Abstract

This study investigates how Corporate Social Responsibility (CSR) influences financial performance in the Middle Eastern banking sector through the mediating roles of corporate reputation, employee engagement, and innovation orientation. Drawing on stakeholder theory and the resource-based view, a survey of 297 senior banking executives was analyzed using structural equation modeling. The results show that CSR has both a direct positive impact on financial performance and an indirect effect by strengthening intangible resources. Among the mediators, innovation orientation emerged as the strongest pathway, followed by employee engagement and reputation. Collectively, the model accounted for more than 60% of the variance in financial performance, confirming that socially responsible strategies are not symbolic but yield tangible economic value. In the Middle Eastern banking sector—characterized by regulatory turbulence, cultural expectations, and digital transformation—CSR initiatives such as financial inclusion programs, green financing, and Sharia-compliant services provide both legitimacy and resilience. These findings highlight the strategic importance of embedding CSR into banking practices, showing that socially responsible institutions not only secure reputational gains but also cultivate motivated employees, foster innovation, and achieve sustainable profitability. By situating CSR within the unique context of Middle Eastern banking, this study extends the literature on CSR—performance linkages in emerging markets and demonstrates how intangible capabilities can be mobilized to secure long-term financial sustainability.

1. Introduction

Over the last decade, Corporate Social Responsibility (CSR) has evolved from a peripheral obligation to a strategic imperative, now integral to corporate agendas worldwide. The move has been prompted by growing challenges that CSR does indeed not only offer reputational advantages but also has a more tangible role to play in a firm’s financial performance. Indicatively, an empirical study by Al Masud et al. (2025) revealed that CSR-led environmental programs have strongly boosted sustainable growth and investment, providing empirical evidence that CSR can enhance bottom lines. There is a corresponding implication in the work of Dela et al. (2024) on the influence of the dimensions of CSR when fully integrated into the competitiveness of a given industry, which had a significant positive impact on financial performance, with only profitable companies showing a negative effect.

In addition to the constraints on company performance, CSR is considered a pillar of corporate reputation, in which company performance is linked to stakeholder confidence, legitimacy, and market robustness. Established organizations have reputable gains (low risks, high customer loyalty, and financial resilience, which are basic concepts highlighted in the recent literature). Despite the reduced number of recent studies that explicitly connect CSR and reputation financially, the theoretical and empirical basis is strong, and reputation as a key mediator is viable to incorporate in holistic models used to investigate the relationship between CSR and its influence on performance.

The impacts of CSR are evident both inwards, i.e., they also touch on employee engagement, which is the emotional investment, well-being, and allegiance that the employees have towards their organization. Christina et al. (2025) confirmed that initiatives of CSR always build a culture of engagement that consequently sparks productivity, creativity, and retention. To support this, Kocollari et al. (2025) reported survey data findings that intrinsic CSR practices assist in maintaining employee tenure, particularly amid organizational turbulence, and, at least, they show the internal motivational drive of responsibility.

At the same time, another critical internal mechanism that CSR determines is the innovation orientation. Anzola-Román et al. (2024) indicated that organizations that have a strategic orientation of corporate social responsibility have an enhanced level of technological and procedural innovation. In addition, Poveda-Pareja et al. (2024) posited that CSR and innovation are collaborative and thereby boost the performance of the firm, creating a synergistic strategic nexus where the speed of both innovation ability and financial performance is expedited.

Even with these changes, a significant gap remains that most CSR research focuses on examining single relationships or relying on secondary data, rather than investigating how CSR, reputation, engagement, innovation, and financial performance interact in a linked context. Specifically, the results of the survey-based models of path analysis are lacking due to the absence of methods to represent the mediated and direct effects simultaneously in the models of path analysis.

The Middle Eastern banking sector presents a unique institutional and competitive environment that distinguishes it from other global regions. Over the past two decades, banks in countries such as Lebanon, Jordan, the Gulf Cooperation Council (GCC), and North Africa have operated within conditions of political instability, regulatory reforms, and rapid financial modernization. Many institutions face pressures to adopt international financial reporting standards, integrate ESG criteria, and expand financial inclusion while maintaining compliance with Sharia principles in Islamic banking. These dynamics have accelerated the adoption of socially responsible and innovative practices, as banks seek to balance profitability with societal expectations and stakeholder legitimacy. In this context, CSR initiatives are not only a matter of corporate communication but serve as instruments to reinforce trust and credibility in environments where institutional confidence is often fragile.

In addition, the Middle Eastern banking sector operates under a highly regulated framework shaped by both international and domestic requirements. Regulatory authorities increasingly mandate compliance with global standards like Basel III, IFRS, and ESG disclosure guidelines. These frameworks require banks to demonstrate capital adequacy, risk management, and transparency, while also incorporating sustainability and social responsibility into reporting obligations. Islamic banking regulations further impose unique compliance requirements rooted in Sharia law, influencing how banks design CSR and financial inclusion initiatives. The alignment of CSR with regulatory expectations is therefore not optional but a necessity for institutional legitimacy, as non-compliance can result in reputational penalties, reduced investor confidence, and restrictions on cross-border operations. This regulatory environment underscores the dual role of CSR as both a compliance mechanism and a strategic instrument, compelling banks in the region to integrate socially responsible practices into their core governance structures.

At the same time, the sector is undergoing a profound transformation driven by digitalization, fintech disruption, and the growing demand for sustainable financing. Banks in the GCC are pioneering green bonds and sustainability-linked loans, while institutions in Lebanon and Egypt are experimenting with digital platforms to address financial exclusion and currency instability. These developments highlight the increasing need for banks to rely on intangible assets such as reputation, employee engagement, and innovation orientation to remain resilient and competitive. As Middle Eastern societies place cultural and religious value on social responsibility and ethical finance, CSR becomes an indispensable strategy to secure legitimacy, attract investment, and build long-term financial sustainability.

This paper aims to address this gap by developing and empirically verifying a multi-path model in which CSR influences corporate reputation, engagement with employees, and the orientation towards innovation, which can promote financial performance—but without omitting the possibility of partial mediation and a direct effect remaining. On theory and practice, this study advances the research literature in several ways: it achieves conceptual clarity by broadly simultaneously studying multiple mediators; it adds methodological rigor as perception-based measures are examined in real-time; it discovers which paths prove to be robust in their performance impact; and it increases the internal validity by accounting possible confounding factors (size, age, industry, and market turbulence).

Beyond addressing methodological gaps, this study also responds to the need for replication and extension by grounding the CSR—performance nexus in additional theoretical perspectives. While Stakeholder Theory and the Resource-Based View (RBV) provide a solid foundation, complementary lenses such as Signaling Theory and Dynamic Capabilities Theory offer deeper insights into how these relationships unfold. Signaling Theory explains how CSR activities send credible messages to external stakeholders, thereby shaping corporate reputation and reducing information asymmetry. Dynamic Capabilities Theory, on the other hand, highlights how CSR fosters organizational adaptability, enabling banks to transform employee engagement and innovation orientation into sustained performance advantages. By integrating these perspectives, this study not only replicates prior models in a new cultural and regulatory setting—the Middle Eastern banking sector—but also extends theoretical reasoning to capture the complex, multi-path mechanisms through which CSR translates into financial performance. This broader theoretical grounding strengthens the persuasiveness of the replication effort and enhances the generalizability of the findings.

Theoretically, this model expands the stakeholder theory in the sense that it establishes a connection between the external (external legitimacy) and internal (engagement, innovation) drivers that together mobilize financial value. In the Dynamic Capabilities sentiment, CSR comes out as a strategic tool driving adaptive, creative organizational reactions. On a managerial level, the research provides a diagnostic tool, enabling the measurement of returns from CSR investments (e.g., reputation-building, engagement practices, innovation support) in monetary terms.

