are the same as above with no taxation. Then once again we get the same levels of advertising levels.

In what concerns the FOCs for prices, we get:

Again, relatively to single-homing case, prices for the rival firm do not enter the FOCs for prices. The reasons for this are the same as pointed out above for the no taxation case: multi-homing reduces competition, since consumers buy from all firms.

Solving for and , we get:

5.3. Taxation versus No Taxation

We can now compare the taxation and the no taxation case in what concerns prices. Start with single-homing. We can see that the difference in prices under no taxation and taxation equals:

Then, as in Foros et al. [16], prices are higher under no taxation than under taxation. This occurs for the reasons pointed out in Foros et al. [16]: in a two-sided market, taxation increases price competition. Accordingly, reducing the tax rate on the selling of news increases the profitability of the consumer market, but does not change the profitability of the advertising market. This reduces the pressure on price competition to attract more demand, and therefore also to increase advertising revenues.

In what relates to the multi-homing case, we have.

Then again as in Foros et al. [16], prices are higher under no taxation than under taxation. This occurs for the reasons just pointed out above for the single-homing case: ad-valorem taxes on selling of news reduces price competition.

We can then see that our model with just ad-valorem taxes on selling of news replicates the results of Foros et al. [16]. Next, we will see if the same occurs when we consider ad-valorem taxes on selling of advertising.

6. No Content Diversification and Ad-Valorem Taxes on Selling of Advertisement

In this section, we introduce ad-valorem taxes on advertising (but continue to not consider content diversification). Again, we first look to the case with single-homing consumers and then look to the case with multi-homing consumers. After, we compare this case with taxation with the case above with no taxation.

6.1. Single-Homing

The first thing to note is that the indifferent consumer is again the same as for the no taxation case.

In turn, the FOCs for advertising equal now:

Solving for and , we get the same advertising levels as with no taxation, i.e., .

In turn, the FOCs for prices equal:

Solving and , we get:

6.2. Multi-Homing

Once more, the indifferent consumers under multi-homing are the same as under the no taxation case above.

In turn, the FOCs for advertising equal now:

Note again that under multi-homing prices of the rival do not enter the FOCs for advertising. This results for the same reason pointed out previously: under multi-homing, consumers buy from all firms and therefore price competition is reduced.

In turn the FOCs for prices equal:

Once more under multi-homing prices of the rival do not enter the FOCs for prices. As we have already said, this is because multi-homing reduces price competition.

Solving the FOCs for prices we get:

6.3. Taxation versus No Taxation

We can now compare the effects of taxation on prices. Start with single-homing. Under single-homing, we have that the difference in prices with no taxation and taxation equal:

We then see that with ad-valorem taxes on selling of advertising, prices are now lower under no taxation. This is the opposite result of Foros et al. [16], where, as we have seen above, prices are higher under no taxation when we consider ad-valorem taxes on selling of news. The reason for this difference is that ad-valorem taxes on selling of news softens price competition. However, ad-valorem taxes on selling of advertising have no effect on price competition. As a result, ad-valorem taxes on selling of advertising, by reducing advertising revenues make firms to compensate this loss by increasing prices of newspapers relatively to the no taxation case.

In turn, under multi-homing, we have that the difference in prices with taxation and no taxation equal:

We then see that when taxes are on advertising, prices are again lower under no taxation. Once more then, this is the opposite result of Foros et al. [16]. As we mentioned above the reason for this is that while ad-valorem taxes on selling of news softens price competition, ad-valorem taxes on selling of advertising have no effect on price competition but reduce revenues, which firms compensate by increasing prices of news.

7. Content Diversification and No Ad-Valorem Taxes

We now in addition to price competition consider also content competition, and allow therefore firms to diversify content, i.e., , . We start with the no taxation case to have a benchmark to compare afterwards with the cases of taxation (ad-valorem taxes on selling of news and ad-valorem taxes on selling of advertising). Again, we consider first the case with single-homing and then multi-homing.

7.1. Single-Homing

With single-homing, we can show that the indifferent consumer is the one that makes:

From the previous expression we can derive the demand for media firm i ():

To solve the game, we start with advertising volumes, (). The First Order Conditions (FOC) in relation to () equal:

Solving for and , we get the same levels of advertising as with no content diversification, .

The FOCs for prices are:

Solving for and , we obtain:

We can now compute the FOC for content diversification, (). Start by noticing that FOC for content diversification can be decomposed into the direct effect of on the demand of media firm i (, ) and an indirect effect of on the demand of firm i via the effect on the price of the rival j (, and ):

We can show that the direct effect and the indirect effect equal:

We can then see that the direct effect of content diversification on demand of the media firm is positive. Accordingly, more content increases demand for the media firm. In turn, the indirect effect is negative. Accordingly, more content increases price competition, i.e., it reduces the price of the rival, which has in turn a negative effect on the demand of the media firm. Even so, the direct effect dominates the indirect effect, and more content diversification has therefore a total positive impact on the demand for the media firm.

We can simplify the FOCs for content diversification and show that they equal:

Solving for and , we obtain:

Then, content diversification increases with the intensity of consumers preferences for their ideal variety (t) and decreases with the costs to provide content ().

