Abstract

The increase in global economic policy uncertainty (EPU), volatility or stock market uncertainty (VIX), and geopolitical risk (GPR) has affected gold prices (GD), crude oil prices (WTI), and stock markets, which present challenges for investors. Sustainable stock investments in emerging markets may minimize and diversify investor risk. We applied the non-linear autoregressive distributed lag (NARDL) model to examine the effects of EPU, VIX, GPR, GD, and WTI on sustainable stocks in seven emerging markets (Thailand, Malaysia, Indonesia, Brazil, South Africa, Taiwan, and South Korea) from January 2012 to June 2023. EPU, VIX, GPR, GD, and WTI showed non-linear cointegration with sustainable stocks in seven emerging markets and possessed different asymmetric effects in the short and long run. Change in EPU increases the return of Thailand’s sustainable stock in the long run. The long-run GPR only affects the return of Indonesian sustainable stock. All sustainable stocks are negatively affected by the VIX and positively affected by GD in the short and long run. Additionally, long-run WTI negatively affects the return of Indonesia’s sustainable stocks. Our findings contribute to rational investment decisions on sustainable stocks, including gold and crude oil prices, to hedge the asymmetric effect of uncertainty.

Keywords:

geopolitical risk; global economic policy uncertainty; sustainable stock; asymmetric; NARDL JEL Classification:

C50; D81; G10; Q40

1. Introduction

Economic policy shifts are regarded as uncertainties of a dynamic nature that may have an impact on businesses (Pástor and Veronesi 2012). Uncertainties are also known as systematic risks, which cannot be avoided and disturb investors. During times of high uncertainty, investors would seek higher returns to risk premium when holding financial assets, which collides with the financial economics theory that explains the positive relationship between risk and returns (Prukumpai et al. 2022). Baker et al. (2016) calculated the economic policy uncertainty index using a newspaper-based approach that reflected economic risks in the United States and pointed out that economic policy uncertainty has a high significant impact on the entire economy. Thus, economic policy uncertainty affects the stock market more than geopolitical risks (GPRs) and financial stress (Das et al. 2019; Kamal et al. 2022; Tran and Vo 2023). The study on economic policy uncertainty were applied to investigate the relationship between stock markets in many countries (see, e.g., Erdoğan et al. 2022; Nusair and Al-Khasawneh 2023). This principle has been applied across many countries, and based on this, Davis (2016) created a global economic policy uncertainty (EPU) index.

The EPU quantifies the influence on stock markets, and relevant research has revealed the relationship between stock markets and commodity markets, such as gold and crude oil, across different countries (see, e.g., Raza et al. 2016; Hoque et al. 2019; Atri et al. 2023). The Chicago Board of Options Exchange (CBOE) volatility index reflects investor fears of US stock market uncertainty (VIX) (Ghumro et al. 2022) and is commonly employed as a benchmark for assessing uncertainty in the stock market (see, e.g., Prukumpai et al. 2022; Tran and Vo 2023). Black Swan events, such as the financial crisis in 2008, the European sovereign debt crisis in 2009, and the oil crisis in 2014, created uncertainty in global stock markets. These effects have drawn considerable attention to a global society confronted with unprecedented COVID-19, which has resulted in the most uncertain crude oil price volatility since the 1970s (Chancharat and Sinlapates 2023). Oil prices have fallen owing to the fall in demand for oil, global stock markets, and the economic and industrial activities of oil-importing countries. Hence, with gold being a safe haven, prices should increase (Baur and Lucey 2010). However, Kamal et al. (2022) found that gold was not affected by the EPU, VIX, or GPR during the COVID-19 pandemic.

The Russia–Ukraine war on 24 February 2022 added to GPR and damaged the economy, as well as affecting global financial markets, while rendering it difficult to recover from the COVID-19 effect. The evidence of the Russia–Ukraine war encourages an increase in energy costs that may occur both in the short run and in the long run (Umar et al. 2022; Wang et al. 2022). Stock markets are sensitive to uncertainty and highly influence investor sentiment. As a result, investors would seek safe-haven assets within a store of value such as gold (Baur and Smales 2020; Lei et al. 2023; Taera et al. 2023). Owing to high uncertainty in previous years, investments in companies with environmental, social, and governance (ESG), known as sustainable stock, have grown in popularity worldwide in the markets because sustainable stock will assist in diversifying risk in the long run (Andersson et al. 2022). By 2022, the investment value of ESG reached USD 41 trillion, exceeding the COVID-19 period in 2020, reaching USD 35 trillion, and is expected to rise to USD 50 trillion by 2025 (Diab 2022). The increase in sustainable stock investment is caused by a shift in demand toward socially responsible investing, which places a greater emphasis on social, environmental, and ethical benefits (Garel and Petit-Romec 2021), as well as the desire to lower risks, especially during a crisis and uncertainty (Mousa et al. 2022).

In addition to an increase in sustainable stock investments, investors should be aware of portfolio management risks. GPR, VIX, EPU, and commodity price changes in recent years have anticipated consequences with a negative effect on the stock market because they are risky assets that are sensitive to uncertainty and dependent on commodity prices (Kamal et al. 2022; Atri et al. 2023). Sustainable stocks are negatively affected by EPU and VIX (Shaikh 2022; Naeem et al. 2023), while they are positively affected by gold and crude oil prices (Darsono et al. 2022). Besides the limited studies on the effect of GPR on sustainable stocks, Taera et al. (2023) indicate that sustainable stock bears a lower risk during high GPR and acted as a safe haven during COVID-19 (Rubbaniy et al. 2022), while Piserà and Chiappini (2024) explained that sustainable stocks are not safe havens, as they have a positive relationship with the stock market. A study by Tang et al. (2023) on financial assets, which is similar to sustainable stocks, concluded that GPR has a negative effect on green bonds. Likewise, GPR and VIX also negatively affect clean energy stocks (Ghosh 2022). Sarker et al. (2023) explained that GPR positively affects clean energy stocks in the long run.