The remainder of this paper is structured as follows. Section 2 reviews the theoretical foundations and develops the research hypotheses. Section 3 describes the methodology, including the sampling strategy, measurement scales, and analytical techniques employed. Section 4 presents the empirical findings, followed by Section 5, which discusses the results in relation to existing literature. Finally, Section 6 outlines the study’s conclusions, highlighting theoretical and managerial implications, limitations, and directions for future research.

2. Theoretical Framework and Hypotheses Development

Stakeholder Theory argues that firms gain legitimacy and long-term survival when they attend to the expectations of stakeholders, while the RBV emphasizes that socially responsible practices generate intangible resources such as trust, loyalty, and goodwill that improve competitiveness. In the Middle Eastern banking context, where legitimacy and credibility are constantly tested, CSR initiatives such as financial inclusion, green financing, and Sharia-compliant services not only enhance social legitimacy but also provide financial advantages. Thus, CSR is expected to directly improve financial performance.

There is a growing opinion that CSR should not necessarily be regarded as a compliance number or a goodwill expenditure, but a strategic tool that is capable of improving the financial performance of a company directly. New studies across different areas and approaches confirm that companies that integrate CSR report much higher financial results in both accounting and market-based appraisals. For instance, a study analyzing CSR-driven environmental policy, conducted in 2025, would reveal that the sustainable growth facilitated by CSR directly contributes to improved financial performance and encourages new investments. The conclusions highlight CSR as an entity capable of increasing economic value, rather than solely boosting reputation (Al Masud et al., 2025). In a cross-sectional analysis of Asian developing-market companies, statistical models reveal that CSR scores reinforce significantly both Tobin Q and return on assets (ROA).

This fact shows, once again, the positive and direct influence of CSR on financial performance in a developing economy (Huyen & Huong, 2025). Strategically, a direct correlation is also reported about CSR in Indian manufacturing (2024), which explains that CSR, together with industry competitiveness, exercises a profound and direct impact on the financial performance of firms (Sharma & Chakraborty, 2024). In addition to these results, a general review with more than a thousand studies on the issue of ESG—performance reveals that ESG and, accordingly, CSR, have a positive correlation with financial performance in most of the reviewed cases, which supports the accuracy of the relationship (Whelan et al., 2021). Moreover, an internationally topical empirical article (2023) makes it clear that CSR has a direct and significant positive impact on financial performance, particularly in a context where the enterprise incorporates environmental and social aspects through every thinking level of its strategic activities (Ruan et al., 2022). These modern results are consistent with the meta-analysis study, which shows that the relationship between CSR and performance may vary. Still, the trend is homogeneous and indicates a positive connection between the two, particularly in cases where CSR strategies are competently implemented and within the context (Li et al., 2019). All this helps H1: CSR appears to have a positive and direct impact on Financial Performance, not to mention as an occasional element in indirect chains of causality, but equally through the immediate strategic and economic advantages to firms that socially responsible practices imply. Therefore, we develop our first hypothesis:

H1.

CSR has a positive direct effect on Financial Performance.

Corporate reputation is an essential intangible asset, since it contributes to the trust of the stakeholders, customer loyalty, and positioning in the market as a whole. From a Signaling Theory perspective, CSR serves as a visible signal of corporate integrity and ethical standards, reducing information asymmetry and strengthening stakeholder trust. Banks that actively pursue CSR align themselves with cultural and religious expectations, enhancing their credibility in markets where trust is fragile. As reputation itself is a strategic resource under RBV, CSR is expected to positively shape corporate reputation. CSR is critical to the development and strengthening of a firm’s reputation, as it demonstrates the company’s commitment to ethical practices, environmental sustainability, and social responsibility. This connection is emphasized by empirical evidence. The path-analytic analysis of the hospitality industry (2022) proves that CSR is, indeed, a significant driver of corporate image, as its effect on the latter is also highly important, and CSR has a direct impact on the positive corporate image (Yan et al., 2022). The results of research dedicated to the topic of strategic communication show that any message related to CSR can constantly positively reinforce the corporate image, increase positive perceptions of stakeholders, and corporate trust (Ajayi & Mmutle, 2021).

Supporting this trend even further, studies examining reputation risk demonstrate that CSR increases corporate image as well as the quality of stakeholder relations, thus highlighting the level of reputation capital that can be produced through effective CSR policies (Wang et al., 2025; He et al., 2025). A local study of financial companies in the Middle East and Northern Africa (MENA) found that CSR disclosure behaviors positively impact corporate reputation, with culturally moderated tones observed. However, the effectiveness of CSR remains distinct and steadfast.

Additionally, structural-equation-modeling studies indicate that a good CSR reputation, supported by cognitive aspects of CSR reports, also influences investor positions and judgments regarding legitimacy, emphasizing the mediating role of CSR in creating a credible corporate identity (Ernst et al., 2025). Collectively, the results offer a strong foundation towards H2: CSR programs have a strong and positive influence on corporate reputation, which solidifies external beliefs of credibility, trust, and legitimacy among different stakeholder teams. The evidence presented above forms the basis for our second hypothesis:

H2.

CSR has a positive effect on Corporate Reputation.

Social Exchange Theory suggests that employees reciprocate when organizations invest in socially responsible practices, fostering higher levels of engagement and commitment. CSR initiatives provide meaning and pride, reinforcing employees’ identification with organizational values. In service-driven sectors like banking, this engagement directly impacts service quality and, ultimately, performance. There is an emerging corpus of literature that highlights the inward effect of CSR, specifically on employee engagement, which is marked by emotional investment, commitment, and the act of sharing the values of organizational culture. Recent research presents corroborating evidence that CSR activities are effective at enhancing stronger engagement. The first-rate empirical work is represented by the Italian SMEs, which scholars investigated the CSR practices through employee experience.

Intrinsic CSR programs, which are seen as aligned with organizational values, rather than mere compliance with regulations, have a significant influence on whether employees stay with their employers. Remarkably, the concept of happiness at work was observed to enhance the effectiveness of CSR, particularly during transitions or turbulent settings, which likely implies the role of CSR in maintaining morale among disengaged employees (Kocollari et al., 2025).

Alongside this, a qualitative-quantitative investigation examined how the meaning of CSR can be experienced by employees using processes of sensemaking. It has demonstrated how calling orientation —the purpose of an employee in their work —and bottom-up participation in determining CSR initiatives are critical in mediating the impact of CSR on job engagement. More to the point, when employees perceive themselves as agents of change in CSR activities and believe their labor contributes positively to the social good, their motivation level increases significantly (Cunha et al., 2022).

Beyond these specific organizational studies, syntheses on a larger scale support the CSR—engagement nexus. A systematic review of the literature across various sectors reveals that CSR is a factor that leads to job satisfaction, organizational commitment, and engagement, ultimately resulting in improved performance-related attributes, such as creativity and retention (Nyantakyi et al., 2023).

Simultaneously, evidence suggests that CSR and human resource branding, including employer appeal, demonstrate to prospective employers in the real world. Organizations with authentic CSR attract more dedicated and committed workers and retain more engaged workers (Ivanov, 2025). These results are consistent with the theoretical foundations of the social identity theory, which posits that employees create a sense of self through their organizational membership, particularly when the organizational values align with their values. CSR campaigns are effective symbolic identifiers of the organizational value, which leads to more identification and thereby engagement.

Further, the psychological ownership theory posits that CSR fosters increased internal stewardship, as employees who perceive the CSR as authentic are more likely to exert discretionary effort, feeling they are part of a larger, meaningful endeavor. Collectively, this study affirms the idea that CSR is not merely a surface-level communication style; it entails deep, underlying motivational effects that strengthen the emotional and behavioral bonds between workers and corporations. CSR increases the engagement of employees through encouraging meaningful occupation, engagement, and emotional connection, which is a strong empirical support of our third hypothesis:

H3.

CSR has a positive effect on Employee Engagement.

