1. Introduction

Over the past five years, global supply chains have experienced a series of unprecedented disruptions caused by overlapping crises, including the COVID-19 pandemic, the Suez Canal blockage, the Russia–Ukraine conflict, maritime security threats in the Red Sea, and substantial shifts in international trade policy, such as the imposition of elevated import tariffs by the United States on goods manufactured in Asia. These events have had a profound impact on numerous industries, particularly those reliant on global sourcing and just-in-time (JIT) inventory practices.

The COVID-19 pandemic, which began in early 2020, triggered widespread factory shutdowns, labor shortages, and transportation restrictions that severely disrupted the global supply of raw materials and components (

Ivanov, 2021). The eyewear industry, which relies heavily on Chinese suppliers, experienced significant production delays and inventory shortages during this period (

PEL Eyewear, 2025). Eyeglass lens manufacturing is particularly dependent on materials such as MR-series optical resins, hard coating agents, photochromic dyes, and anti-reflective coatings. A large portion of these materials is sourced from East Asia, especially China and Japan, due to their technological leadership in polymer chemistry and coating innovation. This geographic concentration created significant vulnerabilities, particularly during COVID-19-related shutdowns and major shipping disruptions in the Red Sea and Suez Canal corridors. Furthermore, the U.S. tariff increases on Chinese imports in early 2025 further heightened procurement risk by increasing landed costs and forcing firms to reconsider sourcing strategies. Recent studies have emphasized that resilience capabilities in supply chain networks have become a strategic priority post-pandemic, especially for industries with global sourcing dependencies (

Guo et al., 2024;

Wang et al., 2022).

In March 2021, the temporary blockage of the Suez Canal further amplified existing vulnerabilities in global logistics networks. The six-day disruption, which halted approximately 12% of global trade, caused significant delays in international shipments and led to escalating transportation costs (

ShipWorks, 2025). This incident underscored the fragility of key maritime corridors and the cascading effects on supply chains dependent on timely deliveries.

Furthermore, the Russia–Ukraine conflict, which began in February 2022, added a new layer of complexity to global supply chain dynamics. International sanctions and export restrictions disrupted the flow of critical raw materials and components, adversely impacting various industries across multiple regions (

Forbes, 2022).

Since late 2023, renewed security concerns in the Red Sea region—particularly due to attacks on commercial vessels by Houthi militants in Yemen—have prompted major shipping lines to reroute vessels around the Cape of Good Hope. This shift has significantly increased transit times and logistics costs (

Morgan, 2025)

. Given that approximately 12% of global maritime trade passes through the Red Sea, these disruptions have imposed substantial operational and financial pressures on supply chain managers (

Supply Chain Digital, 2025).

In early 2025, the United States introduced substantial tariffs on imports from several countries, such as a 104% tariff on Chinese-origin products (

The Verge, 2025). These trade measures have significantly increased import costs for industries dependent on Chinese manufacturing. The eyewear sector, in particular, now faces mounting pressure to adjust its sourcing and pricing strategies accordingly.

The eyeglass lens manufacturing industry presents a particularly relevant context for studying inventory resilience due to its structural and operational characteristics. First, the industry is characterized by high product variety and customization, resulting in a large number of SKUs that require precise coordination across globally distributed production and distribution networks. Second, lens manufacturers depend heavily on specialized raw materials, such as MR resins and coating agents, sourced primarily from East Asian countries like Japan and China, which exposes the industry to geopolitical risk and transport disruptions. Third, the production process demands strict quality control, advanced machinery, and clean-room environments, making it difficult to scale capacity or substitute suppliers in the short term. These factors, combined with the prevalent use of lean inventory practices, amplify the industry’s vulnerability to global shocks and justify its selection as a high-impact case for supply chain risk and resilience analysis. However, these strategies have proven insufficient in responding to extended shipping delays, geopolitical uncertainties, and tariff fluctuations. While lean systems minimize excess inventory and reduce holding costs, they often lack the buffer capacity required to absorb external shocks (

Guo et al., 2024).

Consequently, manufacturers have been compelled to reassess their inventory management practices and adopt more adaptive, resilient approaches. Key response strategies include increasing safety stock levels, diversifying supplier bases to mitigate single-source dependencies, and implementing digital technologies, such as AI-driven forecasting models, real-time inventory tracking platforms, and digital twin simulations, to enhance supply chain visibility and decision-making agility (

Wamba et al., 2022). These evolving practices signal a paradigm shift from cost-centric inventory models to resilience-oriented systems, aligning with the broader trend toward digitally integrated, disruption-resilient supply chain operations in the post-pandemic era.

