Abstract

The 2008 credit crisis changed the manner in which derivative trades are conducted. One of these changes is the posting of collateral in a trade to mitigate the counterparty credit risk. Another is the realization that banks are not risk-free and, as a result, cannot borrow at the risk-free rate any longer. The latter led banks to introduced the controversial adjustment to derivative prices, known as a funding value adjustment (FVA), which is interlinked with the posting of collateral. In this paper, we extend the Cox, Ross and Rubinstein (CRR) discrete-time model to include collateral and FVA. We prove that this derived model is a discrete analogue of Piterbarg’s partial differential equation (PDE), which describes the price of a collateralized derivative. The fact that the two models coincide is also verified by numerical implementation of the results that we obtain.

JEL classifications:

C51; G12; C53; G01

1. Introduction

The 2008 credit crisis emphasized the importance of managing counterparty credit risk correctly. One of the ways to mitigate counterparty credit risk is by posting collateral within a derivative trade. Collateral is a borrower’s pledge of specific assets to a lender, to secure repayment of a liability.

For exchange traded derivatives, i.e., stock options, counterparty credit risk is reduced, because the two counterparties in the trade are required to post margins to the exchange. However, this does not fully eliminate counterparty credit risk. Central counterparty clearing houses (CCPs) are responsible for facilitating trades between the two counterparties. CCPs benefit both parties in a transaction, because they bear most of the credit risk; however, CCPs are not risk-free. As a result, counterparty credit risk is present in exchange traded derivatives. This paper focuses on over-the-counter (OTC) traded derivatives.

Mitigation of counterparty credit risk in OTC derivatives requires collateral, but the posting of collateral is not mandatory. The posting of collateral in a derivative trade is regulated by a credit support annex (CSA). A CSA is a contract that documents collateral agreements between counterparties in trading OTC derivative securities. The trade is documented under a standard contract, called a master agreement, developed by the International Swaps and Derivatives Association (ISDA).

Prior to the 2008 credit crisis, the London Interbank Offered Rate (LIBOR) was seen as an acceptable proxy for the risk-free rate. LIBOR is the rate at which banks could freely borrow and lend. The LIBOR rate includes a spread for the credit risk of the banks. An overnight interest rate swap (OIS) is a swap for which the overnight rate is exchanged for a fixed interest rate for a certain tenor (see Hull and White [1]). An overnight index swap references an overnight rate index, such as the Fed funds rate, as the underlying one for its floating leg, while the fixed leg would be set at an assumed rate.

The difference between LIBOR and the OIS rate is known as the LIBOR-OIS spread. Prior to the 2008 credit crisis, this spread was only a few basis points; it was stable and not significant (see Gregory [2] (p. 286)).

Hunzinger and Labuschagne [3] reports that the default of banks, such as Lehman Brothers and Bear Stearns, disproved the myth in the 2008 credit crisis that banks are risk-free. As a result, the LIBOR-OIS spread spiked to hundreds of basis points in the aftermath of the Lehman default in September 2008, and has remained significant ever since. The LIBOR-OIS spread reached 364.42 basis points (see Gregory [2]). These shifts made it apparent that LIBOR incorporates an adjustment for the credit risk of the banks; therefore, LIBOR is an imperfect proxy for the risk-free rate. The OIS rate appears to be the preferred choice as a proxy for the interest-free rate (see Hull and White [1]).

The 2008 credit crisis drove home the realization that banks are not risk-free, and banks became unable to borrow at preferential rates. This resulted in banks charging a funding value adjustment (FVA) on transactions. FVA is the difference between the price of the derivative and the collateral posted in the trade, multiplied by the difference between growing this amount at the funding rate and the collateral rate. This amount is then discounted back to the initial time. In essence, FVA is a correction made to the risk-free price of an OTC derivative to account for the funding cost in a financial institution.

The inclusion of FVA in pricing financial instruments is a controversial issue. Hull and White [4] argue against it. They argue that the funding costs and benefits realized in a trade violate the idea of risk-neutral pricing and should not be included in the pricing of the derivative. Inclusion of FVA into the price of a derivative trade violates the law of one price in the market, because the two counterparties will price a trade differently (also see Hull and White [1]).

Standard pricing theory ignores the intricacies of the collateralization of the market. The posting of collateral in a derivative trade changes the traditional way in which a derivative is priced. Piterbarg [5] notes fundamental facts regarding derivative pricing when collateral is posted. Posting collateral in an OTC trade may mitigate counterparty credit risk and funding costs; however, this depends on the collateral posted in the trade and how often this collateral is readjusted according to market movements.

Piterbarg [5] extends the Black-Scholes-Merton continuous-time model to include collateral in a derivative trade and also shows how the posting of collateral in a derivative trade affects the price. Piterbarg’s paper won him the Quant of the Year Award in 2011.

For more information on FVA and collateral, the reader is referred to Hull and White [6], Piterbarg [7] and Laughton and Vaisbrot [8].

In practice, a continuous-time model is difficult to implement and is usually discretized to facilitate implementation. The aims of this paper are to extend the Cox, Ross and Rubenstein (CRR) discrete-time model to include dividends and collateral, to discretize Piterbarg’s model, which includes collateral and dividends, and to show that the two resulting models coincide. Furthermore, we show that the difference in price of a CSA trade and a non-CSA trade is a funding value adjustment. The paper concludes with a numerical implementation of our results.

The paper is organized as follows: In Section 2, we extend the CRR model to include collateral on a dividend paying stock. In Section 3, we illustrate one of the main results in the paper, which is that the amount of collateral posted within a derivative trade will change the rate used to discount future expected cash flows. In Section 4, Piterbarg’s PDE, which represents the value of a collateralized derivative trade, is presented in a theorem. Next, in Section 5, the Feynman-Kac is applied to Piterbarg’s PDE in order to write the PDE as an expectation. A numerical implementation is provided in Section 6, followed by a concluding section.

2. The CRR Model with Collateral and Dividends

In this section, we extend the CRR model to include collateral on a dividend paying stock. The type of derivative replicated in this model is not specified, and it is assumed that the trade is between two counterparties that cannot default during the life of the trade.

The notation used is as in Piterbarg [5]. The three different interest rates and the dividend yield required are:

- the rate paid on collateral,

- the rate paid on a repurchase agreement of non-dividend paying stock,

- the rate paid on unsecured funding, and

- the dividend yield on the stock.

The relationship between the rates is:

It is further assumed that in this model, the rates are nominal annual compounded continuous (NACC) and deterministic.

The replicating portfolio, denoted by , is constructed in such a way that the portfolio perfectly replicates the derivative trade at all times and in all states of the world. The quantities constituting the replicating portfolio are:

- Δ amount of stock, and

- γ amount of cash.

