Effects on Carbon Sequestration of Biomass and Investment in State-Owned Forest Farms: A Case Study of Shaanxi Province, China

Abstract

1. Introduction

2. Theoretical Analysis and Research Hypothesis

3. Materials and Methods

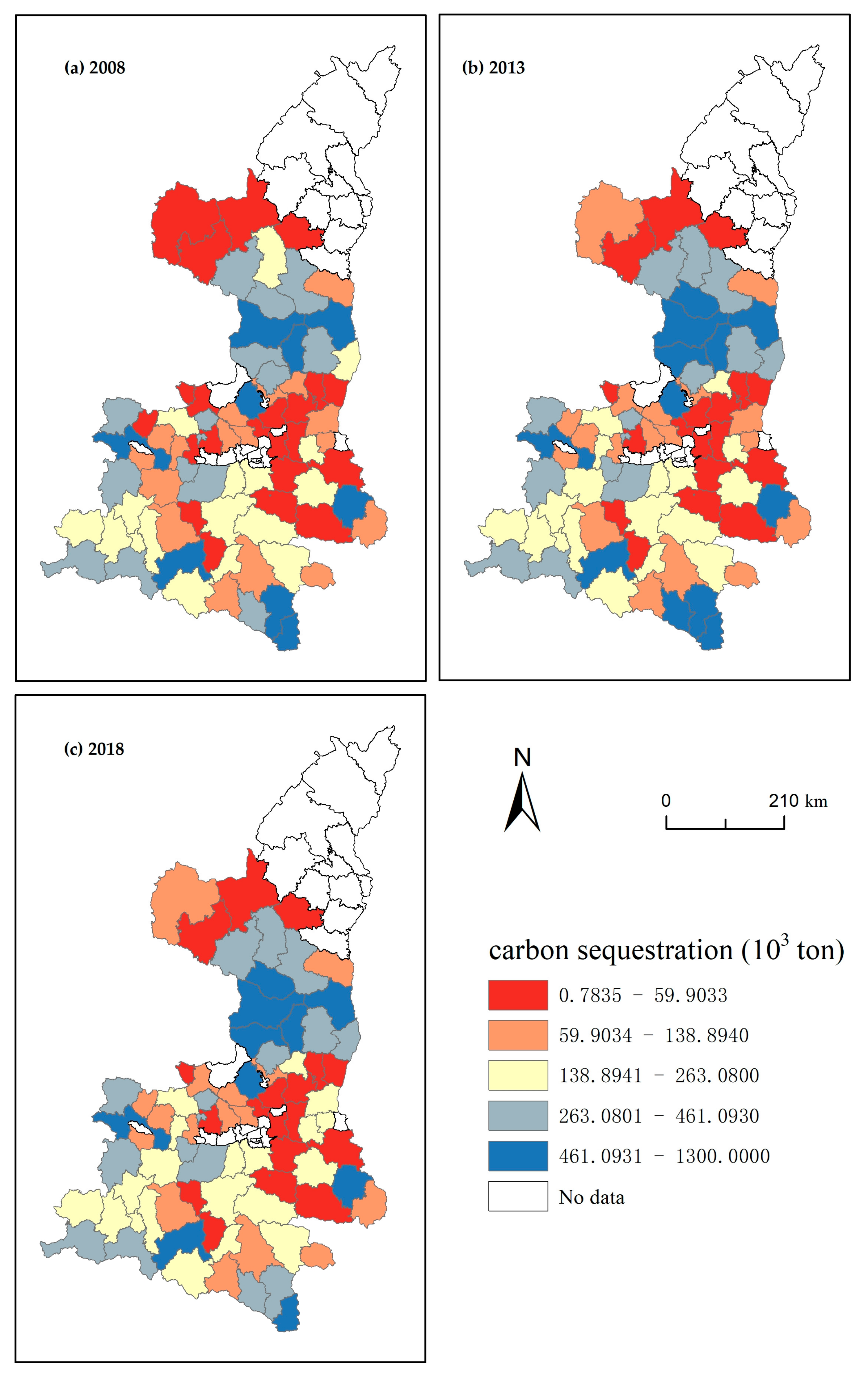

3.1. Study Area

3.2. Variable Selection

- (1)

- Dependent variable. To examine the carbon sequestration effect of SFF investment, we select forest carbon sequestration as the investment output. Forest carbon sequestration is estimated based on China’s forest inventory data [33], which are relatively accurate. However, these data are usually collected only once every five years and are reported at the provincial level, making it difficult to quantify the carbon sequestration of individual SFFs. The InVEST model, which calculates carbon sequestration based on land use changes and fixed parameters [34], considers changes in forest area but does not capture variations in forest quality. The net primary productivity (NPP) of vegetation in remote sensing data accurately characterizes the amount of organic matter accumulated by green plants after photosynthesis minus autotrophic respiration [35]. It can reflect forest vegetation changes in a more timely and continuous manner. Furthermore, forest vegetation tends to sequester carbon more rapidly and in greater quantities than soil, particularly in the early stages of forestation [36], and the carbon storage changes in soil after forestation are more complex [37]. Thus, we use forest vegetation carbon sequestration, estimated via NPP, as the evaluation index of the ecological effect of SFF investment.

