Digital Asset Adoption in Inheritance Planning: Evidence from Thailand

Abstract

1. Introduction

2. Literature Review

2.1. Digital Assets and Inheritance: An Overview

2.2. Demographic Factors

2.3. Knowledge and Awareness of Digital Assets

2.4. Risk Perception

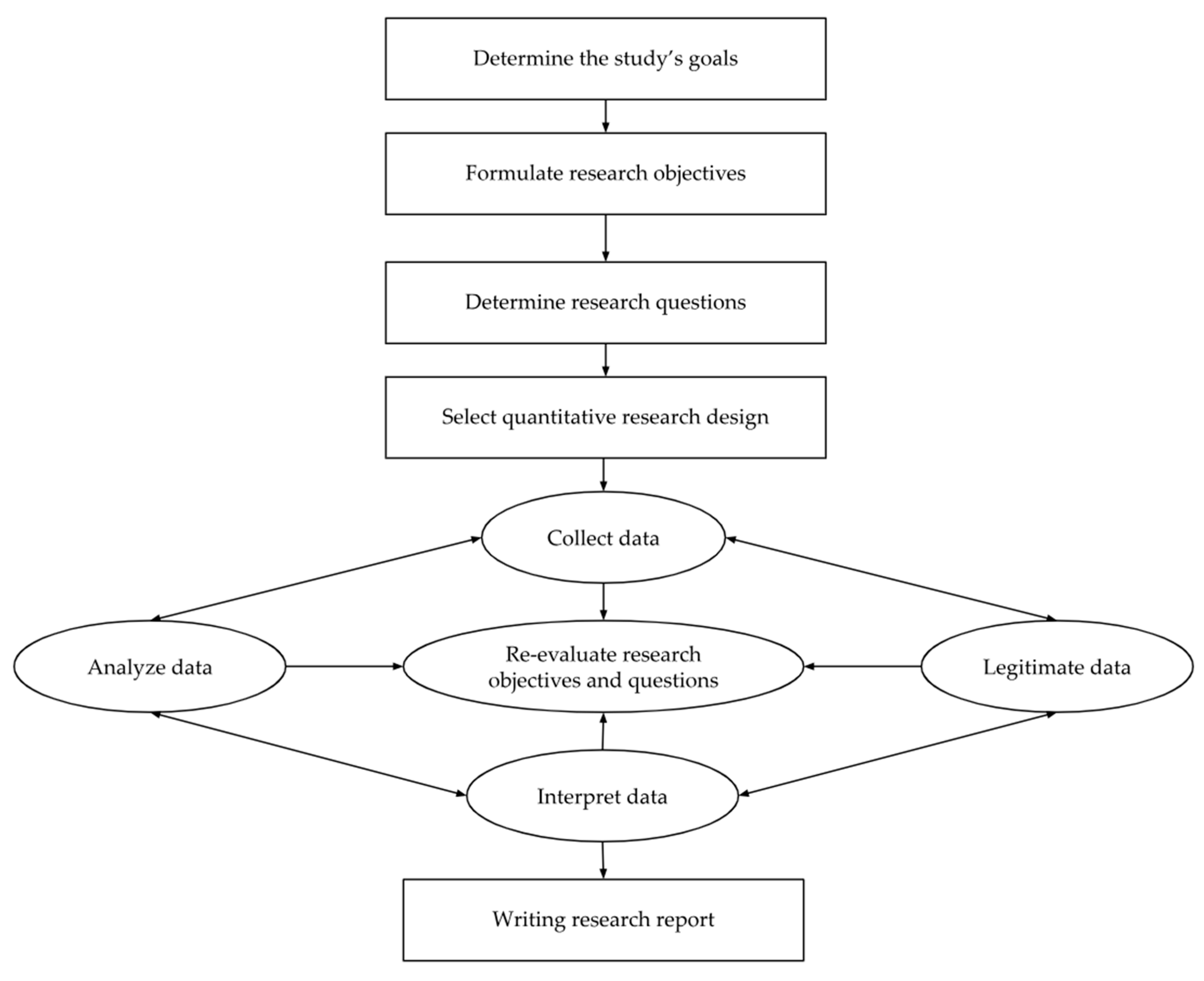

3. Materials and Methods

3.1. Questionnaire Design and Instrument Validation

3.2. Sample Selection

3.3. Data Collection

3.4. Data Analysis

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abramova, S., Voskobojnikov, A., Beznosov, K., & Böhme, R. (2021, May 8–13). Bits under the mattress: Understanding different risk perceptions and security behaviors of crypto-asset users. 2021 CHI Conference on Human Factors in Computing Systems (pp. 1–19), Yokohama, Japan. [Google Scholar] [CrossRef]

