Forecasting Sovereign Credit Risk Amidst a Political Crisis: A Machine Learning and Deep Learning Approach

Abstract

1. Introduction

2. Literature Review

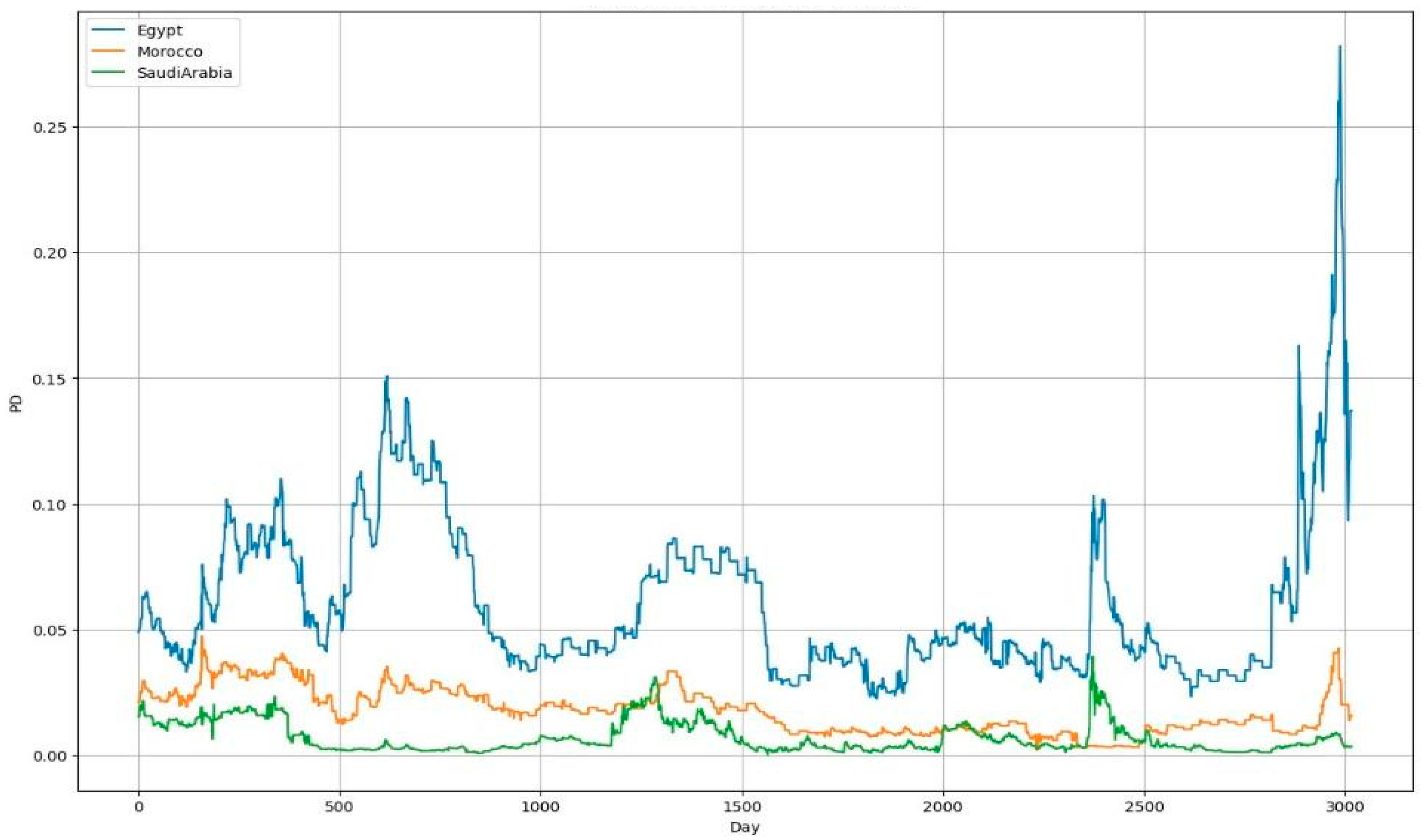

3. Data Description

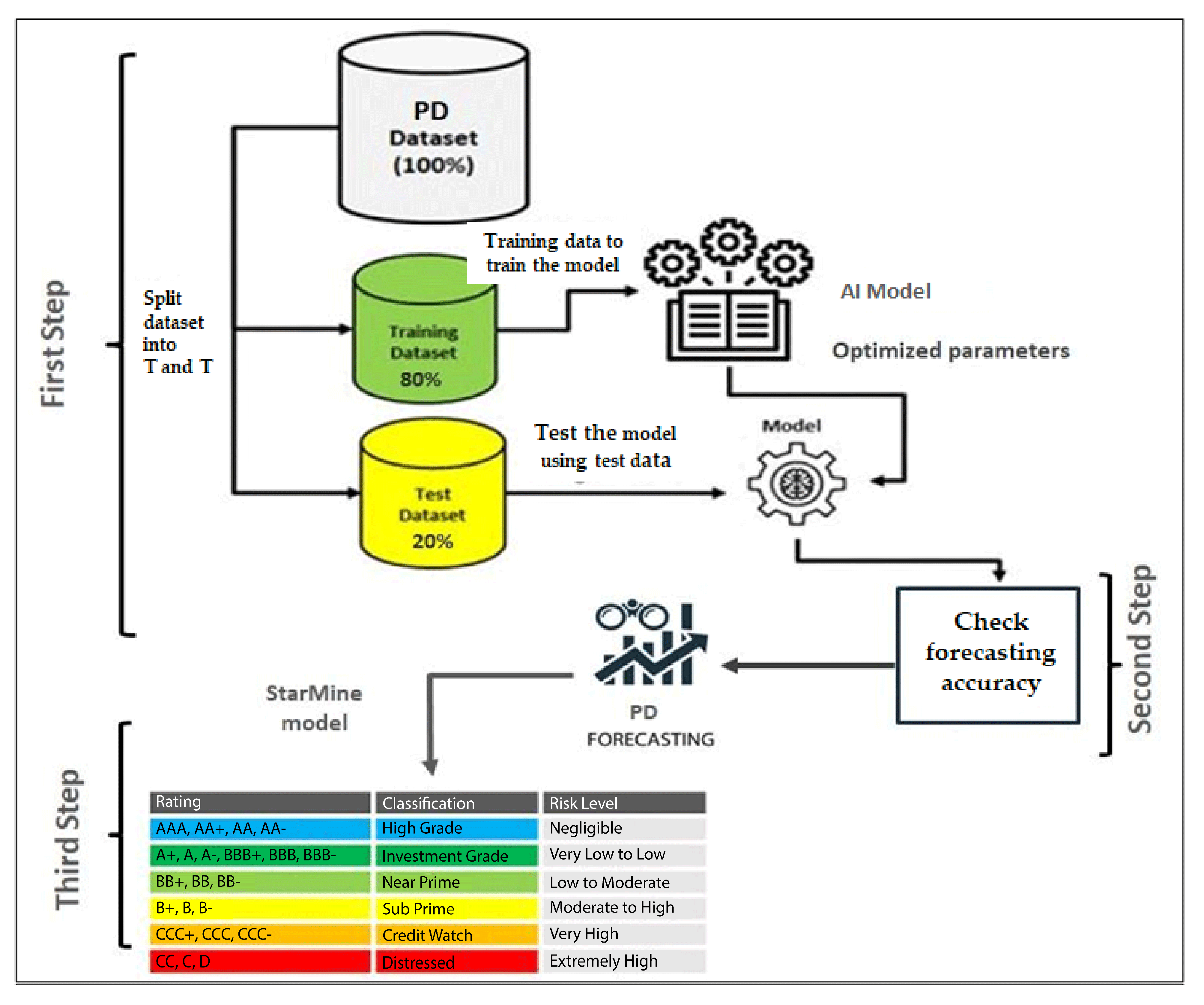

4. Methodology

4.1. Step 1: Implied Default Probability Forecasting

