1. Introduction

Following the success of the first cryptocurrency, Bitcoin, the concept has arisen as an alternative to classic financial systems. Investors’ confidence in DeFi has brought about the fast-paced growth of digital asset classes such as Ethereum, stablecoins, smart contracts, and non-fungible tokens, among others. Many companies and markets support business transactions through digital wallets using cyptocurrencies as the payment mode

Mallqui and Fernandes (

2019). Surprisingly, DeFi’s popularity has also attracted the attention of centralized authorities, such as government authorities and central banks, and has inspired them to push forward the development of their own cryptocurrencies, which are called central bank digital currencies. These authorities have also started thinking about how cryptocurrencies contribute to the economy and addressing regulations for digital assets in, for example, the US, the UAE, and many other countries. Investors, government authorities, and academic researchers continue to pay more attention to cryptocurrencies. In particular, the modeling of cryptocurrencies has become another challenge for quantitative analysts.

Cryptocurrency prices are highly volatile

Nadarajah (

2017), so it is important to model and predict cryptocurrency volatility for risk management purposes. Empirical comparative studies on cryptocurrency prices and their volatilities have often been addressed in the literature. Works on cryptocurrency volatility modeling began by comparing various parametric GARCH-based models

Chu et al. (

2017);

Conrad Christian and Eric (

2018);

Katsiampa (

2017). As artificial intelligence has gained value in financial time–series modeling, research has been extended to machine-learning-based cryptocurrency volatility models

Jiang (

2020);