Dynamic Capabilities Theory highlights a firm’s ability to renew and reconfigure resources in turbulent environments. CSR encourages innovation by embedding long-term thinking, experimentation, and adaptability in corporate culture. For banks in the Middle East, CSR-driven innovation leads to digital solutions, sustainable finance, and socially valuable products that ensure resilience. Innovation orientation, which is the tendency of a firm towards creativity, proactive enhancement, and experimentation, is increasingly recognized as being connected to CSR. An outstanding empirical study illustrates the dramatic effects of environmental CSR on innovation (process) and increasing influence of social CSR on product and process innovation, especially when organizations possess similar internal practices of innovation.

The findings support the idea that CSR, particularly socially based activities, collaborate with innovative organizations to create technological outputs (Anzola-Román et al., 2024). Within the hospitality industry, evidence from Spanish coastal hotels indicates that CSR practices lead to both direct and indirect improvements in performance, with innovation mediating the effects of part of the correlation. Notably, when companies adopt a strategic CSR orientation that aligns closely with their key business strategy, the impact of CSR on performance and innovation becomes even more pronounced.

Quantitative meta-analysis also demonstrates that CSR helps to raise innovative behaviors of employees, stressing that CSR does not merely stimulate morale but ignites creativity and discretionary innovation among employees (Li et al., 2019). In addition to such empirical results, there are theoretical assumptions of the resource-based view which can be used to shed light on the contribution of CSR to the innovation orientation.

The practice of CSR develops intangible firm capabilities in terms of sustainability, efficiency of the processes, and the network of the stakeholders that firms can innovate more effectively and sustainably. In addition, with the help of the dynamic capability’s theory, the CSR-based learning and adaptation would create the environment in which experimentation, change anticipation, and constant enhancement are possible.

Sustainability-oriented management studies provide a deeper context to this: CSR contributes to technological innovation that promotes the digitization of janitorial services, particularly when it is conducted in a mastery climate, which is a culture that rewards learning and flexibility. This association strengthens the argument of how the CSR investments can catalyze innovation via the lenses of modernization and technological upgrade (Wu et al., 2024).

In summary, CSR determines the orientation of innovation by supporting the orientation through structural alignment, creating capacity, and providing support of cultures. Environmental and social practices increase the sensitivity of organizations to innovation opportunities, through strategy and internal preparation. The following body of evidence provides a strong empirical and theoretical backing for our fourth hypothesis:

H4.

CSR has a positive effect on Innovation Orientation.

Under RBV, intangible resources such as reputation, engagement, and innovation provide competitive advantages that translate into superior performance. Reputation reduces risk perceptions, engagement enhances productivity, and innovation drives adaptability. These mechanisms are therefore expected to enhance financial performance. In all the dimensions of strategy, accounting, and finance, the corporate reputation is discussed as a value-relevant intangible, affecting cash flows and the cost of capital. The modern evidence implies that event- and panel-studies reveal that capital markets immediately and substantially value reputational status: when firms do encounter reputational-damaging ESG controversies, abnormal returns decline in the days following the event, suggesting that reputation drives into investors’ perceptions of future profitability and risk (Nicolas et al., 2024).

Finance literature takes the connection a step further and relates reputation with channels of risk and valuation. Evidence provided by smaller samples in the past, now documented using large ones, implies that reputation (and its depreciation as reputational risk) is linked to higher perceived risk and market penalty. In contrast, robust reputational standing coheres with a lower downside risk and more alluring return–risk trade-offs that go along with an unwavering pathway between reputation and market value (Febra et al., 2023; Wong & Zhang, 2024).

On the accounting side, this view of market pricing is reflected. To offer one example, business finance and accounting work demonstrates that the effects of reputational spillovers due to a scandal-tainted partner drag down valuations, which implies that investor beliefs about reputational quality are converted into tangible financial losses to even connected, but not accused, firms—again suggesting that reputation has a financial bite (Preuss & Wielhouwer, 2024).

Respectively, reputation has both revenue and cost-based mechanistic channels. Firms with a positive reputation can negotiate price premia, gain commitment of customers, claim attractive shelf space and alliances on the revenue side, whereas on the cost side, such firms are prone to attract better human capital and retain it, have lesser transaction and monitoring costs with stakeholders, and have reduced frictions in capital access. Examples of finance research analyzing the reputational risk faced in family business and non-family business contain that when a risk concerns reputation, erosion in performance is greater where the socioemotional wealth is primary, indicating that the environment of governance influences how reputation is reflected on the income statement and the balance sheet (Sun & Wu, 2024).

Similar studies in accounting surveys have demonstrated increasing rigor in the operationalization of the term reputation, with studies cautioning that the heterogeneity of measures may reduce or exaggerate the estimated effects (Bigus et al., 2024). Despite this type of heterogeneity, the aggregate pattern indicates that a strong financial performance benefit is associated with a reputation in both cross-industry and cross-geography scenarios, as well as with reputation risk shocks to value. A reasonable criticism is of endogeneity and reverse causation: do the companies that make high profits do more in terms of reputation-enhancing investment, giving an illusory relationship? The latest research uses this by capturing quasi-experiments (event windows), modeling reputational risk shocks, and investigating moderators (cash policy, ownership, culture).

As an example, a reputational risk blow-up would punish the firms with huge cash balances, and the high balances of cash and slack are seen as wasteful and de-weighted on valuation (Wong & Zhang, 2024). On the same note, studies that isolate reputational sentiment and physical damage reveal returns follow the reputational signal itself, which narrows the causal interpretation (Nicolas et al., 2024). The implication here to H5 is that under the more demanding identification, reputation seems to generate financial material variations through risk, growth, and stakeholder channels-points that appear to indicate reputation building and protection is not a superficial afterthought, but an economically sensible strategy. Based on this information, we propose our fifth hypothesis:

H5.

Corporate Reputation has a positive effect on Financial Performance.

The service-profit chain is the most plausible route between engagement and financial performance: engaged workers perform the operations more productively (speed, reliability), which leads to rising customer opinion, and, consequently, sales and profit. Objective firm data in field study showed this cascade across a multi-year, multi-unit engagements in the Journal of Business Research: increased engagement lead to improved measure of service value, which emerged as improved customer perceptions, which then positively affected the growth of same-store sales and controllable profit in future periods- evidence that engagement not only correlates over time with outcomes but can help drive them forward (Lambert et al., 2021).

General studies, since 2020, have also proposed the same finding: engagement can be expected to lead to higher overall organizational performance, resulting in measures of productivity, customer-based metrics, and retention, which all have tangible (direct or lagged) economic outcomes (Kossyva et al., 2023).

Research on the experience of finance service employees goes further to say that engagement fits within an expanded is called an architecture of EX: enhancing day-to-day experience enhances engagement and lowers unwanted turnover and drive performance, supporting the argument that engagement is a lever that managers can pull to achieve financial KPIs as opposed to a soft, distal attitude (Başar, 2024). Mechanism is explained concerning micro-level evidence.

Experimental and field studies indicate that interaction effects improve task performance and extra-role behaviors (helping, initiative), and these micro effects accumulate at the unit level to revenue and margin growth improvements, especially in service and retail environments where customers can observe employee effort. Functional form is also being refined based on recent psychology studies: at extremes of workload, the engagement performance relationship is curvilinear, but within the general scope, it is positive and practically meaningful, as it is consistent with conservation of resources reasoning and the job demands–resources theory (Yao et al., 2022).

There must be attention to some methodological caveats. There are self-reported results and single-source studies, which present the potential common-method objection; they may be cross-sectional in capturing financials, thereby exposing themselves to simultaneity bias, which may be due to higher profitability, with profitable firms investing proportionally more in engagement. These risks are offset by the presence of stronger 202,025 contributions made using archival financials, longitudinal designs, and multi-level models; the JBR study on-field data, for instance, triangulates employee, customer, and financial data covering two years (Lambert et al., 2021).

