Profitability of the First Commercial Thinning, a Simulation Study in Northern Finland

Abstract

1. Introduction

2. Materials and Methods

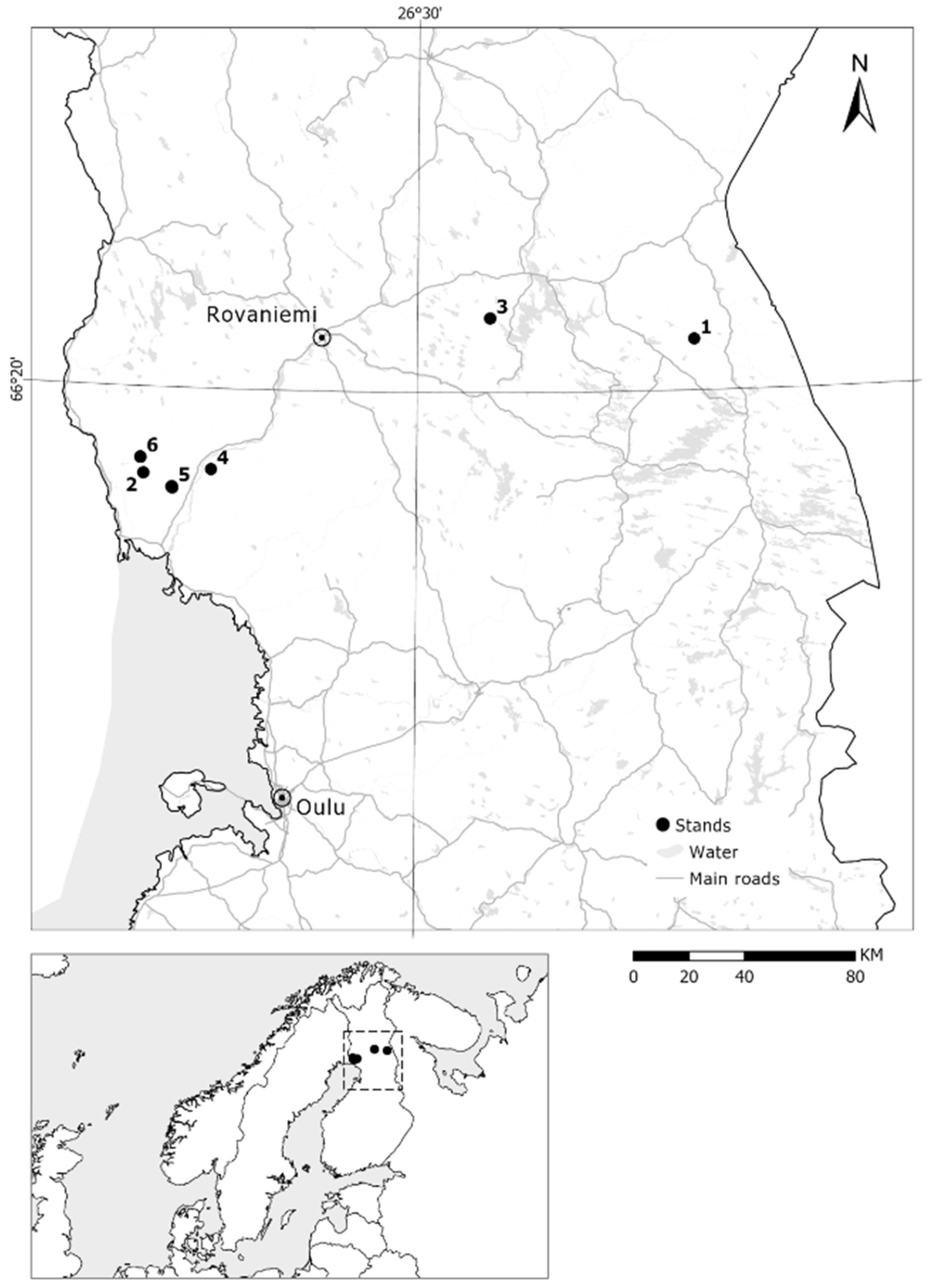

2.1. Forest Data

2.2. Simulations

2.3. Financial Analyses

2.3.1. Private Forest Owner

2.3.2. Contractor

2.4. Economic Data

3. Results

3.1. Logging Costs

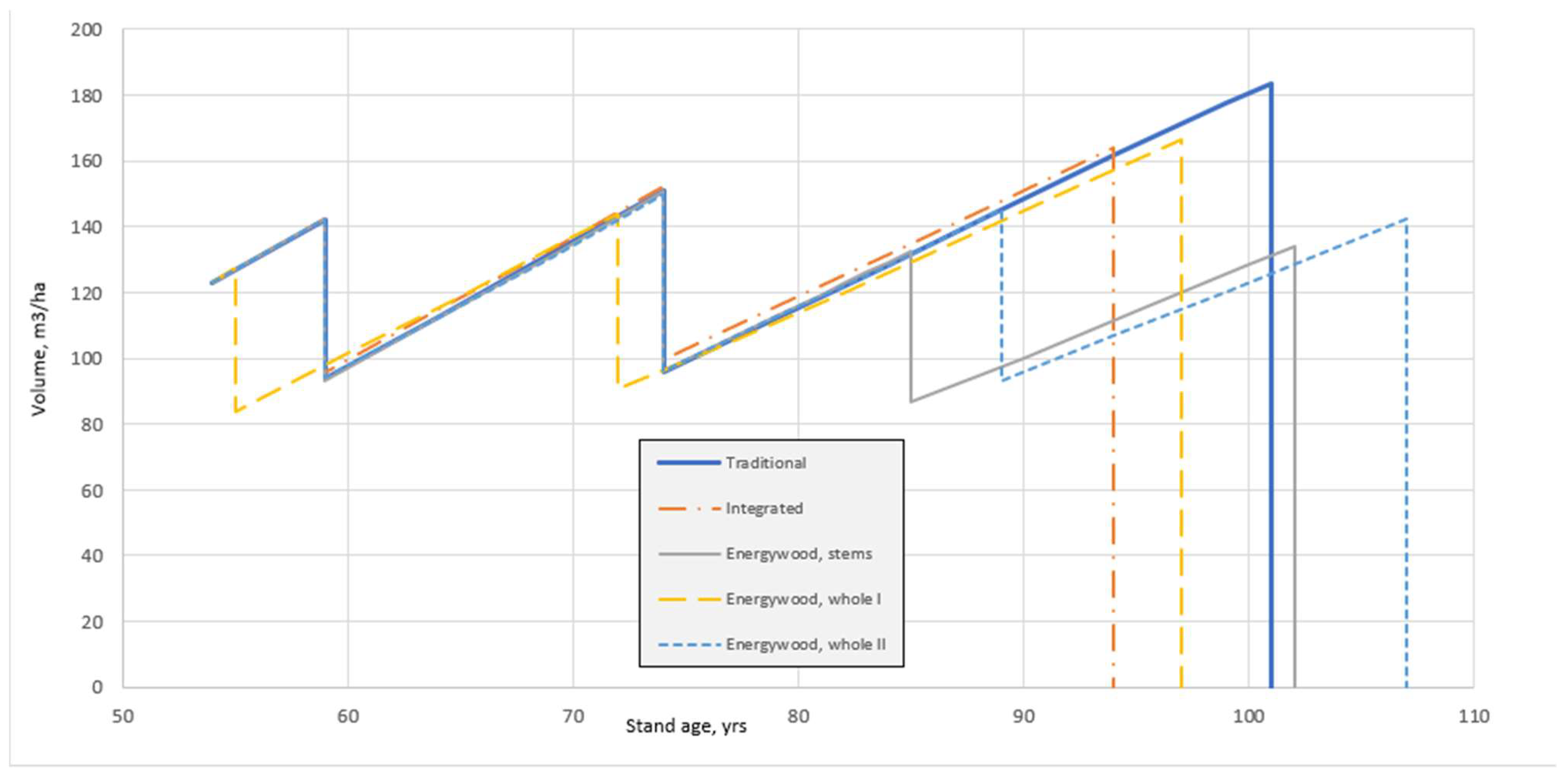

3.2. Growth and Yield

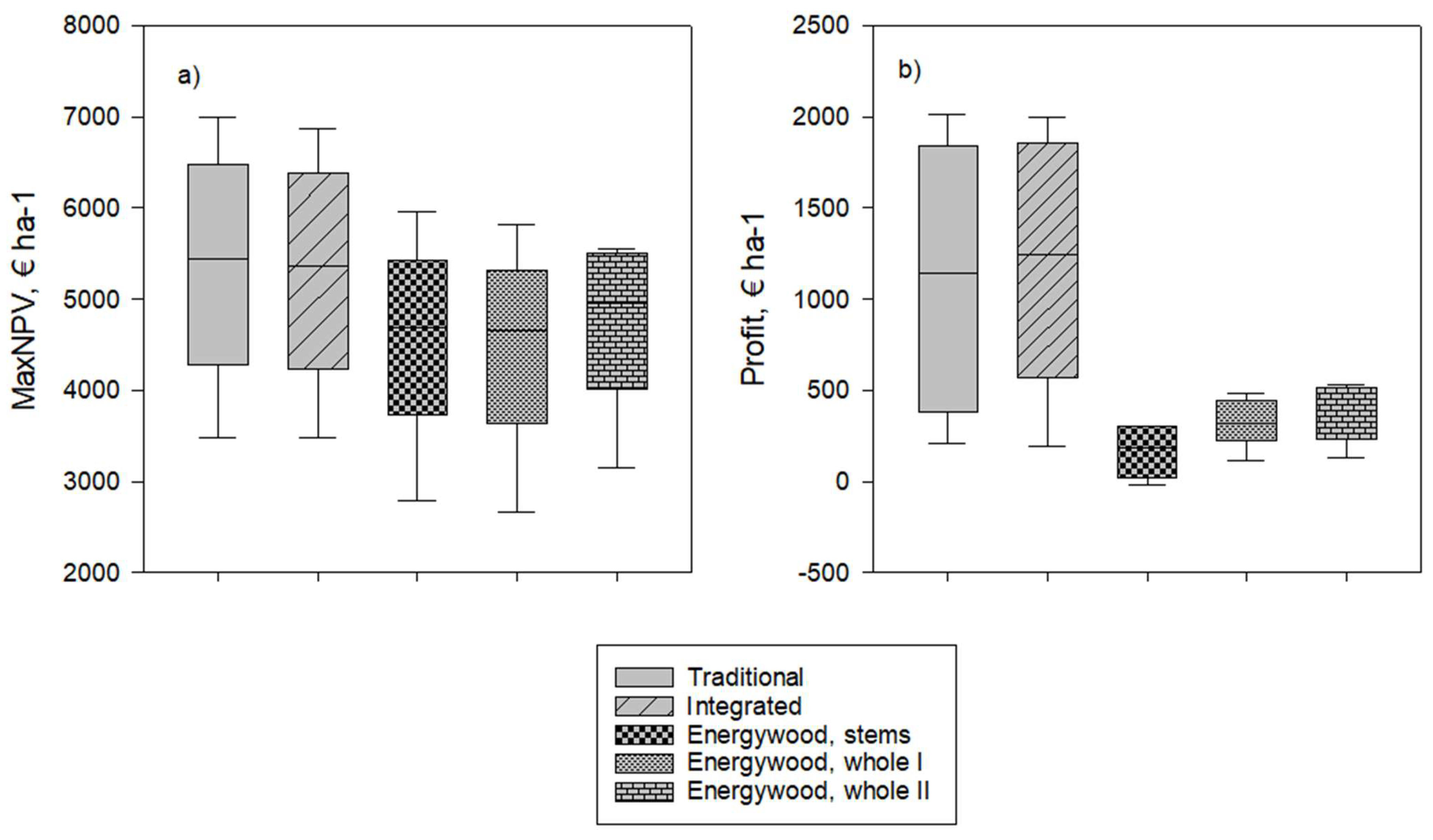

3.3. Financial Performance

4. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ihalainen, A.; Mäki-Simola, E.; Sauvula-Seppälä, T.; Torvelainen, J.; Uotila, E.; Vaahtera, E.; Ylitalo, E. (Eds.) Finnish Forest Resources; Natural Resources Institute Finland (Luke): Helsinki, Finland, 2019; p. 198. [Google Scholar]