Shen et al. (

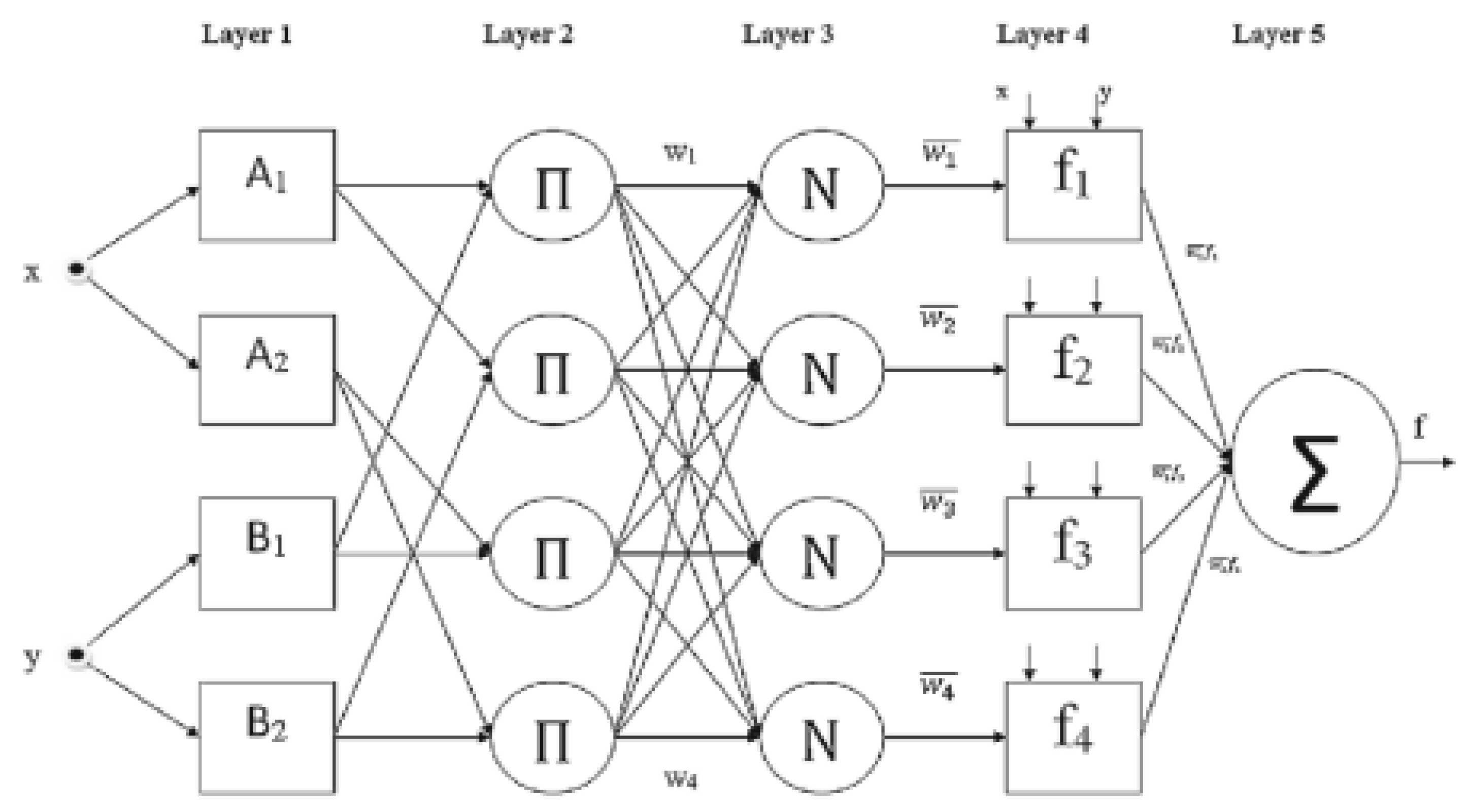

2021). Another direction of stock price volatility modeling consists of combining previous GARCH and machine learning volatility models with fuzzy logic theory, such as the evolving fuzzy GARCH and the neuro-fuzzy inference system named ANFIS.

In this study, we enhance the work of previous empirical studies. We consider three volatility models, which are the GARCH family, ensemble learning, and ANFIS models, for three cryptocurrencies: Bitcoin, Ethereum, and Litecoin. We conduct an in-sample empirical analysis and an out-of-sample forecast accuracy evaluation of these volatility models for each cryptocurrency. To the best of our knowledge, comparative studies using these three types of volatility methods on these three financial crypto-assets have not yet appeared in the literature.

Some motivations for considering these models are as follows. GARCH-type models are well established for capturing various stylized facts concerning cryptocurrency return volatility, such as when capturing volatility clustering. ANFIS uses its flexibility to model nonlinearities. It has captured stylized facts on the volatility of financial variables well in previous work

Conrad Christian and Eric (

2018). The power of ANFIS in stock return volatility modeling leads us to consider it for cryptocurrency price volatility. We consider the boosting tree family of models to benefit from the various advantages of tree-based ensemble learning models. These models are based on regularization techniques and on the aggregation of several decision tree models. Moreover, they are known to be computationally fast compared with other kinds of machine learning methods. When cryptocurrency volatility modeling is reduced to the problem of function approximation, the strength of the boosting tree family appears most appropriate. The boosting tree family has delivered better accuracy in the forecasting of cryptocurrency volatility prediction in the literature.

This article is organized as follows.

Section 2 presents the literature review,

Section 3 presents the methodology, and the following section presents the empirical analysis. The last section provides concluding remarks.

2. Literature Review

Satoshi Nakamoto created Bitcoin in 2009

Satoshi (

2009). This was the first cryptocurrency, and it has rapidly attracted the attention of investors and academics as an alternative to conventional currencies. Ten years later, we had a list of 1536 types of cryptocurrencies with a total market capitalization of USD 321 billion, of which Bitcoin occupied the most considerable share, followed by Ethereum and Litecoin

Kristjanpoller and Minutolo (

2018). Interest in cryptocurrencies never ceases. Our literature analysis will start with an analysis of works on Bitcoin prices and will later include Ethereum and Litecoin prices.