- Aiello, D., Baker, S. R., Balyuk, T., Maggio, M. D., Johnson, M. J., & Kotter, J. D. (2023). Who invests in crypto? Wealth, financial constraints, and risk attitudes (NBER Working Paper No. 31856). National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Aithal, A., & Aithal, P. S. (2020). Development and validation of survey questionnaire & experimental data—A systematical review-based statistical approach. International Journal of Management, Technology, and Social Sciences, 5(2), 233–251. [Google Scholar] [CrossRef]

- Akramov, A. A., Rakhmonkulova, N. K., Khazratkulov, O. T., Inamdjanova, E. E., Imamalieva, D. I., Tuychieva, S. R., Ibodullaev, S. B., Ergashev, A. E., Khamidov, S., & Rustamova, N. R. (2024). The impact of digitalization in inheritance law. Qubahan Academic Journal, 4(3), 100–134. [Google Scholar] [CrossRef]

- Aksorndee, P. (2017). Behaviors and demand of consumers along the market fairs in Bang Lamung District, Chon Buri Province (Independent Study). Ramkhamhaeng University. Available online: http://www.me-abstract.ru.ac.th/index.php/abstractData/viewIndex/104 (accessed on 12 May 2025).

- Ali, A., Salleh, M. A. M., & Mustaffa, N. (2022). Digital inheritance exploration (DIE) through digital inheritance model (DIM)—A guideline for digital assets planning after death. In APS proceedings. Academica Press Solution. Available online: https://www.researchgate.net/publication/365315619 (accessed on 12 May 2025).

- Almenberg, J., & Dreber, A. (2015). Gender, stock market participation and financial literacy. Economics Letters, 137, 140–142. [Google Scholar] [CrossRef]

- Alonso, S. L. N., Jorge-Vázquez, J., Rodríguez, P. A., & Hernández, B. M. S. (2023). Gender gap in the ownership and use of cryptocurrencies: Empirical evidence from Spain. Journal of Open Innovation: Technology, Market, and Complexity, 9(3), 100103. [Google Scholar] [CrossRef]

- Ariya, K. (2023). Comparison between capital market in Thailand and digital asset markets [Doctoral dissertation, Graduate School, Chiang Mai University]. Available online: https://cmudc.library.cmu.ac.th/frontend/Info/item/dc:171306 (accessed on 12 May 2025).

- Berlee, A. (2017). Digital inheritance in The Netherlands. Journal of European Consumer and Market Law, 6(2017), 256–260. Available online: https://research.ou.nl/en/publications/digital-inheritance-in-the-netherlands (accessed on 12 May 2025).

- Bohr, J., & Bashir, M. (2014, July 23–24). Who uses bitcoin? An exploration of the bitcoin community. 2014 Twelfth Annual International Conference on Privacy, Security and Trust (pp. 94–101), Toronto, ON, Canada. [Google Scholar] [CrossRef]

- Brounen, D., Koedijk, K. G., & Pownall, R. A. (2016). Household financial planning and savings behavior. Journal of International Money and Finance, 69, 95–107. [Google Scholar] [CrossRef]

- Busari, S. A., Suleiman, H., & Zakariyah, H. (2023). Ownership transfer of digital assets in Islamic wealth management: A juristic analysis. Journal of Emerging Economies & Islamic Research, 11(3), 36–47. Available online: https://ir.uitm.edu.my/id/eprint/94762/ (accessed on 11 May 2025).

