Characteristics and Concerns of Logging Businesses in the Southeastern United States: Results from a State-Wide Survey from Alabama

Abstract

:1. Introduction

2. Materials and Methods

2.1. Bias Testing

2.2. Software

3. Results and Discussion

3.1. Survey Response

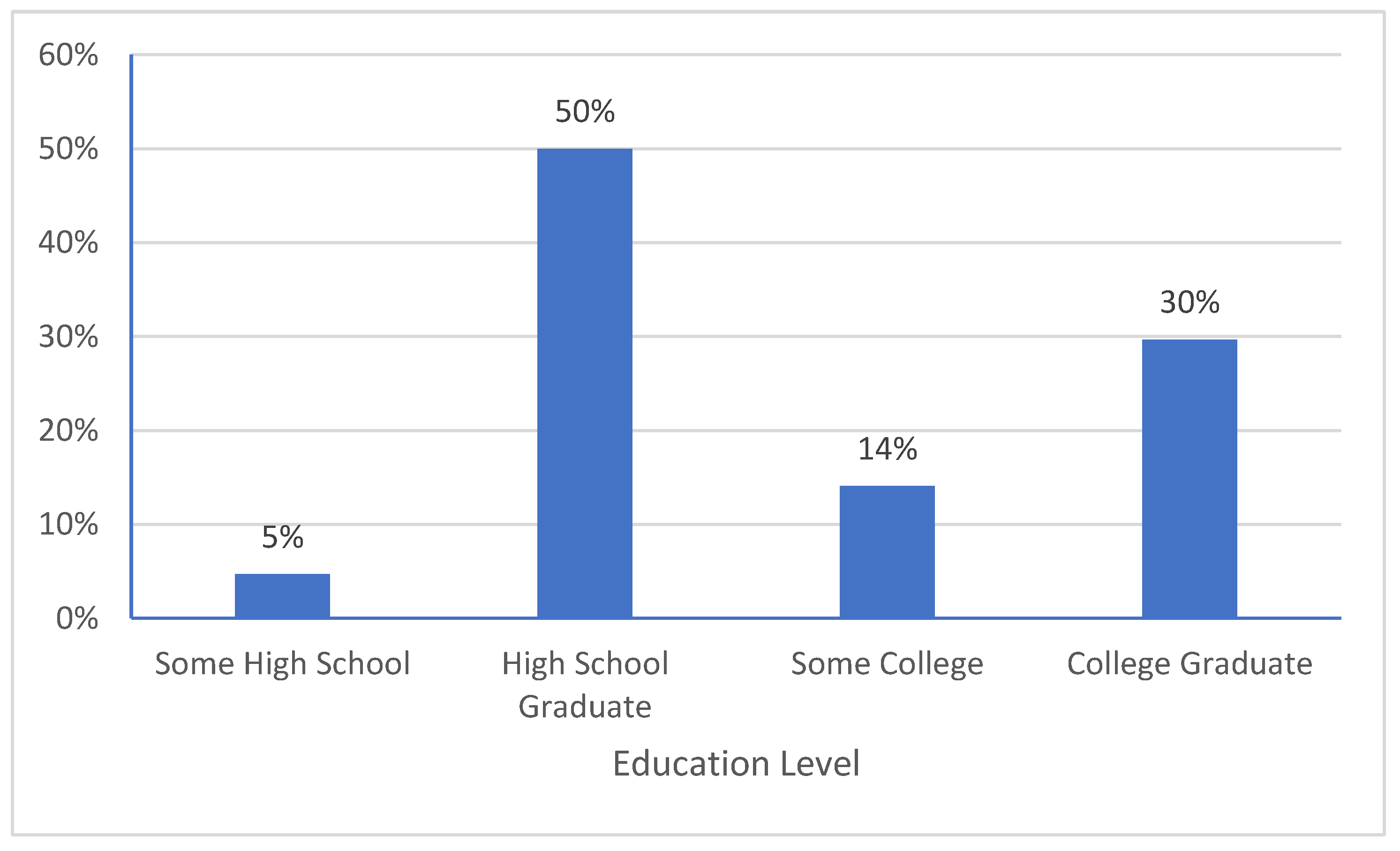

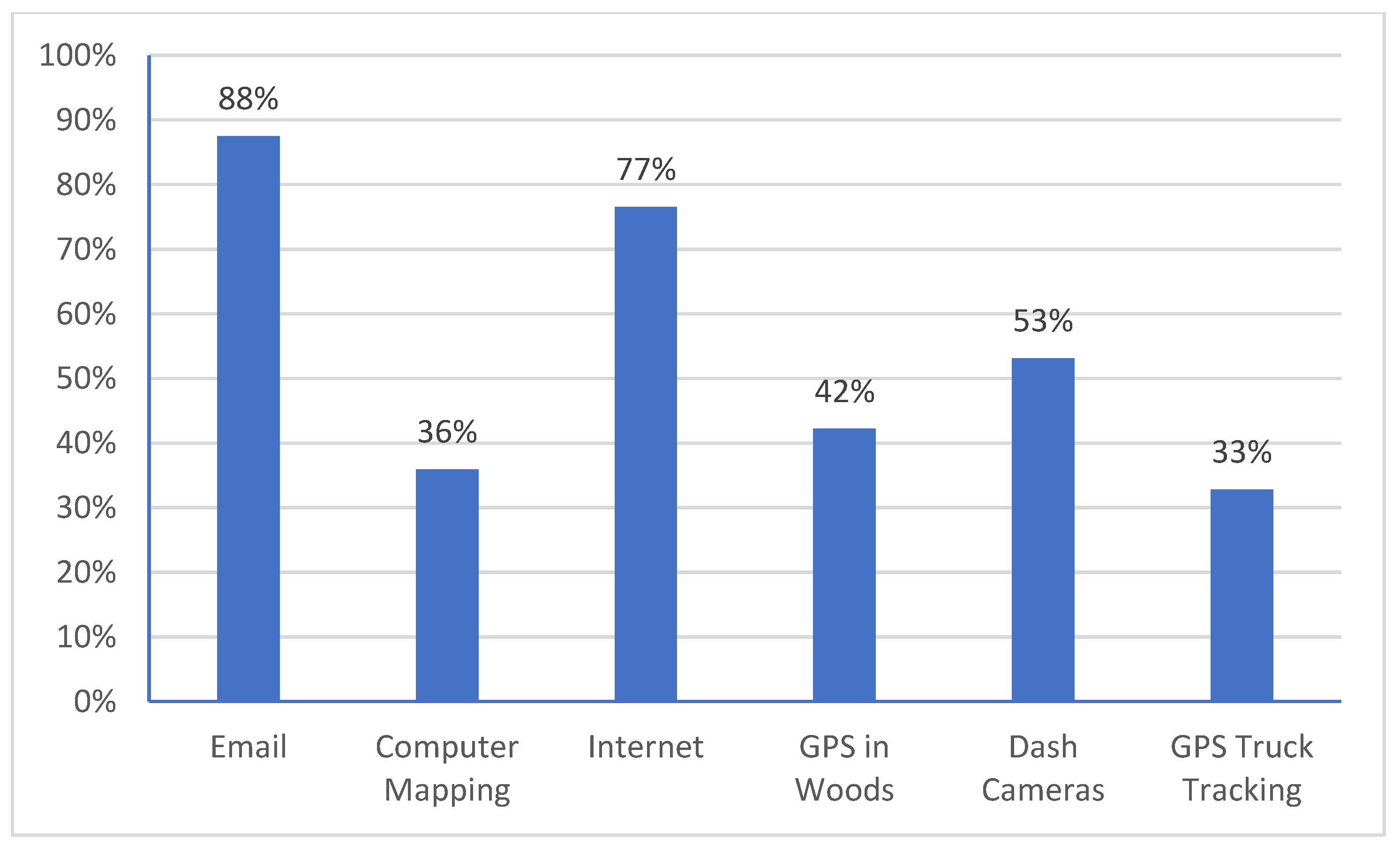

3.2. Demographics

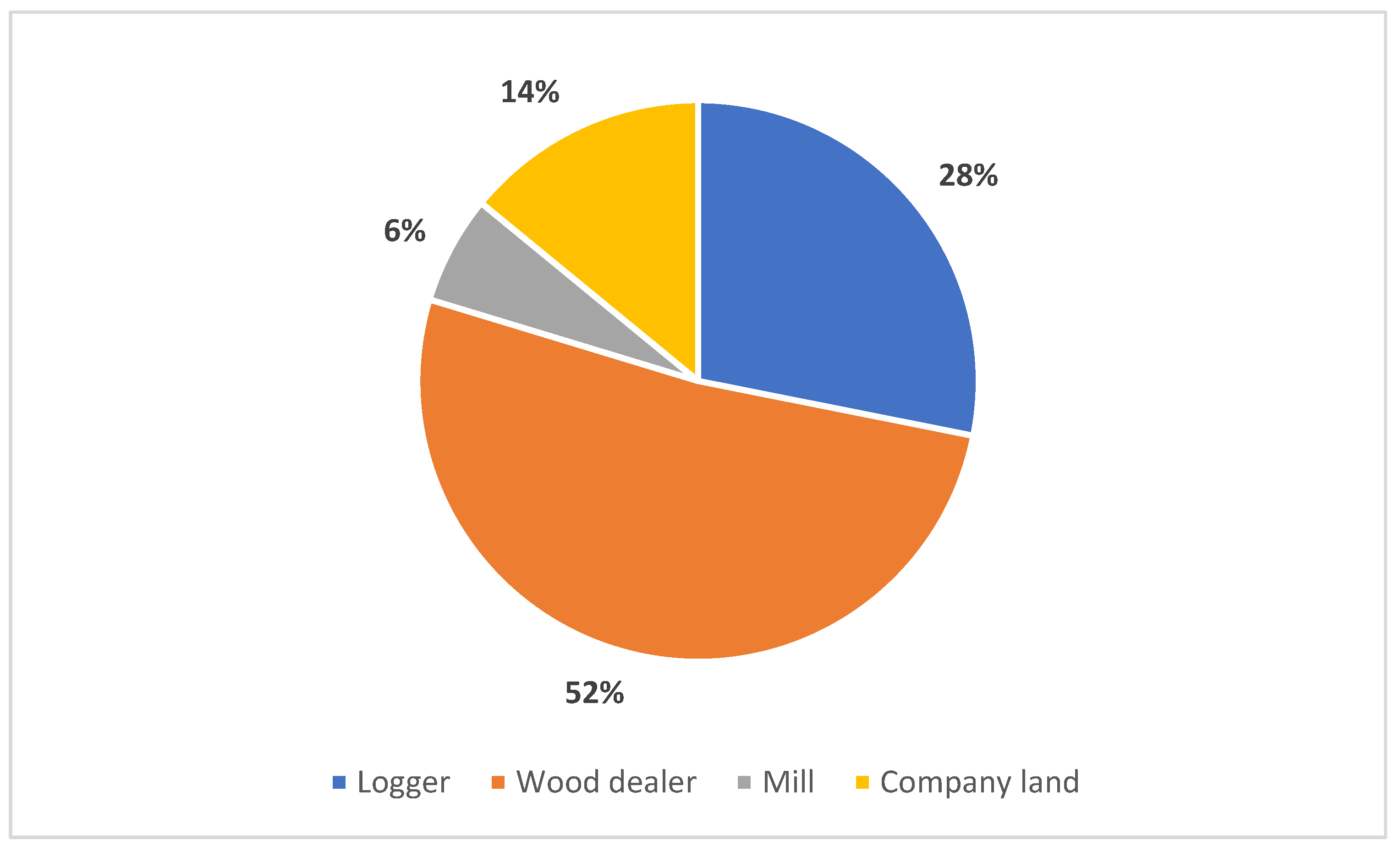

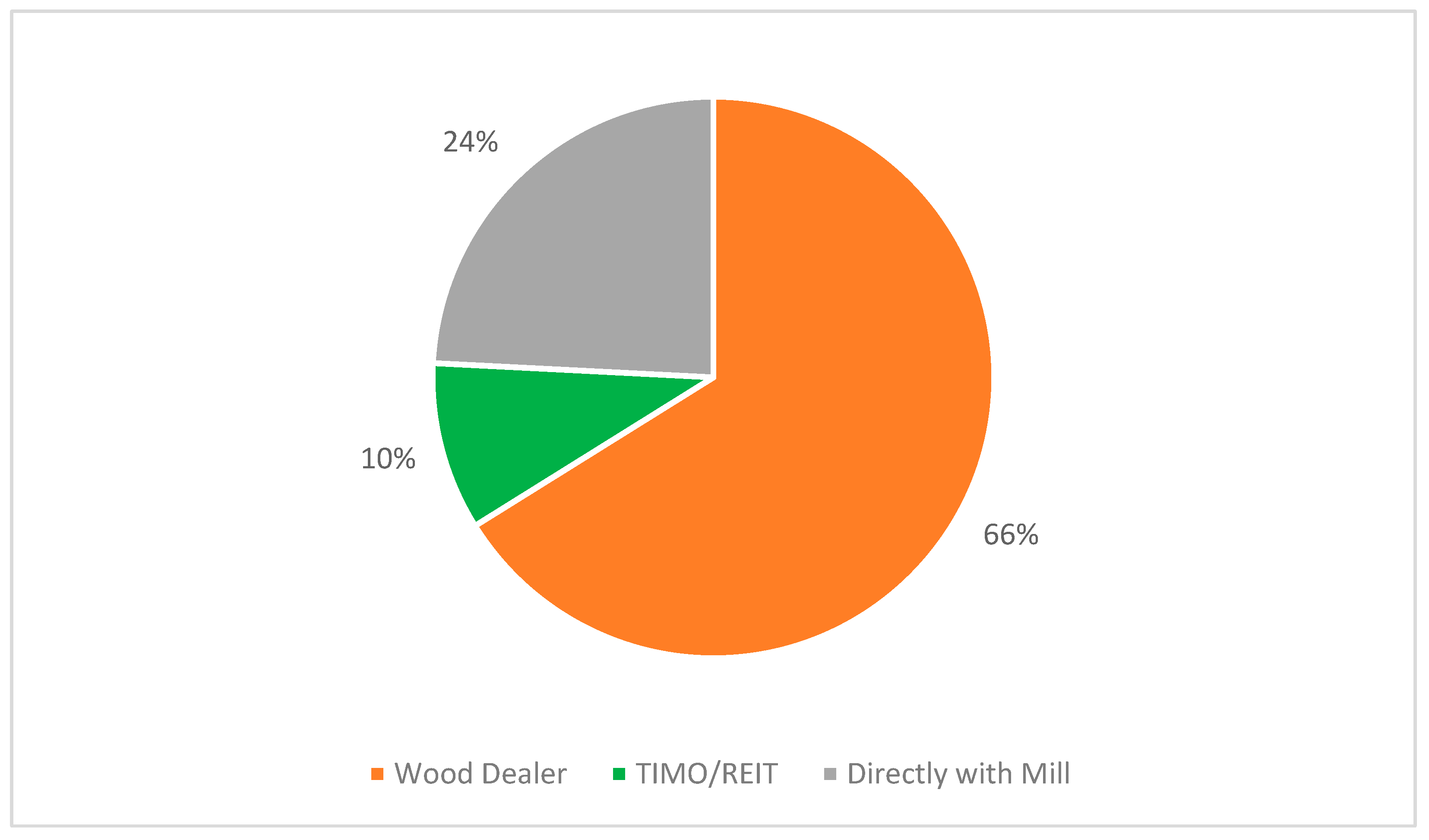

3.3. Harvest Characteristics and Production

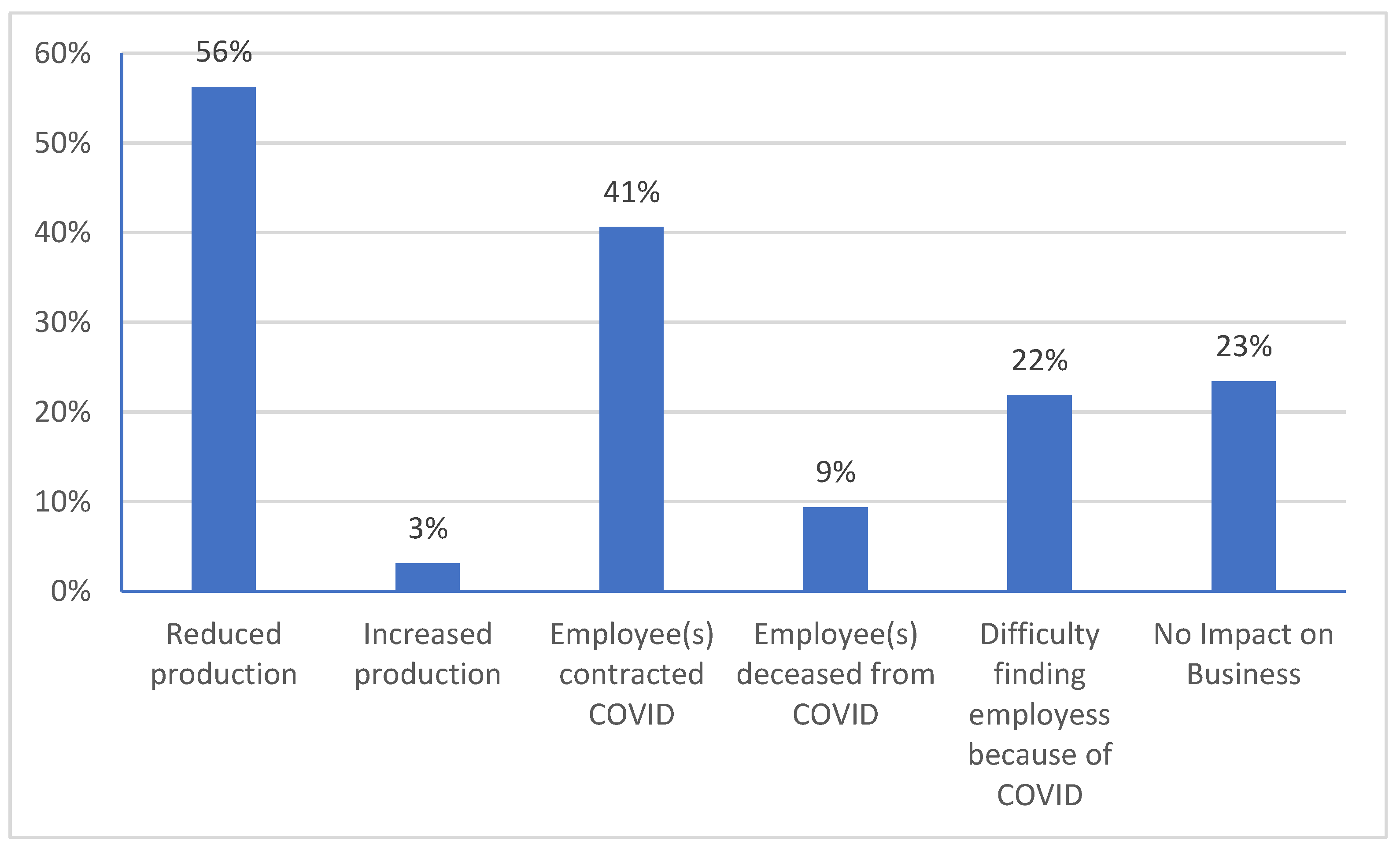

3.4. Business Challenges

3.5. Business Outlook

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Alabama Forestry Commission. Forest Resource Report. 