Blockchain Financial Statements: Innovating Financial Reporting, Accounting, and Liquidity Management

Abstract

1. Introduction

2. Background and Related Works

2.1. Accounting and Financial Statements

2.2. Blockchain

2.3. Architectural Considerations

2.4. Impact of Blockchain on Accounting

- A permanent and unalterable record of all transactions provided by the blockchain ledger that safeguards against fraudulent alterations [23];

- Decentralisation, eliminating the potential for a single point of failure or control, which is often exploited in a fraudulent scheme [23];

- Blockchain transactions being transparent and verifiable by any allowed participant in the network, validating the accuracy of financial information [23];

- Blockchain-based smart contracts being able to automate and enforce compliance with accounting standards and policies [23];

- The real-time and comprehensive nature of blockchain records being able to streamline the auditing process, making it more efficient and less susceptible to human error or intentional oversight [23].

3. Research Methodology

- Wieringa, R.J. [36] focuses on providing guidelines on how information systems and software engineering research can be performed by iterating through activities of designing and refining a technological artefact that improves something for stakeholders.

- Peffers, K et al. [37] communicates a nominal process model for DSRM execution and the mental model for such a research presentation and evaluation.

- Geerts, G.L. [38] illustrates the application and integration of DSRM to Accounting Information System (AIS) research through retroactive analysis.

- The object of its study, which consists of the artefact itself, the contexts, and the interaction within its problem;

- The primary activities, which consist of the design of the artefact to improve the problem context and the investigation of the knowledge about this artefact in its context [36].

- The artefact (the Blockchain Financial Statements (BFS));

- The context (financial reporting and liquidity management);

- The interactions (transactional exchanges among various economic entities and involving BFS).

3.1. The Artefact

3.2. The Context

3.3. The Interactions

- Demonstrating Practical Applicability: The interactions provide evidence of how the BFS system can be implemented and utilised in real-world financial settings, thus bridging the gap between theoretical development and future practical deployment.

- Assessing the System’s Efficacy: Through these interactions, this research assesses the artefact’s effectiveness in facilitating transparent and secure transactions.

- Understanding the Impact: By studying these interactions, this research gains insights into the system’s impact on routine business operations and its role in enhancing the overall quality of financial reporting.

- Identifying Opportunities for Improvement: These interactions also serve as a feedback mechanism, highlighting areas where the BFS system can be further refined to better meet the needs of its potential users.

3.4. The Design and Investigation

4. BFS Technological Stack—Dual-Blockchain Framework

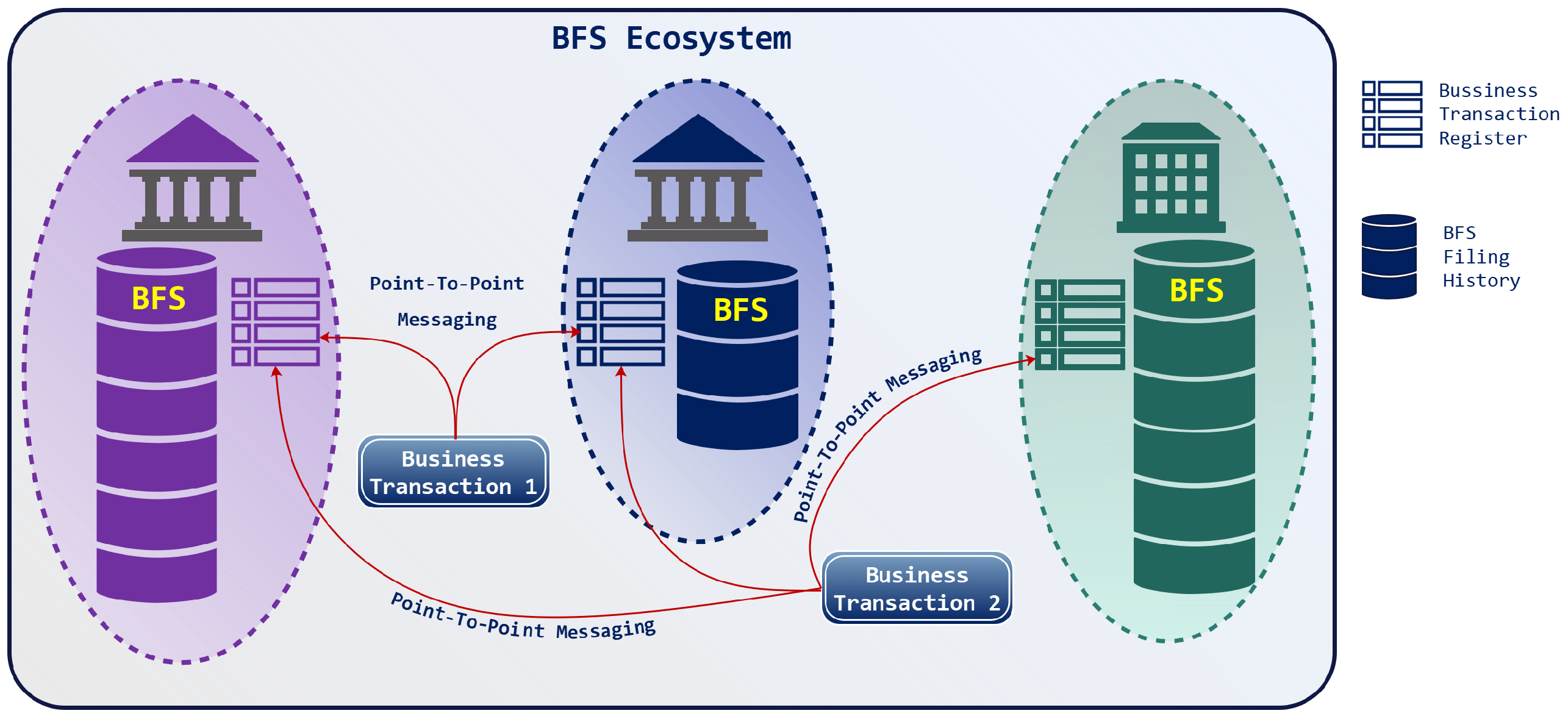

- Economic data generated from completed business transactions are transformed into accounting data, anonymized, classified, aggregated, and then packaged into financial statement reports.

