How Does the Exchange Rate and Its Volatility Influence FDI to Canada? A Disaggregated Analysis

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Literature

2.2. Empirical Literature

3. Methods

Data Sources and Econometric Models

- xi represents the value of the real effective exchange rate at each period;

- t denotes the window mean value of the effective exchange rate;

- t represents the total number of periods (t = 64);

- k denotes the length of the moving average window (k = 4).

- ECTt−1 is the lagged error correction term;

- λ is the ECT coefficient, which denotes the parameter reflecting the rate of correction for adjustments;

- p is the lag order for the dependent variable;

- q is the lag order for the independent variables.

4. Empirical Results and Discussion

4.1. Unit Root Tests

4.2. F-Bound and t-Test

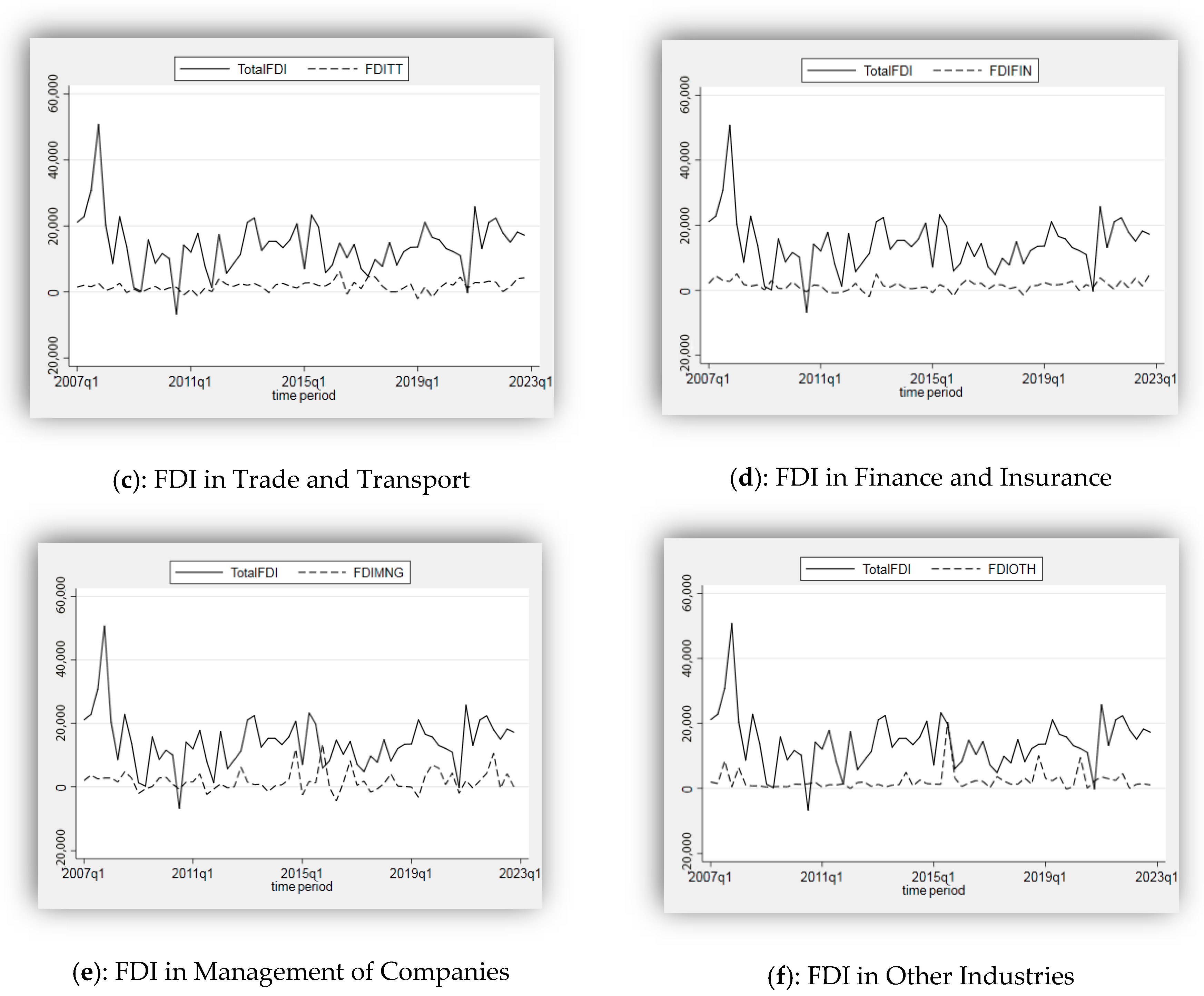

4.3. Results of Aggregate FDI

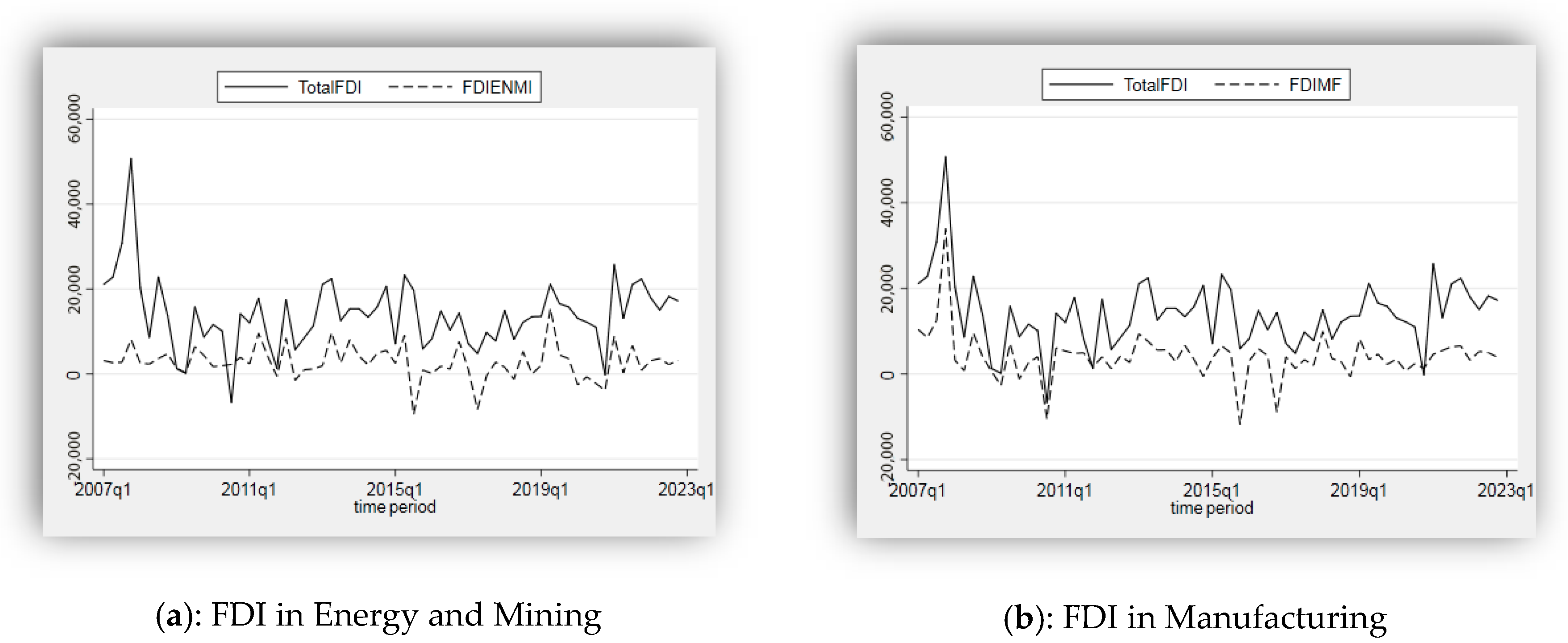

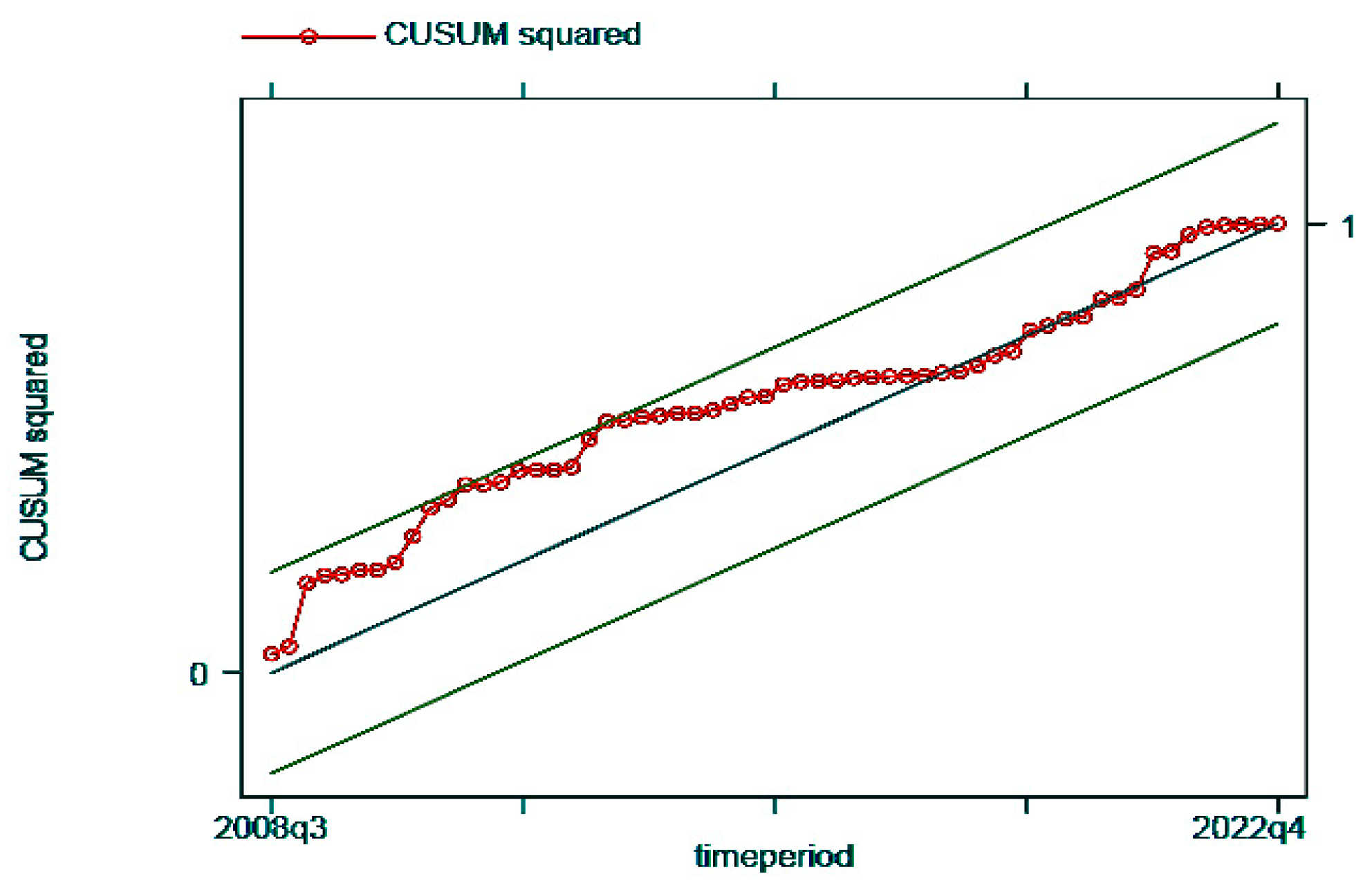

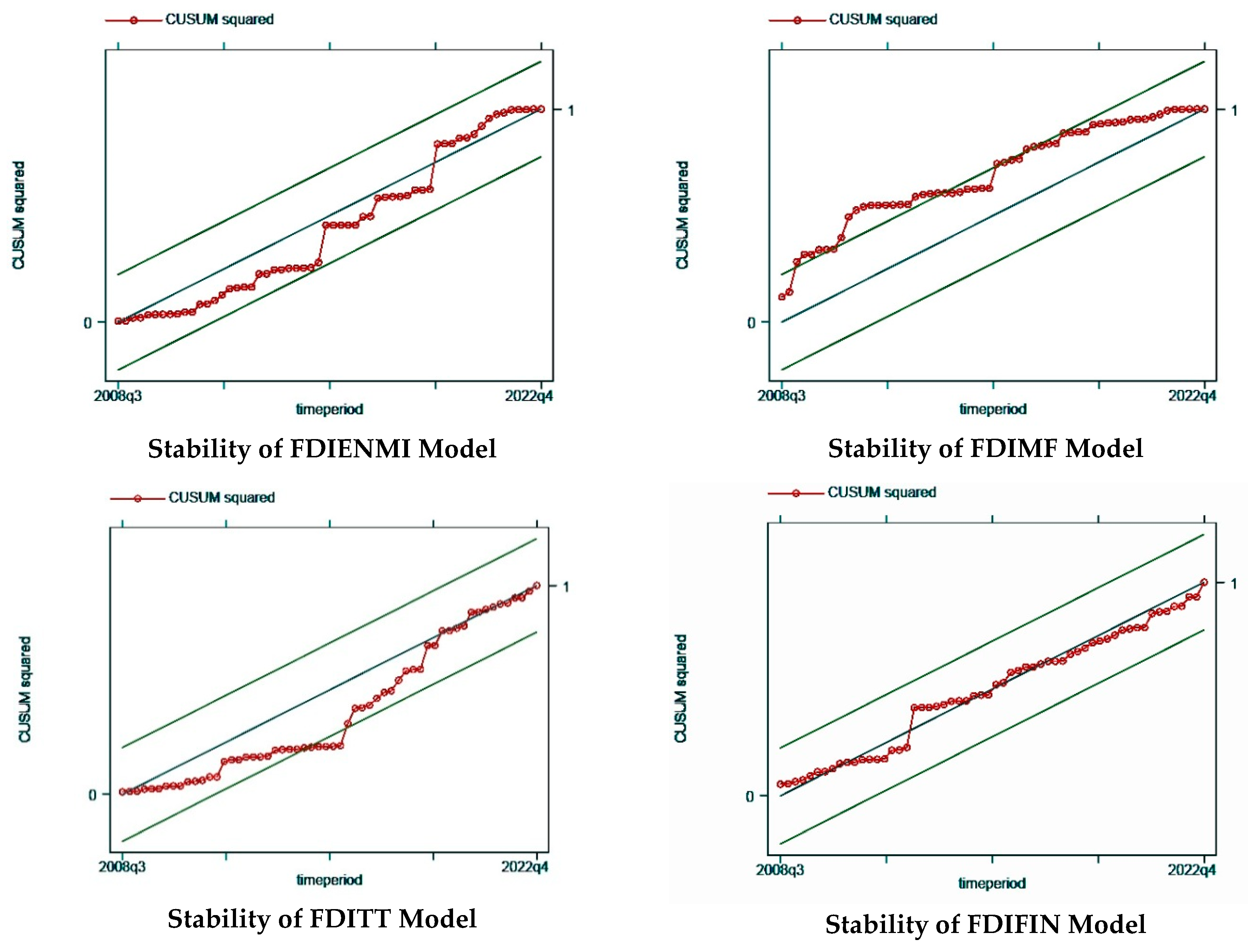

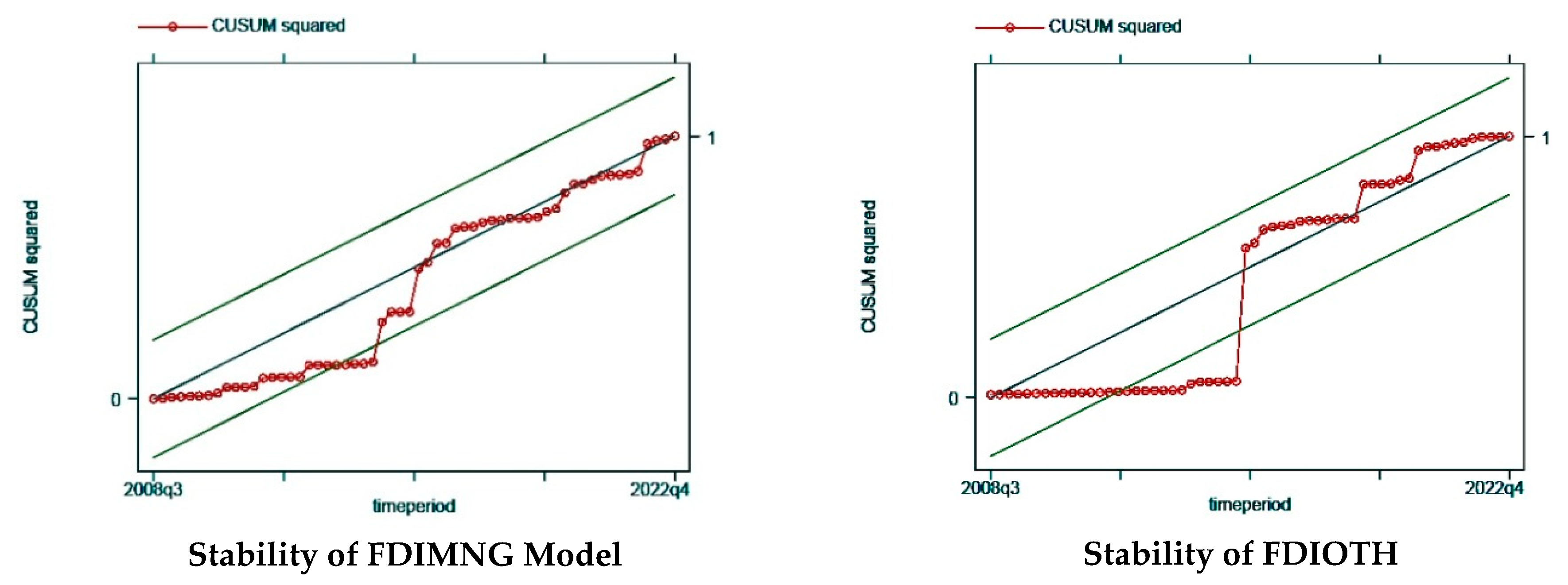

4.4. Disaggregated Analysis: Results for FDI in Sectors

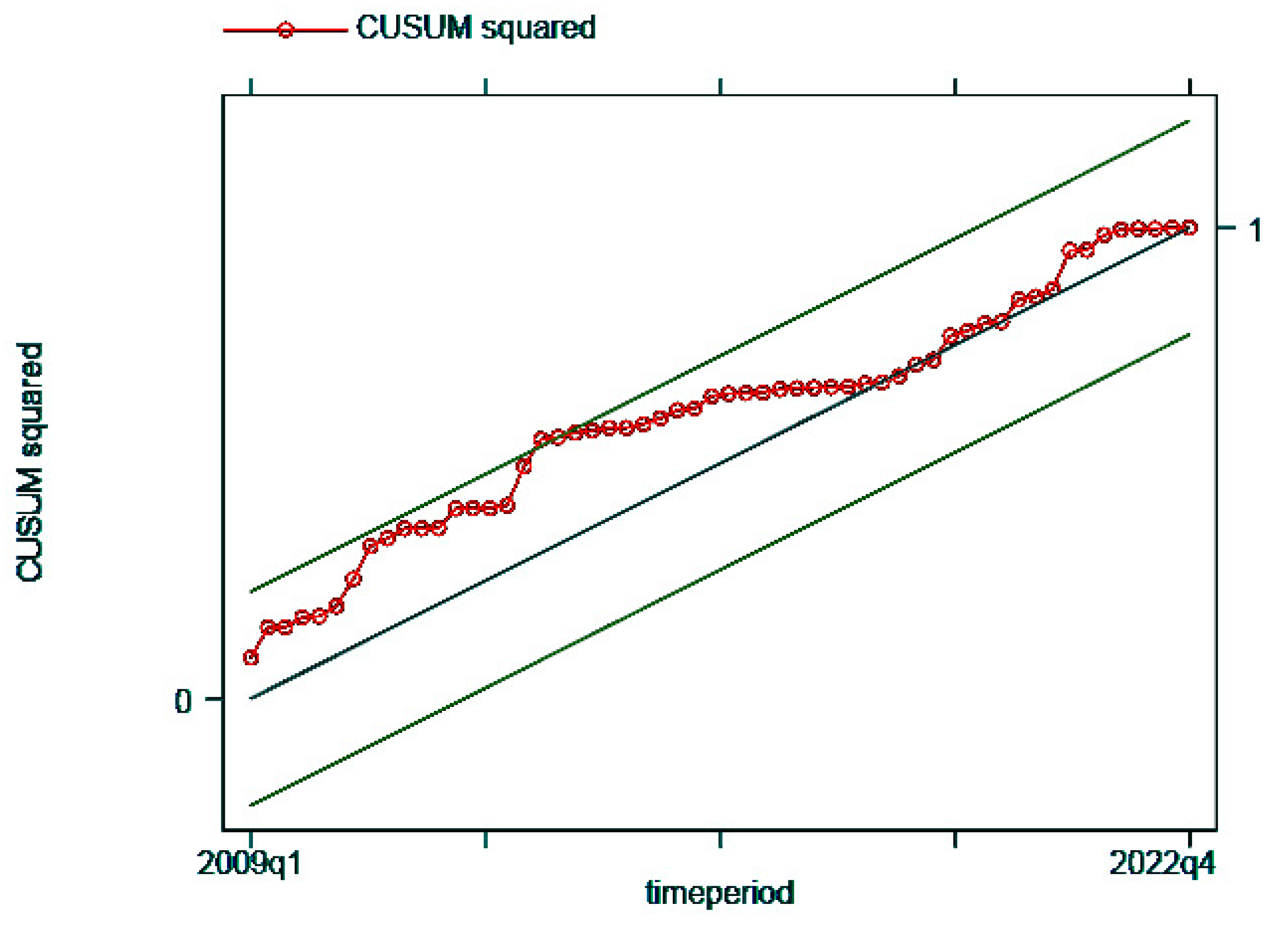

4.5. Results of the Alternative Model: Including Break Points

5. Conclusions and Policy Recommendations