Therefore, uncertainties could unequally or asymmetrically affect sustainable stocks, both positively and negatively. Investors should employ sufficient knowledge for decision making. Thus, under these uncertainties (EPU, GPR, and VIX), investing in emerging markets is a suitable risk diversification strategy, as they bear a lower response than developed countries (Bossman and Gubareva 2023; Tran and Vo 2023). Investing in sustainable stocks is more flexible against environmental issues than investing in capital markets (Shaikh 2022). Studies on sustainable stocks in emerging markets have received little attention. Naeem et al. (2023) pointed out that changes in the VIX are bad news for sustainable stocks in emerging Asian markets. Darsono et al. (2022) explained that investing in Chinese and Brazilian sustainable stocks could only diversify gold and crude oil. In contrast, Cagli et al. (2023) emphasized that investing in sustainable stock in emerging markets could effectively hedge against crude oil. Bhattacherjee et al. (2023) reported that studies on sustainable stocks in each emerging market usually lack concern for GPR and do not provide a comprehensive understanding of the effects of uncertainties, including gold and crude oil prices, on emerging markets.

To address this gap, we consider the effects of EPU, VIX, GPR, and commodity markets such as gold and crude oil, since the effect of uncertainties and commodity markets occurs differently in positive and negative ways. We apply the non-linear autoregressive distributed lag (NARDL) model by Shin et al. (2014) to examine the asymmetric effects on sustainable stock in seven emerging markets, namely Thailand, Malaysia, Indonesia, Brazil, South Africa, Taiwan, and South Korea. Thus, we exclude other emerging markets due to a lack of sufficient data. The model analyzed monthly data from January 2012 to June 2023. Our study offers investors valuable insights into effective portfolio management in situations characterized by uncertainty. Investors can employ data on the effect of sustainable stocks in the short and long run to adjust their portfolios and expected returns. In addition, we offer valuable insights into minimizing the effect of uncertainties on maintaining the stability of a sustainable stock market.

2. Literature Review

Efficient market theory states that the prices of securities accurately reflect perfect information. Investors can expect returns according to their risk profiles. Sharpe (1964) categorized financial market risks into systemic and unsystematic risks. Investors can diversify their investments to avoid unsystematic risks specific to corporate risks. In contrast, systemic risk comes from markets and macroeconomic factors that are unavoidable (Prukumpai et al. 2022). The capital asset pricing model (CAPM) can be used to show systematic risk. However, changes in global markets are also a contributing factor to their influence on stock markets rather than domestic macroeconomics alone (Donadelli 2015). Global economic policy uncertainty (EPU), stock market uncertainty (VIX), and geopolitical risk (GPR) are global risk factors that significantly impact the performance of financial markets, including the co-movement between commodity prices and financial markets. In this study, we examined gold and crude oil prices as commodities. Gold is widely recognized as a safe haven, whereas crude oil plays a crucial role in driving economic activity. Thus, we summarized the literature review into two points: first, uncertainty effects on sustainable stocks, and second, the effects of gold and crude oil prices on sustainable stocks.

2.1. Uncertainty Effects on Sustainable Stock

Economic policy uncertainty causes significant challenges for investors and policymakers in pushing and pulling capital flow in financial markets, while negatively impacting economic activity in terms of demand, leading to a temporary halt in investments and supply, which affects employment and productivity (Bernanke 1983; Bloom 2009). This situation has a negative effect on the performance of stock markets and creates a dilemma among investors, prompting them to make reckless decisions that ultimately lead to a crash in the stock market (Pástor and Veronesi 2013). Additionally, the consequences of economic policy uncertainty can trigger spillover effects on stock markets and sustainable stocks. According to Lean and Nguyen (2014), the US economic policy uncertainty affects the return and volatility of Asia Pacific and North American sustainable stocks due to sustainable stocks being similar to stocks but with a socially responsible investment perspective. A study by Nusair and Al-Khasawneh (2023) discussed the economic policy uncertainty that negatively affects the G7, and the study by Shaikh (2022) discusses the effects on US sustainable stocks. By contrast, Darsono et al. (2022) found that economic policy uncertainty has a positive effect on Russian sustainable stocks. Bhattacherjee et al. (2023) studied the effect of EPU on sustainable stocks in both developed and emerging markets in the long run. A similar study on sustainable stocks by Tang et al. (2023) stated that there are different positive and negative effects of the US economic policy uncertainty on green bonds.

The VIX, in addition to EPU, measures market expectations of uncertainty in the US stock market (S&P 500) over the next 30 days, and is inversely related to the stock prices. Therefore, when there is an increase in VIX, it signifies a corresponding rise in investors’ fear during downside risks (Ghumro et al. 2022) and negatively affects the stock markets in Hong Kong, Australia, and Japan, asymmetrically, in the short and long run (Tran and Vo 2023), as well as sustainable stock in Asia Pacific countries since sustainable stocks are part of stock markets (Naeem et al. 2023). However, VIX has a positive effect on renewable and alternative energy stocks (Ghosh 2022). GPR emerges from political uncertainty in governments and social issues with the potential to affect international relations. The GPR index proposed by Caldara and Iacoviello (2022) employs the same underlying idea as the economic policy uncertainty presented by Baker et al. (2016). GPR is expected to negatively affect the Canadian stock market (Bossman and Gubareva 2023), with asymmetric effects on the Brazilian, South African, and Turkish stock markets (Hoque and Zaidi 2020), while Malaysian and US stocks remain unaffected (Hoque et al. 2019; Kamal et al. 2022).