- Chaisiripaibool, S., Kraiwanit, T., Rafiyya, A., Snongtaweeporn, T., & Yuenyong, N. (2025). Digital asset adoption in developing economy: A study of risk perception and related issues. Risk Governance and Control: Financial Markets & Institutions, 15(1), 37–49. [Google Scholar] [CrossRef]

- Chaiyong, S. (2024, January). Is there a digital afterlife? An online forum explores the complexities of death in the internet age. Bangkok Post. Available online: https://www.bangkokpost.com/life/social-and-lifestyle/2725542/ (accessed on 12 May 2025).

- Chatla, S. B., & Shmueli, G. (2017). An extensive examination of regression models with a binary outcome variable. Journal of the Association for Information Systems, 18(4), 340–371. [Google Scholar] [CrossRef]

- Corbet, S., Lucey, B., Urquhart, A., & Yarovaya, L. (2019). Cryptocurrencies as a financial asset: A systematic analysis. International Review of Financial Analysis, 62, 182–199. [Google Scholar] [CrossRef]

- Crespo, M. O. (2024). Post-mortem data protection and succession in digital assets under Spanish law. In F. A. Carneiro Pacheco de Andrade, P. M. Fernandes Freitas, & J. R. de Sousa Covelo de Abreu (Eds.), Legal developments on cybersecurity and related fields (Law, Governance and Technology Series). Springer. [Google Scholar] [CrossRef]

- Duangsin, V., Kraiwanit, T., Thetlek, R., & Shaengchart, Y. (2023). Non-fungible token economy in a developing country. Journal of Governance & Regulation, 12(3), 120–127. [Google Scholar] [CrossRef]

- Expat Tax Thailand. (2024, April). A comprehensive expat’s guide to Thailand inheritance tax. Available online: https://www.expattaxthailand.com/comprehensive-expats-guide-to-thailand-inheritance-tax/ (accessed on 11 May 2025).

- Ferro, E., Saltarella, M., Rotondi, D., Giovanelli, M., Corrias, G., Moncada, R., Cavallaro, A., & Favenza, A. (2023). Digital assets rights management through smart legal contracts and smart contracts. Blockchain: Research and Applications, 4(3), 100142. [Google Scholar] [CrossRef]

- Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems, 35(1), 220–265. [Google Scholar] [CrossRef]

- Hacibedel, M. B., & Perez-Saiz, H. (2023). Assessing macrofinancial risks from crypto assets. International Monetary Fund. [Google Scholar] [CrossRef]

- Intelligence Team. (2023a, May). Digital asset (Part 1) ‘When Thais are drawn towards digital assets’. Bank of Ayudhya Public Company Limited. Available online: https://www.krungsri.com/en/research/research-intelligence/digital-asset-part1-2023 (accessed on 11 May 2025).

- Intelligence Team. (2023b, May). Digital assets (Part 2) ‘Digital asset trading in Thailand’. Bank of Ayudhya Public Company Limited. Available online: https://www.krungsri.com/en/research/research-intelligence/digital-asset-part2 (accessed on 11 May 2025).

- Investments for Expats. (2025, June). A comprehensive guide to Thailand’s inheritance tax for expats. Investments for Expats. Available online: https://investmentsforexpats.com/a-comprehensive-guide-to-thailands-inheritance-tax-for-expats/ (accessed on 16 June 2025).

- Juhász, Á. (2024). Inheriting digital assets—A glimpse into the future. Juridical Tribune—Review of Comparative and International Law, 14(4), 547–563. [Google Scholar] [CrossRef]

- Kasemrat, R., & Kraiwanit, T. (2023). Acceptance of cryptocurrency in Thailand. Journal of Interdisciplinary Research, 8(1), 1–5. Available online: https://assumptionjournal.au.edu/index.php/eJIR/article/view/6867 (accessed on 11 May 2025).