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | Our total FDI inflows to Canada are the sum of net FDI inflows in all sectors. The net FDI inflow for each sector is the difference between an increase in investment and a decrease in investment in that particular industry. |

| 2 | To overcome the issue of negative values and apply a logarithmic transformation, we attempted a moving average method to smooth the quarterly series; however, this approach did not work due to persistent negative values at the sector level, even after employing the moving average. Additionally, exploring the option of using the ratio of FDI inflows to outflows, as commonly practised in net import studies, also revealed similar challenges. In several cases, the data provided by Statistics Canada on FDI inflows and outflows exhibit negative values; therefore, the ratio remains negative. |

| 3 | To simply the effect of shocks, we also tested a single dummy combining Dum2008q4 and Dum2020q2 and expanded each shock for three quarters. |

| 4 | The results for the Phillip–Perron tests and first-differenced variables are available upon request. |

| 5 | The results of the t-statistics are in the same line with F-statistics. We only report F-statistic. t-statistics are available upon request. |

| 6 | In pursuit of enhancing the robustness of our analytical framework specifically for the effect of the volatility of REER, we embarked on a comprehensive examination as derived from a shifting window, from a four-quarter window to a five-quarter window. Our meticulous investigation revealed that this transition yielded no substantive changes at the sectoral level. Notably, the relationship between the volatility of REER and total FDI demonstrated a regrettably diminished explanatory potency, notably eroding the previously observed long-term statistical significance of this association. Intriguingly, this transition also engendered an unexpected attenuation in the previously established interdependence between LNGDP and total FDI. Furthermore, this transition instigated the emergence of autocorrelation and heteroscedasticity in residuals. |

| 7 | The test results for the Ramsey RESET are available upon request. |

| 8 | As part of the robustness check, using a single dummy variable based on shocks in 2008 (up to three quarters) and 2020 (up to three quarters) did not yield any significant differences in the estimated model outcome. |

| 9 | Results are available upon request. |

References

- Abdullah, Mohammed, and Murshed Chowdhury. 2020. Foreign direct investment and total factor productivity: Any nexus? Margin: The Journal of Applied Economic Research 14: 164–90. [Google Scholar] [CrossRef]