- Korhonen, K.T.; Ihalainen, A.; Ahola, A.; Heikkinen, J.; Henttonen, H.M.; Hotanen, J.-P.; Nevalainen, S.; Pitkänen, J.; Strandström, M.; Viiri, H. (Eds.) Suomen Metsät 2009–2013 ja Niiden Kehitys 1921–2013; Natural Research Institute Finland: Helsinki, Finland, 2017; p. 86. [Google Scholar]

- Korhonen, K.T.; Ihalainen, A.; Strandström, M.; Salminen, O.; Hirvelä, H.; Härkönen, K. Riittääkö puu—VMI-tulokset. In 61. Lapin Metsätalouspäivät, Rovaniemi; METO—Metsäalan Asiantuntijat ry: Helsinki, Finland, February 2019. [Google Scholar]

- Ahtikoski, A.; Hökkä, H. Intensive forest management—Does it financially pay off on drained peatlands? Can. J. For. Res. 2019, 49, 1101–1113. [Google Scholar] [CrossRef]

- Karttunen, K.; Ahtikoski, A.; Kujala, S.; Törmä, H.; Kinnunen, J.; Salminen, H.; Huuskonen, S.; Kojola, S.; Lehtonen, M.; Hynynen, J.; et al. Regional socio-economic impacts of intensive forest management, a CGE approach. Biomass Bionerg. 2018, 118, 8–15. [Google Scholar] [CrossRef]

- Assman, E. The Principles of Forest Yield Study—Studies in the Organic Production, Structure, Increment and Yield of Forest Stands; Pergamon Press: Oxford, UK, 1970; pp. 1–506. [Google Scholar]

- Hakkila, P. Ensiharvennuspuun hyödyntäminen (Utilization of roundwood from first thinnings). Folia Forestalia 1996, 428–433. [Google Scholar]

- Stöd, R.; Siren, M.; Tanttu, V.; Verkasalo, E. Jäävän puuston ja poistuman tekninen laatu ensiharvennusmänniköissä (Technical quality of remaining trees after first thinning). Metsätieteen Aikakauskirja 2003, 2003, 6110. [Google Scholar]