In the literature, many researchers have studied Bitcoin prices/returns, as well as their volatility. Studies have investigated potential factors driving Bitcoin’s price/return dynamics. These factors may come from the supply–demand side of Bitcoin markets, such as the Bitcoin trading volume, or from other financial markets, such as exchange rates or energy and index markets. They may also come from internet discussions about Bitcoin, which can be seen as a proxy for investor interest in Bitcoin; examples include the non-market-based factors of Google trends

Kristoufek (

2013);

Michal et al. (

2015), the volume of daily views on the Bitcoin entry on Wikipedia

Guesmi et al. (

2017), and others. The integration of these internal and external factors into Bitcoin’s price/return dynamics has been of interest. Google trends and Bitcoin trading volume have been stated

Kristoufek (

2013) as determinants for Bitcoin prices/returns. Econometric and automated models have been considered, and they range from linear to machine learning methodologies. Using parametric VAR and VECM dynamics to address the endogeneity problem and to examine the long-term relationship between the considered price series, significant effects of the macroeconomic and financial variables, oil prices, American financial market indices, and exchange rates have been found

Guesmi et al. (

2017).

Some studies focus on changes in Bitcoin price/return directions. They have used machine learning models and algorithms to address such issues. The authors of

Madan (

2014) predicted signs of future changes in Bitcoin prices using a machine learning algorithm. Similar work was conducted by

Mallqui and Fernandes (

2019). The authors of

Rakotomarolahy (

2021) considered daily explanatory variables (such as oil prices, American financial market indices, exchange rates, Google trends from web searches for the word Bitcoin, and the Bitcoin trading volume, which are common in the literature on Bitcoin return modeling) using logistic regression, discriminant analysis, and machine learning classification techniques; they found those variables to be predictors for Bitcoin return directions, with extreme gradient boosting ensemble learning being used for the dynamics.

Cryptocurrency prices are known to be highly volatile. They largely depend on the scarcity of coins and people’s confidence in them, which affects their value and leads to strong upward and downward price fluctuations. Such strong fluctuations characterize the volatility of cryptocurrency price series

Yu (

2019), where companies holding large numbers of them are highly exposed to risks. To help companies manage these risks, predicting the volatility of cryptocurrencies is an essential way to shed light on their behavior and trading strategies.

To model cryptocurrency price volatility, researchers try to tackle various stylized facts. Several works have explored long-run memory in cryptocurrency volatility.

Aurelio Bariviera (

2017) found that the daily volatility of cryptocurrencies exhibited long-term memory over all periods. Similarly, volatility is characterized by long-run dependence behavior

Charfeddine and Maouchi (

2019), and

Lahmiri et al. (

2018) found such dependence with a high degree of randomness. The authors of

Mensi et al. (

2019) showed the existence of dual long-run memory in Bitcoin return and its volatility. Regarding the day-of-the-week effect,

Aharon and Qadan (

2019) addressed the existence of the day-of-the-week effect in cryptocurrency returns and volatility. In particular,

Ma and Tanizaki (

2019) showed the existence of high and significant volatility on Mondays and Thursdays.

For other effects and factor determinants of cryptocurrency volatilities,

Balcilar et al. (

2017) found that the volume cannot predict the volatility of a cryptocurrency. The authors of

Bouri et al. (

2018) confirmed this using copula models, where this financial stress effect limited the direction of the forecast. The authors of

Yu (

2019) and

Baur and Dimpfl (

2018) proved that leverage has a significant impact on the future volatility of cryptocurrencies. Regarding the momentum effect,

Grobys and Sapkota (

2019) showed that there is no significant dynamic reward. However,

Cheng et al. (

2019) found a strong dynamic effect on cryptocurrencies using DFA and MF-DFA. For the overreaction effect,

Chevapatrakul and Mascia (

2024) provided evidence of investor overreaction during days of sharp market declines and weeks of market recoveries. Regarding the spillover effect,

Guesmi et al. (

2017) stated that markets are characterized by return and volatility spillovers, and they are associated with strong positive correlations

Canh et al. (

2019). The authors of

Aysan et al. (

2018) studied the effect of geopolitical risk (GPR). They showed that Bitcoin returns and volatility are negatively and positively affected by GPR. They concluded that cryptocurrencies can be used as a hedging tool against GPR.