- (2)

- Independent variables. SFF investment refers to the total expenditures on forestry activities across all stages of forest growth. These activities specifically include afforestation and reforestation, thinning, fire management, protection against insects, and other related efforts. Furthermore, these expenditures have been adjusted for inflation, using the consumer price index (CPI), to reflect real expenditures. This adjustment ensures a more accurate representation of the investment’s value over time.

- (3)

- Control variables. First, socio-economic factors. As basic factors in production function, labor and land are key inputs that influence the final output, which in this study is the amount of carbon sequestration. To measure the impact of labor and land inputs, we include the number of employees and the operating area of SFFs. Additionally, employee motivation and pressure affect work productivity [38]. Thus, we use employee salary as a proxy variable for motivation and management scale per employee as a proxy for pressure to evaluate their effect on carbon sequestration. Second, natural factors. Carbon accumulation in vegetation occurs through photosynthesis, a process that is temperature-sensitive and typically more efficient at higher temperatures [39]. Thus, temperature may affect carbon sequestration. Wind speed can influence a tree’s physiological processes, growth, and survival [40], potentially affecting carbon sequestration as well. Moderate precipitation is crucial for forest survival and growth [41]. In addition, relatively static factors such as soil quality, slope inclination, and slope orientation are important drivers of forest growth but are not shown separately due to the use of panel fixed effect models. Finally, forest quantity and quality are also influenced by previous forest conditions [42]. To capture this dynamic, we introduce the forest stock lagged by one period as a proxy for the initial forest endowment in the model.

- (4)

- Threshold variables. The threshold variables in this study include investment scale and investment structure. We choose SFF investment in forestry activities as a proxy variable for the investment scale. Since forestation is a key forestry activity and constitutes a significant portion of SFF investment, we use forestation investment as a proxy for investment structure. As with other expenditures, nominal forestation investment is adjusted to real expenditures using the consumer price index (CPI) to account for inflation.

- (5)

- Channel variables. In this study, we assume that the impact of SSF investment on carbon sequestration operates through two channels: increasing forest area and improving forest quality. We use forestation area to represent the increase in forest area, including afforestation area and reforestation area. Forest quality is typically measured by the stock volume per unit area. However, the statistical intervals for forest stock volume data in SFFs are at least five years, making it difficult to reflect changes in forest quality in a timely and continuous manner. Considering that forest management is a key technical means to enhance forest quality, we choose the newly added forest management area as a proxy variable for forest quality improvement.

3.3. Data Sources and Processing

- (1)

- Study period and sample. Our sample consists of 211 state-owned forest farms (SFFs) in Shaanxi Province, with data spanning from 2008 to 2018. The comprehensive reform of SFFs in China commenced in 2015, during which SFFs in Shaanxi underwent mergers and reorganizations, leading to changes in their fundamental characteristics. To ensure consistency and completeness in our dataset, we base our statistical analysis on the information available for these SFFs as of 2008.

- (2)

- Estimation of vegetation carbon sequestration of forests managed by SFFs. Green vegetation absorbs CO2 from the air, produces organic matter, and releases oxygen through photosynthesis. The chemical equation is as follows: , which means that 1.62 g CO2 could be fixed for 1g dry matter formed by the vegetation. The carbon content of the dry matter is about 45% of the NPP. Therefore, the formula for the amount of carbon sequestered is in g/m2 [43,44,45]. Lastly, using the 211 SFFs’ boundary map, we extract the vegetation carbon sequestration of forests managed by each SFF from 2008–2018 by ArcGIS10.7. The NPP data are derived from the Moderate Resolution Imaging Spectroradiometer (MODIS) NPP product (MOD17A3HGF) (https://lpdaac.usgs.gov/products/mod17a3hgfv006/ (accessed on 30 July 2023)) released by the National Aeronautics and Space Administration (NASA), with a spatial resolution of 500 m.

- (3)

- Other variables. The data on SFF investment, employee number, operating area, employee salary, management scale per employee, forest stock, forestation investment, forestation area, and forest management area are obtained from the National Forestry and Grassland Administration (NFGA). Further, we supplement and adjust the data based on our primary survey. The consumer price index data are from the Shaanxi Statistical Yearbook. The average annual precipitation and temperature data are from the resource and environment data cloud platform of the Chinese Academy of Sciences (https://www.resdc.cn/ (accessed on 29 December 2024)). The station data on wind speed are retrieved from the National Meteorological Science Data Center of China (https://data.cma.cn/ (accessed on 29 December 2024)). Variable design and descriptive statistics are reported in Table 1.

