CFO (Chief Financial Officer) Research: A Systematic Review Using the Bibliometric Toolbox

Abstract

1. Introduction

2. CFO Research: Background

3. Review Methodology

3.1. Formulation of Research Questions

3.2. Data Collection

3.3. Bibliometric Tools and Software for Data Analysis

4. Results and Findings

4.1. Performance Trends (RQ1a)

4.1.1. Publication and Citation Trends

4.1.2. Most Prolific Journals (RQ1b)

4.1.3. Articles (RQ1b)

4.1.4. Authors (RQ1b)

Top Publishing Country as Per Corresponding Authors

Top Countries as Per Total Citations

4.2. Science Mapping

4.2.1. Temporal Analysis Using Word Clouds

4.2.2. Bibliographic Coupling (RQ2)

Cluster 1: CFO and Financial Performance (Red)

Cluster 2: CFO and Manipulation in Reporting (Yellow)

Cluster 3: CFO and Financial Decisions (Blue)

Cluster 4: CFO and Earning Management (Green)

Cluster 5: CFO and Audit Management (Sky Blue)

Cluster 6: CFO’s Compensation and Reporting Quality (Purple)

5. Discussion

5.1. Managerial and Industrial Implications

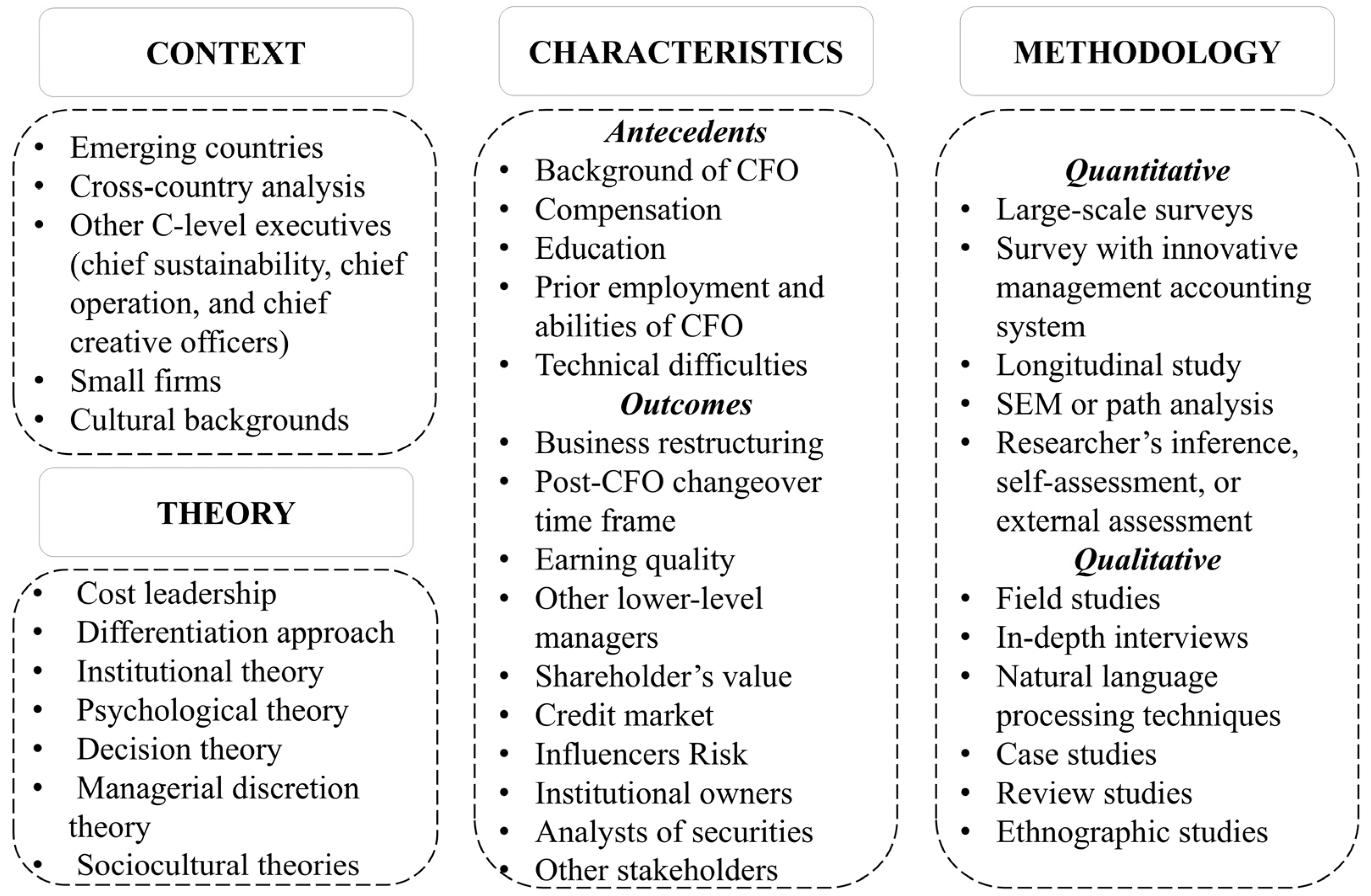

5.2. Directions for Future Research (RQ4)

5.2.1. Theory

5.2.2. Contexts

5.2.3. Characteristics

5.2.4. Methods

6. Conclusions and Limitations

Funding

Data Availability Statement

Conflicts of Interest

References

- Abatecola, Gianpaolo, Gabriele Mandarelli, and Sara Poggesi. 2013. The personality factor: How top management teams make decisions. A literature review. Journal of Management and Governance 17: 1073–100. [Google Scholar] [CrossRef]

- Abernathy, John L., Brooke Beyer, Adi Masli, and Chad Stefaniak. 2014. The association between characteristics of audit committee accounting experts, audit committee chairs, and financial reporting timeliness. Advances in Accounting 30: 283–97. [Google Scholar] [CrossRef]

- Aier, Jagadison K., Joseph Comprix, Matthew T. Gunlock, and Deanna Lee. 2005. The Financial Expertise of CFOs and Accounting Restatements. Accounting Horizons 19: 123–35. [Google Scholar] [CrossRef]

- Alali, Fatima. 2011. Audit fees and discretionary accruals: Compensation structure effect. Managerial Auditing Journal 26: 90–113. [Google Scholar] [CrossRef]

- Altarawneh, Marwan, Rohami Shafie, and Rokiah Ishak. 2020. CEO characteristics: A literature review and future directions. Academy of Strategic Management Journal 19: 1–10. [Google Scholar]

- Anantharaman, Divya, and Yong Gyu Lee. 2014. Managerial risk taking incentives and corporate pension policy. Journal of Financial Economics 111: 328–51. [Google Scholar] [CrossRef]