4.1.1. Machine Learning Models

4.1.2. Deep Learning Models

4.2. Step 2: Performance Criteria

4.3. Step 3: Sovereign Credit Rating Forecasting

5. Results and Discussion

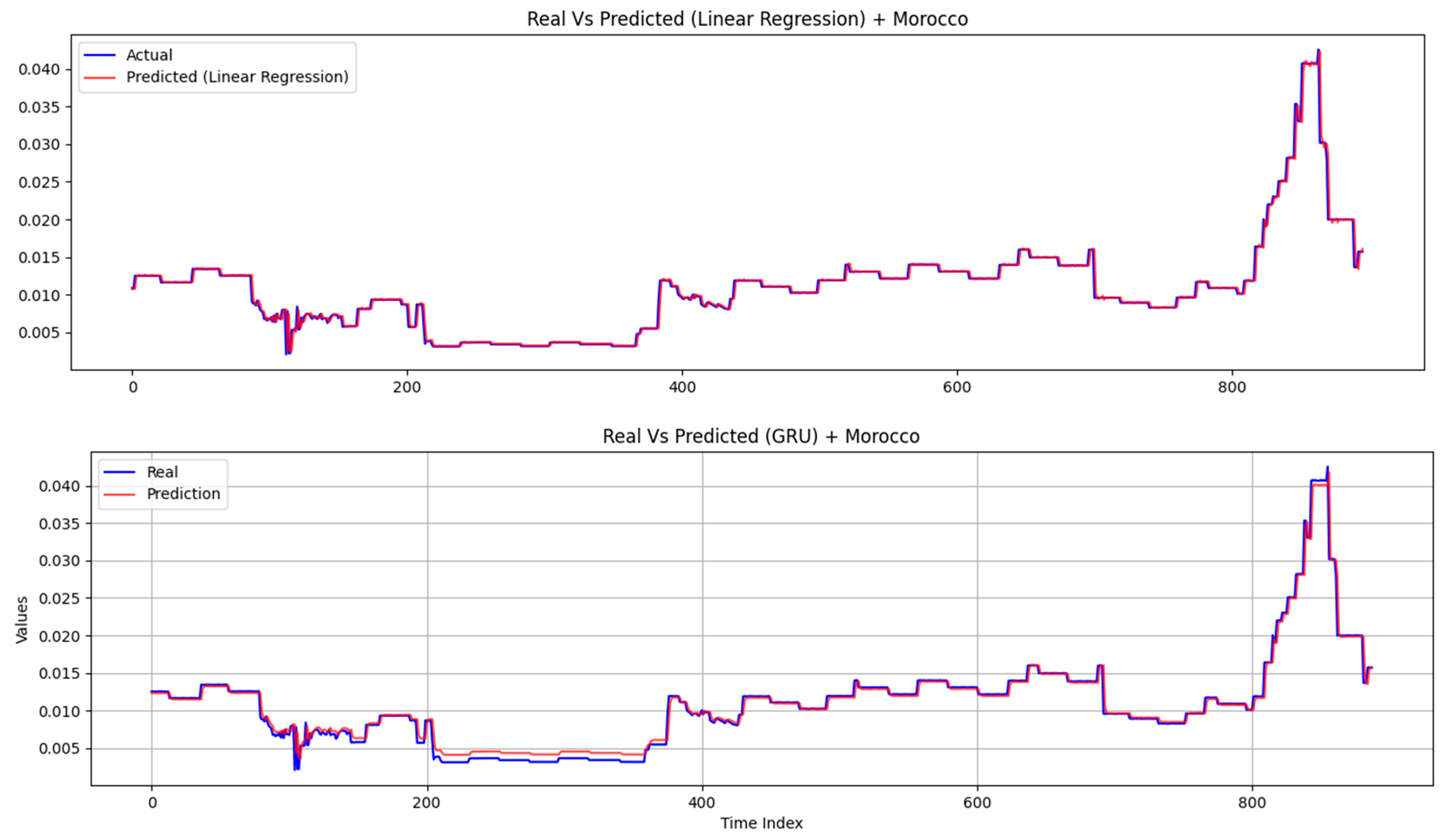

5.1. Implied Default Probability Forecasting Results

5.2. Implied Rating Forecasting Results

6. Conclusions and Managerial Implications

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abid, A., & Abid, F. (2023). A methodology to estimate the optimal debt ratio when asset returns, and default probability follow stochastic processes. Journal of Industrial & Management Optimization, 19(10), 1. [Google Scholar]