2.1. Cash Account of the CRR Model with Collateral

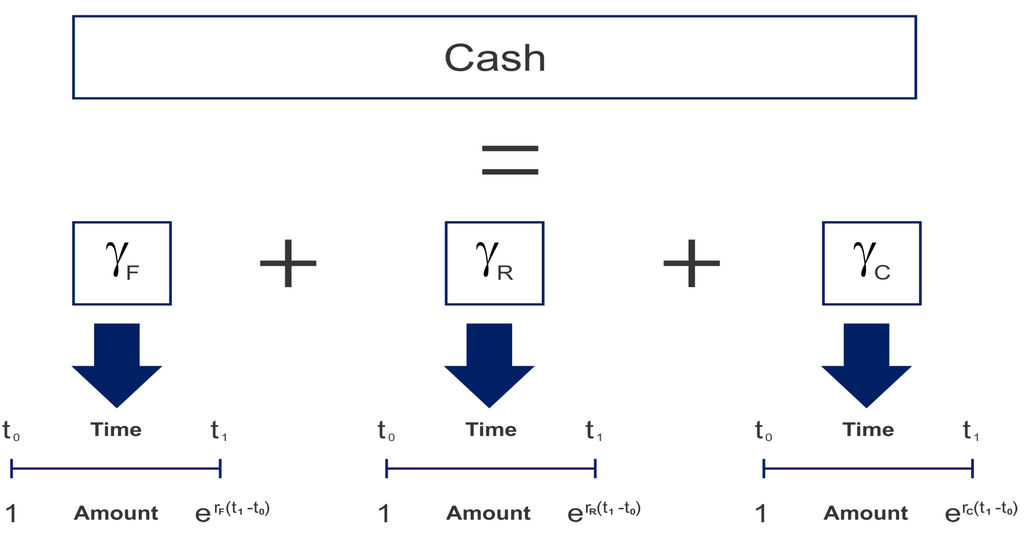

The cash amount, denoted by γ, can be split into three different accounts, namely a funding account, a repo account and a collateral account:

- The amount in the funding account is denoted by . This amount is the difference between two cash amounts, namely the price of the hedging portfolio and the collateral amount. The cash price of the hedging portfolio is denoted by , and the collateral amount is denoted by ; hence . This amount is the amount needed to be borrowed or lent at the unsecured funding rate, . The model makes the assumption that one can borrow or lend cash out at the funding rate without incurring counterparty credit risk.

- The amount in the repo account is denoted by . This account consists of the cash invested or borrowed in order to fund the stock position, , through a repurchase agreement.

- The amount in the collateral account is denoted by . This account contains the collateral posted with the counterparty. This account grows at the collateral rate . The assumptions made about the posted collateral in this model are that no hair cut is applied to the collateral value and that the currency of the collateral and the settlement of the derivative are the same.

The dividend amount, , is the value of the dividend paid on the stock position. When the stock is placed in a repurchase agreement, then the dividend paid by the stock is received by the counterparty holding the stock position in the repo. The counterparty that places the stock in the repo agreement will lose out on the dividend; however, the counterparty is compensated by only paying the repo rate less the dividend yield on the repurchase agreement. Therefore, the repo rate of a dividend paying stock is . The short rate of a particular interest rate at time is denoted by . This is the interest rate from time up to .

Figure 1 illustrates the three accounts that make up the cash account and the rates that are payable or earned on each account.

Figure 1.

Illustration of the various accounts making up the cash account and the rates payable/earned on each.

2.2. One Period Binomial Model with Collateral

The price of a derivative trade with collateral in a one period binomial is presented in the following theorem:

Theorem 2.1.

The price of a general collateralized derivative trade with the absence of counterparty credit risk in a one-period binomial model is:

The conditional expectation operator, denoted by , is conditioned on the stock price at time , where n is a natural number.

If it is assumed that the collateral rate is a proxy for the risk-free rate, then the price of the derivative trade is the sum of the risk-free price and a funding value adjustment,

where is the payoff of the derivative at time , is the amount of collateral posted in the trade at time and and are the short collateral and funding rates at time , respectively. The expectation is made under the -measure.

Proof.

The derivation makes use of a replicating portfolio. If the replicating portfolio is equal to the derivative trade at all times, then to avoid an arbitrage, the price of the derivative must be equal to the replicating portfolio. The initial value of the replicating portfolio consists of stock and γ cash, hence:

The different accounts in the cash amount are invested or borrowed in different bonds, where each bond follows the following processes in the binomial model:

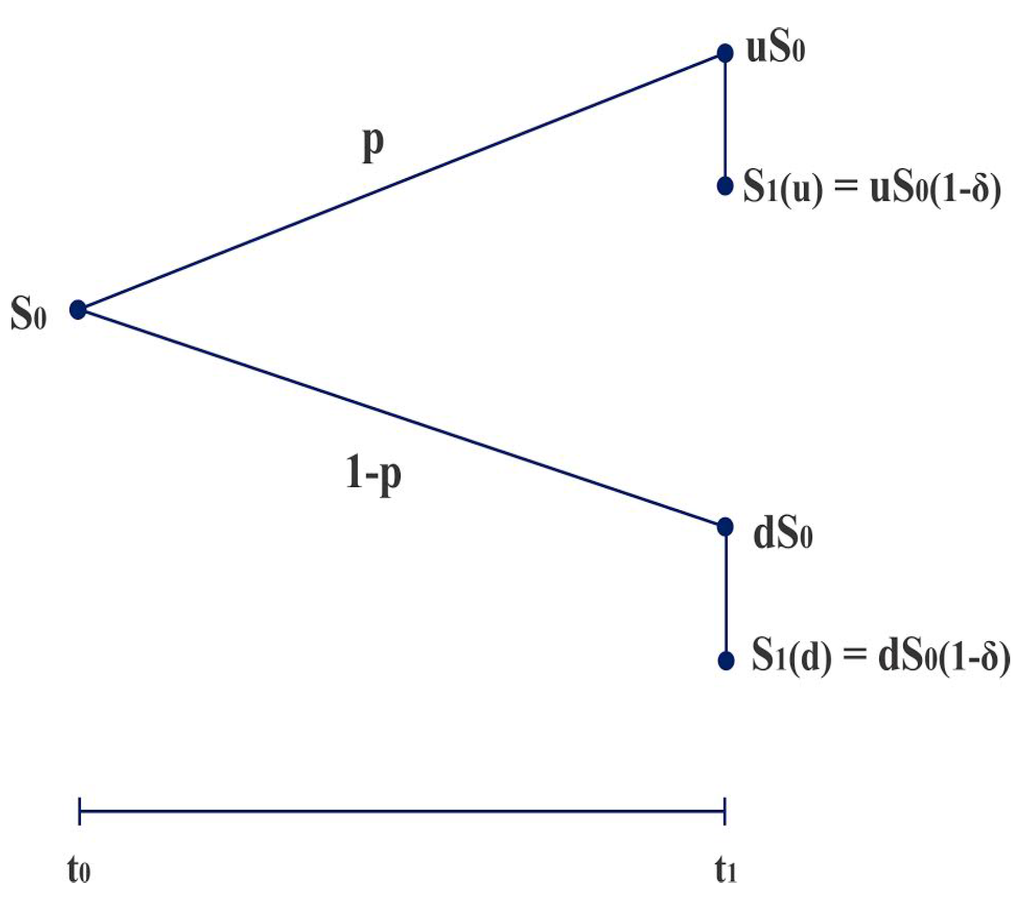

where and at time t all of the bonds are worth one, i.e., . In this discrete model, . The total growth of the cash accounts is the sum of the total growth of the individual bonds. At time , the stock pays a dividend. The stock price will drop by exactly the dividend amount paid at time . The dividend amount of the stock price is denoted by . The value of the dividend is dependent on the outcome of the stock movement. The value of the dividend at time is:

where u is the upward factor and d is the downward factor in the one-period binomial tree.