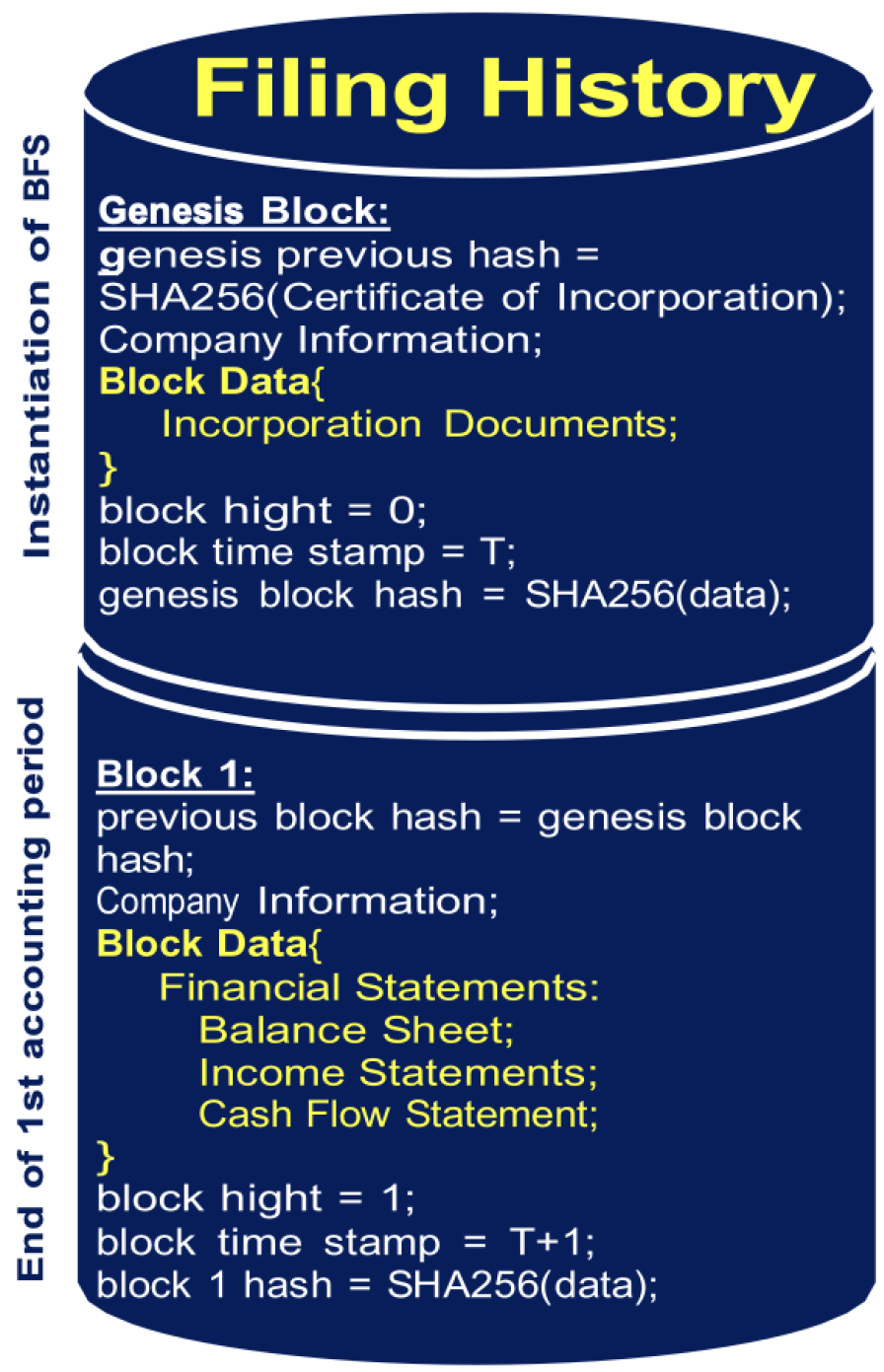

- These reports are stored in a traditional chain of cryptographically linked blocks within a permissioned blockchain data structure—the filing history.

- This separate filing history blockchain is owned and distributed among the members of entities, such as business owners, accountants, employees, and so on.

- Additionally, access permissions to this ledger can be modified and extended to qualified external stakeholders, such as other controlling entities (e.g., shareholders), or government bodies for regulatory or tax purposes.

- Corda’s Flow Framework [11] ensures that sensitive transactional data are only transmitted between the parties relevant to the transaction, thereby remaining confidential between them and safeguarding business-sensitive information.

- Corda’s Transaction Volt [11] is implemented as a business transaction register for each BFS entity. It serves as an application-local off-ledger repository that stores all business transactions (see Figure 2) in their “raw state”, untransformed and ready for accounting processing and future validation if requested.

4.1. Conceptual Decisions vs. Implementation Details

4.2. Data Model

4.3. Query Processing

4.4. Adaptation of Bitcoin and Corda Concepts in BFS

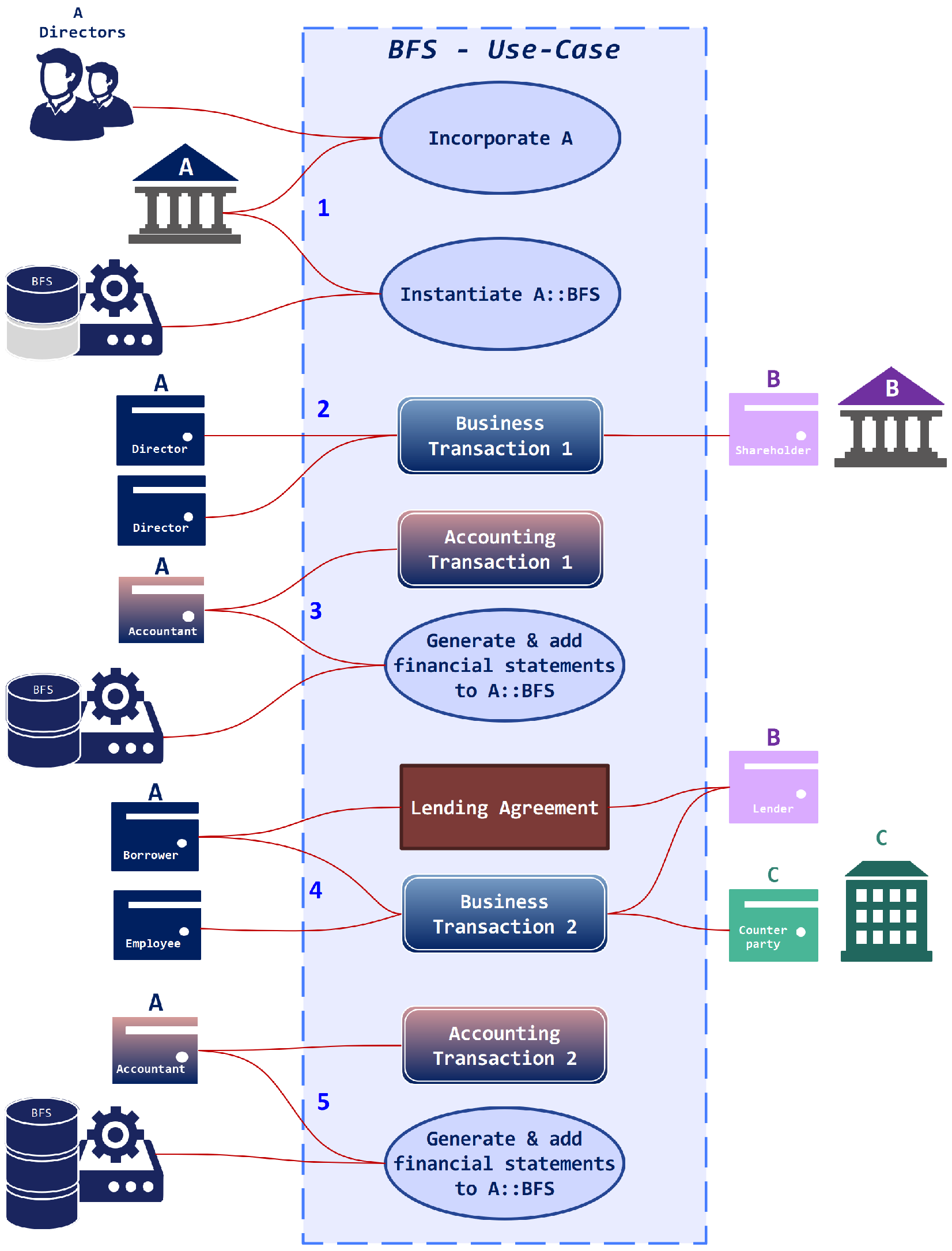

5. Use Case

5.1. Use-Case Participants

- Entity A is a newly incorporated private company limited by shares, which acts as the central business entity in this use case. The roles within Entity A are designed to manage its operations, financial reporting, and interactions with other entities. Its roles are as follows:

- Two director wallets—These wallets are managed by the directors of Entity A. They are responsible for overseeing the overall operations of the company, making strategic decisions, and authorising significant transactions, such as share issuance and sales.

- One accountant wallet—This wallet is managed by the accountant of Entity A. The accountant is responsible for maintaining the company’s financial records, executing accounting transactions, generating financial statements, and ensuring compliance with regulatory requirements.