- Nuutinen, Y.; Kärhä, K.; Laitila, J.; Jylhä, P.; Keskinen, S. Productivity of whole-tree bundler in energy wood and pulpwood harvesting from early thinnings. Scand. J. For. Res. 2011, 26, 329–338. [Google Scholar] [CrossRef]

- Mäkinen, H.; Hynynen, J. Wood density and tracheid properties of Scots pine: Responses to repeated fertilization and timing of the first commercial thinning. Forestry 2014, 87, 437–447. [Google Scholar] [CrossRef]

- Laitila, J.; Heikkilä, J.; Anttila, P. Harvesting alternatives, accumulation and procurement cost of small-diameter thinning wood for fuel in Central-Finland. Silva Fenn. 2010, 44, 465–480. [Google Scholar] [CrossRef]

- Laitila, J.; Väätäinen, K. Truck transportation and chipping productivity of whole trees and delimbed energy wood in Finland. Croat. J. For. Eng. 2012, 33, 199–210. [Google Scholar]

- Petty, A. Opportunities for Cost Mitigation and Efficiency Improvements through Ration Alization of Small-Diameter Energy Wood Supply Chains. Ph.D. Thesis, University of Eastern Finland, Joensuu, Finland, 2014. [Google Scholar]

- Karttunen, K.; Laitila, J.; Ranta, T. First-thinning harvesting alternatives for industrial or energy purposes based on regional Scots pine stand simulations in Finland. Silva Fenn. 2016, 50, 16. [Google Scholar] [CrossRef][Green Version]

- Kärhä, K.; Jouhiaho, A.; Mutikainen, A.; Mattila, M. Mechanized energy wood harvesting from early thinnings. Int. J. For. Eng. 2005, 16, 15–26. [Google Scholar] [CrossRef]

- Heikkilä, J.; Siren, M.; Äijälä, O. Management alternatives of energy wood thinning stands. Biomass Bioenerg. 2007, 31, 255–266. [Google Scholar] [CrossRef]

- Ahtikoski, A.; Heikkilä, J.; Alenius, V.; Siren, M. Economic viability of utilizing biomass energy from young stands—The case of Finland. Biomass Bioenerg. 2008, 32, 988–996. [Google Scholar] [CrossRef]

- Laitila, J.; Väätäinen, K. Productivity and cost of harvesting overgrowth brushwood from roadsides and field edges. Int. J. For. Eng. 2021, 32, 140–154. [Google Scholar]

- Heikkilä, J.; Sirén, M.; Ahtikoski, A.; Hynynen, J.; Sauvula, T.; Lehtonen, M. Energy wood thinning as a part of the stand management of Scots pine and Norway spruce. Silva Fenn. 2009, 43, 129–146. [Google Scholar] [CrossRef]

- Kärhä, K. Integrated harvesting of energy wood and pulpwood in first thinnings using the two-pile cutting method. Biomass Bioenerg. 2011, 35, 3397–3403. [Google Scholar] [CrossRef]

- Laitila, J.; Väätäinen, K. Hakkuutyön tuottavuus metsävarustellulla turvetuotantotraktorilla karsitun aines- ja energiapuun korjuussa (The cutting productivity in integrated harvesting of pulpwood and delimbed energy wood with a forestry-equipped peat harvesting tractor). Suo Mires Peat 2013, 64, 97–112. [Google Scholar]

- Kärhä, K.; Jylhä, P.; Laitila, J. Integrated procurement of pulpwood and energy wood from early wood from early thinnings using whole-tree bundling. Biomass Bioenerg. 2011, 35, 3389–3396. [Google Scholar] [CrossRef]

- Nuutinen, Y.; Björheden, R. Productivity and work processes of small-tree bundler Fixteri FX15a in energy wood harvesting from early pine dominated thinnings. Int. J. For. Eng. 2016, 27, 29–42. [Google Scholar] [CrossRef]

- Petty, A.; Kärhä, K. Effect of subsidies on the profitability of energy wood production of wood chips from early thinnings in Finland. For. Policy Econ. 2011, 12, 575–581. [Google Scholar] [CrossRef]

- Ministry of Agriculture and Forestry of Finland. Available online: https://mmm.fi/en/forests (accessed on 19 May 2021).

- Amacher, G.S.; Ollikainen, M.; Koskela, E. Economics of Forest Resources; The MIT Press: Cambridge, MA, USA, 2009; pp. 1–448. [Google Scholar]

- Niinimäki, S.; Tahvonen, O.; Mäkelä, A. Applying a process-based model in Norway spruce management. For. Ecol. Manag. 2012, 265, 102–115. [Google Scholar] [CrossRef]

- Faustmann, M. Berechnung des Werthes, welchen Waldboden, sowie noch nicht haubare Holzbestände für die Waldwirthschaft besitzen. (Calculation of the value which forest land and immature stands possess for forestry). Allgemeine For. Jagd Zeitung 1849, 25, 441–455. [Google Scholar]

- Parkatti, V.-P.; Assmuth, A.; Rämö, J.; Tahvonen, O. Economics of boreal conifer species in continuous cover and rotation forestry. For. Policy Econ. 2019, 100, 55–67. [Google Scholar] [CrossRef]

- Finnish Forest Centre. Open Database on NIPFs’ Forests Including Silvicultural Status Associated with Each Stand. 2019. Available online: https://www.metsakeskus.fi/en/open-forest-and-nature-information/information-about-finnish-forests (accessed on 17 October 2019).