- Kelley, A. C., & Schmidt, R. M. (2008). Economic demography. In The new palgrave dictionary of economics. Palgrave Macmillan. [Google Scholar] [CrossRef]

- Kharitonova, J. S. (2021). Digital assets and digital inheritance. Law & Digital Technologies, 1(1), 19–26. [Google Scholar] [CrossRef]

- Kraiwanit, T., Limna, P., Wattanasin, P., Asanprakit, S., & Thetlek, R. (2023). Adoption of Worldcoin digital wallet in Thailand. Research in Globalization, 7, 100179. [Google Scholar] [CrossRef]

- Kreiczer-Levy, S., & Donyets-Kedar, R. (2019). Better left forgotten: An argument against treating some social media and digital assets as inheritance in an era of platform power. Brooklyn Law Review, 84(3), 703–744. Available online: https://brooklynworks.brooklaw.edu/blr/vol84/iss3/1/ (accessed on 12 May 2025).

- Lewis, S., & Messy, F. A. (2012). Financial education, savings and investments: An overview (OECD Working Papers on Finance, Insurance and Private Pensions, No. 22). OECD Publishing. [Google Scholar] [CrossRef]

- Loukil, S., Syed, A. A., Hamza, F., & Jeribi, A. (2025). Decoding the dynamic connectedness between traditional and digital assets under dynamic economic conditions. Journal of Theoretical and Applied Electronic Commerce Research, 20(2), 97. [Google Scholar] [CrossRef]

- Mahanakorn Partners. (2024, May 27). Digital asset regulations in Thailand: A comprehensive overview. Mahanakorn Partners Group. Available online: https://mahanakornpartners.com/digital-asset-regulations-in-thailand-a-comprehensive-overview/ (accessed on 12 May 2025).

- Mali, P., & Prakash, G. A. (2019). Death in the era of perpetual digital afterlife: Digital assets, posthumous legacy, ownership and its legal implications. National Law School Journal, 15(1), 124–141. Available online: https://repository.nls.ac.in/nlsj/vol15/iss1/8/ (accessed on 12 May 2025). [CrossRef]

- McCarthy, L. (2015). Digital assets and intestacy. Journal of Science & Technology Law, 21(2), 384. Available online: https://www.bu.edu/jostl/files/2015/12/McCARTHY_NOTE_FINAL-web.pdf (accessed on 12 May 2025).

- Mikk, T., & Sein, K. (2018). Digital inheritance: Heirs’ right to claim access to online accounts under Estonian Law. Juridica International, 27, 117–128. [Google Scholar] [CrossRef]

- Nafiu, A., Balogun, S. O., Oko-Odion, C., & Odumuwagun, O. O. (2025). Risk management strategies: Navigating volatility in complex financial market environments. World Journal of Advanced Research and Reviews, 25(01), 236–250. [Google Scholar] [CrossRef]

- Nasrul, M. A. D., Shah, N. A. M. A., Ibrahim, N. M., & Manaf, Z. I. A. (2023). Overview of digital asset and its process under the inheritance management. International Journal of Business and Technology Management, 5(S5), 199–208. Available online: https://www.researchgate.net/publication/376172147 (accessed on 11 May 2025).

- Paek, H. J., & Hove, T. (2017). Risk perceptions and risk characteristics. In Oxford research encyclopedia of communication. Oxford University Press. [Google Scholar] [CrossRef]

- Paisanthanachot, T., & Chainirun, P. (2023). The study of knowledge and understanding of digital asset financial products of Kasikornthai Bankers in Khon Kean Province. Journal of Modern Learning Development, 8(1), 83–94. Available online: https://so06.tci-thaijo.org/index.php/jomld/article/view/258737 (accessed on 12 May 2025).

- Patel, J., & Bansal, A. (2018). Effect of demographic variables on e-marketing strategies: A review. International Journal of Academic Research and Development, 3(1), 311–321. Available online: https://www.researchgate.net/publication/340142675 (accessed on 11 May 2025).

- Popescu, A. D. (2022). The financial digital assets frontier: The bridge between the past and the future. In A. Pego (Ed.), Handbook of research on global networking post COVID-19 (pp. 189–209). IGI Global. [Google Scholar] [CrossRef]

- Puška, A., Stojanović, I., Šadić, S., & Bečić, H. (2018). The influence of demographic characteristics of consumers on decisions to purchase technical products. The European Journal of Applied Economics, 15(2), 1–16. [Google Scholar] [CrossRef]

- Qi, J., Zhang, Y., & Ouyang, C. (2025). Cryptocurrency investments: The role of advisory sources, investor confidence, and risk perception in shaping behaviors and intentions. Journal of Risk and Financial Management, 18(2), 57. [Google Scholar] [CrossRef]

- Richards, T. (2021, November 18). The future of payments: Cryptocurrencies, stablecoins, or central bank digital currencies? Reserve Bank of Australia. Available online: https://www.rba.gov.au/speeches/2021/sp-so-2021-11-18.html (accessed on 11 May 2025).