We can now also solve for prices and .

7.2. Multi-Homing

With multi-homing, the first thing to note, as shown above, is that there are two indifferent consumers, one for media firm L () and another for media firm R (). Where is the indifferent consumer between buying only from L or from both L and R, and is the indifferent consumer between buying only from R or from both R and L.

The indifferent consumer for media firm L is the one that makes:

where:

Then:

Solving for x, we get the indifferent consumer for L (i.e., the one that is indifferent from buying only from L or from both L and R):

In turn for media firm R, we have that the indifferent consumer is the one that makes:

where is as above and equals:

Then:

Solving for x, we get the indifferent consumer for R (i.e., the one that is indifferent from buying only from R or from both R and L):

We again start by solving the model for advertising volumes, (). The FOCs in relation to () equal:

We can then see that now under multi-homing, it is not only prices of the rival that do not enter the FOCs for advertising but also content diversification of the rival. This shows that multi-homing reduces competition not only price, but also on content diversification. Again, this results from the fact that multi-homing reduces competition, since readers that multi-home buy from both newspapers, and therefore firms do not need to compete for these consumers.

Solving for and , we get the same advertising levels as under single-homing, .

The FOCs for prices are:

We can see again that the FOCs for prices under multi-homing differ from the single-homing case, since now prices and content diversification of the rival do not enter the FOCs. This shows once more that multi-homing softens competition, not only on prices but also for content diversification. This is so, as we have already said, since when consumers multi-home (i.e., they consume from all the firms), competition for consumers is softened.

Solving for and , we obtain:

We can now solve for the FOC of content diversification, (). Start again by noticing that, as for the single-homing case, the FOCs for content diversification can be decomposed into a direct effect of on the demand of media firm i (, ) and an indirect effect of on the demand of firm i via the effect on the price of the rival (, and ):

We can show that the direct effect and the indirect effect equal:

We can then see that, as in the single homing case, the direct effect of content diversification on demand of the media firm is positive. Accordingly, more content increases demand for the media firm. However now under multi-homing this occurs since the indirect effect is canceled. This is so because as we have mentioned above, multi-homing reduces competition for readers that multi-home, since these consume from the two media firms, and therefore firms do not need to compete for them.

We can simplify the FOCs for content diversification and show that they equal:

Then, we have that the content diversification of the rival does not enter the FOCs for content diversification, showing once again that multi-homing reduces competition not just on prices but also on content provision.

Solving for and , we obtain:

Since (the market is covered), and since the SOC for content diversification demands that (see Appendix D), then .

We can now also solve for prices and :

8. Content Diversification and Ad-Valorem Taxes on Selling of News

We now look to the case with ad-valorem taxes on selling of news. We first look to the single-homing case, then to the multi-homing case. We close this section by comparing the no taxation case with the taxation case. We are interested to check if the result in Foros et al. [16], i.e., that ad-valorem taxes on selling of news reduces prices of news, also holds when firms invest in content diversification.

8.1. Single-Homing

We now derive the equilibrium condition of the single-homing case with ad-valorem taxes on selling of news when firms invest in content. The first thing to note is that the indifferent consumer is the same as under no taxation.

It can also be seen that the First Order Conditions (FOCs) in relation to () under taxation are the same as in the no taxation case. Then advertising levels under taxation and no taxation are also equal.

In what concerns prices, we can see that the FOCs in relation to () are:

Solving for and , we obtain:

In what concerns the FOCs for content diversification, as above, these can be divided into a direct and an indirect effect:

It can be seen that the direct and the indirect effect under the taxation case are equal to the no taxation case. This means that also with taxation, content diversification has a positive impact on demand of the media firm. Furthermore, the FOCs for content diversification can be simplified to:

Solving for and , we obtain:

We can now solve for prices to obtain:

8.2. Multi-Homing

In this sub-section, we look to the case of multi-homing with ad-valorem taxes on selling of news. The first thing to note is that the indifferent consumers for firm L and firm R in the taxation scenario are the same as in the no taxation case.

The second thing to note is that the FOCs for advertising volumes, () under taxation are also equal to the FOCs under no taxation. As a result, advertising levels under multi-homing with taxation are also the same, .

In turn the FOCs for prices under the taxation case equal:

As for the no taxation case under multi-homing, with taxation, the FOCs for prices under multi-homing differ from ones under the single-homing case, since now prices and content diversification of the rival do not enter the FOCs. This results from the fact that, as we have already said previously, multi-homing reduces competition on both prices and content, since multi-home consumers consume from the two media firms.

Solving for and , we obtain:

We can now solve for the FOC of content diversification, (). Start again by noticing that the FOC for content diversification can be again decomposed once more into a direct effect and an indirect effect:

We can show that the direct effect and the indirect effect under the taxation case are equal to the no taxation case. Then as for the no taxation case, multi-homing softens price competition.

We can simplify the FOCs for content diversification and show that they equal:

Note again that content diversification of the rival does not enter the FOCs of the firm in relation to content diversification. As we have mentioned, this is due to the fact that multi-homing reduces competition, not only on prices, but also on content provision.