Subsequent syntheses also indicate that effects are cross-country- and cross-industry-replicative. Therefore, the evidence on the impact of engagement on financial performance was more reliably identified in the recent past and thus supports the H6: through increasing operational reliability, customer experience, and human-capital efficiency, engagement increases financial performance. This information leads us to our sixth hypothesis:

H6.

Employee Engagement has a positive effect on Financial Performance.

The innovation orientation, as the strategic commitment toward finding and taking advantage of new ideas, is also correlated with financial performance but in terms of revenue growth (on the one hand, based on the novelty of the products and services), and the efficiencies of the cost (on the other hand, working on the efficiency of the processes). A meta-analysis of 143 studies that synthesized results published in 2024 reveals a positive and significant relationship between innovation and performance in different contexts, with its moderator analysis yielding the efficacy of the relationship, but the relationship is stronger when it pertains to some forms of innovation and in institutional environments (Katebi et al., 2024).

Recent work brings the firm-level relation between innovation orientation and price-based financial performance into focus, revealing when (and when not) customer involvement reinforces (or not) the connection there (Yuk & Garrett, 2023). Such results concur with resource-based and dynamic-capabilities perspectives; i.e., an innovation-based culture accrues hard-to-reproduce stocks of knowledge, reassembles the processes quickly, and transforms ingenuity into money-making solutions and slimmer processes.

Performance effect is not only technological; complementary organizational capabilities count. Studies find that resilient organizations innovate their services, which enhances the success of businesses, which should serve as a reminder that innovativeness orientation does not go unrewarded in those firms that can withstand shocks, learn and respond (Lopez et al., 2024). The findings from meta-analytic studies focusing on business model innovation also indicate positive average impacts on performance, suggesting that a focused business model of innovation drives measurable financial returns, in addition to novelty based on products and processes (Ilyas et al., 2024). Such strategies are also described in contemporary studies on emerging markets and SMEs: In the latter setting, a recent trend is to demonstrate that more innovation-intensive firms have greater sales growth and profitability, with managerial practices and market connections (e.g., commercialization capabilities, customer co-creation, etc.) often moderating the payoff (Katebi et al., 2024). On this basis, the seventh hypothesis is formulated as follows:

H7.

Innovation Orientation has a positive effect on Financial Performance.

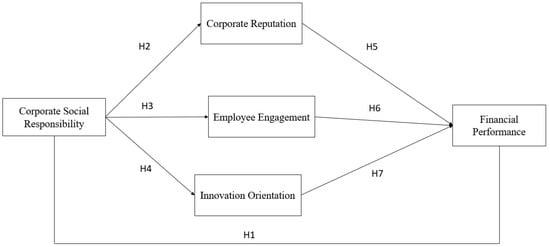

Figure 1 presents the proposed model, which depicts the hypotheses and their interrelationships as previously discussed.

Figure 1.

Research Model. Own elaboration.

3. Research Design

This study utilizes a robust quantitative, survey-based design to explore complex, multi-path causal relationships, a methodological approach well-suited for CSR research in contemporary management science. By collecting primary data through a carefully crafted organizational survey, we bypass the limitations of archival data, enabling real-time, context-rich measurement of latent constructs.

Our modeling strategy employing SEM is strategically chosen to dissect both direct and indirect interactions among Corporate Social Responsibility, Reputation, Employee Engagement, Innovation Orientation, and Financial Performance. This approach aligns with prevailing best practices in strategy and CSR research, where SEM is leveraged to analyze intertwined relational dynamics and mediating mechanisms within empirical models.

3.1. Sample

This study employed a purposive sampling strategy to ensure that responses were collected from individuals with direct knowledge of CSR practices and performance evaluation in the banking sector. The target population consisted of senior managers, department heads, and executives working in commercial and Islamic banks across Lebanon, Jordan, and the GCC countries. These respondents were deliberately selected because of their involvement in strategic decision-making, CSR implementation, and financial performance assessment, which made them well-positioned to provide reliable and informed answers. While purposive sampling limits the ability to generalize findings to all banking employees, it enhances the validity of the results by focusing on respondents with the most relevant expertise. The final sample of 297 participants exceeds the minimum recommended threshold for structural equation modeling (Hair et al., 2019), thereby ensuring adequate statistical power and robustness of the analysis. This approach aligns with prior CSR and banking studies that emphasized the need to survey knowledgeable informants rather than rely on random sampling of less relevant respondents.

3.2. Measures

To operationalize the constructs in this study, validated measurement scales from prior research were adapted to the Middle Eastern banking context. Corporate Social Responsibility (CSR) was measured using five items adapted from Moisescu (2015), focusing on fairness, transparency, and employee treatment (e.g., “This company treats its customers honestly,” “This company pays fair salaries to its employees”). Corporate Reputation was assessed with five items based on Cintamür and Yüksel (2018), capturing perceptions of trust, respect, and stakeholder confidence (e.g., “I perceive this company as trustworthy,” “The company is respected in its industry”). Employee Engagement was measured through five items from Schaufeli (2012), reflecting vigor, enthusiasm, and immersion in work (e.g., “At my work, I feel bursting with energy,” “I am enthusiastic about my job”). Innovation Orientation was evaluated using five items derived from Anzola-Román et al. (2024), emphasizing openness to new ideas, experimentation, and technology adoption (e.g., “Our company actively seeks novel ideas for products or services,” “Management encourages experimentation and creative thinking”). Finally, Financial Performance was measured with five subjective indicators adapted from Muhammad et al. (2021), which compared profitability, revenue growth, cost efficiency, market share, and resilience relative to competitors (e.g., “Our bank’s profitability has significantly improved compared to a year ago”). All items were rated on a five-point Likert scale ranging from 1 (“strongly disagree”) to 5 (“strongly agree”), ensuring consistency across constructs and enabling robust statistical analysis. Further information on the questionnaire can be found in Appendix A.

The selection of constructs is grounded in well-established theoretical perspectives. From a stakeholder theory standpoint, corporate reputation and employee engagement represent the external and internal legitimacy mechanisms that connect firms to their constituencies. The resource-based view and dynamic capabilities theory emphasize innovation orientation as a strategic intangible resource that allows firms to adapt to turbulent environments, particularly relevant in the Middle Eastern banking sector. Financial performance, meanwhile, is the tangible outcome that reflects the translation of these intangible resources into economic value. Other potential variables such as governance or market orientation were deliberately excluded to maintain model parsimony and avoid over-complexity, ensuring that the analysis isolates the most critical intangible pathways identified in the literature.

3.3. Common Method Bias Mitigation

Given the reliance on single-source, cross-sectional survey data, both procedural and statistical methods were applied to mitigate common method bias (CMB). Procedurally, respondents were guaranteed anonymity, and question order was randomized to reduce priming and social desirability effects. Statistically, we deployed diagnostic techniques including Harman’s single-factor test, CFA-marker methods, and full-collinearity assessments to detect and correct for method variance—approaches recommended in advanced behavioral research methodologies.

3.4. Analytical Strategy

To evaluate the adequacy of the structural model, a range of model fit indices were assessed in line with established SEM guidelines. Absolute fit indices, such as the Chi-square to degrees of freedom ratio (CMIN/DF), the Goodness of Fit Index (GFI), and the Root Mean Square Residual (RMR), were used to evaluate how well the hypothesized model reproduces the observed data. Incremental fit indices, including the Normed Fit Index (NFI), Incremental Fit Index (IFI), and Comparative Fit Index (CFI), were examined to compare the proposed model against a null model. Parsimony indices, such as PRATIO, PNFI, and PCFI, were also reported to demonstrate the model’s efficiency relative to its complexity. Finally, the Root Mean Square Error of Approximation (RMSEA) and its confidence interval were considered as indicators of approximate fit. Collectively, these indices provide a comprehensive assessment of model validity, ensuring that the hypothesized relationships are supported by a statistically sound and parsimonious structure.