3.4. Method

3.4.1. Panel Fixed Effects Model

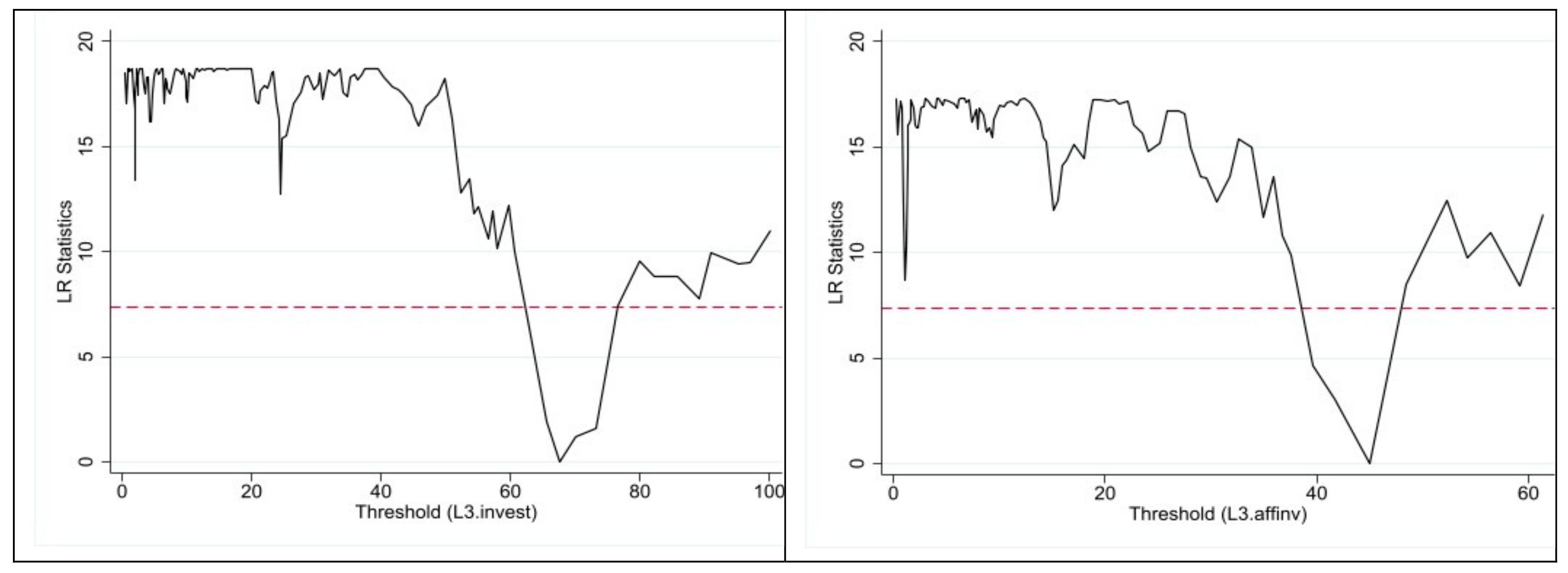

3.4.2. Panel Threshold Model

3.4.3. Mediating Effect Model

4. Results

4.1. Changes in Carbon Sequestration and Investment by SFFs

4.2. Assessment of the Carbon Sequestration Effect of SFF Investment

4.2.1. Analysis of Immediate and Lagged Carbon Sequestration Effect of Investment

4.2.2. Spatial Heterogeneity Analysis of Carbon Sequestration Effect of Investment

4.2.3. Analysis of the Threshold Effects of SFF Investment on Carbon Sequestration

4.2.4. Analysis of the Impact Channels of SFF Investment on Carbon Sequestration

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Filonchyk, M.; Peterson, M.P.; Zhang, L.; Hurynovich, V.; He, Y. Greenhouse Gases Emissions and Global Climate Change: Examining the Influence of CO2, CH4, and N2O. Sci. Total Environ. 2024, 935, 173359. [Google Scholar] [CrossRef] [PubMed]

- Campbell-Lendrum, D.; Neville, T.; Schweizer, C.; Neira, M. Climate Change and Health: Three Grand Challenges. Nat. Med. 2023, 29, 1631–1638. [Google Scholar] [CrossRef] [PubMed]

- Girardin, C.A.J.; Jenkins, S.; Seddon, N.; Allen, M.; Lewis, S.L.; Wheeler, C.E.; Griscom, B.W.; Malhi, Y. Nature-Based Solutions Can Help Cool the Planet—If We Act Now. Nature 2021, 593, 191–194. [Google Scholar] [CrossRef]