Nevertheless, the increased GPR from the Russian–Ukrainian War has presented a challenging obstacle for investors in risk management (Umar et al. 2022). Mousa et al. (2022) suggested that investing in sustainable stock in the Arab region can minimize the risks associated with the outbreak of COVID-19, and be a safe haven (Rubbaniy et al. 2022), also exhibiting lower volatility compared to stock markets in the case of a Russia–Ukraine war (Taera et al. 2023). Sohag et al. (2022) found that GPR has a positive effect on green equity. On the other hand, Shaikh (2022) and Naeem et al. (2023) discovered that economic policy uncertainty and VIX have a negative effect on sustainable stocks, with similar results in the stock markets. The study of sustainable stock, given the current global uncertainty, has been under-examined while there is growing interest in the investment in sustainable stocks. Hence, investors should consider the pros and cons of investing in sustainable stocks with regard to the effects of uncertainty. Thus, we address this gap by analyzing the effects of uncertainty on sustainable stocks in seven emerging markets.

2.2. Gold and Crude Oil Prices Effects on Sustainable Stock

Past studies indicate a significant interest in the relationship between changes in gold and crude oil-price linkages to stock markets. However, a consensus on this relationship remains elusive. Baur and Lucey (2010) stated that gold is a safe haven for stock markets, as it exhibits a negative effect and can hedge stock markets in ten developed markets (Ali et al. 2020). Similarly, Lei et al. (2023) determined that gold prices negatively affected sustainable stock in the developed countries of the Asia–Pacific region and displayed a negative effect on the US stock market in the long run (Atri et al. 2023). Raza et al. (2016) employ the NARDL model to demonstrate that gold prices have an asymmetrically positive effect on the stock markets of India, Chile, South Africa, Indonesia, and Thailand. The Malaysian stock market (Hoque et al. 2019) and the BRCIS group (Raza et al. 2016) had a negative effect on crude oil prices, as well as Singapore, Japan, New Zealand, and the Philippines’ sustainable stock in the long run (Bhattacherjee et al. 2023). Gheraia (2022) argues that crude oil prices have a long-run positive effect on the Saudi Arabian stock market. In addition, the NARDL model was employed to assess the effects of crude oil prices on the Turkish stock markets, as performed by Erdoğan et al. (2022), who found an asymmetric effect of crude oil prices in the short and long run.

Recently, an increase in GPR has affected commodity price volatility. In particular, the spillover effect of crude oil on gold (Wang et al. 2022) and stock markets (Umar et al. 2022), and investment in emerging markets, can contribute to risk reduction (Chancharat and Sinlapates 2023). The rise in awareness of environmental, social, and governance (ESG) investments or sustainable stocks can be explained by increased volatility in commodity prices, particularly gold and crude oil, as well as the presence of uncertainty. According to Andersson et al. (2022), investing in a sustainable stock can help minimize the risks associated with investing in gold and crude oil, while also being a safe haven and hedging portfolio (Cagli et al. 2023). Darsono et al. (2022) proposed that gold and crude oil prices have a positive effect on Chinese, Brazilian, and US sustainable stocks, implying a positive movement. However, this relationship does not serve as a safe haven. Similarly, Piserà and Chiappini (2024) did not find sustainable stock to be a safe haven. In addition, crude oil prices positively affect clean energy stocks (Ghosh 2022). Sarker et al. (2023) discovered an asymmetrical effect of crude oil prices on clean energy stocks.

Past literature reviews have examined phenomena in stock markets with regard to the effects of EPU, VIX, GPR, gold, and crude oil on sustainable stocks, particularly in emerging markets that have been assessed throughout the entire region (see, e.g., Naeem et al. 2023; Lei et al. 2023). However, there has been a lack of focus on the specific details of each country, as well as empirical studies. Moreover, the outbreak of the Russia–Ukraine war, which is unlikely to end, has had wide effects globally. To capture the short- and long-run consequences, we employ the NARDL model to examine the asymmetric effects of uncertainty and commodity markets on sustainable stocks in seven emerging markets.

3. Data and Methodology

3.1. Data

This study examines the asymmetric effects of uncertainty and commodity markets on sustainable stocks in seven emerging markets: Thailand, Malaysia, Indonesia, Brazil, South Africa, Taiwan, and South Korea. The monthly data during January 2012 to June 2023 were employed. The sustainable stocks data were acquired from the official website of Morgan Stanley Capital International, via www.msci.com (accessed on 4 November 2023). Global economic policy uncertainties (EPUs) and geopolitical risk (GPR) were obtained from www.policyuncertainty.com (accessed on 4 November 2023). Stock market uncertainty (VIX) was obtained from the official website of CBOE via www.cboe.com (accessed on 4 November 2023). Gold and crude oil prices were gathered from www.investing.com (accessed on 4 November 2023). Thus, the variable descriptions are shown in Table 1.

Table 1.

Variable descriptions.

However, we exclude other emerging markets due to lack of sufficient data. Gold prices, crude oil prices, and sustainable stocks are returns. EPU, VIX, and GPR are change. This can be put into an equation, thus, , when is return (sustainable stocks, gold, and crude oil) and changes (EPU, VIX, and GPR) in the month t, while is price or the index of month t, and is a natural logarithm.

3.2. Methodology

We applied the nonlinear autoregressive distributed lag (NARDL) model developed by Shin et al. (2014) to demonstrate the magnitude of reaction asymmetry of response variables in the returns (sustainable stocks) due to changes in the explanatory variables (EPU, VIX, GPR, GD, and WTI) in both the short and long run. NARDL can capture both the short- and long-run asymmetric effects by developing a model of asymmetric cointegration into a single equation. Thus, NARDL possesses advantageous characteristics compared to alternative linear econometric models for examining cointegration (Sarker et al. 2023) and has been widely studied with other financial assets (see, e.g., Gheraia 2022; Ghumro et al. 2022; Atri et al. 2023; Tang et al. 2023).