4. Results

Table 1 provides an overview of the sample characteristics of the surveyed banks, offering insights into their size, age, market environment, and ownership type. In terms of bank size, the sample is distributed across small, medium, and large institutions, with the largest group being smaller banks with 1–49 employees (71 banks). In comparison, the most prominent institutions with more than 5000 employees account for 51 banks. For bank age, most institutions were established between 2011 and 2018 (87 banks), showing a strong representation of relatively new banks compared to older ones founded before 1980 (52 banks).

Table 1.

Sample Profiling.

Regarding market turbulence, responses vary across stability levels: 75 banks reported a much more stable environment, whereas 70 indicated a much more turbulent one, showing diverse operating contexts. Finally, the ownership structure shows diversity, with a significant portion of banks being foreign-owned or majority foreign-controlled (91), followed by privately owned domestic banks (86), state-owned banks (70), and mixed ownership institutions (50). This distribution reflects a heterogeneous sample that enhances the generalizability of the study’s findings.

Table 2 presents the factor loadings for the constructs used in the study, namely CR, CSR, EE, FP, and IO, which reflect the validity of the measurement model. The CR items load strongly between 0.807 and 0.852, indicating consistent internal reliability. Similarly, the CSR construct shows solid loadings ranging from 0.762 to 0.821, suggesting that all items are valid indicators. For EE, all items load between 0.785 and 0.840, showing robustness in capturing engagement. The FP items load adequately, with loadings ranging from 0.752 to 0.824, which confirms their relevance in measuring this construct. Finally, the IO items demonstrate high loadings from 0.720 to 0.838, underlining their strong representation of the construct.

Table 2.

Factor Loadings.

Table 3 presents the results of the reliability and validity tests for the constructs CR, CSR, EE, FP, and IO. The Cronbach’s alpha values for all constructs are above the 0.80 threshold (ranging from 0.837 to 0.883), confirming strong internal consistency. The composite reliability (rho_a and rho_c) values are also consistently high, with rho_a between 0.851 and 0.884 and rho_c between 0.800 and 0.883, both exceeding the recommended 0.70 benchmark.

Table 3.

Robustness Tests.

This indicates that the constructs are measured reliably with minimal measurement error. Furthermore, the AVE values for all constructs fall between 0.601 and 0.681, surpassing the minimum acceptable threshold of 0.50. This suggests that more than 60% of the variance in the observed indicators is explained by their respective latent constructs, thereby confirming convergent validity.

Table 4 provides the inter-construct correlations to assess discriminant validity, which ensures that each construct measures a unique dimension of the conceptual model. The correlations demonstrate moderate to strong relationships among the constructs but remain below the critical threshold of 0.85, confirming acceptable discriminant validity. For example, CR is strongly correlated with EE at 0.711 and with IO at 0.712, suggesting that banks with a stronger reputation tend to have more engaged employees and are more innovation oriented. CSR also shows meaningful correlations, particularly with EE (0.691) and IO (0.627), implying that socially responsible practices foster employee motivation and innovative capacity. By contrast, FP maintains relatively weaker correlations, such as 0.321 with CR and 0.387 with EE, indicating that while performance outcomes are linked to intangible factors like engagement and reputation, they operate more independently as a dependent construct.

Table 4.

Discriminant Validity.

An additional diagnostic test confirmed the robustness of the model by ruling out multicollinearity concerns among the independent variables. The variance inflation factor (VIF) values ranged from 1.79 to 2.09, with all tolerance values exceeding 0.47, which are well within accepted thresholds (VIF < 5, tolerance > 0.20). This indicates that the predictors—CSR, corporate reputation, employee engagement, and innovation orientation—are sufficiently distinct and do not overlap to a degree that would bias the results. The absence of multicollinearity thus reinforces the validity of the estimated relationships and strengthens confidence in the study’s findings.

Table 5 summarizes the goodness-of-fit statistics for the structural equation model, showing that the measurement model demonstrates a strong fit to the observed data. The CMIN/DF ratio is 2.342, which falls within the recommended threshold of ≤3.0, confirming a good fit. The GFI (0.903), NFI (0.913), IFI (0.911), and CFI (0.91) all exceed the 0.90 threshold, indicating that the hypothesized model explains the data well compared to alternative models. The RMR value of 0.055 further demonstrates a low residual error, strengthening model validity. Parsimony indices, including PRATIO (0.893), PNFI (0.763), and PCFI (0.813), are within acceptable ranges, suggesting that the model achieves a balance between explanatory power and simplicity. Finally, the RMSEA value of 0.067 with a 90% confidence interval of 0.060–0.074 indicates an acceptable approximation error, supporting the adequacy of the model. Collectively, these indices confirm that the model fits the data well and can be confidently used for hypothesis testing and structural analysis.

Table 5.

Model Fit Indices.

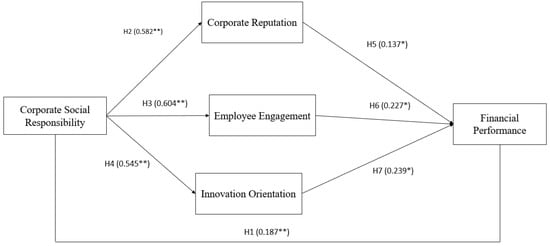

The model presented in Figure 2 demonstrates that CSR exerts both direct and indirect effects on Financial Performance (FP). The direct pathway (H1, β = 0.187, p < 0.01) confirms that CSR alone contributes positively to financial outcomes. Indirectly, CSR strongly enhances Corporate Reputation (H2, β = 0.582, p < 0.01), Employee Engagement (H3, β = 0.604, p < 0.01), and Innovation Orientation (H4, β = 0.545, p < 0.01), which in turn act as mediators. Among these, Innovation Orientation (H7, β = 0.239, p < 0.05) and Employee Engagement (H6, β = 0.227, p < 0.05) show stronger effects on FP compared to Corporate Reputation (H5, β = 0.137, p < 0.05), suggesting that while reputation provides legitimacy, it is the internal mechanisms of workforce alignment and innovative capacity that more effectively translate CSR into profitability.

Figure 2.

Mediated-Moderated Analysis. Note: The asterisks indicate the level of statistical significance, with * p < 0.05 (significant) and ** p < 0.01 (highly significant), showing stronger confidence when more asterisks appear.

The analysis further confirms that CSR influences financial performance not only directly but also indirectly through the mediating roles of corporate reputation, employee engagement, and innovation orientation. These indirect pathways highlight the mechanism through which socially responsible practices are transformed into tangible financial outcomes. Specifically, CSR enhances corporate reputation, which strengthens trust and legitimacy, thereby reducing risk perceptions and supporting long-term profitability. Likewise, CSR fosters employee engagement, generating higher levels of motivation and commitment that directly translate into improved service delivery and financial resilience. Most importantly, CSR drives innovation orientation, which equips banks with the adaptive capabilities needed to navigate technological disruption and market turbulence, ultimately reinforcing financial outcomes. Among the mediators, innovation orientation and employee engagement emerge as the strongest channels, suggesting that CSR creates value primarily by shaping internal organizational resources and capabilities, while reputation plays a complementary but still significant role in translating external legitimacy into economic advantage. These findings support the core proposition of this study that CSR operates as a multi-dimensional driver of performance, leveraging intangible resources to secure both competitiveness and sustainability.

5. Discussion

The findings affirm that CSR exerts a direct and positive impact on financial performance. This reinforces the growing consensus in global and regional research that socially responsible practices are not symbolic gestures but strategic levers for economic advantage. In the Middle Eastern banking system, this conclusion is particularly relevant as banks are frequently scrutinized by regulators, stakeholders, and global markets on governance, sustainability, and social responsibility. Incorporating CSR into strategic planning enables banks to differentiate themselves in turbulent environments, transforming ethical commitments into reputational and financial capital. Regional evidence suggests that active CSR programs attract investment, foster customer loyalty, and mitigate reputational risks in socio-politically unstable contexts. These outcomes align with Al Masud et al. (2025), who highlighted CSR-led environmental initiatives as drivers of sustainable growth, and Huyen and Huong (2025), who showed that CSR adoption in emerging Asian markets yields superior returns on assets and market value. Similarly, Sharma and Chakraborty (2024) confirmed CSR’s role in enhancing competitiveness and profitability in highly contested industries, while Whelan et al. (2021) reported consistent links between ESG initiatives and profitability across sectors.