- Pan, Y.; Birdsey, R.A.; Phillips, O.L.; Jackson, R.B. The Structure, Distribution, and Biomass of the World’s Forests. Annu. Rev. Ecol. Evol. Syst. 2013, 44, 593–622. [Google Scholar] [CrossRef]

- Pan, Y.; Birdsey, R.A.; Phillips, O.L.; Houghton, R.A.; Fang, J.; Kauppi, P.E.; Keith, H.; Kurz, W.A.; Ito, A.; Lewis, S.L.; et al. The Enduring World Forest Carbon Sink. Nature 2024, 631, 563–569. [Google Scholar] [CrossRef]

- Hurteau, M.D. Chapter 27—The Role of Forests in the Carbon Cycle and in Climate Change. In Climate Change, 3rd ed.; Letcher, T.M., Ed.; Elsevier: Amsterdam, The Netherlands, 2021; pp. 561–579. ISBN 978-0-12-821575-3. [Google Scholar]

- Kallio, A.M.I.; Solberg, B.; Käär, L.; Päivinen, R. Economic Impacts of Setting Reference Levels for the Forest Carbon Sinks in the EU on the European Forest Sector. For. Policy Econ. 2018, 92, 193–201. [Google Scholar] [CrossRef]

- Assmuth, A.; Autto, H.; Halonen, K.-M.; Haltia, E.; Huttunen, S.; Lintunen, J.; Lonkila, A.; Nieminen, T.M.; Ojanen, P.; Peltoniemi, M.; et al. Forest Carbon Payments: A Multidisciplinary Review of Policy Options for Promoting Carbon Storage in EU Member States. Land Use Pol. 2024, 147, 107341. [Google Scholar] [CrossRef]

- Weiss, G.; Lawrence, A.; Lidestav, G.; Feliciano, D.; Hujala, T.; Sarvašová, Z.; Dobšinská, Z.; Živojinović, I. Research Trends: Forest Ownership in Multiple Perspectives. For. Policy Econ. 2019, 99, 1–8. [Google Scholar] [CrossRef]

- Whiteman, A.; Wickramasinghe, A.; Piña, L. Global Trends in Forest Ownership, Public Income and Expenditure on Forestry and Forestry Employment. For. Ecol. Manag. 2015, 352, 99–108. [Google Scholar] [CrossRef]

- FAO. Global Forest Resources Assessment 2020: Main Report; FAO: Rome, Italy, 2020; ISBN 978-92-5-132974-0. [Google Scholar]

- National Forestry and Grassland Administration. 2021 China Forestry and Grassland Ecology Integrated Monitoring and Assessment Report; China Forestry Publishing House: Beijing, China, 2023; ISBN 978-7-5219-2082-6. (In Chinese) [Google Scholar]

- Zhou, Y.; Xue, C.; Liu, S.; Zhang, J. Carbon Sequestration Costs and Spatial Spillover Effects in China’s Collective Forests. Carbon Balance Manag. 2024, 19, 14. [Google Scholar] [CrossRef]

- Cheng, K.; Yang, H.; Tao, S.; Su, Y.; Guan, H.; Ren, Y.; Hu, T.; Li, W.; Xu, G.; Chen, M.; et al. Carbon Storage through China’s Planted Forest Expansion. Nat. Commun. 2024, 15, 4106. [Google Scholar] [CrossRef] [PubMed]

- Jin, L.; Yi, Y.; Xu, J. Forest Carbon Sequestration and China’s Potential: The Rise of a Nature-Based Solution for Climate Change Mitigation. China Econ. J. 2020, 13, 1–23. [Google Scholar] [CrossRef]

- del Campo, A.D.; Otsuki, K.; Serengil, Y.; Blanco, J.A.; Yousefpour, R.; Wei, X. A Global Synthesis on the Effects of Thinning on Hydrological Processes: Implications for Forest Management. For. Ecol. Manag. 2022, 519, 120324. [Google Scholar] [CrossRef]

- Qian, C.; Shao, L.; Hou, X.; Zhang, B.; Chen, W.; Xia, X. Detection and Attribution of Vegetation Greening Trend across Distinct Local Landscapes under China’s Grain to Green Program: A Case Study in Shaanxi Province. CATENA 2019, 183, 104182. [Google Scholar] [CrossRef]

- Zhang, H.; Liu, S.; Yu, J.; Li, J.; Shangguan, Z.; Deng, L. Thinning Increases Forest Ecosystem Carbon Stocks. For. Ecol. Manag. 2024, 555, 121702. [Google Scholar] [CrossRef]

- Powers, M.; Kolka, R.; Palik, B.; McDonald, R.; Jurgensen, M. Long-Term Management Impacts on Carbon Storage in Lake States Forests. For. Ecol. Manag. 2011, 262, 424–431. [Google Scholar] [CrossRef]