Solving for and , we obtain:

Since (the market is covered), and since the SOC for content diversification demands that (see Appendix E), then .

We can now also solve for prices and .

8.3. Taxation versus No Taxation

We can now compare the effects of taxation on prices and content diversification. Start with the single-homing-case.

In what concerns prices, we have:

Then, similar to Foros et al. [16], under single-homing, prices are higher in the no taxation case. As in Foros et al. [16], and as we have mentioned above this is the consequence of the two-sidedness of the market.

Foros et al. [16] then argue that reducing taxation could have a double negative impact in the media market since it would not only reduce demand (because of higher prices with no taxation) but also media plurality, because some consumers would stop to multi-home due to higher prices. We will look at multi-homing next, however, as we mentioned in the Introduction, in Foros et al. [16] media plurality is only about two media outlets providing one variety of content, i.e., media firms do not diversify content. When this is the case, media plurality increases if consumers buy two varieties (i.e., they multi-home), and media plurality decreases if consumers just buy one variety (i.e., they single-home). In our model, though, media plurality is more than just multi-homing or single-homing, i.e., buying two varieties or just one. Media plurality is also about how much content media firms provide. This part of media plurality, we can already analyze for the case of single-homing.

In this regard, we can show that the difference in content diversification with taxation and no taxation equals:

Taxation then unambiguously reduces content diversification of media firms. This then puts into light that content diversification is more than just a question of single-homing and multi-homing (demand side) but also about how much media firms provide of content (supply side). In this sense, under single-homing, ad-valorem taxes on selling of news can be positive for prices but are negative for media plurality.

We turn now to the multi-homing case. We start again with prices. We can show that difference in prices between taxation and no taxation equal:

We can see that prices are higher under no taxation than with taxation when (i.e., consumers do not have a very strong preference for their own ideal variety relatively to ad-valorem taxes and the costs to provide content). This is a similar result to the single-homing case above, and to Foros et al. [16]. However, for (i.e., consumers have a strong preference for their own ideal variety relatively to ad-valorem taxes and the costs to provide content), this is no longer necessarily the case. In particular, prices with no taxation can be smaller than under taxation. This differs from both the single-homing case above, and from Foros et al. [16]. The reason for this result is that when consumers have a strong preference for their own ideal variety, increasing prices might not be anymore an option under no taxation, because by doing so the firm can lose consumers to the rival.

In what concerns content diversification, we can show that the difference in content diversification with taxation and no taxation equals:

We then have the same result under single homing and multi-homing: taxation reduces content diversification. Again, what we can take from this result is that we cannot see media plurality just in terms of single-homing (buying from one media firm, just having access to one news source) and multi-home (buying from two media firms, having access to two news source), but also how much diversity of content media firms provide to the market. Furthermore, while the effect of ad-valorem taxes on selling of news can be ambiguous, the effect on content diversification is always negative, since taxes always decrease content provision.

9. Content Diversification and Ad-Valorem Taxes on Selling of Advertisement

In this section, we look to the case with ad-valorem taxes on selling of advertising when firms can diversify content. We again start with the single-homing case, then look to the multi-homing case. We close this section by comparing the no taxation and the taxation case in what respects prices and content diversification.

9.1. Single-Homing

The first thing to note is that the indifferent consumer with taxes on advertisement under single-homing is again the same as with no taxation.

With taxation, however, the FOCs for advertising equal:

Solving for and , we get the same advertising values as in the no taxation case, .

In turn, the FOCs for prices equal:

Solving for and , we obtain:

We can now solve for the FOC of content diversification, (). As above, the FOCs for content diversification can be decomposed into the direct effect of on the demand of media firm i (, ) and an indirect effect of on the demand of firm i via the effect on the price of the rival j (, , ):

It can be shown that the direct effect and the indirect effect are the same as above with no taxation. Therefore the (positive) direct effect dominates the (negative) indirect effect. Then, the FOCs for advertising under taxation and under no taxation are also the same. This means that under single-homing, content diversification under taxation and no taxation are equal, . In other words, ad-valorem taxes on advertising do not affect content provision in the market.

Solving for prices, we have:

9.2. Multi-Homing

The first thing to note with the multi-homing case is that once more the indifferent consumers under multi-homing are the same as for the no taxation case above. In turn, the FOCs for advertising under multi-homing, equal:

Again, with multi-homing, prices and content diversification of the rival do not show up in the FOCs for advertising. This results from multi-homing reducing competition. Solving for and we get the same advertising values as in the no taxation case, .

In turn, the FOCs for prices equal:

Note once more that multi-homing reduces competition on prices and content, since prices and content of the rival do not come up in the FOCs for prices.

Solving for and , we obtain:

In what relates the FOCs for advertising, again these can be decomposed into a direct effect and an indirect effect:

It can be easily shown that the direct and indirect effect are equal to the no taxation case. Then again content diversification increases demand of a media firm.

The FOCs for content diversification can then be simplified to:

Once more with multi-homing, content diversification of the rival does not show up in the FOCs for content diversification. As mentioned several times now, this results from the fact that multi-homing reduces competition.

Solving for and , we obtain:

Since (the market is covered), and since the SOC for content diversification demands that (see Appendix D), then .