The analysis also reveals that CSR significantly enhances CR, underscoring its role as a foundation of legitimacy and trust among stakeholders. In the Middle Eastern context, banks are evaluated not only on financial performance but also on their contributions to social stability and development. CSR strengthens trustworthiness by aligning institutional behavior with cultural, religious, and moral values such as those embedded in Islamic finance, environmental stewardship, and community building. This reputational capital provides resilience in markets where institutional credibility is often fragile. The result is consistent with Yan et al. (2022), who found CSR to improve image and trust, and Ajayi and Mmutle (2021), who linked CSR communication with favorable stakeholder perceptions. Wang et al. (2025) and He et al. (2025) also showed that CSR mitigates reputational risk and bolsters confidence, while Ernst et al. (2025) emphasized CSR-driven reputation as a determinant of investor judgments. Together, these studies highlight that CSR and reputation are inseparable, both theoretically and practically.

Equally, the study confirms that CSR positively influences employee engagement (EE), validating its internal strategic value. In the Middle Eastern banking sector—marked by economic volatility, political uncertainty, and talent migration—CSR initiatives generate a sense of pride and belonging, motivating employees to identify with organizational values. This bond directly affects customer satisfaction and service quality in an industry where human capital is central to competitiveness. Prior literature strongly supports this nexus: Kocollari et al. (2025) showed that CSR-aligned programs retain employees during turbulence, while Cunha et al. (2022) highlight how CSR instills purpose and agency that drive engagement. Nyantakyi et al. (2023) confirmed the positive effects of CSR on commitment and job satisfaction, while Ivanov (2025) links CSR to stronger employer branding. Christina et al. (2025) further showed that CSR fosters sustainable and creative cultures. Collectively, these findings affirm CSR as both an external legitimacy tool and an internal resource that enhances workforce stability and resilience.

The results also establish that CSR significantly promotes innovation orientation (IO), showing that socially responsible banks are more likely to pursue adaptive strategies and technological development. In the Middle Eastern context, where banks face both rapid digital transformation and heightened economic turbulence, CSR fosters innovative responses such as green finance, digital inclusion, and Sharia-compliant financial solutions. This adaptability strengthens resilience and competitiveness. Prior studies reinforce this relationship: Anzola-Román et al. (2024) showed that CSR-oriented firms outperform in innovation, Poveda-Pareja et al. (2024) highlighted the synergistic value creation between CSR and innovation, and Wu et al. (2024) stressed CSR’s role in fostering cultures of experimentation. Li et al. (2019) also found that CSR practices encourage employee-driven creativity and discretionary behavior. Together, these insights confirm CSR as a foundation for organizational adaptability and long-term survival.

The analysis further indicates that corporate reputation (CR) positively impacts financial performance. In Middle Eastern banking, reputation extends beyond market perception to encompass cultural legitimacy and institutional trust. Strong reputations reduce investor risk perceptions, enhance customer loyalty, and safeguard partnerships, especially under conditions of political instability. This finding echoes (Nicolas et al., 2024), who documented market devaluation following ESG-related reputational shocks, and Wong and Zhang (2024), who showed that reputations improve returns by lowering perceived risks. Febra et al., 2023) also linked positive reputation to pricing power and favorable access to capital, while Preuss and Wielhouwer (2024) highlighted the monetary consequences of reputational spillovers. In regions marked by governance scandals and low institutional trust, reputation thus emerges as a critical strategic asset.

Similarly, the study confirms that employee engagement (EE) significantly enhances financial performance. Human capital is shown to be a decisive factor in banking, where employee behavior, satisfaction, and service delivery directly determine financial outcomes. In volatile economies such as Lebanon, CSR-driven engagement mitigates turnover costs, retains talent, and sustains operations despite external shocks. This aligns with Lambert et al. (2021), who validated the service-profit chain linking engagement to profitability, and Kossyva et al. (2023), who found that engagement drives productivity and financial returns. Başar (2024) highlighted that engaged employees in finance directly improve service quality and reduce attrition, while Yao et al. (2022) confirmed that engagement fosters task performance and discretionary behaviors with measurable firm-level impact. In the Middle East, where talent emigration is common, engagement provides banks with a vital competitive advantage.

Finally, the findings highlight that innovation orientation (IO) is the strongest driver of financial performance among the mediators. Innovation equips banks with the adaptability required to navigate fintech disruption, regulatory reforms, and shifting customer expectations. Middle Eastern banks investing in digital banking, green finance, and culturally aligned financial solutions are better positioned to capture new market opportunities and build long-term resilience. This is consistent with Katebi et al. (2024), who confirmed innovation’s strong impact on performance across industries, and Lopez et al. (2024), who emphasized the role of resilience in maximizing innovation value. Ilyas et al. (2024) further documented the financial returns of business model innovation, while Yuk and Garrett (2023) demonstrated that customer involvement enhances innovation’s payoff. These results reaffirm that CSR, by fostering innovation orientation, acts as a catalyst for sustainable profitability in dynamic markets.

6. Limitations

Although there is a strong empirical proof in this research that points to the relationship between CSR, corporate, and employee engagement, innovation orientation, and financial performance, it is not without limitations. First, the use of cross-sectional survey data hampers cause-and-effect interpretation because relationships identified at one fixed time can change with time. Causal relationships can also be determined using Longitudinal data, which enables the analysis of dynamic changes in CSR strategies and outcomes.

Second, the research topic is the banking sector in the Middle East that, on the one hand, creates a profound picture of a challenging and highly complex environment, but, on the other hand, restricts the validity of the research results to different markets or national contexts. There are distinct institutional forces in the banking community, including regulatory and reputation risk, that can increase the magnitude of the relationships.

Third, despite methodological precautions in the form of reliability tests, discriminant validity, and model fit indices, the standard method variance should be considered as a potential issue since all the measures were based on one respondent. Lastly, the differences in cultural and institutional frameworks across the Middle East (e.g., the Gulf and the Levant in banking systems) might affect the meaning and practice of CSR, so that findings should not be viewed as necessarily generalizable.

7. Practical Contributions

The findings of this study carry important implications for both practitioners and policymakers. In the Middle Eastern banking sector, CSR should not be treated as a peripheral obligation but as a strategic investment that simultaneously creates intangible and financial value. By embedding CSR into the core business model—through initiatives such as financial inclusion programs, sustainability-linked lending, and community development projects—banks can strengthen their corporate reputation, enhance employee engagement, and stimulate innovation. These outcomes, in turn, translate into improved competitiveness and long-term financial sustainability.

At the managerial level, greater emphasis should be placed on transparent CSR reporting and active stakeholder dialog. Credibility and accountability not only reinforce reputational gains but also ensure that CSR initiatives are perceived as authentic rather than symbolic. Involving employees directly in the design and implementation of CSR programs is equally critical, as it fosters stronger engagement, internal alignment, and the diffusion of organizational values. Furthermore, banks can leverage CSR as a platform for innovation by aligning sustainability and digital transformation strategies with social responsibility objectives, thereby enhancing their adaptability and resilience in turbulent markets.

From a policy perspective, regulators in the region play a pivotal role in institutionalizing CSR. This can be achieved by incentivizing socially responsible investments, embedding CSR metrics into corporate governance standards, and providing frameworks that encourage sustainable financial practices. Such policy interventions would not only standardize CSR practices but also encourage their diffusion across industries.