2021. Available online: https://forestry.alabama.gov/Pages/Management/Forms/Forest_Resource_Report_2021.pdf (accessed on 1 July 2023).

- Altizer, C. An Introduction to the Southern US Wood Supply System: A Value Chain Approach. In Global Change and Forestry: Economic and Policy Implications, Proceedings of the Southern Forest Economics Workshop, San Antonio, TX, USA, 4–6 March 2007; Nova Science Publishers, Inc.: Hauppauge, NY, USA, 2007. [Google Scholar]

- Conrad, J.L.; Bolding, M.C.; Aust, W.M.; Smith, R.L. Wood-to-energy expansion, forest ownership changes, and mill closure: Consequences for U.S. South’s wood supply chain. For. Policy Econ. 2010, 12, 399–406. [Google Scholar] [CrossRef]

- Boston, K. Forestry Raw Materials Supply Chain Management. In The Management of Industrial Forest Plantations: Theoretical Foundations and Applications, Managing Forest Ecosystems; Borges, J.G., Diaz-Balteiro, L., McDill, M.E., Rodriguez, L.C.E., Eds.; Springer: Dordrecht, The Netherlands, 2014; pp. 467–487. [Google Scholar] [CrossRef]

- Kittler, B.; Stupak, I.; Smith, C.T. Assessing the wood sourcing practices of the U.S. industrial wood pellet industry supplying European energy demand. Energy Sustain. Soc. 2020, 10, 23. [Google Scholar] [CrossRef]

- GcC, S.; Potter-Witter, K.; Blinn, C.R.; Rickenbach, M. The Logging Sector in the Lake States of Michigan, Minnesota, and Wisconsin: Status, Issues, and Opportunities. J. For. 2020, 118, 501–514. [Google Scholar] [CrossRef]