- Rogers, E. M. (2003). Diffusion of innovations (5th ed.). Free Press. Available online: https://search.worldcat.org/title/Diffusion-of-innovations/oclc/52030797 (accessed on 11 May 2025).

- Sagheer, N., Khan, K. I., Fahd, S., Mahmood, S., Rashid, T., & Jamil, H. (2022). Factors affecting adaptability of cryptocurrency: An application of technology acceptance model. Frontiers in Psychology, 13, 903473. [Google Scholar] [CrossRef]

- Sarlet, G. B. S. (2022). Digital identity and the problem of digital inheritance. In M. Albers, & I. W. Sarlet (Eds.), Personality and data protection rights on the internet. Ius gentium: Comparative perspectives on law and justice (Vol. 96). Springer. [Google Scholar] [CrossRef]

- Shoommuangpak, P., & Wongta, O. (2023). Factors affecting investment decision to invest in digital asset of investors in the stock exchange of Thailand. Journal of Humanities and Social Sciences Loei Rajabhat University, 5(1), 1–15. Available online: https://so01.tci-thaijo.org/index.php/husolru/article/view/257102 (accessed on 12 May 2025).

- Siegrist, M. (2021). Trust and risk perception: A critical review of the literature. Risk Analysis, 41(3), 480–490. [Google Scholar] [CrossRef]

- Siegrist, M., & Árvai, J. (2020). Risk perception: Reflections on 40 years of research. Risk Analysis, 40(S1), 2191–2206. [Google Scholar] [CrossRef] [PubMed]

- Sivabala, S., & Vidyasri, P. (2024). Celebrating lives beyond on unveiling the digital legacy manager for empowering personal heritage preservation. In S. Singh, S. Rajest, S. Hadoussa, A. Obaid, & R. Regin (Eds.), Data-driven decision making for long-term business success (pp. 64–86). IGI Global. [Google Scholar] [CrossRef]

- Steen, A., Graves, C., D’Alessandro, S., & Shi, H. X. (2023). Managing digital assets on death and disability: An examination of the determinants of digital asset planning literacy. Australian Journal of Management, 49(4), 561–580. [Google Scholar] [CrossRef]

- Stix, H. (2021). Ownership and purchase intention of crypto-assets: Survey results. Empirica, 48, 65–99. [Google Scholar] [CrossRef]

- Suwannasichon, R. (2023). The problems of digital asset interests and benefits law in Thailand. University of the Thai Chamber of Commerce Journal Humanities and Social Sciences, 43(3), 126–145. Available online: https://so06.tci-thaijo.org/index.php/utccjournalhs/article/view/261942 (accessed on 12 May 2025).

- Tulchinsky, T. H., & Varavikova, E. A. (2014). Measuring, monitoring, and evaluating the health of a population. The New Public Health, 91–147. [Google Scholar] [CrossRef]

- Uakarn, C., Chaokromthong, K., & Sintao, N. (2021). Sample size estimation using Yamane and Cochran and Krejcie and Morgan and green formulas and Cohen statistical power analysis by G* Power and comparisons. APHEIT International Journal of Interdisciplinary Social Sciences and Technology, 10(2), 76–88. Available online: https://so04.tci-thaijo.org/index.php/ATI/article/view/254253 (accessed on 11 May 2025).