- Adhikary, Bishnu Kumar. 2017. Factors influencing foreign direct investment in South Asian economies: A comparative analysis. South Asian Journal of Business Studies 6: 8–37. [Google Scholar] [CrossRef]

- Alam, Abdullah, and Zulfiqur Ali Shah. 2013. Determinants of foreign direct investment in OECD member countries. Journal of Economic Studies 40: 515–27. [Google Scholar] [CrossRef]

- Aliber. 1970. A Theory of Direct Foreign Investment. Edited by Charles P. Kindleberger. The International Corporation, Assymposium Combrite. Cambridge: MIT Press. [Google Scholar]

- Asiamah, Michael, Daniel Ofori, and Jacob Afful. 2019. Analysis of the determinants of foreign direct investment in Ghana. Journal of Asian Business and Economic Studies 26: 56–75. [Google Scholar] [CrossRef]

- Asmah, Emmaneul Ekow, and Francis Kwaw Andoh. 2013. Exchange rate volatility and foreign direct investment in Sub Saharan Africa. Journal for the Advancement of Developing Economies 2: 1–14. [Google Scholar] [CrossRef]

- Babubudjnauth, Ashok, and Boopendra Seetanah. 2020. An empirical investigation of the relationship between the real exchange rate and net FDI inflows in Mauritius. African Journal of Economic and Management Studies 11: 63–74. [Google Scholar] [CrossRef]

- Bank of Canada Annual Report. 2008. Available online: https://www.bankofcanada.ca/2009/01/annual-report-2008 (accessed on 4 April 2023).