- Aria, Massimo, and Corrado Cuccurullo. 2017. Bibliometrix: An r-tool for comprehensive science mapping analysis. Journal of Informetrics 11: 959–75. [Google Scholar] [CrossRef]

- Back, Pascal, and Andreas Bausch. 2019. Not If, But How CEOs Affect Product Innovation: A Systematic Review and Research Agenda. International Journal of Innovation and Technology Management 16: 19300015. [Google Scholar] [CrossRef]

- Banerjee, Anup, Mattias Nordqvist, and Karin Hellerstedt. 2020. The role of the board chair—A literature review and suggestions for future research. Corporate Governance: An International Review 28: 372–405. [Google Scholar] [CrossRef]

- Banker, Rajiv D., Nan Hu, Paul A. Pavlou, and Jerry Luftman. 2011. CIO Reporting Structure, Strategic Positioning, and Firm Performance. MIS Quarterly 35: 487. [Google Scholar] [CrossRef]

- Barker, Vincent L., III, Paul W. Patterson, Jr., and George C. Mueller. 2001. Organizational Causes and Strategic Consequences of the Extent of Top Management Team Replacement During Turnaround Attempts. Journal of Management Studies 38: 235–70. [Google Scholar] [CrossRef]

- Barua, Abhijit, Lewis F. Davidson, Dasaratha V. Rama, and Sheela Thiruvadi. 2010. CFO Gender and Accruals Quality. Accounting Horizons 24: 25–39. [Google Scholar] [CrossRef]

- Beasley, Mark S., Richard Clune, and Dana R. Hermanson. 2005. Enterprise risk management: An empirical analysis of factors associated with the extent of implementation. Journal of Accounting and Public Policy 24: 521–31. [Google Scholar] [CrossRef]

- Beaulieu, Philip R. 2001. The Effects of Judgments of New Clients’ Integrity upon Risk Judgments, Audit Evidence, and Fees. Auditing 20: 85–99. [Google Scholar] [CrossRef]

- Beck, Matthew J., and Elaine G. Mauldin. 2014. Who’s Really in Charge? Audit Committee versus CFO Power and Audit Fees. The Accounting Review 89: 2057–85. [Google Scholar] [CrossRef]

- Bedard, Jean C., Rani Hoitash, and Udi Hoitash. 2014. Chief financial officers as inside directors. Contemporary Accounting Research 31: 787–817. [Google Scholar] [CrossRef]

- Boeker, Warren. 1997. Strategic Change: The Influence of Managerial Characteristics and Organizational Growth. The Academy of Management Journal 40: 152–70. [Google Scholar] [CrossRef]

- Boiko, Kseniia. 2022. R&D activity and firm performance: Mapping the field. Management Review Quarterly 72: 1051–87. [Google Scholar] [CrossRef]

- Borozan, Miloš, Cannito Loreta, and Palumbo Riccardo. 2022. Eye-tracking for the study of financial decision-making: A systematic review of the literature. Journal of Behavioral and Experimental Finance 35: 100702. [Google Scholar] [CrossRef]

- Bose, Iti. 2009. Corporate governance and law-role of independent directors: Theory and practice in india. Social Responsibility Journal 5: 94–111. [Google Scholar] [CrossRef]

- Boubaker, Sabri, John W. Goodell, Satish Kumar, and Riya Sureka. 2023. COVID-19 and finance scholarship: A systematic and bibliometric analysis. International Review of Financial Analysis 85: 102458. [Google Scholar] [CrossRef] [PubMed]

- Brau, James C., and Stanley E. Fawcett. 2006. Initial Public Offerings: An Analysis of Theory and Practice. The Journal of Finance 61: 399–436. [Google Scholar] [CrossRef]

- Brochet, Francois, Lucile Faurel, and Sarah McVay. 2011. Manager-Specific Effects on Earnings Guidance: An Analysis of Top Executive Turnovers. Journal of Accounting Research 49: 1123–62. [Google Scholar] [CrossRef]

- Brunzell, Tor, Eva Liljeblom, and Mika Vaihekoski. 2013. Determinants of capital budgeting methods and hurdle rates in nordic firms. Accounting and Finance 53: 85–110. [Google Scholar] [CrossRef]

- Bruton, Peter. 1982. A reasoned approach to hospital planning in an uncertain world. Health Care Management Review 7: 39–43. [Google Scholar] [CrossRef]

- Burkert, Michael, and Rainer Lueg. 2013. Differences in the sophistication of Value-based Management—The role of top executives. Management Accounting Research 24: 3–22. [Google Scholar] [CrossRef]

- Campello, Murillo, John R. Graham, and Campbell R. Harvey. 2010. The real effects of financial constraints: Evidence from a financial crisis. Journal of Financial Economics 97: 470–87. [Google Scholar] [CrossRef]

- Capizzi, Vincenzo, Andrea Paltrinieri, Debidutta Pattnaik, and Satish Kumar. 2022. Retrospective overview of the journal venture capital using bibliometric approach. Venture Capital 24: 1–23. [Google Scholar] [CrossRef]

- Carpenter, Mason A., Marta A. Geletkancz, and Wm Gerard Sanders. 2004. Upper Echelons Research Revisited: Antecedents, Elements, and Consequences of Top Management Team Composition. Journal of Management 30: 749–78. [Google Scholar] [CrossRef]

- Caselli, Stefano, and Alberta Di Giuli. 2010. Does the CFO matter in family firms? Evidence from Italy. European Journal of Finance 16: 381–411. [Google Scholar] [CrossRef]

- Chadwick, Ingrid C., and Alexandra Dawson. 2018. Women leaders and firm performance in family businesses: An examination of financial and nonfinancial outcomes. Journal of Family Business Strategy 9: 238–49. [Google Scholar] [CrossRef]

- Chava, Sudheer, and Amiyatosh Purnanandam. 2010. CEOs versus CFOs: Incentives and corporate policies. Journal of Financial Economics 97: 263–78. [Google Scholar] [CrossRef]

- Chopra, Meenu, Neha Saini, Satish Kumar, Arup Varma, Sachin Kumar Mangla, and Weng Marc Lim. 2021. Past, present, and future of knowledge management for business sustainability. Journal of Cleaner Production 328: 129592. [Google Scholar] [CrossRef]

- Christopher, Joe, Gerrit Sarens, and Philomena Leung. 2009. A critical analysis of the independence of the internal audit function: Evidence from Australia. Accounting, Auditing and Accountability Journal 22: 200–20. [Google Scholar] [CrossRef]

- Cobo, M. J., A. G. López-Herrera, E. Herrera-Viedma, and F. Herrera. 2011. An approach for detecting, quantifying, and visualizing the evolution of a research field: A practical application to the fuzzy sets theory field. Journal of Informetrics 5: 146–66. [Google Scholar] [CrossRef]