The NARDL equation (Shin et al. 2014) is expressed as follows:

When is the response variable, and are asymmetric long-run parameters; is an error term; and is an explanatory variable vector with the decomposed partial sum of a positive change () and negative change () for , and can thus be presented as

When is the initial value, the process of change in the partial sum of the positive and negative changes can be presented as

Referring to the NARDL in Equations (1) and (2), the asymmetric error-correction model (AECM) can be rewritten as

When is a non-linear error-correction term. The speed of adjustment analysis using AECM is based on , and the equation can be rewritten as:

and , where and are positive and negative long-run coefficients, respectively, while and are positive and negative short-run coefficients, is constant, is a coefficient, and is an error term (white noise).

Equation (6) represents the short- and long-run asymmetric effects of the explanatory variable on the response variable; thus, the cointegration by NARDL, by Shin et al. (2014), in the bound test, according to Pesaran et al. (2001), using the F statistic (FPSS). The null hypothesis of cointegration is and the alternative hypothesis of cointegration is . The Wald test is used to examine the asymmetric effect in the short run when and in the long run when . NARDL can be expressed as follows:

When is the sustainable stock monthly return of emerging market i at time t. We referred to the hedging definition of Baur and Lucey (2010) and Baur and Smales (2020) to analyze the response of sustainable stocks to EPU, VIX, GPR, GD, and WTI. The sustainable stocks can be a strong (weak) hedge when there is a positive correlation (uncorrelation) against EPU, VIX, and GPR. Sustainable stocks can be a strong (weak) hedge when there is negative correlation (uncorrelation) against GD and WTI. Thus, the hypotheses are tested.

4. Result and Discussion

4.1. Descriptive Statistics

Table 2, Panel A, presents a report of descriptive statistics. Except for Taiwan sustainable stock (TAI), all sustainable stocks show lower average returns than gold (GD), while the return of crude oil (WTI) shows a lower average return than all sustainable stocks except the Malaysian sustainable stock (MYS) and the Brazilian sustainable stock (BRA). The TAI exhibits the highest average return, while GPR has the largest average change. All data do not follow a normal distribution, hence the Jarque–Bera statistical test is significant except for GD, which indicates a 0.01 stationary level, or I(0), which is statistically significant, according to the augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) tests. As a result, the data are suitable for applying NARDL, as it is stated by Shin et al. (2014) that data should not indicate stationary at second difference or I(2) (see, e.g., Raza et al. 2016; Gheraia 2022; Sarker et al. 2023).

Table 2.

Descriptive summary.

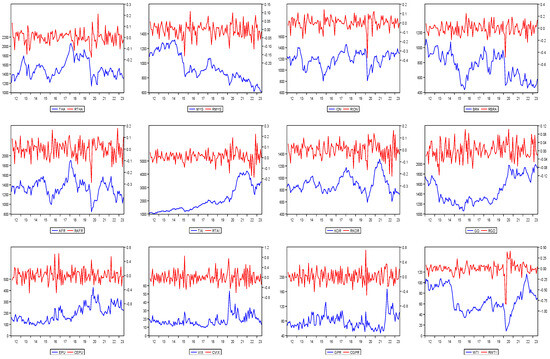

Table 2, Panel B, displays the correlation matrix, and all sustainable stocks maintain a positive relationship with GD and WTI but a negative relationship with global economic policy uncertainty (EPU), stock market uncertainty (VIX), and geopolitical risk (GPR), except MYS and BRA, which bear a positive relationship with GPR. Furthermore, EPU, VIX, GPR, GD, and WTI showed no multicollinearity, due to variance inflation factor (VIF) < 10. Figure 1 shows the movement pattern of prices and returns on sustainable stocks, gold, and crude oil, including index and change of EPU, VIX, and GPR in the data series over the study period.

Figure 1.

Prices and returns of sustainable stocks, gold, and crude oil, including index and change of EPU, VIX, and GPR.

4.2. Asymmetric Effects of EPU, VIX, GPR, GD, and WTI on Sustainable Stock

We applied non-linear autoregressive distributed lag (NARDL) to our study. As a result of non-linear cointegration for seven emerging markets reported in Table 3, we analyze the cointegration using the FPSS test and use the Akaike information criterion (AIC) to select the optimal lag length. Table 4 shows the short- and long-run asymmetrical effects of global economic policy uncertainty (EPU), stock market uncertainty (VIX), geopolitical risk (GPR), gold prices (GD), and crude oil prices (WTI) on the sustainable stocks of Thailand (THA), Malaysia (MYS), Indonesia (IDN), Brazil (BRA), South Africa (AFR), Taiwan (TAI), and South Korea (KOR). Our analysis found that EPU, VIX, GPR, GD, and WTI affect sustainable stock change in an asymmetric manner. We observed a significant statistic for the speed of adjustment (ECM), and all sustainable stocks except THA and IDN show more than −1. Narayan and Smyth (2006) suggest that an ECM coefficient between −1 and −2 implies that equilibrium exists and there is dampened fluctuation. However, the error correction process appears rapidly, and thus the long-run consideration is recommended.

Table 3.

Bounds test for non-linear cointegration.

Table 4.

Result from NARDL model.