We can now also solve for prices and :

9.3. Taxation versus No Taxation

We can now compare the effects of taxation on prices. Under single-homing, we have that the difference in prices with taxation and no taxation equal:

We can then see that with ad-valorem taxes on selling of advertising, prices are lower under no taxation. Once more then, this is the opposite result of Foros et al. [16] with ad-valorem taxes on selling of news, where prices are higher under no taxation. So, the result we obtained before with no content diversification is robust to the introduction of content diversification.

In what concerns content diversification, as we have already noted, we have that:

Then, taxation of advertising under single-homing has no effects on content diversification.

In turn, under multi-homing, we have that the difference in prices with taxation and no taxation equal:

With multi-homing then we have that for , prices are higher with no taxation. In turn, for , prices are lower with no taxation. In other words, when consumers do not have a strong preference for their ideal variety in relation to the cost of diversifying content (low t relatively to ), we can obtain the same result as in Foros et al. [16] that prices are lower under taxation. However, when consumers have a strong preference for their own ideal variety relatively to the costs to diversify content (high t relatively to ), again prices are lower under no taxation. This result is intuitive, when consumers have a low preference to their own ideal variety, firms can increase prices without fearing losing consumers to the rival. The opposite occurs, when consumers have a strong preference for their own ideal variety.

We can also show that the difference in content diversification with taxation and no taxation equals:

Since the SOC for content diversification demands that , then there is more content diversification (and therefore more media plurality) with no taxation. Then in spite of the fact that with multi-homing prices are no longer always lower with no taxation, we still have that content diversification is always higher with no taxation.

10. Discussion of Results

In this paper, we have analyzed the effects of ad-valorem taxes (on selling of news and on selling of advertising) on prices and content diversification. The motivation for this exercise comes from two fronts. First, the Internet has brought new challenges to the media sector. Accordingly, the migration of content from printed newspapers to online news, has reduced newspapers revenues from printed newspapers (subscriptions and sales of printed newspapers and advertising revenues from printed editions). In addition, the online business of newspapers has not yet compensated for the revenue losses from printed editions. This is so because online many news items are free, and newspapers face fierce competition for advertising revenues from online giants such as Google and Facebook.

The question that we analyzed in this paper is if tax policy for newspapers can help them to face these challenges. In particular, if lower ad-valorem taxes on the selling of news and on the selling of advertising can reduce prices for consumers in order to increase demand for news, and free revenues that newspapers can use to increase content provision and therefore increase media plurality in the news market.

Previous analysis has shown that in a two-sided market, ad-valorem taxes on selling of news can contribute to fiercer price competition (and therefore lower prices) and as a result promote multi-homing by consumers, which is positive to media diversity (Foros et al. [16]. For this reason, Foros et al. [16] argued against reducing taxes to newspapers, because it can lead to higher prices and lower media diversity, since consumers can start to be single-homing (buying fewer different newspapers).

We have argued that since the media market is a two-sided market (it sells news to consumers and advertising to advertisers), looking just at taxes on the selling of news does not give the full picture and we should also look to the taxes on the selling of advertising. Furthermore, we have argued that media diversity is not only about single-homing (buying just one newspaper, i.e., have access to one news source) and multi-homing (buying different competing newspapers, i.e., having access to different news sources), but also the diversity of content offered by each newspaper.

In order to look at these issues we followed the literature in media economics and used the Hotelling model of product competition, where media firms receive revenues from both selling news and selling advertising. This choice involves however some limitations. First, the Hotelling model does not consider entry and exit of new competitors. Second, the Hotelling model considers only the duopoly case.7 Third, the Hotelling model looks only at horizontal product differentiation, but not vertical product differentiation (e.g., quality). However, in theoretical analysis we have to balance realism and being parsimonious. We believe that, in this sense our model can give some lessons for the tax policy in the news market that is new for the media economics literature.

Finally, we have not performed a full analysis of the effects on social welfare. We have not done this due to space restrictions and because we think that the results are straightforward from the analysis above. Accordingly, we can easily see that taxes affect the profitability of firms and consumer surplus since it affects prices and content diversification. Consumers benefit with lower prices and more content diversity. Firms can benefit with higher prices if higher prices do not reduce demand. Firms can also benefit with higher consumer diversity since this increases demand.

In what respects taxes, we can say that taxes are unambiguously negative for content diversification and therefore are negative for consumers and for firms. Taxes impact on prices, however, depend on, as we have shown, if taxes are on the selling of news or on the selling of advertising. Taxes on the selling of news can reduce or increase prices. So, the effects on consumer surplus, profits and social welfare can go both ways. In turn, taxes on the selling of advertising tend to increase prices. As we have seen above, this can be positive or negative for firms (depending on if it decreases demand from consumers), but it is always negative for consumers.