- Cohen, Jeffrey, Ganesh Krishnamoorthy, and Arnie Wright. 2010. Corporate governance in the post-sarbanes-oxley era: Auditors’ experiences. Contemporary Accounting Research 27: 751–86. [Google Scholar] [CrossRef]

- Collins, Denton, Adi Masli, Austin L. Reitenga, and Juan Manuel Sanchez. 2009. Earnings Restatements, The Sarbanes-Oxley Act, and the Disciplining of Chief Financial Officers. Journal of Accounting, Auditing and Finance 24: 1–34. [Google Scholar] [CrossRef]

- Dabić, Marina, Bozidar Vlačić, Justin Paul, Leo-Paul Dana, Sreevas Sahasranamam, and Beata Glinka. 2020. Immigrant entrepreneurship: A review and research agenda. Journal of Business Research 113: 25–38. [Google Scholar] [CrossRef]

- Datta, Sudip, and Mai Iskandar-Datta. 2014. Upper-echelon executive human capital and compensation: Generalist vs specialist skills. Strategic Management Journal 35: 1853–66. [Google Scholar] [CrossRef]

- Davidson, Robert, Aiyesha Dey, and Abbie Smith. 2015. Executives’ ‘off-the-job’ behavior, corporate culture, and financial reporting risk. Journal of Financial Economics 117: 5–28. [Google Scholar] [CrossRef]

- Di Giuli, Alberta, Stefano Caselli, and Stefano Gatti. 2011. Are small family firms financially sophisticated? Journal of Banking and Finance 35: 2931–44. [Google Scholar] [CrossRef]

- Dichev, Ilia D., John R. Graham, Campbell R. Harvey, and Shiva Rajgopal. 2012. Earnings Quality: Evidence from the Field. Journal of Accounting and Economics 56: 1–33. [Google Scholar] [CrossRef]

- Diwanji, Vaibhav Shwetangbhai. 2023. Fuzzy-set qualitative comparative analysis in consumer research: A systematic literature review. International Journal of Consumer Studies 47: 2767–89. [Google Scholar] [CrossRef]

- Donthu, Naveen, Satish Kumar, Debmalya Mukherjee, Nitesh Pandey, and Weng Marc Lim. 2021a. How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research 133: 285–96. [Google Scholar] [CrossRef]

- Donthu, Naveen, Satish Kumar, Nitesh Pandey, and Weng Marc Lim. 2021b. Research Constituents, Intellectual Structure, and Collaboration Patterns in Journal of International Marketing: An Analytical Retrospective. Journal of International Marketing 29: 1–25. [Google Scholar] [CrossRef]

- Du, Fei, Guliang Tang, and S. Mark Young. 2012. Influence Activities and Favoritism in Subjective Performance Evaluation: Evidence from Chinese State-Owned Enterprises. The Accounting Review 87: 1555–88. [Google Scholar] [CrossRef]

- Duong, Lien, and John Evans. 2015. CFO compensation: Evidence from Australia. Pacific Basin Finance Journal 35: 425–43. [Google Scholar] [CrossRef]

- Esteves, José. 2009. A benefits realisation road-map framework for ERP usage in small and medium-sized enterprises. Journal of Enterprise Information Management 22: 25–35. [Google Scholar] [CrossRef]

- Fakhar, Saib, Fateh Mohd Khan, Mosab I. Tabash, Gayas Ahmad, Javaid Akhter, and Mujeeb Saif Mohsen Al-Absy. 2023. Financial distress in the banking industry: A bibliometric synthesis and exploration. Cogent Economics & Finance 11: 2. [Google Scholar]

- Favaro, Paul. 2001. Beyond bean counting: The CFO’s expanding role. Strategy & Leadership 29: 4–8. [Google Scholar] [CrossRef]

- Feldmann, Dorothy A., William J. Read, and Mohammad J. Abdolmohammadi. 2009. Financial Restatements, Audit Fees, and the Moderating Effect of CFO Turnover. AUDITING: A Journal of Practice & Theory 28: 205–23. [Google Scholar] [CrossRef]

- Feng, Mei, Weili Ge, Shuqing Luo, and Terry Shevlin. 2011. Why do CFOs become involved in material accounting manipulations? Journal of Accounting and Economics 51: 21–36. [Google Scholar] [CrossRef]

- Fink, Arlene. 2014. Conducting Research Literature Reviews: From the Internet to Paper, 4th ed. Thousand Oaks: SAGE Publications Inc. [Google Scholar] [CrossRef]

- Florackis, Chris, and Sushil Sainani. 2018. How do chief financial officers influence corporate cash policies? Journal of Corporate Finance 52: 168–91. [Google Scholar] [CrossRef]

- Fogel, Kathy, Tomas Jandik, and William R. McCumber. 2018. CFO social capital and private debt. Journal of Corporate Finance 52: 28–52. [Google Scholar] [CrossRef]

- Foschi, Martha. 1996. Double Standards in the Evaluation of Men and Women. Social Psychology Quarterly 59: 237–54. [Google Scholar] [CrossRef]

- Francis, Bill B., Iftekhar Hasan, and Qiang Wu. 2013. The impact of CFO gender on bank loan contracting. Journal of Accounting, Auditing and Finance 28: 53–78. [Google Scholar] [CrossRef]

- Francis, Bill B., Iftekhar Hasan, Qiang Wu, and Meng Yan. 2014. Are Female CFOs Less Tax Aggressive? Evidence from Tax Aggressiveness. The Journal of the American Taxation Association 36: 171–202. [Google Scholar] [CrossRef]

- Francis, Bill B., Iftekhar Hasan, Jong Chool Park, and Qiang Wu. 2015. Gender Differences in Financial Reporting Decision Making: Evidence from Accounting Conservatism. Contemporary Accounting Research 32: 1285–318. [Google Scholar] [CrossRef]

- Gavious, Ilanit, Einav Segev, and Rami Yosef. 2012. Female directors and earnings management in high-technology firms. Pacific Accounting Review 24: 4–32. [Google Scholar] [CrossRef]

- Geiger, Marshall A., and David S. North. 2006. Does Hiring a New CFO Change Things? An Investigation of Changes in Discretionary Accruals. Accounting Review 81: 781–809. [Google Scholar] [CrossRef]

- Gibbins, Michael, Susan A. McCracken, and Steve E. Salterio. 2007. The Chief Financial Officer’s Perspective on Auditor-Client Negotiations. Contemporary Accounting Research 24: 387–422. [Google Scholar] [CrossRef]

- Goodell, John W., Satish Kumar, Weng Marc Lim, and Debidutta Pattnaik. 2021. Artificial intelligence and machine learning in finance: Identifying foundations, themes, and research clusters from bibliometric analysis. Journal of Behavioral and Experimental Finance 32: 100577. [Google Scholar] [CrossRef]

- Goodwin, Jenny. 2004. A comparison of internal audit in the private and public sectors. Managerial Auditing Journal 19: 640–50. [Google Scholar] [CrossRef]

