Forecast Bias in Analysts’ Initial Coverage: The Influence of Firm ESG Disclosures

Abstract

1. Introduction

2. Hypothesis Development

3. Empirical Design

3.1. Data Sources and Sample Description

3.2. Variable Definitions and Methodology

3.3. Summary Statistics

4. Results

4.1. Analyst Initial Forecast Bias

4.2. ESG Score and Analyst Initial Forecast Bias

4.3. Robustness Tests

4.3.1. Addressing the Endogeneity Concerns

4.3.2. Propensity Score Matching (PSM) Analysis

4.3.3. Placebo Test

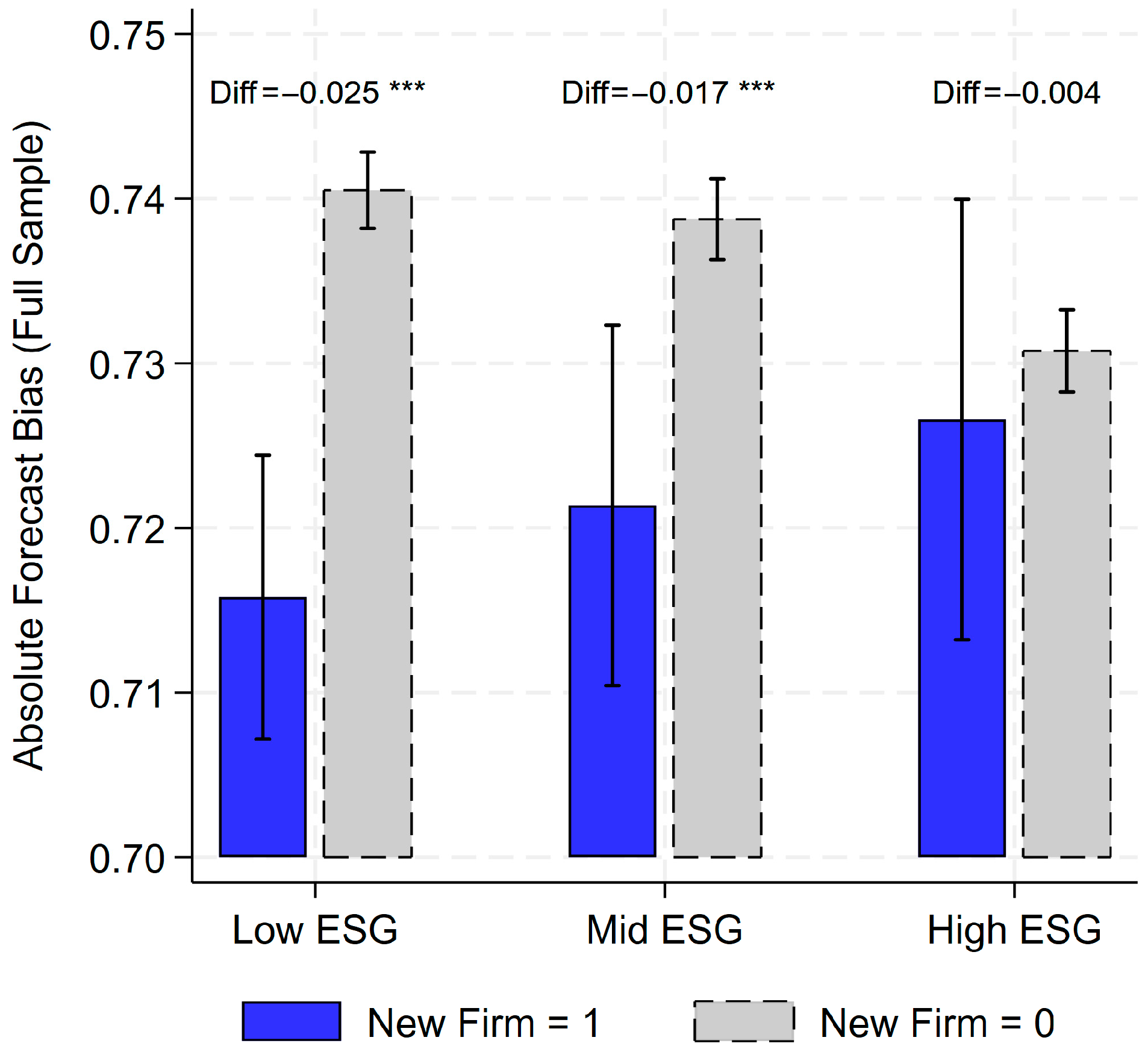

4.3.4. Heterogeneity Analysis

5. Additional Analyses: Analysts’ Price Target Forecasts

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Definition | Data Sources | Reference |

|---|---|---|---|

| Dependent Variables | |||

| EPS Bias | The difference between an analyst’s EPS forecast for a firm for a given fiscal quarter and the mean EPS forecast for that firm, scaled by the standard deviation of all analysts’ EPS forecasts for that fiscal quarter. Forecasts issued more than 90 days before the earnings announcement are excluded. If an analyst issues multiple forecasts for a firm for the same fiscal quarter, only the first forecast issued within the 90-day window is retained. | I/B/E/S | Hirshleifer et al. (2021) |