Figure 2 illustrates the drop in the stock price when paying out the dividend, where p is the real-world probability that the stock moves upwards and is the real-world probability that the stock moves downward.

Figure 2.

One-period binomial asset pricing model with a discrete dividend.

At , the replicating portfolio has two possible outcomes:

The parameters and are now chosen, so that the replicating portfolio is equal to the derivative price at time ; therefore, the following two equations hold:

where . We subtract Equation (3) from Equation (2) and solve for ; hence, the delta of the stock position is:

To solve for , the value of is substituted back into Equation (2), to obtain the following:

Simplifying and rearranging terms and making the substitution yields:

The repo account can be written as:

therefore, substituting Equation (6) into Equation (5) and simplifying yields:

The parameters and have been chosen, such that the replicating portfolio perfectly replicates the derivative payoff. If a contingent claim can be perfectly replicated, then to avoid an arbitrage, the price of the derivative has to be equal to the cost of the replicating portfolio; therefore, the price of the derivative is:

If we define q as:

where , then . Equation (7) can then be written as:

If we interpret q, in Equation (8), as the probability of an upward movement in the stock price, then the expectation of the stock price at time can be written as:

therefore, under this measure, called the -measure, the stock price drifts at the repo rate less the dividend yield. The value of the derivative trade at time can be written as:

where the expectation is taken under the -measure and is the amount of collateral posted in the trade at time . We can rearrange the terms in the above equation in order to write the price of the derivative trade as:

If we assume that the collateral rate is a proxy for the risk-free rate, then the price of the derivative trade is the sum of the risk-free price and a funding value adjustment. The risk-free price is obtained by pricing the derivative trade using the CRR model (see Cox et al. [9]). ☐

2.3. n-Period Binomial Model with Collateral

Next, the one-period model is extended to an n-period model.

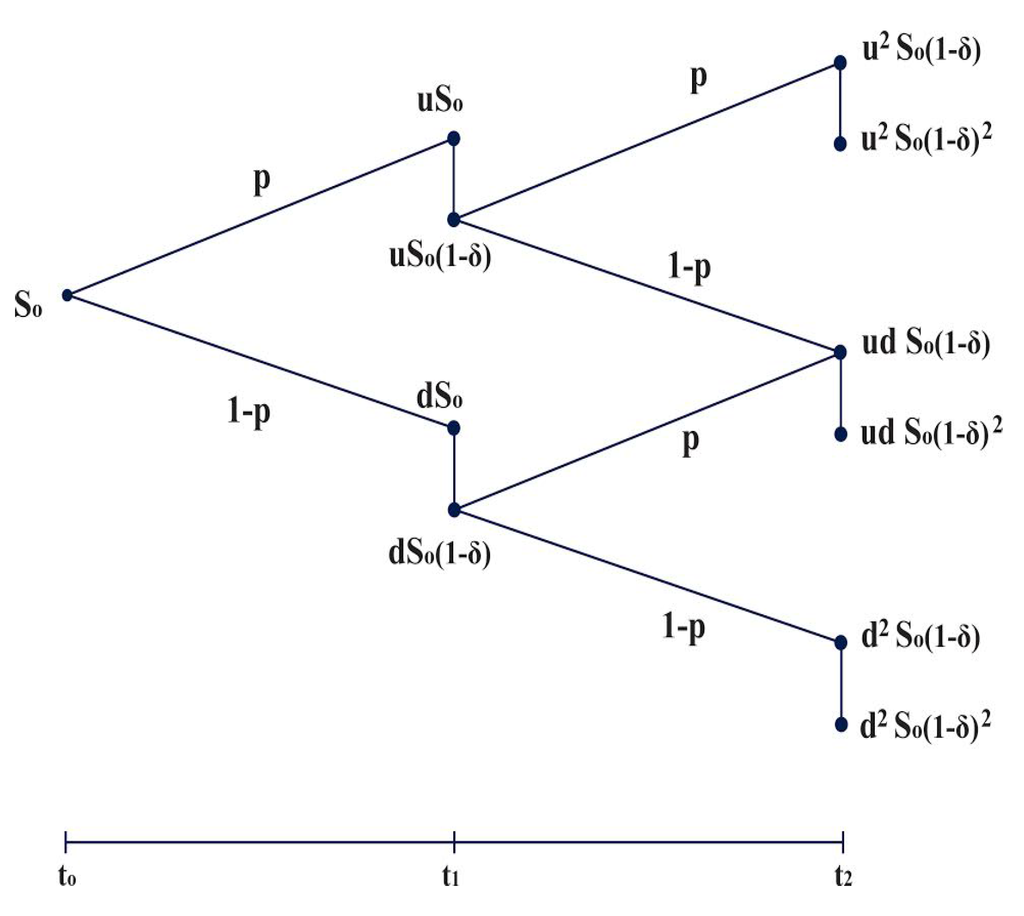

A two-period binomial asset pricing model with discrete dividends is illustrated in Figure 3.

Figure 3.

Two-period binomial asset pricing model with discrete dividends.

The price of a collateralized derivative trade in an n-period model is presented in the following theorem:

Theorem 2.2.

The price of a general collateralized derivative trade with the absence of counterparty credit risk in an n-period binomial model is:

where the expectation is under the -measure. If the collateral rate is assumed to be a proxy for the risk-free rate, then the price of the derivative trade in an n-period binomial model can be written as the sum of the risk-free price and a funding value adjustment,

where is the value of the derivative at time , is the amount of collateral posted in the trade at time and and are the short collateral and funding rates at time , respectively.

Proof.

The proof makes use of the Tower property to extend the one-period model to n periods. The one-period binomial model in Equation (10) holds for the -period; therefore,

where . The price of the derivative at time is:

and the price of the derivative at time is:

Substituting Equation (13) into Equation (14) gives us:

The Tower property states that if , where n and m are natural numbers, then:

(see Shreve [10], Theorem 2.3.2, p. 33). Applying the Tower property to the conditional expectations and because the rates are deterministic, Equation (15) becomes:

If one repeats this methodology, then the initial price of the derivative trade is:

If Equation (12) is written as:

and the same methodology that was applied to Equation (12) is applied to Equation (17), and provided that the collateral rate is used as a proxy for the risk-free rate, then the price of the collateralized derivative trade can be written as the sum of the risk-free price and a funding value adjustment,

☐

We will show that this is the discrete analog of the model presented in Piterbarg [5].