11. Conclusions

In this paper, we have shown that effects of ad-valorem taxes on prices and content diversity depends on if we consider ad-valorem taxes on selling of news or ad-valorem taxes on the selling of advertising. In particular, ad-valorem taxes on the selling of news can contribute to fiercer price competition (and therefore lower prices) and as a result promote multi-homing by consumers, which is positive to media diversity. In turn, ad-valorem taxes on the selling of advertising can conduce to higher prices, since firms need to compensate for the reduction in advertising revenues, and in this way force consumers to single-home, reducing media diversity. The reason for this different result is that ad-valorem taxes on selling of advertising does not affect price competition but reduces advertising revenues which media firms try to recover with higher prices of newspapers.

Another contribution of this paper was to show that when we look to media diversity, we should consider not only how many news sources a consumer has access to (single-homing versus multi-homing), but also the diversity of content that each media firm supplies the market. In order to investigate this, we have also look to the incentives of firms to diversify content when they face ad-valorem taxes on selling of news and ad-valorem taxes on selling of advertising. In this respect, we have found the following. First, if firms can diversify content, ad-valorem taxes on selling of news do not anymore unambiguously increase prices. This will depend on consumers’ intensity of preferences for their ideal variety. Accordingly, if consumers have a strong preference for their ideal variety, prices can be lower in the no taxation scenario relatively to the scenario with ad-valorem taxes on selling of news. This is so because when consumers have a strong preference for their ideal variety, price competition increases.

Second, we show that both ad-valorem taxes on selling of news and ad-valorem taxes on selling of advertising reduces content diversification in the media market relatively to the no taxation case. The reason for this is that to diversify content is costly, and taxation of advertising, by reducing advertising revenues, also reduces firms’ capacity to finance content diversification. This shows that even in the cases where ad-valorem taxes reduce prices (i.e., with ad-valorem taxes on selling of news) promoting consumers to multi-home, media diversity can even so be reduced, because media firms decrease content diversification in the media market.

In this sense, this paper put forward results that are both new in the literature in media economics and have clear policy implications. In terms of the novelty, to the best of our knowledge, we were the first to look to taxes on the selling of advertising. The other papers in the literature have looked only to taxes on the selling of news. The importance of doing this is that, as we have discussed above, taxes on the selling of news and taxes on the selling of advertising have different impacts in the news market, in terms of prices (demand for news) and content provision. In addition, the literature on the field has looked to media diversity just in terms if consumers single-home (i.e., have access to just one source of news) or multi-home (i.e., have access to more than one source of news). We instead argue that media diversity is also about the diversity of content that each media firm provides the market.

In this sense, our paper also gives novel policy implications. First, if governments are afraid of the negative effects that ad-valorem taxes on selling of news can have on prices (Foros et al. [16], governments should use instead ad-valorem taxes on selling of advertising, since taxes on advertising have no effects on price competition. Furthermore, lower taxes on the selling of advertising can increase revenues of media firms, helping them to face the fiercer competition on the internet. Second, governments must however keep in mind that taxation in media markets can have negative effects on content diversification and therefore media plurality. In this sense, this result supports the argument that the tax policy for the media sector can have in impact in media diversity.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

I would like to thank the insights, comments, and suggestions of Dirk Schindler. I am also thankful to Fabrizio Germano and Isa Hafalir, Editors at Games, and five anonymous referees. In addition, I would like to thank Hans Jarle Kind and Guttorm Schjelderup for discussions at an early stage of this project.

Conflicts of Interest

The author declares no conflict of interest.

Appendix A. No Content Diversification and No Ad-Valorem Taxes

Appendix A.1. Single-Homing

Second-Order Conditions (SOCs). The SOCs for advertising equal:

At the symmetric equilibrium (), the SOCs for advertising are always satisfied.

The SOCs for prices equal:

The SOCs for prices are always satisfied.

Appendix A.2. Multi-Homing

Second-Order Conditions (SOCs). The SOCs for advertising equal:

We can see that substituting for and in the SOCs for advertising, these SOCs are always satisfied.

The SOCs for prices are the same as for the single-homing case. Then they are always satisfied.

Appendix B. No Content Diversification and Ad-Valorem Taxes on Selling of News

Appendix B.1. Single-Homing

Second-Order Conditions (SOCs). The SOCs for advertising are the same as for the no taxation case.

The SOCs for prices equal:

Then, the SOCs for prices are always satisfied.

Appendix B.2. Multi-Homing

Second-Order Conditions (SOCs). The SOCs for advertising are the same as for the no taxation case.

The SOCs for prices equal:

Then, the SOCs for prices are always satisfied.

Appendix C. No Content Diversification and Ad-Valorem Taxes on Selling of Advertisement

Appendix C.1. Single-Homing

Second-Order Conditions (SOCs). The SOCs for advertising equal:

We can see that at the symmetric equilibrium (), the SOCs for advertising are always satisfied.

The SOCs for prices are the same as in the no taxation case. Then, the SOCs for prices are always satisfied.

Appendix C.2. Multi-Homing

Second-Order Conditions (SOCs) The SOCs for advertising equal:

We can see that substituting for and in the SOCs for advertising, these SOCs are always satisfied.

The SOCs for prices are the same as for the no taxation case and are therefore always satisfied.

Appendix D. Content Diversification and No Ad-Valorem Taxes

Appendix D.1. Single-Homing

Second-Order Conditions (SOCs). SOCs for advertising:

At the symmetric equilibrium , the SOCs are always satisfied since content diversification cannot be bigger than the size of the line (the Hotelling line has size one).