It is worth noting that most of the studies on cryptocurrency volatility modeling use GARCH-family models in their analysis. The authors of

Katsiampa (

2017) compared six GARCH models to model Bitcoin volatility while addressing possible asymmetry and nonlinearity, and they concluded that AR-CGARCH with long- and short-term components is an optimal model. The authors of

Chu et al. (

2017) fitted 12 GARCH models to each of the seven most popular cryptocurrencies and pointed out the power of IGARCH with persistent volatility and light structural changes. The authors of

Ngunyi et al. (

2019) used 13 GARCH-family models to forecast the volatilities of eight famous cryptocurrencies with 700 daily observations. The authors of

Conrad Christian and Eric (

2018) proposed the GARCH-MIDAS dynamics to capture the high-/low-frequency issues between the daily Bitcoin volatility and the monthly financial and macroeconomic variables when investigating the effect of the latter variables on the variable of interest. The authors of

Walther et al. (

2019) investigated the usefulness of exogenous factors in predicting 1-day, 7-day (one week), and 30-day (one month) cryptocurrency volatility. On a set of 17 different economic and financial factors, the average forecast was then combined using GARCH-MIDAS.

Quyen Thieu (

2017) derived a conditional heteroskedastic model with exogenous variables using the QMV estimation method and the semi-diagonal BEKK method with covariances.

However, the use of machine learning models started to emerge. The authors of

Nakano et al. (

2018) designed artificial neural network (ANN) classification models to extract meaningful trading signals from input technical indicators calculated from time–series performance data at 15-minute time intervals; in particular, the numerical results showed that the use of different technical indicators ultimately allowed overfitting to be avoided. The authors of

Lukáš (

2017) analyzed the realized volatility and predicted the log returns of BTCUSD and EURUSD exchange rates on a daily time scale using an artificial neural network and HARRVJ; they concluded that the EURUSD exchange rate is more volatile than that of BTCUSD.

Xiangxi Jiang (

2020) compared several neuron-based machine learning models (LSTM, MLP, GRU, and RNN) and found that the RNN performed better than other methods. Later, the use of machine learning exploded (see

Khaldi et al. (

2018,

2019);

McNally et al. (

2018);

Shen et al. (

2021); this is not an exhaustive list). The authors of

Bouteska et al. (

2024) compared several boosting and neuronal models and assessed the performance of the tree-based LightGBM model. For other works on tree-based ensemble learning models of volatility, we found

Nasios and Vogklis (

2022);

Ying and Jungang (

2017) for the boosting GBM,

Ke et al. (

2017) for the light boosting LightGBM, and

Li et al. (

2019) for the extreme boosting XGBM models. Few studies have investigated the combination of parametric and non-parametric methods for cryptocurrencies. We can mention the hybrid ANN-GARCH model with PCA preprocessing for predicting Bitcoin volatility

Kristjanpoller and Minutolo (

2018) and SVR-GARCH

Herrera et al. (

2018). Most of these studies were carried out on Bitcoin.

We see the changing behavior of cryptocurrency volatility dynamics for parametric specification, the power of tree-based ensemble learning models, and the limited use of hybrid volatility models on cryptocurrency.

In this research, we are interested in investigating how parametric models can capture stylized facts of cryptocurrency volatilities. The parametric models include models from the GARCH family, which are commonly used to forecast financial assets. We then compare their results with those of non-parametric models. We will consider two non-parametric methods, the hybrid ANFIS and the ensemble learning boosting types, such as the GBM, the XGBM, and the LightGBM, which are widely used in different areas of forecasting due to their strong generalization capabilities.