By examining Equation (18), we see that the price of the derivative is the risk-free price plus a funding value adjustment. The funding value adjustment can be split into two terms, namely a funding benefit adjustment and a funding cost adjustment:

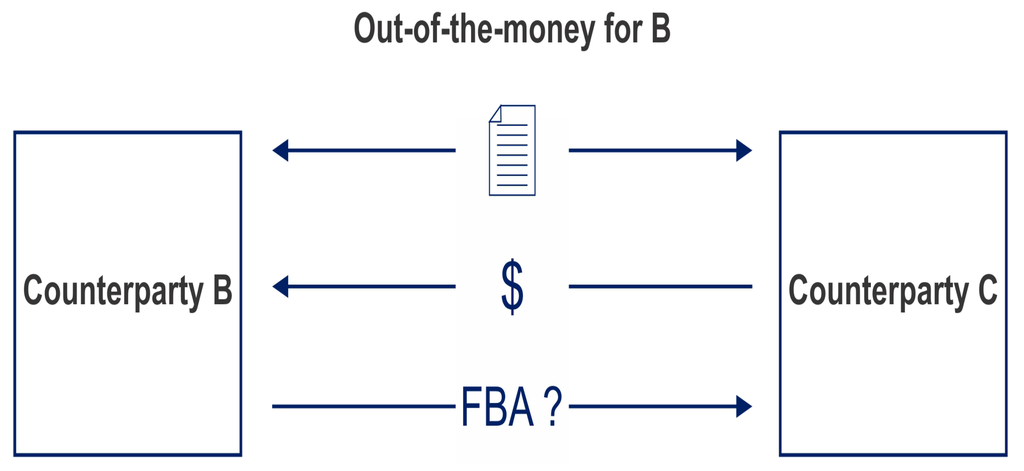

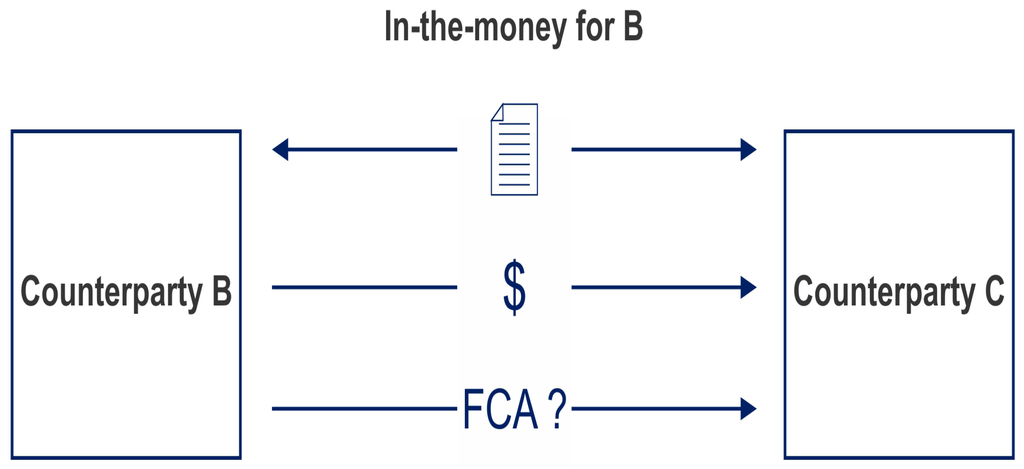

Consider two counterparties, B and C. Let us assume that Counterparties B and C enter into a trade. The funding benefit (cost) adjustment term is the extra benefit (cost) gained (paid) in a trade from investing (borrowing) cash at a higher rate than the risk-free rate.

Let us also assume Counterparty B is a bank and enters into a trade that has an unfavorable mark-to-market. Counterparty B will receive a premium when entering into the trade. If B has to give back this premium by a CSA, then there is no funding benefit. However, if the trade is entered into with no CSA, then B will place the premium of the trade on the money market desk and earn a rate better than the collateral rate earned if B had to place these funds as collateral to C. This discounted value of the spread earned by B on the value of the derivative is known as the FBA. It is determined by B whether or not to give some portion of the FBA back to C, as depicted by Figure 4.

Let us assume now that the two counterparties enter into another trade. This time, Counterparty B enters into a trade that has a favorable mark-to-market to the bank. In this case, B will pay a premium to Counterparty C. If full collateral is required by a CSA, then C will pay back the premium as collateral, and no funding cost is incurred. In this case, Counterparty B will be effectively funding the premium at the collateral rate. However, if no collateral is posted by C, then the premium paid by B will have to be funded through the bank’s treasury desk at a funding rate. This funding rate will be greater than the rate paid on the collateral. This discounted value of the spread paid on the value of the derivative is known as the FCA(see Figure 5).

These arguments only hold if rehypothecation is possible. Rehypothecation means that banks and brokers use, for their own purposes, assets that have been posted as collateral by their clients. Hull and White [4] argue that this excess cost has to be absorbed by the trading desk and not passed to the client, as suggested in this example.

Figure 4.

Illustrating a trade graphically between Counterparties B and C when Counterparty B is out-of-the-money.

Figure 5.

Illustrating a trade graphically between Counterparties B and C when Counterparty B is in-the-money.

Next, we show that the amount of collateral posted in the trade will determine which rate must be used to discount future expected cash flows.

3. Collateral and Determining a Discount Factor

Consider two different values of collateral for Equation (12). When for , which is the case when the seller has to place collateral toward the value of the derivative at every node in the tree, then Equation (18) becomes:

The result that emerges is that if full collateral is posted at each node, then to value the derivative trade, future expected cash flows are discounted using a collateral curve. However, if no collateral is posted throughout the life of the trade, then to value the derivative trade, future expected cash flows are discounted using a funding curve of the bank. We want to stress that this model is a function of market rates only. The theoretical risk-free rate is not present in the pricing formula.

Next, we consider the case when the amount of collateral posted in the trade is some fractional amount of the derivative’s value.

3.1. Partial Collateralization

When entering into a CSA agreement, the two counterparties have to agree on what collateral will be posted, i.e., cash or bonds, and how much collateral needs to be posted. The above model can be generalized by letting the amount of collateral posted in a derivative trade become a fractional amount of the value of the derivative. Letting the collateral amount be some fractional amount of the derivative value in Equation (12) yields:

Solving for , we get:

The rate is defined as:

so that:

and we can write:

Repeating the previous arguments, we get that:

The two special cases are when and , for all i; this corresponds to values of and , respectively. The discount factor rate will be if no collateral is posted and if collateral toward the value of the derivative is posted at each discrete time point throughout the tree.

The following section derives the continuous analogue of the model presented in this section.

4. Black-Scholes-Merton PDE with Collateral and Dividends

In this section, Piterbarg’s Black-Scholes-Merton PDE, which includes collateral on a dividend paying stock, is considered. The stock price process is assumed to follow:

where is a constant, σ is the volatility of the stock and is a standard Brownian motion; and the stock pays a continuous dividend yield.