SOCs for prices:

The SOCs for prices are always satisfied.

SOCs for content diversification:

The SOCs for content diversification are satisfied, i.e., , for .

Appendix D.2. Multi-Homing

Second-Order Conditions (SOCs). SOCs for advertising:

Since , then the SOCs for advertising are satisfied if . In other words, consumers need to have a strong preference for their ideal variety. When this does not happen, consumers will choose to single-home.

SOCs for prices:

The SOCs for prices are always satisfied.

SOCs for content diversification:

The SOCs for content diversification are satisfied for .

Appendix E. Content Diversification and Ad-Valorem Taxes on Selling of News

Appendix E.1. Single-Homing

Second-Order Conditions (SOCs). The SOCs for advertising under taxation are the same as above with no taxation.

SOCs for prices:

The SOCs for prices are always satisfied.

SOCs for content diversification:

The SOCs for content diversification are satisfied for .

Appendix E.2. Multi-Homing

Second-Order Conditions (SOCs). The SOCs for advertising under the taxation case equal the SOCs for advertising under no taxation.

SOCs for prices:

The SOCs for prices are always satisfied.

SOCs for content diversification:

Then the SOCs for content diversification are satisfied if .

Appendix F. Content Diversification and Ad-Valorem Taxes on Selling of Advertisement

Appendix F.1. Single-Homing

Second-Order Conditions (SOCs). SOCs for advertising:

We can see that at the symmetric equilibrium , these SOCs are always satisfied.

SOCs for prices:

The SOCs for prices are always satisfied.

Appendix F.2. Multi-Homing

Second-Order Conditions (SOCs). SOCs for advertising:

We can see that substituting for and in the SOCs for advertising, these SOCs are always satisfied.

SOCs for prices:

The SOCs for prices are then always satisfied.

Notes

| 1 | The advent of Internet has made media diversity even more central since news content is sometimes offered for free. This has lead media firms to loose revenues from both subscriptions and advertising, which in turn has led to the exit of many newspapers (especially local ones) and the reduction of journalists in news rooms and as a result of investigative journalism (see Pew Research Center [10,11,12,13,14,15]). |

| 2 | Hotelling-type models are commonly adopted to investigate platform competition (e.g., Adner et al. [24]; Bakos and Halaburda [25]; Chatterjee and Zhou [26]; Chiang and Jhang-Li [27]; Jiang et al. [28]) and consumer choices (e.g., Wu et al. [29]). See also Athey et al. [30]), Bernstein et al. [31], Chakraborty et al. [32]), Wu and Chamnisampan [33] and Wu and Chiu [34]. |

| 3 | Other papers that analyze taxation in media markets look to the effects of taxation on the collection of personalized data (Bourreau et al., [46]; on tax competition/coordination (Bacache Beauvallet, [47], Gauthier, [48]; on privacy protection (Bloch and Demange, [49], and on transfer pricing and taxation of royalty payments (Juranek et al. [50]). |

| 4 | When we talk about media diversity, we usually think primarily about newspapers, because many news items focus on political issues. However, besides newspapers other type of media firms (magazines, books, films, television, or media platforms) can also be important for media diversity even when they are more entertainment based. For example, movies about minorities can contribute as much to media diversity as an op-ed talking about immigrants. In this paper, then, despite the focus is newspaper, our results could be relevant for other type of media markets besides newspapers that also operate in a two-sided market. |

| 5 | We are implicitly assuming that when a consumer buys a newspaper (or an online subscription of a newspaper) he can potentially consume all news pieces offered by the newspaper. Obviously, some of these news pieces do not conform totally with the preferred variety of this consumer, but some do. In terms of the model, our results do not change if we account for the news pieces that do not conform with this reader preferences. It can be easily seen that even if we account for the news that differ from this reader ideal variety, he has a lower disutility if his ideal variety is supplied than if it is not supplied. |

| 6 | As in Foros et al. [16], we do not consider disutility from advertising. As argued by Foros et al. [16] this assumption is consistent with empirical evidence. See for instance Gentzkow [54], Fan [55] and Gentzkow et al. [9]. |

| 7 | We can however say what would happen in a monopoly, which is the case in the media sector in some countries. In a monopoly, the monopolist has lower incentives to diversify content than with the competition. In this sense, taxes can have even bigger negative effects on content provision. In what concerns prices, we know that in this type of models, monopolists set the monopolist price (which is above the duopolistic price), and therefore taxes will not have implications on prices, since monopolist will continue to set the monopolist price. |

References

- Strömberg, D. Mass Media and Public Policy. Eur. Econ. Rev. 2001, 45, 652–663. [Google Scholar] [CrossRef]

- Strömberg, D. Mass Media Competition, Political Competition, and Public Policy. Rev. Econ. Stud. 2004, 71, 265–284. [Google Scholar] [CrossRef]

- Strömberg, D. Radio’s Impact on Public Spending. Q. J. Econ. 2004, 119, 189–221. [Google Scholar] [CrossRef]