- Goretzki, Lukas, Erik Strauss, and Jürgen Weber. 2013. An institutional perspective on the changes in management accountants’ professional role. Management Accounting Research 24: 41–63. [Google Scholar] [CrossRef]

- Graham, John R., Campbell R. Harvey, and Manju Puri. 2015. Capital allocation and delegation of decision-making authority within firms. Journal of Financial Economics 115: 449–70. [Google Scholar] [CrossRef]

- Graham, John R., Campbell R. Harvey, and Shiva Rajgopal. 2006. Value Destruction and Financial Reporting Decisions. Financial Analysts Journal 62: 27–39. [Google Scholar] [CrossRef]

- Gupta, Vishal K., Sandra Mortal, Bidisha Chakrabarty, Xiaohu Guo, and Daniel B. Turban. 2020. CFO Gender and Financial Statement Irregularities. Academy of Management Journal 63: 802–31. [Google Scholar] [CrossRef]

- Habib, Ahsan, and Mahmud Hossain. 2013. CEO/CFO characteristics and financial reporting quality: A review. Research in Accounting Regulation 25: 88–100. [Google Scholar] [CrossRef]

- Ham, Charles, Mark H. Lang, Nicholas Seybert, and Sean Wang. 2015. CFO Narcissism and Financial Reporting Quality. SSRN Electronic Journal, April 20. [Google Scholar] [CrossRef]

- Ham, Charles, Mark H. Lang, Nicholas Seybert, and Sean Wang. 2017. CFO Narcissism and Financial Reporting Quality. Journal of Accounting Research 55: 1089–135. [Google Scholar] [CrossRef]

- Hambrick, Donald C., and Phyllis A. Mason. 1984. Upper Echelons: The Organization as a Reflection of Its Top Managers. Academy of Management Review 9: 193–206. [Google Scholar] [CrossRef]

- Hennes, Karen M., Andrew J. Leone, and Brian P. Miller. 2008. The Importance of Distinguishing Errors from Irregularities in Restatement Research: The Case of Restatements and CEO/CFO Turnover. The Accounting Review 83: 1487–519. [Google Scholar] [CrossRef]

- Hennessy, Christopher A., and Gilles Chemla. 2022. Signaling, instrumentation, and CFO decision-making. Journal of Financial Economics 144: 849–63. [Google Scholar] [CrossRef]

- Hermanson, Dana R., and Zhongxia Ye. 2009. Why do some accelerated filers with sox Section 404 material weaknesses provide early warning under Section 302? Auditing 28: 247–71. [Google Scholar] [CrossRef]

- Hiebl, Martin R. W. 2015. Agency and stewardship attitudes of chief financial officers in private companies. Qualitative Research in Financial Markets 7: 4–23. [Google Scholar] [CrossRef]

- Hiebl, Martin R. W. 2017. Finance managers in family firms: An upper-echelons view. Journal of Family Business Management 7: 207–20. [Google Scholar] [CrossRef]

- Ho, Simon S. M., and Kar Shun Wong. 2001. A Study of Corporate Disclosure Practice and Effectiveness in Hong Kong. Journal of International Financial Management & Accounting 12: 75–102. [Google Scholar] [CrossRef]

- Hoffman, Donna L., and Morris B. Holbrook. 1993. The Intellectual Structure of Consumer Research: A Bibliometric Study of Author Cocitations in the First 15 Years of the Journal of Consumer Research. Journal of Consumer Research 19: 505. [Google Scholar] [CrossRef]

- Hoitash, Rani, Udi Hoitash, and Karla M. Johnstone. 2012. Internal Control Material Weaknesses and CFO Compensation. Contemporary Accounting Research 29: 768–803. [Google Scholar] [CrossRef]

- Hui, Kai Wai, and Steven R. Matsunaga. 2015. Are CEOs and CFOs Rewarded for Disclosure Quality? Accounting Review 90: 1013–47. [Google Scholar] [CrossRef]

- Indjejikian, Raffi, and Michal Matějka. 2009. CFO Fiduciary Responsibilities and Annual Bonus Incentives. Journal of Accounting Research 47: 1061–93. [Google Scholar] [CrossRef]

- Ishrat, Irna, Mohammad Hasan, Fateh Mohd Khan, and Mohammad Yousuf Javed. 2023. Unraveling the structure and trends of TRIZ approach in business and management: Bibliometric synthesis and future research directions. International Journal of Systematic Innovation 7: 12–46. [Google Scholar] [CrossRef]

- Jain, Jinesh, Nidhi Walia, Simarjeet Singh, and Esha Jain. 2021. Mapping the Field of Behavioural Biases: A Literature Review Using Bibliometric Analysis. Management Review Quarterly. Berlin: Springer International Publishing. [Google Scholar] [CrossRef]

- Jiang, John, Kathy R. Petroni, and Isabel Yanyan Wang. 2008. CFOs and CEOs: Who have the most influence on earnings management? SSRN Electronic Journal, April 16. [Google Scholar] [CrossRef]

- Jiang, John, Kathy R. Petroni, and Isabel Yanyan Wang. 2010. CFOs and CEOs: Who have the most influence on earnings management? Journal of Financial Economics 96: 513–26. [Google Scholar] [CrossRef]

- Kajol, K., Ranjit Singh, and Justin Paul. 2022. Adoption of digital financial transactions: A review of literature and future research agenda. Technological Forecasting and Social Change 184: 121991. [Google Scholar] [CrossRef]

- Kasaraneni, HimaJyothi, and Salini Rosaline. 2022. Automatic Merging of Scopus and Web of Science Data for Simplified and Effective Bibliometric Analysis. Annals of Data Science 11: 785–802. [Google Scholar] [CrossRef]

- Khan, Ashraf, John W. Goodell, M. Kabir Hassan, and Andrea Paltrinieri. 2022. A bibliometric review of finance bibliometric papers. Finance Research Letters 47: 102520. [Google Scholar] [CrossRef]

- Khan, Fateh Mohd, Mohammad Anas, and S. M. Fatah Uddin. 2024. Anthropomorphism and consumer behaviour: A SPAR-4-SLR protocol compliant hybrid review. International Journal of Consumer Studies 48: 1–37. [Google Scholar] [CrossRef]

- Kim, Jeong Bon, Yinghua Li, and Liandong Zhang. 2011. CFOs versus CEOs: Equity incentives and crashes. Journal of Financial Economics 101: 713–30. [Google Scholar] [CrossRef]

- Krishnan, Gopal V., K. K. Raman, Ke Yang, and Wei Yu. 2011. CFO/CEO-Board Social Ties, Sarbanes-Oxley, and Earnings Management. Accounting Horizons 25: 537–57. [Google Scholar] [CrossRef]