- One borrower wallet—This wallet is managed by an employee or an authorised representative and facilitates borrowing activities for Entity A. It is used to request and manage funds borrowed from other entities, such as parent companies or financial institutions.

- One employee wallet—This wallet is managed by an employee of Entity A. It is used to execute day-to-day business transactions, such as purchasing assets, paying suppliers, and other operational activities.

- Entity B is the parent company of Entity A and holds 100% of its shares at incorporation. Entity B plays a crucial role in providing financial support and overseeing the operations of Entity A. Its roles are as follows:

- One shareholder wallet—This is managed by Entity B and represents the ownership stake in Entity A. It is used to hold and manage the shares issued by Entity A, participate in shareholder decisions, and receive dividends or other shareholder benefits.

- One lender wallet—This wallet is used by Entity B to lend funds or assets, such as Treasury bills, to Entity A. It facilitates inter-company lending and supports the financial needs of Entity A for its business operations.

- Entity C is an external business entity that interacts with Entity A in business transactions, such as buying and selling financial instruments. Its role is as follows:

- One counterparty wallet—This wallet is managed by Entity C and is used to engage in transactions with Entity A. In this use case, it is specifically used to sell commercial paper to Entity A in exchange for Treasury bills. The wallet ensures secure and verifiable transactions between Entity C and its counterparties.

5.2. Step-by-Step Use-Case Implementation

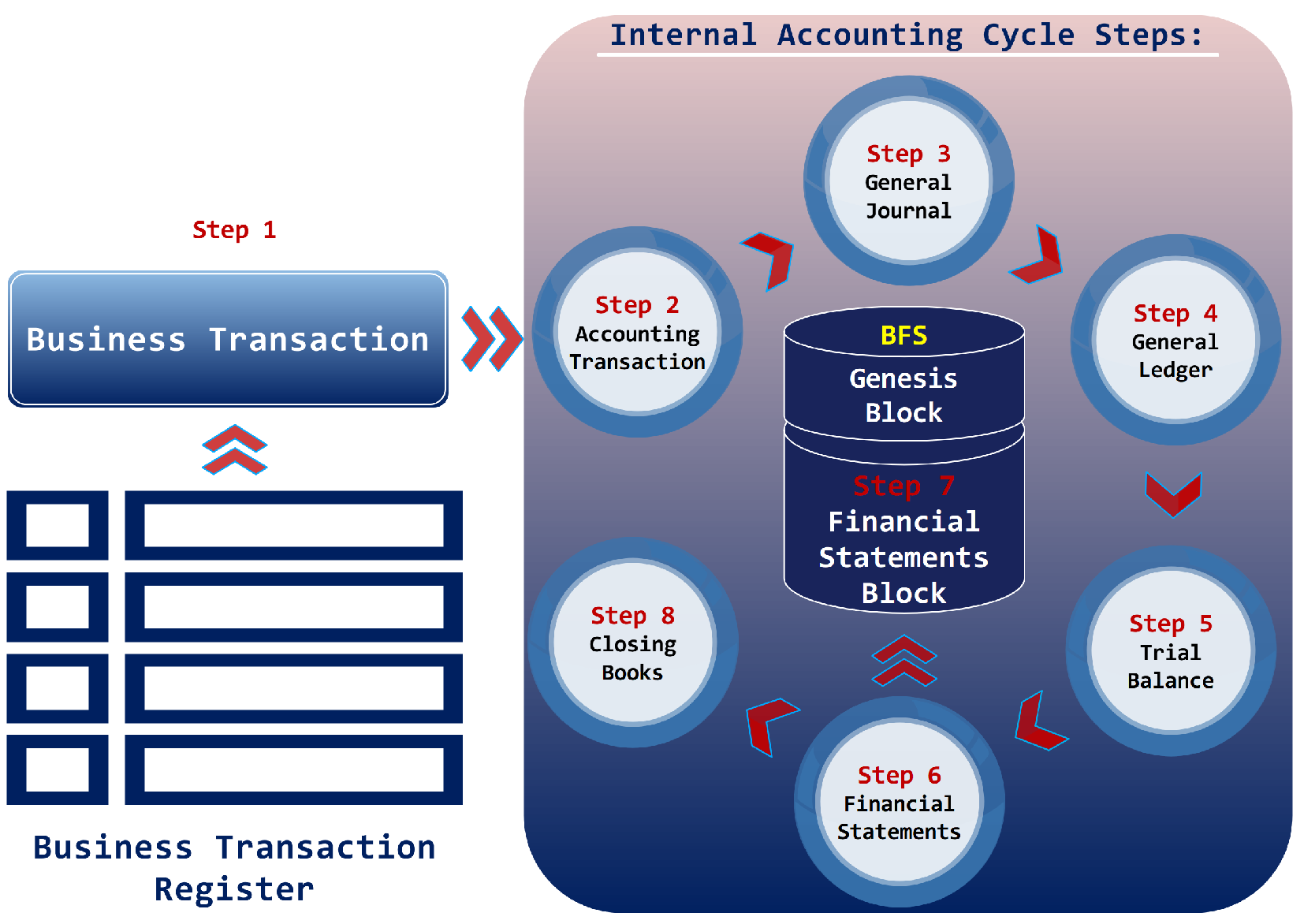

- Entity A Incorporation:Scenario: Entity A is incorporated as a private company limited by shares.Implementation: The BFS system that belongs to Entity A is instantiated and contains the “filing history chain of blocks”, a data structure inspired by the Bitcoin data structure [10]; the integrity of the data within the blocks is guaranteed by the integrity of the ledger itself [2]. In our proposed architecture, the BFS system records the incorporation details of Entity A, including the Certificate of Incorporation, in the genesis block of Entity A’s BFS filing history blockchain, as illustrated in Figure 1. This block is uniquely identified by its hash, ensuring the integrity and authenticity of Entity A’s foundational data.