- Biswas, Sreelata, and Byasdeb Dasgupta. 2012. Real exchange rate response to inward foreign direct investment in liberalized India. International Journal of Economics and Management 6: 321–34. [Google Scholar]

- Blattner, Tobias S. 2006. What Drives Foreign Direct Investment in Southeast Asia? A Dynamic Panel Approach. Frankfurt: European Central Bank. [Google Scholar]

- Blonigen, Bruce A. 1997. Firms-specific assets and the link between exchange rates and foreign direct investment. American Economic Review 87: 447–65. [Google Scholar]

- Chen, Kun-Ming, Hsiu-Hua Rau, and Chia-Ching Lin. 2006. The impact of exchange rate movements on foreign direct investment: Market-oriented versus cost-oriented. The Developing Economies 44: 269–87. [Google Scholar] [CrossRef]

- Chowdhury, Abdur R., and Mark Wheeler. 2008. Does real exchange rate volatility affect foreign direct investment? Evidence from four developed countries. The International Trade Journal 22: 218–45. [Google Scholar] [CrossRef]

- Cushman, David O. 1985. Real exchange rate risk, expectations and the level of direct investment. Review of Economics and Statistics 67: 297–308. [Google Scholar] [CrossRef]

- Cushman, David O. 1988. Exchange rate uncertainty and foreign direct investment in the United States. Weltwirtschaftliches Archiv 124: 322–36. [Google Scholar] [CrossRef]

- Daly, Kevin, and Chanikarn Teresa Tosompark. 2010. The determinants of foreign direct investment in Thailand. In The Impact of the Global Financial Crisis on Emerging Financial Markets. Bingley: Emerald Group Publishing Limited, pp. 709–18. [Google Scholar] [CrossRef]

- Darby, Julia, Andrew Hughes Hallett, Jonathan Ireland, and Laura Piscitelli. 1999. The impact of exchange rate uncertainty on the level of investment. The Economic Journal 109: 55–67. [Google Scholar] [CrossRef]

- de Castro, Priscila Gomes, Elaine Aparecida Fernandes, and Antonio Carvalho Campos. 2013. The determinants of foreign direct investment in Brazil and Mexico: An empirical analysis. Procedia Economics and Finance 5: 231–40. [Google Scholar] [CrossRef]

- Fauzel, Sheereen, Boopen Seetanah, and Raja Vinesh Sannassee. 2015. Foreign direct investment and welfare nexus in Subsaharan Africa. The Journal of Developing Areas 49: 271–83. [Google Scholar] [CrossRef]

- Froot, Kenneth A., and Jeremy C. Stein. 1991. Exchange rates and foreign direct investment: An imperfect capital markets approach. The Quarterly Journal of Economics 106: 1191–217. [Google Scholar] [CrossRef]

- Goldberg, Linda S., and Charles D. Kolstad. 1995. Foreign direct investment, exchange rate variability and demand uncertainty. International Economic Review 36: 855–73. [Google Scholar] [CrossRef]

- Government of Canada. 2022. Global Affairs Report. State of Trade 2021—A Closer Look at Foreign Direct Investment (FDI). Available online: https://www.international.gc.ca/ (accessed on 4 May 2023).

- Hanusch, Marek, Ha Nguyen, and Yashvir Algu. 2018. Exchange Rate Volatility and FDI Inflows: Evidence from Cross-Country Panel Data. MIT Global Practice Discussion Paper. No. 2. Washington, DC: World Bank. Available online: http://hdl.handle.net/10986/29911 (accessed on 24 January 2024).

- Harchaoui, Tarek, Faouzi Tarkhani, and Terence Yuen. 2005. The Effects of the Exchange Rate on Investment: Evidence from Canadian Manufacturing Industries (Working Paper 2005-22). Available online: https://www.bankofcanada.ca/wp-content/uploads/2010/02/wp05-22.pdf (accessed on 25 January 2024).

- Husek, Roman, and Vaclava Pankova. 2008. Exchange rate changes effects on foreign direct investment. Prague Economic Papers 2: 118–26. [Google Scholar] [CrossRef]

- Kiliçarslan, Zerrin. 2018. The relationship between exchange rate volatility and foreign direct investment in Turkey: Toda and Yamamoto causality analysis. International Journal of Economics and Financial Issues 8: 61–67. [Google Scholar]

- Korsah, Emmanuel, Richmell Baaba Amanamah, and Prince Gyimah. 2022. Drivers of foreign direct investment: New evidence from west African regions. Journal of Business and Socio-Economic Development. ahead-of-print. [Google Scholar] [CrossRef]

- Kyereboah-Coleman, Anthony, and Kwame F. Agyire-Tettey. 2008. Effect of exchange rate volatility on foreign direct investment in Sub Saharan Africa: The case of Ghana. Journal of Risk Finance 9: 52–70. [Google Scholar] [CrossRef]

- Lily, Jaratin, Mori Kogid, Dullah Mulok, Lim Thien Sang, and Rozilee Asid. 2014. Exchange rate movement and foreign direct investment in Asian economies. Economics Research International 2014: 320949. [Google Scholar] [CrossRef]

- Lin, Chia-Ching, Kun-Ming Chen, and Hsiu-Hua Rau. 2006. Exchange Rate Volatility and the Timing of Direct Investment: Market Seeking versus Export-Substitution. Taipei: Department of Trade, National Chengchi University, pp. 1–36. [Google Scholar]

- Martins, Jose Fillipe de Sousa. 2015. Impact of Real Exchange Rate Volatility on Foreign Direct Investment Inflows on Brazil, [Em linha]. Lisboa: ISCTE-IUL, Dissertação de Mestrado. [Consult. Dia Mês Ano] Disponívelem. Available online: https://repositorio.iscte-iul.pt/handle/10071/11412 (accessed on 3 May 2023).

- McCloud, Nadine, Michael S. Delgado, and Man Jin. 2023. Foreign capital inflows, exchange rates, and government stability. Empirical Economics. [Google Scholar] [CrossRef]

- Moraghen, Warren, Boopen Seetanah, and Noor Ul Haq Sookia. 2020. The impact of exchange rate and exchange rate volatility on Mauritius foreign direct investment: A sector-wise analysis. International Journal of Finance & Economics 28: 208–24. [Google Scholar] [CrossRef]

- Moran, Kevin, Dalibor Stevanovic, and Adam Kader Toure. 2022. Microeconomic uncertainty and the COVID-19 pandemic: Measure and impacts on the Canadian economy. Canadian Journal of Economics 55: 379–405. [Google Scholar] [CrossRef]

- Nguyen, Thong Trung, Muhammad Ali Nasir, and Xuan Vinh Vo. 2024. Exchange rate dynamics of emerging and developing economies: Not all capital flows are alike. International Journal of Finance & Economics 29: 1115–24. [Google Scholar] [CrossRef]

- Osinubi, Tokunbo S., and Lloyd A. Amaghionyeodiwe. 2009. Foreign direct investment and exchange rate volatility in Nigeria. International Journal of Applied Economics and Quantitative Studies 6: 83–116. [Google Scholar]

- Pesaran, M. Hashem, Yongcheol Shin, and Ron P. Smith. 1999. Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association 94: 621–34. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Ron P. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Economics 16: 289–326. [Google Scholar] [CrossRef]