Despite the growing body of literature on supply chain resilience since 2020, there remains a noticeable lack of empirical studies that focus specifically on the eyeglass lens manufacturing industry. This sector is characterized by high levels of product customization, stringent quality assurance requirements, and complex, globally dispersed supply networks—features that necessitate tailored risk mitigation strategies.

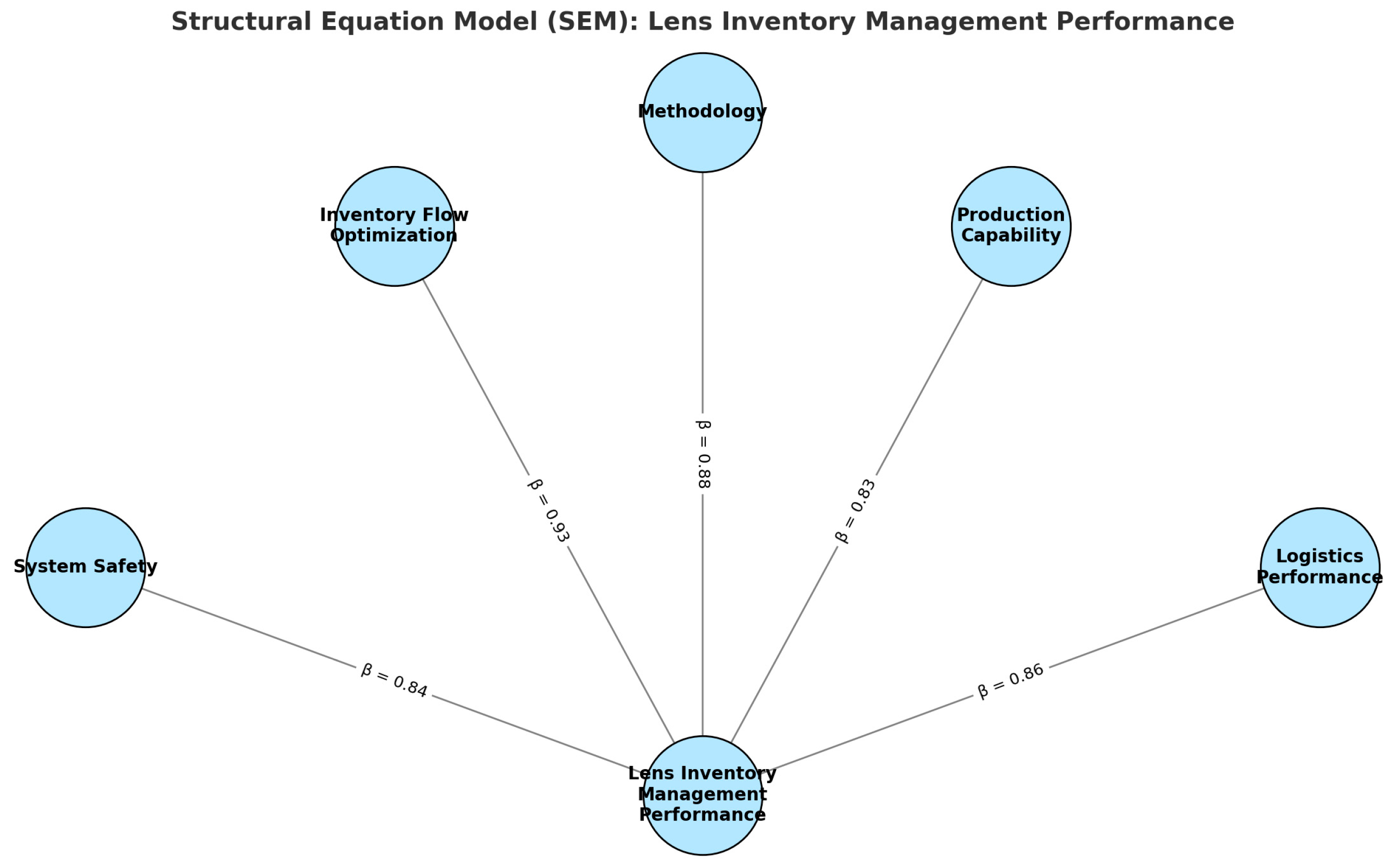

Structural Equation Modeling (SEM) has been widely adopted in supply chain research to model complex relationships among latent constructs such as risk factors, resilience capabilities, and operational outcomes. Prior studies have demonstrated the utility of SEM in analyzing the impact of disruptions and developing robust mitigation strategies (

Tang & Musa, 2021;

Wang et al., 2022;

Guo et al., 2024).