| Abs EPS Bias | The absolute difference between an analyst’s EPS forecast for a firm for a given fiscal quarter and the mean EPS forecast for that firm, scaled by the standard deviation of all analysts’ EPS forecasts for that fiscal quarter. Forecasts issued more than 90 days before the earnings announcement are excluded. If an analyst issues multiple forecasts for a firm for the same fiscal quarter, only the first forecast issued within the 90-day window is retained. | I/B/E/S | Hirshleifer et al. (2021) |

| PTG Bias | The difference between an analyst’s price target forecast for a firm announced in a given calendar quarter and the mean price target forecast for that firm, scaled by the standard deviation of all analysts’ price target forecasts for the firm announced in the same quarter. If an analyst issues multiple forecasts for a firm in the same calendar quarter, only the first forecast is retained. | I/B/E/S | Hirshleifer et al. (2021) |

| Abs PTG Bias | The absolute difference between an analyst’s price target forecast for a firm announced in a given calendar quarter and the mean price target forecast for that firm, scaled by the standard deviation of all analysts’ price target forecasts for the firm announced in the same quarter. If an analyst issues multiple forecasts for a firm in the same calendar quarter, only the first forecast is retained. | I/B/E/S | Hirshleifer et al. (2021) |

| Independent Variables | |||

| New Firm | A dummy variable that equals 1 if an analyst issues an EPS forecast or price target for a firm for the first time, provided the analyst has been listed in the I/B/E/S database for more than two calendar quarters. If the analyst has been listed in the I/B/E/S database for two or fewer calendar quarters, the value is coded as missing. | I/B/E/S | |

| ESG Score | The firm’s weighted generalized mean of environmental, social, and governance rating for year t on a scale of 0 to 100. The score for a given year t is defined as the ESG Disclosure Score from the calendar year preceding the fiscal quarter to which an analyst’s EPS forecast pertains, or the calendar quarter to which an analyst’s price target pertains. | Bloomberg | Wong et al. (2021) |

| Analyst Cov | The number of analysts issuing EPS forecasts for a firm for a given fiscal quarter (for the EPS sample), or the number of analysts issuing price target forecasts for a firm in a given calendar quarter (for the price target sample). EPS forecasts issued more than 90 days before the earnings announcement are excluded. | I/B/E/S | Diether et al. (2002); Hirshleifer et al. (2019); Gao et al. (2025) |

| EPS Disp | The standard deviation of all analysts’ EPS forecasts for a firm for a given fiscal quarter, scaled by the mean forecast. Forecasts issued more than 90 days before the earnings announcement are excluded. If an analyst issues multiple forecasts for a firm for the same fiscal quarter, only the first forecast issued within the 90-day window is retained. | I/B/E/S | Diether et al. (2002); Tang et al. (2025) |

| PTG Disp | The standard deviation of all analysts’ price target forecasts for a firm announced in a given calendar quarter, scaled by the mean forecast. If an analyst issues multiple forecasts for a firm in the same calendar quarter, only the first forecast is retained. | I/B/E/S | Diether et al. (2002); Tang et al. (2025) |

| Forecast Age | The number of days between the announcement date of an analyst’s EPS forecast for a firm for a given fiscal quarter and the earnings announcement date for the corresponding quarter. | I/B/E/S | Hirshleifer et al. (2019); Hirshleifer et al. (2021) |

| Analyst Exp | The number of years from the first time the analyst appears in the I/B/E/S EPS forecast database (for the EPS sample) or the price target database (for the price target sample) to the announcement date of the EPS or price target forecast under consideration. | I/B/E/S | Hirshleifer et al. (2021) |

| No. of Firms | The number of firms an analyst has covered up to the calendar quarter immediately preceding the announcement date of the EPS or price target forecast under consideration. | I/B/E/S | Hirshleifer et al. (2019); Hirshleifer et al. (2021) |

| Turnover | The average turnover ratio over the 12-month period ending one month before the start of the calendar quarter in which an analyst’s EPS forecast or price target forecast is announced. The turnover ratio for a stock in a given month is defined as the monthly trading volume divided by the number of shares outstanding. | CRSP | Hirshleifer et al. (2019); Tang et al. (2025) |

| Return Vol | The standard deviation of a stock’s monthly returns over the 12-month period ending one month before the start of the calendar quarter in which an analyst’s EPS forecast or price target forecast is announced. | CRSP | Hirshleifer et al. (2019) |

| Mkt Cap | Market capitalization of a firm measured in millions of dollars, calculated as the stock price (prccq) multiplied by the number of shares outstanding (cshoq), measured at the end of the fiscal quarter preceding the fiscal quarter to which the analyst’s EPS forecast pertains (for the EPS sample), or at least four months prior to the announcement of the price target forecast (for the price target sample), to ensure the information was available to analysts at the time of forecasting. If the data is unavailable in Compustat, market capitalization is calculated using CRSP data. All values are adjusted to 2022 U.S. dollars. | CRSP; Compustat | Hirshleifer et al. (2019) |