- Kumar, Satish, Dipasha Sharma, Sandeep Rao, Weng Marc Lim, and Sachin Kumar Mangla. 2022a. Past, Present, and Future of Sustainable Finance: Insights from Big Data Analytics through Machine Learning of Scholarly Research. Annals of Operations Research, January. [Google Scholar] [CrossRef]

- Kumar, Satish, Saumyaranjan Sahoo, Weng Marc Lim, and Léo Paul Dana. 2022b. Religion as a social shaping force in entrepreneurship and business: Insights from a technology-empowered systematic literature review. Technological Forecasting and Social Change 175: 121393. [Google Scholar] [CrossRef]

- Larcker, David F., and Anastasia A. Zakolyukina. 2012. Detecting Deceptive Discussions in Conference Calls. Journal of Accounting Research 50: 495–540. [Google Scholar] [CrossRef]

- Li, Chan, Lili Sun, and Michael Ettredge. 2010. Financial executive qualifications, financial executive turnover, and adverse SOX 404 opinions. Journal of Accounting and Economics 50: 93–110. [Google Scholar] [CrossRef]

- Li, Yiwei, and Yeqin Zeng. 2019. The impact of top executive gender on asset prices: Evidence from stock price crash risk. Journal of Corporate Finance 58: 528–50. [Google Scholar] [CrossRef]

- Lim, Weng Marc, Sheau-Fen Yap, and Marian Makkar. 2021. Home sharing in marketing and tourism at a tipping point: What do we know, how do we know, and where should we be heading? Journal of Business Research 122: 534–66. [Google Scholar] [CrossRef]

- Lins, Karl V., Henri Servaes, and Peter Tufano. 2010. What drives corporate liquidity? An international survey of cash holdings and lines of credit. Journal of Financial Economics 98: 160–76. [Google Scholar] [CrossRef]

- Lisic, Ling Lei, Linda A. Myers, Timothy A. Seidel, and Jian Zhou. 2019. Does Audit Committee Accounting Expertise Help to Promote Audit Quality? Evidence from Auditor Reporting of Internal Control Weaknesses. Contemporary Accounting Research 36: 2521–53. [Google Scholar] [CrossRef]

- Liu, Xiaozhong, Jinsong Zhang, and Chun Guo. 2013. Full-text citation analysis: A new method to enhance scholarly networks. Journal of the American Society for Information Science and Technology 64: 1852–63. [Google Scholar] [CrossRef]

- Liu, Yin, Huiqi Gan, and Khondkar Karim. 2021. The effectiveness of chief financial officer board membership in improving corporate investment efficiency. Review of Quantitative Finance and Accounting 57: 487–521. [Google Scholar] [CrossRef]

- Liu, Yu, Zuobao Wei, and Feixue Xie. 2016. CFO gender and earnings management: Evidence from China. Review of Quantitative Finance and Accounting 46: 881–905. [Google Scholar] [CrossRef]

- Malaysian Institute of Accountants. 2016. Competency Framework for Chief Financial Officers (CFOS) in Public Interest Entities. Available online: https://www.oecd.org/careers/competency_framework_en.pdf (accessed on 5 December 2023).

- McCracken, Susan, Steven E. Salterio, and Michael Gibbins. 2008. Auditor-client management relationships and roles in negotiating financial reporting. Accounting, Organizations and Society 33: 362–83. [Google Scholar] [CrossRef]

- Menz, Markus. 2012. Functional Top Management Team Members: A Review, Synthesis, and Research Agenda. Journal of Management 38: 45–80. [Google Scholar] [CrossRef]

- Mian, Shehzad. 2001. On the choice and replacement of chief financial officers. Journal of Financial Economics 60: 143–75. [Google Scholar] [CrossRef]

- Mukherjee, Debmalya, Satish Kumar, Deepraj Mukherjee, and Kirti Goyal. 2022. Mapping five decades of international business and management research on india: A bibliometric analysis and future directions. Journal of Business Research 145: 864–91. [Google Scholar] [CrossRef]

- Naranjo-Gil, David, Victor S. Maas, and Frank G. H. Hartmann. 2009. How CFOs Determine Management Accounting Innovation: An Examination of Direct and Indirect Effects. European Accounting Review 18: 667–95. [Google Scholar] [CrossRef]

- Ng, Poh Yen, Mumin Dayan, and Anthony Di Benedetto. 2019. Performance in family firm: Influences of socioemotional wealth and managerial capabilities. Journal of Business Research 102: 178–90. [Google Scholar] [CrossRef]

- Papadakis, Vassilis M., and Patrick Barwise. 2002. How Much Do CEOs and Top Managers Matter in Strategic Decision-Making? British Journal of Management 13: 83–95. [Google Scholar] [CrossRef]

- Park, Hyunjun, and Youngtae Yoo. 2017. A Literature Review on Chief Executive Officer Hubris And Related Constructs: Is The Theory Of Chief Executive Officer Hubris An Antecedents Or Consequences? Journal of Applied Business Research (JABR) 33: 703. [Google Scholar] [CrossRef]

- Patel, Ritesh, Milena Migliavacca, and Marco E. Oriani. 2022. Blockchain in banking and finance: A bibliometric review. Research in International Business and Finance 62: 101718. [Google Scholar] [CrossRef]

- Pattnaik, Debidutta, Mohammad Kabir Hassan, Satish Kumar, and Justin Paul. 2020. Trade credit research before and after the global financial crisis of 2008—A bibliometric overview. Research in International Business and Finance 54: 101287. [Google Scholar] [CrossRef]

- Paul, Justin, and Alexander Rosado-Serrano. 2019. Gradual Internationalization vs Born-Global/International New Venture Models: A Review and Research Agenda. International Marketing Review 36: 830–58. [Google Scholar] [CrossRef]

- Paul, Justin, Weng Marc Lim, Aron O’Cass, Andy Wei Hao, and Stefano Bresciani. 2021. Scientific procedures and rationales for systematic literature reviews (SPAR-4-SLR). International Journal of Consumer Studies 45: 01–16. [Google Scholar] [CrossRef]

- Peni, Emilia, and Sami Vähämaa. 2010. Female executives and earnings management. Managerial Finance 36: 629–45. [Google Scholar] [CrossRef]

- Peterson, Randall S., D. Brent Smith, Paul V. Martorana, and Pamela D. Owens. 2003. The impact of chief executive officer personality on top management team dynamics: One mechanism by which leadership affects organizational performance. Journal of Applied Psychology 88: 795–808. [Google Scholar] [CrossRef]

- Pieper, Torsten M. 2010. Non solus: Toward a psychology of family business. Journal of Family Business Strategy 1: 26–39. [Google Scholar] [CrossRef]

- Pinho, Celso R. A., Maria Luiza C. Pinho, Seyda Z. Deligonul, and S. Tamer Cavusgil. 2022. The agility construct in the literature: Conceptualization and bibliometric assessment. Journal of Business Research 153: 517–32. [Google Scholar] [CrossRef]