A self-financing (i.e., no money is injected or extracted) replicating portfolio of the derivative is constructed. The replicating portfolio consists of a stock position and cash,

As in the discrete analog, the cash account is invested or borrowed in different bonds, which satisfy the following bond processes:

where and, at time t, the value of each of the bonds is worth one. In order to compute the change in the derivative’s price, Itô’s lemma (see Itô [11] and Itô [12]) is used. Itô’s lemma is stated in terms of the stock process in Equation (25).

Lemma 4.1.

Piterbarg’s Black-Scholes-Merton PDE with collateral (see Piterbarg [5]) is given in the following theorem.

Theorem 4.2.

The value of a general collateralized derivative trade with the absence of credit risk on a dividend paying stock satisfies the following PDE:

We refer the reader to Piterbarg [5] for a proof of Theorem 4.2.

If , where r is the risk-free rate, i.e., secured lending and unsecured lending occur at the same rate and at the risk-free rate, then Theorem 4.2 reduces to the original Black-Scholes-Merton PDE for a dividend paying stock.

5. Discretizing the Piterbarg Model Yields the CRR Model with Collateral

In this section, the aim is to show that discretizing the Piterbarg model yields the CRR model with collateral as derived in Section 2. This is achieved by applying the Feynman-Kac theorem to Piterbarg’s PDE, which yields the PDE in the form of an expectation. This shows that the price of a derivative, in both the discrete-time and continuous-time case, can be written as an expectation and makes it easy to compare the two models.

The Feynman-Kac theorem (see Karatzas and Shreve [14]) can be stated as:

Theorem 5.1.

Suppose that:

- is continuous, is of class and satisfies the Cauchy problem:where the function is the final payoff of the derivative contract and is the stock process, and

- also satisfies the polynomial growth condition:for some .

Then, admits the stochastic representation:

on , where is the filtration generated from the Brownian motion in the stock price process and the expectation is under the -measure. In particular, such a solution is unique.

Next, we write the PDE in Theorem 4.2 in the form of an expectation:

Corollary 5.2.

The price of a general collateralized derivative trade with the absence of counterparty credit risk is:

where the expectation is under the -measure 2. If the collateral rate is assumed to be a proxy for the risk-free rate, then the price of the derivative trade can be written as the sum of the risk-free price and a funding value adjustment:

Proof.

The Feynman-Kac theorem is now applied to Theorem 4.2 by rearranging the terms in the PDE as follows:

The application of the Feynman-Kac theorem yields:

We can also write Equation (29) as:

and using the Feynman-Kac theorem, the price of the derivative can be written as:

☐

6. Numerical Implementation

We provide a numerical implementation of Piterbarg’s model. The model is implemented using a PDE approach and a binomial lattice approach. We show how the two methods converge to a unique price when pricing a collateralized European put option. The difference in price between a collateralized derivative and non-collateralized derivative is shown numerically. Finally, an analysis is provided to show that there still exists significant credit risk, even when collateral, to the value of the mark-to-market of derivative, is posted within a trade.

6.1. PDE Approach

Finite difference schemes are used to approximate the solutions to differential equations, which is a parabolic partial differential equation in this case. We use an implicit Euler scheme to approximate the price surface of a general derivative trade (see Brandimarte [15]) satisfying Piterbarg’s PDE. The implementation of the implicit Euler scheme is based on the work by Richardson [16].

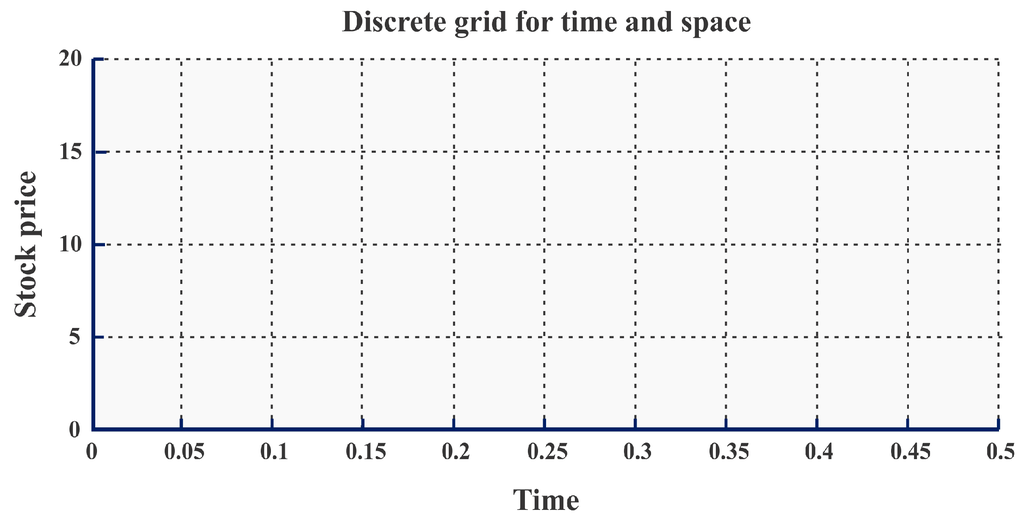

The asset value discretisation is given by , and the time discretisation is given by . The value of the derivative at each grid point is denoted by

where and . Figure 6 is an illustration of the time and space grid used to approximate the PDE.

Figure 6.

Discrete grid of time and space.

We are solving backwards in time from expiry of the option; therefore, a backward difference approximation is used for the first time derivative. A central difference is used for the first space derivative, because it yields a more accurate approximation than a forward or backward difference, and a second-order difference approximation is used for the second space derivative. In order to give more insight into the workings of implementing this PDE numerically, we refer the reader to Appendix A.

The terminal and boundary conditions for a European put option are the following:

where is defined in Equation (23).