| ROA | The Return on Assets (ROA) ratio, calculated as quarterly income before extraordinary items (ibq) divided by total assets (atq), measured at the end of the fiscal quarter preceding the fiscal quarter to which the analyst’s EPS forecast pertains (for the EPS sample), or at least four months prior to the announcement of the price target forecast (for the price target sample), to ensure the information was available to analysts at the time of forecasting. | Compustat | Hirshleifer et al. (2019); Gao et al. (2025); Tang et al. (2025) |

| B/M | The Book-to-Market (BM) ratio of a firm, calculated as the book value of equity divided by market capitalization, measured at the end of the fiscal quarter preceding the fiscal quarter to which the analyst’s EPS forecast pertains (for the EPS sample), or at least four months prior to the announcement of the price target forecast (for the price target sample), to ensure the information was available to analysts at the time of forecasting. | Compustat | Diether et al. (2002) |

| Sales Growth | The growth rate in a firm’s sales (salesq) over a fiscal quarter, measured at the end of the fiscal quarter preceding the fiscal quarter to which the analyst’s EPS forecast pertains (for the EPS sample), or at least four months prior to the announcement of the price target forecast (for the price target sample), to ensure the information was available to analysts at the time of forecasting. | Compustat | Hirshleifer et al. (2019); Gao et al. (2025) |

| 1 | For instance, see Jegadeesh and Kim (2010); Hirshleifer et al. (2019) and F. Li et al. (2021) among others. |

| 2 | For a detailed methodology of the Bloomberg ESG Disclosure Score, including its components, data collection process, and weighting scheme, see the official documentation available on the Bloomberg Professional Services website at https://www.bloomberg.com/professional/products/data/enterprise-catalog/esg/#overview (accessed on 13 October 2025). |

| 3 | For instance, Baader Bank Selects Bloomberg’s Comprehensive ESG Data for SFDR Reporting, 25 November 2024, https://www.bloomberg.com/professional/insights/press-announcement/baader-bank-selects-bloombergs-comprehensive-esg-data-for-sfdr-reporting/#:~:text=Bloomberg%20announced%20today%20that%20Baader,Disclosure%20Regulation%20(SFDR)%20reporting (accessed on 13 October 2025). |

| 4 | In our main tests, analyst forecast bias is measured relative to the mean forecast. As an untabulated robustness check, we also use the median forecast as the consensus, and the results remain highly consistent. These results are available upon request. |

| 5 | Most variables, with the exception of the ESG scores and the dummy variable New Firm, are winsorized at the 1st and 99th percentiles. |

| 6 | According to Table 1, the standard deviations of EPS Bias and the rescaled ESG Score (divided by 100) are 0.908 and 0.163, respectively. This implies that a one-standard-deviation increase in ESG Score is associated with a 0.019-standard-deviation increase in EPS Bias (). |

| 7 | To alleviate concerns about potential multicollinearity between the ESG score and the interaction term, we calculated their correlation, which is 0.067, suggesting that multicollinearity is not a significant issue. In addition, we computed variance inflation factors (VIFs) for the regressions in Table 2 and Table 3. All VIFs are below 5, further confirming that multicollinearity is not a concern in our results. |

| 8 | EPS Bias is defined as the difference between an analyst’s EPS forecast and the mean forecast, scaled by the cross-sectional standard deviation of all forecasts for the same firm-quarter. |

| 9 | We also conduct robustness checks addressing endogeneity and heterogeneity concerns for the PTG forecast sample, and our results remain consistent across these tests. |

| 10 | See “SEC Adopts Rules to Enhance and Standardize Climate-Related Disclosures for Investors”, 6 March 2024, https://www.sec.gov/newsroom/press-releases/2024-31 (accessed on 13 October 2025). And “SEC votes to end defense of climate disclosure rules”, 27 March 2025. https://www.sec.gov/newsroom/press-releases/2025-58 (accessed on 13 October 2025). |

References

- Acheampong, A., & Elshandidy, T. (2025). Does sustainability disclosure improve analysts’ forecast accuracy? Evidence from European banks. Financial Innovation, 11(1), 25. [Google Scholar] [CrossRef]

- Bancel, F., Glavas, D., & Karolyi, G. A. (2025). Do ESG factors influence firm valuations? Evidence from the field. Financial Review, 60(4), 1191–1223. [Google Scholar] [CrossRef]

- Barron, O. E., & Stuerke, P. S. (1998). Dispersion in analysts’ earnings forecasts as a measure of uncertainty. Journal of Accounting, Auditing & Finance, 13(3), 245–270. [Google Scholar]

- Bofinger, Y., Heyden, K. J., & Rock, B. (2022). Corporate social responsibility and market efficiency: Evidence from ESG and misvaluation measures. Journal of Banking & Finance, 134, 106322. [Google Scholar] [CrossRef]

- Boulton, T. J. (2024). Mandatory ESG disclosure, information asymmetry, and litigation risk: Evidence from initial public offerings. European Financial Management, 30(5), 2790–2839. [Google Scholar] [CrossRef]