- Preuße, Heide. 2012. Reference Budgets for counselling on how to manage private household finance—Requirements and patterns based on international experience. International Journal of Consumer Studies 36: 602–10. [Google Scholar] [CrossRef]

- Rashid, Umra, Mohd Abdullah, Saleh F.A. Khatib, Fateh Mohd Khan, and Javaid Akhter. 2024. Unravelling trends, patterns and intellectual structure of research on bankruptcy in SMEs: A bibliometric assessment and visualisation. Heliyon 10: e24254. [Google Scholar] [CrossRef] [PubMed]

- Rasul, Tareq, Weng Marc Lim, Michael Dowling, Satish Kumar, and Raouf Ahmad Rather. 2022. Advertising expenditure and stock performance: A bibliometric analysis. Finance Research Letters 50: 103283. [Google Scholar] [CrossRef]

- Rhodes, Jo, Richard Hung, Peter Lok, Bella Ya-Hui Lien, and Chi-Min Wu. 2008. Factors influencing organizational knowledge transfer: Implication for corporate performance. Journal of Knowledge Management 12: 84–100. [Google Scholar] [CrossRef]

- Robinson, John R., Stephanie A. Sikes, and Connie D. Weaver. 2010. Performance Measurement of Corporate Tax Departments. The Accounting Review 85: 1035–64. [Google Scholar] [CrossRef]

- Rumstadt, Franz, and Dominik K. Kanbach. 2022. CEO activism. What do we know? What don’t we know? a systematic literature review. Society and Business Review 17: 307–30. [Google Scholar] [CrossRef]

- Salleh, Zalailah, and Jenny Stewart. 2012. The role of the audit committee in resolving auditor-client disagreements: A malaysian study. Accounting, Auditing and Accountability Journal 25: 1340–72. [Google Scholar] [CrossRef]

- Sharma, Amalesh, Laxminarayana Yashaswy Akella, and Sourav Bikash Borah. 2022. Knowledge structure of chief marketing officers (CMOs): A review, bibliometric analysis, and research agenda. Journal of Business Research 151: 448–62. [Google Scholar] [CrossRef]

- Srivastava, Mukta, Neeraj Pandey, and Gordhan K. Saini. 2022. Reference price research in marketing: A bibliometric analysis. Marketing Intelligence and Planning 40: 604–23. [Google Scholar] [CrossRef]

- Srivastava, Saurabh, Shiwangi Singh, and Sanjay Dhir. 2020. Culture and international business research: A review and research agenda. International Business Review 29: 101709. [Google Scholar] [CrossRef]

- Steyn, Maxi. 2014. Organisational benefits and implementation challenges of mandatory integrated reporting. Sustainability Accounting, Management and Policy Journal 5: 476–503. [Google Scholar] [CrossRef]

- Sureka, Riya, Satish Kumar, Sisira Colombage, and Mohammad Zoynul Abedin. 2022. Five decades of research on capital budgeting—A systematic review and future research agenda. Research in International Business and Finance 60: 101609. [Google Scholar] [CrossRef]

- Switzer, Lorne N., and Jun Wang. 2013. Default Risk Estimation, Bank Credit Risk, and Corporate Governance. Financial Markets, Institutions and Instruments 22: 91–112. [Google Scholar] [CrossRef]

- Tanrikulu, Ceyda. 2021. Theory of consumption values in consumer behaviour research: A review and future research agenda. International Journal of Consumer Studies 45: 1176–97. [Google Scholar] [CrossRef]

- Tinsley, Howard E. A., and David J. Weiss. 2000. Interrater reliability and agreement. In Handbook of Applied Multivariate Statistics and Mathematical Modelling. San Diego: Academic Press, pp. 95–124. [Google Scholar] [CrossRef]

- Tiwary, Nishant Kumar, Rishi Kant Kumar, Shagun Sarraf, Prashant Kumar, and Nripendra P. Rana. 2021. Impact assessment of social media usage in B2B marketing: A review of the literature and a way forward. Journal of Business Research 131: 121–39. [Google Scholar] [CrossRef]

- Tomar, Sweta, Satish Kumar, and Riya Sureka. 2021. Financial Planning for Retirement: Bibliometric Analysis and Future Research Directions. Journal of Financial Counseling and Planning 32: JFCP-19-00062. [Google Scholar] [CrossRef]

- Uddin, Nancy, and Peter R. Gillett. 2002. The effects of moral reasoning and self-monitoring on CFO intentions to report fraudulently on financial statements. Journal of Business Ethics 40: 15–32. [Google Scholar] [CrossRef]

- Uhde, David Alexander, Patricia Klarner, and Anja Tuschke. 2017. Board monitoring of the chief financial officer: A review and research agenda. Corporate Governance: An International Review 25: 116–33. [Google Scholar] [CrossRef]

- van Eck, Nees Jan, and Ludo Waltman. 2010. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 84: 523–38. [Google Scholar] [CrossRef] [PubMed]

- Velte, Patrick, and Martin Stawinoga. 2020. Do chief sustainability officers and CSR committees influence CSR-related outcomes? A structured literature review based on empirical-quantitative research findings. Journal of Management Control 31: 333–77. [Google Scholar] [CrossRef]

- Velte, Patrick. 2020. Do CEO incentives and characteristics influence corporate social responsibility (CSR) and vice versa? A literature review. Social Responsibility Journal 16: 1293–323. [Google Scholar] [CrossRef]

- Vrontis, Demetris, and Michael Christofi. 2021. R&D internationalization and innovation: A systematic review, integrative framework and future research directions. Journal of Business Research 128: 812–23. [Google Scholar] [CrossRef]

- Widener, Sally K. 2007. An Empirical analysis of the levers of control framework. Accounting, Organizations and Society 32: 757–88. [Google Scholar] [CrossRef]

- Wilmshurst, Trevor D., and Geoffrey R. Frost. 2000. Corporate environmental reporting. Accounting, Auditing & Accountability Journal 13: 10–26. [Google Scholar] [CrossRef]

- Winschel, Julija, and Martin Stawinoga. 2019. Determinants and effects of sustainable CEO compensation: A structured literature review of empirical evidence. Management Review Quarterly 69: 265–328. [Google Scholar] [CrossRef]

- Yu, Mei. 2023. CEO Duality and firm performance: A systematic review and research agenda. European Management Review 20: 346–58. [Google Scholar] [CrossRef]

- Zhang, Yan, and Margarethe F. Wiersema. 2009. Stock market reaction to CEO certification: The signaling role of CEO background. Strategic Management Journal 30: 693–710. [Google Scholar] [CrossRef]

- Zhang, Yucheng, Meng Zhang, Jing Li, Guangjian Liu, Miles M Yang, and Siqi Liu. 2021a. A bibliometric review of a decade of research: Big data in business research—Setting a research agenda. Journal of Business Research 131: 374–90. [Google Scholar] [CrossRef]