- Abid, A., & Abid, F. (2024). Sovereign credit risk in Saudi Arabia, Morocco and Egypt. Journal of Risk and Financial Management, 17(7), 283. [Google Scholar] [CrossRef]

- Abid, A., Abid, F., & Kaffel, B. (2020). CDS-based implied probability of default estimation. The Journal of Risk Finance, 21(4), 399–422. [Google Scholar] [CrossRef]

- Abid, A., & Suissi, N. (2024). Sovereign CDS spread and term structure forecasting based on neural network. Global Business Review. [Google Scholar] [CrossRef]

- Annaert, J., De Ceuster, M., & De Jonghe, F. (2000). Modelling European credit spreads. Deloitte & Touche. [Google Scholar]

- Ao, S. I., & Fayek, H. (2023). Continual deep learning for time series modeling. Sensors, 23(16), 7167. [Google Scholar] [CrossRef]

- Apergis, N. (2015). Forecasting Credit Default Swaps (CDSs) spreads with newswire messages: Evidence from European countries under financial distress. Economics Letters, 136, 92–94. [Google Scholar] [CrossRef]

- Augustin, P., Sokolovski, V., Subrahmanyam, M. G., & Tomio, D. (2022). How sovereign is sovereign credit risk? Global prices, local quantities. Journal of Monetary Economics, 131, 92–111. [Google Scholar] [CrossRef]

- Avino, D., & Nneji, O. (2014). Are CDS spreads predictable? An analysis of linear and non-linear forecasting models. International Review of Financial Analysis, 34, 262–274. [Google Scholar] [CrossRef]

- Badr, O. M., & El khadrawi, A. F. (2016). Macroeconomic variables, government effectiveness and sovereign credit rating: A case of Egypt. Applied Economics and Finance, 3(4), 29–36. [Google Scholar] [CrossRef]

- Bai, M., Zhou, Z., Li, J., Chen, Y., Liu, J., Zhao, X., & Yu, D. (2024). Deep graph gated recurrent unit network-based spatial–temporal multi-task learning for intelligent information fusion of multiple sites with application in short-term spatial–temporal probabilistic forecast of photovoltaic power. Expert Systems with Applications, 240, 122072. [Google Scholar] [CrossRef]

- Barry, I. (2022). Arabie saoudite-situation économique et financière en 2022. Ambassade de France en Arabie Saudite—Service économique de Riyad. Available online: https://www.tresor.economie.gouv.fr/Pays/SA (accessed on 20 May 2025).

- Blair, D. (2013). Counterparty credit risk. In Financial derivatives. Working Paper. John Wiley & Sons, Inc. [Google Scholar] [CrossRef]

- Boumahdi, M. A. (2022). Fiche pays Egypte. Ministère de l’Economie des Finances et de la Souvraineté Industrielle et Numérique, Service Economique du Caire, Direction Générale du Trésort. [Google Scholar]

- Chen, K., Zhou, Y., & Dai, F. (2015, October 29–November 1). A LSTM-based method for stock returns prediction: A case study of China stock market. 2015 IEEE International Conference on Big Data (Big Data) (pp. 2823–2824), Santa Clara, CA, USA. [Google Scholar]

- Cipollini, A., & Missaglia, G. (2008). Forecasting industry sector default rates through dynamic factor models. Journal of Risk Model Validation, 2(3), 59–79. [Google Scholar] [CrossRef]

- Cortez, B., Carrera, B., Kim, Y. J., & Jung, J. Y. (2018). An architecture for emergency event prediction using LSTM recurrent neural networks. Expert Systems with Applications, 97, 315–324. [Google Scholar] [CrossRef]

- Dwyer, D., Zan, L., Shisheng, Q., Heather, R., & Jing, Z. (2012). CDS-implied EDF TM credit measures and fair-value spreads. In Basel III credit rating systems: An applied guide to quantitative and qualitative models (pp. 257–301). Palgrave Macmillan. [Google Scholar] [CrossRef]