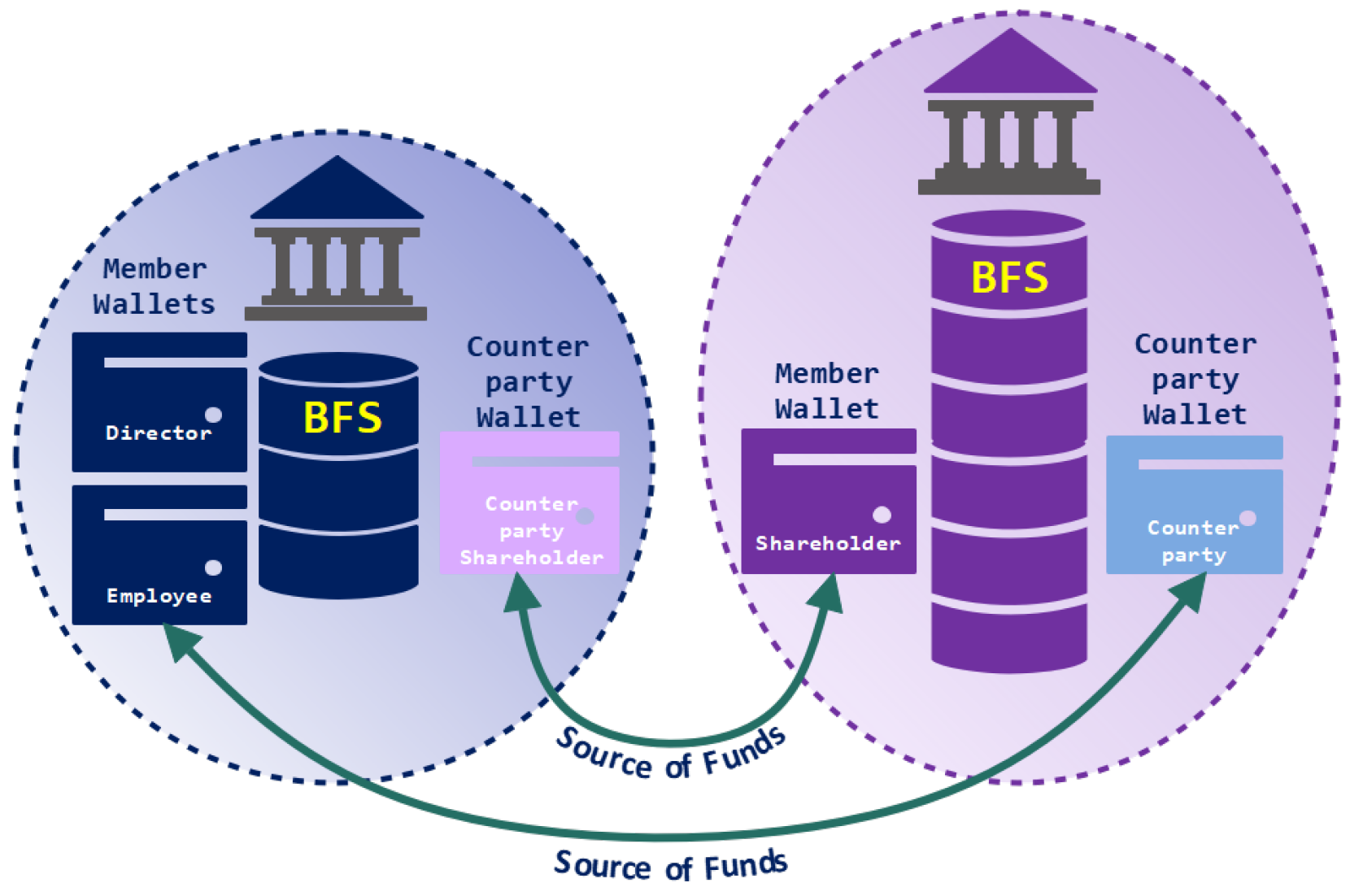

- Business Transaction 1—Share Purchase:Scenario: Entity B, as the parent of Entity A, purchases shares from Entity A and becomes the sole shareholder at incorporation.Implementation: The BFS system documents the shareholding structure, linking Entity B’s wallet to Entity A’s blockchain, as illustrated in Figure 4 and described further. The BFS system processes this transaction using a BFS business transaction smart contract and tokenised shares in accordance with Corda’s Flow Framework [11], which provides point-to-point data broadcast only to the counterparties of the business transaction. The BFS business transaction smart contract automates the transfer of share certificate tokens from Entity A’s ownership through Entity A’s director wallet to Entity B’s shareholder wallet in exchange for digital funds that are simultaneously transferred from Entity B to Entity A. The successfully completed transaction is then recorded in the business transaction registers of Entity A’s BFS and Entity B’s BFS, respectively, in accordance with Corda’s Transaction Vault [11]. This flow is illustrated in Figure 2.

- First Accounting Transaction:Scenario: Entity A records its first accounting transaction related to the share purchase.Implementation: The accountant of Entity A initiates the first accounting transaction smart contract, which automates the BFS accounting cycle; this is illustrated in Figure 5. BFS accounting smart contracts transform economic data generated by the first business transaction into accounting data and post this accounting data into the accounting journals and ledgers of the BFS system that belongs to Entity A. Final financial statements are automatically generated and appended to the BFS filing history blockchain, ensuring the accuracy and transparency of Entity A’s financial reporting data. These final financial statements are published in the Bitcoin-inspired data structure of Entity A’s BFS filing history block, as illustrated in Figure 1.

- Business Transaction 2–Four-Party Atomic Swap of Treasury Bills for Commercial Paper:Scenario: Entity A begins its economic activity, where part of its business objective is to purchase commercial paper from Entity C, and Entity C requires payment in Treasury bills in exchange for commercial paper. Entity A does not hold Treasury bills but its parent company, Entity B, does. Entity A requests Treasury bills from Entity B to enable the purchase of commercial paper from Entity C. Subsequently, Entity B lends Treasury bills to Entity A, which then uses them to purchase commercial paper from Entity C.Implementation: The BFS system executes this four-party atomic swap using BFS smart contracts. Step 1: Entity B transfers Treasury bills to Entity A. This transaction is executed by two parties: the lender wallet of Entity B and the borrower wallet of Entity A. Step 2: Entity A transfers the Treasury bills to Entity C in exchange for commercial paper. This transaction is executed by two parties: the employee wallet of Entity A and the counterparty wallet of Entity C.

- Second Accounting Transaction:Scenario: The accountant of Entity A records the acquisition of commercial paper and the corresponding use of Treasury bills in its accounting records.Implementation: The accountant wallet of Entity A initiates the second accounting transaction smart contract, as illustrated in Figure 5. BFS accounting smart contracts transform the economic data generated by the second business transaction into accounting data and post this accounting data in the accounting journals and ledgers of the BFS system that belong to Entity A. Final financial statements are automatically generated and appended to the BFS filing history blockchain, ensuring the accuracy and transparency of Entity A’s financial reporting data. These final financial statements are published in the Bitcoin-inspired data structure of Entity A’s BFS filing history block, as illustrated in Figure 1. This ensures that Entity A’s financial statements accurately represent its current financial position utilising the tamper-proof nature of the cryptographically linked blocks in the adapted blockchain architecture.