- Ahtikoski, A.; Karhu, J.; Ahtikoski, R.; Haapanen, M.; Hynynen, J.; Kärkkäinen, K. Financial assessment of alternative breeding goals using stand-level optimization and data envelopment analysis. Scand. J. For. Res. 2020, 35, 262–273. [Google Scholar] [CrossRef]

- Tharakan, P.J.; Volk, T.A.; Lindsey, C.A.; Abrahamson, L.P.; White, E.H. Evaluating the impact of three incentive program on the economics of cofiring willow biomass with coal in New York State. Energ. Policy 2005, 33, 337–347. [Google Scholar] [CrossRef]

- Tonteri, T.; Hotanen, J.P.; Kuusipalo, J. The Finnish forest site type approach: Ordination and classification studies of mesic forest sites in southern Finland. Vegetatio 1990, 87, 85–98. [Google Scholar] [CrossRef]

- Metcalfe, T.S.; Charbonneau, P. Stellar structure modeling using a parallel genetic algorithm for objective global optimization. J. Comp. Phys. 2003, 185, 176–193. [Google Scholar] [CrossRef]

- Ahtikoski, A.; Salminen, H.; Hökkä, H.; Kojola, S.; Penttilä, T. Optimising stand management on peatlands: The case of northern Finland. Can. J. For. Res. 2012, 42, 247–259. [Google Scholar] [CrossRef]

- Hyytiäinen, K.; Tahvonen, O. The effects of legal limits and recommendations on timber production: The case of Finland. For. Sci. 2001, 47, 443–454. [Google Scholar]

- Salminen, H.; Lehtonen, M.; Hynynen, J. Reusing legacy FORTRAN in the MOTTI growth and yield simulator. Comput. Electron. Agr. 2005, 49, 103–113. [Google Scholar] [CrossRef]

- Hynynen, J.; Salminen, H.; Ahtikoski, A.; Huuskonen, S.; Ojansuu, R.; Siipilehto, J.; Lehtonen, M.; Eerikäinen, K. Long-term impacts of forest management on biomass supply and forest resource development: A scenario analysis for Finland. Eur. J. For. Res. 2015, 134, 415–431. [Google Scholar] [CrossRef]

- Juutinen, A.; Ahtikoski, A.; Lehtonen, M.; Mäkipää, R.; Ollikainen, M. The impact of a short-term carbon payment scheme on forest management. For. Policy Econ. 2018, 90, 115–127. [Google Scholar] [CrossRef]

- Hynynen, J.; Salminen, H.; Huuskonen, S.; Ahtikoski, A.; Ojansuus, R.; Siipilehto, J.; Lehtonen, M.; Rummukainen, A.; Kojola, S.; Eerikäinen, K. Scenario Analysis for the Biomass Supply Potential and the Future Development of Finnish Forest Resources; Working Papers of the Finnish Forest Research Institute 302; Natural Resources Institute Finland (Luke): Helsinki, Finland, 2014; Unpublished work. [Google Scholar]

- Kojola, S.; Ahtikoski, A.; Hökkä, H.; Penttilä, T. Profitability of alternative management regimes in Scots pine stands on drained peatlands. Eur. J. For. Res. 2012, 131, 413–426. [Google Scholar] [CrossRef]

- Mönkkönen, M.; Juutinen, A.; Mazziotta, A.; Miettinen, K.; Podkopaev, D.; Reunanen, P.; Salminen, H.; Tikkanen, O.-P. Spatially dynamic forest management to sustain biodiversity and economic returns. J. Environ. Manag. 2014, 134, 80–89. [Google Scholar] [CrossRef]

- Helin, T.; Salminen, H.; Hynynen, J.; Soimakallio, S.; Huuskonen, S.; Pingound, K. Global warming potentials of stemwood used for energy and materials in Southern Finland: Differentiation of impacts based on type of harvest and product lifetime. GCB Bioenergy 2016, 8, 334–345. [Google Scholar] [CrossRef]

- Aro, L.; Ahtikoski, A.; Hytönen, J. Profitability of growing Scots pine on cutaway peatlands. Silva Fenn. 2020, 54, 18. [Google Scholar] [CrossRef]

- Ahtikoski, A.; Haapanen, M.; Hynynen, J.; Karhu, J.; Kärkkäinen, K. Genetically improved reforestation stock provides simultaneous benefits for growers and a sawmill, a case study in Finland. Scand. J. For. Res. 2018, 33, 484–492. [Google Scholar] [CrossRef]