- Ding, Z.; He, Y.; Liu, S.; Zhang, X.; Hu, W.; Yao, S. Assessing the Ecological Effects of Fiscal Investments in Sloping Land Conversion Program for Revegetation: A Case Study of Shaanxi Province, China. Forests 2024, 15, 2. [Google Scholar] [CrossRef]

- Deng, L.; Zhao, Y. Investment Lag, Financially Constraints and Company Value—Evidence from China. Emerg. Mark. Financ. Trade 2022, 58, 3034–3047. [Google Scholar] [CrossRef]

- Ding, Z.; Yao, S. Ecological Effectiveness of Payment for Ecosystem Services to Identify Incentive Priority Areas: Sloping Land Conversion Program in China. Land Use Policy 2021, 104, 105350. [Google Scholar] [CrossRef]

- Gao, G.; Ding, G.; Wang, H.; Zang, Y.; Liang, W. China Needs Forest Management Rather Than Reforestation for Carbon Sequestration. Environ. Sci. Technol. 2011, 45, 10292–10293. [Google Scholar] [CrossRef]

- Chuai, X.; Xia, M.; Xiang, A.; Miao, L.; Zhao, R.; Zuo, T. Vegetation Coverage and Carbon Sequestration Changes in China’s Forest Projects Area. Glob. Ecol. Conserv. 2022, 38, e02257. [Google Scholar] [CrossRef]

- Hong, S.; Ding, J.; Kan, F.; Xu, H.; Chen, S.; Yao, Y.; Piao, S. Asymmetry of Carbon Sequestrations by Plant and Soil after Forestation Regulated by Soil Nitrogen. Nat. Commun. 2023, 14, 3196. [Google Scholar] [CrossRef] [PubMed]

- Murdoch, W.; Polasky, S.; Wilson, K.A.; Possingham, H.P.; Kareiva, P.; Shaw, R. Maximizing Return on Investment in Conservation. Biol. Conserv. 2007, 139, 375–388. [Google Scholar] [CrossRef]

- Gao, L.; Li, H. Improving Carbon Sequestration Capacity of Forest Vegetation in China: Afforestation or Forest Management? Forests 2023, 14, 1077. [Google Scholar] [CrossRef]

- Yao, Y.; Piao, S.; Wang, T. Future Biomass Carbon Sequestration Capacity of Chinese Forests. Sci. Bull. 2018, 63, 1108–1117. [Google Scholar] [CrossRef]

- Clay, L.; Motallebi, M.; Song, B. An Analysis of Common Forest Management Practices for Carbon Sequestration in South Carolina. Forests 2019, 10, 949. [Google Scholar] [CrossRef]

- Hou, J.; Yin, R.; Wu, W. Intensifying Forest Management in China: What Does It Mean, Why, and How? For. Policy Econ. 2019, 98, 82–89. [Google Scholar] [CrossRef]

- Yang, Y.; Yuan, X.; An, J.; Su, Q.; Chen, B. Drivers of Ecosystem Services and Their Trade-Offs and Synergies in Different Land Use Policy Zones of Shaanxi Province, China. J. Clean. Prod. 2024, 452, 142077. [Google Scholar] [CrossRef]

- National Forestry and Grassland Administration. China Forestry and Grassland Statistical Yearbook; China Forestry Publishing House: Beijing, China, 2023; ISBN 978-7-5219-2444-2. (In Chinese) [Google Scholar]

- Cheng, F.; Tian, J.; He, J.; He, H.; Bao, G.; Yang, Y.; Liu, G.; Zhang, Z. China’s Future Forest Carbon Sequestration Potential under Different Management Scenarios. Trees For. People 2024, 17, 100621. [Google Scholar] [CrossRef]

- Houssoukpèvi, I.A.; le Maire, G.; Aholoukpè, H.N.S.; Fassinou, D.J.M.; Amadji, G.L.; Chapuis-Lardy, L.; Chevallier, T. Effect of Land Use Change on Carbon Stocks in an Agricultural Region of Southern Benin. Land Degrad. Dev. 2023, 34, 1447–1463. [Google Scholar] [CrossRef]

- Gu, X.; Zhao, H.; Peng, C.; Guo, X.; Lin, Q.; Yang, Q.; Chen, L. The Mangrove Blue Carbon Sink Potential: Evidence from Three Net Primary Production Assessment Methods. For. Ecol. Manag. 2022, 504, 119848. [Google Scholar] [CrossRef]

- Cai, W.; He, N.; Li, M.; Xu, L.; Wang, L.; Zhu, J.; Zeng, N.; Yan, P.; Si, G.; Zhang, X.; et al. Carbon Sequestration of Chinese Forests from 2010 to 2060 Spatiotemporal Dynamics and Its Regulatory Strategies. Sci. Bull. 2022, 67, 836–843. [Google Scholar] [CrossRef] [PubMed]