- Greene, W.D.; Mayo, J.; de Hoop, C.; Egan, A. Causes and costs of unused logging production capacity in the southern United States and Maine. For. Prod. J. 2004, 54, 29–37. [Google Scholar]

- Flick, W.A. The Wood Dealer System in Mississippi: An Essay on Regional Economics and Culture. J. For. Hist. 1985, 29, 131–138. [Google Scholar] [CrossRef]

- Bailey, C.; Sinclair, P.; Bliss, J.; Perez, K. Segmented Labor Markets in Alabama’s Pulp and Paper Industry. Rural. Sociol. 1996, 61, 475–496. [Google Scholar] [CrossRef]

- Conrad, J.L.; Greene, W.D.; Hiesl, P. The Evolution of Logging Businesses in Georgia 1987–2017 and South Carolina 2012–2017. For. Sci. 2018, 64, 671–681. [Google Scholar] [CrossRef]

- Bardekjian, A.C.; Nesbitt, L.; Konijnendijk, C.C.; Lötter, B.T. Women in urban forestry and arboriculture: Experiences, barriers and strategies for leadership. Urban For. Urban Green. 2019, 46, 126442. [Google Scholar] [CrossRef]

- Greenslade, C.; Murphy, R.; Morse, S.; Griffiths, G.H. Seeing the Wood for the Trees: Factors Limiting Woodland Management and Sustainable Local Wood Product Use in the South East of England. Sustainability 2020, 12, 10071. [Google Scholar] [CrossRef]

- Ellis, A. Succession Planning, Perceived Barriers, and Proposed Solutions of Logging Business Owners in Georgia and Florida. Master’s Thesis, University of Georgia, Athens, GA, USA, 2023. [Google Scholar]