- Bradshaw, M. T. (2002). The use of target prices to justify sell-side analysts’ stock recommendations. Accounting Horizons, 16(1), 27–41. [Google Scholar] [CrossRef]

- Buchanan, B., Cao, C. X., & Chen, C. (2018). Corporate social responsibility, firm value, and influential institutional ownership. Journal of Corporate Finance, 52, 73–95. [Google Scholar] [CrossRef]

- Cai, H., Yao, T., & Zhang, X. (2024). Confirmation bias in analysts’ response to consensus forecasts. Journal of Behavioral Finance, 25(3), 334–355. [Google Scholar] [CrossRef]

- Christensen, D. M., Serafeim, G., & Sikochi, A. (2022). Why is corporate virtue in the eye of the beholder? The case of ESG ratings. The Accounting Review, 97(1), 147–175. [Google Scholar] [CrossRef]

- Clement, M. B., & Tse, S. Y. (2005). Financial analyst characteristics and herding behavior in forecasting. The Journal of Finance, 60(1), 307–341. [Google Scholar] [CrossRef]

- Da, Z., Hong, K. P., & Lee, S. (2016). What drives target price forecasts and their investment value? Journal of Business Finance & Accounting, 43(3–4), 487–510. [Google Scholar] [CrossRef]

- del Río, C., López-Arceiz, F. J., & Muga, L. (2023). Do sustainability disclosure mechanisms reduce market myopia? Evidence from European sustainability companies. International Review of Financial Analysis, 87, 102600. [Google Scholar] [CrossRef]

- Demartis, S., & Rogo, B. (2024). The relationship between ESG scores and Value-at-Risk: A vine copula–GARCH based approach. Journal of Risk and Financial Management, 17(11), 517. [Google Scholar] [CrossRef]

- Demiroglu, C., & Ryngaert, M. (2010). The first analyst coverage of neglected stocks. Financial Management, 39(2), 555–584. [Google Scholar] [CrossRef]

- Derrien, F., Krüger, P., Landier, A., & Yao, T. (2022). ESG news, future cash flows, and firm value. Swiss finance institute research paper No. 21-84, HEC Paris research paper No FIN-2021-1441. Available online: https://ssrn.com/abstract=3903274 (accessed on 13 October 2025). [CrossRef]

- Dhaliwal, D. S., Radhakrishnan, S., Tsang, A., & Yang, Y. G. (2012). Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. The Accounting Review, 87(3), 723–759. [Google Scholar] [CrossRef]

- Diether, K. B., Malloy, C. J., & Scherbina, A. (2002). Differences of opinion and the cross section of stock returns. The Journal of Finance, 57(5), 2113–2141. [Google Scholar] [CrossRef]

- Easterwood, J. C., & Nutt, S. R. (1999). Inefficiency in analysts’ earnings forecasts: Systematic misreaction or systematic optimism? The Journal of Finance, 54(5), 1777–1797. [Google Scholar] [CrossRef]

- Eichholtz, P., Holtermans, R., Kok, N., & Yönder, E. (2019). Environmental performance and the cost of debt: Evidence from commercial mortgages and REIT bonds. Journal of Banking & Finance, 102, 19–32. [Google Scholar] [CrossRef]

- Ertimur, Y., Muslu, V., & Zhang, F. (2011). Why are recommendations optimistic? Evidence from analysts’ coverage initiations. Review of Accounting Studies, 16(4), 679–718. [Google Scholar] [CrossRef]

- Gao, X., Luo, J., & Zhao, Q. (2025). Impact of equity pledges on analysts earnings forecasts. Finance Research Letters, 71, 106380. [Google Scholar] [CrossRef]

- Grewal, J., Hauptmann, C., & Serafeim, G. (2021). Material sustainability information and stock price informativeness. Journal of Business Ethics, 171(3), 513–544. [Google Scholar] [CrossRef]

- Hashim, N. A., & Strong, N. C. (2018). Do analysts’ cash flow forecasts improve their target price accuracy? Contemporary Accounting Research, 35(4), 1816–1842. [Google Scholar] [CrossRef]

- Helbok, G., & Walker, M. (2004). On the nature and rationality of analysts’ forecasts under earnings conservatism. The British Accounting Review, 36(1), 45–77. [Google Scholar] [CrossRef]

- Hilary, G., & Menzly, L. (2006). Does past success lead analysts to become overconfident? Management Science, 52(4), 489–500. [Google Scholar] [CrossRef]

- Hirshleifer, D., Levi, Y., Lourie, B., & Teoh, S. H. (2019). Decision fatigue and heuristic analyst forecasts. Journal of Financial Economics, 133(1), 83–98. [Google Scholar] [CrossRef]

- Hirshleifer, D., Lourie, B., Ruchti, T. G., & Truong, P. (2021). First impression bias: Evidence from analyst forecasts. Review of Finance, 25(2), 325–364. [Google Scholar] [CrossRef]

- Hong, H., & Kubik, J. D. (2003). Analyzing the analysts: Career concerns and biased earnings forecasts. The Journal of Finance, 58(1), 313–351. [Google Scholar] [CrossRef]