- Hong, S.; Yin, G.; Piao, S.; Dybzinski, R.; Cong, N.; Li, X.; Wang, K.; Penuelas, J.; Zeng, H.; Chen, A. Divergent Responses of Soil Organic Carbon to Afforestation. Nat. Sustain. 2020, 3, 694–700. [Google Scholar] [CrossRef]

- Lee, M.T.; Raschke, R.L. Understanding Employee Motivation and Organizational Performance: Arguments for a Set-Theoretic Approach. J. Innov. Knowl. 2016, 1, 162–169. [Google Scholar] [CrossRef]

- Michaletz, S.T.; Cheng, D.; Kerkhoff, A.J.; Enquist, B.J. Convergence of Terrestrial Plant Production across Global Climate Gradients. Nature 2014, 512, 39–43. [Google Scholar] [CrossRef]

- Schindler, D.; Bauhus, J.; Mayer, H. Wind Effects on Trees. Eur. J. For. Res. 2012, 131, 159–163. [Google Scholar] [CrossRef]

- Campos, G.E.P.; Moran, M.S.; Huete, A.; Zhang, Y.; Bresloff, C.; Huxman, T.E.; Eamus, D.; Bosch, D.D.; Buda, A.R.; Gunter, S.A.; et al. Ecosystem Resilience despite Large-Scale Altered Hydroclimatic Conditions. Nature 2013, 494, 349–352. [Google Scholar] [CrossRef]

- Liu, S.; Xia, J. Forest Harvesting Restriction and Forest Restoration in China. For. Policy Econ. 2021, 129, 102516. [Google Scholar] [CrossRef]

- Chen, J.; Fan, W.; Li, D.; Liu, X.; Song, M. Driving Factors of Global Carbon Footprint Pressure: Based on Vegetation Carbon Sequestration. Appl. Energy 2020, 267, 114914. [Google Scholar] [CrossRef]

- Yu, C.; Xu, L.; He, N.; Li, M.; Kang, X. Optimization of Vegetation Carbon Content Parameters and Their Application in Carbon Storage Estimation in China. Sci. Total Environ. 2024, 955, 176912. [Google Scholar] [CrossRef]

- Seiler, W.; Crutzen, P.J. Estimates of Gross and Net Fluxes of Carbon between the Biosphere and the Atmosphere from Biomass Burning. Clim. Change 1980, 2, 207–247. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold Effects in Non-Dynamic Panels: Estimation, Testing, and Inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

| Name | Variable Description | Unit | Mean | Std |

|---|---|---|---|---|

| vegetation carbon sequestration of forests managed by state-owned forest farms (SFFs) | 103 ton | 275.2000 | 259.6000 | |

| SFF investment in forestry activities | 104 CNY | 65.3100 | 122.1000 | |

| the number of employees | person | 64.9300 | 55.8400 | |

| the operating area of SFF | 104 hectare | 4.1740 | 128.3000 | |

| employee salary | 104 CNY | 4.5220 | 2.4540 | |

| management scale per employee | 104 hectare/person | 0.0294 | 0.0263 | |

| average annual temperature | °C | 10.9900 | 1.6640 | |

| wind speed | m/s | 2.1860 | 0.6040 | |

| average annual precipitation | mm | 567.8000 | 144.9000 | |

| forest stock | 104 m3 | 70.3700 | 80.4700 | |

| SFF forestation investment | 104 CNY | 40.2841 | 74.8255 | |

| newly added forestation area each year | hectare | 27.9643 | 49.5186 | |

| newly added forest management area each year | hectare | 233.2923 | 402.9774 |

| Dependent Variable | Model (1) | Model (2) | Model (3) | |||

|---|---|---|---|---|---|---|

| Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | |

| 0.0134 | (0.0097) | |||||

| 0.0204 ** | (0.0080) | 0.0205 ** | (0.0080) | |||

| 0.2938 *** | (0.1097) | 0.1803 ** | (0.0887) | 0.1776 ** | (0.0875) | |

| 0.0014 *** | (0.0001) | 0.0003 ** | (0.0002) | 0.0004 *** | (0.0002) | |

| 286.5185 | (243.4076) | 211.0327 | (204.9238) | 209.2659 | (203.6356) | |

| 3.8632 *** | (0.4153) | 0.5741 * | (0.3088) | 0.5588 * | (0.3086) | |

| 0.0776 *** | (0.0288) | 0.0401 * | (0.0236) | 0.0386 | (0.0240) | |

| 4.5247 *** | (1.2382) | 8.4828 *** | (1.3288) | 8.5642 *** | (1.3389) | |

| 105.3658 *** | (13.4941) | 169.1637 *** | (16.9281) | 164.4290 *** | (16.2244) | |