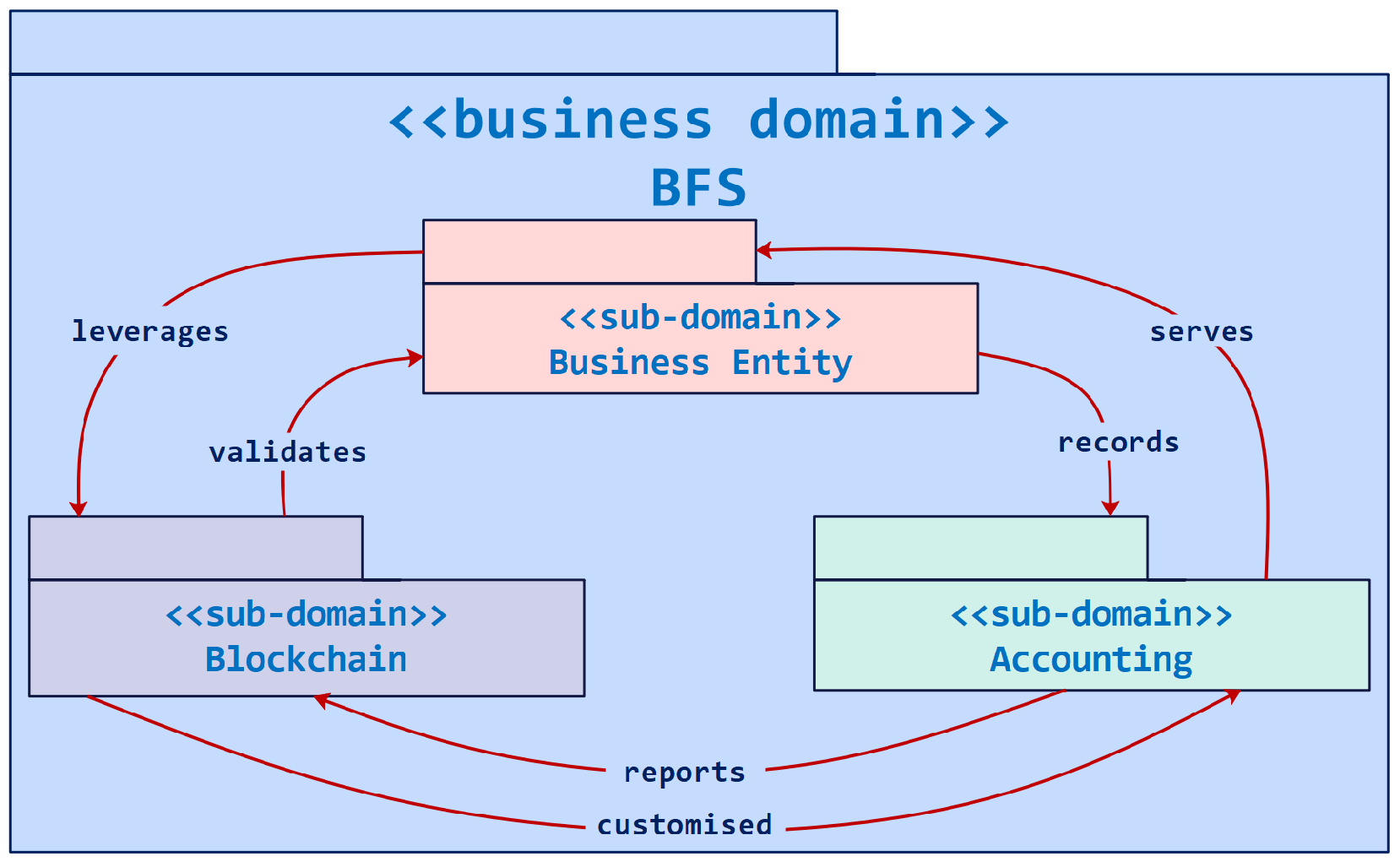

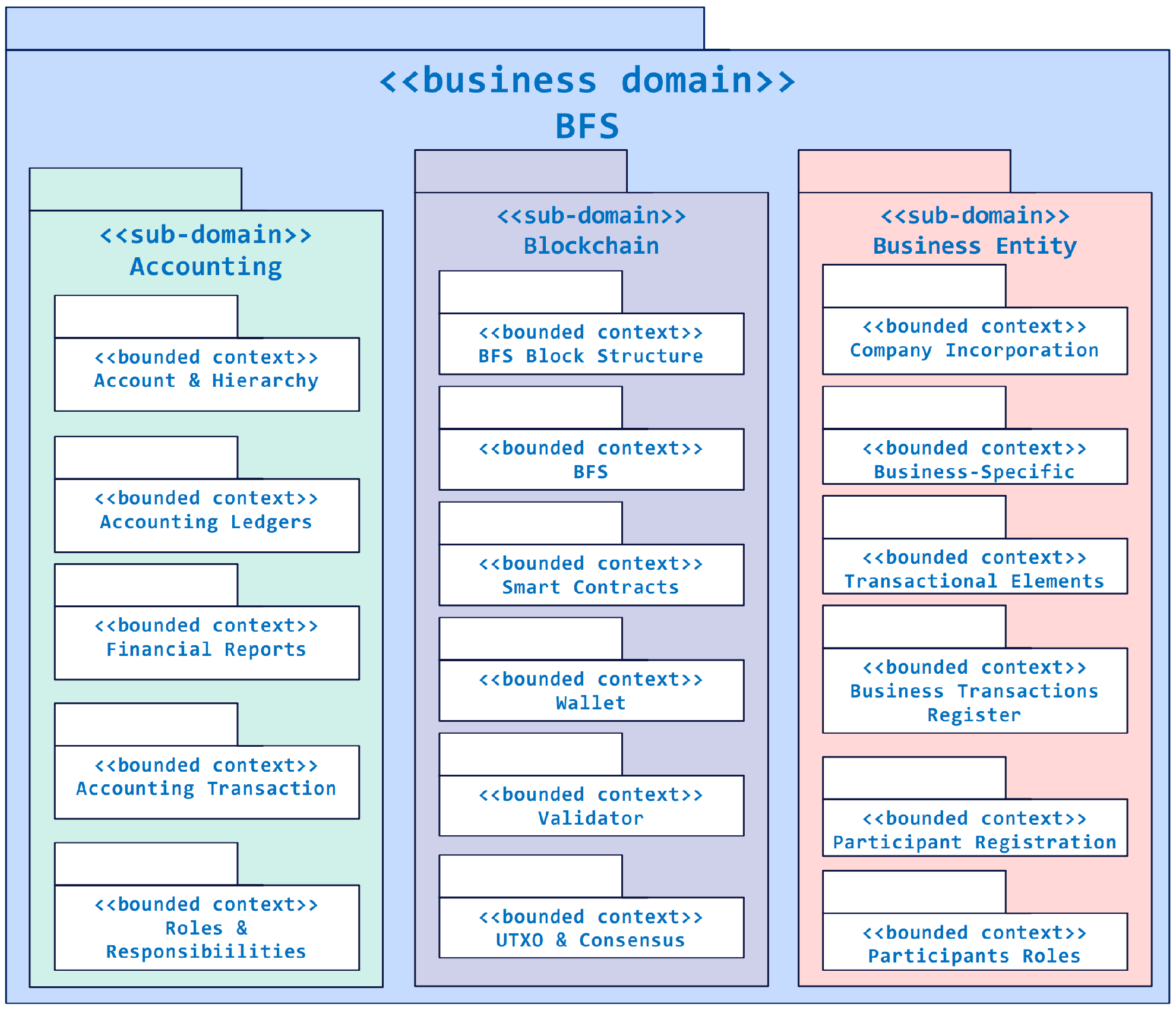

6. BFS Architectural Approach

- Top-level domain—This is defined as the subject area around which an entire software solution, such as the BFS system, is structured. It serves as the foundation upon which all other aspects of the software are developed, integrating critical elements of blockchain technology, financial accounting, and business entity management into a cohesive whole.

- Domain and sub-domain models—These function as conceptual object models that delineate various aspects of the overarching top-level domain. These models encapsulate both the behaviour and data necessary for the BFS system, illustrating the required information and its organisational structure. By defining these models, the BFS system clarifies the data interactions and functionalities needed across different segments of the business and technological processes, facilitating precise and efficient implementation.

- Bounded contexts—These represent granular subsets within the broader system that encapsulate the internal complexities of each sub-domain. They are specifically tailored sections of the model where distinct aspects of the project’s functionality are isolated and managed. By defining clear boundaries around these contexts, the architecture ensures that the specific requirements and functionalities of each domain are addressed precisely, without interference from others, thereby maintaining coherence and integrity throughout the system.

- Ubiquitous language—This is the common domain language used for describing and understanding entities, elements, methodologies, and all relevant components within domain models and bounded contexts.

7. BFS Architecture Components

Organizations which design systems … are constrained to produce designs which are copies of the communication structures of these organizations.

7.1. Actors, Roles, Elements, and Fundamental Processes

- Member wallet: This wallet represents individuals or entities that have ownership or interests in this entity or are employed by this entity in any capacity. This wallet type is registered with its BFS entity and is awarded role-relevant functionality and full or enhanced access rights to the internal BFS data, e.g., directors, employees, and others. Figure 4 illustrates an example of two member wallets owned by a director and an employee of the dark-blue BFS entity. Additionally, a single member wallet of the purple entity is indicated in a darker purple in Figure 4 and is a part of that entity’s personnel.

- Counterparty wallet: This concept for a wallet is based on a “customer account” registered with an e-commerce website. For example, in Figure 4, for the purple entity to transact with the dark-blue entity, one or both of them have to register a counterparty-type wallet with each other. This counterparty wallet (light purple or light blue in Figure 4) is part of the corresponding BFS infrastructure, although it is owned by another BFS. Furthermore, the counterparty wallet supports a direct communication channel with its owning BFS. This data communication channel is called a “source of funds” (see the green arrows in Figure 4) and is utilised to move escrow funds to cover transactional liabilities.