- Strömberg, D. Natural Disasters, Economic Development, and Humanitarian Aid. J. Econ. Perspect. 2007, 21, 199–222. [Google Scholar] [CrossRef]

- Strömberg, D. How the Electoral College Influences Campaigns and Policy: The Probability of Being Florida. Am. Econ. Rev. 2008, 98, 769–807. [Google Scholar] [CrossRef]

- Sunstein, C. Republic.com 2.0; Princeton University Press: Princeton, NJ, USA, 2007. [Google Scholar]

- Sunstein, C. #Republic: Divided Democracy in the Age of Social Media; Princeton University Press: Princeton, NJ, USA, 2016. [Google Scholar]

- Gentzkow, M.; Shapiro, J.; Sinkinson, M. The Effect of Newspaper Entry and Exit on Electoral Politics. Am. Econ. Rev. 2011, 101, 2980–3018. [Google Scholar] [CrossRef]

- Gentzkow, M.; Shapiro, J.; Sinkinson, M. Competition and Ideological Diversity: Historical Evidence from US Newspapers. Am. Econ. Rev. 2014, 104, 3073–3114. [Google Scholar] [CrossRef]

- The Pew Research Center. State of the News Media 2016; Pew Research Center: Washington, DC, USA, 2016. [Google Scholar]

- The Pew Research Center. The Modern News Consumer; Pew Research Center: Washington, DC, USA, 2016. [Google Scholar]

- The Pew Research Center. The Future of Truth and Misinformation Online; Pew Research Center: Washington, DC, USA, 2017. [Google Scholar]

- The Pew Research Center. State of the News Media 2018; Pew Research Center: Washington, DC, USA, 2018. [Google Scholar]

- The Pew Research Center. News Use Across Social Media Platforms 2018; Pew Research Center: Washington, DC, USA, 2018. [Google Scholar]

- The Pew Research Center. Partisans Remain Sharply Divided in Their Attitudes about the News Media; Pew Research Center: Washington, DC, USA, 2018. [Google Scholar]

- Foros, Ø.; Kind, H.-J.; Wyndham, T. Tax-Free Digital News? Int. J. Ind. Organ. 2019, 66, 119–136. [Google Scholar] [CrossRef]

- European Commission. VAT Rates Applied in the Member States of the European Union; European Commission: Brussels, Belgium, 2021. [Google Scholar]

- Centre for Media Pluralism and Media Freedom. Monitoring Media Pluralism in the Digital Era: Application of the Media Pluralism Monitor in the European Union, Albania, Montenegro, the Republic of North Macedonia, Serbia and Turkey in the Year 2021; Media Pluralism Monitor (MPM); Centre for Media Pluralism and Media Freedom (CMPF): Florence, Italy, 2022. [Google Scholar]

- Hotelling, H. Stability in Competition. Econ. J. 1929, 39, 41–57. [Google Scholar] [CrossRef]

- d’Aspremont, C.; Gabszewicz, J.; Thisse, J.-F. On Hotelling’s “Stability in competition”. Econometrica 1979, 47, 1145–1150. [Google Scholar] [CrossRef]

- Rochet, J.-C.; Tirole, J. Platform Competition in Two-Sided Markets. J. Eur. Econ. Assoc. 2003, 1, 990–1029. [Google Scholar] [CrossRef]

- Anderson, S.; Coate, S. Market Provision of Broadcasting: A Welfare Analysis. Rev. Econ. Stud. 2005, 72, 947–972. [Google Scholar] [CrossRef]

- Armstrong, M. Competition in Two-Sided Markets. RAND J. Econ. 2006, 37, 668–691. [Google Scholar] [CrossRef]

- Adner, R.; Chen, J.; Zhu, F. Frenemies in Platform Markets: Heterogeneous Profit Foci as Drivers of Compatibility Decisions. Manag. Sci. 2020, 66, 2432–2451. [Google Scholar] [CrossRef]

- Bakos, Y.; Halaburda, H. Platform Competition with Multihoming on Both Sides: Subsidize or Not? Manag. Sci. 2020, 66, 5599–5607. [Google Scholar] [CrossRef]

- Chatterjee, P.; Zhou, B. Sponsored Content Advertising in a Two-Sided Market. Manag. Sci. 2021, 67, 7560–7574. [Google Scholar] [CrossRef]

- Chiang, I.R.; Li, J.H. Competition Through Exclusivity in Digital Content Distribution. Prod. Oper. Manag. 2020, 29, 1270–1286. [Google Scholar] [CrossRef]

- Jiang, B.; Tian, L.; Zhou, B. Competition of Content Acquisition and Distribution under Consumer Multipurchase. J. Mark. Res. 2019, 56, 1066–1084. [Google Scholar] [CrossRef]

- Wu, X.; Zha, Y.; Ling, L.; Yu, Y. Competing OEMs’ Responses to a Developer’s Services Installation and Strategic Update of Platform Quality. Eur. J. Oper. Res. 2022, 297, 545–559. [Google Scholar] [CrossRef]

- Athey, S.; Calvano, E.; Gans, J.S. The Impact of Consumer Multi-Homing on Advertising Markets and Media Competition. Manag. Sci. 2018, 64, 1574–1590. [Google Scholar] [CrossRef]