- Ugli, M. M. D. (2024). Digital inheritance: Transfer of real rights according to the procedure of universal succession. International Journal of Law and Criminology, 4(3), 17–21. [Google Scholar] [CrossRef]

- Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27(3), 425–478. [Google Scholar] [CrossRef]

- Voskobojnikov, A. (2021). Towards understanding and improving the crypto-asset user experience [Doctoral dissertation, University of British Columbia]. [Google Scholar] [CrossRef]

- Vučković, R. M., & Kanceljak, I. (2019). Does the right to use digital content affect our digital inheritance? EU and Comparative Law Issues and Challenges Series, 3, 724–746. [Google Scholar] [CrossRef]

- Wahab, N. A., Katuk, N., Hussain, M. A., Zainol, Z., Maamor, S., & Kamis, N. S. (2024). A proposed framework of Islamic inheritance and estate planning of digital assets: The Malaysian case of crypto assets. ISRA International Journal of Islamic Finance, 16(2), 45–64. [Google Scholar] [CrossRef]

- Wata, T. (2016). Legal measures for managing the deceased’s digital assets in online accounts. Thammasat Business Law Journal, 6, 1–20. Available online: https://so05.tci-thaijo.org/index.php/TBLJ/article/view/112729 (accessed on 11 May 2025).

- Webley, P., & Nyhus, E. K. (2006). Parents’ influence on children’s future orientation and saving. Journal of Economic Psychology, 27(1), 140–164. [Google Scholar] [CrossRef]

- Xie, X., Osińska, M., & Szczepaniak, M. (2023). Do young generations save for retirement? Ensuring financial security of Gen Z and Gen Y. Journal of Policy Modeling, 45(3), 644–668. [Google Scholar] [CrossRef]

- Yolanda, M. K., Paramitha, C. L., & Putra, M. R. S. (2024). Exploring digital assets inheritance: A comparative study of transnational legal frameworks and practices. AURELIA: Journal Penelitian dan Pengabdian Masyarakat Indonesia, 4(1), 942–951. Available online: https://rayyanjurnal.com/index.php/aurelia/article/view/4483 (accessed on 16 June 2025). [CrossRef]

- Zamoras, J. M. J., Dalumpines, S. S., & Refugio, J. G. (2024). Cryptocurrency investment risks and perceived usefulness: Basis of cryptocurrency risk management plan. Journal of Governance Risk Management Compliance and Sustainability, 4(1), 72–88. [Google Scholar] [CrossRef]

| General Information | Frequency | Percentage | |

|---|---|---|---|

| Gender | Male Female | 353 277 | 56.0 44.0 |

| Age | Less than 35 years old 35–44 years old 45–55 years old Over 55 years old | 270 143 196 21 | 42.9 22.7 31.1 3.3 |

| Status | Single Married (with children) Married (without children) Divorced Other | 336 182 89 2 21 | 53.3 29.0 14.1 0.3 3.3 |

| Education | Lower than bachelor’s degree Bachelor’s degree Higher than bachelor’s degree | 96 473 61 | 15.2 75.1 9.7 |

| Occupation | Freelancer Government officer Private company employee Business owner Student | 15 213 125 43 234 | 2.4 33.8 19.9 6.8 37.1 |

| Income | Less than THB 15,000 THB 15,000–25,000 THB 25,001–35,000 THB 35,001–45,000 More than THB 45,000 | 144 102 151 158 75 | 22.9 16.2 24.0 25.0 11.9 |

| Savings | THB 1000–5000 THB 5001–10,000 THB 10,001–15,000 THB 15,001–20,000 More than THB 20,000 | 291 269 21 4 45 | 46.3 42.7 3.3 0.6 7.1 |