Given its methodological strength, SEM is employed in the present study to examine the multidimensional factors influencing inventory resilience in the eyeglass lens manufacturing sector. Furthermore, although various theoretical resilience frameworks have been proposed, their practical effectiveness in managing inventory risks during global crises in this specific industry remains underexplored. This study seeks to address the following research question:

How do stock system, inventory optimization, standardized methodology, production capability, and logistics performance influence inventory resilience in the eyeglass lens manufacturing sector under global crisis conditions?

To investigate this question, the following hypotheses are proposed:

H1: The stock system has a significant positive effect on lens inventory resilience.

H2: Inventory optimization has a significant positive effect on lens inventory resilience.

H3: Standardized methodology has a significant positive effect on lens inventory resilience.

H4: Production capability has a significant positive effect on lens inventory resilience.

H5: Logistics performance has a significant positive effect on lens inventory resilience.

This study seeks to address the existing research gap by conducting an empirical case study focused on lens inventory management within the eyeglass manufacturing industry during the period of compounded global crises from 2020 to 2025. Drawing upon data collected through structured questionnaires and analyzed using Structural Equation Modeling (SEM), this study investigates five critical dimensions of inventory-related risk: system safety, inventory flow optimization, standardized methodology, production capability, logistics performance, and macroeconomic pressures. The objective is to generate both theoretical contributions and actionable managerial insights aimed at strengthening supply chain resilience in high-precision manufacturing contexts amid persistent global uncertainty.

While the existing literature offers various conceptual frameworks on supply chain resilience, there remains a notable gap between theory and real-world implementation, particularly in niche manufacturing industries such as optical lenses. This study aims to bridge this gap by operationalizing theoretically grounded constructs through sector-specific indicators validated by industry experts. By doing so, the research contributes not only to the academic understanding of inventory-related risks but also provides practical insights for decision-makers navigating supply chain disruptions in highly specialized and precision-driven environments.

4. Interpretation in the Context of Lens Inventory Management

During the study period, firms frequently experienced demand–supply mismatches resulting from unpredictable order flows and logistics bottlenecks, especially in the aftermath of pandemic-related recovery phases and Red Sea shipping disruptions. High-mix, low-volume manufacturers such as lens producers had to manage this volatility by synchronizing demand signals with inventory levels and increasing responsiveness in material sourcing and dispatch.

To complement the quantitative findings from the SEM analysis, selected qualitative responses from open-ended questions were analyzed to provide contextual depth. Several respondents highlighted challenges such as inconsistent supplier lead times, urgent reallocations due to transit delays, and limited visibility into upstream supply risks. These practitioner insights reinforced the significance of constructs like inventory optimization and logistics performance, particularly in volatile global trade environments.

These adaptive strategies were reflected in the elevated relevance of inventory optimization and logistics performance in the SEM results. Firms operating across Southeast Asia, many of which rely on extended maritime supply chains and lean inventory strategies, experienced significant disruptions due to pandemic-related closures and ongoing shipping route volatility, particularly in the Red Sea corridor. Companies that exhibited higher inventory performance were those that adopted a combination of digital technologies, proactive inventory strategies, and operational agility.

The interpretation of each construct’s role is detailed below:

Stock System (SS): Implementation of structured warehouse zoning, maintenance of buffer inventory levels, and enforcement of secure access controls enhanced physical and operational continuity during crises.

Inventory Optimization (IO): Integration of real-time data analytics, visibility across suppliers and warehouses, and synchronized raw material allocation were instrumental in reducing order fulfillment delays and stock imbalances.

Standardized Methodology (SM): Using standardized forecasting protocols, cycle-based planning, and scenario-specific restocking procedures contributed to better alignment between supply availability and dynamic demand patterns.

Production Capability (PC): Flexible capacity scheduling, shift reallocation, and equipment modularity allowed for rapid adaptation to demand surges and production shifts necessitated by disruptions.

Logistics Performance (LP): The capacity to reroute shipments, switch between transportation modes, and collaborate with alternative third-party logistics providers was essential to mitigate the effects of port closures and extended lead times.

Collectively, these strategic capabilities enabled firms to achieve a more balanced inventory posture, minimizing holding costs while ensuring service level continuity under volatile global conditions. The results reinforce that supply chain resilience in high-precision industries requires a multidimensional and integrated approach.