Beyond its managerial and policy implications, this research also makes significant theoretical contributions. By synthesizing stakeholder theory, the resource-based view, and dynamic capabilities, it demonstrates how CSR can simultaneously generate external legitimacy (via reputation), internal cohesion (through employee engagement), and adaptive capacity (via innovation). Methodologically, the study’s use of structural equation modeling to examine direct and mediated effects provides a rigorous empirical framework that enhances the reliability of its conclusions.

8. Future Research Lines

Building on the limitations outlined above, several directions for future research can be proposed. First, to overcome the restriction of cross-sectional design, longitudinal studies are needed. These would allow scholars to capture how CSR practices evolve over time and how their impacts on performance shift in response to changing political, economic, and regulatory conditions in the Middle East. Longitudinal data could provide stronger evidence of causality, especially in contexts where external turbulence makes CSR strategies more adaptive and fluid.

Second, the sectoral and geographical focus of this study suggests the need for comparative research. Extending the analysis beyond the banking sector to industries such as telecommunications, energy, and healthcare would offer insight into whether the mediating effects of reputation, engagement, and innovation operate consistently across different sectors. Likewise, cross-country comparisons within the Middle East could shed light on how variations in culture, institutional frameworks, and governance models influence the CSR—performance relationship. This would enhance both the external validity and regional relevance of the findings.

Third, to address the limitation of relying on single-source survey data, future studies should adopt mixed-method approaches. Combining surveys with qualitative interviews, case studies, or secondary performance data could mitigate common method bias while adding contextual depth. In particular, qualitative exploration of employees’ and stakeholders’ experiences could provide a richer understanding of how CSR is perceived internally and externally, and how it becomes embedded in organizational culture.

Finally, future research could explore moderating variables not considered in this study. Factors such as leadership style, digital transformation, or regulatory pressures may shape the strength and direction of CSR’s effects on both financial and non-financial performance. By systematically testing these moderators, researchers can identify under what conditions CSR delivers the most value, providing actionable guidance for managers and policymakers.

Collectively, these avenues would address the current study’s limitations, advance theoretical development, and contribute to a more comprehensive and context-sensitive understanding of CSR’s role in organizational performance.

Author Contributions

Conceptualization, K.S., S.E.-P. and C.M.-C.; Methodology, formal analysis and data curation, K.S.; Original draft preparation, S.E.-P. and C.M.-C.; Visualization, S.E.-P.; Supervision, C.M.-C.; Project administration, K.S., S.E.-P. and C.M.-C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Ethical review and approval were waived for this study due to the anonymous and voluntary nature of the online questionnaire, which posed minimal risk to participants, in accordance with the institutional guidelines of ESIC Business and Marketing School.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study. Participants were provided with information about the study’s purpose, procedures, and data handling, and consented voluntarily by proceeding with the survey.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Informed Consent Form

- Study Title:

- Corporate Social Responsibility, Innovation Orientation, and Employee Engagement: Pathways to Enhancing Financial Performance in the Middle Eastern Banking Sector

- Purpose of the Study:

- This study aims to investigate the relationships between corporate social responsibility, corporate reputation, innovation orientation, employee engagement, and financial performance in the Middle Eastern banking sector. The research seeks to provide insights into how organizational practices contribute to sustainable business outcomes.

- Procedures:

- If you agree to participate, you will be asked to complete a structured survey that includes questions on corporate social responsibility practices, employee engagement, innovation strategies, and organizational performance. The survey will take approximately 15–20 min to complete.

- Voluntary Participation:

- Participation in this study is entirely voluntary. You may choose not to participate or to withdraw at any time without penalty or negative consequences.

- Confidentiality:

- All responses will remain anonymous. No identifying personal or institutional information will be collected. Data will be analyzed in aggregate form only and used solely for academic purposes.

- Risks and Benefits:

- There are no anticipated risks associated with participating in this study. The questions pertain to general organizational practices and perceptions, and do not involve sensitive personal information. While there is no direct financial benefit to participants, your input will contribute to advancing academic knowledge and providing practical insights for the banking industry.

- Contact Information:

- If you have any questions about this study, you may contact the principal investigator at khodor.shatila@icn-artem.com.

- Consent Statement:

- By proceeding with the survey, you acknowledge that you have read and understood the information above, that your participation is voluntary, and that there is no risk involved in completing the survey. You consent to participate in this study.

- 1.

- Bank SizeHow many full-time employees does your bank have?

- A.

- 1–49

- B.

- 50–249

- C.

- 250–999

- D.

- 1000–4999

- E.

- 5000 or more

- 2.

- Bank AgeIn what year was your bank founded?

- A.

- Before 1980

- B.

- 1980–1999

- C.

- 2000–2010

- D.

- 2011–2018

- E.

- 2019 or later

- 3.

- Market TurbulenceCompared to one year ago, how would you rate changes in market conditions affecting your banking operations?

- A.

- Much more stable

- B.

- Slightly more stable

- C.

- No significant change

- D.

- Slightly more turbulent

- E.

- Much more turbulent

- 4.

- Ownership TypeWhat best describes your bank’s ownership structure?

- A.

- State-owned or Government-controlled

- B.

- Privately owned (local/domestic shareholders)

- C.

- Foreign-owned or majority foreign-controlled

- D.

- Mixed ownership (domestic and foreign)

- 1.

- Corporate Social Responsibility (CSR)

- This company treats its customers honestly.

- This company has employees that offer complete information about products to customers.

- This company pays fair salaries to its employees.

- This company offers safety at work to its employees.

- This company treats its employees fairly (without discrimination or abuses).

- 2.

- Corporate Reputation

- I perceive this company as trustworthy.

- The company has a positive image among its stakeholders.

- The company is respected in its industry.

- Stakeholders have confidence in this company’s leadership.

- The company is seen as having a strong standing in its community.

- 3.

- Employee Engagement

- At my work, I feel bursting with energy.

- I am enthusiastic about my job.

- I feel happy when I am working intensely.

- I am immersed in my work.

- I feel strong and vigorous while working.

- 4.

- Innovation Orientation

- Our company actively seeks novel ideas for products or services.

- Management encourages experimentation and creative thinking.

- We are quick to adopt better ways of doing things.

- We regularly explore new technologies or processes.

- Innovation is a strategic priority in our organization.

- 5.

- Financial Performance

- Our bank’s profitability has significantly improved compared to a year ago.

- Our revenue growth outpaces that of our primary competitors.

- We have enhanced cost-control efficiency relative to peer banks.

- Our market share has increased compared to competitors.

- The bank’s financial performance has shown greater resilience under risk than its rivals.

References

- Ajayi, O. A., & Mmutle, T. (2021). Corporate reputation through strategic communication of corporate social responsibility. Corporate Communications: An International Journal, 26, 1–15. [Google Scholar] [CrossRef]

- Al Masud, A., Hossain, M. T., Hossain, M. A., Naher, M. K., & Hasan, M. M. (2025). Enhancing financial performance through corporate social responsibility: Mediating role of environmental innovation and environmental performance. Cleaner and Responsible Consumption, 17, 100279. [Google Scholar] [CrossRef]

- Anzola-Román, P., Garcia-Marco, T., & Zouaghi, F. (2024). The influence of CSR orientation on innovative performance: Is the effect conditioned by the implementation of organizational practices? Journal of Business Ethics, 190(1), 261–278. [Google Scholar] [CrossRef]

- Başar, D. (2024). The relationship between employee experience and employee engagement with the moderating role of positive affect in finance sector. Borsa Istanbul Review, 24(5), 908–915. [Google Scholar] [CrossRef]

- Bigus, J., Hua, K. P. M., & Raithel, S. (2024). Definitions and measures of corporate reputation in accounting and management: Commonalities, differences, and future research. Accounting and Business Research, 54(3), 304–336. [Google Scholar] [CrossRef]