- Hong, H., Kubik, J. D., & Solomon, A. (2000). Security analysts’ career concerns and herding of earnings forecasts. The RAND Journal of Economics, 31(1), 121–144. [Google Scholar] [CrossRef]

- Huang, R., Krishnan, M., Shon, J., & Zhou, P. (2017). Who herds? Who doesn’t? Estimates of analysts’ herding propensity in forecasting earnings. Contemporary Accounting Research, 34(1), 374–399. [Google Scholar] [CrossRef]

- Irvine, P. J. (2003). The incremental impact of analyst initiation of coverage. Journal of Corporate Finance, 9(4), 431–451. [Google Scholar] [CrossRef]

- Jannati, S., Kumar, A., Niessen-Ruenzi, A., & Wolfers, J. (2025). In-group bias in financial markets. Management Science. [Google Scholar] [CrossRef]

- Jegadeesh, N., & Kim, W. (2010). Do analysts herd? An analysis of recommendations and market reactions. The Review of Financial Studies, 23(2), 901–937. [Google Scholar] [CrossRef]

- Ke, B., & Yu, Y. (2006). The effect of issuing biased earnings forecasts on analysts’ access to management and survival. Journal of Accounting Research, 44(5), 965–999. [Google Scholar] [CrossRef]

- Li, F., Lin, C., & Lin, T. (2021). Salient anchor and analyst recommendation downgrade. Journal of Corporate Finance, 69, 102033. [Google Scholar] [CrossRef]

- Li, Y., Gong, M., Zhang, X., & Koh, L. (2018). The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. The British Accounting Review, 50(1), 60–75. [Google Scholar] [CrossRef]

- Lim, T. (2001). Rationality and analysts’ forecast bias. The Journal of Finance, 56(1), 369–385. [Google Scholar] [CrossRef]

- Luo, K., & Wu, S. (2022). Corporate sustainability and analysts’ earnings forecast accuracy: Evidence from environmental, social and governance ratings. Corporate Social Responsibility and Environmental Management, 29(5), 1465–1481. [Google Scholar] [CrossRef]

- Malmendier, U., & Shanthikumar, D. (2014). Do security analysts speak in two tongues? The Review of Financial Studies, 27(5), 1287–1322. [Google Scholar] [CrossRef]

- McNichols, M., & O’Brien, P. C. (1997). Self-selection and analyst coverage. Journal of Accounting Research, 35, 167–199. [Google Scholar] [CrossRef]

- Park, M., Yoon, A., & Zach, T. (2025). Sell-side analysts’ assessment of ESG risk. Journal of Accounting and Economics, 79(2–3), 101759. [Google Scholar] [CrossRef]

- Roger, T. (2024). Do financial analysts care about ESG? Finance Research Letters, 63, 105289. [Google Scholar] [CrossRef]

- Serafeim, G., & Yoon, A. (2023). Stock price reactions to ESG news: The role of ESG ratings and disagreement. Review of Accounting Studies, 28(3), 1500–1530. [Google Scholar] [CrossRef]

- Sohn, B. C. (2012). Analyst forecast, accounting conservatism and the related valuation implications. Accounting & Finance, 52, 311–341. [Google Scholar]

- Tang, S., Qin, C., & Qi, F. (2025). Circuit courts and capital market transparency: Evidence from analysts’ earnings forecasts. Finance Research Letters, 77, 107150. [Google Scholar] [CrossRef]

- Wang, Z., & Xing, T. (2025). ESG information disclosure, stock price informativeness and corporate digital transformation. Applied Economics, 57(6), 600–616. [Google Scholar] [CrossRef]

- Wong, W. C., Batten, J. A., Ahmad, A. H., Mohamed-Arshad, S. B., Nordin, S., & Adzis, A. A. (2021). Does ESG certification add firm value? Finance Research Letters, 39, 101593. [Google Scholar] [CrossRef]

- Zhang, H., Zhang, H., Tian, L., Yuan, S., & Tu, Y. (2024). ESG performance and litigation risk. Finance Research Letters, 63, 105311. [Google Scholar] [CrossRef]

- Zhang, X. F. (2006). Information uncertainty and stock returns. The Journal of Finance, 61(1), 105–137. [Google Scholar] [CrossRef]

| Variable | Obs. | Mean | Std. Dev. | P25 | Median | P75 |

|---|---|---|---|---|---|---|

| EPS Bias | 631,660 | 0.000 | 0.908 | −0.634 | 0.000 | 0.627 |

| Abs EPS Bias | 631,660 | 0.736 | 0.552 | 0.304 | 0.631 | 1.051 |

| New Firm | 631,660 | 0.048 | 0.214 | 0.000 | 0.000 | 0.000 |

| ESG Score | 631,660 | 28.245 | 16.272 | 14.876 | 23.141 | 39.669 |

| Analyst Cov | 631,660 | 12.572 | 7.338 | 7.000 | 11.000 | 17.000 |

| EPS Disp | 631,660 | 0.282 | 0.845 | 0.035 | 0.073 | 0.185 |

| Forecast Age | 631,660 | 66.965 | 27.150 | 50.000 | 81.000 | 89.000 |

| Analyst Exp | 631,660 | 12.368 | 8.292 | 6.000 | 11.000 | 18.000 |

| No. of Firms | 631,660 | 39.221 | 23.268 | 22.000 | 35.000 | 52.000 |

| Turnover | 631,660 | 0.252 | 0.201 | 0.132 | 0.194 | 0.300 |

| Return Vol | 631,660 | 0.102 | 0.059 | 0.063 | 0.087 | 0.124 |

| Mkt Cap | 631,660 | 20,290.934 | 48,835.255 | 1587.159 | 4702.835 | 16,003.228 |