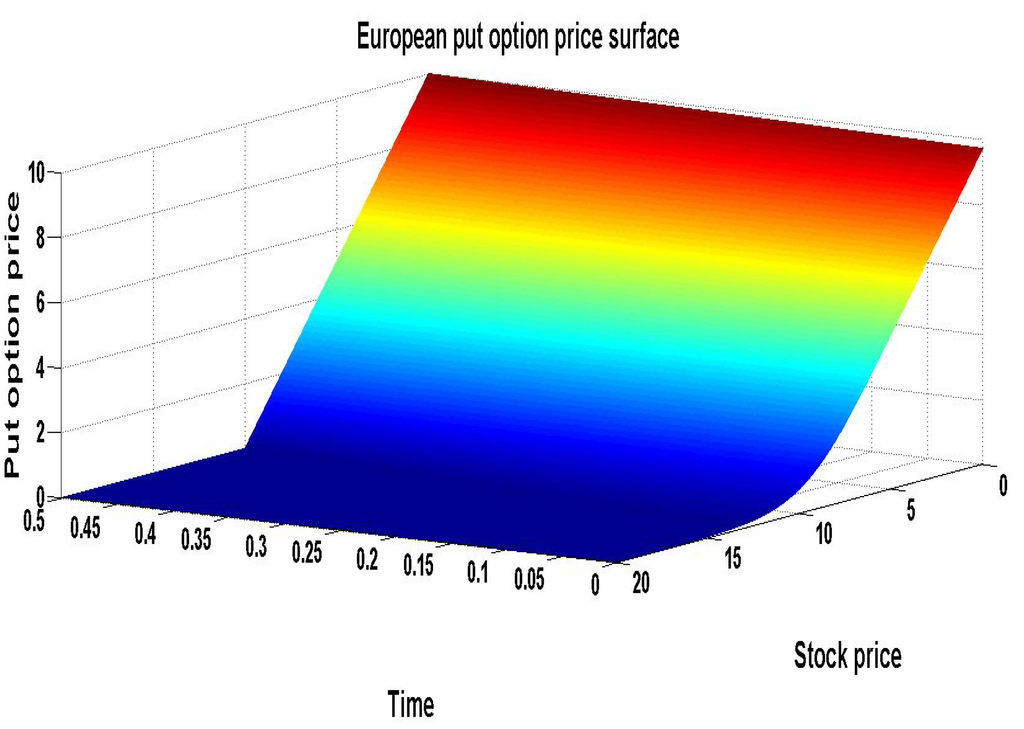

Figure 7 illustrates the price surface of a European put option with parameters: , , (5000 time increments), (1000 space increments), , , , , , , .

Figure 7.

Collateralized European put option surface using the PDE approach with parameters: S0 ∈ [0, 20], K = 10, dt = 0.0001 (5000 time increments), ds = 0.02 (1000 space increments), T = 0.5, t ∈ [0, T], rC = 0.04, rR = 0.05, rF = 0.06, rD = 0.01, σ = 0.3 and θ = 1.

6.2. Binomial Lattice Approach

The price of the same European put option is computed using the binomial asset pricing model derived in Section 2.

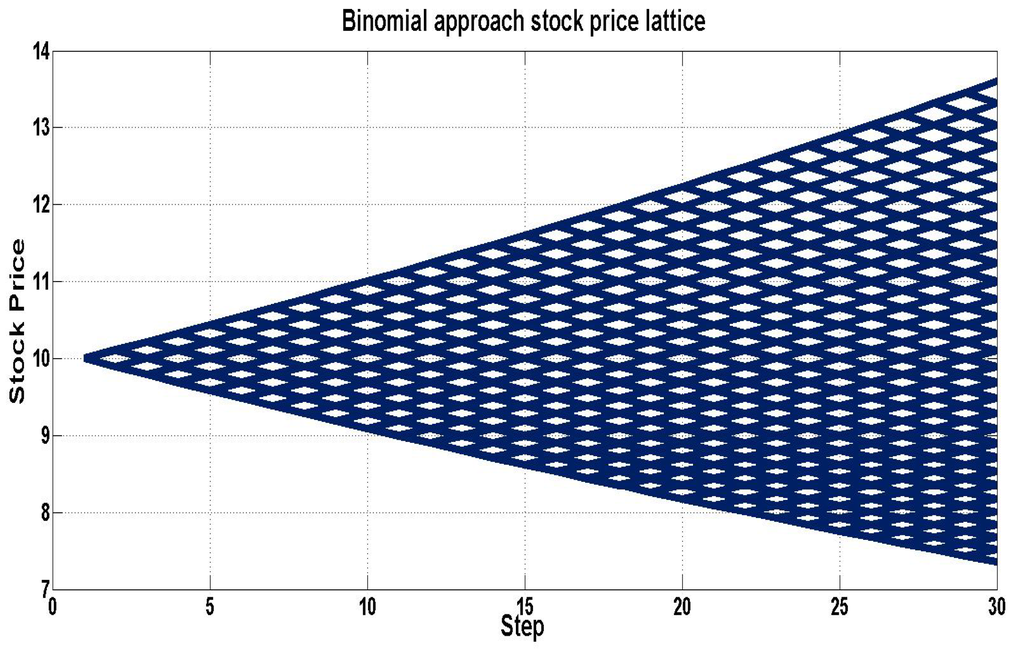

Let u be the upward factor and d the downward factor of the stock price. When constructing a binomial tree to represent the movements in a stock price, the parameters u and d are chosen to match the volatility and the drift of the stock price process. The parameters u and d are estimated using the method of moments (see Higham [17]) in order to match the drift and volatility of the stock price.

In order to give more insight into the workings of the method, the values of u and d are derived from first principles. The derivation of the parameters in the binomial asset pricing model are provided in Appendix B.

The up and down factors of a dividend paying stock in the binomial tree are:

and:

The probability of an upward movement is:

The time difference between each node in the tree, i.e., , is constant; therefore, we do not index u, d and q.

The parameters for the stock price process are: , for all i, , and . Figure 8 illustrates a binomial asset price lattice.

Figure 8.

Stock price binomial lattice with parameters: µ = 1.039576, d = 0.962091, ℙ(up) = 0.5 and n = 30.

The binomial asset pricing model is used to price the same European put option as in the PDE approach with the parameters: , , (5000 time increments), , , , , , .

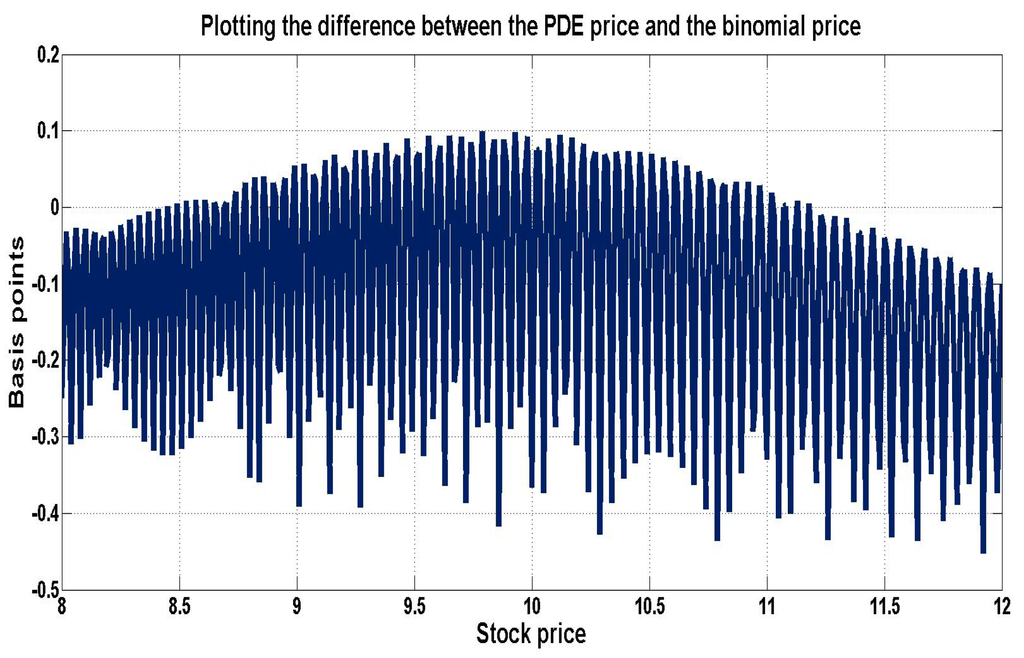

In Figure 9, the difference between the PDE and binomial model approaches are graphically illustrated for varying initial stock prices. This shows that the two approaches converge to within basis points of each other for the given parameters. The case when no collateral is posted also has similar convergence.