| −0.0463 *** | (0.0051) | −0.0494 *** | (0.0050) | −0.1090 *** | (0.0255) | |

| 0.47 × 10−4 ** | (0.19 × 10−4) | |||||

| −28.4931 | (33.1313) | −176.2015 *** | (38.6152) | −148.7546 *** | (35.6728) | |

| Dependent Variable | Model (1) | Model (2) | Model (3) | |||

|---|---|---|---|---|---|---|

| Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | |

| 0.0007 ** | (0.0003) | |||||

| 0.0237 ** | (0.0094) | |||||

| 0.0194 * | (0.0109) | |||||

| 0.0159 | (0.0409) | |||||

| 0.0033 *** | (0.0012) | |||||

| 0.0100 | (0.0229) | |||||

| 0.0275 *** | (0.0045) | |||||

| 0.1760 ** | (0.0890) | 0.1756 * | (0.0955) | |||

| 0.0003 * | (0.0002) | 0.0004 ** | (0.0002) | |||

| 218.9743 | (205.5504) | 208.0520 | (207.7339) | |||

| 0.6260 | (0.4035) | |||||

| 0.6993 ** | (0.2937) | |||||

| −0.0000 | (0.0001) | 0.0413 * | (0.0240) | 0.0427 * | (0.0257) | |

| 0.0261 *** | (0.0037) | 8.6899 *** | (1.3357) | 8.3780 *** | (1.0936) | |

| 0.4397 *** | (0.0239) | 169.6308 *** | (16.9656) | 164.1186 *** | (16.5692) | |

| −0.0002 *** | (0.0000) | −0.0492 *** | (0.0050) | −0.0480 *** | (0.0045) | |

| 3.8445 *** | (0.1159) | −179.4045 *** | (38.7256) | −173.4944 *** | (37.1942) | |

| Dependent Variable | Model (1) Total | Model (2) LP | Model (3) GP | Model (4) QM | Model (5) QM |

|---|---|---|---|---|---|

| Coef. (Std. Err.) | Coef. (Std. Err.) | Coef. (Std. Err.) | Coef. (Std. Err.) | Coef. (Std. Err.) | |

| 0.0633 ** | |||||

| (0.0244) | |||||

| 0.0154 | |||||

| (0.0094) | |||||

| −0.0063 | |||||

| (0.0091) | |||||

| 0.0551 ** | |||||

| (0.0243) | |||||

| 0.0182 * | |||||

| (0.0093) | |||||

| 0.1887 *** | |||||

| (0.0695) | |||||

| 0.0403 * | |||||

| (0.0236) | |||||

| 0.1663 * | 0.2975 | −0.0025 | 0.1791 | 0.0887 | |

| (0.0883) | (0.1928) | (0.1471) | (0.1355) | (0.0737) | |

| 0.0004 *** | 0.0018 *** | −4.1316 | 17.5880 *** | 5.0524 * | |

| (0.0002) | (0.0003) | (5.7741) | (4.3109) | (2.8848) | |

| 197.4308 | 519.4576 * | 0.9823 | −140.7945 | −135.0922 ** | |

| (202.9090) | (276.6049) | (328.7091) | (86.4219) | (51.6657) | |

| 0.6300 ** | 8.6092 *** | −0.6903 | −2.9989 *** | 5.4195 * | |

| (0.3070) | (0.8796) | (0.4815) | (0.7954) | (2.7664) | |

| −0.6878 ** | |||||

| (0.2874) | |||||

| 0.0374 | 0.8567 | 0.0476 | −0.2814 * | −0.0492 | |

| (0.0239) | (0.6139) | (0.0334) | (0.1664) | (0.0468) | |

| 8.3233 *** | −1.8977 | 9.4331 *** | −2.4761 | 0.7075 | |

| (1.3080) | (2.9184) | (2.7819) | (1.7293) | (1.5747) | |

| 169.0218 *** | 115.0373 *** | 188.3097 *** | −42.9636 | 10.0726 | |

| (16.7848) | (16.5836) | (35.8951) | (26.5840) | (22.5065) | |

| −0.0485 *** | −0.1213 *** | −0.0346 *** | 0.0054 | 0.0271 *** | |

| (0.0049) | (0.0110) | (0.0090) | (0.0067) | (0.0081) | |

| −173.6377 *** | −40.1273 | −206.6136 ** | 316.8026 *** | 155.6403 *** | |

| (38.1359) | (58.9262) | (81.1402) | (48.0002) | (31.3895) | |

| Sample size | 212 | 75 | 74 | 63 | 63 |

| Threshold Variables | Threshold Type | F-Value | p-Value | Bootstrap Times | Threshold Value | 95% of Confidence Interval |