| Total | 630 | 100.0 | |

| Digital Assets as Inheritance | Frequency | Percentage |

|---|---|---|

| No | 139 | 22.1 |

| Yes | 491 | 77.9 |

| Total | 630 | 100.0 |

| Chi-Square | df | Sig. | ||

|---|---|---|---|---|

| Step 1 | Step | 318.658 | 9 | 0.000 |

| Block | 318.658 | 9 | 0.000 | |

| Model | 318.658 | 9 | 0.000 |

| Step | −2 Log Likelihood | Cox and Snell R-Squared | Nagelkerke R-Squared |

|---|---|---|---|

| 1 | 346.257 a | 0.397 | 0.609 |

| Observed | Predicted | ||||

|---|---|---|---|---|---|

| Digital Assets as Inheritance | Percentage Correct | ||||

| No | Yes | ||||

| Step 1 | Digital Assets as Inheritance | No | 88 | 51 | 63.3 |

| Yes | 14 | 477 | 97.1 | ||

| Overall percentage | 89.7 | ||||

| B | S.E. | Wald | df | Sig. | Exp(B) | ||

|---|---|---|---|---|---|---|---|

| Step 1 a | Score | 0.502 | 0.086 | 33.871 | 1 | 0.000 | 1.652 |

| Gender | 1.485 | 0.380 | 15.310 | 1 | 0.000 | 4.416 | |

| Age | −1.481 | 0.260 | 32.453 | 1 | 0.000 | 0.227 | |

| Being single | −0.625 | 0.558 | 1.255 | 1 | 0.263 | 0.535 | |

| Education | 0.450 | 0.358 | 1.577 | 1 | 0.209 | 1.568 | |

| Being a student | −1.135 | 0.614 | 3.418 | 1 | 0.064 | 0.322 | |

| Income | 0.945 | 0.195 | 23.576 | 1 | 0.000 | 2.572 | |

| Savings | 0.588 | 0.175 | 11.317 | 1 | 0.001 | 1.800 | |

| Risk | −0.464 | 0.206 | 5.078 | 1 | 0.024 | 0.629 | |

| Constance | 1.613 | 1.131 | 2.036 | 1 | 0.154 | 5.019 |

| Chi-Square | df | Sig. | ||

|---|---|---|---|---|

| Step 1 | Step | 310.455 | 6 | 0.000 |

| Block | 310.455 | 6 | 0.000 | |

| Model | 310.455 | 6 | 0.000 |

| Step | −2 Log Likelihood | Cox and Snell R-Squared | Nagelkerke R-Squared |

|---|---|---|---|

| 1 | 354.462 a | 0.389 | 0.597 |

| Observed | Predicted | ||||

|---|---|---|---|---|---|

| Digital Assets as Inheritance | Percentage Correct | ||||

| No | Yes | ||||

| Step 1 | Digital Assets as Inheritance | No | 88 | 51 | 63.3 |

| Yes | 10 | 481 | 98.0 | ||

| Overall percentage | 90.3 | ||||

| B | S.E. | Wald | df | Sig. | Exp(B) | ||

|---|---|---|---|---|---|---|---|

| Step 1 a | Score | 0.496 | 0.079 | 39.221 | 1 | 0.000 | 1.643 |

| Gender | 1.490 | 0.345 | 18.628 | 1 | 0.000 | 4.437 | |

| Age | −1.004 | 0.169 | 35.405 | 1 | 0.000 | 0.366 | |

| Income | 1.202 | 0.155 | 59.995 | 1 | 0.000 | 3.325 | |

| Savings | 0.652 | 0.159 | 16.809 | 1 | 0.000 | 1.920 | |

| Risk | −0.697 | 0.166 | 17.582 | 1 | 0.000 | 0.498 | |

| Constance | 0.873 | 0.731 | 1.428 | 1 | 0.232 | 2.394 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kraiwanit, T.; Limna, P.; Suradinkura, S. Digital Asset Adoption in Inheritance Planning: Evidence from Thailand. J. Risk Financial Manag. 2025, 18, 330. https://doi.org/10.3390/jrfm18060330

Kraiwanit T, Limna P, Suradinkura S. Digital Asset Adoption in Inheritance Planning: Evidence from Thailand. Journal of Risk and Financial Management. 2025; 18(6):330. https://doi.org/10.3390/jrfm18060330

Chicago/Turabian StyleKraiwanit, Tanpat, Pongsakorn Limna, and Supakorn Suradinkura. 2025. "Digital Asset Adoption in Inheritance Planning: Evidence from Thailand" Journal of Risk and Financial Management 18, no. 6: 330. https://doi.org/10.3390/jrfm18060330

APA StyleKraiwanit, T., Limna, P., & Suradinkura, S. (2025). Digital Asset Adoption in Inheritance Planning: Evidence from Thailand. Journal of Risk and Financial Management, 18(6), 330. https://doi.org/10.3390/jrfm18060330