- Flannery, M. J., Houston, J. F., & Partnoy, F. (2009). Credit default swap spreads as viable substitutes for credit ratings. University of Pennsylvania Law Review, 158, 2085. [Google Scholar]

- Gao, T., Chai, Y., & Liu, Y. (2017, November 20–22). Applying long short term memory neural networks for predicting stock closing price. 2017 8th IEEE International Conference on Software Engineering and Service Science (ICSESS) (pp. 575–578), Beijing, China. [Google Scholar]

- Gogineni, A., Panday, I. K., Kumar, P., & Paswan, R. K. (2024). Predicting compressive strength of concrete with fly ash and admixture using XGBoost: A comparative study of machine learning algorithms. Asian Journal of Civil Engineering, 25(1), 685–698. [Google Scholar] [CrossRef]

- Hilscher, J., & Wilson, M. (2017). Credit ratings and credit risk: Is one measure enough? Management Science, 63(10), 3414–3437. [Google Scholar] [CrossRef]

- Hull, J., Predescu, M., & White, A. (2004). The relationship between credit default swap spreads, bond yields, and credit rating announcements. Journal of Banking & Finance, 28(11), 2789–2811. [Google Scholar]

- Hull, J. C. (2014). Options, futures, and other derivatives. Pearson. [Google Scholar]

- Hung, C. H. D., Banerjee, A., & Meng, Q. (2017). Corporate financing and anticipated credit rating changes. Review of Quantitative Finance and Accounting, 48, 893–915. [Google Scholar] [CrossRef]

- International Monetary Fund. (2013). Chapter 2: A new look at the role of sovereign credit default swaps. In Global financial stability report (pp. 57–92). IMF. [Google Scholar]

- Jacobs, M., Jr., Karagozoglu, A. K., & Layish, D. N. (2016). Credit risk signals in CDS market vs agency ratings. The Journal of Risk Finance, 17(2), 194–217. [Google Scholar] [CrossRef]

- Jarrow, R. A., Lando, D., & Turnbull, S. M. (1997). A Markov model for the term structure of credit risk spreads. The Review of Financial Studies, 10(2), 481–523. [Google Scholar] [CrossRef]

- Kamath, M. V., Prashanth, S., Kumar, M., & Tantri, A. (2024). Machine-learning-algorithm to predict the high-performance concrete compressive strength using multiple data. Journal of Engineering, Design and Technology, 22(2), 532–560. [Google Scholar] [CrossRef]

- Khan, M. A., Khan, R., Algarni, F., Kumar, I., Choudhary, A., & Srivastava, A. (2022). Performance evaluation of regression models for COVID-19: A statistical and predictive perspective. Ain Shams Engineering Journal, 13(2), 101574. [Google Scholar] [CrossRef]

- Kiarie, J., Mwalili, S., & Mbogo, R. (2022). Forecasting the spread of the COVID-19 pandemic in Kenya using SEIR and ARIMA models. Infectious Disease Modelling, 7(2), 179–188. [Google Scholar] [CrossRef] [PubMed]

- Li, J., Hao, J., Sun, X., & Feng, Q. (2021). Forecasting China’s sovereign CDS with a decomposition reconstruction strategy. Applied Soft Computing, 105, 107291. [Google Scholar] [CrossRef]

- Li, Z., & Tam, V. (2017, November 27–December 1). A comparative study of a recurrent neural network and support vector machine for predicting price movements of stocks of different volatilites. 2017 IEEE Symposium Series on Computational Intelligence (SSCI) (pp. 1–8), Honolulu, HI, USA. [Google Scholar]

- Lima, P. A. S. B. D. (2021). Forecasting sovereign CDS returns via deep learning [Doctoral dissertation, Universidade de São Paulo]. [Google Scholar]

- Longstaff, F. A., Pan, J., Pedersen, L. H., & Singleton, K. J. (2011). How sovereign is sovereign credit risk? American Economic Journal: Macroeconomics, 3(2), 75–103. [Google Scholar] [CrossRef]