5. Discussion

This study empirically investigated the effects of five critical dimensions, system safety, inventory flow optimization, standardized methodology, production capability, and logistics performance, on lens inventory management performance during periods of global crisis. The results confirm that all proposed constructs significantly contribute to inventory resilience. Furthermore, the strong theoretical grounding of each construct reinforces the model’s relevance in both academic and practical contexts. By aligning with the established literature in supply chain resilience and operational risk, this study’s constructs capture multidimensional factors essential to managing inventory under prolonged disruption. This ensures that the findings not only validate theoretical expectations but also offer actionable insights for industry practitioners. These findings are particularly relevant for high-precision manufacturing sectors, such as eyeglass lens production, which continue to face systemic threats in the post-pandemic era, including geopolitical conflicts, maritime insecurity, and abrupt shifts in global trade policies (

Ivanov & Dolgui, 2020).

In particular, the results provide managers in the eyewear industry with practical direction for mitigating risks related to raw material dependency, inventory imbalances, and shipping delays, especially in high-SKU, low-volume environments. The constructs identified in this study offer a framework for improving service continuity while maintaining cost control and operational flexibility amid ongoing global uncertainty.

5.1. Theoretical Interpretation of SEM Results

Among the five latent variables, inventory optimization (IO) demonstrated the strongest influence (β = 0.93), emphasizing the critical importance of real-time demand visibility, synchronized inventory tracking, and agile material allocation. These capabilities align with the existing literature that underscores the role of AI-powered forecasting, predictive analytics, and integrated digital inventory platforms in enabling responsive and adaptive supply chain operations (

Ivanov, 2023). Organizations that prioritize inventory flow optimization are better equipped to reduce supply–demand mismatches, minimize backorders, and ensure continuity of service during turbulent periods.

Standardized methodology (SM) also showed a significant effect (β = 0.88), indicating that formalizing standard operating procedures, forecast cycles, and contingency replenishment plans contributes substantially to operational resilience. As highlighted, procedural rigor is particularly vital in high-SKU environments, where complexity and short lead times necessitate structured planning and disciplined execution (

Wang et al., 2022).

Logistics performance (LP) (β = 0.86) reflects a firm’s capacity to adapt logistics operations through multimodal transport strategies and flexible routing. Recent disruptions in the Red Sea and the Suez Canal have underscored the vulnerabilities of geographically concentrated shipping routes. Logistics flexibility, enabled through strategic redundancy and partnerships with third-party logistics (3PL) providers, is a cornerstone of systemic resilience (

Gölgeci & Kuivalainen, 2020).

Production capability (PC) (β = 0.83) and stock system (SS) (β = 0.84) further validate the importance of internal operational readiness. Agile manufacturing setups, modular equipment, and flexible labor allocation help firms respond rapidly to demand volatility. Concurrently, robust safety protocols and effective inventory zoning reduce operational disruptions and internal risk exposure (

Gölgeci & Kuivalainen, 2020).

Inventory optimization (IO) demonstrated the strongest influence (β = 0.93), highlighting the importance of real-time demand visibility and agile material allocation. Standardized methodology (SM) also had a significant effect (β = 0.88), showing that formalized procedures enhance operational resilience. Logistics performance (LP) (β = 0.86) reflects the ability to adapt logistics operations through flexible routing, crucial during disruptions. Production capability (PC) (β = 0.83) and stock system (SS) (β = 0.84) emphasize the need for internal readiness, with agile setups and robust safety protocols mitigating risks. These factors collectively contribute to a more resilient supply chain (See

Figure 1).

5.2. Theoretical Contributions

This study advances the scholarly discourse in the field of Supply Chain Risk Management (SCRM) by introducing and empirically validating a multidimensional SEM-based framework tailored to the optical lens industry. The framework integrates both internal and external dimensions of resilience and provides a holistic perspective on inventory risk mitigation. By demonstrating that resilience-oriented strategies can outperform traditional lean systems under high uncertainty, this research supports the evolving view that operational agility and digital integration are critical for supply continuity in crisis scenarios (

Guo et al., 2024).

Furthermore, the findings reinforce the concept that cross-functional alignment—linking logistics, production, inventory control, and planning—is essential for sustaining performance in disrupted environments. The framework offers a sector-specific tool that may also be adaptable to other high-precision and customer-sensitive industries.

5.3. Managerial Implications

The findings of this study provide actionable managerial insights for the eyeglass lens manufacturing sector, particularly under ongoing global disruptions. Inventory Optimization emerged as a key enabler for managing volatile demand and reducing mismatches in high-SKU, customized environments. The SEM results highlight the importance of real-time demand tracking, agile stock reallocation, and AI-based forecasting to close fulfillment gaps and control excess inventory.