- Tahvonen, O.; Pihlainen, S.; Niinimäki, S. On the economics of optimal timber production in boreal Scots pine stands. Can. J. For. Res. 2013, 43, 719–730. [Google Scholar] [CrossRef]

- The Forestry Development Centre Tapio. Metsänhoidon Suositukset; Äijälä, O., Koistinen, A., Sved, J., Vanhatalo, K., Väisänen, P., Eds.; The Forestry Development Centre Tapio: Helsinki, Finland, 2014; p. 136. [Google Scholar]

- Nurminen, T.; Korpunen, H.; Uusitalo, J. Time consumption analysis of the mechanized cut-to-length harvesting system. Silva Fenn. 2006, 40, 335–363. [Google Scholar] [CrossRef]

- Laitila, J.; Asikainen, A.; Nuutinen, Y. Forwarding of whole trees after manual and mechanized felling bunching in pre-commercial thinnings. Int. J. For. Eng. 2007, 18, 29–39. [Google Scholar] [CrossRef]

- Laitila, J.; Niemistö, P.; Väätäinen, K. Productivity of multi-tree cutting in thinnings and clear cuttings of young downy birch (Betula pubescens) dominated stands in the integrated harvesting of pulpwood and energy wood. Balt. For. 2016, 22, 116–131. [Google Scholar]

- Niemistö, P. Runkolukuun perustuvat harvennusmallit. In Thinning Models Based on the Number of Stems; Research Papers 432; Finnish Forest Research Institute: Helsinki, Finland, 1992; p. 18. [Google Scholar]

- Jylhä, P.; Dahl, O.; Laitila, J.; Kärhä, K. The effect of supply system on the wood paying capability of a kraft pulp mill using Scots pine harvested from first thinnings. Silva Fenn. 2010, 44, 695–714. [Google Scholar] [CrossRef][Green Version]

- Laitila, J.; Ahtikoski, A.; Repola, J.; Routa, J. Pre-feasibility study of supply systems based on artificial drying of delimbed stem forest chips. Silva Fenn. 2017, 51, 5659. [Google Scholar] [CrossRef]

- Luke (Natural Resources Institute Finland). Statistics Database; Natural Resources Institute Finland: Helsinki, Finland, 2020; Available online: https://statdb.luke.fi/PXWeb/pxweb/en/LUKE/?rxid=9dc1d1ef-f143-49af-aff3-61e935eadc8f (accessed on 14 September 2020).

- Statistics Finland. Consumer Price Index Release, Appendix table 3, Cost-of-living Index 1951:10=100. 2020. Available online: https://www.stat.fi/til/khi/2017/11/khi_2017_11_2017-12-14_tau_003_en.html (accessed on 16 September 2020).

- Laitila, J.; Väätäinen, K.; Kilpeläinen, H. Integrated harvesting of industrial roundwood and energy wood from clearcutting of a Scots pine-dominated peatland forest. Int. J. For. Eng. 2020, 31, 19–28. [Google Scholar] [CrossRef]

- Di Fulvio, F.; Kroon, A.; Bergström, D.; Nordfjell, T. Comparison of energy wood and pulpwood thinning systems in young birch stands. Scand. J. For. Res. 2011, 26, 339–349. [Google Scholar] [CrossRef]

- Di Fulvio, F.; Bergström, D. Analyses of a single-machine system for harvesting pulpwood and/or energy-wood in early thinnings. Int. J. For. Eng. 2013, 24, 2–15. [Google Scholar] [CrossRef]

- Karlsson, L.; Nyström, K.; Bergström, D.; Bergsten, U. Development of Scots pine stands after first biomass thinning with implications on management profitability over rotation. Scand. J. For. Res. 2015, 30, 416–428. [Google Scholar] [CrossRef]

- Niemistö, P.; Kilpeläinen, H.; Poutiainen, E. Effect of first thinning type and age on growth, stem quality and financial performance of a Scots pine stand in Finland. Silva Fenn. 2018, 52, 21. [Google Scholar] [CrossRef]

- Nuutinen, Y.; Miina, J.; Saksa, T.; Bergström, D.; Routa, J. Comparing the characteristics of boom-corridor and selectively thinned stands of Scots pine and birch. Silva Fenn. 2021, 55. [Google Scholar] [CrossRef]

- Assmuth, A.; Tahvonen, O. Optimal carbon storage in even- and uneven-aged forestry. For. Policy Econ. 2018, 87, 93–100. [Google Scholar] [CrossRef]

- Huuskonen, S.; Ahtikoski, A. Ensiharvennuksen ajoituksen ja voimakkuuden vaikutus kuivahkon kankaan männiköiden tuotokseen ja tuottoon. (The effect of the timing and intensity of the first thinning on the wood yield and economic yield of a pine stand on a fairly dry forest site type). Metsätieteen Aikakauskirja 2005, 2, 99–115. [Google Scholar]