- He, M.; Li, W.; Smidt, M.; Zhang, Y. What Drives the Change in Employment in the US Logging Industry? A Directed Acyclic Graph Approach. For. Prod. J. 2022, 72, 265–275. [Google Scholar] [CrossRef]

- Conrad, J.L.; Greene, W.D.; Hiesl, P. A Review of Changes in US Logging Businesses 1980s–Present. J. For. 2018, 116, 291–303. [Google Scholar] [CrossRef]

- Rissman, A.R.; Geisler, E.; Gorby, T.; Rickenbach, M.G. “Maxed Out on Efficiency”: Logger Perceptions of Financial Challenges Facing Timber Operations. J. Sustain. For. 2022, 41, 115–133. [Google Scholar] [CrossRef]

- He, M.; Smidt, M.; Li, W.; Zhang, Y. Logging Industry in the United States: Employment and Profitability. Forests 2021, 12, 1720. [Google Scholar] [CrossRef]

- Scott, E.; Hirabayashi, L.; Graham, J.; Hansen-Ruiz, C.; Luschen, K.; Sorensen, J. The Impact of COVID-19 on Northeast and Appalachian Loggers. J. Agromed. 2022, 27, 329–338. [Google Scholar] [CrossRef]

- Bruck, S.R.; Parajuli, R.; Chizmar, S.; Sills, E.O. Impacts of COVID-19 pandemic policies on timber markets in the Southern United States. J. For. Bus. Res. 2023, 2, 130–167. [Google Scholar]

- Taggart, D.; Egan, A. Logging across Borders and Cultures: An Example in Northern Maine. For. Prod. J. 2011, 61, 561–569. [Google Scholar] [CrossRef]

- MacDonagh, P.; Roll, J.; Hahn, G.; Cubbage, F. Timber Harvesting Production, Costs, Innovation, and Capacity in the Southern Cone and the U.S. South. In Timber Buildings and Sustainability; Concu, G., Ed.; IntechOpen Ltd.: London, UK, 2019; p. 115. [Google Scholar]

- Spinelli, R.; Magagnotti, N.; Jessup, E.; Soucy, M. Perspectives and challenges of logging enterprises in the Italian Alps. For. Policy Econ. 2017, 80, 44–51. [Google Scholar] [CrossRef]

- Ke, S.; Qiao, D.; Zhang, X.; Feng, Q. Changes of China’s forestry and forest products industry over the past 40 years and challenges lying ahead. For. Policy Econ. 2019, 106, 101949. [Google Scholar] [CrossRef]

- Midgley, S.J.; Stevens, P.R.; Arnold, R.J. Hidden assets: Asia’s smallholder wood resources and their contribution to supply chains of commercial wood. Aust. For. 2017, 80, 10–25. [Google Scholar] [CrossRef]

- Conrad, J.L.; Grove, P.M. Timber Security Practices, Vulnerabilities, and Challenges in the Southern United States. Soc. Nat. Resour. 2020, 33, 842–858. [Google Scholar] [CrossRef]

- Clack, W.J. A comparison of rural crimes in Australia (NSW) and South Africa. Int. J. Reg. Rural. Remote Law Policy 2019, 2, 40–59. [Google Scholar] [CrossRef]

- Nunvailer, L.; Negru, C.; Popa, B. Wood harvesting sector in Suceava county: Financial and economic challenges. Rev. Padur. 2020, 135, 1–14. [Google Scholar]

- Asanzi, P.; Putzel, L.; Gumbo, D.; Mupeta, M. Rural livelihoods and the Chinese timber trade in Zambia’s Western Province. Int. For. Rev. 2014, 16, 447–458. [Google Scholar] [CrossRef]

- Kline, K.L.; Dale, V.H.; Rose, E. Resilience Lessons from the Southeast United States Woody Pellet Supply Chain Response to the COVID-19 Pandemic. Front. For. Glob. Chang. 2021, 4, 674138. [Google Scholar] [CrossRef]

- Duc, N.M.; Shen, Y.; Zhang, Y.; Smidt, M. Logging productivity and production function in Alabama, 1995 to 2000. For. Prod. J. 2009, 59, 22–26. [Google Scholar]

- Diniz, C.; Smidt, M.; Cooper, J.; Zhang, Y. Logging Crew Attributes by Region in the Southeast USA. Croat. J. For. Eng. 2023, 44, 431–439. [Google Scholar] [CrossRef]

- Mori, A.S.; Kitagawa, R. Retention forestry as a major paradigm for safeguarding forest biodiversity in productive landscapes: A global meta-analysis. Biol. Conserv. 2014, 175, 65–73. [Google Scholar] [CrossRef]

- US Bureau of Labor Statistics, n.d. Private. NAICS 4-Digit Industries, Alabama 2022 Fourth Quarter, All Establishment Sizes Source: Quarterly Census of Employment and Wages. Available online: https://data.bls.gov/cew/apps/table_maker/v4/table_maker.htm#type=8&year=2022&qtr=4&own=5&area=01000&supp=0 (accessed on 13 July 2023).