- Zhang, Yucheng, Zhongwei Hou, Feifei Yang, Miles M Yang, and Zhiling Wang. 2021b. Discovering the evolution of resource-based theory: Science mapping based on bibliometric analysis. Journal of Business Research 137: 500–16. [Google Scholar] [CrossRef]

- Zupic, Ivan, and Tomaž Čater. 2015. Bibliometric Methods in Management and Organization. Organizational Research Methods 18: 429–72. [Google Scholar] [CrossRef]

| Description | Results |

|---|---|

| Publication-related metrics | |

| Total publications (TPs) | 669 |

| Total cited publications (TCPs) | 654 |

| Total sources (journals) | 267 |

| Article (e.g., conceptual and empirical) | 669 |

| Number of active years (NAYs) | 34 |

| Productivity per active year (PAY) | 11.84 |

| Number of contributing authors (NCAs) | 1362 |

| Author of single-authored document (ASA) | 118 |

| Author of co-authored document (ACA) | 1244 |

| Single-authored publications (SAs) | 129 |

| Co-authored publications (CAs) | 540 |

| Citation-related metrics | |

| Total citations (TCs) | 17,094 |

| Average citations per publication (TC/TP) | 25.55 |

| h-index | 57 |

| Journal | h | Number of Publications | Total Citations |

|---|---|---|---|

| Journal of Financial Economics | 13 | 14 | 2903 |

| Accounting Review | 9 | 10 | 1205 |

| Journal of Accounting and Economics | 7 | 7 | 1048 |

| Contemporary Accounting Research | 11 | 15 | 848 |

| Accounting Horizons | 10 | 14 | 656 |

| Journal of Accounting Research | 6 | 7 | 596 |

| Accounting, Organizations and Society | 2 | 2 | 525 |

| Journal of Accounting and Public Policy | 6 | 11 | 455 |

| Accounting, Auditing & Accountability Journal | 1 | 1 | 417 |

| Journal of Finance | 3 | 3 | 385 |

| Article Citations | Title | Year | Local Citations | Global Citations | LC/GC Ratio (%) | Normalised Local Citations | Normalised Global Citations |

|---|---|---|---|---|---|---|---|

| Campello et al. (2010) | The real effects of financial constraints: Evidence from a financial crisis | 2010 | 7 | 906 | 0.77 | 0.62 | 8.19 |

| Kim et al. (2011) | CFOs versus CEOs: Equity incentives and crashes | 2011 | 23 | 496 | 4.64 | 5.07 | 10.64 |

| Hennes et al. (2008) | The importance of distinguishing errors from irregularities in restatement research: The case of restatements and CEO/CFO turnover | 2008 | 40 | 478 | 8.37 | 10.30 | 8.23 |

| Widener (2007) | An empirical analysis of the levers of control framework | 2007 | 2 | 430 | 0.47 | 0.67 | 7.25 |

| Wilmshurst and Frost (2000) | Corporate environmental reporting: A test of legitimacy theory | 2000 | 1 | 417 | 0.24 | 7.00 | 5.21 |

| Dichev et al. (2012) | Earnings quality: Evidence from the field | 2013 | 0 | 416 | 0.00 | 0.00 | 6.76 |

| Brau and Fawcett (2006) | Initial public offerings: An analysis of theory and practice | 2006 | 5 | 375 | 1.33 | 0.55 | 4.86 |

| Beasley et al. (2005) | Enterprise risk management: An empirical analysis of factors associated with the extent of implementation. | 2005 | 3 | 347 | 0.86 | 0.43 | 4.92 |

| Jiang et al. (2010) | CFOs and CEOs: Who has the most influence on earnings management? | 2010 | 90 | 323 | 27.86 | 7.94 | 2.92 |

| Feng et al. (2011) | Why do CFOs become involved in material accounting manipulations? | 2011 | 77 | 281 | 27.40 | 16.99 | 6.03 |

| Author | Author’s Affiliation | h-Index | g-Index | Total Citations | Total Publications |

|---|---|---|---|---|---|

| Campbell R. Harvey | Duke University | 6 | 6 | 1619 | 6 |

| John R. Graham | Fuqua School of Business, Duke University | 5 | 7 | 1598 | 7 |

| Murillo Campello | Cornell University | 1 | 1 | 906 | 1 |

| Yiwei Li | Essex Business School, University of Essex, UK | 6 | 6 | 631 | 6 |

| Shivaram Rajgopal | Columbia Business School | 4 | 4 | 550 | 4 |

| Jeong-Bon Kim | Department of Accountancy, City University of Hong | 2 | 2 | 530 | 2 |

| Liandong Zhang | Department of Accountancy, City University of Hong | 1 | 1 | 496 | 1 |

| Geoffrey R. Frost | University of Newcastle, Newcastle, Australia | 2 | 2 | 483 | 2 |

| Trevor D. Wilmshurst | Victoria University of Technology, Melbourne, Australia | 2 | 2 | 483 | 2 |

| Karen M. Hennes | University of Oklahoma | 1 | 1 | 478 | 1 |

| Country | TC | Average Article Citations |

|---|---|---|

| USA | 6017 | 42.98 |

| United Kingdom | 676 | 21.81 |

| Australia | 574 | 17.94 |

| Canada | 529 | 19.59 |

| China | 381 | 9.77 |

| Germany | 282 | 25.64 |

| Singapore | 281 | 281.00 |

| Finland | 271 | 45.17 |

| Spain | 255 | 36.43 |

| Malaysia | 181 | 11.31 |

| Clusters | Publication Title | Author | TC | TLS |

|---|---|---|---|---|

| Cluster 1: CFO and | An empirical analysis of the levers of control framework | Widener (2007) | 430 | 37 |

| Financial | Corporate environmental reporting | Wilmshurst and Frost (2000) | 417 | 8 |

| performance | Stock market reaction to CEO certification: the signaling role of CEO background | Zhang and Wiersema (2009) | 230 | 108 |

| CIO reporting structure, strategic positioning, and firm performance | Banker et al. (2011) | 193 | 23 | |

| Factors influencing organizational knowledge transfer: Implication for corporate performance | Rhodes et al. (2008) | 135 | 6 | |

| An institutional perspective on the changes in management accountants’ professional role | Goretzki et al. (2013) | 131 | 17 | |

| Organisational benefits and implementation challenges of mandatory integrated reporting | Steyn (2014) | 108 | 1 | |

| How CFOs determine management accounting innovation: An examination of direct and indirect effects | Naranjo-Gil et al. (2009) | 102 | 93 | |

| Upper-echelon executive human capital and compensation: Generalist vs. specialist skills | Datta and Iskandar-Datta (2014) | 86 | 81 | |

| The effects of judgments of new clients’ integrity upon risk judgments, audit evidence, and fees | Beaulieu (2001) | 86 | 9 | |