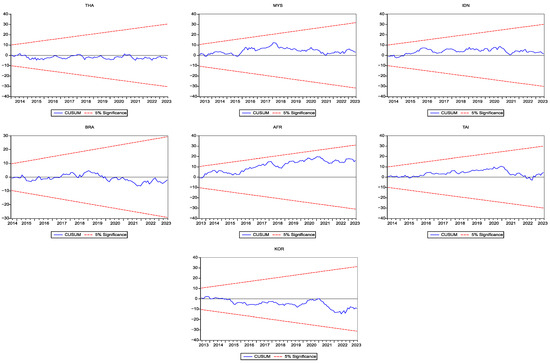

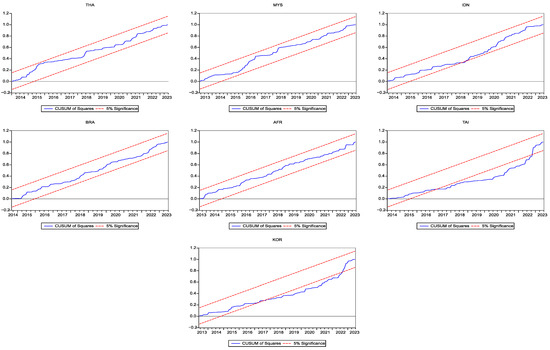

Furthermore, the diagnostic tests conducted on sustainable stocks revealed no serial correlation except for the AFR and no heteroskedasticity except for IDN, TAI, and KOR. The residual series were found to be normal except for TAI (Table 4, Panel C). The stability test for the cumulative sum of recursive residuals (CUSUM) and the CUSUM of squares (CUSUMSQ) indicates the stability of the coefficients and variances (Figure A1 and Figure A2).

The details of the short run in Table 4, Panel A, show that returns on KOR, AFR, and TAI decline by 4.50%, 5.80%, and 6.30% when positive EPU shocks increase by 1%. The increase in negative EPU shocks by 1% will result in increased returns on MYS and KOR by 3.50% and 5.60%, respectively, which is consistent with Shaikh’s (2022) study on US sustainable stocks. However, this effect was not observed for THA, IND, or BRA. Thus, investing in sustainable stocks serves as diversification and a weak hedge.

The positive (negative) VIX shocks increased (decreased) by 1%, leading to returns on sustainable stocks in all markets declining between 6.30% and 13.70% (increasing between 4.90% and 26.00%), a declining situation except for BRA. Thus, investors’ fear of increasing stock market volatility is reflected in the returns on sustainable stocks in seven emerging markets. Additionally, positive GPR shocks increased by 1%, resulting in returns on THA, IND, and KOR, which declined between 5.70% and 8.90%. Negative GPR shocks in the previous month increased by 1%, resulting in decreases of 7.80% and 11.20% in IND and AFR, respectively. This illustrates that short-run GPR will result in investors’ fear and require longer investment decisions. Therefore, an increase in GPR affects sustainable and clean energy stocks (Ghosh 2022).

Additionally, positive GD shocks increasing by 1% will result in increased sustainable stock returns by 27.50% to 81.30%, while negative GD shocks will decrease returns on AFR, IND, and MYS by 39.00%, 26.20%, and 25.90%, respectively. Thus, sustainable stock investment in seven emerging markets can only serve as a diversifier for GD, given the short-run positive movement in GD. Similarly, Darsono et al. (2022) revealed a short-run positive relationship between gold prices and returns for Chinese and Indian sustainable stocks. A 1% increase in positive WTI shocks results in an increasing return on KOR, AFR, and BRA of 6.61%, 9.90%, and 19.90%, respectively. A 1% increase in negative WTI shocks results in a decreasing return on the AFR of 8.30%. Our study suggests that sustainable stocks can serve as diversifiers in the crisis of short-run energy prices caused by rising crude oil prices, leading to a higher demand for alternative energy. Sustainable stocks will benefit from this situation, in addition to decreasing returns when crude oil prices decline. This is consistent with Ghosh’s (2022) finding that clean energy stocks have a positive relationship with crude oil. Similarly, Andersson et al. (2022) concluded that sustainable stock investment serves as a diversifier for crude oil.

Nevertheless, the long-run asymmetrical effect that captures positive () and negative () effects will not necessarily develop in the same fashion as in the short run, except for VIX and GD. Positive and negative shocks continue to affect sustainable stocks in the long run (Table 4, Panel B). According to Bhattacherjee et al. (2023), the VIX will continue to affect Australian and Canadian sustainable stocks, similar to the 12 sustainable stocks that are affected by gold prices in the long run (Darsono et al. 2022). An increase in positive (negative) EPU shocks results in an increased return on THA and a decreased return on TAI and KOR (an increased return on MYS, TAI, and KOR). However, Shaikh (2022) found a negative relationship between economic policy uncertainty and US sustainable stocks. Our findings explain why increased EPU causes markets to overreact. However, this behavior will be adapted in the long run, and sustainable stocks are socially responsible investments with the potential to grow (Diab 2022). Thus, increasing returns on sustainable stocks make THA a strong hedge under global economic policy uncertainty. According to Cagli et al. (2023), sustainable stocks could be hedged during the COVID-19 pandemic. The positive (negative) GPR shocks will decrease (increase) the returns on IND in the long run and likewise in the short run. Consequently, an increase in GPR is a trigger for investors’ risk assessment and sell-off, resulting in a negative market reaction that is similar to the South African stock market (Hoque and Zaidi 2020). The long-run GPR has no effect on the remaining six sustainable stocks, such as the long-run EPU.

An increase in long-run positive WTI shocks increases the returns on AFR and KOR, whereas an increase in long-run negative WTI shocks decreases the returns on AFR. Hence, positive movements and increasing crude oil prices encourage the use of alternative energy sources. Consequently, this leads to an increasing return on sustainable stocks, whereas returns on IND exhibit a decrease (increase) with an increase in long-run positive (negative) WTI shocks. On the other hand, Darsono et al. (2022) observed a positive long-run effect of crude oil prices on sustainable stocks, as did a study on clean energy by Sarker et al. (2023). Our findings explain that Indonesia relies heavily on crude oil and fossil fuels and that Indonesian sustainable stock markets exhibit limited access and have demonstrated the highest volatility (S.D.2) among other sustainable stocks in Asia throughout the study (Table 2, Panel A). An increase in crude oil prices leads to long-run economic costs and, interestingly, appears as bad news for Indonesian sustainable stocks (Table 4, Panel B). Economic growth, interest rates, and exchange rates in each country may determine the magnitude of this effect. Thus, sustainable stocks in seven emerging markets can hedge against EPU, GPR, and WTI while only diversifying VIX and GD, which differ heterogeneously among countries.