|---|---|---|---|---|---|---|

| Single threshold *** | 18.84 | 0.0067 | 300 | 67.6162 | [63.0935, 70.0000] | |

| Double threshold | 5.76 | 0.5500 | 300 | |||

| Ito1 (g1) | 67.6162 | [64.1132, 70.0000] | ||||

| Ito2 (g2) | 4.2402 | [4.1115, 4.5074] | ||||

| Single threshold ** | 17.40 | 0.0200 | 300 | 44.9730 | [39.6172, 48.4746] | |

| Double threshold | 6.17 | 0.4533 | 300 | |||

| Ito1 (g1) | 44.9730 | [39.6172, 48.4746] | ||||

| Ito2 (g2) | 1.1368 | [1.0089, 1.2658] |

| Dependent Variable | Model (1) | Model (2) | ||

|---|---|---|---|---|

| Coef. | Std. Err. | Coef. | Std. Err. | |

| 0.2005 *** | (0.0498) | |||

| 0.0287 *** | (0.0085) | |||

| 0.1715 *** | (0.0429) | |||

| 0.0265 *** | (0.0084) | |||

| 0.1947 ** | (0.0830) | 0.1956 ** | (0.0838) | |

| 0.0007 *** | (0.0002) | 0.0006 *** | (0.0002) | |

| 219.7877 | (181.7626) | 216.7021 | (184.7303) | |

| 0.4775 | (0.3038) | 0.4821 | (0.3035) | |

| 0.0388 | (0.0245) | 0.0360 | (0.0243) | |

| 8.6122 *** | (1.3246) | 8.5985 *** | (1.3380) | |

| 171.5553 *** | (17.0094) | 171.7060 *** | (17.0138) | |

| −0.0487 *** | (0.0051) | −0.0490 *** | (0.0050) | |

| −186.8902 *** | (38.6199) | −186.2519 *** | (38.7229) | |

| Dependent Variable | Model (1) forarea | Model (2) cs | Model (3) manarea | Model (4) cs | ||||

|---|---|---|---|---|---|---|---|---|

| Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | |

| 0.3979 *** | (0.0078) | 3.2913 *** | (0.1739) | |||||

| 0.0214 * | (0.0126) | 0.0215 * | (0.0128) | |||||

| 0.0473 * | (0.0284) | |||||||

| 0.0068 ** | (0.0031) | |||||||

| 0.0320 | (0.0281) | 0.4319 ** | (0.1753) | 0.6539 | (0.4294) | 0.4350 ** | (0.1754) | |

| −0.0002 *** | (0.0001) | 0.0005 ** | (0.0002) | 0.0103 *** | (0.0009) | 0.0004 | (0.0002) | |

| −35.0928 | (24.4492) | 480.1693 ** | (206.4552) | −397.2365 | (364.2288) | 492.0913 ** | (203.6209) | |

| −0.4575 *** | (0.1251) | 1.1347 ** | (0.4427) | −8.6398 *** | (1.6434) | 1.1272 ** | (0.4404) | |

| −0.0081 | (0.0061) | 0.0516 ** | (0.0234) | 0.0263 | (0.0789) | 0.0517 ** | (0.0232) | |

| −0.4876 | (0.6892) | 9.7702 *** | (1.9688) | −3.4194 | (5.9429) | 9.7898 *** | (1.9589) | |

| −2.9316 | (2.1796) | 163.9812 *** | (20.0134) | −34.0568 | (28.3978) | 163.8713 *** | (20.0780) | |

| −0.0059 *** | (0.0022) | −0.0512 *** | (0.0073) | 0.0017 | (0.0249) | −0.0514 *** | (0.0073) | |

| 19.8754 ** | (8.0704) | −215.4015 *** | (51.1824) | 150.7665 * | (89.3798) | −216.0878 *** | (51.2887) | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, L.; Li, H.; Li, S. Effects on Carbon Sequestration of Biomass and Investment in State-Owned Forest Farms: A Case Study of Shaanxi Province, China. Forests 2025, 16, 60. https://doi.org/10.3390/f16010060

Gao L, Li H, Li S. Effects on Carbon Sequestration of Biomass and Investment in State-Owned Forest Farms: A Case Study of Shaanxi Province, China. Forests. 2025; 16(1):60. https://doi.org/10.3390/f16010060

Chicago/Turabian StyleGao, Li, Hua Li, and Shuqiang Li. 2025. "Effects on Carbon Sequestration of Biomass and Investment in State-Owned Forest Farms: A Case Study of Shaanxi Province, China" Forests 16, no. 1: 60. https://doi.org/10.3390/f16010060

APA StyleGao, L., Li, H., & Li, S. (2025). Effects on Carbon Sequestration of Biomass and Investment in State-Owned Forest Farms: A Case Study of Shaanxi Province, China. Forests, 16(1), 60. https://doi.org/10.3390/f16010060