Production capability also plays a vital role. Modular production setups, cross-trained labor, and flexible scheduling enable firms—especially in RX and finished lens segments—to adapt to shifting demand. At the same time, logistics resilience is critical amid maritime disruptions (e.g., Red Sea crisis). Firms are advised to diversify transport routes, establish regional buffers, and work with multiple 3PL providers to sustain delivery reliability and cost efficiency.

These managerial implications collectively support supply chain risk mitigation by enhancing visibility, agility, and adaptability. Firms that adopt even partial elements of this framework, such as demand tracking or flexible routing, can reduce exposure to raw material shortages, production delays, and logistics bottlenecks. By framing these actions as both preventive and responsive measures, this study offers a practical roadmap for enterprises navigating continued global volatility.

Collectively, these strategies help manufacturers address raw material dependency (e.g., MR resins from Japan and China), long lead times, and increasing transport costs—especially acute in Southeast Asia. By enhancing visibility, agility, and adaptability, firms can mitigate supply chain risks both reactively and proactively.

This study contributes a practical roadmap for high-precision, globally connected manufacturers to navigate supply uncertainty using structured and scalable resilience strategies.

5.4. Limitations and Future Research

Although this study provides valuable insights into the risk factors affecting inventory resilience in the eyeglass lens manufacturing sector, several limitations should be acknowledged. First, the empirical analysis is based on data collected from a single multinational manufacturer. While the case offers contextual depth, the findings may have limited generalizability. Future studies should expand the sample to include firms from diverse geographical regions and supply chain structures to enhance external validity. Second, the present study does not incorporate mediating or moderating variables that could further explain the dynamics within the proposed SEM framework. Variables such as firm size, supply chain complexity, or regulatory environment may significantly influence how operational capabilities affect inventory performance. Future research could explore these relationships to gain a more nuanced understanding.

The study adopts a cross-sectional design, capturing responses during a specific timeframe (January to March 2025). While this study considers a series of global crises beyond COVID-19, such as the Red Sea shipping disruptions, U.S. tariff escalation, and geopolitical instability, it does not yet capture the emerging influence of digital transformation drivers, particularly generative AI (Gen AI), on inventory decision-making.

Given the increasing role of AI-based tools in demand forecasting, material planning, and real-time inventory tracking, future research should examine how Gen AI capabilities interact with traditional supply chain resilience constructs to improve agility and risk mitigation in dynamic environments.

Longitudinal studies will also be valuable to assess how resilience strategies evolve over time and adapt to new technological or geopolitical developments. By integrating digital maturity and AI-readiness into future frameworks, researchers can generate more future-proof models that support decision-making in complex and rapidly shifting global supply chains.

6. Conclusions

This study presents a comprehensive empirical assessment of supply chain risk factors that influence lens inventory management within the context of global crises. The validated Structural Equation Modeling (SEM) framework identifies five critical determinants of inventory resilience: system safety, inventory flow optimization, standardized methodology, production capability, and logistics performance. Together, these constructs explain a substantial proportion of the variance in inventory performance, emphasizing the dual importance of internal operational readiness and external supply chain adaptability for maintaining business continuity.

The findings underscore the specific inventory-related vulnerabilities inherent to the eyeglass lens manufacturing sector, which is characterized by high product customization, stringent quality control standards, and globally distributed production networks. In such a volatile and uncertain environment, traditional lean inventory models designed to minimize holding costs have proven insufficient. Instead, a resilience-oriented inventory management strategy that integrates digital monitoring tools, procedural standardization, and transport flexibility offers a more effective framework for mitigating disruptions and aligning inventory levels with shifting market demands.

Firms that invest in real-time inventory tracking, modular production systems, and formalized risk management protocols are better positioned to reduce operational disruptions and maintain service performance. This is particularly crucial in the lens industry, where shipment delays or inventory shortages can directly impact customer satisfaction, prescription accuracy, and competitive positioning. In this context, inventory resilience emerges as a core strategic capability.

These findings contribute to the broader discourse in supply chain management by providing both theoretical validation and actionable guidance. This study supports the evolving paradigm shift from cost-minimization strategies to integrated, proactive, and resilience-based inventory models. Moreover, the proposed framework offers a sector-specific blueprint that can be adapted to other high-precision, quality-sensitive manufacturing environments that face similar global disruptions.