Table 5 shows the Wald test evaluation of the asymmetrical effects of EPU, VIX, GPR, GD, and WTI on sustainable stocks in the seven emerging markets in the short and long run. The following are short- and long-run asymmetric relationships: EPU, GPR, and WTI on THA presented both short and long-run effects; GPR effects on IND and AFR were in the short run; VIX effects on BRA and TAI were in the short run; VIX effects on AFR and KOR were in the long run; WTI effects on TAI were in the short run; and GD effects on TAI and KOR were in the short run.

Table 5.

Wald tests for long-run and short-run symmetry.

5. Conclusions and Policy Implications

Uncertainty is a factor that affects every aspect of the economy, possibly affecting pricing and returns in stock markets, based on financial economics theory. The spillover effect in financial markets influences investors’ behavior and portfolio risk-management decisions. Investing in emerging markets and sustainable stocks are diversification options. Similarly, sustainable stocks state a consensus on the importance of investing in low-carbon and global sustainability. However, both investment risk and hedging are uncertain in the financial spectrum. Moreover, the rise in geopolitical risk from the Russia–Ukraine war has impacted the financial and commodity markets, as well as investor sentiment. Therefore, we study the asymmetric effect of global economic policy uncertainty, stock market uncertainty, geopolitical risks, gold prices, and crude oil prices on sustainable stocks in seven markets: Thailand, Malaysia, Indonesia, Brazil, South Africa, Taiwan, and South Korea. We applied the NARDL model and examined the monthly data from January 2012 to June 2023. The empirical findings validate the non-linear cointegration between global economic policy uncertainty, stock market uncertainty, geopolitical risk, gold prices, and crude oil prices with sustainable stocks in seven emerging markets.

Fluctuations in global economic policy uncertainty, stock market uncertainty, geopolitical risks, gold prices, and crude oil prices impose short- and long-run asymmetric effects on sustainable stock in seven emerging markets. In the long run, a positive effect on global economic policy uncertainty will ultimately lead to an increase in the adjustment of Thailand’s sustainable stocks. Thus, Thailand’s sustainable stock is a strong hedge. Indonesian, Brazilian, and South African sustainable stocks are weak hedges because of their absence of positive and negative effects. In addition, during geopolitical risks, sustainable stocks in seven emerging markets are weak hedges, except for the Indonesian sustainable stock. Positive (negative) effects on stock market uncertainty or bad news (good news) result in a decrease (increase) in sustainable stocks in seven emerging markets, indicating investors’ fear in the short and long run. Furthermore, they show more responses towards bad news than to good news. Similarly, an increase in the positive (negative) effect of gold prices results in an increase (decrease) in sustainable stocks in the seven emerging markets. Thus, sustainable stocks in seven emerging markets lack the potential for direct hedging against gold prices in both the short and long run. Indonesian sustainable stocks can potentially be a direct hedge against crude oil prices due to their positive and negative effects in the long run. Therefore, it is advisable to invest in Thailand’s sustainable stock during an increase in global economic policy uncertainty and invest in Indonesian sustainable stocks when crude oil prices increase. During periods of high geopolitical risk, it is recommended to invest in seven emerging markets, except for Indonesian sustainable stocks. Hence, investment in the sustainable stock of seven emerging markets is a diversifier under stock market uncertainty and changes in gold prices.

Our study finds that investors tend to overreact in the short run, which leads to flight safety. However, investors may adapt their behavior in the long run as they are unaffected by global economic policy uncertainty and geopolitical risk. Therefore, our findings would enable domestic and foreign investors to design their portfolios by selecting sustainable stocks in emerging markets to minimize risk from global economic policy uncertainty, geopolitical risk, and changes in crude oil prices. Policymakers may consider the asymmetry of uncertainty as a risk factor when implementing policies, particularly in the initial stages of global economic policy uncertainty and geopolitical risks that affect investor sentiment. Hence, prioritizing specific policies to capture investors’ trust and advocate sustainable stock investments will contribute to the accomplishment of the United Nations Sustainability Goals (SDGs). Nevertheless, the limitations of our study include an absence of discussion at the corporate and industrial levels, providing an opportunity to analyze the effect of uncertainties on the return of sustainable business or environmental, social, and governance (ESG). The heterogeneous themes of macroeconomic risk factors include inflation, the world uncertainty index (WUI), the financial stress indicator, economic uncertainty-related queries (EURQs), and other financial assets such as currency and treasury bonds. Finally, further details on the bullish, bearish, and normal conditions of the market can be applied using quantile-on-quantile regression.

Author Contributions

Conceptualization, P.N., T.B. and P.P.; methodology, P.N. and P.P.; software, P.N.; validation, P.N. and P.P.; formal analysis, P.N. and P.P.; investigation, P.N., T.B. and P.P.; data curation, P.N. and T.B.; writing–original draft, P.N., T.B. and P.P.; writing–review and editing, P.N., T.B. and P.P.; visualization, P.P.; supervision, T.B.; funding acquisition, P.N. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Faculty of Management Sciences, Buriram Rajabhat University (Grant number 3/2024) and the APC was funded by the Buriram Rajabhat University.

Data Availability Statement

Data available on request from the authors.