| ROA | 631,660 | 0.009 | 0.033 | 0.002 | 0.010 | 0.022 |

| BM | 631,660 | 0.518 | 0.599 | 0.216 | 0.393 | 0.669 |

| Sales Growth | 631,660 | 0.041 | 0.226 | −0.038 | 0.022 | 0.090 |

| Variable | EPS Bias | EPS Bias > 0 | EPS Bias < 0 | Abs EPS Bias | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| New Firm | 0.013 ** | 0.012 ** | −0.014 *** | −0.014 *** | 0.022 *** | 0.020 *** | −0.019 *** | −0.018 *** |

| (2.10) | (2.05) | (−2.74) | (−2.70) | (4.67) | (4.10) | (−5.17) | (−4.90) | |

| ln(1 + Analyst Cov) | −0.012 *** | −0.004 | −0.026 *** | −0.018 *** | 0.025 *** | 0.025 *** | −0.011 *** | −0.010 *** |

| (−3.03) | (−0.95) | (−8.21) | (−4.92) | (8.44) | (7.32) | (−4.74) | (−3.58) | |

| EPS Disp | 0.001 | 0.001 | −0.008 *** | −0.008 *** | 0.006 *** | 0.005 *** | −0.006 *** | −0.006 *** |

| (0.50) | (0.39) | (−6.24) | (−5.73) | (4.32) | (3.58) | (−6.24) | (−5.89) | |

| ln(1 + Forecast Age) | 0.045 *** | 0.045 *** | 0.032 *** | 0.033 *** | 0.004 ** | 0.002 | 0.014 *** | 0.015 *** |

| (18.27) | (18.03) | (15.68) | (15.91) | (2.25) | (1.25) | (8.38) | (8.86) | |

| ln(1 + Analyst Exp) | 0.009 | 0.009 | −0.004 | −0.004 | 0.010 | 0.009 | −0.006 | −0.004 |

| (0.69) | (0.68) | (−0.44) | (−0.42) | (1.13) | (0.94) | (−0.86) | (−0.53) | |

| ln(1 + No. of Firms) | −0.032 ** | −0.035 *** | 0.006 | 0.006 | −0.023 ** | −0.023 ** | 0.014 * | 0.013 * |

| (−2.47) | (−2.63) | (0.58) | (0.60) | (−2.49) | (−2.52) | (1.94) | (1.78) | |

| Turnover | −0.020 * | −0.004 | −0.018 ** | −0.013 | 0.004 | −0.008 | −0.008 | 0.001 |

| (−1.89) | (−0.29) | (−2.14) | (−1.07) | (0.59) | (−0.73) | (−1.38) | (0.10) | |

| Return Vol | −0.044 | −0.123 *** | −0.054 * | −0.046 | −0.032 | −0.036 | −0.006 | 0.002 |

| (−1.10) | (−2.78) | (−1.89) | (−1.41) | (−1.18) | (−1.14) | (−0.31) | (0.09) | |

| ln(1 + Mkt Cap) | −0.010 *** | −0.006 | −0.008 *** | −0.005 | 0.001 | 0.001 | −0.005 *** | −0.002 |

| (−5.96) | (−1.41) | (−6.48) | (−1.52) | (1.00) | (0.31) | (−4.64) | (−0.78) | |

| ROA | −0.075 | −0.015 | 0.027 | 0.039 | −0.016 | −0.017 | 0.041 | 0.041 |

| (−1.33) | (−0.24) | (0.62) | (0.81) | (−0.43) | (−0.38) | (1.30) | (1.21) | |

| Variable | EPS Bias | EPS Bias > 0 | EPS Bias < 0 | Abs EPS Bias | ||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| ln(1 + B/M) | −0.009 | −0.003 | −0.018 *** | −0.013 | 0.005 | 0.015 ** | −0.011 *** | −0.013 ** |

| (−1.17) | (−0.28) | (−3.10) | (−1.57) | (0.91) | (1.97) | (−2.62) | (−2.15) | |

| Sales Growth | 0.006 | 0.004 | −0.000 | −0.002 | 0.010 ** | 0.005 | −0.004 | −0.002 |

| (0.98) | (0.62) | (−0.00) | (−0.34) | (2.27) | (1.23) | (−1.24) | (−0.77) | |

| Intercept | 0.037 | −0.007 | 0.751 *** | 0.697 *** | −0.766 *** | −0.753 *** | 0.719 *** | 0.684 *** |

| (0.89) | (−0.12) | (23.06) | (16.20) | (−25.33) | (−19.46) | (28.71) | (21.13) | |