- AccountID is a fundamental element in accounting [9]. In the BFS system, each AccountID is structured to allow comprehensive tracing of transactions affecting account balances within a given accounting period. Additionally, these identifiers are integral to the operation of accounting smart contracts, linking business transactions to appropriate accounts for consistent recording in journals and accurate reflection in financial statements.

- AccountCategory is an enum designed to enable the standardised and hierarchical consolidation of accounts within a specific AccountCategory. The ordering of AccountCategory can contain elements such as CASH(), OTHER_ASSETS(), and more. This alignment with traditional accounting practices within the BFS system serves as a standardised categorisation structure for the representation of financial information for the purposes of reporting, analysis and decision-making [9].

- AccountClass is an enum that enables the standardised consolidation of accounts within each AccountCategory into key categories and classes [9]. These classes are represented within the BFS system as the enum AccountClass and can contain elements such as assets, liabilities, equity, income, or expenses.

- General Journal (GJ): A data repository for a day-to-day chronological registration of accounting information on all ongoing allowable transactions [9]. It is the first point of entry for the data from completed business transactions, transformed through accounting transaction smart contracts.

- General Ledger (GL): A data repository within the BFS system for a set of homogeneously defined accounts, classified to contain cryptographically linked chronological details of the relevant side of the accounting entries and provide an ending (aggregated) account balance [9]. Traditionally, only monetary values are posted to the relevant accounts in the GL—GeneralLedgerAccount. However, in the BFS application, the existing traditional data structure is significantly enhanced by integrating innovative blockchain concepts:

- –

- Utilising Corda’s “Transaction Vault” [12] framework, the BFS system embeds a layer of blockchain traceability within each entry of the GeneralLedgerAccount. Each of these entries additionally contains a list of unique cryptographic hashes from relevant business transactions, together with cryptographic hashes of accounting smart contracts that govern the accounting rules for the value posted within GeneralLedgerAccount. This novel feature ensures that the provenance of each financial record is securely and persistently stored, enhancing the integrity and verifiability of the BFS system’s accounting records.

- –

- Variables from GeneralLedgerAccount and its entries are utilised by the validator of the BFS system to facilitate input values within the novel BFS UTXO model and in the BFS system’s funds verification consensus mechanism.

- Trial Balance (TB): A list of the debit and credit entries and footings for each ending account balance from the GL. This is the last repository prior to the publication of the final financial statement reports within the BFS system’s filing history.

- ReportEntry is an elemental data structure that represents the final balance entry extracted from the GL. In the BFS system, each instance of ReportEntry for the financial statements contains a map of all cryptographic identifiers of the completed business transactions that affected this reporting value. This feature ensures that the origin and authenticity of every financial record can be securely traced back to its source, significantly enhancing the transparency, security, and reliability of published reports. This innovation makes accounting falsification challenging, providing regulators with an additional data authenticity tool within the domain of financial accounting and potentially setting a new standard for auditability and verifiability in the digital age.

- Report is an integration of the traditionally defined financial report, such as a “balance sheet”, within the BFS system.

- enum ReportType is an initial categorisation mechanism for generating financial statement reports. This enumerator serves as a final consolidation tool for the hierarchical grouping of accounts. Each element of this enumerator also marks the type of financial report added to the final reporting package.

- FinancialSatements is the final packaging for all reports for this accounting period. This object is the one that will be subsequently packaged within the data structure of the block in the filing history blockchain, as illustrated in Step 7 of the accounting cycle in Figure 5.

- Utilising AccountID, the account is retrieved from the COA repository;

- Every account is assigned an AccountCategory field at the instantiation of this account. This AccountCategory field is mapped to a particular accounting category, such as “cash”;

- This AccountCategory field is then consolidated within AccountClass into a group, e.g., “assets”;

- This group is then further consolidated by ReportType into a grouping for the financial report, such as a balance sheet;

- This ReportType grouping will govern the mapping hierarchy within the final financial statements for each Report when generated;

- Concurrently, the final closing value, together with the relevant provenance data from the GL, is instantiated into a new ReportEnrty for each AccountID published in the financial statements;

- These ReportEnrty instances are collected within the relevant Reports, where they are hierarchically arranged based on their AccountIDs, providing the structural integrity of the traditional financial statement;

- Next, in the final Report, the AccountClass grouping is employed once more to logically consolidate the relevant ReportEnrty instances;

- In the final step in the generation of FinancialStatements, the mapping between each ReportType and the corresponding Report is completed;

- Lastly, agreed and hashed FinancialStatements are published as part of the data structure within the BFS system’s block.

- UTXO: In the BFS system, UTXO is designed as a process, not a data model. It is utilised by the BFS system’s consensus mechanism and is a novel method relevant to accounting. It utilises accounting transaction smart contract functionality to fetch the latest entry from the relevant accounts in the GL to provide pre-settlement verification of monetary claims made by the counterparties of the business transactions, ensuring that the offered funds are available.

- Consensus: The BFS system employs a “funds verification” consensus mechanism that introduces a novel approach to verifying transactional integrity within a blockchain-integrated accounting framework. This method ensures the economic validity of transactions by comparing the transaction value against the available funds in the latest accounting records of an economic entity, confirming that sufficient funds exist to cover the transaction. Unlike traditional consensus mechanisms that seek broad network agreement, the BFS system’s consensus model focuses on bilateral verification between transacting parties, utilising accounting data to confirm the financial soundness of transactions without revealing sensitive details. This targeted approach leverages concepts from Zero-Knowledge Proofs (ZKP) to maintain privacy, confirming the truthfulness of fund availability claims to the involved parties without disclosing any further financial information.

- Verifying the integrity of transactional data, including checks for the completeness, accuracy, and consistency of transactional data;

- Verifying the validity of signatures to confirm that transactions have been initiated by legitimate parties and have not been tampered with during transmission;

- The tokenisation process, which involves converting sensitive data into non-sensitive data tokens that can be shared within the blockchain ecosystem. Tokenisation helps to maintain data privacy while allowing transactions to be processed and verified on the network. The BFS project uses tokenisation to facilitate the transfer of ownership of financial assets relevant to the use case. Examples of financial assets tokenised in this project include shares, share certificates, commercial paper, and Treasury bills.

7.2. Key Smart Contracts

- Business transactions;

- Accounting transactions;

- The accounting cycle.

- Identifying and Analysing Business Transactions. The financial accounting cycle only recognises transactions that have or will have monetary implications, i.e., those resulting in an exchange of funds at some point [9]. These transactions are collected for processing within the same accounting period, and their impact on the company’s finances is assessed.

- Activating Accounting Transaction Smart Contracts. This step involves gathering economic descriptors about business transactions. It is facilitated through accounting smart contracts designed to enhance efficiency and reduce errors, making the whole process more streamlined and reliable. These accounting smart contracts define the accounting rules that govern the transformation of economic data produced by business transactions into accounting data. This process ensures adherence to a set of rules for recognising which financial accounts will be impacted by each business transaction.

- Recording Transactions in a General Journal. After identification, the transformed data from business transactions are recorded chronologically as journal entries in the company’s books, starting with the general journal (GJ).

- Posting Transactions to the General Ledger. Entries from the GJ are then posted to the general ledger (GL), a master record that provides a complete overview of all financial accounts and the evolution of their values.

- Generating Entries for the Running Trial Balance. At the end of the accounting period (continuously or on demand), the final balances from the general ledger are automatically calculated, ensuring accuracy and reducing the potential for errors or manipulations. Only these final balances are posted to the running trial balance, clarifying details from the GL account. This step is necessary to ensure that debits equal credits, essential for analysis, error identification, and corrections to ensure the accuracy of financial records before financial statement preparation. The resulting final trial balance is used to construct the financial statements—the end product of the accounting reporting.