Acknowledgments

The authors gratefully acknowledge the financial support received for the publication of this article from Buriram Rajabhat University. The authors would like to express appreciation for the editor and the four anonymous reviewers for their constructive comments and suggestions. During the preparation of this work, the authors used the paraphrasing tool QuillBot Artificial intelligence (AI) and Grammarly to perform a grammatical check and English language enhancement. After using these tools, the authors reviewed and edited the content as needed, and take full responsibility for the content of publication.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Ali, Sajid, Elie Bouri, Robert Lukas Czudaj, and Syed Jawad Hussain Shahzad. 2020. Revisiting the valuable roles of commodities for international stock markets. Resources Policy 66: 101603. [Google Scholar] [CrossRef]

- Andersson, Emil, Mahim Hoque, Md Lutfur Rahman, Gazi Salah Uddin, and Ranadeva Jayasekera. 2022. ESG investment: What do we learn from its interaction with stock, currency and commodity markets? International Journal of Finance and Economics 27: 3623–39. [Google Scholar] [CrossRef]

- Atri, Hanen, Hanen Teka, and Saoussen Kouki. 2023. Does US full vaccination against COVID-19 immunize correspondingly S&P500 index: Evidence from the NARDL approach. Heliyon 9: e15332. [Google Scholar] [CrossRef] [PubMed]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Brian M. Lucey. 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. The Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Lee A. Smales. 2020. Hedging geopolitical risk with precious metals. Journal of Banking & Finance 117: 105823. [Google Scholar] [CrossRef]

- Bernanke, Ben S. 1983. Irreversibility, uncertainty, and cyclical investment. The Quarterly Journal of Economics 98: 85–106. [Google Scholar] [CrossRef]

- Bhattacherjee, Purba, Sibanjan Mishra, and Sang Hoon Kang. 2023. Does market sentiment and global uncertainties influence ESG-oil nexus? A time-frequency analysis. Resources Policy 86: 104130. [Google Scholar] [CrossRef]

- Bloom, Nicholas. 2009. The impact of uncertainty shocks. Econometrica 77: 623–85. [Google Scholar] [CrossRef]

- Bossman, Ahmed, and Mariya Gubareva. 2023. Asymmetric impacts of geopolitical risk on stock markets: A comparative analysis of the E7 and G7 equities during the Russian-Ukrainian conflict. Heliyon 9: e13626. [Google Scholar] [CrossRef]

- Cagli, Efe C. Caglar, Pinar Evrim Mandaci, and Dilvin Taşkın. 2023. Environmental, social, and governance (ESG) investing and commodities: Dynamic connectedness and risk management strategies. Sustainability Accounting, Management and Policy Journal 14: 1052–74. [Google Scholar] [CrossRef]

- Caldara, Dario, and Matteo Iacoviello. 2022. Measuring geopolitical risk. American Economic Review 112: 1194–225. [Google Scholar] [CrossRef]

- Chancharat, Surachai, and Parichat Sinlapates. 2023. Dependences and dynamic spillovers across the crude oil and stock markets throughout the COVID-19 pandemic and Russia-Ukraine conflict: Evidence from the ASEAN+6. Finance Research Letters 57: 104249. [Google Scholar] [CrossRef]

- Darsono, Susilo Nur Aji Cokro, Wing-Keung Wong, Tran Thai Ha Nguyen, and Dyah Titis Kusuma Wardani. 2022. The economic policy uncertainty and its effect on sustainable investment: A panel ARDL approach. Journal of Risk and Financial Management 15: 254. [Google Scholar] [CrossRef]

- Das, Debojyoti, M. Kannadhasan, and Malay Bhattacharyya. 2019. Do the emerging stock markets react to international economic policy uncertainty, geopolitical risk and financial stress alike? The North American Journal of Economics and Finance 48: 1–19. [Google Scholar] [CrossRef]

- Davis, Steven J. 2016. An index of global economic policy uncertainty. Macroeconomic Review 15: 91–97. [Google Scholar]

- Diab, Adeline. 2022. ESG May Surpass $41 Trillion Assets in 2022, But Not without Challenges. Bloomberg Intelligence. Available online: https://www.bloomberg.com/company/press/esg-may-surpass-41-trillion-assets-in-2022-but-not-without-challenges-finds-bloomberg-intelligence/ (accessed on 4 November 2023).

- Donadelli, Michael. 2015. Asian stock markets, US economic policy uncertainty and US macro-shocks. New Zealand Economic Papers 49: 103–33. [Google Scholar] [CrossRef]

- Erdoğan, Levent, Reşat Ceylan, and Mutawakil Abdul-Rahman. 2022. The impact of domestic and global risk factors on Turkish stock market: Evidence from the NARDL approach. Emerging Markets Finance and Trade 58: 1961–74. [Google Scholar] [CrossRef]

- Garel, Alexandre, and Arthur Petit-Romec. 2021. Investor rewards to environmental responsibility: Evidence from the COVID-19 crisis. Journal of Corporate Finance 68: 101948. [Google Scholar] [CrossRef]

- Gheraia, Zouheyr. 2022. The asymmetric impact of COVID-19 pandemic on the crude oil-stock markets nexus in KSA: Evidence from a NARDL model. International Journal of Energy Economics and Policy 12: 137–45. [Google Scholar] [CrossRef]

- Ghosh, Sudeshna. 2022. COVID-19, clean energy stock market, interest rate, oil prices, volatility index, geopolitical risk nexus: Evidence from quantile regression. Journal of Economics and Development 24: 329–44. [Google Scholar] [CrossRef]

- Ghumro, Niaz Hussain, Ishfaque Ahmed Soomro, and Ghulam Abbas. 2022. Asymmetric effect of exchange rate and investors’ sentiments on stock market performance. Journal of Economic and Administrative Sciences. Published electronically April 25. [Google Scholar] [CrossRef]

- Hoque, Mohammad Enamul, and Mohd Azlan Shah Zaidi. 2020. Global and country-specific geopolitical risk uncertainty and stock return of fragile emerging economies. Borsa Istanbul Review 20: 197–213. [Google Scholar] [CrossRef]

- Hoque, Mohammad Enamul, Low Soo Wah, and Mohd Azlan Shah Zaidi. 2019. Oil price shocks, global economic policy uncertainty, geopolitical risk, and stock price in Malaysia: Factor augmented VAR approach. Economic Research-Ekonomska Istraživanja 32: 3700–32. [Google Scholar] [CrossRef]