- Christina, J. L., Alamelu, R., & Nigama, K. (2025). Synthesizing the impact of sustainable human resource management on corporate sustainability through multi method evidence. Discover Sustainability, 6(1), 666. [Google Scholar] [CrossRef]

- Cintamür, İ. G., & Yüksel, C. A. (2018). Measuring customer based corporate reputation in banking industry: Developing and validating an alternative scale. International Journal of Bank Marketing, 36(7), 1414–1436. [Google Scholar] [CrossRef]

- Cunha, S., Proença, T., & Ferreira, M. R. (2022). Employees perceptions about corporate social responsibility—Understanding CSR and job engagement through meaningfulness, bottom-up approach and calling orientation. Sustainability, 14(21), 14606. [Google Scholar] [CrossRef]

- Dela, E., Ye, J., & Berhe, H. M. (2024). The impact of corporate social responsibility on financial performance in Indonesian highly polluted industries: Mediating role of industry competitiveness. SAGE Open, 14(4), 21582440241259479. [Google Scholar] [CrossRef]

- Ernst, C. A., Kunz, J., Fischer, T. M., & Ludwig, L. M. (2025). Investors’ reactions to CSR reputation and disclosure assurance: An experimental analysis. Journal of Management and Governance, 17, 1–44. [Google Scholar] [CrossRef]

- Febra, L., Costa, M., & Pereira, F. (2023). Reputation, return and risk: A new approach. European Research on Management and Business Economics, 29(1), 100207. [Google Scholar] [CrossRef]

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. [Google Scholar] [CrossRef]

- He, C., Zhang, J., Wang, L., Wang, W., & Li, F. (2025). Targeted poverty alleviation and corporate financial performance: The CSR strategy perspective. Australian Journal of Management, 50(2), 631–653. [Google Scholar] [CrossRef]

- Huyen, D. T., & Huong, P. M. (2025). Effect of corporate social responsibility on financial performance in Asian firms-A historical empirical analysis. Journal of Scientific Research and Reports, 31(5), 549–557. [Google Scholar] [CrossRef]

- Ilyas, I. M., Kammerlander, N., Turturea, R., & van Essen, M. (2024). When business model innovation creates value for companies: A meta-analysis on institutional contingencies. Journal of Management Studies, 61(5), 1825–1883. [Google Scholar] [CrossRef]

- Ivanov, A. (2025). Corporate social responsibility employer branding and employee attraction and retention: Review of literature and research agenda. BRICS Journal of Economics, 6(1), 53–71. [Google Scholar] [CrossRef]

- Katebi, A., Eghdam, H. H., Baseri, H., & Salehi, A. M. (2024). The relationship between innovation and organizational performance: A meta-analysis. Journal of Management & Organization, 30(6), 2474–2494. [Google Scholar] [CrossRef]

- Kocollari, U., Demaria, F., & Cavicchioli, M. (2025). Time after time: Exploring the role of CSR on employees’ long-lasting working relationships in Italy. Small Business Economics, 65, 995–1021. [Google Scholar] [CrossRef]

- Kossyva, D., Theriou, G., Aggelidis, V., & Sarigiannidis, L. (2023). Outcomes of engagement: A systematic literature review and future research directions. Heliyon, 9(6), e17565. [Google Scholar] [CrossRef]

- Lambert, A., Jones, R. P., & Clinton, S. (2021). Employee engagement and the service profit chain in a quick-service restaurant organization. Journal of Business Research, 135, 214–225. [Google Scholar] [CrossRef]

- Li, L., Li, G., & Chan, S. F. (2019). Corporate responsibility for employees and service innovation performance in manufacturing transformation: The mediation role of employee innovative behavior. Career Development International, 24(6), 580–595. [Google Scholar] [CrossRef]

- Lopez, E., Flecha-Ortiz, J. A., Santos-Corrada, M., & Dones, V. (2024). The role of organizational resilience in SME service innovation and value cocreation. Journal of Services Marketing, 38(4), 443–459. [Google Scholar] [CrossRef]

- Moisescu, O. I. (2015). Development and validation of a measurement scale for customers’ perceptions of corporate social responsibility. Management & Marketing Journal, 13(2), 311–332. [Google Scholar]

- Muhammad, L., Ishrat, R., Iqbal, M. M. W., & Afridi, J. R. (2021). Impact of organizational culture on subjective financial performance: A study of banking sector in Pakistan. Ilkogretim Online, 20(1), 3813–3829. [Google Scholar]

- Nicolas, M. L., Desroziers, A., Caccioli, F., & Aste, T. (2024). ESG reputation risk matters: An event study based on social media data. Finance Research Letters, 59, 104712. [Google Scholar] [CrossRef]

- Nyantakyi, G., Atta Sarpong, F., Adu Sarfo, P., Uchenwoke Ogochukwu, N., & Coleman, W. (2023). A boost for performance or a sense of corporate social responsibility? A bibliometric analysis on sustainability reporting and firm performance research (2000–2022). Cogent Business & Management, 10(2), 2220513. [Google Scholar]

- Poveda-Pareja, E., Marco-Lajara, B., Úbeda-García, M., & Manresa-Marhuenda, E. (2024). Innovation as a driving force for the creation of sustainable value derived from CSR: An integrated perspective. European Research on Management and Business Economics, 30(1), 100241. [Google Scholar] [CrossRef]

- Preuss, S., & Wielhouwer, J. L. (2024). The reputational costs of connections to controversial politicians: Evidence from political scandals. Journal of Business Finance & Accounting, 51(9–10), 2523–2560. [Google Scholar] [CrossRef]

- Ruan, R., Chen, W., & Zhu, Z. (2022). Linking environmental corporate social responsibility with green innovation performance: The mediating role of shared vision capability and the moderating role of resource slack. Sustainability, 14(24), 16943. [Google Scholar] [CrossRef]

- Schaufeli, W. B. (2012). The measurement of work engagement. In Research methods in occupational health psychology (pp. 138–154). Routledge. [Google Scholar]

- Sharma, D., & Chakraborty, S. (2024). Corporate social responsibility and financial performance: Does CSR strategic integration matter? Cogent Business & Management, 11(1), 2392182. [Google Scholar] [CrossRef]

- Sun, Y., & Wu, Z. (2024). Reputational risk and firm performance: Family versus nonfamily firms in different regulatory environments. Journal of International Financial Markets, Institutions and Money, 93, 101976. [Google Scholar] [CrossRef]

- Wang, O., Wu, H., & Li, C. (2025). Corporate social responsibility performance and litigation risk. Finance Research Letters, 72, 106584. [Google Scholar] [CrossRef]

- Whelan, T., Atz, U., Van Holt, T., & Clark, C. (2021). ESG and financial performance. Uncovering the Relationship by Aggregating Evidence from, 1(2015–2020), 10. [Google Scholar]

- Wong, J. B., & Zhang, Q. (2024). ESG reputation risks, cash holdings, and payout policies. Finance Research Letters, 59, 104695. [Google Scholar] [CrossRef]

- Wu, W., Shi, J., & Liu, Y. (2024). The impact of corporate social responsibility in technological innovation on sustainable competitive performance. Humanities and Social Sciences Communications, 11(1), 707. [Google Scholar] [CrossRef]

- Yan, X., Espinosa-Cristia, J. F., Kumari, K., & Cioca, L. I. (2022). Relationship between corporate social responsibility, organizational trust, and corporate reputation for sustainable performance. Sustainability, 14(14), 8737. [Google Scholar] [CrossRef]

- Yao, J., Qiu, X., Yang, L., Han, X., & Li, Y. (2022). The relationship between work engagement and job performance: Psychological capital as a moderating factor. Frontiers in Psychology, 13, 729131. [Google Scholar] [CrossRef]

- Yuk, H., & Garrett, T. C. (2023). Does customer participation moderate the effects of innovation on cost-based financial performance? An examination of different forms of customer participation. Journal of Business Research, 156, 113479. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).