- Huuskonen, S.; Hynynen, J. Timing and intensity of precommercial thinning and their effects on the first commercial thinning in Scots pine stands. Silva Fenn. 2006, 40, 645–662. [Google Scholar] [CrossRef]

- Ojansuu, R.; Mäkinen, H.; Heinonen, J. Including variation in branch and tree properties improves timber grade estimates in Scots pine stands. Can. J. For. Res. 2018, 48, 542–553. [Google Scholar] [CrossRef]

- Viiri, H. Parantaako vai heikentääkö metsänhoito metsien kestävyyttä metsätuhoja vastaan? (Does forest management in general improve or weaken the resilience towards abiotic and biotic damages?). Metsätieteen Aikakauskirja 2020. [Google Scholar] [CrossRef]

- Pukkala, T.; Miina, J.; Kurttila, M.; Kolström, T. A spatial yield model for optimizing the thinning regime of mixed stands of Pinus sylvestris and Picea abies. Scand. J. For. Res. 1998, 13, 31–42. [Google Scholar] [CrossRef]

- Hyytiäinen, K.; Ilomäki, S.; Mäkelä, A.; Kinnunen, K. Economic analysis of stand establishment for Scots pine. Can. J. For. Res. 2006, 36, 1179–1189. [Google Scholar] [CrossRef]

- Schwab, O.; Bull, G.; Maness, T. A mill-specific roundwood demand equation for southern and central Finland. J. For. Econ. 2005, 11, 95–106. [Google Scholar] [CrossRef]

- Morland, C.; Schier, F.; Janzen, N.; Weimar, H. Supply and demand functions for global wood markets: Specification and plausibility testing of econometric models within the global forest sector. For. Policy Econ. 2018, 92, 92–105. [Google Scholar] [CrossRef]

- Chudy, R.P.; Hagler, R.W. Dynamics of global roundwood prices—Cointegration analysis. For. Policy Econ. 2020, 115, 102155. [Google Scholar] [CrossRef]

| Stand Number | Main Tree Species | Site Type * | Stem Number/ha | Basal Area, m2/ha | Mean Height, m | Mean DBH **, cm |

|---|---|---|---|---|---|---|

| 1 | Scots pine | MT | 2044 | 24.63 | 9.58 | 15.13 |

| 2 | Norway spruce | MT | 1434 | 33.28 | 14.05 | 19.70 |

| 3 | Scots pine | MT | 1664 | 25.98 | 10.57 | 15.58 |

| 4 | Norway spruce | MT | 1689 | 35.68 | 13.67 | 18.33 |

| 5 | Norway spruce | Mtkg | 1320 | 32.95 | 14.29 | 20.21 |

| 6 | Norway spruce | Mtkg | 1481 | 26.72 | 12.47 | 17.71 |

| Felling Method | Pine Logs | Spruce Logs | Birch Logs | Pine Pulpwood | Spruce Pulpwood | Birch Pulpwood |

|---|---|---|---|---|---|---|

| Regeneration felling | 53.54 | 51.70 | 45.86 | 18.37 | 20.01 | 17.53 |

| Thinning | 47.18 | 48.78 | 38.59 | 14.85 | 16.23 | 14.04 |

| First thinning | 40.90 | 42.69 | 33.76 | 12.35 | 12.21 | 12.23 |

| First thinning Roadside prices 1 | 57.31 | 53.17 | -- | 27.79 | 32.12 | -- |

| First thinning Price of energy wood 2 | 23.18 | 23.18 | 23.18 | 23.18 | 23.18 | 23.18 |

| Silvicultural costs | ||||||

| Mounding | 405.90 € ha−1 | |||||

| Planting | 640.23 € ha−1 | |||||

| Seeding | 251.13 € ha−1 | |||||

| Early precommercial thinning | 369.96 € ha−1 | |||||

| Precommercial thinning | 452.68 € ha−1 | |||||

| Improvement of young stands | 458.64 € ha−1 | |||||

| Option | Stem/Tree Volume. dm3 | Cutting Removal. m3 ha−1 | Logging Cost. € m−3 |

|---|---|---|---|

| Traditional | 129.58 (44.28) 1 | 64.44 (14.83) [19.6] 4 | 20.51 (2.94) |

| Integrated | 131.30 (35.05) | 75.81 (16.00) [18.9] | 19.97 (2.74) |

| Energy wood, d.tems 2 | 110.67 (126.31) | 50.87 (6.60) | 20.10 (2.30) |

| Energy wood I 2 | 138.30 (29.40) | 59.91 (7.92) | 17.97 (1.57) |

| Energy wood II 3 | 145.00 (31.89) | 64.85 (8.68) | 17.66 (1.62) |

| Stand | Management option | Cutting Removal of the 1st Thinning, m3 ha−1 | Total Cutting Removal m3 ha−1 Ongoing b Future c | Rotation Period, yrs Ongoing Future | ||