- Kamal, Javed Bin, Mark Wohar, and Khaled Bin Kamal. 2022. Do gold, oil, equities, and currencies hedge economic policy uncertainty and geopolitical risks during covid crisis? Resources Policy 78: 102920. [Google Scholar] [CrossRef]

- Lean, Hooi Hooi, and Duc Khuong Nguyen. 2014. Policy uncertainty and performance characteristics of sustainable investments across regions around the global financial crisis. Applied Financial Economics 24: 1367–73. [Google Scholar] [CrossRef]

- Lei, Heng, Huiling Liu, Minggao Xue, and Jing Ye. 2023. Precious metal as a safe haven for global ESG stocks: Portfolio implications for socially responsible investing. Resources Policy 80: 103170. [Google Scholar] [CrossRef]

- Mousa, Musaab, Adil Saleem, and Judit Sági. 2022. Are ESG shares a safe haven during COVID-19? Evidence from the Arab region. Sustainability 14: 208. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Sitara Karim, Imran Yousaf, Aviral Kumar Tiwari, and Saqib Farid. 2023. Comparing asymmetric price efficiency in regional ESG markets before and during COVID-19. Economic Modelling 118: 106095. [Google Scholar] [CrossRef] [PubMed]

- Narayan, Paresh Kumar, and Russell Smyth. 2006. What determines migration flows from low-income to high-income countries? An empirical investigation of Fiji–U.S. migration 1972–2001. Contemporary Economic Policy 24: 332–42. [Google Scholar] [CrossRef]

- Nusair, Salah A., and Jamal A. Al-Khasawneh. 2023. Changes in oil price and economic policy uncertainty and the G7 stock returns: Evidence from asymmetric quantile regression analysis. Economic Change and Restructuring 56: 1849–93. [Google Scholar] [CrossRef]

- Pástor, Lŭboš, and Pietro Veronesi. 2012. Uncertainty about government policy and stock prices. The Journal of Finance 67: 1219–64. [Google Scholar] [CrossRef]

- Pástor, Lŭboš, and Pietro Veronesi. 2013. Political uncertainty and risk premia. Journal of Financial Economics 110: 520–45. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Piserà, Stefano, and Helen Chiappini. 2024. Are ESG indexes a safe-haven or hedging asset? Evidence from the COVID-19 pandemic in China. International Journal of Emerging Markets 19: 56–75. [Google Scholar] [CrossRef]

- Prukumpai, Suthawan, Yuthana Sethapramote, and Pongsak Luangaram. 2022. Political uncertainty and the Thai stock market. Southeast Asian Journal of Economics 10: 227–57. [Google Scholar]

- Raza, Naveed, Syed Jawad Hussain Shahzad, Aviral Kumar Tiwari, and Muhammad Shahbaz. 2016. Asymmetric impact of gold, oil prices and their volatilities on stock prices of emerging markets. Resources Policy 49: 290–301. [Google Scholar] [CrossRef]

- Rubbaniy, Ghulame, Ali Awais Khalid, Muhammad Faisal Rizwan, and Shoaib Ali. 2022. Are ESG stocks safe-haven during COVID-19? Studies in Economics and Finance 39: 239–55. [Google Scholar] [CrossRef]

- Sarker, Provash Kumer, Elie Bouri, and Chi Keung Lau Marco. 2023. Asymmetric effects of climate policy uncertainty, geopolitical risk, and crude oil prices on clean energy prices. Environmental Science and Pollution Research 30: 15797–807. [Google Scholar] [CrossRef] [PubMed]

- Shaikh, Imlak. 2022. On the relationship between policy uncertainty and sustainable investing. Journal of Modelling in Management 17: 1504–23. [Google Scholar] [CrossRef]

- Sharpe, William F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance 19: 425–42. [Google Scholar] [CrossRef]

- Shin, Yongcheol, Byungchul Yu, and Matthew Greenwood-Nimmo. 2014. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt: Econometric Methods and Applications. Edited by William C. Horrace and Robin C. Sickles. New York: Springer Science and Business Media, pp. 281–314. [Google Scholar] [CrossRef]

- Sohag, Kazi, Shawkat Hammoudeh, Ahmed H. Elsayed, Oleg Mariev, and Yulia Safonova. 2022. Do geopolitical events transmit opportunity or threat to green markets? Decomposed measures of geopolitical risks. Energy Economics 111: 106068. [Google Scholar] [CrossRef]

- Taera, Edosa Getachew, Budi Setiawan, Adil Saleem, Andi Sri Wahyuni, Daniel KS Chang, Robert Jeyakumar Nathan, and Zoltan Lakner. 2023. The impact of Covid-19 and Russia-Ukraine war on the financial asset volatility: Evidence from equity, cryptocurrency and alternative assets. Journal of Open Innovation: Technology, Market, and Complexity 9: 100116. [Google Scholar] [CrossRef]

- Tang, Yumei, Xihui Haviour Chen, Provash Kumer Sarker, and Sarra Baroudi. 2023. Asymmetric effects of geopolitical risks and uncertainties on green bond markets. Technological Forecasting & Social Change 189: 122348. [Google Scholar] [CrossRef]

- Tran, Minh Phuoc-Bao, and Duc Hong Vo. 2023. Asia-Pacific stock market return and volatility in the uncertain world: Evidence from the nonlinear autoregressive distributed lag approach. PLoS ONE 18: e2085279. [Google Scholar] [CrossRef] [PubMed]

- Umar, Zaghum, Sun-Yong Choi, Onur Polat, and Tamara Teplova. 2022. The impact of the Russia-Ukraine conflict on the connectedness of financial markets. Finance Research Letters 48: 102976. [Google Scholar] [CrossRef]

- Wang, Yihan, Zeeshan Fareed, Elie Bouri, and Yuhui Dai. 2022. Geopolitical risk and the systemic risk in the commodity markets under the war in Ukraine. Finance Research Letters 49: 103066. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).