- Russ, Katheryn Niles. 2007. The endogeneity of the exchange rate as a determinant of FDI: A model entry and multinational firms. Journal of International Economics 71: 344–72. [Google Scholar] [CrossRef]

- Saleem, Hummera, Malik Shahzad Shabbir, Bilal Khan, Shahab Aziz, Maizaitulaidawati Md Husin, and Bilal Ahmed Abbasi. 2021. Estimating the key determinants of foreign direct investment flows in Pakistan: New insights into the co-integration relationship. South Asian Journal of Business Studies 10: 91–108. [Google Scholar] [CrossRef]

- Serenis, Dimitrios, and Nicholas Tsounis. 2012. A new approach for measuring volatility of the exchange rate. Procedia Economics and Finance 1: 374–82. [Google Scholar] [CrossRef][Green Version]

- Sharifi-Renani, Hosein, and Maryam Mirfatah. 2012. The impact of exchange rate volatility on foreign direct investment in Iran. Procedia Economics Finance 1: 365–73. [Google Scholar] [CrossRef]

- Shrestha, Min B., and Guna R. Bhatta. 2018. Selecting appropriate methodological framework for time series data analysis. The Journal of Finance and Data Science 4: 71–89. [Google Scholar] [CrossRef]

- Statistics Canada, Table 36-10-0026-01. 2023. Balance of International Payments, Flows of Canadian Direct Investment Abroad and Foreign Direct Investment in Canada, by North American Industry Classification System (NAICS), Quarterly (×1,000,000). Available online: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610002601 (accessed on 25 January 2024).

- Sung, Hongmo, and Harvey E. Lapan. 2000. Strategic Foreign Direct Investment and Exchange-Rate Uncertainty. International Economic Review 41: 411–23. [Google Scholar] [CrossRef]

- Vincent, Agunuwa Ekokotu, Inaya Lucky Salubi, and Proso Tomothy. 2017. Evaluating the effect of exchange rate on foreign direct investment (FDI) in Nigeria. Journal of Academic Research in Economics 9: 34–48. [Google Scholar]

- Walsh, James P., and Jiangyan Yu. 2010. Determinants of Foreign Direct Investment: A Sectoral and Institutional Approach. IMF Working Paper No. WP/10/187. Tokyo: International Monetary Fund, Asia Pacific Department. [Google Scholar]

- Warren, Moraghen, B. Seetanah, and N. Sookia. 2023. An investigation of exchange rate, exchange rate volatility and FDI nexus in a gravity model approach. International Review of Applied Economics 37: 482–502. [Google Scholar] [CrossRef]

| Period | Total Net FDI | Energy and Mining (FDIENMI) | Manufacturing Industries (FDIMF) | Trade and Transport (FDITT) | Finance and Insurance (FDIFIN) | Management of Companies and Enterprises (FDIMNG) | Other Industries (FDIOTH) |

|---|---|---|---|---|---|---|---|

| 2022Q1 | 17,978 | 3118 (17.35%) | 3223 (17.93%) | 77 (0.42%) | 908 (5.06%) | 10,673 (59.36%) | −22 (−0.12%) |

| 2022Q2 | 15,063 | 3650 (24.23%) | 5259 (34.91%) | 1563 (10.37%) | 3784 (25.12%) | −477 (−3.16%) | 1285 (8.53%) |

| 2022Q3 | 18,243 | 2232 (12.23%) | 5001 (27.41%) | 4083 (22.38%) | 1344 (7.37%) | 4179 (22.91%) | 1404 (7.70%) |

| 2022Q4 | 17,221 | 3188 (18.51%) | 3915 (22.73%) | 4311 (25.03%) | 4804 (27.90%) | −45 (−0.26%) | 1047 (6.07%) |

| Variables | Test Statistic | p-Value | Stationary Status |

|---|---|---|---|

| FDITOTAL | −4.278 ** | 0.0034 | Stationary in level |

| FDIENMI | −5.479 ** | 0.0000 | Stationary in level |

| FDIMF | −5.238 ** | 0.0001 | Stationary in level |

| FDITT | −4.412 ** | 0.0021 | Stationary in level |

| FDIFIN | −4.659 ** | 0.0008 | Stationary in level |

| FDIMNG | −6.530 ** | 0.0000 | Stationary in level |

| FDIOTH | −5.683 ** | 0.0000 | Stationary in level |

| LNGDP | −3.521 * | 0.0372 | Stationary in level |

| LNOPEN | −2.688 | 0.2411 | Non-stationary in level |

| LNREER | −2.431 | 0.3633 | Non-stationary in level |

| LNVOL | −2.855 | 0.1774 | Non-stationary in level |

| Critical values | α = 0.01, −4.124 | α = 0.05, −3.488 | α = 0.1, −3.173 |

| Significance Level | [I(0)] L(10%) | [I(1)] L(10%) | [I(0)] L(5%) | [I(1)] L(5%) | [I(0)] L(2.5% | [I(1)]) L(2.5%) | [I(0)] L(1%) | [I(1)] L(1%) |

|---|---|---|---|---|---|---|---|---|

| Critical Values | 2.45 | 3.52 | 2.86 | 4.01 | 3.25 | 4.49 | 3.74 | 5.06 |

| Equation | ARDL totalfdi lngdp lnopen lnreer lnvol, lags(1 0 1 1 0) ec btest | |||||||

| F-Statistic | 7.994 | Result | Cointegration | |||||

| Equation | ARDL fdienmi lngdp lnopen lnreer lnvol, lags(1 0 0 0 0) ec btest | |||||||

| F-Statistic | 15.474 | Result | Cointegration | |||||

| Equation | ARDL fdimf lngdp lnopen lnreer lnvol, lags(1 0 0 1 1) ec btest | |||||||

| F-Statistic | 12.922 | Result | Cointegration | |||||

| Equation | ARDL fditt lngdp lnopen lnreer lnvol, lags(1 0 0 1 0) ec btest | |||||||

| F-Statistic | 10.148 | Result | Cointegration | |||||

| Equation | ARDL fdifin lngdp lnopen lnreer lnvol, lags(1 0 0 1 1) ec btest | |||||||

| F-Statistic | 10.780 | Result | Cointegration | |||||

| Equation | ARDL fdimng lngdp lnopen lnreer lnvol, lags(1 0 0 0 1) ec btest | |||||||

| F-Statistic | 14.224 | Result | Cointegration | |||||

| Equation | ARDL fdioth lngdp lnopen lnreer lnvol, lags(1 1 0 0 1) ec btest | |||||||