| Obs. | 631,307 | 631,304 | 311,458 | 311,411 | 314,962 | 314,914 | 631,307 | 631,304 |

| Firm FE | No | Yes | No | Yes | No | Yes | No | Yes |

| Analyst FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year-Quarter FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.036 | 0.034 | 0.048 | 0.052 | 0.042 | 0.046 | 0.035 | 0.034 |

| Variable | EPS Bias | EPS Bias > 0 | EPS Bias < 0 | Abs EPS Bias | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| New Firm | −0.004 | −0.006 | −0.040 *** | −0.039 *** | 0.030 *** | 0.029 *** | −0.035 *** | −0.036 *** |

| (−0.40) | (−0.55) | (−4.61) | (−4.57) | (3.45) | (3.35) | (−5.55) | (−5.53) | |

| ESG Score | −0.004 | −0.013 | −0.021 * | −0.022 | −0.007 | −0.007 | −0.010 | −0.009 |

| (−0.32) | (−0.55) | (−1.88) | (−1.16) | (−0.63) | (−0.41) | (−1.26) | (−0.66) | |

| New Firm × ESG Score | 0.069 * | 0.074 * | 0.105 *** | 0.105 *** | −0.030 | −0.037 | 0.066 *** | 0.071 *** |

| (1.81) | (1.93) | (3.21) | (3.21) | (−0.96) | (−1.19) | (2.75) | (2.92) | |

| Obs. | 631,307 | 631,304 | 311,458 | 311,411 | 314,962 | 314,914 | 631,307 | 631,304 |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | No | Yes | No | Yes | No | Yes | No | Yes |

| Analyst FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year-Quarter FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.036 | 0.034 | 0.048 | 0.052 | 0.042 | 0.046 | 0.035 | 0.034 |

| Variable | EPS Bias | EPS Bias > 0 | EPS Bias < 0 | Abs EPS Bias | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| New Firm | 0.005 | 0.004 | −0.042 *** | −0.043 *** | 0.047 *** | 0.047 *** | −0.044 *** | −0.045 *** |

| (0.36) | (0.29) | (−3.56) | (−3.53) | (3.96) | (3.92) | (−4.97) | (−4.95) | |

| ESG Score | 0.015 | −0.008 | −0.028 * | −0.019 | 0.028 * | 0.019 | −0.033 *** | −0.021 |

| (0.72) | (−0.23) | (−1.69) | (−0.69) | (1.92) | (0.74) | (−2.75) | (−1.06) | |

| New Firm × ESG Score | 0.017 | 0.019 | 0.080 * | 0.085 * | −0.085 * | −0.098 ** | 0.079 ** | 0.086 ** |

| (0.31) | (0.34) | (1.71) | (1.81) | (−1.86) | (−2.13) | (2.20) | (2.38) | |

| Obs. | 296,270 | 296,233 | 146,758 | 146,652 | 146,786 | 146,702 | 296,270 | 296,233 |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | No | Yes | No | Yes | No | Yes | No | Yes |

| Analyst FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year-Quarter FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.043 | 0.045 | 0.054 | 0.059 | 0.046 | 0.051 | 0.039 | 0.041 |

| Panel A: 1-to-1 Nearest Neighbor Matching | ||||

| Variable | EPS Bias | EPS Bias > 0 | EPS Bias < 0 | Abs EPS Bias |

| (1) | (2) | (3) | (4) | |

| New Firm | 0.009 | −0.049 *** | 0.023 * | −0.055 *** |

| (0.55) | (−3.50) | (1.66) | (−5.48) | |

| ESG Score | −0.038 | −0.137 ** | −0.104 * | 0.024 |

| (−0.51) | (−2.10) | (−1.67) | (0.54) | |

| New Firm × ESG Score | 0.022 | 0.103 ** | −0.002 | 0.102 *** |

| (0.39) | (2.11) | (−0.04) | (2.90) | |

| Obs. | 57,668 | 28,554 | 28,902 | 57,668 |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Analyst FE | Yes | Yes | Yes | Yes |

| Year-Quarter FE | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.037 | 0.049 | 0.032 | 0.0384 |

| Panel B: 1-to-3 Nearest Neighbor Matching | ||||

| Variable | EPS Bias | EPS Bias > 0 | EPS Bias < 0 | Abs EPS Bias |

| (1) | (2) | (3) | (4) | |

| New Firm | 0.011 | −0.039 *** | 0.038 *** | −0.045 *** |

| (0.88) | (−3.55) | (3.37) | (−5.68) | |

| ESG Score | −0.009 | −0.054 | −0.006 | −0.017 |

| (−0.17) | (−1.14) | (−0.12) | (−0.50) | |

| New Firm × ESG Score | 0.000 | 0.090 ** | −0.049 | 0.097 *** |

| (0.00) | (2.30) | (−1.24) | (3.39) | |

| Obs. | 106,048 | 51,341 | 51,966 | 106,048 |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Analyst FE | Yes | Yes | Yes | Yes |

| Year-Quarter FE | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.052 | 0.088 | 0.074 | 0.0544 |