- Generating Financial Statements. Adapting this step to the BFS system’s architecture involves automating the generation of the final balance sheet from the finalised running trial balance. The balance sheet is a critical financial statement summarising a company’s financial position at a specific point in time, detailing assets, liabilities, and shareholders’ equity. By automating the generation of the balance sheet, the BFS system ensures accuracy and reduces the potential for human error, facilitating a more efficient and reliable financial reporting process.

- Publishing the Financial Statements on Blockchain. The penultimate step in the BFS system’s accounting cycle is the publication of the balance sheet in the blockchain financial statement data structure, referred to as the filing history of the BFS system. This integration into the blockchain ledger secures the financial information against unauthorised alterations and enhances the auditability of financial statements. By leveraging blockchain’s inherent properties of immutability and transparency, this step ensures that financial data are readily verifiable and accessible, thereby providing confidence among stakeholders and regulatory bodies.

- Closing the Books. Finally, temporary accounts are closed out to permanent accounts, like retained earnings, and the company prepares for the next accounting cycle.

8. Implementation and Discussion

8.1. Discussion

- Immutable and Verifiable Data: The BFS system’s architecture leverages blockchain’s inherent tamper-proof nature, ensuring that all transactional data reflected in financial statements are immutable. This feature directly addresses the issues of data integrity and trust in financial reporting.

- Privacy and Accountability: The dual-blockchain framework, incorporating elements from both the Bitcoin and Corda platforms, enables a balance between the need for transactional privacy and the requirement for accountability. While the Bitcoin framework provides an immutable, cryptographically linked data structure for the BFS system’s filing history, the Corda platform’s Flow Framework and Transaction Vaults introduce a refined approach to data privacy and traceability.

- Immutable and Verifiable Data: The core of the BFS system’s design philosophy is the guarantee of data immutability and verifiability. By leveraging blockchain technology, the BFS system ensures that once a transaction is recorded within the block data structure or the filing history blockchain, it cannot be altered or deleted. This immutability, paired with the system’s inherent ability to verify the authenticity and accuracy of the recorded data, provides stakeholders with a reliable foundation for trust in the financial statements and reports generated by the BFS system.

- Verifiable Transactional Data: The BFS architecture’s core is its ability to produce verifiable transactional data, a fundamental need for all stakeholders within the economic ecosystem. By leveraging blockchain technological processes, the BFS system ensures that each transaction, from its initiation to its final inclusion in the subsequent financial statements, carries a unique cryptographic identifier, ensuring its origin and integrity.

- Real-time Validation of Transactions: In addition to maintaining verifiable records, the BFS system provides real-time validation of transaction capability, particularly critical in today’s fast-paced economic environment, where the timeliness of financial information can significantly impact decision-making and strategic planning. The BFS system employs a dynamic validation mechanism, where transactions are recorded instantaneously in accounting journals and can be validated in real time as they are processed through the accounting cycle. This ensures that stakeholders have access to the most current and accurate financial data, facilitating immediate insight into the entity’s financial activities and status.

- Real-Time Auditing and Verification with Privacy Preservation: A notable innovation within the BFS framework is the report entry structure within the financial statements. Similar to the ledger entries, it diverges from traditional accounting practices by offering a more detailed view of the accounts in financial reports. Leveraging the data tractability framework of Corda, the BFS system ensures that each transaction contributing to the final balances within the report entries of the balance sheet can be continuously tracked, providing a level of traceability and verification for every record. By enabling this direct link back to the source of each transactional record, the BFS system sets a precedent for future financial reporting standards, potentially revolutionising the landscape of financial auditing and validation in the blockchain era.

- Balancing Privacy with Accountability: In addition to the source hashes, the report entries include a mapping of the encrypted identities of the participants in these transactions within the report entry data. The inclusion of mapping the transactional hashes and encrypted identities reinforces the BFS system’s commitment to accountability while facilitating privacy preservation for individual participants through encryption.

8.1.1. Expected Data Volumes in the BFS System

- Each business transaction, including metadata, could range from a few kilobytes to several megabytes, depending on the complexity and the amount of data involved (e.g., digital signatures, transaction details, or timestamps). For a mid-sized enterprise, this could translate to hundreds of transactions per day, each adding a few kilobytes to the BFS system’s business transaction register.

- Accounting data, including journal entries and ledgers, are likely to be smaller but still significant, especially when aggregated over time.

- Financial statements generated instantaneously or at the end of accounting periods will be stored on the BFS system’s filing history blockchain. Each statement, including balance sheets, income statements, and so on, could range from a few kilobytes to several megabytes depending on the complexity and detail. For a large corporation with frequent transactions, the data volume could reach several terabytes over time.

- Overall, the total data volume will depend on the frequency and complexity of transactions and the number of entities involved. Assuming an average of 500 transactions per day, with each transaction consuming around 5 KB, the annual data volume would be approximately 912 MB. Financial statements and other reports would add to this volume, making it feasible for businesses to manage data efficiently on the blockchain.

8.1.2. Anticipated Data Throughput and Query Frequency

- Transaction processing throughput in comparative blockchain systems can range from a few transactions per second (TPS) to tens of TPS depending on the underlying blockchain technology and network configuration. Advanced platforms such as Corda, designed for high throughput and low latency, are known for high TPS.

- The frequency of queries for accounting data and reports may be frequent, especially during peak periods such as financial audits, regulatory reporting deadlines, and end-of-quarter financial reviews. The frequency of queries can range from a few per day for small businesses to several hundred per day for larger enterprises, and the BFS system’s capabilities should be optimised in future research efforts to accommodate these demands.

- The BFS architecture prioritises overall performance, ensuring that querying is not hindered. By leveraging off-ledger storage for accounting ledgers, the most frequently accessed data, the BFS system maintains high performance by supporting the frequent implementation of the “funds verification consensus” model.

8.2. Conceptual Efficiency of the BFS System

9. Future Work and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- BIS. Distributed Ledger Technology in Payment, Clearing and Settlement—An Analytical Framework; Technical Report No. 157; Bank for International Settlements: Basel, Switzerland, 2017. [Google Scholar]

- Dashkevich, N.; Counsell, S.; Destefanis, G. Blockchain Application for Central Banks: A Systematic Mapping Study. IEEE Access 2020, 8, 139918–139952. [Google Scholar] [CrossRef]

- Hileman, G.; Rauchs, M. Global Blockchain Benchmarking Study. 2017. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3040224 (accessed on 1 April 2024).

- Ducas, E.; Wilner, A. The security and financial implications of blockchain technologies: Regulating emerging technologies in Canada. Int. J. 2017, 72, 538–562. [Google Scholar] [CrossRef]

- Marengo, A.; Pagano, A. Investigating the factors influencing the adoption of blockchain technology across different countries and industries: A systematic literature review. Electronics 2023, 12, 3006. [Google Scholar] [CrossRef]

- UK Government. Financial Support for Businesses during Coronavirus (COVID-19). 2020. Available online: https://www.gov.uk/government/collections/financial-support-for-businesses-during-coronavirus-covid-19 (accessed on 1 April 2024).

- UK Government. New Hotline Launched to Report COVID Fraudsters. April 2021. Available online: https://www.gov.uk/government/news/new-hotline-launched-to-report-covid-fraudsters (accessed on 1 April 2024).

- UK Government. Measuring Error and Fraud in the COVID-19 Schemes. 2021. Available online: https://www.gov.uk/government/publications/measuring-error-and-fraud-in-the-covid-19-schemes (accessed on 1 April 2024).

- Stolowy, H.; Ding, Y. Financial Accounting and Reporting: A Global Perspective, 5th ed.; Cengage Learning EMEA: London, UK, 2019. [Google Scholar]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Available online: https://assets.pubpub.org/d8wct41f/31611263538139.pdf (accessed on 1 April 2024).