| F-Statistic | 14.923 | Result | Cointegration | |||||

| Variable | Coefficient | STD Error | T-Statistics | p-Value |

|---|---|---|---|---|

| ECT (−1) | −0.7958685 | 0.1283949 | −6.20 *** | 0.000 |

| ∆LNGDPt | 55,686.17 | 26,944 | 2.07 ** | 0.043 |

| ∆LNOPENt | −4058.413 | 48,260.94 | −0.08 | 0.933 |

| ∆LNREERt | 127,713.6 | 38,599.68 | 3.31 *** | 0.002 |

| ∆LNVOLt | 3880.538 | 2216.76 | 1.75 * | 0.086 |

| Constant | −1,012,511 | 473,346.8 | −2.14 ** | 0.037 |

| R2 | 0.5061 | Adjusted R2 | 0.4433 | |

| Variable | Coefficient | STD Error | T-Statistics | p-Value |

|---|---|---|---|---|

| LNGDPt−1 | 69,969.07 | 33,166.74 | 2.11 ** | 0.039 |

| LNOPENt−1 | 87,694.13 | 37,910.07 | 2.31 ** | 0.024 |

| LNREERt−1 | 65,256.19 | 24,877.63 | 2.62 ** | 0.011 |

| LNVOLt−1 | 4875.854 | 2673.373 | 1.82 * | 0.074 |

| Industry/Sector | Variable | Coefficient | STD Error | T-Statistics | p-Value |

|---|---|---|---|---|---|

| Energy and Mining (FDIENMI) | ECT (−1) | −1.121983 | 0.128131 | −8.76 *** | 0.000 |

| ∆LNGDPt | 20,290.28 | 13,950.67 | 1.45 | 0.151 | |

| ∆LNOPENt | −5445.683 | 15,652.36 | −0.35 | 0.729 | |

| ∆LNREERt | 26,247.58 | 10,300.41 | 2.55 ** | 0.014 | |

| ∆LNVOLt | 728.6559 | 1147.577 | 0.63 | 0.528 | |

| Constant | −418,765.3 | 243,999.8 | −1.72 * | 0.092 | |

| Overall Fit Measures | R2 | 0.5758 | Adjusted R2 | 0.5386 | |

| Manufacturing Industries (FDIMF) | ECT (−1) | −0.9861048 | 0.1241345 | −7.94 *** | 0.000 |

| ∆LNGDPt | 14,048.73 | 18,372.53 | 0.76 | 0.448 | |

| ∆LNOPENt | 40,466.99 | 20,709.41 | 1.95 * | 0.056 | |

| ∆LNREERt | 74,235.58 | 25,149.04 | 2.95 *** | 0.005 | |

| ∆LNVOLt | 5552.736 | 2499.272.688 | 2.22 ** | 0.030 | |

| Constant | −327,461.1 | 321,617.7 | −1.02 | 0.313 | |

| Overall Fit Measures | R2 | 0.5889 | Adjusted R2 | 0.5366 | |

| Trade and Transport (FDITT) | ECT (−1) | −0.9573658 | 0.1360218 | −7.04 *** | 0.000 |

| ∆LNGDPt | 5408.358 | 5773.209 | 0.94 | 0.353 | |

| ∆LNOPENt | 4385.413 | 6427.042 | 0.68 | 0.498 | |

| ∆LNREERt | 10,026.85 | 7832.668 | 1.28 | 0.206 | |

| ∆LNVOLt | 355.7322 | 479.5271 | 0.74 | 0.461 | |

| Constant | −71,558.11 | 100375.6 | −0.71 | 0.479 | |

| Overall Fit Measures | R2 | 0.4847 | Adjusted R2 | 0.4295 | |

| Finance and Insurance (FDIFIN) | ECT (−1) | −1.013493 | 0.1396756 | −7.26 *** | 0.000 |

| ∆LNGDPt | 5078.019 | 5458.375 | 0.93 | 0.356 | |

| ∆LNOPENt | 4360.178 | 6079.007 | 0.72 | 0.476 | |

| ∆LNREERt | 14,094.35 | 7527.826 | 1.87 * | 0.066 | |

| ∆LNVOLt | 1459.764 | 771.5681 | 1.89 * | 0.064 | |

| Constant | −80,405.18 | 95,216.37 | −0.84 | 0.402 | |

| Overall Fit Measures | R2 | 0.4981 | Adjusted R2 | 0.4342 | |

| Management of Companies and Enterprises (FDIMNG) | ECT (−1) | −1.070065 | 0.1310698 | −8.16 *** | 0.000 |

| ∆LNGDPt | 14,834.43 | 11,997.36 | 1.24 | 0.221 | |

| ∆LNOPENt | 10,718.42 | 13,390.37 | 0.80 | 0.427 | |

| ∆LNREERt | 4551.116 | 8690.936 | 0.52 | 0.603 | |

| ∆LNVOLt | −1018.394 | 1632.55 | −0.62 | 0.535 | |

| Constant | −230,676.6 | 209,110.9.5 | −1.10 | 0.275 | |

| Overall Fit Measures | R2 | 0.5595 | Adjusted R2 | 0.5123 | |

| Other Industries (FDIOTH) | ECT (−1) | −1.134691 | 0.1320199 | −8.59 *** | 0.000 |

| ∆LNGDPt | −39,251.69 | 21,029.02 | −1.87 | 0.067 | |

| ∆LNOPENt | 24,425.95 | 12,235.82 | 2.00 * | 0.051 | |

| ∆LNREERt | −12,124.32 | 8183.108 | −1.48 | 0.144 | |

| ∆LNVOLt | 2045.576 | 1444.99 | 1.42 | 0.163 | |

| Constant | 187,245.5 | 195,445.2 | 0.96 | 0.342 | |

| Overall Fit Measures | R2 | 0.6157 | Adjusted R2 | 0.5668 | |

| Industry | Variable | Coefficient | STD Error | T-Statistics | p-Value |

|---|---|---|---|---|---|

| Energy and Mining (FDIENMI) | LNGDPt−1 | 18,084.31 | 12,371.58 | 1.46 | 0.149 |

| LNOPENt−1 | 4853.625 | 13,967.01 | −0.35 | 0.729 | |

| LNREERt−1 | 23,393.93 | 9008.224 | 2.60 ** | 0.012 | |

| LNVOLt−1 | 649.436 | 1020.102 | 0.64 | 0.527 | |

| Manufacturing Industries (FDIMF) | LNGDPt−1 | 14,246.69 | 18,571.79 | 0.77 | 0.446 |