|---|---|---|---|---|---|---|

| Stand 1 | Traditional | 45.0 (0.0) | 279.1 | 324.0 | 101 | 98 |

| Integrated | 54.0 (10.7) a | 266.2 | 356.3 | 94 | 104 | |

| Energywood stems | 46.0 (46.0) | 275.2 | 304.7 | 102 | 95 | |

| Energywood whole I | 52.0 (52.0) | 268.9 | 346.3 | 101 | 102 | |

| Energywood whole II | 52.0 (52.0) | 299.2 | 314.4 | 107 | 96 | |

| Stand 2 | Traditional | 76.0 (0.0) | 303.7 | 404.3 | 110 | 78 |

| Integrated | 88.0 (12.5) | 312.8 | 381.0 | 110 | 78 | |

| Energywood stems | 52.0 (52.0) | 311.9 | 426.0 | 111 | 81 | |

| Energywood whole I | 59.0 (59.0) | 319.2 | 442.6 | 111 | 83 | |

| Energywood whole II | 60.0 (60.0) | 315.8 | 420.3 | 110 | 80 | |

| Stand 3 | Traditional | 58.0 (0.0) | 352.0 | 355.9 | 91 | 87 |

| Integrated | 69.0 (11.6) | 361.6 | 369.9 | 91 | 89 | |

| Energywood stems | 47.0 (46.6) | 352.3 | 363.0 | 91 | 87 | |

| Energywood whole I | 57.0 (56.8) | 362.8 | 388.1 | 91 | 91 | |

| Energywood whole II | 68.0 (67.9) | 364.0 | 391.6 | 91 | 92 | |

| Stand 4 | Traditional | 82.0 (0.0) | 325.3 | 390.8 | 112 | 79 |

| Integrated | 95.0 (13.5) | 330.3 | 414.6 | 111 | 82 | |

| Energywood stems | 64.5 (64.5) | 320.9 | 413.1 | 110 | 82 | |

| Energywood whole I | 76.0 (75.7) | 335.9 | 437.8 | 112 | 85 | |

| Energywood whole II | 75.5 (75.5) | 332.4 | 423.3 | 111 | 83 | |

| Stand 5 | Traditional | 79.0 (0.0) | 304.7 | 402.6 | 110 | 78 |

| Integrated | 91.0 (13.3) | 317.0 | 413.8 | 111 | 79 | |

| Energywood Stems | 51.0 (50.9) | 317.6 | 425.7 | 112 | 81 | |

| Energywood whole I | 63.0 (62.5) | 323.3 | 442.8 | 112 | 83 | |

| Energywood whole II | 75.0 (74.5) | 332.4 | 423.3 | 111 | 83 | |

| Stand 6 | Traditional | 48.0 (0.0) | 295.7 | 381.2 | 111 | 77 |

| Integrated | 58.0 (9.5) | 325.5 | 428.7 | 111 | 81 | |

| Energywood Stems | 45.2 (45.0) | 298.2 | 372.4 | 111 | 76 | |

| Energywood whole I | 53.3 (53.0) | 303.8 | 385.8 | 111 | 78 | |

| Energywood whole II | 54.0 (53.6) | 312.6 | 399.2 | 114 | 80 | |

| Traditional | 64.4 (0.0) d | 310.1 | 376.5 | 105.8 | 82.8 | |

| Integrated | 75.8 (11.8) | 318.9 | 395.4 | 104.7 | 85.5 | |

| Average | Energywood stems | 50.8 (50.8) | 312.7 | 384.2 | 106.3 | 83.7 |

| Energywood whole I | 59.9 (59.9) | 319.0 | 407.2 | 106.3 | 87.0 | |

| Energywood whole II | 64.9 (64.9) | 326.1 | 395.3 | 107.3 | 85.7 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahtikoski, A.; Laitila, J.; Hilli, A.; Päätalo, M.-L. Profitability of the First Commercial Thinning, a Simulation Study in Northern Finland. Forests 2021, 12, 1389. https://doi.org/10.3390/f12101389

Ahtikoski A, Laitila J, Hilli A, Päätalo M-L. Profitability of the First Commercial Thinning, a Simulation Study in Northern Finland. Forests. 2021; 12(10):1389. https://doi.org/10.3390/f12101389

Chicago/Turabian StyleAhtikoski, Anssi, Juha Laitila, Anu Hilli, and Marja-Leena Päätalo. 2021. "Profitability of the First Commercial Thinning, a Simulation Study in Northern Finland" Forests 12, no. 10: 1389. https://doi.org/10.3390/f12101389

APA StyleAhtikoski, A., Laitila, J., Hilli, A., & Päätalo, M.-L. (2021). Profitability of the First Commercial Thinning, a Simulation Study in Northern Finland. Forests, 12(10), 1389. https://doi.org/10.3390/f12101389