Figure 9.

Difference between the PDE price and the binomial lattice price for a collateralized European put option with parameters: , , (5000 time increments), ds = 0.02 (1000 space increments), , , , , , .

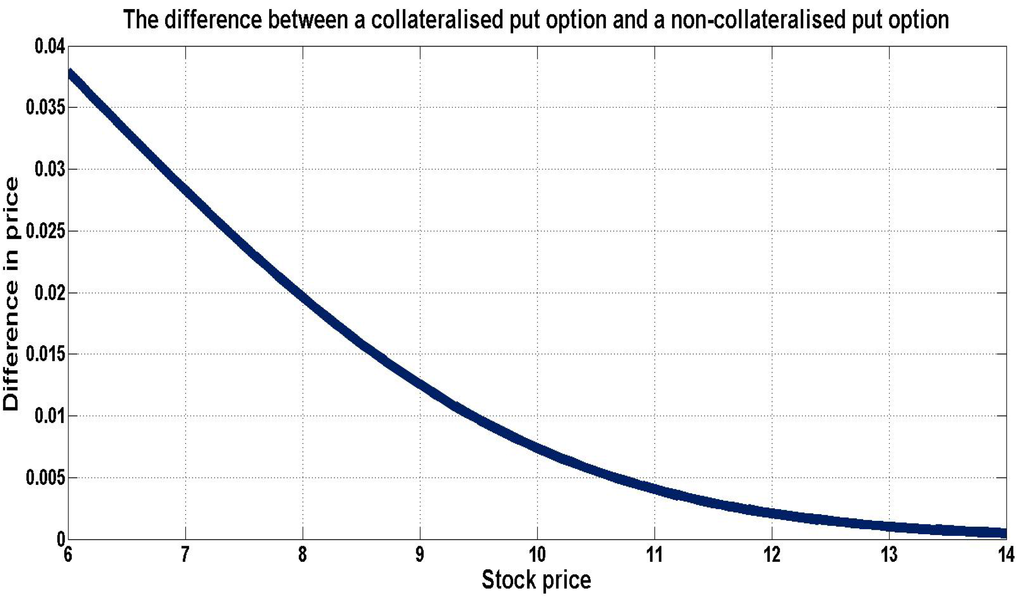

The same European put option is priced; however, this time, the trade is not collateralized. The difference in price of the two put options is plotted for varying initial stock prices in Figure 10. The difference is positive; therefore, the price of a collateralized European put option is higher than that of the non-collateralized put. The difference represents the funding value adjustment of a non-collateralized put option.

Since:

for a European put option, the funding benefit adjustment reduces to zero, and hence, . The shape of the FCA term is similar to the initial price of a European put option. As illustrated in Figure 10, the funding cost adjustment will increase when the underlying put option value increases. This happens when the initial stock price decreases.

Figure 10.

Difference in price between a collateralized European put option and a non-collateralized European put option for various initial stock prices with parameters: , , (5000 time increments), ds = 0.02 (1000 space increments), , , , , , .

Table 1 illustrates the at-the-money prices of the European put option for the PDE and binomial model approaches when collateral is posted and when no collateral is posted. This shows that when a European put option is traded with collateral, then the price of the derivative will be greater than the price of the same derivative, which does not include collateral.

Table 1.

Summary of collateralized and non-collateralized European put option prices for the PDE approach and the binomial lattice approach with parameters: , , , , , , .

| European Put Option | PDE Price | Binomial Lattice Price |

|---|---|---|

| Full collateral | 0.741011 | 0.740992 |

| No collateral | 0.733637 | 0.733619 |

| FCA | −0.007374 | −0.007372 |

6.3. Default Risk Caused by Readjusting Collateral at Discrete Times

Next, we investigate the default risk of adjusting collateral at discrete time points in a derivative trade.

If the market were to move substantially between two realigning (margining) dates, a significant loss could be faced if a counterparty defaults.

We illustrate that even when a derivative trade is fully collateralized and margined daily, there still exists significant counterparty credit risk. A specific realization path for a European put option is simulated. The European put option that we use is a three-year put with the following parameters: and . Three different margin periods are considered, namely a one-day period, a ten-day period and a one-month period. The assumption is made that the seller of the option places the mark-to-market of the option as collateral at each discrete time point. The seller earns the collateral rate on the posted margin. At the initial time , the seller receives the premium for the put option and, at the same time, returns the premium as collateral; hence, . Then, after time, the value of the buyers position in the trade is:

where represents the length of the margin period.

At time , the collateral posted with the buyer is readjusted to the value of . At each of the discrete margin time points, the difference between the exposure of the put option and the collateral amount in the margin account before readjustment is represented as a percentage of the exposure of the option; hence:

where . The default risk at each of the discrete margin time points is plotted in a histogram represented in Figure 11.

Figure 11.

The distribution of the default risk of a collateralized European put option for three different recollateralization periods with parameters: , T = 3 and

Figure 11 illustrates the distribution of the default risk for each of the values, namely one month, one week and one day. A normal distribution is superimposed over each default risk distribution. From Figure 11, one can see that as the margin period becomes shorter, the distribution of the default risk becomes less disperse and the distribution becomes more normal. Even for a margin period of one day, as in an exchange, there still exists significant default risk. If the seller of the European put option defaults on the trade between margin periods, then the buyer could lose up to 5% of the value of the European put option if the , for all i, is one day and up to 30% if , for all i, is one month. The margin period for an OTC derivative trade between a bank and its client may be up to one month, disproving the myth that full collateral completely mitigates credit risk exposure. Thresholds have not been taken into account; however, if these were considered in the margining, then the dispersion of the default risk distribution would be even wider.

7. Conclusions

A replicating portfolio is used to extend the CRR discrete-time binomial model to include collateral on a dividend paying stock.

The continuous-time model of Piterbarg, which extends the Black-Scholes-Merton model to include collateral on a dividend paying stock is considered. An application of the Feynman-Kac theorem to Piterbarg’s PDE provides a description of Piterbarg’s model in terms of a conditional expectation (with respect to the -measure). The latter form of the model shows that the discrete version of the Piterbarg model and the discrete-time CRR model (as derived in Section 2) coincide.

The description of Piterbarg’s model in terms of a conditional expectation also indicates that the amount of collateral posted determines which discount factor is used when valuing a general derivative. If the value of the collateral posted with the counterparty is equal to the value of the derivative during the life of the trade, then in order to price the derivative, the future expected cash flows are discounted using the collateral curve. If no collateral is posted, then the value of the derivative is obtained by discounting future expected cash flows using the funding curve of the bank.

The results are numerically implemented. The discrete version and the continuous version of this model converge when the number of periods in the binomial lattice is large and the time increments in the PDE’s grid discretisation tend to zero. The credit risk for three margin periods in a derivative trade is considered, and it is shown that even when a trade is fully collateralized, there still exists credit risk within the trade, because of the period between margin dates.