| LNOPENt−1 | 41,037.21 | 20,857.86 | 1.97 * | 0.054 | |

| LNREERt−1 | 31,202.02 | 13,531.79 | 2.31 ** | 0.025 | |

| LNVOLt−1 | 577.2225 | 1571.322 | 0.37 | 0.715 | |

| Trade and Transport (FDITT) | LNGDPt−1 | 5649.208 | 5922.851 | 0.95 | 0.344 |

| LNOPENt−1 | 4580.708 | 6696.589 | 0.68 | 0.497 | |

| LNREERt−1 | −710.5176 | 4362.839 | −0.16 | 0.871 | |

| LNVOLt−1 | 371.5739 | 490.9721 | 0.76 | 0.452 | |

| Finance and Insurance (FDIFIN) | LNGDPt−1 | 5010.415 | 5357.417 | 0.94 | 0.354 |

| LNOPENt−1 | 4302.13 | 5993.253 | 0.72 | 0.476 | |

| LNREERt−1 | 2112.857 | 3901.402 | 0.54 | 0.590 | |

| LNVOLt−1 | 353.1931 | 453.4005 | 0.78 | 0.439 | |

| Management of Companies and Enterprises (FDIMNG) | LNGDPt−1 | 13,863.11 | 11,447.45 | 1.21 | 0.231 |

| LNOPENt−1 | 10,016.6 | 12,485.86 | 0.80 | 0.426 | |

| LNREERt−1 | 4253.121 | 8213.515 | 0.52 | 0.607 | |

| LNVOLt−1 | 1520.994 | 969.5335 | 1.57 | 0.122 | |

| Other Industries (FDIOTH) | LNGDPt−1 | −7024.7 | 9848.779 | −0.71 | 0.479 |

| LNOPENt−1 | 21,526.52 | 10,527.39 | 2.04 ** | 0.046 | |

| LNREERt−1 | −10,685.13 | 7093.479 | −1.51 | 0.138 | |

| LNVOLt−1 | 56.44542 | 817.9582 | 0.07 | 0.945 |

| Equation | Durbin–Watson d-Statistic | Breusch–Godfrey LM Test | Result |

|---|---|---|---|

| Energy and Mining (FDIENMI) | 2.006071 | Chi2 = 0.014 p-value = 0.9044 | No serial correlation |

| Manufacturing Industries (FDIMF) | 2.114834 | Chi2 = 1.563 p-value = 0.2112 | No serial correlation |

| Trade and Transport (FDITT) | 1.913474 | Chi2 = 0.967 p-value = 0.3254 | No serial correlation |

| Finance and Insurance (FDIFIN) | 1.927294 | Chi2 = 0.144 p-value = 0.7047 | No serial correlation |

| Management of Companies and Enterprises (FDIMNG) | 2.043401 | Chi2 = 0.752 p-value = 0.3858 | No serial correlation |

| Other Industries (FDIOTH) | 1.987832 | Chi2 = 0.003 p-value = 0.9535 | No serial correlation |

| Equation | White’s Test for Homoscedasticity | Result | Jarque–Bera Normality Test | Result |

|---|---|---|---|---|

| Energy and Mining (FDIENMI) | Chi2 (20) = 21.65 p-value = 0.3601 | Homoscedastic | Chi2 = 16.5 p-value = 0.00026 | Not Normally Distributed |

| Manufacturing Industries (FDIMF) | Chi2 (35) = 50.18 p-value = 0.046 | Heteroscedastic | Chi2 = 113.1 p-value = 2.7 × 10−25 | Not Normally Distributed |

| Trade and Transport (FDITT) | Chi2 (27) = 27.34 p-value = 0.4454 | Homoscedastic | Chi2 = 1.787 p-value = 0.4092 | Normally Distributed |

| Finance and Insurance (FDIFIN) | Chi2 (35) = 35.68 p-value = 0.4361 | Homoscedastic | Chi2 = 2.416 p-value = 0.2988 | Normally Distributed |

| Management of Companies and Enterprises (FDIMNG) | Chi2 (27) = 28.85 p-value = 0.3681 | Homoscedastic | Chi2 = 19.34 p-value = 6.3 × 10−5 | Not Normally Distributed |

| Other Industries (FDIOTH) | Chi2 (35) = 39.32 p-value = 0.2826 | Homoscedastic | Chi2 = 676 p-value = 2 × 10−147 | Not Normally Distributed |

| Variable | Coefficient | STD Error | T-Statistics | p-Value |

|---|---|---|---|---|

| ECT (−1) | −0.8197537 | 0.1254389 | −6.54 *** | 0.000 |

| ∆LNGDP t | 74,449.34 | 28,101.16 | 2.65 ** | 0.011 |

| ∆LNOPENt | 76,998.87 | 30,570.11 | 2.52 ** | 0.015 |

| ∆LNREERt | 156,240 | 41,417.96 | 3.77 *** | 0.000 |

| ∆LNVOLt | 5173.725 | 2334.7 | 2.22 ** | 0.031 |

| dum2008q4t | 15,627.67 | 8592.137 | 1.82 * | 0.074 |

| dum2020q2t | 17,380.83 | 8559.968 | 2.03 ** | 0.047 |

| Constant | −1,341,135 | 493,876.3 | −2.72 *** | 0.009 |

| R2 | 0.5399 | Adjusted R2 | 0.4717 | |

| Variable | Coefficient | STD Error | T-Statistics | p-Value |

|---|---|---|---|---|

| LNGDPt−1 | 90,819.16 | 33,526.86 | 2.71 *** | 0.009 |

| LNOPENt−1 | 93,929.27 | 35,825.29 | 2.62 ** | 0.011 |

| LNREERt−1 | 78,548.72 | 24,867.09 | 3.16 *** | 0.003 |

| LNVOLt−1 | 6311.317 | 2707.447 | 2.33 ** | 0.024 |

| dum2008q4t−1 | 19,063.86 | 10,635.04 | 1.79 * | 0.079 |

| dum2020q2t−1 | 21,202.51 | 10,243.03 | 2.07 ** | 0.043 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lajevardi, H.; Chowdhury, M. How Does the Exchange Rate and Its Volatility Influence FDI to Canada? A Disaggregated Analysis. J. Risk Financial Manag. 2024, 17, 88. https://doi.org/10.3390/jrfm17020088

Lajevardi H, Chowdhury M. How Does the Exchange Rate and Its Volatility Influence FDI to Canada? A Disaggregated Analysis. Journal of Risk and Financial Management. 2024; 17(2):88. https://doi.org/10.3390/jrfm17020088

Chicago/Turabian StyleLajevardi, Hooman, and Murshed Chowdhury. 2024. "How Does the Exchange Rate and Its Volatility Influence FDI to Canada? A Disaggregated Analysis" Journal of Risk and Financial Management 17, no. 2: 88. https://doi.org/10.3390/jrfm17020088

APA StyleLajevardi, H., & Chowdhury, M. (2024). How Does the Exchange Rate and Its Volatility Influence FDI to Canada? A Disaggregated Analysis. Journal of Risk and Financial Management, 17(2), 88. https://doi.org/10.3390/jrfm17020088