- Mao, H., Fang, P., Zheng, Y., Tian, L., Li, X., Wang, P., Peng, L., & Li, G. (2023). Continuous grip force estimation from surface electromyography using generalized regression neural network. Technology and Health Care, 31(2), 675–689. [Google Scholar] [CrossRef]

- Masi, F. (2024). Introduction to regression methods. In Machine learning in geomechanics 1: Overview of machine learning, unsupervised learning, regression, classification and artificial neural networks (pp. 31–92). ISTE Ltd.; John Wiley & Sons, Inc. [Google Scholar]

- McNally, S., Roche, J., & Caton, S. (2018, March 21–23). Predicting the price of bitcoin using machine learning. 2018 26th Euromicro International Conference on Parallel, Distributed and Network-Based Processing (PDP) (pp. 339–343), Cambridge, UK. [Google Scholar]

- Meng, Q., Wang, Y., An, J., Wang, Z., Zhang, B., & Liu, L. (2019, June 23–25). Learning non-stationary dynamic Bayesian network structure from data stream. 2019 IEEE Fourth International Conference on Data Science in Cyberspace (DSC) (pp. 128–134), Hangzhou, China. [Google Scholar]

- Moscatelli, M., Parlapiano, F., Narizzano, S., & Viggiano, G. (2020). Corporate default forecasting with machine learning. Expert Systems with Applications, 161, 113567. [Google Scholar] [CrossRef]

- Naifar, N. (2020). What explains the sovereign credit default swap spreads changes in the GCC region? Journal of Risk and Financial Management, 13(10), 245. [Google Scholar] [CrossRef]

- Neftci, S., Santos, A. O., & Lu, Y. (2005). Credit default swaps and financial crisis prediction (No. 114). Working Paper Series. FINRISK. [Google Scholar]

- Oldenburg, M., Boitiere, A., Jiquel, S., Boumahdi, M. A., & Cosson, A. (2022). La lettre economique d’Egypte (No. 134). Ambassade de France en République Arabe d’Egypte—Service économique du Caire. [Google Scholar]

- Paret, A. C., & Gilles, D. (2015). Sovereign default in emerging market countries: A transition model allowing for heterogeneity. Amundi Asset Management Working Paper, WP-049-2015. Amundi Asset Management. [Google Scholar]

- Piccolo, A., & Shapiro, J. (2022). Credit ratings and market information. The Review of Financial Studies, 35(10), 4425–4473. [Google Scholar] [CrossRef]

- Robinson, J. W., Hartemink, A. J., & Ghahramani, Z. (2010). Learning non-stationary dynamic bayesian networks. Journal of Machine Learning Research, 11(12), 3647–3680. [Google Scholar]

- Rodríguez, I. M., Dandapani, K., & Lawrence, E. R. (2019). Measuring sovereign risk: Are CDS spreads better than sovereign credit ratings? Financial Management, 48(1), 229–256. [Google Scholar] [CrossRef]

- Romanyuk, K. (2021). Impact of the COVID-19 pandemic on the US credit default swap market. Complexity, 2021(1), 1656448. [Google Scholar] [CrossRef]

- Samarawickrama, A. J. P., & Fernando, T. G. I. (2017, December 15–16). A recurrent neural network approach in predicting daily stock prices an application to the Sri Lankan stock market. 2017 IEEE International Conference on Industrial and Information Systems (ICIIS) (pp. 1–6), Peradeniya, Sri Lanka. [Google Scholar]

- Selvin, S., Vinayakumar, R., Gopalakrishnan, E. A., Menon, V. K., & Soman, K. P. (2017, September 13–16). Stock price prediction using LSTM, RNN and CNN-sliding window model. 2017 International Conference on Advances in Computing, Communications and Informatics (ICACCI) (pp. 1643–1647), Udupi, India. [Google Scholar]

- Shahrour, M. H., Arouri, M., & Rao, S. (2024). Linking climate risk to credit risk: Evidence from sectorial analysis. The Journal of Alternative Investments, 27(3), 118–135. [Google Scholar] [CrossRef]