| Cluster 2: CFO and manipulation in reporting | Earnings quality: Evidence from the field | Dichev et al. (2012) | 416 | 238 |

| CFOs and CEOs: Who have the most influence on earnings management? | Jiang et al. (2010) | 323 | 139 | |

| Detecting deceptive discussions in conference calls | Larcker and Zakolyukina (2012) | 267 | 94 | |

| Does hiring a new CFO change things? An investigation of changes in discretionary accruals | Geiger and North (2006) | 229 | 103 | |

| CFO gender and accruals quality | Barua et al. (2010) | 210 | 123 | |

| Gender differences in financial reporting decision making: Evidence from accounting conservatism | Francis et al. (2015) | 208 | 267 | |

| Performance measurement of corporate tax departments | Robinson et al. (2010) | 167 | 10 | |

| Female executives and earnings management | Peni and Vähämaa (2010) | 162 | 104 | |

| Executives’ “off-the-job” behavior, corporate culture, and financial reporting risk | Davidson et al. (2015) | 122 | 175 | |

| CFO narcissism and financial reporting quality | Ham et al. (2017) | 111 | 183 | |

| Cluster 3: CFO and financial decisions | CFOs versus CEOs: Equity incentives and crashes | Kim et al. (2011) | 496 | 145 |

| The real effects of financial constraints: Evidence from a financial crisis | Campello et al. (2010) | 906 | 8 | |

| Initial public offerings: CFO perceptions/Initial public offerings: An analysis of theory and practice | Brau and Fawcett (2006) | 375 | 10 | |

| What drives corporate liquidity? An international survey of cash holdings and lines of credit☆ | Lins et al. (2010) | 252 | 41 | |

| CEOs versus CFOs: Incentives and corporate policies | Chava and Purnanandam (2010) | 251 | 55 | |

| Capital allocation and delegation of decision-making authority within firms | Graham et al. (2015) | 144 | 68 | |

| Value destruction and financial reporting decisions | Graham et al. (2006) | 87 | 17 | |

| The chief financial officer’s perspective on auditor-client negotiations* | Gibbins et al. (2007) | 81 | 55 | |

| Managerial risk taking incentives and corporate pension policy | Anantharaman and Lee (2014) | 77 | 122 | |

| The impact of CFO gender on bank loan contracting | Francis et al. (2013) | 71 | 72 | |

| Cluster 4: CFO and earning management | The importance of distinguishing errors from irregularities in restatement research: The case of restatements and CEO/CFO turnover | Hennes et al. (2008) | 478 | 114 |

| Why do CFOs become involved in material accounting manipulations? | Feng et al. (2011) | 281 | 147 | |

| The financial expertise of CFOs and accounting restatements | Aier et al. (2005) | 204 | 41 | |

| Financial executive qualifications, financial executive turnover, and adverse SOX 404 opinions | Li et al. (2010) | 175 | 100 | |

| On the choice and replacement of chief financial officers | Mian (2001) | 161 | 22 | |

| Earnings restatements, the Sarbanes-Oxley Act, and the disciplining of chief financial officers | Collins et al. (2009) | 78 | 86 | |

| CFO fiduciary responsibilities and annual bonus incentives | Indjejikian and Matějka (2009) | 76 | 112 | |

| Internal control material weaknesses and CFO compensation* | Hoitash et al. (2012) | 70 | 205 | |

| Financial restatements, audit fees, and the moderating effect of CFO turnover | Feldmann et al. (2009) | 67 | 128 | |

| Chief financial officers as inside directors | Bedard et al. (2014) | 62 | 284 | |

| Enterprise risk management: An empirical analysis of factors associated with the extent of implementation | Beasley et al. (2005) | 347 | 1 | |

| Cluster 5: CFO and audit | Corporate governance in the post-Sarbanes-Oxley era: Auditors’ experiences* | Cohen et al. (2010) | 251 | 65 |

| management CFO | Who’s really in charge? Audit committee versus CFO power and audit fees | Beck and Mauldin (2014) | 104 | 131 |

| Auditor–client management relationships and roles in negotiating financial reporting | McCracken et al. (2008) | 95 | 14 | |

| The association between characteristics of audit committee accounting experts, audit committee chairs, and financial reporting timeliness | Abernathy et al. (2014) | 89 | 116 | |

| A critical analysis of the independence of the internal audit function: evidence from Australia | Christopher et al. (2009) | 88 | 30 | |

| A comparison of internal audit in the private and public sectors | Goodwin (2004) | 57 | 3 | |

| Does audit committee accounting expertise help to promote audit quality? Evidence from auditor reporting of internal control weaknesses | Lisic et al. (2019) | 43 | 106 | |

| The role of the audit committee in resolving auditor-client disagreements: A Malaysian study | Salleh and Stewart (2012) | 41 | 34 | |

| Cluster 6: CFO’s compensation and reporting quality | A study of corporate disclosure practice and effectiveness in Hong Kong | Ho and Wong (2001) | 80 | 3 |

| Influence activities and favoritism in subjective performance evaluation: Evidence from Chinese state-owned enterprises | Du et al. (2012) | 78 | 4 | |

| Manager-specific effects on earnings guidance: An analysis of top executive turnovers | Brochet et al. (2011) | 50 | 67 | |

| Are CEOs and CFOs rewarded for disclosure quality? | Hui and Matsunaga (2015) | 46 | 75 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rashid, U.; Abdullah, M.; Tabash, M.I.; Naaz, I.; Akhter, J.; Al-Absy, M.S.M. CFO (Chief Financial Officer) Research: A Systematic Review Using the Bibliometric Toolbox. J. Risk Financial Manag. 2024, 17, 482. https://doi.org/10.3390/jrfm17110482

Rashid U, Abdullah M, Tabash MI, Naaz I, Akhter J, Al-Absy MSM. CFO (Chief Financial Officer) Research: A Systematic Review Using the Bibliometric Toolbox. Journal of Risk and Financial Management. 2024; 17(11):482. https://doi.org/10.3390/jrfm17110482

Chicago/Turabian StyleRashid, Umra, Mohd Abdullah, Mosab I. Tabash, Ishrat Naaz, Javaid Akhter, and Mujeeb Saif Mohsen Al-Absy. 2024. "CFO (Chief Financial Officer) Research: A Systematic Review Using the Bibliometric Toolbox" Journal of Risk and Financial Management 17, no. 11: 482. https://doi.org/10.3390/jrfm17110482

APA StyleRashid, U., Abdullah, M., Tabash, M. I., Naaz, I., Akhter, J., & Al-Absy, M. S. M. (2024). CFO (Chief Financial Officer) Research: A Systematic Review Using the Bibliometric Toolbox. Journal of Risk and Financial Management, 17(11), 482. https://doi.org/10.3390/jrfm17110482