- Armstrong, J.; Overton, T. Estimating Nonresponse Bias in Mail Surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- StataCorp. Stata Statistical Software: Release 18; StataCorp LLC: College Station, TX, USA, 2023. [Google Scholar]

- Germain, R.; Regula, J.; Bick, S.; Zhang, L. Factors impacting logging costs: A case study in the Northeast, US. For. Chron. 2019, 95, 16–23. [Google Scholar] [CrossRef]

- Conrad, J.L. Log truck insurance premiums, claims, and safety practices among logging businesses in the US South. Int. J. For. Eng. 2023, 34, 204–215. [Google Scholar] [CrossRef]

- Wangsiripitak, S.; Hano, K.; Kuchii, S. Traffic Light and Crosswalk Detection and Localization Using Vehicular Camera. In Proceedings of the 2022 14th International Conference on Knowledge and Smart Technology (KST), Online, 26–29 January 2022; pp. 108–113. [Google Scholar] [CrossRef]

- Greber, B.J.; Smith, H.D. An Analysis of Multiple Product Merchandising Strategies for Loblolly Pine Stumpage. South. J. Appl. For. 1986, 10, 137–141. [Google Scholar] [CrossRef]

- Grove, P. Analysis of Private Timber Sale Transactions and Landowner Revenues in Evolving Markets in the U.S. South. Master’s Thesis, University of Georgia, Athens, GA, USA, 2019. [Google Scholar]

- Lamichhane, S.; Mei, B.; Siry, J. Spatial Spillover Effects of Pine Sawtimber Stumpage Prices in the US South. For. Sci. 2023, 69, 230–240. [Google Scholar] [CrossRef]

- Louis, L.T.; Kizha, A.R. Wood biomass recovery cost under different harvesting methods and market conditions. Int. J. For. Eng. 2021, 32, 164–173. [Google Scholar] [CrossRef]

- Zhang, D.; Butler, B.J.; Nagubadi, R.V. Institutional Timberland Ownership in the US South: Magnitude, Location, Dynamics, and Management. J. For. 2012, 110, 355–361. [Google Scholar] [CrossRef]

- Sass, E.M.; Markowski-Lindsay, M.; Butler, B.J.; Caputo, J.; Hartsell, A.; Huff, E.; Robillard, A. Dynamics of Large Corporate Forestland Ownerships in the United States. J. For. 2021, 119, 363–375. [Google Scholar] [CrossRef]

- US Energy Information Administration, n.d. Weekly U.S. No 2 Diesel Retail Prices (Dollars per Gallon). Available online: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EMD_EPD2D_PTE_NUS_DPG&f=W (accessed on 15 July 2023).

- Castillo, A.G.; Tian, N.; Pelkki, M. The impact of rapid fuel costs inflation on Arkansas’ logging sector. J. For. Bus. Res. 2022, 1, 75–89. [Google Scholar]

- Jordà, Ò.; Nechio, F. Inflation and wage growth since the pandemic. Eur. Econ. Rev. 2023, 156, 104474. [Google Scholar] [CrossRef]

- MacDonald, P.; Clow, M. “Things Was Different in the South”: The industrialization of pulpwood harvesting systems in the Southeastern United States 1945–1995. Technol. Soc. 2010, 32, 145–160. [Google Scholar] [CrossRef]

- Kent, P.; Haralambides, H. A perfect storm or an imperfect supply chain? The U.S. supply chain crisis. Marit. Econ. Logist. 2022, 24, 1–8. [Google Scholar] [CrossRef]

- Zhang, X.; Stottlemyer, A. Lumber and Timber Price Trends Analysis During the COVID-19 Pandemic; White Paper; Texas A&M Forest Service: College Station, TX, USA, 2021.