| Variable | EPS Bias | EPS Bias > 0 | EPS Bias < 0 | Abs EPS Bias | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| New Firm | 0.009 | 0.006 | −0.004 | −0.003 | 0.012 | 0.011 | −0.009 | −0.008 |

| (0.82) | (0.53) | (−0.44) | (−0.29) | (1.31) | (1.22) | (−1.31) | (−1.21) | |

| ESG Score | 0.008 | 0.008 | −0.021 * | −0.024 | −0.002 | 0.009 | −0.013 | −0.019 |

| (0.52) | (0.33) | (−1.72) | (−1.21) | (−0.14) | (0.49) | (−1.49) | (−1.29) | |

| New Firm × ESG Score | −0.040 | −0.031 | −0.010 | −0.011 | −0.024 | −0.028 | 0.008 | 0.010 |

| (−1.03) | (−0.80) | (−0.28) | (−0.30) | (−0.72) | (−0.82) | (0.35) | (0.40) | |

| Obs. | 564,081 | 564,063 | 278,052 | 277,988 | 281,990 | 281,942 | 564,081 | 564,063 |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | No | Yes | No | Yes | No | Yes | No | Yes |

| Analyst FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year-Quarter FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.036 | 0.034 | 0.048 | 0.052 | 0.042 | 0.046 | 0.035 | 0.034 |

| Variable | EPS Bias | EPS Bias > 0 | EPS Bias < 0 | Abs EPS Bias | ||||

|---|---|---|---|---|---|---|---|---|

| Low Forecast Dispersion | High Forecast Dispersion | Low Forecast Dispersion | High Forecast Dispersion | Low Forecast Dispersion | High Forecast Dispersion | Low Forecast Dispersion | High Forecast Dispersion | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| New Firm | −0.002 | 0.000 | −0.050 *** | −0.047 *** | 0.010 | 0.048 *** | −0.030 ** | −0.050 *** |

| (−0.12) | (0.02) | (−3.05) | (−3.33) | (0.62) | (3.28) | (−2.50) | (−4.80) | |

| ESG Score | −0.008 | −0.030 | 0.010 | −0.061 * | 0.002 | −0.010 | 0.006 | −0.029 |

| (−0.21) | (−0.67) | (0.34) | (−1.69) | (0.07) | (−0.29) | (0.27) | (−1.09) | |

| New Firm × ESG Score | 0.034 | 0.141 ** | 0.123 ** | 0.194 *** | −0.005 | −0.040 | 0.061 | 0.125 *** |

| (0.53) | (1.97) | (2.15) | (3.19) | (−0.10) | (−0.71) | (1.51) | (2.80) | |

| Obs. | 209,922 | 209,994 | 101,724 | 103,933 | 104,900 | 104,229 | 209,922 | 209,994 |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Analyst FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year-Quarter FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.040 | 0.038 | 0.055 | 0.065 | 0.043 | 0.063 | 0.033 | 0.037 |

| Variable | PTG Bias | PTG Bias > 0 | PTG Bias < 0 | Abs PTG Bias | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| New Firm | 0.047 *** | 0.018 | 0.064 *** | 0.050 *** | −0.024 *** | −0.026 *** | 0.041 *** | 0.035 *** |

| (7.25) | (1.59) | (13.37) | (5.86) | (−5.23) | (−3.28) | (12.07) | (5.82) | |

| ESG Score | −0.004 | 0.008 | 0.015 | 0.002 | ||||

| (−0.12) | (0.43) | (0.71) | (0.10) | |||||

| New Firm × ESG Score | 0.117 *** | 0.057 * | 0.007 | 0.023 | ||||

| (3.15) | (1.85) | (0.28) | (1.11) | |||||

| Obs. | 556,597 | 556,597 | 276,077 | 276,077 | 274,406 | 274,406 | 556,597 | 556,597 |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Analyst FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year-Quarter FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.108 | 0.108 | 0.088 | 0.088 | 0.097 | 0.097 | 0.063 | 0.063 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fallah, M.; Han, S.; Zhao, L. Forecast Bias in Analysts’ Initial Coverage: The Influence of Firm ESG Disclosures. J. Risk Financial Manag. 2025, 18, 585. https://doi.org/10.3390/jrfm18100585

Fallah M, Han S, Zhao L. Forecast Bias in Analysts’ Initial Coverage: The Influence of Firm ESG Disclosures. Journal of Risk and Financial Management. 2025; 18(10):585. https://doi.org/10.3390/jrfm18100585

Chicago/Turabian StyleFallah, Mohammadali, Sulei Han, and Le Zhao. 2025. "Forecast Bias in Analysts’ Initial Coverage: The Influence of Firm ESG Disclosures" Journal of Risk and Financial Management 18, no. 10: 585. https://doi.org/10.3390/jrfm18100585

APA StyleFallah, M., Han, S., & Zhao, L. (2025). Forecast Bias in Analysts’ Initial Coverage: The Influence of Firm ESG Disclosures. Journal of Risk and Financial Management, 18(10), 585. https://doi.org/10.3390/jrfm18100585