- Shahrour, M. H., & Dekmak, M. (2023). Intelligent stock prediction: A neural network approach. International Journal of Financial Engineering, 10(01), 2250016. [Google Scholar] [CrossRef]

- Shaw, F., Murphy, F., & O’Brien, F. (2014). The forecasting efficiency of the dynamic Nelson Siegel model on credit default swaps. Research in International Business and Finance, 30, 348–368. [Google Scholar] [CrossRef]

- Siami-Namini, S., & Namin, A. S. (2018). Forecasting economics and financial time series: ARIMA vs. LSTM. arXiv, arXiv:1803.06386. [Google Scholar]

- Thornary, B., Fèvre, A. S., Meyer, A., Lequillerier, V., El Kasmi, S., Morin, L., & Laboureau, T. (2022a). Direction de l’évaluation des études et de la prospective—Fiche Maroc. BPIFRANCE. [Google Scholar]

- Thornary, B., Fèvre, A. S., Meyer, A., Lequillerier, V., El Kasmi, S., Morin, L., & Laboureau, T. (2022b). Direction de l’évaluation des études et de la prospective—Fiche pays Arabi Saudite. BPIFRANCE. [Google Scholar]

- Vieira, M., & George, B. (2016). Starmine sovereign risk model. Refinitiv, RE105787/12-19. Available online: https://solutions.refinitiv.com/StarMineNAsia-Whitepapers (accessed on 20 February 2025).

- Vukovic, D. B., Romanyuk, K., Ivashchenko, S., & Grigorieva, E. M. (2022). Are CDS spreads predictable during the COVID-19 pandemic? Forecasting based on SVM, GMDH, LSTM and Markov switching autoregression. Expert Systems with Applications, 194, 116553. [Google Scholar] [CrossRef]

- Wang, Y., Liao, W., & Chang, Y. (2018). Gated recurrent unit network-based short-term photovoltaic forecasting. Energies, 11(8), 2163. [Google Scholar] [CrossRef]

- Zhang, L., & Jánošík, D. (2024). Enhanced short-term load forecasting with hybrid machine learning models: CatBoost and XGBoost approaches. Expert Systems with Applications, 241, 122686. [Google Scholar] [CrossRef]

- Zhang, R., Li, Y., & Gui, Y. (2023). Prediction of rock blasting induced air overpressure using a self-adaptive weighted kernel ridge regression. Applied Soft Computing, 148, 110851. [Google Scholar] [CrossRef]

- Zhou, Q., Wang, C., & Zhang, G. (2020). A combined forecasting system based on modified multi-objective optimization and sub-model selection strategy for short-term wind speed. Applied Soft Computing, 94, 106463. [Google Scholar] [CrossRef]

- Zhu, H. (2006). An empirical comparison of credit spreads between the bond market and the credit default swap market. Journal of Financial Services Research, 29, 211–235. [Google Scholar] [CrossRef]

| Saudi Arabia | Morocco | Egypt | |

|---|---|---|---|

| Min | 0.0000619 | 0.002088 | 0.02230 |

| Mean | 0.0068816 | 0.017385 | 0.06017 |

| Max | 0.0392032 | 0.047295 | 0.28196 |

| Sd | 0.005991241 | 0.008852734 | 0.03207076 |

| J-B test (p-value) | 1247.4 (<2.2 × 10−16) | 164.29 (<2.2 × 10−16) | 6980.9 (<2.2 × 10−16) |

| ADF (p-value) | −3.9823 (0.011) | −3.7785 (0.02005) | −2.7323 (0.2683) |

| Architecture | Units (Numbers) | Activation Function |

|---|---|---|

| LSTM | LSTM units: 50 Output: 1 neuron | ReLU Sigmoid |

| RNN | RNN units: 50 Output: 1 neuron | ReLU Sigmoid |

| GRU | GRUs: 50 Output: 1 node | ReLU Sigmoid |

| Bi-LSTM | Bi-LSTM units: 50 (bidirectional) Output: 1 neuron | ReLU Sigmoid |

| If One-Year PD (%) Is Greater Than | And One-Year PD (%) Is Less Than or Equal to | Then Rating Is |