- R3. Corda Flow Framework. 2023. Available online: https://cbdctalks.com/technology/what-is-r3-corda/ (accessed on 1 April 2024).

- Brown, R.G. The Corda Platform: An Introduction; R3: New York, NY, USA, 2018; Available online: https://www.corda.net/content/corda-platform-whitepaper.pdf (accessed on 1 April 2024).

- Brown, R.G.; Carlyle, J.; Grigg, I.; Hearn, M. Corda: An Introduction. 2016. Available online: https://docs.r3.com/en/pdf/corda-introductory-whitepaper.pdf (accessed on 1 April 2024).

- Hearn, M.; Brown, R.G. Corda: A Distributed Ledger. In Corda Technical White Paper; Corda: Dallas, TX, USA, 2016; Volume 6. [Google Scholar]

- Rio, D.; César, A. Use of distributed ledger technology by central banks: A review. Enfoque UTE 2017, 8, 1–13. [Google Scholar]

- Rückeshäuser, N. Do We Really Want Blockchain-Based Accounting? Decentralized Consensus as Enabler of Management Override of Internal Controls. In Proceedings of the 13. Internationalen Tagung Wirtschaftsinformatik (WI 2017), St. Gallen, Switzerland, 12–15 February 2017; pp. 16–30. [Google Scholar]

- Hans, B. Blockchains, real-time accounting, and the future of credit risk modeling. Ledger 2019, 4. [Google Scholar] [CrossRef]

- Peters, G.W.; Panayi, E. Understanding Modern Banking Ledgers through Blockchain Technologies: Future of Transaction Processing and Smart Contracts on the Internet of Money; Springer International Publishing: New York, NY, USA, 2016; pp. 239–278. [Google Scholar]

- David, Y. Corporate Governance and Blockchains; NBER Working Paper No. 21802; National Bureau of Economic Research: Cambridge, MA, USA, 2015. [Google Scholar]

- Andersen, N. Blockchain Technology A Game-Changer in Accounting? Deloitte: Costa Mesa, CA, USA, 2016; pp. 1–5. [Google Scholar]

- Mei, F.; Ge, W.; Luo, S.; Shevlin, T. Why do CFOs become involved in material accounting manipulations? J. Account. Econ. 2011, 51, 21–36. [Google Scholar]

- Centobelli, P.; Roberto, C.; Pasquale, D.V.; Eugenio, O.; Giustina, S. Blockchain technology design in accounting: Game changer to tackle fraud or technological fairy tale? Account. Audit. Account. J. 2022, 35, 1566–1597. [Google Scholar] [CrossRef]

- Bonsón, E.; Bednárová, M. Blockchain and its implications for accounting and auditing. Meditari Account. Res. 2019, 27, 725–740. [Google Scholar] [CrossRef]

- McCallig, J.; Robb, A.; Rohde, F. Establishing the representational faithfulness of financial accounting information using multiparty security, network analysis and a blockchain. Int. J. Account. Inf. Syst. 2019, 33, 47–58. [Google Scholar] [CrossRef]

- Moll, J.; Yigitbasioglu, O. The role of internet-related technologies in shaping the work of accountants: New directions for accounting research. Br. Account. Rev. 2019, 51, 100833. [Google Scholar] [CrossRef]

- Garanina, T.; Ranta, M.; Dumay, J. Blockchain in accounting research: Current trends and emerging topics. Account. Audit. Account. J. 2022, 35, 1507–1533. [Google Scholar] [CrossRef]

- Hassani, H.; Huang, X.; Silva, E. Banking with blockchain-ed big data. J. Manag. Anal. 2018, 5, 256–275. [Google Scholar] [CrossRef]

- Guo, Y.; Liang, C. Blockchain Application and Outlook in the Banking Industry. Financ. Innov. 2016, 2, 24. [Google Scholar] [CrossRef]

- Tinn, K. Smart Contracts and External Financing. 2018. Available online: https://ssrn.com/abstract=3072854 (accessed on 1 April 2024).

- Walker, M. Bridging the Gap between Investment Banking Architecture and Distributed Ledgers. 2017. Available online: https://ssrn.com/abstract=2939281 (accessed on 1 April 2024).

- Schmitz, J.; Leoni, G. Accounting and auditing at the time of blockchain technology: A research agenda. Aust. Account. Rev. 2019, 29, 331–342. [Google Scholar] [CrossRef]

- Mohanty, D.; VorugantI, N.K.; Patel, C.; Manglani, T. Implementing Blockchain Technology for Fraud Detection in Financial Management. BioGecko 2023, 12, 2. [Google Scholar]

- Oladejo, M.T.; Jack, L. Fraud prevention and detection in a blockchain technology environment: Challenges posed to forensic accountants. Int. J. Econ. Account. 2020, 9, 315–335. [Google Scholar] [CrossRef]

- Mingming, T. Research on the application of blockchain technology in accounting information system. In Proceedings of the 2020 International Conference on Virtual Reality and Intelligent Systems, ICVRIS, Zhangjiajie, China, 18–19 July 2020; pp. 330–334. [Google Scholar]

- Secinaro, S.; Dal Mas, F.; Brescia, V.; Calandra, D. Blockchain in the accounting, auditing and accountability fields: A bibliometric and coding analysis. Account. Audit. Account. J. 2021, 35, 168–203. [Google Scholar] [CrossRef]

- Wieringa, R.J. Design Science Methodology for Information Systems and Software Engineering; Springer: Berlin/Heidelberg, Germany, 2014. [Google Scholar]

- Peffers, K.; Tuunanen, T.; Rothenberger, M.A.; Chatterjee, S. A Design Science Research Methodology for Information Systems Research. J. Manag. Inf. Syst. 2007, 24, 45–77. [Google Scholar] [CrossRef]

- Geerts, G.L. A Design Science Research Methodology and Its Application to Accounting Information Systems Research. Int. J. Account. Inf. Syst. 2011, 12, 142–151. [Google Scholar] [CrossRef]

- Richards, M.; Ford, N. Fundamentals of Software Architecture: An Engineering Approach; O’Reilly Media: Sebastopol, CA, USA, 2020. [Google Scholar]

- Evans, E. Domain-Driven Design: Tackling Complexity in the Heart of Software; Addison-Wesley Professional: Boston, MA, USA, 2004. [Google Scholar]

- Bird, C. Conway’s Law. In Making Software: What Really Works, and Why We Believe It; O’Reilly Media, Inc.: Sebastopol, CA, USA, 2010; p. 187. [Google Scholar]

- Companies House. Companies House. 2024. Available online: https://www.gov.uk/government/organisations/companies-house (accessed on 1 April 2024).

- NetSuite. Accounting Cycle. 2022. Available online: https://www.netsuite.com/portal/resource/articles/accounting/accounting-cycle.shtml (accessed on 1 April 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dashkevich, N.; Counsell, S.; Destefanis, G. Blockchain Financial Statements: Innovating Financial Reporting, Accounting, and Liquidity Management. Future Internet 2024, 16, 244. https://doi.org/10.3390/fi16070244

Dashkevich N, Counsell S, Destefanis G. Blockchain Financial Statements: Innovating Financial Reporting, Accounting, and Liquidity Management. Future Internet. 2024; 16(7):244. https://doi.org/10.3390/fi16070244

Chicago/Turabian StyleDashkevich, Natalia, Steve Counsell, and Giuseppe Destefanis. 2024. "Blockchain Financial Statements: Innovating Financial Reporting, Accounting, and Liquidity Management" Future Internet 16, no. 7: 244. https://doi.org/10.3390/fi16070244

APA StyleDashkevich, N., Counsell, S., & Destefanis, G. (2024). Blockchain Financial Statements: Innovating Financial Reporting, Accounting, and Liquidity Management. Future Internet, 16(7), 244. https://doi.org/10.3390/fi16070244