Subsequent to the paper by Piterbarg [5], Hull and White [18], Burgard and Kjaer [19] and Burgard and Kjaer [20] have extended derivative pricing to include bilateral credit risk and funding costs. These approaches include adjustments, such as a credit value adjustment (CVA), a debit value adjustment (DVA) and a collateral value adjustment (CollVA), in derivative pricing. However, it appears that not all academics, practitioners and regulators agree on which adjustments should be included in pricing a derivative.

The Basel III Accord extensively advises on CVA. However, as yet, it does not seem to provide any substantial direction on the controversial notations of DVA and FVA. This poses problems in terms of derivative pricing and the accounting of derivatives on the balance sheet (see KPMG [21]).

In our view, these are currently the greatest challenges facing derivative pricing.

Acknowledgments

The authors would like to thank Carolus Reinecke for many helpful discussions. The second named author would also like to thank the NRF(Grant Number 87502) for financial support. We also would like to acknowledge the two anonymous reviewers for their helpful comments and suggestion.

Author Contributions

The authors contributed jointly to the paper.

Appendix: Derivations

A. Solving the Piterbarg PDE Numerically

Using the approximations described in Section 6.1, the discretisation of the Piterbarg PDE, given in Theorem 4.2, is:

where is the value of collateral posted in the trade at time and stock price . In the implementation of the model, throughout the various methods, we assume that all rates are constant. We also assume that the collateral amount can be written as some fractional amount of the value of the derivative,

which yields:

Rearranging Equation (A2) yields:

where:

These equations can be written in matrix form:

where the matrix M and the vector is defined as:

The value of is known, and is the quantity we require; therefore,

for . The two extreme cases for the value of the collateral are considered. The first case is when the collateral amount is zero, i.e., . In this case, Equation (A3) becomes:

The second case is when collateral toward the value of the derivative is posted continuously, i.e., . In this case, Equation (A3) becomes:

B. Deriving the Parameters for the Binomial Asset Pricing Model

Different authors appear to have slightly different views on how to approach this problem; however, all are based on the original binomial method of Cox et al. [9]. We take the approach by Higham [17]. The method of moment matching is used in order to solve for the parameters u and d.

Let q be the probability of an upward movement of the stock and be an i.i.d Bernoulli random variable, such that:

and and . If , then the stock moves up, and if , then the stock moves down on the step; therefore, the stock price at time is given by:

where n is the number of steps in the tree. Rearranging Equation (A7), we have that:

Taking logs of both sides of the equation yields:

Before applying the method of moment matching, we first need to calculate the expected value and variance of the log returns of the stock process. The stock process is given by the following stochastic differential equation:

From It’s lemma, we know that:

and by integrating both sides:

where . Taking the expected value and variance of Equation (A12) yields:

and:

We now match the expected values in Equations (A9) and (A13) and the variances in Equations (A10) and (A14) to obtain the following two equations:

We have two equations and three unknowns, namely q, u and d. We fix one of the three parameters and solve for the other two. To pick out a particular solution, the probability parameter is set to , and then, the other two parameters are solved using Equations (A15) and (A16); hence, for all :

and:

where .

Conflicts of Interest/Disclaimer

The authors declare no conflict of interest.

This paper represents the views of Chadd B. Hunzinger alone and not the views of Rand Merchant Bank.

References

- J. Hull, and A. White. “LIBOR vs. OIS: The derivatives discounting dilemma.” J. Invest. Manag. 11 (2013): 14–27. [Google Scholar]

- J. Gregory. Counterparty Credit Risk and Credit Value Adjustment—A Continuing Challenge for Global Financial Markets, 2nd ed. London, UK: Wiley & Sons Ltd., 2012. [Google Scholar]

- C. Hunzinger, and C.C.A. Labuschagne. “The Cox, Ross and Rubinstein tree model which includes counterparty credit risk and funding costs.” North Am. J. Econ. Financ. 29 (2014): 200–217. [Google Scholar] [CrossRef]

- J. Hull, and A. White. “The FVA debate.” Risk Mag. 25 (2012): 83–85. [Google Scholar]

- V. Piterbarg. “Funding beyond discounting: Collateral agreements and derivatives pricing.” Risk Mag. 23 (2010): 97–102. [Google Scholar]

- J. Hull, and A. White. “Valuing derivatives: Funding value adjustments and fair value.” Financ. Anal. J. 70 (2014): 46–56. [Google Scholar] [CrossRef]

- V. Piterbarg. “Cooking with collateral.” Risk Mag. 25 (2010): 58–63. [Google Scholar]

- S. Laughton, and A. Vaisbrot. “In defence of FVA.” Risk Mag. 25 (2012): 18–24. [Google Scholar]

- J. Cox, S. Ross, and M. Rubinstein. “Option pricing: A simplified approach.” J. Financ. Econ. 7 (1979): 229–263. [Google Scholar] [CrossRef]

- S. Shreve. Stochastic Calculus for Finance 1—The Binomial Asset Pricing Model, 1st ed. New York, NY, USA: Springer, 2004. [Google Scholar]

- K. Itô. “Stochastic integral.” Proc. Imp. Acad. Tokyo 20 (1944): 519–524. [Google Scholar] [CrossRef]

- K. Itô. “On stochastic differential equations.” Mem. Am. Math. Soc. 4 (1951): 1–51. [Google Scholar]

- J. Björk. Arbitrage Theory in Continuous Time, 2nd ed. New York, NY, USA: Oxford University Press Inc., 2004. [Google Scholar]

- I. Karatzas, and S.E. Shreve. Brownian Motion and Stochastic Calculus, 2nd ed. New York, NY, USA: Springer, 1991. [Google Scholar]

- P. Brandimarte. Numerical Methods in Finance & Economics, 2nd ed. New Jersey, NJ, USA: John Wiley & Sons Publications, 2006. [Google Scholar]

- M. Richardson. “Numerical Methods for Option Pricing.” PhD Thesis, Mathematical Institute, University of Oxford, Oxford, UK, 2009. [Google Scholar]

- D. Higham. An Introduction to Financial Option Valuation. Cambridge, UK: Cambridge University Press, 2008. [Google Scholar]

- J. Hull, and A. White. “Collateral and credit issues in derivatives pricing. Forthcoming.” J. Credit Risk. [CrossRef]

- C. Burgard, and M. Kjaer. “Partial differential equation representations of derivatives with bilateral counterparty risk and funding costs.” J. Credit Risk 7 (2011): 75–93. [Google Scholar] [CrossRef]

- C. Burgard, and M. Kjaer. “Generalised CVA with funding and collateral via semi-replication. ” [CrossRef]

- KPMG. “Challenges facing the South African derivatives market.” In Bank Survey Report. Johannesburg, South Africa: KPMG, 2013. [Google Scholar]

- 1.Here, means that the first partial derivative with respect to time of the function is continuous and that the second derivative of the function with respect to the space variable, i.e., , is also continuous.

- 2.The filtration is not included in the expectation operator for ease of notation. The subscript in the conditional expectation, i.e., , indicates that the expectation is conditioned on the filtration at time t.

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).