|---|---|---|

| 0.000% | 0.123% | AAA |

| 0.123% | 0.332% | AA |

| 0.332% | 0.851% | A |

| 0.851% | 1.879% | BBB |

| 1.879% | 4.107% | BB |

| 4.107% | 12.052% | B |

| 12.052% | 20.973% | CCC |

| 20.973% | 100.0% | CC |

| Egypt | Methods | Model | RMSE | MAE | MAPE |

| Machine Learning | Linear Regression | 0 | 0.001864 | 2.48 | |

| Ridge Regression | 0.01 | 0.005937 | 9.07 | ||

| Lasso Regression | 0.04 | 0.030998 | 59.02 | ||

| Kernel Ridge | 0.01 | 0.004823 | 6.21 | ||

| XGBoost | 0.02 | 0.004785 | 4.72 | ||

| Deep Learning | RNN | 0.002322 | 0.002322 | 3.18 | |

| LSTM | 0.002439 | 0.002439 | 3.5 | ||

| BiLSTM | 0.003048 | 0.003048 | 4.41 | ||

| GRU | 0.003698 | 0.003698 | 7.13 |

| Morocco | Methods | Model | RMSE | MAE | MAPE |

| Machine Learning | Linear Regression | 0 | 0.000272 | 3.2 | |

| Ridge Regression | 0.01 | 0.00496 | 77.54 | ||

| Lasso Regression | 0.01 | 0.010435 | 163.4 | ||

| Kernel Ridge | 0 | 0.001497 | 13.78 | ||

| XGBoost | 0 | 0.001254 | 28.75 | ||

| Deep Learning | RNN | 0 | 0.001005 | 15.06 | |

| LSTM | 0 | 0.001114 | 20.72 | ||

| BiLSTM | 0 | 0.000691 | 11.67 | ||

| GRU | 0 | 0.000516 | 8.7 |

| Saudi Arabia | Methods | Model | MAE | RMSE | MAPE |

| Machine Learning | Linear Regression | 0.25 × 10−6 | 3.56 × 10−4 | 5.66 | |

| Ridge Regression | 0 | 0.002782 | 96.84 | ||

| Lasso Regression | 0.01 | 0.004401 | 154.83 | ||

| Kernel Ridge | 0 | 0.002093 | 37.94 | ||

| XGBoost | 0 | 0.000418 | 7.27 | ||

| Deep Learning | RNN | 0.000534 | 0.000534 | 15.27 | |

| LSTM | 0.000457 | 0.000457 | 8.38 | ||

| BiLSTM | 0.000428 | 0.000428 | 7.77 | ||

| GRU | 0.000427 | 0.000427 | 8.59 |

| Country | Min | Max | Mean | Sd |

|---|---|---|---|---|

| Egypt | 0.075993 | 0.136974 | 0.097644 | 0.017155 |

| Morocco | 0.015397 | 0.016442 | 0.016132 | 0.000231 |

| Saudi Arabia | 0.003366 | 0.006208 | 0.00539 | 0.000776 |

| Country | Egypt | Morocco | Saudi Arabia |

|---|---|---|---|

| CDS-based implied rating | B | BBB | A |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abid, A. Forecasting Sovereign Credit Risk Amidst a Political Crisis: A Machine Learning and Deep Learning Approach. J. Risk Financial Manag. 2025, 18, 300. https://doi.org/10.3390/jrfm18060300

Abid A. Forecasting Sovereign Credit Risk Amidst a Political Crisis: A Machine Learning and Deep Learning Approach. Journal of Risk and Financial Management. 2025; 18(6):300. https://doi.org/10.3390/jrfm18060300

Chicago/Turabian StyleAbid, Amira. 2025. "Forecasting Sovereign Credit Risk Amidst a Political Crisis: A Machine Learning and Deep Learning Approach" Journal of Risk and Financial Management 18, no. 6: 300. https://doi.org/10.3390/jrfm18060300

APA StyleAbid, A. (2025). Forecasting Sovereign Credit Risk Amidst a Political Crisis: A Machine Learning and Deep Learning Approach. Journal of Risk and Financial Management, 18(6), 300. https://doi.org/10.3390/jrfm18060300