- Vaughan, D.; Edgeley, C.; Han, H.-S. Forest Contracting Businesses in the US Southwest: Current Profile and Workforce Training Needs. J. For. 2022, 120, 186–197. [Google Scholar] [CrossRef]

- Gurtu, A. Truck transport industry in the USA: Challenges and likely disruptions. Int. J. Logist. Syst. Manag. 2023, 44, 46–58. [Google Scholar] [CrossRef]

- Lang, A.H.; Mendell, B.C. Sustainable Wood Procurement: What the Literature Tells Us. J. For. 2012, 110, 157–163. [Google Scholar] [CrossRef]

- Van Kooten, G.C.; Schmitz, A. COVID-19 impacts on U.S. lumber markets. For. Policy Econ. 2022, 135, 102665. [Google Scholar] [CrossRef] [PubMed]

- English, L.; Pelkki, M.; Montgomery, R.; Tian, N.; Popp, J. Evaluating Economic Impacts of COVID-19 for Arkansas’ Agriculture and Forestry Sectors in 2020. In Proceedings of the Mid-Continent Regional Science Association Conference, Grand Rapids, MI, USA, 9–10 June 2022. [Google Scholar] [CrossRef]

- Muhammad, A.; Hellwinckel, C.M.; Anosike, E.; Taylor, A. Economic Impact of the COVID-19 Pandemic on Tennessee Forest Product Exports; Institute of Agriculture, The University of Tennessee: Knoxville, TN, USA, 2022; p. W1064. [Google Scholar] [CrossRef]

- Russell, M.B. A Summary of COVID-19 Pandemic Assistance to US Forest Products Companies. For. Prod. J. 2022, 72, 253–257. [Google Scholar] [CrossRef]

- Smith, J.J. An Analysis of the Harvesting Costs and Productivity of Logging Contractors within the Eastern United States. Master’s Thesis, Mississippi State University, Starkville, MS, USA, 2009. [Google Scholar]

- Conrad, J.L.; Vokoun, M.M.; Prisley, S.P.; Bolding, M.C. Barriers to logging production and efficiency in Wisconsin. Int. J. For. Eng. 2017, 28, 57–65. [Google Scholar] [CrossRef]

- He, W.; Goodkind, D.; Kowal, P.R. An Aging World: 2015; U.S. Department of Service: Washington, DC, USA, 2016.

- Bloom, D.E.; Chatterji, S.; Kowal, P.; Lloyd-Sherlock, P.; McKee, M.; Rechel, B.; Rosenberg, L.; Smith, J.P. Macroeconomic implications of population ageing and selected policy responses. Lancet 2015, 385, 649–657. [Google Scholar] [CrossRef]

- Fritz, E. Industrial Apprentice Training for Forestry Graduates—Committee on Apprentice Training, Pacific Logging Congress. J. For. 1941, 39, 288–290. [Google Scholar]

- Egan, A.; Taggart, D. Who Will Log? Occupational Choice and Prestige in New England’s North Woods. J. For. 2004, 102, 20–25. [Google Scholar]

| Mean | 95% CI (±) | Median | Percent | |

|---|---|---|---|---|

| Number of Employees | ||||

| Employees per firm | 12.4 | 2.83 | 8 | |

| Truck drivers per firm | 4.3 | 1.3 | 3 | |

| Number of Crews | 1.7 | 0.39 | 1 | |

| Relations between Owners and Employees | ||||

| Employees related to owner | 1.5 | 0.39 | 1 | |

| % firms employing relatives | 31.20% | |||

| Ages of Owners and Employees | ||||

| Owner age | 56.2 | 3.05 | 56 | |

| Years of owning or operating a logging business | 25.7 | 3.47 | 24.5 | |

| Avg. employee age | 48.2 | 2.1 | 50 | |

| Difference in Age (Owner–Employee) | 8.1 | 3.24 | 9 |

| Percentage of firms without truck driver employees | 14.10% |

| Percentage of firms using contract trucking | 71.88% |

| For firms using contract trucking, percentage of loads hauled: | |

| Less than 25% of loads: | 42.60% |

| 26%–50% of loads: | 17.00% |

| 51%–75% of loads: | 10.60% |

| More than 75% of loads: | 29.80% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bowman, T.; Jeffers, S.; Naka, K. Characteristics and Concerns of Logging Businesses in the Southeastern United States: Results from a State-Wide Survey from Alabama. Forests 2023, 14, 1695. https://doi.org/10.3390/f14091695

Bowman T, Jeffers S, Naka K. Characteristics and Concerns of Logging Businesses in the Southeastern United States: Results from a State-Wide Survey from Alabama. Forests. 2023; 14(9):1695. https://doi.org/10.3390/f14091695

Chicago/Turabian StyleBowman, Troy, Samuel Jeffers, and Kozma Naka. 2023. "Characteristics and Concerns of Logging Businesses in the Southeastern United States: Results from a State-Wide Survey from Alabama" Forests 14, no. 9: 1695. https://doi.org/10.3390/f14091695

APA StyleBowman, T., Jeffers, S., & Naka, K. (2023). Characteristics and Concerns of Logging Businesses in the Southeastern United States: Results from a State-Wide Survey from Alabama. Forests, 14(9), 1695. https://doi.org/10.3390/f14091695