- Bernstein, F.; DeCroix, G.A.; Keskin, N.B. Competition between Two-Sided Platforms under Demand and Supply Congestion Effects. Manuf. Serv. Oper. Manag. 2020, 23, 1043–1061. [Google Scholar] [CrossRef]

- Chakraborty, S.; Basu, S.; Ray, S.; Sharma, M. Advertisement Revenue Management: Determining the Optimal Mix of Skippable and non-Skippable Ads for Online Video Sharing Platforms. Eur. J. Oper. Res. 2021, 292, 213–229. [Google Scholar] [CrossRef]

- Wu, C.-H.; Chamnisampan, N. Platform Entry and Homing as Competitive Strategies under Cross-Sided Network Effects. Decis. Support Syst. 2021, 140, 113428. [Google Scholar] [CrossRef]

- Wu, C.-H.; Chiu, Y.-Y. Pricing and Content Development for Online Media Platforms Regarding Consumer Homing Choices. Eur. J. Oper. Res. 2023, 305, 312–328. [Google Scholar] [CrossRef]

- Doganoglu, T.; Wright, J. Multi-Homing and Compatibility. Int. J. Ind. Organ. 2006, 24, 45–67. [Google Scholar] [CrossRef]

- Doganoglu, T.; Wright, J. Exclusive Dealing with Network Effects. Int. J. Ind. Organ. 2010, 28, 145–154. [Google Scholar] [CrossRef]

- Kim, H.; Serfes, K. A Location Model with Preference for Variety. J. Ind. Econ. 2006, 54, 569–595. [Google Scholar] [CrossRef]

- Choi, J. Tying in Two-Sided Markets with Multi-Homing. J. Ind. Econ. 2010, 58, 607–626. [Google Scholar] [CrossRef]

- Anderson, S.; Foros, Ø.; Kind, H.J. Product Functionality, Competition, and Multi-Purchasing. Int. Econ. Rev. 2017, 58, 183–210. [Google Scholar] [CrossRef]

- Dewan, R.; Jing, B.; Seidmann, A. Product Customization and Price Competition on the Internet. Manag. Sci. 2003, 49, 1055–1070. [Google Scholar] [CrossRef]

- Alexandrov, A. Fat Products. J. Econ. Manag. Strategy 2008, 17, 67–95. [Google Scholar] [CrossRef]

- Kind, H.J.; Schjelderup, G.; Stähler, F. Newspaper Differentiation and Investments in Journalism: The Role of Tax Policy. Economica 2013, 80, 131–148. [Google Scholar] [CrossRef]

- Kind, H.J.; Koethenbuerger, M. Taxation in Digital Media Markets. J. Public Econ. Theory 2018, 20, 22–39. [Google Scholar] [CrossRef]

- Kind, H.J.; Koethenbuerger, M.; Schjelderup, G. Efficiency Enhancing Taxation in Two-Sided Markets. J. Public Econ. 2008, 92, 1531–1539. [Google Scholar] [CrossRef]

- Belleflamme, P.; Toulemonde, E. Tax Incidence on Competing Two-Sided Platforms. J. Public Econ. Theory 2018, 20, 9–21. [Google Scholar] [CrossRef]

- Bourreau, M.; Caillaud, B.; De Nijs, R. Taxation of a Digital Monopoly Platform. J. Public Econ. Theory 2018, 20, 40–51. [Google Scholar] [CrossRef]

- Bacache Beauvallet, M. Tax Competition, Tax Coordination, and E-Commerce. J. Public Econ. Theory 2018, 20, 100–117. [Google Scholar] [CrossRef]

- Gauthier, S. Efficient Tax Competition under the Origin Principle. J. Public Econ. Theory 2018, 20, 85–99. [Google Scholar] [CrossRef]

- Bloch, F.; Demange, G. Taxation and Privacy Protection on Internet Platforms. J. Public Econ. Theory 2018, 20, 52–66. [Google Scholar] [CrossRef]

- Juranek, S.; Schindler, D.; Schjelderup, G. Transfer pricing regulation and taxation of royalty payments. J. Public Econ. Theory 2018, 20, 67–84. [Google Scholar] [CrossRef]

- Garcia Pires, A. Media Diversity, Advertising, and Adaptation of News to Readers’ Political Preferences. Inf. Econ. Policy 2014, 28, 28–38. [Google Scholar] [CrossRef]

- Gabszewicz, J.; Laussel, D.; Sonnac, N. Press Advertising and the Ascent of the Pensée Unique. Eur. Econ. Rev. 2001, 45, 641–651. [Google Scholar] [CrossRef]

- Peitz, M.; Valletti, T. Content and Advertising in the Media: Pay-TV versus Free-To-Air. Int. J. Ind. Organ. 2008, 26, 949–965. [Google Scholar] [CrossRef]

- Gentzkow, M. Valuing new goods in a model with complementarity: Online newspapers. Am. Econ. Rev. 2007, 97, 713–744. [Google Scholar] [CrossRef]

- Fan, Y. Ownership consolidation and product characteristics: A study of the US daily newspaper market. Am. Econ. Rev. 2013, 103, 1598–1628. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).